#US tariffs and green tech

Explore tagged Tumblr posts

Text

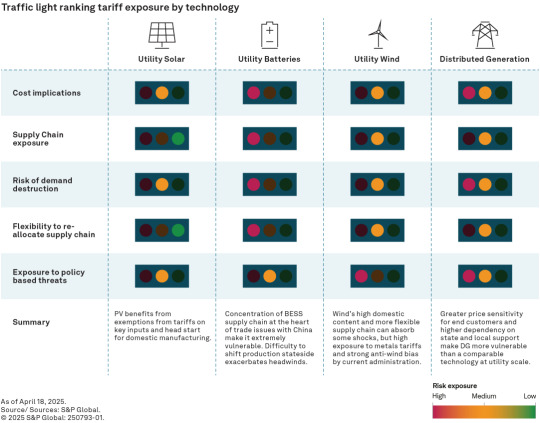

Impact of Trade Wars on Sustainable Energy Projects

How will the trade wars affect sustainable energy projects and products? S&P Global has a report that analyzes this. Any long-term conclusions are risky, given the US propensity to alter course (TACO tactics). But thanks to them for giving it a try. This traffic light analysis is helpful to understand the implications for different utility grade technologies. Batteries seem to be hit the…

View On WordPress

#clean energy policy uncertainty#cleantech investment uncertainty#energy transition trade impacts#energy transition traffic light analysis#impact of trade policy on clean energy#innovation#Logistics#renewable energy supply chain risks#renewable sector trade exposure#supply chains#sustainable energy trade tensions#trade wars and renewable energy#US tariffs and green tech#utility-scale renewable technologies

0 notes

Text

"The man who has called climate change a “hoax” also can be expected to wreak havoc on federal agencies central to understanding, and combating, climate change. But plenty of climate action would be very difficult for a second Trump administration to unravel, and the 47th president won’t be able to stop the inevitable economy-wide shift from fossil fuels to renewables.

“This is bad for the climate, full stop,” said Gernot Wagner, a climate economist at the Columbia Business School. “That said, this will be yet another wall that never gets built. Fundamental market forces are at play.”

A core irony of climate change is that markets incentivized the wide-scale burning of fossil fuels beginning in the Industrial Revolution, creating the mess humanity is mired in, and now those markets are driving a renewables revolution that will help fix it. Coal, oil, and gas are commodities whose prices fluctuate. As natural resources that humans pull from the ground, there’s really no improving on them — engineers can’t engineer new versions of coal.

By contrast, solar panels, wind turbines, and appliances like induction stoves only get better — more efficient and cheaper — with time. Energy experts believe solar power, the price of which fell 90 percent between 2010 and 2020, will continue to proliferate across the landscape. (Last year, the United States added three times as much solar capacity as natural gas.) Heat pumps now outsell gas furnaces in the U.S., due in part to government incentives. Last year, Maine announced it had reached its goal of installing 100,000 heat pumps two years ahead of schedule, in part thanks to state rebates. So if the Trump administration cut off the funding for heat pumps that the IRA provides, states could pick up the slack.

Local utilities are also finding novel ways to use heat pumps. Over in Massachusetts, for example, the utility Eversource Energy is experimenting with “networked geothermal,” in which the homes within a given neighborhood tap into water pumped from underground. Heat pumps use that water to heat or cool a space, which is vastly more efficient than burning natural gas. Eversource and two dozen other utilities, representing about half of the country’s natural gas customers, have formed a coalition to deploy more networked geothermal systems.

Beyond being more efficient, green tech is simply cheaper to adopt. Consider Texas, which long ago divorced its electrical grid from the national grid so it could skirt federal regulation. The Lone Star State is the nation’s biggest oil and gas producer, but it gets 40 percent of its total energy from carbon-free sources. “Texas has the most solar and wind of any state, not because Republicans in Texas love renewables, but because it’s the cheapest form of electricity there,” said Zeke Hausfather, a research scientist at Berkeley Earth, a climate research nonprofit. The next top three states for producing wind power — Iowa, Oklahoma, and Kansas — are red, too.

State regulators are also pressuring utilities to slash emissions, further driving the adoption of wind and solar power. As part of California’s goal of decarbonizing its power by 2045, the state increased battery storage by 757 percent between 2019 and 2023. Even electric cars and electric school buses can provide backup power for the grid. That allows utilities to load up on bountiful solar energy during the day, then drain those batteries at night — essential for weaning off fossil fuel power plants. Trump could slap tariffs on imported solar panels and thereby increase their price, but that would likely boost domestic manufacturing of those panels, helping the fledgling photovoltaic manufacturing industry in red states like Georgia and Texas.

The irony of Biden’s signature climate bill is states that overwhelmingly support Trump are some of the largest recipients of its funding. That means tampering with the IRA could land a Trump administration in political peril even with Republican control of the Senate, if not Congress. In addition to providing incentives to households (last year alone, 3.4 million American families claimed more than $8 billion in tax credits for home energy improvements), the legislation has so far resulted in $150 billion of new investment in the green economy since it was passed in 2022, boosting the manufacturing of technologies like batteries and solar panels. According to Atlas Public Policy, a research group, that could eventually create 160,000 jobs. “Something like 66 percent of all of the spending in the IRA has gone to red states,” Hausfather said. “There certainly is a contingency in the Republican party now that’s going to support keeping some of those subsidies around.”

Before Biden’s climate legislation passed, much more progress was happening at a state and local level. New York, for instance, set a goal to reduce its greenhouse gas emissions from 1990 levels by 40 percent by 2030, and 85 percent by 2050. Colorado, too, is aiming to slash emissions by at least 90 percent by 2050. The automaker Stellantis has signed an agreement with the state of California promising to meet the state’s zero-emissions vehicle mandate even if a judicial or federal action overturns it. It then sells those same cars in other states.

“State governments are going to be the clearest counterbalance to the direction that Donald Trump will take the country on environmental policy,” said Thad Kousser, co-director of the Yankelovich Center for Social Science Research at the University of California, San Diego. “California and the states that ally with it are going to try to adhere to tighter standards if the Trump administration lowers national standards.”

[Note: One of the obscure but great things about how emissions regulations/markets work in the US is that automakers generally all follow California's emissions standards, and those standards are substantially higher than federal standards. Source]

Last week, 62 percent of Washington state voters soundly rejected a ballot initiative seeking to repeal a landmark law that raised funds to fight climate change. “Donald Trump’s going to learn something that our opponents in our initiative battle learned: Once people have a benefit, you can’t take it away,” Washington Governor Jay Inslee said in a press call Friday. “He is going to lose in his efforts to repeal the Inflation Reduction Act, because governors, mayors of both parties, are going to say, ‘This belongs to me, and you’re not going to get your grubby hands on it.’”

Even without federal funding, states regularly embark on their own large-scale projects to adapt to climate change. California voters, for instance, just overwhelmingly approved a $10 billion bond to fund water, climate, and wildfire prevention projects. “That will be an example,” said Saharnaz Mirzazad, executive director of the U.S. branch of ICLEI-Local Governments for Sustainability. “You can use that on a state level or local level to have [more of] these types of bonds. You can help build some infrastructure that is more resilient.”

Urban areas, too, have been major drivers of climate action: In 2021, 130 U.S. cities signed a U.N.-backed pledge to accelerate their decarbonization. “Having an unsupportive federal government, to say the least, will be not helpful,” said David Miller, managing director at the Centre for Urban Climate Policy and Economy at C40, a global network of mayors fighting climate change. “It doesn’t mean at all that climate action will stop. It won’t, and we’ve already seen that twice in recent U.S. history, when Republican administrations pulled out of international agreements. Cities step to the fore.”

And not in isolation, because mayors talk: Cities share information about how to write legislation, such as laws that reduce carbon emissions in buildings and ensure that new developments are connected to public transportation. They transform their food systems to grow more crops locally, providing jobs and reducing emissions associated with shipping produce from afar. “If anything,” Miller said, “having to push against an administration, like that we imagine is coming, will redouble the efforts to push at the local level.”

Federal funding — like how the U.S. Forest Service has been handing out $1.5 billion for planting trees in urban areas, made possible by the IRA — might dry up for many local projects, but city governments, community groups, and philanthropies will still be there. “You picture a web, and we’re taking scissors or a machete or something, and chopping one part of that web out,” said Elizabeth Sawin, the director of the Multisolving Institute, a Washington, D.C.-based nonprofit that promotes climate solutions. “There’s this resilience of having all these layers of partners.”

All told, climate progress has been unfolding on so many fronts for so many years — often without enough support from the federal government — that it will persist regardless of who occupies the White House. “This too shall pass, and hopefully we will be in a more favorable policy environment in four years,” Hausfather said. “In the meantime, we’ll have to keep trying to make clean energy cheap and hope that it wins on its merits.”"

-via Grist, November 11, 2024. A timely reminder.

#climate change#climate action#climate anxiety#climate hope#united states#us politics#donald trump#fuck trump#inflation reduction act#clean energy#solar power#wind power#renewables#good news#hope

2K notes

·

View notes

Text

Trump takes Elon Musk's side in H-1B visa debate, says he's always been a fan of the program

President-elect Donald Trump on Saturday sided with his top supporter and billionaire tech CEO Elon Musk in a public spat over the use of the H-1B visa, saying he fully supports the foreign tech worker program, which some of his supporters oppose. Trump’s remarks followed a series of social media posts by Elon Musk, the CEO of Tesla (TSLA.O) and SpaceX, who vowed on Friday night to go to “war” to protect the U.S. foreign worker visa program. Trump, who has tried to limit the use of visas during his first term, told the New York Post on Saturday that he also favored the visa program. “I have a lot of H-1B visas in my portfolio, I’m a big fan of H-1B. “I’ve used it many times. It’s a great program,” he said. Elon Musk, a naturalized U.S. citizen born in South Africa, has been granted an H-1B visa, and his electric car company Tesla has been granted 724 such visas this year. H-1B visas are generally valid for three-year periods, although holders can extend them or apply for a green card.

The row was sparked earlier this week by far-right activists who criticized Trump's choice of Sriram Krishnan, an Indian-American venture capitalist, to be an artificial intelligence advisor, saying it would influence the Trump administration's immigration policies.

Elon Musk's tweet was aimed at Trump supporters and immigration extremists, who are increasingly calling for the repeal of the H-1B visa program amid a heated debate over immigration and the place that skilled immigrants and foreign workers bring into the country with work visas. On Friday, Steve Bannon, a confidant of Trump, criticized the "big tech oligarchs" for supporting the H-1B program and called immigration a threat to Western civilization. In response, Musk and many other tech billionaires have drawn a line between what they consider legal immigration and illegal immigration. Trump has promised to deport all immigrants who are in the United States illegally, impose tariffs to help create more jobs for American citizens and severely limit immigration. The visa issue shows how technology leaders like Musk - who played an important role in the presidential transition, advising key personnel and policies - are now attracting the attention of their base. The U.S. tech industry relies on the government’s H-1B visa program to hire skilled foreign workers to help run their companies, a workforce that critics say undercuts the wages of American citizens. Elon Musk spent more than a quarter of a billion dollars to help Trump get elected in November. He has been writing regularly this week about the lack of domestic talent to fill all the positions needed at American tech companies.

#donald trump#trump#elon musk#usa#new york#news#politics#united states#usa politics#election 2024#h 1b visa#america#usaelection2024#us politics#us presidents#usvisa#usa visa#work visa

23 notes

·

View notes

Text

Donald Trump’s upending of the global economy has raised fears that climate action could emerge as a casualty of the trade war.

In the week that has followed “liberation day”, economic experts have warned that the swathe of tariffs could trigger a global economic recession, with far-reaching consequences for investors – including those behind the green energy projects needed to meet climate goals.

Fears of a prolonged global recession have also tanked oil and gas prices, making it cheaper to pollute and more difficult to justify investment in clean alternatives such as electric vehicles and low-carbon heating to financially hard-hit households.

But chief among the concerns is Trump’s decision to level his most aggressive trade tariffs against China – the world’s largest manufacturer of clean energy technologies – which threatens to throttle green investment in the US, the world’s second-largest carbon-emitter.

The US is expected to lag farther behind the rest of the world in developing clean power technologies by cutting off its access to cheap, clean energy tech developed in China. This is a fresh blow to green energy developers in the US, still reeling from the Trump administration’s vow to roll back the Biden era’s green incentives.

Leslie Abrahams, a deputy director at the Center for Strategic and International Studies (CSIS) in Washington DC, said the tariffs would probably hinder the rollout of clean energy in the US and push the country to the margins of the global market.

Specifically, they are expected to drive up the price of developing clean power, because to date the US has been heavily reliant on importing clean power technologies. “And not just imports of the final goods. Even the manufacturing that we do in the United States relies on imported components,” she said.

The US government’s goal to develop its manufacturing base by opening new factories could make these components available domestically, but it is likely to take time. It will also come at considerable cost, because the materials typically imported to build these factories – cement, steel, aluminium – will be subject to tariffs too, Abrahams said.

“At the same time there are broader, global economic implications that might make it difficult to access inexpensive capital to build,” she added. Investors who had previously shown an interest in the US under the green-friendly Biden administration are likely to balk at the aggressively anti-green messages from the White House.

Abrahams said this would mean a weaker appetite for investment in rolling out green projects across the US, and in the research and development of early-stage clean technologies of the future. This is likely to have long-term implications for the US position in the global green energy market, meaning it will “cede some of our potential market share abroad”, Abrahams added.

It’s important to distinguish between the US and the rest of the world, according to Kingsmill Bond, a strategist for the energy thinktank Ember.

“The more the US cuts itself off from the rest of the world, the more the rest of the world will get on with things and the US will be left behind. This is a tragedy for the clean energy industry in the US, but for everyone else there are opportunities,” he said.

Analysis by the climate campaign group 350.org has found that despite rising costs and falling green investment in the US, Trump’s trade war will not affect the energy transition and renewables trade globally.

One senior executive at a big European renewable energy company said developers were likely to press on with existing US projects but in future would probablyinvest in other markets.

“So we won’t be doing less, we’ll just be going somewhere else,” said the executive, who asked not to be named. “There is no shortage of demand for clean energy projects globally, so we’re not scaling back our ambitions. And excluding the US could make stretched supply chains easier to manage.”

Countries likely to benefit from the fresh attention of renewable energy investors include burgeoning markets in south-east Asia, where fossil fuel reliance remains high and demand for energy is rocketing. Australia and Brazil have also emerged as countries that stand to gain.

The challenge for governments hoping to seize the opportunity provided by the US green retreat will be to assure rattled investors that they offer a safe place to invest in the climate agenda.

Although the green investment slowdown may be largely limited to the US, this still poses concerns for global climate progress, according to Marina Domingues, the head of new energies for the consultancy Rystad Energy.

“The US is a huge emitter country. So everything the US does still really matters to the global energy transition and how we account for CO2,” she said. The US is the second most polluting country in the world, behind China, which produces almost three times its carbon emissions. But the US’s green retreat comes at a time when the country was planning to substantially increase its domestic energy demand.

After years of relatively steady energy demand, Rystad predicts a 10% growth in US electricity consumption from a boom in AI datacentres alone. The economy is also likely to require more energy to power an increase in domestic manufacturing as imports from China dwindle.

In the absence of a growing energy industry, this is likely to come from fossil fuels, meaning growing climate emissions. The US is expected to make use of its abundance of shale gas, but it is planning to use more coal in the future too.

In the same week that Trump set out his tariffs, he signed four executive orders aimed at preventing the US from phasing out coal, in what climate campaigners at 350.org described as an “abuse of power”.

Anne Jellema, the group’s executive director, said: “President Trump’s latest attempt to force-feed coal to the US is a dangerous fantasy that endangers our health, our economy and our future.”

5 notes

·

View notes

Text

Excerpt from this story from Climate Change News:

While US President Donald Trump has ripped up much of his predecessor’s climate and foreign policy, he has pushed forward with Joe Biden’s pursuit of metals and minerals abroad while shifting the strategic focus from clean energy to military use, analysts say.

Biden spent some of his final days as US leader in Angola, talking up a railway that will bring copper and cobalt from Central Africa to the continent’s west coast where the materials can be shipped to the US.

Since coming to power in January, Trump has discussed deals to provide military assistance to the war-torn nations of Ukraine and the Democratic Republic of Congo (DRC) in return for minerals, threatened to take over mineral-rich Greenland, and is reportedly considering a new law that would bypass UN discussions so as to allow mining of the deep seabed in international waters.

This week, Massad Boulos, Trump’s senior advisor on Africa, travelled to DRC as his first port of call shortly after being appointed. In a meeting with DRC President Felix Tshisekedi, Boulos – father-in-law to Trump’s daughter – said the US had reviewed the DRC’s minerals proposal. He said he was “pleased to announce that the President and I have agreed on a path forward for its development,” according to a statement from the DRC government.

While the details of the mooted deal are not yet public, Boulos said he would work with Tshisekedi to build a deeper relationship that benefits both the Congolese and American people and “to stimulate American private sector investment in the DRC, particularly in the mining sector”.

A day earlier, Trump exempted key minerals like copper and cobalt from the new trade tariffs he slapped on nations around the world.

The big unanswered question is why his administration is so keen to secure supplies of these resources, which are increasingly sought after because they are key to advancing the clean energy transition.

Fadhel Kaboub, associate professor of economics at Denison University in Ohio, said Trump’s interest is likely driven primarily by the importance of critical minerals for military and high-tech purposes. “The Trump administration is known for its anti-climate action rhetoric,” he said, adding that its priority is definitely not the energy transition, but other competitive sectors such as defence.

Once extracted and processed, minerals like copper and cobalt – which the DRC has in abundance – can be used in clean technology or for military equipment, among other things. Copper can be used to channel green electricity or as a liner for anti-tank missiles. Cobalt can be used for electric vehicle batteries or alloys for fighter jets.

3 notes

·

View notes

Text

My media this week (2-8 Mar 2025)

📚 STUFF I READ 📚

🥰 The Village Library Demon-Hunting Society (C.M. Waggoner, author; Cindy Piller, narrator) - extremely entertaining read! recced by my friend door. billed as a 'riotous mix of Buffy the Vampire Slayer and Murder, She Wrote' and surprisingly those comps are extremely accurate. Love the conceit. also really liked what it said about never being too old/cool for whimsy.

😊 His Roommate's Pleasure (Lana McGregor) - enjoyable, short (30K) jock/nerd college roommates erotic romance, delivers precisely what it advertises

💖💖 +158K of shorter fic so shout out to these I really loved 💖💖

Consensual Catfishing (foresthearts) - Stranger Things: Steddie, 32K - reread. modern AU, told via social media, absolutely delightful. Great art & great execution of the set up.

Broken Bird's Wing (sheafrotherdon) - The Old Guard: Kaysanova, 14K - reread. A 'The Repair Shop' AU, lovely & warm & gentle

📺 STUFF I WATCHED 📺

The Shots You Take Virtual Event (with Rachel Reid & KD Casey)

Handsome - Leslie Jones gives Handsome a happy ending

Doctor Odyssey - s1, e9

Make Some Noise - s3, e19

Smartypants - s2, e1

Death in Paradise - s14, e3

Tech Support | WIRED - Dungeon Master Brennan Lee Mulligan Answers DnD Questions

One Song Podcast - Madonna's "Into the Groove" with Guillermo Díaz

Harley Quinn - s5, e5-8

D20: A Court of Fey and Flowers - "The Rule of Sneakery" (s15, e8)

D20: Adventuring Party - "Doctor Green Hunter" (s10, e8)

D20: A Court of Fey and Flowers - "Theater of War" (s15, e9)

D20: Adventuring Party - "Do Clothes Die?" (s10, e9)

D20: A Court of Fey and Flowers - "You Will Never Know a Lonely Day Again" (s15, e10)

🎧 PODCASTS 🎧

Pop Culture Happy Hour - Our 2025 Oscars Recap

The Sporkful - Eggs, Raw Milk, And Tariffs, Oh My!

Welcome to Night Vale #263 - Hysteria Land

⭐ Rebel Ever After - Trans identity & polyamory in romance with TJ Alexander

The Atlas Obscura Podcast - Arizona’s Big, Big Souvenir

Shedunnit - The Mystery Short Story

Vibe Check - Modern Scriptures at On Air Fest

Pop Culture Happy Hour - Favorite SNL Musical Moments

The Atlas Obscura Podcast - This Dog Stole Madrid’s Heart

Switched on Pop - Playing "Hide and Seek" with Imogen Heap

99% Invisible - A Beetle By Any Other Name

Off Menu - Ep 281: David Tennant

Pop Culture Happy Hour - Mickey 17 And What's Making Us Happy

It's Been a Minute - Is Hollywood soft censoring Palestinian art?

Today, Explained - The Zizian "death cult"

Handsome - Pretty Little Episode #29

⭐ The Atlas Obscura Podcast - McAtlas with Gary He

Endless Thread - Terminally Online

⭐ Imaginary Worlds - Fantasy Through a Muslim Lens

⭐ Twenty Thousand Hertz+ - “The Autumn, She’s Been Hit!” The wish that changed Halo forever

Strong Songs - "Fast As You Can" by Fiona Apple

🎶 MUSIC 🎶

True Metal Warriors

'80s Prom Dance

Letters to Cleo

MAYHEM [Lady Gaga] {2025}

Relaxing '80s Rock

Presenting Dua Lipa

The Romantics

#sunday reading recap#bookgeekgrrl's reading habits#bookgeekgrrl's soundtracks#fanfic ftw#ao3 my beloved#fan makers are a *gift*#dropout tv#lady gaga#letters to cleo#the romantics#dua lipa#'80s music#that twenty thousand hertz ep on halo was really‚ really good#as was the interview with tj alexander#20k hz podcast#switched on pop podcast#rebel ever after podcast#the atlas obscura podcast#imaginary worlds podcast#vibe check podcast#pop culture happy hour podcast#one song podcast#99% invisible podcast#endless thread podcast#strong songs podcast#welcome to night vale#the sporkful podcast#off menu podcast#handsome podcast#it's been a minute podcast

3 notes

·

View notes

Text

economy of HAIQIN

------------------------------------------------------------------------------

date: november 24, 2024

------------------------------------------------------------------------------

The Economy of Haiqin

Currency

Haiqian (HQN):

The currency symbol, HQN, is recognized regionally for stability and is commonly pegged against the USD. With a favorable exchange rate of 1 HQN to 0.75 USD, the Haiqian serves as a benchmark for economic health in neighboring countries.

Digital Currency:

As a forward-thinking nation, Haiqin has integrated digital currency into daily life. Roughly 80% of transactions are conducted digitally, promoting a cashless economy and streamlining payment methods for both domestic and international trade.

Banking & Financial Inclusion:

A highly developed banking sector offers easy access to financial services through mobile banking, particularly aiding small businesses. Public investment in financial education is substantial, aimed at improving fiscal literacy among citizens.

Trade Relations

Exports

Agricultural Products:

Due to fertile land and a favorable climate, Haiqin exports high-quality agricultural products, particularly fruits, vegetables, and grains during Iktoia. Specialty items, such as exotic herbs and teas unique to Haiqin, have a growing global market. These products are particularly sought after during harvest seasons, aligning with major festivals like Iktoia.

Artisanal Crafts:

Renowned for handmade textiles, clothes, pottery, and jewelry, the craftsmanship of Haiqin is a cornerstone of cultural exports, with a significant sales boost during the Festival of Arts.

Technology:

Leading the way in green energy, Haiqin exports solar panels, software, and sustainable tech solutions to several nations.

Imports

Raw Materials:

Haiqin imports metals, oil, and minerals essential to its manufacturing sectors.

Luxury Goods:

High-end fashion, imported automobiles, and gourmet foods are popular among the elite, highlighting Haiqin’s demand for imported luxury.

Wealth Distribution

Income Disparities:

While Haiqin as a whole is wealthy, income inequality is evident, with urban centers like Stellis holding the majority of economic wealth, while more rural areas face economic challenges. The wealthy class largely consists of business magnates, tech industry leaders, and high-ranking government officials.

Middle-Class Growth:

Urban centers, particularly Stellis, have seen a rise in middle-class citizens, contributing to consumer spending and economic diversification.

Regional Disparities:

While urban areas enjoy greater access to services and infrastructure, rural areas have fewer economic opportunities, relying heavily on agriculture and artisanal crafts.

--scripted out poverty <333

Taxes & Tithes

Income Tax:

A progressive income tax scales from 10% to 35%, ensuring that higher earners contribute more significantly. Revenues from taxes fund public services, healthcare, and social programs.

Property Tax:

Property taxes are assessed based on land value and are used to fund local infrastructure projects.

Trade Taxes & Tariffs:

Sales taxes on goods and services, coupled with protective tariffs, help sustain local industries, particularly in agriculture and manufacturing. A national sales tax applies to consumer goods and services, with specific tariffs on imports to protect Haiqin’s domestic industries.

Corporate Tax Incentives:

To encourage growth in key sectors, the government offers tax breaks and incentives to companies in tech and renewable energy fields, helping drive innovation and economic diversification.

Major Industries

Technology:

The tech sector is a powerhouse, with a focus on sustainable solutions, AI, and renewable energy technology. Haiqin has invested heavily in research and development, becoming known for cutting-edge advancements that are exported worldwide.

Agriculture:

Haiqin’s agriculture not only supplies its people with fresh produce but also generates export income. Farming is closely tied to cultural festivals like Iktoia, with agriculture supported by governmental subsidies and modernized techniques.

Tourism:

Festivals and natural beauty attract a steady influx of tourists, making tourism a primary economic driver. Events such as the Iktoia harvest festival, Nera Day, and Lunar Fest draw visitors year-round. The government promotes eco-tourism, highlighting Haiqin’s forests, mountains, and coastal regions.

Employment & Labor

Diverse Job Market:

The Haiqin labor market is diverse, with jobs spanning agriculture, technology, tourism, and manufacturing. The tech sector alone has led to a surge in jobs, while seasonal agricultural work remains important for rural populations.

Labor Laws & Unions:

Labor unions are active and influential, protecting fair wages and working conditions. Seasonal labor opportunities peak during harvest and festival seasons, with temporary roles often filled by students and short-term workers.

Social Safety Nets:

Haiqin’s social safety nets include universal healthcare, unemployment benefits, and retirement funds. The government aims to prevent poverty, supporting citizens in need with housing assistance, job retraining, and social programs for the elderly and disabled.

Sustainability Initiatives

Green Policies:

With eco-friendly initiatives spanning multiple sectors, Haiqin leads in sustainable agriculture, renewable energy, and waste reduction programs.

Circular Economy:

Recycling and resource-efficient production are emphasized. Industries are incentivized to minimize waste, with taxes on high-pollution businesses encouraging green alternatives.

Environmental Partnerships:

Collaboration with environmental organizations has facilitated eco-tourism and green business practices, creating jobs focused on conservation and sustainable development.

Infrastructure and Transportation

Transportation Networks: Haiqin boasts a modernized transportation system, with high-speed railways connecting major cities, public electric buses, and bike-sharing programs in urban areas. The government has invested heavily in infrastructure to reduce congestion and support eco-friendly transport.

Energy Sector: Haiqin generates most of its energy from renewable sources, including solar, wind, and hydroelectric power. Its commitment to reducing carbon emissions has led to advanced green energy technologies, some of which are exported.

#reality shifter#reality shifting#shiftblr#shifting community#shifting#shifting motivation#shifting reality#dr scrapbook#dr world#reyaint#anti shifters dni

4 notes

·

View notes

Text

Who Is the Best Energy Provider in Australia?

There’s no single “best” energy provider for everyone — but Red Energy, Origin, and AGL consistently rank high across customer service, pricing, and availability. If you want green energy, look at Powershop or Amber Electric. For flat rates and Aussie call centres, Red Energy shines. The real best provider is the one that fits your usage habits, tariff preference, and location.

Is there really a best energy provider?

Short answer: not exactly.

That’s like asking, What’s the best car? Well… do you want a ute, an EV, or something that won’t wake the baby during school drop-off?

Energy is personal — shaped by where you live, how much power you use, whether you have solar, and whether you're chasing price, service, or sustainability. What’s “best” for a retired couple in suburban Perth could be totally different to a young family with rooftop solar in regional Victoria.

So instead of chasing a winner, we’ll break down the contenders — the providers that Aussies trust, avoid, or quietly rave about to their neighbours.

Which energy companies have the best customer service?

If you’ve ever tried explaining a billing issue to a chatbot at 11pm, you know that service matters.

These providers consistently get high marks for Aussie-based call centres, fast response times, and actually solving problems without escalating you 17 times.

Red Energy

Owned by: Snowy Hydro

Standout feature: All calls answered in Australia — often under 30 seconds

Why people like them: Clear bills, friendly service, flat-rate plans

Powershop

Owned by: Shell (yes, that Shell)

Green rating: Very high

App experience: Slick and insightful, especially for solar households

Momentum Energy

Owned by: Hydro Tasmania

USP: Proudly Australian, green-leaning, good rural support

Many Aussies report that Red and Momentum feel like “old-school service in a modern industry.” Not perfect — but you can usually get someone who listens.

Who offers the cheapest electricity plans?

Now we’re talking numbers. And here’s the real talk: The cheapest energy provider for you depends on your postcode and usage.

That said, based on comparison data and market trends, here are some of the usual suspects when it comes to low-cost plans:

ReAmped Energy – Often has market-leading rates, though service can vary

Tango Energy – Popular in Victoria for stable, low-cost plans

Energy Locals – Transparent pricing, flat membership fee model

Mojo Power – Good for tech-savvy users and households with solar

If you want cheap, look for providers with low daily supply charges and competitive usage rates. Some providers lure you in with a low rate but sting you with daily fees that add up to $300+ a year.

Which provider is best for solar feed-in?

Got solar? You want the best bang for your export buck — but beware: the highest feed-in rate doesn’t always equal the best deal overall.

Here’s what savvy solar households are choosing in 2025:

Amber Electric

Model: Dynamic wholesale pricing (great when market prices spike)

Warning: Can be unpredictable — not for the faint of heart

Discover Energy

USP: AI-powered platform to maximise solar exports

Best for: Battery owners or tech-forward homes

Energy Locals

Structure: Fixed low margin, pass-through model — simple and fair

Some smaller players offer flashy rates (e.g., 20c+ feed-in) but apply caps or conditions that dilute the benefit. Always read the fine print.

Who are the most ethical and green providers?

If you're chasing carbon-neutral or 100% renewable energy, these companies score well with the Green Electricity Guide:

Powershop – Still green despite its Shell ownership

Diamond Energy – Aussie-owned, solar-friendly

Momentum Energy – Owned by Tasmania’s state-owned hydro scheme

Energy Locals – Offers 100% carbon-neutral plans

Ethical providers typically invest in renewables, offer fair feed-in rates, and avoid fossil fuel assets. Bonus points if they don’t offshore their support teams.

What if you don’t want to research all this yourself?

You’re not alone. Hundreds of thousands of Aussies are tired of comparing tariffs, reading usage graphs, and decoding energy jargon.

That’s where an energy broker comes in handy. Brokers take your postcode, usage profile, and priorities — then compare real offers across retailers. The good ones don’t push you toward “sponsored” plans either.

Think of it like a mortgage broker — but for your power bill.

FAQ: Finding the Right Energy Provider

Q: Is switching energy providers hard? A: Nope. It takes a few minutes online or over the phone. You won’t lose power — the switch is seamless.

Q: How often should I review my energy plan? A: At least once a year. Even if you like your provider, newer plans might offer better rates.

Q: Can I keep my old plan if prices rise? A: Usually not. Most retailers can update rates after a contract ends or with 30 days’ notice.

Final Thoughts

So, who’s the best energy provider in Australia?

That depends on you.

If you want simplicity and service, Red Energy is a strong bet. If you care about the planet, Powershop or Diamond Energy might be your pick. If you’re counting every dollar, ReAmped or Energy Locals could deliver savings.

The good news? You’ve got choice. And in a country with some of the highest electricity prices in the world, choice is more than a luxury — it’s a power move.

Just don’t feel like you have to figure it all out alone. With support from a trusted energy broker, you can cut through the confusion and land the deal that actually works for you.

0 notes

Text

Europe Imports: Trends, Challenges, and Opportunities in the Global Trade Landscape

Introduction: The Role of Imports in Europe’s Economy

Europe, home to some of the most developed economies in the world, is a major player in global trade. Imports play a crucial role in the region’s economic ecosystem, feeding its industrial base, consumer market, and service sectors. From energy and electronics to textiles and agricultural goods, Europe Imports depend on a diverse range of imports to meet domestic demands and support its industries. As globalization continues to evolve, understanding the dynamics of Europe’s import landscape is essential for policymakers, businesses, and consumers.

Key Import Categories in Europe

Europe imports a wide array of goods, with some of the most prominent categories including:

Energy Products: Crude oil, natural gas, and petroleum products are among Europe’s top imports. The region’s limited domestic energy resources make it heavily reliant on imports from countries like Russia, Norway, the Middle East, and North Africa.

Machinery and Electronics: High-tech machinery, semiconductors, and consumer electronics are primarily imported from Asia, especially China, Japan, and South Korea. These imports support Europe’s automotive, aerospace, and tech industries.

Agricultural and Food Products: Despite having a strong agricultural sector, Europe imports significant quantities of fruits, vegetables, coffee, cocoa, and seafood. These products often come from Latin America, Africa, and Southeast Asia to meet diverse consumer tastes.

Textiles and Apparel: Fashion-forward countries like Italy and France still import large volumes of textiles and finished garments, mainly from Bangladesh, India, Turkey, and China.

Raw Materials and Chemicals: Europe’s manufacturing sector depends on the steady import of raw materials like metals (copper, lithium, iron), rare earth elements, and chemicals for industrial use.

Major Trading Partners

Europe maintains robust trade relations with countries around the world. Some of its top import partners include:

China: The EU’s largest source of imports, China provides electronics, machinery, textiles, and manufactured goods.

United States: A key supplier of aircraft, pharmaceuticals, and high-tech goods.

Russia: Historically a major energy supplier, although geopolitical tensions and sanctions have shifted some of this trade.

Switzerland and the UK: Close neighbors with strong economic ties in pharmaceuticals, chemicals, and luxury goods.

Developing Nations: Countries in Africa, Asia, and Latin America supply agricultural products, raw materials, and low-cost manufactured goods.

Challenges in Europe’s Import Ecosystem

While Europe’s import network is vast and vital, it is not without challenges:

Geopolitical Tensions: Conflicts such as the Russia-Ukraine war have disrupted energy imports, leading to price hikes and a rethinking of energy strategies.

Supply Chain Disruptions: Events like the COVID-19 pandemic exposed vulnerabilities in global supply chains, affecting the timely delivery of goods.

Trade Protectionism: Tariffs, trade barriers, and political disagreements can hinder smooth import operations and increase costs for businesses and consumers.

Sustainability Concerns: The environmental impact of long-distance imports and sourcing from regions with lax environmental standards is a growing concern for European regulators and consumers.

Regulatory Compliance: Complex regulations within the EU regarding safety, labeling, and standards can pose hurdles for foreign exporters.

Opportunities for Growth and Innovation

Despite the challenges, Europe’s import sector offers ample opportunities:

Diversification of Supply Sources: Reducing dependency on a few countries by seeking alternative suppliers can enhance supply chain resilience.

Digitalization and Smart Logistics: Advanced technologies like AI, blockchain, and IoT can improve supply chain visibility and efficiency.

Green Imports: Importing sustainable products and raw materials aligns with Europe’s climate goals and the European Green Deal.

Trade Agreements: New and renewed trade deals with countries like Canada (CETA), Japan (EPA), and Mercosur nations can boost imports under preferential terms.

Support for SMEs: Simplifying import procedures and offering guidance to small and medium enterprises can help them compete globally.

Conclusion: Balancing Dependence and Independence

Europe’s import ecosystem is a complex yet essential part of its economic framework. As the continent faces new geopolitical, environmental, and technological challenges, it must strike a balance between maintaining a healthy flow of imports and building strategic independence in critical sectors. Through diversification, innovation, and sustainable practices, Europe can strengthen its position as a resilient and forward-thinking global trade partner.

Follow more information : https://europeimports.com.au/ezarri-mosaic-tiles/

1 note

·

View note

Text

Fintech & Clean Energy Convergence: Powering a Sustainable Financial Future

In the age of climate consciousness and digital disruption, two powerful forces are reshaping the global economy, Fintech and Clean Energy. Once seen as separate sectors, these industries are now converging to create innovative solutions that drive sustainability, financial inclusion, and energy transformation.

This blog dives into how Fintech is accelerating the clean energy revolution and why mastering financial modelling, through the Best Financial Modelling Certification Course in Kolkata, is critical for professionals looking to thrive at this intersection.

The Clean Energy Boom: A Quick Snapshot

From solar and wind to green hydrogen and EVs, the clean energy sector is experiencing explosive growth:

Global investments in clean energy surpassed $1.8 trillion in 2023

India aims to generate 50% of its electricity from renewable sources by 2030

Financing clean energy projects is now a top priority for governments and private investors

However, financing large-scale green projects isn't easy. This is where Fintech steps in.

How Fintech is Transforming Clean Energy

Fintech brings digital innovation, automation, and data intelligence to financial services. When applied to clean energy, it creates opportunities such as:

1. Green Crowdfunding Platforms

Startups like Sun Exchange and Energeia use Fintech to enable individuals to invest in solar projects, making clean energy financing more democratic.

2. Decentralized Energy Trading

Blockchain-powered platforms allow peer-to-peer trading of solar energy, where consumers can sell excess energy directly to neighbors.

3. AI-Driven Credit Scoring

For rural solar installations, fintech startups use alternative data (mobile usage, utility bills, etc.) to assess creditworthiness and unlock financing.

4. Pay-as-You-Go Energy

Digital wallets and mobile money platforms allow users in developing regions to access solar power in affordable micro-payments.

The Role of Financial Modelling in This Convergence

With billions being poured into clean energy, investors, startups, and governments need accurate financial models to:

Forecast energy project returns

Assess risks like policy changes, weather patterns, and price volatility

Model carbon credit earnings

Structure financing instruments like green bonds and sustainability-linked loans

This is why professionals entering this field need advanced financial modelling skills—best gained through a structured program like the Best Financial Modelling Certification Course in Kolkata.

Why Choose the Best Financial Modelling Certification Course in Kolkata?

Kolkata is emerging as a hub for sustainable development and tech-driven finance. A top-tier financial modelling course in this city equips you with:

Core finance knowledge: NPV, IRR, DCF, project finance

Energy-specific modelling: Renewable asset modelling, PPA (Power Purchase Agreement) structures, tariff simulations

Excel & Python skills: Build dynamic models, analyze large datasets

ESG integration: Evaluate environmental and social risks

Case studies: Real-world modelling of solar parks, EV startups, and green fintech platforms

This makes you job-ready for roles at the convergence of sustainability and finance.

Career Roles at the Fintech-Energy Crossroads

If you’re thinking about your future, here are some roles gaining traction:

Green Finance Analyst

Renewable Energy Project Modeller

Sustainable Fintech Product Manager

Carbon Markets Strategist

ESG Investment Analyst

Each of these roles demands a solid foundation in financial modelling and a deep understanding of sustainable finance, making your upskilling journey more important than ever.

Indian Startups Leading the Way

Several Indian ventures are leading the fintech-clean energy movement:

ReNew Power partnered with financial institutions for digital green bond issuance

M-Power provides pay-as-you-go solar kits via fintech-enabled microloans

Ohm Mobility leverages digital platforms to fund EV charging networks in smart cities

This growing synergy creates tremendous opportunities for finance professionals to innovate, analyze, and lead.

Final Thoughts: Finance + Tech + Energy = Future

The convergence of Fintech and Clean Energy is more than a trend—it’s a transformation. As the world races toward net-zero goals, financial innovation will be key to making clean energy accessible, affordable, and scalable.

For those looking to make a career in this intersection, the right skills are non-negotiable. Enrolling in the Best Financial Modelling Certification Course in Kolkata ensures you not only understand the numbers but can build the financial future of clean energy, from the ground up.

0 notes

Text

Vietnam Export and Import Data: Strategic Insights from Data Vault Insights

Vietnam has become one of Southeast Asia’s most vibrant trade hubs, thanks to its export-driven growth and rapidly evolving import structure. Analyzing Vietnam export data and Vietnam import data provides essential insights for businesses, analysts, and policymakers. At Data Vault Insights, we offer accurate, up-to-date, and actionable trade intelligence that reveals the patterns behind Vietnam’s global commerce.

Vietnam’s Trade Overview

With trade turnover exceeding $730 billion in 2024, Vietnam has solidified its position in global supply chains. Exports reached approximately $370 billion, while imports totaled about $360 billion, delivering a healthy trade surplus. This balance reflects the country’s efficiency in value-added manufacturing and growing domestic demand for industrial inputs.

Key trading partners include the United States, China, Japan, South Korea, and EU nations. Vietnam's involvement in high-impact trade agreements—such as the EVFTA and CPTPP—has reduced tariffs and expanded market access, encouraging both exports and imports.

At Data Vault Insights, our comprehensive datasets help businesses identify high-opportunity markets and understand the underlying trends driving these figures.

Vietnam Export Data: Leading Sectors

Vietnam’s economy thrives on its strong and diversified export sector. According to Vietnam export data available on Data Vault Insights, the top exported categories include:

Electronics and Components: Products like smartphones, tablets, and integrated circuits dominate exports, driven by foreign investment from tech giants like Samsung and Intel.

Textiles and Garments: Vietnam ranks among the world’s largest garment exporters, known for high-quality and fast turnaround capabilities.

Footwear: As a global manufacturing hub, Vietnam’s footwear exports cater to major international brands.

Agricultural Goods: The country is a top exporter of rice, coffee, pepper, cashews, and seafood.

Machinery and Tools: This growing sector reflects Vietnam’s move toward industrial sophistication.

Export trends highlight a shift toward value-added production and green manufacturing, with the government and private sector investing in sustainability to meet ESG standards.

Vietnam Import Data: What Drives Demand

Vietnam imports a wide array of raw materials and components necessary for its export manufacturing and domestic consumption. Based on Vietnam import data from Data Vault Insights, key imports include:

Electronic Components and Semiconductors: These are vital for the assembly of devices destined for export.

Petroleum and Fuels: Despite some domestic production, Vietnam heavily relies on imported energy.

Textile Raw Materials: Yarn, cotton, and fabrics are largely imported to support its garment industry.

Chemicals and Pharmaceuticals: As the healthcare and industrial sectors grow, so does demand for specialized imports.

Automotive Parts and Vehicles: Both luxury and commercial vehicle imports are on the rise, alongside parts for local assembly.

These import patterns show how Vietnam strategically sources inputs for high-margin exports. Data Vault Insights enables users to explore supplier countries, import trends, and HS code-level granularity to make smarter sourcing and investment decisions.

Trade Policy and Economic Implications

Vietnam’s participation in over a dozen FTAs and its commitment to WTO principles make it a reliable trade partner. Customs modernization, digitization, and port infrastructure upgrades have improved trade efficiency.

However, risks such as global inflation, geopolitical tensions, and supply chain disruptions require careful monitoring. By using Data Vault Insights, businesses can adapt quickly to shifts in demand, tariffs, and regulatory landscapes.

Conclusion: Why Trade Data Matters

Vietnam’s thriving trade ecosystem offers significant opportunities—but only for those equipped with the right insights. Export growth in electronics and garments, and import demand for critical inputs, paint a picture of a resilient and globally integrated economy.

Data Vault Insights is your partner in navigating this landscape. Whether you're analyzing Vietnam export data, tracking imports by product or country, or developing a market entry strategy, our tools provide clarity, accuracy, and strategic value.

Visit Data Vault Insights to access real-time trade data and make informed decisions in Vietnam’s evolving trade market.

0 notes

Text

Empowering Chennai Through Solar Innovation: The Role of Hackathons in Driving Green Energy Adoption

As Chennai grapples with rising energy demands and the growing effects of climate change, solar energy has emerged as a beacon of hope. Today, solar panel installation in Chennai is more than just an eco-conscious choice — it’s becoming a necessity for homes, businesses, and even public infrastructure.

While government subsidies and private companies are doing their part, another unlikely player has joined the mission to accelerate solar adoption: the hackathon. What do 48 hours of coding and innovation have to do with rooftop solar panels? More than you might think.

The Power of Hackathons: Fast-Tracking Clean Tech

Hackathons bring together developers, engineers, designers, and problem-solvers in a high-energy environment where they collaborate to create working solutions — often from scratch — within a short time. Increasingly, green-tech hackathons in Chennai are focusing on sustainability, climate resilience, and renewable energy.

In one such event organized by an environmental startup incubator, the theme was “Clean Energy for Every Household.” One team developed an AI-based solar cost estimator tailored specifically for Chennai’s rooftops. Using GIS data and local electricity tariffs, the tool provided users with an instant quote and a five-year savings forecast. The aim? Make solar panel installation in Chennai simple, transparent, and data-driven.

Solving Chennai-Specific Challenges

Unlike general energy solutions, solar projects in Chennai face localized challenges: inconsistent awareness, unpredictable monsoons, coastal humidity, and building regulation complexity. Hackathons allow innovators to address these Chennai-specific issues head-on.

For instance, a winning solution from a recent university hackathon introduced a predictive maintenance app for solar panels, which alerts users when cleaning or servicing is required — a crucial feature in Chennai’s dust-prone environment. Another group developed a marketplace app that connects verified solar installers with end-users, with a focus on customer reviews and compliance checks.

These projects, although built in a short span, show how local ingenuity can remove friction from the installation process.

Fueling Solar Startups

Beyond ideas, hackathons have become breeding grounds for green-tech startups. Several Chennai-based solar entrepreneurs trace their roots back to student competitions or community tech events. With mentorship from industry experts and seed funding from clean energy accelerators, these teams transform hackathon concepts into real-world businesses.

One such startup created a tool that identifies underutilized rooftops in public buildings — such as schools and hospitals — and proposes feasible solar installation models using AI. They now partner with NGOs and civic bodies to implement these ideas, contributing to Chennai’s broader sustainability goals.

Engaging the Next Generation of Change-Makers

Perhaps the greatest benefit of integrating hackathons into the solar movement is the engagement of youth. Students who may not have previously considered solar energy as a field of innovation now find it exciting and impactful.

Through these events, they learn about technical aspects like photovoltaic efficiency, financial modeling, and government policy, while also building empathy for communities with limited energy access. This blend of tech skills and social awareness is creating a new generation of green entrepreneurs right here in Chennai.

Solar Panel Installation Meets Smart Tech

The result of this hackathon-driven innovation? Smarter, faster, and more accessible solar panel installation in Chennai. With apps that simplify decision-making, tools that provide clarity on investment returns, and platforms that connect trusted installers with customers, the entire ecosystem is being reshaped.

As Chennai continues to urbanize and digitize, the convergence of solar energy and smart technology will only deepen — and hackathons will play a vital role in that transformation.

Conclusion

The path to a greener Chennai doesn’t lie only in large infrastructure projects or government mandates. It lies equally in community-driven innovation, youthful creativity, and the willingness to solve local problems with global thinking.

Hackathon may be short in duration, but their impact on solar panel installation in Chennai is long-lasting. They spark ideas, build businesses, and most importantly, empower a city to choose a sustainable future.

0 notes

Text

US markets close green as Trump tariff drama muddies outlook

U.S. stocks rose Thursday, with the S&P 500 up 0.4%, after Nvidia’s strong first-quarter earnings lifted sentiment. However, gains were tempered by renewed uncertainty over President Donald Trump’s tariff policy following conflicting court decisions. The tech-heavy Nasdaq Composite also climbed 0.39%, while the Dow Jones Industrial Average added 127 points, or 0.3%, despite a 3.4% drop in…

0 notes

Text

IT Stocks on Fire!Infosys, Wipro Surge Up to 3.5% After US Court Bombshell

Infosys shares experienced a surge, climbing 2.3% to Rs 1,609, as investors rushed to secure the stock before it went ex-dividend. The final dividend of Rs 22 per share has a record date of May 30, making May 29 the last day to buy shares to qualify. The total dividend for FY25 will be Rs 43 per share.

Shares of Infosys Ltd rose as much as 2.3% to Rs 1,609 on Thursday, as investors scrambled to buy the stock before it turns ex-dividend on Friday. With the company’s record date for its final dividend of Rs 22 per share set for May 30, Thursday marks the last chance for investors to acquire shares and become eligible for the payout.

IT stocks in focus today: Domestic technology stocks came under the bulls’ radar in Thursday’s session, May 29, after being beaten down in the last couple of trading sessions. The selling in IT stocks had also exerted pressure on the front-line indices.

The renewed interest lifted all stocks in the Nifty IT pack into the green, with LTIMindtree, Persistent Systems, Infosys, and Wipro emerging as the top gainers, jumping up to 3.5% in intraday trade.

Consequently, the Nifty IT index rose nearly 2% to the day’s high of 38,121 and was set to end May with a gain of 5.4%, snapping its four-month losing streak.

A Look Back: How Trade Rules Have Affected IT Stocks

Indian IT sector stocks have often reacted a lot to trade rules. For example, in February 2025, TCS and Infosys saw drops of up to 3.5% after the U.S. government said it would match tariffs.

India’s taking action to address trade issues with the U.S. by making some big changes. One of the key steps involves scrapping the 6% “Google tax” on internet advertising. This tax put in place in 2016, was aimed at overseas tech firms doing business in India without a physical office there. By getting rid of it, India might be hoping to influence U.S. choices on tariffs.

What’s Next for Investors?

Short-Term Volatility: Today’s gains signal positivity, but uncertainty lingers. IT stocks might fluctuate as the situation unfolds.

Long-Term Outlook: Indian IT’s future depends on trade dispute outcomes and global economic trends. Companies with diverse clients and flexible strategies could better handle these challenges.

As U.S. tariffs loom Indian IT companies aim to balance their optimism about monetary policy with caution about possible trade barriers. The coming weeks will prove crucial to determine the sector’s ability to adapt to these global economic shifts.

“Investments in the securities market are subject to market risks.”

Indian Stock Market is always in a ups and downs trend and the Intensify Research team keeps a close eye on the stock market to ensure that you remain in a good position in the market.

#stockinvestment#sharemarketing#stock market#stocks#sharetrading#investment#sharetrader#share this post#shareinvestor#sharemarket

1 note

·

View note

Text

U.S. Isolationism and "Abandoning Europe": The Restructuring of Global Order Under Hegemonic Logic

#isolationism #trump’s us isolationism #abandon europe

I. The Century-Old Gene of Isolationism and Its Contemporary Mutation

Isolationism is not an invention of the Trump era but a strategic tradition deeply embedded in America’s diplomatic DNA. Since George Washington articulated the principle of "avoiding entanglements with European politics" in his 1796 Farewell Address, isolationism has oscillated between imperial expansion and strategic retrenchment. Its core logic lies in preserving strength during relative national decline or excessive intervention costs. The Trump administration’s "America First" policy represents both continuity and mutation of this tradition—superficially withdrawing from international commitments like the Paris Agreement and Iran Nuclear Deal (exemplified by the 2020 WHO withdrawal), while strategically reallocating resources to Indo-Pacific competition with China through transactional diplomacy.

Unlike classical isolationism, its contemporary iteration exhibits "selective disengagement": militarily demanding NATO allies raise defense spending to 5% of GDP and assume greater responsibilities (evidenced by excluding the EU from the 2025 U.S.-Russia Riyadh talks), economically launching trade wars against Europe (25% tariffs imposed in February 2025), yet intensifying global interventions in tech containment and supply chain restructuring. This "aggressive isolationism" embodies a hegemonic cost-shifting strategy, compelling European self-reliance to alleviate U.S. strategic overextension.

II. Europe’s Decline: Structural Crisis and Geopolitical Shockwaves

U.S. strategic contraction has triggered Europe’s "cliff-like" erosion of global influence. Economically, the EU’s share of global GDP shrank from 19.27% in 2022 to 17.3% in 2025, overtaken by China. Technologically, Europe lacks AI giants to rival OpenAI and lags in the green energy revolution. More critically, its security dependency persists: 78% of NATO defense budgets rely on U.S. funding (2024 data), marginalizing the EU in mediating the Ukraine conflict. Europe’s exclusion from the 2025 Riyadh negotiations exposed its role as a pawn in great-power games.

Three structural contradictions underpin Europe’s crisis:

1. Welfare-state erosion and industrial hollowing: Manufacturing value-added plummeted from 18% (2000) to 12% (2025).

2. Fragmented decision-making: Unanimous votes among 27 members delayed gas price caps for 11 months during the Russia sanctions.

3. Clash between values and interests: Macron’s "strategic autonomy" clashes with German pro-U.S. factions, deepening reliance on China—EU-China trade surged 40% (2022-2025), with Huawei’s 5G market share exceeding 35%.

III. Global Order Fracturing and Multipolar Acceleration

The U.S. "abandonment" of Europe accelerates global realignment:

• Militarily: NATO faces existential crisis as U.S. European Command troop levels drop 40% to 30,000 by 2025, forcing Franco-German "European Army" initiatives despite budget disputes.

• Economically: RCEP and BRICS expansion (15 members by 2025) challenge dollar hegemony, with RMB reserves in the EU rising to 12%.

Russia and China emerge as primary beneficiaries:

• Russia: Energy "eastward pivot" boosts China trade to 35%, while expanding influence via the Shanghai Cooperation Organization.

• China: The Digital Silk Road consolidates footholds in Hungary and Serbia, circumventing U.S. tech blockades (7nm chip breakthroughs despite export controls costing $23 billion in 2024).

IV. Historical Lessons and Future Scenarios

History shows isolationism never achieves true insulation. The 19th-century high tariffs bred Civil War tensions, while pre-WWII neutrality failed to prevent Pearl Harbor. Today’s U.S. "offshore balancing" struggles to sustain unipolarity as the Global South demands climate justice and BRICS lending surpasses the World Bank.

Three trajectories may define the next decade:

1. Europe’s "limited autonomy": Rapid-response forces emerge but remain NATO-dependent.

2. Indo-Pacific "dual-core rivalry": ASEAN adopts hedging strategies amid U.S.-China competition.

3. Fragmented multilateralism: WTO stagnation vs. 589 regional trade pacts (2025).

Ultimately, U.S. isolationism is not retreat but tactical recalibration of hegemony. Its success hinges on rewriting global rules amid decline—a defining challenge of 21st-century power politics.

Insights: The essence of U.S. isolationism and Europe’s decline lies in a hegemon’s cost-control tactics during relative decline. For China, this presents strategic opportunities to deepen South-South cooperation while guarding against systemic risks in governance vacuums—where "America First" collides with "European autonomy," conflict may find fertile ground.

0 notes

Text

Unlock Global Trade Insights with Real-Time Trade Statistics

In today's hyperconnected economy, global trade statistics are more than just numbers—they're a strategic resource. Businesses, policymakers, investors, and researchers rely on trade data to identify trends, optimize operations, and stay ahead of the competition. With global trade exceeding $32 trillion annually, real-time visibility into cross-border transactions is vital for making informed, profitable decisions.

What Are Global Trade Statistics?

Global trade statistics refer to data collected and published by governments and international bodies detailing the import and export of goods and services. These datasets typically include:

Commodity types and quantities (often categorized under HS codes)

Country of origin and destination

Value (in USD or local currency)

Transportation mode and ports used

Trade balance figures (deficits/surpluses)

This information is typically derived from customs records and shipping declarations, then processed by national statistical agencies or global organizations such as the WTO, IMF, or UN Comtrade.

Why Global Trade Data Matters

1. Market Intelligence and Expansion

Companies eyeing global markets use trade statistics to evaluate demand, monitor competitors, and pinpoint promising export destinations. By analyzing country-specific import volumes and key buyers, businesses can tailor marketing strategies and build more effective distribution networks.

2. Competitive Benchmarking

Trade data reveals who’s importing and exporting what, where, and at what value. This helps businesses benchmark performance against rivals, spot new entrants, and assess market share changes over time.

3. Supply Chain Optimization

Understanding trade flows enables better sourcing decisions. Companies can identify low-cost suppliers, reduce risks from overreliance on single regions, and respond quickly to geopolitical or regulatory shifts.

4. Trade Compliance and Risk Management

Accurate trade data ensures compliance with international laws and tariff codes. It also flags potential red flags such as sanctioned regions, dual-use goods, or unusual price discrepancies that might indicate fraud or evasion.

5. Policy and Investment Analysis

Governments and financial institutions use trade statistics to guide foreign policy, allocate resources, and manage trade agreements. Investment firms rely on macroeconomic trade trends to model growth opportunities and sectoral risks.

Current Trends Shaping Global Trade Statistics

Digital Trade and E-Commerce: The rise in digital services and cross-border e-commerce is reshaping trade flows, requiring more granular, tech-driven data models.

Sustainability Metrics: Green trade policies and carbon border adjustments are increasingly embedded in trade data analysis to support ESG goals.

Real-Time Data Access: Traditional quarterly reports are no longer sufficient. Businesses now demand real-time trade data to stay competitive and agile.

AI and Predictive Analytics: Advanced platforms use AI to forecast trade disruptions, price trends, and shipment patterns from massive datasets.

Marketing with a Data-Driven Edge

For businesses operating in a fast-moving global environment, access to reliable and timely trade statistics is a competitive differentiator. Whether you're a logistics company optimizing routing, a manufacturer sourcing raw materials, or a startup seeking new markets, trade data fuels more precise, cost-effective, and timely decisions.

This is where Trade Data Monitor stands out.

As a trusted provider of up-to-date global trade statistics, Trade Data Monitor offers proprietary tools and datasets that go beyond raw numbers. Their platform delivers custom analytics, user-friendly dashboards, and expert insights to help users convert data into action.

With coverage spanning over 120 countries and millions of data points, Trade Data Monitor enables organizations to:

Discover top-performing markets and trade partners

Monitor competitors’ global shipments in real time

Stay compliant with evolving international trade laws

Visualize trade routes, commodity shifts, and tariff impacts

Conclusion: Transform Insights into Action

Global trade statistics are no longer just a back-office concern—they're a front-line tool for growth. Whether you're navigating post-pandemic recovery, dealing with tariffs, or looking to launch a product globally, actionable trade data offers clarity in a world of complexity. With partners like Trade Data Monitor, businesses can confidently harness global trade statistics to drive smarter strategies, build resilience, and capture global opportunities.

0 notes