#Doji candlestick pattern

Explore tagged Tumblr posts

Text

How to Trade the Harami Cross (Bullish) Pattern: A Complete Guide

The Harami Cross (Bullish) pattern is a powerful and reliable candlestick formation in technical analysis that signals a potential reversal from a downtrend to an uptrend. Understanding how to identify and trade this pattern can give traders an edge in timing entry points and managing risk effectively. In this post, we’ll break down the Harami Cross (Bullish) pattern, explain its significance,…

#Best bullish reversal patterns#Best strategy for trading bullish Harami Cross in stock market#Bullish candlestick pattern strategy#Bullish Harami Cross strategy#Bullish Harami trading strategy#bullish momentum shift#Bullish reversal candlestick patterns#candlestick chart reversal signals#Candlestick patterns for beginners#Doji candlestick meaning#Harami Cross Bullish Pattern#Harami Cross candlestick pattern#Harami Cross chart example#Harami Cross confirmation signal#Harami Cross pattern entry and exit points#Harami Cross strategy for beginners in technical analysis#Harami Cross technical analysis#Harami Cross trading setup with confirmation#Harami Cross vs Bullish Harami#Harami Cross with volume confirmation strategy#How to identify and trade the Harami Cross candlestick pattern#How to identify Harami Cross#How to trade Harami Cross#How to use RSI with bullish Harami Cross#Japanese candlestick patterns#learn technical analysis#Price action trading strategy#Profitable candlestick patterns for swing traders#reliable candlestick signals#Step-by-step guide to bullish Harami Cross pattern

0 notes

Text

Doji Candlestick: Gain an Edge in Trading

Candlestick charts are important for traders, which have common 35 types candlestick patterns. One of the most popular patterns is Doji patterns. It stand out for their ability to signal market indecision and potential reversals. A Doji candlestick pattern occurs when a security’s open and close prices are nearly equal, creating a cross-like shape on the chart. This pattern indicates a balance between buyers and sellers, often hinting at a pause or potential change in the market trend.

What Is Doji Candlestick?

A Doji candlestick is a unique and valuable formation on a price chart that indicates a state of indecision in the market. It occurs when a security’s opening and closing prices are almost equal, resulting in a very small or non-existent body and a cross-like appearance. This pattern is significant because it reflects a balance between buyers and sellers, often preceding a potential reversal or significant change in the market trend.

⚠️Tip: “Cross-like appearance” refers to the shape resembling a cross or plus sign (+).

Characteristics of a Doji Candlestick

Appearance: The Doji candlestick resembles a plus sign or a cross due to its very narrow body and equal length upper and lower shadows.

Formation: It is created when the price of security opens, fluctuates to a high and low, and then closes at a point very close to the opening price.

Interpretation: The Doji indicates market indecision and can often precede a reversal or continuation of the current trend, depending on its position on the chart and other market indicators.

Types of Doji Candlestick

Gravestone Doji This type of Doji has a long upper shadow and no lower shadow, with the open, close, and low prices all at the same level. It often indicates a potential bearish reversal when it appears at the top of an uptrend, suggesting buyers could not sustain higher prices and sellers took control by the close.

Dragonfly Doji The Dragonfly Doji has a long lower shadow and no upper shadow, with the open, closed, and high prices all at the same level. When found at the bottom of a downtrend, it typically signals a potential bullish reversal, indicating that sellers dropped prices lower. Still, buyers could bring prices back up to the opening level.

Long-Legged Doji Characterized by long upper and lower shadows and a small body in the middle, the Long-Legged Doji indicates significant market indecision. The extensive price range within the session shows that neither buyers nor sellers could gain control, making it a strong signal of potential market reversal or continuation, depending on the context.

Standard Doji This Doji pattern has small upper and lower shadows, with the open and close prices nearly equal. It signifies general indecision in the market. Traders should look at the preceding and following candlesticks to interpret its meaning, as it can signal either a reversal or continuation of the current trend.

4-Price Doji The rarest type, the 4-Price Doji, has the open, high, low, and close prices all at the same level, resulting in a simple horizontal line without any shadows. This pattern represents complete market indecision and typically occurs during periods of very low volatility.

Read more: FinxpdX

Download PDF: 35 Candlestick Patterns

#investing#investment#finance#financial#forex#forextrading#forex market#forex indicators#candlestick#candlesticks pattern#Doji candlestick

0 notes

Text

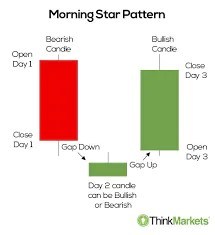

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

How to read candlestick charts and patterns for better trades?

Candlestick charts are a powerful tool for making better trading decisions. Each candle shows the open, high, low, and close price for a specific time frame. Patterns like Doji, Hammer, Engulfing, and Shooting Star can signal potential reversals or trend continuations.

To read them effectively:

Look for pattern confirmation with volume.

Understand bullish vs. bearish signals.

Combine candlestick analysis with support and resistance levels or indicators like RSI.

Learning to read these patterns takes practice and guided learning. At Empirical Academy, we offer hands-on training in technical analysis, including live candlestick chart reading.

📚 Learn to trade with clarity and confidence. 👉 Enroll now: https://www.empiricalacademy.net

0 notes

Text

Bitcoin Holding $105K During War Is Bullish for Crypto

Key points: A week of solid inflows into the spot Bitcoin ETFs improves the prospects of a rally toward $110,000. HYPE, BCH, AAVE, and OKB could march higher if Bitcoin sustains above $105,000. Bitcoin (BTC) is forming a Doji candlestick pattern on the weekly chart, indicating indecision between buyers and sellers. Despite the near-term uncertainty, analysts remain bullish on Bitcoin’s…

0 notes

Text

Gravestone Doji: Spotting Market and Business Reversals

📊 In the world of financial markets, timing is everything. Imagine you’re a trader staring at a stock chart, watching a sharp decline unfold. Prices dip lower and lower, and the bears seem to have the upper hand. Just as you prepare to close your position, the candlestick pattern that appears on the chart sends a jolt of curiosity through you. It’s a Gravestone Doji—a shape that looks like a…

0 notes

Text

Mastering Indian Stock Market Trading & Investing: Technical Analysis for Smart Decisions

If you've ever found yourself staring at stock charts, wondering what those zigzag lines really mean or how seasoned traders predict market moves so accurately—it’s time to dive deep into the fascinating world of technical analysis.

Whether you're a beginner aiming to make your first trade or a budding investor who wants to understand market trends better, technical analysis is your gateway to reading the stock market like a pro. It’s not magic. It’s strategy—and with the right mindset, tools, and a bit of practice, anyone can learn it.

In this guide, we’ll explore what technical analysis is, how it's used in Indian stock market trading, and why mastering it can be a game-changer for your financial future.

What is Technical Analysis, Really?

At its core, technical analysis is about analyzing price movements and patterns. Instead of focusing on a company’s balance sheet or profits (which is fundamental analysis), technical analysis zooms in on stock charts, volume trends, support/resistance levels, and indicators like RSI, MACD, and moving averages.

Here’s the idea: history often repeats itself in the markets. Traders believe that past price movements can provide clues about future behavior.

But don’t worry—it’s not about memorizing hundreds of formulas. It’s about recognizing patterns, understanding market psychology, and using tools that are available to everyone.

Why is Technical Analysis Crucial in Indian Stock Market Trading?

India’s stock market, with major exchanges like NSE and BSE, is vibrant, fast-moving, and full of opportunities. With retail participation increasing and more young investors entering the scene, understanding technical analysis is not just a skill—it’s a competitive edge.

Here's why it matters:

📈 Volatility is Opportunity: Indian stocks often experience sharp movements. Technical analysis helps you time entries and exits better.

🔍 Helps Filter the Noise: News, opinions, and rumors? Technical charts let the price action speak for itself.

🕒 Perfect for Short-term & Swing Trading: Want to catch trends that last a few days or weeks? TA is your best friend.

💼 Complements Long-Term Investing: Even if you’re a long-term investor, knowing when to buy a fundamentally strong stock can greatly enhance returns.

Core Principles of Technical Analysis

To make smart decisions, you need a few essentials in your toolkit. Let’s break them down.

1. Price Discounts Everything

This is the first rule of technical analysis. Every known factor—earnings, news, expectations—is already reflected in the price.

2. Trends are Key

Markets move in trends: upward (bullish), downward (bearish), or sideways. Identifying the trend early can give you a head start.

3. History Tends to Repeat Itself

Humans drive the markets. Emotions like fear and greed lead to recurring price patterns.

Must-Know Tools and Indicators for Beginners

Learning technical analysis doesn’t mean staring blankly at complex graphs. Start with these basic tools:

🟢 Moving Averages (MA)

They smoothen price data to help you identify the trend. A simple 50-day and 200-day MA combo can reveal bullish or bearish signals.

🟣 Relative Strength Index (RSI)

A momentum indicator that tells you if a stock is overbought or oversold. It works on a scale of 0-100. Typically, above 70 means overbought; below 30 means oversold.

🔵 MACD (Moving Average Convergence Divergence)

Used to catch trend reversals. It gives crossover signals that many day traders live by.

🟡 Support and Resistance

Support is a level where buyers enter; resistance is where sellers dominate. Price tends to bounce between these zones.

🔴 Candlestick Patterns

Japanese candlesticks offer visual insights into market psychology. Patterns like Doji, Hammer, and Engulfing tell a story of potential reversals.

A Real-World Example: Let’s Analyze a Stock

Let’s say you’re looking at Infosys. You open the daily chart and notice:

The RSI is around 80 ➜ The stock might be overbought.

It’s near a resistance level it couldn’t cross twice before.

A bearish engulfing candle forms.

This is a potential short signal.

On the flip side, if the stock is near its 200-day MA, RSI is around 35, and a hammer pattern appears near support—you might consider buying.

The beauty of technical analysis? These setups repeat over time.

Day Trading vs Swing Trading vs Investing: How Does TA Fit?

✅ Day Trading

Entry and exit in the same day.

Requires strict discipline and quick decision-making.

TA is essential—especially 5-min, 15-min, hourly charts.

✅ Swing Trading

Positions held for days or weeks.

Based on short-to-medium-term trends.

Ideal for working professionals.

✅ Investing

Long-term horizon, but TA helps in timing your entry.

For example: Buying at a support level during a correction can improve returns significantly.

How to Start Learning Technical Analysis the Smart Way?

The internet is full of content, but not all of it is structured or beginner-friendly. If you’re serious about mastering it, choose a comprehensive, beginner-to-advanced course that focuses on the Indian stock market context.

We highly recommend starting with this Indian Stock Market Trading | Investing: Technical Analysis!! course. It’s perfect for beginners, filled with practical charting tips, live examples, and Indian stock-specific case studies.

Not only will it teach you chart reading, but you’ll also learn how to:

Use charting platforms effectively

Apply 20+ indicators in real-world scenarios

Build your trading strategy

Avoid beginner mistakes

Read volume like a pro

Whether you want to trade Bank Nifty, mid-cap stocks, or explore intraday and positional strategies, this course brings clarity and depth in a step-by-step format.

Common Mistakes New Traders Make (and How to Avoid Them)

Many new traders jump in with high hopes and little prep. Here’s how not to fall into the same traps:

❌ Trading Without a Plan: Always have entry, stop-loss, and target.

❌ Overusing Indicators: More isn’t better. Stick to 2–3 that suit your style.

❌ Ignoring Risk Management: Never risk more than 1–2% of your capital on a single trade.

❌ Letting Emotions Rule: Fear and greed are your biggest enemies.

Consistency comes from mindset, not just methods.

Building Your Trading System with Technical Analysis

Once you get the basics, build your own trading system—a repeatable strategy that aligns with your risk appetite.

Ask yourself:

What’s my trading style? (Scalping, Intraday, Positional)

What’s my entry signal? (Crossover, pattern, breakout)

What’s my stop-loss logic? (Fixed %, below support)

What are my exit rules? (Trailing stop, fixed reward ratio)

Test your system. Backtest it. Paper trade. And once it works—scale it.

Is Technical Analysis Foolproof?

No system is perfect. Technical analysis gives probabilities, not certainties. But when used correctly, it dramatically tilts the odds in your favor.

It's not about predicting the future. It's about reading the present clearly enough to make informed decisions.

That’s the edge that sets apart successful traders from the rest.

Final Thoughts: Why Now is the Best Time to Learn Technical Analysis

With rising retail participation in India’s stock market and easy access to free and paid charting tools, this is the perfect time to learn technical analysis.

Whether you're doing it to:

Create a side income,

Manage your investments better,

Or someday trade full-time,

Mastering technical analysis opens a whole new dimension in your financial journey.

And the best part? You don’t need a finance degree or fancy tools—just curiosity, a good course, and a willingness to learn.

Start your journey with confidence. Explore the Indian Stock Market Trading | Investing: Technical Analysis!! course today and take your first step toward smarter investing.

0 notes

Text

Candlestick Patterns: Mastering Market Moves with Accurate and Profitable Setups

In technical analysis, Candlestick Patterns are among the most powerful tools traders use to predict price movements. These patterns, originating from Japanese rice traders in the 18th century, provide visual cues about market sentiment, momentum, and potential reversals.

While there are dozens of candlestick formations, not all are equally reliable or easy to use. In this guide, we will focus on the most accurate and easy-to-understand candlestick patterns that offer strong profit potential, especially for swing traders and intraday traders.

What Are Candlestick Patterns?

A candlestick represents the price movement of an asset within a specific timeframe (e.g., 5-minute, daily, weekly). Each candlestick shows four key prices:

Open

High

Low

Close

The body (thick part) shows the range between the open and close. The wicks (or shadows) show the highs and lows. A green (or white) body shows a bullish candle, while a red (or black) one shows a bearish candle.

When grouped, Candlestick Patterns reveal momentum, reversals, or continuation of trends—making them highly valuable for timing trades.

1. Bullish Engulfing Pattern – Strong Buy Signal

Structure: A small red candle followed by a larger green candle that completely engulfs the previous day’s red candle.

Meaning: It indicates a strong reversal from bearish to bullish sentiment.

Best Used In: Downtrends or near support zones.

✅ Why It Works: It shows buyers stepping in with strong conviction, overpowering the previous day’s sellers.

2. Bearish Engulfing Pattern – Strong Sell Signal

Structure: A small green candle followed by a larger red candle that engulfs the previous green one.

Meaning: Suggests a reversal from bullish to bearish sentiment.

Best Used In: Uptrends, especially after a rally.

✅ Why It Works: It often signals that buyers are exhausted and sellers are gaining control.

3. Hammer – Bullish Reversal Pattern

Structure: Small body with a long lower wick, usually forming after a downtrend.

Meaning: Buyers rejected lower prices, showing potential for reversal.

Best Used In: Downtrends or oversold markets.

✅ Why It Works: Signals exhaustion of selling pressure and potential entry of buyers.

4. Shooting Star – Bearish Reversal Pattern

Structure: Small body with a long upper wick after an uptrend.

Meaning: Price attempted to rise but failed, indicating weakness.

Best Used In: Uptrends or near resistance.

✅ Why It Works: It highlights a failed rally, often followed by price correction.

5. Doji – Indecision, But Powerful with Confirmation

Structure: Very small body with long wicks, showing close is near the open.

Meaning: Market is undecided—watch for what happens next.

Best Used In: At the top or bottom of trends.

✅ Why It Works: Dojis often precede reversals, especially when followed by strong confirmation candles.

6. Morning Star – Bullish Reversal

Structure: A three-candle pattern: a long red candle, followed by a small body (Doji or Spinning Top), and a strong green candle.

Meaning: Shift from bearish to bullish momentum.

Best Used In: Downtrends or after corrections.

✅ Why It Works: Indicates transition from selling pressure to strong buying.

7. Evening Star – Bearish Reversal

Structure: Long green candle, followed by a small-bodied candle, then a long red candle.

Meaning: Sign of exhaustion in an uptrend, often preceding a downtrend.

Best Used In: Uptrends or after a bullish rally.

✅ Why It Works: Shows that buyers are losing steam and sellers are gaining control.

How to Maximize Profits with Candlestick Patterns

🔎 1. Combine with Support and Resistance

Candlestick patterns are more effective when they occur at key technical levels. For example, a Bullish Engulfing pattern at strong support offers a higher probability of success.

⚙️ 2. Use in Conjunction with Indicators

Pair candlestick patterns with tools like Relative Strength Index (RSI) or Moving Averages to confirm trend reversals or continuations.

⏱️ 3. Focus on Volume Confirmation

High volume on the reversal candle adds credibility to the signal. Volume confirms the participation of institutional players.

📈 4. Time Your Entry and Exit

Don’t trade on the pattern alone. Wait for confirmation candles or enter on the next candle’s break of the reversal level. Set clear stop-losses below/above the pattern for safety.

Final Thoughts

Candlestick Patterns are essential for anyone looking to understand price action and predict market behavior. When used correctly, patterns like the Bullish Engulfing, Hammer, and Morning Star can offer high-probability entry points for profitable trades.

What separates successful traders from the rest is not just identifying patterns but using them in the right context—with support, volume, and indicators backing them up. Simplicity, accuracy, and discipline are the keys to making candlestick patterns a reliable part of your trading strategy.

0 notes

Text

How to Read Stock Charts for Beginners?

If you’re new to investing, learning how to read stock charts for beginners can feel like deciphering a foreign language. But don’t worry—it’s easier than it looks. Stock charts are powerful tools that help you understand market trends, spot opportunities, and make smarter investment decisions. Whether you're a casual trader or planning long-term investments, mastering the basics of stock charts is the first step toward building confidence and growing your portfolio.

How to Read Stock Charts for Beginners – Understanding the Basics

Stock charts visually show a stock's price over time. They allow investors to track price movements, trading volume, and patterns that can help predict future performance.

The most common types of stock charts include:

Line charts – Simple and clean, showing the closing prices over a set period.

Bar charts – Display opening, closing, high, and low prices for each time unit.

Candlestick charts – Popular among traders, offering visual cues with color-coded bars.

Key Components of a Stock Chart

1. Price and Time Axes

Stock charts usually have time on the horizontal (X) axis and price on the vertical (Y) axis. This setup shows how the stock's price changes over days, weeks, or months.

2. Volume Bars

Volume bars appear at the bottom of most charts. They show how many shares were traded during a specific period. High volume often means strong interest or big news.

3. Moving Averages

Moving averages smooth out price data over a certain period, helping you spot trends.

Simple Moving Average (SMA): The average price over a defined time (e.g., 50-day SMA).

Exponential Moving Average (EMA): Gives more weight to recent prices.

Reading Candlestick Charts

Candlestick charts are ideal for beginners who want more detail in a visual format. Each candlestick represents one period (like a day) and shows:

Open and Close: The “body” of the candle.

High and Low: The “wicks” or “shadows” above and below the body.

Color: Green means the stock closed higher than it opened; red means it closed lower.

Recognizing common candlestick patterns—like dojis, hammers, and engulfing candles—can help forecast market behavior.

Identifying Trends and Patterns

Understanding trends can help you determine when to buy or sell.

Types of Market Trends

Uptrend: A series of higher highs and higher lows.

Downtrend: A series of lower highs and lower lows.

Sideways/Flat: Little movement in either direction.

Common Chart Patterns

Head and Shoulders: Indicates potential trend reversal.

Double Top/Bottom: Suggests strong support or resistance.

Flags and Pennants: Short-term continuation patterns.

Practical Tips for Beginners

Keep It Simple

Start with line or candlestick charts and focus on one stock at a time.

Combine Charts with Research

Charts are helpful, but always consider news, earnings reports, and broader market conditions.

Use Reliable Tools

Many platforms offer beginner-friendly charting tools. For a helpful resource on getting started, check out this complete beginner’s guide on how to read stock charts.

📊 Final Thoughts + CTA

Learning how to read stock charts for beginners doesn’t have to be overwhelming. By focusing on basic chart types, understanding key components, and recognizing simple patterns, you’ll gain the confidence to analyze stocks like a pro.

1 note

·

View note

Text

forex scalping strategy for beginners

1. Introduction to Forex Scalping

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

TELEGRAM CHANNEL

Forex scalping is a fast-paced trading strategy where traders aim to profit from small price changes in the market. A scalper typically enters and exits trades within minutes—or even seconds—to capture small pip gains repeatedly throughout the trading session.

For beginners, scalping might seem intense, but with proper discipline, understanding, and tools, it can become a profitable trading method.

2. Advantages and Disadvantages

Advantages

Quick Profits: Since trades last minutes, you can quickly realize gains (or losses).

Low Exposure to Risk: Short time in the market means reduced exposure to unpredictable market news.

Frequent Opportunities: There are many setups during high liquidity periods.

Compounding Effect: Many small wins can accumulate into significant profits.

Disadvantages

High Stress: Constant monitoring and quick decision-making can be stressful.

Requires Focus and Time: Scalping is time-intensive and requires full attention.

Higher Transaction Costs: Frequent trading can lead to higher spreads and commissions.

Risk of Overtrading: Temptation to take too many trades in a short period can lead to losses.

3. Understanding the Forex Market Basics

Before jumping into scalping, you need to understand the fundamentals of the Forex market:

Currency Pairs: Forex is traded in pairs (e.g., EUR/USD, GBP/JPY). Scalpers usually trade major pairs due to tight spreads and high liquidity.

Pips and Spreads: A pip is the smallest price movement in a currency pair. The spread is the difference between the buy (ask) and sell (bid) prices.

Leverage: Many brokers offer leverage, which magnifies both profits and losses. Beginners should use this cautiously.

4. Choosing the Right Trading Platform and Broker

Scalping requires a reliable and fast broker. Here's what to look for:

Broker Requirements

Low Spread and Commission: Since scalping focuses on small price moves, tight spreads are essential.

No Restrictions on Scalping: Ensure the broker allows scalping strategies.

Fast Order Execution: Slippage can ruin scalping trades; you need instant order execution.

Regulated Broker: Choose a broker regulated by a recognized authority (FCA, ASIC, NFA, etc.)

Platform Features

Real-Time Charts: You need charts that update instantly.

Customizable Indicators: Useful for implementing your strategy.

One-Click Trading: For fast execution.

MT4 or MT5 Platforms: These are the most popular among scalpers.

5. Essential Tools and Indicators for Scalping

1. Moving Averages (MA)

Purpose: Identifies trend direction.

Common Types: Simple Moving Average (SMA), Exponential Moving Average (EMA).

Scalping Use: Short MAs (e.g., 5 EMA and 20 EMA) to identify entry/exit points.

2. Bollinger Bands

Purpose: Measures volatility and overbought/oversold conditions.

Scalping Use: Price bouncing off the outer bands signals entry points.

3. Stochastic Oscillator

Purpose: Shows momentum and overbought/oversold zones.

Scalping Use: Buy in oversold areas; sell in overbought zones.

4. Relative Strength Index (RSI)

Purpose: Measures the strength of price movements.

Scalping Use: 5-period RSI for quick signals.

5. Price Action and Candlestick Patterns

Purpose: Provides insight into market sentiment.

Scalping Use: Pin bars, engulfing candles, and dojis at support/resistance.

6. Step-by-Step Scalping Strategy

Trading Pair Selection

Focus on major pairs like EUR/USD, GBP/USD, USD/JPY due to high liquidity and low spreads.

Timeframes

Use 1-minute (M1) and 5-minute (M5) charts for scalping.

Analyze trends using a higher timeframe (M15 or M30).

Step-by-Step Strategy: 5 EMA + 20 EMA + Stochastic RSI

Indicators Setup:

5-period EMA (fast line)

20-period EMA (slow line)

Stochastic RSI (14, 3, 3)

Entry Rules:

Buy Setup:

5 EMA crosses above 20 EMA (bullish crossover).

Stochastic RSI below 20 and starting to curve upward.

Price pulls back slightly toward EMAs (not far from crossover).

Candlestick pattern confirming reversal (e.g., bullish engulfing).

Sell Setup:

5 EMA crosses below 20 EMA (bearish crossover).

Stochastic RSI above 80 and starting to curve downward.

Price pulls back to EMAs.

Candlestick pattern confirming bearish move (e.g., bearish pin bar).

Exit Rules:

Take Profit: 5–10 pips (based on volatility and spread).

Stop Loss: 3–5 pips below/above entry candle or recent support/resistance.

Risk-Reward Ratio: Aim for at least 1:1; ideally 2:1.

Best Times to Trade:

London Open (8:00 AM GMT)

New York Open (1:00 PM GMT)

Avoid low liquidity times (late Asian session or before major news events).

7. Risk Management in Scalping

Scalping requires a strict risk management plan because the frequency of trades can amplify losses.

1. Position Sizing

Never risk more than 1% of your account per trade.

Use a position size calculator based on stop-loss distance.

2. Limit Daily Losses

Set a daily stop-loss limit, such as 3% of your account balance. Walk away after hitting it.

3. Avoid Overtrading

Limit your trades per day (e.g., max 5–10 quality setups).

Quality > Quantity.

4. Use a Journal

Record every trade: entry, exit, reason, result, emotion.

Helps you analyze patterns and improve over time.

8. Psychology of a Scalper

1. Emotional Control

Stay calm under pressure. Avoid revenge trading.

Accept losses as part of the game.

2. Patience and Discipline

Wait for your setup. Don’t force trades.

Stick to your strategy. Don’t chase the market.

3. Confidence Through Practice

Use a demo account to refine your strategy.

Backtest with historical data.

4. Speed and Focus

Be decisive, but not impulsive.

Avoid distractions during trading hours.

9. Common Mistakes to Avoid

1. Trading Without a Plan

Scalping without rules is gambling. Always follow a tested strategy.

2. Using High Leverage

High leverage can wipe out your account in minutes.

Use conservative leverage (e.g., 1:10 or 1:20 for beginners).

3. Ignoring News Events

Unexpected news can spike volatility.

Always check the economic calendar.

4. Trading Low-Liquidity Pairs

Wider spreads = harder to make profits.

Stick to majors with tight spreads.

5. Holding Trades Too Long

Scalping = quick in, quick out.

Don’t turn scalps into swing trades if price moves against you.

10. Conclusion

Forex scalping can be a rewarding strategy for traders who are disciplined, focused, and patient. For beginners, it offers an exciting way to learn about market movements and build trading experience quickly. However, it demands a solid understanding of the market, risk management, and the right psychological mindset.

Key Takeaways:

Start with a demo account to master your strategy.

Choose a reliable broker with low spreads and fast execution.

Use technical indicators like EMA, Stochastic RSI, and candlestick patterns.

Practice strict risk management and never trade based on emotion.

Constantly review and improve your strategy using a trade journal.

Bonus Tip: Simple Scalping Checklist

Before entering a trade, ask yourself:

Is the market in a trend or range?

Are EMAs giving a clear crossover signal?

Is the stochastic in an overbought/oversold zone?

Is there a confirming price action signal?

Are you within the high-volume trading hours?

Have you set your stop-loss and take-profit?

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex indicators#forex#forex factory#forex online trading#forex market#crypto#forex ea#forexsignals#forex trading

0 notes

Text

Exploring Day Trading Opportunities in 2025,

Day trading has evolved into a lucrative venture, attracting traders eager to explore financial markets. With advanced technology and the rising prominence of proprietary trading platforms, day trading 2025 presents exciting opportunities. Apex Trader Funding plays a crucial role in supporting traders by providing capital and essential trading tools. This guide outlines key strategies, essential resources, and how day trading funded accounts can enhance trading success.

The Core of Day Trading

Day trading is more than executing trades; it requires a deep understanding of market trends, risk management, and discipline. Traders must analyze the best online day trading platforms and utilize structured evaluation processes to refine their approach. Apex Trader Funding empowers traders by offering financial backing, reducing personal risks, and fostering skill development.

Financial markets blend local and global influences, making it essential to monitor economic changes and regulations. Leveraging day trading resources helps traders make informed decisions and gain a competitive edge.

Cultivating a Mindset for Day Trading Success

A successful day trading success mindset is built on discipline and strategic thinking. While many perceive day trading as a shortcut to wealth, true success demands emotional control and consistency.

A structured trading plan ensures traders stay focused. For example, a strategy with a 65% win rate requires consistency across multiple trades. Maintaining a trading journal to track decisions, emotions, and outcomes aids in improving strategies.

Self-awareness plays a critical role in mitigating emotional triggers like greed or frustration. Implementing mindfulness techniques, meditation, and pre-trade rituals can help traders handle market volatility. Additionally, transitioning to live day trading requires resilience—losses are inevitable, but recovery plans and stress management techniques support long-term stability.

Essential Day Trading Resources

Success in day trading 2025 depends on using the right tools. Key resources include:

Trading Platforms: Choosing from the best day trading platforms, such as TradingView, ensures traders have access to advanced charting tools and real-time data.

Performance Tracking Tools: Software like Google Sheets or Excel helps traders analyze trade execution and refine strategies.

Prop Trading Platforms: Apex Trader Funding in the UK offers traders access to firm-provided funds, enabling them to trade without risking personal capital.

Economic Calendars: Staying informed about global and local financial events is crucial. Platforms like Investing.com provide updates that influence trading decisions.

Beyond these essentials, advanced traders can explore stock screeners like Finviz or real-time news aggregators like Benzinga Pro. Books such as Trading in the Zone by Mark Douglas are invaluable for mastering trading psychology.

Understanding Supply and Demand in Day Trading

Mastering understanding supply and demand day trading in the UK is fundamental to achieving success. Candlestick charts provide insights into price action, helping traders recognize key trends. Essential strategies include:

Identifying Support and Resistance Levels: Support zones indicate strong buying interest, while resistance levels highlight selling pressure.

Leveraging Candlestick Patterns: Patterns like Dojis and engulfing formations help predict price movements.

Risk Management: Stop-loss orders and controlled position sizing protect capital.

Volume analysis and round-number psychological price points (e.g., £100, £1,000) are also critical indicators. Apex Trader Funding offers traders tools to simplify complex market analysis, providing an edge in executing precise trades.

Transitioning to Live Day Trading

A structured approach is crucial when transitioning to live day trading . Steps for a smooth transition include:

Practice with Simulated Accounts: Apex Trader Funding provides demo accounts, allowing traders to refine strategies before entering live markets.

Maintain a Trading Journal: Tracking each trade helps traders assess strengths, weaknesses, and opportunities.

Join Trading Communities: Engaging with trading groups fosters learning and networking opportunities.

Understanding market-specific nuances is key. Apex Trader Funding UK provides educational and professional resources to guide traders through this transition effectively.

Unlocking Potential with Apex Trader Funding

Funding for day trading has never been more accessible, thanks to platforms like Apex Trader Funding. This proprietary trading firm allows traders to complete evaluations and access significant trading capital ranging from £25,000 to £150,000. Traders can keep up to 90% of their profits, eliminating the stress of risking personal savings.

By combining education, trading tools, and financial backing, Apex Trader Funding ensures that traders have the resources needed to succeed in day trading in the UK.

Take the First Step Toward Day Trading Success

Day trading requires preparation, discipline, and the right support system. Apex Trader Funding UK provides traders with access to capital, innovative tools, and a thriving community for continuous growth.

Visit apextraderfunding.com today to embark on your trading journey with confidence. With expert guidance and comprehensive resources, day trading 2025 in the UK offers limitless potential for success.

#funding traders in united kingdom#the funded trader in united kingdom#funded trading accounts in united kingdom

0 notes

Text

Master the Doji Candlestick Pattern: Top 4 Exclusive Variations Every Trader Should Know!

Curious about how Doji candlestick patterns work in trading?

Discover their meaning, types, and how to use them for better market decisions.

Perfect for beginners and experienced traders alike!

#DojiPattern#CandlestickChart#StockMarketTips#TechnicalAnalysis#TradingForBeginners#ForexTrading#CryptoTrading#Stofiniq#InvestmentTips#LearnTrading

0 notes

Text

Options Trading Candlestick Pattern Strategy

Candlestick pattern strategies are powerful tools used by traders to make quick, informed decisions during options trading sessions. These patterns help identify market trends, reversals, and potential entry and exit points.

At Intratrade Research, we specialize in offering options trading tips in India, backed by technical analysis and years of market experience. Using candlestick strategies can significantly increase your chances of making profitable trades.

Some of the most popular candlestick patterns used in options trading include:

1. Doji

2. Hammer

3. Engulfing pattern

4. Morning Star

5. Shooting Star

By mastering these patterns, traders can gain a strong edge in the fast-moving options trading market. When paired with reliable options trading tips, these strategies become even more effective.

Intratrade Research provides options trading tips that help you make informed decisions based on current market trends. Our team of experts tracks the market closely and delivers tips designed to maximize your gains.

0 notes