#Taxation guide

Text

Join the discussion on cannabis legalization with our comprehensive article, complete with a detailed list of where cannabis is legal in the U.S. Explore the nuances of state laws and share your insights with the community. Don't miss out on this valuable resource. #CannabisDiscussion #LegalizationGuide #JoinTheConversation 🌿🗣️

#cannabis legalization#state regulations#taxation systems#social equity programs#cannabis industry#marijuana laws#federal vs. state conflict#public health initiatives#employment laws#labor regulations#advocacy groups#industry associations#legal status#state-by-state guide#PURE5™#cannabis processing equipment

3 notes

·

View notes

Text

EPF Balance Check: PF Balance Check With or Without UAN

Learn how to easily check your EPF balance with or without UAN. Discover various methods like SMS, missed call, and online portal for PF balance check. Taxbuddy provides best itr filing services

#itr efiling platform#tax services#tax filing services#accounting#business#finance#financial#financial planning#audit#itrfiling online#itr filing services#calculator#income#online income#money#savings#services#personal finance#investments#investing#taxbuddy#tax#taxation#taxes#economy#finances#blog#guides

0 notes

Text

Expert assistance in GST LUT filing matters significantly due to its intricate nature and legal implications. Professionals ensure accurate documentation, timely submission, and compliance adherence, mitigating risks and optimizing benefits for businesses engaged in export activities. For more insights, read our blog.

#GST#LUTFiling#Export#Compliance#Business#Taxation#Consultation#Documentation#Verification#Submission#Acknowledgment#Process#Guide#StepByStep#Seamless#Efficiency#BusinessCompliance#ExportActivities#TaxRegulations#Expertise

0 notes

Text

GST Made Easy: Step-by-Step e-Filing Strategies for Businesses

Introduction

Navigating the intricacies of Goods and Services Tax (GST) often poses a significant challenge for businesses. However, armed with the right strategies and a comprehensive step-by-step tax filing guide, the GST process can become more manageable. In this blog, we will explore effective e-filing strategies tailored for businesses, ensuring a seamless and stress-free experience. Additionally, we'll delve into essential Taxation strategies for businesses can adopt to optimize their overall tax filing process.

Understanding GST

Goods and Services Tax, commonly referred to as GST, stands as a comprehensive indirect tax levied on the supply of goods and services. Compliance with GST regulations is pivotal for businesses to evade penalties and maintain a smooth flow of operations. Let's dissect the process with a detailed step-by-step guide to e-filing.

Step 1: Registration and Documentation:

The initial stride in the GST e-filing process involves ensuring that your business is duly registered under GST. Gather all necessary documents, including business registration details, PAN card, and proof of address. A robust registration process lays the groundwork for a seamless e-filing experience.

Step 2: Determine Your GST Liability:

Pinpoint the applicable GST rates for your goods and services. Accurate classification is paramount for calculating your GST liability correctly. This step guarantees compliance with GST rules and mitigates errors in your e-filing.

Step 3: Maintain Accurate Records:

Maintain meticulous records of all business transactions. Utilize accounting software to streamline the process and uphold transparent records of financial activities. This approach facilitates easy reconciliation and aids in generating precise GST returns.

Step 4: Timely Invoicing:

Issue invoices promptly, ensuring compliance with GST regulations. Include all necessary details such as GSTIN, HSN codes, and tax rates. Timely and accurate invoicing is pivotal in averting discrepancies in your e-filing.

Step 5: File Your Returns Regularly:

Regular filing of GST returns is imperative for staying compliant. Utilize the GST portal or reliable GST software to file returns accurately and on time. This step is critical to preventing late fees and maintaining an untarnished tax record.

Taxation Strategies for Businesses:

In addition to mastering the GST e-filing process, businesses can embrace effective taxation strategies to optimize their financial position. Let's explore some key strategies:

Tax Planning: Implement a robust tax planning strategy to legally minimize your tax liability. Explore available deductions, exemptions, and credits to optimize your overall tax position.

Expense Tracking: Maintain a detailed record of business expenses. Proper expense tracking enables you to claim legitimate deductions, ultimately reducing your taxable income.

Invest in Tax-Advantaged Assets: Consider investments in tax-advantaged assets to optimize your tax position. Explore options such as tax-saving mutual funds and other instruments offering tax benefits.

Utilize Tax Credits: Identify and leverage available tax credits, which may include research and development credits, energy credits, or other incentives provided by the government.

Conclusion:

Mastering GST e-filing is an integral facet of financial management for businesses. By adopting a strategic step-by-step tax filing guide and implementing effective taxation strategies, businesses can not only stay compliant but also optimize their overall tax position. Stay informed, maintain accurate records, and leverage technology to simplify the process. With these strategies in place, businesses can confidently and efficiently navigate the complex world of taxation.

0 notes

Text

Taxation of crypto investments globally

🌍 News about crypto taxation in South Korea and around the world! Starting in 2022, cryptocurrency exchange operators in South Korea will be subject to a 20% corporate tax and a 2.2% local tax. Users of exchanges will also have to pay 20% income tax and 2.2% local tax if their monthly trading volume exceeds 20 million won. There are also an increasing number of cases of tax evasion in the cryptocurrency market through various trading methods. Globally, the taxation rate of virtual assets varies from country to country. In the United States, Canada, Japan, and Europe, the taxation method of virtual assets is applied slightly differently. Please consider taxes when trading virtual assets and proceed with the transaction! 💰

#virtualasset#taxation#taxes#taxpayment#taxavoidance#tax office#tax accountant#tax investigation#tax administration#corporate tax#income tax#local tax#tax guide#tax calculation#tax return#tax check#tax exemption#tax increase#tax problem#tax imposition#tax deduction#tax refund#tax transfer

0 notes

Text

US Tax Season

Hi everyone!! Idk how many people this will reach, but I wanna post some resources for US residents since tax season is here. I’m a graduate taxation student who intends to work in family/small business/non profit tax.

If taxes are really intimidating to you I don’t blame you, they’ve been made super inaccessible and hard to learn about. There are some resources out there that are really worth looking into, which I would highly recommend!

If you want to file your taxes from home and made less than $73,000 from all sources of income this year, check out the IRS Free File page. There are options to fill out all tax forms yourself without auto calculations OR an even better option which is self guided free filing platforms with auto calculations. There are multiple services that can help with the self guided forms, I’d suggest finding the best fit for you. Some may offer free federal tax returns but need payment for state tax returns.

I’d also highly recommend checking out the IRS VITA (Volunteer Income Tax Assistance) program which I will be volunteering with starting next week. It’s a program ran by volunteers who have to get certified and take tests to be able to file basic/slightly advanced tax returns for individuals who made under $60,000 from all sources of income in the previous year. It’s an in person program where you’d bring all your tax forms and sit down with a volunteer who would help you file your tax return. The website linked above has another link to look for volunteer centers in your area. Some locations may need an appointment, but as far as I know most accept walk ins.

For both of these you’ll need all tax forms from the previous year (W2s, 1099s, 1098Ts, etc). If you don’t know if you’ll need it, I’d bring it as opposed to not. I don’t know how many questions I can answer because I’m still fairly new to this, but I am certified to prepare tax returns for US residents. If you have any questions feel free to ask!

527 notes

·

View notes

Text

Yawns, g'morning.

I'm thinking about Vaxleth and episode 51, as. Most of us are, really. Holy shit.

And I think Vax's divine nature played a role in how Ludinus was able to set and bait this trap. I don't think we'd have gotten this outcome if Vax was still a mortal Champion, like his sister. Furthermore, Keyleth’s position as Voice of the Tempest was also critical here.

Let me explain: let's say some other half of a ship could have fulfilled this orb critera. If we pretend that any Champion could do (I think they needed the divine aspect of Vax's unlife but play along here), why not bait the trap for Vex, or Pike, or Scanlan, or Yasha?

Beyond the 'Vax is practically an angel now and has orb properties' angle, I think part of it is the sheer... everything that is mortal. If Percy was captured Vex would have any number of solutions - send Trinket in, attack at range, Rogue it up, or do the sensible thing and bring in friends. The living are variable, you can't count on them to behave as you need.

Ludinus loathes gods and their servants: of course he'd expect them to be predictable - and he'd be right! Vax is not all Vax anymore (see Dalen's Closet and Tal’Dorei Reborn), he's a deathless shepherd and servant of the Raven Queen. Why would he think this through? He has no life to lose, only Keyleth’s to save. You don’t need to consider how to use a shield, you just do. People shape their plans around the steady expectations of gods, their almost immutable domains, and Vax is divine enough for that to apply to him. They'd know he would behave exactly as he did. It could be argued living!Vax would as well, and there are several songs and historical records about him, so worst came to worst Ludinus could hope that this is maintained. But that's an uncertainty, and not fitting for a centuries-long plan.

And now the second part: it had to be Keyleth. They couldn't have used Vex to draw him out, I don’t think, as much as it pains me. Either the story of Dalen's Closet was limited to the guests and any lil kids who heard the Ballad of Derrig or it proves the Champion cannot willingly approach his sister. It took a Wish for that.

Vex has had five kids, spent thirty years protecting Whitestone, and has her fingers in the financial goings on of all Tal’Dorei. By no means does she have a small impact on the world: her smallest taxation decisions could mean poverty or wealth for thousands! But many of her biggest impacts on the future, on destiny, have already come to pass. Her adventures in Vox Machina, the children she bore, the decades of decisions she's already made (I doubt she'd be on the council for even a few years without changing much of her sphere to her liking.)

Keyleth is the Voice of the Tempest. She will, hopefully, live almost two thousand years. Imagine all the lives she will impact in that time! Directly! The Matron must be so familiar with her strand of fate because it touches so many, many others!

Even if Vax, somehow, did not remember her. Even if he was a shell of himself. This is someone the Matron cannot let die before her time (hopefully a thousand plus years from now). This is one person she would have to bend the rules for and see saved, and there's just the man for the job. She would not allow intervention for Vex, or Percy, or those nieces and nephews Vax surely watches. Not Velora, not Scanlan, not Gilmore. Keyleth, with centuries of work to do in this world, with generations to guide, is too valuable.

What I'm saying is... literally no other ship could have pulled this off. None. This was built for Vaxleth, from its very bones. You could have, say, an AU where Vex is the Champion of Ravens (wink), and this would not be certain enough for Ludinus to bank on it. Very likely, but not assured (the Matron could refuse to intervene, or they could intervene in a less 'take me instead you lil red-storm shit' way, etc.).

Evil plans bank on the inevitable. Gravity, greed, time. Their love is inevitable, a law of nature.

It could not have been anyone else

#Vaxleth is! not one of my main ships.#EXCEPT for those dozen-ish episodes where Vax is a Revenant and the angst is top tier and OH BOY DOES THIS DELICER#deliver*#cr spoilers#critical role spoilers#critical role#critrole spoilers#vaxleth#vax'ildan#keyleth#keyleth of the air ashari#cr c3e51#c3e51#campaign 3#vox machina#ludinus da'leth#cr meta

376 notes

·

View notes

Text

from @/wtp.resist on Instagram:

Tax Day is Monday, April 15th... just 4 days away ‼️ 💸

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Follow this outline for an easy-to-understand guide on how to participate in war tax resistance this year. If you are unable to participate in war tax resistance but still wish to legally protest, please see slide #7. We want to encourage people to think big and act with courage, but we also understand not everyone can resist in the same way, so we wanted to provide several measures of resistance and resistance support in our Act I — War Tax Resistance — Tax Blackout 2024 Campaign.

���⠀⠀⠀⠀⠀⠀⠀⠀

Our #TaxBlackout goal is 50 million people... with 16% of the U.S. population participating with at least 5% being redirected to vetted emergency relief in Gaza, Washington D.C. will receive a message loud and clear:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

We will not fund Genocide and Imperialism!

transcript of all slides under the cut

slide 1: Act I Tax Resistance

by @ WTP.resist / We the People

The Tax Blackout 2024 Guide

Tax Resistance

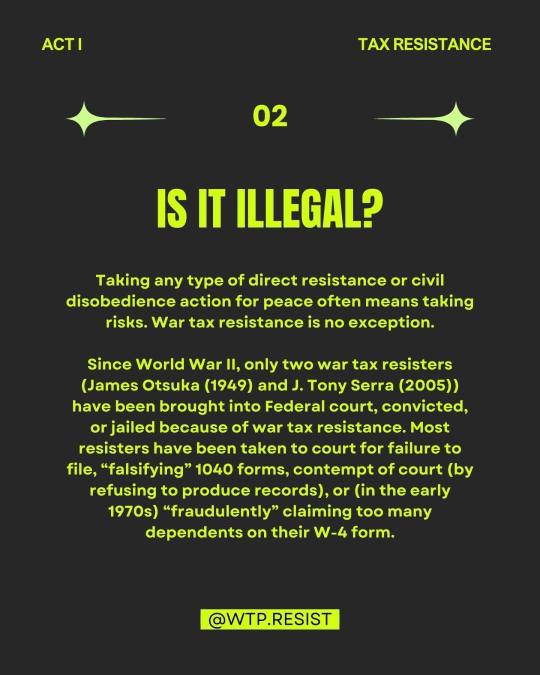

slide 2: Is It Illegal?

Taking any type of direct resistance or civil disobedience action for peace often means taking risks. War tax resistance is no exception.

Since World War I, only two war tax resisters (James Otsuka (1949) and J. Tony Serra (2005)) have been brought into Federal court, convicted, or jailed because of war tax resistance. Most resisters have been taken to court for failure to file, "falsifying" 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) "fraudulently" claiming too many dependents on their W-4 form.

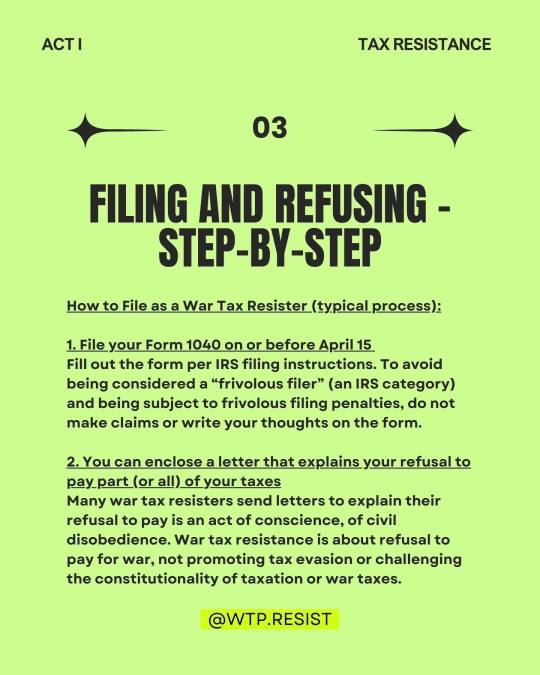

slide 3: Filing And Refusing - Step-By-Step

How to File as a War Tax Resister (typical process):

1. File your Form 1040 on or before April 15

Fill out the form per IRS filing instructions. To avoid being considered a "frivolous filer" (an IRS category) and being subject to frivolous filing penalties, do not make claims or write your thoughts on the form.

2. You can enclose a letter that explains your refusal to pay part (or all) of your taxes

Many war tax resisters send letters to explain their refusal to pay is an act of conscience, of civil disobedience. War tax resistance is about refusal to pay for war, not promoting tax evasion or challenging the constitutionality of taxation or war taxes.

slide 4: Filing And Refusing - Step-By-Step

3. Refusal Options:

Refuse a symbolic amount, a percentage (at least 5%), or refuse all of the federal income tax (see next slides).

4. Withholding Adjustments:

Salaried employees can increase the # of deductions on their W-4 form at any time to owe federal income taxes on April 15, and then can choose how much you want to refuse. Take the form home fill it out and return only the first page of the form, not the worksheet (page 3), to your employer. If you are self-employed and don't use a W-4 form, you must adjust the amount of estimated taxes you pay quarterly to resist when you file.

slide 5: Methods Of Resistance

1. File and Refuse to Pay

This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (we are asking at least 5%) a percentage representing a "military" portion, or the total amount (since a portion of whatever is paid still goes to the military).

2. Refuse to File a Tax Return

NWTRCC recommends filing your taxes or the IRS will file on your behalf. They cannot garnish wages until the tax debt has been assessed, which can take some time. The statute of limitations begins at the point the tax is assessed.

slide 6: Methods Of Resistance Continued

3. Earn Less Than The Taxable Income

This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed.

4. Tariffs and Excise Taxes

Today, thousands of people continue to "Hang Up On War" by refusing to pay the small amount on their local telephone bill listed as "Federal Excise Tax" or "Federal Tax." This federal excise tax, like many others, pays into the general fund of the U.S. government - the same place your federal income taxes go. The monies in the general fund help to pay for the Pentagon, the militarization of our culture, and war.

slide 7: Ways To Legally Resist

Send a letter of protest with your 1040 tax form.

Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

Write letters to editors protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

Write a message of protest on the check you send with your tax forms.

Pay the tax with hundreds of small-denomination checks or coins.

Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

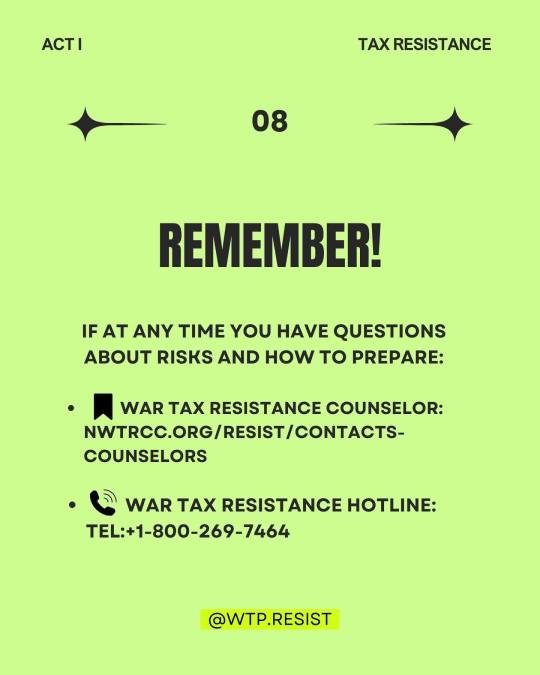

slide 8: Remember!

If at any time you have questions about risks and how to prepare:

War Tax Resistance Counselor: NWTRCC.org/resist/contacts-counselors

War Tax Resistance Hotline:

TEL: +1-800-269-7464

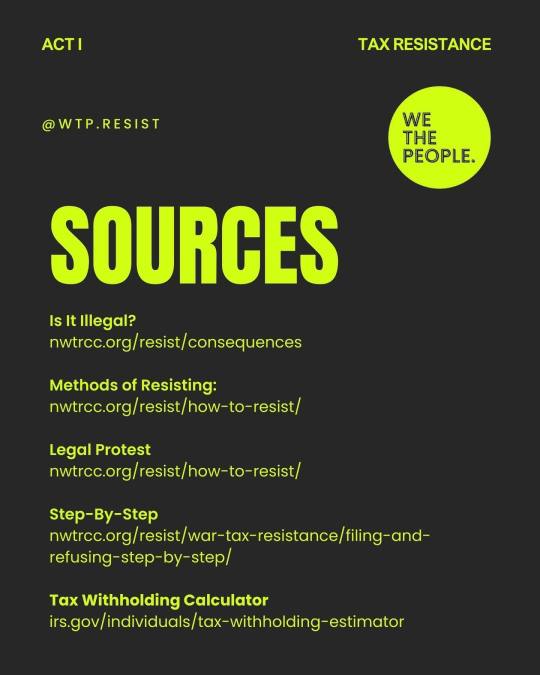

slide 9: Sources

Is It Illegal?

nwtrcc.org/resist/consequences

Methods of Resisting:

nwtrcc.org/resist/how-to-resist/

Legal Protest

nwtrcc.org/resist/how-to-resist/

Step-By-Step

nwtrcc.org/resist/war-tax-resistance/filing-and-refusing-step-by-step/

Tax Withholding Calculator

irs.gov/individuals/tax-withholding-estimator

#tax resistance#war tax resistance#we the people#free palestine#palestine#EndIsraelsGenocide#tax blackout 2024#anti imperialism

30 notes

·

View notes

Note

you keep mentioning making money off of games like hsr but how? im dying to know

All right I'll make a proper post about this lmfao. May I present

The Invalid's Guide to Making Money Off Mobile Games

(Please note I'm using my affiliate links, so if you click through and join up I will get rewarded at no cost to you.)

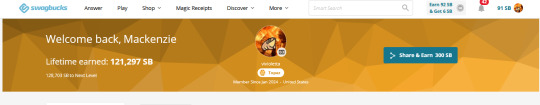

The primary way that I make money is through Swagbucks. (I also use Inbox Dollars, but I tend to use Swagbucks more for different deals. They're both owned by the same parent company.) Swagbucks is a survey website, but they also offer affiliate deals with mobile games. For proof that I'm not grifting, here is my profile.

Each swagbuck (SB) is a penny, so 100 is a dollar, 1000 is 10 dollars. As you can see as of posting this, I've earned 121, 297 SB or $1,212.97 since I started in January. I play various mobile games for a few hours every day, but I took a break for about a month and a half since I was getting burned out. I cash out to Paypal usually, but you can get a bunch of different gift cards, it's nice to be able to directly get people gift cards for their birthdays through the website.

There are a ton of different offers to choose from, from various sponsors of varying levels of credibility. They'll offer to complete different checkpoints within the game for SB within a certain amount of time.

When I'm looking for an offer to start, I'm looking for a few things in particular. The amount on offer has to be worth my time. Usually, I'm looking for offers in the $40-$150 range. Anything above that is likely to have a catch, require massive amounts of in-app purchases to complete, or is downright impossible. I always consult the swagbucks reddit to check out offers beforehand, so I don't waste my time. I also consider the time investment I'm putting in. Usually 1000 levels of a puzzle game for $35 is the minimum I'm looking for. For idle games, I'm looking more in the $50 minimum range.

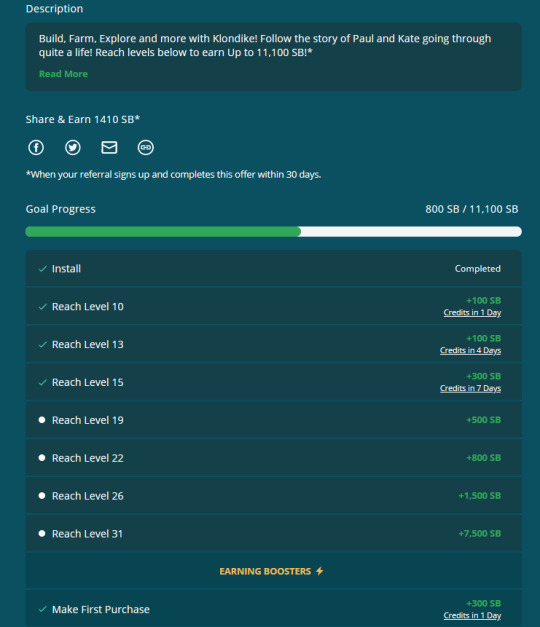

This is one of the offers I'm currently working on. (the game is Klondike, for $110 total offer)

Typically with an offer in this range, I know I'm going to make a few purchases. I always try to go for stamina boosters on the cheap. I've spent about $5 so far and I'm only a week into this and already about 1/3 of the way done. I log in multiple times a day since I am, as I've stated, disabled, so I have the freedom to do so. If you do not have the ability to be so on top of things, I recommend looking at the second to last goal point, and making that your target.

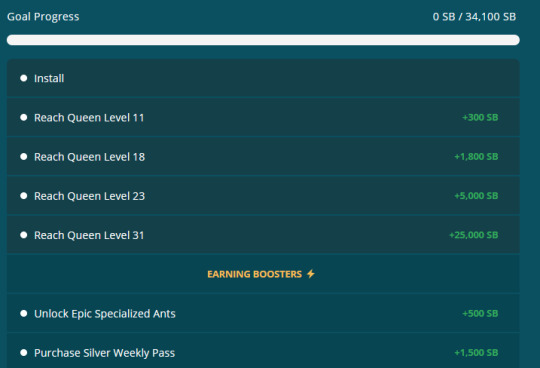

Other offers are like this

(This is Ant Legion, a game I've played before). As you can see the amount on offer is significantly higher. $340 to be exact, though keep an eye out for things like "purchase X"--typically those are 1:1 rebates, so you get a boost for free. With these types of games, you're going to be making substantially more in-app purchases. When I try this offer, I'm going to budget about $40-$50 so that I'm still making a profit of about $285. Understand that there is risk involved--if I spend that money and I *don't* make it all the way to 31 in time, I'm SOL.

Swagbucks also offers gambling games. Just stay away from those. I did one and spent about $70 to make a profit of about $150, but none of it was from the app itself. They're predatory and meant to funnel in-app purchases, though again, check the reddit. There might be a couple that are legit.

Typically with Swagbucks, I like to be doing 3 offers at a time--two idle games, and one puzzle game. I'll check my idle games throughout the day to make progress, and sit and binge the puzzle games to get to the level checkpoints (Usually about 1000 levels, which isn't as bad as it sounds.)

Before I get into the next section, this is very important, please listen to me.

If you cash out for more than the minimum threshold for taxation in your country, you will owe taxes on the money you make.

You'll need to do research for your individual situation. For USAmericans, the threshold is $600. I budget about 10% of that to go into taxes, and I have a spreadsheet with receipts for in-app purchases which qualify as business expenses in this case. Here is the SB page for more info.

Next, I've just started using Mistplay after being bombarded with ads about it. generally, I like it. I'm also not saying that it's possible to double-dip SB and Mistplay rewards, because I would not do that because it's against terms and conditions, but it might be possible (though I definitely don't recommend it).

Mistplay works differently in that it offers 'units' for playing games for a certain amount of time. I've earned about 500 units in a day playing mobile games for a few hours, and minimum cash out starts at $5 for 1800 units. Overall it's a nice system that allows me to make money on more "fun" games that I'd otherwise be playing anyway without making money, such as for instance, Honkai: Star Rail which I'm planning on starting tonight. And if you do join Mistplay, this is my recruit link ;).

Overall tips:

be prepared to watch ads. I have my shit set up on multiple devices, I have a phone and a tablet with different games on each and I usually have ads going on on one screen while I'm playing merge what the fuck ever on the other. That's how they're making the money to give to you, pussy up etc.

It does take some dedication to rack up big numbers. I consider myself on a fairly relaxed grind and usually play mobile games for about four hours a day. You can try out your limits and whatnot

RESEARCH. you can download a game and test it outside of the SB tracking to try it out, or check out the subreddit. Mucho helpful information.

IF YOU DO AN OFFER and it DOES NOT TRACK CORRECTLY do not panic. Complete the offer to the best of your ability, take screenshots, and use the SB help center to request your missing SB credit. They usually get back to me within a business day with my shit in pending.

It's a slow crawl to victory. You'll be like "i am not making fucking ANYTHING." and then the next week you'll be like. pending for $100. Be patient.

Check out the other shit on the SB and Inbox Dollars websites. I occasionally do surveys for over a dollar (though I use Forthright for surveys because overall it pays better for my time.)

Good luck gamers!

And. Please don't like. blow me up about this being a scam or whatever? I see people press x to doubt but the proof is in my bank account. Or well. My medical provider's bank account now because I've been using the money to slowly pay off bills.

7 notes

·

View notes

Text

Unleashing the Power of Public Finance Assignment Assistance

Hey Tumblr community! 🌈

Embarking on a journey through the intricate world of public finance assignments? 📚✏️ Look no further! Here at FinanceAssignmentHelp.com, we've got your back with top-notch assistance tailored just for you.

Public finance assignments can be a challenging maze of concepts and theories, but worry not—our experts are here to guide you every step of the way. 🌐💼 Wondering how to navigate the complexities of taxation, government expenditures, and budgeting? Help with public finance assignments is just a click away.

Our dedicated team of experts specializes in providing comprehensive support, ensuring you not only understand the subject matter but also excel in your assignments. Whether you're a student grappling with fiscal policy analysis or diving into the intricacies of public debt, our experts bring a wealth of knowledge to the table. 🎓🌟

Why choose FinanceAssignmentHelp.com for your public finance assignments? 🤔💡 First and foremost, our commitment to excellence sets us apart. We understand the importance of delivering high-quality content that reflects a deep understanding of the subject matter. When you seek help with public finance assignments, you're tapping into a reservoir of expertise and dedication.

Our experts are not just writers; they're seasoned professionals with backgrounds in public finance. This means you receive guidance from individuals who have hands-on experience in the field. We believe in going beyond the textbook, offering real-world insights that enrich your understanding and elevate your assignments to a whole new level. 🚀🌍

And let's talk about deadlines. We get it—student life is a whirlwind of assignments, exams, and social obligations. That's why our team is committed to delivering your public finance assignments promptly. We understand the value of time, and our goal is to provide you with solutions that meet the highest academic standards without compromising on timeliness. ⏰🚚

But our commitment doesn't end with the delivery of your assignment. We believe in fostering a learning environment where questions are welcomed, and doubts are clarified. Our interactive approach ensures that you not only submit a stellar assignment but also gain valuable insights that contribute to your academic growth. 🌱📈

So, there you have it—your go-to destination for public finance assignment help. Navigate the complexities of government finance with confidence, armed with the expertise of FinanceAssignmentHelp.com. 🛡️💻

Ready to elevate your public finance game? Click the link in our bio and let the learning journey begin! 🌐📲

#FinanceAssignmentHelp#PublicFinance#AssignmentAssistance#AcademicExcellence#ExpertGuidance#LearningJourney#StudentLife#FinanceExperts#PublicFinanceAssignment#TopNotchHelp#DeadlineFriendly#KnowledgeIsPower#StudySmart#AcademicSupport#FinanceGurus#UnlockYourPotential#StudentResources#ExploreLearnExcel

10 notes

·

View notes

Text

Barovian Tales: Tax Season

Editor’s note: Escher reference to previous Barovian Tale here.

So, there I was in my office counting my money, when there was a gentle knock at the door. I scurried my cash back into its hiding spot and said “come in.”

Gary, my Illithid barista, opened the door with his mind and floated in menacingly. “This is your yearly reminder that taxes are due tomorrow, boss.” Then he eerily floated backward out the door, shutting it once more.

Drat. I hate tax season.

The periodic shakedowns by Rahadin were bad enough, but when Strahd and his entourage showed up to Barovia with an armed escort to collect yearly tribute to “defend the land” it means we all go broke. Sure, you can try to hide your money and underpay the Devil Strahd, but that guy has been around the block and not easily fooled. You don’t want to get caught, believe me.

On the other hand, business has been down lately, and revenue has been low. If I pay Strahd’s exorbitant taxes I’ll be out of businsss.

Think, Oleksii, think.

Wait, temples and churches are tax-exempt. I just need to start a religion long enough to dodge taxation this year and stay afloat.

“Gary,” I yell as I throw open the plank of wood that serves as my office door, “organize a staff meeting, I’ve got an idea.”

Fast-forward three weeks to the big day.

Imagine if you will Barovia village, all dismal, dilapidated, and depressing as usual. Imagine the entire town, even Mad Mary, poured out onto the street with their meager offerings at their feet, all lined up side by side before an armed party from Castle Ravenloft, their faces and hands obscured, surrounding one jet-black horse carriage with two horses dark as night.

At the head of the escort stands the dread elven chamberlain, Rahadin. In one hand he carries a ledger. One of the guards sets up a chair, table, and an ink well plus quill.

The bored chamberlain opens the ledger and reads off each household one by one, commanding them to step forward. Each family presents their offerings, either cash, or payment in kind. One young man, the eldest son of Farmer Grigory, protests that the taxes are too high, and in no time the guards descend on him and beat him within an inch of his life. Rahadin does not miss a beat, and calls the next household.

Finally, Rahadin calls out my name, Oleksii.

I step forward dressed in garish, ornate robes, with little brass bells, that I spent a week sewing. The bright yellow sash across the front reads, “In Waffle We Trust”, and “Have You Accepted the Eternal Waffle As Your Personal Sav-“ the rest got cutoff by the edge of the sash.

Rahadin, visibly confused, said, “I must say, love the outfit you chose for this festive, merry occasion.”

Due to the aura of screams around him, I heard only one out three words: I love you this occasion.

Now it was my turn to be confused: “um, thank you?”

Annoyed, he moved on and began to read me my assessed taxes.

I retorted, “my lord, I have turned a new leaf and Barovian Chicken and Waffles is now the High Temple of the Eternal Waffle”.

“A temple, that worships waffles…?” said Rahadin incredulously.

“Yes my lord. It came to me in a revelation one night. While prepping one night, my kitchen was bathed in a golden-brown, syrup-colored light and a powerful voice spoke to me. It said ‘Oleksii, be not afraid, for you shall be my emissary in this world’ and behold I was awakened to the Truth! I am no longer a for-profit business, but a religious non-profit organization.”

Rahadin looked annoyed, and was about to say something when suddenly he looked back. “Our Master would like to speak to you. Come forward.”

I gulped visibly.

My knees were shaking as I approached the carriage. I could feel the cold, dark aura emanating from within. Oh crap, I was way in over my head.

From the darkness of the carriage, I heard a deep, commanding voice. “Step forward.”

I did as commanded, trying to remain calm. Inside, my insides felt like jelly.

“Guide my men and I to your temple. I wish to learn more about this new religion in my domain.”

“Yes, milord.”

Each step to the shop felt like a march. I knew I was busted. I had taken precautions, but Strahd would no doubt see right through the ruse, then who knows what?

We came to the storefront, where I had hastily painted over “Barovian Chicken and Waffles” with “Most Ancient and High Temple of the Eternal Waffle”, and had some flowers strewn about the door.

The carriage parked very close to the door and the guards encircled us, screening us from view.

The door of the carriage lurched open, and I profusely bowed as Strahd emerged. Except, it wasn’t Strahd.

“Escher?” I said.

I took 1d4+1 bludgeoning damage as he hit me upside the back of my head. “Pipe down, you idiot!” he hissed.

We hustled into temple/restaurant and closed the door. Inside, I had covered the counter with flowers and candles the Eternal Waffle. Gary stood at his post near the espresso machine, dressed in similar robes. He raised his arms and telepathically broadcasted, “praise be to the golden brown, saccharine other-planar entity that I am required by work policy to venerate.”

From the back I could hear Viktor the Pantry Ghost wailing half-hearted praises too: “praise to the Eternal Waffle, who doesn’t suck like Oleksii!”

Facepalm.

“Cut it out guys! The jig is up!”

Once we sat down, Escher pulled no punches. “You dumb peasant, this little tax evasion scheme of yours has gotten Strahd’s attention. He’s concerned about a new cult in his domain.”

“But why are you here?”

“I’ve been standing in for Strahd for decades. He hates tax collection. Only Rahadin knows it’s me. Except, thanks to you, Strahd was going to come in person this time. For that little Yuletide favor you did me, I convinced him to stay home so I could look into it.”

Swallowing hard, I said, “well, what do you suggest?”

Escher stared at me with his cold, undead eyes. “Just pay your taxes. Thanks to corporate loopholes, kickbacks, and suspect write offs, you’re only paying 4cp a year.”

“You’re right, Escher,” I said, “I am getting screwed.”

He continued to eye me expectantly.

I sighed. “Fine.”

By order of “Strahd”, the Temple was ordered shut down with the Church of the Morninglord declared the only official religion in Barovia. I paid my taxes, and restored my shop to the way it was.

That didn’t stop a number of Barovians from creating heretical Waffle cults though. Soon, pilgrims flocked to Barovian Chicken and Waffles, fighting with rival sects, branding each other apostates, and even running off on crusades through the Mists.

The homicide rate in Barovia was up, but hey, so were profits at BCnW.

Just another week in Barovia.

Epilogue: some months later, a finely written letter arrived from Castle Ravenloft. In it, Escher wrote:

The Lord himself applauds your clever scheme. But you now owe 50gp in punitive damages. Pay up, or starting delivering fried chicken and waffles to the Castle nightly.

—E

(Sad trombone) Just another week in Barovia.

#curse of strahd#barovian tales#barovian chicken and waffles#ravenloft#dnd#ttrpg#barovia#d&d#dungeons and dragons#life in barovia#waffles#fried chicken

5 notes

·

View notes

Text

GST LUT (Letter of Undertaking) filing is crucial for exporters as it enables them to conduct exports without paying Integrated Goods and Services Tax (IGST) upfront. This process ensures cash flow management, compliance with regulations, streamlined export procedures, competitive pricing, and facilitates business expansion into global markets. Find comprehensive guidance and valuable insights in our blog.

#GST#LUTFiling#Export#Compliance#Business#Taxation#Consultation#Documentation#Verification#Submission#Acknowledgment#Process#Guide#StepByStep#Seamless#Efficiency#BusinessCompliance#ExportActivities#TaxRegulations#Expertise

0 notes

Text

GST Made Easy: Step-by-Step e-Filing Strategies for Businesses

Introduction

Navigating the complexities of Goods and Services Tax (GST) can be a daunting task for businesses. However, with the right strategies and a step-by-step tax filing guide your GST becomes a more manageable process. In this blog, we will explore effective e-filing strategies for businesses, ensuring a smooth and hassle-free experience. Additionally, we'll delve into essential taxation strategies for businesses can adopt to optimize their tax filing process.

Understanding GST

Goods and Services Tax, commonly known as GST, is a comprehensive indirect tax levied on the supply of goods and services. For businesses, compliance with GST regulations is crucial to avoid penalties and ensure a seamless flow of operations. Let's break down the process with a step-by-step guide to e-filing.

Step 1: Registration and Documentation

The first step in the GST e-filing process is to ensure that your business is registered under GST. Collect all the necessary documents, including business registration details, PAN card, and proof of address. Proper registration sets the foundation for a smooth e-filing experience.

Step 2: Determine Your GST Liability

Identify the applicable GST rates for your goods and services. Accurate classification is crucial to calculate your GST liability correctly. This step ensures compliance with GST rules and prevents errors in your e-filing.

Step 3: Maintain Accurate Records

Keep meticulous records of all your business transactions. Use accounting software to streamline the process and maintain a transparent record of your financial activities. This will facilitate easy reconciliation and help in generating accurate GST returns.

Step 4: Timely Invoicing

Issue invoices promptly and ensure they comply with GST regulations. Include all the necessary details such as GSTIN, HSN codes, and tax rates. Timely and accurate invoicing is key to avoiding discrepancies in your e-filing.

Step 5: File Your Returns Regularly

GST returns must be filed regularly to stay compliant. Use the GST portal or reliable GST software to file your returns accurately and on time. This step is critical to prevent late fees and maintain a clean tax record.

Taxation Strategies for Businesses

In addition to mastering the GST e-filing process, businesses can adopt effective taxation strategies to optimize their financial position. Let's explore some key strategies:

Tax Planning: Implement a robust tax planning strategy to minimize your tax liability legally. Explore available deductions, exemptions, and credits to optimize your tax position.

Expense Tracking: Maintain a detailed record of business expenses. Proper expense tracking allows you to claim legitimate deductions, reducing your taxable income.

Invest in Tax-Advantaged Assets: Consider investments in tax-advantaged assets to optimize your tax position. Explore options such as tax-saving mutual funds and other instruments that offer tax benefits.

Utilize Tax Credits: Identify and utilize available tax credits. This could include research and development credits, energy credits, or other incentives offered by the government.

Conclusion

Mastering GST e-filing is a crucial aspect of financial management for businesses. By following a Step-by-step tax filing guide approach and implementing effective taxation strategies for businesses can not only stay compliant but also optimize their tax position. Stay informed, keep accurate records, and leverage technology to simplify the process. With these strategies in place, businesses can navigate the world of taxation with confidence and efficiency.

0 notes

Text

Why Choose Chartered Accountants for Your Financial Needs

In Dubai's quick financial landscape, every small, medium, and large business wants to grow quickly and adapt to their changing business environment and business ethics, consequently our top-rated company, Hussain Al Shemsi Chartered Accountants, offers the best and highest quality accounting and auditing services in the UAE. Our Expert Chartered Professional Accountants provide high-quality accounting services throughout the UAE, including Accounting, Tax Accounting, Consultancy and Advisory and other professional chartered accounting services.

What are Chartered Accountants?

Chartered Accountants are professional Certified Accountants who specialize in business accounting, auditing, financial statement activities, filing corporate tax returns, and also promote business consulting and advisory services. When it comes to Dubai, Ajman, Sharjah, and other UAE locations, our Hussain Al Shemsi Chartered Accountants (HALSCA) team is the most Experienced Chartered Professional Accountants. Our team specializes in auditing, accounting, consulting, tax advisory services, industry driving reviews, and other chartered accounting services in the UAE.

The Role of Chartered Accountants

Taxation Services

HALSCA, the Expert chartered accountants in Dubai, specialize in providing the Best Taxation Services in the UAE that will guide you through difficult tax issues. With intricate knowledge of tax-effectiveness and compliance with the law while managing your financial affairs, whether you are an individual taxpayer, a corporation, or a trust, Hussain Al Shemsi Chartered Accountants provides the top taxation services in the UAE.

Auditing and Assurance

Auditing is an important function in all businesses, hence the Audit and Assurance report is required for a variety of reasons. Audit and assurance is the process of evaluating business accounts and confirming data in financial statements using a variety of documents. The audit process can assist detect corporate risks.

Financial Planning and Advisory

Efficient financial planning and advisory is crucial for long-term prosperity in Dubai's changing economic environment. In order to help individuals and organizations reach their financial objectives, chartered accountants provide strategic advising services. They provide helpful advice and recommendations based on your particular situation, ranging from investment research to budgeting.

The Advantages of Using a Chartered Accountant

Professionalism and Expertise

Dubai's chartered professional accountants are highly knowledgeable and experienced in financial management. Their commitment and professionalism guarantee that your financial affairs are managed with the highest care and attention to detail.

Compliance with Regulations

Navigating the complex regulatory environment of Dubai, UAE, can be challenging without expert guidance. Chartered accountants reduce the possibility of non-compliance and the fines that come with it by making sure your financial procedures follow local laws and regulations.

Strategic Business Guidance

Chartered accountants are trusted advisors who provide strategic insights to propel corporate growth, going beyond simple math calculations. Their experience can assist you in navigating obstacles and seizing chances whether you're growing your business or venturing into new industries.

Accuracy and Efficiency of Finance

You can anticipate increased accuracy and efficiency in your operations when chartered accountants are in charge of your financial processes. They can find chances for optimization and simplify procedures thanks to their sophisticated accounting tools and thorough attention to detail.

Conclusion

Choosing Hussain Al Shemsi Chartered Accountants (HALSCA) Reliable Chartered Professional Accountants in Dubai, UAE, is a strategic move for anyone serious about their financial health. These experts bring a level of professionalism, expertise, and strategic insight that is unmatched in the financial sector. Whether you're a small business looking to optimize your operations, a large corporation seeking efficiency improvements, or an individual in need of personal financial advice, expert chartered accountants in Dubai can provide the guidance and support you need. Their comprehensive services, from tax planning to auditing and financial advisory, ensure that your financial needs are met with precision and care. By partnering with a chartered accountant, you are investing in a secure and prosperous financial future.

#best audit firm in dubai#top accounting firm in ajman#professional chartered accountants in ajman#professional chartered accountants near me#best audit firm in uae#best accounting firm in uae

2 notes

·

View notes

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.

6. Risk Management: Assess and manage risks effectively by diversifying your investment portfolio, conducting thorough due diligence, and implementing risk mitigation strategies. Consider geopolitical risks, currency fluctuations, regulatory changes, and market volatility when making investment decisions.

7. Sustainability and ESG Factors: Consider environmental, social, and governance (ESG) factors when evaluating investment opportunities in India. Increasingly, investors are prioritizing sustainability and responsible investing practices to mitigate risks, enhance long-term value, and align investments with their values and principles.

8. Stay Flexible and Agile: Remain flexible and agile in adapting to changing market conditions, regulatory requirements, and investor preferences. India's business environment is dynamic and evolving, requiring investors to stay nimble and responsive to emerging opportunities and challenges.

India offers a wealth of investment opportunities for international investors seeking high growth potential and diversification benefits. With its robust economy, favorable demographic trends, and supportive regulatory environment, India continues to attract capital inflows across various sectors. By understanding the Indian investment landscape, adopting sound investment strategies, and leveraging local expertise, international investors can capitalize on India's growth story and unlock significant value for their investment portfolios. As India continues on its path of economic development and reform, it remains a compelling destination for investors looking to participate in one of the world's most dynamic and promising markets.

In conclusion, navigating the “Invest in India” landscape requires careful planning, strategic decision-making, and a long-term perspective. By understanding the key sectors, regulatory considerations, investment strategies, and tips outlined in this guide, international investors can position themselves to capitalize on the vast opportunities offered by India's vibrant economy and emerging market dynamics. With the right approach and guidance, investing in India can yield attractive returns and contribute to portfolio diversification and long-term wealth creation for investors around the globe.

This post was originally published on: Foxnangel

#regulatory environment#international investors#investment opportunities#investment ideas#india's economy#startup india#investing in India#investment opportunities in india#investments in india#foxnangel

2 notes

·

View notes

Text

How to Set Up an LLC in Pennsylvania: Step-by-Step Guide by TRUIC

Establishing a Limited Liability Company (LLC) varies across states, and Pennsylvania has its own specific process. New business owners can find the process confusing, but this comprehensive guide by TRUIC will remove the guesswork. Continue reading to find out how to create an LLC in Pennsylvania.

Types of LLCs in Pennsylvania USA

Pennsylvania offers various LLC types to suit different business needs:

Single-member LLC: Consists of one owner (member) who holds all ownership rights.

Member-managed LLC: A multi-member LLC where all owners (members) have a say in decision-making and manage the business.

Manager-managed LLC: A multi-member LLC where members appoint a manager to handle daily operations, suitable for larger LLCs.

Restricted LLC: For professional services like medicine, dentistry, law, etc., requiring registration as a restricted professional company.

Benefit LLC: Formed to create a general public benefit, impacting society and the environment positively.

Domestic LLC: An LLC formed within Pennsylvania.

3 Steps to Setup LLC in Pennsylvania USA

Setting up an LLC in Pennsylvania involves filing several documents with the Department of State and can be done online or by mail.

Step 1: Select a Distinct Name for Your LLC

Ensure your chosen LLC name is unique by using Pennsylvania’s business entity search tool. If the name is available, but you're not ready to register, you can reserve it for 120 days.

Naming Rules:

Must include "company," "limited," "limited liability company," or their abbreviations.

Must not include words like "corporation" or "incorporated."

Step 2: Choose a CROP, or Registered Office

You need to provide a physical address in Pennsylvania for your LLC, or enter into an agreement with a Commercial Registered Office Provider (CROP) to provide this address.

Step 3: Put Your LLC Documents in Order

Submit a Certificate of Organization and a docketing statement to the Pennsylvania Department of State. Veterans may apply for a fee waiver. For LLCs formed elsewhere, file a Foreign Registration Statement.

Register an LLC online in Pennsylvania

Filing online is efficient and straightforward. Visit the Pennsylvania Department of State's website to access the online filing portal, complete the necessary forms, and pay the filing fee.

What does it take to start an LLC in PA?

While it's challenging to avoid all costs, you can minimize expenses by handling the filing yourself and serving as your own registered agent. Utilize free resources for creating your operating agreement.

Creating an LLC with Just One Member in Pennsylvania

Similar steps apply to LLCs with many members. Single-member LLCs benefit from simplified management and flexible taxation, often being treated as a disregarded entity for tax purposes.

Lets Find: Is PA a good state for an LLC?

Advantages of a PA LLC

Limited Liability Protection: Personal assets are protected from business liabilities.

Tax Flexibility: Choose from various tax structures to optimize tax obligations.

Simplified Compliance: Fewer formalities than corporations.

Enhanced Credibility: Boosts business trust and legitimacy.

How much does it cost to start an LLC in Pennsylvania: know more

Primary costs include the filing fee for the Certificate of Organization, registered agent fees (if applicable), and publication costs (if needed). Additional costs might include legal assistance for drafting documents.

Processing Fee: $125

State Filing Fee: $125, payable to Pennsylvania's Commonwealth; nonrefundable

Mailing Address:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

A Docketing Statement must be sent with your Certificate of Organization if you file it by mail.

Check out our Pennsylvania Certificate of Organization tutorial for assistance in filling out the form.

How Long Does It Take to Get an LLC in PA?

Online Filing: Typically processed within 5-10 business days.

Mail Filing: Can take several weeks due to processing times.

Crucial Actions Following LLC Formation

Obtain an Employer Identification Number (EIN)

necessary if your LLC employs a large number of people. Get a free EIN from the IRS website.

Create an Operating Contract

While not required, an operating agreement is crucial for outlining management structure, ownership, and operational procedures, helping to prevent disputes.

Keep Your Personal and Business Assets Apart

Open a business bank account and keep business transactions separate from personal ones to maintain liability protection.

Submit Your Decennial Report

Pennsylvania requires a decennial report every 10 years to update business information. The next filing period is in 2031.

Also Evaluate LLCs in Florida, California, and New York USA

LLC in New York

Includes filing fees, a publication requirement, and biennial statements. The publication requirement can be costly due to the need to publish in newspapers For all information go and visit LLC in New York.

LLC in California

Involves filing fees and an annual franchise tax. Requires biennial Statement of Information filings but no publication requirement and Visit for further details click to LLC in California.

LLC in Florida

Requires filing Articles of Organization with a filing fee. No publication requirement and straightforward annual report filings. For more comprehensive details, please visit LLC in Florida.

Conclusion

Setting up an LLC in Pennsylvania is a strategic move for many entrepreneurs. Follow this step-by-step guide by TRUIC to navigate the process confidently. Whether forming a single-member or multi-member LLC, Pennsylvania provides a supportive business environment.

Ready to form your LLC? Visit TRUIC for user-friendly resources and start your LLC formation journey today. Together, let's make your company's vision a reality.

2 notes

·

View notes