#California Tax

Photo

Customer: I WANT A LICENSE PLATE WITH "CAT" ON IT, AND I FIGURED A CUSTOM PLATE CAUSES ME TO PAY MORE IN TAXES... SO I AM PAYING THE CAT TAX.

DMV: CAT TAX CAT SLANG FOR VAGINA

Verdict: DENIED

#California license plate with text CAT TAX#bot#ca-dmv-bot#california#dmv#funny#government#lol#public records

320 notes

·

View notes

Text

YES, PLASTIC BAG BANS HELP PREVENT POLLUTION REALLY WELL

"Plastic bags are everywhere - littering our streets, clogging up our rivers, and choking wildlife in the ocean.

But after years of campaigning from environmental groups, many places have banned them entirely.

Over 100 countries now have a full or partial ban on single-use plastic bags. Between 2010 and 2019, the number of public policies intended to phase out plastic carryout bags tripled.

The results of such tough rules are starting to show.

What is a plastic bag ban?

A plastic bag ban is a law that restricts the use of lightweight plastic bags in shops. Sometimes they are totally banned, and sometimes consumers have to pay a fee to buy them.

The bans often only apply to thin plastic bags, with thicker, reusable ones still available for purchase.

Bangladesh became the first country to introduce a ban on plastic bags back in 2002.

Such total bans are common throughout Africa and Asia. These areas import much of the Global North’s ‘recyclable’ rubbish and so face the consequences of plastic mismanagement more acutely.

In addition to plastic bags, many countries ban other types of single-use plastic like in the EU which has got rid of single use cutlery, straws, balloon sticks, and coffee buds.

Which European countries use the most plastic bags?

In Europe, 18 countries have imposed bans on thin plastic bags - including France, Germany, Italy, Iceland, and Albania.

A further 23 countries require consumers to pay a fee. Two more - Switzerland and Norway - allow the plastic industry to impose a ‘voluntary charge’ on the use of the bags.

Plastic bag consumption is highest in the Baltic and Nordic countries, Eurostat data from 2019 reveals. Latvia (284 bags per person, per year) and Lithuania (332) consumed far more plastic bags than any other European country. This could change, however as from 2025, Latvian shops will no longer be permitted to give away free plastic bags. A similar prohibition will come into force in Lithuania this year.

The lowest plastic bag usage can be found in Portugal (8), Belgium (17) and Poland (23). Portugal banned the bags in 2021, two years after Poland. [Note: To be clear, that is 8 plastic bags per person per year! Way lower than I thought was currently possible!]

Do plastic bag bans work?

Plastic bag bans have so far been highly successful. A ban on thin plastic bags in California reduced consumption by 71.5 per cent.

Research shows that taxes work too. According to a 2019 review of existing studies, levies and taxes led to a 66 per cent reduction in usage in Denmark, more than 90 per cent in Ireland, between 74 and 90 per cent in South Africa, Belgium, Hong Kong, Washington D.C., Santa Barbara, the UK and Portugal, and around 50 per cent in Botswana and China.

And the impact is visible on the ground too.

At a 2022 annual beach clean in New Jersey, US - where a ban was recently introduced - the number of plastic bags collected dropped 37 per cent on the previous year. Straws and takeaway containers dropped by a similar amount.

“It’s really, really encouraging to see those numbers trending down for the bags, straws, and foam containers,” said Clean Ocean Action Executive Director Cindy Zipf. Clean Ocean Action is a charity that is instrumental in organising the beach clean."

-via EuroNews.Green, 4/5/23

#sustainability#plastic pollution#plastic#single use plastic#plastic ban#pollution#water pollution#taxes#european union#california#denmark#iceland#ireland#new jersey#ocean#oceanography#good news#hope

394 notes

·

View notes

Text

By Topher L. McDougal

California will be the first U.S. state to charge an excise tax on guns and ammunition, starting in July. The new tax — an 11% levy on each sale — will come on top of federal excise taxes of 10% or 11% for firearms and California’s 6% sales tax.

The National Rifle Assn. has characterized the law that allows this new tax, the Gun Violence Prevention and School Safety Act, as an affront to the Constitution. But the reaction from the gun lobby and firearms manufacturers may hint at something else: the effect that the measure, which is aimed at reducing gun violence, may have on sales.

For the record:

10:20 a.m. May 21, 2024 — An earlier version of this piece stated that U.S. gun sales grew tenfold over the past 20 years. They grew fourfold.

One way to think about the law’s ramifications is to compare state tax policies on firearms with those on alcohol and tobacco products. It’s not for nothing that these all appear in the name of the Bureau of Alcohol, Tobacco, Firearms and Explosives. The ATF focuses on those products because, while legal, they can cause significant harm to society in the form of drunken driving, for example, or cancer-causing addictions. They also have a common history: All have been associated with criminal organizations seeking to profit from illicit markets.

Alcohol and tobacco products are thus usually subject to state excise taxes. By making a given product more expensive, this type of tax leads people to buy less of it, reducing the harm to society while generating tax revenue that the state can theoretically use to offset those harms that still accrue.

California, for instance, imposes a $2.87 excise tax on each pack of cigarettes. That tax is higher than the national average but much lower than New York’s $5.35 levy. California also imposed a vaping excise tax of 12.5% in 2021.

Of the four ATF product families, firearms have enjoyed the absence of any state excise taxes. Until now.

Anti-gun advocates and policy analysts have long called for the firearm industry to be subject to the same types of taxes as alcohol and tobacco given the harms that firearms cause. The national rate of gun homicides in 2021 was 4.5 per 100,000 people, eight times higher than Canada’s rate and 77 times that of Germany. It translates into 13,000 lives lost every year.

Additionally, nearly 25,000 Americans die from firearms suicide each year. Moreover, more people suffer nonfatal firearm injuries than die by guns, according to the Centers for Disease Control and Prevention.

Gun deaths and injuries aren’t just tragic — they’re expensive. One economist estimated the benefit-cost ratio of the U.S. firearms industry at roughly 0.65 in 2009. That means for every 65¢ it generates for the economy, the industry produces $1 of costs. And that calculation didn’t include nonfatal injuries within the U.S., or the cost of firearm harms occurring outside the country with U.S.-sold weapons.

U.S. gun sales have grown fourfold over the past 20 years to about 20 million guns annually, and they’re now deadlier and more expensive than ever. California is making sure they are taxed accordingly.

And what should that tax amount to? There’s an argument to be made that firearms should be taxed at a higher level than alcohol and tobacco, which are consumable products that disappear as soon as they’ve been used — guns stick around. They accumulate and can continue to impose costs long after they’re first sold.

When the new law takes effect in July, California will tax firearms at about the level of alcohol. But the state would have to apply an excise tax of an additional 26% to equal its effective tax on tobacco.

It’s unclear how the new tax will affect gun violence. In theory, it should be highly effective. In 2023, some colleagues and I modeled the U.S. market for firearms and determined that for every 1% increase in price, demand decreases by 2.6%. This means that the market should be very sensitive to tax increases.

Using these figures, another colleague recently estimated that the California excise tax would reduce gun sales by 30% to 44%. If applied across the country, the tax could generate an additional $1.5 billion to $1.9 billion in government revenue.

But a problem may come from surrounding states: It’s already easy to illegally transport guns bought in Nevada, where laws are more lax, to California. But there’s some evidence that suggests our state’s new policy won’t be neutralized by its neighbors.

When the federal assault weapons ban expired in 2004, making it much easier to buy AR- and AK-style rifles across much of the U.S., gun murders in Mexico skyrocketed. Two studies show the exception was the Mexican state of Baja California, right across the border from California, which had kept its state-level assault-weapons ban in place.

Gun seizures in Mexico show that all four U.S. states bordering Mexico rank in the top five state sources of U.S.-sold guns in Mexico. But California contributes 75% less than its population and proximity would suggest it should.

So, California laws seem to already be making a difference in reducing gun violence. The excise tax could accomplish still more. If it does, other states may follow California’s lead and work to reduce firearm violence by hitting gun manufacturers at the spot they value most — their bank accounts.

#us politics#news#los angeles times#op ed#2024#gun rights#gun violence#2nd amendment#taxes#excise tax#Gun Violence Prevention and School Safety Act#us constitution#national rifle association#Bureau of Alcohol Tobacco Firearms and Explosives#california#gun crime#gun control

25 notes

·

View notes

Text

she's sick of me fr

#zee rambles#i can't help it i was reading the instructions for my state's tax forms and read all the california ones re: widowers#kate: soft writer genius#obsessed with the period at the end of her sentence

21 notes

·

View notes

Text

Al Capone’s Jail Cell, Alcatraz, #181

San Francisco, California

Bob Cronk

#alcatraz#alcatraz island#san francisco#san franciso bay#california#prison#jail#tax evasion#mobsters#the mob#bob cronk#bob cronk photography#original photographers#photographers on tumblr#photography on tumblr#original photography#bobcronkphotography#black &white#incarceration

89 notes

·

View notes

Text

The IRS is testing out a free on-line direct tax filing system meant to replace for low and medium tax payers commercial tax preparation software, like TurboTax.

TurboTax in particular has long lobbied against this, and helped kill it under the Trump administration. But in 2022 as part of the Inflation Reduction Act President Biden signed the IRS was tasked with developing this system which mirrors what many of America's peers, like Japan and Germany do for taxes.

2024 will park a pilot program to test the system in a few states before going nation wide hopefully in 2025, if you live in Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California or New York you may qualify, so check!

it almost doesn't need saying but I'll say it, this program will never make it nation wide if Trump is President in 2025.

#IRS#taxes#tax day#Florida#california#New York#turbotax#news#politics#US politics#good news#thanks Biden#Joe Biden

19 notes

·

View notes

Text

💙I FUCKING LOVE CALIFORNIA💙

#tax this shit to death#GO GAVIN GO💙#california girl🩵🌸#born and raised#THANK YOU GRANDMA FOR GETTING US HERE BACK IN ‘44🩵#california history

26 notes

·

View notes

Text

I take back what I said about everyone ignoring the fact that libraries exist and there's no excuse to pirate because why does California libraries charge you $5 for interlibrary loans (non-refundable even if it was unavailable) when they have a crappy catalogue of maybe 100 books and 5 dvds they only have because someone donated it

#meanwhile my beloved IL libraries with#0 late fees#10 automatic renewals#long due dates#5 million physical copies of books + fantastic digital library#what is california using its taxes on#fuck organic eggs give me some books

7 notes

·

View notes

Text

#usa news#us politics#usa today#usa#usa politics#usa election#taxes#economy#income tax#income#taxation#california#californication#us taxes#us taxpayers

5 notes

·

View notes

Text

#good news#Arizona#mental health#Texas#tampon tax#period tax#new zealand#California#caste discrimination#gun show loophole#mississippi#lgbt representation#lgbt rights#love is love#love wins#lgbt pride#hawaiʻi#harm reduction#lego#braille#climate action#climate activism#climate science#climate crisis#climate justice#climate change#climate solutions#lgbt equality#climate emergency#climate news

26 notes

·

View notes

Text

Filthy rich Republicans wish to tax poor people more so that the rich can get even more tax brakes when the GOP is in power. That's pretty much the story of Eric Hovde.

Hovde is running against incumbent Wisconsin US Senator Tammy Baldwin.

Wisconsin is a fairly moderate state. But it features some of the most despicable Republicans outside the old Confederacy.

In 2017, Sunwest Bank CEO Eric Hovde advocated for reforms that would raise taxes for 72 million Americans, including retirees and low-income earners. Hovde, a Republican, is expected to announce a U.S. Senate campaign in Wisconsin soon.

Hovde, who has been endorsed by national Republicans to challenge Democratic Sen. Tammy Baldwin in 2024, made the proposal in a Nov. 18, 2017, appearance on the radio program “The Vicki McKenna Show.”

[ ... ]

Analysis by the nonpartisan Tax Policy Center found the plan would have also raised taxes for middle- and working-class families as well as retirees.

“More than 80 percent of the tax increase would be paid by households making about $54,000 or less, and 97 percent would be paid by those making less than about $100,000,” wrote Howard Gleckman, a senior fellow with the organization. “Low-income families with children would pay the most: Achieving Scott’s goal would slash their after-tax incomes by more than $5,000, or more than 20 percent. A Scott-like plan would raise taxes on middle-income households by an average of $450.”

Scott’s plan failed to pass, but he has not given up pushing for it. If Hovde were to join him in the Senate and support the measure, it could gain traction.

In Wisconsin, Scott’s plan would have raised taxes for 32% of people, according to analysis by the nonpartisan Institute on Taxation and Economic Policy.

Hovde wants to take away your healthcare in addition to raising your income tax (if you're not a millionaire).

Hovde ran unsuccessfully in the Republican primary for U.S. Senate in 2012, and during that campaign he called for a total repeal of the Affordable Care Act, which in 2022 made it possible for 212,209 individuals in Wisconsin to obtain affordable health insurance coverage.

The Eric Hovde and Donald Trump Agenda: Take Away Critical Health Care Protections From Wisconsinites

Hovde doesn't even live in Wisconsin. Just sayin'...

Bice: Eric Hovde may run for Senate in Wisconsin, but he's living large in Laguna Beach, California

Did I mention that Eric Hovde is an anti-abortion fanatic.

ERIC HOVDE ON ABORTION

#eric hovde#republicans#eric “california” hovde#wisconsin#us senate#eric hovde wants to raise your taxes#abortion#roe v. wade#the sanctity of reproductive freedom#eric hovde opposes women's rights#eric hovde wants to repeal obamacare#tammy baldwin#re-elect tammy baldwin#vote blue no matter who#vote democratic#election 2024

7 notes

·

View notes

Text

I got a raise today 💸💸💰💰🪙💸💰💵🤑💸🤑🤑💵💰

3 notes

·

View notes

Text

Alcatraz Island

San Francisco, California

Bob Cronk

#alcatraz#alcatraz island#san francisco#prison#al capone#machine gun kelly#Alphonse Capone#tax evasion#George Kelly#birdman#Robert stroud#bob cronk#original photography#original photographers#photographers on tumblr#bobcronkphotography#pier 33#whitey bolger#photography on tumblr#california

101 notes

·

View notes

Text

https://x.com/GRE8TBLACKSHARK/status/1701210980087136399?s=20

9 notes

·

View notes

Text

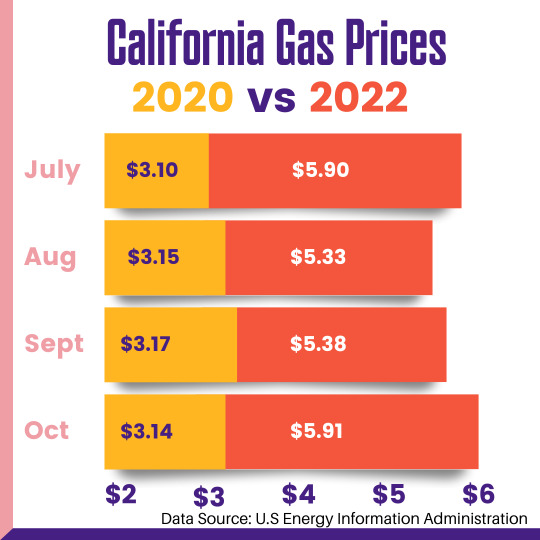

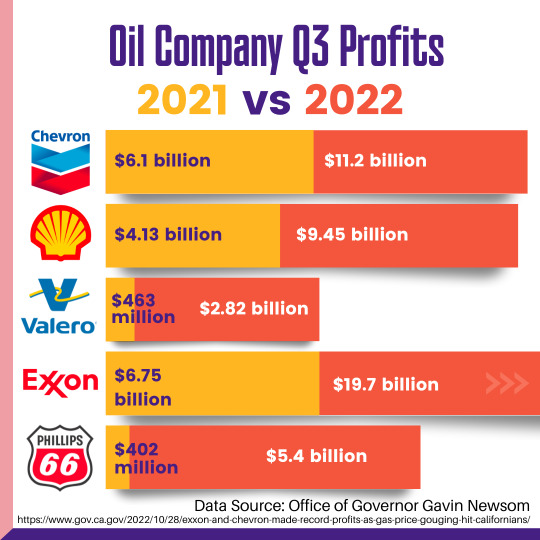

California, let's #StopBigOil

In 2020, while working families across California suffered economic turmoil amidst a global pandemic, we also saw peak gas prices reaching as high as nearly $6. While oil companies claimed that the cause of this increase was state taxes or the war in Ukraine,

the reality is that these prices were the result of price gouging and corporate greed.

In 2021, California taxes on oil had not increase and the United States was EXPORTING more petroleum than it was importing. Crude oil costs were actually dropping as gas prices remained high.

Long story short, oil companies took advantage of Californians in an already trying time for the sake of their own financial benefit. As a result, oil companies saw RECORD profits and face no penalties.

In effort to stop this from happening again, California Senator Nancy Skinner introduced Assembly Bill 2, an oil price gouging penalty bill. This bill is what working families across California need & deserve, but it won’t pass without support from our CA Legislators.

Sign our petition to let your legislator know that you’re watching & you expect their support for SB2 to #StopBigOil : https://actionnetwork.org/petitions/support-an-oil-price-gouging-penalty

#california#vote#oil and gas#wfp#working families party#progressive#tax the rich#eat the rich#pro union#environment#climate action

22 notes

·

View notes

Text

Make Taxation Theft Again Shirt

Championing Liberty: Make Taxation Theft Again Shirt

Make Taxation Theft Again Shirt, Sweatshirt, Hoodie And More.

Description: Elevate your voice for freedom with our Make Taxation Theft Again Shirt. Crafted with care and designed for both comfort and style, this shirt isn't just clothing—it's a declaration. Made from premium materials, it ensures durability while making a powerful statement against unjust taxation policies.

Store Here:

https://www.usatrendyshirt.com/make-taxation-theft-again-shirt

Introduction: Join the movement for individual sovereignty and fiscal accountability with our Make Taxation Theft Again Shirt. In a world where taxation often feels like an infringement on personal liberties, wearing this shirt signifies your commitment to challenging the status quo. With its bold design and superior quality, it's more than just apparel—it's a symbol of resistance. Let your attire speak volumes and stand up for what you believe in with the Make Taxation Theft Again Shirt.

#taxation#tax#taxes#business#finance#taxrefund#usa#america#canada#uk#love#newyork#california#travel#fashion#Make Taxation Theft Again Shirt

2 notes

·

View notes