#mortgage-restructuring

Explore tagged Tumblr posts

Text

What to Do When You Can’t Pay Your Mortgage: A Step-by-Step Guide

Life can be unpredictable. Whether it is due to a job loss, medical emergency, or rising living expenses, many homeowners find themselves in the tough position of falling behind on their mortgage payments. If you are struggling to keep up and need help with mortgage assistance, you’re not alone—and you do have options.

Step 1: Don’t Ignore the Problem

It is natural to feel overwhelmed, but ignoring the issue will only make it worse. Lenders may begin the foreclosure process after just a few missed payments, so it's crucial to act as soon as you know you will have trouble paying.

Step 2: Review Your Finances

Create a clear picture of your financial situation. List your income, expenses, and debts. Understanding how much you can afford helps when speaking with lenders or applying for mortgage assistance.

Step 3: Contact Your Lender Immediately

Many homeowners avoid contacting their lender out of fear or embarrassment—but this is a critical mistake. Most lenders want to help you avoid foreclosure. Be honest about your situation and ask about available mortgage restructure or forbearance options.

Step 4: Consider Mortgage Restructuring

If your financial hardship is more permanent, you may want to explore a mortgage restructure. This means modifying the terms of your loan—such as the interest rate, monthly payment, or loan term—to make it more affordable.

Restructuring can:

Lower your monthly payment

Help you catch up on missed payments

Prevent foreclosure

Your lender may require financial documentation, so be prepared to provide proof of income, expenses, and hardship.

Step 5: Consider a Mortgage Restructure

Restructuring your mortgage could significantly lower your monthly payments and give you more breathing room. This might involve extending your loan term, reducing your interest rate, or even deferring payments to the end of the loan.

Make sure you are working with a trusted advisor or organization that understands the ins and outs of mortgage restructure programs.

Step 6: Watch Out for Scams

Unfortunately, financial distress can make homeowners vulnerable to scams. Be wary of anyone who asks for upfront fees or guarantees to "save your home." Always verify credentials and stick with reputable services.

Step 7: Stay Informed and Be Proactive

Continue checking in with your lender, monitor your credit report, and keep records of all communication. Staying involved and organized gives you more control over your path to recovery.

You are Not Alone—Help Is Available

If you are feeling the pressure, don’t face it alone. Pathway Mortgage Relief is here to provide compassionate, personalized support to help you navigate the process. Whether you need guidance applying for mortgage assistance or want to explore restructuring your mortgage, we are just a phone call away.

Take the first step today. Let’s protect your home and your peace of mind—together.

0 notes

Text

Debt Relief Made Easy with LIN International Debt Solutions

LIN International offers proven Debt Solutions to lighten your financial burden. Discover our comprehensive approach to debt management and regain your financial stability.

#personal loan settlement and litigation services#credit card settlement plan#debt advisory and restructuring#dubai debt consolidation service#loan settlement services#mortgage restructuring services in the uae#credit card settlement#home loan settlement in uae

0 notes

Text

BEIJING — China’s struggling real estate developers won’t be getting a major bailout, Chinese authorities have indicated, warning that those who “harm the interests of the masses” will be punished.

“For real estate companies that are seriously insolvent and have lost the ability to operate, those that must go bankrupt should go bankrupt, or be restructured, in accordance with the law and market principles,” Ni Hong, Minister of Housing and Urban-Rural Development, said at a press conference Saturday.

“Those who commit acts that harm the interests of the masses will be resolutely investigated and punished in accordance with the law,” he said. “They will be made to pay the due price.”

That’s according to a CNBC translation of his Mandarin-language remarks published in an official transcript of the press conference, held alongside China’s annual parliamentary meetings.

Ni’s comments come as major real estate developers from Evergrande to Country Garden have defaulted on their debt, while plunging new home sales have put future business into question.

In 2020, Beijing cracked down on developers’ high reliance on debt for growth in an attempt to clamp down on property market speculation. But many developers soon ran out of money to finish building apartments, which are typically sold to homebuyers in China ahead of completion. Some buyers stopped paying their mortgages in a boycott.

Authorities have since announced measures to provide some developers with financing. But the national stance on reducing the role of real estate in the economy hasn’t changed.

This year’s annual government gathering has emphasized the country’s focus on investing in and building up high-end manufacturing capabilities. In contrast, the leadership has not mentioned the massive real estate sector as much.

Real estate barely came up during a press conference focused on the economy last week, while Ni was speaking during a meeting that focused on “people’s livelihoods.”

Ni said authorities would promote housing sales and the development of affordable housing, while emphasizing the need to consider the longer term.

Near-term changes in the property sector have a significant impact on China’s overall economy.

Real estate was once about 25% of China’s GDP, when including related sectors such as construction. UBS analysts estimated late last year that property now accounts for about 22% of the economy.

Last week, Premier Li Qiang said in his government work report that in the year ahead, China would “move faster to foster a new development model for real estate.”

“We will scale up the building and supply of government-subsidized housing and improve the basic systems for commodity housing to meet people’s essential need for a home to live in and their different demands for better housing,” an English-language version of the report said.

next time you complain about how things are in America, consider that if you lived in some kind of scary communist country like China, you wouldn't even get to fund a bailout for the real estate company owners who ruined the economy like you can (whether you like it or not) in the good old US of A! 🇺🇲

1K notes

·

View notes

Text

Oliver Willis at Daily Kos:

The Department of Veterans Affairs is ending a program that has helped over 17,000 veterans attain homeownership. It is just the latest in a series of attacks and slights against veterans from President Donald Trump. The VA announced on Thursday that it was putting an end to the Veterans Affairs Servicing Purchase Program. The program purchases defaulted mortgage loans for veterans facing financial hardship and then offers them as direct loans with a fixed 2.5% interest rate. “Beginning May 1, 2025, VA's Veterans Affairs Servicing Purchase Program [VASP] ... will stop accepting new enrollees,” the VA said in a statement to NPR. “This change is necessary because VA is not set up or intended to be a mortgage loan restructuring service.” Experts say this will create a crisis for veterans and their families. “Halting the VASP program will increase the number of veterans facing foreclosure unless the VA and Congress implement a permanent partial claim option as soon as possible,” said Bob Broeksmit, president and CEO of the Mortgage Bankers Association, in a statement. [...] Congressional Republicans back Trump’s decision to cut off this lifeline for veterans. In a joint statement Rep. Mike Bost of Illinois, chair of the House Committee on Veterans Affairs, along with Rep. Derrick Van Orden of Wisconsin), chair of the Subcommittee on Economic Opportunity, said, “We—along with many of our colleagues—had serious concerns about the impact VASP would have on not only the future of VA’s home loan program, but the mortgage lending business as a whole. Today, the Trump administration rightfully put an end to VA’s VASP program.” The program’s closure is the latest in a series of attacks on veterans from the Trump administration. Under the auspices of Elon Musk’s Department of Government Efficiency, the VA has cut staff—likely adding to wait times for veterans seeking care while also complicating efforts in dealing with day-to-day care issues.

Donald the Draft Dodger is not a friend of our veterans, as his regime put an end to the Veterans Affairs Servicing Purchase Program. The VASPP helped veterans on mortgage loans regarding homeownership.

#US Military#Donald Trump#Veterans Affairs#Trump Administration II#Veterans Affairs Servicing Purchase Program#Military#Mortgage Loans#Derrick Van Orden#Mike Bost#Home Ownership

10 notes

·

View notes

Text

President Trump's Achievements

Hey!! What has Donald Trump done while he was in office (as at July, 2017)!!!

1.Supreme Court Judge Gorsuch

2.59 missiles dropped in Syria.

3.He took us out of TPP

4.Illegal immigration is now down 70%( the lowest in 17 years)

5.Consumer confidence highest since 2000 at index125.6

6.Mortgage applications for new homes rise to a 7 year high.

7.Arranged 20% Tariff on soft lumber from Canada.

8.Bids for border wall are well underway.

9.Pulled out of the lopsided Paris accord.

10.Keystone pipeline approved.

11.NATO allies boost spending by 4.3%

12.Allowing VA to terminate bad employees.

13.Allowing private healthcare choices for veterans.

14.More than 600,000. Jobs created

15. Median household income at a 7 year high.

16. The Stock Market is at the highest ever In its history.

17. China agreed to American import of beef.

18. $89 Billion saved in regulation rollbacks.

19. Rollback of A Regulation to boost coal mining.

20. MOAB for ISIS

21. Travel ban reinstated.

22. Executive order for religious freedom.

23. Jump started NASA

24. $600 million cut from UN peacekeeping budget.

25. Targeting of MS13 gangs

26. Deporting violent illegal immigrants.

27. Signed 41 bills to date

28. Created a commission on child trafficking

29. Created a commission on voter fraud

30. Created a commission for opioids addiction.

31. Giving power to states to drug test unemployment recipients.

32. Unemployment lowest since may 2007.

33. Historic Black College University initiative

34. Women In Entrepreneurship Act

35. Created an office or illegal immigrant crime victims.

36. Reversed Dodd-Frank

37. Repealed DOT ruling which would have taken power away from local governments for infrastructure planning

38. Order to stop crime against law enforcement.

39. End of DAPA program.

40. Stopped companies from moving out of America.

41. Promoted businesses to create American Jobs.

42. Encouraged country to once again

43. 'Buy American and hire American

44. Cutting regulations 2 for every one created.

45. Review of all trade agreements to make sure they are America first.

46. Apprentice program

47. Highest manufacturing surge in 3 years.

48 $78 Billion promised reinvestment from major businesses like Exxon, Bayer, Apple, SoftBank, Toyota...

49. Denied FBI a new building.

50. $700 million saved with F-35 renegotiation.

51. Saves $22 million by reducing white house payroll.

52. Dept of treasury reports a $182 billion surplus for April 2017

(2nd largest in history.

53. Negotiated the release of 6 US humanitarian workers held captive in egypt.

54. Gas prices lowest in more than 12 years.

55. Signed An Executive Order To Promote Energy Independence And Economic Growth

56. Has already accomplished more to stop government interference into people's lives than any President in the history of America.

57. President Trump has worked with Congress to pass more legislation in his first 100 days than any President since Truman.

58. Has given head executive of each branches 6 month time Frame dated march 15 2017, to trim the fat. restructure and improve efficacy of their branch.

Observe the pushback the leaks the lies as entrenched POWER refuses to go silently into that good night!

I hope each and every one of you copy and paste this everywhere, every time you hear some dim wit say Trump hadn't done a thing!

THANK YOU!!!

Oh, yeah, and there's this..........

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#societal collapse#the communist manifesto#commandant kamala#kamala harris#the great awakening#truth justice and the american way#president trump#i'm more maga than ever!#maga 2024

26 notes

·

View notes

Text

How Company Directors Can Secure the Best Deals in 2025

In 2025, the financial landscape for limited company directors and business owners continues to evolve. While opportunities to build wealth through homeownership remain strong, many entrepreneurs still struggle to get mortgage approvals that accurately reflect their income potential. This challenge doesn't stem from a lack of earnings, but rather from how those earnings are structured—and how lenders interpret them.

Whether you're applying for a mortgage as a limited company director or a self-employed professional, understanding the nuances of mortgages with company profit, net profit mortgages, and other specialised options is essential.

Why 2025 is a Turning Point for Company Director Mortgages

As lending regulations modernise, there’s a clear shift away from "one-size-fits-all" underwriting. Many lenders embrace flexible assessment models, designed to serve applicants with non-traditional income. This is especially true for:

Limited company directors

Business owners with retained profit

Self-employed individuals

Directors are drawing low salaries/dividends for tax efficiency.

Previously, these groups were forced to take out lower mortgage amounts based solely on declared personal income. Now, lenders are more open to assessing broader financial indicators, like company net profit and retained earnings, to determine borrowing capacity.

The Rise of Net Profit and Retained Earnings Mortgages

Net Profit Mortgages

Instead of focusing on salary or dividends, net profit mortgages use your company’s bottom line to measure affordability. If your business earned £100,000 in profit last year—even if you only drew £30,000 personally—a net profit-based lender may assess your affordability based on the full figure.

This approach benefits:

Directors reinvesting in growth

Those planning for retirement

Entrepreneurs keep income within the business for stability.

Mortgages with Company Profit

Some lenders go one step further by considering mortgages with company profit, including retained earnings over several years. This allows for higher borrowing limits without forcing business owners to restructure their income or draw larger dividends.

Specialist advisers at The Mortgage Pod note that more clients are now approved using their profit figures, allowing them to borrow what they can truly afford, not just what they’ve withdrawn on paper.

Why Standard Brokers May Not Be Enough

Mainstream mortgage advisers may not have the tools or knowledge to effectively present a director’s income. Many company owners are turning to brokers specialising in business owners' and self-employed mortgages.

According to Strive Mortgages, the ability to interpret tax documents, understand company structures, and liaise with lenders who offer manual underwriting makes a substantial difference in approval rates.

Documents You’ll Need in 2025

Lenders in 2025 still require documentation, but open banking and digital account sharing have streamlined the process. Here’s what most lenders will ask for when evaluating directors or self-employed applicants:

1–2 years of company accounts (certified)

Tax calculations (SA302S) and tax year overviews

Business bank statements

Details of retained profits and dividend schedules

Accountant’s confirmation of income

Even if revenue dips during a past tax year, a strong current year or a clear explanation may help mitigate lender concerns, especially with brokers who know how to present the data correctly.

Two Trusted Specialists for Business Owners

We’ve seen a clear shift in how lenders treat business owners, and that’s good news for our clients, says Steve Humphrey, founder of The Mortgage Pod. His team focuses exclusively on helping professionals with complex income structures find the right mortgage solutions.

Likewise, Jamie Elvin, Director at Strive Mortgages, adds, “Too many directors are being held back by systems that don’t reflect modern income realities. Our job is ensuring their applications tell the full financial story.”

Both firms emphasise education, transparency, and lender-matching to increase the chances of approval and the size of the mortgage available.

2025 Opportunities: Business-Friendly Lenders & Better Terms

As competition among lenders increases, some are actively seeking to grow their business customer base by offering:

Lower deposit options (as low as 10% in some cases)

Flexible affordability criteria

Faster underwriting using open banking

Cashback incentives for company directors

These new products are designed to help business owners compete in a fast-paced property market, especially in regions where demand still outpaces supply.

Conclusion: Take Control of Your Financial Narrative

In 2025, company directors have more power than ever to shape their mortgage outcomes—if they know where to look. Whether you're considering your first property or remortgaging for expansion, it’s essential to find advisers who understand the language of business.

By working with experienced mortgage brokers like The Mortgage Pod and Strive Mortgages, you can access lenders who recognise your company’s full financial strength, not just your payslip.

For business owners ready to invest in their future, the path to homeownership is no longer blocked by rigid income definitions. It's paved with tailored advice, strategic presentation, and financial partners who truly get it.

3 notes

·

View notes

Note

I saw ur post in the solarpunk tag and! I think we can do better! I think nobody should have to work ever, because how do we pick who's exempt? who's making that decision? the only way I can think for it to be fair is if the person themself gets to make that decision.

bc like the system you're describing isn't hypothetical and as someone who's gone through a nightmare of uncaring bureaucracy just to be allowed not to work due to disability I can say it doesn't work and definitely doesn't feel like a utopia!

I don't follow you and not gonna come back to this so do with it what you want but yeah something to consider I guess

Points I agree with:

People should have the ability to self-determine their capacity to work, and should not be expected to work if they are unable to.

External parties should not be deciding who is able or unable to work.

Points I disagree with:

"Nobody should have to work ever"

I may be misunderstanding you, but... life is work. Someone needs to drive trains, design functional sewerage systems, deliver babies, rescue people from burning buildings, grow rice, implement grain shipping logistics, change diapers, develop vaccines, wash clothes, teach children to read, sterilise surgical equipment, provide counselling to antisocial or dangerous people, cook food for the elderly, insert urinary catheters, repair potholes in roads, pick up rubbish, code the software that checks pressure in dam walls, etc.

None of the above jobs are particularly sexy. Very few people would dream of performing any of these roles when they are growing up. But the work is necessary to maintain a functional society. What links these jobs is that they are meaningful. They help. They improve society. People can find purpose and fulfillment in these tasks because they know they are helping society, even if indirectly.

There are so many jobs in our current society that do not provide a benefit to anyone other than a select few capitalists. If we restructured to become more 'solarpunk' (which I interpret as more communist and likely more anarchist than current societies), these capitalist jobs wouldn't exist, and we wouldn't miss them. Merchant bankers, advertising executives, influencers, soldiers, funko-pop factory workers (I have a personal dislike for these products; such an overt waste of materials and for literally no benefit! people often don't even take them out of their packets?!?!), mortgage brokers, the list goes on.

If we redirected the people working in these capitalist jobs towards roles that directly help society.... everyone would work a lot less, but society would function just as effectively, if not more so. There would be fewer jobs, and more people to do them. There would be more chance to rest and enjoy leisure time. And yes, some people would probably be able to never work at all, if they chose to. But if the work is meaningful, I genuinely believe most people would want to work, and I don't think it's unreasonable to expect people to do something meaningful for others even for just a few hours a week (clean the dishes at the cafeteria or babysit your friend's kids). But no, I don't think people's work contributions should be monitored or quantified at all, unless it's to tell people to rest when they are overworked. People should work of their own volition. And of course those with disabilities or any other factors that prevent them from working safely shouldn't need to work if they are unable or unwilling.

An interesting book that portrays a world that is anarcho-communist is The Dispossessed, by Ursula K LeGuin. It details the struggle between the need for work VS personal freedom exceptionally well.

(Original post linked below)

38 notes

·

View notes

Text

A Week of My Enigma - Courting

Fandom: My Hero Academia, Boku no Hero Academia

Rating: G

Genre: Fluff

AN: A week of Enigma Bakugou prompt fills.

Words: 1426

Katsuki knew he was moving fast - he and Deku had only been courting for a few weeks, still had finals and to graduate and figure out where they were going to become sidekicks. He knew this was generally the final step, proving to your chosen mate that you could provide, that there was a safe den to nest in somewhere, somewhere protected where the omega could be cared for. Not that Izuku needed to be cared for; even being an enigma, the supposed top of the food chain, a hunter even of alphas that could forced them to bow with a single lift of his lip, Izuku still took him out an even number of times whenever they sparred.

He was strong, he was beautiful and wonderful and everything inside of Katsuki knew. Had known for a while, he knew; even when he wanted to hate the damn nerd, a part of him had been drawn towards his strength, his conviction, had whined every time he’d raised his hand against him. It was easier now, now that they were friends, that Izuku had accepted his courting gift, had blushed and smiled and immediately wrapped himself in the scented All Might blanket Katsuki had given him over a katsudon dinner. Their mixed smells had been enough to almost make him drool, the venom-laced saliva filling his mouth as he watched Izuku rub his cheek against the soft fabric and purr.

So yeah, maybe he was moving quickly, but Katsuki had known for a long time that he loved Izuku, that he wanted him and hoped he was wanted in return. So if that meant skipping right to this step in courting, well, if it got him a yes then it would be worth it.

His parents had been supportive, more than ready to cosign for him even though what he’d made during his time interning over the last few years was more than enough for a down payment. The old hag especially had been excited at his decision, crowing something about a bet or some other bullshit. He’d even put his idiots to work, exchanging study sessions for help sorting through listings to find the perfect place. Thankfully he had; it’d been Mina to actually find the apartment that’d been put up for sale, slamming the printout down excitedly on the table they’d set up in Kirishima’s bedroom (like hell they were allowed in his).

“This place is, at max, a twenty minute train ride from the furthest of the agencies you applied to, and only a ten minute walk from two of the ones he did. The kitchen is huge, two baths, three bedrooms - the master for you two, a guest, and an office when you have to bring paperwork home. You can also keep his collection to the guest and office, so you won’t have to fall asleep staring at All Might’s face every night. An in-unit washer and dryer, a balcony to eat on, a living room you can host both the squads in; come on, Blasty, trust me,” Mina had finished with a smirk, crossing her arms across her chest. “He’s going to love it. It’s perfect.”

And, begrudgingly, she was right. The walkthrough had taken forever, the entire pack insisting on coming with him to check the place out, though it’d been nice to see exactly how much space they all had to sprawl. The more they’d examined the place, harassing the realtor with their litany of questions, the more he could imagine himself and Izuku here. Living there, eating breakfast and dinner before and after work, cuddling on some couch, cooking together, maybe a brat or two or twelve before they had to find somewhere larger. It was a good place to start, and just like he knew Izuku was his, he knew this was too.

It was surprisingly easy for a newly eighteen-year-old soon to be sidekick to get a mortgage, but hey. He wasn’t going to complain. It was on the pricier side, but he knew with the notoriety they’d all gained from taking down the LOV, it wouldn’t take long for him to be able to afford it outright. Even with the Commission's restructuring, with more villains being sent to rehab and therapy than jail, a hero’s pay in the upper ranks was still hefty, and the merch sales alone from the fans biting at the bit to buy a toy or a knock off of his mask wasn’t anything to sneeze at. So the papers were signed, the keys handed over, and the place was his.

His and Izuku’s.

He didn’t buy much; he knew the nerd would want to have a hand in that, and even if this was an old ass custom, he wanted Izuku to have some say at least. He did get them a bed, bringing Pink Cheeks in on the deal so she could help him move the damn thing into place without breaking his back. Though, whether or not dealing with her squealing for a whole hour had been worth it was still up in the air. Some cooking shit, so he could make them a few meals whenever they were there. And nesting shit. Everything he’d read had been clear on that, that Izuku would build the nest, but he had to provide the materials.

A week after he got everything set up, it took almost an hour to convince Izuku to leave the dorms, promising him crepes and extra training and all the notes he’d gathered from the others in the class to pry him away from the books. Even high up in the class rankings, Izuku was still worried about the upcoming tests, scared that his hours of studying wouldn’t be enough to let him pass. A joke, really, but still something the nerd worried about. But with all the promises, as well as a pocket sized guide that Katsuki gave him to keep him entertained on the train, soon enough he was guiding his distracted love into the elevator, enjoying his obliviousness as, for the first time, he actually asked where they were going.

“You’ll see.” Katsuki flashed him a smile as he held up the key, ignoring Izuku’s protests as he just walked into the apartment, one of two on the floor. Strolling in, he started pulling things from the fridge; luckily he had everything needed to make crepes, and had placed an order for fresh fruit on the train.

For a long moment he heard nothing, trying to ignore the lack of sound when he’d expected at least a flurry of questions. He knew Izuku could smell them; he’d thoroughly scented the place after everything had been brought in, had stolen some of Izuku’s clothes and brought them over so his own smell could spread. It was so clearly theirs, despite this being the first time Izuku had ever been there. Finally, soft footsteps began to make their way through the apartment, a peek of green in the corner of his eye as he cooked, small noises of approval reaching his ears as each door was opened and closed, a chirp of happiness at the sight of the bedroom and the pile of blankets and pillows, a hum of interest as he considered the signs Katsuki had put up to give him something to imagine.

He was just plating the first of the crepes when strong arms wrapped around his waist, Izuku’s face burying in between his shoulder blades. “You know,” he said, his voice muffled but clearly please, “most people don’t give a den as a courting gift until after a few years, not a month and a half.”

“I’m an enigma,” Katsuki snorted. “There’s literally three of us currently alive. You’re the one of a kind holder of One for All. We don’t count as ‘most.’”

“You know what this means, right? What it implies,” Izuku asked, pulling away. Katsuki turned just as Izuku was wrapping his arms around himself, his eyes looking everywhere except Katsuki. Katsuki knew; he’d done his research, knew all the implications giving this kind of gift made. Reaching out, he pulled Izuku into his arms, nuzzling at his scent gland, relaxing into the smell of the man he hoped would agree to be his.

“I do. What do you say?”

Izuku kissed him, long and slow and sweet, barely even a kiss at all with how much he was smiling by the time they pulled away from each other.

“I say yes, Kacchan. I’ll marry you.”

[END]

If there are any questions/requests, I have a Curious Cat and a Retrospring! :3

curiouscat.live/9r7g5h

retrospring.net/@9r7g5h

And if you would like to support me, I have a Ko-fi! :3c Tips are appreciated! Comms are open, so if you're interested, info is on my Ko-fi page.

Ko-fi: https://ko-fi.com/9r7g5h

#the 9 one queues it#fanfic#bakudeku#bkdk#mha#bnha#my hero academia#fanfiction#katsudeku#izuku midoriya#bakugou katsuki#enigma Bakugou#omega Midoriya#Courting

21 notes

·

View notes

Text

How to Avoid Foreclosure: 10 Proven Strategies to Save Your Home

Facing foreclosure is one of the most stressful experiences a homeowner can endure. But the good news? Foreclosure is not inevitable — there are many ways to stop foreclosure and protect your home and financial future. Whether you're behind on mortgage payments or anticipating trouble ahead, this guide will walk you through how to avoid foreclosure with practical, proven strategies.

1. Contact Your Lender Immediately

The worst thing you can do is ignore the situation. Call your lender as soon as you anticipate a missed payment. Most lenders offer loss mitigation options, including modified payment plans, deferment, or forbearance agreements.

Related keyword: contact mortgage lender to avoid foreclosure

2. Apply for a Loan Modification

A loan modification adjusts the terms of your mortgage — reducing your monthly payment, interest rate, or extending the loan term — to make it more affordable. It’s a powerful tool many homeowners use to avoid losing their home.

Related keyword: modify home loan to prevent foreclosure

3. Use a Forbearance Agreement

If you’re experiencing temporary financial hardship due to job loss, illness, or a natural disaster, a forbearance agreement can pause or reduce your payments for a limited time. This gives you breathing room without immediately triggering foreclosure proceedings.

Related keyword: mortgage forbearance to stop foreclosure

4. Refinance Before It’s Too Late

If you still have decent credit and equity in your home, refinancing could lower your monthly payment or consolidate other debts. This option is ideal before default happens, so act early.

Related keyword: refinance to avoid foreclosure

5. Seek Foreclosure Assistance Programs

Government and nonprofit organizations offer free or low-cost foreclosure assistance programs that help you explore your legal and financial options. HUD-approved housing counselors are trained to negotiate with lenders on your behalf.

Related keyword: government help to avoid foreclosure

6. Explore a Repayment Plan

Lenders may allow you to catch up on missed payments by adding a portion of the delinquency to your regular monthly mortgage over time. It’s a structured way to pay off mortgage arrears without foreclosure.

Related keyword: repayment plan for past due mortgage

7. Sell Your Home Before Foreclosure

If keeping your home isn’t an option, consider selling it before the foreclosure process begins. Selling allows you to preserve your credit and potentially walk away with equity, depending on your home's market value.

Related keyword: sell home fast to stop foreclosure

8. Consider a Short Sale

If your home is worth less than what you owe, a short sale might be possible. This involves selling your home for less than your mortgage balance — with lender approval — and can help you avoid foreclosure on your record.

Related keyword: short sale to avoid foreclosure

9. Sign a Deed in Lieu of Foreclosure

This option lets you voluntarily transfer ownership of your home to the lender in exchange for debt forgiveness. While not ideal, it’s less damaging to your credit than a full foreclosure.

Related keyword: deed in lieu of foreclosure option

10. File for Bankruptcy (Last Resort)

Filing Chapter 13 bankruptcy can temporarily halt foreclosure proceedings and give you time to restructure your debts. This should be considered a last resort after exploring all other options, and requires consultation with a bankruptcy attorney.

Related keyword: use bankruptcy to stop foreclosure

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Act Early to Protect Your Home

The sooner you take action, the more options you'll have to prevent home foreclosure. Whether it's modifying your loan, applying for hardship programs, or selling your home on your terms, the key is to stay informed and proactive.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#contact mortgage lender to avoid foreclosure#modify home loan to prevent foreclosure#mortgage forbearance to stop foreclosure#refinance to avoid foreclosure#government help to avoid foreclosure#entrepreneur#personal finance#personal loans

1 note

·

View note

Text

Craigdarroch Castle is located in Victoria, British Columbia, Canada. Wealthy coal baron Robert Dunsmuir built the Victorian-era Scottish Baronial mansion in the late 1800’s. Dunsmuir died before the castle was completed, and his sons finished the castle. Upon widow Dunsmuir’s death, the castle was sold to a land speculator who divided the estate into buildable lots. He then raffled the castle to the residents of the parcels. The winner, Solomon Cameron, mortgaged the castle for other investments that unfortunately failed. Craigdarroch Castle became the property of the Bank of Montreal in 1919. The castle was restructured to serve as a military hospital until the 1970’s. Currently, the castle is owned by the Craigdarroch Castle Historical Museum Society. The castle houses furnishings from the 1890’s, and numerous stained-glass windows that are documented by The Institute of Stained Glass in Canada. There’s intricate woodwork, which includes a prefabricated 87 step grand oak staircase built in Chicago, Illinois. The exterior boasts Romanesque arches, recessed entrances, rows of windows, and cylindrical towers with conical capstones.

4 notes

·

View notes

Text

I am so unbelievably grumpy and tired and basically am throwing the equivalent of a toddler tantrum because I am just so done with life right now.

Work is going through a restructure but they’ve done it so badly. I’m facing being disestablished in my role so yay no income for me how great which like, fine, whatever we’ll be ok. I have five months redundancy pay which is good but honestly like. Can we not just catch a break. We want to move. I want to start having kids soon. Can’t do either of those things without a fucking income. Our mortgage preapproval is going to expire and I don’t think I’m gunna have payslips to slide through with a secondary approval again which is shit.

Don’t know which city we’re going to be living in which makes it a bit Fkn difficult to decide where to apply for jobs.

If I do get a job in palmy I’m going to be taking at least a 30% pay cut which again, fine, can deal, but that messes up the amount we can borrow for the house so we won’t be able to afford the price bracket we want to move to which is then like, why bother moving coz the whole point is to upgrade and get somewhere better.

Maternity leave payment will be fkd if I do get pregnant coz I won’t meet all the government requirements for payment and just it all fucking sucks.

We’ve had really shit offers for our house and that’s hard not to take personally even though o totally get it ya know. I see the economic situation and everything that’s going on and I get it but we have put a tonne of work into this house and it’s awesome and it sucks not to see that reflected in the offers but anyway.

My stupid husband won’t just throw caution to the wind and pack up and do something fun which is beyond frustrating. We have been so Fkn hammered by life since 2020 and at this point I’m running out of reasons to keep trying. Everytime I think we’ve built something good and we’re finally on the up, something else comes along and just smashes us and I’m so over it.

The urge to cry is overwhelming at this point. The desire to stay in bed is high.

I’ve spent four very long weeks showing up for my team and one of the other managers teams at work and doing my damndest to get them through the worst of this restructure but far out it’s a lot. It’s so rough.

I’m just so tired of fighting all the time. I’m so sick of being resilient, and putting on a brave face and showing up. I actually just want the time and space to have a decent breakdown and to not have to deal with anyone except myself. I don’t want to keep having to censoring everything to be palatable for other people.

Just let me catch my Fkn breath, pls.

3 notes

·

View notes

Text

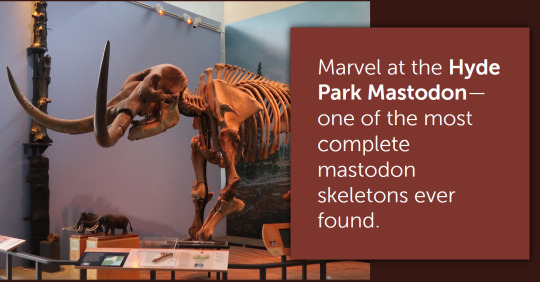

It's really gratifying to see people sharing this and commenting about buying/donating; the Museum of the Earth really is a gem and the Paleontological Research Institution (PRI) that runs it does critical work in collecting and preserving "orphan" fossil collections. To explain/expand on a couple things, the financial straits they're in started a couple years ago when a $30 million donation fell through for reasons unknown. They severely restructured and downsized in 2023 to keep things going (including dramatically reducing staff and re-homing about 70 animal ambassadors from the Cayuga Nature Center which is also run by PRI, to ensure the animals got consistent care), but they are now in a critical spot with the mortgage and may be foreclosed on soon.

If you're at all in the Finger Lakes area, I recommend dropping in on a weekend - they've got an incredible mastodon skeleton, a new Blaschka glass specimen exhibit, and a full right whale skeleton hanging from the ceiling; they do Fossil ID Saturdays where you can bring in what you've found and get an expert opinion, and they do mask-required days regularly as well.

If you have ever been tempted by a Paleozoic Pal, like a a stuffed trilobite or a full size eurypterid body pillow, now's the time to buy one, before they and a really lovely little museum are gone for good 😭😭😭

43K notes

·

View notes

Text

LIN International Debt Solutions: Your Path to Financial Freedom

Unlock financial peace with LIN International's Debt Solutions. Our experts craft tailored strategies to help you conquer debt and take control of your financial future

#personal loan settlement and litigation services#credit card settlement#credit card settlement plan#dubai debt consolidation service#debt advisory and restructuring#home loan settlement in uae#loan settlement services#mortgage restructuring services in the uae

0 notes

Text

The Role of a Mortgage Refinancing Lawyer

Refinancing your mortgage involves more than just securing a better interest rate—it requires careful legal guidance to avoid costly mistakes. A Mortgage Refinancing Lawyer in Calgary plays a vital role in reviewing loan agreements, ensuring compliance with local laws, and protecting your financial interests throughout the process. They help you understand the fine print, manage document preparation, and negotiate terms when necessary. Whether you're switching lenders or restructuring your loan, having a legal expert by your side ensures a smooth and secure transaction. Their guidance is especially crucial in Calgary’s evolving and competitive real estate market.

0 notes

Text

Here's a long list of President Trump's achievements whilst in office. You Koolaid drinking democrats better get yourself another cup, because this is going to take some time:-

What has Donald Trump done while he was in office (as at July, 2017)!!!

1.Supreme Court Judge Gorsuch

2.59 missiles dropped in Syria.

3.He took us out of TPP

4.Illegal immigration is now down 70%( the lowest in 17 years)

5.Consumer confidence highest since 2000 at index125.6

6.Mortgage applications for new homes rise to a 7 year high.

7.Arranged 20% Tariff on soft lumber from Canada.

8.Bids for border wall are well underway.

9.Pulled out of the lopsided Paris accord.

10.Keystone pipeline approved.

11.NATO allies boost spending by 4.3%

12.Allowing VA to terminate bad employees.

13.Allowing private healthcare choices for veterans.

14.More than 600,000. Jobs created

15. Median household income at a 7 year high.

16. The Stock Market is at the highest ever In its history.

17. China agreed to American import of beef.

18. $89 Billion saved in regulation rollbacks.

19. Rollback of A Regulation to boost coal mining.

20. MOAB for ISIS

21. Travel ban reinstated.

22. Executive order for religious freedom.

23. Jump started NASA

24. $600 million cut from UN peacekeeping budget.

25. Targeting of MS13 gangs

26. Deporting violent illegal immigrants.

27. Signed 41 bills to date

28. Created a commission on child trafficking

29. Created a commission on voter fraud

30. Created a commission for opioids addiction.

31. Giving power to states to drug test unemployment recipients.

32. Unemployment lowest since may 2007.

33. Historic Black College University initiative

34. Women In Entrepreneurship Act

35. Created an office or illegal immigrant crime victims.

36. Reversed Dodd-Frank

37. Repealed DOT ruling which would have taken power away from local governments for infrastructure planning

38. Order to stop crime against law enforcement.

39. End of DAPA program.

40. Stopped companies from moving out of America.

41. Promoted businesses to create American Jobs.

42. Encouraged country to once again

43. 'Buy American and hire American

44. Cutting regulations 2 for every one created.

45. Review of all trade agreements to make sure they are America first.

46. Apprentice program

47. Highest manufacturing surge in 3 years.

48. $78 Billion promised reinvestment from major businesses like Exxon, Bayer, Apple, SoftBank, Toyota...

49. Denied FBI a new building.

50. $700 million saved with F-35 renegotiation.

51. Saves $22 million by reducing white house payroll.

52. Dept of treasury reports a $182 billion surplus for April 2017 (2nd largest in history).

53. Negotiated the release of 6 US humanitarian workers held captive in egypt.

54. Gas prices lowest in more than 12 years.

55. Signed An Executive Order To Promote Energy Independence And Economic Growth

56. Has already accomplished more to stop government interference into people's lives than any President in the history of America.

57. President Trump has worked with Congress to pass more legislation in his first 100 days than any President since Truman.

58. Has given head executive of each branches 6 month time Frame dated march 15 2017, to trim the fat. restructure and improve efficacy of their branch.

Observe the pushback the leaks the lies as entrenched POWER refuses to go silently into that good night!

I hope each and every one of you copy and paste this everywhere, every time you hear some dim wit say Trump hadn't done a thing!

THANK YOU!!!

#politics#us politics#democrats are corrupt#world politics#democrats will destroy america#wake up democrats!!#president trump#republicans#democrat lies#democrats are stupid#democrats#liberalism is a mental disorder#liberal media#democrat corruption#media corruption#corrupt system#judicial ethics#judicial system#judiciary#mainstream media#media interference

30 notes

·

View notes

Text

Property Refinance Agent Malaysia

Secure the Best Deals with a Trusted Mortgage Refinance Agent in Malaysia: Expert Guidance from Chuyao.solutions

Refinancing a property is one of the smartest financial decisions a homeowner in Malaysia can make—if done right. With changing interest rates, evolving loan packages, and the rising cost of living, many Malaysians are turning to refinancing as a way to reduce monthly repayments, unlock equity, or consolidate debts. However, the process can be confusing and time-consuming, especially if you've experienced a loan application rejected in Malaysia. That’s why working with a qualified Mortgage refinance agent Malaysia is more important than ever.

At Chuyao.solutions, we specialize in helping clients navigate the complexities of mortgage refinancing. Whether you're based in Kuala Lumpur or anywhere across Malaysia, our role as your dedicated mortgage consultant in KL ensures you get expert advice, customized solutions, and end-to-end support to make the right financial move.

Why Work with a Mortgage Refinance Agent in Malaysia?

The refinancing process isn’t just about switching banks or lowering interest rates. It involves comparing loan structures, evaluating long-term savings, understanding fees, and ensuring your application stands the best chance of approval. A mortgage refinance agent in Malaysia serves as your personal financial strategist—negotiating with banks, optimizing your loan profile, and guiding you through legal and valuation procedures.

At Chuyao.solutions, our agents work closely with major banks, including CIMB, to bring you the most competitive offers. We’re not just advisors—we’re your financial partners.

What Does a Property Refinance Agent in Malaysia Do?

A Property Refinance Agent Malaysia is more than just a middleman. Here’s what we offer at Chuyao.solutions:

Loan review and financial assessment: We evaluate your current mortgage terms and identify potential areas of savings.

Comparison of multiple bank offers: We bring offers from top banks like CIMB, Maybank, Public Bank, and more to your fingertips.

Customized recommendations: We tailor refinancing solutions to your income, credit score, and financial goals.

End-to-end application support: From document preparation to liaising with lawyers and valuers, we handle it all.

Appeals for rejected applications: If your loan application was rejected in Malaysia, we help you reapply with a stronger case.

Understanding the CIMB Refinance Housing Loan Options

cimb refinance housing loan packages are among the most competitive in Malaysia. Known for their flexible terms and attractive interest rates, CIMB offers refinancing options that cater to both salaried and self-employed individuals.

Some of the key benefits of CITI's refinancing packages include:

Lower interest rates compared to legacy mortgages.

Flexible repayment periods (up to 35 years or until age 70).

Cash-out refinancing options based on property value.

Attractive zero-moving cost (ZMC) packages for eligible clients.

At Chuyao.solutions, we have direct communication channels with CIMB’s mortgage team, giving you a faster, smoother, and more transparent application process. We help you assess whether a CIMB refinance housing loan is suitable for you, and if not, we bring you better alternatives.

What to Do If Your Loan Application Was Rejected in Malaysia

One of the most common problems homeowners face is a loan application rejected Malaysia This often happens due to reasons such as:

Poor credit history

High debt-to-income ratio

Insufficient income proof

Employment instability

Issues with property title or valuation

A rejected application can be discouraging, but it’s not the end of the road. At Chuyao.solutions, we’ve helped numerous clients overcome rejections by identifying the root cause and working on practical solutions:

We conduct a full credit health check.

We guide you on restructuring debts to reduce your DSR (Debt Service Ratio).

We recommend suitable banks that are more lenient based on your profile.

We assist in improving your documentation and presentation to banks.

Don’t let a rejection stop you. Let our experts at Chuyao.solutions turn your rejection into approval.

Why a Mortgage Consultant in KL Makes a Difference

Being based in Kuala Lumpur, Chuyao.solutions offers hyper-local insights into the mortgage and refinancing landscape. As an experienced Mortgage consultant kl we understand the unique needs of property owners in the city—from high-rise condominium investors in Mont Kiara to landed homeowners in Cheras.

Our on-ground expertise allows us to:

Suggest the best loan packages based on local property values.

Navigate high-DTI (Debt-to-Income) challenges common among urban clients.

Facilitate fast-track applications through our KL banking contacts.

Advise investors on refinancing multiple properties for portfolio growth.

Whether you're in the Klang Valley or surrounding suburbs, our KL-based consultants provide in-person and virtual consultations tailored to your needs.

The Refinancing Process with Chuyao.solutions

Here’s what the typical refinancing journey looks like when you work with us:

Initial Consultation: We assess your financial standing, current mortgage, and property value.

Loan Package Comparison: We shortlist top offers from banks including CIMB, Hong Leong, Alliance, and more.

Application Preparation: We help you gather documents such as income proof, EPF statements, and property title.

Bank Submission & Negotiation: We liaise with banks, negotiate interest rates, and address any concerns proactively.

Legal & Valuation Coordination: We work with trusted lawyers and valuers to ensure smooth processing.

Approval & Disbursement: Once approved, we manage the disbursement and closing stages efficiently.

Real-Life Success: How We Helped a Client Save RM80,000

One of our recent clients in KL had a mortgage with an interest rate of 4.6%. We helped them refinance through CIMB at 3.4%, resulting in total savings of over RM80,000 across the loan tenure. Their monthly payments also dropped by RM350, freeing up cash for their children's education fund.

This is just one of many stories where Chuyao.solutions has made a real impact.

0 notes