#financial loan

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

80 notes

·

View notes

Text

In October, tens of millions of borrowers will be required to pay their monthly federal student loan bills for the first time since March 2020, the Department of Education clarified Monday.

The pandemic-related pause on both payments and interest accumulation has been set to end later this summer, though the exact date payments would be due was a little fuzzy.

The Biden administration had previously said that the pause would end either 60 days after June 30 or 60 days after the Supreme Court rules on the separate student loan forgiveness program – whichever comes first.

A law passed in early June to address the debt ceiling officially prevented the pandemic-related pause from being extended again. The repayment date has been extended a total of eight times under both the Biden and Trump administrations.

“Student loan interest will resume starting on September 1, 2023, and payments will be due starting in October. We will notify borrowers well before payments restart,” the Department of Education said in a statement sent to CNN Monday.

The update was first reported by Politico.

Borrowers typically receive their bill statements from their loan servicer a few weeks before they are due. Not every borrower’s bill is due at the same time of the month.

The Department of Education has said that it will be in direct communication with borrowers and ramp up its communication with student loan servicers before repayment resumes.

Student loan experts recommend that borrowers reach out to their student loan servicer with any questions about their loans as soon as possible, especially if they are interested in enrolling in an income-driven repayment plan. Those plans, which set payments based on income and family size, can lower monthly payments but require borrowers to submit some paperwork.

Federal student loan borrowers can check the Federal Student Aid website for updates on resuming payments.

SOME BORROWERS COULD BE AT RISK OF DEFAULT

Some borrowers may struggle to resume paying their monthly student loan bills.

More student loan borrowers are currently behind on other kinds of bills than they were before the COVID-19 pandemic, according to a recent study by the Consumer Financial Protection Bureau.

The report also said that about 1 in 5 student loan borrowers have risk factors that suggest they could struggle when scheduled payments resume, like being delinquent on student loan payments before the pandemic or having multiple student loan servicers.

When payments restart, many people might be confused about how much they owe, when to pay and how. Millions of borrowers will have a different servicer handling their student loans since the last time they made a payment.

Originally, the pause on federal student loan payments was put in place to help borrowers struggling financially due to the pandemic.

From a jobs perspective, the economy has largely recovered from the pandemic-related disruptions. In May, 3.7 million more people were working than in February 2020.

But there are some soft spots. Major layoffs have recently been announced at big companies like Disney and Amazon. Earlier this year, a regional banking crisis was set off by the collapse of Silicon Valley Bank, the largest bank to fail since the 2008 financial crisis. And inflation remains high but is cooling after reaching a 40-year peak last year.

STUDENT LOAN FORGIVENESS STILL ON THE TABLE

Meanwhile, all eyes are on the Supreme Court as borrowers wait to see if the Biden administration will be allowed to move forward with its student loan forgiveness program. A decision is expected in late June or early July.

Under the proposal, individual borrowers who made less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 a year could see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

But several lawsuits argue that the Biden administration is abusing its power and using the pandemic as a pretext for fulfilling the president’s campaign pledge to cancel student debt.

No debt has been canceled yet. But if the Supreme Court allows the program to take effect, it’s possible the government moves quickly to forgive the debts of 16 million borrowers who the administration already approved for relief.

If the Justices strike down Biden’s student loan forgiveness program, it could be possible for the administration to make some modifications to the policy and try again – though that process could take months.

#us politics#news#cnn politics#president joe biden#biden administration#student loan forgiveness#cancel student loans#federal student loans#student debt forgiveness#student loan debt#us supreme court#scotus#2023#Department of Education#politico#Consumer Financial Protection Bureau

171 notes

·

View notes

Text

Punkasshunter's Calligraphy Commission Sheet

What it is:

These projects are mostly basic calligraphy, but I am now offering some simple letter illumination! I'm able to work in both copperplate (pointed pen/"script") and broad-edge hands, and am most practiced in blackletter ("gothic", broad nib).

Mostly, I've done silly video game-related quotes and memes, but am willing to do anything not specified in my "will NOT do" within reason.

Here are some examples of my work, more of which can be found in my calligraphy tag!

I have a good variety of inks and mediums, including solids in most basic colors, a few pearlescents, and even watercolors, and this will likely be updated soon with a swatch guide! If I don't have a particular color that's desired, I can likely obtain it with some additional time.

What I WON'T do:

• Hate speech of any kind

• Explicit sexual stuff within discretion, fetish

• That's about it, but I reserve the right to decline if anything else uncomfortable.

Pricing:

This pricing may be subject to change in the future to reflect the significant amount of work that goes into these and to not undercut other artists, but I'm going to try to keep pricing low as I gain experience.

For reference, here are my Rhodia Dotpad A5 and A4 notepads next to each other!

A5 (smaller) sheet

• Base rate: $4 for dot grid paper, $5 for blank

• Per additional page: $1

A4 (larger) sheet:

• Base rate: $5 for dot grid paper, $6 for blank

• Per additional page: $1.50

Illuminated letters are an upcharge of $.20 per letter.

For an additional $1 on any, I can physically mail the completed work to you with an address! Otherwise, I will just send a scan of the completed work to you digitally.

I will also discount $.50 if you don't wish to choose your ink color.

Timeframe:

While an individual piece may not take long, I am a disabled creator and also an alive human person. Your piece may be quicker, but please give a buffer time of about 3 days from the time of commission.

Please send communications through dm on here! I'm able to accept payment via Venmo, PayPal, or Ko-fi.

#Calligraphy#My calligraphy#Commissions#I would appreciate anyone who reblogs this!#Edit: Okay forget that part about being financially safe lol#Found out literally today that my private student loans went into repayment#And I'm still not physically able to work in any consistent capacity at an in-person job

533 notes

·

View notes

Text

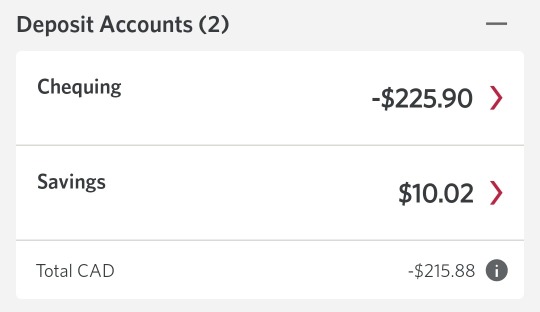

Hey so. It looks like that time again where I have to ask for a little help

My insurance ran out and I had to pay out of pocket for my physiotherapy session today. It's also a short pay week because hubby lost a day of work due to his inner ear problem last week

Long story short:

After paying the rent, this is the situation. Hubby Jon has about $160 in his account, not enough to get me out of overdraft. I'm trying to decide whether to cancel our meal kits or skimp on groceries, we can't afford both. I mean. Technically between us we have negative $55 so... we can't really afford either

I also have a minor medical procedure scheduled for tomorrow and I'd sure like to have food in the house while I'm recovering. It would be one less thing to worry about.

Anyway.

If you have a few bucks to spare, I would appreciate a tip over at my Ko-Fi:

Thank you for reading

#as always please do not feel pressured to tip if you are in a tough spot yourself#i will not die if u don't donate. i will mooch off family for loans if i need to. i'd rather not but if it comes to that i will#and i do have enough food in the house to last at least... 3-4 days? probably more if i get creative#but yeah. not gonna die. a little help would just be nice#mod post#financial stuff#ko-fi#btw the recovery time should only be a few days it's a minor procedure no worries. i have god and codeine on my side. also antibiotics

175 notes

·

View notes

Text

I'm so proud of myself about finances in the past couple months. I still struggle with money but I did enough meditation and journaling and practicing about it to make myself able to actually face my loans and credit cards and savings and bills and start really truly organizing and addressing them for the first time in years instead of just flying by the seat of my pants.

Like. This is a huge deal for me. I've felt like I'm in deadly danger every time I've tried to think about money for years and years. I'm finally able to look it in the face and stare it down and start to organize and plan on purpose instead of just keeping up with the minimum to stay afloat. I'm so proud of myself.

It's still a refrain of "GUILT (funny link)" every time I think about money but I'm able to actually make spreadsheets and face the numbers and monthly tracking again, and even make a new full budget which I haven't been able to do in ages.

still feel guilt, overwhelm, and helplessness, but no longer feel as much deep elemental shame and terror. that's progress baby

#we don't need to talk about how many months and months of therapy visits and doctor appointments I put on credit cards#among other things#but I had to put my foot down about it a couple months ago and shout at myself a little saying HEY#I AM SHAKING YOU BY THE SHOULDERS I AM SHOUTING FOR YOU TO HEAR#OF COURSE IT WAS A TERRIBLE FINANCIAL DECISION BUT YOU WEREN'T EVEN EXPECTING TO BE ALIVE#THE CREDIT CARD DEBT WAS NECESSARY TO KEEP YOU ALIVE AND IT DID AND EVERYTHING ELSE IS WAY LESS IMPORTANT THAN THAT#why the FUCK are you feeling SO ASHAMED for making the best decision you knew how to make at the time???#just because you know NOW that you could have tried some other options doesn't mean you did THEN#you may have known enough to feel shame and guilt yes but you would never in a million years have gotten the help you needed fast enough#by attempting to go another route#you didn't trust anyone besides a very few handfuls of people and even them it wasn't fully#and the stress of running it through parental insurance was so terrifying to you bc you didn't know what that would do#and you never had cosigners for anything your whole adult life. it's OKAY#you fucking DID YOUR BEST#YOU HAVE LEARNED. YOU HAVE MADE CHANGES. YOU HAVE ALREADY DONE BETTER#YOU WILL CONTINUE TO LEARN AND IMPROVE OVER TIME#it is not the end of the world. even the utilities sending you to debt collections etc etc#YOU ARE FIGURING IT OUT ONE PIECE AT A TIME#MORE PEOPLE ARE ASHAMED AND AFRAID OF THEIR OWN FINANCES THAN YOU THINK#if the people who fought and argued with and shamed you for considering student loans much less taking them out#had wanted you to actually be financially safer and healthier#they could have just fucking helped out or cosigned your loans or actively helped you find other solutions#instead of spending months and months telling you it was the worst decision ever and would ruin you financially for decades and such#you made the best decisions you could with the level of terror and knowledge that you had. it was enough to keep you alive.#isn't that enough?#isn't it a victory to survive?? isn't that enough??????#god i'm cringing at sharing this but if it's been this hard for me surely at LEAST one of you has also made financial mistakes or regrets#and seeing me be honest that I fucked it all up too and it's a mess and I'm just climbing back through it as best as I can as I go#will hopefully make at least one of you feel a tiny bit less alone

37 notes

·

View notes

Text

I wonder if she's indebted to Mammon somehow 🤔

#I mean she was running from loan sharks in the episode#so who knows what other kinds of financial shenanigans she's gotten herself into 🤷♀️#At first I thought that maybe she sold her soul to Mammon but idk if the Sins work like that I forgor 🥲#hazbin hotel#mimzy

38 notes

·

View notes

Text

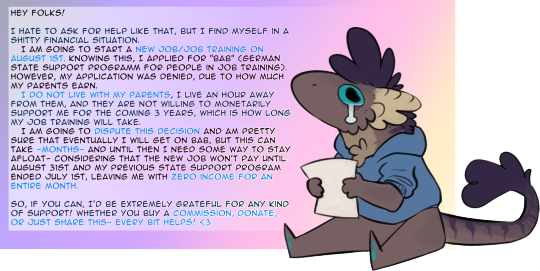

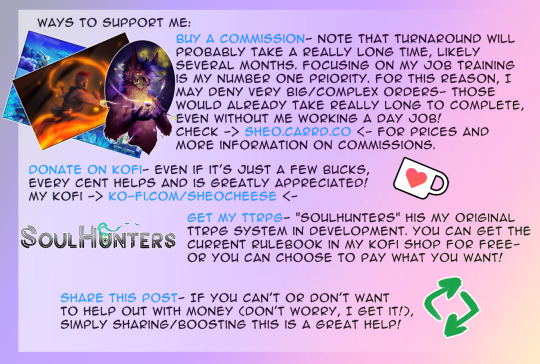

I know everyone is struggling, but even Reblogs would help a lot and those are free.

Links:

Carrd: https://sheo.carrd.co

Ko-fi: https://ko-fi.com/sheocheese

Soulhunters: https://ko-fi.com/s/0eed5f817b

Also Iremembered I have some adopts up for sale, if you're interested in that: https://toyhou.se/Sheo/characters/folder:4493098

#call for aid#artists on tumblrs#I hate to be asking for financial help#but I'm. Kinda panicking a little whenever I think about having to somehow pay rent+student loans AND buy food next month#but fingers crossed once I get the BAB thing settled and I finish the job training#I will never have to ask the internet for help again in order to survive

53 notes

·

View notes

Text

MY 2023 GOALS

The goals I set this year vs what I actually accomplished.

Enroll in WGU and complete a degree in 6 months

-I enrolled and switched my degree a few times. I am now enrolled in the master's program with WGU and I want to land a system admin job in the year year after I graduate that pay $90k-$120k. I am also getting Cisco and RedHat certified, so *fingers crossed* .

Pay off my student loan debt

-On December 22nd of 2023 I will officially be DEBT FREE!!! I struggled, worked 2 jobs, burned out a couple of times and made many sacrifices. I can honestly say I am very, very proud of myself. I questioned many days could I get debt free and even thought about waiting on relief, but I finally did thank God!

Get a job paying over $65k

-I took a course and landed an SDR role within a company and my job with OTE pays $72k. It's a hard job, but I am learning everyday and I hope that I can continue with the company as long as possible.

Get my credit above the 700s

-This is a yes and a no! I won't officially get my new score until the new year, but since all my debt will be gone, it should be past THE 700S.

Lose 50 lbs.

-I really struggled with my weight this year as well as my eating. What I learned is I needed to simplify my routine. I start turning on anime and watching that while I walk at a speed of 3.0-3.5 on the treadmill. I walk an hour everyday, but Sunday. I will lay out the plan on how and when I'll lose this weight in a later post.

#dream life#feminine#self love#little big steps#black women in femininity#level up#level up on a buck#feminine black women#vulnerable#level up journey#debtreduction#debt collection agency#debt collection services#financial#student debt#banking#economy#financial planning#debt#student loans#weight loss#new year#new year new me#leveluponabuck#the level up diaries#pivot

33 notes

·

View notes

Text

This is probably my only option if I ever want to finish college so it’s worth a shot. I am only 8 classes away from graduating college and getting my bachelor’s degree. This whole time I had no idea that the Pell Grant has a 6 year limit, so I thought I’d do college the “smart” way and take two classes at a time as to not overwhelm myself and make sure I could completely focus on learning the class subjects while handling work and everyday life. Except now unfortunately I am left unable to finish my classes and graduate even though I want to, and I’m still going to have to pay back loans for the classes that I did attend. I just want to finish my last 8 classes and get my bachelors degree in Advertising & Marketing Communications (which I picked because I thought I’d be able to make good money in that field while also being able to get creative and have some fun.) I’m the first and still the only person in my family to even get accepted into a college, I want to graduate so badly and I’m so close. Anything at all helps and it will all go towards tuition and books, even if I only get enough for one more semester.

I don’t really expect to get anything from this but I figured it’s worth it to try. Please share this post if you can, thank you so much 💕

#GoFundMe#fundraising#finance#financial aid#college#University#donations#donate#donate if you can#anything helps#student#student loans#I’m so poor

25 notes

·

View notes

Text

i’ve never understood the idea of lending your friends/family money. just give it to them. and if you can’t afford to just give that money away then don’t, or find another solution. but lending money with the expectation of getting it back, especially if one or both parties are struggling financially, just seems like a recipe for resentment

#cricket chirps#it genuinely took me until i saw that post that was like ‘it’s good financial practice to not give money away unless you don’t expect to#see it again’ to realize that lots of people do loans with their friends#i don’t want my friends to ever feel like they owe me. it’s a gift

20 notes

·

View notes

Text

I’m pretty committed to getting this surgery at all costs but the costs are starting to add up

#because it’s a month earlier than planned i have less money and less PTO and less time#so what should have been ‘it’s a bit of a stretch but it’s well within manageable range’#is now actually ‘pull from long term savings and scramble for extra hours and live on student loans and maybe take leave without pay’#can anything anything anything please be easy#it’s not the financially wise decision but i don’t want to live like this anymore#and i don’t know how to survive another ‘cancel it and wait another 3 years’#sepulchritudinous#top surgery

24 notes

·

View notes

Text

Bullshit Reasons Not to Buy a House: Refuted

Keep reading.

If you found this helpful, consider joining our Patreon.

11 notes

·

View notes

Text

for every "how dare you plan to spend money out of your entertainment budget while i, a complete stranger to you, am still poor" post i see i am buying another $3 worth of crabs

#look. i get that people in bad financial situations are tetchy#which is why i talked myself out of reblogging several stupid posts#but this is just the 'how dare poor people buy starbucks' argument except coming from other poor people#if you wouldn't begrudge a fellow poor person their sugary coffee just because you yourself don't have a coffee budget this week#then shut the fuck up about people wanting to give up a week's coffee to maybe help a website they enjoy#'if everybody donated to my kofi instead of to tumblr then i wouldn't be poor anymore'#yeah probably but also no one knows who you are and you're not specialer than any of the other poor ppl who enjoy this site#meanwhile we ALL know what tumblr is. because we live here#it's like 'why did they donate to save the savings & loan instead of to the individuals in the town who had loans out'#also. why does everyone think that solving the moderation problem is free!!!#that shit is very hard work! it's not a solved problem algorthmically at all#this site has 200 employees and 21 million posts a DAY#crab day#tumblr meta#dove.txt

51 notes

·

View notes

Text

Was gonna post a whole rant but I’ll save myself some time and just say I fucking hate capitalism and all the bootlickers who simp for it. Capitalism simps are seriously some of the most morally deficient people out there.

#I was motivated to write this post because I read a comment where some guy told a girl her mom is “’stupid and financially irresponsible”’#bc she’s still paying off her student loans 10 years later#while HE a proud capitalist has paid off three loans and only got mommy and daddy’s help with the first one#eject these people into the sun I’m done trying to reason with them#anti capitalism#Fuck capitalism

78 notes

·

View notes

Text

Mortgage Calculator Service in California:

Use the free California Mortgage Calculator to estimate your monthly payment, including taxes, mortgage insurance, principal, and interest.

A mortgage calculator helps in calculating things in a few minutes.

Buying a new home is a time of dreams and opportunity, but navigating the mortgage process can also make it stressful and confusing. Different interest rates and repayment terms can make it difficult to compare mortgage loan offers.

Our mortgage calculator should help you understand everything. This helpful tool makes it easy to find mortgage loans and choose the best deal for you.

How to Use This Calculator:

Our mortgage calculator can help you understand how differences in interest rates and repayment terms affect the size of your monthly payment and the total cost of a home over time. Little information is required to get started. Adding a few more details using the calculator's optional advanced options can give you an even clearer idea of what your monthly mortgage payment might look like for different loans.

- House Price: This is the amount you pay the house seller. If you are in the early stages of home shopping, use the seller's asking price for comparison, but remember that this number is negotiable. If you are shopping in a highly competitive market and expect to be one of several bidders, you may want to bid above the asking price. In slower markets or for properties that have been on the market for a longer period of time, a bid below the asking price could be successful. Work with a real estate professional/ Mortgage Advisor to set your bidding strategy.

- Down Payment: When you enter the house price, the calculator automatically fills in the Down Payment field to reflect 20% of the house price. This is the standard down payment required for most traditional mortgages. Many mortgage lenders, including those who make government-backed loans, will accept lower down payments, usually in exchange for higher interest rates and/or fees - and with the stipulation that you pay for mortgage insurance, which you can factor into the calculator's advanced features.

- Term (in years): Enter the number of years required for the mortgage to be repaid. By default, this calculator assumes a 30-year mortgage, as this is the most common home loan term in America. Other standard mortgage terms include 15 years, 20 years, and 40 years. Adjust this number according to the offer you are evaluating. All things being equal, longer mortgage terms mean lower monthly payments, but also significantly higher interest costs over the life of the loan.

- Interest Rate: Enter the interest rate for the loan you are considering. Be sure to enter the interest rate, not the APR (annual percentage rate). These numbers may be similar, but the APR reflects interest costs plus additional financing costs like fees and mortgage insurance.

#mortgage#term#payments#downpayment#downpay#insurance#usa#united states#canada#advisor#mortgage adviser#financial advisers#calculator#calculations#california#year#loan#house#sale#service

186 notes

·

View notes

Text

21 notes

·

View notes