#yes momentum as in THAT really important physic quantity

Text

Once again i did notes (for my fics) instead of working on the very important work i have to do but this time its ok because i meant to take off today and rest anyway.

and besides i did something i had always wanted to do since fricken 2019!

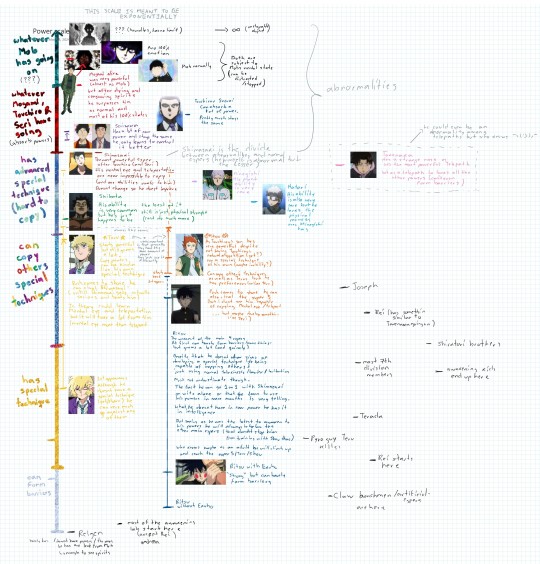

I DID A POWER SCALE FOR THE MP100 ESPERS!!!

As you can see im still missing the 7th division claw members and the awakening lab kids (and others) buts its ok because i did the most important ones!

(also those missing are all around the same level anyway)

As i watched mp100 I ve always classified the espers in 5 categories(excluding mobs own) depending of their abilities in my mind which i put on the side and also they way i understand their powers (aka telepaths/seers/spiritists behaving differently)

(or at least the way i see all of this)

i included notes explainning why i put them the way i did (good luck understanding them) and even how their powers grew during the story!

even thought ive had this cale in my mind for years i never realized how much ritsu grows in it! (even though i did him so dirty lmao)

i made this mostly as a handy reference for myself but if you want to use it feel free to do it (ñ

or to askme if you are curious about anything!

... Except why Teru and Shou got extra lines... I don't even know it myself I just know they make sense

(I think besides their first appearance im also marking their status as of the world dominatiom arc and at the end of the story (dotted lines are the leaves they reach when pushed to their limits... Not recommended))

dunno when ill get to finish this but when i do it ill update it here or maybe in another post and link it... who knows

Edit: although I named the zone "can copy others special techniques" it doesn't necessarily has to be copied.

That zone actually is "can use more than 1 specialized technique".

I put "copy" because I believe each techquine is innate to some psychic somewhere and while yeah you could come up with a technique on your own different than the one you already have I think it's easier to do it once you see someone else doing it. Aka easier to copy techniques than to create them yourselves.

Copying techniques isn't that easy either (remember the scale is exponential) which is why Teru being able to do it on the spot is so remarkable and says a lot about his level of power.

#mob psycho 100#mp100#nie's writing#the lines on the side indicate where exactly on the scale the charcters fall#i havent had the chance to talk about it on my fics like i wanted but ill mentiont it quickly here#the reason why shimazaki powers are so unique or at least mental eye is its because as the nerd i am i decided shimazakis powers is#literally sensing the momentum of things#yes momentum as in THAT really important physic quantity#my man here could detect a photon (aka see) if he focused hard enough#that of course would require him to shut down others stimulus which isnt that great#but the point is he COULD do it#he is that powerful#thats why in my super 5 bullet fic hes so good at weighing stuff#he can detect the slightest change in momentum (momentum is related to both velocity and mass and energy and PFFFFT)#and thats also why his ability would be very VERY HARD to copy and why i consider he is also an abnormality#but a tiny one (compared to mob and the others)

37 notes

·

View notes

Text

For @broimbi because their continued interest in By Lost Ways keeps me engaged, and prompted this slight detour into the notes of Roy on the trick behind crafting magical arrows. Not totally one hundred percent sure I’m ‘canonizing’ this as officially part of the story’s backstory, but it is all set before the start of it, and mostly just a humorous exploration of the magic. You don’t really need prior knowledge of DC to follow along, or even the story itself, as the important stuff all gets recovered in his own words anyway.

The notes of one Roy Harper on the magic-science of feathercrafting and fletching:

Herein lies everything I’ve uncovered, experimented and surmised on the subject of using magical feathercraftings in pursuit of archery. For posterity, see. So that future generations can bask in the brilliance of me.

Hey, that rhymed.

Now of course, people have been used feathercrafting to make arrows with special properties for centuries. But I always felt, from a very young age, that there was so much more to the artform than had been discovered so far, and so many more secrets within the Deck, specific to archery, just waiting to be unlocked. And thus began my own lifelong quest to seek out and uncover those mysteries, and leave my own mark upon the art of feathercrafting arrows.

It had nothing to do with me being bored, and anyone who says otherwise is a liar who should be ignored. Especially if their name is West.

To start off, a lot of feathercrafting is self-explanatory, when it comes to making arrows....sure, everyone knows that most feathers have more than a couple different properties, but arrows themselves tend to be a lot more finite in function, and thus there’s only so many ways - and so many reasons - for which people would modify them with feathercraftings. Thus any time you use feathers of all the same kind when crafting an arrow - say, much like you would if you were making a non-magical arrow - you’re pretty much only going to get one magical effect.....though that’s usually all you’re looking for.

So whether you use three or four feathers, it makes no difference if they’re all of the same type. Any arrow made with seagull feathers, for example, is made with distance in mind....to channel the magical properties of the Regent of Distance, and thus magically extend an arrow’s flight. Arrows made with sparrow feathers, its opposing Regent force, are looking to reduce distance, with such arrows often being utilized over the centuries by so-called snipers....the magic of their sparrow feathers ‘eating up’ the distance they cross at a much greater rate than they would non-magically, with gains made here to accuracy, impact, etc. But I’ll get back to that.

But similarly, tanager feathers are pretty much all you need for an incendiary arrow, something you just want to ignite upon impact, while canary feathers have long been used to make the kind of arrows West calls screamers, which is reason number five hundred and ten why he’s never allowed near my workshop. And also shouldn’t be allowed to speak, ever. Or at least not in civilized company. No, I had it right the first time, ever. Gotta trust my instincts.

So, that’s all pretty much a given. And when you use three different feathercraftings of all different kinds in your arrow, you suddenly get a lot going on all at once, unlocking a lot of interesting combinations, but its still fairly straightforward. All three feathercraftings lend their magic simultaneously, working in concert either in flight or upon impact, or at least not at odds directly. Unless two of those feathercraftings are of opposing Regents, at which point their magic will just cancel each other out, but why would you even do that, that’s stupid and wasteful, what’s the point. Opposing regents act in opposition to each other. They’re opposites. Everyone knows that, duh.

Unless....hang on, just had a thought.

Okay so technically, because its not like opposing Regents cancel each other out completely, or completely negate each other and the forces they embody, and in fact according to legend and acts of ridiculousness as witnessed by me, watching my best friend the Robin Regent be ridiculous, like when you consider that in a lot of ways and times and places the Regents and their respective forces are meant to act as limiting agents upon each other, not negating ones......okay, so theoretically, there could be purpose to combining, say, sparrow and seagull craftings to the same arrow, if you were able to in some way quantify how much their magic acts upon each other, and thus calculate say.....how to combine sparrow and sea gull feathers in such a way as to get a precise distance as an end result, with the sea gull feathers magically increasing the length of the arrow’s flight, but the sparrow feathercrafting being precise enough in....diluting the sea gull feathercraftings, for lack of a better word, that it ensures the arrow doesn’t overshoot its mark but rather while enhanced in distance, still is limited in how enhanced it is and thus can still strike a far off target with precision. Obviously, there wouldn’t have been much point to this line of thought in ages past because the greater issue here is there’s not much point to an arrow that flies significantly further than you can aim anyway, but with advances in telescopics and magnifying lens, that’s no longer the given that it once was, which means.....

Hang on notes, and by notes I mean self, and also future audiences of fans legion in number.....I’m about to go revolutionize the entire art of feathercrafting arrows!

****

Okay, after a looooot of experimentation, and I do mean a lot, I have concluded that yes, my idea here has merit, and no, I’m probably not the first to think of it. But rather, the reason its not a known thing practiced the world over is because getting the mitigating effects of one Regent’s feather upon another in arrow-making, like, requires precise calculations that are dependent on a math and units of measurement that I don’t think have been invented yet? Like, to do what I’m trying to do, or make it happen reliably rather than sporadically, one first has to have some system of measuring the magical forces embodied and contained within each feathercrafting, and so manipulate and cultivate the feathercraftings via their size, shape and combination, in such a way as to result in the precise magical output without getting in the way of the fletchings enabling the arrow’s flight in the first place, rather than hindering it. Its that last part that’s really the sticking point....obviously, people combining feathercraftings and manipulating their magical output via the shaping of the feathers themselves...this is something that’s been done in all sorts of ways in all parts of society throughout civilization....but usually its considered to be more of an art than a science. Something without hard and fast rules, something most feathercrafters say is more a matter of feel and intuition rather than looking to engineer - and replicate - precise results with each and every crafting. But archery doesn’t allow for that kind of thing.....it’s physics, its momentum and force and angle and lift and drag and all kinds of things that require knowing exactly what you’re working with when you notch each arrow to your string, otherwise, might as well shoot yourself in the foot. Its just not something that’ll work, at least not in any worthwhile way, without having that science for reliably combining feathercrafted fletchings in known ways, to act as a known quantity on the magical output.

So, guess I’ll have to admit defeat.

Orrrrrrrr, I’ll just have to invent that myself!

Ding ding ding, the roar of the crowds have it, the decision has been made, option two is the clear winner!

*****

Endless months, feathers, arrows and “you look so dumb right now, haha I love it”s from West later.....the secret to this still eludes me.

Whatever. I’m not bitter about it. I’m not.

I’ve figured a lot else out in the meanwhile, anyway, and I’m getting the hang of tricks no other archer I know of has even imagined. That I mean, I know of, anyway. Maybe they exist. Who cares, I’m still at the cutting edge of my field here is the point.

So, the mixing and matching of feathercraftings from two different Regents who aren’t in opposition, and thus whose magic can only add to each others.....

Turns out, there’s a lot more to even just that, than I ever imagined.

Looking back through the notes that were definitely a good idea to keep even if they’d probably be a more useful idea if I learned to remember to add to them more often, I see at one point I was about to expand upon what happens when you have three feathercraftings of all different types combined in one arrow. Well, as I said then, that’s not really a new idea either, so most everyone already knows how that works. As long as none of the three are from opposing Regents, they each by default seem to exert the same magical influence on the arrow, whether in flight or upon impact depending on the nature of each feather and their magic.

Say you take a dove feathercrafting, and an owl, and a seagull.....the seagull’s magic is naturally predisposed to arrow flight, being that of the regent of distance - unless there’s some way to tweak or delay the activation of its magic to ensure it doesn’t release until impact, and thus ensures it’s magic will actually be spent in some way upon its target, though not sure what you’d be looking to do to a target with distance magic, still, food for thought maybe, hmmm -

Where was I? Oh right. So the seagull feathercrafting is by default inclined to exert itself on an object in motion - such as the arrow in flight - and enhance the distance it travels. The dove feathercrafting, by contrast, is inclined to exert itself upon impact, with most dove-crafted arrows being termed things like ‘shockers’ by morons such as West, who are way too responsible for way too many of our colloquialisms in society, something really should be done about that, but delivering electrical shocks upon impact, channeling electricity in some way....or as people in past centuries often termed it, channeling lightning.

But I mean, you never know.....more than one place has a legend or story of arrows that ‘call the lightning’ and while a lot of people just tend to assume that was their ‘uneducated’ way of describing the electricity-generating properties of a dove-crafted arrow shocking someone it struck....given what we know these days about so-called electromagnetism, and the relationship between electricity - even in the form of lightning - and magnetism, specifically magnetic metals and alloys.....what if those stories weren’t just talking about your basic ‘shocker’ arrows at all? Imagine a battle that was say, taking place during a storm, and a dove-crafted arrow that upon impact didn’t just release an electric jolt of its own into its target....but rather acted as a kind of superconductor that was basically like a magical lightning rod, calling the next lightning bolt to zero in on it specifically? Now that’s what I would call ‘calling the lightning.’

Note to self: experiment with this immediately. Enlist West’s help, but do not tell him why. Need to know information only.

Y’know, Donna’s always saying that us humans of this world - as opposed to wherever the hell it is Themyscirans and Atlanteans come from - have forgotten more than we know. I really should remember to ask her what exactly she means by that one of these days, instead of just staring at her without blinking cuz she’s doing things like talking and gesturing and I mean....have you seen her? The way she just....talks and gestures....look you would get distracted too, notes, is all I’m saying, and don’t say I don’t know that cuz I do know that because you’re me.

Aaaaand I’m officially talking to myself. Great. Awesome.

Getting back to my point, heroically, and with effort that should be applauded, take heed legions of future fans......so as stated, the sea gull crafting is predisposed to exert itself upon an arrow’s flight, while the dove crafting defaults to exerting itself upon impact. The owl crafting, as most already know, is similarly predisposed to exert itself upon flight. With most owl-crafted arrows being termed ‘silencers’ and used to strike a target without warning, as the sound of the arrow’s flight is nullified by the silencing magic of owl feathers.

But does that have to be the case? What if - I can’t help but circle back to that idea of shaping a feathercrafting to almost time-release its magic - just saying, imagine if you could design an arrow with owl feathercraftings that don’t just silence the arrow in flight....but also create a silencing bubble upon impact, with their magic ensuring that the target makes no noise when your arrow hits home, even if you weren’t aiming for a kill-shot to the throat, say, but rather an immobilizing shot to a limb or appendage that wouldn’t in and of itself stop them from screaming or shouting?

Ugh, there’s got to be a way to do that, a trick to it somehow. There just has to be because....okay, yes, I know, its magic, I suppose it doesn’t have to do anything but just exist, but....I’m telling you, me, posterity, whatever.....there’s something to this, this is a question of how that just needs an answer, and the answer is me, that’s who, fuckers!

Look, obviously I meant to say this is a question of who’s going to be the one to figure out the secret, don’t be such a self-deprecating pedant, self. Nobody likes those.

Anyway, so the combination of sea gull, owl and dove fletchings is such that you’ll get an arrow that’s silent in flight, covers a magically extended amount of ground, and delivers an electrical shock upon impact.

Unless there’s a way to change whether crafted fletchings of certain types must always expended their magic in flight versus be delayed and only released upon impact.

Great, now I have to figure that one all out for myself too, since no one else seems to want to do the hard work. I better have the kind of genius that’s actually appreciated during my own time rather than post-humously, is all I’m saying.

Oh yeah, and also, so the ummm, thing about what happens when you combined just two different feather-craftings in specific, in an arrow with three fletchings. Ie that thing I never got around to detailing before and was thus what I was going to detail now this time but that I obviously did not do this and oh look, Garth is calling us all for supper and I have to go before Wally poisons mine, you understand. Next time. I’ll get to it for sure next time. Which will be uh....later this week, probably.

*****

So that was a whole fucking year ago, huh? Don’t hate me, future fans, I was busy saving the world with my friends, Dick lost his Robin regency and moped about it even though he was the Owl Regent then almost immediately and just didn’t fucking tell anyone for two months which what even is that about, I would like to know, except then it turned out well no, I wouldn’t like to know as actually that was mostly just him angsting about some deep dark family history of his with this secret society of Owl Regent worshippers or whatever in Gotham and like, can I just say, with emphasis, fuck Gotham and everything to ever come out of that place except for Dinah, who is amazing obviously, and thus too good for Ollie, also obviously, even if he’s not actually being the worst currently and we actually had a decent(ish) conversation the other day, and oh yeah. The Cult of Owl-Worshippers or whatever, so right, those are a thing, and they suck, and we had to team up with Dick’s replacement Robin Regent, who I of course was inclined to hate on principle, except he’s actually an adorable little shit that I gotta say will probably make a damn good Robin. Anyway, so that was a whole thing that took forever and a day, and then cheering Dick up and helping him adjust to his new station or whatever also took time, but was definitely worth it for reasons that are many and complicated and have nothing to do with me being like “in love with him or whatever” so just shut up, you have no idea what you’re talking about and you sound just like West.

Anyway. Moving on.

Right, so back to the whole thing about what if you have an arrow with three feathers and feathercraftings of two different types - hah! So turns out, its a good fucking thing I waited to tackle this topic, as I accidentally unearthed a whole shitload of new insights and approaches here over this past year, so. Y’know. Yeah. I definitely took my time getting back to that with reasons. That were deliberate, and well thought out, and also totally real things that exist.

So.

Imagine you have one arrow. Its got three fletchings. Two of them are feather-craftings of one type, with the third being of a different type. Now conventional wisdom previously would have you believe that the end result of this combination would prioritize one Regent’s magic over the other, but it being completely random which magic would be the one emphasized and either modified or amplified by the other....and with it making no difference whatsoever what feathers were used, which one was used as the stabilizer fletching, etc. The arrow that resulted from the combination of two different magics would be a combination of those two magics, certainly, but beyond that, its just down to the whims of Mother Sky.

Except, I have discovered, through thorough experimentation and keen insights and intuition and also intellect, hi, yes, I have all three, who is so sexy, yes that is me....

That this is not true.

Or at least, I don’t think it is.

I’m pretty sure, anyway.

Look, the takeaway is that far be it from me to pretend to know the mind of a goddess, I mean, I’m not trying to sound egotistical or anything, but I’m starting to be of the suspicion that Mother Sky is a lot less whimsical than the stories would have us believe. And that there is actually a pretty precise method to her madness, and it just lies in having a better understanding of the Deck than we actually do. But the answers are there! They just need. Insights. Delivered by the likes of yours truly.

So. Let’s get insightful.

The one constant with this two-to-one combination type of arrow, is that either the one feather will modify the magic of the other two, or the two feathers will amplify the magic of the one feather. But which results is not actually random at all, I don’t think, but rather, has to do with where the feathers and their corresponding Regents fall within the Deck.

As legends tell it, there is a definite order to the Deck, though different cultures and civilizations have had differing ideas over the millennia as to what that precise order is. But the idea is always the same: in the beginning, there was Mother Sky, who existed in a place that was not a place, as it was before places existed because she’d yet to invent them, basically. But then from nothing, she created her companions, the birds that embodied or contained within them or just inspired the various pieces of creation and fundamental forces, depending on which version of the story you go with. And when she was done, she created people, and then before she left to create elsewhere, she turned her companions into people as well, the first Regents, to watch over her creation in her stead, via the pieces of her own power she entrusted them with.

But the point being, she built the Deck - and creation - piece by piece, rather than all at once. And everything either built upon what came before it - acting as a modifier, you might say, if you were brilliant, and/or me - or else it amplified what came after it. Because creation got more and more complex the further she went with it, and so the ways the previous pieces existed and interacted with each other and later additions, got more and more intricate and complex.

See where I’m going with this?

Its okay. I’ll elaborate. I don’t mind.

So everyone agrees that the Sparrow is the first card in the Deck, that’s a given. No one disputes the order of the first full talon, the set of four complete Regents that make a whole. First there was nothing, and then Mother Sky called into being the first sparrow, and with it came space, so that the first thing that was not her had somewhere to exist. Like, she may not have needed existence in order to exist, but she was a goddess, they can do that I guess. Everything else? Existence required. So in order for her to have her first companion, that necessitated also creating at the same time the first piece of existence, so that something could exist outside of just her. And then from there, she created the seagull and more space, so it could exist too, and then she sent it forth to go as far and wide as it wanted to and thus created more space everywhere it went. And that’s why the sparrow and the seagull are less space and more space, the reduction and propagation side of the same thing, but you’re gonna want to pay attention in a second because I have an insight here that you won’t find most anywhere else, and it is stunning if I do say so myself.

But first, let’s continue. So after space, Mother Sky next created time. Calling first into being the hummingbird, the eventual Regent of joy and vitality, the encapsulation of time in an instant, existing with no need for anything beyond just that....and then to create more of it anyway, she created the crane, the eventual Regent of permanence and longevity.

And then, most agree, she created the magpie and with it, things, and then the kingfisher and with it, more things. The regents or forces embodying quantity. And then came entropy, or “things change.” First with the robin, and then things change more, with the vulture.

Now, let’s get insightful. As I was saying, conventional wisdom, that conniving old coot, would have you believe that the opposing Regents act as negating influences on each other. That they cancel each other out. Why? Different theories. Most popular ones being that it was to keep each other in check, so that none would get too powerful and thus imbalance all of creation, or try to usurp it and rule it in her stead.

I have come to believe, however, that this is hogwash. Perhaps even complete balderdash. Why would she need to? We also all agree that the reason Regents come and go is because periodically and at her whim, she takes back her power from one and gives it to someone else. So....who needs proxies to act to keep other proxies in check....when she herself can simply just....take back that power at any time, if she’s for any reason displeased at how a Regent is wielding it?

So I suspect the truth is not so complex, or rather, that there’s no complexity here at all. Its exactly as stated in every version of our creation myth.....these opposing Regents, while they may be in opposition, are not actually meant to cancel each other out or negate each other....something none of them actually do. No, they’re just the dual forces of each aspect of creation. The opposite sides of a spectrum that simply represent that each exist along a spectrum.

Granted, most theologians don’t have Dick Grayson for a best friend, so let’s not be too hard on them. But having witnessed him up close and in action since pretty much his first day as the Robin Regent, I can assure everyone: he has always been just as much a force of entropy as any Vulture Regent. And that’s why similarly, the Magpie Regent exists as one of the two regents of quantity, even though its magic makes less of things, it takes things away.

But the one thing it never does, is make no things.

Think about it. Unless I’m missing some legend somewhere, nowhere in history has a Magpie Regent or its magic ever resulted in something being just...completely nonexistent. Same with the Sparrow. It reduces distance, space, consumes it magically, eats it up, whatever...but it doesn’t ever result in the complete non-existence of space.

We refer to there being a reduction and a propagation side to each Regent and their corresponding force....but reduction simply means to reduce. Nowhere does it say “all the way to zero.” Instead, I believe, the point of the various reduction regents and forces is that they push creation back along the spectrum more towards their side of things.....where they exist as the only unit of that particular force or aspect....but they still very much do exist. The Magpie might reset things back to one, emblematic of when it and what it represented was the only ‘thing’ that existed other than the goddess and her other Regents, the first unit of quantity rather than a time/space continuum full of possibility but nothing more finite or existant than that. But it’ll never - can never - push things past just that unit of one. It can’t negate something out of existence entirely. That’s a power only Mother Sky has, and that she’s never delegated to anyone else.

And that, I believe, is why whether feathercraftings act upon one another to modify or amplify each other, is not random at all, but just has to do with where they fall in the Deck, in relation to each other. When you view the Deck as being about opposing forces contained within spectrums, rather than negating forces existing outside of spectrums, it makes sense - just like the creation myths all talk of her building upon creation and adding to it, widening it, making more....of course magic isn’t going to be about undoing all of her hard work, but rather just more of the same.

And thus, lower-Deck cards will always exert themselves upon higher-Deck cards, and not the other way around....because all of creation is geared towards making the most of its upper reaches as it builds and builds upon itself.

Creation reaches upwards, as if to the sky, is what I’m saying. This just is sometimes more obvious than at other times.

So take a sparrow-crafting and two hummingbird-craftings, as an example.

Its not actually random, or about which you use two feathers of and which only one: the sparrowcrafting or craftings will always act upon the hummingbird, and never the other way around. Additionally, you’ll see what appears to be the same result either way, but this is because of the close connection between time and space. They’re part of the same talon, the same hand of four. They exist upon the same continuum. Either way, you result in an arrow that seems to cross a short amount of distance much more rapidly than it otherwise would.

And what actually results is the sparrow’s magic acts upon the hummingbird’s magic....so that how much space is consumed in relationship to the hummingbird’s rapid-rate of time....that’s what goes up.

So what the extra feather decides, really, is which magic gets two parts magic for the one part magic brought to the equation by the other feather. It just really makes no particular difference in this specific instance, due to them all still being on the same specific continuum. If you have two sparrow feathers for one hummingbird feather.....you’re essentially requisitioning two times a magical rate of distance to be consumed in correlation to the speed-up effect brought on by the hummingbird crafting. Ergo....an arrow that crosses a short amount of distance far more quickly than otherwise possible. Now reverse that, and use one sparrow crafting accompanying two hummingbirdcraftings....what you’ve done here is requisitioned two times a magical rate of time to be consumed in correlation with the space-consuming distance magic of the sparrow crafting....thus resulting in....an arrow that crosses a short amount of distance far more quickly than otherwise possible. Not just different perspectives of the same phenomenon....but the same phenomenon resulting from different manipulations of the same forces....and all those forces being closely linked enough to make the precise nature of what’s happening seem less distinct than it actually is.

Now let’s progress to combining two craftings from different hands, to make the differences more distinct.

Take here, for instance, a combination of swan and crane. Now you might be surprised, legions of future fans, as swan-craftings are rarely used as fletchings. Due to there being little use for arrows that make things float upon impact. But this is only true of people who don’t have housemates who frequently yell at you for experimenting with arrows that do things other than just make something float harmlessly. And there’s not much harm that can result in using pillows for target practice even if the pillows then just float aimlessly for various periods of time afterward.

Who knew annoying housemates could have such a beneficial impact upon science? Yes, even a West may have a purpose. Its true. What a strange and wonderful world we live in.

Anyway.

So after much experimentation, and even more experimentation to replicate the results reliably....I can safely confirm that regardless of how you combine the craftings, the swan magic will always be prioritized, with the lower-Deck magic, that of the crane, acting as the modifier upon it. Meaning one way or another, what results is the effects of the swan’s levitation magic being extended by the crane’s longevity magic.

The only thing that changes, results from whether its two crane feathers used, or two swan feathers. Here’s where two parts magic for one part....other magic, I guess....comes into play:

If its two cranecraftings per one swancrafting, the cranecrafting will still modify the swan, and what will actually be amplified, the magic you get more of, is that the rate of the cranecrafting’s modification of the swancrafting. Basically, the result you’ll see is the target floating due to the swan magic, but for longer than would normally happen, as the crane crafting extends the duration of the swan magic’s effects.....and with the second crane crafting essentially doubling the time-extending effects.

In comparison, if you go with two parts swan for one part crane, the cranecrafting again modifies the swan, but for a shorter period of time, as what’s actually amplified here is the swan magic. The amount the arrow can levitate upon impact, the weight of the target struck, that’s what’s doubled, with the overall effect simply magically extended by one unit of magical time modification.

Now this opens up a ton of possibilities all on its own, but it did seem to sound the death knell for my time release magic arrow idea.....or so I thought....until insight once again struck like divine inspiration. Which seems to masquerade as sleep deprivation an awful lot. But as I said, who am I to understand the ways of a goddess? Ah well.

So, its no surprise this didn’t occur to me earlier, as the archer in me balks at the very thought....but what about combining hummingbird and cranecraftings with a third? Hummingbirdcraftings have been used for centuries as crossbow bolts, if you’re working with a small enough one, and its been proven possible that while not advisable from a purely physics-prioritizing standpoint to shorn the feathers of much larger birds to small enough sizes that they can be utilized as fletchings on the very same, very small crossbow bolts.....but the combination of magics that unleashes has proven worth it on some occasions. Still, I don’t think anyone has ever tried utilizing both a crane and a hummingbird-crafting on the same crossbow bolt...but that’s largely because nobody sees much point in calling upon the magic of two Regents thought to cancel each other out.

But if its not actually in their nature to cancel each other out entirely, but rather at most to be mitigating factors or influences.....and if my theory about feathers always modifying the magic of higher Deck cards, never lower, is correct, as it clearly is for I am brilliant and also sexy, don’t forget that last part, its critical.....

Then cranecraftings, as low in the Deck as they stem from, still can be modified by three specific craftings themselves: those of sparrows and sea gulls....and also hummingbirds.

Which means, it might be possible to create a crossbow bolt with a combination of one cranecrafting, one hummingbird, and one other.....where the hummingbird acts as a mitigating agent upon the cranecrafting, before the latter acts upon the third. Basically, if I can crack the secret to definitively quantifying or measuring the magic of each crafting, down to a decimal point, and thus deal in fractions of a whole crafting rather than just units of one.....then I could mix and match hummingbird-craftings with cranecraftings that are measured to have more magic than the former. Which if my theory is right, would mean that the hummingbird and cranecraftings would essentially ‘cancel each other out’ but only until the hummingbird’s magic was fully consumed.....but the cranecrafting still having some magic left in it that only then at that point, once no longer held in check, would act upon a third feather. And thus resulting in the time release phenomenon I’m aiming for.

Look, its possible, and I will figure out how to make it happen, or my name isn’t Roy “Look how awesome my butt is” Harper.

Will look into this and report back.

****

Still have not cracked that secret. Still not allowed to use West for target practice. Still not saying these two things are in any way linked, just putting that out there.

I keep telling the rest of them its for science, but do they care? Noooo. Ugh. Barbarians. If this was ten thousand years ago and it were up to them, we would never master the tool that is fire, all because they’d never let me set the tool that is Wally on fire to demonstrate how useful fire can be.

Why do they hate progress? I just wanna know.

****

Still working on that time release magic thing. Still being thwarted. Revolutionizing archery by way of magic is hard. Why did nobody warn me that was a thing?

But you know what else is a thing? Physics! Its a wonderful, wonderful thing.

Obviously I already knew about physics, hello, but I didn’t know so much about physics until Dick wandered home with a new best friend named Victor Stone. He does that an awful lot. He swears its not a Regent thing, but I think its definitely a Regent thing. None of the rest of us seem to manifest magical friend-summoning fields that call weirdly attractive and also nice and also knowledgeable friends to flock to them like they’re some kind of magnetic north. Which is a physics thing, that my new friend Victor Stone taught me.

I’m just saying, I go out to get dinner for the bunch of us, all I come home with is dinner. Dick goes out to do the same, and he comes home with first an Atlantean, then a Themysciran, and then a Wally, and still no dinner. And even West, for all his.....West-ness, is descended from a hummingbird Regent and thus possessed of innate magic coloring his personal association with time, so he’s not totally useless even if he does a great impersonation of useless ninety percent of the time. And thus doesn’t exactly disprove what I’m getting at here.

One of these days, he’s gonna wander in like “hey everyone, come meet my new best friend, she seems completely normal and boring but that just means she’s probably Mother Sky herself in disguise for some absurd reason. Nothing about this has anything to do with me or how sexy my stupid face is.”

And shut up, that still doesn’t mean I’m in love with him, I just have eyes and I use them, that’s it.

Anyway, this time Dick brought home my new best friend who is Vic and thus I shall magnanimously let it go and not make a big deal out of it, for reasons that as you can see, have nothing to do with anyone’s face, no matter how stupidly sexy it might be.

So! Physics!

Most of it seems to be just unnecessarily complicated ways of saying things everybody already knows, so, basically what I always claimed it was despite baselessly having no real way of knowing this. Hah! Validation to me.

But some of it happens to be ways of saying things that might already be known, but are here put forth in ways they aren’t usually spoken of or pictured as, and thus spark new thoughts and ideas. And thus there does appear to be some merit to some of it, which is not validating in and of itself, but is inspiring, so I’m calling it a lateral move and counting it as still being a point for me.

(Look I may not know how or why or when, but one day, these points will come in handy and mean something, I just know it.)

Anyway, so there I was with my new friend Vic discussing abstracts theories of physics like the learned intellectuals that we are, just us, nobody else, shut up Garth, go eat a fish, nobody asked you.....

When Vic says something about force equaling velocity times mass. And I sat up and said wait, what was that thing you were saying a minute ago about velocity equaling.....and Vic says velocity equals distance over time? And I snap my fingers and go that’s it, that’s the very one. Vic, you beautiful balding genius, you’ve done it again!

Wait, what have I done again, Vic asks, and also how, we’ve literally only known each other twelve hours, and I explain to him all about my uncanny intuition and valid predictions of the future meaning that this is obviously just the first of many fruitful collaborations and thus totally counts, all while I busily make sketches and do math.

Because its occurred to me, see, that for centuries archers have used distance magics to shorten or extend the amount of space an arrow covers in flight, for a variety of purposes that still ultimately just revolve around accuracy or distance simply as an obstacle to be overcome.....but what if distance is treated not as the focal point for which an arrow is feathercrafted, but rather simply a means to an end that otherwise has aims other than just crossing distance?

Basically, as I explained while setting up a target of considerable durability and a small crossbow bolt fletched just with sparrow-craftings....what if distance magic is utilized not for the distance, but solely to magnify the force that results from how much - or how little - a distance it crosses over time?

And then from thirty paces away, I smashed a tiny crossbow bolt through the target with as much force as if I had fired that same bolt from a mere two paces away. The boom was quite satisfying. Also the validation. Again, that’s always just nice.

And then I modified another crossbow bolt with a mix of sparrow and hummingbird to increase that rate of velocity even further, and I did it again, to an even bigger boom.

Which means, notes and future fans alike, I may not have quite cracked the code of fractional but reliable increments of magical implementation just yet, but I now have more material to work with....because as I already suspected due to my awareness of their link via continuum, but hadn’t quite yet put a specific named connection to myself, distance over time equaling not just velocity but the key to time-lapsed magical effects means its not just hummingbird and crane feathers that could make all the difference there, but also sea gull and sparrow.

Force multipliers, Vic named our breakthrough. Or said was already the name for them. Hard to say, my ears were still ringing, but I err on the side of whichever gives us credit.

Either way, its a great name.

******

Vic and I have been experimenting with triple-compounding the effects of three different feathercrafted fletchings per arrow. Or tri-parting as I’ve been calling it. Try-harding, Dick calls that. I kicked him out of the workshop after that. I will not be disrespected within my own personal space like that, not even by his stupid sexy face. Besides, I can still see it well enough from through the window, so its fine.

Anyway, the triple threat combinations. At the base of it all lies a lot of trial and error with different manipulations of time and space, ie our force multipliers. So first, we started working with just those, to see what else we might be missing or overlooking in regards to these base-layer feathers that have had all kinds of other uses just lurking right under peoples’ noses for millennia.

Its not like they aren’t used for plenty already, of course. Take hummingbird-fletched crossbow bolts for starters. Plenty of archers throughout civilization have utilized them in conjunction with bolts tipped in different sedatives or poisons. Shoot a bolt at someone from close enough away that its magic isn’t consumed entirely in flight, and the temporal acceleration effects of the hummingbird magic then exert themselves upon the next nearest thing....the poison or sedative coating the bolt, which from there spread through the bloodstream of the person it impacts....now at a magically expedited rate of time. Similarly, plenty of assassins have used bolts or arrows coated in poison and fletched with crane.....to extend the effects of poison and whatnot upon the person shot with one.

Same thing with combinations of two types of craftings, both of which are known to default to exerting themselves on the same thing: arrow’s flight or arrow’s impact. Obviously we’re not reinventing the wheel with something like combining crane and canary, with both magics working in conjunction on the same things at the same time.....thus extending both the flight and the magical effect in-flight of a canary crafting’s ear-splitting shriek.

So its not as though we were expecting to uncover a lot more along the way to what we were really looking to explore, just us doing our due diligence until that point. And in no way were we delaying our experimentation out of nervousness that this wasn’t the long-sought next step in my lifelong pursuit of Science-Magic: The Roy Harper Way, and worrying that this theory like so many others would simply fizzle into failure. No. Don’t be dumb. That absolutely wasn’t a thing here.

So was the real hold-up all along just us stalling and killing time until Donna left on mysterious Themysciran missions because the night before she’d looked at us theorizing excitedly and decided to douse that flame by sighing and saying, ‘you’re going to blow up the house’? To which we naturally replied ‘don’t be daft, we’re not going to blow up the house.’ And to which she replied ‘oh yeah, you’re totally going to blow up the house’? Were we basically just tarrying and occupying ourselves with lesser experiments of no real value until she was gone like the ill omen she insists on being and that we simply refuse to see proven right? At least not when she’s around to witness it?

Right, so...yes. It was definitely that last one. That was literally the entire reason.

Look, if you’d ever had Donna sighing and despairingly shaking her head while listing totally understandable reasons why you shouldn’t do the thing that you were still going to do regardless because well, duh, you had to, obviously.......you’d understand.

The point being, the second she was out the door we quit wasting time with that load of crap, and brought out the real toys. Or....test subject....thingies ...prototypes! That’s it, that’s the word.

So first off, we started with the combination hummingbird plus sparrow plus shrike feather craftings. Shrikes, of course, being the magic of bindings and battles, and with the Shrike Regent being Boone, some sort of love-hate friend-nemesis of Dick’s past that he refused to ever elaborate on, no matter how much ranting he did on the subject of the man when he came up even tangentially. This of course, was our first real mistake. This was about the time when I kicked Dick out of the workshop, the timing here being a total coincidence, even if I did happen to mutter in passing that if he love-hates the guy so much he should just marry him already. Or kill him. Whichever. Preferably the killing thing though.

Unfortunately, adding insult to injury, or potentially injury to West if he interrupted us one more time, the shrike combos were getting us nowhere. Like the true friend he is, and sensing my dwindling mood and also its corresponding effects on West’s future, Vic suggested we switch gears and try combining just time-craftings with dove and something else.

Which is what brought us to the hummingbird-dove-kingfisher combo, and our first real success.

You see, as I’ve mentioned before, tanager-fletched arrows aren’t anything new....they’ve been used as incendiaries for thousands of years....but the why of it, with Vic’s additional physics insight, brought up some interesting theories. Same with the way dove-fletched arrows had been used for their electrifying properties for ages.

The reason dove-fletched arrows carry the properties they do, as he explained it, is that by channeling the electromagnetic force embodied by the Dove Regent - specifically, the propagation or amplifying side of that spectrum - its like the arrowhead becomes a magnet drawing electrical impulses to it out of the air it passes through. The whole atmosphere contains what he calls ionized particles, which is not apparently, the same thing as baby lightning. Even if its really just the potential for lightning, and thus totally fits in my opinion. But what our eyes perceive as simply an arrow slicing through empty air, in terms both scientific and magical, in another sense the arrow is swimming through a sea of ionized potential, collecting some of that to itself along the way, and delivering the totality of that through its arrowhead upon point of impact.

What tanager-fletched arrows do is apparently not hugely different in theory, even if it does tap into different physical properties. Essentially, tanager feathers, embodying the amplifying side of the thermodynamics spectrum, act upon the combustibility of oxygen, which is all around us in the air we breathe. Oh, also, the air is just fire waiting for a big enough match, apparently. That was good to know. So again, two different forces, two different kinds of particles which are not the same thing as molecules except when they are, and actually, what happens when dove arrows do what they do is only a little bit like what happens when tanager arrows do what they do, but still mostly not at all the same, even if they do happen to sound totally the same but whatever Victor....anyway, the point is physics is great and useful but also at the same time totally confusing and annoying, but what happens when you combine all this information with my contribution that is the keen scientific observation that the lower in the Deck will always act upon the higher in the Deck?

Something actually useful, not that I’m trying to rub it in or anything.

But the way I understood it, if the combustibility of a tanager arrow comes from how much and how combustible the oxygen it draws to it is, upon striking a target and delivering the additional magical spark of a tanager-crafting....and if the electrical impact that results from a dove arrow comes from the nature of a dove arrow to draw enough particles to it in abundance, with the combination of tanager and dove meaning its the latter that will exert itself on the former....the end result is you’re going to get a super-combustible arrow, instead of merely a combustible one.

And the drawback of an incendiary arrow, as any archer knows, is that it can only do so much. Firing an arrow that will burst into flame upon impact is all well and good....but if the place of impact is largely wet and incombustible, that first flicker is still going to die out before ever becoming more. But if that first burst is more than just a mere flicker....and if its immediately fanned and fed and magically fueled by say, the existence of a third crafted fletching, that of a kingfisher, whose magic by nature creates more.....

Well, apparently muddy beaches go up quite nicely when lit by an arrow of this variety. Particularly if you then follow it up by a swift volley of kingfisher arrows aimed purely at magnifying the resulting fire itself.

I might have gotten a bit carried away with the fire-lit cackling with which I celebrated our success, but on the other hand, I made West wet his pants, so. Worth it.

*******

Bit of a rough-weather atmosphere in our house this past week, as apparently the rocks I set on fire with our little tanager-fletching experiments happened to be Garth’s favorite rocks, and he’s a bit perturbed with me as a result. Nobody seems to care, no matter how often I point it out, that its just weird to have favorite rocks, and who even does that, because Garth that’s who and I guess I was supposed to somehow just....know this?

Anyway, it was ‘advised’ emphasis on my skeptical assessment of that last word there, that I avoid fire in my experiments for the time being. Which is fine by me.

On to....magical ice arrows!

Now ice isn’t a force, its not a thing that you can make more of like fire, as I explained to Dick and Wally earlier. Its the reduction side of thermodynamics, the less than....essentially, you don’t so much make ice as you do...remove heat. Thus a tern-fletched arrow isn’t really a frost arrow, its more accurately, a heat sink.

They didn’t need to know that it was basically Vic that explained it all that way to me about an hour or so earlier. Besides, the heat sink bit was all my addition, and that was the really important part, clearly.

What was mostly of interest to me here, was its prospects in magically replicating what happens when you get metal cold enough, fast enough. Which brought me to the hummingbird-tern feather crossbow bolt combo, two parts tern feathers and only one hummingbird feather as a modifier. What I was after was double the heat-sink properties of tern magic, sped up by a hummingbird-crafting.

It mostly worked.

The tern feathers drew in heat well enough, and the hummingbird-crafting sped up the process enough that more cracks would have spread through the metal the bolt was embedded in....if the bolt had.....actually embedded itself into the metal. I’m pretty sure, anyway.

It was the damn force side of the equation that was still getting in my way. Even when I did get a bolt to sink home in something that was already brittle enough to lodge into even if it couldn’t penetrate all the way through on its own, the force still was lacking without magical amplification. But there was no fletching I could add to magically modify the force of the bolt itself that wouldn’t also exert itself elsewhere, even upon just the hummingbird feather. I even tried adding a sea-gull feather and then firing the bolt from merely a foot away, trying to maximize the force without using up the distance modifier during actual flight time, and that was the biggest find of the day and it was a total accident as I realized two seconds after firing it that I was supposed to be trying to amplify the force by reducing the distance, and thus I meant to use a sparrow fletching, not a sea gull!

But then what actually happened is my crossbow bolt embedded itself and ended up magically making enough more space for me to follow up with two more bolts, and then the combination of multiple bolts all drawing heat from around them at a magically enhanced rate led to the whole thing growing brittle with cracks all the way through it, which.....was not at all what I was going for but was still useful to know, so, I’m calling it a win. It counts.

Look, it just does, okay? You’re my notes, I’m not supposed to feel judged by you. You’re doing this all wrong.

******

Dick brought home a new friend today, named Kory. She seemed like a perfectly, nice ordinary girl at first glance. Then she took off an illusion-casting crow mask and revealed she’s actually a seven foot tall, golden skinned, ‘battle priestess of X’Hal,’ whatever that means, but the rest of all that sounds about normal.

Oh and also, what that means apparently is she’s from a whole other world and she voyaged here in a ship that apparently travels between stars which is a thing that can happen, and also she has green-glowing eyes but that’s just because she can make magic green fire that can burn through anything, no big deal. Also, she can fly. Also, also, did I mention she’s a princess? Because duh, of course she’s a princess, why wouldn’t she be a princess, haha you sound so dumb right now.

Dick’s eyes glazed over and he stopped paying attention at “she can fly.” Not that I noticed. Or cared.

Anyway, apparently ships that can travel between stars being a thing that can happen is not actually the new information that I thought it was, as then Garth tried to insist that he’d totally mentioned that before which umm, lie. I definitely mentioned it before, he said, like a liar, and I think I would have remembered if you had, I said because hello, and then Donna said she and Garth had always been clear about Atlanteans and Themyscirans originally coming from worlds other than this one and okay fine but nobody ever said that involved ships that fly between stars I said. But of course its not like I had anyone to back me up on that because Dick was too busy trying to marry Kory with his eyes which will probably even work because obviously his eyes are very marriage material everyone knows that and West was busy being West so its not like he counts, and in conclusion, all my friends are either aliens and/or assholes. Except for Vic, who did say he’d run away with me and get married, but I’m pretty sure he was just humoring me. He wasn’t even drunk.

Whatever. The big takeaway here is that clearly I am like, this close to unraveling the mysteries of all magic everywhere and that’s why Mother Sky has decided to be mean to me, because she is threatened and also, like. Just mean.

*****

Turns out Kory’s actually a lovely person. So I guess I just can’t have anything, huh?

****

Also none of this still has anything to do with being in love with Dick, which I’m not, because obviously, and Wally’s still wrong about everything, because also obviously. And if he doesn’t shut up, I’m going to make a magical Wally-smiting arrow just for him. I don’t totally know what its going to do yet, but just see if I don’t!

*****

So over dinner last night, Kory was telling us all a bit about Tamaranean magic and how it works and what being a battle-priestess of X’Hal means.

So on her world, its told, their creator goddess X’Hal created everything out of herself, and so is herself in everything. With there being some kind of corresponding connection between the emotional or spiritual side of things, and the physical or material. And Tamaraneans have a periodic table that’s actually all about emotions rather than physical elements, and their magic is called spirit-alchemy and its about manipulating the elements or physical world by being in control of their corresponding emotions?

I don’t think I’m explaining it right. Okay, so basically, the way Kory described it is everything on their world was created by X’Hal, like, feeling a specific thing. From her passion, X’Hal created fire. From her hope, light. From her joy, weightlessness. And all the way up and down the material and elemental plane. So when she refers to the thousand names of X’Hal, its because of the whole “X’Hal” is in everything idea, and thus when speaking of each of those things, one’s also speaking of X’Hal.

But where the magic part of things comes in, is if like Kory, you train from a very young age to be what’s called a priest-adept. Or priestess. You get it. But the idea is all things are part of X’Hal and she’s in all things, and her people, the Tamaraneans, are all like X’Hal....enough so that they can manipulate parts of the world around them, wholly by manipulating the parts of themselves that are...spiritually resonant with those things, I guess.

So with Kory, the reason she can fly, and glow, and create soulfire which is what she calls the green glowing fire she makes that can blast through anything.....all of this derives from her spending most of her lifetime training to have a total mastery of three specific mental and emotional states. The ones that, in reflection of X’Hal, correspond with fire, light and weightlessness. By mastering her passions, broad sense of the word, she manifests soulfire which she creates much like X’Hal created...fire fire. Via her own mastery of and understanding of hope - not totally sure what that all entails, but that’s the connection - she similarly is able to manifest light, and her flight and weightlessness come from her control and knowledge of her own joy, for just...herself, life, everything. The battle-priestess bit is just her own kind of vocational calling rather than a specific group, but her magic only works because her own mastery of self is so extensive that she’s able to find even the joy in battle, the passion in fighting, the hope for victory, that let her still tap into the specific emotions that lend her this magic, even while in the midst of fighting for her life.

Obviously what she’s talking about is easier said than done, and the Tamaranean idea of self-control goes a fair bit deeper than get up and take a lap when someone, not naming names, says something particularly dumb.....but from the sounds of it she’s kind of a big deal back on her homeworld not even for the princess thing so much as for having mastery of three different states, no matter how connected. Like a lot of people spend their whole lives attempting to master just one, and she just happened to be adept level at three already.

I asked if anyone’s ever mastered all thousand, which apparently was a really funny joke, so looks like I’m hilarious in Tamaranean, but seems that’s not really a thing. “We’re like X’Hal,” was how Kory put it. “But only X’Hal can be X’Hal.”

Which does make sense, when you put it like that.

**************

Okay, so I was just picking Kory’s brain about spirit-alchemy a little more, specifically about her super-strength and where that comes from, since I thought joy, passion and hope were her three focuses. Except she didn’t know what I was talking about first, as she said that wasn’t one of her powers. Except I know for a fact that I saw her punch through a solid stone wall once, and said as much, and then she was just oh, that’s just part of my mastery of joy.

Which needed a little more clarification than that, because....what.

Basically though, it sounds like their emotional table is a lot like the spectrums between two opposing Regents throughout our Deck. Like a lot of what they work on mastery of is as much the absence of its opposite side as it is something in and of itself. Apathy is the opposite of passion, the negation of soulfire, but its not something someone seeks to master, so much as its an extension of their mastery of passion. After all, if one summons a form of passion within themselves in order to create soulfire, then by banishing the soulfire, even if just because they no longer have use for it, isn’t that and the emotional equilibrium that results in that....isn’t that effectively apathy? Same thing with hope....just because the goal of mastering that wasn’t to create an absence of light, that doesn’t mean that being able to put out the light she herself creates isn’t still connected to that emotional field and something requiring her awareness of it.

Which brings us to weightlessness. Her flight is a manifestation of joy, even when using it in battle, but utilizing it most effectively, as in changing elevations rapidly and with precision, often requires the inverse just as much as creating weightlessness for herself in the first place. So her control of self has to be so absolute that she can be a thousand feet in the air and then just let herself plummet, carrying with her all the force that entails, and only at a hundred feet in the air summoning her inner joy and using spirit-alchemy to instantly transmute that into the weightlessness that once again keeps her aloft but now at that new, lower elevation.

But the point being.....up until that last split second when she comes out of a dive and re-engages her magical weightlessness.....she and any strike she’s delivering, contain the full force its opposite.

Not at all unlike how you could describe swan and ostrich craftings.

So that’s when Vic and I just looked at each other and yelled: Force multipliers!

Forget time and distance modifiers, its the mass! The key is the mass! The propagation side of gravity even if applied not to go up or down because the gravitational force is only being applied magically, to modify other forces, not the physical mass of the arrow itself! This is it! This is the key!

Our first attempt put a crossbow bolt through an inch of solid steel. Now just waiting on Vic to get back with all the hawk and dove and tern and tanager feathers we have, we’re so close I can taste it!

Ugh, if Dick doesn’t marry this beautiful alien warrior princess, I’ll marry her myself! Or both. I could just marry both of them I guess. I mean, its for science.

Okay, Vic’s here, will report on findings later!

******

So, we accidentally blew up the house. I don’t want to talk about it.

Still think I’m right though. Just needs fine-tuning.

Might wait a bit before I bring that up. No reason. Just seems the sort of thing that can wait until we find a new house.

17 notes

·

View notes

Text

I think my actual point with my gushing the other day was actually just a tangential extra-universe thing about how Of Beren and Luthien, especially in conjunction with the Lay of Leithan, more than any other part of the Silmarillion, is so strongly…fictional. Like, the pattern of the story elements – and since so many story elements are so tightly glued to certain ideas or feelings for the reader, the pattern of the ideas that are dragged along with the story elements as well -- hogs the steering wheel and the mirror-positions and the headlight-settings of the entire story to such an extent, and leaves so little of the story up to the sequence of events experienced by the characters-as-hypothetically-real-people-being-hypothetically-real.

This includes some explicit ones like ‘lmao no that character death sucked rewrite it pls’ and ‘well the silmaril IS in my hand’ but I mean mostly a lot of much vaguer things like repeating images and concepts and pointed echoes (forests, dungeons, thrones, wolves, oaths, hands, death - Sauron letting Gorlim go to Eilinel by killing him - etc), the density of songs, and Sauron beating Finrod through the power of Better Meta and things like that. And not even in a ‘the plot makes no sense so the ideas fill the void’ sort of thing. I mean, there’s some of that too, but the plot is actually surprisingly well-interwoven with regard to, eg, the action in one location/group moving into or affecting another location/group. It’s just that it’s...low-influence. The characters act more like they’re walking along the lines of printed text and each repetition in imagery, or each verse in the Lay, or pausing to burrow deeper every time the prose text stops to quote some verses from the Lay, rather than as if they’re walking along through an actual forest. As if the usual differential in knowledge/perspective between the reader and the characters (I mean, knowledge of the story’s story-ness, structural elements, like imagery and tropes and narrative devices - not knowledge of plot information), is much smaller than normal.

So the world all around them becomes like, more of a theater's props & costume warehouse, not a maze or path, because lmao whatever the end result is only mildly important! the important part is that Luthien on a time should be etc, and reinterpreting the world according to themselves rather than learning and/or moving according to the world. Which is I guess why the story is full of repetition and things which embody or haul with them concepts that aren’t there for our idiot duo to fight or achieve or even understand, necessarily, though they do, sometimes, but mainly…to cause to happen, or to come face-to-face with. To illuminate one possible interpretation of these things through their lens. And also kind of provide a sort of example for how different landscapes of the other Silm stories can be illuminated through other lenses to yield the same concepts, rearranged etc -- but the Lay is aggressively exaggerated in its fantastical-ness and myth-ness compared to the other Silm stories occurring in this timeframe, not only in the quantity and specificity of the random magic and stuff flung around in-universe, but also especially in terms of pacing choices, and what's deemed important by those choices. And really, I cannot get that Norse Mythology Fenrir-esque fanart out of my mind. And that quote Diana Wynne Jones recalled about Tolkien’s annoyed mumbled college lectures on rearranging meaning and emphasis and conservation-of-detail choices to change one story to a different one without changing the events the characters experience.

I think this is why the story of Beren and Luthien somehow has far more to do with Lord of the Rings than any other part of the Silmarillion does, and LOTR has more to do with the story of Beren and Luthien than most of the other stories in the Silmarillion, and not so much in the way where the things Beren and Luthien did actually has something to do with the things that happen or exist in LOTR in-universe (like, say, the entire race of Numenoreans, or whatever.) I mean the story itself has so much to do with the story of LOTR, the elements and emotional beats (though not the order or proportions of the beats, or all their imagery) are so closely shared and/or echoed throughout the main plot of LOTR. Beren and Luthien’s story has mostly to do with LOTR’s A-plot, the quest to destroy the ring - the quest which is totally not gonna work by all logic and amdir but that’s not really the point, the point is that the decision - initial and continuous - to go through with the quest into the black unknown contains and attracts and sparks those flares of light and beauty and grace that happened to Beren and Luthien again and again, and also saved them both in similar ways - light propelling light, light summoning light, and evil flickering out from lack of oxygen and momentum and imagination.

It happens in/to/with very different contexts and goals and emotions and characters, but the interior elements of meaning inside the things that make up the story of Beren and Luthien filter through in forms that are so eerily…intact, over the countless centuries down to the ring quest. Yes, the light of that same silmaril they swiped filtering down to be caught once again in Galadriel’s star-glass and shining out again in Shelob’s lair is so very very real. Yet story elements are all exactly as fake/real/true/untrue as each other, the supposed difference in tangibility or tractability that exists irl between physical objects and ideas dissolves inside a story if an author lets it. So it is not any more real or directly connected than “I will not say the day is done/Nor bid the stars farewell” sung through the stone walls of the tower. These two stories among the legendarium are the two that are most insistently and visibly about being a story.

#lay of leithian#the silmarillion#beren#luthien tinuviel#lord of the rings#meta etc#can you guess that the number 1 complaint about all the writing i've ever done has always been 'did you know this doesn't have a thesis'

60 notes

·

View notes

Text

Here’s what CEOs said on this week’s earnings calls

Each week we read dozens of transcripts from earnings calls and presentations as part of our investment process. Below is a weekly post which contains some of the most important quotes about the economy and industry trends from those transcripts. Click here to receive these posts weekly via email.

The Dow broke through 20,000 and optimism is the mood of the moment. Last week US Bank said that optimism hasn’t translated to action quite yet. But comments this week from Cullen Frost Bank suggest that it’s only a matter of time. Companies are eager to invest in growth and are moving forward with plans that they had delayed. There doesn’t seem to be much standing in their way at the moment. The new president loves that the Dow is at a new record and although he talked about bubbles on the campaign trail now he wants it to keep going “up, up, up.” Presidents often get their way.

The Macro Outlook:

The industrial economy is seeing a broad based improvement

“it was broad-based growth in Industrial, both in terms of the businesses and in terms of the geographical area…And if you look upon PMI, the United States had a PMI of 54.7% in the quarter, China 51.4%, and Germany 55.6%. If you think about that in terms of big economies that will help us as we move forward, and as I said, it was broad-based.” —3M CEO Inge Thulin (Conglomerate)

Customers are moving forward with plans they had delayed

“As I have gone around the state, visiting all our locations during the month of December, one thing it was a consistent message was how many customers particular I would say mid and small customers are moving forward with plans that they had, had delayed, right? Somebody had a piece of equipment they want to put in and they can wait for six months, after they got the clarity from the political situation, the word was let’s move forward, let’s move forward now. So I think you are definitely seeing just general optimism in the market moving forward…I think we are seeing momentum increase. I would expect loan growth to be better than 2016 for sure.” —Cullen Frost CEO Phillip Green (Bank)

The housing market is solid

“The market therefore is a very solid market…we continue to see good sales trends in January, very early into spring.” —DR Horton CEO David Auld (Homebuilder)

The Hawaiian economy remains “pretty darn strong”

“the economy remains pretty darn strong. There really aren’t any factors at this point pointing to a softening or a downturn in the local economy. So I think that’s, if you will, the tailwind that we are looking at from a loan perspective and a deposits perspective” —Bank of Hawaii CEO Peter Ho (Bank)

Even energy producers are excited again

“Customers are excited again, and our conversations have changed from being only about cost control to how we can meet their incremental demand.” —Halliburton CEO Dave Lesar (Oil Service)

Texas’ economy never faltered

“Despite lingering low oil prices in the first half of 2016, the Texas economy grew faster than the national average and all other energy states. The service sector and the I-35 corridor remain strong throughout the downturn. According to the Texas Workforce Commission, Texas added 210,000 jobs last year. The unemployment rate in December was 4.6%.” —Cullen Frost CFO Jerry Salinas (Bank)

Corporations can’t wait for lower taxes

“Obviously our new administration is pro-business, but there’s a lot of moving parts in that…I think we’re all waiting to see if there’s a tax reform package that would allow us the ability to access overseas cash and repatriate cash…I think that would make a big difference for a lot of multinationals” —Abbott Labs CEO Miles White (Healthcare)

“I think all of us recognized we’ve got a new administration in Washington which has an agenda to be friendly to business and I think, we’re anxious to see how all of that will play out certainly tax reform is the biggest single item that we’re focused on this year.” —United Technologies CEO Greg Hayes (Conglomerate)

“I think what GE wants and what we think is most important to competitiveness for U.S. companies is essentially a competitive tax rate, something that looks more like the OECD averages, which is just roughly 21%, 22%.” —GE CEO Jeff Immelt (Conglomerate)

“we also are advocating for the modernization of the US tax codes. As both sides in the aisle in the Washington have noted, the US tax code for business is outdated and in many cases makes the US a more costly place to do business leaving US workers and the US economy at a disadvantage. We are very encouraged by the proposals currently in discussion and we will support business tax policy that is competitive with most developed countries and encourages innovation and growth.” —Johnson and Johnson CEO Alex Gorsky (Healthcare)

But in theory, lower corporate tax rates increase WACC

“if the risk free rate goes up, cost of equity goes up. If the tax rate goes down then our after-tax cost of borrowing theoretically goes up…if you just started with those two simple assumptions, you would look at that and say, gee, if the risk free rate goes up and if the tax rate goes down, you would speculate that our overall cost of capital would go up.” —Travelers CEO Alan Schnitzer (Insurance)

Still, Trump couldn’t be more pleased

“The Dow on top of it just hit 20,000. First time in history. I’m very proud of it. And now we have to go up up up. We don’t want it to just stay there. That’s gonna be the challenge, but its gone up a lot since I won. Don’t forget when I won people thought maybe it will go down, but the business world doesn’t think that. The business world knows me, they don’t think that. And it was a steady climb and now we just hit a record and a number that’s never been hit before, so I was very honored.” —President Donald Trump (Government)

International:

US optimism hasn’t translated to international optimism yet

“I think outside the U.S., I really haven’t seen much change in interplay, post the election in terms of what our customers are saying and how to think” —General Electric CEO Jeff Immelt (Conglomerate)

Many companies remain positive on China though

“China continues to be a very attractive opportunity. This is a market that is among the highest growth rates across the world on a sustained basis and that really hasn’t changed.” —Procter and Gamble CFO Jon Moeller (Packaged Goods)

“performance was driven by strong results in China…Notably, China had a strong quarter with comparable sales of 7.9%” —McDonald’s CEO Steve Easterbrook (Fast Food)

“Looking ahead in the China market, we expect another year of significant volume growth. Category demand should remain strong” —Kimberly Clark CEO Thomas Falk (Packaged Goods)

China is posturing for free trade

“In a world with a plethora of uncertainties, China offers an anchor of stability and growth with its consistent message of support for reform, openness, and free trade. The times may be difficult. But that’s all the more reason not to lose sight of these principles, which have stood China—and the world—in good stead.” —Chinese Premier Li Keqiang (Government)

Financials:

The credit window wont stay open forever