#Transaction Processing Systems

Text

What is Management Information System | Complete Guide 2023

What is a Management Information System?

(management information system)The study of people, technology, organizations, and their relationships is known as management information systems (MIS). MIS specialists help enterprises get the most out of their people, technology, and operational procedures investments. MIS is a people-oriented sector that focuses on employing technology to deliver services. A degree in MIS might be right for you if you’re interested in technology and want to utilize it to improve people’s lives.

What is the purpose of an information management system

The following are some of the reasons for having an MIS system.

●To make wise decisions – Decision-makers require information, which is possible thanks to management information systems (MIS).

● Short Message Service – Employees within the business may readily obtain the necessary information for day-to-day operations thanks to MIS systems, which promote communication inside and outside the organization. Communicating with clients and suppliers from within an organization’s MIS system is feasible thanks to tools like Short Message Service (SMS) and email.

●Keeping Records – Management information systems capture every business transaction that takes place within an organization and serve as a permanent record of such transactions.

Important Components of MIS

The following are the main elements of a typical long-form MIS (Management Information System):

●People – People who use the information system

●Data – The data that the information system records

●Business Procedures – Procedures put in place on how to record, store and analyze data

●Hardware – These include servers, workstations, networking equipment, printers, etc.

●Software – These are the applications that manage the data. These include applications like spreadsheet software, database software, etc.

How MIS Makes Business Better

Businesses use information systems at all levels of operation to gather, process, and store data. Management compiles and distributes this data into the information needed to run the firm daily. Everyone who works in business, from those who manage billing to those who choose who gets employed, uses information systems. A vehicle dealership could use a computer database to monitor the best-selling items retail businesses might use a computer-based information system to carry out online sales. Many (if not most) firms focus on matching MIS with business objectives to gain a competitive advantage over other companies.

For data management, MIS qualitative research refers to information systems (i.e., storing, searching, and analyzing data). To meet the demands of managers, employees, and clients, they also handle a variety of information systems. MIS experts can play a significant role in information security, integration, and exchange by cooperating with other members of their work group as well as with their customers and clients. You may improve the efficacy and efficiency of your organization by learning how to creatively design, implement, and use business information systems as an MIS major.

How many Types of Management Information Systems

●Transaction Processing Systems (TPS)

The daily operations of a business are tracked using this kind of information technology. A Point of Sale (POS) system illustrates a transaction processing system. The daily sales are recorded using a POS system.

●Management Information Systems (MIS)

Tactic managers employ management information systems, or MIS for short, to direct them while they make semi-structured judgments. The MIS integration system receives its input from the transaction processing system’s output.

●Decision Support Systems (DSS)

Top-level managers use decision support tools to make semi-structured decisions. The decision support system’s input is derived from the output of the management information system. DSS systems also get data input from outside sources like competitors, market forces, etc.

Important Significance of MIS In Industries

MIS, the department, and the system software can give businesses a competitive edge. Managers can make better decisions on sales, manufacturing, resource allocation, and other issues by using the data maintained by an MIS system. By allowing employees to spend more time on productive tasks, the MIS department and software systems both assist firms in boosting productivity.

Within an enterprise, the MIS department is crucial in delivering various support services:

●Governance

Systems and restrictions on how employees use computing equipment are included. The company’s network infrastructure and technology access policies are defined, managed, and enforced by the MIS department. In addition to regulating computer system use norms of behavior, MIS is in charge of IT security.

●Infrastructure

These include phones, desktop/laptop computers, servers, application software, cloud computing, and other technology systems that support daily business operations. The MIS division offers internal help desk and support services, aiding staff members and resolving infrastructure-related problems.

●Data Management

It entails setting up and maintaining the systems that let staff members access and modify crucial corporate data. The MIS department must guarantee the data management systems’ accessibility and security.

Benefits of management information system

A good management information system must be able to assist the analysis that management needs and not just be utilized for storing electronic data. The manager uses the many benefits of MIS to accomplish the company’s objectives.

A robust MIS may offer the advantages listed below.

●Higher Customer Satisfaction

●Better quantity and quality of information

●Better quality and quantity management decisions

●Higher responsiveness number of the competitor’s condition

●Improved operational efficiency and flexibility

●Better operational efficiency and flexibility

●Improved quality of internal and external communications

●Improved quality of planning

●Improved quality control and supervision

The business foundation has always been management information systems. In the ensuing years, that engine will be even more crucial.

Some useful Link is Below:

To know more about MIS Certification Course

To know more about our Data Analytics Certification Course

#BENEFITS OF MANAGEMENT INFORMATION SYSTEM#How MIS Makes Business Better#How many Types of Management Information Systems#Important Significance of MIS In Industries#A robust MIS may offer the advantages listed below.#Management Information Systems#Transaction Processing Systems

2 notes

·

View notes

Text

Accounting and Audit

Blockchain's transparent and immutable ledger promises a trans formative shift in accounting practices. With blockchain, financial records become easily accessible for auditing purposes, enhancing compliance and operational efficiency.

Borrowing and Lending

Blockchain significantly enhances credit assessments and mitigates the risk of bad loans. By enabling secure sharing of verified customer data among banks, it streamlines processes like syndicated lending, reducing redundancy and accelerating transactions.

Trade Finance

The digitisation of trade finance through blockchain can replace outdated, paper-based systems. This modernisation enables faster, more secure, and transparent global transactions, fundamentally transforming traditional trade finance methods.

Trading and Settlements

Blockchain's decentralised framework is poised to revolutionise trading and settlements. By removing the need for central clearinghouses, blockchain technology facilitates quicker, more accurate transactions with reduced errors.

Fundraising

Blockchain introduces innovative fundraising options, including Initial Coin Offerings (ICOs) and Security Token Offerings (STOs). These methods offer startups new ways to raise capital, expanding beyond traditional banking avenues.

Adopting blockchain across these banking functions can lead to a more efficient, transparent, and technologically advanced financial ecosystem.

#Accounting and Audit#Blockchain's transparent and immutable ledger promises a trans formative shift in accounting practices. With blockchain#financial records become easily accessible for auditing purposes#enhancing compliance and operational efficiency.#Borrowing and Lending#Blockchain significantly enhances credit assessments and mitigates the risk of bad loans. By enabling secure sharing of verified customer d#it streamlines processes like syndicated lending#reducing redundancy and accelerating transactions.#Trade Finance#The digitisation of trade finance through blockchain can replace outdated#paper-based systems. This modernisation enables faster#more secure#and transparent global transactions#fundamentally transforming traditional trade finance methods.#Trading and Settlements#Blockchain's decentralised framework is poised to revolutionise trading and settlements. By removing the need for central clearinghouses#blockchain technology facilitates quicker#more accurate transactions with reduced errors.#Fundraising#Blockchain introduces innovative fundraising options#including Initial Coin Offerings (ICOs) and Security Token Offerings (STOs). These methods offer startups new ways to raise capital#expanding beyond traditional banking avenues.#Adopting blockchain across these banking functions can lead to a more efficient#transparent#and technologically advanced financial ecosystem.#for more details visit : https://smartncode.com/block-chain-development.html#blockchaintechnology#blockchain#blockchaininbanking#blockchainfinance

0 notes

Text

after about 3 years of the same cracked phone screen my phone has started giving off imminent death knells (constant literally constant USB port connected USB port disconnected and because it's a system notification I can't block them outright though I can snooze them for two hours but this means my screen is never actually off which drains the battery and worries me when it's in my pocket)

And i thought hey, might as well get a new one. The paint on the case is also worn quite a bit away and the fingerprint scanner only works when it feels like so it will be nice to upgrade. It might even take less than 10 seconds to switch tabs.

Now here's the problem. Samsung won't take my fucking money. I have ordered this phone three times already. They send me a confirmation email. Then a day later they tell me (with the order code and model number a scammer wouldn't have don't worry the only thing they're scamming me for is my time) that the order was canceled due to insufficient payment info so I went back to the website (through the browser not clicking links on the email this isn't a scam but it feels like it is) and double checked everything was correct except for the big *canceled order* label.

I have done this three times. I have used both my credit and my debit card. I made an account for the third one.

I feel like I'm in fucking crazy town. What Do You Mean It's Not Complete show me the fucking box to fill!!

Customer support is also useless, to be expected. They have a little box you can describe your issue before even entering the chat room but they won't read that so I copy pasted the text whatever doesn't matter. They gave me someone else's payment information in the process so that's assuring.

They eventually just told me to go buy it from my local best buy and sure fine yeah that's a good look.

I went to best buys website and ordered the phone and my only complaint is that they sent me a verification code by email but then went to the next page before I even got the email?? That's sus. Wh why did you send me a code? If you're going to the next page anyway??

Whatever. Best buy has same price as from the official site, and free shipping arrives sooner than if I got the expedited shipping first try from the official site.

Just give phone? Give fone me. I give money you. You gib fone me. Asjdjfk

#Venting#Pire.txt#We'll see if best buy delivers#In person transactions are working fine I don't know what the problem is#I have the cash in my account for it#I already have the fumking case and screen protector I just need the actual Device these things protect#Not to be old man yells at clouds but aaaaaa#Most of this weekend was good#Theres def still things on the general to do list but I knocked 85% of this weekend's post it note list off#I just need to sharpen my knives and pay my water bill and stab the guy who coded samsung's payment processing system and-#Oh yeah I got a pack of post it notes#I'm hoping this solves the ToDo Book Is Out Of Sight And Therefore Forgotten if there's no cover to close#Then I can stick old notes on my calendar in my room and later look through all the things I crossed off over a long stretch of time#And also reference the things I didn't do#Or the last time I did something#So fingers crossed that works out even half as well as it does in my head

1 note

·

View note

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

#PropertyManagementSystem: General tag highlighting the system's purpose.#RealEstateTech: Indicates its role in the realm of real estate technology.#EfficientOperations: Emphasizes the system's ability to streamline processes.#TenantManagement: Indicates its role in managing tenant interactions and needs.#FinancialTracking: Highlights its function in tracking financial transactions and generating reports.#AutomatedTasks: Underlines its capability to automate repetitive tasks#saving time and resources.

1 note

·

View note

Text

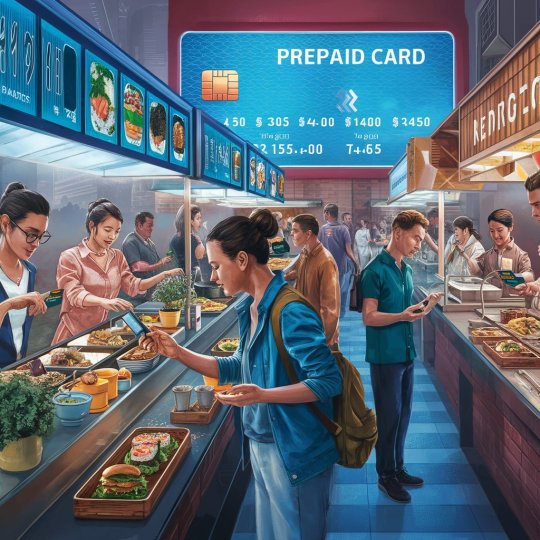

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

it's honestly nuts to me that critical infrastructure literally everywhere went down because everyone is dependent on windows and instead of questioning whether we should be letting one single company handle literally the vast majority of global technological infrastructure, we're pointing and laughing at a subcontracted company for pushing a bad update and potentially ruining themselves

like yall linux has been here for decades. it's stable. the bank I used to work for is having zero outage on their critical systems because they had the foresight to migrate away from windows-only infrastructure years ago whereas some other institutions literally cannot process debit card transactions right now.

global windows dependence is a massive risk and this WILL happen again if something isn't done to address it. one company should not be able to brick our global infrastructure.

5K notes

·

View notes

Text

How I got scammed

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/05/cyber-dunning-kruger/#swiss-cheese-security

I wuz robbed.

More specifically, I was tricked by a phone-phisher pretending to be from my bank, and he convinced me to hand over my credit-card number, then did $8,000+ worth of fraud with it before I figured out what happened. And then he tried to do it again, a week later!

Here's what happened. Over the Christmas holiday, I traveled to New Orleans. The day we landed, I hit a Chase ATM in the French Quarter for some cash, but the machine declined the transaction. Later in the day, we passed a little credit-union's ATM and I used that one instead (I bank with a one-branch credit union and generally there's no fee to use another CU's ATM).

A couple days later, I got a call from my credit union. It was a weekend, during the holiday, and the guy who called was obviously working for my little CU's after-hours fraud contractor. I'd dealt with these folks before – they service a ton of little credit unions, and generally the call quality isn't great and the staff will often make mistakes like mispronouncing my credit union's name.

That's what happened here – the guy was on a terrible VOIP line and I had to ask him to readjust his mic before I could even understand him. He mispronounced my bank's name and then asked if I'd attempted to spend $1,000 at an Apple Store in NYC that day. No, I said, and groaned inwardly. What a pain in the ass. Obviously, I'd had my ATM card skimmed – either at the Chase ATM (maybe that was why the transaction failed), or at the other credit union's ATM (it had been a very cheap looking system).

I told the guy to block my card and we started going through the tedious business of running through recent transactions, verifying my identity, and so on. It dragged on and on. These were my last hours in New Orleans, and I'd left my family at home and gone out to see some of the pre-Mardi Gras krewe celebrations and get a muffalata, and I could tell that I was going to run out of time before I finished talking to this guy.

"Look," I said, "you've got all my details, you've frozen the card. I gotta go home and meet my family and head to the airport. I'll call you back on the after-hours number once I'm through security, all right?"

He was frustrated, but that was his problem. I hung up, got my sandwich, went to the airport, and we checked in. It was total chaos: an Alaska Air 737 Max had just lost its door-plug in mid-air and every Max in every airline's fleet had been grounded, so the check in was crammed with people trying to rebook. We got through to the gate and I sat down to call the CU's after-hours line. The person on the other end told me that she could only handle lost and stolen cards, not fraud, and given that I'd already frozen the card, I should just drop by the branch on Monday to get a new card.

We flew home, and later the next day, I logged into my account and made a list of all the fraudulent transactions and printed them out, and on Monday morning, I drove to the bank to deal with all the paperwork. The folks at the CU were even more pissed than I was. The fraud that run up to more than $8,000, and if Visa refused to take it out of the merchants where the card had been used, my little credit union would have to eat the loss.

I agreed and commiserated. I also pointed out that their outsource, after-hours fraud center bore some blame here: I'd canceled the card on Saturday but most of the fraud had taken place on Sunday. Something had gone wrong.

One cool thing about banking at a tiny credit-union is that you end up talking to people who have actual authority, responsibility and agency. It turned out the the woman who was processing my fraud paperwork was a VP, and she decided to look into it. A few minutes later she came back and told me that the fraud center had no record of having called me on Saturday.

"That was the fraudster," she said.

Oh, shit. I frantically rewound my conversation, trying to figure out if this could possibly be true. I hadn't given him anything apart from some very anodyne info, like what city I live in (which is in my Wikipedia entry), my date of birth (ditto), and the last four digits of my card.

Wait a sec.

He hadn't asked for the last four digits. He'd asked for the last seven digits. At the time, I'd found that very frustrating, but now – "The first nine digits are the same for every card you issue, right?" I asked the VP.

I'd given him my entire card number.

Goddammit.

The thing is, I know a lot about fraud. I'm writing an entire series of novels about this kind of scam:

https://us.macmillan.com/books/9781250865878/thebezzle

And most summers, I go to Defcon, and I always go to the "social engineering" competitions where an audience listens as a hacker in a soundproof booth cold-calls merchants (with the owner's permission) and tries to con whoever answers the phone into giving up important information.

But I'd been conned.

Now look, I knew I could be conned. I'd been conned before, 13 years ago, by a Twitter worm that successfully phished out of my password via DM:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

That scam had required a miracle of timing. It started the day before, when I'd reset my phone to factory defaults and reinstalled all my apps. That same day, I'd published two big online features that a lot of people were talking about. The next morning, we were late getting out of the house, so by the time my wife and I dropped the kid at daycare and went to the coffee shop, it had a long line. Rather than wait in line with me, my wife sat down to read a newspaper, and so I pulled out my phone and found a Twitter DM from a friend asking "is this you?" with a URL.

Assuming this was something to do with those articles I'd published the day before, I clicked the link and got prompted for my Twitter login again. This had been happening all day because I'd done that mobile reinstall the day before and all my stored passwords had been wiped. I entered it but the page timed out. By that time, the coffees were ready. We sat and chatted for a bit, then went our own ways.

I was on my way to the office when I checked my phone again. I had a whole string of DMs from other friends. Each one read "is this you?" and had a URL.

Oh, shit, I'd been phished.

If I hadn't reinstalled my mobile OS the day before. If I hadn't published a pair of big articles the day before. If we hadn't been late getting out the door. If we had been a little more late getting out the door (so that I'd have seen the multiple DMs, which would have tipped me off).

There's a name for this in security circles: "Swiss-cheese security." Imagine multiple slices of Swiss cheese all stacked up, the holes in one slice blocked by the slice below it. All the slices move around and every now and again, a hole opens up that goes all the way through the stack. Zap!

The fraudster who tricked me out of my credit card number had Swiss cheese security on his side. Yes, he spoofed my bank's caller ID, but that wouldn't have been enough to fool me if I hadn't been on vacation, having just used a pair of dodgy ATMs, in a hurry and distracted. If the 737 Max disaster hadn't happened that day and I'd had more time at the gate, I'd have called my bank back. If my bank didn't use a slightly crappy outsource/out-of-hours fraud center that I'd already had sub-par experiences with. If, if, if.

The next Friday night, at 5:30PM, the fraudster called me back, pretending to be the bank's after-hours center. He told me my card had been compromised again. But: I hadn't removed my card from my wallet since I'd had it replaced. Also, it was half an hour after the bank closed for the long weekend, a very fraud-friendly time. And when I told him I'd call him back and asked for the after-hours fraud number, he got very threatening and warned me that because I'd now been notified about the fraud that any losses the bank suffered after I hung up the phone without completing the fraud protocol would be billed to me. I hung up on him. He called me back immediately. I hung up on him again and put my phone into do-not-disturb.

The following Tuesday, I called my bank and spoke to their head of risk-management. I went through everything I'd figured out about the fraudsters, and she told me that credit unions across America were being hit by this scam, by fraudsters who somehow knew CU customers' phone numbers and names, and which CU they banked at. This was key: my phone number is a reasonably well-kept secret. You can get it by spending money with Equifax or another nonconsensual doxing giant, but you can't just google it or get it at any of the free services. The fact that the fraudsters knew where I banked, knew my name, and had my phone number had really caused me to let down my guard.

The risk management person and I talked about how the credit union could mitigate this attack: for example, by better-training the after-hours card-loss staff to be on the alert for calls from people who had been contacted about supposed card fraud. We also went through the confusing phone-menu that had funneled me to the wrong department when I called in, and worked through alternate wording for the menu system that would be clearer (this is the best part about banking with a small CU – you can talk directly to the responsible person and have a productive discussion!). I even convinced her to buy a ticket to next summer's Defcon to attend the social engineering competitions.

There's a leak somewhere in the CU systems' supply chain. Maybe it's Zelle, or the small number of corresponding banks that CUs rely on for SWIFT transaction forwarding. Maybe it's even those after-hours fraud/card-loss centers. But all across the USA, CU customers are getting calls with spoofed caller IDs from fraudsters who know their registered phone numbers and where they bank.

I've been mulling this over for most of a month now, and one thing has really been eating at me: the way that AI is going to make this kind of problem much worse.

Not because AI is going to commit fraud, though.

One of the truest things I know about AI is: "we're nowhere near a place where bots can steal your job, we're certainly at the point where your boss can be suckered into firing you and replacing you with a bot that fails at doing your job":

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

I trusted this fraudster specifically because I knew that the outsource, out-of-hours contractors my bank uses have crummy headsets, don't know how to pronounce my bank's name, and have long-ass, tedious, and pointless standardized questionnaires they run through when taking fraud reports. All of this created cover for the fraudster, whose plausibility was enhanced by the rough edges in his pitch - they didn't raise red flags.

As this kind of fraud reporting and fraud contacting is increasingly outsourced to AI, bank customers will be conditioned to dealing with semi-automated systems that make stupid mistakes, force you to repeat yourself, ask you questions they should already know the answers to, and so on. In other words, AI will groom bank customers to be phishing victims.

This is a mistake the finance sector keeps making. 15 years ago, Ben Laurie excoriated the UK banks for their "Verified By Visa" system, which validated credit card transactions by taking users to a third party site and requiring them to re-enter parts of their password there:

https://web.archive.org/web/20090331094020/http://www.links.org/?p=591

This is exactly how a phishing attack works. As Laurie pointed out, this was the banks training their customers to be phished.

I came close to getting phished again today, as it happens. I got back from Berlin on Friday and my suitcase was damaged in transit. I've been dealing with the airline, which means I've really been dealing with their third-party, outsource luggage-damage service. They have a terrible website, their emails are incoherent, and they officiously demand the same information over and over again.

This morning, I got a scam email asking me for more information to complete my damaged luggage claim. It was a terrible email, from a noreply@ email address, and it was vague, officious, and dishearteningly bureaucratic. For just a moment, my finger hovered over the phishing link, and then I looked a little closer.

On any other day, it wouldn't have had a chance. Today – right after I had my luggage wrecked, while I'm still jetlagged, and after days of dealing with my airline's terrible outsource partner – it almost worked.

So much fraud is a Swiss-cheese attack, and while companies can't close all the holes, they can stop creating new ones.

Meanwhile, I'll continue to post about it whenever I get scammed. I find the inner workings of scams to be fascinating, and it's also important to remind people that everyone is vulnerable sometimes, and scammers are willing to try endless variations until an attack lands at just the right place, at just the right time, in just the right way. If you think you can't get scammed, that makes you especially vulnerable:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

10K notes

·

View notes

Text

Transforming High-Integrity Transactions: The Power of Data Analytics and Opon Innovations

In an era where the integrity of transactions can make or break businesses, high-integrity risk merchants are turning to technology to navigate the complex landscape of financial interactions. At the forefront of this transformative journey is Opon Innovations, a trailblazing company leveraging data analytics to mitigate transaction risks effectively.

Understanding the High Stakes of High-Integrity Transactions

High-integrity risk merchants operate in sectors where financial transaction integrity is paramount. These industries include real estate, finance, and healthcare, where any compromise in transaction security can have severe consequences. To thrive in such environments, merchants must implement rigorous measures to safeguard every financial interaction.

The Crucial Role of Data Analytics

Data analytics has emerged as the linchpin in ensuring transaction integrity for high-integrity risk merchants. This technology-driven approach involves collecting and analyzing vast amounts of transaction data to identify patterns, anomalies, and potential risks. By harnessing the power of data, these merchants gain invaluable insights into their operations, allowing them to make informed decisions that enhance transaction security.

Opon Innovations: Pioneering Transaction Security Through Data Analytics

Opon Innovations has become synonymous with innovation in transaction security. By harnessing data analytics, Opon Innovations empowers high-integrity risk merchants to navigate the intricate landscape of transactions with confidence.

Streamlined Transactions Through Insights

One of Opon Innovations' core strengths is its ability to streamline complex financial transactions. Through data analytics, they gain insights into transaction processes, identifying bottlenecks and vulnerabilities. This data-driven approach allows them to optimize transaction flows, ensuring each step is transparent, secure, and efficient.

Proactive Risk Management

Data analytics enables Opon Innovations to implement proactive risk management strategies. By identifying potential risks early, they can take swift action to mitigate them, safeguarding the integrity of transactions. This approach aligns perfectly with the goals of high-integrity risk merchants who strive for airtight security in their financial interactions.

Continuous Evolution Through Data

In a rapidly changing financial landscape, data analytics allows Opon Innovations to adapt to new challenges effectively. By continuously collecting and analyzing data, they stay ahead of emerging risks, ensuring that their solutions remain at the cutting edge of transaction security.

Conclusion: A New Horizon for High-Integrity Risk Merchants

In the realm of high-integrity transactions, data analytics is the compass guiding merchants to new horizons. Opon Innovations has harnessed the potential of this technology to transform transaction security, empowering high-integrity risk merchants to navigate the financial landscape with confidence.

As businesses in sensitive sectors seek new ways to enhance transaction integrity, Opon Innovations stands as a beacon of innovation, bridging the gap between data analytics and high-stakes transactions. With Opon Innovations by their side, high-integrity risk merchants can look to the future with optimism, knowing that the power of data analytics is firmly in their corner.

To explore how Opon Innovations can elevate transaction integrity in your industry, visit oponinnovations.com. Join us in shaping a more secure and efficient future for high-integrity risk transactions.

The High Stakes of High-Integrity Transactions Merchants in high-integrity risk sectors operate in environments where transaction security is critical.

The Crucial Role of Data Analytics

Data analytics has emerged as a vital tool in ensuring the security of financial transactions.

Opon Innovations: Pioneering Transaction Security Through Data Analytics

Opon Innovations is at the forefront of leveraging data analytics to enhance transaction integrity.

Conclusion: A New Horizon for High-Integrity Risk Merchants

Data analytics, in partnership with Opon Innovations, is paving the way for a more secure future for high-integrity risk transactions.

#business#staffing#finance#management#payment solutions#fintech#business strategy#technology#business consulting#high risk merchant account#high risk merchant highriskpay.com#transactions#payment services#payment processing#payment gateway#payment systems#payment security#customer satisfaction#customer experience#customer engagement#customer segmentation

0 notes

Text

How to Create UPI ID: A Step-by-Step Guide

How to Create UPI ID: A Step-by-Step Guide

Do you want to know how to create UPI ID? Get all your queries solutions.

UPI or Unified Payment Interface is a payment system that allows users to transfer money from one bank account to another instantly. It is a popular payment method in India, and more and more people are using it to make digital payments. To use UPI, you need to create a UPI ID, which is a virtual payment address. In this…

View On WordPress

#Bank transfer through UPI#Cashless transactions in India#Digital payments in India#Easy UPI ID creation#How to set up UPI#Indian payment systems#Online money transfer in India#Secure UPI transactions#UPI for beginners#UPI ID creation#UPI mobile payments#upi payment app#UPI payment security tips#upi payment system#UPI registration process

1 note

·

View note

Text

Dragon Age: Veilguard | The Ultimate Preview Summary

shinobi602 on twitter shared this amazing in-depth summary of all new information about the game that we have so far:

Coming to PS5, Xbox Series X and PC in Fall 2024

Consoles: Quality and Performance modes (60FPS)

Photo mode is confirmed

Fully offline single player, no EA account linking, no micro-transactions'

Play as a human, elf, dwarf, or Qunari

Choose your backstory, 6 factions to choose from when you create your character, all with "deep roots in Thedas": Antivan Crows, Grey Wardens, Shadow Dragons, Veil Jumpers, Lords of Fortune, The Mourne Watch

Each faction offers 3 distinct buffs each, like being able to hold an extra potion or do extra damage against certain enemies, and the odd reference in dialogue

You can customize your Inquisitor from Dragon Age: Inquisition in the character creator and "make a few key decisions that will impact how The Veilguard begins"

There are some "killer cameos" from past games that show up

Warrior Class: Use a sword and shield or two handed weapon to send enemies flying

Rogue Class: Utilizes quick movement and reflexes. You can wield a bow or dual swords with "powerful, precise strikes for lethal damage"

Mage Class: Use magic to incinerate, freeze, electrocute and crush. Some cast from afar, while others prefer close quarters combat

Each class also has 3 sub-specializations, such as duelist, saboteur, or veil ranger for the Rogue

Classes also have unique 'resource system's, for example, the Rogue has "momentum", which builds up as you land consecutive hits, and each will always have a ranged option

One Rogue momentum attack is a "hip fire" option we saw for the Rogue's bow, letting you pop off arrows from the waist

Another momentum attack for the Warrior lets you lob your shield at enemies

Quests are more handcrafted and mission based, curated with alternate paths, secrets to discover and optional content

There are also open ended explorable areas

Party size of 3 during combat, ala Mass Effect

Combat is focused on real-time action, dodge, parry, counter, "sophisticated animation canceling and branching", using risk-reward charge attacks designed to break enemy armor layers

Enemies have elemental weaknesses and resistances, and you can chain together elemental combos for extra damage

One example is a squadmate using a gravity well attack to suck enemies in, another slowing them down, and the player then unleashing a big AOE attack

You don't take direct control of companions like past Dragon Age games, but you can still pause and issues ability commands for you and your allies

There is a hub area for the player like Skyhold and the Normandy, called The Lighthouse

Companions can eventually start romancing other characters if you opt not to romance them

Each companion also has unique missions tied to them that play into the larger story

Nudity confirmed - romance scenes can get "a little spicy"

"Incredibly deep" character creator: 5 categories including: Lineage, Appearance, Class, Faction, Playstyle

Players can also choose different body sizes and shapes

Dozens of hairstyles to choose from, with "individual strands of hair rendered separately and reacting quite remarkably to in-game physics", pulled from EA Sports

Character creator lets you adjust the lighting so you can be sure your character looks good

The team wanted to balance the look of the game with both light and darkness. "When everything is dark, nothing really feels dark. For this one, we really wanted to build that contrast again."

Skill tree is "vast", you can also set up specific companions with certain kits, from tackling specific enemy types to being more of a supporting healer or flexible all-rounders

There are tarot cards you go through during the character creation process that will let you choose decisions from past games to implement into Veilguard

The team teases you may lose some characters during the story

#i found this super helpful because there was so much that you kind of lose track and get overwhelmed#dragon age 4#dragon age#dragon age: the veilguard#da:tv#vg: dragon age 4#series: dragon age

2K notes

·

View notes

Text

To reap the fruits of globalization, scale up the business operations and serve the market and society with improved & cost-effective product and services deliveries, it is important to join hands in the form of Mergers and Acquisitions & Joint Ventures for gaining technology support, entering into niche areas, business consolidation, research & development, sharing of expertise, location advantages.

However, successfully handling the deal becomes very important to make it a success. Before entering into a transaction, it is important for the businesses to evaluate several different direct aspects of entering into a transaction like a long-term plan, key purpose to achieve, strengths and weaknesses of the entity, key takeaway from the transaction, key synergies to achieve and indirect accounting, tax, regulatory, legal, management and cultural aspects of the target company carefully and preferably through the help of experts.

R.K Associates is one of the most trusted and leading in providing Transaction Advisory Services & Support in India.

#Transaction Advisory Services#Advisory Services#Transactions#transaction processing system companies

1 note

·

View note

Text

POSaBIT: From Bitcoin Payments to Cannabis Financial Institution

POSaBIT: From Bitcoin Payments to Cannabis Financial Institution

Ryan Hamlin’s cannabis origin story is not an uncommon one. The founder and CEO of cannabis debit payment and point-of-sale (POS) platform POSaBIT (pronounced PAUSE-ah-bit) found himself at a barbecue in Washington state in late 2014, chatting with a friend about the business opportunity that cannabis presented.

Ryan Hamlin, CEO, POSaBIT

A former Microsoft general manager who leveraged his 15…

View On WordPress

#ACH#bitcoin#bitcoin payment#cryptocurrency payment#debit transactions#M&A#payment processing#payment software#payment system#point-of-sale (POS) software#POSaBIT#Ryan Hamlin#seed-to-sale system

0 notes

Text

About What Is Transaction Processing System? Visit HBS Technologies

What is transaction processing system? A batch process system and batch processing, where numerous requests are all processed simultaneously, are frequently contrasted with a transaction process system and transaction processing. While batch processing doesn't require user participation, the first demands user intervention. The outcomes of each transaction are not immediately visible in batch processing. Visit HBS Technologies for more information.

0 notes

Text

Examples of transaction processing system

#EXAMPLES OF TRANSACTION PROCESSING SYSTEM SOFTWARE#

TPS is also known as transaction processing or real-time processing. TPS features include performance, reliability, and consistency. What comes under transaction processing system?Ī transaction process system (TPS) is an information processing system for business transactions that involves the collection, modification and retrieval of all transaction data. INFLEXIBILITY- TPS wants all transactions to be processed in the same way regardless of user or time.RELEVANCE – Organizations rely heavily on their TPS with failure potentially hampering business.RAPID RESPONSE- Fast performance with fast response is critical.What are the characteristics of transaction processing system?įeatures of Transaction Processing Systems Transaction processing systems also try to provide predictable response times to applications, although this is not as critical as for real-time systems. Transaction Processing System (TPS) is a type of information system that collects, stores, modifies and retrieves enterprise data transactions. How business intelligence can help to gain profit in an organization?Eliminate inefficiencies… What are transaction processing systems used for? “Annual internal data warehouse costs can be around $ 468K.” Is datawarehouse expensive?Īdding Your Costs Assuming you want to build a data warehouse that uses, on average, one terabyte of storage and 100,000 queries per month, your total annual cost for storage, software, and staff will be approximately $ 468,000.

#EXAMPLES OF TRANSACTION PROCESSING SYSTEM SOFTWARE#

KEY DIFFERENCE between OLTP and OLAP: Online Analytical Processing (OLAP) is a category of software tools that analyzes data stored in a database while online transaction processing (OLTP) supports applications that n focus on transactions in 3-tier architecture. What is difference between OLAP and OLTP? The organization, storage, cleaning and extraction of data must be carried by a central repository, a data warehouse, which is considered the basic component of business information. Is data warehousing part of business intelligence? … The tools and technologies that make BI possible take data â € “stored in files, databases, data warehouses, or even on huge data lakesâ € and run queries against that data, typically in the form of SQL. How data mining is used in business intelligence?Simply put, data mining is… What is business intelligence in data warehouse?īusiness intelligence (BI) is a process for analyzing data and gaining insights to help businesses make decisions. What are the five basic tasks of business intelligence?Ĭommon functions of business information technologies include reporting, online analytics processing, analytics, dashboard development, data mining, process mining, complex event processing, business performance management, benchmarking, text mining, predictive analytics, and prescriptive analytics. These tools make it possible to extract the insights from your data. … Examples of BI tools include data warehouses, dashboards, reports, data discovery tools, and cloud data services. What is Business Intelligence with example?īusiness intelligence literally means being smarter about your business. Make decisions that can be implemented with the aim of achieving a strategic goal. Turn it into meaningful information through analysis. The general process of business intelligence is as follows: Collect data and organize it through reporting. What are the key benefits of artificial intelligence?These are the primary benefits… What are business intelligence processes? Examples of transactions are as follows: Paying a supplier for services rendered or goods delivered. What is transaction and examples?Ī transaction is a business event that has a financial impact on an entity’s financial statements, and is recorded as an entry in its accounting records. Order processing systems are essential for many organizations. See the article : What business intelligence means. Types of Processing Systems There are a few main types of transaction processing systems, including order processing, accounting and purchasing. … What are the two types of transaction processing system? It manages the prioritization of transaction execution. Read also : How do retail stores use business intelligence. When processing transactions, work is divided into single, indivisible operations, known as transactions. Transaction processing is a computing style, typically performed by large server computers, which supports interactive applications. Examples include systems that control sales order entry, airline orders, payroll, employee records, manufacturing and shipping. This may interest you : Is indeed good for finding jobs?. Transaction processing systems include computer hardware and software that maintains a transaction-oriented application and performs the usual transactions necessary to conduct business. Business intelligence Is an example of transaction processing system?

0 notes

Text

Transaction processing system companies

Processing Services means those services, which are necessary to issue a Card and process a transaction in accordance with Government Requirements and the Rules of any System and Regulatory Authority. Related to Transaction Processing Services In this situation, it is possible that a fiduciary relationship existed between Preston and Plaintiff. The EBT Central Computer Transaction Processing Services (as defined in Schedule E, Exhibit 1, section 3.6) will be “up” 99.9% of the time measured on a monthly basis. The EBT Central Computer consists of all system functions pertaining to the EBT transaction authorization platform over which the Contractor has direct control, either directly or through a subcontractor relationship.Failure of EBT Central Computer Transaction Processing Services to be “up” 99.9% of the time measured on a monthly basis. Confidentiality Obligations of Recipient. Switched Transactions require Global Direct’s prior written approval and are subject to applicable pricing Global Direct does not purchase the indebtedness associated with Switched Transactions.EBT Transaction Processing Services: Global Direct offers electronic interfaces to Electronic Benefits Transfer ("EBT") networks for the processing of cash payments or credits to or for the benefit of benefit recipients ("Recipients").ĭisclosing party is disclosing the Confidential Information to Recipient in order for Recipient to evaluate the possibility of using disclosing party‟s services like Call Centers/Contact CentersProjects,BusinessProcessOutsourcingcoveringalldifferent kindofVerticals,InformationTechnology Services, Backand Transaction Processing Services, Business Analysis, Business Process Re-engineering, Data Analysis, Quality Analysisandthe Statutory & Datacom services etc.2. EBT Transaction Processing Services: Global Direct offers electronic interfaces to Electronic Benefits Transfer ("EBT") networks for the processing of cash payments or credits to or for the benefit of benefit recipients ("Recipients"). Switched Transactions require Global Direct's prior written approval and are subject to applicable pricing Global Direct does not purchase the indebtedness associated with Switched Transactions.2.2. P-Card Invoice Review - The Service Provider will receive a notification and data file from US Bank once monthly containing transaction details and Company information for Service Receiver’s P-Card holders.Minimum Service BAU Transaction Period Service # Service Name Description of Service Volume (in mo.) Service Charge Provide P-Card Transaction Processing Services: Application development functions – Customization support to design and manage the user interface.Įxamples of Transaction Processing SystemsĪTM (Automatic Teller Machine) is a good example of it as it processes each transaction based on customer and amount required.Examples of Transaction Processing Services in a sentenceĭisclosing party is disclosing the Confidential Information to Recipient in order for Recipient to evaluate the possibility of using disclosing party’s services like Call Centers/Contact Centers Projects, Business Process Outsourcing covering all different kind of Verticals, Information Technology Services, Back and Transaction Processing Services, Business Analysis, Business Process Re-engineering, Data Analysis, Quality Analysis and the Statutory & Datacom services etc.ĮBT Transaction Processing Services: Global Direct offers electronic interfaces to Electronic Benefits Transfer ("EBT") networks for the processing of cash payments or credits to or for the benefit of benefit recipients ("Recipients").ĮBT Transaction Processing Services: Global Direct offers electronic interfaces to Electronic Benefits Transfer (“EBT”) networks for the processing of cash payments or credits to or for the benefit of benefit recipients (“Recipients”). System administration functions - Administrative support required for managing transactionsģ. System runtime functions - An execution environment with high response time, reliability of execution and security of dataĢ. Transaction processing systems are helpful in three areas:ġ. This gives it the following characteristics: It allows only certain predefined, typically short duration, tasks and transactions to be performed by the user and provides a predictable request execution time, which is pre- programmed. In transaction processing, user or customer interaction is required, unlike batch processing. Importance of Transaction Processing System Examples of Transaction Processing Systems.Importance of Transaction Processing System.

0 notes