#best invoice software in india

Text

Transform your small business with the best online invoice software

Are you a business owner or want to establish your business and are looking for user-friendly billing software for small business free? With the advent of digitalization, most businesses are moving towards online business these days.

What is the meaning of invoice software for business?

Billing software for small business free automates business invoicing operations by quickly generating a list of services, products, and the total amount and sending it to clients as a billing.

Manual invoicing can cause lots of calculation errors. Even a small and simple mistake in billing can result in a heavy loss of business. With the best invoice software in India for small businesses, you can create and customize your billing, manage and process payments quickly, and generate reports that help you monitor the finances of your business.

What are the advantages of using billing software for small business free?

The following are the perks of using billing software for small business free:

Cost-effective: Not having the best online invoice software can be an extra burden on business owners. You need stationery items like ink, paper, and time. But with the best online invoice software, you can save all the information on one system without causing a burden on the business owner.

Instant updates: The best invoice software in India will update you on all the daily sales of your business and integrate with inventory and accounting software. In this way, you will have complete knowledge about the business inventory.

Reminders: The best invoice software in India helps in making the professional approach towards the reminder of overdue payment. With the help of the best online invoice software, you can stay conscious of the payments, and soon the situation of pending payments will be eradicated from the business.

Accessibility: The accessibility of the best invoice software in India makes it simple for small business owners to get notifications anywhere, and this way, the business owner can keep an eye on the business while sitting somewhere else.

Integration: Unlike other billing systems, the best online invoice software integrates with other software to smooth the billing process. With integration, invoice software for business makes it easier for you to run the business.

Quick billing: In a manual billing system, we enter the price and other details manually and then calculate them, which consumes lots of time. This time-consuming process can be done within minutes with the help of invoice software for business.

Security: All the information uploaded to the invoice software is safe and secure. The billing software has a top-notch security system so that no one can breach the security of the software. Eazybills also offers top-quality data security for your business.

How to select the best invoice software in India?

There are various billing software programs that claim to be the best, but it is your responsibility to inquire about the billing software before finalizing any particulars for your business. Billing software plays a vital role in the reputation of a business, so it may have a good as well as a bad impact on your business, depending upon the selection of billing software.

Following are the important pointers that you need to consider:

Check the authenticity of the software by checking its rating on Google, reading feedback, and contacting previous users.

Confirm that it offers all the features that you need.

Have a robust security system or not.

The final words It is clear that billing software for small business free , plays an important role for small businesses, so be cautious while selecting billing software, or you can directly contact us, as Eazybills is one of the best invoice software companies in India. So hurry up, contact us now, and we will revert back as soon as possible.

#best billing software in india#billing software for pc#easy billing software#easy software for billing#best invoice software in india#best online invoice software#invoice software for business#billing software for small business free

0 notes

Text

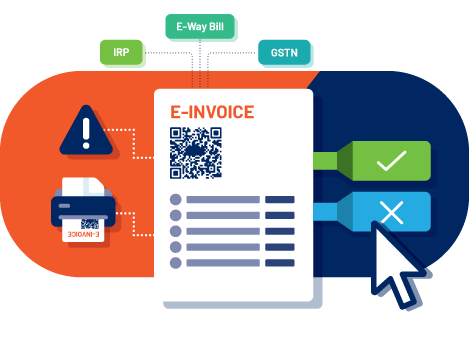

Why E-Invoicing is in Focus nowadays

The government has initiated the trial of the e-way bill system from 15 January 2018 for the generation of e-way bills for intra-state and Interstate movement of goods but the system is expected to be rolled out soon and make it mandatory for transporters and organizations to generate the new e-way bill online according to the law of GST and in compliance with rules of the CGST rules.

Every taxpayer or every registered person who transferred his goods or causes to the movement of goods of value exceeding ₹50,000 concerning supply or the reasons which are other than supply or for inward supply from an unregistered person then e-way bill generation is necessary.

The relevance of GST E-invoicing software plays a role, as it is well known that E-invoicing is not a new technology but its relevance has grown multiple folds in recent times.

For choosing the best E-invoicing software india, users must keep an eye out for one of the features for choosing E-invoicing software is its ability to integrate with an accounting system.

This software allows the users to see where your operating funds were channeled and for that, you can also determine where your business finances are headed and in which direction.

E-way bill portal has also released the e-way bill APIs to license GST Suvidha providers for helping large transporters or large organizations automate the entire process by integrating their solution within an ERP taxpayer or an existing e-way bill system for generating new e-way bills online in real-time.

A user can generate the bulk E-way bill from the system by using software or when the user needs to generate multiple bills available in one shot they can generate the bulk E-way Bill by adopting touchless technologies of e-invoicing.

The concept of an E-way bill to generate online under GST was to abolish the Border Commercial Tax post to avoid the evasion of tax in India.

So it is crucial to know every aspect related to the E-way bill system under GST. The E-way bill system is very much important for both parties whether it would be for the government or the business industry.

For More Information

Call +91-7302005777

Or visit https://unibillapp.com/

#e way bill generate online#best e invoicing software#gst e invoicing software#eway bill generate online#generate e way bill online#e invoice software free#gst e way bill software#e invoicing software india#e invoicing software free#e invoicing software download

2 notes

·

View notes

Text

Jewellery Billing Software Online munim. online munim jewellery software has features like billing , accounting, barcoding . contact us at +91 8237218685

0 notes

Text

#jewellery software#jewellery software demo#jewellery software free#jewelry software#jewellery invoice software#best jewellery software india#jewellery billing software#jewellery software demo in english#moneylending software#accounting software#girvi software#jewellery mobile app#jewellery#jewellery pos software#jewellery management software#jewellery software stock management#jewellery shop mobile app#inventory management software

0 notes

Text

Opt for the Best e-Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy.

For more detail :- https://meontechnologie.wixsite.com/meon-technologies/post/opt-for-the-best-e-invoice-software-in-india

0 notes

Text

#Website and Mobile App Development Company#Android and iOS App Development company#mobile app development company#iOS app development services#Android app development services#App Development Company#Mobile App Development Company in Noida#Android App Development Company#Android App Development Company in Noida#iOS App Development Company in Noida#iOS App Development Company#iOS App Development Company India#Mobile Application Development company#Invoicing Software development company in Noida#Billing & Invoice Software Development Company Near me#eCommerce app development services#eCommerce App Development Company#Best Website Development Services in Noida#Best Website Development Services in India#Best Website Development Company in Noida#Web Development Services in Noida#Web Development Company in Noida#software development company in noida#software development company in india#Best software development company in india#Best Software Development Companies in India#Software Development Company India#Web Designing Company#Website Designing in Noida#Best Website Design Company in Noida

0 notes

Text

Online GST Billing, Invoicing & Accounting Software App For Small Business - Onlinekhata

Simplify your bookkeeping with our user-friendly online accounting software. Manage your finances effortlessly, track expenses, generate invoices, and stay organized. Start streamlining your business operations today.

https://onlinekhata.co.in/

#Accounting and billing software#Billing#Invoicing & Accounting Software#Best Billing and Invoicing Software#Online Billing & Invoicing Software in India#GST Billing Software for Small Business

0 notes

Text

GST Billing Management Software

There is a huge demand among all the business owners in India for reliable GST solutions, with the help of a robust infrastructure of IT including advanced GST Billing Management Software, businesses aim to achieve compliance as returns, registration, and payments can be done at the click of a single button. Nowadays organizations whether it is big or small, require technical support to stay at withholding trends of the market and be ahead of the competition.

The Best Accounting Software in India would offer support for the management of ledger, accounts, inventories, and other kinds of financial operations. The accounting software offers a gamut of benefits that includes the convenience of filing data, cost-effectiveness, easy access to data, speed, accuracy, and also the option to customize. The Best GST Accounting Software in India also supports the business in keeping track of their financial data, calculating different types of taxes, and generating invoices and bills as per the guidelines of GST.

The accounting software also helps in reducing the chances of errors and maintaining the accuracy of data using the GST accounting software program, all the financial operations from tax filing to invoicing or payment to filing reports are done with the help of a single button. This also helps in avoiding the paperwork and manual efforts as well as saving the cost.

The GST Billing Management Software also automates the tax and rates by the process of business. The GST accounting software also provides customizable options as per the specific business requirement. Different organization requires GST accounting software as this helps in simplifying the accounting function and help them focus on providing customer service. It remains cost-efficient and a super easy way to increase the productivity of the business as it can manage from any device.

For More Details: -

Contact us: - +91 - 7078602005

Visit Us: - https://unibillapp.com/

#GST Billing Management Software#Business Management Software#Free GST Billing Software#GST Billing Software#Best Billing Software#Invoice Software India#Software for Business Management#Easy Billing Software#Invoice Storage Software

0 notes

Text

Best Accounting Software in India

Accounting software helps in doing various accounting and bookkeeping tasks, it also stores the financial data of a business and is often used to perform various business transactions. Today’s modern accounting software is always connected to the Internet so this means you can connect from any Internet-capable device like your smartphone or laptop.

This provides an online space where you can access the data called the cloud, online accounting software automatically update and receive because it is always connected to the Internet. For different things there are different kinds of accounting software that do various things most of them automatically enter, analyse or restore the data for you. This is especially useful for all those who want to save their time on a task like a bank reconciliation.

Accounting software also offers different tools like invoicing, payroll, bill payment, and financial reporting. Good accounting software is a must for those entrepreneurs who want to steer their business to success. It should not only be capable of presenting a quick summary or any kind of detailed presentation of losses and profits along with the other financial transactions but it should also keep you meeting the legal requirements of a specific region or country where your business is operating or where your business is set up.

Aside from these evolving legalities your choice of adopting the accounting software should let you automate the labour-intensive accounting task, reduce the risk of human error in the workplace especially when you are working in a virtual setup. Reliable accounting software always meets the legal requirements of the region or the country where the business operates.

Furthermore, the majority of accountants now feel that traditional accounting is no longer required to stay competitive so for that. They not only have to accurately process accounts receivable, cash flows, and other paperwork and they also need to remain compliant with the requirement of industry and keep up with the regulatory changes that are among the biggest challenge for the accounting firms. According to the online accounting statistics almost 82% of the accountants recognized that the clients have become more demanding today.

So because of this demand, 91% of them rely on the technology of accounting to increase productivity. As such aside from these evolving legalities, the choice of accounting software should let the automate labour-intensive accounting task and test preparation, and in general, they meet the demands of today’s modern business. Cloud-based ERP or accounting software is designed primarily for small to mid-size business, this also provides builtin reporting and business intelligence tools that helps in providing the real-time financial visibility across the business.

For More Information: -

Contact us: - +91-7302005777

Visit us: - https://unibillapp.com/

#Best Accounting Software in India#Best Billing Software in India#Inventory Management Software in India#Easy Billing Software in India#Sales Management Software in India#Invoice Software India#Business Management Software India

0 notes

Text

Best Billing Machines in India

Effectiveness in transactions is essential in the busy realms of commerce and retail. Billing machines, a crucial tool in this process, have advanced significantly over time, with UDYAMA POS setting the standard in India. This article highlights UDYAMA POS's ground-breaking position in the industry while examining the innovations, customer satisfaction, and variety of (Best Billing Machines in India) that are supplied. (Best Billing Machines in Delhi) are essential for streamlining billing processes because they provide cutting-edge functionality catered to various corporate requirements. The choice of billing machines can have a big impact on revenue creation and productivity for businesses of all sizes, from small merchants to multinational corporations.

Considering the Value of Billing Equipment

Competent billing is the foundation of any flourishing company. For any type of business—retail, dining, or service—accurate and timely invoicing is essential to preserving both the company's finances and its reputation with clients. This procedure is automated using billing machines, which streamlines transactions and lowers the possibility of errors. Contemporary billing machines enable organizations to improve operational efficiency and concentrate on their core competencies by providing functions such as inventory management, sales analysis, and tax calculation.

Essential Factors to Take-into-Account:

Creative Software for Billing:

Linked billing software is the cornerstone of modern billing systems. Look for systems with powerful reporting features, user-friendly interfaces, and customizable invoice templates. These features simplify the process of creating invoices and provide useful information on sales patterns and inventory management.

Choices for Internet Access:

In today's networked environment, billing machines with several connectivity options are more versatile and easy. Bluetooth and Wi-Fi enabled devices facilitate seamless communication with other corporate systems, allowing for real-time data synchronization and remote management.

Reliable Payment Processing:

Security is essential while processing financial transactions. Choose billing machines with robust encryption features and PCI-compliant payment processing services installed. This ensures the confidentiality and integrity of client data while lowering the risk of fraud and data breaches.

Design compactness and portability:

Small, portable billing devices are ideal for businesses with limited space or that are mobile. Look for portable devices with long-lasting batteries and sturdy construction. This simplifies invoicing in a number of contexts, including shop counters and outdoor events.

Possibility of Development and Enhancement:

Invest in scalable and easily upgraded invoicing solutions to accommodate future business growth and changing needs. Modular systems with interchangeable parts facilitate the easy integration of additional features as your business expands.

UDYAMA Point of Sale Advantages

The Indian billing machine market has seen a radical transformation thanks to UDYAMA POS's state-of-the-art technology and customer-focused mentality. A selection of models designed to satisfy particular business needs are available from UDYAMA POS. These approaches have improved the checkout experience for customers while also increasing operational efficiency.

There are many different types of billing machines available on the market, ranging from sturdy desktop models for high-volume organizations to portable devices for transactions while on the go. Every kind has distinctive qualities designed for particular commercial settings, which emphasizes how crucial it is to choose a machine that fits your operational requirements.

Features of a Billing System to Take-into-Account

Durability, connectivity choices, and convenience of use are important factors to take-into-account when selecting a billing machine. A machine that performs well in these categories can significantly improve business operations by facilitating faster and more dependable transactions.

(Best UDYAMA POS Billing Machine) Models

A range of models that are notable for their cost, dependability, and functionality are available from UDYAMA POS. With the help of this section's thorough analysis of these best models, you can make an informed choice depending on your unique business needs.

How to Choose the Right Invoicing Equipment

When choosing a billing machine, it's important to evaluate your company's needs, budget, and the features that are most important to your daily operations. This guide provides helpful guidance to assist you in navigating these factors.

Benefits of Changing to a Modern Billing System

Modern billing systems, such as those provided by UDYAMA POS, can greatly improve customer satisfaction and efficiency. The several advantages of performing such an upgrade are examined in this section, ranging from enhanced client satisfaction to streamlined operations.

Advice on Installation and Upkeep

Making sure your billing machine is installed correctly and receiving routine maintenance is essential to its longevity and dependability. Important setup and maintenance advice for your new gadget is included in this section.

Field Research: UDYAMA POS Success Stories

The revolutionary effect of UDYAMA POS billing devices on businesses is demonstrated by actual success stories from the retail and hospitality industries. These case studies demonstrate how businesses have benefited from increased customer satisfaction and operational efficiency thanks to UDYAMA POS technology.

All products in the Billing Machine are:

(Handy POS Billing Machine)

(Android POS Billing Machine)

(Windows POS billing Machine)

(Thermal Printer Machine)

(Label Printer Machine)

Enhancing Efficiency with Best Billing Machines in India:

The adoption of the (best billing machines in Noida) has revolutionized the way businesses manage their finances. These advanced solutions offer a myriad of benefits, including:

Simplified Billing Procedures: By automating invoice generation and payment retrieval, billing procedures are made more efficient and less prone to human error and delay.

Enhanced Accuracy: Up-to-date billing software guarantees precise computations, removing inconsistencies and billing conflicts.

Improved Customer Experience: Easy and quick transactions increase client happiness and loyalty and encourage recurring business.

Real-Time Insights: Rich reporting tools offer insightful information on inventory control and sales performance, facilitating well-informed decision-making.

Observance of Regulatory Mandates: Pre-installed compliance tools guarantee that financial reporting requirements and tax laws are followed, lowering the possibility of fines and audits.

Frequently Asked Questions:

Are billing systems appropriate for all kinds of companies?

Absolutely! Billing machines come in various configurations and are tailored to suit the needs of diverse businesses, from small retailers to large enterprises.

Can billing devices accept several forms of payment?

Yes, most modern billing machines support multiple payment options, including cash, credit/debit cards, mobile wallets, and online payments.

How frequently should the software on billing machines be updated?

It's recommended to update billing machine software regularly to ensure optimal performance, security, and compatibility with the latest regulations and technologies.

Do billing machines need to be connected to the internet?

While internet connectivity is not mandatory for basic billing operations, it may be necessary for accessing cloud-based features, software updates, and remote management capabilities.

Is it possible to link accounting software with billing machines?

Yes, many billing machines offer integration with popular accounting software packages, facilitating seamless data transfer and reconciliation.

Are POS terminals easy to use?

Most billing machines are designed with ease of use in mind, featuring intuitive interfaces and straightforward setup processes. Training and support are typically provided to ensure smooth adoption and operation.

UDYA MA POS, a business renowned for its wide range of products, innovative solutions, and happy clients, is the result of searching for the (best billing machines in India). Considering how organizations are always changing, choosing the right billing system is essential. Thanks to its commitment to quality and innovation, UDYAMA POS is a leader in the billing machine industry, ensuring that transactions will become more streamlined, dependable, and fast in the future. The strategic decision to invest in the (top billing machines in Gurgaon) could have a significant effect on businesses of all kinds. These innovative solutions help organizations thrive in the present competitive market by streamlining billing processes, increasing precision, and providing insightful data.

Regardless of the size of your business, selecting the correct billing equipment is critical to increasing productivity and spurring expansion.

Visit the website for more information: www.udyamapos.com

2 notes

·

View notes

Text

Streamline your GST Return with Online GST Billing Software

With the arrival of Goods and Services Tax (GST) on July 1, 2017, the whole Indian business witnessed the beginning of comprehensive tax filing protocols. While many small businesses and MSMEs (medium small and micro enterprises) found the process overwhelming at the beginning, the best GST billing software in India helped fill the gap and helped businesses to adopt GST completely. There are multiple online GST billing software options available for each business type, and you can choose the best GST billing software based on your business needs. Most online GST billing software offers a wide range of advantages.

What is online GST billing software?

Online GST billing software is a comprehensive tool that allows companies, proprietors, and MSMEs to file, track, and manage their GST returns. The free GST billing software enables you to comply with the latest GST rules and regulations, calculate the correct amount of tax to be paid to the government, file your returns, and pay your taxes on time to avoid late charges. The free GST billing software is a boon for traders, distributors, manufacturers, producers, and retailers.

There are many small businesses that have struggled with GST filings due to a lack of tech knowledge, while some businesses have found the best GST billing software. But this problem can be easily overcome by getting the best GST billing software in India.

Online GST billing software like Eazybills is making the GST filing process smooth and effortless. Eazybills is the best GST billing software because it makes GST compliance smooth. With Eazybills, you can save both time and money.

List of Benefits of the Best GST Billing Software

The best GST billing software can help take away the difficulties of manually calculating taxes and reconciling mismatched reports, amongst other things. Here is a brief list of some of the benefits of online GST billing software:

Simple Data Filling: Exporting the business data manually can be a lengthy and time-consuming process. To save both money and time, a GST billing software offers easy GST registration, quick transfer of accounting data, and reconciliation for timely and error-free GST filing.

Time-saving: It doesn’t matter what the nature of your business is; there are a number of documents and information that are required every month for GST return filing. Collecting and managing all the data can be overwhelming, so GST billing software will help you save time with the proper management of documents and sending reminders to vendors.

Secure Data Storage: Since all the financial and accounting data, bills, and other important information are stored electronically, it is important to ensure that it is stored safely. GST software makes sure that your data is secured by putting in passwords and authentication steps to access it.

Parting Words

GST billing software is a helping hand for business owners. While GST software facilitates faster and simpler filing of GST returns, it also helps prevent financial losses. Finding the best GST billing software in India can be a struggle for many business owners who want all-in-one software. Fortunately, Eazybills offers an overall solution to this problem and helps business entities file GST returns using the GST software in an easy, hassle-free, and super-quick manner. Hurry Up! Connect with us for a demo today!

#billing software#free billing software#free gst billing software#free online gst billing software#online billing software#best billing software#easy billing software#invoice software#best invoice software#free invoice software#invoicing software#free invoicing software#best billing software in india#best invoice software in india#online invoicing software

0 notes

Text

Reliable & Complete E-Invoicing Solution

Electronic invoicing or GST e invoicing software in India is a method for creating invoices and it enables the invoices created through one software program that is accessible by the other software, it has also reduced the need for further data entry and the labor-intensive manual process.

It is an invoice that has been produced using a single standard format so that others can share the electronic data or ensures information consistency.

E-invoicing software provides a reliable and complete invoicing solution, it provides the features for generation, tracking, or managing the invoices.

Unibill App is an GST e invoicing software in India that helps in generating the E invoices in a single click, also it automatically prints IRN or invoice reference number and QR code with the invoicing software.

It is certified software which means your invoices can be directly uploaded to the IRP portal to generate the E invoices seamlessly.

There are so many benefits of the Unibill App, the best GST e-invoicing software as it reduces the reporting of the same invoice details multiple times, it helps in real-time tracking of invoices, confirms the ITC eligibility, it prevents errors and fraud, it saves time and effort to file returns or it helps in reducing the reporting of same invoice details in multiple times.

There are some key factors to be considered while choosing a GST E-invoicing software like whether it can generate bulk E-way Bill invoices seamlessly whether it can generate E-way Bills along with E invoices as applicable or whether it has the flexibility to use the offline mode to generate the E invoices that deals in possible network issues.

Electronic invoicing is a system in which all B2B invoices are uploaded electronically and then authenticated by the designated portal.

Post authentication, a unique invoice reference number is generated along with the QR code and that needs to be printed on the invoice.

Electronic invoices apply to all the businesses that are registered under GST and those that issue B2B invoices in a phased manner as notified by the central government.

Therefore there are many benefits of E-invoicing, first, it can curb tax evasion and with this the chances of editing invoices are low.

For More Information

Call us on +91-7302005777

Or visit https://unibillapp.com/

#best e invoicing software#gst e invoicing software#e invoice software free#e invoicing software india#e invoicing software#e invoicing software download#gst e way bill software#eway bill generate online#generate e way bill online#e way bill generate online

0 notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

Opt for the Best e Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy. So, what are you waiting for? Embrace the advanced e-invoicing technologies and stay ahead in the tough competition.

Find the Best auto mailer software.

Significance of Customer Service Tools

Customer service tools are not a new concept, but these are indispensable for organisations to handle their customer issues and enhance their experience. These software solutions are based on ticketing systems and allow customer support representatives to track, manage, and set priorities based on client preferences. In this system, the customers get a notification regarding their raised tickets, and they can complete and upload the documents related to the bug issues they are facing. For more details, visit the website!

Enhance your Customer Trip Plans with Itinerary Creator

An itinerary creator tool is specially designed for the travel industry, which reduces the burden of travel agents as well as travel enthusiasts. This software empowers users to create beautiful itineraries with the help of advanced artificial intelligence algorithms and saves time and energy. It enables users to make travel plans quickly and efficiently under their budgets. If you're interested in getting a free demo, don't hesitate to fix a schedule right now!

source

#best e-invoice software in India#best auto mailer software#Customer service tools#itinerary creator

0 notes

Text

https://jabitsoft.com/10-key-signs-for-introducing-an-erp-solution-to-your-business/

#Website and Mobile App Development Company#Android and iOS App Development company#mobile app development company#iOS app development services#Android app development services#App Development Company#Mobile App Development Company in Noida#Android App Development Company#Android App Development Company in Noida#iOS App Development Company in Noida#iOS App Development Company#iOS App Development Company India#Mobile Application Development company#Invoicing Software development company in Noida#eCommerce Application Development Company#eCommerce app development services#eCommerce App Development Company#Custom E-Commerce App Development#Custom Software Development Services#Best Website Development Services in Noida#Best Website Development Services in India#Best Website Development Company in Noida#Web Development Services in Noida#software development company in india#Best software development company in india#Best Software Development Companies in India

0 notes