#private capital

Text

#europe#pandemic#dubai#private funding#private capital#anthonyjerdine#finance#anthonylewisjerdine#miami#foundationwealthcapital#banking#foundation-wealth#private banking#anthony jerdine#venturecapital#anthonyjerdine jerdine#miamibeach#anthony jerdine vail#vail#london#dubailife#youtube#vailvillage#colorado#vailcolorado#european union#california#losangeles#beverlyhills#america

2 notes

·

View notes

Text

Global Capital Finance for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

The Importance of Infrastructure Funds and Private Capital in Shipping Finance

In June 2023 the Marine Money event took place in New York, with the conference’s infrastructure funds panel moderated by Brian Innes from the Bank of America. Mr. Innes noted the recent plethora of large deals which have seen infrastructure funds and private capital providing finance to shipping, filling the gap left by the diminishing role of commercial bank shipping.

youtube

The Importance of Long-Term Deals

During the conference, the benefits of infrastructure funds were discussed, specifically their inherent long-dated investment horizons and propensity to seek stable and risk-adjusted returns. Loli Wu, managing director of investment banking at the Bank of America, pointed to the current abundance of potential funding opportunities. He suggested that infrastructure funds now have an expanding and logical part to play in shipping finance, especially given the fact that, in his opinion, public markets aren’t pricing relevant cash flows very efficiently.

Non-Bank Funds Providers

As part of the conference, the panel on private capital (moderated by Dylan Potter from Vedder Price) looked at the spectrum of non-bank funds providers which evolved from shipowners who had put out their vessels under financial leases. One of the earliest examples of this type of lending occurred in the early 2000s, when shipowner Northern Navigation joined forces with financier DVB, creating NFC Shipping Funds.

Private Equity Demonstrating Growing Interest in Maritime Investment

Shipping industry experts like Atef Abou Merhi know that the maritime industry as a whole is undergoing major transformation in the wake of sustainability imperatives and recent technological innovations. Partly due to this, as well as the industry’s track record of resilience, private equity is increasingly steering investments towards shipping with a view to unlocking new value and reshaping operations.

For example, many private equity firms are now identifying the potential for modernization and optimization within the shipping sector, with investments directed towards those companies offering innovations solutions in areas including supply chain visibility, fleet management, and maritime logistics.

The shipping industry is particularly susceptible to volatility due to global political tensions, fluctuating freight rates, and regulatory changes. However, by leveraging their financial expertise, private equity firms are becoming involved in the shipping sector to mitigate risks via strategic investments that aim to support expansion and operational stability.

Given this, shipping companies that are backed by private equity are well positioned to seize growth opportunities and effectively navigate challenges. Take a look at the embedded PDF for more information about private equity.

#Atef Abou Merhi#Shipping#Shipping Investment#Infrastructure Funds#Private Capital#Shipping Finance#Non-Bank Funds#Private Equity#Maritime Investment#Youtube

1 note

·

View note

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

#class war#class warfare#classism#capitalism#red lobster#toys r us#aeropostale#sears#private equity#parasites

3K notes

·

View notes

Photo

As the sleeping giant China continues to grow, the United States is becoming more and more reliant on private capital to secure the critical minerals needed for its economy. With the Communist government in Beijing asserting its dominance over the global supply of these resources, it is becoming increasingly difficult for American businesses to compete. Unless something changes, the U.S. will soon fall behind in the race to secure these minerals, with disastrous consequences for the economy.

1 note

·

View note

Photo

United Bridge Partners is a private bridge infrastructure company in the United States. We develop, build, own and operate toll bridges across the country. Our mission is to solve public infrastructure needs with private capital and provide safe, reliable and efficient transportation solutions.

0 notes

Photo

Rockfleet Financial Services, Inc. and its CEO Catherine Corrigan have been recognized by Economic Journal as one of the Top 15 Innovative Brands and Individuals to Watch for in 2023.

Congratulations to all the innovative brands, including Uber, Insight Timer, NVIDIA, Regan Hillyer International, MaskIT, Oliver Pott, LockDocs, EarthHero , Paul Marks & Co, Inteligex, Aidan Bowers, LightBody, Darkpool Liquidity, and Smart Work Live

http://bit.ly/3XQTQVc

#innovative#rockfleet#financial services#wealth management#public finance#private capital#financial advisor

0 notes

Text

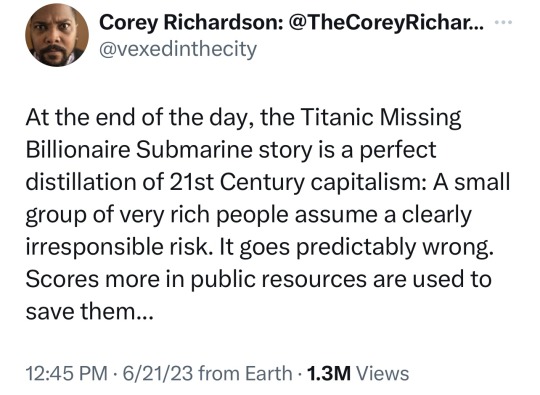

Such a good analogy for “privatizing the profits, but socializing the losses.”

Taxpayers, not the wealthy owners of OceanGate, will be paying the millions of dollars in costs for the search and rescue—and I almost wouldn’t have a problem with that (the coastguard rescues hapless people every day, and I don’t think that regular citizens should be forced to pay for their own rescues, because saving people is what a society should come together and do).

But the owners of OceanGate not only knew of the risks, they eschewed any kind of government regulation (like having an emergency location beacon that would have made the search far easier) because they said it would inhibit growth and profits. And I can’t help but believe that the coastguard and the navy and all of the other public agencies, are searching just a little bit longer and a little bit harder, because it’s rich people who are missing.

And don’t even get me started on how Greece’s coastguard is most likely responsible for the murder of hundreds of refugees, or how Italy and much of Europe have made it national policy for their coastguards to not help refugees at sea.

Anyway, it’s well past time for more people to start seriously thinking about how our society always bails out banks and wealthy billionaires, but tells poor people to exercise better judgment and pull themselves up by their bootstraps.

4K notes

·

View notes

Text

Promote the alignment and mobilization of private capital towards the SDGs.

The Sustainable Development Gaoals (SDGs) provide the blueprint framework to make investment decisions that are driven by impact not by profit alone. UNDP’s service offer contributes to promoting the alignment and mobilization of private capital towards the SDGs through

originating SDG investment project pipelines

accessing public and private capital for SDG investment

aligning business operations with the SDGs

supporting and enabling policy environment for SDG investment

UNLOCKING PRIVATE CAPITAL AND ALIGNING BUSINESS OPERATIONS FOR THE SDGS.

#private capital#SDG investment project#Public Capital#UNDP#Sustainable Development Goals#FinancingSDG

0 notes

Text

1K notes

·

View notes

Text

The conservative Tories are doing to the UK what the Republicans want to do to the U.S.

#privatizing = plundering#late stage capitalism#corporate greed#republicans will pick your pockets and turn you into literal serfs#republican assholes#crooked donald#maga morons#republican hypocrisy#f—k the Tories#F—k the Republicans

242 notes

·

View notes

Text

Global Business Loans for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

have you ever wanted a poetically inclined screen reader with an attitude, gradually developing sense of humanity, and penchant for using the word fuck more than could ever be necessary?

hi, i’m john doe-

#his shark tank pitch would just be him manufacturing more copies of the book that held him with more fragments of the KIY inside them#he’d give one to mark cuban and we'd have capitalism malevolent#john malevolent#malevolent#private eyes#jarthur

228 notes

·

View notes

Text

The tax sharks are back and they’re coming for your home

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TODAY (Apr 27) in MARIN COUNTY, then Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

One of my weirder and more rewarding hobbies is collecting definitions of "conservativism," and one of the jewels of that collection comes from Corey Robin's must-read book The Reactionary Mind:

https://en.wikipedia.org/wiki/The_Reactionary_Mind

Robin's definition of conservativism has enormous explanatory power and I'm always finding fresh ways in which it clarifies my understand of events in the world: a conservative is someone who believes that a minority of people were born to rule, and that everyone else was born to follow their rules, and that the world is in harmony when the born rulers are in charge.

This definition unifies the otherwise very odd grab-bag of ideologies that we identify with conservativism: a Christian Dominionist believes in the rule of Christians over others; a "men's rights advocate" thinks men should rule over women; a US imperialist thinks America should rule over the world; a white nationalist thinks white people should rule over racialized people; a libertarian believes in bosses dominating workers and a Hindu nationalist believes in Hindu domination over Muslims.

These people all disagree about who should be in charge, but they all agree that some people are ordained to rule, and that any "artificial" attempt to overturn the "natural" order throws society into chaos. This is the entire basis of the panic over DEI, and the brainless reflex to blame the Francis Scott Key bridge disaster on the possibility that someone had been unjustly promoted to ship's captain due to their membership in a disfavored racial group or gender.

This definition is also useful because it cleanly cleaves progressives from conservatives. If conservatives think there's a natural order in which the few dominate the many, progressivism is a belief in pluralism and inclusion, the idea that disparate perspectives and experiences all have something to contribute to society. Progressives see a world in which only a small number of people rise to public life, rarified professions, and cultural prominence and assume that this is terrible waste of the talents and contributions of people whose accidents of birth keep them from participating in the same way.

This is why progressives are committed to class mobility, broad access to education, and active programs to bring traditionally underrepresented groups into arenas that once excluded them. The "some are born to rule, and most to be ruled over" conservative credo rejects this as not just wrong, but dangerous, the kind of thing that leads to bridges being demolished by cargo ships.

The progressive reforms from the New Deal until the Reagan revolution were a series of efforts to broaden participation in every part of society by successively broader groups of people. A movement that started with inclusive housing and education for white men and votes for white women grew to encompass universal suffrage, racial struggles for equality, workplace protections for a widening group of people, rights for people with disabilities, truth and reconciliation with indigenous people and so on.

The conservative project of the past 40 years has been to reverse this: to return the great majority of us to the status of desperate, forelock-tugging plebs who know our places. Hence the return of child labor, the tradwife movement, and of course the attacks on labor unions and voting rights:

https://pluralistic.net/2022/11/06/the-end-of-the-road-to-serfdom/

Arguably the most potent symbol of this struggle is the fight over homes. The New Deal offered (some) working people a twofold path to prosperity: subsidized home-ownership and strong labor protections. This insulated (mostly white) workers from the two most potent threats to working peoples' lives and wellbeing: the cruel boss and the greedy landlord.

But the neoliberal era dispensed with labor rights, leaving the descendants of those lucky workers with just one tool for securing their American dream: home-ownership. As wages stagnated, your home – so essential to your ability to simply live – became your most important asset first, and a home second. So long as property values rose – and property taxes didn't – your home could be the backstop for debt-fueled consumption that filled the gap left by stagnating wages. Liquidating your family home might someday provide for your retirement, your kids' college loans and your emergency medical bills.

For conservatives who want to restore Gilded Age class rule, this was a very canny move. It pitted lucky workers with homes against their unlucky brethren – the more housing supply there was, the less your house was worth. The more protections tenants had, the less your house was worth. The more equitably municipal services (like schools) were distributed, the less your house was worth:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

And now that the long game is over, they're coming for your house. It started with the foreclosure epidemic after the 2008 financial crisis, first under GW Bush, but then in earnest under Obama, who accepted the advice of his Treasury Secretary Timothy Geithner, who insisted that homeowners should be liquidated to "foam the runways" for the crashing banks:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

Then there are scams like "We Buy Ugly Houses," a nationwide mass-fraud outfit that steals houses out from under elderly, vulnerable and desperate people:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The more we lose our houses, the more single-family homes Wall Street gets to snap up and convert into slum properties, aslosh with a toxic stew of black mold, junk fees and eviction threats:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Now there's a new way for finance barons the steal our houses out from under us – or rather, a very old way that had lain dormant since the last time child labor was legal – "tax lien investing."

Across the country, counties and cities have programs that allow investment funds to buy up overdue tax-bills from homeowners in financial hardship. These "investors" are entitled to be paid the missing property taxes, and if the homeowner can't afford to make that payment, the "investor" gets to kick them out of their homes and take possession of them, for a tiny fraction of their value.

As Andrew Kahrl writes for The American Prospect, tax lien investing was common in the 19th century, until the fundamental ugliness of the business made it unattractive even to the robber barons of the day:

https://prospect.org/economy/2024-04-26-investing-in-distress-tax-liens/

The "tax sharks" of Chicago and New York were deemed "too merciless" by their peers. One exec who got out of the business compared it to "picking pennies off a dead man’s eyes." The very idea of outsourcing municipal tax collection to merciless debt-hounds fell aroused public ire.

Today – as the conservative project to restore the "natural" order of the ruled and the ruled-over builds momentum – tax lien investing is attracting some of America's most rapacious investors – and they're making a killing. In Chicago, Alden Capital just spent a measly $1.75m to acquire the tax liens on 600 family homes in Cook County. They now get to charge escalating fees and penalties and usurious interest to those unlucky homeowners. Any homeowner that can't pay loses their home.

The first targets for tax-lien investing are the people who were the last people to benefit from the New Deal and its successors: Black and Latino families, elderly and disabled people and others who got the smallest share of America's experiment in shared prosperity are the first to lose the small slice of the American dream that they were grudgingly given.

This is the very definition of "structural racism." Redlining meant that families of color were shut out of the federal loan guarantees that benefited white workers. Rather than building intergenerational wealth, these families were forced to rent (building some other family's intergenerational wealth), and had a harder time saving for downpayments. That meant that they went into homeownership with "nontraditional" or "nonconforming" mortgages with higher interest rates and penalties, which made them more vulnerable to economic volatility, and thus more likely to fall behind on their taxes. Now that they're delinquent on their property taxes, they're in hock to a private equity fund that's charging them even more to live in their family home, and the second they fail to pay, they'll be evicted, rendered homeless and dispossessed of all the equity they built in their (former) home.

It's very on-brand for Alden Capital to be destroying the lives of Chicagoans. Alden is most notorious for buying up and destroying America's most beloved newspapers. It was Alden who bought up the Chicago Tribune, gutted its workforce, sold off its iconic downtown tower, and moved its few remaining reporters to an outer suburban, windowless brick building "the size of a Chipotle":

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Before the ghastly hotel baroness Leona Helmsley went to prison for tax evasion, she famously said, "We don't pay taxes; only the little people pay taxes." Helmsley wasn't wrong – she was just a little ahead of schedule. As Propublica's IRS Files taught us, America's 400 richest people pay less tax than you do:

https://pluralistic.net/2022/04/13/for-the-little-people/#leona-helmsley-2022

When billionaires don't pay their taxes, they get to buy sports franchises. When poor people don't pay their taxes, billionaires get to steal their houses after paying the local government an insultingly small amount of money.

It's all going according to plan. We weren't meant to have houses, or job security, or retirement funds. We weren't meant to go to university, or even high school, and our kids were always supposed to be in harness at a local meat-packer or fast food kitchen, not wasting time with their high school chess club or sports team. They don't need high school: that's for the people who were born to rule. They – we – were meant to be ruled over.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/26/taxes-are-for-the-little-people/#alden-capital

#pluralistic#chicago#illinois#alden capital#the rents too damned high#debt#immiseration#chicago tribune#private equity#vulture capital#cook county#liens#tax evasion#taxes are for the little people#tax lien certificates#tax sharks#race#racial capitalism#predatory lending

382 notes

·

View notes