#private loan

Text

5 Tips to Secure a Personal Loan with a Low CIBIL Score

Your CIBIL score plays a crucial role in determining your creditworthiness and ability to secure loans. A low CIBIL score can pose challenges when seeking financial assistance, but it doesn't mean obtaining a personal loan is impossible.

With strategic planning and diligent efforts, individuals with a low CIBIL score can still access the funds they need.

Here are five tips to help you secure a personal loan despite having a low CIBIL score:

Explore Alternative Lenders

Traditional banks and financial institutions often have stringent eligibility criteria, making it challenging for individuals with low credit scores to secure loans.

Instead, consider alternative lenders such as non-banking financial companies (NBFCs), online lenders, or peer-to-peer lending platforms.

These lenders may have more lenient criteria and be willing to extend credit to individuals with lower credit scores.

Provide Collateral or Guarantor:

Offering collateral or having a guarantor can significantly improve your chances of securing a personal loan for low CIBIL score. Collateral, such as property, vehicles, or valuable assets, provides security to the lender in case of default.

Similarly, having a creditworthy guarantor who is willing to co-sign the loan agreement assures the lender of repayment, reducing the risk associated with lending to someone with a low credit score.

Opt for a Secured Loan:

Secured personal loans are backed by collateral, making them less risky for lenders compared to unsecured loans. If you have assets that can be pledged as security, consider applying for a secured personal loan.

By offering collateral, you demonstrate your commitment to repaying the loan, which may outweigh the impact of your low CIBIL score in the lender's decision-making process.

Demonstrate Stable Income and Employment:

Lenders often prioritize the borrower's ability to repay the loan on time. Even with a low CIBIL score, demonstrating a stable source of income and steady employment history can strengthen your loan application.

Provide proof of regular income through salary slips, bank statements, or income tax returns to showcase your repayment capacity.

A consistent income stream reassures lenders of your financial stability and increases your chances of loan approval.

Apply for a Small Loan Amount:

When applying for a personal loan with a low CIBIL score, consider requesting a smaller loan amount. Lenders may be more willing to approve smaller loan amounts as they pose lower risk.

By borrowing a modest sum, you demonstrate responsible borrowing behavior and increase the likelihood of loan approval. As you repay the loan on time and improve your creditworthiness, you can gradually access larger loan amounts in the future.

0 notes

Text

Private Student Loan $100 Bonus NO FEES

🧑🎓Hi! I thought you might want to check out SoFi’s Private Student Loan with flexible repayment options and no fees. Learn more and use my link to apply for a SoFi Private Student Loan and you can get a $100 welcome bonus 💰:

#referral codes#referral links#driskol referrals#money loans#student loans#private loan#fyp#for your page#for you page#driskolestate#follow#like

0 notes

Text

I think Biden stopped taking the online anti-voting Left seriously (if he was ever aware of them) when the people that spent 4 years saying Obama’s drone usage made him worse than Trump in order to make their Both Sides arguments made nary a peep when Biden stopped nearly all US drone operations.

#Biden ending the drone war was on paper a massive W for the left that loved to post that one comic#about how ‘they say the next drone will be sent by a woman’#but they spent all their time bitching about how their private loans won’t get paid off#until suddenly they cared about foreign policy when it was time to say that Biden was personally leading the IDF into battle

300 notes

·

View notes

Text

Republican Boomers: Life’s not fair, get used to it!!

*Student Loan Forgiveness is introduced*

The same Boomers: Hey, that’s not fair!!

#student loans#student loan forgiveness#boomers#i think they fail to mention how much less money they paid for their school#am I willing to pay a little more stuff to help people out?#of fucking course I am!!#i fucking have student loans too but mine are private so I really won’t benefit from the plan#but that doesn’t mean millions of other people are struggling too#both of my folks only went for two years#i know you didn’t pay nearly what others are paying now#I know I’ll get hate for this post but whatever lmao#be mad about it 😂

1K notes

·

View notes

Text

Private equity plunderers want to buy Simon & Schuster

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Last November, publishing got some excellent news: the planned merger of Penguin Random House (the largest publisher in the history of human civilization) with its immediate competitor Simon & Schuster would not be permitted, thanks to the DOJ's deftly argued case against the deal:

https://pluralistic.net/2022/11/07/random-penguins/#if-you-wanted-to-get-there-i-wouldnt-start-from-here

When I was a baby writer, there were dozens of large NY publishers. Today, there are five - and it was almost four. A publishing sector with five giant companies is bad news for writers (as Stephen King said at the trial, the idea that PRH and S&S would bid against each other for books was as absurd as the idea that he and his wife would bid against each other for their next family home).

But it's also bad news for publishing workers, a historically exploited and undervalued workforce whose labor conditions have only declined as the number of employers in the sector dwindled, leading to mass resignations:

https://lithub.com/unlivable-and-untenable-molly-mcghee-on-the-punishing-life-of-junior-publishing-employees/

It should go without saying that workers in sectors with few employers get worse deals from their bosses (see, e.g., the writers' strike and actors' strike). And yup, right on time, PRH, a wildly profitable publisher, fired a bunch of its most senior (and therefore hardest to push around) workers:

https://www.nytimes.com/2023/07/18/books/penguin-random-house-layoffs-buyouts.html

But publishing's contraction into a five-company cartel didn't occur in a vacuum. It was a normal response to monopolization elsewhere in its supply chain. First it was bookselling collapsing into two major chains. Then it was distribution going from 300 companies to three. Today, it's Amazon, a monopolist with unlimited access to the capital markets and a track record of treating publishers "the way a cheetah would pursue a sickly gazelle":

https://pluralistic.net/2023/07/31/seize-the-means-of-computation/#the-internet-con

Monopolies are like Pringles (owned by the consumer packaged goods monopolist Procter & Gamble): you can't have just one. As soon as you get a monopoly in one part of the supply chain, every other part of that chain has to monopolize in self-defense.

Think of healthcare. Consolidation in pharma lead to price-gouging, where hospitals were suddenly paying 1,000% more for routine drugs. Hospitals formed regional monopolies and boycotted pharma companies unless they lowered their prices - and then turned around and screwed insurers, jacking up the price of care. Health insurers gobbled each other up in an orgy of mergers and fought the hospitals.

Now the health care system is composed of a series of gigantic, abusive monopolists - pharma, hospitals, medical equipment, pharmacy benefit managers, insurers - and they all conspire to wreck the lives of only two parts of the system who can't fight back: patients and health care workers. Patients pay more for worse care, and medical workers get paid less for worse working conditions.

So while there was no question that a PRH takeover of Simon & Schuster would be bad for writers and readers, it was also clear that S&S - and indeed, all of the Big Five publishers - would be under pressure from the monopolies in their own supply chain. What's more, it was clear that S&S couldn't remain tethered to Paramount, its current owner.

Last week, Paramount announced that it was going to flip S&S to KKR, one of the world's most notorious private equity companies. KKR has a long, long track record of ghastly behavior, and its portfolio currently includes other publishing industry firms, including one rotten monopolist, raising similar concerns to the ones that scuttled the PRH takeover last year:

https://www.nytimes.com/2023/08/07/books/booksupdate/paramount-simon-and-schuster-kkr-sale.html

Let's review a little of KKR's track record, shall we? Most spectacularly, they are known for buying and destroying Toys R Us in a deal that saw them extract $200m from the company, leaving it bankrupt, with lifetime employees getting $0 in severance even as its executives paid themselves tens of millions in "performance bonuses":

https://memex.craphound.com/2018/06/03/private-equity-bosses-took-200m-out-of-toys-r-us-and-crashed-the-company-lifetime-employees-got-0-in-severance/

The pillaging of Toys R Us isn't the worst thing KKR did, but it was the most brazen. KKR lit a beloved national chain on fire and then walked away, hands in pockets, whistling. They didn't even bother to clear their former employees' sensitive personnel records out of the unlocked filing cabinets before they scarpered:

https://memex.craphound.com/2018/09/23/exploring-the-ruins-of-a-toys-r-us-discovering-a-trove-of-sensitive-employee-data/

But as flashy as the Toys R Us caper was, it wasn't the worst. Private equity funds specialize in buying up businesses, loading them with debts, paying themselves, and then leaving them to collapse. They're sometimes called vulture capitalists, but they're really vampire capitalists:

https://www.motherjones.com/politics/2022/05/private-equity-buyout-kkr-houdaille/

Given a choice, PE companies don't want to prey on sick businesses - they preferentially drain off value from thriving ones, preferably ones that we must use, which is why PE - and KKR in particular - loves to buy health care companies.

Heard of the "surprise billing epidemic"? That's where you go to a hospital that's covered by your insurer, only to discover - after the fact - that the emergency room is operated by a separate, PE-backed company that charges you thousands for junk fees. KKR and Blackstone invented this scam, then funneled millions into fighting the No Surprises Act, which more-or-less killed it:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

KKR took one of the nation's largest healthcare providers, Envision, hostage to surprise billing, making it dependent on these fraudulent payments. When Congress finally acted to end this scam, KKR was able to take to the nation's editorial pages and damn Congress for recklessly endangering all the patients who relied on it:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

Like any smart vampire, KKR doesn't drain its victim in one go. They find all kinds of ways to stretch out the blood supply. During the pandemic, KKR was front of the line to get massive bailouts for its health-care holdings, even as it fired health-care workers, increasing the workload and decreasing the pay of the survivors of its indiscriminate cuts:

https://pluralistic.net/2020/04/11/socialized-losses/#socialized-losses

It's not just emergency rooms. KKR bought and looted homes for people with disabilities, slashed wages, cut staff, and then feigned surprise at the deaths, abuse and misery that followed:

https://www.buzzfeednews.com/article/kendalltaggart/kkr-brightspring-disability-private-equity-abuse

Workers' wages went down to $8/hour, and they were given 36 hour shifts, and then KKR threatened to have any worker who walked off the job criminally charged with patient abandonment:

https://pluralistic.net/2023/06/02/plunderers/#farben

For KKR, people with disabilities and patients make great victims - disempowered and atomized, unable to fight back. No surprise, then, that so many of KKR's scams target poor people - another group that struggles to get justice when wronged. KKR took over Dollar General in 2007 and embarked on a nationwide expansion campaign, using abusive preferential distributor contracts and targeting community-owned grocers to trap poor people into buying the most heavily processed, least nutritious, most profitable food available:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

94.5% of the Paycheck Protection Program - designed to help small businesses keep their workers payrolled during lockdown - went to giant businesses, fraudulently siphoned off by companies like Longview Power, 40% owned by KKR:

https://pluralistic.net/2020/04/20/great-danes/#ppp

KKR also helped engineer a loophole in the Trump tax cuts, convincing Justin Muzinich to carve out taxes for C-Corporations, which let KKR save billions in taxes:

https://pluralistic.net/2020/06/02/broken-windows/#Justin-Muzinich

KKR sinks its fangs in every part of the economy, thanks to the vast fortunes it amassed from its investors, ripped off from its customers, and fraudulently obtained from the public purse. After the pandemic, KKR scooped up hundreds of companies at firesale prices:

https://pluralistic.net/2020/03/30/medtronic-stole-your-ventilator/#blackstone-kkr

Ironically, the investors in KKR funds are also its victims - especially giant public pension funds, whom KKR has systematically defrauded for years:

https://pluralistic.net/2020/07/22/stimpank/#kentucky

And now KKR has come for Simon & Schuster. The buyout was trumpeted to the press as a done deal, but it's far from a fait accompli. Before the deal can close, the FTC will have to bless it. That blessing is far from a foregone conclusion. KKR also owns Overdrive, the monopoly supplier of e-lending software to libraries.

Overdrive has a host of predatory practices, loathed by both libraries and publishers (indeed, much of the publishing sector's outrage at library e-lending is really displaced anger at Overdrive). There's a plausible case that the merger of one of the Big Five publishers with the e-lending monopoly will present competition issues every bit as deal-breaking as the PRH/S&S merger posed.

(Image: Sefa Tekin/Pexels, modified)

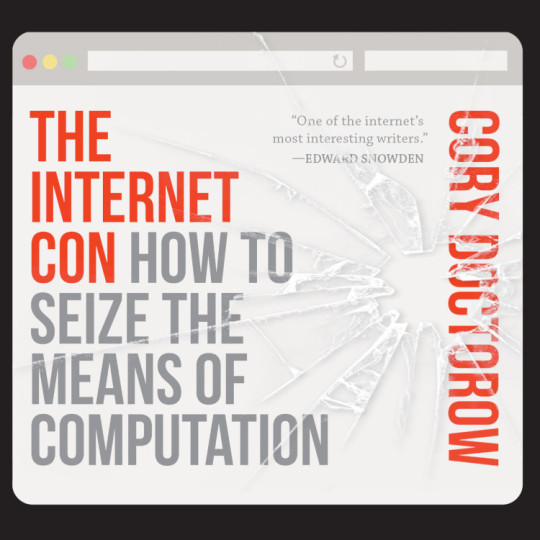

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/08/vampire-capitalism/#kkr

#kkr#simon and schuster#publishing#penguin random house#ppp loans#looters#plunderers#vampire capitalism#vulture capitalism#debt#private equity#pe#harmful dominance#monopoly#trustbusters#incentives matter#labor#writing#publishing workers#recorded books#overdrive#glam#libraries#toys r us#pluralistic

187 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

184 notes

·

View notes

Text

Punkasshunter's Calligraphy Commission Sheet

What it is:

These projects are mostly basic calligraphy, but I am now offering some simple letter illumination! I'm able to work in both copperplate (pointed pen/"script") and broad-edge hands, and am most practiced in blackletter ("gothic", broad nib).

Mostly, I've done silly video game-related quotes and memes, but am willing to do anything not specified in my "will NOT do" within reason.

Here are some examples of my work, more of which can be found in my calligraphy tag!

I have a good variety of inks and mediums, including solids in most basic colors, a few pearlescents, and even watercolors, and this will likely be updated soon with a swatch guide! If I don't have a particular color that's desired, I can likely obtain it with some additional time.

What I WON'T do:

• Hate speech of any kind

• Explicit sexual stuff within discretion, fetish

• That's about it, but I reserve the right to decline if anything else uncomfortable.

Pricing:

This pricing may be subject to change in the future to reflect the significant amount of work that goes into these and to not undercut other artists, but I'm going to try to keep pricing low as I gain experience.

For reference, here are my Rhodia Dotpad A5 and A4 notepads next to each other!

A5 (smaller) sheet

• Base rate: $4 for dot grid paper, $5 for blank

• Per additional page: $1

A4 (larger) sheet:

• Base rate: $5 for dot grid paper, $6 for blank

• Per additional page: $1.50

Illuminated letters are an upcharge of $.20 per letter.

For an additional $1 on any, I can physically mail the completed work to you with an address! Otherwise, I will just send a scan of the completed work to you digitally.

I will also discount $.50 if you don't wish to choose your ink color.

Timeframe:

While an individual piece may not take long, I am a disabled creator and also an alive human person. Your piece may be quicker, but please give a buffer time of about 3 days from the time of commission.

Please send communications through dm on here! I'm able to accept payment via Venmo, PayPal, or Ko-fi.

#Calligraphy#My calligraphy#Commissions#I would appreciate anyone who reblogs this!#Edit: Okay forget that part about being financially safe lol#Found out literally today that my private student loans went into repayment#And I'm still not physically able to work in any consistent capacity at an in-person job

533 notes

·

View notes

Text

#us politics#republicans#conservatives#twitter#tweet#ian millhiser#gop#us supreme court#justice clarence thomas#justice samuel alito#harlan crow#paul singer#scotus#private jets#billionaires#fuck billionaires#student loans#student loan debt#student loan forgiveness#freeze student debt#student debt forgiveness#2023

137 notes

·

View notes

Text

Adding active interest rates back to the federal loans on our debt tracking spreadsheet 🥴🥺

Nothing is technically due until October, but we’ll start payments again in September to stay ahead of accrued interest.

ETA: Dammit our monthly payment is actually up to $1,450 for federal and private combined 😑

Please learn from my in-laws’ mistakes and don’t tell your kid to take out private student loans with 11%+ interest rates.

#our total monthly student loan payment is back up to $1300#yikes#that’s both private and public combined#I have a plan#we will be okay#🥴🥴🥴🥴

30 notes

·

View notes

Text

I FINALLY QUALIFY FOR PUBLIC SERVICE LOAN FORGIVENESS

My initial student loan was $54,935.92.

I paid over $30,887.83*

My loan is currently at $51,756.93.

I thought I had made all 120 qualifying payments last year. I had to submit and resubmit the PSLF application multiple times, because it kept getting sent back because of problems with how my employers signed the form. It turned out some of the payments didn't qualify, so I had to stick with helljob for at least another year.

I definitely had made 120 qualifying payments this year, so I sent the application in December 2023.

Just got notified now that I have made all qualifying payments. I've made three extra payments, even.

"After we receive the approval, it may take up to 90 business days to process this information."

Three more months of helljob, because I still don't trust this is going to go through and I don't want to quit until I know my loans are gone. I do not have anything lined up after helljob, and I'm terrified of losing my helljob health insurance because I got medical complications. But I hate helljob. I hate helljob so much and my first emotion waking every workday is despair.

At least the loan payments have been paused until the reimbursement is processed. Theoretically I should get reimbursed for the extra payments, too.

* This was only my qualifying payments. The total amount I paid was higher. The website isn't showing me the non-qualifying payments and I have to submit a formal request to get my full payment history. I submitted the request, but it will take a few days to be sent to me.

#This has been a nightmare btw#why yes higher education in the US is a huge scam and utterly inaccessible to most people rn#This wasn't even all of my loans I also got a private loan that I paid off years ago with help from family#I'm one of the LUCKY ones and this ruined my life#student loans#us higher education#what really makes me want to strangle my past self is that I only took these loans because I wanted to be a doctor#like I actually had my bachelor's degree paid off. I didn't need to do this to myself.#But I wanted to be a doctor so I gambled my entire future without realizing I was even gambling let alone that the game was rigged#and I lost it all. Didn't even make med school.#Every single adult I asked for advice on higher education or loans told me 'you're smart and you'll figure it out don't worry'#I've always been a gullible sucker#personal stuff#pslf#public service loan forgiveness

8 notes

·

View notes

Text

Personal loan in Noida

Vintage Finance provides Instant Personal loans in Noida. Applicants may apply for a hassle-free Loan with minimum documentation. It is a registered RBI firm and a Non-Banking Finance Company (NBFC).

0 notes

Text

I forgot how gruesome the art process is, this is horrible terrible

#ALL THE GOOD SHIT IS IN PRIVATE SCHOOLS#AND THEYRE EXPENSIVVEEEE FUCK ME#I may have to take out a loan and I hate that#reminder that my comms are open….. augh……

8 notes

·

View notes

Text

I regret my choices for college sometime, but I really did the best with what I had. I couldn't afford to go to art school out of state. I couldn't even afford going to UT like I had wanted to (before Austin became bloated and unbearable). My college didn't offer illustration degrees, so I went with Drawing & Painting (even though that's really for studio art).

I ultimately don't regret going to school there, because I met two of my best friends there. But it is frustrating.

#personal#I took out a lot of loans just to go to my school. and I'm still lucky because they were federal and not private#the path less traveled etc etc

7 notes

·

View notes

Text

Girl Math is getting this email and then immediately pre-spending that payment amount in my head for the next few months

#yes I verified it first#and unfortunately I do still have private student loans too#but like - better than nothing#a little annoyed that they waited#until five days after#I made my first payment in three and a half years#like can I get that money back?#definitely glad I didn't keep paying through the pause though!

8 notes

·

View notes

Text

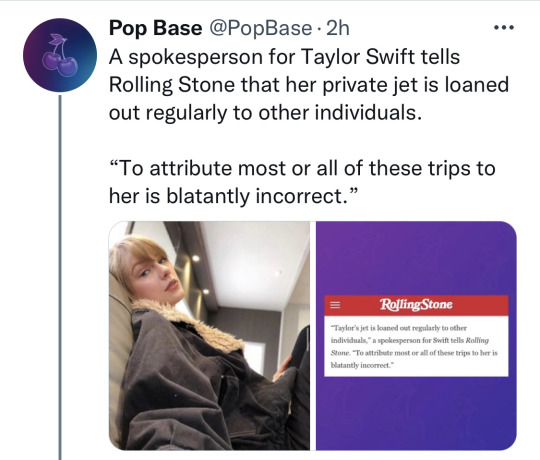

Hmmm

#I was gonna stay on hiatus and not post about this#but since there’s this…. I don’t agree but I understand#her lending out her plan means less private jets in the air which is good#also the people saying ‘why doesn’t she just fly commercial’….. she literally cannot do that lol#it’s a huge safety risk for one#I think people are making it a bigger deal than it is tbh#like… all of your favs have private jets and Taylor only has this much bc she loans it to others… she car pools… that helps#tp#taylor swift

101 notes

·

View notes

Text

#student loans#please boost#for my american followers#if you have a PRIVATE student loan#not a federal one okay#but if you have a private student loan it can be worth trying to prove the company claiming the debt did not acquire it legitimately#i'm serious fucking boost this okay#people need to know they have tools and weapons against predatory student loan lenders trying to shake people down for money

12 notes

·

View notes