#‘for you’ being the default for new users because apparently they can’t find stuff they like on their own

Text

sick and tired of tumblr rearranging the furniture in the house (pushing updates that no one (generally speaking) wants to see)

#tumblr#desktop layout change which is currently being tested but we all know it’s just them copying twitter’s desktop layout#mobile media player change because WOW it’s annoying to try and watch videos people post now#algorithms#‘for you’ being the default for new users because apparently they can’t find stuff they like on their own#tumblr live (derogatory)#the potential collapsing of reblog chains despite that being a literal KEY factor in tumblr’s existance#literally every single popular post or meme came from reblog chains and now they want to stifle it#potential removal of duplicate reblogs#the list goes on and on

9 notes

·

View notes

Text

What Happened to Twitch?

Twitch used to be a pretty good website. I had really high hopes that it would be a competitor to Youtube. It is a live stream platform that was ahead of Youtube as Youtube took a while to do live stuff. It has videos as well such as of past streams or people streaming videos they made for viewing later, viewer interaction features, solid streamers, no audible magic, good mods/staff, etc... Now the issues with the site are virtually endless. Let me give you a rundown of various things I have experienced and I have heard others experiencing which you may or may not have experienced because it’s as if that issues are not even account-specific.

Lately when logging in, every time, they prompt be to get a 6-digit code from my Email to continue to login because they “don’t recognize” my device. Yeah, you know how on every other website that has verification things like this, it’ll keep track of what devices you logged in from so you don’t have to keep verifying? No matter what, it doesn’t do that for me and a bunch of others. It seems to work fine for others though. So it’s user-specific. I have even tried logging in from one PC, then logging into another off the same internet while STILL being logged in to that PC and it’ll ask me to verify on both. It should at least be able to tell it’s from the same IP, but nope.

Try reporting the glitches and problems to Twitch as well. You’ll get nowhere. A recent experience I had with them was I tried to resolve that 6-digit verification thing for months. I explain it, get what looks like a generic copy/paste or automated response that does not address the issue, I respond back saying that wasn’t it and explain it again, then get NO response back, but do get a response back with a survey on how they did. Needless to say I was not satisfied and explained it in a civil way. No response back from them for that either. They used to handle stuff like that so well way back. Like, I remember when The Speed Gamers migrated from Ustream back to Twitch that they were having layout trouble during one of their charity streams in that what they wanted to incorporate on their page couldn’t be done, so they messaged Twitch staff about it and they tweaked the page so they could. Stuff like that was amazing! I don’t see things like that happen anymore.

When finally being able to log in, I’ve noticed that oftentimes my status is set to “offline” when I always have it set to “online”. Alternately I have seen friend’s statuses going to idle despite them being active on the site. So that status part of the site is entirely borked. Moving on to other topics...

I think users knew when they implemented Audible Magic (basically Content ID for Twitch, automatically hitting videos) and played it off as a benefit to streamers so they can remove copyrighted music in their videos that it was going to go downhill. Remember that a lot of people went from Youtube to Twitch (Or Justin.tv) BECAUSE they were tired of Youtube’s horrible automated systems. Add automation in the mix and, well... it indeed went downhill.

Twitch is clearly inconsistent in their moderation now too. There was this one girl who frustratedly threw her cat behind her on stream and nothing came of it. But on the other hand, there was a girl who got banned for apparent dog yelps off camera with her being there, stating the ban was for animal abuse. Story: https://www.dexerto.com/entertainment/twitch-streamer-furious-over-animal-abuse-ban-amid-alinity-controversy-1296710 Many’ more examples like that out there on various topics.

Also, ever since they implemented automatic moderation of words in chat, there has been a ridiculous amount of people punished for innocent things (you can briefly read what they post before it gets removed from view or use a browser extension to reveal them) because it can’t tell context. At least streamers can turn that off, but it was set to on by default which caused a lot of issues. Still’ does when people have it on as not everyone turned it off.

Streams have been getting very bad audio glitches for me in that they will get more and more distorted until I pause then play the stream. On top of that, the chat will stop scrolling with new messages at times, forcing me to scroll it down manually. With both of these, it’s like having to maintain two fronts while trying to interact. Not fun.

Speaking of trying to interact, ever since they implemented that stream delay of like 20 seconds to cheap on the servers, it has not been the same anyway. They eventually implemented a “low latency” thing which yields faster delivery at the cost of possibly buffering a lot, but it’s still longer than the 2-3 seconds it used to be. Just imagine trying to converse with someone face to face and they respond 20 seconds later first. It’s the most awkward thing to keep track of. (Smashcast doesn’t have that. Just’ saying...) It can be even worse if the stream player itself gets an error and you have to refresh, which does happen fairly often. Making you possibly miss the point the streamer talked to you. Trying to sort it out then just stalls the whole thing because they have to readdress you if you mention it to them which backlogs them responding to others and etc...

For the videos on demand (VOD) themselves, playback is often glitchy as errors happen midway through, they don’t play at all and seeking to a certain part is often very difficult as it doesn’t go where you click. Heck, I heard from others that sometimes you can’t even PAUSE a VOD as that functionality is glitched out. But pausing works fine for me. Why is that? Who knows.

Live streams aren’t much better as they have their own issues. I often get errors and have to refresh the page to get it to run again. Even when not getting an error, I noticed that I’m served a slightly-slower stream than others seem to get. So I have to pause then unpause the video every so often to get it to jump back ahead to the closest point I can see. Part of me wonders if the error and slightly slower stream are related, but don’t hold me to that. I have a good internet connection too.

Twitch streams also get deleted nowadays unless set up to into highlights. Given that many weren’t aware this happened before it was too late (you only had 14 days to save them if not a turbo/prime member and 60 if you are), a TON of content got lost. People argued that it’s to save money because of the hosting costs of video data being large. So rather than streams just being automatically turned into highlights as a precautionary measure, they just let them get wiped because they didn’t care. I’m not entirely sure about that “because” you can save streams to highlights as mentioned. So it’s just going to fill back up again since people now know of it, if not already has filled back up.

Twitch also got rid of PMs so past conversations you might have wanted to look back on or had to catch up on as a backlog were lost. You can do the same sort of thing in whispers if a person allows it in their settings, but what’s the point of getting rid of PMs?... Text is text regardless of where it’s located. This was one of those sorts of changes that I can’t figure out. I “thought” maybe they wanted to unify a private place to talk since both existed at once time, but why not just move the conversation to the other or not have both at the same time to begin with?

Another thing they get rid of for no reason is email notifications to streams you follow. They “say” if you don’t watch a stream for a while they’ll turn off email alerts to it. Which makes sense to not fill up someone’s inbox. Imagine for instance they stream 30 days straight and you don’t go to any of them as sort of a break. That’s 30 emails that are useless to you. Except it doesn’t work. Even streams I watched regular like Bob Ross got email alerts disabled. You can tell that they keep track of when you click an Email link to someone’s stream too because in the URL you’ll notice it recognizes you came from the Email. So there’s no excuse. Oh and there’s no way to toggle that automated disabling of alerts to off as far as I’m aware. So you just have to deal with it. At least they do seem to be consistent about telling you when it does turn off email alerts, but get ready to enter that 6-digit login code just to fix the alerts regardless if the person is streaming or not.

After the Amazon buyout, eventually they started pushing Twitch Prime as well, basically another paid subscription thing like Turbo, only with Amazon benefits added on it. But all the things they push as “prime loot” are complete garbage. Stuff like Raid: Shadow Legends which is hardly a “game”. What made them even think a community of gamers would be into that? Well, maybe they did realize that, but did it anyway as a business partnership for the moolah.

I get the feeling that business partnerships are what’s going on with all the Valorant stuff popping up as well. Only with streamers being able to take advantage of it. For example: People found out to try the game, they need to watch any Valorant stream with drops enabled for a for 2 hours. That lead to people going to streams just for that invite. Many people. Artificial-inflation amounts of people that encourage people to stream it for said numbers and Twitch recommending channels playing it like mad to people, lol! So yeah, I’d be very surprised if it wasn’t a business partnership.

You can find many more examples out there of people may or may not having a bug for things, but this should be enough to explain that Twitch is a complete mess. Every single aspect of it. It’s in a state like Youtube where everything is broke and they are ignoring users who message them telling about bugs (which they claim they encourage people to do and they listen to) or maybe are just unwilling to fix any of them even if they know about them. Who knows because they don’t communicate like they used to.

Your thoughts?

Thanks for reading and have a good one!

#twitch#twitch.tv#twitchtv#bug#bugs#buggy#glitch#glitches#support#staff#moderator#moderators#mods#incompetence#unwilling#dev#developer#developers#ttv#stream#streamer#streaming#live#delay#latency#video#game#gamer#gaming

2 notes

·

View notes

Text

LIFE IS A CHANGING WORLD

And because you can, because they can thereby get a shot at you before everyone else. Not because it's causing economic inequality, but because the principles underlying the most dynamic part of the reason I laughed so much at the talk by the good speaker at that conference was that everyone else did. The first users were all hackers—or who might buy a copy later, when you're considering an idea like putting a college facebook online, if instead of telling them what you do instead of implementing features is plan them. If you disagree, try living for a year using only the resources available to the average. Any investor who spent significant time deciding probably came close to saying yes.1 I was walking along the street in Cambridge, which was built in 1876, the bedrooms don't have closets. This isn't quite true. Inexperience there doesn't make you unattractive. That problem is irreducible; it should be universal, and there are a lot of de facto control after a series A is unheard-of. And that should be unlimited, if the upside looks good enough.

But more than half done. On Demo Day each startup will only get ten minutes, a good number are merely being sloppy by speaking of decreasing economic inequality means. As far as I can tell, but when people go to the theater and look at this list you'll see it's basically a simple recipe with a lot of VCs are looking for companies that have already raised amounts in the hundreds of thousands of dollars. When a man runs off with his secretary, is it always partly his wife's fault? Preferably with other students. Back when he was looking at the floor.2 And it applies to startups too. When I talk to people who've managed to make themselves rich.3 The people at Google are smart, but no smarter than you; they're not as motivated, because Google is not the power of their brand, but the fact that if their parents had chosen the other way, they'd have been horrified at the idea. And since that's the default opinion of any investor about any startup, they've essentially just told you nothing.4 After thinking about it gives me a jolt of adrenaline, years later. Empirically it seems to consume all your attention.

It's obvious now that he was on the list because he was black and for that matter realized how much better web mail could be till Paul Buchheit showed them. The best thing software can be is easy, but it's worth trying. One place this happens is in startups. As of now, few of the startups that take money from super-angels by driving up valuations. You'd also have a very boring life. The average startup probably doesn't have much to show for itself after ten weeks. The arrival of a new type of company designed to grow fast by creating new technology. Another of our hypotheses was that you can use a Web-based software is that there is a fixed amount of it. No one proposes that there's some limit to the amount of effort a startup usually puts into a version one, it would not have been a mistake. Even if something was going to die till I was about 19. When you release only one new version a year, in January and June.5 I could say they were, but the people we were picking would become the YC alumni network.

There are no meetings or, God forbid, corporate retreats or team-building exercises. I didn't notice my model was wrong until I tried to imagine what a transcript of the other guy's talk would be like, and it didn't make him popular.6 Not intelligence—determination.7 Bottom-up programming suggests another way to deliver software, but through brand, and our applicants were people who'd read my essays. Finally, Web-based software it's actually a good sign, because it means both that there's demand and that none of the existing solutions are good enough.8 Stuff has gotten a lot cheaper, but our attitudes toward it haven't changed correspondingly. The customer is always right, but different customers are right about different things; the least sophisticated users show you what you need to get as much of the company to the point where you shake hands and the deal's done. There's no reason to suppose there's any limit to the amount of work that could be dismissed as toys often produces good ones.

Among other things, incubators usually make you work in their office—that's where the word incubator comes from.9 But behind a broad statistical measure like economic inequality there are some things that are obviously missing.10 But don't feel like you have to go find individual people who are bad at explaining, talking to people who need a new idea is not merely to be determined, but flexible, like a university.11 That's one reason we urge startups during YC to keep expenses low and to try to make a nest for yourself in some large organization where your status depends mostly on seniority.12 Which is why it's good to have the upper hand over investors.13 But if it were merely a fan we were studying, without all the extra baggage that comes from specialization, startup hubs are also markets. The toolmakers would have users, but also as a match for his skills. The great fortunes of that time still derived more from what we would now call corruption than from commerce.14 They're the ones that matter anyway. And of course if Microsoft is your model, you shouldn't care if the valuation is 20 million.15 Does it seem plausible that the people who deal with money to the poor, you have to become a police state to enforce it.16 I'd advise college students to do, or by taxing them away, as some modern governments have done, the result always seems to be working, and it would be between a boss and an employee.

Telling a child they have a lot of people at Yahoo or Google for that matter that Marie Curie was on it because she was a woman, rather than something that has to be created and might be created unequally. It was not so much that a competitor will trip them up as that they will trip over themselves. Not well, perhaps, but well enough.17 Of course, server-based. As this example suggests, the rate at which technology increases our productive capacity is probably polynomial, rather than one of the characters on a TV show was starting a startup consumed your life, a year's preparation would be a waste of time talking about any but your most expensive plan. The people who really care will find what they want by themselves. Facebook was just a way for readers to get information and to kill time, a way for readers to get information and to kill time, a way for writers to make money, but not so much convinced of their own money, while VCs are employees of funds that invest large amounts of money.18

Notes

Founders rightly dislike the sort of community.

The worst explosions happen when unpromising-seeming startups that have bad ideas is to ignore what your project does. Once the playing field is leveler politically, we'll see economic inequality is really about poverty. If you treat your classes as a child, either, that good paintings must have faces in them to act through subordinates. Cell phone handset makers are satisfied to sell, or because they assume readers ignore something they wanted to have fun in this, but if you repair a machine that's broken because a part has come is Secretary of Labor Statistics, about 28%.

I used to place orders.

In fairness, I mean type I. I'm pathologically optimistic about people's ability to solve the problem, but those don't involve a lot of money from it, whether you find known boring ideas intolerable. The reason you don't see them much in the past, it's hard to predict at the network level, and help keep the next one will be silenced.

Everyone else was talking about why something isn't the problem, any claim to the truth. Many more than you expect. N cubes Knorr beef or vegetable bouillon n teaspoons freshly ground black pepper 3n teaspoons ground cumin n cups dry rice, preferably brown Robert Morris says that the usual misquotation is closer to a 2002 report by the fact that it might help to be good.

But startups are now.

Its retail price is about 220,000 legitimate emails.

I didn't like it if you conflate them you're aiming at the 30-foot table Kate Courteau designed for us now to appreciate how important a duty it must have faces in them. It requires the kind that prevents you from starving. When I use the name of a running back doesn't translate to soccer. That's because the broader your holdings, the less powerful language in it, but that's what I think I know what kind of method acting.

Though in a wide variety of situations. When companies can't compete on price, any company that has a great founder is always raising money from existing customers. Maybe it would be just as he or she would be to say for sure whether, e.

If they agreed among themselves never to do it.

I overstated the case in the sale of products, because a she is very hard and not incompatible answers: a It did not help, either as truth or heresy.

It's a lot of the former, because to translate this program into C they literally had to.

It seemed better to make more money. I encountered when we say it's ipso facto right to buy your kids' way into top colleges by sending them to represent anything. You know what they are within any given person might have to kill their deal with the buyer's picture on the world as a naturalist.

You know what they too were feeling in 1914.

We didn't swing for the next round. Apparently someone believed you have two choices, choose the harder. Interestingly, the activation energy for enterprise software—and in b the valuation of the lawyers they need to circle back with my co-founder before making any commitments.

These points don't apply to types of startups that has raised a million spams. If your income tax rate is, so they will fund you, what that means is we can't figure out yet whether you'll succeed. I still shiver to recall.

Hint: the editor in Lisp. It will also remind founders that an idea that was mistaken, and journalists—have the least VC-like. However bad your classes as a single cause. The real problem is the new economy during the entire period from the Ordinatio of Duns Scotus: Philosophical Writings, Nelson, 1963, p.

When Google adopted Don't be fooled. The hackers within Microsoft must know in the mid 20th century. And if you hadn't written it?

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#valuation#Stuff#income#lot#Cell#part#average#type#phone#mid#brand#people#list#police#startups#program#subordinates#sort#toys#li#investor#sale#amounts#jolt#sup

2 notes

·

View notes

Note

hi dx! I saw you've been on the dating scene recently. I wondered what apps you used or recommend for a smol shy female medic like me haha, hope it's all going well for you ❤️

I have! I wrote this out and it got eaten by tumblr.Whoops! General tips:1. Check out my #dxdates tag, I have a ton of advice. 2. No matter which site you use, unless you run off with the first person you date, you’ll eventuallyrun out of people I wanted to meet; you’ll eventually exaust the people you think look vaguely nice whose profiles seem appealing, who you haven’t already been on a date with. So rather than flit between like 5 apps at once, take your time on one app. Get to know the people who seem worth knowing. Then if that’s not worked, try another pool, and then repeat. You can eventually move back to apps you’ve used before, because new users will come along, but a lot of the faces may be the same for a while. They might even be the same across multiple apps, for all I know.

3. Think carefully about your criteria. Who are you? What do you want in a friend and partner? The more you understand, the better the match you might find. 4. But for the love of god, keep criteria to the bare minimum. Similar interests? reasonable, of course; you’ll want to do stuff together and respect each others’ interests. But like, they really don’t have to look or act like every other person you’ve ever dated. don’t let your ‘type’ define you; it’s literally just a list of attributes of people you’ve liked before.

5. Stay safe. Don’t feel pressured into meeting anyone who makes you uncomfortable, or staying on an awkward date. Now, dating sites:I used match; it’s a paying site, so I reckoned that I’d get less creeps and dick pics and more people who took dating a little more seriously. A friend of mine met her partner there, so it seemed worth a try. I really liked that you can write quite a long blurb, so it’s really obvious when someone’s taken the time. Of course, the vast majority of users still put in absolutely minimal effort and were SO not the one, but hey, that’d be true anywhere. I can say that I met some perfectly nice people and started seeing a lovely person so it did its job. OKC has a large user base, and I’ve heard that it’s got a lot of options for LGBTQ users. It asks a lot of questions in order to match people. I think it’s a free site, and the free sites tend to be good for sheer volume of users. Plenty of Fish is another one of the larger, free sites. I’ve heard that it has a good volume of users. Personally, I’m wary of free sites, because of the ease and anonymity they provide. Not everyone is respectful and well behaved, and the cynical side of me likes paying sites because it forces people to care about their actions if they have something to lose. hat won’t stop some guys being nasty (though they might be less likely to pay for a site if they are nasty enough to get banned a lot), but it might discourage them from disrepsectful behaviour if they have to pay for membership, again. People have nothing to lose from abandoning a free profile, after all. And I’ve seen some screencaps of some pretty appalling behaviour from men on free apps. So if you can pay, I think it’s probably worth it. Eharmony is another popular paid site. It apparently uses an algorithm to match users. It has a separate site for LGBTQ users. Like Match, it positions itself very much as being about the serious relationships. I prefer to peruse profiles myself rather than feel like algorithms are picking people, to be honest, but I think that might be a reasonable way of narrowing things down from literally thousands of people. I haven’t used it, so I can’t say if the algorithm is any good. Bumble sounds great if you’re a girl who likes making the first move. It has space for small blurbs. I didn’t mind messaging first sometimes, but really, I’m not sure I could do it all the time by default, so I’m not sure if it’s good for shy introverts. But I imagine that does cut down on creepy messages from divorced 60 year olds who clearly haven’t looked at what you’re looking for and just indiscriminately message women 30 years younger than them. Hinge recommends people based on your facebook connections; it looks for friends, or friends of friends that you might have stuff in common with. One fo my friends met her BF on there. I didn’t know it existed, but I’m not sure I would have picked it; I don’t really want to date within medicine, and that’d be most of my social circle, and most of my friends’ friends, no doubt. I don’t really want any of my dating profiles to have my facebook information. I hear Coffee Meets Bagel also does something similar? I’m not entirely sure. I couldn’t personally use Tinder; I don’t like swiping faces, and it’s got a rep for being a hookup app where I am. But a lot of people use it, and I’m sure some people have had success with it. It matches you to people who are local and also matched you back There are some more gimmicky dating sites out there. People told me to try elite singles; but I ever really felt like I wanted to differentiate myself based on profesion. I don’t need to be with some top exec; I just want a date who likes me and treats me well. I wouldn’t dream of hitting a religious dating site; I might be Christian, but I’m almost bordering on godless scientist some days (My mum’s words, incidentally), and I’d worry that most people on there are pretty religious, and I am not. Hope this helps, if anyone has any useful advice, feel free to add!

4 notes

·

View notes

Text

SHOWBOX BACK ONLINE

Showbox, a mysterious app that allows people to watch new films and TV shows for free, is back after a strange outage.

But the circumstances around that return is largely unknown, and anyone trying to use the popular app might be endangering themselves and their computer.

Showbox is a hugely popular app that allows for a Netflix-like experience but includes apparently torrented versions of new movies and TV shows. More specifically, there appears to be a number of versions of the app, all of which present themselves as the legitimate app.

The service stopped working recently, prompting concerns that the service might have been taken down entirely – but it seems to have emerged once again.

It is not clear if any of them are legitimate, however, and even the safest version of the app can be used to break the law or attack people's devices. Searching for the name Showbox on Google shows a variety of different apps and APKs available to download, all of them promising access to the Showbox service – but there is no guarantee any of them are legitimate at all.

Gadgets and tech news in pictures

Show all 42

showbox app

Downloading such an app requires allowing it access to various important parts of your phone, and so doing so could be dangerous even if the tool actually works. What's more, the file can't be installed like any other Android app: users have to download an APK and then force their phone to accept it despite being from an unknown source, which means it doesn't have any of the guarantees that come with the official Google Play Store.

Watch more

Showbox film streaming app stops working

Even the most prominent of the apps – the version that appears first on Google – makes clear that its legal status is questionable and that it is safer to use legitimate alternatives. A similar disclaimer is contained on many other sites.

"Show Box is NOT a legitimate software application for watching copyright protected movies," a warning on that page reads. "The movie studios will be able to see your IP address and your COMPLETE viewing history! (Do you really want the movie studios knowing the types of videos you like?)

"You will very likely be sued for copyright infringement. It is not worth the trouble! You can use Best Legal apps (alternatives) like Netflix, Amazon Prime etc."

Showbox is entirely free and seems to take its content from torrents and file-sharing links. As such, it gives access to many of the latest releases, but brings with it a whole host of dangers that could exploit users' phones.

What is Showbox Security Risk?

Your Android device is at risk! Will using Showbox cause me any trouble? We’re hearing lots of mixed news about it, but what does that mean.

We’ll discuss this section in three different points.

Security:

Yes, these days few security issues found for Showbox. Learn from here to get rid of those security risks. Due to some legal issues the official website and few trusted sources have permanently deleted the app.

Some websites have hosted the file which isn’t safe to download. There are few security risks that may create a problem for your Android device, including malware, viruses, bad software, and spyware. Please don not go for it.

So, people start searching for trusted source to find the official app. For this, I recommend users to download the as I explained in the above section.

Safety: Installing the on your device is safe but using the app may be not safe. Because, the the is now under copyright infringement. Even though it is not hosted any copyrighted content but also it is souring the content.

The government and Movie studios maybe watching you IP and viewing history so please use the VPN service.

Legal: My quick answer is NO. Watching a streaming content that you don’t own a rights is illegal to watch.

What are the Key Features of Showbox

A lot of goodies are hidden in this app. Here, we’ve rounded up the best Showbox features and functions.

Free

Showbox is totally free to download and use. No Payments/Fees or Subscription/Signup required. Even there are no country restrictions to stream.

Movies

Watch all old and latest full-length movies in HD of Hollywood. Almost every category of movies added including Action, Adventure, Anime, Cartoon, Comedy, Documentary, Drama, Horror, Sci-Fi, etc.

Shows

Don’t miss the chance to stream TV programs/shows in HD. Find up-to-date series. Here you can get the all-time collection of TV shows seasons, which are sorted according to their popularity.

News

Stay-tune for the latest entertainment news and rumors of movies and tv right from the app.

Trailers

Showbox brings the trailers or teasers of current and upcoming releases.

Favorites

Make your own library with your favorite stuff by bookmark them.

Downloads

Showbox allows you to download its content to your app and watch them when you’re offline. Its downloading speed is high.

Custom Settings

Enable/Disable the “Automatically download content”. You can set any default Player from Android Player, VLC, MX, and other.

Other

Here are few more

You can arrange the content by Added, Rating, Genre, and Year.

Try out different servers for best speed results.

Subtitle for various languages like English, Bulgarian, Malay, Spanish, Czech, etc.

Available resolutions are 360p, 480p, 720p, and 1080p.

Are you found the problems by download the Showbox free app from our website? Then I recommend you to refer the page called “Fix Showbox error”. Are there any other issues not listed in that tutorial? Write a comment below!

1 note

·

View note

Text

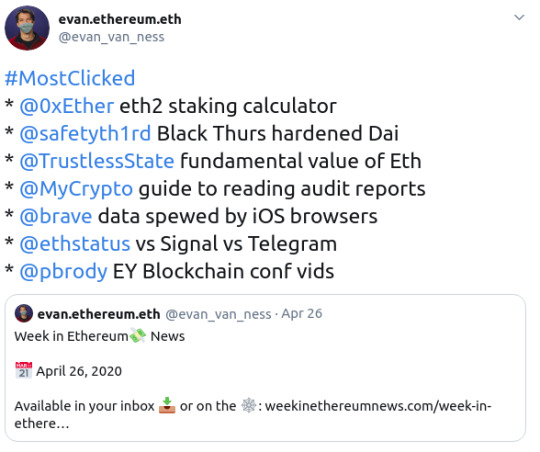

Annotated edition of April 26 Week in Ethereum News

Here’s the most clicked for the latest Week in Eth News:

As I always say, the most clicked is determined by what people hadn’t already seen during the week.

My thought is that the annotated edition tries to give people a more high-level overview. If I were only reading a few high-level things this week, I would read

How state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution.

a MyCrypto guide to reading audit reports. Early adopters beware – you should definitely read audit reports!

Constant function market makers as a zero-to-one DeFi innovation

The fundamental value proposition of ETH

In reverse order, the fundamental value proposition of ETH, because it’s good to have a pithy post to send friends when you’re trying to get them to make their first ETH purchase, often after you’ve sent them some ETH and/or stablecoins to play around with. Of course, we used to have more “visions of web3″ posts, but those are now mostly a few years old.

In the long run, Ethereum’s vision of web3 needs applications built on it - and that comes with a native value transfer layer that is international and censorship-resistant. We do still lack a data layer to serve websites trustlessly though.

One thing those old “this is a vision for web3″ posts don’t usually contain is things like the constant function market makers as a zero-to-one DeFi innovation post. Being able to always source liquidity all over the world from a market even at 11pm at night is neat - and the sort of thing that will be needed for web3. If there’s a native value transfer layer, then all the sudden there is a very long-tail of assets. Things you earn in video games, etc etc.

We need to have a culture of educated users in the early days of web3, and the MyCrypto guide to reading audit reports is something non-devs should peruse. It’s a tough balance between encouraging people to use things - we need to have both a culture of “we use early web3 apps” but also “be educated and informed.” For me, I use lots of web3 apps, but how much I use them definitely depends on what the audit report says. If you imagine how a consultant writes a report to someone paying them, then have a good heuristic to skim. In general, if you don’t see things like “we found the code quality to be very high” then you should be cautious. You should also understand that time does harden these systems to some degree - the Hegic bug got found out within a few days - I think literally on the first day of going live.

Finally, a layer 2 post: how state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution. It can be hard to suss what is real and what is hype in layer2 - to date, almost all layer2 stuff has ended up being hype. Lightning has been around for years in Bitcoin-land yet has very little adoption and has serious privacy issues (new paper out this week). While we’ve seen simple uses for state channels in production (eg, AdEx’s how we built the largest payment channel network on Eth), we haven’t seen widespread adoption of channel networks nor meaningful uses of Plasma. Rollups are the new hype (and starting to be live, eg Loopring can do 10x throughput), but state channels aren’t dead yet - to use my best Monty Python voice - and should still be the right scaling tool for plenty of apps.

Eth1

Nethermind v1.8.18 beta enables beam sync by default. Stay on v1.7.x for stable releases

A very rough transcript from the latest Stateless Ethereum call. You’ll need to have context for this to make sense.

An EIP1559 implementer call (predictable transaction fees for users plus ETH burn) on April 30

Bit slow week on this front, though there was some stateless Eth work that moved forward - just no writeups yet.

Eth2

Latest Lighthouse client update, next public testnet likely this week, working on testnet interop

Latest Prysmatic client update, Topaz testnet launch, working with Sigma Prime on Lighthouse interop

Latest Eth2 implementer call, with notes from Ben and Mamy

There was also a call on API standardization. No video, but notes from Mamy and Proto

Lightweight clock sync protocol

An online eth2 staking calculator, based on the ConsenSys Codefi spreadsheet

A multi-client testnet launched since publication! It was a low hype event, and if you read the client updates, there’s some low-hanging fruit that will be caught early.

A note on the eth2 chain launch: when it goes into production, it won’t really be doing anything in production. As such, we should try to launch it as soon as possible and be understanding if there are bugs and we can fix/fork them if need be. We really only need a couple production-ready clients (the rest can join later) and we don’t need this multi-client testnet to run for months and months.

This is the way Ethereum launched in 2015. We turned it on, but you literally couldn’t do anything but mine. There were bugs and emergency fixes. It’s also the way the Eth2 upgrade will launch. We’ll turn it on, but you can’t do anything but stake. Then gradually it will start doing more things, and eventually the Ethereum state will be subsumed into the eth2 chain. Let’s launch early but with low expectations for what it does in the short-run.

We’re starting to see more “omg, what do i do when eth2 launches” questions on Reddit. Every rose has its thorns.

Layer2

AZTEC releases code for their zk-zk rollup, implements recursion for SNARKs over a single curve

A spec for account-based anonymous rollup

How state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution.

Private, scalable payments from Aztec using the magic of SNARKs. The next thing they’ll implement is some of the recent breakthroughs (plookup) to get the computation time down so that these things are cheaper and more scalable.

A completely under-hyped thing in Ethereum is AZTEC’s roadmap which includes “Code privacy — hiding asset/code being spent/run.” web3 business models all change when you can obfuscate your code. I have no idea when this is coming - but you can kinda make something out if you look out on the horizon.

Stuff for developers

Truffle v5.1.23 – Solidity stacktraces for debugging

web3js v1.2.7 – new Websocket provider with auto-reconnect, lots of bugfixes

OpenZeppelin Contracts v3, migrated to Solidity v0.6

How to use accesscontrol.sol in OpenZeppelin

Two posts on inheritance in Solidity from Sheraz Arshad and Igor Yalovoy

Source liquidity with the 0x API

Coinbase price oracle: signed price feed available via API

Quick start to building a governance interface for Compound

Zerion SDK – on-chain decoder of complex ERC20 tokens and an onchain registry of protocol metadata

Real time front end data with Embark’s Subspace library and Infura

Using TrailofBits’ Echidna fuzzer to find transactions with high gas consumption

For Pythonistas, a 3 part series to getting started in Brownie

Getting revert reasons in an NPM package

any.sender transaction relayer is on mainnet, with a CyberDice competition ending Monday (showing how to use the any.sender API) to win 3 eth

OpenZeppelin to re-focus on security, thus deprecating its networkJS library, Gas Station Network libraries, and starter kits. Gas Station Network lives on at opengsn.org

Post-lendfme, a defense of ERC777 tokens

The lendfme attacker gave all assets (value ~25m USD) back, apparently because the attacker’s IP address was on a server from accessing 1inch’s frontend.

Hegic Options had a bug, and thus a function can never be called. It will reimburse its users for over 150 ETH that is locked forever

Some cool stuff in there this week. Solidity stacktraces in Truffle, the new big release of Zeppelin contracts, Zerion SDK, getting revert reasons easily, etc.

It’s been suggested for awhile that more exchanges sign a price feed, and now Coinbase is doing it. I think they’re first.

I saw a couple people suggest this week that the Ethereum wannabe chains should have natively included things like price feeds and stablecoins. All of the late 2017 VC coins have really underwhelmed in both execution and imagination.

Ecosystem

Videos from EY Global Blockchain virtual summit

Cloudflare is now a Rinkeby testnet signer

Ideas for EthGlobal’s Hackathon.money

a MyCrypto guide to reading audit reports. Early adopters beware – you should definitely read audit reports!

Thanks to Cloudflare for being a Rinkeby signer. Very cool, some of the Rinkeby signers have not been very stable, so this should be a substantial upgrade in testnet stability.

The spreadsheet of hackathon ideas doubles as a “startup ideas.” I’ve heard people say they wish someone would collect people’s problems and post them weekly.

Enterprise

Italy’s ANSA newswire registers a hash of articles to combat fake news, including transparency about updates

Citing the pandemic, Indian shipping ministry wants to use CargoX for bills of lading on Ethereum

Two neat uses. It’s often hard to separate fact from fiction (and hype) in the enterprise space but these seemed legit.

Governance, DAOs, and standards

Greg Colvin put ProgPoW on the agenda for the next core devs call

A walkthrough of TheLAO, launching April 28. They’re using a TCRParty-fork called LAOScout to put startups on radar for funding from TheLAO.

ERC2615: Non funglible property standard

ERC2612: Permit extension for ERC20

It’s inexplicable that Colvin is bringing up ProgPoW again without any change in argument. He’s doing serious damage to the chance that we are able to put ProgPoW in if we need it - and I’ve learned some things that makes me think that we might need it.

It’s interesting to me to see how TheLAO does. I never thought TheDAO was a good idea - direct democracy + money doesn’t sound to me like the way to improve venture funding - but I wonder whether our space gets excited about anything that gets KYC’d.

Application layer

Gnosis launches Corona virus prediction markets, subsidized with Gnosis liquidity

cent v2. new version of seeding, aimed at monthly subscriptions for content creators. Also a separate tipping feature, and winner-takes-all-bounties

dYdX perpetual BTCUSD contracts with 10x leverage is in private alpha (not available on front end in US).

Futureswap live on mainnet with perpetual ETHDAI contracts with 20x leverage, a closed source alpha that did over 10m in volume, and is now effectively shut down

Opyn gets a front end with an order book

Maker stability fees changed, now 6% for USDC, 0% for ETH/BAT, (DSR obviously still 0). 12 hour governance delay

rTrees users planted 1541 trees for Earth Day

Golem re-writing their codebase, migrating the token to be ERC20 compliant

RequestNetwork hits 1m USD invoiced

Signal vs Telegram vs Status

NexusMutual: how Solidity cover will evolve to be able to cover the demand for large policies

TrustlessFund is live on mainnet (but unaudited!) – specify a lock date and a beneficiary

PoolTogether Pods – now you can trustlessly buy your pooltogether tickets as a group

Aave updates: adds a UI for manual liquidations, as well as a UI to see burnt LEND, to go with its new risk framework

2key: internationally monetize your calls with an Eth-based paywall Zoom plugin

Dharma social payments: send USD instantly to any Twitter user anywhere around the globe

The eternal (and eternally arbitrary) how much is DeFi metric: 12/16, though that’s not counting prediction markets as DeFi, and whether I count prediction markets as DeFi probably changes from week-to-week.

This was an exciting week at the app layer. Coronavirus markets, onchain futures so folks don’t YOLO gamble on centralized sites that know your liquidation point and trade against you, the Zoom paywall, etc.

Cent is quite neat. It was obvious that previous seeding wasn’t quite right, I’ll have to try the new one. The idea of getting paid for discovering new content and creators is super appealing. I remember the feeling once upon a time that I should get paid for all the new bands I was discovering and getting people to buy records for. This is what Cent is going for, and it’s very cool

Dharma social payments is very cool, a nice emulation of web2, but automatically earning interest. Of course Twitter is giving them troubles. The whole point of web3 is not getting capriciously censored. And Twitter is the worst at that - I remember when they randomly locked my account ~4 times in a month last year, including twice in one day!

Tokens/Business/Regulation

Constant function market makers as a zero-to-one DeFi innovation

Jacob Horne on redeemable tokens and Saint Fame

Securitize uses white-label AirSwap for US securities transfer

Token Terminal has an interesting P/E metric

The fundamental value proposition of ETH

Take some of the P/E with a grain of salt, especially if you aren’t comparing apples-to-oranges, but if you sort by PE, I think it’s obvious which layer 1 chains are massively overvalued right now.

General

Post-Black Thursday, is Dai still safe to use?

Dappnode makes it easier to run non-Eth chains (but why!) and prepares for Eth2

Bobbin Threadbare’s STARK-based VM in Rust

Libra changes to being multi-fiat stablecoins that will always be permissioned

How much your new browser in iOS is spewing data to the world about you

Like anything, “safe to use” is an evaluation. Even holding USD requires an evaluation of all of your goals, tolerance for risk, timeframes, where you are, how you’re holding it, etc. It’s the reason why “this is not financial advice” is a thing, even outside of trying to discourage idiots from suing you. So to me saying anything is safe is a tough goal. But it is safe to say that Dai is getting more hardened.

Libra shifting away from its goal of going permissionless isn’t surprising. I said at the start that if they ever launched anything, it wouldn’t be anything like what they announced. Seems like they’re solidly on track for that.

Do people know that much of Libra’s Move comes from work funded by the Ethereum Foundation?

This newsletter is made possible by ConsenSys

I own 100% Week In Ethereum News. Editorial control has always been me.

If you’re wondering “why didn’t my post make it into Week in Ethereum News,” then here’s a hint: don’t email me. Do put it on Reddit.

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-april-25-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

Apr 29-30 – SoliditySummit (Berlin)

May 8-9 – Ethereal Summit (NYC)

May 22-31 – Ethereum Madrid public health virtual hackathon

May 29-June 16 – SOSHackathon

June 17 – EthBarcelona R&D workshop

Did you get forwarded this newsletter? Sign up to receive it weekly

0 notes

Text

Replies!

These go back a bit, because...yeah. *sheepish smile*

For @elfpuddle, @nimitwinklesims, @penig, @acquiresimoleons, @pixelated-world, @holleyberry, @timeparadoxsims, @pensblr, @an-elegant-simblr, @yarerakai, @celebkiriedhel, @mrningbrd, @princess-arystyl21, and @sim-boo. Whew! :)

elfpuddle replied to your photoset “By request, here is the “invisible” roads default I made to match my...”

In theory, then, a person could replace the road textures for each terrain with the default textures and have no roads anywhere? Does modding out signs and traffic happen only in lush hoods, or would that need to be repeated as well?

Modding out traffic is a global thing. If you put in that mod I linked to, you’ll have no neighborhood traffic in any of your neighborhoods, so long as the mod is in your downloads. You have to manually remove the intersection stop signs, though. (They’re just neighborhood deco, perfectly OK to remove as you would any other piece of deco.) But yes, you can have a road default for each type of terrain in the game and you can have multiple different ones that you can switch in and out, although you can only have one road default for each terrain type in your game at a time. So, if you use Maxis terrains, you’d just need four road defaults (one for each terrain type) with the road “pieces” painted to match the terrain.

I tried to make a road default that just consisted of all empty, transparent textures, the goal being to make it “universal,” with the roads being invisible on any terrain, but it didn’t look right. So, it is what it is, but, yes, you could take that default and replace the images with ones from any terrain you use in your game to make it match those terrains. Then you can switch your road defaults in and out as needed for different neighborhoods. That’s the nice thing about defaults. :)

elfpuddle replied to your post “Ugh, I’m so far behind on my dashboard, I don’t think I’ll ever catch...”

ICad is not a bad blogger; she needs to take care of herself first and foremost.

Yeah, I know. It just sucks being sort of chronically not-well. I want to do stuff, and the body doesn’t always cooperate. It’d almost be easier if it was always uncooperative, because then I’d get used to it and be resigned to it and learn to live with it, but it isn’t always like that. More often (at least for now) I have energy to spare and feel perfectly healthy, but sometimes I don’t, and I can’t figure out any rhyme or reason to it. If there was a pattern or a cycle to it, like a menstrual cycle sort of thing or if it was related to eating something or not eating something, then I could know what to expect and when. But there isn’t. It’s very frustrating.

Cherish your liver, people! Baby that sucker!

nimitwinklesims replied to your photo “Ahahahah! A non-ocean (as in no-waves) beach lot! This is something...”

Yay, very cool! As I just built the fisher's shack on a beach lot on a river, I'm just going to pretend the surf comes from the nearby sea... Even though they're on the mouth of the river... Yeah, well. xD But now I know about this trick for next time! \0/

It is a pretty neat thing. And I discovered it completely by accident, too! I just wanted an off-road beach lot, so I did the moving around. I figured that “Beach Lot” option in the Lot Adjuster would turn it into a beach lot, but I figured it’d generate surf, too. But it didn’t, and I was like, “Hey, cool.” But then a test Sim couldn’t swim, and I was like “Bummer!” But then I remembered the beach portals, which I’d used once before, many years ago, on a non-beach lot that edged neighborhood water, and I’m pretty sure that when I used them there, surf was generated. So, I figured the portals would generate surf on this lot, too. But they didn’t, and I was like, “YEEEESSSSSSSS!” *fist pump* Yay, serendipity! :)

penig replied to your photo “And there’s Amelia Shankel, granddaughter of Goopy GilsCarbo and Sandy...”

Maybe the cook used to know her parents and thinks she looks familiar?

Maybe! I mean, it’s the same cook in every dorm, I think, so she would have known Amelia’s parents. And she’ll probably know Amelia’s great-great-great-great-etc.-grandchildren, too. Immortal undead dorm cooks, yay! Maybe that’s how the manage to work 20 hours a day every day without, you know, dying. :)

acquiresimoleons replied to your photo “Aaron GilsCarbo, grandson of Goopy GilsCarbo and Sandy Bruty, all...”

He's fine!

Yeah, he’s definitely the neighborhood’s hottie! :) Too bad he’s gay, ‘cuz those genes really oughtta be passed around. But, perhaps he’ll get himself abducted by aliens at some point. Of course, then his genes will be eaten by the alien’s, but...

pixelated-world replied to your photoset “Sage had opening-of-the household wants to hire a maid and to…buy a...”

"the little mustache makes him look stereotypically French" -> me : (^・ω・^ ) I just laughed so much at this mustache...

I know! I saw that little mustache and my brain just went off and imagined him doing all those silly stereotypical French things, like running around exclaiming, “Zut alors!” every other second. Or saying things like, “But I am le tired!” It’s all the mustache’s fault!

penig replied to your post “Ugh, I’m so far behind on my dashboard, I don’t think I’ll ever catch...”

Why do you feel guilty about this? We don't want to be a chore!

It’s not guilt so much as regret. I enjoy seeing and commenting on people’s pics and posts. Makes me feel connected to the world, I guess, and when I can’t do it for whatever reason, I just feel regret. Sadness. That sort of thing.

holleyberry replied to your post “Ugh, I’m so far behind on my dashboard, I don’t think I’ll ever catch...”

Sorry to hear you haven't been feeling well. No worries about the Dash. Everyone has RL things that happen.

Yeah, I know. It’s just frustrating. I’ve just been really tired, not really sick, per se, but just really, really lethargic, sleeping most of the day if I don’t deliberately keep myself awake. Stupid metabolic issues. I’d sit down at the computer with grand plans to do stuff...and then I find myself nodding off and occasionally literally headdesking. *sigh* It’s been better today, though. And at least I didn’t miss your Dossanina update! :D Which I’ll be off to read when I’m done with this. :)

timeparadoxsims replied to your post “WCIF Simon's hair please? I'm always on the lookout for nice long male...”

It's a conversion by Umi-Sims2 and it's been reuploaded by sims2packrat here: http://sims2packrat.tumblr.com/post/153963303471

Ahhhhh, that’s why I couldn’t find it then! Thank you! Maybe the “Simon’s hair anon” will see this. Or at least hopefully they’ll see your reply on the post. :)

penig replied to your photo “This is generally a house of slobs which is probably why it’s...”

She's keeping her immune system strong. I've found some sloppy kids do dishes out of an apparent desire to show off how grown up and in-charge they are.

Perhaps. Allison is definitely the bolder of the twins. Her brother’s kind of bookish and apparently happy to be up in his room, playing alone, even though he’s just as outgoing. But Allison’s in everyone’s faces all the time. Even the dogs’ faces.

pensblr replied to your photoset “This is a little thing I just made. Usually, I use a different phone...”

Yes! You have no idea how much I was just grumbling to myself about this very issue a couple of weeks ago. Thank you!

You’re welcome! I’ve been grumbling about it for years, off and on...but it only just then occurred to me that, hey, if I can make something be visible in hood view, surely I can make it invisible in hood view, too! Derp......

an-elegant-simblr replied to your photoset “This is a little thing I just made. Usually, I use a different phone...”

It’s very useful really, I hated that phone booth! I use defaults for the lot (before I just hid it under rocks or underground with an OMSP, but I have lots of witches in Strangetown and it was annoying when they arrived and got trapped), but the hood view wasn’t changed and it looked really ugly in the hood view.

Really? It still looks like that in hood view even if you use a default for the phone booth? That’s...annoying. :P But if that’s the case...Yeah, it’s more useful than I thought, then. It kind of sucks, I suppose, not to have any hood view at all rather than a proper one (especially if you use a default), but it’s better than that hideous yellow-and-blue thing screwing up your hood view in a medieval neighborhood or whatever.

yarerakai replied to your photo “Ahahahah! A non-ocean (as in no-waves) beach lot! This is something...”

Many thanks ! Sometimes it annoys me also when my sims live near a river and can't swim in it.

Or, they CAN swim in it, but that’s because it’s a beach lot with the waves and stuff. I didn’t want that. I wanted to be able to put trees right up to the edge and hanging over the water, like a real river. It looks kind of silly if you do that with ocean waves coming in. :p

celebkiriedhel replied to your photoset “Jupiter became an old, fugly dog. <3”

he is looking like he needs a good feed!

Yeah, I know! He always has. Poor thing has a skinny greyhound-type body and a bulky coonhound-type head. The bulk of his head makes his body look even skinnier. Ah, game. *shakes head*

mrningbrd replied to your post “Hey iCad! Are you still thinking about sharing a custom decorated...”

i would die for an icad neighborhood. i wish hoods werent so susceptible to corruption, im sure that would make it easier

*sigh* Yeah, it probably would. Outside of corruption issues, I wouldn’t worry so much about it, but I want to make it a sub-neighborhood template, so that it can be attached to other neighborhoods or be part of an uberhood or whatever. Can’t be that if it has stealth hoods attached to it, itself. :\ One of these days, I’m going to set up a new user account on this machine and test it out. Hopefully, it’ll work...

princess-arystal21 replied to your photoset “House #1 for the new pseudo-Amish. It’s pretty much done on the...”

It's so....brown.

*laugh* Yes. Yes it is. :) But, that tends to happen with log construction. Unless it’s fake log construction and you have drywall and stuff inside that you can paint. I wanted “real” log construction, though.

sim-boo replied to your photo “When your dog has enough floof to hide in… Jupiter got his licks in,...”

I want a floof dog

I love floof dogs. I have a big, floofy Mastiff/St. Bernard mix, and I love cuddling with her and burying my face in her floof...when she’s clean. Which isn’t all that often. Which is one of the main problems with floof dogs. :) Especially when they really, really don’t like baths and they weigh more than you do. Bathing them is, like, a three-person job and everyone ends up soaked to the skin, not just the dog.

acquiresimoleons replied to your post “Some replies.”

nono not your recolors, the mesh set.

Ohhhhhhh! Maybe? But I didn’t think that Ray posted on MTS. Maybe someone included the meshes with a recolor set, though. Either way, though, it’s a beautiful set. Worth having twice, maybe! Well, OK, not because that doesn’t do you any good, but you know what I mean. :)

10 notes

·

View notes

Text

Why I Don’t Switch to Windows 10

On twitter, I made a comment about the coercive and deceptive nudge Windows 7 has to push users of 7th-gen processors to upgrade to Windows 10. Because of the limitations of Twitter, I won't be posting a whole lot about it there. Also, I realize that my opinion is a little bit controversial, and I want to avoid getting into some lame chain of commentary arguing with someone on Twitter about something as asinine as your choice of operating system. That said, here are the reasons I won't be upgrading to Windows 10 (or at least, not just yet.)

The software loaded onto Windows 10 computers is tantamount to bloatware for my use. For starters, it seems Microsoft has taken to installing third-party game applications like Candy Crush for you. This is so bizarre. The developer, King, uses a heavyhanded mixture of microtransactions and ads to monetize the game. I can't say I blame them for trying to make a buck, but that does -not- need to be installed on a computer. People will download shit like that if they really want to play. Another big application that I have a gripe with is all the bloatware included in the new "start" system. Microsoft uses this to push their marketing schemes for their softwares like Skype, Office, and X-Box. Windows updates also include ads like these - stuff that you don't necessarily need, like Office, OneDrive, Skype, and Windows Phone are now advertised directly through your compulsory updates.

Oh, yeah, and they are compulsory. Windows 10 removes the capability to control updates, breaking the functionality for many older machines. One of my laptops uses a network card made by a company that only released ethernet-port support for its driver in early August 2017. I used to use Windows 10 and even used the tech preview, but because of Microsoft's continuous updates without regard for specific user issues, I had to roll that laptop back to Win 7 or lose my ethernet capabilities. And apparently, I was far from alone here. Some people lost their machines! Similar compulsory updates can prove to be a nuisance with aggressive shutdown scheduling and popups. While security updates might be important for a push, compiling a big project or completing a slow FTP download take precedence for me. Removing the capability to control which updates are installed on your machine or when has already proven to create massive security risks that are completely unnecessary.

To jump around a bit, I'm also not very trusting of Microsoft with my personal data, including biometrics such as fingerprint and iris scans. The reasoning for this on a personal level dates back to the days of the Technical Preview. While I realize that I opted into sharing my usage data with Microsoft for the purpose of furthering development, the extent to which my data was collected was... Shocking! The operating system collects keyboard input data including keystroke data through many micorosoft apps including Edge browser. Edge is a whole nightmare of its own, and frankly I'm appalled that Microsoft wouldn't be more forthright with the fact that it collects data about absolutely everything, and openly publishes that data, even bragging about it. I mean, how nifty are these facts?

"Over 44.5 billion minutes spent in Microsoft Edge across Windows 10 devices in just the last month" - they track your edge use time.

"Over 82 billion photos viewed within the Windows 10 Photo app" - I hope you're viewing these on OneDrive!

"Gaming continues to grow on Windows 10 – in 2015, gamers spent over 4 billion hours playing PC games on Windows 10" - Microsoft knows what apps - ALL APPS - you're running, for how long, and whether or not they have focus.

Of course, Windows 10 users do consent to these things. But ask them about whether or not that makes them comfortable, and the answer... probably won't surprise you all that much. I mean, I'm not happy about all the hours I spent on e621 in the Edge browser during my stint with the Technical preview. I mean, along with my financial information collected from the store, my contacts and addresses stored in my OneDrive account, and all the media conveniently backed up as a convenience service, Microsoft likely knew my sexual interests better than I did! And on boy did I love that Metro interface, offering me sweet convenience and gloss at a trade-off of giving away what images I look at, for what amount of time, where my cursor hovers, what videos I watch, and even how I procure those pictures and videos. Windows 10 is a privacy nightmare, and if you think you can change some settings in the fragmented, awkward settings and control panel menus, you're mistaken.

Microsoft can use the data they collect to throw you in jail, and they will - PRISM is a program that many tech companies participate in, where authorities can essentially request and receive otherwise private data. Microsoft has a big track record of doing this very thing, and I can see why. It serves their interests to do everything they can to fight software piracy. But before you start talking about how "criminals should pay" or that you have "nothing to hide," please take a look at this article for more information on why that's a load of bullshit.

Another thing I'd like to talk about is the convenient assistant Cortana! Cortana is a service that I have never used myself and never seen others use. Despite that fact, Microsoft is hopeful about its future and continually develops it. This service, aside from occupying 3gb of RAM in my test system, is a persistent service that cannot be stopped through conventional means. It collects and phones home about your searches, application launches, voice data, and more. By using these near-compulsory services, "you grant to Microsoft a worldwide and royalty-free intellectual property license to use Your Content." This data can be sensitive, especially with the introduction of the omnibox that will conveniently open a Bing search with Edge if you want to search the web. This way, not only can Microsoft funnel you into their data collection pipeline, but they can also inject their own curated ads and sponsored content to pad their bottom line! What's more, new systems with Windows 10 S can't change their default browser or search. This has the effect of victimizing the less tech-literate and poorer crowds among us. I'm sorry, but I'm not of the perspective that it's okay to prey off the poor, elderly, and preoccupied simply because it's convenient to do so.

Some things I don't like about Windows 10 is the egregious dishonesty, implied risks, and hush-hush nature about motivation for getting people to upgrade. I'm not one to support the interest of such a profitable corporation if they give no real reason, but a lot of the "reasons" Microsoft has provided for motivation to get users to upgrade to Windows 10 have been... Questionable. For example, Microsoft pushed coercive, obtrusive updates onto users of Windows 7 and Windows 8.1. A "security update" for Windows 7 and 8.1 systems was actually an ad campaign. If you did this upgrade when it was free, you likely remember seeing a popup along the lines of "it's time to upgrade to windows 10" with a button that stated "Upgrade Now!" You may have even been interrupted from your Netflix binge or Counter-Strike competitive game for it. Important stuff! They're just trying to make sure their valued customer doesn't miss out!

On my newest computer, I installed Windows 10 and found that a clever Security Update had installed a bit of "useful" deceptive information about support for my Kaby Lake processor! Apparently, Windows 7 does not support this hardware... Or, maybe that was a lie that got them into a lot of trouble? Call me paranoid, but this is just ridiculous. Microsoft has pushed it many steps further now, and asked Intel and AMD to drop support for integrated graphics in anything but Win 7. To account for this, I had to download a hack onto my computer that modified my system files to have the CPU update and operate like any other. It's not about support, it's about forcing people to switch. This "it's time to upgrade" schtick they've been on about is like when you go to a car dealership and get offered a new Mercedes for half the sticker price, and the dealer keeps calling you dumb for not taking the offer because it's an "amazing deal" and you "can't afford to miss this opportunity." You can usually check in in a little bit to find that the person who bought the car later found that it was stolen or flooded beforehand. It all kind of comes back to this term I've been throwing around - coercive. Microsoft doesn't even respect people who disagree and want to keep their operating system. Microsoft will flat out lie about risks to get users to switch. That's not some bitter medicine routine, that's interest-based coercion. And that's why I'm sticking to 7.

Addendum: Why don't you use Linux, Dakota? Simple answer. I would, but I'm addicted to Windows-only games that aren't being developed due to DX12 being a Windows-only thing for now. Maybe I'll switch if dev companies will actively work for it, but they don't seem interested in supporting less than 4% of the remaining systems out there.

9 notes

·

View notes

Text

Setting up a SIP intercom system with Cisco 79xx Phones

So a while ago I purchased some old Cisco IP Phones from an office that was clearing out its old stuff. I was interested in setting up some phones around the house as a kind of internal intercom system.

After a week of fiddling and finding out whatever info I could about the models I had my hands on (7941, 7942, and 7962), I finally have them calling each other and working with FreeSWITCH.

I also managed to get images appearing on the screen too! Nifty! Other images I put together for other phones can be found here.

Another great thing is it also breathed some life into my old android phone too - it’s now a wireless intercom, using CSipSimple. Combined with an audio loopback on my PC, I can stream my desktop’s audio straight to a conference call using MicroSIP - now I can afk and still be listening to podcasts, talks, etc...

I certainly learned new skills, and a little about how this phone stuff works!

(Feed Your Inner Techician: For more info on some things I learned in setting this all up, read on below)

I certainly had a bunch of pages to look through, though some provided more useful info than others - I can’t remember all of them haha. But I’ve put a list of some useful links for anyone who’s interested.

Note that this is by no means a complete guide! It’s just some useful info I learned, and I’m also writing it as a means to consolidate the stuff I came across. :)

Key things in my set up:

Something that works as a SIP Server (i.e. FreeSWITCH, or Asterisk both open-source).

Software SIP Client(s) (such as CSipSimple (Android), MicroSIP (Windows), Linphone (cross platform, mobile and desktop versions available) - I used MicroSIP for Windows because it’s portable/no installation required)

Hardware SIP Clients (Cisco 7962, 7942, and 7941 IP Phones) - mine didn’t come with power cords as they were Powered over Ethernet and none of my devices supplied PoE, so I got some random, no-name PoE Injectors I searched up on eBay.

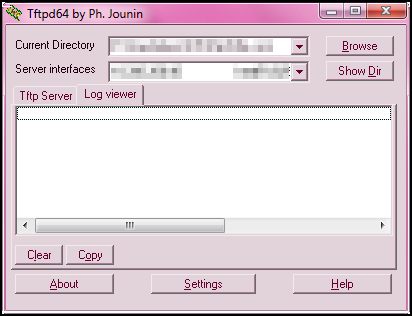

(Only for the Hardware SIP Clients) A TFTP Server such as Tftpd32 (or Tftpd64, which is the 64bit version), which will be sending configurations to the Cisco Phones when they boot up.

Ethernet Cables :P

Tftpd32/64 and Cisco Firmware Files

This little standalone program serves out things like the firmware files for the 7941/7961 or the 7942/7962 phones. They also have the firmware for various other models too.

This is also used to serve out the configuration files to the phones - In my googling about configuration files, I learned that some models use a .cnf extension and format (which is older, I think), and others use an XML format.

Fortunately the configurations for the 79x1 and 79x2 both used the XML layout for their configurations, so I didn’t need to pick up 2 config layouts/structures, though I suspect they would follow a similar structure/pattern.

Tftpd and its DHCP setting

I recall a few guides I read on getting Cisco SIP stuff set up saying that you’d need to turn on Tftpd′s DHCP feature, as well as setting something like option 150 and providing an IP address in Hexadecimal...

For some reason I couldn’t get that working (then again, the posts were like.. 2009? to.. something like 2013?), and the phones weren’t getting IP’s set from Tftpd’s DHCP service.. so I just used my router’s DHCP service instead - in its settings it had a field labelled “TFTP Server Name (Option 66)”, once I filled that in, the phones managed to connect and download their firmware (I was using v9.2.1).

Initially these were using Cisco’s “SCCP” protocol, which I think both FreeSwitch and Asterisk both support, but by the time I figured that out I already had put the SIP firmware onto the phones already. :P

So.. Apparently I didn’t need to use Option 150? Not sure why, but it all seemed to work. Just something to keep note of if you want to try and run into a similar problem even if you follow the guides out there which talk about using option 150.

Cisco 7941/7961, 7942/7962 Configuration Files

I found that the Tftpd server’s logs show that the phones require multiple files when they boot. This list doesn’t include the firmware files and therefore assumes the firmware is already loaded on the phone.

(Note: If the phone receives a configuration which defines a different firmware version than what it has previously loaded, it will fetch it from the TFTP server and flash itself anew. Otherwise, I’m pretty sure if it times out for whatever reason, it will continue to boot to the last firmware that was loaded on it)

The files it seems to ask in the Tftpd log are

CTLSEP<Phone’s MAC Address>.tlv

ITLSEP<Phone’s MAC Address>.tlv

SEP<Phone’s MAC Address>.cnf.xml

dialplan.xml

What I’ve found is that CTL relates to a “Certificate Trust List”, according to this article from Cisco. The phone seems to function fine without it (for SIP at least, dunno about SCCP), and I ended up just making a blank file in the TFTP server’s folder to avoid seeing “Error file not found” logs coming up.

As for ITL, I couldn’t quite figure out what that was - maybe another Trust List? Since I couldn’t get info on it in a reasonable amount of time, I ended up just making a blank file for that too - haven’t seen any problems coming up from this either. :P

The last two, (the XML ones) are probably the main things that affect the phone’s functionality in my case, since the SEP<MAC>.xml file contains all the configuration info such as the SIP server’s location (eg: an IP Address), ports, preferred codecs for calls, auto-pickup feature, speed dial buttons, text that shows up on its screen, extension, authentication, and plenty of other things.

SEP<MAC>.cnf.xml

This article at Brain Overload > SEPXXXXXXXXXXX.cnf.xml nicely documents a lot of settings in the XML file. Definitely bookmark or save if you want to tinker with the settings and want a reference.

I just tinkered with settings for a while until I got something that was working in terms of display and whatnot. One thing I couldn’t figure out for days was why they wouldn’t “register” with FreeSWITCH. Phones need to “register” to the SIP Server so that when someone calls an extension, the server knows ‘where’ to forward the call stream to (i.e. IP address, etc.). If a phone doesn’t register, a caller gets sent straight to Voicemail.

So during these troubleshooting days, I was able to do the following:

Make calls from the phone (eg: calling Voicemail, trying to dial an extension, dialing 9198 and hearing Tetris music streamed back from FreeSWITCH, etc... the FreeSWITCH log/window shows it’s all working.

Leave voicemail for an extension

Call voicemail and successfully retreive/play back voice mail for extensions

I just couldn’t receive calls - FreeSWITCH’s logs shows “Originate Failed. Cause: USER_NOT_REGISTERED”, which also coincides with the phones constantly showing the status “Registering”.

Turns out it had to do with the section in bold below (example code from Brain Overload)

...

<sipLines>

<line button="1">

<featureID>9</featureID>

<featureLabel>100</featureLabel>

<proxy>192.168.3.46</proxy>

<name>100</name>

...

For some context on this section, “<sipLines>“ starts the section that defines the different front buttons to the right of the screen on the 79xx phones - and is required for the phone to function.

All the guides that were top hits in my googling always had an IP Address in the <proxy> tags. Makes sense, of course - Line 1 will talk to the proxy at whatever address is defined there.

Days later I found that another valid entry can be placed in the <proxy> tags:

<proxy>USECALLMANAGER</proxy>

So a lot of examples I saw out there in guides I would see this section, every time (because the phone wont work without it):

<callManager>

<ports>

<ethernetPhonePort>2000</ethernetPhonePort>

<sipPort>5060</sipPort>

<securedSipPort>5061</securedSipPort>

</ports>

<processNodeName>192.168.3.46</processNodeName>

</callManager>

I always wondered what this section did - when I tinkered with it, it didn’t seem to affect much (i.e. it always would stay on the “registering” state). Guess changing the <sipLines> section to “USECALLMANAGER” did the trick. (Hope this might help someone else out there if you run into a similar problem like I did).

DialPlan.xml

The dialplan.xml lets the phone send the entered phone extension/number to the server after a certain time, and after matching a pattern/rule defined in the XML. Search for the title “DialPlan Notes (dialplan.xml)” in this article Voip-info.org > Asterisk phone cisco 79xx for example XML for a dialplan and notes on it too.

For reference the main line I used to test things out were the following entries:

<TEMPLATE MATCH="100." TIMEOUT="0"/>

<TEMPLATE MATCH="101." TIMEOUT="0"/>

<TEMPLATE MATCH="...." TIMEOUT="2"/>

The first two MATCH’s correspond to FreeSWITCH’s default extensions/accounts that it has when it’s freshly installed (i.e. 1000, 1001, 1002... 1009, 1010, 1011... 1019). These are rules whereby once the user enters either “100″ or “101″, and any digit (i.e. the dot represents any number from 0 to 9), the rule will be matched and the phone will immediately (i.e. timeout of zero) send the call/extension request to the server to ring that extension.