#Equity Markets

Explore tagged Tumblr posts

Text

Equity Markets Rally on Easing Trade Tensions, But Profit-Taking Looms as Focus Shifts to US Economic Data

Equity markets are rising due to easing trade tensions between major economic powers, with investors becoming less bearish on risky assets. However, gains may be largely priced in, and focus could shift back to fundamentals. The FBM KLCI may see mild profit-taking after recent gains, and lower liners could face a pullback as investors secure profits and reassess market dynamics. Key economic…

0 notes

Text

Investing Future with Motilal Oswal Jaipur: A Path to Financial Growth

One of the most successful strategies of generating money and safeguarding your financial future is equitiesinvestment. It might make a world of difference to have a reliable financial partner by your side whereas stock markets continue to change.Motilal Oswal has come to represent dependability & knowledgeable suggestion, and a strong emphasis on building wealth for investors in Jaipur.

Why Equity Investing?

Investing in equity has the potential to yield better returns than assets with fixed income and particularly in the long run. They present chances for rapid development, yet also carry an appropriate amount of danger. By purchasing stock, you can participate in the growth of businesses that have the potential for significant returns if they are successful.

The Motilal OswalAdvantage Offering reliableinvestments solutions catered to each person's financial objectives, Motilal Oswal Jaipur has been a pioneer in this field. The firm assists clients in making well-informed selections and assures that investments are in line with long-term wealth objective of equities research and market analysis. One of the biggest advantages of partnering with Motilal Oswal is the tailored strategy. regardless of your level of experience, their staff can provide tailored plans that reflect your risk patience and your financial goals & the current state of the market.

Why Invest in Equityfor Motilal Oswal Jaipur?

Research: Motilal Oswal is well known for producing exhaustive & high-quality research.

personalized Advisory: The financial path of each investor is distinct. A devoted financial advisor at Motilal Oswal Jaipur will assist you in building a portfolio that is customised to meet your individual goals.

Long-Term money Creation: Using equity investments as the primary means for guaranteeing a stable fiscal future & Motilal Oswal emphasizes on accumulating money over an extended period of time.

Technological Edge: Clients can simply navigate their portfolios and get real-time updates and execute transactions quickly thanks to modern instruments and software.

Investing in Your Future Whilst the stock market can be unpredictable, risks can be reduced and rewards can be increased with professional advice. Investingin the decades to come with Motilal Oswal of Jaipur guarantees you the backing of one of India's top financial service companies. Motilal Oswal Jaipur's equities spending can put you on the road to success whether the objectives are to grow your wealth, save for retiring, or reach other financial goals. In conclusion, partnering with Motilal Oswal Jaipur is a wise move for everyone wishing to invest in stocks and build an enjoyable financial future as markets change and possibilities present themself.

#article#investment#motilaloswal#news#broker#jaipur#motilaloswaljaipur#googlemaps#invest#stockmarket#investingfuture.in#googlenews#equity trading#equity#equity mutual funds#equity markets#equity financing#equity investment#employees#report#market#banks#debt

0 notes

Text

Impact of FIIs, DIIs, and Other Investors in Equity Markets

Image by felicities on Freepik Impact of FIIs, DIIs, and Other Investors in Equity Markets: Foreign Institutional Investors (FIIs): Market Liquidity: FIIs bring substantial foreign capital into the market, increasing liquidity and trading volumes. Market Sentiment: Their investment decisions significantly influence market sentiment. Large-scale buying can create bullish trends, while…

#DII#equity markets#FII#HNWI#investment impact#market liquidity#Market Sentiment#market stability#retail investors#Stock Market

0 notes

Text

Exploring the Significance of Dividends in Equity Markets

Dividends as a Cornerstone of Investment

Understanding the role of dividends in equity markets is crucial for investors aiming to build robust portfolios. Dividends, essentially portions of a company's profit paid out to shareholders, play a vital role in the investment landscape. This article delves into the significance of dividends and their impact on equity markets, offering insights into why they are more than just a source of income for investors.

The Role of Dividends in Enhancing Returns

One of the key aspects of dividends is their contribution to total investment returns. Historically, dividends have formed a significant portion of the long-term returns for many equity indices, such as the S&P 500. This is particularly true in stable, well-established companies that have a consistent record of paying out dividends. Over time, these dividends can accumulate and significantly enhance the overall return of an investment portfolio.

Dividends also offer a measure of stability in the volatile world of stock investing. While stock prices can fluctuate widely, dividends tend to be more stable, providing a regular income stream. This can be particularly appealing in uncertain market conditions or during economic downturns, where they can offer a cushion against falling stock prices.

Fundamental Analysis and Dividend Metrics

Beyond their contribution to total returns, dividends are also a valuable tool in the fundamental analysis of stocks. When assessing the value and potential of a stock, dividends offer a tangible measure of a company's financial health and profitability. A consistent or growing dividend pay-out can be a sign of a company's underlying strength and its ability to generate cash flow.

This aspect of dividends is crucial for investors who base their investment decisions on fundamental analysis. Dividend metrics, such as dividend yield and pay-out ratio, provide insights into a company's performance that might not be immediately apparent from its stock price alone. Therefore, dividends can serve as an additional layer of analysis, aiding investors in making more informed decisions.

Reducing Portfolio Risk and Volatility

Another significant advantage of dividends is their role in reducing overall portfolio risk and volatility. Dividend-paying stocks have historically been less volatile than non-dividend-paying stocks. This can be particularly beneficial during market downturns or bear markets, where dividend-paying stocks often outperform their non-paying counterparts.

This risk-reducing characteristic of dividends stems from the regular income they provide, which can mitigate potential losses from stock price declines. Additionally, companies that consistently pay dividends are often seen as more financially stable and less risky, making them attractive to risk-averse investors.

Tax Efficiency of Dividends

Investors often overlook the tax advantages associated with dividends. Qualified dividends, for instance, are taxed at a lower rate compared to ordinary income, making them a tax-efficient source of income. This aspect of dividends can significantly impact the net returns for investors, particularly for those in higher tax brackets.

Inflation and Purchasing Power Preservation

Dividends also play a vital role in preserving the purchasing power of capital. In an environment where inflation erodes the value of money, dividends, especially those that grow over time, can help investors maintain or even increase their purchasing power. This is particularly important for long-term investors who need to ensure that their investments do not lose value in real terms over time.

Long-term Benefits and Diversification

Looking at dividends from a long-term perspective, they are instrumental in driving equity returns. This is evident even in growth-oriented markets, where dividends contribute significantly to total returns over extended periods. For instance, in markets like the US and the UK, a considerable portion of the total returns over the past decades has come from reinvested dividends.

Furthermore, dividends offer an effective way to inflation-proof investment portfolios. Historically, dividend growth has outpaced inflation, providing real growth in income over the long term. This characteristic is especially crucial in periods of high inflation, where preserving the real value of investments becomes a primary concern for investors.

Harnessing the Power of Diversification

Diversification is a fundamental investment principle, and dividends contribute significantly to this aspect. Broad equity index exposures that offer access to diversified dividend distributions can provide a defensive quality to portfolios. This is particularly true during market downturns, where dividends can be reinvested at lower stock prices, potentially amplifying returns when markets recover.

In summary, dividends are a key element in equity investing, offering multiple benefits including enhanced returns, reduced risk, tax efficiency, and inflation protection. They are not just a source of income but also a crucial component in portfolio construction and risk management. Understanding and leveraging the power of dividends can thus be a game-changer for investors looking to build and maintain robust, profitable portfolios.

Harnessing Innovative Platforms in Equity Investing

The evolving landscape of equity investing has seen the emergence of pioneering platforms like Spiking, which have garnered significant attention for their innovative approaches. These platforms represent a new era in financial technology, combining advanced algorithms and data analytics to provide investors with unique insights and tools.

One such platform, Spiking, has been recognized for its AI-driven capabilities, enabling retail investors to track and analyze the trades of experienced investors in real time. This approach not only democratizes access to financial information but also reduces information asymmetry in the market. By providing retail investors with the same level of data insights as more experienced investors, these platforms level the playing field in the equity markets.

The significance of such platforms lies in their ability to turn vast amounts of data into actionable insights. This is particularly relevant in today's fast-paced financial environment, where timely and informed decision-making is crucial. By offering real-time tracking and analysis, these platforms empower investors to make more informed and strategic investment choices.

Furthermore, the recognition of these platforms by established programs like the IBM Hyper Protect Accelerator underscores their potential impact on the financial industry. Such collaborations open doors to new opportunities and resources, further fueling innovation and growth.

In conclusion, as the equity investing landscape continues to evolve, platforms like Spiking are at the forefront, driving innovation and offering new ways for investors to engage with the market. Their success and recognition highlight the growing importance of technology and data in shaping the future of finance.

dailymotion

0 notes

Text

Global Stocks Fall as Investors Stress Over Recession

cThe S&P 500 file in the US fell 1.1%, the Stoxx Europe 600 list fell 1.2%, and the MSCI Asia Pacific Record fell 1.3%. The auction was set off by various elements, including: Worries about the conflict in Ukraine and its effect on the global economy. Rising expansion and the possibility of additional loan cost climbs from national banks. A stoppage in monetary development in China and other…

View On WordPress

#Asset values#Bear market#Economic crisis#Economic downturn#Equity markets#Financial markets#Global stocks#Investment#Investor concerns#Market sell-off#Market volatility#Recession#Stock Market#Stock prices

0 notes

Text

S&P 500 scores best day in 3 weeks as bond yields ease back

U.S. stocks finished higher on Wednesday as yields on long government bonds retreated from 16-year highs, helping lift the S&P 500 to its best day in three weeks. The Dow Jones Industrial Index SPX, +0.81% gained about 125 points, or 0.4%, ending near 33,128, according to preliminary FactSet data. The boost, however, failed to push the blue-chip index back into the green for the year, a day after…

View On WordPress

#article_normal#bond markets#BX:TMUBMUSD10Y#BX:TMUBMUSD30Y#COMP#construction#Construction/Real Estate#Consumer Products#debt#Debt/Bond Markets#Derivative Securities#DJIA#Dow Jones Industrial Average#DXY#economic news#Equity Markets#Exchange Traded Funds#investing#Investing/Securities#NASDAQ Composite Index#real estate#S&P 500 Index#securities#SPDR S&P 500 ETF Trust#SPX#spy#U.S. 10 Year Treasury Note#U.S. 30 Year Treasury Bond#U.S. Dollar Index (DXY)

0 notes

Text

💪 Unleash the Power of Sweat Equity in Business ❗

🔰 Sweat Equity is the secret gem of business success. It's the art of exceeding financial investments by valuing skills, dedication, and time. Bringing founders, employees, and partners into a world of mutual growth, our comprehensive blog reveals its secrets. Join us in this synergy of ownership and effort!

Explore more at 👉 here

Download the mobile app👉 here

0 notes

Text

From Bearish to Bullish: Wall Street Analysts Embrace Soft Landing - What It Means for Equities and the Economy!"

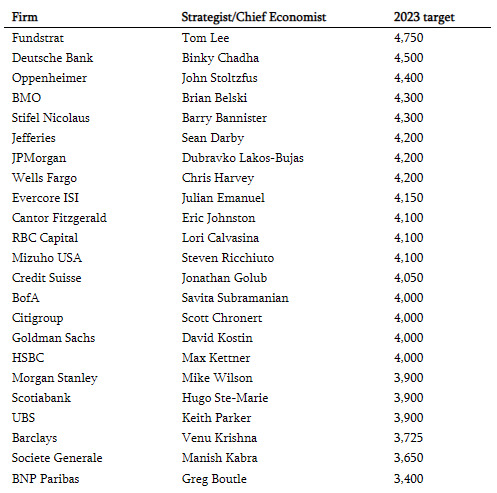

At the beginning of 2023, Wall Street analysts predicted a challenging first half for the equity market, painting a bearish outlook. They saw a number of headwinds, including rising inflation, interest rates, and the war in Ukraine. However, they also believed that the market would rebound in the second half of the year. Mike Wilson of Morgan Stanley predicted that the S&P 500 would fall to 3,000 in the first half of the year and then rebound to 3,900 by the end of the year. JP Morgan’s Dubravo Lakos-Bujas said they expect S&P 500 to re-test Oct 2022 lows in H1 '23. Michael Hartnett of Bank of America said that he stayed bearish on risk assets in H1, likely turning bullish H2; market narrative to shift from Inflation and rates “shocks” of ’22 to recession and credit “shocks” in H1’23. Average 2023 year end target for S&P was 4,080

Source: StreetInsider.com

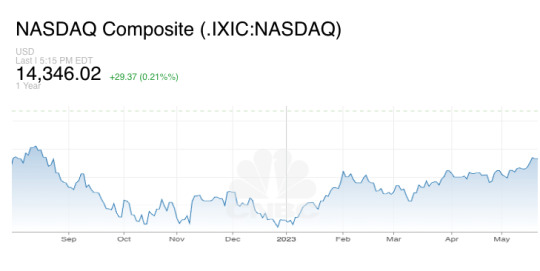

Source: Cnbc.com

Source: Cnbc.com

Shift to a soft landing

As the equity market has performed unexpectedly well, the analysts who once predicted a rough ride have now rallied behind the notion of a soft landing. This shift in sentiment can be attributed to several positive indicators that have emerged since the beginning of the year.

One reason is that inflation has started to come down. The Consumer Price Index (CPI) rose 9.1% in Oct 2022, but it has since come down to 3.0% in June 2023.. This is still above the Fed's target of 2%, but it is a sign that inflation is starting to ease

Another reason is that the US consumer is still strong. Consumer spending accounts for about 70% of the US economy, and it has remained strong even in the face of rising inflation. This suggests that consumers are still willing to spend, which is a good sign for the economy.

The labor market is also strong. The unemployment rate is at a 50-year low, and there are more job openings than there are unemployed people. This means that businesses are still hiring, which is a good sign for economic growth

As a result of these factors, Goldman Sachs has reduced its probability of a recession to 20%. Mike Wilson of Morgan Stanley has also thrown in the towel, saying that he was wrong about the market, and most of the equity analysts on Wall street have revised their year end targets upwards

Other analysts who have changed their tune include David Kostin of Goldman Sachs, who now believes that the economy will avoid a recession, and Peter Oppenheimer of Goldman Sachs, who now believes that the Fed will be able to engineer a soft landing. Even Fed Chair Jerome Powell has changed his tone. In a recent press conference, he said that the Fed's staff does not expect a recession, which is a significant change from his previous tone.

What to expect with a soft landing?

The biggest question is what the change in tone of equity analysts and Fed Chair Jerome Powell means for the equity markets and economy? Answer is nothing. In fact, it could be a red flag. There are a number of examples of this. In Feb 2007, Fed Chairman Ben Bernanke, after increasing the Fed Fund rate, expressed broad satisfaction that the nation remains on track for a "soft landing," a modest slowdown in growth that would reduce upward pressure on prices without aggravating unemployment. What followed was one of the worst financial crises in 2007-09. Fed did pull off soft landing in 1994-95, but inflation wasn’t very high during that period.

As you can see, there is no guarantee that a soft landing will be achieved, even if equity analysts and Fed Chairs change their tone. Investors should be aware of the risks and be prepared for the possibility of a recession. The risks to the equity markets are now higher than they were at the start of 2023.

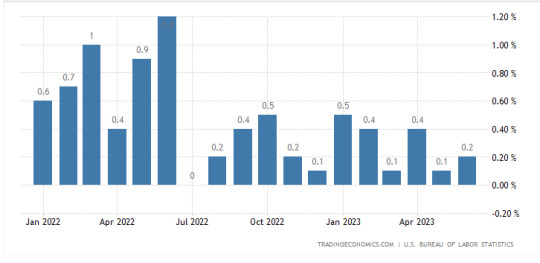

One reason for this is the base effect. In the first half of 2023, inflation was declining due to the base effect. This means that the comparison to inflation in the same period of the previous year was lower, making inflation appear to be lower than it actually was. However, in the second half of 2023, the base effect will reverse, and inflation will likely increase

Source: Tradingeconomics.com

Another reason for the increased risks is the extremely low equity risk premium. The equity risk premium is the difference between the expected return on stocks and the risk-free rate. Importantly, the equity risk premium—or the extra return an investor can expect for investing in the stock market instead of risk-free 10-year Treasuries—is at its lowest level in about 20 years given P/E has expanded from 16 to 20

Finally, the positioning of portfolio managers has also changed. At the start of 2023, most portfolio managers were positioned very conservatively. However, as the markets have rallied, they have become more aggressive. Bloomberg's Global Equity Positions Index shows that the average equity exposure of global equity funds has increased from 56.7% at the start of 2023 to 61.2% as of July 2023

These factors suggest that the risks to the equity markets are now higher than they were at the start of 2023. The longer the Fed keeps the current hawkish stance of higher for longer, the higher the probability of an economic accident. The equities markets are not priced for a material economic accident, and the risk-reward ratio is worse right now. One factor that is working in favor of equity markets is momentum and it is a very strong factor for short-term. In the last five instances when inflation peaked above 5% (1970, 1974, 1980, 1990 and 2008), a recession followed. Will it be different this time?

Disclaimer:

The information presented in this blog post is for informational purposes only and should not be considered as investment advice. Readers are advised to conduct their own research before making any financial decisions. The author assumes no responsibility for the accuracy or relevance of the cited data and comments in this blog.

About the Author:

Aman Deep Singh Ahuja is a seasoned professional with a background in finance and technology. Currently working at Google. His prior experience includes serving as an Associate Partner at McKinsey & Company in New York. He holds an MBA from Darden School of Business, B.Tech from IIT Bombay and has cleared all three levels of CFA Connect with him on LinkedIn at Aman Ahuja

1 note

·

View note

Text

Markets extend correction from life-time peaks

Foreign fund outflows and crude oil prices hovering above USD 80 per barrel also weighed on equity markets.

MUMBAI: Equity benchmark indices declined in early trade on Monday, extending corrections from their life-time peaks for the second consecutive session, dragged down by index heavyweight Reliance Industries after the company missed street estimates due to weak performance in oil-to-chemicals (O2C) business.

Foreign fund outflows and crude oil prices hovering above USD 80 per barrel also weighed on equity markets as traders were awaiting the US Federal Reserve’s monetary policy decision to be announced this week.

The 30-share BSE Sensex declined 87.24 points or 0.13 to 66,597.02.

The broader NSE Nifty fell 10.65 points or 0.05 per cent to 19,734.35.

From the Sensex pack, Kotak Mahindra tanked more than 3 per cent and Reliance tumbled close to 2 per cent in the initial trade.

“RIL Q1 Results misses street estimates due to weak performance in oil-to-chemicals (O2C) business on account of a sharp reduction in crude oil prices and lower price realisation of downstream products,” said Prashanth Tapse, Sr VP Research analyst at Mehta equities Ltd.

JSW Steel, Tata Steel and Tech Mahindra were other laggards.

On the other hand, Mahindra & Mahindra and Larsen & Toubro gained more than 1 per cent.

IndusInd Bank, Axis Bank and Tata Motors were among other gainers.

Of the 30 stocks, 18 were trading in green while on the 50-stock index Nifty, 27 were in positive territory.

“The near-term market trend will be influenced by a host of factors like the recent Q1 results, some major results expected this week and policy decisions like the Fed meeting outcome on Wednesday,” V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said in his market outlook.

Vijayakumar further noted that the Fed is likely to raise the rate by 25 bp on Wednesday, but the market movement will be decided by the commentary of the Fed chief regarding future inflation and rate trends.

Investors may wait and watch these events unfold.

On Friday, both the indices settled more than 1 per cent lower in the previous session, snapping their six-day record-breaking rally.

The BSE benchmark tumbled 887.64 points or or 1.31 per cent to settle at 66,684.26 on Friday.

NSE Nifty fell by 234.15 points or 1.17 per cent to end at 19,745.In Asian markets, Nikkei 225 was up 1.38 per cent, while the stock markets in Hong Kong and Shanghai were not trading.

The US markets ended broadly higher on Friday.

Global oil benchmark Brent crude was trading 0.14 per cent lower at USD 80.96 a barrel.

Foreign Institutional Investors (FIIs) were sellers on Friday as they sold equities worth Rs 1,998.77 crore, according to exchange data.

0 notes

Text

Japan sees an equity market collapse as Chaos Theory and the Carry Trade collide

It has already been a rather extraordinary start to the financial week and I warned social media of problems to come on Friday. The existing equity market falls plus the rally in the Japanese Yen meant that the Japanese equity market was going to be at risk of being limit down. At the close Monday, the benchmark index was down 4,451.28 points, or 12.40%, to 31,458.42. According to Nikkei data, it…

#Bank of Japan#business#Carry Trade#Chaos Theory#economy#equity markets#Finance#Interest Rates#nikkei 225#QE#stock market crash

0 notes

Text

Weekly Overview: Global productivity gains sound the alarm. FOMC minutes due out this week.

In this week's market update, we'll be taking a closer look at the recent performance of the NASDAQ, the impact of inflation and monetary policies in the US and China, and how all of this could shape the future of the equity markets and commodities. We'll also discuss the upcoming US labor data and its significance in assessing the state of the economy.

#US inflation#foundation for investments#global productivity#productivity gains#economic growth#major growth#positive productivity#equity markets#unemployment rate.#Consumer price index#inflation rate#Investment strategies#portfolio management#Productivity trends

0 notes

Text

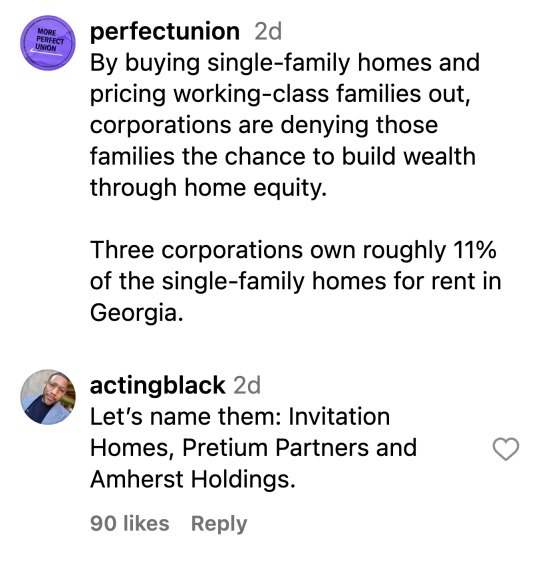

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

Private equity rips off its investors, too

I'm coming to DEFCON! TOMORROW (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

It's amazing how many of the scams that have devastated our economy and everyday people owe their success to the fact that we assume that rich people know what they're doing, so if they're doing something, it must be real.

Think of how many people lost everything by gambling on junk bonds, exotic mortgage derivatives, cryptocurrency and web3, because they saw that the largest financial institutions in the world were going all-in on these weird, incomprehensible bets.

Then there are the people who are convinced that online advertising is built around a mind-control ray, because tech companies claim that's what they have ("I am an evil dopamine-loop-hacking wizard and I can sell anything to anyone!"), and because huge, sober blue-chip companies hand billions to these soi dissant svengalis. Sure, online ads are a swamp of clickfraud and garbage, but would these super smart captains of industry spend so much on online advertising if it didn't work super-well?

http://pluralistic.net/HowToDestroySurveillanceCapitalism

From our worms'-eye-view here on the ground, it's easy to assume that rich people and the people who sell them stuff are all on the same side. "If you're not paying for the product, you're the product," right? If Facebook is tormenting you with surveillance advertising, it must be doing so on behalf of the surveillance advertisers, for whom Mark Zuckerberg has bottomless reservoirs of honest, forthright impulses.

The reality is simultaneously weirder, and obvious in hindsight. The reason Zuck is tormenting you is that he's a remorseless sociopath who doesn't care who he hurts. He rips off everyone he can rip off, and that includes advertisers, who have seen steady price-hikes and lower-fidelity targeting, even as ad-fraud has skyrocketed while Facebook draws down its anti-fraud spending:

https://www.404media.co/where-facebooks-ai-slop-comes-from/

This is not to say that Facebook advertisers have your best interests at heart, that they aren't engaged in active deception in order to better themselves at your expense. Rather, it's to say that there's no honor among thieves, and Zuck is an equal-opportunity predator. Moreover, both Zuck and his advertisers are credulous dolts, so the mere fact that they are pouring money into something (advertisers: FB ads; Zuck: metaverse) it doesn't follow that these are real or important or the coming thing.

For me, the Ur-example of "rich people are dumb, even when it comes to money" is the private equity sector. I've written a lot about PE, and how destructive it is to the real economy, from Toys R Us to pet grooming:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

How they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And how they actually created the death panels that Sarah Palin warned us about (it's OK, though: these death panels are run by the efficient private sector, not government bureaucrats):

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

The devastating effect of private equity on the real economy is increasingly well understood, and a curious side-effect of this is that people assume that if PE is destroying their lives, they must be doing so on behalf of their investors, who are making bank.

But – like Zuck – PE bosses are just as happy to steal from their investors as they are to to steal from the workers and customers of the businesses they acquire on those investors' behalf. They swaddle this theft in performative complexity and specialized jargon, but when you strip all that away, you find more fraud.

All the misery that PE inflicts on workers, communities and customers are just a convincer in a Big Store con, a bid to make the scam seem credible. For a certain kind of investor, any economic activity that destroys communities and workers' livelihoods must be a good bet. This is the dynamic at work in the pitch of AI image-generator companies, who spend tens of billions on technology that there is no substantial market for:

https://pluralistic.net/2024/07/25/accountability-sinks/#work-harder-not-smarter

AI image generators represent a high-profile, extremely visible example of "a job that AI can do." Nevermind that AI illustration went from a novelty to a tired cliche in less than a year. Even if you think that AI illustrations are a perfect substitute for commercial illustrations, that still won't come anywhere near making AI companies a profit. Add up the entire wage bill for every commercial illustrator in the world, hand it to Open AI, and you're not even gonna cover the kombucha budget for Open AI's staff kitchens.

Hell, all the wages of every commercial illustrator that ever lived won't pay back even a fraction of the money the AI companies spent on image generators. The pauperization of an entire class of creative workers is just a canned demo, a way to fool investors into thinking that there is a whole universe of similarly situated workers whose wages can be diverted to AI companies. This is the logic of small-time spammers, scaled up to the scale of the entire S&P 500. Smalltime spammers looked at AI and thought, "OK, I can generate as much botshit as I want on demand for free. Science fiction magazines pay $0.10/word. So if I generate a billion words, I'll get $100 million." But that's not how any of that works: sf magazines don't buy botshit, and even if they did, the entire market for short fiction adds up to what Sam Altman spends on a single designer t-shirt. The point of destroying these beloved, useful things isn't to make a lot of money by taking their markets – it's to convince dopey, panicked rich people to give you lots of money you can steal, because they think you can do this to every market and they don't want to miss out on the opportunity of a lifetime:

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

Take "divi recaps": after a private equity firm acquires a company (by borrowing money against its assets), it typically declares a "special dividend," emptying out the company's cash reserves and pocketing them. A "divi recap" is when PE then takes out another massive loan against the company's (remaining) assets and pockets that:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

All of this happens under an opaque cloud, thanks to the light-to-nonexistent disclosure rules for PE. A public company has to open its books for the SEC, its investors, and the world. PE is private – and so are its finances. It is absolutely routine for PE bosses to put their spouses, kids, and pals on the payroll and hand them millions for doing little to nothing, all at the expense of their investors:

https://www.nakedcapitalism.com/2022/02/sec-set-to-lower-massive-boom-on-private-equity-industry.html

PE bosses charge huge fees to their investors – not merely the usual 2-and-20 (2% of the funds under management and 20% of any profits) – but also a wide variety of special one-off fees that pile to the sky. They also dip into their investors' funds to issue themselves massive loans that they use to make side-bets, without telling the investors about it:

https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#gary-gensler

PE investors are chickens ripe for the plucking: take "continuation funds," which allow PE bosses to soak the rich people and pension funds who supply them with billions:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Remember 2-and-20? 2% of all the money you manage, every year, and 20% of all the profits. You'd think that these would be somewhat zero sum, right? If you use some of your investors' cash to buy a company, and then sell off that company for a profit, you get the 20%, but now the pot of money you're managing has gone down by the amount you used to buy the company, and so your 2% carry goes down, too.

But what if you sell your portfolio companies to yourself, using your investors' own money? When you do that, you continue to hold the company on your PE firm's books, meaning you continue to get the 2% carry, and you can pocket 20% of the sale price as a "profit":

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

This is straight-up fraud, wrapped up in so much jargon that it can successfully masquerade as "financial engineering" ("financial engineering" is really just a euphemism for "fraud"). PE bosses keep coming up with new, exotic ways to steal from their investors. The latest scam is "tax receivable agreements":

https://archive.ph/RczJ9

On its face, this is a tax scam. When a company goes public, early investors generally hold stock in the original partnership or LLC; this company ends up holding a ton of shares in the new, public company. When they sell those non-public shares in the LLC, this creates a (potentially gigantic) tax credit.

A TRA hustle involves tracking down these LLC shareholders and convincing them to sign off on dumping the LLC's shares, which generates a huge tax credit for the public company. The hustler offers to split these credits with the LLC holders.

All of this is especially attractive to PE bosses, who often take a company private, do a bunch of "financial engineering" and then take it public again, leaving the PE firm as the owner of those LLC shares that can be converted to a TRA and a huge windfall – which the PE bosses pocket, because they (not their investors) are holding those credits.

This scam is really doing big numbers. KKR – the monsters who killed Toys R Us – just diverted $650 million in TRA loot, prompting a lawsuit from Steamfitters union pension fund, which had handed these jerks millions of its members' money to gamble with:

https://archive.ph/kqQvI

This highlights another very weird aspect of the PE scam: they are absolutely dependent on pension funds. To add insult to injury, PE funds are notorious union-busters – they use union money to buy companies and destroy their unions:

https://pluralistic.net/2023/10/05/mr-gotcha/#no-ethical-consumption-under-capitalism

People who try to understand the PE business model often give up, because it seems to make no sense, leading many to assume that they're too unsophisticated to grasp the complex financials here. For example, PE is absolutely dependent on massive loans as a way of looting its businesses, but it also often defaults on those loans. Why do banks and investors keep making huge loans to PE deadbeats? Because – like the PE fund investors – they are credulous dolts.

The reason PE seems like a scam is that it is a scam. It is a fractal scam – every part of it is a scam. You might have heard about the "carried interest" tax loophole that allows PE bosses to avoid billions in taxes on the money they steal from their investors, creditors, workers and customers. Most people assume "carried interest" has something to do with "interest" on a loan. Nope: "carried interest" is a 16th century nautical tax rule designed for mercantalist sea-captains who had an "interest" in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

But rich people and other "sophisticated investors" (like pension fund investment managers) are no smarter than the rest of us. They are herd animals. When they see other rich people piling into some scheme or asset class, they rush to join them, which makes the asset price go up, which makes them think they're smart (until the inevitable rug-pull). When one plute jumps off the Empire State Building, the rest of them jump, too.

Which is why there's more money flooding into PE than at any time in history, $2.62T in "dry powder," handed over to greedy, thieving PE bosses in a poker game where everyone is the sucker at the table:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/08/sucker-at-the-table/#clucks-definance

#pluralistic#tra#tax receivable asset#financial engineering#private equity#two sided markets#pe#looters#sucker at the table#kkr#debt#dry powder

381 notes

·

View notes

Text

Trump, not content with picking MAGA pockets and pay-for-play WH schemes, now set on Americans' nest eggs:

youtube

#boiler room alert

#gambling#bankruptcy#trump#us politics#us pensions#pension fund#usa#us workforce#private equity#stock market#economy#robbing the working class#working class#blue collar#us congress#maga#pay for play#scams#quid pro quo#traitor trump#potus#us presidents#white house#nest eggs#retirement#americans#deregulation#fraud#selling out americans#401(k)

26 notes

·

View notes

Text

In the last year I have become obsessively aware of private equity and the companies that are sold to them. I am allergic to a lot of things, corn being a horrible one. It’s in everything. But you know what it’s not in? Those same food aisles crunchy moms go down. So that’s primarily where I get my quick stuff, snacks, and juices. Over the last 5 years, each brand in that aisle has grown smaller which prompted me to look them up. Shrinkflation became the tell tale sign of a product that was newly under private equity. There’s a tiny percentage of brands in grocery stores that are not under private investments and if they don’t shrinkinflate, the change their recipe. Sometimes they do both so you are more angry over one or the other and don’t catch both changes at the same time.

Then we have hospitals that were once locally owned going to private investors. My hometown OBGYN had a board of locals that loved their hospital. One of the board members (😡Gale) wanted to retire early but didn’t want someone to take her place and so the board wouldn’t let her retire. So she found a private equity firm to take her position (there was some sneaky shit happening here) where they then forced the board members to give up their spots and merge their hospital under their brand. The quality of care immediately went down and the doctors were required to use a system where once their ability to be in tune with their patients and give them the time of day- now makes it so hard to give patients more than 5 minutes of their time.

Then there are the homes. Have yall noticed how many luxury apartment buildings are going up for $2500+ per month? Have you noticed if they are being filled completely? I mean come on, we are constantly being told that housing is limited and that we need more apartments to bring housing prices down. So filling those complexes shouldn’t be an issue right? Have you noticed they all look the same nationally? Have you noticed the same modular town homes going up on land that was big enough for 1 family home? What would have been ~2k sqft now broken down between 5 homes to ~800sqft. Or how there’s actually plenty of homes for a family of 3 but they are all owned under an LLC and each room is being rented out for ~$1800? Or on the flip side, there’s absolutely no 3 bedroom apartments to rent because they are designing apartments for roommates only and in that world 200 sqft studios to 900 sqft 2 beds 1 bath are the only thing profitable?

We were raised to believe the US is a free market and assumed it would never change. And although it was at one time, here we are with a handful of sand and a theory on free market.

A couple days ago I decided to do my own research and had to become my own detective because, and as the video states this as well, absolutely no one is talking about this.

This was a very interesting listen to by someone who really knows their studies. I thought, man, there’s nothing we can do about this. Nothing at all. But stick to the end of the video- after she freezes (it continues I swear). Yall know from my history, Trump could eat a bag of dicks. But, he’s still our president and if he has history of wanting this closed, maybe this can happen. It’s the only sliver of light I see out of this.

If we make enough noise, can we really stop this hell hole from becoming one and done? To take us back to a free market would do wonders for our skin.

#washington dc#politics#president trump#trump#tiktok#free market#investors#private equity#important#maybe ask your red family to call their representatives in this?

12 notes

·

View notes

Text

My Balto plushes. ♥️ Yes, I do have two each of the sitting Balto and Jenna. I am not looking to sell any. From a collector side of things, I’ve been slowly accumulating them all mint with tags. The only one I don’t have tagged is the laying down Jenna. I’m actively on the lookout for one, and when I achieve one, the laying Jenna plush I have now is going to live with a friend of mine. That’ll give him a full set too! In terms of my tagless sitting Balto and Jenna, Balto was a birthday gift earlier this year (2024) and I recently managed to get Jenna for very cheap. I cuddle with those two. Further helps me to leave my pristine ones alone, for fear of messing them up! I recommend owning these plush to anyone who’s shown interest in them. Aside from getting a tagged laying Jenna, I don’t plan to get any more of these. I don’t need doubles of the whole set. They fluctuate in price, but it’s not impossible to get a good deal. I’ve also seen an increase of people finding them in thrift too. I’m not trying to get anyone’s hopes up in saying that. But I am saying it could happen. ♥️ Also, so as not to make anyone think there’s an official one out there, the Steele plush was custom made for me in a trade. He’s a one of a kind plush, I love him too!

#plush#plushie#toy#vintage#dog#balto toy#balto 1995#balto plush#balto movie#balto#toys#Balto Jenna#1995#universal studios#amblimation#equity marketing#toys r us#exclusive

19 notes

·

View notes