#it. it removed ALL of my passives and locked me out of buying future passives

Text

i hate getting interested in something that's very not well known bc like i wanna talk to ppl about my silly little dice game that im supremely bad at but nobody will know what half of what I'm saying means

#echos#i had such a good run going 😭😭😭#i was at like 1500 rolls and i had an AMAZING lottery setup with like three 77777 faces on one die#like. the die came like that it was wild most of the time they just have like five 100s faces#i had a ton of lottery dice and then a ton of numeric 77s dice#and a few clovers in the mix#but then i saw one passive ability and monkey brain saw the word lottery and immediately clicked on it#i fucked myself over SO hard. bc i bought All In which deletes ALL your points unless you get a successful lottery roll#that's good in a REALLY strong lottery setup with like dozens of lottery dice rolling at once#but for me it just absolutely BROKE my setup bc i didn't have enough lottery faces to guarantee i didn't lose it all#and then immediately afterwards i saw a cheap passive upgrade#that said something something 'remove passive upgrade' so i again went monkey brain and clicked thinking i could remove All In#it. it removed ALL of my passives and locked me out of buying future passives#and since my run was relying SO hard on those passives (other than All In. fuck that one) i just lost. like all my point gain#it was so sad to watch#like sad in a funny way like WOW am i bad at this game LMAO#i don't take it too seriously bc of course the kid whose worst enemy is numbers is not gonna be good at. a numbers game.#i just think it's funny to every now and then just watch it slowly crash and burn#i wish Roll had an endless mode i wanna see what fucked up evil numbers i can make when i don't have a roll limit

1 note

·

View note

Text

A monster-taming game recommendation list for fans of Pokemon

Whether you're a pokemon fanatic obsessed with all things pokemon past and present, or a veteran fan disillusioned with GameFreak's recent adoption of monetary philosophies and strategies reminiscent of other major game publishers, or looking for a monster-taming fix as you await new Pokemon content...

I'm compiling here a post of little-known games in the genre that Pokemon fans are likely to enjoy!

Under readmore cause long, but some of these games really don’t get the attention they deserve, so if you have the time, please read!

(I am also likely to keep updating and editing this post)

First up is Temtem!

Temtem is a game made by and for Pokemon fans, from the spanish indie developer Crema. Temtem is currently in early access on Steam and PS5, and is likely to remain in early access until sometime late next year. Full launch will include a Nintendo Switch release, too. Despite this, it has plenty of content to explore before full release. The developers are active, release new content on a semi-regular basis, and are responsive to the community as a whole and individuals if you happen to come across a bug you want to report.

Temtem boasts a wide variety of monsters to collect and train. It takes place in the Airborne Archipelago, a system of floating islands that orbit their star, the Pansun. The monsters inhabiting the archipelago are called Temtem, or tem(s), for short.

As far as game mechanics go, it has many similarities to Pokemon, but also many important distinctions. The biggest one, in my opinion, is that the element of chance has been removed from battle entirely. Moves cannot miss, have the same power constantly, and status afflictions have an obviously displayed countdown to when they will wear off (for instance, sleep lasts as long as it says it will last. Not 2-4 turns). PP does not exist, either. Your tems can battle for as long as their HP holds out. In place of PP, a new system called Stamina exists. Stamina is an individual stat, like HP and Attack. Each move costs a certain amount of stamina. If you go over the amount of stamina your tem has, the deficit is detracted from your health instead, and that tem cannot move next turn. Stamina passively regenerates a certain amount each turn, and items and moves exist that can heal stamina. All battles are also double-battles, you and your opponent will typically have two tems on the field at a time. This is just a few of the differences Temtem has from Pokemon, but they're some of the biggest ones.

Temtem is also a massively multiplayer game. You complete the storyline independently (or with a friend through co-op!), but in the overworld you can see other, real players moving around and interacting with the world. There is also public and area-specific chat you can talk to other players through. Despite this, all multiplayer functions are (currently) completely optional. You do not need to interact with others to complete the game.

Overall, Temtem is suitable for the Pokemon fan who is looking for a more challenging experience. Temtem is not a walk in the park you can blaze through with a single super-strong monster. For one, individual tem strength is more well-balanced than it is in Pokemon. There are very few (if any!) completely useless tems. Even some unevolved tems have their niche in the competitive scene! Aside from that, enemy tamers are scaled quite high, and you typically cannot beat them just from the exp you get from other enemy tamers. You have to do some wild-encounter grinding if you want to progress.

Temtem is a very fun game and I've already gotten over 100 hours out of it, despite only 3/5-ish of the planned content being released!

However, I do feel obligated to warn any prospective players of one thing: the current endgame is quite inaccessible. After you complete what is currently implemented of the main storyline, there is still quite a lot left to explore and do, but much of it is locked behind putting a lot of hours into the game. You kind of have to get perfect temtem to do the current PVE (and this is also somewhat true for the PVP too). By perfect I mean you have to breed a good tem and then train it to get the preferable EVs (called TVs in temtem). This takes... well, for a whole team... tens of hours. Of boring grinding. Some people enjoy it! But I don't. Regardless, the game was still worth buying because the non-endgame content is expansive and fun.

So overall, pros & cons:

Pros

Battle system is more friendly towards a competitive scene

Cute monsters

Lots of gay characters, also you can choose pronouns (including they/them) independently from body type and voice

Less difference between the objectively bad tems and good tems than there is in Pokemon

Lots of stuff to do even in early access

Most conversations with dialog choices have the option to be a complete ass for no reason other than it’s fun

Having less type variety in your team is less punishing than in Pokemon due to the synergy system and types overall having less weaknesses and resistances

At least one major character is nonbinary

Cons

Falls prey to the issue of MMOs having in-game economies that are only accessible to diehard no-life players

Related to the above point, cosmetics are prohibitively expensive

Endgame CURRENTLY is inaccessible to most players unless you buy good monsters from other players or spend tens of hours making your own. However I must add that the grind is great if you like that kind of thing and is quite easy and painless to do while watching a show or something.

Here is their Steam page and here is their official website.

Next is Monster Hunter: Stories!

This is a spinoff game of the Monster Hunter franchise released for the 3DS in 2018. If you're anything like me, and you've played the core Monster Hunter games, you've often thought "Man, I wish I could befriend and ride these cool dragon creatures instead of killing or maiming them!"

Well now you can! In Stories, as I will be calling it, you play as a rider rather than a hunter. Riders steal monster eggs from wild nests to raise them among humans as companions and guardians. And yes, egg stealing is a whole mechanic in of itself in this game.

This game works pretty differently from most monster-collecting games. You do battle (usually) against one or two wild monsters using your own, except you fight alongside your monsters too. With swords and stuff. There's armor and weapons you can smelt to make yourself stronger. Type match-ups also kind of don't exist in this game? Except they do? But not in a way you'd expect?

The vast majority of attacking moves you and your monster use fall into categories reminiscent of rock-paper-scissors. Moves can be categorized as power, speed, or technical. Speed beats power, technical beats speed, and power beats technical. The matchup of your move vs your opponent's determines how a turn will go down. If one move beats the other in matchup, then the winner's move will get to go and the loser doesn't get to do anything. If you tie, you both get hit, but for reduced damage. There's also abilities and basic attacks, with abilities basically being the same as pokemon moves, and basic attacks just being "I hit you for normal damage within this category". Also, you don't control what your monster does all the time in battle. You can tell it to use abilities, but what kind basic attacks it carries out is determined by its species' preference. Velicidrome, for instance, prefers speed attacks, but Yian Garuga prefers technical. Stamina also exists in this game in a very similar manner to Temtem.

Overall this game carries over a lot of mechanics Monster Hunter fans will find familiar (how items and statuses work for instance). You don't have to have played a core Monster Hunter game to enjoy Stories though! It's fine and is easy to understand as a stand-alone.

The story has some likable characters and is rather long (it was actually adapted into an anime!), for those of you who enjoy a good story.

I'd really recommend this one especially. If it sounds fun to you and you can drop $30, just do it. I bought it on a whim and I got a few weeks' worth of playing almost nonstop out of it, and I didn't even get to do everything! (I got distracted by Hades, oops)

Stories is also getting a sequel later next year on the nintendo switch! How exciting!

And yes, you do ride the monsters.

Pros & cons:

Pros

Large variety of cool monsters to befriend and raise

Pretty lengthy story

Every tamable monster is also rideable

Deceptively simple combat mechanics, easy to be okay at, hard to master

Incorporates some mechanics from early turn-based party rpgs like Final Fantasy for a nice twist on the monster collecting genre

Cons

Many monsters are objectively outclassed by other ones, making what can be in an actually good team more limited than you’d expect

3DS graphics inherently means the game looks like it was made 7 years before its time

Here is the Monster Hunter Stories official 3DS product page.

And here is Monster Sanctuary!

Monster sanctuary is a game that just had its 1.0 launch- meaning it was in early access and no longer is! Although the devs say they still plan to implement a few more things into the game in future updates. It is available on Steam, Nintendo Switch, Xbox One, and PS4.

Monster sanctuary is a metroidvania twist on the typical monster collecting game, meaning it is also a sidescrolling platformer in which you use abilities you gain throughout the game to explore the world around you. The abilities in this case are the monsters you get! Every monster has an ability that helps you traverse the sanctuary.

Speaking of the sanctuary, the game is set in one. The monster sanctuary is a magically shielded area, cut off from the rest of the world, created by an order of monster keepers, people who befriend and protect the mystical monsters inhabiting the world. Humankind encroached too far on the natural habitat of monsters and were hostile to the native wildlife, so the keepers created an area of varied environments to safely protect and preserve the remaining monsters of the world.

Unlike many other monster collecting games, this game only has 5 types: fire, water, earth, air, and neutral. However, the types themselves do not possess resistances and weaknesses. Instead, each monster has its own assigned weaknesses and resistances. And yes, this can include things like debuffs, physical vs special attacks, and the typical elemental types.

All battles are also 3 vs 3! And unlike in pokemon, where you can only hit the enemies nearest, all monsters have the ability to hit any opponent they want. Turns also work a little differently in that speed doesn't exist, you just use 1 move per monster in your turn and then it goes to your opponent's turn. Your monsters hit in whatever order you want them to.

There is also a quite important combo system in this game, where every hit builds a damage multiplier for the next. Moves often hit multiple times per turn. Healing and buffing actions also build this combo counter. So what monsters you have move in what order really counts!

But the main mechanical difference between this and other games in the genre is how it handles levels and skills. Instead of learning a set move at a certain level, this game incorporates a skill tree, and you get to allocate points into different skills as you grow stronger. And jeez, these skill trees are really extensive. Monster sanctuary is a theorycrafter's dream. Each monster has a unique, specially tailored skill tree, making every monster truly able to have its own niche. You can make use of whatever monster you want if you just put thought into it!

And like Temtem, this game is not made to be beatable by children. I'm sure a child could beat it, but it's not made to be inherently child-friendly like pokemon. It's honestly quite difficult.

On top of that, you are actively encouraged to not just be scraping by each battle. Your performance in battle is rated by an automated system that scores your usage of various mechanics like buffs and debuffs applied, type matchups, and effective usage of combos. The rating system directly influences the rewards you get from each battle, including your likelihood of obtaining an egg from one of the wild monsters you battled (no, you don't catch wild monsters in this game, you get eggs and hatch them). If you're not paying attention to how the game works and making good, effective use of your monsters, you'll have a hard time expanding your team!

The music is also really good, it's made by nature to be able to play over and over and not get old as you explore each area, and the composer(s) really did a good job with this. Some area songs, namely the beach one, I especially enjoy, so much so I've actually played it in the background while I do work.

This is a game I would really recommend. If I made it sound intimidating, it is by no means unbeatable, you're just gonna have to put some thought into how you play. At no point did I actually feel frustrated or like something was impossible. When I hit a wall, I was able to recognize what I did wrong and how I could improve, or I could at least realize something wasn't working and experiment until I found a solution. It's challenging in a genuinely fun, rewarding way.

Pros & cons:

Pros

Extremely in-depth combat system

I genuinely don’t know if there’s an objectively bad monster in this game

Evolution exists but is completely optional, as even un-evolved monsters can be great

Entire soundtrack is full of bangers

Large and diverse variety of monsters to tame

Cons

Story is a little lackluster, but passable

That’s the only con I can think of

Here’s a link to their Steam page and the game’s website.

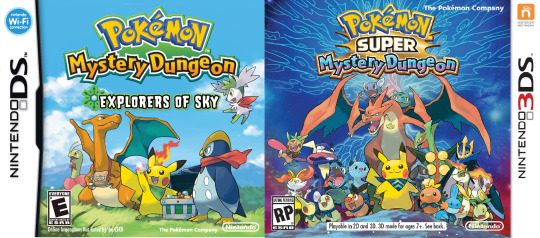

A kind of unorthodox recommendation is the Pokemon Mystery Dungeon series!

Likelihood is that everyone reading this has heard of this series already, but just in case anyone hasn't, I thought I'd include it! I would categorize this as a hybrid between the mystery dungeon genre and the monster collecting genre, because you recruit pokemon as you play and can use those pokemon on your team!

If you're unaware, the mystery dungeon genre is a small subset of dungeon crawler games where you progress through randomly generated levels called mystery dungeons. Throughout the dungeons, there will be enemies to fight and items to collect. The challenge of these games is mostly due to the stamina aspect of them, in that you have to manage your resources as you progress through the level. If you go all out in each fight, you will inevitably lose quite quickly. You have to learn to win against enemies while balancing your use of items and PP, so you have enough for the next fight, and the fight after that.

Pokemon mystery dungeon in particular is famous for its stories, the likes of which isn't seen often in Pokemon games. They are hugely story-driven games and are notable for the emotional depth they possess. It's pretty normal for the average player to cry at least once in the span of the game. There's lots of memes about that specifically.

This entry in my list is also unique for being a series. So, which one should you play first? It actually doesn't matter! Each storyline is entirely self-contained and requires no knowledge of prior entries. The quality of each entry varies and is a point of contention among fans. I say you should play all of them, because they all have their merits (though some more than others.... coughgatestoinfinitycough). They're mostly distinct for the generation of Pokemon they take place in. Rescue team is gen 3, Explorers is gen 4, Gates to Infinity is gen 5, Super Mystery Dungeon is gen 6, and Rescue Team DX is a remake of a gen 3 game but has the mechanics and moves of a gen 8 game.

My only real caution is that you play Explorers of Sky, not Darkness or Time. Sky is basically a combination of the two games with added items and content. It's an objective upgrade over its predecessors, and I honestly wouldn't waste money on the other two.

I’m not going to include a pros and cons list for the PMD series because I’m incredibly biased and it wouldn’t be an honest review.

Next is Monster Crown!

Monster Crown is a monster collecting game that seems to take heavy inspiration from early-gen Pokemon games in particular. It is currently in early access on Steam and is not expensive. I learned about it through the developers of Monster Sanctuary, when they recommended it on their official Discord.

The game has lots of charm and interesting creature designs, and an entirely new take on monster typings as well. Instead of monster types being based off of natural elements like fire, water, electricity, etc. Monster Crown uses typings that seem to be influenced by the personalities of the monsters. For instance, Brutal, Relentless, and Will are all monster types!

It also captures a lot of the charm many of us look fondly upon in early GameBoy-era games. The music is mostly chiptune, with some more modern backing instruments at times, and the visuals are very reminiscent of games like Pokemon Crystal in particular. Monster Crown is definitely the monster collecting game for fans of the 8-bit era!

The thing that stands out the most to me about this game is the breeding system. Instead of one parent monster passing down its species to its offspring, you can create true hybrids in this game.

However, it is very early access. I would consider the current build as an alpha, not even a beta yet! So temper your expectations here. I have not encountered any major bugs, but visual glitches here and there are quite common. The game also could definitely use some polish and streamlining, and is quite limited in content currently. But the dev(s) seem quite active, so I fully expect these kinks to be worked out in time!

The reviews are rather positive, especially for being in early access. I'm all for expanding the monster collecting genre, so if you're looking to expand your horizons in that sense, I would recommend you at least give this one a look! I personally had quite a bit of fun playing Monster Crown and am going to keep an eye out for updates.

Pros & cons:

Pros

Charming artstyle, appealing monster designs

Faithful callback to a bygone era of gaming

Controls are fairly simple and easy to get the hang of (and are completely customizable!)

Cool breeding and hybridization mechanics

There's a starter for each monster type!

You can choose your pronouns, including they/them!

Cons

Inherent nature of being very early access means can be clunky and unpolished at times

Also not much content as of right now, see above

User interface could use some redesign in places

Here’s their Steam page and the official website!

Here’s an oldie but a goodie, Azure Dreams!

This is one I actually haven’t played, mostly because it’s really old and therefore only practically accessible if you play it on an emulator, unless you're one of those old game collectors. Azure Dreams was developed by Konami and released for the PS1 in 1997. My impression of it was that it either didn’t sell well or only took off in Japan, because it’s actually really hard to find any comprehensive information about it on the internet.

Azure Dreams is a monster collecting - dating sim hybrid. You can build relationships with various characters and can pursue some of them romantically, although that isn’t the main draw of the game. There is also a stripped-down version that exists for the GameBoy Color, which forgoes the dating portion of the game entirely.

Azure Dreams is kind of like a mystery dungeon game in that you progress through a randomly generated, ever-changing tower using the help of the familiars you have accrued throughout your adventure. Similarly to Monster Hunter: Stories, you yourself also take part in the fighting alongside your monsters. Each time you enter the tower, your character’s level is lowered to 1, but your familiars keep their experience. Thus, progression is made through strengthening your monsters. To obtain monsters, you collect their eggs, just like in Monster Sanctuary (which, turns out, was at least partially inspired by this game!)

Due to this game being very old and on the PS1, the visuals leave a lot to be desired... but if you can get past that, Azure Dreams has lots of replayability and customization to how you play the game. To this day, it appears it has a somewhat active speedrunning community!

If you don’t mind the effort of using an emulator, and like old games, Azure Dreams just might be that timesink you were looking for in quarantine.

Honorable mentions:

Pokemon Insurgence (or any Pokemon fangame/ROMhack, really!) is a Pokemon fangame that introduces Delta Pokemon, which are really cool type-swapped versions of existing Pokemon. It’s sufficiently challenging and has a lot of variety in what you can catch in the wild, so you can pretty much add whatever you want to your team! The story is quite good, and the main campaign is multiple times longer than a typical Pokemon game’s campaign. Download it here!

ARK: Survival Evolved is NOT a monster collecting game BUT you do get to tame and fight alongside a lot of really cool extinct species, including but not limited to the dinosaurs we all know and love. This game is genuinely fun as hell, especially with friends, but I must warn you: never play on official servers. I highly recommend singleplayer, playing on a casual private server, or making your own server. Here’s the Steam page.

#pokemon#temtem#monster sanctuary#monster hunter stories#monster crown#azure dreams#pokemon mystery dungeon#pokemon alternatives

692 notes

·

View notes

Text

Spice and Tea || Zhongli

EVERYTHING seemed to be much grander in the city of Liyue Harbor. The tall, towering structures were built from an endless budget of mora, glistening in the darkness. Golden-amber lights shown from each building, they were nearly blinding, but so beautiful. It were these very details that made the city so popular with the tourists... though it was a rather different matter for those who resided here. Besides the fact, these colors reminded you of something — no, someone.

This someone was currently in front of you, his tall figure leading you through the streets. His long, ebony hair swishing in a ponytail behind him, the soft-looking strands almost slapped you in the face several times. He then glanced back at you, his golden hues digging into your soul. “Are you alright? You look quite out of it,” he observed.

Blinking for a few seconds, you cleared your throat and quickly nodded. “I am? I didn’t realize.”

Actually, it wasn’t too surprising that you were. The memory of Zhongli telling you that he was the Geo God was resurfacing. No matter how much time you had to process all of this, you could never truly grasp it. A god? How could someone like him... be something so impressive? But the evidence was there. From the way he looked to the way he acted, his entire being symbolized the city.

You first acquainted him when you found him lingering around your stall, curious of the herbs and spices that were laid out for sale. Dressed in exquisite clothing in multiple shades of brown, you assumed he was someone of high status. Intimidated by him immediately, you steered clear of him and only spoke when he had any inquires. His voice low and calm, he turned out to be really philosophical. His knowledge of the herbs you tended to was profound, and you couldn't help but be in awe. When he finally decided to buy something, it left you dumbstruck. He didn't have mora on himself. How could someone not have mora on themselves?! He was a mystery to you.

Chasing him away for making a fool out of yourself, you couldn't believe you wasted time on him. However, that wasn't the last time you saw him. He visited a few times a week, coming without mora as always. To this, you were supposed to kick him out, for he provided no business. But deep down inside, you had no heart to do so, not when he looked so passionate talking about mundane things like herbs. Listening to him speak left you at ease, so a smile would take place on your lips more often.

So here you were now. The two of you developed a closer relationship throughout the weeks. Yet, the news of Zhongli as a god seemingly complicated things. Why would he spend time with a mere mortal being like you? You were nothing compared to him, a speck of dust within his years. In no time, he would forget you... and the thought of that hurt.

Brushing those thoughts away, you decided it was best to enjoy this moment with him. The future was unknown, concerning the two of you, but worrying would only add wrinkles onto your face. Speeding up your pace, you were side by side with the consultant of Wangsheng Funeral Parlor. He rose his eyebrows, sending you a soft smile that left you flustered.

"Why do we have to go to a teahouse when I already have herbs to make tea out of?" you complained. "I'll be the one spending my mora too."

He blinked in surprise. He always did this when someone brought up the currency, as if he didn't realize mora existed. "Oh, that's right. The tea is going to cost pretty expensive," he said, humming. He looked unbothered, knowing he was a total parasite to you. Damn, if he was a god, couldn't he at least create some mora and have you become rich?

The teahouse was coming into view, the homely building wide and spacious. Strolling through the front door, you were led to a table for two. Sitting yourself down in front of Zhongli, you watched as he professionally scanned through the menu.

"Do you have any preferences?" he asked you. "If not, I know a good one. It's refreshing and has this distinct taste that never fails to reduce stress. After all, a lot happened today, did it not?"

He was correct in that. Today, the newest stocks for your spices didn't deliver on time, because the wagon fell into the ditch. This was a great annoyance to your day, but you decided to go check on it, in exchange that you would get your products safely. What you didn't know was that the wagon had ran into hilichurls earlier, who still lingered there when you arrived at the scene of crime. Ambushed by the creatures, it was thought you were to meet your end when someone saved you in time. It was no other than the Geo God himself, the very one sitting across from you at this moment.

This encounter had struck more doubts within you. The difference in strength and power between you and Zhongli was out of this world. You were so weak, but he slashed those monsters dead with a few hits. It made you wonder if it was better if he didn't need know you; you were such a nuisance for him, someone not worth of his time.

"Thank you for saving me back then," you said for the millionth time already. "I guess paying for the tea shouldn't be a big deal, since I wouldn't even be here if it weren't for you."

"It was a pleasure saving you. You are my favorite merchant, after all." He crossed his arms across his chest and leaned on the back of the chair, looking pleased with himself. A staff member approached the table and he went to order tea. Once they were gone, the consultant leaned forward, gazing intently at you. His gloved hand lifted from beneath and was placed on top of your head. Stroking your [h/c] locks endearingly, he was throwing you off drastically. He was never this affectionate. "Go get some rest after this. Don't go back to the market -- it should be closing soon anyway."

Much to your disappointment, he removed his hand when a teapot was set in the middle. Porcelain tea cups were stacked beside it, ready to be used. Elegantly reaching for them, he poured the steamy liquid into the fragile cups, handing one to you and keeping the other for himself.

Patiently blowing into the tea, you took a sip and melted at the taste of it. He was right; this was almost enough to erase all your worries away.

"This citrus and honey scent stemming from it... it reminds me of you, [Y/N]," he said softly. His lashes lowered, showcasing how long and dark they were. Beautiful. Why was he so beautiful? "Soothing and warm. You allowed me at your stall when no else did. You became a haven, if I dare say." He sipped his tea and let out a content sigh. "Most relationships I've had with others were bounded through contracts. Although, with you, there is none and I still find myself returning to see you. Is this the meaning of sentiment then?"

You were thoroughly unprepared with his words. He kept surprising you today. Was he somehow affected by the near death experience you had today? That couldn't possibly be true. "I-I don't know," you choked out.

It was silent for the next few minutes. Averting your eyes away from him, you buried your face into your cup, gulping down the rest of its contents. Now empty, you hurried to pour in more tea, hoping you didn't look as awkward as you felt. Meanwhile, his features were passive to the point it was unreadable. What was he thinking about?

"Am I making you uncomfortable?" he asked bluntly. Your shoulders stiffening, you quickly shook your head in denial. "I see. And yes, to see you almost dying, it frightened me. I couldn't bear to lose you." Your mouth parted in shock. Did he somehow read your mind?

But his words... they touched you, making tears prickle the corners of your eyes. Blinking them away, you gulped and fixed your posture self-consciously. He truly cared about you.

Before you could stop yourself, you summoned up the courage to voice the question that had been on your mind all night long. "Will you forget me someday?"

He chuckled in amusement, shaking his head afterwards. Reaching for your hand, he guided it to the side of his face. His skin soft and smooth under your fingertips, the feeling of it sent your heart racing. His crimson bangs brushed you, tingles erupting on your tender skin. He nuzzled himself into the crook of your palm, fluttering his eyes shut. "Never. You will be thought of during every tea I drink, every herb I analyze, every merchant I meet, and every hilichurl I fight. Memories with you will be cherished forever... so don't go forgetting me either."

#zhongli#genshin#genshin x y/n#genshin x reader#zhongli x reader#reader insert#liyueharbor#romance#fluff#oneshot#OneShots#genshin impact#tea#writing#love#angst#childe#tartaglia#lumine#xiao#diluc#kaeya

189 notes

·

View notes

Text

Untouched (pt2)

A/n: OOOOOKKKAAYY yes. So I have been chipping away at this because I have like 20 other Fics I'm working on at the same time in between the videos I'm making. But part 2 is finally here! Hopefully part 3 will come much faster.

TW: child marriage I guess. manipulation, lies, torture

It was several hours later before Boss joined Kai in the lounge for tea. Yui had fallen asleep on the couch next to him, her tea half finished and cold.

Boss took in the scene of the two of the two children across from him as he sipped his tea.

Seeming to come to a decision he placed his cup down on the table.

“I am glad to see you getting along with someone your age Kai.”

“She is…. Interesting.” Kai replied, his eyes moving to the sleeping girl next to him.

“Indeed.” Boss sighed heavily, “as much as I hate to admit it, her dirtbag father was correct about her being beneficial to us.”

“Will you be adopting her into the family then?”

Boss sighed again and scrubbed a hand over his face in a rare show of fatigue.

“No. Not exactly.” He straightened his shoulders and locked eyes with Kai. “She will be marrying into the family.”

The statement shocked Kai. It wasn’t like Boss to marry a child off to an adult for power.

“Don’t you think she’s too young. A child bride and a grown man…”

Boss blinked and let out a booming laugh.

“It seems you misunderstood my intentions. She would be marrying you Kai.”

“What?”

“As my successor you will need someone beside you. Even as strong as you are. I realize you both are young. But you are both strong. And as your guardian I want to make sure you don’t miss out on the same things I did.”

Kai sighed and closed his eyes briefly, processing.

Opening his eyes he looked back at his adoptive father. “You’ve already made up your mind on this haven’t you?”

Boss crossed his arms over his chest, his expression firm. “Yes. This is the best choice. For both of you and the future of the group.”

Kai stood and made his way to the door. “If that is what you want then I have no ground to object. But I can’t speak for how Yui will take the news.”

Yui didnt make any objections to Boss’ request. How could she!? He was going to take car of her, and he had removed her horrible father from the equation. She was nothing but grateful for the protection he was offering, even if it meant she became a pawn in the greater scheme of things.

The wedding was held a week after Boss had made his decision, in secret and within the walls of the yakuza. It was a formal but extremely small affair.

The two exchanged rings which they wore on chain necklaces. Yui kept examining the ring Kai had given her after the ceremony, rotating it around between her fingers as she walked down the hall with Kai toward their rooms.

“If you keep doing that it will tarnish” he commented with a sigh.

“Oh, sorry. Its just…its really pretty. I’ve never had jewelry before.” A slight embarrassed blush colored her cheeks.

She was so adorably honest with him, it was becoming habit for him to drop his guard and get comfortable with her.

“Then I’ll teach you how to keep it from tarnishing. So it stays pretty.”

Yui smiled at him, “Thank you Kai. I’ll take good care of it.”

****************************************** 6 years later *****************************************

Yui was making her bed when there was a knock on her bedroom door.

“Yui, its Kai. Can I come in?”

Blushing she grabbed her silk robe off the closet door and pulled it on, quickly closing the front and tying it closed. She exhaled to calm herself.

“Yes of course, come in” Yui sat down on her bed.

Kai entered her room, closing the door behind him and leaning against it. She supposed she shouldn’t have expected any less, since it wouldn’t be like him to come see her in his sleepwear, but she was still surprised he was already fully dressed.

“There’s something I wanted to tell you about.”

“Is this about me using the kitchen again? Look, I told you I want to cook for you. I get bored and I found a cookbook in the library. I don’t see what is so wrong with me learning-“

“Calm down, I’m not here to scold you for learning how to cook. You can keep doing so if that’s really what you want to do. But it’s not necessary. We have people who will cook.”

She grabbed a pillow, hugging it to her chest. “So you’ll let me keep cooking!?”

“If that’s what you want to keep doing then yes. I’m not going to stop you from having hobbies.”

“Thank you Kai!”

“You don’t need to thank me for something as basic as this you know”

Yui just smiled at him in response. Kai sighed, though he was glad she was at least happy.

Kai crossed the room and sat next to her on her bed, putting his elbows on his knees and threading his gloved fingers together. It was a very relaxed and casual posture that was rare for him.

Though it had become habit for him to feel comfortable in her space and around her, her quirks passive benefits cleaning the very air around her; soothing his anxiety about the dirt and germs.

“So what was the thing you wanted to tell me?”

“Well, to put it simply you and I are moving. I purchased a house outside of the compound for us.”

“Oh! How exciting! When will we be moving then?”

Kai smirked at her reaction behind his mask “Tomorrow.”

“Tomorrow! But we haven’t packed. And how is the house ready? Didn’t you just buy it?”

In general Yui had learned not to question Kai’s ability to do the impossible, or to doubt him when he would ask something impossible of her, but this entire development had taken her by surprise.

“I commissioned the build a few months ago. Its completely finished and ready to move in. Don’t worry about packing. Someone will take care of it. We leave tomorrow morning so be sure to take anything with you that you want immediately.”

She seemed a bit anxious, squeezing her toes tightly against the carpet. Kai reached over, capturing a lock of her long long hair between his gloved fingers, “you seem nervous.”

She nodded slightly, hugging the pillow tighter. “Its just so sudden…. I can’t help but feel your keeping something from me”

Kai’s fingers around her lock of hair froze from their slight caress. It was moments like these he hated. He hated how damn perceptive she could be even without any information.

“I see. I suppose it does seem sudden. It had been on my mind for awhile. You know I’m taking over for Boss when he passes. As it is with his current health I’ve been handling most of the business. I just feel having a home for us off the compound, away from where I handle dangerous business, would be safer.” He brought his hand up to caress her cheek.

“Im really not keeping anything from you Yui.” He lied, tucking her hair behind her ear.

“I just want to keep you safe from any unsavory characters that come here” Kai fed her half truths, his focus on reassuring her that everything was fine.

She didn’t need to know about his dealings with the League of villains, his plans to revive the yakuza, his experiments with Eri’s quirk, the war he was waging and intended to win. He wouldn’t subject her to those horrors. Truthfully he hadn’t even been angry at her for cooking for him. He had just used it as an excuse because she had nearly caught him coming up from the secret basement with his arms covered in Eri’s blood.

Keeping Yui in a house away from the group was for the best to move their agenda forward. She would be free to pursue whatever hobbies she desired in their new home, away from dirty dealings and prying eyes.The house would have guards on the grounds and all the comforts they would need.

Kai looked into her sunset eyes, and the image of a bird in a cage appeared in his mind. He frowned behind his mask.

No.

No, she wasn’t a bird in a cage. She was just… important. She needed to be kept safe.

He had promised to keep her safe. And he would.

#overhaul#MHA#OC#some canon shit#hurt#comfort#villans#shit is starting#world building#writing#fan fiction#part 2

7 notes

·

View notes

Text

Treason

"I've introduced you to those with me. Why don't you introduce me to the reason you've brought an army to my doorstep, Lord Highshoal?"

"Why official matters of course, a Lord should not travel without proper protection I'm sure you understand. We simply could not be so careless."

"You have that many enemies, Lord Highshoal? When I was just a Baroness, as you are just a Baron now, I only traveled with a small entourage. It draws less attention. Highly recommended."

That should have been the warning for Elaianna. It should have been at that point that she had told Nallaen to go and find her daughters. It should have been then she begun to warn people over the communication devices to prepare for the worst, to prepare for evacuating those that needed it. Yet she had delayed, trying to get to the root of the problem. She had tried to gather fact before acting too rashly. While a boon in most cases, it was a flaw in this particular one.

"They are for future protection, and yours of course."

"Is that the official business you are here for, Lord Highshoal? To offer me your protection?" she inquired with a passive expression and a tone of neutrality. A wall was up on the Duchess's countenance, not giving the man an inch.

They were his assurance. The furthest thing from her protection.

"Well I would insist on it- you'll need ample protection for your travel." Travel? Oh how fun it was being coy and giving half the story to force her into the trap of asking by what he meant.

"I have no intention of traveling in the near future, Lord Highshoal. I've plenty of business to keep me here," she responded. "Whatever your source was that proclaimed otherwise was amiss. You should take that up with your source of information."

Yet another red flag. The should have, would have, could haves all replaying in Elaianna’s mind as she went over the night’s events. She felt a sickening twist in her gut, having only parting reassurances over the communication devices, and no true knowledge on if Nallaen had been successful in spiriting away her daughters. If only she had acted sooner, then she’d know.

Ah, the time was right. Perfect, absolutely perfect. "Actually-" Lord Umber paused, pulling up his official letter marked with the seal and signature of Lord Stormsong. "Ahem!" The Lord all but announced numerous times with a deep clear of his throat. "By order of Lord Stormsong, protectorate of Stormsong Valley, speaker of Sea and Tides, you are hereby under arrest for treason against the good people and Lord of the Valley." He'd turn the page, place it on the table then slide it forward.

Whether good or bad luck, Thomas was not there. He was at sea. The Lord only had one of the Stalsworth’s. Her husband was still there not just for the House, but their family, and their Company. Some would argue they were one in the same. Such were the immediate thoughts through her mind as she told Nallaen that he hadn’t much time to waste. The girl’s would have to go as they were. Pajamas for the journey. Admirable as it was that he wanted to get the girls in something more travel worthy, time was not on their side.

That was when her guard, Kaitlyn spoke, breaking her usual solemn silence. EXCUSE THE FUCK OUT OF ME!?" Her hand was immediately on her sword as she was ready to behead him at Anna's word. She just needed that word.

Elaianna's hand rose up and to the side, blindly moving in a single gesture to the general Kaitlyn-sword-area in silent motion to stay her hand. “Find my husband and my children in my absence. They’ll need it. This has just begun,” she requested of Kaitlyn over the communication stones. Their private connection had been her way to plead with her guard to look after those other than herself. She stared at the decree. "What treason have I committed?" she demanded, before her gaze shot back to the Lord, dove grey eyes hard as steel.

Kaitlyn immediately removed her hand, though the look in her eyes was clear. If that fat fuck made a wrong move, she'd end him.

While they could have taken care of the Lord then and there, there was an army at their door. Literally. What would it have cost them? Stormhollow’s people? Nerina? Aberdeen? Elaianna’s compliance was the only way she saw to buy her family and her people time to get to safety. This was her mess, and she had to fix it.

"I believe it says quite clearly right here," Lord Umbert leaned forward. "Betrayal of oath, unlawful claimant of labor crew, occupying lands, aaand...well it goes on, Miss Nesbitt, you get the jist." When Kaitlyn rose her voice in protest the Lord sat backwards, his knight immediately dropping his hand to his own blade while the tidesage beside him took up arms readily.

"Stalsworth," she corrected. "Lady Stalsworth." She looked over the decree before tossing it back on the table. "I swore no oath to Lord Stormsong. In fact, he was rather absent after my inheritance of Stormhollow." Her lips pursed. "As for unlawful claimant of labor crew? ...The unlawful claimant is declared by your Lord. I've denied him my people as slaves.”

"Stalsworth, Nesbitt, it doesn't matter at this point, traitor-" Lord Umbert waves his hand in disgust, done with the drabble he now perceived her as, the veil being lifted from his grand performance. "Your family was granted this land in good faith by Lord Stormsong under their oaths of fealty and you have broken trust, and they are not slaves woman, mind your tongue- they are privileged servants brought to bountiful work with ample returnings for their labor, to which you disturbed. Lord Carston-" The knight behind Lord Umbert nodded, stepping forward at a raising hand. "See the traitor to irons."

The iron bit against Elaianna’s wrists. With her shoulders squared back, even in shackles, she had managed to maintain some semblance of dignity even in the face of the situation. Such posture was gone as she felt the ache in her muscles from hours in the forced position of arms behind her back. She had gotten out of bad situations before though. Surely she’d get out of this one.

But what of her people?

"Ah but of course one more matter-" Giddy Lord giggle.

Elaianna planted the heels of her shoes into the floor and looked over her shoulder, narrowing her gaze. "What matter?”

Captain Clewance glanced at Lord Highshoal with silent ire, he squinted in anticipation.

Lord Umbert saved the best for last, the desert, the tasty bits, the lip smacking eight-piece tender combo- Producing another document, Lord Umbert unfurled the letter and placed it on the table, speaking of it as if he'd memorized it. “By further decree, Lord Stormsong appoints myself, Lord Umbert Highshoal, to the station of protectorate of the territory of Stormhollow until trial’s end, and/or, replacement deemed necessary. All persons native born or who shall remain in Company or House of the traitor Ellaiana Nesbitt-Stalsworth are hereby further conscripted into service to House Highshoal and the territory of Stormhollow until further notice and are subject to new laws…”

Sabine had dropped all pretense of being cordial as she glowered at the man. When he made his announcement, she lurched to her feet and slapped her palms on the table,"CAREFUL, my lord. Not all who work for the company are subjects of Kul'tiras and to take them would be a mistake."

"Then they may leave my little crumpet, but those that remain in employ work for me now."

"They work for the Duke Stalsworth," Elaianna declared over her shoulder. "And the Duchy's heirs."

"No...they used to, ta-ta my dear."

"They may tolerate you here, but never forget, you're nothing more than dirt on the heel of their boots," she managed to say before she was forcefully shoved out of the room. Once out of the room, she righted herself as much as a Lady in shackles could, to walk with as much dignity and grace as she could, chin in the air. Carston, the tidesage and the handful of men that had accompanied Lord Highshoal inside Stormhollow Castle escorted the Lady through her own halls, and into a carriage outside locked from the outside, for transportation. Kaitlyn followed the men taking her lady away as she wanted to keep her well in sight until it was no longer a viable option. This was the depth of her loyalty.

As Elaianna was 'guided' into the carriage, she gave Kaitlyn a last look. "Thank you, friend." Not Miss Cavanaugh. Not Guard. Not Kaitlyn. Friend. It was then that the door was shut, severing the last look both women had of one another.

Sabine ground her teeth as she watches the Duchess led out of the room and moved to make her own exit," Right then, I will go and inform them now, then... Lord Protectorate."

Clewance ground his teeth, swallowing indignation. He gathered his papers to distract his mind. “I would have leave as well, my Lord.” Clewance glanced at his men nervously, wishing to be on the sea without delay.

Elaianna would have been all the more restless and plagued with dread if she knew what had happened then. If she had known what happened to her Harbor Mistress and Captain.

Ignorance is bliss, or so they say.

@atc-wra @tirasiansails @thomasstalsworth @eidrich-crone @korduun @gloryofsteel @wrahaleth (mention of Nerina)

34 notes

·

View notes

Text

401k vs Real Estate – Which Is Best?

401k vs Real Estate – Which Should You Invest In?

For the first part of my career, I invested the traditional way that most of us do – in retirement accounts. I did this because it was all I knew to do and also how most of the millionaires in the books, The Millionaire Next Door, The Automatic Millionaire, The Latte Factor and Everyday Millionaires, gained a seven figure net worth.

Now I realize there’s multiple different investing options but I feel that we can boil them down into one of three categories:

Traditional investing – 401k & IRAs using stocks, bonds, mutual funds, etc. With this method, you invest over the course of your career and don’t start accessing funds until retirement with hopes of never running out of money. You mainly rely on compound interest to make your money grow over a long time period. Usually 40+ years. Again, this is what I’ve mainly focused on doing up until the last few years.

Non-Traditional investing – With this method, you don’t have to wait 30-40 years to begin using your money. An example would be investing in cash flowing real estate such as multifamily syndications. Once you purchase enough to cover your monthly expenses then congratulations, you’ve reached financial freedom.

Combination investing – This would be a combination of #1 and #2 above. This is what I’ve currently shifted towards.

Pros & Cons – 401k vs Real Estate

When researching information for this article, there were many pros and cons to both investing in a 401k vs real estate. It’s ultimately going to come down to…YOU.

Most people invest in what they’re most comfortable and knowledgeable about. Also, you should have a list of financial goals to help navigate the road to success.

When I talk about success, it’s what your definition of it means to you and not anyone else.

For some, they may have a goal of working until they can’t work anymore and are content investing in a 401k their entire career.

For others, they may want to experience retirement earlier and work on their own terms when they become financially free using investments such as real estate for cash flow.

Neither of these options are wrong, it’s all about you, your risk tolerance and goals.

Let take a look at the pros and cons of 401k vs real estate investing so you can make the best decision for yourself.

401k Pros

Tax Breaks When You Contribute

Similar to investing in a Health Savings Account (HSA), annual 401k contributions are tax-deductible unless you’re investing in a Roth 401k (see below).

What this means is that you’re allowed to deduct the amount you invest from your taxable income. This is especially helpful as being a high income earner, your tax bill is going to be one of your largest annual expenses.

Roth Conversion

Some companies allow you the option of investing in either a Roth 401k or IRA. If you own your own practice, you can have this set up for you.

When contributing to these types of accounts, the money is taxed BEFORE going in and you’re not allowed to take a deduction. The good news is that when the money is taken out, you pay NO taxes at that time.

You can also perform a Backdoor Roth Conversion.

A backdoor Roth is simply a conversion of money in a traditional IRA to a Roth IRA. Currently, anyone can convert money that they have put into a Traditional IRA to a Roth IRA, no matter how much income they earn.

All of this works because, in 2010, the federal government removed the income limits for IRA conversions, creating a Roth IRA loophole. Of course, you’ll need to get the mechanics right. Consult your accountant and/or tax attorney if you have any questions before doing so.

High Contribution Limit

For 2019, the annual contribution limit for a 401k, 403b, and Thrift Savings Plans is $19,000. If you’re reading this article, more than likely you’re a high-income earner.

For you, I’d recommend investing at least 20% of your income each year.

For instance, someone making $200,000 should aim to invest $40,000 a year or more.

Investing in one of these retirement accounts can get you halfway there in this example.

Matching Contributions

I had a conversation recently with a new teacher regarding her 401k. Her employer, along with many others, offer some type of match which is basically free money. In essence, when she puts up money, they do too.

There are two main types of matching contributions: Partial and Dollar for Dollar Matching

Partial Matching

If your employer offers partial matching, typically they’ll match part of the money you invest, but not all of it. Usually it’s up to a certain amount.

One of the most common matches is 50% of what you put in, up to 6% of your salary.

In other words, your employer matches half of whatever you contribute, but no more than 3% of your total salary .

This is what my teacher friend’s employer offers. So in order for her to maximize the match, she’d have to put in 6%. If she wants to put in more, say 9%, her employer is only going to put in 3% because that’s their match.

Dollar-for-Dollar Matching

This type of matching is self-explanatory. When someone puts in a certain amount into their 401k, their employer matches it. Similar to the partial matching, but up to a certain amount.

Here’s what Dave Ramsey tells a caller that has debt but wants to know if he should contribute to a 401k in which his employer offers a match:

youtube

Now let’s move on to the downside on 401k investing.

401k Cons

Higher Taxes on Profits From Your 401k Investment

As mentioned earlier, your taxes are deferred when you invest in a traditional 401k. As nobody can predict the future, nobody will know the tax bracket you’ll be in when you do decide to retire.

If you wind up in a high tax bracket, the taxes on your profits could be higher than expected.

Less Flexibility

Typically, when investing in a 401k, your choices are limited. Most employer-sponsored plans are short on options especially if you’re looking for choices that are outside of the basic asset classes of stocks, bonds and cash.

Early Withdrawal Fees

A major disadvantage of locking up your money in a retirement account such as a 401k is that you’ll be penalized for taking it out early. This especially affects those that want to retire early and will need the money sooner than later.

Even if you’re experiencing a financial hardship and have to take money out early, you’re still be penalized.

Pros Of Real Estate Investing

Ability to Leverage

Successful real estate investors know that leveraging property is one of the major advantages of why they invest in the first place.

As equity grows in rental property, you’re able to leverage it to continue buying more. This would be difficult to do within a retirement account.

Depreciation and Tax Advantages

One of the main reasons I started investing in real estate was to take advantage of the tax benefits. The government encourages us to invest in real estate as they offer tax breaks for things such as property:

depreciation

maintenance

insurance

taxes

legal fees

Also, rental income is not subject to self-employment tax.

Appreciation

One of the most important aspects of real estate investing is location, location, location. If property is bought in the right location, then you can expect the value to increase. Once you’re ready to sell, this appreciation allows you to make even more profit beyond your rental income.

Build Equity

One of the main reasons investors buy real estate in the first place is that they know that their tenants are going to pay down the mortgage and expenses. What this does is allow them to pay off the mortgage with OPM (other people’s money) and also build equity at the same time.

Take Advantage Of 1031 Exchange

Section 1031 of the Internal Revenue Code allows you and me, the taxpayers, a way to defer taxes by exchanging one property and replace it with a like-kind property. Basically you’re able to take all of the proceeds from the sale of one property and buy another and the taxes on the transaction are deferred.

Passive Income

Without a doubt, one of the greatest benefits of real estate investing is the passive income generated. Whether you’re an active or passive investor (like me), you’ll still be able to enjoy this stream of income.

Also, if you’re currently working and don’t need to use the income now, you can save it for future investing.

Cons Of Real Estate Investing

Real Estate Can Be Time Consuming

One of the main reasons passive investors avoid actively owning real estate is the time commitment being a landlord requires.

I have several friends that own single family homes, apartments and even storage units. They’re constantly complaining about the amount of time it takes to maintain them such as keeping them occupied and performing regular maintenance.

Long-term Investment

Whether active or passively investing, real estate investing should be approached as a longer-term strategy. If you need money quickly for an emergency, you’re not able to liquidate your investment for cash. It takes time to sell a property if you’re actively investing.

For those investing passively such as in syndications, there’s typically a 5-7 year hold time on your investment.

Active Investing Can Be Problematic

The #1 reason I chose to not actively own property at this stage of my life was to avoid dealing with tenants. If you’re an active investor, you know what I’m talking about.

Tenants are humans (at least I hope they are) and humans can cause problems. For instance, one of the biggest problems you can run into are tenants that decide to not pay their rent. The cash flow on the property can take a major hit especially if they move out leaving the property in a poor condition which require more money to repair.

Risks Are Involved

Whether you realize it or not, any type of investment comes with its share of risks. Real estate is no different. There’s always a risk of losing money.

When I first started passively investing, I didn’t know what I was doing. I was putting my trust in a website that was supposed to only advertise the best properties available to passively invest in. Now, after losing money during one of those deals, I’ve come to realize the risk involved if you don’t understand the investing process.

Which Investment Strategy Wins?

Now that we’ve discussed the pros and cons of both real estate and traditional investing, which is best?

According to Sam over at Financial Samurai, he likes investing in real estate over saving in a 401k.

The best strategy for you is…well it depends on YOU.

What’s your long-term vision or goals?

Do you have an Investor Policy Statement? The Physician On Fire claims you should, and he’s right.

If not, consider creating one. It’ll help you define your goals and the strategies you intend to implement based on your preferences. Again, it’s all about what’s best for you. Not your buddy you eat lunch with on Tuesdays.

Hybrid Approach

For me personally, I take a hybrid approach. We max out our retirement accounts in index funds to take full advantage of the tax deductions they offer.

It’s also an easy method to become an “Automatic Millionaire” with a “set it and forget it” approach.

After we max out these accounts along with the kids’ 529 plans, any left over money goes toward investing in syndications.

Most of the deals I invest in are for accredited investors requiring a minimum of $50,000. I save extra money on a monthly basis in a Vanguard money market account until I’m able to invest in these types of deals.

This is why I call it a hybrid approach:

some in traditional retirement funds

some in real estate

If you’re considering taking advantage of more income producing investments other than stocks and bonds, you may want to consider real estate as you’ll be able to potentially retire much earlier than expected.

The post 401k vs Real Estate – Which Is Best? appeared first on Debt Free Dr..

from Debt Free Dr. https://ift.tt/2NzI5jN

via IFTTT

0 notes

Text

You will find no better way to delight in the outside the house on a warm day then in snug outside home furnishings. Aku tidak berapa percaya kepada budak-budak tersebut kerana memang aku tahu setiap kali aku mandi zaidin memang tak lepas peluang untuk mengintai tubuh ku. Namun begitu aku diam sahaja perkara tersebut, bukan nya orang lain, anak saudara suami aku juga yang aku anggap macam anak suadara aku juga.

These folks who are aiding below-deliver the locals have adapted to the existing Apartheid norm of on the lookout down upon the area African South African South Africans as inferior, lazy and prison in their ways whenever interacting with Africans from the north of South Africa, within South Africa.

Most African peoples in South Africa know and understand that each own and collective psychology are designed from all those experiences which can be consciously retrieved from memory, composed heritage, far too as to those activities which have been forgotten or repressed, but which nevertheless characterize by themselves in personal and collective behaviors, tendencies, traditions, emotional responsivities, perspectives, ways of being aware of and processing data, attitudes and reflex-like reactions to selected stimuli and conditions.

To start with he puts the butt plug, anal douche, a tube of Vaseline, a locking chain and plastic gloves on the table just before me. Future he finds a suitable free place by me, kneels in Latest, pressing his deal with to the flooring, head in close proximity to my right foot, knees spread, heels pointing up, 30 cm chain concerning ankles taut, hands put behind his again as far as they go. Mistress, slave prepared for anal douche, Mistress” OK, go for it” He normally takes the douche, draws his head to his knees, to be ready access to his driving with the anal douche, when he squirts the contents to his asshole, and waits.

In this cost array ($70 to $150), you'll discover several of the characteristics of superior-conclude chairs, which consist of multiple tray and chair-top positions; casters for mobility, with a locking attribute for harmless parking; a reclining seat for infant feeding; one-hand removable tray; foldability for storage; and a three- or five-position harness plus a passive restraint when made use of with the tray.

Usually I like to haggle whilst purchasing anywhere I go, but in Cuba, I felt the folks made so minimal money to begin with, I just ordered points at the value advised to me. If you adore buying, regretably your thrill is not going to be quenched in this article.

I've been to dozens of them, and following every 1 the Whites really feel so Lots improved about themselves because Buy Korah Barrel Chair By Cyan Furniture Buying Guide they invested an night time with their darker brothers, and the official Negros-oh,let me explain to you!-they use people meetings to emotionally blackmail White people, wringing concessions out of them for their individual particular development.

Disadvantages: Watch for chairs in this cost assortment with grooves in the seat's molded plastic (a gunk entice); cotton seat pads as an alternative than vinyl, which are likely not to hold up far too over time; and trays with side release buttons that are out there to your child.

0 notes

Text

Recent Purchase: Apple

New Post has been published on http://edsocme.com/recent-purchase-apple/

Recent Purchase: Apple

It wasn’t long ago that I wrote a focus ticker article on Apple (AAPL) that raised concerns that I had about its weighting in my portfolio and the potential for me to trim shares. Ultimately, I didn’t follow through (though it’s too bad because in hindsight, I would have timed that trade up pretty well). However, I decided that there wasn’t another company in the market that I would rather own (which is why AAPL is by far my largest holding in the first place), so selling any shares would just result in a downgrade of quality. More recently, I penned a piece highlighting the potential for AAPL’s share price to rise above the $300/share mark in the next 12-18 months, in response to an analyst’s call. Obviously with that sort of short-term price target, I remain really bullish on shares. So, with that in mind, I put my asset allocation concerns and added to my AAPL position today as shares dipped more than 20% below their recent 52-week highs, buying shares at $186.50.

The reason that my AAPL position has grown so large is because I’ve bought shares on just about every dip that the company has experienced since I began my investing career. I’ve said it time and again, AAPL shares are the easiest stock in the market for me to buy and own. These shares check all of the boxes that I’m looking for from both a fundamental perspective and a shareholder rewards one as well. AAPL is the core building block on my long-term dividend growth portfolio. Even after recent weakness, I see no reason to change that sentiment.

Speaking of dividend growth, that seems like the best place to start here. AAPL is not included in many DGI portfolios because it doesn’t have a very long annual dividend increase streak. The company didn’t begin paying its dividend until 2012; however, since then Apple management has rewarded shareholders with annual increases each and every year. Since initiating its dividend AAPL’s dividend growth CAGR is ~10%. Being that AAPL’s dividend payout ratio remains low at ~24% and the company is expected to continue to post double digit EPS growth into the foreseeable future, I expect for these double digit annual increases to continue. Simply put, if I had to pick one company to give me double digit dividend growth over the next decade or two, the pick would be AAPL.

Assuming that the current ~10% annual increase rate is maintained over the long-term, the passive income that AAPL generates for me will double every 7 years or so. I know that some investors look at AAPL’s low, ~1.5% yield and like to place negative focus on that. However, I think it’s important to point out that the reason AAPL’s yield is currently so low is because of the stock’s recent price appreciation. This is a great problem to have.

Furthermore, as a long-term investor, I think it’s probably more important to focus on the compounding potential of Apple’s dividend rather than its yield in the short-term. I’ve only been a shareholder of AAPL for 6 year or so, yet my yield on cost has already risen significantly. After my recent AAPL purchase, the cost basis of my overall position has risen to $106.79, meaning that my yield on cost is ~2.75%. At the current 10% annual increase rate, it won’t be long before that percentage rises significantly higher. This is the beauty of owning an equity that posts double digit dividend growth.

But, as amazing as AAPL’s dividend growth potential is, it’s honestly dwarfed by the power of the other half of the shareholder return proposition: buybacks. For years, AAPL has been known for its enormous cash hoard. With so much of its cash locked up overseas due to unfavorable tax rates, AAPL’s wealth grew and grew to levels that the majority of countries on earth were envious of. And now that the tax rates have changed, AAPL management has mentioned that it would like to go cash neutral on the balance sheet, meaning that there are hundreds of billions of dollars that the company is looking to spend.

AAPL will undoubtedly continue to investing billions into R&D. There is potential for large scale M&A as well, though historically, AAPL management has been hesitant to go with route, favoring organic innovation for growth. AAPL used some of its repatriated cash hoard to give investors a slightly largest dividend increase than normal in May, but it appears that the vast majority of those funds will be dedicated towards AAPL’s share buyback. Management authorized $100b+ for share buybacks earlier in the year and we’re beginning to see he power of this repurchase with management spending ~$73b on share repurchases during the trailing twelve months.

I know that many investors wish that these billions were paid out in dividends, but looking out longer term, we really begin to see the power of AAPL’s share buyback. Since 2013, AAPL has reduced its outstanding share count by 22.7%. This plays a large role in the company’s strong EPS growth, which in hand, lowers the payout ratio and makes long-term dividend growth more sustainable.

Here’s how I look at it. Since 2013, AAPL has retired ~1.4b shares. Right now, AAPL’s quarterly dividend payment is $0.73/share. This means that AAPL’s buyback program is saving the company $1b+ per quarter in dividend related expenses. This cost savings figure will only continue to grow as more and more shares are retired and the quarterly dividend in continued to be increased.

I think that AAPL management can realistically retire 5-8% of the company’s outstanding share count over the next year or so. A lot of the recent pullback has been centered around fears of a sales slowdown. Well, even if that were to the case and AAPL only posted moderate revenue growth and margins stayed flat (which is unlikely due to the fact that ASP’s and high margin service revenues are rising) AAPL will post strong bottom line gains because of the reduced share count. Supply and demand is on my side as a long-term shareholder with AAPL reducing its float.

What’s more, Warren Buffett and Berkshire Hathaway (NYSE:BRK.A)(BRK.B) continue to increase their position and I can only assume that they’re planning on AAPL being a long-term stake for them. Between the buyback and Berkshire, I suspect that a large percentage of AAPL’s shares are going to be removed from the market which should help to put a floor under the stock in the short-term.

But even if Buffett wasn’t bullish on the name, I would still consider the recent sell-off to be irrational. I understand that the market doesn’t like question markets. Apple removing the hardware unit data from its future reports is probably a concern to certain analysts who try to make short-term projections, but to me, it doesn’t matter much. Actually, I agree with Apple CEO, Tim Cook, and his belief that the company is valued too low because of the market’s focus on hardware and if removing the unit sales data shifts that focus to the fundamentals (like rising sales, margins, earnings, etc) then I think it will be a great thing for the stock.

I know that some analysts and investors alike see the data reporting change as a dubious means to hide demand issues, but I simply don’t see it. Apple remains the leading brand globally in the smart phone space. Apple’s brand is aspirational and synonymous with success across the world. If I had an Apple share for every time that I’ve heard someone talk about the death of the smart phone/iPhone, then I’d be a millionaire many times over. Sure, peak smart phone may be on the horizon. Maybe hardware refresh cycles will continue to grow longer as it becomes harder for companies like Apple to make meaningful innovations in the hardware space. Either way, the service revenue streams will likely continue to grow alongside the global active user base.

Shares are irrationally cheap at this point even if the company’s sales are flat (or slightly negative). Sure, if iPhone sales fall off of a cliff, then an AAPL sell-off is justified, but I see no catalyst for this to happen. My point is this: Apple doesn’t need to continue to post double digit iPhone growth to be a great investment.

Why? Because the company’s share are cheap, valued at ~14x 2019 EPS expectations. This means that the most profitable company on earth is valued with a premium below the broader market’s. With this in mind, i’s no wonder that Apple is willing to spend so much money on a buyback.

Source: F.A.S.T. Graphs

Any shift in sentiment should result in multiple expansion. I think a 17x multiple is fair for a company with Apple’s fundamentals. If this were to happen, we’d be looking at gains of nearly 20% from here based upon 2019 EPS expectations. And, as previously discussed, I think those EPS estimates are low and will end up being well above the current $13.50 average. I think it’s feasible for AAPL to earn $15 or so in 2019, meaning that shares could easily rise to a $250/share price or more in the next 12 months or so and still be priced fairly.

Source: F.A.S.T. Graphs

As you can see on the F.A.S.T. Graph above, even if shares continue to trade in this sub-market 15x range, investors are likely to experience double digit long-term total returns. Only time will tell. But, in the meantime, I’m content to accumulate shares alongside Buffett and collect this rising dividend.

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Recent Purchase: Apple

New Post has been published on http://edsocme.com/recent-purchase-apple/

Recent Purchase: Apple

It wasn’t long ago that I wrote a focus ticker article on Apple (AAPL) that raised concerns that I had about its weighting in my portfolio and the potential for me to trim shares. Ultimately, I didn’t follow through (though it’s too bad because in hindsight, I would have timed that trade up pretty well). However, I decided that there wasn’t another company in the market that I would rather own (which is why AAPL is by far my largest holding in the first place), so selling any shares would just result in a downgrade of quality. More recently, I penned a piece highlighting the potential for AAPL’s share price to rise above the $300/share mark in the next 12-18 months, in response to an analyst’s call. Obviously with that sort of short-term price target, I remain really bullish on shares. So, with that in mind, I put my asset allocation concerns and added to my AAPL position today as shares dipped more than 20% below their recent 52-week highs, buying shares at $186.50.

The reason that my AAPL position has grown so large is because I’ve bought shares on just about every dip that the company has experienced since I began my investing career. I’ve said it time and again, AAPL shares are the easiest stock in the market for me to buy and own. These shares check all of the boxes that I’m looking for from both a fundamental perspective and a shareholder rewards one as well. AAPL is the core building block on my long-term dividend growth portfolio. Even after recent weakness, I see no reason to change that sentiment.

Speaking of dividend growth, that seems like the best place to start here. AAPL is not included in many DGI portfolios because it doesn’t have a very long annual dividend increase streak. The company didn’t begin paying its dividend until 2012; however, since then Apple management has rewarded shareholders with annual increases each and every year. Since initiating its dividend AAPL’s dividend growth CAGR is ~10%. Being that AAPL’s dividend payout ratio remains low at ~24% and the company is expected to continue to post double digit EPS growth into the foreseeable future, I expect for these double digit annual increases to continue. Simply put, if I had to pick one company to give me double digit dividend growth over the next decade or two, the pick would be AAPL.

Assuming that the current ~10% annual increase rate is maintained over the long-term, the passive income that AAPL generates for me will double every 7 years or so. I know that some investors look at AAPL’s low, ~1.5% yield and like to place negative focus on that. However, I think it’s important to point out that the reason AAPL’s yield is currently so low is because of the stock’s recent price appreciation. This is a great problem to have.