#PredatoryLending

Text

What You Need to Know to Avoid Predatory Lending?

Predatory lending is defined as any lending situation that is not structured in the borrower's best interests. To avoid predatory lending, conduct due diligence on any possible lender and ensure that they are licensed and in good standing with appropriate regulatory organizations.

Speak with your real estate agent: If you have questions about your lender, your agent may be able to help. Maybe your worries are just regular home-buying nerves. Perhaps not. An skilled agent should be able to tell the difference. Of course, if your loan was recommended to you by your realtor, this may not be the greatest alternative.

Examine your paperwork: Look for blank sections or documents near signature lines, dollar figures that do not match the amount you are attempting to borrow, and fees that are greater than usual. An origination cost that is noticeably higher than this is grounds for concern.

Make contact with a state or federal resource: If you believe your lender is acting unethically or illegally, the Department of Housing and Urban Development (HUD) maintains a list of local options organized by state that can assist you.

Please contact the FBI: Mortgage fraud is a felony. Contact the FBI if you believe you are a victim.

Contact the Department of Housing and Urban Development (HUD) at the following address: To report a concern with your lender, you can email the HUD directly.

Speak with another lender: You have the right to a second opinion at any time. Try asking a trusted friend or family member for a referral to another lender. Speaking with another lender may either assuage your anxieties or confirm your suspicions.

In the US, a home invasion happens every 15 seconds. This alarming number demonstrates the need of taking every safety measure possible to safeguard your home and loved ones from harm with cove security system. We all desire a world that is more secure and tranquil. And it begins in our own neighborhoods.

#Lending#mortgage#PredatoryLending#HomeBuyingOptions#Home#BetterHome#SmartHome#HUD#HousingOptions#HOAS#HomeSecuritySystem#HomeAutomation#RealEstate#BrokerCompany

3 notes

·

View notes

Text

We’re expected to believe the system has simply always been as it is now, like a yo-yo dieter who loses a few, gains more back, loses a few, gains more back, on and on. Like a system dominated by the Fed and its bullsh!t cycles of QE and QT is the best we can do and we should accept it and go back to sleep. Reminds me of Bill Hicks:

Go back to bed, America. Your government has figured out how it all transpired. Go back to bed, America. Your government is in control again. Here’s American Gladiators. Watch this, shut up. Go back to bed, America. Here is American Gladiators. Here is 56 channels of it!

The questions we’re not supposed to ask are WHY do we live this way? WHO profits from it? HOW did it get this way? You’re supposed to shrug your shoulders and blithely say, “I guess this is how the world works.”

0 notes

Text

Learn About Money: Helping Communities Beat Financial Stress

#financialeducation #financialstress #financialtrauma #predatorylenders #underservedcommunities

#Business#financialeducation#financialstress#financialtrauma#predatorylenders#underservedcommunities

0 notes

Photo

Financial Word of the Day: Financial Literacy Financial literacy is the state of being knowledgeable about personal financial management. This includes knowing how to balance a checkbook, read, and interpret lending agreements, and creating and maintaining a spending plan. Did you know that lack of financial literacy is one of the most prevalent sources of delinquent debt? Many individuals in debt fail to: - evaluate credit offers properly - do not understand interest rates and finance charges - are not proactive in the management of their A QUESTION FOR EVERYONE... How many of you were taught how to budget when you were a child? Do you know how to reconcile your receipts with what you've paid out every week or month? Do your child(ren) know how to fill out a check? Do your child(ren) know how to sign their name and read cursive? If I gave a free webinar on how to help your kids have a 750+ score before they reach the age 18, would you be present? Please like, comment, and share. Sharing is caring😊 Need help with increasing your credit score, let's have a conversation and you may book an appointment with me for a Discovery Call: https://bit.ly/3rgz0hi. I partner with #MortgageLenders, #Realtors, and other #RealEstateProfessionals to help them close more homeowners! The more you know, the more you can grow! #RiseUpFinancialFreedomSolutions #BeAboutYourCredit #GettingIntoDebt #CollectionAgencies #ConsumerWorkouts #CreditCouseling #DebtSettlement #DeficiencyBalance #FinancialLiteracy #LawSuits #MortgageWorkouts #NoticeOfAcceleration #NoticeOfDefault #NoticetoQuit #PredatoryLending #CreditScoreIncrease #CreditScoreImprovement #BeAboutYourBusiness #CreditReport #CreditRestoration #Renters #Tenants (at Rise Up Financial Freedom Solutions LLC) https://www.instagram.com/p/CR2iR70hYbE/?utm_medium=tumblr

#mortgagelenders#realtors#realestateprofessionals#riseupfinancialfreedomsolutions#beaboutyourcredit#gettingintodebt#collectionagencies#consumerworkouts#creditcouseling#debtsettlement#deficiencybalance#financialliteracy#lawsuits#mortgageworkouts#noticeofacceleration#noticeofdefault#noticetoquit#predatorylending#creditscoreincrease#creditscoreimprovement#beaboutyourbusiness#creditreport#creditrestoration#renters#tenants

2 notes

·

View notes

Text

California Caps Interest Rates on Certain Loans

Class-action litigation attorney Jeffrey Douglas Kaliel opened law offices in Washington, DC, more than two years ago. As a lawyer with extensive experience, Jeffrey Douglas Kaliel has worked on cases involving predatory lending practices in the banking industry.

Predatory lending practices have always been a part of the national discussion. In California, the legislature has passed a bill that will cap the interest rates on consumer “payday” loans. According to CNBC, California has always had problems related to unfair payday loan practices.

A payday loan is a relatively small amount of money that an institution lends at a high-interest rate. The loan is to be repaid on the borrower’s next payday. The California law, AB 539, also called the Fair Access to Credit Act, prevents lenders from charging more than 36 percent interest on loans between $2,500 and $10,000.

Payday loans are a favorite of workers living paycheck to paycheck because the requirements for approval are lenient. Borrowers need only a valid piece of identification, a bank account, and proof of income. The requirements are lax because the interest on the loans is extremely high.

1 note

·

View note

Photo

Thanks for the support? (3) #toronto #yongestreet #moneydirect #predatorylending #lgbtq #pride #blacklivesmatter https://www.instagram.com/p/CBqgelmgcBk/?igshid=1x8egty5ed7i6

0 notes

Photo

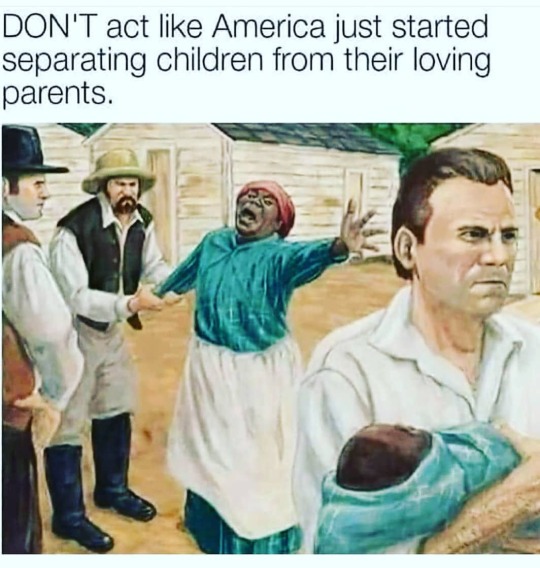

Separating children from their families is as normal as apple pie and baseball in America...But you claim family values...#ThisIsAmerikkka #ChattelSlavery #RedLining #PrivatizedPrisons #UnRealisticSentencing #PredatoryLending https://www.instagram.com/p/B8rS5kJhLocxTPm0W6eMUkiMRMIjLDInMC4gUc0/?igshid=1jw7yw7wubj31

0 notes

Photo

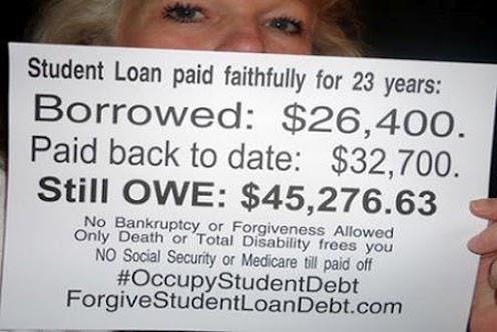

@berniesanders #studentloans #presidentialrace2020 #berniesanders #predatorylending #auntiekim https://www.instagram.com/p/BzjRITWphBH/?igshid=xflel5qvahih

0 notes

Photo

In an emergency you might need some extra cash fast. Having your emergency fund at the ready would be ideal to cover your conundrum, but what if your emergency fund has been depleted, or you can’t or don’t want to use a credit card or line of credit to get through a crisis? There are other options out there – a cash advance or a payday loan. But beware – these options pose some serious caveats. If you are ready to take control of your financial future. Let’s grab coffee. Read more here: https://wealthwave.com/ryanwinkle/blog/payday-loans-cash-advances #NewMoneyHabits #Wealthwave #Relentless #paydayloans #predatorylending #controlyourfuture #takethepowerback #howmoneyworks (at Innovative Urban Solutions) https://www.instagram.com/p/BtWP7QIhpVq/?utm_source=ig_tumblr_share&igshid=54j3t4ix8jyn

#newmoneyhabits#wealthwave#relentless#paydayloans#predatorylending#controlyourfuture#takethepowerback#howmoneyworks

0 notes

Video

I Never Play Fair When It Comes To Credit. Get Ready To Join What Will Eventually BECOME The Number One Credit Community In The Country. If You Don't Know How To Cheat, Then You're Not Even In The Game. #coreypsmith #conspiracyofcredit #mcs #winner #losangeles #houston #lifestyle #realestateinvestor #millionairemindset #luxurylifestyle #selfmade #memphis #realshit #predatorylending #blacksuccess #blackwealth #entrepreneur #creditrepairservices #mentor #coaching #motivation https://www.instagram.com/p/Bu1bZdHnAC-/?utm_source=ig_tumblr_share&igshid=x8q1bjnk30ei

#coreypsmith#conspiracyofcredit#mcs#winner#losangeles#houston#lifestyle#realestateinvestor#millionairemindset#luxurylifestyle#selfmade#memphis#realshit#predatorylending#blacksuccess#blackwealth#entrepreneur#creditrepairservices#mentor#coaching#motivation

0 notes

Photo

SourceFunding.org founder W. Michael Short interviewed on @wcbsnewsradio880 “Small Business Spotlight.” #smallbusiness #businessfinance #businessfinancing #businessfunding #startupnews #businessnews #socialenterpreneur #entrepreneur #usa #financialinclusion #economicdevelopment #economicempowerment #predatorylending #onlinelending #fintech #nyc (at WCBS Newsradio 880)

#businessfinancing#economicempowerment#economicdevelopment#nyc#businessnews#predatorylending#fintech#smallbusiness#businessfunding#socialenterpreneur#financialinclusion#onlinelending#entrepreneur#usa#startupnews#businessfinance

0 notes

Photo

Just chilling at the #predatorylending #store #grrr #art #magick #meditation #ontheroad #seeokc (at Oklahoma City, Oklahoma)

0 notes

Photo

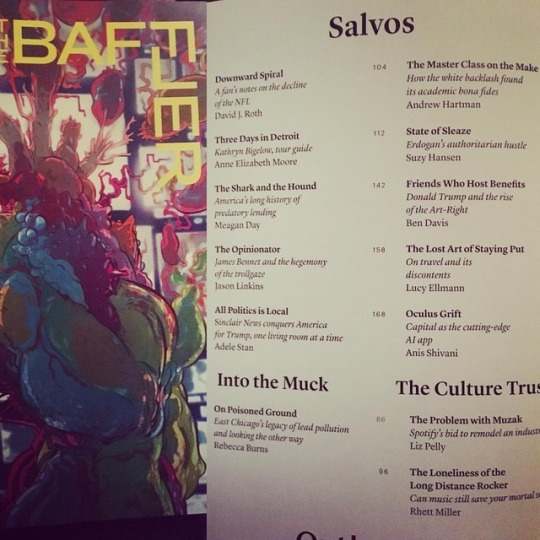

@thebafflermag #issue 37 looking spectacular #printisnotdead #salvos #thomasfrank #subscription // #spotify #music #chicago #epa #pollution #turkey #erdogan #predatorylending #sinclair #media #trump // #essays (at Providence, Rhode Island)

#subscription#epa#turkey#chicago#pollution#predatorylending#salvos#spotify#thomasfrank#trump#media#erdogan#music#issue#sinclair#printisnotdead#essays

0 notes

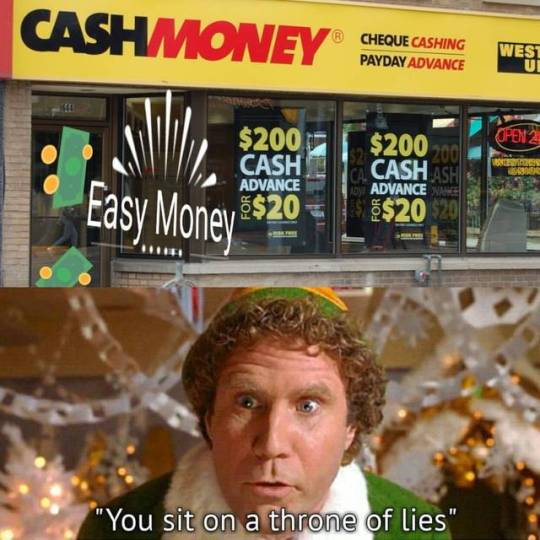

Photo

Don't fall into the payday loan trap!!! They charge crazy interest and so many people get caught in a cycle of financial death with them. Don't be fooled, these "businesses" are legalized loan sharks, predatory lenders that prey on the poor & unprepared. • • #LoanSharks #CashMoney #MoneyMart #ThroneOfLies #Elf #ChristmasMovies #PredatoryLending #YoureNotSanta

0 notes

Photo

Word of the Day: Notice To Quit (Notice to vacate) A notice to quit or vacate is a document a renter receives from the landlord as a first step in the eviction process. Avoiding an eviction is something that is beneficial to understand before signing a lease agreement. Due to the pandemic, this has become a huge issue for many families. If you are having trouble coming up with the money due to a temporary setback, contact the landlord and explain the situation. With the moratorium, renters have until July 31st, this Saturday, before landlords have the right to send a notice to vacate before filing a summary ejectment and complaint if you are behind on your rent. A QUESTION FOR EVERYONE... Have you been financially affected due to the pandemic and are behind in rent? Have you made any arrangements that will work out in your favor while you search for employment or another place to move to that's affordable? Do you understand that rent is going up more than it will ever remain "affordable"? Are you ready to find a way to prepare for homeownership? Please like, comment, and share. Sharing is caring😊 Need help with increasing your credit score, let's have a conversation and you may book an appointment with me for a Discovery Call: https://bit.ly/3rgz0hi. I partner with #MortgageLenders, #Realtors, and other #RealEstateProfessionals to help them close more homeowners! The more you know, the more you can grow! #RiseUpFinancialFreedomSolutions #BeAboutYourCredit #GettingIntoDebt #CollectionAgencies #ConsumerWorkouts #CreditCouseling #DebtSettlement #DeficiencyBalance #FinancialLiteracy #LawSuits #MortgageWorkouts #NoticeOfAcceleration #NoticeOfDefault #NoticetoQuit #PredatoryLending #CreditScoreIncrease #CreditScoreImprovement #BeAboutYourBusiness #CreditReport #CreditRestoration #Renters #Tenants (at Rise Up Financial Freedom Solutions LLC) https://www.instagram.com/p/CR7EvgThxnM/?utm_medium=tumblr

#mortgagelenders#realtors#realestateprofessionals#riseupfinancialfreedomsolutions#beaboutyourcredit#gettingintodebt#collectionagencies#consumerworkouts#creditcouseling#debtsettlement#deficiencybalance#financialliteracy#lawsuits#mortgageworkouts#noticeofacceleration#noticeofdefault#noticetoquit#predatorylending#creditscoreincrease#creditscoreimprovement#beaboutyourbusiness#creditreport#creditrestoration#renters#tenants

0 notes

Photo

@Regrann from @indivisiblenorthseattle - #RobertReich #StudentLoanDebt #PredatoryLending

0 notes