#Parabolic SAR trading strategies

Text

Mastering Trading with the Parabolic SAR: A Comprehensive Guide

Introduction

In the dynamic world of financial markets, traders are constantly seeking tools and indicators to assist them in making informed decisions. One such tool that has gained popularity among traders is the Parabolic Stop and Reverse (SAR) indicator.

Developed by Welles Wilder, the Parabolic SAR is a versatile indicator that can help traders identify potential trend reversals, set…

View On WordPress

#Financial market trading indicators#Financial Markets#learn technical analysis#moving average#Moving average and Parabolic SAR#Parabolic SAR#Parabolic SAR reversal strategy#Parabolic SAR trading strategies#Risk Management#SAR calculation#SAR interpretation#Stop-Loss#Stop-loss with Parabolic SAR#technical analysis#technical analysis tools#Trading Indicators#Trading Strategies#Trading with SAR indicator#Trend Following#Trend following with Parabolic SAR#Trend Reversal

0 notes

Text

Unveiling Parabolic SAR: A Comprehensive Guide

In the ever-evolving landscape of technical analysis, traders and investors seek tools that offer clarity amidst market volatility and uncertainty. Enter the Parabolic SAR (Stop and Reverse) indicator, a powerful tool designed to identify potential trend reversals and provide valuable insights into market dynamics. Whether you're a novice trader or a seasoned investor, understanding the mechanics and applications of the Parabolic SAR can be instrumental in making informed trading decisions and navigating the complexities of financial markets.

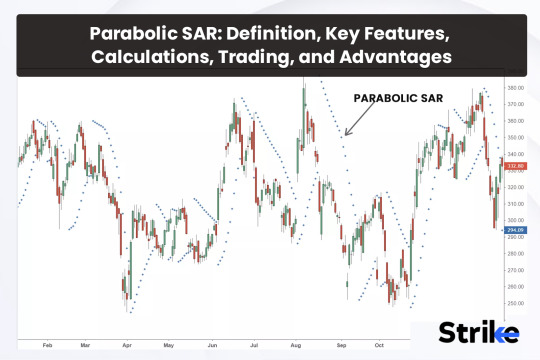

Introduction to Parabolic SAR:

Developed by Welles Wilder, the Parabolic SAR is a trend-following indicator that highlights potential trend reversals in financial markets. It accomplishes this by plotting points on a chart that represent potential stop-loss levels, adjusting these points dynamically as the price of an asset changes over time.

How Does Parabolic SAR Work?

The Parabolic SAR indicator places dots either above or below the price of an asset, depending on the direction of the trend. During an uptrend, the dots are below the price, while during a downtrend, the dots are above the price. The spacing between the dots increases as the trend accelerates, hence the "parabolic" nature of the indicator.

Interpreting Parabolic SAR Readings:

The primary use of Parabolic SAR is to identify potential trend reversals and establish trailing stop-loss levels. Traders typically interpret Parabolic SAR signals as follows:

Uptrend:

When the Parabolic SAR dots are below the price, it indicates an uptrend.

Traders may consider entering long positions or maintaining existing long positions as long as the dots remain below the price.

The dots serve as dynamic trailing stop-loss levels, gradually rising as the trend progresses.

Downtrend:

Conversely, when the Parabolic SAR dots are above the price, it signals a downtrend.

Traders may consider entering short positions or holding existing short positions as long as the dots remain above the price.

Similar to uptrends, the dots act as dynamic trailing stop-loss levels, descending as the downtrend continues.

Strategies for Using Parabolic SAR:

Trend Reversals:

When the price crosses over the Parabolic SAR dots, it may signal a potential trend reversal.

For example, when the price crosses above the dots during a downtrend, it could indicate a bullish reversal, prompting traders to consider exiting short positions or even entering long positions.

Trailing Stop-Loss:

Traders can use the Parabolic SAR dots as dynamic trailing stop-loss levels to protect profits and manage risk.

As the trend progresses, the stop-loss levels adjust accordingly, allowing traders to lock in gains while giving the trade room to breathe.

Confirmation with Other Indicators:

Combine Parabolic SAR with other technical indicators or chart patterns to confirm signals and enhance trading decisions.

For example, use Parabolic SAR in conjunction with moving averages or oscillators to validate trend direction and momentum.

Limitations and Considerations:

While Parabolic SAR offers valuable insights into trend reversals and trailing stop-loss levels, traders should be aware of its limitations and exercise caution:

Whipsaws: In choppy or ranging markets, Parabolic SAR may generate false signals, resulting in whipsaws and potential losses.

Adaptability: Adjust the parameters of Parabolic SAR (e.g., acceleration factor) to suit the specific characteristics of the asset and trading timeframe.

Confirmation: Always confirm Parabolic SAR signals with other technical indicators or fundamental analysis to reduce the likelihood of false positives.

Conclusion:

In the dynamic world of financial markets, the Parabolic SAR stands as a beacon of clarity, offering traders valuable insights into trend dynamics and potential reversal points. Whether you're a day trader, swing trader, or long-term investor, incorporating Parabolic SAR into your trading toolkit can enhance your ability to identify profitable opportunities, manage risk, and optimize returns. By mastering the interpretation and application of Parabolic SAR signals, traders can navigate the complexities of financial markets with confidence and precision, striving towards greater profitability and success.

0 notes

Text

Exness Pakistan

6 top ADX indicator strategies to use in online trading

Traders use different types of strategies on a platform because they enable them to get more ideas about various things. The Average Directional Index (ADX) is one of the indicators that allows a trader to measure the strength of a trend with high accuracy. A high ADX indicates a strong trend, and a low ADX suggests a weak market. ADX is useful for both day trading and swing trading purposes that let traders make the most informed decisions. Whether it is a new or experienced trader, they should know the top ADX strategies in online trading.

What are the best ADX strategies to follow in trading?

Combining ADX with Parabolic SAR

A trader should consider combining ADX with parametric SAR because they provide ways to know current trends and potential reversal points. For instance, one can identify a bullish trend when the ADX line is above 25 and the parabolic SAR is below the price bars. This combination works well for identifying a strong trend with potential for further upside.

Using ADX in the Directional Movement (DM) system

One should consider using ADX in the Directional Movement (DM) system that has three lines. It provides methods to measure bullish movements, apart from evaluating the strength of a trend. However, it is wise to combine the same with other tools to get more insights.

Evaluating a strong trend

Traders should evaluate a strong trend when the reading goes above 25. A reading above 25 indicates a strong trend and the likelihood of a trend developing. This, in turn, gives ways to proceed further that will help achieve the best results.

Determining the direction of a trend

A trader should determine the direction of a trend by using the last 50 candlesticks. Using a sample size of 50 candlesticks gives ways to determine a trend. The Exness Pakistan trading platform allows traders to trade different types of assets with the best indicators. It allows a trader to focus more on various things with high accuracy.

ADX price divergence

ADX price divergence issues a warning against a trend during the trading process. On the other hand, a trader should learn more about the strategy with more attention.

The Holy Grail

The Holy Grail strategy involves combining ADX with a moving average that helps find pullbacks using price action. Traders should learn strategies from different sources to maximize efficiency in trading.

1 note

·

View note

Text

Best Forex Robot - Best Free Forex Trading Robot

Best Forex Robot - Best Free Forex Trading Robot

The main thing about these helpful apps is that traders can configure them themselves to help make their trading strategy even more unique or set it up according to a particular signal that other experts have discovered. Nevertheless, expert advisors are great tools that can be used for a variety of different situations. Still, they typically work best in trending markets, and they also need to have effective money management strategies in place as well.

The name "robot" comes from the fact that this software does not need constant interaction like humans usually do while doing trades manually since they can be set to execute certain orders whenever certain conditions become true, sending buy and sell signals.

The best forex robots come in all shapes and sizes may or may not have great success rates. However, you should not follow anyone's advice to use a particular free forex robot without first knowing the facts. Hence, it is recommended that you try and test as many free expert advisors as possible before settling on one or none at all.

The best Forex robots can be classified into various categories: scalping systems, trend following systems, grid trading systems, and martingale systems. So, you may go for the scalping robot mt4 free. However, these best free forex EA programs vary depending on indicators used, such as Parabolic SAR (Stop And Reverse) or RSI (Relative Strength Index), or price action based like Fibonacci retracement levels. All these strategies usually work together with other strategies, which make them even more efficient.

The most common method for creating the best forex robot experts advisor is by using MetaQuotes Language 4 (MQL4), which is the built-in programming language of the most popular forex trading platform, MetaTrader 4. Expert advisors written in MQL4 are able to trade on all currency pairs listed on MT4.

#crypto#forexmoney#forexnews#forexprofit#forexsignals#forexstrategy#forexsuccess#forextips#forextrading#day trading

#best forex brokers#forex account types#forex bonus & forex signals. we offer#forex brokers by country#forex brokers comparison#forex reviews#forex trading platforms#free forex education#scam brokers list#trading resources

0 notes

Text

A Complete Guide to Trend-Following Indicators

There are many distinct trading indicators available on the financial markets, each with a specific function. These indicators are useful for assessing, trading, and making money from the constantly shifting state of price movement.

It is crucial to group these indicators according to their application and the market conditions in which they are most effective for analyzing price movement and providing trading tips.

But before proceeding further, let’s proceed to know what is a trend following a trading strategy.

What Is a Trend Following Indicators?

Technical tools called trend-following indicators assess the strength and direction of trends throughout the selected time frame. Some trend-following indicators are plotted right on the price panel, sending out negative signals when they are above the price and bullish signals when they are below the price. Others are drawn below the panel, producing up- and down-ticks from 0 to 100 or over a central ‘zero’ line, producing bullish or bearish divergences when opposing prices.

The majority of trend-following indicators are ‘lagging’, which means that they produce a buy or sell signal after a trend or reversal has already begun. The most common trailing trend-following indicator is the moving average. These indicators can also be ‘leading’, which means they anticipate price action before it occurs by comparing momentum across many time frames and doing multiple calculations. A well-liked leading trend-following indicator is the parabolic stop and reverse (Parabolic SAR).

There are three main purposes for these indicators. They first make an effort to inform the technician of a changing trend or impending reversal. Second, they make an effort to forecast both short- and long-term price movements. Thirdly, they validate findings and indications in the price pattern and other technical indicators. The parameters used to create the trend-following indication have the most influence on signal dependability. Examples include the generation of distinct buy and sell signals by a 50-day moving average and a 200-day moving average, which may be effective in one-time frame but not the other.

Top Trend-following Indicators

Here, in this section, we will explain the best trend following indicators. Let’s take a quick look:

Moving Averages

One of the most often used trend-following indicators is the moving average. The average price of an asset over a given period of time is shown by a moving average, which is a line. Before making a transaction while you trade forex online, you should frequently use moving averages to confirm the direction and intensity of a trend.

Moving Average Convergence Divergence (MACD)

The difference between two moving averages is measured by the trend-following indicator known as the Moving Average Convergence Divergence (MACD). In order to enter or exit transactions at the ideal time traders frequently use the MACD to spot changes in momentum or trend direction.

Bollinger Bands

A common trend-following indicator called Bollinger Bands uses a series of lines to depict the top and bottom of a trading range. Bollinger Bands are frequently used by traders to assist spot overbought and oversold market circumstances as well as probable trend reversals.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another popular trend-following indicator. By contrasting the average gains and losses over a given time period, the RSI gauges the force of a trend.

The RSI is often used by traders to spot overbought and oversold market conditions, which can aid them in making better trading decisions.

Trend Following advantages

Numerous benefits of trend following method include:

Big victories are possible, unlike with previous strategies.

Minimal transaction costs.

Your entrances and exits don’t have to be timed perfectly.

As the trend gets stronger, you could increase your position to increase your chances of making money.

Trend Following Disadvantages

Additionally, there are several drawbacks to trend following, the most prevalent of which are as follows:

It can be difficult mentally to ride the trend.

The win rate (number of winning trades divided by the number of lost trades) is lower.

Because trend following demands that the trend be already in motion, you’ll miss the trend’s beginning.

Final Thoughts

On a leading Forex trading platform, the trader can predict the stock price and choose the optimum time to purchase or sell the stock by using a trend-following technique, which is straightforward. To develop the technique, one needs just employ one trading indicator or one or more indicators in combination.

You can use the different methods for your trades now that you are aware of what trend trading is and what it entails. Before using your strategies, you must, however, perfect them. Use all the tools you have at your disposal, including charts, candlestick patterns, research data, and other tools, to examine the trends.

Originally Published on Theomnibuzz

Source: https://theomnibuzz.com/a-complete-guide-to-trend-following-indicators/

0 notes

Video

youtube

Trading Mastery: MACD, ADX, Parabolic SAR Strategies Revealed,Market Success Blueprint with MACD, ADX, Parabolic SAR Techniques,Trading Mastery: MACD, ADX, Parabolic SAR Strategies Revealed,Market Success Blueprint with MACD, ADX, Parabolic SAR Techniques,Optimize Your Trades: MACD, ADX, Parabolic SAR Strategy Unveiled,Profitable Trading Secrets: MACD, ADX, Parabolic SAR Strategies,Strategic Trading Signals: MACD, ADX, Parabolic SAR Mastery,Maximize Profits with MACD, ADX, Parabolic SAR Trading Tactics,Proven Strategies: MACD ADX Parabolic SAR for Trading Success,Elevate Your Trading Game: MACD, ADX, Parabolic SAR Techniques,Mastering Market Trends: MACD, ADX, Parabolic SAR Strategies,Trade Like a Pro: MACD, ADX, Parabolic SAR Success Guide,MACD Trading Strategies,ADX Indicator Strategies,Parabolic SAR Trading Techniques,MACD ADX Trading Signals,How to Use Parabolic SAR Effectively,MACD Trading Tips and Tricks,ADX Indicator Explained for Traders,Parabolic SAR Trend Analysis,MACD ADX Strategy for Beginners,Mastering Parabolic SAR in Trading,

0 notes

Video

youtube

⚡ Daily $2500 Profit: Olymp Trade Strategy with 2 Parabolic Sar 💲

0 notes

Text

ADX and Parabolic SAR EAs: Trend Confirmation

Trend confirmation is a vital aspect of successful trading, allowing traders to validate the strength and direction of market trends before making trading decisions. Two popular technical indicators used for trend confirmation are the Average Directional Index (ADX) and the Parabolic Stop and Reverse (SAR). forex Expert Advisors (EAs) are frequently employed to automate trading strategies based on these indicators. In this article, we will explore the ADX and Parabolic SAR indicators, how EAs implement strategies using them, and the advantages of trend confirmation in trading.

1. Understanding the ADX and Parabolic SAR Indicators

What Is the ADX Indicator?

The Average Directional Index (ADX) is a technical indicator that measures the strength and direction of a trend. It is part of the Directional Movement System and is composed of three lines:

ADX Line: The ADX line quantifies the strength of the trend, with values ranging from 0 to 100. Higher values indicate a stronger trend, while lower values suggest a weaker or sideways market.

+DI Line: The Positive Directional Indicator (+DI) measures the strength of the uptrend. It is calculated by comparing the current high to the previous high.

-DI Line: The Negative Directional Indicator (-DI) measures the strength of the downtrend. It is calculated by comparing the current low to the previous low.

What Is the Parabolic SAR Indicator?

The Parabolic Stop and Reverse (SAR) is a trend-following indicator designed to identify potential reversal points in price trends. It places dots either above or below price candles, indicating the direction of the trend. When dots switch from being above to below the price, it suggests a potential trend reversal from bullish to bearish, and vice versa.

2. Implementing ADX and Parabolic SAR Strategies with EAs

EAs are used to automate trading strategies based on the ADX and Parabolic SAR indicators. Here's how EAs implement these strategies:

a. Strategy Definition

Traders define the ADX and Parabolic SAR strategy, specifying parameters such as the timeframes for these indicators, the conditions for trend confirmation, and the entry and exit criteria.

b. Market Analysis

The EA continuously analyzes market conditions by calculating the ADX and Parabolic SAR values based on historical and real-time price data.

c. Signal Generation

Based on the predefined strategy and the interaction of price with the ADX and Parabolic SAR, the EA generates trading signals. These signals indicate potential entry and exit points and the direction of the trade (long or short).

d. Order Execution

The EA automatically executes trades based on the generated signals. It can place market orders, limit orders, or stop orders, depending on the strategy's conditions.

e. Risk Management

Effective risk management is crucial when using ADX and Parabolic SAR-based strategies. EAs often incorporate stop-loss and take-profit levels based on these indicators or other risk management techniques.

f. Position Monitoring

The EA continuously monitors open positions, tracks changes in ADX and Parabolic SAR values, and makes adjustments as necessary. This may involve trailing stops, modifying take-profit levels, or closing positions.

3. Advantages of Trend Confirmation with ADX and Parabolic SAR EAs

a. Objective Trend Assessment: ADX and Parabolic SAR EAs provide objective signals for confirming trends, reducing emotional biases in trading decisions.

b. Versatility: These indicators can be applied to various asset classes and timeframes, making them adaptable to different trading preferences.

c. Improved Timing: Trend confirmation helps traders enter and exit trades at more opportune moments, potentially increasing profitability.

4. Considerations for Using ADX and Parabolic SAR EAs

a. Strategy Development: Traders should thoroughly understand the ADX and Parabolic SAR strategy they are using and consider backtesting it with historical data.

b. Risk Management: Implement proper risk management, including stop-loss and take-profit levels, to protect capital when trading with ADX and Parabolic SAR EAs.

c. Real-Time Monitoring: Continuously monitor the performance of trend confirmation strategies and be prepared to make adjustments if market conditions change.

In conclusion, ADX and Parabolic SAR EAs offer traders a valuable tool for confirming trends and making more informed trading decisions. The ability to objectively assess trend strength and potential reversals can enhance trading strategies and potentially lead to more profitable outcomes. However, traders should approach trend confirmation with a well-defined strategy, effective risk management, and continuous monitoring to maximize their effectiveness in navigating dynamic market conditions.

0 notes

Text

Does an indicator work in Forex?

Indicators can be useful tools in Forex trading, but they are not foolproof and do not guarantee success. An indicator in Forex is a mathematical calculation based on historical price data, volume, or open interest that aims to provide insights into market trends, momentum, volatility, and potential entry or exit points for trades.

Super Arrow mt4 indicator

Different types of indicators exist, including:

1. **Trend-following indicators**: These indicators help traders identify the direction of the prevailing trend in the market. Examples include Moving Averages (MA), Ichimoku Cloud, and Parabolic SAR.

2. **Oscillators**: Oscillators help traders identify overbought or oversold conditions in the market, which can suggest potential reversal points. Examples include the Relative Strength Index (RSI), Stochastic Oscillator, and the Moving Average Convergence Divergence (MACD).

3. **Volatility indicators**: These indicators measure the degree of price variability in the market. Examples include the Average True Range (ATR) and Bollinger Bands.

While indicators can provide valuable insights and support decision-making, they are not perfect and have limitations. Here are some points to consider:

1. **Lagging nature**: Many indicators are based on past price data, so they can lag behind real-time market movements. This lag can lead to delayed signals and potentially missed opportunities.

2. **False signals**: Indicators can produce false or misleading signals, especially during choppy or ranging market conditions. Relying solely on indicators without considering other factors can be risky.

3. **Subjectivity**: Traders may interpret indicators differently, leading to varying trading decisions. The effectiveness of an indicator can depend on the trader's experience and skill in using it.

4. **Changing market conditions**: Market dynamics can change over time, affecting the reliability of certain indicators. An indicator that worked well in the past may not perform as effectively in the future.

Indicators can be useful tools in Forex trading, but it's essential to understand their limitations and use them in conjunction with other analysis methods. Indicators are mathematical calculations based on historical price data or other market-related information, and they are used to provide insights into potential market trends, momentum, volatility, and other aspects of the price action.

Some commonly used indicators in Forex trading include Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, and many others.

The effectiveness of indicators depends on various factors, including the trader's strategy, timeframe, and the market conditions. Here are some points to consider regarding the use of indicators:

1. Lagging Nature: Most indicators are lagging in nature, meaning they use past price data to generate signals. As a result, they may not provide real-time insights into market movements and can sometimes give delayed signals.

2. Subjectivity: Different traders may interpret indicators differently, leading to varying trading decisions. This subjectivity can sometimes lead to conflicting signals or confusion.

3. Complementary Analysis: Indicators are best used as part of a comprehensive trading strategy, along with other forms of analysis like fundamental analysis, price action analysis, and market sentiment analysis.

4. False Signals: Indicators can generate false signals, especially in choppy or sideways markets. Relying solely on indicators without considering other factors may lead to poor trading decisions.

5. Historical Performance: Past performance of an indicator does not guarantee future results. Market conditions can change, and indicators may lose their effectiveness during certain periods.

6. Over-optimization: Traders should avoid over-optimizing indicators to fit historical data perfectly, as it may lead to curve-fitting and unreliable results in live trading.

In conclusion, indicators can be valuable tools when used judiciously and in conjunction with other analysis methods. Traders should avoid relying solely on indicators and focus on building a robust trading strategy that considers multiple factors influencing the market. Continuous learning, practice, and risk management are essential components of successful Forex trading.

0 notes

Text

Unveiling Mastery: The 12 Best Technical Analysis Tools for Traders

Technical analysis is a fundamental aspect of trading in the financial markets. It involves studying historical price and volume data to forecast future price movements. Traders employ various tools to analyze charts and identify potential trading opportunities. From simple trendlines to complex indicators, the arsenal of technical analysis tools is vast and diverse. In this article, we'll explore 12 of the best technical analysis tools that traders use to make informed decisions and enhance their trading strategies.

Moving Averages: Moving averages are among the most popular technical analysis tools. They smooth out price data by calculating the average closing price over a specified period. Traders use moving averages to identify trends, determine support and resistance levels, and generate buy or sell signals.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100 and is used to identify overbought or oversold conditions in the market. Traders look for divergences between price and the RSI to anticipate potential reversals.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that consists of two lines – the MACD line and the signal line. Traders use MACD to identify changes in trend direction, confirm trend strength, and generate buy or sell signals.

Bollinger Bands: Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below the moving average. They help traders identify volatility and potential reversal points. When the price touches or crosses the upper or lower band, it may indicate overbought or oversold conditions.

Fibonacci Retracement: Fibonacci retracement levels are based on the mathematical relationships identified by the Fibonacci sequence. Traders use Fibonacci retracement levels to identify potential support and resistance levels and predict the extent of price corrections during trends.

Volume Profile: Volume profile displays the volume traded at each price level over a specified period. It helps traders identify significant support and resistance zones based on the volume of trades. Traders use volume profile to confirm price movements and anticipate potential reversals.

Ichimoku Cloud: The Ichimoku Cloud is a comprehensive indicator that provides insights into trend direction, momentum, and support and resistance levels. It consists of several components, including the Kumo (cloud), Tenkan-sen (conversion line), and Kijun-sen (baseline). Traders use the Ichimoku Cloud to identify trend changes and trading opportunities.

Stochastic Oscillator: The Stochastic Oscillator is a momentum indicator that compares the closing price of a security to its price range over a specified period. It oscillates between 0 and 100 and is used to identify overbought or oversold conditions. Traders look for bullish or bearish divergences to anticipate reversals.

Average True Range (ATR): ATR measures market volatility by calculating the average range between high and low prices over a specified period. Traders use ATR to set stop-loss and take-profit levels based on the volatility of the market.

Pivot Points: Pivot points are mathematical calculations based on the previous day's high, low, and close prices. They help traders identify potential support and resistance levels for the current trading day. Pivot points are widely used by day traders to plan entry and exit points for their trades.

Parabolic SAR (Stop and Reverse): Parabolic SAR is a trend-following indicator that provides entry and exit signals based on price momentum. It places dots above or below the price chart, indicating potential trend reversals. Traders use Parabolic SAR to trail stop-loss orders and identify potential trend changes.

Volume Oscillator: Volume oscillator compares the volume of trades over two different periods and displays the difference as an oscillator. It helps traders identify changes in volume momentum and confirm the strength of price movements. Traders use volume oscillator to identify bullish or bearish signals based on volume divergence.

In conclusion, mastering technical analysis tools is essential for traders looking to navigate the dynamic world of financial markets. While the tools mentioned above are among the most popular and widely used, it's important for traders to experiment and find the combination of tools that best suits their trading style and objectives. By incorporating these technical analysis tools into their trading strategies, traders can make more informed decisions and increase their chances of success in the markets.

0 notes

Text

What are Trading Indicators?

If you're new to trading or looking to enhance your trading strategies, understanding trading indicators is a crucial step. Trading indicators are powerful tools that help traders analyze market conditions, identify trends, and make informed trading decisions. They are mathematical calculations applied to historical price and volume data, providing insights into potential entry and exit points, market strength, and trend reversals. By incorporating these indicators into your trading approach, you can gain a competitive edge and increase your chances of success in the financial markets.

From trend-following indicators that highlight the direction of the market to oscillators that help identify overbought or oversold conditions, there is a wide range of trading indicators to choose from. Each indicator has its unique calculation methodology and interpretation. Some popular examples include Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence). These indicators can be applied to various financial markets, such as stocks, forex, commodities, and cryptocurrencies, enabling traders to make informed decisions across different asset classes.

Are you ready to take your trading to the next level? By mastering the art of trading indicators, you can gain valuable insights into market trends, price movements, and potential reversals. Join me in my upcoming blog posts, where we'll explore different types of trading indicators in detail, learn how to use them effectively in your trading strategies, and uncover advanced techniques to maximize their effectiveness. Get ready to enhance your trading skills, make smarter trading decisions, and embark on a successful trading journey. Stay tuned and get ready to dive into the fascinating world of trading indicators!

What is a Trading Indicator?

Trading indicators are mathematical calculations or visual representations of market data that provide insights into the current and future direction of price movements in financial markets. These indicators are derived from various types of data, such as price, volume, or open interest, and are used by traders to identify potential trading opportunities, determine market trends, and make informed trading decisions.

Types of Trading Indicators

There is a wide range of trading indicators available, each designed to serve a specific purpose and provide unique insights into market dynamics. Let's explore some of the most commonly used types of trading indicators:

Trend Following Indicators

Trend following indicators are used to identify and confirm the direction of market trends. These indicators are particularly useful for traders who prefer to ride the momentum of an established trend. Some popular trend following indicators include Moving Averages, Average Directional Index (ADX), and Parabolic SAR.

- Moving Averages: Moving averages calculate the average price over a specific period and help smooth out price fluctuations, making it easier to identify trends.

- Average Directional Index (ADX): The ADX indicator measures the strength of a trend and helps traders determine whether a market is trending or ranging.

- Parabolic SAR: The Parabolic SAR indicator is used to identify potential trend reversals and provides stop-loss levels for traders.

Best Trend Following Indicators

Oscillators

Oscillators are indicators that fluctuate within a specific range, indicating overbought or oversold conditions in the market. These indicators are valuable for identifying potential turning points in the price and generating buy or sell signals. Commonly used oscillators include Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements and is used to identify overbought or oversold conditions in the market.

- Stochastic Oscillator: The Stochastic Oscillator compares the closing price of an asset to its price range over a specific period, helping traders identify potential reversals.

- Moving Average Convergence Divergence (MACD): The MACD indicator is a versatile tool that combines trend-following and momentum elements. It provides signals based on the interaction between two moving averages.

Oscillators Indicators

Volume Indicators

Volume indicators analyze the trading volume of a security and provide insights into the strength or weakness of a price movement. These indicators help traders confirm trends, identify potential reversals, and gauge market participation. Popular volume indicators include On-Balance Volume (OBV), Chaikin Money Flow, and Volume Weighted Average Price (VWAP).

- On-Balance Volume (OBV): The OBV indicator measures buying and selling pressure based on the cumulative volume of a security. It helps traders confirm trends and anticipate trend reversals.

- Chaikin Money Flow: The Chaikin Money Flow indicator combines price and volume data to measure the flow of money into or out of a security. It helps traders assess the strength of a price trend.

- Volume Weighted Average Price (VWAP): The VWAP indicator calculates the average price weighted by trading volume. It is commonly used by day traders to identify potential support or resistance levels.

Volume Indicators

Volatility Indicators

Volatility indicators measure the rate at which prices of a security fluctuate. These indicators help traders identify periods of high or

low volatility, which can be useful for determining entry and exit points. Volatility indicators can also assist in setting appropriate stop-loss and take-profit levels. Some widely used volatility indicators include Bollinger Bands, Average True Range (ATR), and Donchian Channels.

- Bollinger Bands: Bollinger Bands consist of a moving average (typically the 20-day simple moving average) and two standard deviation lines above and below the moving average. They expand and contract based on market volatility, providing insights into potential price breakouts or reversals.

- Average True Range (ATR): The ATR indicator measures the average range between high and low prices over a specified period. It helps traders gauge the volatility of an asset and determine suitable stop-loss levels.

- Donchian Channels: Donchian Channels plot the highest high and lowest low prices over a specified period. Traders can use these channels to identify breakouts and set stop-loss or take-profit levels.

Volatility Indicators

Sentiment Indicators

Sentiment indicators gauge the overall sentiment or market psychology of traders and investors. These indicators help assess whether the market is bullish, bearish, or neutral, and can be valuable for contrarian trading strategies. Examples of sentiment indicators include the Put/Call Ratio, the Volatility Index (VIX), and the Commitment of Traders (COT) report.

- Put/Call Ratio: The Put/Call Ratio compares the trading volume of put options to call options. A high ratio suggests bearish sentiment, while a low ratio indicates bullish sentiment.

- Volatility Index (VIX): The VIX, also known as the "fear index," measures market volatility and investor expectations of future price fluctuations. It can be used as a contrarian indicator, with high levels indicating fear and potential buying opportunities.

- Commitment of Traders (COT) report: The COT report provides insights into the positions of large traders, such as commercial hedgers and institutional investors. It helps traders assess the sentiment and positioning of market participants.

Sentiment Indicators

How to Use Trading Indicators

Now that we have explored the different types of trading indicators, let's discuss how to effectively use them in your trading strategies. Keep in mind that trading indicators should not be used in isolation but rather in conjunction with other analysis techniques and risk management principles. Here are some key considerations when using trading indicators:

Define Your Trading Goals and Strategy

Before incorporating trading indicators into your approach, it's essential to define your trading goals and strategy. Determine your preferred trading style (e.g., day trading, swing trading, or long-term investing) and the financial markets you want to trade (e.g., stocks, forex, or commodities). This clarity will help you select the most relevant indicators for your trading objectives.

Understand the Indicator's Calculation and Interpretation

Each trading indicator has a specific calculation methodology and interpretation. Take the time to understand how the indicator is calculated and what signals or insights it provides. Read the indicator's documentation, consult reputable educational resources, or seek guidance from experienced traders to grasp its nuances fully.

Avoid Indicator Overload

While it may be tempting to use multiple indicators simultaneously, it's crucial to avoid indicator overload. Having too many indicators can lead to conflicting signals and confusion. Instead, focus on a few well-chosen indicators that complement each other and align with your trading strategy. Remember, quality over quantity.

Combine Indicators for Confirmation

One effective way to use trading indicators is to combine different types of indicators to confirm signals. For example, you can use a trend-following indicator to identify the overall trend and an oscillator to pinpoint potential entry or exit points within that trend. When multiple indicators align and generate signals in the same direction, it increases the probability of a successful trade.

Implement Proper Risk Management

While trading indicators can provide valuable insights, it's crucial to implement proper risk management strategies alongside their use. Here are some risk management principles to keep in mind:

- Set Stop-Loss and Take-Profit Levels: Determine your risk tolerance and set appropriate stop-loss and take-profit levels for each trade. Stop-loss orders help limit potential losses if the market moves against your position, while take-profit orders allow you to secure profits when the price reaches your target.

- Use Position Sizing: Calculate the appropriate position size for each trade based on your risk tolerance and the distance between your entry and stop-loss levels. Position sizing ensures that you don't risk an excessive amount of your capital on a single trade.

- Diversify Your Portfolio: Avoid overexposure to a single asset or market. Diversify your portfolio by trading multiple assets or using different trading strategies. This helps spread your risk and reduce the impact of adverse price movements.

- Practice Proper Capital Management: Only allocate a portion of your trading capital to any single trade. Avoid risking a significant portion of your funds on a single trade, as it can lead to substantial losses. Instead, divide your capital among multiple trades to diversify risk.

- Regularly Review and Adjust: Continuously monitor your trades and assess their performance. If certain indicators or strategies are consistently underperforming, consider making adjustments or exploring alternative approaches. Regularly reviewing and adapting your trading plan is essential for long-term success.

Advanced Strategies for Trading with Indicators

Now that we have covered the basics of trading indicators and their usage, let's delve into some advanced strategies that can help you maximize their effectiveness.

Multiple Time Frame Analysis

One powerful technique is to perform multiple time frame analysis. Instead of relying solely on a single time frame, such as the daily chart, consider analyzing higher and lower time frames as well. For example, if you are trading based on a daily chart, also examine the weekly and hourly charts. This approach provides a broader perspective of the market and helps you identify trends and patterns that may not be evident on a single time frame. By aligning signals across multiple time frames, you can increase the probability of successful trades.

For instance, if the daily chart indicates an uptrend, but the weekly chart shows a strong resistance level approaching, it may be wise to exercise caution and consider taking profits or adjusting your position size.

Indicator Divergence

Divergence occurs when the price of an asset moves in the opposite direction of the indicator. It often signifies a potential trend reversal or a weakening of the current trend. Divergence can be bullish or bearish.

Bullish Divergence: Bullish divergence occurs when the price forms lower lows, but the indicator forms higher lows. It suggests that selling pressure is weakening, and a bullish reversal may be imminent. Traders can look for bullish divergence as a potential buying opportunity.

Bearish Divergence: Bearish divergence occurs when the price forms higher highs, but the indicator forms lower highs. It indicates that buying pressure is diminishing, and a bearish reversal may be on the horizon. Traders can watch for bearish divergence as a signal to consider short positions or tighten stop-loss levels.

Confirmation with Candlestick Patterns

Candlestick patterns provide valuable insights into market sentiment and can be used to confirm signals generated by trading indicators. By combining the analysis of candlestick patterns with indicator signals, you can strengthen your trading decisions.

For example, if a trend-following indicator generates a buy signal, look for bullish candlestick patterns, such as a bullish engulfing pattern or a hammer, to confirm the signal. Similarly, if an oscillator indicates overbought conditions, watch for bearish candlestick patterns, like a shooting star or a bearish engulfing pattern, to validate the potential reversal.

Customizing Indicator Settings

Most trading indicators come with default settings, but they can be adjusted to suit your trading style and preferences. Experimenting with different parameter settings can help fine-tune the indicators for improved accuracy.

For instance, moving averages have different periods (e.g., 20-day, 50-day, or 200-day). Shorter periods are more sensitive to price movements, while longer periods provide a smoother average. Find the balance that aligns with your trading strategy and the time frame you are analyzing.

Backtesting and Optimization

Before implementing any indicator-based strategy in live trading, it is essential to backtest and optimize the strategy using historical data. Backtesting involves applying your trading rules to past market data to assess their performance. This process helps you evaluate the profitability and reliability of your strategy before risking real capital.

Additionally, optimization allows you to test different indicator settings and parameters to find the optimal configuration for your strategy. Remember to use out-of-sample data to validate your optimized strategy to ensure it is not overfitting to past data.

Combine Indicators from Different Categories

Another approach is to combine indicators from different categories to gain a more comprehensive view of the market. For example, you can combine a trend-following indicator, such as the Moving Average, with an oscillator, such as the Relative Strength Index (RSI), to identify potential entry points within an established trend. By using indicators from different categories, you can leverage the strengths of each indicator and increase the robustness of your trading strategy.

For instance, you could wait for a trend-following indicator to confirm the direction of the market trend. Once the trend is established, you can then look for oversold or overbought conditions using an oscillator to pinpoint favorable entry or exit points within that trend. This combination helps you align your trades with the prevailing trend while also considering market momentum.

Remember, it's important to strike a balance and avoid overcrowding your charts with too many indicators. Focus on a few well-chosen indicators that complement each other and provide meaningful insights into the market conditions you are trading.

Practice Discipline and Patience

Trading with indicators requires discipline and patience. Avoid the temptation to enter trades solely based on a single indicator signal. Wait for additional confirmation from other indicators or analysis techniques before executing a trade. By exercising patience and waiting for high-probability setups, you can increase your chances of success.

Additionally, stick to your trading plan and avoid impulsive decisions based on short-term market fluctuations. Trust the signals generated by your indicators and follow your predefined risk management rules consistently.

Continual Learning and Adaptation

The financial markets are dynamic and ever-changing, requiring traders to continually learn and adapt. Stay updated with the latest developments in trading indicators and techniques. Explore new indicators, study different trading strategies, and analyze market conditions to refine your approach.

Engage with trading communities, participate in forums or webinars, and read educational materials to gain insights from experienced traders. Continual learning and adaptation will help you stay ahead of the curve and enhance your trading skills over time.

Conclusion

Trading indicators are powerful tools that can provide valuable insights into market trends, momentum, and potential reversals. By understanding the different types of indicators, employing advanced strategies, and combining indicators effectively, you can enhance your trading decisions and improve the overall profitability of your trades.

However, it's important to remember that indicators are not infallible and should always be used in conjunction with other analysis techniques and risk management principles. Developing a robust trading strategy that incorporates indicators while considering market conditions and individual preferences is key to successful trading.

Remember, trading requires practice, discipline, and continual learning. Regularly assess and evaluate your trading performance, adapt your strategies as needed, and always prioritize risk management. With time, experience, and a deep understanding of trading indicators, you can navigate the financial markets with confidence and increase your chances of achieving consistent profitability.

FAQs

What are trading indicators? Trading indicators are mathematical calculations applied to historical price and volume data in the financial markets. They help traders analyze market conditions, identify trends, and make informed trading decisions. These indicators provide insights into potential entry and exit points, market strength, and trend reversals. They come in various types, such as trend-following indicators, oscillators, volume-based indicators, and volatility indicators. How do trading indicators work? Trading indicators work by processing historical market data to generate signals or graphical representations that traders can interpret. They use mathematical formulas and statistical calculations to identify patterns, trends, and potential market conditions. Traders can use these indicators to confirm or validate their trading strategies, identify buying or selling opportunities, and manage risk. What are some commonly used trading indicators? There is a wide range of trading indicators available, and the choice of which to use depends on the trader's trading style and preferences. Some commonly used trading indicators include Moving Averages, Relative Strength Index (RSI), Bollinger Bands, MACD (Moving Average Convergence Divergence), Stochastic Oscillator, and Fibonacci retracement levels. Each indicator has its specific calculation method and interpretation, providing different insights into the market. Can trading indicators guarantee profitable trades?

Read the full article

0 notes

Link

#candlestickpatterns#forexmarketanalysis#Forextrading#momentumindicators#movingaverages#oscillators#supportandresistance#technicalindicators#tradingstrategies#trendanalysis

0 notes

Photo

How to Use ADX (Average Directional Index) in Forex

Average Directional Index or ADX Indicator referred to as a “market strength indicator.” ADX indicator invented by J. Welles Wilder. Pioneer in technical analysis who also devised the Relative Strength Index Indicator, the Parabolic SAR, and many other indicators. ADX is a technical analysis tool that traders may use to gain a better read on the broader market.

Visit: https://www.milliva.com/blog/know-how-to-use-adx-indicator-in-your-forex-trading/

Follow Us

Blog: https://www.milliva.com/blog

Instagram - https://www.instagram.com/millivafx

Twitter - https://twitter.com/milliva_fx

Linked in - https://www.linkedin.com/in/milliva-fx-386902221

Facebook - https://www.facebook.com/Millivaforex

#milliva #forex #Trading #trader #currencypairs #money #investment #profit #bonus #welcomebonus #freedeposit #fx #trending #new #updates #successful #forexmarket #trade #strategies #ideas #top #topper #daytrading #forexsignal #fxsignal #fxgraph #stock #business #invest #finance

0 notes

Text

FX Technique Parabolic SAR ADX

FX Technique Parabolic SAR ADX

FX Technique Parabolic SAR ADX

View On WordPress

0 notes

Text

FX Technique Parabolic SAR ADX

FX Technique Parabolic SAR ADX

FX Technique Parabolic SAR ADX

View On WordPress

0 notes