#chart pattern analysis

Explore tagged Tumblr posts

Text

laguestbook.com/finance/what-is-the-currency-trading-and-how-to-start-with-proper-knowledge/

What is the Currency Trading and How to Start with Proper Knowledge:- Trading in forex and related derivatives takes place over the counter as well as on exchanges. From all over the globe, the Foreign exchange market is the largest financial market, larger than the equity or debt market. Read more: https://laguestbook.com/finance/what-is-the-currency-trading-and-how-to-start-with-proper-knowledge/

0 notes

Text

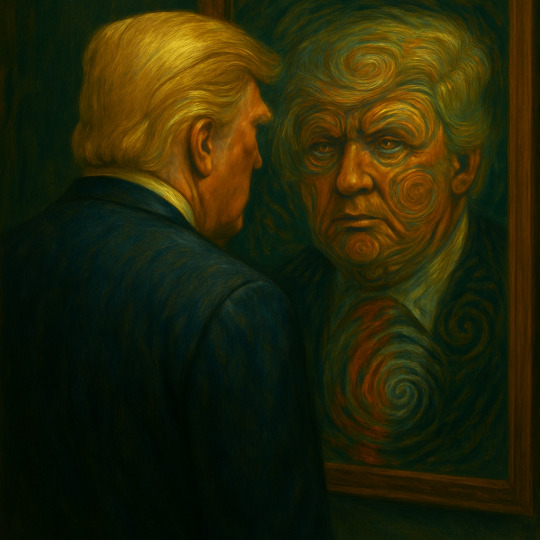

A Spiral Reading of Donald Trump’s birthday:

(June 14, 1946)

20.4.2.228.12.1

Sagittarius Sun, Capricorn Spiral, Leo Moon, Pisces Age.

A chart built for projection.

The Sun speaks loudly, the Moon seeks attention, and the Spiral climbs toward legacy.

Capricorn Spiral drives the structure. Sagittarius provides the story.

Leo Moon fuels the need to be seen, known, and remembered.

Born into the haze of the Pisces Age—where illusion is influence, and belief shapes reality.

He became a mirror. And the world stared back. And what a spectacle it was.

Protected under CC BY-NC-ND 4.0. Sharing welcome. Alteration or resale not permitted.

#spiral reading#spiral time#birth chart#zodiac#Astro analysis#symbolism#cultural commentary#timeline weird#reflection#collapse as pattern#character study#archetypes#spiral lore#coded posting#donald trump#trump#fuck trump#trump 2024

7 notes

·

View notes

Text

Best Online Trading Platform - Flows Trading

Flows Trading is an best online trading platform designed to enhance traders' decision-making and performance. It offers over 100 technical indicators and drawing tools, customizable charting layouts, and real-time market data, allowing for precise technical analysis.

The platform includes a comprehensive trading journal that automatically logs trades and performance metrics, helping users identify strengths and weaknesses.

Additionally, Flows Trading supports programmable custom indicators through a simple scripting language, enabling traders to create and backtest their own indicators.

#best online trading platform#online trading#flows trading#share market#share market analysis#chart patterns

2 notes

·

View notes

Text

Importance of chart analysis for equity investments

Image by freepik Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial: Benefits of Chart Analysis in the Indian Stock Market 1.Trend Identification The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

Technical Analysis in a Nutshell

Technical analysis is a method used to evaluate and forecast the price movements of financial instruments, such as stocks, commodities, and currencies, by analyzing historical price data and trading volumes. Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis relies on patterns, trends, and statistical indicators to make trading decisions. This article…

#Bollinger Bands#Chart Patterns#Divergence#Entry and Exit Points#Exponential Moving Average#Financial Markets#Fundamental Analysis#MACD#Market Movements#Moving Average#Moving Average Convergence Divergence#Oversold Conditions#Position Sizing#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Security#Stop-Loss#Support And Resistance#Technical Analysis#Trading Decisions#Trading Strategies#Trading Volume#Trend Lines#Volatility

2 notes

·

View notes

Text

Technical Analysis & Trend Patterns: Learn Share Market Trading the Right Way

At Chart Monks, we believe that trading is a skill — not a gamble. If you’re tired of confusion, indicator overload, or following calls blindly, it’s time to change the way you trade. With our practical approach to technical analysis and real-time understanding of trend continuation patterns, we help you learn online trading the right way — with clarity, confidence, and control.

Whether you're a complete beginner or someone looking to refine your strategies, we offer some of the best trading courses in India tailored to every stage of your journey.

Why Choose Chart Monks to Learn Online Trading?

Unlike traditional platforms that focus heavily on theory or flashy strategies, we simplify the process. At Chart Monks, we teach you to read the price action, understand market psychology, and make independent decisions based on structure and logic — not noise.

Our mission is to provide online trading courses for beginners and intermediate traders that are grounded, actionable, and free from unnecessary complexity.

Trading Classes for Beginners – Build a Strong Foundation

If you're just getting started, you don’t need complicated strategies. You need a strong foundation. That’s why our trading classes for beginners focus on what truly matters:

Understanding how price moves

Identifying market phases

Recognizing demand and supply zones

Reading structure and trend continuation patterns

Managing risk and maintaining discipline

We break down each concept in a simple, visual way that anyone can understand — no financial background needed. You’ll gain the skills to trade independently, without relying on tips or signals.

Share Market Technical Analysis Course – Learn What Really Moves the Market

Our share market technical analysis course is one of the most practical and insightful programs available online in India. We go beyond just candlesticks and indicators. We train you to see the bigger picture — how institutions move the market, how retail traders react, and how you can stay ahead by reading pure price action.

Inside this course, you’ll learn:

How to recognize and trade trend continuation patterns with confidence

How to build high-probability setups using price structure

The psychology behind big moves

How to avoid common traps and false breakouts

Real chart examples from the Indian stock market

This isn’t about memorizing patterns — it’s about understanding why the market moves and where it’s likely to go next.

Avoid Trading Burnout – Train with Clarity and Focus

Many traders face trading burnout not because they lack motivation, but because they’re overwhelmed with too much conflicting information. At Chart Monks, we remove that stress by offering a structured, step-by-step learning journey.

Our approach helps you:

Focus on one system and master it

Avoid information overload from too many sources

Gain mental clarity with simple, repeatable strategies

Build the right mindset to handle wins and losses calmly

At Chart Monks, we believe trading success is 20% strategy and 80% psychology. That’s why we also help you develop the mental discipline to stay consistent.

Online Trading Courses in India – Learn Anytime, Anywhere

We understand that flexibility is important. That’s why we offer all our online courses —so you can learn whenever and wherever it suits you. Whether you're working full-time, in college, or trading part-time, our online trading courses for beginners are designed to fit your schedule.

With our platform, you get:

Lifetime access to course material

Mobile and desktop-friendly video content

Downloadable resources and charts

Live sessions and mentor support

Community access for feedback and progress tracking

No need to travel or attend costly seminars — with Chart Monks, everything is available from the comfort of your home.

What Makes Our Trading Courses Online the Best?

There are many platforms offering trading courses online, but few truly focus on what matters. We stand out by:

Teaching real price action, not just theory

Breaking down live chart examples from the Indian stock market

Focusing on trend continuation patterns and practical setups

Helping you develop a consistent mindset

Offering support through mentorship, not just videos

Keeping things affordable and transparent

We don’t promise overnight success. We promise real skills and lifelong learning.

Free Online Courses for Trading – Start With Zero Risk

Still unsure if our courses are the right fit? Try our free online courses for trading. These mini-courses give you an introduction to how we teach and what we cover. You’ll learn key trading concepts, market structures, and entry-level technical analysis — all at zero cost.

They’re a great way to test the waters and see if our approach aligns with your goals.

Prepared to Begin Your Trading Journey with the Right Approach?

If you’re serious about trading and want to learn in a clear, practical, and mentally sustainable way, Chart Monks is here to guide you. Whether you're looking for trading classes for beginners, a share market technical analysis course, or a full online trading course in India, we’ve got the roadmap you need.Start with our free courses, or dive into our full programs to transform your approach to the market. Call us now at +91-9220943789, Visit: www.chartmonks.com.

#Learn Online Trading#Trading Classes For Beginners#Share Market Technical Analysis Course#Trend Continuation Patterns#Trading Courses Online#Best Trading Courses#Trading Burnout#Free Online courses For Trading#Online Trading Courses For Beginners#Online Trading Course in India#Price Action#Technical Analysis Course#Chart Monks

0 notes

Text

youtube

Looking to spot trend reversals before the rest of the market catches on? This video breaks down powerful reversal signals every smart trader should know to maximize profits and minimize losses. In this detailed guide, we uncover the top reversal patterns, indicators, and techniques used by successful traders across the stock, forex, and crypto markets. Learn how to identify momentum shifts, trap zones, and entry/exit points that could change the game for your trading strategy. Whether you're day trading, swing trading, or investing long-term, understanding reversal signals is key to protecting your capital and boosting returns. Websites: https://tradegenie.com/ https://nosheekhan.com/ Twitter - https://twitter.com/marketswizard Facebook - https://www.facebook.com/financialmar Head Office: Trade Genie Inc. 315 South Coast Hwy 101, Encinitas, CA 92024 Phone Number: 212-408-3000 #ReversalSignals #TradingProfits #TechnicalAnalysis #PriceAction #ChartPatterns #StockMarketTips #ForexTrading #CryptoSignals #SwingTrading #DayTrading #TrendReversal #SmartTrading #UnlockProfits #TradingEducation #MarketMoves

#Reversal-Signals#Trading-Profits#Technical-Analysis#Price-Action#Chart-Patterns#Stock-Market-Tips#Forex-Trading#Crypto-Signals#Swing-Trading#Day-Trading#Trend-Reversal#Smart-Trading#Trading-Education#Youtube

0 notes

Text

Nifty Forecast Tomorrow: Expert Predictions and Market Trends You Should Know

If you're looking for the most accurate Nifty forecast for tomorrow, you're not alone. Every day, thousands of traders and investors closely follow the Nifty 50 index, aiming to anticipate the next market move and get a step ahead of the volatility. In this post, we break down key technical levels, current sentiment, and expert-backed strategies to help you prepare for the trading session ahead.

📊 What Is the Nifty 50 and Why Its Forecast Matters

The Nifty 50 is India’s flagship stock market index, representing 50 of the largest and most liquid companies listed on the National Stock Exchange (NSE). It's a key barometer for market trends and investor confidence.

A well-researched forecast for Nifty 50 movement tomorrow can be highly valuable for:

Intraday traders planning entry and exit points.

Swing traders timing short-term opportunities.

Investors staying aligned with macroeconomic trends.

🔍 Nifty 50 Technical Analysis for Tomorrow

1. Key Support and Resistance Levels

Based on today’s market close and recent trading patterns:

Support zones: 22,300 and 22,180

Resistance zones: 22,500 and 22,640

If the index breaks above 22,500 with momentum, it may push higher. A drop below 22,180 could shift sentiment toward bearish.

2. Moving Averages

Nifty is trading above both 20-day and 50-day EMAs, suggesting the trend remains positive.

The Relative Strength Index (RSI) is around 58–60, reflecting healthy momentum without overbought conditions.

3. Candlestick Pattern

Today’s session showed indecision, forming a neutral candle. A breakout candle or a bullish engulfing pattern tomorrow would be a strong confirmation of upward momentum.

🗣️ Market Sentiment & Global Cues

Sentiment in the market remains cautiously optimistic. Some of the key global and domestic factors influencing the Nifty forecast tomorrow include:

U.S. Federal Reserve commentary on interest rates

Movement in crude oil prices

INR/USD exchange rate fluctuations

Institutional investor activity (FII/DII inflow/outflow)

FIIs were net buyers today, a signal that global appetite for Indian equities remains intact — at least for now.

📈 Expert Outlook: Nifty Forecast for Tomorrow

Analysts are leaning towards a mild bullish trend continuing into tomorrow’s session, assuming no sudden negative cues overnight. That said, volatility is likely to spike during the first hour of trade.

Here are some smart trading reminders:

Don’t chase early price gaps.

Stick to well-defined stop losses.

Wait for volume confirmation, especially near breakout zones.

💡 Tip: A breakout above 22,500 on strong volume could provide a high-probability setup for short-term trades.

🛠️ Action Plan for Traders

Intraday Traders

Observe the first 15–30 minute range for market direction.

Indicators like MACD, RSI, and volume spikes are crucial for timing entries.

Use a trailing stop-loss strategy once in profit.

Positional Traders

Consider adding long positions above 22,500 with upside targets around 22,800.

If Nifty dips below 22,180, reassess and wait for a base to form before entering.

🔗 Live Updates and Tools

Want more granular data? For real-time charts, key levels, and analyst videos, check out the full Nifty 50 forecast and live analysis page.

📬 Final Thoughts

A well-informed Nifty prediction for tomorrow helps traders cut through the noise and take calculated risks. No forecast is 100% guaranteed, but combining technical signals, market sentiment, and global cues can give you an edge.

Trade smart. Stay disciplined. And always have a plan.

#nifty forecast tomorrow#nifty 50 prediction#nifty 50 forecast#nifty technical analysis#nifty trend tomorrow#share market forecast#stock market prediction#nifty outlook#nifty analysis#nifty trading strategy#nifty support and resistance#nifty levels tomorrow#intraday trading tips#stock market india#nifty market trend#nifty tomorrow analysis#nifty movement prediction#NSE forecast#indian stock market forecast#market trend analysis#technical analysis nifty 50#nifty 50 chart#fii dii data analysis#stock market update today#trading view nifty#nifty live updates#nifty chart pattern#nifty stock tips#nifty breakout strategy#nifty candlestick analysis

0 notes

Text

Chart Pattern Analysis in Saudi Arabia:- Ellipsys Financial Market is your trusted transparent forex broker, offers expert forex trading courses and trading solutions. In case you are a beginner or an experienced trader, we provide the tools, education, and transparency needed for success in the global forex market. Learn to trade with confidence, backed by professional support and proven strategies. Choose Ellipsys for trusted forex brokerage and complete trading education to your goals. https://www.elpmarkets.com/patterns.html

0 notes

Text

Top 8 Must-Know Chart Patterns in Technical Analysis | NTA®

Discover the 8 essential chart patterns every trader should master. Enhance your trading strategy with insights into market trends and price action analysis.

0 notes

Text

Mukka Proteins Acquires 51% Stake in GSM Marine Export for ₹14 Crore

Mukka Proteins Limited has announced the successful acquisition of a 51% stake in GSM Marine Export, a partnership firm engaged in the manufacturing of fish meal and fish oil. The acquisition, finalized through capital contribution for a consideration not exceeding ₹14 crore, is in line with the company’s strategic vision to strengthen its core business operations. In its regulatory filing under…

View On WordPress

#MUKKA 52-week high#MUKKA 52-week low#MUKKA EPS#MUKKA NSE#MUKKA P/E ratio#MUKKA price to book ratio#Mukka Proteins dividend yield#Mukka Proteins financials#Mukka Proteins investment analysis#Mukka Proteins Ltd financial ratios#Mukka Proteins Ltd IPO review#Mukka Proteins Ltd share price#Mukka Proteins Ltd stock news#Mukka Proteins market cap#Mukka Proteins quarterly results#Mukka Proteins share#Mukka Proteins share performance#Mukka Proteins shareholding pattern#Mukka Proteins stock analysis#MUKKA stock chart#MUKKA stock forecast#MUKKA stock price#MUKKA stock review#MUKKA stock trading volume#MUKKA stock volatility

0 notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

Analyzing Vedic Astrological Patterns in Criminals' Birth Charts

The Astrological Study of Criminals: Insights from a Data-Driven Approach

This article presents a comprehensive astrological study on criminals, based on the birth charts of 242 individuals with criminal cases against them. The studys aim was to identify common astrological patterns among these individuals, providing insights into potential astrological indicators of criminal behavior. This research ensures a robust and varied dataset, allowing for in-depth analysis and conclusions.

Read More.

#Astrology#Research#Criminal#Behavior#Birth#Chart#Study#Astrological#Patterns#Crime#ZodiacInsights#Analysis#CrimeStudy#Community#Indicators#dkscore#aiastrology#astrology#karma#predictions#astrological#analysis#pastlife

0 notes

Text

Why Every Trader Should Learn Multiple Charts Pattern Analysis

In the dynamic world of trading, patterns are more than just lines and shapes on a chart—they are visual representations of market psychology, a roadmap to potential price movement. For traders looking to enhance their market analysis and decision-making skills, learning Multiple Charts Pattern analysis is not just beneficial—it’s essential.

Whether you're new to trading or a seasoned market participant, understanding various chart patterns can dramatically improve your success rate. This article explores why every trader should learn Multiple Charts Pattern analysis and how this skill forms the foundation of profitable trading strategies.

The Power of Patterns in Trading

Each chart pattern captures the interplay of buyer and seller psychology, offering a glimpse into market sentiment. These patterns, when correctly interpreted, can signal whether the market is likely to continue its current direction or reverse course. Patterns such as head and shoulders, double tops and bottoms, triangles, flags, and wedges provide traders with clear entry and exit signals.

However, relying on just one or two familiar patterns can limit your potential. The complexity of markets is reflected in the diverse and intricate patterns they produce. That’s why it’s important to learn Multiple Charts Pattern analysis—to broaden your perspective and increase your adaptability in different market conditions.

What is Multiple Charts Pattern Analysis?

Multiple Charts Pattern Analysis is the practice of studying and recognizing a wide range of technical chart patterns across various timeframes and market scenarios. Rather than focusing solely on one chart type or timeframe, traders analyze different patterns from candlestick charts, bar charts, line charts, and more. They also explore these patterns across daily, weekly, and intraday time frames to get a comprehensive view of market behavior.

This approach helps traders spot potential setups with greater accuracy, avoid false signals, and align their trades with the broader market trend.

Benefits of Learning Multiple Charts Pattern Analysis

Improved Decision Making: When you learn Multiple Charts Pattern techniques, you gain a structured way to interpret market data. This leads to better, faster decision-making and increased confidence in your trades.

Greater Flexibility in Trading Strategies: Not all markets move the same way. By mastering different chart patterns, you can adapt your trading strategy to suit trending, ranging, or volatile markets.

Reduced Emotional Trading: Fear and greed can cloud judgment, leading traders to act on impulse rather than logic. A solid understanding of chart patterns adds discipline to your trading, helping you rely on logic and analysis instead of gut feelings.

Enhanced Risk Management: Most chart patterns come with well-defined areas for placing stop-loss and take-profit orders. This clarity allows for better risk-reward setups, keeping losses small and maximizing potential gains.

How to Start Learning Multiple Charts Pattern Analysis?

With the growing availability of trading courses online, mastering this skill is more accessible than ever. With structured guidance, practical demonstrations, and community support, online courses help traders go from beginner to advanced level at their own pace.

When looking to learn trading online, make sure the course includes:

A wide variety of chart patterns

Real-world trading examples

Practice charts and quizzes

Access to mentors or peer groups

The best online trading course will not only teach you the patterns but also show you how to apply them in live market scenarios.

Why Traders Prefer Online Learning?

More traders today are turning to online trading courses due to their accessibility, flexibility, and cost-effectiveness. Instead of spending hours sifting through scattered resources, these courses offer a streamlined path with expert insights and practical tips.

At Chart Monks, for example, our online trading course is designed specifically to help you learn Multiple Charts Pattern analysis in a structured and engaging way. From beginner-level basics to advanced strategies, our course modules guide you through every step of the journey with clarity and confidence.

Real-World Application of Multiple Chart Patterns

Consider a situation where a head and shoulders pattern develops on the daily chart, while a bullish flag takes shape on the 15-minute timeframe. A trader who understands both patterns can make a more informed decision—perhaps waiting for the intraday breakout to align with the longer-term trend reversal before entering a trade.

This kind of multi-pattern, multi-timeframe approach allows for:

Stronger confirmation before trade execution

Precision in entry and exit points

Reduced risk due to enhanced clarity

Such insights are only possible when you've committed the time to learn Multiple Charts Pattern analysis thoroughly.

Final Thoughts

To keep up with the ever-changing markets, your trading game must keep improving. Limiting yourself to a handful of patterns may provide short-term success, but if you're aiming for long-term consistency, mastering Multiple Charts Pattern Analysis is crucial.

With the right online trading course, dedication, and practice, any trader can develop this vital skill. So if you’re serious about leveling up your trading game, it’s time to learn Multiple Charts Pattern analysis and turn uncertainty into opportunity.

Ready to start your journey? Take the next step in your trading journey by visiting Chart Monks and exploring our expert-led online courses. Learn at your own pace, sharpen your skills, and become a more confident and consistent trader.

#Learn Multiple Charts Pattern#Multiple Charts Pattern Analysis#Learn Trading Online#Online Trading Course#Trading Courses Online#Chart Monk

0 notes

Text

Binge-Worthy Trading: When Technical Analysis Meets Your Watch List

Hey streaming fanatics turned traders! Ever notice how your chart analysis skills improved after watching 47 episodes of your favorite show in one sitting? No? Let me explain this hilarious connection between your Netflix addiction and trading success!

Remember how you predicted that plot twist in your favorite series because you noticed all the subtle hints? That's exactly what technical analysis is - except instead of predicting who ends up with who, you're predicting where prices might go. And trust me, both can be equally dramatic!

Think about your favorite crime series. You know how detectives look for patterns to solve cases? Well, traders are basically market detectives! Instead of looking for clues at a crime scene, we're searching for clues in our charts. Though sometimes the market commits crimes against our portfolio, but that's another story...

The best part is how similar chart patterns are to TV show formulas. You've got your reversal patterns (like season finales), continuation patterns (like mid-season episodes), and those false breakouts (like clickbait episode titles that promise more than they deliver).

And don't even get me started on double tops and bottoms - they're like those classic "evil twin" episodes. Just when you think you know what's happening, the market pulls a soap opera move on you!

Concluding paragraph: So next time someone tells you you're watching too much TV, just tell them you're actually studying advanced pattern recognition for your trading career! And remember, just like you wouldn't skip to the last episode of a series, don't rush your trading journey. Enjoy the show, learn the patterns, and maybe keep some popcorn handy for those volatile market days!

#trading entertainment#Netflix analysis#market patterns#trading humor#technical analysis basics#chart patterns#trading psychology#market trends#trading education#beginner trading

1 note

·

View note

Text

Head and Shoulders Chart Pattern in Stock Trading

The Head and Shoulders pattern is a chart formation that often signals a reversal in the trend of a financial asset like stocks, commodities, or currencies. Traders use this pattern to spot when a market is about to shift from an upward trend to a downward trend (or vice versa), making it an essential tool for both beginners and experienced investors. This pattern has three peaks with the centre peak shaped like a ‘head’ supported by the two ‘shoulders’ or smaller peaks on either side which gives the pattern its name.

Read Full Blog Post: Head and Shoulders Pattern in Technical Analysis

#Head and Shoulders Chart Pattern in Technical Analysis#How to Trade using Head and Shoulders Pattern#Different Types of Head and Shoulders Pattern#Head And Shoulders Pattern In Stock Trading#Inverse head and shoulders pattern

0 notes