#automation success

Explore tagged Tumblr posts

Text

From Fear to Fiercely Building a Global Real Estate Business with Alicia Jarrett

Key Takeaways Fear doesn’t have to stop you—Alicia Jarrett proves that bold action builds empires. Systems and delegation are the keys to scaling a business from anywhere in the world. Women can thrive in investing by leading with both heart and strategy. United States Real Estate Investor United States Women in Real Estate Investing with Alicia Jarrett https://youtu.be/qnKpV-lt5GE Follow and subscribe to United States Women in Real Estate Investing worldwide on your favorite podcast platform. spotify apple amazon iheart pocket castbox overcast pandora United States Real Estate Investor United States Real Estate Investor The Leap That Changed Everything When Alicia Jarrett left her secure corporate job in Melbourne, Australia, she didn’t have all the answers—just a powerful vision and an even stronger determination. She dared to dream beyond borders, and that dream led her straight into the heart of U.S. real estate investing. “I didn’t want to build someone else’s dream anymore—I wanted to build my own.” In this episode of United States Women In Real Estate Investing, host Jeune Ortiz sits down with Alicia to uncover the mindset, systems, and purpose that allowed her to create a thriving real estate business from across the globe. From Corporate to Courageous Alicia’s story begins like many others—trapped in the rhythm of corporate life, silently craving something more. But unlike most, she took action. She chose the uncertainty of real estate over the comfort of routine, knowing that true freedom would never be found in a cubicle. “I was scared, but I did it scared.” It’s this fearless mentality that became her foundation. And with that courage, she not only entered a new industry—she disrupted it. Building an Empire from Another Continent Operating out of Australia while investing in the U.S. is no small feat. But Alicia didn’t let geography limit her vision. She built a rock-solid team, leveraged virtual assistants, and created data-driven systems that allowed her to thrive in a completely different country. “We built Supercharged Offers to help others do exactly what we did—scale smart, and scale boldly.” Through her companies, Supercharged Offers and Global Citizens, Alicia now empowers other investors, especially women, to break free from limiting beliefs and take control of their financial futures. Real Systems. Real Delegation. Real Freedom. The secret to Alicia’s success? Systems and delegation. She realized early on that she couldn’t—and shouldn’t—do it all. “Stop treating your business like a hobby. If you want real results, build a real structure.” Alicia shares how clarity, automation, and the right team can transform chaos into consistency—and why every woman in real estate should aim to work smarter, not harder. Leading with Heart and Strategy Alicia’s mission goes beyond business. She wants women to see what’s possible when they stop letting fear dictate their choices. “You don’t have to know everything. You just have to take the first step—and keep walking.” Her story is a call to every woman who’s been told she’s not enough, not ready, or not capable. Alicia is living proof that the only limits that matter are the ones we accept. No Borders, No Limits—Only What You Choose to Believe Alicia Jarrett’s journey isn’t just about building a real estate business—it’s about building a life of intention, courage, and possibility. From Melbourne to middle America, her story reminds us that we’re only ever one brave decision away from a brand new life. “The life you want is already waiting. The only question is: will you go after it?” If you’ve ever doubted whether you have what it takes to succeed in real estate—or anything else—this episode is your proof that you absolutely do. Discover the unstoppable energy of USWIREI where fierce, fearless women reveal how real estate investing transformed their lives. From flipping homes in high heels to building empires one rental at a time, these stories don’t just inspire; they ignite.

United States Women in Real Estate Investing is your space to learn, grow, and rise, surrounded by powerhouse women just like you. This is more than a podcast. It’s your permission slip to think bigger, act bolder, and claim your place in the world of wealth. Ready to be empowered? Your real estate journey starts right here. United States Real Estate Investor Contact Alicia Jarrett Supercharged Offers Global Citizens Women in Leadership Development Alliance LinkedIn United States Real Estate Investor Mentioned References Rich Dad Poor Dad by Robert Kiyosaki Who Not How by Dan Sullivan and Dr. Benjamin Hardy Atomic Habits by James Clear United States Real Estate Investor Transcript Hello and welcome to United States Women in Real Estate Investing. I'm your host, Janae Ortiz. I'm also founder of REI Social. And on this podcast, I'm so happy that I get to interview some amazing women who are doing fantastic things in the world of real estate. And today with me, I have Alicia Jarrett. And, Alicia, welcome to the show. So glad to meet you. Thank you. You too. Happy to be here. Oh, my goodness. I'm so glad to meet you too. And for two people who have names that nobody else gets right, we both got it right. I love that. I love that. Yeah. I did have to practice it a couple of times to to get your name, but, yeah, I I think we both appreciate it when somebody, you know, works works at it to get our names. Especially. Yeah. Most people that that will be watching this that know me know that I also go by AJ just go with AJ. It's much easier. That's okay. I go by June. I'll answer to that. Sure. Just say, hey, you. And I'm like, yes. I'm here. What do you need? Yeah. Someone called me Juan once. So I was like, okay. Oh, but that's really funny. So I've had a liquea once as well where they phonetically pronounce the c, and I was like, alright. Interesting. Interesting. But we're not here to talk about names. We're here to talk real estate. And those names are pretty easy to pronounce. That's right. That's right. We go on and on about our names. So welcome to the show. And, I think the first thing our guests are gonna notice probably is your distinctive accent. Yeah. I did well, morning and they were like, Are you English or New Zealand? And I said, No, I'm I'm Australian, but maybe it's because I've done business in The US for eight years that maybe my accent is a little, a little off. But, yes, I am an Aussie doing business over here in The US. I've been doing real estate over here for eight years now and, absolutely love it. I'm here in Phoenix at the moment. But I still spend my time between Australia and The US. So I'm I'm back and forth all the time. So what inspired you to do business in The US? Great question. So I guess that the first thing is The US and for anybody watching this that already does real estate in The US and feels like it's difficult, let me give you the perspective from the other side of the world. The US has so much opportunity when it comes to real estate, how to do real estate, the different strategies, the different asset classes, the ways that we can do marketing, all these different things. None of those really exist in Australia. So in Australia, the the the norm or the culture, if you like, on how people do real estate is you go to a realtor or a broker and they transact the deal. That's it. Doing off market deals is not really something that that is custom over there. Very, very small amount. And the main reason it's it's small is because the access to data and the ability to do marketing over there at a low cost is non existent. The other thing as well, Jeanne, is the the entry point in the Australian market is super high. Like, you and I were just talking about that you're from California. I want you to think San Diego, Beverly Hills, those kind of prices. Like, the average house in Australia, and I'm talking average three bedroom, two bath family home in the outskirts of the main cities.

You're looking at the city I'm from in Melbourne, looking at about 1.3 to 1,400,000.0 minimum. Oh, wow. It's crazy. It's big. Yeah. So coming to The US was an easy decision to do business because access to data, ability to do marketing, ability to do off market deals. It was just a ticked all the red boxes, Janaye. So we started doing houses and fix and flips eight years ago, and now we do vacant land and we do marketing. Okay. Awesome. Well, we're gonna get into some of that too because, you and I talked backstage a little bit and you got some amazing stuff cooking also with your, supercharged offers business. Yes. Before we get to that, though, one other follow-up question. So how what got you into the world of real estate investing? So you're in Australia, and and by all accounts, it is not a thing to do out there. So how did you find out about it and what got you started? Well, it is a thing to do real estate investing in Australia, but it's a buy and hold strategy. And then it's what what they call, negative gearing. So and I know that that exists here, but basically you buy a property, you put a tenant in it, you then get your tenant to pay something and then any losses that you make with the interest on your property, which is everybody, main strategy that people do. So in terms of off market deals, fixing and flipping, wholesaling, all of that, that doesn't really exist. So do people buy properties and do them up and sell them? Yes. But it's not anything like what happens over here. So we already had a couple of properties in Australia and I love the idea of property. It's not my background. I am not a real estate professional by any shape or or form. But I went to a seminar that was talking about different industries across the world and, you know, different markets and what you can get involved in. And I always knew, Janae, that I wanted to have a business that as long as I had a laptop and a phone, I could do business from anywhere. Have that business that was reliant on me and my time, which is the actual business I had before getting into real estate. I was doing consulting and leadership development and training. And so I was always having to exchange my time for money when it came to how much I could make. Done with that. I want to move to a different business model. And so the idea of doing business in The US and real estate here got put in front of me. And I did a little bit of research and I went home to my partner at the time and I said, I think think we can do something here. This sounds pretty cool. Let's go and explore it. So we did and we ended up buying our first property which was a a little house in Jacksonville, Florida. I think we bought it for about 17,000, did a small rehab, 90 something. And it was the easiest deal I'd ever done. And I was like, let's do that again. Yeah. Right? Give me some more of those. Yep. So is there a place, a specific state, that you prefer to do business in? There is. Yeah. So so all of the time that we've done deals over here, whether or not we were doing fixing and flipping and then moving into vacant land, we've pretty much stuck with Florida. And the main reason is it keeps giving us deals. We've got a big buyers list there. We we know some developers and builders there that we can sell properties to. Our realtor is on the ground there. We've got a great title company there. So we haven't needed to go out of Florida at all yet. However, with supercharged offers, we've got customers doing deals all over The US. So even though we personally only do Florida, I get to see what all of our customers are doing. And there are deals everywhere, Janae. Everywhere. Yep. There are. And, you know, there are also deals happening no matter what the economy is doing. There is always money to be made in real estate. You just have to kinda know your strategy and and figure it out. Correct. And and adjust your strategy for the current market. Like, it's been really interesting the last couple of weeks.

I've had some customers because we do direct mail for our customers. I've had some customers go, gee, the recent months my response rates haven't been great. And I'm like, yeah, because the market shifted. So now instead of just doing one letter, maybe you need to do one letter, followed up by a postcard, followed up by some cold calling. Because sellers still want to sell, but they're holding on at the moment. No, every market goes in cycles, and I've been espousing this for the last few weeks that we're in a we're in the downturn cycle at the moment, right? And everyone, if they listen to the big media, you would think that now's a terrible time to do real estate. It's not. It's just a market doing its thing, like all markets do. Selling in this market because some people need to liquidate to then, you know, increase their cash flow. There's always buyers in this market. I even go back to 02/2008 and, we call it the contrarian buyer. So contrary to what the market is doing, they're still going in and transacting. People that hold on to properties, people that buy low and sell high, land bankers, developers, builders Yeah. They're all still going out there and buying vacant land. So there's still a move with it. Yes. Yeah. Absolutely. Okay. Cool. And you've mentioned a couple of times now, supercharged offers and marketing. So tell tell us a little bit about that and what you do for investors. Start by saying why did we create supercharged offers? So, previously backstage, I was mentioning what what we do and and basically we have a done for you real estate acquisitions marketing service, the marketing team for the real estate investor. And, and that constitutes everything from grabbing and pulling and scrubbing their data, sending out their direct mail, doing cold calling for them with a US based team, building websites and sales funnels, creating ads and audiences on Facebook and Google, building out their social network, and creating this entire end to end engine that's nurturing their leads for them. So So all that we really want the real estate investor to do is tell us whether they wanna do deals and what types of deals. When leads come in, build that relationship and close the lead. Everything in the middle, we do for them. So why did we start? Had at the time, like, we felt just really disjointed in our own marketing, Janae. We had one company doing our data, another company and a VA that had to do our data for us. We had another company that was doing our direct mail, another one that was doing our our websites, another one doing our social ads, another one doing our cold call cold calling. So we had all these different people doing things for us, but it was just didn't kind of work together. Right? And so we thought at the time surely there's got to be a more efficient way of running our marketing because having those five different companies, it was a lot to manage. And when it got overwhelming, it sometimes it meant that we missed a month during marketing and then our pipeline would come down. We might miss another month and then we're down even further. So we just really felt like our business was quite disjointed and bit of a roller coaster. So at that time, we went, this is about four and a half years ago, we went looking for a specialized real estate marketing company that could do all the things that we wanted. And guess what? We couldn't find them. We found ones that were just doing data and mailings. We found others that were just doing cold calling. We found people that were just hosting standard websites. But nothing that was tailored to what we wanted as a real estate investor and how we wanted to run our business. So we we created it ourselves and and here we are four and a half years on, we've got a couple of hundred customers across nine countries, all doing business in The US. And I think because we are global, we seem to attract a lot of people that want to lean on our expertise to how to do business in The US as well, which is kind of cool.

I I wake up every day super grateful for the fact that help so many people with their businesses. It's really awesome. Yeah. That is really awesome. I love that. And I think if people wanna know more, they can go to superchargedoffers.com. Yes? Okay. Absolutely. And same on Facebook. Just go to superchargedoffers on Facebook. And we'd be more than happy to help. And now we've got people these days and and that do vacant land, single family, self storage, warehousing, you name it. We can do all of it. And the one thing I just wanna come back to and the other thing I get super passionate about. When you're a real estate investor, you make your money when you're doing deals. When you're speaking with sellers and building relationships and liaising with your buyers on their buy box and marrying up deals and making deals happen. Right? All this other stuff that you've got to do with your business like pulling data, getting direct mail done, arranging cold calling, managing your online footprint. All of that stuff takes time. And not only does it take time, but I don't know about you, Janae, with, REI social because I I get what you're about as well. But a lot of real estate investors are not great at that stuff. And nor should they be, you know. What they should be good at is building those relationships with sellers and buyers and doing deals. Absolutely. %. And I can totally relate to the craziness of just managing all of the different tasks because, I mean, there hasn't seemed to be one company who could manage it all and basically take it off your plate. You know, offering the services is one thing, but then actually literally taking it off your plate is fantastic. So You're right. It makes total sense to me why you've been in business for four and a half years and probably only growing from here. Yes. Exactly. And we do work with our customers for a minimum six months. And the reason for that is, again, there's too many other companies out there that I noticed. And this is my little bit of a bug bear, if you can call it that. But I see a lot of these different educators or marketing companies that are kind of an overnight thing. So you you jump in, do what you need to do, and then they kind of leave you be. And we're like, no. We we need to be with our customers for the long term because two, they're just getting started or maybe they're an experienced person that they're going through a growth phase. Like wherever they're at, we've got to meet them there. And it does take quite a few months now to get properties under contract with your acquisition, then sell them in your disposition, like the cycle is quite long. 2021, we are talking one to two month cycle. Now, 2023, here we are, we are talking more like a four to six month cycle. So you know, we need to be there and support our people throughout, throughout that journey. Yeah. Yeah. Absolutely. I was actually literally talking about that with my business partner today about the the shifting and, you know, having to put some longer drip campaigns in place just to stay in touch and, you know, just always be there because deals are taking a little bit longer to produce. Correct. Yep. And you gotta be patient. Yeah. And this is I think this is the time as well, Janae, when we're going through this market shift that we we were talking about before. This is the time that tests who's really a real estate investor and who's someone playing on the outskirts that is happy to walk away. And I often look at that and go that's not necessarily a bad thing because when the market's high, everyone wants to jump in. Everyone wants to be a fix and flipper or get into vacant land and do all these things because it's the the, you know, it's the in thing. But then when it gets tough, when it gets difficult, that's the time that it sorts out the people that are really serious versus those that aren't. And when those that aren't leave the market, that creates more opportunity for those that are.

Yep. Yep. Absolutely. Yep. I love that. So let's see. We talked a little bit about where you're from, how you got started, and things like that. Are there any kind of favorite deal types that you have or favorite kinds of people that you work with? Oh, both. So on the people side, we actually work with a number of different coaches in the vacant land space. Because we always say that we're not an educator, we're an implementer. Implementation. And if I can call out one in particular, Jaren Barnes, he's got a really fantastic group called the Land Maverick Society. He's just awesome. He's like us. He's partners with people on deals and he holds their hand through their first couple of deals to really get people successful, which I think is is amazing. Because again, I see so many educators out there that just push someone to a course, but then they've got no support after that. So I think some of my favorite people are the ones that have the same mindset as us that you do better when you link arms with people, and you can do deals together and do business together. I think that's amazing. In terms of the types of deals, obviously, we do vacant land. So we moved away from the houses a few years ago and got into vacant land. I love the deals that are kind of two of them. One of them is where the seller needs to get rid of their property, but it's got problems like probates or title issues or things like that when no one else is willing to help them. And when myself and my title company can really get in and make that happen for them, I love that because they just get this sense of relief. And they're like, inherited property and they're like, I didn't even know we had it in the family. I don't want this property. Now I've got to pay taxes on it. Like, what? So I love those deals because we're able to make people happy. But I equally love the development deals where we're working on one at the moment. That's a 10 acre parcel that we're hoping to subdivide and work with a developer on to put some more affordable housing into an area. And those kind of deals I love. They're longer deals and there's more involved, but they get super exciting because you're starting to change communities then when you're doing that kind of stuff. Yeah. Yeah. That's fabulous. So we've talked a lot about some positive things. Your first deal where you was super simple. You made a ton of money and all these positive things. And I know, in real estate, it's not always, you know, pretty sunshine, rainbows, and things like that. Tell me about one of the, the lessons, the harder lessons that you had to learn as a investor. I think one of the ones, and I've talked about this on many podcasts, but probably not not to your audience. So it comes back to the shift that we made when we were doing, houses and then when we shifted to vacant land. And that shift happened because we moved strategies. So we were doing affordable housing, we were fixing and flipping just, you know, basic family homes that people could move back into and have a roof over their head and have somewhere that they could call home, which is wonderful. We weren't going after the big awesome properties. But then we did. We found a big property and we went, this is too good to be true. Let's, you know, let's buy this one. It's against our strategy. But look, it's on a great street, it's in a great neighborhood, it's a great house, doesn't need much work done to it at all. So we bought it thinking it would probably be, I don't know, eight to twelve week project at the most. You know, not not a huge amount that needed doing. We're gonna be putting new flooring in. Kitchen was great. Needed to change over the bathrooms. Give it a really good paint job. There was some external stuff that needed doing just, you know, cleaning it up, painting it, etcetera. But then we got started, and our project team that was on it, the more it's like an onion. Right? The more that you peel back the layers, the more seems to be revealed.

Yeah. And this was one of those projects, Shanae, that instead of three months, it took twelve. Instead of a budget of, you know, 70,000, it was more like 300,000. Oh. And yeah. And we had people steal things from the the site. We had contractors leave. We had a break in where they saw the fridge and the washing machine, and just all, what if you know, whatever could go wrong did go wrong. Wow. At the end of twelve months, we sold the property, and we basically broke even. So we didn't enter into a loss, but I guess if you look at your time and stress in that those twelve months, it was a loss, right? And so then we really sat back and went, well lesson learned, let's not deviate from our strategy. But lesson number two is, you know that was also at the time, this is going back about six years ago now, that everybody wanted to get into single family. So you know people were stealing contractors left, right and center and paying them double to go work on their work sites and all these kinds of crazy things. Time, all right, we're trying to do this from the other side of the world. Let's maybe look at a different asset class. And then exploring that, that's when we came across vacant land. And it is much easier. Yeah. So whilst that was a tough challenge, it ended up being a good thing because it led us to where we are now. So when you had this experience and you said that you had deviated from your strategy. Is that what you said? Mhmm. What was so what was the strategy and how did you deviate? What was the deviation? Yeah. The strategy was buying, affordable housing. So we were looking at, houses that we could buy between, say, 20 to $40,000 on average, in not the greatest neighborhoods, but neighborhoods that there were still families that needed homes. And we were doing a basic fix and flip to those, when looking at our ARV and wanting to make a certain amount on each of those deals. So that was working well. Then all of a sudden, we bought this house that was 200,000. I see. Yeah. Got it. Not the same neighborhood, not the same fixtures and fittings, not the same project and even more problems than some of the other houses we've done. So, you know. So traumatic, so traumatic for you that you moved all the way to vacant land instead. We did, we actually switched asset classes. And I look at that now as a blessing, because I think had we tried to continue in the single family space, we, you know, it's just so competitive now to try and get a good off market deal that's got an ARV that meets your numbers, and, trying to get good contract teams. It's it's it's a minefield. It really is. So I'm kinda glad that we got out. Yeah. Yeah. I hear you on that as well. So, you know, we have listeners who are in all kinds of, I don't know, I guess, degrees or experience levels in their business. Yep. And and for the listeners who want to know how to get started, maybe even doing vacant land. Like, what advice do you have to give them on what is the best way to do that? Yep, great question. Apologies if you can hear a dog barking in the background. There's one outside. No worries. The best way to do it is to start with some education. There's actually lots of free education out there now on vacant land. So there's a couple of websites. One I'd suggest is RE like RE Real Estate Tipster, RE Tipster with Seth Williams. He's also got a fantastic YouTube channel and he's a great guy. I've met Seth a few times and he's very giving in all of his information. There's also another one out there called Land Conquest. That's by a guy called Pete Reese, who's based in California. He actually took all of his knowledge of doing land over the last many, many years and put out a free course. It's literally free, the whole thing. There's another one I mentioned with Jaren Barnes called the Land Maverick Society. That's actually a paid program, but he does deals with you. So it's literally somebody holding your hand and funding deals for you, which is really cool.

So I'd start off with some basic education. Because as much as vacant land is a pretty easy asset class to do, it does have its intricacies, you know that is different from houses. So do some education and some research, then just like you do with the single family market, or any other market, do some marketing. Send out some letters, do some cold calling, get out to your prospects and start a conversation. One thing I will say that I'm very big on is, you know, I think a couple of years ago, people that were doing off market deals, Janae, they still thought that they could send out some marketing and leads would come in and, you know, they just could send them to a voice mail and get back to them in a few days. No. It doesn't work that way. This is relationship business before it's a real estate business. Or the other way to put it is it's people before it's properties. People these days want to know who are they doing business with? Are you legit? You know, how many deals have you done? Are you someone that is going to help me with the problems that I've got with this property where a Realtor won't? So you do need to get on the phone and when people do call back about their properties, you need to jump on straight away and start a conversation with them. Now you might not know at that stage how to do offers and how to close on it. That's okay. Just build the relationship and go and seek help. There's loads of places out there that you can get help from. Those education places, Facebook groups, your local title company, that may do the closing for you. You know, when you go to your title company and say, hey, I've got a property that I want to make an offer on. Do you have a wholesale contract I can use? 99% of them will have one. And if they're gonna be the one soon the closing for you, then ask, you know, which is the contract that you guys will close on depending upon what state and county you're in that can be that can be different. So just get out there, do some marketing, set yourself up to have, you know, an an online presence so that your prospects can check you out and start doing deals. Oh, yeah. I love that. Great advice. Awesome advice. As far as marketing goes, because you do have kind of a a marketing business, What is the kind of marketing that you're seeing working really well right now? Yeah. Yeah. Definitely direct mail and cold calling still work really, really well. SMS still works really, really well in vacant land, but I personally steer clear of it Because all the regulations that have come down since 10 DLC dropped in all of that. Like really, there's a lot of people out there doing SMS and they're still not following the rules. And you can get your number taken away like that. So I'm like, I'm all about ethics in this business too. So we stick with direct mail and cold call because it's acceptable, it's governed, there's a good way to do it. So sending out direct mail is one. And making sure that your direct mail piece is really tailored to your audience. So if you've got a whole bunch of data for people that you want to talk about their properties with, segment that data into what are the people that have infill lots? What are the ones that have large acreage? What are the ones that maybe own multiple properties? And each of those should have their own marketing message that is sent to them. So that you are individualizing that message and personalizing it as much as you can. And then doing cold calling as well. With cold calling, couple of hints and tips there. Go to a cold calling team that, is local because definitely using an American based dialer does help. And ask them if they use a local number. So wherever they're dialing to, so let's say they were doing Georgia, which you and I spoke about before, make sure they've got a local Georgia number that they're using because that's also gonna increase your response rate too. Right. Good. Yeah. I love that. And, you know, if you're not doing vacant land, the the same theory holds true for any of your marketing.

You've got a segment for the audience. Putting something out there that's like we buy we buy fast with cash, quick close, etcetera. That doesn't offer enough connection to the pain that you can solve for somebody. So it's very important to just address the pain points that you can actually help with that resonate with that person's individual situation. Correct. And you might not get it right every time, but by g, it makes a difference when you're at least giving an effort around that. So even in your data, if you're vacant land, we we do a lot of filtering and scrubbing on the data for our customers, and we've got some customers that love doing probate deals. So we'll look for the deals in there that were either transacted with a quick claim deed or transacted with a hundred dollar sale because they're often the ones that have been inter family transfers. And we might send them a letter that says, hey, we're not sure, but we think you might have actually got this this, inherited this property. If that's true and you still need to do a probate or you're not sure what to do, maybe give us a call and we'll just give you a free consultation on your your options of what to do with the land. You know, open up some dialogue with your your prospects. Yeah. I love that. Great advice, Alicia. I love that. So, you're obviously you've got a lot going on. You know, you've got your real estate in investing business. You've got your marketing business. Tell me what your long term plan is. Where do you see yourself in, like, five years? Oh. So in five years, Janae, I wanna be like, honestly, I wanna be living in Italy sipping on a cocktail. That's my goal in five years. I love Italy. I'm not Italian, but I I've always said that I wanna live in Italy someday. Like, I'm I'm 48 now, so that'll be in my mid fifties by then or early fifties. So that's gonna sound pretty cool. But the thing is, I don't see us doing anything different business wise because we're here for the long term. We want to keep growing our business, adding more products and services and different things to help real estate investors out. So yeah, and so I do see us ourselves at some stage putting in more of another layer of people in the business so that we can step away a little bit and, and start to manage more rather than doing. No, for anybody out there who started a business, they will know that it's not easy. We've been doing this four and a half years and we are we're working the grind. So hopefully getting to the stage in five years that we can ease back a bit, have the business kind of run itself. And, you know, we've got some evergreen things we're working on as well, like you. Live life a little bit more. Yeah. Yeah. Good. Yeah. And as long as like you said in the very beginning of our interview here, as long as you have your laptop and an Internet connection, you can do your business. Correct. Correct. Minus the Internet connection that we had in the middle. Oh, yeah. You know, technology is great when it works, and when it doesn't, it's horrible. Absolutely. Alright. So, again, you have a lot going on, and I know, you know, it can be it can be a little bit draining no matter how excited you are to do what you do. Some days, they're just hard. And in real estate, it's so unpredictable, you know, and there are many times when you are just literally biting your nails, worried about, you know, how is the deal gonna close? If it's gonna close, what problems are gonna have to overcome? Are we gonna be able to, you know, do what needs to be done, etcetera? How do you or, so it's a two two part question. First, how do you stay sane through the craziness of of real estates kind of ups and downs and unknowns, and also, how do you stay motivated to to get up and and kind of slay the dragon another day? I couldn't agree more with your summary there of of of the the world of real estate. Like, it is very unpredictable. A lot of isn't, especially, and I'd say being a business owner, things are predictable and they're not.

Like, no one day is the same as the next, right? To come back to your question about how do I stay sane? I'm not sure I am, Janae. So there's a little bit of craziness in me because to do what we do and work sixty, seventy hours a week, you've got to be a little bit on the crazy side, right? That's not crazy as in bad crazy, but crazy as in determined, resilient, goal driven, like doing stuff that other people aren't willing to do or don't want to do. And that's cool. I'm totally happy if people don't wanna do what I do, because I'm living my life and doing this on my terms. So how do I stay sane in that? I guess first and foremost is not not lose the North Star. So the North Star is is that the lifestyle that I wanna lead, the people that I wanna help, and the outcomes that I want from being a business owner. You have days I had one last week where there was tears and there was tantrums and I was like, Oh, I can't do this anymore. But then you pick yourself up, you dust yourself off and you're like, Nope, Today's, you know, let's end the day on a high and tomorrow's a new day. And things have a way of changing really quickly. Right? We're going through a real growth phase at the moment that's really put us under a lot of pressure, and some of our customers have acknowledged that as well. So we in those moments, I think humility and being humble and saying, hey, I get that I've been hard to catch, but I'm here. You know, call me if you need me, get in touch if you need me, don't complain about it, just contact me. I'll find time and I'll make time. So having that that humbleness is also really important to to don't don't let your don't let your mind kinda get away from the the purpose of what you're doing. In terms of staying motivated, I get motivated by our customers because I was on a call last week and well, there's two things last week. One was I was on a customer call because I do regular check ins with our customers. And one of our customers, Doug, who's based in Texas, I was like, Doug, how's your pipeline looking? Tell me. And he's like, AJ, we're four months in and I'm sitting on about $180,000 worth of profit. I've got two closings next week. That's gonna net me another 50. I am off and running. And I was like, yes, yes, yes. I get so excited for our customers. And then the next day, we have a little app that people called VideoAsk that our customers can leave us testimonials. And two of my beautiful customers, Charlotte and Matt, without knowing, they they recorded a a testimonial and sent it through to me. And I sat there and cried, but they were happy tears. Because, you know, beginning of the year, this is a couple that were super struggling to make their business work. They were about to give up. They were like, we can't do this anymore, AJ. And I was like, guys, let's stick with it. Let's just stick with what we know. Ignore all the bright, shiny stuff that's going on because there's lots of bright, shiny things out there. Let's just stick with what we know. They're about to close out the year with $120,000 profit. Nice. And I'm like, you know, it's stuff like that, Janae, that keeps me motivated because not every customer is successful. Like, we talked about before with sending someone to voice mail and getting back to your leads three or four days later. You know, we do have a lot of successful customers that are very driven and very customer focused, and they know that this is all about relationships and they get success. So when I get stuff like that, that's what keeps me going. Yeah. I love that. That's, you know, that's one of the things that got me into real estate investing anyway in the first place is just helping the people. Right? Helping the people with these troubled properties with all these problems that are they're, you know, stressed every single day, not underwater with, you know, the financials or, you know, just the house is a burden or anything like that. You know?

And then I love on your business side too, just being able to help investors harness their success so that way they can help more of those people who are struggling. Yep. Speaking my language. Absolutely. Absolutely. Yep. That's why I started REI Social as well, just to do the same thing, to empower real estate investors to be able to help more people. You know? And I think that's a it is a great way to stay motivated, and I love you how you were talking about the North Star and just not losing sight of that because Yeah. It's it's easy to do. It gets, you know, clouds go over that North Star and sometimes %. Yeah. %. Yep. Very cool. So, I've asked you quite a few questions today and, I'm wondering if there's anything that you were hoping I would ask you that I didn't ask you or or anything else that you'd like to impart to some of our listeners? No. I've actually really loved your conversation, Janai. I think you've asked some really insightful questions and things that made me think, which I love. And, yeah. I don't know if if I guess if your if your listeners have got anything, feel free to reach out to me, you know, I'm more than happy to answer any questions or explain more about the things that I've talked about today and go into more detail. But I think we've covered a lot, to be honest. I think we have too. And it has been an absolute pleasure talking to you, learning about your business and, just meeting you in general. You as well, Janae. And thank you so much for having me on. I really appreciate it. Thank you. Alright. So let's go ahead. Let's call this a wrap and, we'll go ahead and close out. Thank you for joining us on this episode and remember to subscribe to the podcast on your favorite podcast app. You can also head over to realestateinvestor.com for more real estate industry news and other podcasts. Thanks for joining us and I'll see you next time. Universe media mastering. Your audio, more listenable.

#Alicia Jarrett#automation success#bold decisions#brand building#Business Strategy#California#data-driven business#fearless leadership#female empowerment#fix and flip#growth mindset#international investing#investor stories#Jeune Ortiz#los angeles#Melbourne investing#mindset shifts#podcast feature#podcast spotlight#Sandra Fernandez#scaling operations#targeted marketing#US business growth#virtual team building#women entrepreneurs#Women in Business#women who lead

0 notes

Text

Driving Growth with BPM Process Management

For businesses aiming to scale efficiently, streamlining internal support functions like HR, Finance, and Procurement is critical. This is where process automation services play a transformative role. Automating routine and repetitive tasks allows teams to operate with speed, consistency, and fewer errors.

A forward-thinking automate company invests in tools and systems that reduce manual dependency. By adopting automation softwares, support teams can handle tasks like payroll processing, invoice approvals, or onboarding more effectively. These tools not only save time but also boost accuracy and compliance.

Central to this transformation is workflow management software, which helps track, assign, and optimize tasks across departments. It provides visibility into daily operations, allowing managers to monitor performance, identify bottlenecks, and make informed decisions in real-time.

When powered by a strong BPM business process framework, automation becomes even more impactful. Business Process Management (BPM) focuses on defining and improving processes before automating them—ensuring that operations are not just faster, but smarter. It allows organizations to build agile, scalable workflows that support long-term growth.

Understanding and refining workflow processes is essential for automation success. Mapping out each step clearly allows businesses to identify redundancies and streamline how work flows across teams. Whether it’s document approvals or data entry, automating the right processes can result in significant efficiency gains.

In essence, process automation is not just about saving time—it’s about empowering internal functions to contribute more strategically. Businesses that invest in automation today build the foundation for operational excellence tomorrow.

0 notes

Text

It's sad when AI bros do not seem to understand the difference between industrial work and creative work. It only shows that they can only understand anything as a tool. But if everything is a tool, I wonder what they are working towards.

#I get this mansphere vibe where the goal in their heads is but this vague idea of 'success' with money as a score#And maybe having kids all day (also as a score)#Many 'Get rich quick' schemes but not many 'Get fullfillment big' schemes#If you replace everything with automation what are you planning to spend that free time on? They never seem to have a non-related hobby#text

96 notes

·

View notes

Text

🚀 Your Workflow Deserves an Upgrade! 🚀 Ready to take your business to the next level? 💼✨ Get our FREE ERP DEMO and see the results for yourself! 🌟

#magtec#erp#automation#business#efficiency#software#technology#innovation#digitaltransformation#enterprise#solutions#productivity#success#growth#management#finance#humanresources#supplychain#logistics#cloud#saas#onpremises#hybrid#integration#scalability#customization#support#trustedpartner#magtecerp#magtecsolutions

3 notes

·

View notes

Text

Unlock the secrets to success with "5 Habits of Millionaire Entrepreneurs You Need to Copy!" In this insightful video, we dive deep into the daily routines and mindsets of the world’s wealthiest entrepreneurs. Discover how these powerful habits can transform your productivity, boost your creativity, and elevate your business acumen. Whether you're an aspiring entrepreneur or a seasoned business owner, adopting these strategies can lead to remarkable growth and financial success.

Don't forget to like and share this video with anyone looking to level up their entrepreneurial game!

#MillionaireMindset #EntrepreneurHabits #SuccessTips #BusinessGrowth #FinancialFreedom

#marketing#affiliatemarketing#business#success#business automation#passive income strategies#artificial intelligence#machine learning solutions#passive income

2 notes

·

View notes

Text

How to Create and Sell Online Courses

The virtual getting to know industry is booming, and if you have know-how or capabilities to percentage, growing and selling online courses can be a profitable opportunity. Platforms like LearnWithChandeep.Com provide super guidance on how to monetize your know-how efficiently. Here’s how you could emerge as a successful path creator and make cash selling online courses.

1. Identify Your Niche and Audience

Before creating a course, determine your niche and target audience. Think approximately:

What talents or knowledge do you own that others would possibly find treasured?

Who will benefit the most from your route?

What trouble does your path clear up

For example, LearnWithChandeep.com offers specialized courses, each catering to a specific audience, such as Faceless Video Mastery Course, Instagram Growth & Monetization, and Business Growth Templates.

2. Plan and Structure Your Course

Once you’ve identified your niche, outline your course content. A successful course typically includes:

Introduction & Learning Objectives: Explain what students will gain.

Step-by-Step Modules: Break down complex topics into easy-to-digest lessons.

Engaging Multimedia: Use videos, PDFs, templates, and quizzes to enhance learning.

Actionable Assignments: Encourage students to apply what they’ve learned.

3. Create High-Quality Content

Course quality is crucial to success. Consider the following:

Video Content: Even if you don’t want to appear on camera, courses like Faceless Video Mastery teach how to create compelling content without showing your face.

Downloadable Resources: Offer worksheets, templates, and guides to add value.

Professional Audio & Visuals: Good lighting and clear audio improve engagement.

4. Choose the Right Platform

Decide where to host your course. You can use:

Self-Hosting: Build a course platform on your own website like LearnWithChandeep.com.

Marketplaces: Sell on platforms like Udemy or Teachable.

Social media & Email Marketing: Promote through Instagram, YouTube, and email lists.

5. Market and Sell Your Course

To maximize sales, you need a strong marketing strategy:

Use social media: Grow an audience and promote your course.

Leverage SEO: Optimize content for search engines.

Offer Discounts & Bonuses: Provide early-bird pricing or bonus content.

Engage with Your Students: Create a community through Q&A sessions or live webinars.

6. Scale and Automate for Passive Income

Once your course gains traction, you can:

Automate sales funnels with ads.

Bundle multiple courses for higher earnings.

Create membership plans for recurring revenue.

Contact Us

For expert guidance on creating and selling online courses, visit LearnWithChandeep.com or contact [email protected] or 995-306-3642.

#Become a successful course creator#Make money selling online courses#Online course business strategies#Course creation for passive income#Best platforms to sell online courses#Step-by-step guide to creating online courses#How to price your online course#How to make faceless videos#Faceless video creation course#YouTube faceless automation course#Passive income with faceless videos

2 notes

·

View notes

Text

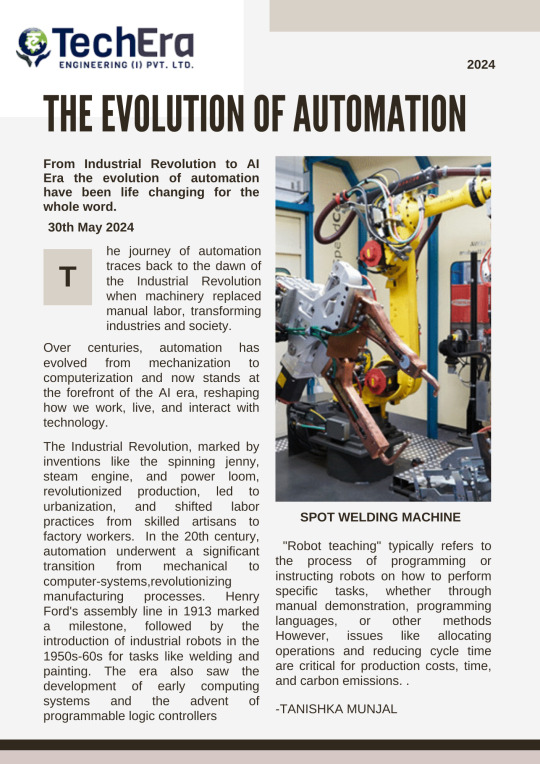

The most awaited article of the year is here ... Evolution of automation is all yours now !!!

#aerospace#automation#machine learning#artificial intelligence#success#inspiring quotes#architecture#article#trending#viral#viral trends#market trends#viralpost#automotive#automatically generated text#software#engineering#search engine optimization

9 notes

·

View notes

Text

#CRM benefits#customer relationship management#business success#increase sales#improve customer satisfaction#data management#sales automation#customer retention#CRM insights#streamline tasks#marketing automation

2 notes

·

View notes

Text

No More Hassles: Sigzen Technologies Simplifies Retail with ERPNext

In the dynamic world of retail, staying ahead means having the right tools to manage operations efficiently. With the advent of ERPNext Retail by Sigzen Technologies, retailers can bid farewell to the complexities and embrace a streamlined approach to their business management. Let’s dive into how ERPNext Retail is revolutionizing the retail landscape. ERPNext Retail is a comprehensive Retail…

View On WordPress

#Ecommerce Solutions#ERPNext#Inventory Management#Retail Automation#Retail Success#Retail Tech#RetailManagement

2 notes

·

View notes

Text

Strengthening Internal Teams with Automation Softwares

For businesses aiming to scale efficiently, streamlining internal support functions like HR, Finance, and Procurement is critical. This is where process automation services play a transformative role. Automating routine and repetitive tasks allows teams to operate with speed, consistency, and fewer errors.

A forward-thinking automate company invests in tools and systems that reduce manual dependency. By adopting automation softwares, support teams can handle tasks like payroll processing, invoice approvals, or onboarding more effectively. These tools not only save time but also boost accuracy and compliance.

Central to this transformation is workflow management software, which helps track, assign, and optimize tasks across departments. It provides visibility into daily operations, allowing managers to monitor performance, identify bottlenecks, and make informed decisions in real-time.

When powered by a strong BPM business process framework, automation becomes even more impactful. Business Process Management (BPM) focuses on defining and improving processes before automating them—ensuring that operations are not just faster, but smarter. It allows organizations to build agile, scalable workflows that support long-term growth.

Understanding and refining workflow processes is essential for automation success. Mapping out each step clearly allows businesses to identify redundancies and streamline how work flows across teams. Whether it’s document approvals or data entry, automating the right processes can result in significant efficiency gains.

In essence, process automation is not just about saving time—it’s about empowering internal functions to contribute more strategically. Businesses that invest in automation today build the foundation for operational excellence tomorrow.

0 notes

Text

#AI applications in agile and hybrid project management#Smart automation tools for efficient workflow execution#Real-world case studies of AI-driven project success#Spotify

0 notes

Text

The Blueprint to Unleashing Citywide Takeovers for Real Estate Domination with Jason Palliser

Key Takeaways Jason Palliser built a 34-strategy lead generation system that allows investors to dominate their market without a marketing budget. His biggest lesson came from nearly losing tens of thousands on a flip, which he salvaged through lease option strategies and collaboration. His favorite technology is a custom automation tool that follows up with motivated leads and funnels them through specialized landing pages to increase conversion. United States Real Estate Investor Real Estate Investing Success Tampa with Jason Palliser https://youtu.be/h26h-NoBekY Follow and subscribe to Real Estate Investing Success worldwide on your favorite podcast platform. spotify apple amazon iheart pocket castbox overcast pandora United States Real Estate Investor United States Real Estate Investor Inside the Mind of a Real Estate Machine Builder In this explosive episode of Real Estate Investing Success, the spotlight lands on Jason Palliser—a man who doesn’t just play the real estate game. He redesigns the board entirely. Known for his powerful “Two-Day Investment Blueprint,” Jason brings an arsenal of 34 off-market lead strategies that overwhelm the competition and eliminate the need for traditional marketing budgets. He’s not just building a business. He’s crafting a system. One that transforms average investors into takeover artists capable of owning their city—deal after deal, lead after lead. Freedom, Not Fortune, Fuels the Mission Palliser doesn’t chase dollars. He chases freedom. After years in the funding world watching investors live a relaxed, wealth-driven lifestyle while he clocked hours as a banker, he decided to flip the script. His career pivot wasn’t about adding zeros—it was about escaping constraints. And through that shift, he built something few can match. From TV Fame to Tactical Warfare After working with household names like Rich Dad, Poor Dad and Flipping Boston, Jason had options. But he chose to walk away from the speaking circuit and tech support madness. Why? To go all in on what works—building complete, tactical investment machines for individual investors ready to scale. The result? His Two-Day Blueprint was born—a real estate battle plan tailored to dominate every niche, from absentee owners to junk removal leads. The Moment It All Nearly Fell Apart Behind the success, there's always a scar. Jason’s most painful stumble came from arrogance—a dangerous overconfidence in his funding access. He believed that because he had the capital, he could fix any flip gone sideways. But one wrong deal taught him a ruthless lesson. He bought a property expecting a hefty return, but as the market cooled, the offers shrank. He rejected a modest profit hoping for a better deal, only to be left holding a losing asset. Payments stacked. Options dwindled. The flip that was supposed to shine became a weight around his neck. And yet, it was through this exact struggle that Palliser discovered the power of lease options. By collaborating with other investors, he salvaged the deal, collected upfront payments, and eventually sold the property at a profit years later. It was a storm, but he navigated through—scarred but stronger. The Tech That Turns Leads Into Contracts Automatically Jason’s favorite technology isn’t flashy—it’s lethal. He’s built a custom system that automatically follows up with motivated leads, tailored to each of his 34 lead sources. Whether it’s a tax-delinquent homeowner or an expired listing, the system delivers the right message at the right time, without delay. This platform doesn’t just follow up. It houses dedicated websites for each type of distressed seller. When a property owner visits a tax-assistance landing page, it’s not just an offer—it’s a strategic ambush. One that converts skepticism into signed contracts. “When a lead shows up, we already know what they need—and we’re ready to solve it instantly.” Not Just Success—Predictable, Sustainable Success

What drives Jason today? Sustainability. He’s not interested in flashy wins or one-time flips. He’s obsessed with building machines that deliver predictable contracts, every single month. That’s what he calls success: knowing the machine will spin and produce, without fail. “Success is waking up with absolute clarity, knowing you’ll close multiple deals monthly—no guesswork, no stress.” Real Estate Reimagined Through Ruthless Precision Jason Palliser doesn’t teach investors to compete, he teaches them to dominate. His strategy isn’t about sending another postcard or dialing more numbers. It’s about flipping the game board, redefining the rules, and walking away with the prize before others even show up. With the tools, the tech, and the tenacity to back it up, Palliser proves that success in real estate isn’t just possible—it’s predictable. For those willing to build the blueprint, the city is theirs for the taking. See more incredible content to ignite your real estate dreams with Real Estate Investing Success—where powerhouse investors reveal the secrets, strategies, and unstoppable drive that’s fueling their path to wealth and ultimate freedom. These stories aren’t just inspiring; they’re the spark that could transform your own journey! United States Real Estate Investor Contact Jason Palliser 2 Day Investment Blueprint United States Real Estate Investor Favorite Technology Jason Palliser’s Favorite Technology Jason’s favorite technology is his custom-built follow-up and lead conversion system. This internal platform does three powerful things: Automated Lead Follow-Up: Every lead from his 34 acquisition channels is immediately followed up with, using tailored messaging for that specific lead type. Niche-Specific Websites: For high-value leads like tax-delinquent owners, his system uses dedicated websites disguised as public assistance programs. This earns trust and triggers inbound contact from motivated sellers. Conversion Without Pressure: Because leads reach out willingly, the sales process feels less like persuasion and more like guidance. “The tech does the heavy lifting,” he explains. “It follows up, nurtures, and converts while I focus on strategy.” It’s not just tech—it’s a silent partner that turns leads into deals with ruthless consistency. Mentioned References Rich Dad Poor Dad by Robert Kiyosaki REI BlackBook (software) Flipping Boston (TV show) featuring TMIREI guest Dave Seymour United States Real Estate Investor Transcript Welcome successors today. We're talking to Jason Pallister, the creator of the two day investment blueprint, real estate investors plan or blueprint, as you could say, to grow to six and seven figures. Jason, welcome to the show. Thanks for being here. Hey, thank you. Happy to be here. All right. So are you ready to talk some real estate investing with me today? Yeah, absolutely hit me with anything you want. I'm ready to roll. Awesome. Awesome Okay, so before we get into the business part of things, how about you tell us a little bit about your personal life? Okay, so Born and raised in st. Louis kind of like you three four years ago said With my wife hey, I've been here 40-something years. I've seen the arch. I know what it looks like Let's move to someplace warm kind of like we talked about before we started today, right? Right right down in st. Pete St. Pete slash Tampa in Florida for the last three and a half years and it's wonderful and there's no state income tax. So That's what we love to do we love travel and We love being active tennis racquetball all the fun stuff. So On the personal side, that's kind of what we do my wife does National Pet Rescue and stuff like that for ASPCA vet tech stuff. And so that's really rewarding. I did my first foster because she Said hey you can do it I was nervous about fostering our first puppy and we did and Then I grew attached to her. So when it came time to somebody else to adopt her I had I had some

real feelings about that so That's what on the personal level it's kind of what we do love travel and Love supporting her taking care of any animal that needs help. Awesome. Awesome. That's good. That's good How many how many animals you got in the house so far? we have two that are we have a 14 year old which is her pride and joy named Monty and little pogo and then we have a Chihuahua who Feels like he's a 150 pound dog, even though he's six pounds. So that's Right now, right, right. Yeah. Yeah, my daughter. She loves loves loves pets. She's yeah, she's crazy about him So Jason you are the creator of the two-day investment blueprint. It is a blueprint that's designed to take investors To grow into a six to seven figure real estate investing business. Tell us a little bit about that and why you created it Oh, yeah, so I've been in this space for 23 years I've been investment banking for 26 specializing private money hard hard money lending and And also getting bank financing for investors strictly strictly work with investors on that. So about three years into that I Realized I would leave a closing as a banker and helping out an investor get funding, right? They would walk out and high-five me and they make 50 grand and I'm leaving the closing as a banker making two grand I'm like, wait a second. I got a degree in finance. This math doesn't work for me so I transitioned to what I call the dark side, which was investing myself for the last 23 years and So what happened is is a bigger companies like rich dad poor dad Flipping Boston TV show stuff like that. They started hiring me for my Funding expertise because I was top 100 in the nation for funding and I knew every investment program There was I could get funding on almost anything. But what quickly transition was they're like, wow, you're doing lots of deals They're like man. What are you doing to get to those deals? and I saw the value and just diving really deep into the marketing side of things like how do I How do I get to all the off-market properties first? So they started asking me to create these programs Centered around the front end of the business which is getting to everything first and From there I created a software called rei black book Some of your listeners may may know what that is. It's a real estate automation tool. It's used by Kiyosaki and some other people that private label it and gurus at private label it around the nation that Listeners would know and I'm so what happened where the blueprint came was that I got tired of speaking for all these places and hey go to Seattle and teach owner financing for the weekend or lead generation and so I canceled about 20 speaking contracts and Sold the software company so I didn't get 300 support emails a day anymore Which is a dream come true between me you and the listeners. Yeah, and so people for years said hey Can you hey that map that you're showing us that organized map where you attack a city 34 ways? so most investors know five or six ways to get an off-market property and we have 34 and the reason for that is that In the course of doing all the speaking and stuff some larger companies like what we call institutional money or hedge fund players Said hey, look, we need 40 homes a month. We need 50 homes a month. We need 4,000 homes in Dallas in 60 months it we heard you the guy that can put together an engine that'll do that Which I just simply called a blueprint It turned into the two-day blueprint because these companies like man in two days you literally lay out the blueprint So that's where the two-day blueprint came from and about five six years ago. I started doing it for individual investors So if you can imagine for years at the TV show stuff people raising their hand or when we go on a break They're like hey come here And you think you could build me that same map and then off-market attack and I said look I'm too busy Speaking doing 10 to 15 deals a month doing private money blah

blah blah And so once I sold all that stuff and canceled those speaking contracts I'm like, hey I will do an official off-market blueprint build out for you and literally attack the city 34 ways all the way down doing Direct mail for free if they do it exactly how we want them to do and be in 30,000 mailboxes Which took me 11 years to figure that out So that's where the two-day blueprint came from is that people are like man over two days You can literally take over a city and not do the same five things like a vacant list a high equity list and let's do some text messaging and and I'm so There's a better way to attack a marketplace So that's what the two-day blueprint came from and we do about nine or ten of those build outs a year, man That's incredible. That's that's awesome. That's I mean, there's no better word to use then awesome That's pretty that's pretty cool, man. I love hearing that and inspection is especially kind of Bringing it into the tech space which a lot of a lot of investors don't really thoroughly think that that's even an option You know, but you you did it. That's that's incredible. I love it. Well here's the people that are listening Antonio I've never wrote a line of code in my life. I'm not some Technical wizard. I just hired the people and said hey, can you make it do this? Which would save me a lot of time and energy. Hey, could you make this part of the? Investment machine, can you create a widget that does this and and pay them to do it and then put it all together that so Anybody can do it. So yeah. Yeah So you may actually have answered this next question. I'm gonna answer it asking anyway What's what's the one word or phrase that comes to mind for the reason you got into real estate investing? That's that's a good question you asked me a really good question So the reason I did is I freedom I saw I saw the freedom that you know I'm I was on the funding side creating freedom for all these investors and they're like, oh, I'm going golfing and this and that oh my gosh, I got I got any more mortgage appointments today And again, I was doing that at a high level and making a pretty good living But their their lifestyle just seems so much more Relaxed and laid-back and they had freedom. So that's when I said, you know, and I I need to dive into this real estate investment sandbox and Once I did I never looked back. It's the it's the best business decision I've ever made What's your favorite part about being a real estate investor? helping homeowners and while also creating a win for The investment side of the business so it's finding a way to be a solution for a homeowner that needs some help An off-market homeowner that has some level of motivation and then getting the back end Win-win, which is depositing a large sum of money or getting a good short-term rental and having Very good cash flow. So That's that's what I love about it Now there's no way that all this time. You've been doing real estate investing that everything's been so perfect and beautiful There's no way okay So what was the time throughout the journey that you've had so far when you felt most unsuccessful oh That's easy so And I in in The the problems arose because of me as a byproduct So I walked around and I would say probably two years into me doing some real estate investing I was just getting some properties and fixing and flipping them. I started doing a couple rentals and Where the most difficult time for me was is that I walked around going? Wow, I I have all the knowledge and all the funding which everybody comes to me for that and everybody wants it So I've got all the money. So I was like man, I can this is great I'm gonna invest and I can do anything because I got the money I got I got access to the money and So I figured I could do any deal and work my way out of it just because I could get funding where most people may struggle with that right but what happened was is My attitude was a little cavalier

about it And so I was like, oh I can get this and do that and move this around and and so what happened was the market started to turn just a little bit not a lot just a little bit and I had a flip and That flip took extra time and in this I'm sure will resonate with most people and if you've been doing it a while You've run into some variation of this It costs a little bit more than I thought and it took a little bit more time When we put it on the market, you know I was all in at 225 and was trying to get 265 out of it The market started getting a little tighter people are making a little bit lower offers I I had an offer like 232 like man, I'm not gonna make seven grand on this I'm gonna I'm gonna reject that offer and just wait market turned a little bit more Then I dropped the sales price ten grand then people are making lower offers and what I had into it So I was just like oh gosh, I'm gonna I'm gonna take my I'm gonna take my first real estate investment black eye here. I could feel it coming right and I'm so What happened? Was the people that I had helped throughout the years get funding where they? Perceived that they were stuck and I helped them out on that side with the funding side I went to a few of them that do lease options and I'm like, what do I do here? I'm like I had an offer on the table That's gone where I could make a little bit of money and I just didn't want to do it But now I'm in a pickle. And so what they did was they showed me how to lease option the property So I had real heartburn. I'm like, wow, I'm gonna I'm gonna probably end up and I was making payments over time So now I'm in a position to where even if I sold it at 230 You know a little bit above what I originally had into it I've already made payments to where I'm gonna lose 5 10 15 grand maybe even 20 grand So they said hey, let's advertise this out. There's a lease with an option to buy so I found a couple ladies who wanted to do a lease with an option to buy and Got some money down fast forward. I release option that property over a seven-year period because I Renewed with the ladies and took some more non-refundable money down They were about 15 grand into it and but ultimately they couldn't get financing I got it. I got one other person in there that was renting it did the same thing at least with an option and Fast forward like seven years. I ended up selling it I want to say for 265 270, but they paid down my note over time So what looked like a world-class punch in the face ended up because I relied on other people's expertise That I had helped through the years ended up coming out a little bit ahead at the at the end But it was that was stressful. That was a stressful. I'd be lying if I didn't say I walk around and it consumed me during the day I got all these other things going on, but that was consuming me because I was like, what am I gonna do with it? Yeah, yeah, that was my worst spot Yeah that's that's what I always say man relationships are almost everything if not everything because if you don't have them you don't know where to Go or don't know where to turn just like you did when something starts going wrong and the lease options That's that's always one of the better options that real estate investing provides. It's pretty cool Yeah, no, it was I'm glad they showed it to me and quite frankly since I know the funding side of things Yeah, like I knew I knew what that person needed to do or clear up to qualify with my banker head on so That that technique had real sex appeal to me when the investors like let's approach it this way Because I knew why that person couldn't buy today. So I put in place. Hey, you need to do these things Ultimately the ladies didn't they had to clear up a couple things and then one of them took a job where they were self-employed So then they had to wait two years all that good stuff, right? But but that's why that that technique had sex appeal to me because I knew what they would need

to do to qualify So do you feel that uh your previous employment doing mortgages and things like that? Do you think that gives you a personal advantage in this industry? Yeah for this reason Countless times over the years people come to me like hey, man I've done some investment deals and now the banks are telling me I got to put more money down and I Wasn't prepared for that. And I'm so I walk around knowing when I'm looking at a property or making an offer I know what I can and can't do on the funding side. I know how much I'm gonna have to put down I know how long it might take for this type of deal to get funding so I can write a I can write a really good contract With the right dates on it and I know how much I'm gonna have to put down and the rug is not getting yanked out From underneath me quite frankly on the banking side That's that's where my business kind of grew because I got to a point where I didn't take on a single client Unless they went through a 22 question checklist and anybody that hears this. I'm happy to send it to you So I built my career on this is a 22 question investment checklist. It's a non-negotiable You have to read this so that you know what credit scores required after five deals that you have financed How much do you have to put down on your fifth deal? Can you do commercial deal on a residential house? So all these things were the people make mistakes. I created a spreadsheet on that. That's that's how I kicked off the Investment funding banking side of my career and that's that's awesome. That's totally vital. That's excellent. I love that Wow Good good job, man You're the insider that everybody needs. You know that Wow cool What one positive goal are you focused on in your REI business today? On the helping people outside just helping people see a clear path to being free and And showing them how to do multiple deals a month without needing a real estate budget that's the number one reason people come to do a two-day blueprint build out what this is, let me show you how we attack a city 34 ways and 18 of those techniques are free. They don't cost anything. We just need to show you how we do it. So For me personally, it's the reason I still do this quite frankly is that showing a showing an investor how to run this like a machine and do multiple contracts a month without needing a budget and seeing them succeed and and Have the freedom that they deserve. That's that's the number one Back-end payoff and result from helping people. That's incredible Currently, what's your favorite technology you use in your business? Um, I would say that We have some tools built that that automatically follow up with a motivated lead. So when we're going through and Having these 34 different Investment leads and sandboxes to play in right those leads need to go somewhere. So we've built Remember, I built a technology company. So we We built some custom stuff that when the leads pour in they're automatically followed up for each type of lead the right way so so for me personally, it's um, just the The follow-up pieces in the in the end it also houses all of our websites for the different Types of leads we get like a tax delinquent person that comes in front of us is behind on their property taxes That's a top two or three lead source because we track every lead source one to thirty four It gets us when I say it's a top ten. You should pay attention because it's one of three metrics if not all three it's fastest conversation to contract Highest level of motivation or highest equity spread and payoff. So delinquent property tax homeowners are Comprised all three of those so it's a very very good lead I always tell people to go after a list of two years behind or more Because the bank they probably don't have a mortgage because the bank would have already foreclosed because I'm a banker I see. Yeah, because they would lose their lien position at a tax sale So now you're going after leads that are