#accounting software cloud

Explore tagged Tumblr posts

Text

Accounting Software | Infotech Singapore

From invoicing to tax preparation, our accounting software has you covered. Run your business with confidence and clarity.

0 notes

Text

What is ERP and Why Your Small Business Needs It?

Running a small business is a challenging but rewarding endeavor. You wear many hats, juggle countless tasks, and constantly strive for growth. But as your business expands, managing everything with spreadsheets and disconnected software can become a major bottleneck. That's where Enterprise Resource Planning (ERP) systems come in.

What Exactly is an ERP?

Think of an ERP system as the central nervous system of your business. It's a type of software that integrates all your core business processes into a single, unified platform. This means your sales, inventory, accounting, human resources, and other departments can all access and share the same data in real-time.... Read More

#coquicloud#business#businesstips#entrepreneurs#odoo#technologies#techtips#software#saas#small business#business management#business consulting#efficiency#innovation#digitaltransformation#technologynews#productivitytips#cloud solutions#Coqui Cloud#Latino Businesses#Odoo Implementation#technews#Odoo Support#business automation#CRM#Accounting#Inventory Management

4 notes

·

View notes

Text

Tired of paper piles? 🚫 Go paperless with Magtec ERP Software! 💻 Streamline your workflow and boost efficiency. It's time to embrace the digital future.

#erp#business#software#management#automation#enterprise#resources#planning#solution#system#cloud#industry#finance#accounting#supplychain#inventory#crm#hr#manufacturing#distribution#retail#healthcare#education#hospitality#smallbusiness#mediumenterprise#largeenterprise#magtecerp#magtec#magtecsolutions

3 notes

·

View notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Expanding your business to multiple locations can be a great way to increase sales, reach new customers, and grow your brand. However, it can also be a challenge to manage multiple locations effectively. Suvit is an all-in-one accounting automation platform that strives to make finance cool again! Suvit is more than just a platform; it's a financial game-changer.

#tally solutions#automation for accountants#accounting automation software#automated bank statement processing#1950s#e invoice in tally#tally on cloud#tally automation

2 notes

·

View notes

Text

youtube

Welcome to an enlightening keynote presentation on the game-changing synergy between Artificial Intelligence (AI) and Enterprise Resource Planning (ERP), delivered by a seasoned Project Manager with a wealth of industry experience.

Read More: What Are The Benefits Of ERP System?

#erpsolution#AIinerp#braincavesoft#erp#software#business#erpsoftware#technology#crm#sap#erpsystem#erpsolutions#ecommerce#accounting#ocd#cloud#clouderp#saphana#sapbusinessone#dynamics#finance#tecnologia#education#management#marketing#Youtube

2 notes

·

View notes

Text

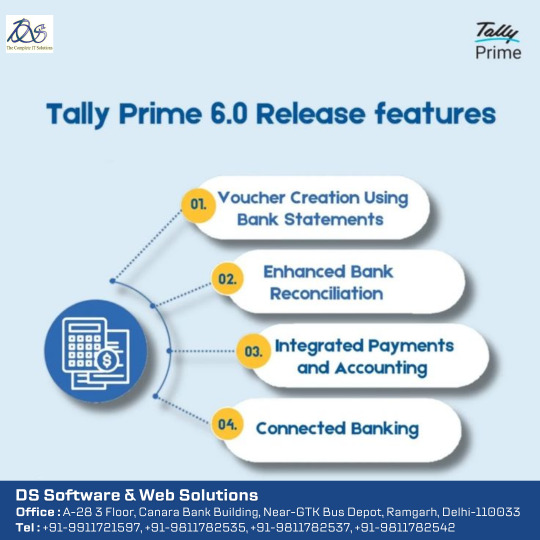

TALLY PRIME 6.0 RELEASE FEATURES

Here’s a comprehensive overview of the new capabilities in TallyPrime 6.0, officially released on 9 April 2025

1. Connected Banking & Automation:-

Real‑time bank integration: Connect securely to your bank using Tally.NET credentials to view live balances and statements inside Tally.

Auto‑voucher creation: Import bank statements to automatically generate payment/receipt vouchers with full details (narration, instrument no/date), in bulk or merged.

Smart reconciliation & e‑payments: One-click matching with rule-based and bulk options; create and track NEFT/IMPS payment files via e-Payment module supporting 18+ Indian banks.

2. Enhanced Banking Reports & Dashboards:-

New Banking Activities dashboard tile: shows pending reconciliations, balances, e‑payment statuses with drill-down reports.

Improved reporting in vouchers/day‑books, capturing bank account, instrument and reconciliation status; detailed Edit Log now tracks changes to UPI, bank date/instrument.

3. Streamlined Data Split & Verification:-

Simplified Data Split: new interface with enhanced options—single or dual company splits, progress bar, and robust pre‑split verification.

Resolves memory glitches and errors during large data operations .

4. Profile Management & Notifications:-

In‑app Profile section: modify contact info tied to serial number directly in Tally.

Semi‑annual reminders ensure your contact details stay current.

5. GST, TDS, VAT & Tax Enhancements:-

GSTR‑1 improvements: smarter filing with Excel Utility v5.4 for GSTR‑3B and breakup of B2B/B2C HSN summaries (Phase III from 1 April 2025).

Enhanced TDS/VAT reporting: precise calculations and correct state-wise reporting.

GCC compliance: bilingual (English/Arabic) invoicing, Arabic numerals, VAT formats for Kuwait/Qatar.

6. Income‑Tax & Regulatory Updates:-

Updated support for Income-Tax slabs under the 2025–26 Finance Bill, including rebate (87A), marginal relief, revised Form 16/24Q annexures.

7. Developer (TDL) Enhancements:-

New attributes & functionality: Skip-Forward, Disable Period on Tile, Multi‑Objects, IsPatternMatch, and Recon Status collection filter.

Internal optimization: Opening BRS details moved out of bank master to improve performance.

#tallyprime#tally on cloud#accountingsoftware#tallysoftware#cloud accounting software#cloudcomputing

0 notes

Text

Streamline your finances with custom accounting software by InStep Technologies. We build scalable, secure, and easy-to-use solutions tailored to your business needs—trusted by SMEs, startups, and enterprises. Automate, analyze, and grow smarter with our expert development team.

#accounting software development#custom accounting software#finance software development#cloud accounting software#small business accounting software#accounting app development#enterprise accounting solutions#billing and invoicing software#bookkeeping software solutions#financial reporting software#AI accounting software#software for accountants#tax management software#online accounting system#InStep accounting solutions

0 notes

Text

India Accounting Software Market Size, Share 2025-2033

India’s accounting software market reached a value of USD 639.99 Million in 2024 and is projected to grow to USD 1,416.62 Million by 2033, reflecting a CAGR of 9.20% during 2025–2033. The market is expanding rapidly due to the increasing use of automation, artificial intelligence (AI), and cloud-based platforms in financial operations.

#india accounting software market#accounting automation india#cloud accounting software india#ai in accounting india#msme accounting tools india

0 notes

Text

Why Small and Medium Businesses Need HR Software in Dubai

Running a small or medium-sized business (SMB) in a competitive market like Dubai comes with its own set of challenges—especially when it comes to managing employees, payroll, and compliance. That’s where HR software in Dubai becomes not just helpful, but essential. Investing in the right technology can streamline your operations, reduce manual tasks, and empower your team to focus on growth.

Efficiency and Accuracy in Daily HR Tasks

Traditional HR processes involve a lot of paperwork, manual data entry, and back-and-forth communication. This not only increases the chances of errors but also consumes valuable time. HR software in Dubai allows businesses to automate repetitive tasks like attendance tracking, leave management, and payroll calculations. This means fewer errors, more accurate data, and better use of your HR team's time.

Better Compliance and Record-Keeping

UAE labor laws require companies to maintain detailed employee records, follow proper procedures for leave and benefits, and ensure fair treatment across the board. Cloud based HRMS Dubai solutions help businesses stay compliant by maintaining accurate, centralized records that can be accessed securely from anywhere. Built-in alerts and audit trails also ensure that you never miss important deadlines or policy changes.

Scalable Solutions for Growing Teams

One of the key advantages of cloud-based HR solutions is scalability. As your team grows, your HR software should grow with it. Whether you're hiring your first employee or expanding to multiple branches, a cloud based HRMS Dubai platform can adapt to your needs without requiring costly upgrades or IT infrastructure changes.

Integration with Other Business Tools

Small and medium businesses often look for all-in-one solutions to keep costs low and processes streamlined. Leading HR software platforms now integrate with other essential tools, including accounting software for all business types. This integration allows seamless data sharing between HR and finance teams, ensuring consistency in payroll, tax reporting, and financial planning.

Promote Productivity and Employee Satisfaction

Happy employees are productive employees. With features like self-service portals, automated leave requests, and transparent payroll processing, HR software helps improve the employee experience. When your team feels valued and supported, they’re more likely to stay engaged and committed to your business goals.

Get Started with OnTech Digital

If you're a small or medium-sized business looking to simplify HR operations, OnTech Digital offers the perfect solution. Our cloud based HRMS in Dubai is designed to support growing teams with user-friendly, secure, and scalable tools. We also provide accounting software for all business needs, making OnTech a one-stop digital partner.

0 notes

Text

Simple Online Invoicing

Aninvoice is an online invoicing platform designed to simplify billing processes for small businesses and freelancers. It offers features such as customizable invoice templates, automated billing, and secure payment processing to streamline financial transactions and enhance cash flow management. For more information Visit Us: https://aninvoice.com/

0 notes

Text

Maximize Team Efficiency with Cloud Construction Accounting Software - Ankpal

Cloud Construction Accounting Software transforms project management by providing real-time access to critical financial data. Teams can reduce errors, streamline budgeting, and gain valuable insights by tracking expenses and managing invoices effortlessly. This software ensures compliance with regulations, enhances transparency, and improves decision-making for better project outcomes.

#Cloud Construction Accounting Software#automated financial tracking#best software for construction accounting

0 notes

Text

MargBooks is India's premier provider of Online Accounting Software, offering a hassle-free solution for businesses to effortlessly manage their operations from any location. With the #1 Online Accounting Software, businesses can efficiently handle GST invoices, retail invoices, inventory, re-orders, banking, and more. This user-friendly platform empowers businesses with seamless control and accessibility, making accounting tasks simple and convenient. Marg Books ensures that businesses can run smoothly by providing a comprehensive suite of tools to streamline their financial processes. Experience the ease of managing your business with Marg Books, where efficiency meets simplicity.

#accounting#online accounting#software#saas#online billing software#cloud based billing#cloud based accounting

3 notes

·

View notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

"Switch to Tally on Cloud – Because Business Shouldn’t Be Bound by Location!

Who Should Use Tally on Cloud?

SMEs looking to scale operations

Accounting firms managing multiple clients

Business owners traveling or working remotely

Enterprises with distributed teams

Startups needing affordable tech solutions

We Provide Best Tally Prime Software Services and give many facility and features to tally prime software . Tally on Cloud it’s a solution for easy, economical, efficient and with securely to use Tally from anywhere, anytime and from any devices with the help on just an internet connection.

Tally Prime is a rearranged arrangement that runs the unpredictable parts of your business, for example, bookkeeping, tally software team chat messaging apps accounting marg accounting software consistence and procedures out of sight. Count is anything but difficult to learn and can with least assets.

1 note

·

View note