#warren buffett's advice

Text

Warren Buffett’s Advice for How to Making Money in the Stock Market – 2023

Warren Edward Buffett is an American business tycoon and investor. He has the best financial advice for the Indian stock market. if you want to invest in stocks so you look out for warren buffett's investment advice he is the best investor and has top stock Knowledge. Check the Bull vs Bear Market detail here!

#warren buffett's advice#warren buffett investment advice#Bull vs Bear Market#warren buffett stock advice#warren buffett financial advice#investors like warren buffett#bad investment#good stock#bull market#big bull of indian stock market#bear market#currently trading#online investment service#warren buffett top stocks#warren buffett best investments

1 note

·

View note

Text

3 notes

·

View notes

Text

“Knowing the edge of your competency is important. If you think you know more than you do, you will get in trouble”

Warren Buffett

#warren buffett#quotes#tips#motivation#business#inspiration#leadership#foryou#success#explore#trending#self improvement#follow#following#viral#customers#followers#fypage#decision making#advice#followforfollowback#followme#listening#thinking

2 notes

·

View notes

Text

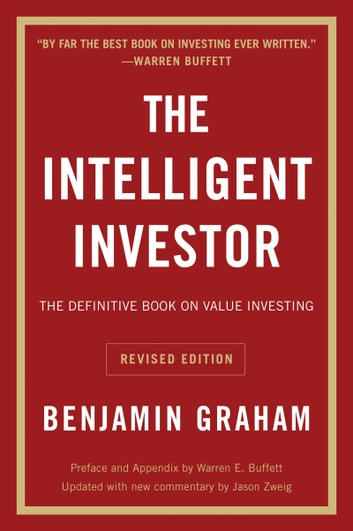

Unlocking Financial Wisdom: Insights from Benjamin Graham's "The Intelligent Investor"

If you're on a journey towards mastering the world of investing, one book stands out above the rest: Benjamin Graham's timeless classic, "The Intelligent Investor." Revered by many, including the legendary Warren Buffett, this book has served as a guiding light for countless investors seeking to navigate the complexities of the financial markets. In this blog post, we’ll delve into the key takeaways from Graham’s work, share some essential financial advice, and explore why this book could change your life too.

https://shorturl.at/pFCia

1. **Understanding Value Investing**

At the core of "The Intelligent Investor" is the concept of value investing. Graham emphasizes the importance of purchasing stocks that are undervalued and have the potential for long-term growth. This means looking beyond short-term market fluctuations and focusing on a company’s intrinsic value. By identifying stocks trading for less than their true worth, investors can build a robust portfolio that stands the test of time.

2. **The Margin of Safety**

One of Graham's fundamental principles is the "margin of safety." This concept revolves around investing with a buffer that protects you from unforeseen market downturns. By buying securities at a price significantly lower than their intrinsic value, you lower your risk. This approach is particularly crucial in today’s volatile markets, where uncertainty can lead to erratic price swings. Incorporating a margin of safety into your investments not only minimizes potential losses but also enhances your chances of achieving favorable long-term returns.

3. **The Importance of a Long-Term Perspective**

Graham advocates for a long-term investment strategy, which is a sentiment echoed by Buffett. In a world driven by instant gratification, it’s easy to get caught up in day-to-day market movements. However, successful investing requires patience and a steady hand. Graham teaches us that short-term fluctuations are often noise that can cloud our judgment. By adopting a long-term perspective, you can stay focused on your investment goals and ride out the market's ups and downs.

4. **Emotional Discipline is Key**

Investing can be an emotional rollercoaster, but Graham stresses the importance of maintaining emotional discipline. Fear and greed can lead to poor decision-making, often resulting in losses. By sticking to a well-defined investment strategy and avoiding impulsive reactions to market trends, you will be better positioned to achieve your financial goals. Remember, successful investing is more about temperament than intellect.

5. **Continuous Learning and Adaptation**

Graham believed that the investment landscape is always evolving. Therefore, continuous learning is essential for any investor. Reading books, following market trends, and staying informed about economic indicators will enhance your understanding and help you make informed decisions. "The Intelligent Investor" serves as an excellent foundation, but it’s essential to build upon that knowledge over time.

6. **Putting It All Together**

Warren Buffett famously referred to "The Intelligent Investor" as “by far the best book on investing ever written.” His endorsement is a testament to the book’s profound impact on countless investors, including himself. By embracing Graham’s principles, you can embark on a transformative journey toward financial success.

Incorporating the lessons from "The Intelligent Investor" into your investment strategy can lead to a more disciplined, informed, and prosperous financial future. Whether you’re a seasoned investor or just starting, this book is a must-read that will provide you with invaluable insights.

#intelligent#investors#finance#warren buffett#financial freedom#books and reading#self growth#motivation#reading#life advice#financial advice

0 notes

Text

youtube

Warren Buffett- You Only Need To Know These 7 Rules!

Are you looking for the key to success? Look no further than Warren Buffett the world’s most successful investor. In this video, we will explore the 7 rules of Warren Buffett’s that you need to know. Let's watch the entire video and learn about these rules in detail.

👉 Subscribe to my channel to stay tuned: https://bit.ly/4aXYMxD

From understanding the price versus intrinsic value to holding on for the long haul, Buffett's wisdom spans fundamental principles that have stood the test of time in the ever-changing landscape of finance and business. Learn how to seize great opportunities, stick to what you know, invest based on facts rather than emotions, and prioritize the integrity and talent of managers.

Join us on this journey through Buffett's philosophy and discover how his principles can guide you toward a more secure and fulfilling financial future. If you're ready to take control of your financial destiny and unlock the secrets of success, this video is very helpful for you.

Have thoughts, questions, or your own Buffett-inspired success stories? Drop a comment below and let's continue the conversation. Remember, smart financial decisions today lead to a more secure and fulfilling tomorrow.

#warren buffett#warren buffett advice#warren buffett motivation#warren buffett 7 rules of investing#warren buffett investment strategy#warren buffett 7 rules that you need to know#wealth building#financial education#warren buffett interview#how to invest like warren buffett#warren buffett rules of investing#money mindset#warren buffett how to invest for beginners#buffett#you only need to know these 7 rules#Youtube

0 notes

Video

youtube

7 Things the Poor Waste Money On: Warren Buffet's Advice

#youtube#In this insightful video we dive into Warren Buffett's expert advice on seven financial pitfalls that might be holding you back from achievi

0 notes

Text

#warren buffett#warren buffett advice#warren buffett interview#warren buffett investment strategy#warren buffett 2023#warren buffett stocks#warren buffett stocks to buy#buy and hold#warren buffett investing#how to invest like warren buffett#warren buffett portfolio#warren buffett speech#warren buffet#warren buffet buy and hold#warren buffets advice why you should buy and hold#warren buffett motivation#warren buffett stock advice

0 notes

Text

Life advice from the world's richest people

Warren Buffett, the world's best investor🌟.

He believes there are 3 things that are more important than anything else in life when it comes to investing.

Find out the top 3 lessons from Buffett and learn them for a better investing life.

1️⃣ Value investing: Value judgment first

Warren Buffett believes in value investing. He emphasizes the importance of accurately assessing a company's value when investing. It's all about comparing a company's intrinsic value to its market value by thoroughly analyzing its performance, financial condition, and competitiveness💼.

2️⃣ Patience: Time is your friend in investing

Warren Buffett's favorite strategy is to invest in companies with high growth potential and hold on to them for the long haul🌱 It's important to be patient and watch them grow over time as they prove their worth over time.

3️⃣ Active Investing: Seize the Opportunity

Warren Buffett believes in investing aggressively when opportunities present themselves💡 However, he emphasizes that it's not a matter of blindly investing, but rather seizing opportunities and acting prudently within your means.

Remember to invest in value, be patient, and be aggressive, and we wish you success in your investing life.Put his advice into practice and become a better investor🌟.

#warren buffett#value investing#patience#active investing#get rich quick#corporate values#investment philosophy#life advice#secrets to success

0 notes

Text

10 Best Warren Buffett Money Advice 2023

(10 Best Warren Buffett Money Advice 2023) Warren Buffett is arguably the best-known, most-respected investor of all time. Buffett is also known for his folksy charm and his memorable quotes about the art of investing.

When you’re aiming to reach the top of the mountain, it’s usually wise to closely follow the footprints of those who have successfully made the climb before you. Your odds of investing success can increase exponentially if you learn and apply Buffett’s best investing tips.

0 notes

Photo

💸Best WARREN Buffett Advices On Investing Money💸💰 SUBSCRIBE our youtube channel for More BUFFET'S Quotes. HERE 👉: https://youtu.be/tdXBlrXPfSU #warrenbuffett #warren #buffett #advices #warrenbuffettquotes #warrenbuffetquotes #warrentbuffet #warren_buffett #warrentbuffett #warren_buffet #warrenbuffettquote #buffettvminimalis #warrenbuffettwisdom #buffetlivre (at New York, city) https://www.instagram.com/p/Ci7m2SKPjV7/?igshid=NGJjMDIxMWI=

#warrenbuffett#warren#buffett#advices#warrenbuffettquotes#warrenbuffetquotes#warrentbuffet#warren_buffett#warrentbuffett#warren_buffet#warrenbuffettquote#buffettvminimalis#warrenbuffettwisdom#buffetlivre

0 notes

Text

WHY INVESTING IN YOURSELF WILL CHANGE YOUR LIFE

"The best thing you can do is to be exceptionally good at something," said Buffett. He added, "Whatever abilities you have can't be taken away from you. They can't actually be inflated away from you. ... So the best investment by far is anything that develops yourself, and it's not taxed at all."

- Warren Buffet

There is a reason people call Mr. Buffet the "Oracle/Sage Of Omaha".

Not only he is great at asset management and making the right predictions when it comes to the financial markets, but he is also very wise and offers great advice.

Investing in your own self is the only type of investment you can make that is absolutely safe and guaranteed to give you a return on investment that would satisfy you.

Knowledge is fuel. You are the vehicle.

We are living in times of abundance. Knowledge and data curation is the hottest skill someone can learn right now. That's what AI models like ChatGPT do. They curate useful data from trash. That's what you should also do with your mind. Throw out what's hindering your growth and feed your brain with nutritious food for thought.

We are nearing the "Age Of Abundance", the Golden Saturnian Age of our times. Don't fall into oblivion.

The resources are within a finger's reach. You are actually holding the most precious asset in your hands right now, that's how I reached you.

Whoever takes advantage of this situation will succeed.

Read books, articles, essays. Watch videos and documentaries. Educate yourself for free. If you have the ability to get a university degree for free, do it ! Don't fall in the trap of "degrees are useless". Instead choose to educate yourself in subjects that interest you and make you even more savvy. Invest in evergreen skills. Learn content creation, marketing and money management. Study philosophy to learn the art of critical thinking.

In the next 10 years we will all transform from 9 to 5 slaves to freelancers and one-person businesses. This is where we are headed. Notice all the lay-offs and how artificial intelligence has taken the world by storm.

Be proactive.

#finance#level up journey#leveling up#leverage#level up#investment#essay#source:thesirencult#hypergamyblr#seduction#tarot reading#ai#business#entreprenuership

378 notes

·

View notes

Text

Below is a piece on mating psychology I wrote for Onn Health. It is aimed primarily at (heterosexual) men, yet the insights offered here are broadly applicable to everyone.

The two most powerful predictors of happiness and life satisfaction are working in the right profession and finding the right spouse.

You can commit a lot of blunders in your life, but if you manage to get two things right, you will maximize your chance of long-term wellbeing.

Our choice of job and our choice of spouse are central to our happiness because they are where we spend most of our lives—at work and with our families. Therefore, we should devote a good deal of time concentrating on how to make the best possible decision for these two sources of potential happiness. Indeed, making the wrong choice can lead to potential misery.

Interestingly, much of modern advice prioritizes education and career, often relegating relationships to a secondary concern or valuing them primarily for their potential to enhance career ambitions.

Relationships, though, are critical for our health and wellbeing. Studies have found that the effect of poor relationship quality on mortality is as strong as the effects of better-known risk factors, such as smoking and alcohol use, and even stronger than other important factors, such as sedentariness and obesity.

For those who are focused on their careers, choosing the right partner can fuel occupational success. For instance, people with conscientious romantic partners tend to report higher job satisfaction and income, and are more likely to be promoted. This pattern held even after controlling for the study participants’ own conscientiousness. A disciplined and hard-working romantic partner can help us succeed in our own careers.

Indeed, there are examples of well-known men and the women who have helped them in their journeys:

Mr Beast:

“I have someone who I think is very beautiful, very intelligent, makes me better, is constantly pushing me, is okay with me working hard, makes me smarter. And just all these different things. For me, love just makes me a better person.”

Connor McGregor:

“My girlfriend worked very hard throughout the years and stuck by me when I had essentially absolutely nothing. I only had a dream that I was telling her.”

Chris Bumstead:

“She just built this confidence in me… It was a really important moment for my personal growth, champion growth, relationship growth.”

Warren Buffett:

“Susie really put me together. She believed in me. She got me to believe in myself, and that changed my life.”

“And I would not only have not turned out to be the person I turned out to be, but I actually wouldn’t have been as successful in business without that. She made me more of a whole person.”

These examples show only one side of the story. In healthy relationships, both partners are expected to receive net benefits and grow.

Research in evolutionary and social psychology has illuminated key findings that help us to understand how people choose mates, as well as the factors that predict relationship success.

George Vaillant, former director of the multigenerational Harvard Study of Adult Development, has noted that “warm, intimate relationships are the most important prologue to a good life.”

Warm relationships supply benefits to both happiness and health.

How do people go about choosing mates? In popular culture, we often hear two different adages when it comes to relationship formation: Opposites attract, and birds of a feather flock together.

The former might make for a good romantic comedy. But in the real world, people tend to mate assortatively. We generally favor romantic partners who are similar to ourselves.

This is especially true for education and intelligence. In the U.S., for example, if your highest level of education is a high school diploma, your probability of marrying a college graduate is only nine percent. In contrast, if you hold a college degree, your probability of marrying a fellow college graduate is sixty-five percent. Interestingly, though, couples’ similarity in intelligence does not seem to predict relationship satisfaction.

Beyond education, we also tend to choose romantic partners who are similar to ourselves in terms of age, political orientation, religious affiliation, and socioeconomic status.

Does similarity predict stronger relationship satisfaction? The answer seems to be no. A meta-analysis concluded that “similarity had very little effect on satisfaction.” This doesn’t mean, of course, that similarity is meaningless for romantic satisfaction. More likely, similarity is necessary but not sufficient for romantic satisfaction. That is, while similarity does not guarantee relationship satisfaction, strong dissimilarities might be “deal-breakers” that would contribute to discontent. Your romantic partner holding the same political beliefs as you doesn’t necessarily mean you’ll be 100% satisfied with each other; but if they take the opposite stance on every view you hold, there’s a strong chance that relationship wouldn’t last very long.

So what does predict relationship satisfaction?

One factor seems to be authenticity. A team of psychologists found that the link between authenticity in relationships and relationship satisfaction is very strong. For instance, people who strongly agreed with statements such as “I share my deepest thoughts with my partner even if there’s a chance he/she won’t understand them” reported being particularly happy in their relationships. Interestingly, the study found that authentic people tended to mate with other authentic people, whereas deceptive individuals tend to attract deceptive partners. This seems to be another example of assortative mating, whereby people find themselves in relationships with partners similar to themselves.

What else besides authenticity predicts relationship satisfaction? A 2016 paper in Evolution and Human Behavior, authored by Daniel Conroy-Beam, Cari D. Goetz, and David Buss explored what makes people happy in their relationships. They discovered that people were less satisfied in relationships when their partners were less desirable compared to other potential choices. However, this was specifically the case for individuals who were more attractive than their partners. That is, people were satisfied with mates who were either more attractive than themselves, or more attractive than alternative choices. In short, when people were with partners who were attractive and hard to replace, then they were more likely to be satisfied. It seems that people aren’t asking themselves, “Does my partner fulfill my relationship needs?” Rather, they ask “Is my partner better than the realistic alternatives?” We aren’t gauging on some objective rubric. Rather, we grade our partners on a curve, comparing them to others we could reasonably hope to pair with.

This gets to the question of how we should approach searching for a compatible mate. An important idea from decision theory that can assist with this is known as the 37% rule, or “the secretary problem.” Suppose you’re looking for the best candidate for a secretary position (or any other job). The rule says that you should estimate how many total applicants are likely to seek the position, interview the first 37 percent of them, and remember the best out of that initial sample. Then, continue interviewing until you find a candidate who is even better than that. Once you find that better candidate, hire him or her. That is how you select the optimal candidate.

The problem with this rule is that it takes a lot of time and energy, especially if you are faced with a large number of possible candidates. You can’t realistically date 37% of all women you might possibly be interested in, and then keep going until you find someone more compatible than the best in that batch. However, researchers have found that a similar rule called “Try a Dozen” can work just as well as the 37% rule. According to this simpler approach, you would date a dozen possible romantic partners, remember the best of them, and then pick the very next prospect who is even more appealing to you. Of course, this is just a theoretical model that sheds light on the challenges of trying to optimize a difficult decision. It has many shortcomings and is not necessarily applicable to all individuals in all circumstances.

Many men try to get the hottest possible partner they can find. But this can present its own problems. As David Buss has said, “Mates, once gained, must be retained.” An average guy might manage to get a few dates with a supermodel. But the supermodel’s array of potential alternative options can introduce potential instability into the relationship. This can lead to jealousy, increased mate guarding, warding off potential romantic rivals, increased stress, heated arguments, and so on.

Of course, the reverse is not ideal. Entering a relationship with someone who is noticeably less attractive than you can give rise to dissatisfaction, conflict, and a wandering eye as you consider possible alternatives. The ideal situation, as Buss says, is “when both people feel lucky to be with the other person.” Of course, if your current pool of mates you could reasonably hope to attain is less attractive than you’d like, there is a simple option: Become more attractive yourself. For appearance, keep up on personal grooming and hygiene; improve your health and fitness; buy clothes that are stylish and fit well; get a good haircut. As a man, you can also level up your attractiveness by earning a promotion at work, switching to a higher paying position, or seeking a cool side job (bartenders, musicians, and volunteer firefighters don’t get paid like surgeons but still appeal to many women).

Many people have noticed that young people are unrealistically expected to know what career they will pursue at the age of 18 or 22. Seldom does anyone point out that the same logic applies to long-term romantic commitment. Interestingly, while there is a lot of guidance for how to choose a good career, far less support is available for choosing the right spouse.

Choosing a mate is not just choosing a mate. It’s also casting a vote for who you will be and who your children will be. [...]

Mate choice also profoundly influences children. If you have kids, your partner’s genetics will significantly influence their intelligence (at least 60% heritable), personality traits (more than 40% heritable), and mental health (more than 30% heritable). And as I cover extensively in my book, healthy, stable relationships benefit children. Having a partner who contributes to such a relationship will be instrumental in your child’s development and wellbeing.

Given the importance of marriage in a man’s life, it is crucial to choose a compatible spouse. Knowing which qualities to avoid and which to seek out can save you from future emotional and perhaps financial ruin.

People often focus on attributes they would like in a partner, but it is perhaps even more important to know which characteristics to avoid. “Red flags,” in common parlance. [...]

Smith offers a quote in another of his books, The Tactical Guide to Women, “Look for the red flags early in the relationship. If anything pops up early on, don’t let that slide. Most people are on their best behavior in the beginning. They hide it well until around the six-month mark. For example, if she gets drunk and is screaming at you for no reason within the first month, run as fast as you can. Don’t let something like that slide. There are underlying issues there.” This doesn’t mean that they are a bad person or unworthy of love or anything like that. But drinking and yelling is a sign that such a person might not be ideal for a long-term relationship commitment.

What about beneficial traits, or so-called “green flags?”

Smith suggests seeking clarity, maturity, and stability in a potential mate.

Anybody can communicate well when they and the relationship are at their best. Clarity, though, encompasses reliable communication and the ability to communicate during stormy periods. [...] Good relationships require that both partners express themselves constructively, especially during times of stress.

Relatedly, inquisitiveness is an important skill. It cuts through ambiguities and insecurities. Within a relationship, if one person behaves in an insensitive manner, a sign of inquisitiveness would be if his or her partner, rather than expressing anger, calmly asks why and listens. This can open the path to communication and understanding, rather than mutually escalating hostilities. [..]

Emotional maturity is another green flag. Some signs of this skill: She can calm herself when she’s sad or angry, she accepts reality, she keeps commitments, she takes care of relationships and doesn’t burn bridges, she bases important decisions on values rather than impulse, and she possesses the emotional resources to function well among coworkers, family, and friends.

Stability, another positive quality, indicates that a woman handles her personal challenges and cares for herself so that her life (and yours) isn’t a series of crises. As Smith puts it, a woman “who is unwilling to strive for her best state of mental health is unlikely to succeed in relationships.” [...]

This perspective on relationships underscores the importance of mutual support and shared growth. The notion of the “special woman” and “special man” transcends the conventional understanding of romantic partnerships, emphasizing a deeper, more harmonious connection. This link is not solely about love or attraction or sex; it is about finding a partner who understands, encourages, and participates in your life journey. Such a relationship becomes a crucible for personal and professional development, where both individuals are not just companions but co-architects of a shared future.

3 notes

·

View notes

Text

indian stock market

Title: Navigating the Stock Market: A Beginner's Guide

Introduction

The stock market is a dynamic and complex financial ecosystem where investors buy and sell shares of publicly-traded companies. It's a place where fortunes can be made and lost, but understanding the fundamentals can significantly reduce the risk associated with investing. In this beginner's guide to the stock market, we'll explore the basics, terminology, and strategies to help you embark on your investment journey with confidence.

Chapter 1: What is the Stock Market?

Definition: The stock market is a marketplace where buyers and sellers trade ownership in companies through stocks (equity).

Historical Perspective: Learn about the origins and evolution of stock markets.

Types of Stock Markets: Understand the differences between major stock exchanges (e.g., NYSE, NASDAQ).

Chapter 2: Stock Market Participants

Investors: Discover the various types of investors, from individual traders to institutional investors.

Public Companies: Explore why companies go public and what it means for investors.

Regulators: Learn about the regulatory bodies that oversee stock markets.

Chapter 3: Stock Market Basics

Stocks and Shares: Differentiate between stocks and shares and understand their value.

Market Indices: Discover how indices like the S&P 500 and Dow Jones work.

Market Orders: Learn about market orders, limit orders, and stop orders.

Trading Hours: Know the opening and closing times of stock markets.

Chapter 4: Investment Strategies

Long-Term Investing: Explore the benefits of buy-and-hold strategies.

Day Trading: Understand the fast-paced world of day trading.

Value Investing: Learn about the principles made famous by Warren Buffett.

Risk Management: Discover strategies to mitigate risk and protect your investments.

Chapter 5: Analyzing Stocks

Fundamental Analysis: Evaluate a company's financial health and performance.

Technical Analysis: Study price charts and indicators to make short-term predictions.

Sentiment Analysis: Understand how market sentiment can affect stock prices.

Chapter 6: Diversification and Portfolio Management

Diversification: Learn how to spread risk by investing in various asset classes.

Building a Portfolio: Explore the process of constructing a well-balanced investment portfolio.

Rebalancing: Understand the importance of periodically adjusting your portfolio.

Chapter 7: Tax Implications and Regulations

Capital Gains Tax: Discover how profits from stock trading are taxed.

IRA and 401(k): Learn about tax-advantaged retirement accounts for long-term savings.

Chapter 8: Common Pitfalls and Mistakes

Overtrading: Avoid the urge to make excessive, impulsive trades.

Ignoring Research: Stress the importance of thorough research before investing.

Emotional Decision-Making: Learn to manage emotions when making investment decisions.

Chapter 9: Staying Informed

Financial News: Keep abreast of financial news and its impact on the market.

Investment Resources: Explore useful websites, books, and forums for learning and advice.

Conclusion

The stock market can be an exciting and rewarding place for investors, but it's crucial to approach it with knowledge and a well-thought-out strategy. With a solid understanding of the basics, a clear investment plan, and the discipline to stick to it, you can navigate the stock market and work towards achieving your financial goals. Remember that, like any other endeavor, successful stock market investing takes time, patience, and continuous learning.

2 notes

·

View notes

Text

youtube

Unlocking Wealth: Warren Buffet Speech Will Change Your Financial Future

Discover the secrets to financial success with Warren Buffett's timeless wisdom! In this video, we break down Buffett's insightful speech that can revolutionize the way you think about wealth, success, and personal growth. Let's watch the entire video and learn more about how Warren Buffet's speech will change your financial future.

👉 Subscribe to my channel to stay tuned: https://bit.ly/4aXYMxD

In today's video, we learn a thought-provoking speech by the legendary Warren Buffet, a beacon of financial acumen. Prepare to be inspired and empowered as we uncover the key principles that can reshape your financial future.

We can also learn how to maximize your earning potential, make smart financial decisions, and cultivate admirable qualities for long-term success. Gain invaluable insights on avoiding credit card debt, choosing a fulfilling career, and prioritizing personal integrity.

Warren Buffett's transformative speech, where he unveils the key principles that can reshape your financial destiny. From understanding the true value of your future earnings to prioritizing personal development and integrity, Buffett's advice offers a roadmap to sustainable wealth and success.

Whether you're a seasoned investor or just starting your financial journey, this video is for you and strategies that can help you build a solid foundation for financial stability and prosperity.

If you're ready to take charge of your financial future and unleash your full potential, don't miss out on this empowering discussion. Like, subscribe, and hit the notification bell to stay updated on our latest content. Let's embark on this journey to financial freedom together.

#warren buffet speech#warren buffett#en buffettwarren buffett investment strategy#warren buffett investment#wealth building#warren buffet speech will change your financial future#you can become rich#warren buffett financial advice#warren buffett's transformative financial wisdom#financial education#money management#warren buffett motivational speech#Youtube

0 notes

Text

Warren Buffett secret books to Generational Wealth!!

"Welcome, book enthusiasts and investors! Today, I would like to introduce you to some of the most valuable books on investment and wisdom by the legendary investor, Warren Buffett. These books will provide you with valuable insights and guidance to make better investment decisions and build financial success. Let's take a closer look!"

The Intelligent Investor by Benjamin Graham

First up, we have the timeless classic 'The Intelligent Investor' by Benjamin Graham, who was Warren Buffett's mentor. This book is an investment bible that has inspired generations of investors worldwide. It teaches you the value of being a smart and patient investor."

Graham focuses on identifying undervalued companies and investing for long-term success. He teaches you to think like a businessperson, evaluate fundamental values, and build a diversified portfolio. 'The Intelligent Investor' is an indispensable tool for any serious investor."

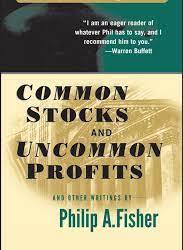

Common Stocks and Uncommon Profits" by Philip Fisher

Next on the list is 'Common Stocks and Uncommon Profits' by Philip Fisher, also a favorite of Warren Buffett. Fisher takes you on a journey through his unique approach to stock investing. He focuses on finding companies with exceptional growth opportunities and long-term values.

Fisher emphasizes the importance of thoroughly understanding the business and its management. He shares valuable perspectives on assessing competitive advantages, product quality, and long-term growth prospects. 'Common Stocks and Uncommon Profits' will help you identify companies that can lead you to financial success."

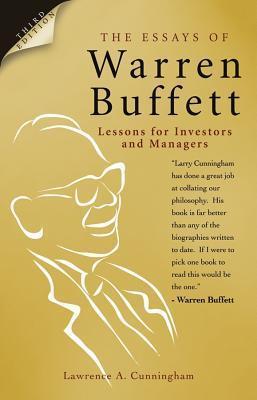

The Essays of Warren Buffett: Lessons for Corporate America" edited by Lawrence A. Cunningham

"Lastly, I would like to introduce 'The Essays of Warren Buffett: Lessons for Corporate America,' which is a collection of Buffett's own letters and essays to Berkshire Hathaway shareholders. This is a unique opportunity to learn directly from the master himself."

"The book provides unique insights into Buffett's investment philosophy, ethics, and long-term thinking. You will learn about his approach to valuation, risk management, and how he builds and manages successful companies. 'The Essays of Warren Buffett' is a goldmine of wisdom for anyone aspiring to become a better investor and business leader."

Today, I have presented you with three books that are essential for any investment enthusiast and business-minded individual. These books, including 'The Intelligent Investor' by Benjamin Graham, 'Common Stocks and Uncommon Profits' by Philip Fisher, and 'The Essays of Warren Buffett' edited by Lawrence A. Cunningham, will equip you with valuable knowledge and perspectives to navigate the complex world of investments."

"Whether you are an experienced investor or just starting your journey as an investment enthusiast, these books will provide you with insights from some of the greatest minds in the investment world. Through their wisdom and experience-based advice, you will learn to make informed decisions, evaluate companies thoroughly, and build a solid portfolio."

"Don't miss the opportunity to benefit from decades of investment wisdom collected within the pages of these books. Take control of your financial future and take the first step towards building your path to financial success."

"Purchase these books today and let them be your guide to becoming a smarter and more successful investor. You can find them at your local bookstore, online, or in electronic format. Don't postpone your journey to financial wisdom – start today!"

youtube

#moneymaking#working#profit#financial#income#books#reading#book review#warren buffet quotes#warren buffett#coinbase#binance#krypto#stockexchange#trader#mining#Youtube

2 notes

·

View notes

Text

The F.A.L.L. List - August 22 - November 22

May I present: the FALL list! FALL is my latest seasonal booklist, short for Financial And Life-skills Literacy, which delightfully forms an acronym that matches the season! I really wanted to focus on developing my Being a Better Adult Skills this fall, so I made this short list to help keep me motivated on my quest! All of these were chosen because, according to reviews, recommendations from friends, and pre-existing booklists, they offer some tidbits of wisdom or advice on how to be a better adult (or human!).

Take Care of Your Type: An Enneagram Guide to Self Care by Christina S. Wilcox

Ascent of Money: A Financial History of the World by Niall Ferguson

The Best Investment Advice I Ever Received: Priceless Wisdom from Warren Buffett, Jim Cramer, Suze Orman, Steve Forbes, and Dozens of Other Top Financial Experts by Liz Claman

Rich Dad Poor Dad by Robert T. Kiyosaki

The Power of Habit: Why We Do What We Do in Life and Business by Charles Duhigg

The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing by Marie Kondo

Grit: The Power of Passion by Angela Duckworth

Bonus

Becoming Better Grownups: Rediscovering What Matters and Remembering How to Fly by Brad Montague

Books in orange font are those that I’ve already read during the challenge period (I started on August 22), and books in purple are ones I’m currently reading. I’m a bit late in posting this, but I’m closing it out on November 22nd, so I wanted to share while I still have a bit of time left with the list!

#FALL#fall of financial and life skills literacy#financial and life skills literacy#2022 booklist#trying my best#I think I’m gonna start posting some of the many many booklists I create

7 notes

·

View notes