#Public debt

Text

#us politics#republicans#conservatives#donald trump#gop#trump administration#economics#economy#unemployment rate#tax breaks#public debt#health insurance#gun production#culture wars#corporate profits#economic turmoil#2024 elections#memes

72 notes

·

View notes

Text

Former President Trump ran up the national debt by about twice as much as President Biden, according to a new analysis of their fiscal track records.

WHY IT MATTERS: The winner of November's election faces a gloomy fiscal outlook, with rapidly rising debt levels at a time when interest rates are already high and demographic pressure on retirement programs is rising.

• Both candidates bear a share of the responsibility, as each added trillions to that tally while in office.

• But Trump's contribution was significantly higher, according to the fiscal watchdogs at the Committee for a Responsible Federal Budget, thanks to both tax cuts and spending deals struck in his four years in the White House.

BY THE NUMBERS: Trump added $8.4 trillion in borrowing over a ten-year window, CRFB finds in a report out this morning.

• Biden's figure clocks in at $4.3 trillion with seven months remaining in his term.

• If you exclude COVID relief spending from the tally, the numbers are $4.8 trillion for Trump and $2.2 trillion for Biden.

STATE OF PLAY: For Trump, the biggest non-COVID drivers of higher public debt were his signature tax cuts enacted in 2017 (causing $1.9 trillion in additional borrowing) and bipartisan spending packages (which added $2.1 trillion).

• For Biden, major non-COVID factors include 2022 and 2023 spending bills ($1.4 trillion), student debt relief ($620 billion), and legislation to support health care for veterans ($520 billion).

• Biden deficits have also swelled, according to CRFB's analysis, due to executive actions that changed the way food stamp benefits are calculated, expanding Medicaid benefits, and other changes that total $548 billion.

BETWEEN THE LINES: Deficit politics may return to the forefront of U.S. policy debates next year.

• Much of Trump's tax law is set to expire at the end of 2025, and the CBO has estimated that fully extending it would increase deficits by $4.6 trillion over the next decade.

• High interest rates make the taxpayer burden of both existing and new debt higher than it was during the era of near-zero interest rates.

• And the Social Security trust fund is rapidly hurtling toward depletion in 2033, which would trigger huge cuts in the retirement benefits absent Congressional action.

WHAT THEY'RE SAYING: "The next president will face huge fiscal challenges," CRFB president Maya MacGuineas tells Axios.

• "Yet both candidates have track records of approving trillions in new borrowing even setting aside the justified borrowing for COVID, and neither has proposed a comprehensive and credible plan to get the debt under control," she said.

• "No president is fully responsible for the fiscal challenges that come along, but they need to use the bully pulpit to set the stage for making some hard choices," MacGuineas said.

#us politics#news#republicans#conservatives#donald trump#gop#trump administration#2024#biden administration#president joe biden#national debt#Committee for a Responsible Federal Budget#public debt#debt#interest rates#Social Security#deficits#Maya MacGuineas#Axios

30 notes

·

View notes

Text

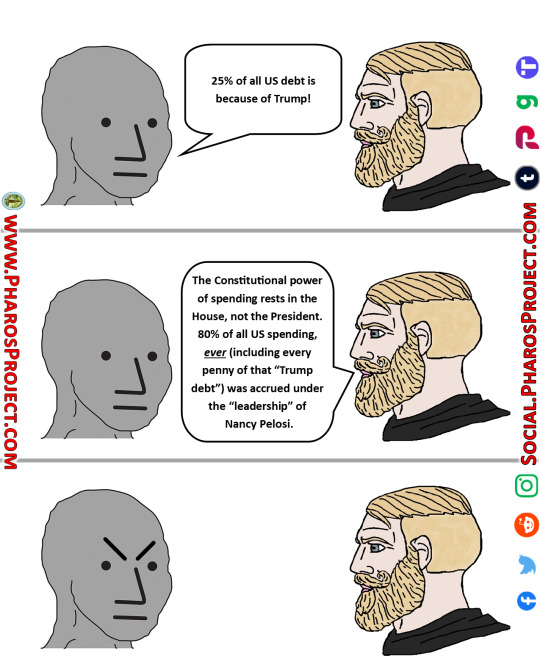

The "legacy" of Nancy Pelosi

#Nancy Pelosi#democrat hypocrisy#liberal hypocrisy#hypocrisy#debt#public debt#government debt#democrat gaslighting#gaslighting#democrats are evil#democrats are hypocrites

38 notes

·

View notes

Text

🇺🇳🇺🇲 TOTAL GLOBAL DEBT WAS US$92 TRILLION AS OF 2022

TOTAL US PUBLIC DEBT IN 2022 WAS $31 TRILLION

MEANING THE UNITED STATES IS RESPONSIBLE FOR JUST A HAIR OVER ONE THIRD OF GLOBAL PUBLIC DEBT.

Understand that no other country on earth can print money and just spend it the way the United States does because the rest of the world doesn't have sovereignty over the World Reserve Currency.

If any other country attempted to print money and manipulate markets the way the United States does, first off we'd sanction them for having an independent policy, and secondly, it would rapidly result in runaway inflation.

But because the US has sovereignty over the World's Reserve Currency, the United States can and does manipulate markets and print money however it likes, and the rest of the world, especially in the Global South, are literally forced to subsidize this US debt by buying US dollars at horrible exchange rates that favor Western countries in order to do trade, oftentimes with countries that have NOTHING to do with the United States because that's just how the international system has been designed (by the US and UK) to force countries to trade in dollars using Western banks.

And this advantage is baked into the system itself.

This means foreign countries in the Global South are subsidizing the very Imperialism oppressing them, subsidizing the 900 or so US military bases around the world.

@WorkerSolidarityNews

#debt#public debt#us public debt#us debt#us imperialism#imperialism#us hegemony#hegemony#western imperialism#colonialism#western colonialism#neocolonialism#neoliberalism#socialism#communism#marxism leninism#socialist politics#socialist news#marxism#socialist#communist#marxist leninist#politics#national debt#world bank#IMF#multipolarity#multipolar world#WorkerSolidarityNews#news

10 notes

·

View notes

Link

Calling it now, DOA.

#House Republicans#House GOP#Speaker Kevin McCarthy#Congressman Chip Roy#Republicans#emergency plan#debt limit#budget negotiations#$31 trillion#debt ceiling#public debt#U.S. Treasury#Congress#House of Representatives#divided government#Government Shutdown?

4 notes

·

View notes

Text

Debt Discrimination

April 26 2024

By PK Morgan

Most of the middle and lower classes have worked all of their lives to support their families. It’s not always easy and speed bumps called financial crisis are scattered everywhere.

Our solution was rarely found in asking our country to pay our way out of debt that we freely took on to feed our children or buy that shiny new car. We worked to pay it off. But…

View On WordPress

0 notes

Text

"On Chinese Currency: Coin and Paper Money" (1877) by Willem Vissering - PDF:

https://upload.wikimedia.org/wikipedia/commons/c/c7/On_Chinese_Currency_-Coin_and_Paper_Money_By_Willem_Vissering%281877%29_-_Version_2.pdf

Full disclosure: I haven't read the book myself. Was brought to my attention by TXMC:

https://www.youtube.com/watch?v=Ytjzfjz5Bzk

0 notes

Text

India's Debt: Not Risky as China's, But rather Still a Concern

India’s debt is a complicated issue with a long history. The country’s debt-to-Gross domestic product proportion has been on a consistent ascent lately, and presently remains at 81.9%. This is like China’s debt-to-Gross domestic product proportion of 83%. In any case, the dangers related with India’s debt are not so perfect as China’s. India has a more youthful populace and a higher development…

View On WordPress

#Debt sustainability#Debt-to-GDP ratio#External debt#Fiscal deficit#Government borrowing#India&039;s debt#Public debt

0 notes

Text

Busia Senator Calls for Debt Audit and Redistribution of Payments

Busia Senator and prominent activist, Okiya Omtatah, has taken to social media to call for a comprehensive audit of Kenya’s debts and a redistribution of payments based on the beneficiaries. Omtatah argues that those debts that have directly benefited Kenyans should be prioritized for repayment, while those that have not served the interests of the country should be shouldered by those who…

View On WordPress

0 notes

Text

Source

Good

#politics#us politics#government#the left#progressive#current events#news#bernie sanders#medical debt#health#health care#public health

2K notes

·

View notes

Link

So there you are.

Congress cannot force a default.

0 notes

Text

I owe the Israelis 10 dollars

If you don't hear from me, you know what to do

0 notes

Link

pCelebrated economist Michael Hudson thinks that the world of academic economics is both deceptive and essentially wrong in its formulations of the role of money and debt. Hudson says today’s oligarchic monetary systems invariably reinforce the flow of profits from labor to the top of the economic ladder. The result is unsustainable debt, which he says is an historical pattern that goes back a couple thousand years. Something has to give. Ellen and Michael spend the hour discussing what that might look like./p

#public debt#national debt#debt relief#debt ceiling#debt#economics#economy#finance#financial#moneycontrol#money

0 notes

Link

So much for getting some rest for a few months.

#debt limit#emergency measures#negotiations#Congress#Public Debt#$31 trillion#extraordinary measures#default#irreparable harm#U.S. Treasury#Treasury Secretary Janet Yellin#Government Shutdown?

1 note

·

View note

Text

This is how the Stability Pact changes in Europe. And for Italy the result is bittersweet

This is how the Stability Pact changes in Europe. And for Italy the result is bittersweet

Differentiated debt repayment plans depending on the state. Most frequent penalties (including risk of losing PNRR money)

The Stability Pact in the EU is currently suspended, but will come into force again from 2024. However, it will never be the same. The rules will no longer be the same for everyone. The 60% debt-to-GDP and 3% deficit limits remain, but each state will have its own specific…

View On WordPress

0 notes

Text

Support member States’ efforts to implement macroeconomic policies towards inclusive growth and sustainable prosperity.

The Arab region’s need for government spending is increasing, but government revenues are not rising in parallel. Governments are therefore resorting to borrowing to finance their spending needs. Consequently, government debt is rising to unsustainable levels because of inefficient public finance management and the lack of a prudent fiscal policy response to public debt, thus exacerbating the debt service burden, stressing the already limited fiscal space, and impeding budgeting towards social development priorities.

#macroeconomics#arab countries#government debt#public finance management#fiscal policy response#public debt#Escwa#inclusive growth#sustainable prosperity

0 notes