#loan and finance

Text

The Best refinance companies: no.1 guide

The Best refinance companies: no.1 guide

The Best refinance companies Diaries

There are many Gains to renewing your home finance loans, such as the use of less costly fascination rates and new payment conditions.

A refinance allows you to get an improved offer on your own assets by renegotiating your unique funding phrases with all your lender or One more fiscal establishment.

We would like this to become an “earn-win” situation. So…

View On WordPress

0 notes

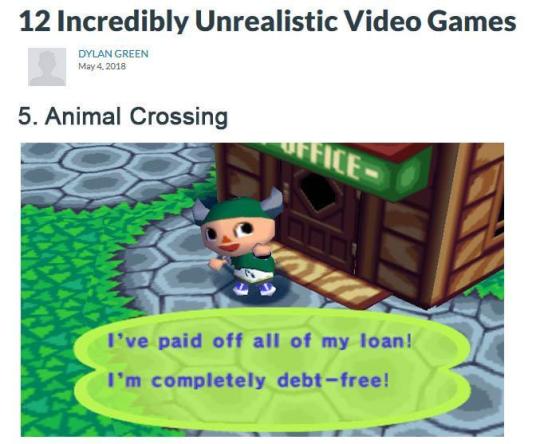

Photo

#animal crossing#nintendo#funny#gaming#video games#gamecube#villager#lol#humor#meme#relatable#debt#student loans#economy#money#finance#retro#2000s#2000ish#wild world#ds#nintendo ds#acww#accf#wii#acnl#3ds#new leaf#acpc#new horizons

3K notes

·

View notes

Text

Answer for how long (after graduation/after stopping) it was until you no longer had any student debt, regardless of how you achieved that– including if any of it was cancelled or forgiven, or you had outside help paying it off (e.g. your parents or partner helped).

–

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 5#polls about school#student debt#student loans#economics#college#university#debt#money#finances

263 notes

·

View notes

Text

Now that student loans are starting back up-

(The following is absolutely not art related at all)

Hey guys! Posting this here because I find it important-

Money is super scary shit and can cause a lot of anxiety, but please please for the love of god-

Do not avoid looking at your finances.

I cannot stress this enough. I'm in no real position to give any meaningful advice other than that. Keeping an eye on your finances and looking at them at least once a week will help break the cycle of money avoidance.

I spent most of my life being super money avoidant due to how I was raised and it caused me to get into a really rough patch because I straight up missed nearly a year of student loan payments. It very nearly fucked over my whole financial life. Thankfully it has a happy ending- I paid off my loans in 2019 and have effectively repaired my credit score (after a lot of work.)

I am currently helping some family members budget for student debt repayments because I had both fucked around and found out, so I'm trying to use that recovery and lessons learned to help the people in my life.

Please please please keep up to date with your own finances. Budget (it's honestly really easy even though it sounds intimidating.) Gamify it if you gotta. Just be sure you are looking at your account and are aware of your money situation at all times.

711 notes

·

View notes

Text

143 notes

·

View notes

Text

I've said it before but conservatives really have no concept of cost vs price. It costs $2 to produce one vial of insulin, Pfizer charges you $1000, and conservatives will confidently tell you it would cost the average taxpayer $2000 under universal healthcare. You are the easiest mark in the world. Why are you price gouging yourself?

#orcspeak#i saw someone say that forgiving $220k in student loans would cost every taxpayer $400k#like you realize college doesn't actually cost that much right#you know that student loan financers don't actually produce anything right#the charge is completely arbitrary#eliminating scams doesn't actually cost America anything you know that right

1K notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

86 notes

·

View notes

Text

When you date an investor

#banking#finance#crypto#digitalcurrency#investing#investment banking#loans#money#student memes#memes#meme#funny#relatable#insidesjoke#humor#maths#low

73 notes

·

View notes

Text

Reminder: Unsurprisingly Joe Biden failed us again, so student loan interest starts accruing again on Friday.

That means if you can, you should start paying your loans again on Friday. You aren’t required to until October, but that allows a full month of interest to accrue on your loans. If you start paying on Friday, that’s at least one less month you’ll have to pay in the future. Because Joe Biden ain’t helping you and debt forgiveness is not real for most of us.

Debt forgiveness is real if you make below $32,800/year and you should look into the SAVE plan if you do

156 notes

·

View notes

Note

Hey Sam, do you remember how long it took for your student loan discharge to show up on your credit report? It's been eight months and my loans are still on my credit report and I can't get Mohela to answer me about when they'll report it. I submitted a complaint to the DoE a few weeks ago, but who knows when I'll hear back. I guess I was just wondering if this type of delay is out of the ordinary.

Oh, man, it never even crossed my mind to look. My credit score was hovering around 800 when I began the loan discharge process and is now in the 810 range, so I never bothered to check. I had to go log into CreditKarma just now to see.

I think this must be backdated, but according to TransUnion, my loans were closed in September 2020. The reason this must be backdated is that my forgiveness wasn't finalized and approved until April of 2021. Like my balance didn't zero out until 2021, but the paperwork went into the system in September 2020, so presumably the closure was retroactive to that. I don't think any closed loan falls off for several years, but I don't know how they handle an open loan that you have actually discharged. I don't know what kind of delay is normal (I may have even had one myself and just not noticed).

As far as I know carrying a student loan balance doesn't have a huge impact on your credit score as long as they're not reporting you in arrears/late, so hopefully it's not killing your credit somehow. You might consider sending a registered letter to the bureaus, disputing the error; they may be able to shake that information loose from the loan administrators. In any case, good luck with it!

Readers, if you have advice please do share! Remember to comment or reblog, as I don't post asks sent in response to other asks.

46 notes

·

View notes

Text

General Motors Acceptance Corp, 1956

#GMAC#ad#1956#vintage#advertisement#automobile financing#thrifty terms#car loan#baby#birthday ca#e#1950s#retro#finance plan#advertising

95 notes

·

View notes

Text

no.1 Best home refinance

no.1 Best home refinance

The Basic Principles Of Best home refinance

Comprehend the breakeven position. That’s the moment at which the discounts in month-to-month payments offset the level of the closing expenditures. This refinances calculator can assist you to come to a decision.

Account icon

An icon in The form of an individual’s head and shoulders. It generally suggests a user profile. Login Advertiser Disclosure…

View On WordPress

0 notes

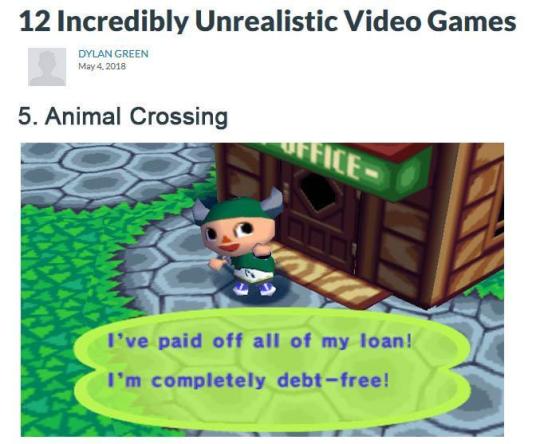

Photo

#animal crossing#nintendo#gamecube#funny#lol#humor#meme#money#economy#gaming#video games#debt#student loans#college#finances#2000s#2000ish#retro#ds#nintendo ds#acww#wii#accw#3ds#new leaf#acnl#acpc#pocket camp#new horizons#acnh

3K notes

·

View notes

Text

I'm so proud of myself about finances in the past couple months. I still struggle with money but I did enough meditation and journaling and practicing about it to make myself able to actually face my loans and credit cards and savings and bills and start really truly organizing and addressing them for the first time in years instead of just flying by the seat of my pants.

Like. This is a huge deal for me. I've felt like I'm in deadly danger every time I've tried to think about money for years and years. I'm finally able to look it in the face and stare it down and start to organize and plan on purpose instead of just keeping up with the minimum to stay afloat. I'm so proud of myself.

It's still a refrain of "GUILT (funny link)" every time I think about money but I'm able to actually make spreadsheets and face the numbers and monthly tracking again, and even make a new full budget which I haven't been able to do in ages.

still feel guilt, overwhelm, and helplessness, but no longer feel as much deep elemental shame and terror. that's progress baby

#we don't need to talk about how many months and months of therapy visits and doctor appointments I put on credit cards#among other things#but I had to put my foot down about it a couple months ago and shout at myself a little saying HEY#I AM SHAKING YOU BY THE SHOULDERS I AM SHOUTING FOR YOU TO HEAR#OF COURSE IT WAS A TERRIBLE FINANCIAL DECISION BUT YOU WEREN'T EVEN EXPECTING TO BE ALIVE#THE CREDIT CARD DEBT WAS NECESSARY TO KEEP YOU ALIVE AND IT DID AND EVERYTHING ELSE IS WAY LESS IMPORTANT THAN THAT#why the FUCK are you feeling SO ASHAMED for making the best decision you knew how to make at the time???#just because you know NOW that you could have tried some other options doesn't mean you did THEN#you may have known enough to feel shame and guilt yes but you would never in a million years have gotten the help you needed fast enough#by attempting to go another route#you didn't trust anyone besides a very few handfuls of people and even them it wasn't fully#and the stress of running it through parental insurance was so terrifying to you bc you didn't know what that would do#and you never had cosigners for anything your whole adult life. it's OKAY#you fucking DID YOUR BEST#YOU HAVE LEARNED. YOU HAVE MADE CHANGES. YOU HAVE ALREADY DONE BETTER#YOU WILL CONTINUE TO LEARN AND IMPROVE OVER TIME#it is not the end of the world. even the utilities sending you to debt collections etc etc#YOU ARE FIGURING IT OUT ONE PIECE AT A TIME#MORE PEOPLE ARE ASHAMED AND AFRAID OF THEIR OWN FINANCES THAN YOU THINK#if the people who fought and argued with and shamed you for considering student loans much less taking them out#had wanted you to actually be financially safer and healthier#they could have just fucking helped out or cosigned your loans or actively helped you find other solutions#instead of spending months and months telling you it was the worst decision ever and would ruin you financially for decades and such#you made the best decisions you could with the level of terror and knowledge that you had. it was enough to keep you alive.#isn't that enough?#isn't it a victory to survive?? isn't that enough??????#god i'm cringing at sharing this but if it's been this hard for me surely at LEAST one of you has also made financial mistakes or regrets#and seeing me be honest that I fucked it all up too and it's a mess and I'm just climbing back through it as best as I can as I go#will hopefully make at least one of you feel a tiny bit less alone

39 notes

·

View notes

Text

Some Canadians who have turned to high-interest loans due to not qualifying for traditional credit could lose access to them as the government prepares to pass new laws targeting predatory lenders, according to the Canadian Lenders Association.

The federal government is planning to prohibit lenders from charging borrowers interest rates over 35 per cent as part of its proposed criminal interest rate regulations(opens in a new tab). The cap would be reduced from 47 per cent, and would be the first time in 44 years Ottawa changed the "criminal" rate of interest.

But the change could have "unintended consequences," said Jason Mullins, vice chair of the Canadian Lenders Association (CLA) and president and CEO of Toronto's consumer finance company goeasy Ltd. CLA represents over 300 lenders (except payday lenders). These companies serve small businesses as well as prime and non-prime Canadian consumers.

Continue Reading

Tagging @politicsofcanada

41 notes

·

View notes

Text

found out there's a pnach cheat you can use to mute nova's calls in xillia 2 (she gets REALLY insistent if your current gald is over the quantity of the next payment) and now i'm imagining nova calling him and ludger just stares at the ghs in silence and blocks her number

#i can also picture elle protesting 'ludger you can't do that!'#can he even block her number though?#his finances and traveling permissions are already controlled by the ghs#and surely debtors would try to pull stuff like this enough times there's a workaround#x2 talk#also yeah you can cheat engine it and give you more gald but making all payments in one go makes you miss on skits#and until a certain point in story you will also get it stalled and can't actually finish paying the loan

15 notes

·

View notes