#data protection insurance for businesses

Text

Data Protection: Legal Safeguards for Your Business

In today’s digital age, data is the lifeblood of most businesses. Customer information, financial records, and intellectual property – all this valuable data resides within your systems. However, with this digital wealth comes a significant responsibility: protecting it from unauthorized access, misuse, or loss. Data breaches can have devastating consequences, damaging your reputation, incurring…

View On WordPress

#affordable data protection insurance options for small businesses#AI-powered tools for data breach detection and prevention#Are there any data protection exemptions for specific industries#Are there any government grants available to help businesses with data security compliance?#benefits of outsourcing data security compliance for startups#Can I be fined for non-compliance with data protection regulations#Can I outsource data security compliance tasks for my business#Can I use a cloud-based service for storing customer data securely#CCPA compliance for businesses offering loyalty programs with rewards#CCPA compliance for California businesses#cloud storage solutions with strong data residency guarantees#consumer data consent management for businesses#cost comparison of data encryption solutions for businesses#customer data consent management platform for e-commerce businesses#data anonymization techniques for businesses#data anonymization techniques for customer purchase history data#data breach compliance for businesses#data breach notification requirements for businesses#data encryption solutions for businesses#data protection impact assessment (DPIA) for businesses#data protection insurance for businesses#data residency requirements for businesses#data security best practices for businesses#Do I need a data privacy lawyer for my business#Do I need to train employees on data privacy practices#Does my California business need to comply with CCPA regulations#employee data privacy training for businesses#free data breach compliance checklist for small businesses#GDPR compliance for businesses processing employee data from the EU#GDPR compliance for international businesses

0 notes

Text

Consumer Privacy Update: What Organizations Need to Know About Impending State Privacy Laws Going into Effect in 2024 and 2025

Over the past several years, the number of states with comprehensive consumer data privacy laws has increased exponentially from just a handful—California, Colorado, Virginia, Connecticut, and Utah—to up to twenty by some counts.

Many of these state laws will go into effect starting Q4 of 2024 through 2025. We have previously written in more detail on New Jersey’s comprehensive data privacy law,…

#American Privacy Rights Act#APRA#consumer data privacy#contractual terms#data handling practices#Delaware#GLBA#Gramm-Leach-Bliley Act#Health Insurance Portability and Accountability Act#HIPAA#IOWA#Maryland#Minnesota#Montana#Nebraska#new hampshire#New Jersey#PHI#protected health information#right to access#risk assessment#small businesses#state#Tennessee

0 notes

Text

What is Intellectual Property in My Business and How Can I Protect It?

Intellectual property (IP) is a crucial part of any business regardless of the nature or size of the company, however, it can often be overlooked when it comes to protecting your assets. Intellectual property can offer you a competitive edge within your industry, contributing to the overall value of your company and in many cases, your products or services too.

Understanding what constitutes…

0 notes

Text

Explore how cloud security is reshaping the way insurance businesses protect sensitive data and offer enhanced services.

A win-win for insurers and customers alike!

1 note

·

View note

Text

As businesses increasingly rely on digital technology to operate, cyber threats are becoming more prevalent. Cyber insurance can provide protection for your business against the financial losses and reputational damage caused by cyber attacks. Learn about the importance of cyber insurance in the digital age.

https://anilsolankijaat.com/the-importance-of-cyber-insurance-in-the-digital-age-protecting-your-business-from-cyber-threats/

0 notes

Text

Cyber Insurance: Protecting Your Business from Cyber Threats

What Is Cyber Insurance? Protect Your Business from Cyber Threats

#Lewandowski #BiggestMediaScam #Cryptocurency #thebabyfloki #ThursdayThoughts #INDWvsAUSW #Pawan_Khera #BoycottGermany

Hello everyone, As you you all know we are advancing rapidly in the field of Technology and our life is becoming digitized, we are coming towards Technology and Cyber Insurance because of that we are forcing ourselves to the threat of cyber attacks and data breaches. Morever you should know that businesses, in particular, are vulnerable to these threats, as you know that they handle sensitive…

View On WordPress

#Business assets#Business continuity#Business insurance#Cyber insurance#Cybersecurity#Data breaches#Data protection#Hacker attacks#Information security#Insurance coverage#IT security#life insurance#Network security#Online security#Privacy protection#Risk management#Small business#Technology protection#Technology risks#what is cyber insurance

1 note

·

View note

Text

Understanding the Different Types of Cyber Insurance Available for Small Business Owners

Understanding the Different Types of Cyber Insurance Available for Small Business Owners

As a small business owner, you have a lot on your plate. From managing employees to keeping the lights on, the last thing you want to think about is the possibility of a cyber attack. Unfortunately, cybercrime is a very real threat for small businesses, and it’s important to understand the different types of cyber insurance available to protect your business.

One of the most common types of…

View On WordPress

#breach#businesses#compliance#coverage#cyber#cybercrime#data#insurance#liability#network#protection#risk#security#small

0 notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

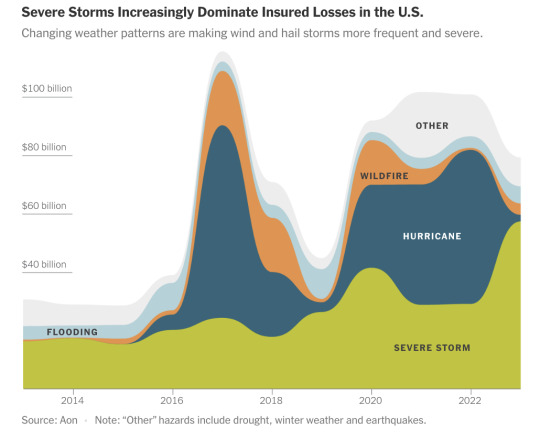

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

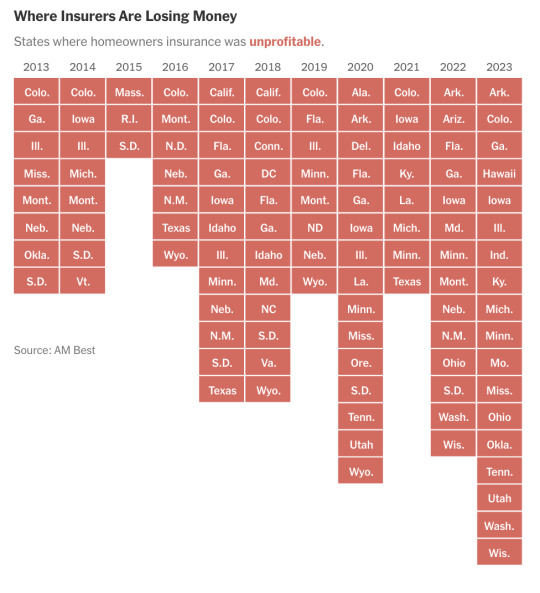

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

Probably not a hot take

I currently have on my desk three notices of data breaches which may affect me, and expect two more in the next week.

Now, clearly there are "hackers". However, I also know that if these companies followed established data protection standards these breaches would be meaningless.

These are issues because of corporate negligence and greed. The causes are twofold:

First, companies collect way too much data. They track our browsing habits. Our spending habits. Our sleeping habits. Why? in the hope that maybe later they can sell that data. There's an entire economy built around buying and selling information which shouldn't even exist. There's no reason, as a consumer, for my Roomba to upload a map of the inside of my house to the iRobot servers. It provides zero value to me, it's not necessary for the robot to operate. The company can't even articulate a business need for it. They just want to collect the data in order to sell it later.

Second, companies are incredibly lax about IT security. They're understaffed, underfunded, and they often don't bother training people on the technology they have, nor do they install and configure it (hint: a firewall doesn't count if it's still sitting in a box on the datacenter floor).

And I think the only way for companies to sit up and take notice is to make them bleed. You can issue guidelines as much as you want, they won't care because making changes and performing due diligence is expensive. They'd much rather just snoop on their customers and sell it all.

So what we need to do, is set a regulatory environment in which:

We recognize that customers, not companies are the victims of data breaches. The companies which are breached are not victims, they are accomplices.

Create a legal definition of private data. This should definitely include medical data, SSNs, &c, but should be broad enough to include information we'd not think about collecting normally (someday in the future, someone will create a toilet which is able to track how often you flush your toilet. They WILL want to sell that data. Fuck 'em.)

[I would also want to sneak in there some restrictions clarifying that disclosing this data is covered under the 5th amendment - that no one else can provide your medical data in a court of law, and that you cannot be compelled to do so.]

Create a legal set of guidelines for data security. This needs to be a continuing commitment - a government organization which issues guidance annually. this guidance should establish the minimum standards (e.g., AES128 is required, AES256 certainly qualifies, it's not "the FITSA guidelines only allow AES128, we can't legally use AES512").

Legislate that failure to follow these guidelines to protect private data is negligence, and that responsibility for corporate negligence goes all the way up to the corporate officers. This should be considered a criminal, not civil, matter.

Restrict insurance payouts to companies when the cause is their own negligence.

Set minimum standards for restitution to victims, but clearly state that the restitution should be either the minimum, or 200% the cost to make the victim "whole" - whichever is higher. This must be exempted from arbitration and contractual restrictions - fuck DIsney's bullshit; no one signs their rights away.

Make the punishments for data negligence so severe that most companies - or at least their officers - are terrified of the risks. I'm talking putting CISOs and CEOs in jail and confiscating all their property for restitution.

The goal here is to make it so that the business model of "spy on people, sell their information" is too damned risky and companies don't do it. Yes, it will obsolete entire business models. That's the idea.

10 notes

·

View notes

Text

Best for industrial law and labour law for HR

HR labor law is the area where employment-related legal requirements and HR management practices converge. This area is crucial for making sure businesses manage their workforces efficiently and adhere to all relevant rules and regulations. The following are some salient features of HR labor law.

Hiring and Recruitment: HR practitioners must be aware of the laws pertaining to hiring and recruitment procedures, such as those pertaining to equal employment opportunity (EEO) and anti-discrimination, as well as those regulating the hiring of foreign nationals and minors.

Employment Agreements and Contracts: HR specialists are frequently in charge of creating and managing employment agreements, which may contain provisions pertaining to pay, benefits, working hours, and layoff policies. They are responsible for making sure that these contracts abide by all applicable labor laws and rules.

Wages and Hours: HR departments are in charge of making sure that rules pertaining to minimum wage, overtime compensation, and other requirements pertaining to remuneration are followed. This entails abiding with rules like the Fair Labor Standards Act (FLSA) in the US or comparable laws in other nations.

Workplace Safety and Health: By putting policies and processes in place that go by occupational safety and health standards, HR professionals help to promote workplace safety and health. They might also assist in organizing safety procedure training and managing workers' compensation claims.

HR departments are frequently tasked with handling matters related to employee relations, including as grievances, disciplinary actions, and conflicts. They have to make sure that employee rights are upheld and that disciplinary actions adhere to labor regulations.

Employee Benefits and Leave: Human resources specialists oversee benefit schemes like health insurance, paid time off, and retirement plans. Laws pertaining to the administration of benefits, such as those governing leave entitlements like the Family and Medical Leave Act (FMLA), must be understood by them.

Termination and Layoffs: HR specialists are in charge of managing employee terminations, including any necessary layoffs or downsizing projects. They have to make sure that all termination procedures adhere to labor rules, including giving notice and paying severance when necessary.

Employee Privacy and Data Protection: When handling sensitive employee data, HR departments are in charge of protecting employee privacy and making sure that data protection rules are followed.

Union Relations: HR specialists may be involved in collective bargaining discussions, contract administration, and handling in companies where workers are members of a union.

To know "How many labour laws are there ?" click here

6 notes

·

View notes

Text

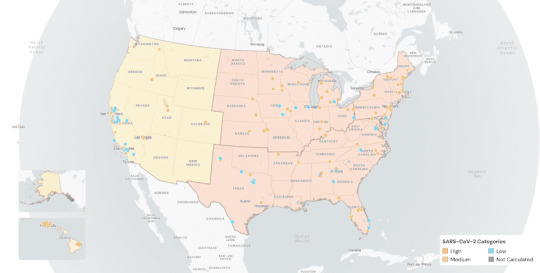

The Weather (according to Wastewater)

SARS-CoV-2 levels in wastewater are being reported by Biobot again as they file an appeal with the CDC. For now, we will use the map below from WastewaterSCAN, another source for wastewater surveillance. One quarter of the nation’s wastewater testing sites remain shut down while the appeal is being processed, creating an overall gap in data reliability that we could continue to experience for several months to come. We anticipate releasing another COVID map depicting transmission levels developed by the People’s CDC in the coming weeks.

According to WastewaterSCAN, nationally, COVID wastewater levels are at medium while the Northeast, Midwest, and the South are high since their last update from October 31, 2023. Across the US, COVID wastewater levels are at 239.7 Pepper mild mottle virus (PMMoV) Normalized on October 31, 2023, down from a peak of 430.5 PMMoV Normalized on August 28, 2023, but slightly up from 201.8 PMMoV Normalized on October 18, 2023. PMMoV normalization differs from how Biobot normalizes data, so the raw numbers are not directly comparable with Biobot’s.

Wins

On October 27-29, #namingthelost hosted a memorial at St Mark’s Church in-the-Bowery in NYC in order to name, honor, and mourn the individuals that we have lost and continue to lose due to COVID and COVID-related complications. On their homepage, #namingthelost states “We know it didn’t have to be this way, that our country’s leaders made choices that risked our lives. We know we can choose a different way forward that is about caring for all of us.”

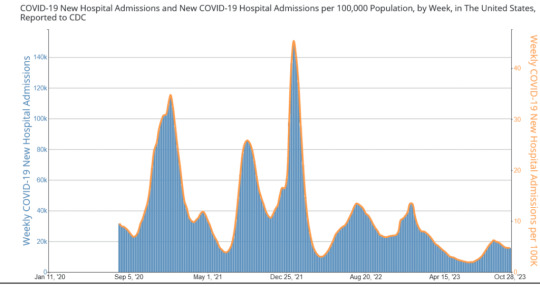

Hospitalizations and Deaths

New weekly hospitalizations associated with COVID have stopped dropping, staying at a constant of over 15,000 hospitalizations for the past three weeks including the week of October 28, 2023. According to the CDC’s COVID Data Tracker, there have been another 4,000 reported deaths from COVID in the past month of October. We mourn these 4,000 individuals as this is not “normal.” A reminder that the lives and livelihoods of everyone in our entire society continue to remain at stake. Do not lower your standards as many in society, especially those in the business sector, normalize this ongoing atrocity as they demand for a return to on-site work even though most people prefer the option of remote work. Continue to demand layers of protection such as high-quality masking, ventilation, filtration, and testing, in all settings to prevent ongoing COVID infections, hospitalizations, Long COVID, and death.

Vaccines and Treatment

Do not wait to get an updated COVID vaccine for those 6 months and older! Multiple options are available including Pfizer, Moderna, or Novavax. Access continues to be challenging especially for those with certain health insurance plans or who are uninsured. Lack of interest and access difficulties have likely all contributed to a low uptake of only 3.5% of Americans receiving the most recent and updated COVID vaccine. The Bridge Access program ensures no-cost access and you can find a location as determined by the federal government, but be sure to call ahead and ask to ensure local participation.

Similarly, federal funding for COVID treatment options, such as Paxlovid and Lagevrio, have transitioned from the federal government to health insurance plans on November 1, 2023. Individuals with Medicare or Medicaid will have access through the end of 2024 and those uninsured will have access at least through the end of 2028 via the federal government, but limited information has been provided. Test to Treat locations continue to provide no-cost access to those without insurance while Pfizer’s Patient Assistance Program can also provide no-cost access to Paxlovid (Nirmatrelvir–Ritonavir). If your health insurance plan does not cover COVID treatments such as Paxlovid, you can participate in the Co-Pay Savings Programs offered by Pfizer, which drops the cost out-of-pocket down to 140 dollars.

Long COVID

The scientific understanding of Long COVID continues to grow with a recent study demonstrating that viral persistence may potentially affect some individuals resulting in Long COVID. However, another study that compared Long COVID outcomes among patients who received Paxlovid at the Veterans Health System did not observe lower rates of Long COVID after treatment. A guaranteed treatment for Long COVID remains to be determined while the primary approach in avoiding this is to employ layers of protection such as consistently using a high quality mask or respirator in order to lower the risk, ultimately preventing a COVID infection.

Take Action

HICPAC, the federal committee that advises the CDC and DHHS on infection control practices in healthcare, met on November 2-3 and voted on draft documents, which continue to fail to protect patients and healthcare workers from COVID infections. We provided a nationwide virtual space to protest the CDC HIPCAC meeting on Thursday, November 2nd. Multiple members of the People’s CDC were recognized to provide public comments to members of HICPAC during the meeting. We also submitted the following official statement this week as our comment. We provide instructions and asked you to also submit a comment to them using our recommendations in response to their terrible decision via email to [email protected] by 11:59 pm on Monday, November 6th to include in their meeting minutes (date has passed). The next steps of their process will include the publication of draft documents in the Federal Register, which can be reviewed and commented on by the general public.

Lastly, local groups are a primary opportunity to impact your community. Get involved locally and join a local group.

#op#covid#long covid#covid isn't over#covid 19#covid-19#coronavirus#pcdc#people's cdc#pandemic#covid news#covid19#public health#covid pandemic#medical#medical news#img#described in alt text

18 notes

·

View notes

Text

Health care systems do their best to safeguard against breaches. But all of us could be doing more to protect our confidential health data. That starts with understanding when this data is most at risk.

When a patient called to ask if she could email me a CT report and imaging, I wanted to help. But I heard the loud whirring of a smoothie or espresso machine and figured she was at a public café. She confirmed that she was calling from a coffee shop.

I asked her to use our hospital portal from home to protect her privacy. She said she wasn’t sure she remembered her login details and didn’t want to wait. She also didn’t understand why her records wouldn’t be protected under the Health Insurance Portability and Accountability Act of 1996.

“I’m not surprised,” says Nichole Sweeney, general counsel and chief privacy officer for Chesapeake Regional Information System for Patients, a nonprofit health information exchange for several US states.

“The public may not realize that consumer-generated data is not protected. What she does with her own information is not secure. The federal government doesn’t regulate the health data itself. It’s the actual facility, medical office, or hospital—under HIPAA, a covered entity under that designation.”

Many of us also have devices at home that collect and store personal data about our health. I asked Sweeney if that data is covered if my doctor asked me to use the device.

She explains, “If I get my blood pressure taken at a clinic or any medical office, that is covered, and your personal data is protected. But if you take readings at home, this is not HIPAA. It’s not regulated. Those new wearable trackers? Those are not covered either. You’re on your own.”

So what else is not regulated? People. Any person using their own data is not covered under HIPAA.

Matt Fisher worked as a health care corporate and regulatory attorney. He is now general counsel for Carium, a virtual care platform. He believes people need more education about HIPAA and its limitations.

“It works effectively for what it was designed to do within the traditional health care industry. The issue is the assumption that it protects all information regardless of setting,” he says. “The fact is, as an individual who holds their own information HIPAA does not apply at all.”

Beyond hospitals and private medical offices, who is actually covered? Subcontractors. These include third-party associates, health plans, insurance companies, and individual physician providers. Labs, clinics, and any other medical offices that bill for their services are also expected to be HIPAA-compliant. Notably, this does not include social media businesses.

Even doctors, notoriously busy and working long hours, don’t always have the luxury of using patient portals to communicate effectively. They’re more likely to text or email colleagues with potentially sensitive information, all on personal devices that may or may not be locked down. But their goal is fast and efficient patient care, not necessarily data security.

Zubin Damania, who is a doctor and goes by ZDoggMD on social media, uses satire on his YouTube channel to educate viewers and poke fun at the health care system. His more than 488,000 YouTube subscribers no doubt include health care employees, but you don’t have to be one to appreciate parodies like “EHR State of Mind” (EHR is short for electronic health records), which is set to Alicia Keys’ hit “Empire State of Mind,” or “Readmission,” a play on R. Kelly’s “Ignition.” Damania hopes to inspire change in the health care tech sector so, as he puts it, “doctors can just be doctors.” Another target of his satire? Massive health data portals like Epic. He and other physicians believe the design of these systems can actually hinder security if medical personnel find it more restrictive than care-focused.

“Epic and others like it were not designed for use by clinicians on the front line trying to help patients,” he says. “These systems are giant billing platforms. It’s varying fields of data to be walled off.”

Sadly, Epic and others like it are all we have when it comes to storing patient data safely, and despite their flaws, these portals are still the safest available option for doctors and patients. Health care facilities are strictly regulated to receive federal government funding, and they must pass safety certifications, including security protections for patient data. They also seek to maintain industry recognition in order to stay credible and competitive. Want to make a hospital exec nervous? Tell them the Joint Commission is coming by for a visit. They need those gold star approval ratings.

Some patients are under the misconception that these systems are not really that secure. But in the past few years, data breaches have been rare (though they do happen). Hackers frequently target hospitals and health care systems for ransomware attacks, but it doesn’t pay for hackers to demand money when robust backups exist. While the industry has made some progress, the problem of individuals taking personal risks continues.

A former Department of Homeland Security adviser and a doctor, Chris Pierson is CEO of BlackCloak, a company that specializes in personal digital protection from financial fraud, cybercrime, reputational damage, and identity theft. He believes vigilance is key for doctors and patients alike.

Protect Your Entire Family

“I don’t think people realize that once someone is able to get just one piece of information, that can lead to opening others’ private data,” Pierson says. “It’s no longer the original individual on their computer, but additional family members’ identity that can be compromised.”

He explains that even if one organization keeps your data safe, another associated one may not, and that’s where criminals will strike.

“It’s not just medical offices. It’s your pharmacy, labs, insurance company, anyone who keeps personal information. That has real value, and selling it is the priority.”

Victims of identity theft can be revictimized when personal information gets into multiple hands. A street address and verified phone number can go far, especially if the phone contains many contacts, who then become vulnerable to attack themselves.

“If you get Mom’s info, you can get the child’s as well. An ID card, social security, all of it, and then they have the ability to collect false medical claims or just extortion. It’s a two for one.”

Two-Factor Authentication Is Worth the Effort

Pierson mentions how critically important it is to use a multistep authentication system. Your level of protection goes up considerably just by using secure passwords and one-time authentication codes.

Thankfully, setting all this up is easier than it sounds. Apps on your phone or tablet can help. Google Authenticator, when paired with a service that supports authenticator apps, provides a six-digit number that changes every few seconds and can keep people out of your data even if they have your username and password. Other companies ask users to enter an SMS code as the second authentication factor, in addition to a password, although SMS codes are less secure than authenticator apps. Either approach is better than none—unless a hacker is in physical possession of your phone, they are not getting access.

Social Media and Tracking

Social media is becoming a popular way for health care providers and entrepreneurs to connect with the public—and often to sell them treatments or advice. These Instagram or TikTok accounts may offer tips from someone in the medical industry, which can appeal to those facing rising health care costs and difficulties accessing care. But an internet doctor’s background or popularity does not ensure that they observe strong privacy guidelines or secure their transactions.

My Instagram is flooded with offers promising everything from better sleep to improved sexual health. It’s nice to have options, but that help and any information you receive from those accounts or send to them isn’t covered under HIPAA. Any time you pay out of your own pocket for health-related items or services, or on a direct-to-consumer health app, there is no recourse if someone steals your personal information or shares it.

Along with social media and direct-to-consumer health options comes large-scale data tracking. Outside of official medical practices, you should view surveillance as an expectation, rather than an exception.

Ask Questions

When you sign up for any service, whether through a new doctor’s patient portal or an online supplement shop, ask how your data is stored and where it goes. Read the privacy policies and settings, even briefly, to find out what options you have to restrict the sale or reuse of your data. Check the default settings to make sure you’re not giving away too much information. Find out if the service or platform offers two-factor authentication and set that up if it’s available. Know that it’s rare for anyone to need your social security number, no matter what a customer service agent says. A birth date and address is usually enough.

Pierson and others agree that we all need to consider security from several angles and do our best to protect ourselves and our loved ones. “The sophistication of identity attacks will always evolve and change. Remember, they only have to get it right once, but we have to guess right all of the time.”

29 notes

·

View notes

Text

Ohio Business Insurance: A Comprehensive Guide

Ohio business insurance is a critical component for any business operating in the Buckeye State. It provides financial protection against a wide range of risks, from property damage and liability claims to employee injuries and data breaches. This comprehensive guide will delve into the various types of Ohio business insurance, the factors influencing premiums, and tips for selecting the right coverage for your business.

https://sihasah.com/ohio-business-insurance-a-comprehensive-guide/

2 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

Business Operation Plan

1. Business Overview

Business Name: Little Ladoo Baby Food

Business Concept: Producing and selling organic baby food at farmers' markets and via social media.

Vision: To provide nutritious and organic baby food options to health-conscious parents.

Mission: To promote healthy eating habits from an early age and support local farmers.

2. Product Description

Product Line: Organic baby food blends (purees) made from locally sourced ingredients.

Initial Offerings: Start with a limited variety of flavors (e.g., Cardamom flavor halwa, Oats, rice, and foxnuts).

Differentiation: Emphasize freshness, organic certification, and locally sourced ingredients.

3. Operational Goals

Short-term (First Year):

Establish a presence at 2-3 local farmers' markets.

Build a customer base and gather feedback.

Develop a presence on social media platforms.

Long-term (Next 3 Years):

Expand the product line with new flavors and packaging options.

Distribute through local baby stores and online platforms.

Explore opportunities for regional expansion.

4. Operational Strategies

Production:

Location: Utilize a licensed commercial kitchen for food preparation.

Ingredients: Source organic produce from local farms to maintain freshness and quality.

Process: Implement strict food safety and quality control measures.

Distribution:

Initially sell directly at farmers' markets.

Gradually introduce online sales through social media platforms (Instagram, Facebook).

Explore partnerships with local baby boutiques and health stores.

Marketing:

Branding: Create a logo and brand identity that conveys freshness and health.

Promotion: Offer samples at farmers' markets; use social media for product showcases and customer testimonials.

Customer Engagement: Collect feedback to improve products and build customer loyalty.

5. Financial Plan

Startup Costs: Estimate costs for kitchen rental, ingredients, packaging, and initial marketing efforts (e.g., sampling).

Revenue Streams: Farmers' market sales, online sales via social media, and potential wholesale to local stores.

Profitability: Calculate the breakeven point and projected profit margins.

6. Risk Management

Food Safety: Ensure compliance with health regulations and maintain high food safety standards.

Supply Chain: Develop relationships with reliable local suppliers to minimize supply chain risks.

Market Risks: Monitor customer preferences and market trends to adapt product offerings accordingly.

7. Timeline

Launch Date: Specify the timeline for starting operations at farmers' markets and social media introduction.

Milestones: Set achievable milestones for product development, market expansion, and revenue growth.

8. Team and Responsibilities

Founder/Owner: Oversee overall operations, product development, and marketing.

Kitchen Staff: Hire or collaborate with kitchen personnel for food preparation.

Sales and Marketing: Manage farmers' market sales and social media marketing efforts.

9. Legal Considerations

Permits and Licenses: Obtain necessary permits for food handling and sales.

Insurance: Purchase liability insurance for product safety and protection.

10. Evaluation and Review

Performance Metrics: Track sales data, customer feedback, and social media engagement.

Adjustment: Regularly review operational strategies and adjust based on market response and business goals.

By developing a comprehensive operational plan, I'll have a clear roadmap to guide the launch and growth of "Little Ladoo" Baby Food. This plan will help me stay focused, manage resources effectively, and navigate challenges as I establish my business in the marketplace.

4 notes

·

View notes

Text

The most common risks in Entrepreneurship

Entrepreneurship is inherently risky, with no guarantees of success. Whether you’re launching a startup, growing a small business, or pursuing a new venture, you’ll inevitably encounter challenges and uncertainties. Understanding the most common risks in entrepreneurship is essential for mitigating potential pitfalls and increasing your chances of success. In this blog post, we’ll explore some of the most prevalent risks entrepreneurs face and strategies for managing them effectively.

Financial Risk:

Financial risk is one of the most significant challenges for entrepreneurs. Starting and running a business requires capital for initial investment, operating expenses, and growth initiatives. However, many entrepreneurs need more resources, and cash flow constraints and uncertain revenue streams make financial management a critical concern. To mitigate financial risk, entrepreneurs should develop realistic budgets, secure adequate funding, monitor cash flow closely, and explore alternative financing options such as loans, grants, or equity investments.

Market Risk:

Market risk refers to the uncertainty associated with changes in consumer preferences, competitive dynamics, and economic conditions. Entrepreneurs must conduct thorough market research, analyze industry trends, and assess market demand to identify opportunities and threats. However, even with careful planning, market conditions can change rapidly, posing challenges for startups and established businesses. To manage market risk, entrepreneurs should stay agile, adapt to changing market conditions, diversify revenue streams, and maintain a customer-centric approach to product development and marketing.

Operational Risk:

Operational risk encompasses various challenges related to day-to-day business operations, including supply chain disruptions, technology failures, regulatory compliance issues, and human resource management. Poorly managed operations can lead to inefficiencies, delays, and costly mistakes that impact business performance and reputation. Entrepreneurs should implement robust processes and systems to mitigate operational risk, invest in technology and infrastructure, and prioritize employee training and development. Additionally, having contingency plans and disaster recovery strategies in place can help minimize the impact of unforeseen events on business operations.

Legal and Regulatory Risk:

Entrepreneurs must navigate a complex web of laws, regulations, and compliance requirements at the local, state, and federal levels. Violating legal or regulatory requirements can result in fines, penalties, lawsuits, and damage to reputation. Joint legal and regulatory risks include intellectual property disputes, contract breaches, data privacy violations, and labor law violations. Entrepreneurs should seek legal counsel, stay informed about relevant laws and regulations, and implement robust compliance programs to mitigate legal and regulatory risk. Additionally, having appropriate insurance coverage can provide extra protection against legal liabilities.

Reputational Risk:

Reputational risk is the potential damage to a business’s reputation and brand value due to negative publicity, customer complaints, ethical lapses, or public relations crises. In today’s digital age, news spreads quickly through social media and online platforms, making reputation management a critical concern for entrepreneurs. Entrepreneurs should prioritize transparency, integrity, and ethical business practices to safeguard their reputations. Building solid relationships with customers, employees, and stakeholders and proactively addressing issues and concerns can help protect the business’s reputation.

Conclusion:

Entrepreneurship is inherently risky, but with careful planning, strategic decision-making, and resilience, entrepreneurs can navigate challenges and seize opportunities for growth and success. By understanding the most common risks in entrepreneurship and implementing proactive risk management strategies, entrepreneurs can increase their chances of achieving their goals and building sustainable businesses. While risks will always be present, embracing them as opportunities for learning and growth can empower entrepreneurs to overcome obstacles and thrive in today’s dynamic business environment.

2 notes

·

View notes