#paper losses

Text

How Goldman Sachs's "tax-loss harvesting" lets the ultra-rich rake in billions tax-free

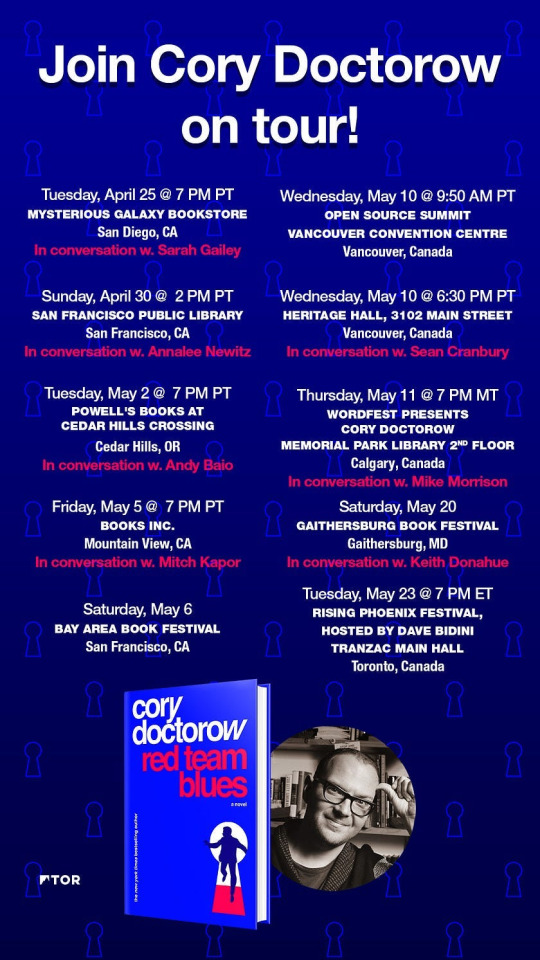

Tomorrow (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

With the IRS Files, Propublica ripped away the veil of performative complexity disguising the scams that the ultra-rich use to amass billions and billions (and billions and billions) of dollars, paying next to no tax, or even no tax at all. Each scam is its own little shell game, a set of semantic and accounting tricks used to gussy up otherwise banal rip-offs.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

The finance sector has a cute name for this kind of complexity: MEGO, which stands for "my eyes glaze over." If you're trying to rip off a mark, you just pad out the prospectus, make it so thick they decide there must be something good in there, the same way that any pile of shit that's sufficiently large must have a pony under it...somewhere.

Propublica's writers haven't merely confirmed just how little America's oligarchs pay in tax - they've also de-MEGO-ized each of these scams, like the way that Peter Thiel used the Roth IRA - a tax-shelter for middle-class earners to help save a few thousand dollars for retirement - to make $5 billion without paying one cent in tax:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

One of my favorite IRS Files reports described how Steve Ballmer - the billionaire ex-CEO of Microsoft - laundered vast fortunes into a state of tax-free grace by creating hundreds of millions in "losses" from his basketball team, the LA Clippers. Ballmer paid 12% tax on the $656 million he took out of the Clippers - while the players whose labor generated that fortune paid 30-40% on their earnings:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

That was Propublica's first Ballmer story, back in the summer of 2021. But they ran a followup last February that I missed (it came out while I was on a book tour in Australia), and it's wild: a tale of "loss harvesting," a form of fuckery involving Goldman Sachs that's depraved even by their own standards:

https://www.propublica.org/article/irs-files-taxes-wash-sales-goldman-sachs

Loss farming is a scam that was invented in the 1920s, whereupon it was promptly banned by Congress. But Goldman and other plutocrat Renfields have come up with tiny modern variations on this century-old con that the IRS is either unable or unwilling to address.

Here's how it works. Say you've got a stock portfolio where some of the stocks have gone up and others have gone down. You want to sell the high stocks and hang onto the low ones until they bounce back. But if you sell those stocks that have gone up, you have to "realize" the profit from them and pay 20% capital gains tax on them (capital gains tax is the tax you pay on money you get from owning things; it's much lower than income tax - the tax you pay for doing things).

But you pay tax on your net capital gains - the profits you've made minus the losses you've suffered. What if you sold those loser stocks at the same time? If you made a million on the good stocks and lost a million on the bad ones, your net income is zero - and so is your tax bill.

The problem is that selling stocks when they've gone down is a surefire way to go broke. Every investing book starts with this advice: you will be tempted to hold onto your stocks that are going up, because they might continue to go up. You'll be tempted to sell your stocks that are going down, because they may continue to go down. But if you do that, you'll only sell the stocks that have lost money, and never sell the stocks that have made money, and so you will lose everything.

Back when the pandemic started, your shares in movie theater chains were in the toilet, while your stock in tech companies shot through the roof. If you sold the tech stocks then and held onto your movie stocks and sold them now, you'd have cleaned up - today, tech stocks are down and movie theater stocks are up. But if you sold the cinema shares when they bottomed out, and held onto your tech stocks when they were peaking, you'd be busted today.

So selling your loser stocks to offset the gains from your winners is a bad idea. That's where loss-farming comes in: what if you sold your tech stocks at their peak, and sold your bottomed-out cinema stocks at the same time, but then bought the cinema stocks again, right away? That way you'd have the "loss" from selling the cinema stocks, but you'd still have the stocks.

That's called "wash trading," and Congress promptly banned it. If you've heard of wash-trading, it's probably something you picked up during the NFT bubble, which was a cesspit of illegal wash-trading. Remember all those eye-popping NFT sales? It was just grifters with multiple wallets, buying NFTs from themselves, making it seem like there was this huge, white-hot market for monkey JPEGs. Wash-trading.

Turns out that crypto really did democratize finance...fraud.

Wash-trading has been illegal for a century, but brokerages have invented modern variations on the theme that are legal-ish, and the most lucrative versions of these scams are only available to billionaires, through companies like Goldman Sachs.

There are a bunch of these variations, but they all boil down to this: there are lots of ways to sell an asset and buy it again, while making it look like you bought a different asset. Like, say you're invested in Chinese tech companies through an exchange-traded fund (ETF) that bundles together "all the Top Chinese tech stocks."

Maybe you bought this fund through Vanguard, the giant brokerage. Now, say Chinese stocks are way down, because the Chinese government is doing these waves of lockdowns on the factory cities. If you could sell those Chinese stocks now, you'd get a massive loss, enough to wipe out all the profits from all your good stocks.

But of course, China's going to figure out the lockdown situation eventually, so you don't want to actually get rid of those stocks right now, especially since they're worth so much less than you paid for them. So right after you sell your Vanguard Chinese tech ETF shares, you buy the same amount of Schwab's Chinese tech-stock ETF.

An ETF of "leading Chinese tech companies" is going to have basically the same companies' stock in it, no matter whether it's sold by Vanguard, State Street or Schwab. But as far as the IRS is concerned, this isn't a wash-trade, because you sold a thing called "Vanguard ETF" and bought a thing called "Schwab ETF" and these are different things (even if the main difference is the name on the wrapper, and not what's inside).

There's other ways to do this. For example, lots of companies have different "classes" of stock. Under Armour sells both Class A (voting) and Class C (nonvoting) stocks. Though voting stock is worth a little more than nonvoting stock, they both rise and fall together - if the Class A shares are up 10%, so are the Class C shares. So you can dump your Under Armour Class A's, buy Under Armour Class C's and own essentially the same amount of Under Armour stock - but as far as the IRS is concerned, you just sold your interest in one company and bought an interest in a different company, and you can take a big loss and write down your profits from other stock trades.

The IRS does prohibit wash-trading, but only in the narrowest sense. Brokerages are obliged to report trades in which a customer buys and sells exactly the same security, with the same unique ID (the CUSIP number), within 60 days. Beyond that, IRS guidance is extraordinarily wishy-washy, calling on filers to "consider all the facts and circumstances" of their transactions. Sure, that'll work.

Propublica found zero instances of the IRS targeting any of these trades, ever, for enforcement. That's especially true of the most egregious version of loss-harvesting, a special version that only the ultra-rich can take advantage of, called "direct indexing." You might know about "index funds," where a brokerage sells a single fund that tracks a broad index of stocks - for example, you can buy an S&P 500 index that goes up and down with the total value of the top 500 stocks in America.

Direct indexing is something that giant banks like Goldman Sachs offer to their very richest clients. The brokerage buys a mix of stocks that are likely to track the whole index, and puts those shares directly into the client's account. Rather than owning shares in a fund that owns the stocks, you own the stocks directly. That means that when you want to harvest some losses, you can sell just a few of the stocks in the index, rather than your shares in the whole fund.

Here's how that works. In 2017, the US index was up 20%; global indexes were up even more. Steve Ballmer made a bundle. But Goldman Sachs, acting on Ballmer's behalf, sold s few of the stocks in the portfolio and harvested a $100,000,000 loss, that Ballmer could use to trick the IRS into treating his massive profits as though he'd made very little taxable income.

Goldman uses a whole range of tricks to keep billionaires like Ballmer in a lower tax-bracket than the janitors who clean the floors after his team's games. They not only buy and sell different classes of stock in companies like Discovery and Fox; they also buy and sell the same company's stock in different countries. For example, they sold Ballmer's shares in Shell in one country, and then immediately bought the same amount of shares in another country. The IRS doesn't treat this as a wash-trade, despite the fact that the shares have the same value, and, indeed, companies like Shell routinely merge their overseas and domestic shares with no change in valuation.

Thanks to Goldman's ruses - and the IRS's willingness to accept them - Ballmer's wealth has swollen to grotesque proportions. He generated $579 million in losses from 2014-18, and as a result, got to keep at least $138m that he'd have otherwise had to pay to the IRS.

Goldman's not the only one in on this game: Iconiq Captial - a firm that also offers marriage partner scouting for its richest clients - has $13.2 billion under management on behalf of just 337 people. Among those high-rollers: Mark Zuckerberg, whose $88m in gains from Iconiq investments were offset by $34m in imaginary losses that the company manufactured with wash-trades.

In theory, the simplest form of wash-trading - selling your Vanguard China fund and buying a Schwab China fund - is available to any investor. Leaving aside the fact that the top 1% of Americans own most of the stock, this is still a deceptive proposition. This kind of wash-trading only benefits investors who hold their shares outside of a sheltered retirement account, which is a vanishing minority indeed.

Instead, the primary beneficiaries of this activity are the usual suspects: convicted monopolists like Ballmer, or useless scions of wealthy families, like the kids of Walmart founder Sam Walton, who emerged into this world through very lucky orifices and are thus effectively exempt from the need to work or pay tax for life.

Jim Walton is Sam Walton's youngest orifice-lottery-winner. Young Jim saw a $10 billion increase in his wealth from 2014-18, making him the tenth richest person in America. Thanks to wash-trading, he declared only $111 million of that $10 billion on his taxes, and paid $0.00 in tax on that $10 billion gains.

One way that the rich are especially well-situated to exploit loss-harvesting is in converting short-term gains - which are taxed at 40% - into long-term gains, which are taxed at 20%. For people who make a lot of money buying and selling shares as pure speculation, flipping them in less than a year, wash-trading can create the appearance of long-term holdings. Analyzing their trove of leaked IRS files, Propublica showed that Americans who report over $10 million in income almost never report short-term gains. Instead, two-thirds of the richest Americans report short-term losses.

One fascinating wrinkle is that rich people may not even know this is going on. Whatsapp co-founder Brian Acton, managed to "lose" $2.9 million when he sold $17 million in shares - the same day he bought $17 million in shares in nearly the same companies from another brokerage. Then, a few months later, he reversed those transactions, selling his new fund and buying the old one and harvesting another $600,000 in losses.

When Propublica asked Acton about this, he told them he was "not really aware of any events like that...Broadly my wealth is managed by a wealth management firm and they manage all the day to day transactions."

This is completely believable and consistent with the extraordinarily frank account of how elite money-management works that Abigail Disney described in 2021, where the ultra-rich are insulated from the scams, tricks and wheezes that lawyers and accountants dream up to keep their fortunes steadily mounting with no action needed on their part:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Could the IRS block this kind of wash-trading? Yes, but they'd need action from Congress. The most effective way to do this would be to force shareholders to "mark to market" the value of their holdings, taxing them each year on the fluctuations in their portfolio.

Propublica notes that this is incredibly unlikely to happen, though. As an alternative, Congress could change the rule that blocks investors from claiming losses when they buy and sell "substantially identical" shares with a rule that applies to "substantially similar" stocks. This proposal comes from Columbia Law's David Schizer, who says the law "ought to be updated to reflect how people invest today instead of how they invested 100 years ago."

But for any of that to have an effect, the IRS would have to change its auditing and enforcement practices, which currently see low-income earners (who can't afford fancy tax-lawyers who'll tie up the IRS for months or years) being disproportionately targeted, while America's super-rich, ultra-rich, and stupid-rich are allowed to submit the most hilariously, obviously fictional returns and get away with it.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

[Image ID: A dilapidated shack. A sign reading 'Internal Revenue Service Building' stands next to it. From its eaves depends another sign, reading 'Internal Revenue Service' and bearing the IRS logo. From the window of the shack beams the grinning face of billionaire Steve Ballmer. Behind the shack is a DC avenue terminating in the Capitol Dome.]

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Image:

Matthew Bisanz (modified)

https://commons.wikimedia.org/wiki/File:NYC_IRS_office_by_Matthew_Bisanz.JPG

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Ted Eytan (modified)

https://commons.wikimedia.org/wiki/File:2021.02.07_DC_Street,_Washington,_DC_USA_038_13205-Edit_%2850920473547%29.jpg

CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

--

Bart Everson (modified)

https://www.flickr.com/photos/editor/1287341637

Eric Garcetti (modified)

https://commons.wikimedia.org/wiki/File:Steve_Ballmer_2014.jpg

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#paper losses#direct indexing#tax-loss harvesting#steve ballmer#propublica#irs files#the rich are different from you and me#mego#wash trading#tax evasion#goldman sachs#vampire squid#mark zuckerberg

88 notes

·

View notes

Text

we could have had ed asking “hey, d’you wanna do something weird?” before they got married and stede answering with a knowing grin. we could have had a wedding with a swelling drop of gnossienne no 5, a culmination of all their moments leading to this most precious one. we could have had the crew helping each of them get ready, lucius no doubt chatting away with a giddy and nervous stede, and fang putting flowers in ed’s hair. we could have had them running hand-in-hand beneath the crew with all their arms up, cheering for their captains one more time, being showered in petals. we could have finally got to see them have their dance they were robbed off at calypso’s birthday, with new rings on their fingers. we could have had stede’s wish of marrying for love come to fruition for him, and ed’s wedding-topper daydream become a reality as he married his handsome blonde groom. we could have finally heard stede specifically say the words “i love you” during the wedding we all knew was coming, and gotten to see ed’s eyes widen and shine. we should have.

#no because i genuinely won’t ever be over this#what a loss. what an utter loss#ofmd#ed x stede#quill to paper

294 notes

·

View notes

Text

There’s just something about stories that allow teenage girls to feel their anger without prettying it up. Rachel from Animorphs. KJ from Paper Girls (honestly, ALL the Paper Girls in different ways). Ellie from The Last of Us. So often, narratives find ways to sand the edges off a teen girl’s fury, make her sweet or overly verbal instead of violent. Stories that allow young girls to be angry, to be bloody, to bite back at the world with sharpened teeth—those are always my jam.

#animorphs#the last of us#paper girls#more stories that worry less about being pretty and more about feeling that incandescent rage that comes from being belittled#and overlooked. and told to smile.#more stories that don’t care about being cute so much as making an impact#even ugly ones. even ones marked by a loss of control#I’m listening to the animorph books and goddamn does it hit that Rachel is a thirteen year old girl planning Murder

766 notes

·

View notes

Text

Kix *slamming open the door to the barricks after a 20 minute power nap in the medbay*: IT'S GET UP O'CLOCK!!!! RISE AND SHINE VODE!!

Dogma *startles and falls from his bunk*: Agh!

Jesse *bolts up, half asleep, arms raised*: Fight me!!

Echo *who was in a cuddle pile with Fives and Hardcase, violently shoves Fives off the bunk in a rush to get up*: Ready to go!

Fives *on the floor, being stood on by Echo*: Oft *wheezed breath*

Hardcase *dead to the world*

Tup *sits up, hair everywhere*: What's going on?

Rex *standing next to Kix, pinching the bridge of his nose*: So we have drills to do.

#yes i think you do need to run some drills with those reactions#they were a bit disorganised#though if it was a real threat they would probably be better#maybe#kix was kept up in medbay by their injuries which he fixed and then paper work for said injuries#who wants to write a report about how a vod got his helmet stuck to his hair?#(it was actually glued on but luckily they got it unstuck without too much hair loss)#they learnt from that mistake#they're all a little but startled#arc trooper echo#arc trooper fives#arc trooper jesse#clone trooper tup#clone trooper dogma#clone trooper hardcase#clone medic kix#captain rex#star wars#incorrect star wars quotes#the clone wars#tcw#clone wars#incorrect clone wars quotes#501st#501st shenanigans

562 notes

·

View notes

Text

I’m sorry for what I said in the tags of the ocean post. I’ll throw myself in the garbage. You can dm me your therapy bills.

But come on. That song.

Won't you fall for me, from reality? To the rhythm of eternity. But then the I am yours to the end, so won't you fall for me?

But then! The oh god I wish you were here. It’s like his timeline is all messed up and he’s thinking of the before and the during and the after all at once.

#cw grief and loss#sometimes I am personally attacked by my own thoughts#but imagine elderly Dew and Rain#quietly existing side by side#Rain reading another true crime novel while Dew noodles away on the guitar#but he can’t for too long because his joints are swollen and arthritic#Rain hears his breath change and knows he’s in pain#gently pries the guitar from him and then rubs the soreness away with his cool fingers#fingers that are now spindly the backs of his hands are like translucent paper with pretty blue age spots#and Dew still thinks they’re the must beautiful thing he’s ever seen#almost as beautiful as his face#and he tells him so and he smiles and all the lines in his face that come from laughter grief joy frustration all crease at ones#the both fall asleep watching some terrible tv show hand in hand on the hideous reclining sofa that Dew insisted they buy#because it’s comfortable and rain thinks it’s so tacky but he secretly agrees that the lumbar support is heavenly#Dew walks faster now that Rain but Rain would never know because Dew will always match his pace and never leave him behind#until he really does have to leave him behind one last time#fuck my entire life

43 notes

·

View notes

Text

Looks like I'm gonna be on strike next week (wed-fri) for the first time in my life!

(We're protesting our current right wing government that's attempting to worsen things for workers and unemployed people, and basically everyone who isn't rich or a big company)

Technically I'm not a member of the striking union, and thus won't get paid for my strike days (I belong to a different unemployment fund that isn't part of this strike) but most of the people here including our department managers are all walking out, plus I also want to put up a middle finger at the current government so I'm going too.

Looks like a great excuse to go visit my family for an extended weekend!

#shut up paper#I am glad that it's my morning shift week so it's smaller loss anyway#with 12€ something an hour for three six hour days without evening bonuses I'm only losing about 200-ish €#which does sting but not as bad as if I lost late shift days with eight hours and bonuses for late hours#but the stuff our government is doing would be a bigger loss for everyone around#so marching out I go!#to my parents' sofa!

37 notes

·

View notes

Text

context:

ignoring the fact that justin said teenie tiny…ANYWAYS

#inanimate insanity#ii oj#oj ii#ii paper#paper ii#payjay#osc#object shows#nicomariruby art#nicomariruby ii art#nicomariruby osc art#doodle#ALSO I DID NOT INTEND FOR THIS TO (ALMOST) BE LOSS.#I PROMISE!!!!!#these doodles r fun tho i should do them more

282 notes

·

View notes

Text

what's the one thing mulder & scully go through (together or separately) that absolutely crushes your soul? like there's so much that's really terrible, but what hits *you* hardest?

#for me it's the loss of their sisters#cannot watch paper clip ever#i struggle with that whole run of episodes even though i love them so much#oubilette is impossible to watch#mulder and scully#the x files#txf fandom

75 notes

·

View notes

Text

Redraw of something i realised i never posted to quote. Yes

Michelle and Nora !!!!

#queued post. hihihi#death strands#ive been thinking so hard about them and how similar they are#family trauma.recent loss of a loved one.guilt.smoke motif.repressed emotions.neurodivergent#bonks them in the head with am empty paper towel roll#mitzdraws#art#drawing#original characters#digital art#character design

52 notes

·

View notes

Text

You got a lil something there man might wanna check that out

#ranboo#genloss#i art#ranboo fanart#generation loss#genloss fanart#generation loss fanart#tw blood#tw gore#tw slight gore#its not like. good. but hEY ITS A LEARNING PROCESS#trying to do more traditional shit n stuff#the white corners are bcz i used clips to hold down the paper#just didnt bother to fill em in lmao

86 notes

·

View notes

Text

Attack for @bugspores !!

#all the care guide says is 'biomass'#art#digital art#artfight#artfight 2023#realized i forgor the paper texture on artfight proper.... hell on earth#oh well mostly i just like the paper texture so thats the only loss#i see cute bug. i draw cute bug.

129 notes

·

View notes

Text

idk how to live so im going to talk to myself out loud until i do

#listen. take a deep breath. i know your bpm is high but you need to think with me for a second.#remember that you are paper thin. all your facets are sheets of paper and what you gave her is just another one.#make a new one. you dont need it. you dont need her to see you. i know you think you need her but you will be okay. i know its hard.#you wish you could have shown her how you loved her. listen to yourself. you are made of paper.#she might be concrete or maybe wood or maybe gold. you need to start laying your roots elsewhere. shut that thought down#and blink and listen. the parts you keep thinking of arent lost. they still happened and they are yours to keep.#there is beauty in this loss. tell me about the beauty in this loss. its okay to think about it. you got to see it all and nothing more#and this is great because it would have been bad. you know it would be violent in a way you dont need. you know this to be true.#you are going to look at that empty space in her shape and youre going to fill it with everything that happened when you knew her.#the memories with her but then also the the way your friends talked you through it. the game with the clovers.#your first allergic reaction you almost died and you couldnt stop laughing and you were held so close to their hearts.#learning the names for all the floursecent gene tracking dyes that everyone else knows already. about the exam - listen again.#i know you think if you fail your life is over but you need to try your best. youre not going to get a good grade in a uni test for the fir#youre going to make up for it. youre going to make sure you make up for it. do you understand? i love you. you have to do this.#right now you need to sit up. breathe. i know your heart hurts. go to the living room. grab something to eat. i dont care if you feel full.#youre going to clean your mattress heater. youre going to study a bit longer and then youre going to sleep. youre going to tell your mother#im sorry and i might genuinely fail a test. shes going to tell you its okay. if you do badly in this course you can just become a neurosurg#just agree. dont argue right now. its okay. youre okay. you are paper thin. i know any puncture hurts.#breathe. think of your friends. think of their hands in yours. it isnt eternal.youve lived through worse. the empty sky is still beautiful.#the lack of her is still beautiful

20 notes

·

View notes

Text

Wanna be at ease? 🍃

#today and tomorrow consist of necessary trauma#as in opening up old wounds#i am all bad jolts#hopefully this will be the last time i have opened my psychological file#or as i call it: the paper witness to loss of life in complete deterioration#see? im negative#ill be back when i feel human#gonna hide a bit

56 notes

·

View notes

Photo

redesigned Lizarks i made for virtu.pet + a couple bonus recolors! happy with how these came out

#the reason mutant is pixelated at full size is because i realized i didn't have to redraw all of the limbs + eyes. so i didn't#its also my least favorite of these- i feel like i should have made the blue accents brighter. ah well overall i'm happy#that snowflake guy is Christmas/Yuletide#didn't know if the goal was to have less designs that were specifically Christmas themed so i went with a paper snowflake theme#figured losing a 'its the basic pet with a santa hat and holly wreath on' design was no big loss#virtu.pet#my art#neopets

143 notes

·

View notes

Text

survival of the fittest: predictions for generation two

i said in rancord sub-boosty chat that i would probably write a comprehensive meta regarding my theories for generation two and then it got nuked bc i wrote way too much in one message w spoiler blinders so here it is!

spoilers for generation loss episodes one, two, and three.

given that i started watching genloss assuming it was an allegory for genetic algorithms in ai due to the language of “generations” (knowing now that generation loss, as a concept, refers to “degradation of quality resulting from imperfect reproduction techniques”) i think that there's an element both of refinement and of deterioration here. a couple of elements are at play:

for those unfamiliar, a genetic algorithm is a method by which self-learning ai acquire and refine their pool of knowledge. very generally speaking, ai are trained in “generations,” with each generation learning from its predecessor and improving upon itself to reach its ultimate goal. to this end, genetic algorithms use process of elimination to narrow down the best ai—in other words, natural selection: survival of the fittest. the strongest wins.

in the context of genloss, this seems to align with showfall media’s goal: creating the Perfect Hero for their Perfect Show. it also, perhaps, hints at what’s to come in generations two and three. i get the feeling that we will be seeing new ranboos, each one better equipped for the tasks demanded by the show than their previous iterations, and yet also retaining the knowledge that allowed the generations before them to survive. what are favorable traits within the ecosystem of showfall media? complacency? levelheadedness? the ability to perform unflinching normalcy under hellish conditions? at any rate, showfall media wants the generations of our hero, ranboo, to eventually acquire the skills to be the ideal protagonist and engaging pov character, whatever that may entail. it’d behoove us to keep an eye out for changes in generation two that seem influenced by the erratic and even unstable nature of generation one.

(on a slight tangent: this is also how our brains learn things, and is relevant to trauma formation and retention. we often develop trauma responses to specific things—triggers—because those are what helped us survive traumatic experiences. there is positive reinforcement here: because we survived, we will do it again, and again, and again. parallel to natural selection, our brains prune responses; this is why trauma survivors have altered responses to things that may seem completely normal for people who don’t share those triggers or responses with them. altered response in brain structures, particularly the amygdala (the so-called “fear center”) are part of the observed neurobiological differences btwn those with and without ptsd—but i digress.)

on to generation loss. this has probably already been theorized before so i won’t beat a dead horse, but in the context of knowledge retention and crystallization as mentioned above, i think we’ll also see the next generations deteriorate significantly. this may manifest as more frequent breaks between the narrative of the show and what’s actually happening (e.g. this clip [blood and emotional distress tw] of the showfall media illusion breaking and us being shown ranboo elbow deep in charlie’s blood) and likely more emotional turmoil and derealization on the part of generation two and three. i wonder if generation two will inherit generation one’s cracked mask as a symbolic gesture and as an implicit warning, but that’s just broad speculation (and i imagine that mask is pretty much crushed to bits by now).

also re:the idea of imperfect reproduction causing the phenomenon of generation loss. we have to remember that ranboo is not the only character to be rescripted. charlie has had multiple generations. sneeg has had multiple generations. it’s sort of implied jerma has had multiple generations just by proxy of how long he’d been part of the genloss project. circling back to charlie and sneeg, though: their generations were imperfect. they made mistakes that broke the flow and immersion of the show, and it cost them. the generation that made the mistake was killed, and a new generation—streamlined, scripted, perfectly seamless—was put in their place. i found sneeg particularly rebellious, and also wonder about the importance of that hat and how it seemingly granted him self-awareness. at a guess it was because the hat was a holdover from the previous episode so the continuity error was what fucked sneeg up, in which case the hat didn’t actually have to be put on sneeg for the same effect to happen, but sneeg did hold it together remarkably well—long enough to attempt an escape. i wonder if that, too, was scripted. i wonder if everything we saw, everything we were handed with both hands by showfall and by hetch, was scripted.

ultimately i was super intrigued by genloss and am hyperfixating on it, if you couldn’t already tell. it was an incredible production with an incredible cast, story, costuming—everything. i’m in love with it. thank you to ranboo and to everyone on the cast and crew for genloss and i’m very excited for what’s next.

other stuff that stuck out to me that didn’t quite fit into this prediction:

hetch isn’t the founder, he’s just someone who appears to have control over the production that ranboo specifically was starring in (which is still a lot of executive power). saying that makes me wonder if there are other shows showfall media is in charge of, and genloss is just one of them. i found it interesting that hetch told ranboo to keep his mask at the outset of ep3, and this was the main reason why i personally did not trust him.

according to the genloss bts twitter, there was a “live” ending. that said, i think hetch opening the floor for ranboo to speak directly to the audience was what ultimately swung the vote so far to “die.” i’ve seen people talking about this already: we swarmed the vote en masse for “live” until hetch told ranboo they would just be reprogrammed into the show again, and ranboo begged. they begged us to let them die. look at us. we were never going to be able to say no to them. (i also think ranboo’s death makes for a compelling story in the future regarding my theory of generations, but i don’t know what the “live” ending would have looked like, so this is fully biased.)

thinking about how the show was shaped to culminate to ep3 from the beginning. we’ve seen and heard hetch through it all, and he was the one to break the illusion for ranboo. every last bit was scripted. uhh something something i think ranboo’s rebellion against chat in ep3 was also intended, even if the specific code that he chose wasn’t scripted. it really defeats a person to realize nothing is in their control, you know? the freedom was an illusion after all.

sources

what is generation loss (concept)?

how genetic algorithms work

human-guided machine learning

optimization of knowledge acquisition

#generation loss#genloss#generation loss meta#genloss meta#generation loss spoilers#long post#ranboo#chrys analyzes#this is more concise and focused than the papers i write for school lmao

60 notes

·

View notes

Text

Oh my god, I think my unhinged spreadsheet has actually identified a distinctive, definitive change in terminology from medieval to early modern texts. Comparing the Stowe and LL Tána directly really shows up the subtle differences and this one's SIGNIFICANT

#LOSS OF A PHOPA??? CERTIFIED LOSS OF A PHOPA IN STOWE??#oh! oh! finn can have little a support for their terminological argument. as a treat#finn is not doing a phd#popa paper

21 notes

·

View notes