#type of insurance

Text

Understanding the Basics – Types of Life Insurance

Life insurance is defined as an arrangement between an insurer, on behalf of the national government depending on its ownership and otherwise, and the insured. It guarantees that compensation would be provided if the insured loses their life within the coverage period or as otherwise specified in the terms and agreements of the policy. In life insurance plans the beneficiaries who have been nominated by the insured receive said compensation when the event, for which it is to be provided, happens. The most prominent such event is the loss of the life of the insured.

Term insurance policies

When you think of the various types of life insurance policies the first name that comes to mind is that of term insurance policies. As the name of these policies would indicate these policies cover you only for a certain period such as 10, 20, or 30 years. These policies do not have any cash value which means that here you would not get any maturity benefit. This implies that even if you live after the coverage period is over you would not get any money from your insurer as you get in other kinds of life insurance plans. This is also the reason why these policies are cheaper.

The other kinds of life insurance policies

Term insurance is not the only type of insurance. You also have others following:

endowment policies

unit-linked insurance plans

money-back policies

whole life policies

annuity or pension plans

Endowment policies are what we are accustomed to in terms of life insurance here in India. This is in the sense that it is these policies that provide you with a lump sum amount when you live after the coverage period. Unit-linked insurance plans, or ULIPs, offer you the opportunity to build wealth along with providing you with life protection.

When it comes to the future you can be sure of one thing that you can never be sure of anything. While you would not want anything unfortunate to happen to you it is still better that you are prepared for such circumstances in life. This is where life insurance policies from the top service providers in the domain such as PNB MetLife can be of immense help to you in every sense of the word. Having such a policy would help your near and dear ones at least have a financial cushion should something bad happen to your life.

0 notes

Text

Types of Life Insurance Policies

Life insurance is a contract between an individual and an insurance company in which the insurer agrees to pay a sum of money to a selected beneficiary upon the insured person’s death.. Let’s explore the various types of life insurance policies available in the market today.

Read More: What is life insurance?

Importance of Life Insurance

Life insurance plays a vital role in securing the…

View On WordPress

0 notes

Text

Insurance vs Assurance – Let’s have a brief difference

Insurance and assurance are two types of common products which are widely sold in the market these days. But both insurance and assurance are two completely different products offering more or less the same thing which is confusing and misunderstood.

Here in this article, we will discuss insurance vs assurance which will help you to learn the key differences between both and how these two are separated from each other.

Insurance vs assurance

Definition

Insurance can be defined as the financial arrangement in which the insurance company commits or enters into an agreement to indemnify the loss of an insured person due to any kind of natural calamity or any personal mishappening that happens to the insured person.

In that case, the insurance amount might be small, or some percentage of this loss caused to the insured, or else it can also be a lump sum amount of money for which the insured has subscribed for.

On the other hand, assurance can be defined as an agreement between the insurance company and the insured person that the company will provide cover for an event that may likely happen sooner or later in the life of the person getting insured.

Objective

Insurance provides financial stability in case of any uncertainties where an assurance pays out predetermined money when an event takes place.

Allowable Number of Claims

One major difference between insurance and assurance is that all policyholders associated with insurance can file several claims, whereas those with assurance can only file one.

Different Types of Policies

Insurance generally includes things like car insurance, health insurance, and mobile phone insurance, among other things while Assurance involves life insurance, term insurance, endowment plans, ULIPs, and other financial products.

Principle

The primary principle of Insurance is the principle of indemnity on the other hand assurance is based on the principle of certainty.

Policy Duration

Insurance policies are usually for short-term whole life while the policies primarily based on assurance are usually long term.

The Nature of Risks

Another primary difference between insurance and assurance is that theft, burglary, catastrophes, fire, accidents, and other unknown risks are generally covered by insurance, while assurance only covers death.

Conditions

Insurance plans have several conditions on which the company decides what kinds of loss or damages are covered within that policy. Along with that, the amount is definitely payable.

On the other hand, an assurance general comes with specific plans or paths to save and protect a definite benefit at maturity. Thus they are usually life insurance plans, for example, whole life insurance, endowment plans, and to a specific degree term insurance.

Claim payment

The claim payment is approximately equal to the amount of loss in the case of insurance. For example, the cost of repair and replacement of vehicle parts, hospitalization bills, etc. are generally covered by insurance.

Whereas Pre-decided amounts are generally covered for a specific event in case of assurance. For example, a major illness such as cancer, the death of the policyholder, etc.

Conclusion

Although insurance and assurance are two similar things as they both provide financial compensation, both of them are quite different from each other in their scope and usage.

So it is very important for you to know, understand, and be well acquainted with all these terms if you want to purchase insurance.

Understanding the meaning and significant difference between insurance and assurance can surely assist you in better way to comprehend the insurance plan’s benefits.

0 notes

Text

Different Types of Insurance (You Should Have)

No one truly knows what the future holds for them. You may have big dreams and aspirations to realize, but all that enthusiasm can come to a standstill due to unforeseen mishaps.

However, the good thing is that such misfortunes will not let you suffer much damage if you have insurance in advance.

While you cannot predict or stop accidents from occurring, you can make plans for future financial remunerations just in case.

So, here are the must-have insurance policies we advise that you have as a precaution.

Health Insurance

This insurance is essential for everyone, regardless of age. It covers overwhelming medical expenses, including medical consultation fees, surgeries, check-ins, rehabilitation programs, and tests.

As long as you are insured, you will not go bankrupt from paying huge medical bills.

You can obtain health insurance for yourself and your family through private insurance companies, federal health insurance marketplaces, or even your employer.

Life Insurance

Not to be confused with health insurance, life insurance offers an entirely different type of assurance for specific risks.

It safeguards your family from financial hardships following your demise.

While health insurance covers hospitalization and payment for mild and critical illnesses, life insurance helps your family recuperate and maintain their lifestyle after death.

It is ironic because you don't get to spend your life insurance.

But if you are willing to let your family maintain their lifestyle in your absence, you should purchase this insurance.

youtube

Long-term Disability (LTD) Insurance

If you ever suffer an accident that could forcibly put you out of work for an extended period, you wouldn't have to worry about the lost income if you have this insurance.

Long-term Disability Insurance is a policy that pays the insured a stipulated percentage of their monthly payment should they become disabled due to an accident or illness.

It does not apply to pre-existing disabilities but only to the ones caused by accidents, old age, and even diseases like cancer.

After three months of disability, you will receive a portion of your pay tax-free.

It would help if you got this insurance to reduce the costs of the risks associated with unprecedented disabilities. This is also considered a smart financial move.

Property Insurance

As a property owner, you should have reliable financial protection over your properties in case they get unintentionally damaged or lost. In such cases, you will see the value of property insurance.

As the name implies, property insurance protects your property from risks of natural causes like blizzards, tornadoes, fire, tsunamis, and other weather hazards.

In addition, this insurance also covers losses caused by human factors such as riots, theft, vandalism, and many more.

Property insurance mainly covers commercial properties like corporate buildings and equipment, but it can similarly be extended to household properties.

You can discuss the details with an insurance company to obtain this protection plan.

Conclusion

Since there is no telling what can happen to you in the nearest future, you need to have several insurance policies as a backup financial plan. Insurance is a good alleviation scheme.

Think of it as the light at the end of the tunnel. With it, you will have financial coverage should you suffer irreparable damage.

Therefore, you need to get one quickly.

#GreenSprout#GreenSprout insurance#type of insurance#insurance types by GreenSprout#life insurance#health insurance

0 notes

Note

as a fellow deluyuyu looking out for another deluyuyu.. do NOT look at Yunho's Saitama Day 2 pictures 💀🧎🏻♀️🕳 we don't have the hotteok health insurance!!

bro.

YOU'RE TELLING ME WE WITNESSED THE YIPPLE???? HE ACTUALLY BROKE THE WALL DFKJGHJDFHGJKDF

AND HE LOOKED THIS HOT ANYWAY???

I. AM. NOT. OKAY.

#i seriously need to touch some grass after all the scrolling i did#but can i just say my heart is feeling things it should not feel#AND HE LOOKS SO UGH FDJKGH DFHGKJDFHDADDYSDKFJGHKJDFHG IN THE LAST PUCS#I AM NOT FINE#DELUYUYU SHOULD BE A COINED TERM ATP#HOTTEOK HEALTH INSURANCE WHAT WHO#anon thank you for informing me what i missed today#yet another day i cry myself to sleep bc i wont get to see this yunho#fist in my mouth screaming into the pillow as i type#💌#jeong yunho#yunho#ateez#yumi.asks

435 notes

·

View notes

Note

I feel like Howdy would be the type to go to the dollar store to save money then complain when something is like $1.99

i second this....

#he also seems like the type to have the funds to shop regularly at like. idk whole foods and H&M#but he exclusively thrifts and goes to dollar tree & the 99 cent store and shit#i know this man's coupon game is Insane#probably has a whole extra wallet purely for coupons and gift cards....#in the checkout line the store winds up owing Him money#rambles from the bog#further solidifying that if howdy pillar was a real person id fuckin hate him lmao#itd be On Sight!#wait lmao#howdy would get seriously injured#and while everyone is freaking out / calling 911#howdy has a calculator out typing up the cost of an ambulance ride / hospital bills / insurance#he pauses looking at the total.#then starts calculating funerary costs#they get sick of waiting for an ambulance and just shove him in the car#sally leans over to see that howdy is googling cremation urns based on price#IM SORRY THIS IS INSANELY FUNNY TO ME#im sitting here at my laptop snickering like an idiot#sally just smacks the phone out of his hands....

99 notes

·

View notes

Text

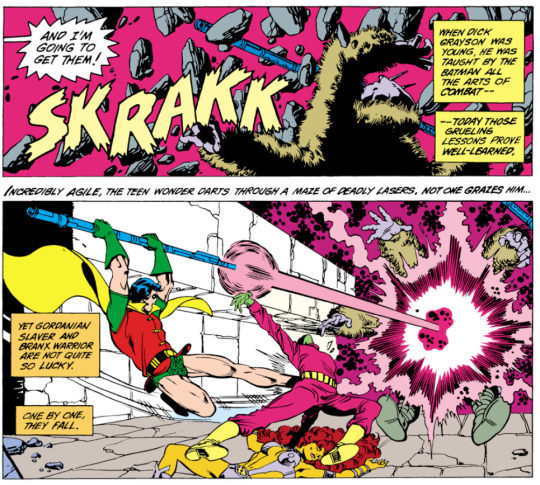

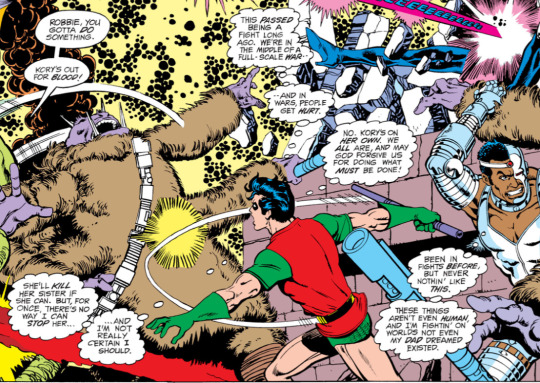

You remember when dick was in space (for the first time with the new teen titans) because komand’r took Kory back and they needed to save her? And you remember how he understood it was a war they were fighting and that they needed to do what they had to in order to survive it? And how when Gar told him he needed to control Kory, dick wondered if he even should try to stop her from killing her sister? And how he literally killed to save her (there’s some deniability but he’s literally hitting them with lasers described as deadly right in the head)? I do.

#something about dick doing this and understanding it’s war and war doesn’t always give you the choice to follow a moral code if you want to#live through it and make sure the one you love make it through too#and something about the change when the scenario called for it being oh so#similar to how Kory tried to pause her own teachings and relationship with combat while on earth#then despite knowing this was the type of battle Kory was raised for#the series had dick talking about how she was becoming more barbaric#and uncontrolled at times#when I think it would have been a much more interesting if they#instead chose to explore dick and Kory’s relationship with this “switch” or coming of age discovery + assimilation side by side#kory learning the balance of her heritage (she is tamaranian no matter what ) and her new life (she’s on earth and the battle there is#not the same solar system wide war she was raised to fight. The things she was taught are true for her home and her people but this is a#new home for her. a new beginning. a new life with new family. She is tamaranian and always will be but for now she’s on earth)#dick leaning to balance his past ( Bruce was his mentor and guide. he taught morality and ethics and all but gave him a what should you do#Guide during their years working together) and who he wants to be#(he’s not Bruce and what Bruce needs or thinks necessary doesn’t always ring true for dick too#he’s stepping into being his own man and part of that is forming his own views and opinions separate from his parent/mentor. Bruce will#never kill or let someone die if he can stop it. but dick? should he step in front of a bullet for a murderer over insuring someone else’s#safety first? his teammates? his families? he doesn’t know if that’s the kind of man he wants to be)#dc#dickkory#anyway#:)#does this make sense to anyone but my 5am running on two hrs of sleep brain#something about both of them being taught something by strict instructors#(the war lords and the bat)#and them learning#as all people have to#that most things are situational#new scenarios call for new things

26 notes

·

View notes

Text

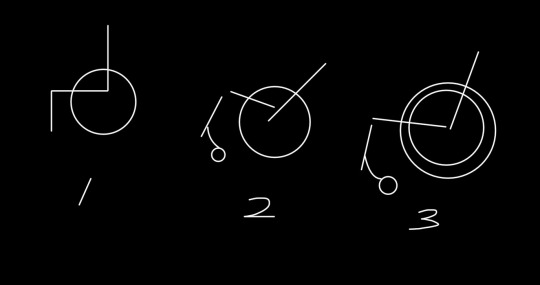

also. figured out (part of*) issue of why lean forward like shrimp in wheelchair despite very leaned back backrest

(* part where wheelchair mechanical issue anyway, imagine there body issue component too but no idea why body do it)

is because dump issue!!!!

[id: simple drawing of 3 wheelchairs. wheelchair 1 has straight back n straight seat & form 90 degree angle. wheelchair 2 have leaned back backrest which make back rest to seat angle more than 90 degree but back of seat is also lower than front of seat (has lots of dump). wheelchair 3 have bigger wheels represent by two circles instead of one, back rest is leaned back n angle more than 90 degree but no dump. end id]

so. standard is chair 1 right. everything straight & perpendicular & 90 degree. this make body sit like shrimp because need use core to make sure body stay up and well

so lean backrest back, make angle more than 90 degrees. then soon after, make dump bigger, so back of seat lower than front of seat. figure 2 exaggerated but something like that. this work because dump make sure gravity -> body actually lean back (i think)

but then got bigger wheels (like. still same 24 rim size, just wheels bigger bc have anti pop technology). erased much of dump. think body don’t naturally tolerate angle??

don’t know how explain. but is dump issue

but already at greatest dump current chair can naturally do. just erased by wheel

so thinking abt other ways to increase dump… or increase difference between front seat height vs back seat higher

maybe put in foam wedge under cushion?? but custom cut expensive

don’t recommend do this if you have other options lol imagine this create more issues but can’t really … get another chair

#🍞.txt#wheelchair user#file under: if tell ATP this they will again say you need new better configured chair at very least if not better type chair altogether but#alas insurance bs

37 notes

·

View notes

Note

you might have already answered this before but what’s the process of paying for your reduction been like? is any of it getting covered by insurance? I’ve wanted a reduction for so long but it seems so far out of reach

Well, I'm uninsured, and lost my beautiful dollars at the start of the year so for me, the process of paying for my reduction has been fundraising the money, and subsequently paying the full price for the operation.

#I haven't paid it yet. I put down a deposit for my surgery date#and I'll pay day of.#but yeah I am NOT the person you wanna ask. definitely go to some type of subreddit for this info#not the freelance artist w no money... not that bitch... don't ask her#sergle answers#in a way... insurance did cover 100% of the surgery. if we refer to my followers. as a group. as Insurance.

77 notes

·

View notes

Text

This tweet is 100% correct and fellow people with bpd are replying like "you say this like insurance covers DBT and isnt 350 a visit. also there isnt a specific medicine for bpd also its expensive. hope this helps 😍" and while yes that is partly true (theres definitely insurance that covers dbt because i know dozens of people who have insurance that covers dbt. For one) i think there is no price tag worth more than the relief of going into bpd remission. There are ways to get help that fit specifically you, and getting help is worth more than anything. BPD is a trauma based disease, coming from both generational trauma and lived trauma, and trauma therapy has made leaps and bounds in recent years. Medication can be used to treat symptoms so trauma therapy and DBT may be more effective for you. A life beyond the pain you've always known exists for you, and it wants you to be there

#Let me just state this: I'm currently in bpd remission and I come from a long line of literal psychopaths#I'm not even being dramatic there are people in my direct lineage that fit diagnostic criteria for serial killers#Trauma runs deep in my veins and ruled the majority of my life thusfar#The woman who created DBT had bpd even#that being said for some people treatment is just out of arms reach#something that I want to work towards in my life is getting my money up and going to school for psychology#and I want to create a new intensive type of therapy#I wont detail the plans here lol I haven't even reached some of the stepping stones i need to do that#But I'm hoping that its something that will provide relief to those who dont have insurance#If someone wants me to actually explain in depth how medication + therapy works for bpd i would love to explain because I've spent a huge#portion of these last 4 years researching it

11 notes

·

View notes

Text

hey

this post isn't very good news, and I'm sorry about that. My condition has been fluctuating in this past week and I fear it's taking a turn down again. On top of that, I've been trying to catch up with medical bills and dealing with the associated paperwork. Behind the scenes, fic editing has slowed down to a near halt because a lot of the fic ended up having to be rewritten last second. We're almost at arc 2 (this first arc isn't very big) and I have very little written for it; that is to say, I would've had to take a hiatus anyway to try building back up a buffer for it.

Since it was going to happen anyway (regardless of it happening now or later) I've decided to take a (hopefully small, god willing) hiatus now instead to focus on my health and the responsibilities I've been putting off, on top of editing the rest of arc 1 and building that buffer back up. I don't know exactly when fic posting will start up again, but I can only express that I don't want to be away for too long. I'll still be around for messages, and I'll try to post status updates as they come in (those will probably become the new weekly/biweekly posts instead of fic posts until I have enough fic to start posting regularly again).

#ANtics#important#i'm. not really happy at all that it's come to this but as i'm typing this my hands shake i feel nauseous and i keep getting hot flashes#ok the author curse is real. goddamn#i thought things were going back to normal and then they like... didnt. so hopefully some time away to focus on being niceys to myself-#in between insurance+hospital phone calls will actually allow things to return to normal... hopefully.#idealistically i don't see myself being away for longer than a month or two but you better believe i'm going to be doing everything i can-#to come back sooner so uh. cue hiatus. check back in a few weeks probably for a status update#and please please remember to drink water. it's summer now and it'll probably be the hottest one on record

10 notes

·

View notes

Text

i dont think i’m ever going to find a therapist that genuinely helps me

11 notes

·

View notes

Text

spent no less than 6 hours going insane about The Characters tonight lads

#this would be fine except i am supposed to be editing a real actual scientific paper type manuscript and not fanfiction#And Yet#ramblings#how do i teach my brain to Compartmentalize again#the answer is probably go back on adhd meds and baby im trying but the insurance system is thwarting me with everything its got

4 notes

·

View notes

Text

I’m discovering an important part of aging. If I have a problem that I’ve never found help for, I have to manually ask myself, “How long has it been since you tried?”

If it’s been 3+ years, there’s sometimes new tools or strategies or knowledge, and it is crucial for me to periodically check for new help for old problems. Otherwise I will just suffer needlessly. Even 1 chronic thing is fucking exhausting and it’s so cool to finally finally finally get it fixed, even if there isn’t help for all of my Health Stuff.

#this is kinda about dentist work and GI issues#when I was 18 I asked for the dentist to fix something and she said no. lol. she said it would probably fix itself and that the surgery for#it was frustrating for the surgeon and the patient and it was painful and tricky.#but I have dental insurance now and apparently after 8 years they now use lasers and it takes like 30 minutes and isn’t that bad!#also for my GI issues??? I’ve always struggled with the ‘eat more fiber’ advice because it never helps and often makes it worse#but recently! a doctor explained various types of fiber! and recommended I increase one and decrease the other! and I’m so bad at changing m#my diet so it’s a slow process to test out the advice. but so far it seems to be helping! either that or the slight improvement is coinciden#either is possible. but still! new knowledge! new strategies! new understandings of old strategies!#it’s really cool#soren learning to survive capitalism

66 notes

·

View notes

Text

I haven’t been on tumblr in over a week BECAUSE things have been HECTIC over here. There’s too much to get into rn but as far as today goes both Juni and Rory had surgeries today.

We have a new vet bc our old one missed too much with Juni and Rory and prolonged their illnesses because of it. That’s why Rory needed a second and now, two weeks from now, a third surgery. We are not mad at him, he is a good man. We just want our pets in more thorough care.

Thank GOD I got my backpay right before this all happened— can you imagine if I didn’t have any money rn?? I’m paying for both Juni and Rory (since Tyrell covered all my vet costs the last few years) and I don’t know the exact number rn but I know I’ve dropped at minimum $4880 on them over the last week. 😳 I feel so lucky that I was able to.

Half of Rory’s canine tooth was left behind, penetrating her sinus cavity. There were also two other teeth with exposed nerves that had to be removed today. They couldn’t get it all bc she started to get cold so they had to wake her up. So to finish up the last bit she’s going back in in two weeks, and they’re doing that one for free, thankfully.

Juni is perfectly healthy and now that the tumor is removed she might return to normal. That is, if it was a mast cell tumor. Original vet didn’t biopsy upon diagnosis so we don’t actually know until the biopsy from surgery comes back. It does behave like a mast cell tumor, though. But she’s also young. Either way, they got it all. They think her GI issues are either from the mast cell tumor, or from her allergies. So if they don’t subside after recovery then she has to do a more strict prescription diet trial.

Oh! Juni has insurance with a $700 deductible so we may be reimbursed for some of her expenses. Rory does not have insurance.

#Tyrell’s worried Juni’s insurance will take back their approval of the claim if it turns out it was allergies#But as of rn it’s still just as likely that it was from the tumor#can they take it back after they approve it? idk#we’ll see#regardless I’m just so thankful that this occurred while I could afford to cover it#there has been other stuff going on too but I don’t presently have the wherewithal to type it#things at home have greatly improved though#dogblr#catblr#Juni#Rory

7 notes

·

View notes