#data center expansion

Explore tagged Tumblr posts

Text

Maryland Pays, Virginia Plays: How an Energy Project Is Sacrificing Maryland Land for Northern Virginia’s Big Tech Boom

When Joanne Frederick first saw the survey stakes hammered into the edge of her family’s Frederick County farm, she thought it was a mistake.Nobody had asked permission.Nobody had warned her.And nobody told her the electricity would be flowing out of Maryland — not in. “They told us it was about reliability,” she said. “What they didn’t tell us was who it was for.” The Maryland Piedmont…

#corporate land grab#data center expansion#data-centers#eminent domain abuse#energy justice#infrastructure sacrifice zones#land rights#Maryland environmental issues#Maryland farmers#Maryland Piedmont Reliability Project#MPRP#rural land preservation#Stop MPRP#virginia#Virginia data centers

0 notes

Text

Ultimate Guide to Investing in Industrial Real Estate in 2025

Key Takeaways Industrial real estate—including warehouses and data centers—provides a stable investment opportunity amid evolving U.S. commerce. Technology advancements and urban development are fueling demand and creating new avenues for growth within this sector. Understanding resilience factors and strategic approaches is essential for maximizing returns in 2025. Unlocking the Potential of Modern Industrial Spaces If you're thinking about where to grow your money in 2025, industrial real estate in the U.S. stands out like a beacon. Picture warehouses buzzing with activity and data centers powering daily life—these spaces drive modern commerce and offer you real stability. With technology shaping how goods move and cities evolving fast, you have a chance to get ahead. But what makes these properties so resilient, and which strategies will set you up for real success next year? Key Drivers of Industrial Real Estate Performance in 2025 In 2025, several powerful forces are shaping the future of industrial real estate in the United States. You’ll notice that e-commerce growth is driving high demand for warehouses, last-mile delivery hubs, and specialized cold storage. Innovative leasing has become common, as businesses want flexible terms that support inventory swings and supply chain resilience. Investors and developers need to watch out for growing threats like title fraud and squatting, which can cause significant financial setbacks if not proactively managed. Infrastructure investments are boosting areas near highways, ports, and major cities, making these locations even more valuable. Vacancy rates have risen slightly due to a steady pace of new deliveries, highlighting the importance of location and tenant quality when making investment decisions. Investors focus on properties that align with these trends—close to transportation and population centers, with smart upgrades like automation. You can see how lifestyle changes, like faster shipping expectations and the rise of subscription services, push demand further. If you understand these drivers, you’re better prepared to spot opportunities—and act dynamically. Pros and Cons of Industrial Property Investments Thinking about investing in U.S. industrial real estate? One big plus is the steady rental income you can get from long-term leases, especially when your tenants are reliable. Of course, it’s not all smooth sailing—you’ll need to keep an eye on vacancy risks and changes in demand, since even solid markets can shift unexpectedly. Industrial real estate values have outpaced retail and office sectors in recent years, making this sector particularly attractive for investors seeking growth. The good news is that spotting the right opportunities for upgrades can't only increase your property’s value, but also help you stay ahead of the competition. Rental Income Stability Although real estate investments come in many shapes and sizes, industrial properties often stand out for their reliable rental income. If you want steady returns, you'll appreciate how tenant diversification cushions you against single-company downturns. Leasing to multiple tenants spreads your risk and keeps income flowing, even if one renter leaves. With lease escalation clauses, you benefit from regular rent increases—national in-place rents grew 6.6% to 6.7% year-over-year in Q1 2025, showing exceptional income growth. Unlike other sectors, industrial buildings typically require fewer costly improvements. This means your net returns are stronger, and you'll spend less time on renovations. Rising vacancy rates in some regions—now at 8% nationally and higher in places like Phoenix and Chicago—may pose a challenge for income stability, highlighting the importance of choosing your market carefully. However, some regions haven't matched national averages, and shrinking lease rate spreads might test future rent gains. Still, strong demand makes income stability a leading advantage. Vacancy and Absorption Risks

Steady rental income can bring peace of mind, but every investment comes with its own set of challenges. When you invest in industrial real estate, vacancy and absorption risks are never far behind. Vacancies in the U.S. industrial market climbed to 8.5% in early 2025, as new developments outpaced demand. Notably, regions like New Jersey experienced the highest rent growth at 11.3%, signaling that while some markets see strong pricing power, high rents could also limit the pool of prospective tenants. You might see rents cool and your income shrink if market saturation grows or if technological disruption alters the way tenants use space. Net absorption has slowed, which means fewer new tenants are filling spaces. Higher long-term interest rates and uncertain trade policies also add to the risk. To protect your investment, diversify across locations, watch for signs of market saturation, and remain alert to changes caused by technological disruption and shifting economic conditions. Value-Add Opportunities If you’re looking to shape the future of American industry—and capture strong returns along the way—value-add industrial real estate offers a unique playground. Picture an older industrial park filled with outdated warehouses. By upgrading these spaces with warehouse automation and modern layouts, you can reset below-market rents and appeal to logistics and e-commerce tenants craving efficiency. Industrial assets offer stability and cost efficiency for investors, giving owners a dependable income stream even as improvements are underway. Renovating older stock for hybrid uses—like blending manufacturing and logistics—taps into reshoring trends and drives above-average returns. Still, you should weigh the risks: locked-in leases may slow your rent resets, while supply chain delays can spike redevelopment costs. Retrofitting for ESG standards or specialized tenants adds complexity. Success depends on market timing, smart tenant mixes, and keen analysis of national and local demand swings. Comparing Industrial and Commercial Real Estate Sectors When you look at the environment of industrial and commercial real estate in the U.S., it feels a bit like comparing a steady mountain to a rolling hill. Industrial real estate offers you a trail marked by strong historical trends, while commercial sectors can feel unpredictable. If you’re thinking about market diversification for your portfolio, studying these differences is key. Industrial spaces usually show steady growth and low vacancy rates, making them dependable no matter the economic forecast. Notably, industrial properties remain stable, with vacancy rates held at 6.8% in Q3 2024, driven by ongoing demand from e-commerce and logistics. In contrast, commercial properties like offices and retail spaces often react faster to market ups and downs. Here are four things to think about when comparing these sectors: Industrial properties often have lower vacancies. Industrial investments thrive on stability and cost efficiency. Commercial spaces face higher volatility. Market diversification often favors industrial for steady returns. Warehousing Demand and Distribution Center Growth Have you noticed how quickly packages show up at your door these days? That speed isn’t luck—it’s a direct result of booming warehousing demand and rapid distribution center growth. E-commerce continues to soar, driving the need for more warehouse space across the U.S. In 2025, expect warehouses to expand even more, powered by Innovative Parcel Logistics and Automated Inventory Management. These tools help companies deliver products faster and handle larger volumes with precision. Vacancy rates are expected to rise intermittently as new facilities enter the market, but strong demand continues to keep the sector healthy. Industry disruption from agile new entrants has also pushed companies to improve speed and efficiency in warehouse operations. Distribution centers are also strategically popping up closer to major cities, making deliveries quicker and more reliable.

Automated technology ensures operations run smoothly, saving both time and money. As consumer spending rises and supply chains get smarter, investing in warehouses becomes essential for meeting the ever-growing demands of modern logistics. Role of Data Centers and Flex Space in Portfolio Diversification As boxes move faster from warehouses to your doorstep, another quiet revolution is changing what industrial real estate can do. You're seeing a surge in data centers, thanks to massive AI infrastructure needs and the shift from pure logistics to tech-driven assets. In order to maximize return on investment, strategic management practices, such as regular inspections and open communication, should also be applied in evaluating these emerging property types. Flex spaces—offering hybrid office, storage, and light manufacturing—let you tap into cross-sector synergy, making your portfolio nimble and resilient. In the U.S., blending data centers and flex space helps you steer market shocks, as each asset’s strengths offset the other's risks. Today, about 60% of public REIT market cap now sits outside traditional sectors like pure industrial, helping you benefit from much broader diversification when adding new asset types to your portfolio. Here’s how you can benefit: Capture stable returns as AI infrastructure fuels the need for data centers. Diversify risk by adding flex space with adaptable leasing. Maximize value via conversions between asset types. Leverage cross-sector synergy in growth markets. Evaluating Industrial REITs Versus Direct Investment Though many investors dream about owning a warehouse or high-tech facility, you don’t need millions to step into the world of industrial real estate. You can begin with Industrial REITs, buying shares for as little as $50, letting you enjoy income without the headaches of direct ownership. But if you crave control—setting up biometric security, choosing tenants, or driving ethical investing decisions—direct investment may suit you better. Compare your options: Recent market data shows that Industrial REITs delivered competitive total returns through both dividends and capital appreciation in 2025. Building a financial cushion is a critical strategy that helps investors navigate market cycles and take on opportunities in both REITs and direct ownership. Feature Industrial REITs Capital Needed Low (share price) Liquidity High (sell shares) Yield 3.96%–12.27% (2025) Management Professional teams Risk Diversified portfolio REITs let you submerge quickly and ethically, but direct investment rewards hands-on effort and customization. Your path depends on your vision. Build-to-Suit Projects and Customization Trends We’re seeing a real shift across the U.S. as more companies look for spaces designed specifically for them—everything from high-tech manufacturing facilities to last-mile delivery centers. With build-to-suit projects, it’s all about meeting those unique requirements, whether that means installing extra-tall ceilings for automation or adding on-site solar panels for sustainability. Creating the right environment through brand storytelling can also make these spaces more attractive and memorable for tenants. Additionally, as demand-driven project pipeline continues to lag behind due to zoning hurdles and construction slowdowns, these customized facilities give tenants the certainty and operational efficiency that speculative development can’t match. By responding to these needs, you’re not just providing a building; you’re actively shaping what’s next for American industry. Growing Demand for Customization While industrial real estate keeps changing, the demand for build-to-suit projects and tailored spaces has taken center stage across the U.S. You’ll notice a shift from traditional, cookie-cutter warehouses to spaces designed for specific industries and advanced manufacturing needs. This new trend isn’t just about fancy upgrades—it’s rooted in the historical development of industry and our growing urban infrastructure.

As companies aim to stay ahead, they’re asking for more custom features than ever before. Build-to-suit projects are increasingly popular as tenants want to secure long-term leases in facilities precisely designed for their needs, which also helps reduce the risk of oversupply in certain sectors. Here’s why this matters for you: Semiconductor and EV growth: These industries need specialized buildings due to technical demands. Advanced technology support: Custom facilities help companies integrate automation and AI. Environmental responsibility: Tenants want eco-friendly buildings to meet regulations. Flexible design: Adaptable spaces prepare you for future changes in your business model. Tenant-Driven Design Features Demand for tailored spaces isn’t just a trend—it’s completely changing the way industrial properties are built and used across the U.S. Today, tenants expect more than four walls and a roof. They want high-tech infrastructure, automation, and smart technology woven into every detail. Build-to-suit projects let you offer true space customization, making your property align perfectly with tenants’ unique business needs. As technology-enabled properties that elevate tenant engagement become a top opportunity in commercial real estate, integrating digital building systems and flexible infrastructure is not just expected but increasingly essential for attracting quality tenants. Integrate AI-driven features and energy-efficient systems to deliver tenant amenities that boost productivity and comfort. Consider wellness zones, flexible workspaces, and sustainability features—adding value for companies focused on innovation and employee satisfaction. When you focus on tenant-driven design features, you don’t just attract tenants; you build loyalty and long-term partnerships that can set your industrial investments apart in the 2025 market. Understanding Cap Rates and High-Yield Industrial Assets Even as the market keeps shifting, understanding cap rates is one of the most important skills for investors looking to spot high-yield opportunities in U.S. industrial real estate. Cap rates show the return you’ll get compared to the property’s price, making them a key measure when sizing up deals. If you’re eyeing high-yield assets, pay special attention to industrial zoning and environmental regulations—these often impact both property value and long-term returns. Over the past year, cap rates have declined across all classes, supporting sustained investor demand even in uncertain times. Now, consider these essentials: Cap rates for Class A, B, and C properties vary, so know your target range. High-yield assets usually sit in strong markets like Dallas or Miami. Interest rates and GDP growth directly influence cap rate trends. Tenant quality and mid-sized facility demand drive leasing success. Think smart, act informed—maximize your gains. Off-Market Strategies for Sourcing Industrial Deals Spotting the right cap rate is just one piece of the high-yield puzzle—but getting first crack at a high-potential industrial property gives you a real edge. You can tap into off-market strategies by reaching out directly to property owners, networking at industry events, and partnering with skilled real estate agents who know the local U.S. market. Taking inspiration from business leaders who emphasize community connections, building sincere relationships can enhance access to off-market opportunities and long-term deal flow. Leverage data-driven platforms to spot hidden gems and build a reputation that attracts exclusive opportunities. As the industrial and manufacturing sector is projected to be a top investment opportunity in 2025, focusing on these properties can align your strategy with emerging demand and strong fundamentals. Off-market deals let you secure properties with lower competition and often better pricing. These strategies also offer the opportunity for innovative leasing or leasing consolidation, letting you tailor deals to tenant needs and boost value.

Still, be prepared: information can be scarce, due diligence matters, and strong negotiation skills will be vital. Top U.S. Metro Areas for Industrial Investment in 2025 Thinking about diving into industrial real estate? Coastal cities such as Jacksonville and Houston are still standout choices, thanks to their strong port access and solid infrastructure. Meanwhile, inland markets like Dallas-Fort Worth and Kansas City are gaining serious traction, driven by rapid growth and supportive local policies. Notably, metropolitan areas are central hubs of economic activity across the US, fueling much of the national momentum in industrial sectors. In cities like St. Louis, recent urban renewal efforts and major new funding are transforming former decline into opportunity, paving the way for dynamic investment environments. Whether you’re leaning toward the coasts or looking inland, there’s a lot to consider—let’s take a closer look at what makes these top metro areas so appealing for industrial investment in 2025. Coastal Cities Outperform Peers While many cities compete for your investment, coastal cities across the U.S. stand out as powerful hubs for industrial real estate in 2025. These cities thrive on port synergy and have demonstrated impressive coastal resilience, even in the face of climate risks. If you’re searching for vibrant options, look closely at places like Jacksonville, Miami, Tampa, and Houston. Coastal cities are also benefiting from international appeal and strong commercial real estate activity, which further accelerates investor interest and development potential. Why do these markets outperform their peers? Consider these advantages: Expanding infrastructure: Upgraded ports and logistics drive steady demand. Demographic growth: Rapid population increases fuel the need for industrial spaces. Diverse economies: Cities with varied industries provide stability and growth. Robust job markets: Employment growth supports long-term investment success. Inland Hubs Gain Momentum Coastal cities often steal the spotlight, but it’s the nation’s inland hubs that are rapidly building a new kind of industrial real estate powerhouse for 2025. If you trace historic trends, you’ll see places like the Inland Empire, Houston, and Richmond steadily claiming more investor attention. Surging leasing activity, import growth, and expanding logistics networks set these markets up for strong returns. But you should recognize market challenges too—price disparities and shifting tenant needs demand a smart strategy. Houston’s economic diversification and affordable operations offer resilience, while Phoenix and Nashville leverage regional connections to shine. Markets with growing populations and job opportunities serve as a foundation for sustainable industrial real estate growth in these regions. Inland Empire’s robust sales and import-driven demand showcase its unmatched momentum. When you look beyond the coasts, you’ll discover inland hubs rewriting the industrial investment story. Industrial Property Financing and Lending Options Curious about how you can finance your next industrial property deal? You've got a range of options to contemplate, each with its own advantages and lending requirements. In 2025, U.S. industrial real estate investors face fierce competition due to high demand, higher interest rates, and evolving loan products. As you explore financing, remember that lease negotiation skills and landlord incentives might boost your deal’s appeal, especially when working with alternative lenders or during seller financing discussions. Keeping regular inspections in mind can also minimize costly damages to your property investment over time. Commercial loans generally have shorter terms and require larger down payments compared to residential mortgages, meaning that you should prepare for a significant initial investment when seeking your industrial property loan. Here are four key lending options to review:

Bank Loans: Offer flexible leverage but require strong credit and business history. Life Company Loans: Favor long-term, stable properties for risk-averse investors. CMBS Loans: Provide large-scale, competitive loans with stricter terms. Hard Money Loans: Deliver fast, short-term capital, typically at higher rates. Cash Flow Analysis for Industrial Properties Once you’ve figured out your financing, it’s time to look closely at how much money your industrial property will actually put in your pocket. Cash flow analysis starts with your net operating income (NOI)—that’s the money left after subtracting key expenses like taxes, insurance, maintenance, and utilities from your total rent. Many investors also deduct a standard vacancy factor from potential rent to account for unoccupied periods or non-paying tenants, ensuring their projections are realistic. U.S. industrial spaces often offer stable cash flows because leases run longer and tenant turnover stays low. When determining your timeline for returns, remember that break-even points on industrial properties are typically reached after several years, depending on market conditions and total costs. As industrial automation and shifting supply chain dynamics keep driving demand, you’ll want to project future cash flows with a Discounted Cash Flow (DCF) model. Check cash-on-cash returns, IRR, and make sure debt service coverage is healthy. Don’t overlook possible costs for capital repairs or changing tenant needs. Smart cash flow analysis puts you in control of your investment’s future. Navigating Leasing Trends and Triple-Net Lease Structures As you explore the world of U.S. industrial real estate, leasing trends and triple-net lease structures quickly become key to your success. Leasing activity is booming, especially for modular spaces, as tenants seek agility for industries like battery technology and urban farming. Triple-net leases let you offload most property expenses and enjoy more stable cash flow, but tenants are taking on rising operational costs. Warehouse lease renewals are costlier than ever, with U.S. asking rents reaching $10.13/SF in Q4—a 61% increase from Q4 2019.] To steer through today’s market, keep these essential tips in mind: Focus on mid-sized logistics facilities for robust demand. Explore secondary markets with lower land costs and faster permitting. Prioritize properties with sustainability features—these attract higher-paying tenants. Choose newer, build-to-suit assets when possible; they reduce default risks and vacancy. Stay informed and adapt to maximize your returns. Industrial Asset Management: Best Practices and Tips Even in a fast-changing world, strong asset management sets you apart in U.S. industrial real estate. To thrive, you need to blend industrial innovation with asset resilience. Start by focusing on effective expense management, always watching costs, and using smart budgeting tools. Schedule regular maintenance, so problems never become expensive surprises. Build open, reliable communication with your tenants and vendors—you’ll cultivate loyalty and trust. Here's a quick reference table: Best Practice Benefit Preventive maintenance Fewer unexpected repairs Energy efficiency Lower utility costs Tenant feedback Higher tenant retention Manage financials diligently—keep your cash flow strong and understand every cent. Finally, lead proactively by planning capital improvements and always refining your emergency responses. Driven asset management builds sustainable value—and your edge in the market. Don't overlook the impact of quality paints on both property durability and visual appeal, as selecting the right products can help your assets retain their value over time. Underwriting and Valuation of Industrial Real Estate Deals When you’re underwriting industrial real estate deals, think of it as taking a deep dive into the property’s future cash flow—will it stay steady and strong, or are there risks that could throw things off course?

It’s important to make sure your rent growth projections actually reflect what’s happening in the local market; guessing too high can really skew your investment outlook. And don’t forget to pay close attention to vacancy and absorption rates, since these will give you a clear idea of how quickly you can lease up any empty space and keep your money working for you. Incorporating upgrades that boost property value and enhance safety, such as modernized electrical systems, can also play a key role in improving long-term returns and retaining tenants. Now that we’ve covered the basics, let’s take a closer look at the different valuation approaches you can use for industrial properties. Evaluating Cash Flow Potential How do you really know if an industrial property will bring in steady cash flow? You need to dig into the details that truly impact an investment’s success. Environmental impact can affect a property’s long-term appeal, while zoning regulations can limit or boost potential uses. Next, it’s imperative to review market data and measure operational efficiency. Here’s how you can evaluate cash flow potential: Analyze tenant mix and lease structure: Reliable tenants and strong leases create predictable income streams. Review historical sales prices and vacancy rates: Past market performance sets a baseline for future expectations. Check financial statements and property appraisals: These help verify the property’s real income and expenses. Examine key metrics: Pay attention to Loan-to-Value (LTV), Debt Service Coverage Ratio (DSCR), and Net Operating Income (NOI). Assessing Rent Growth Assumptions Looking beyond cash flow, you also need to judge whether rent growth assumptions in industrial real estate deals make sense. In 2025, experts project modest rent increases—just 1–3% nationwide, even though some Southern markets might see stronger gains. Pay close attention to market regulation and zoning policies, because they shape how much new supply can enter an area and affect rent trends. While concessions like free rent are increasing, they lower the true rent landlords collect. Some areas, like Los Angeles, are even experiencing rent drops of over 10% year-over-year. Always dig into local data: Are zoning policies limiting new projects? Is market regulation keeping growth in check? Use this research as your guide—it’ll help ensure your assumptions reflect reality, not just wishful thinking. Analyzing Vacancy and Absorption In industrial real estate, understanding vacancy and absorption trends can make or break your investment strategy. You need a sharp eye on both historical vacancy and current market absorption to stay ahead. With national vacancy rates hitting decade highs—nearing 8.5%—and market absorption lagging behind the swell of new supply, you must read the market’s pulse. Some regions—Miami and Seattle, for example—still show strong tenant interest, but national numbers tell a cautionary tale. Here’s how to decode these shifts: Review historical vacancy—watch for patterns that signal risk or opportunity. Compare supply deliveries to market absorption each quarter. Identify markets where excess supply threatens rent growth or lease renewal. Adjust your underwriting to include higher vacancy and slower absorption in 2025. Stay vigilant to safeguard your investments. Value-Add and Adaptive Reuse Opportunities While many investors focus on buying and holding, true growth often comes when you breathe new life into industrial properties. Think of it as industrial art—turning overlooked warehouses into supply chain masterpieces. You can target under-leased spaces and raise rents to match the market. Upgrade with energy-efficient lighting, HVAC, or better insulation to spark tenant interest and cut costs. Expand loading docks, add cold storage, or even automate with smart tech to make your property stand out. Adaptive reuse is powerful, too—old malls can become ultimate last-mile delivery hubs if you focus on strong structural features and the right zoning.

Evaluate local demand, especially where e-commerce drives growth. By creatively repositioning assets, you can transform forgotten buildings into high-demand supply chain anchors. As you implement these strategies, consider how tokenized investments are also making it possible to diversify your capital allocation and enhance the liquidity of industrial real estate portfolios. Industrial Property Tax Planning and Incentives Even small steps in industrial property tax planning can open big savings and reshape your investment returns. Tax incentives aren’t just past stories—they’re active tools you can use now to thrive in 2025. By understanding historical tax incentives and current zoning regulations, you position your industrial real estate projects for maximum financial success. Here's how you can benefit today: Apply for abatement programs: Explore GPLET for 8-year property tax breaks or site-specific PILOT deals. Claim equipment exemptions: Seize the new $500,000 personal property tax exemption for machinery. Leverage clean energy credits: Use Section 48E for solar, microgrid, and storage tax credits, with extra bonuses for U.S.-made content. Access regional programs: Target Opportunity Zones with zoning fast-tracks and local job training reimbursements. Incorporating a sustainability focus into your industrial property tax strategy not only increases cost savings but also aligns your investments with emerging industry trends and long-term viability. With the right strategy, every tax dollar saved fuels your property's long-term growth. Impact of Logistics and Last-Mile Distribution on Site Selection New tax incentives can set your investment up for bigger wins, but smart owners look beyond the balance sheet. When you pick a site for industrial real estate, you need to understand how last-mile logistics shape demand. E-commerce giants and smaller retailers want warehouses close to customers, even if urban congestion pushes up costs. They're grabbing urban micro-fulfillment sites fast, despite tough zoning rules and higher property prices. Automation and AI-powered routing let teams overcome traffic and make those costly miles count. At the same time, facilities with strong EV infrastructure get priority, as green fleets become the norm for U.S. cities. If you pick real estate near EV charging corridors and labor pools, you set yourself up for enduring investment value. Just as strategic painting choices can boost demand in residential rentals by appealing to broad audiences and enhancing key features, selecting sites that maximize natural light, flexibility, and operational efficiencies can give your industrial properties a competitive edge. ESG and Energy Efficiency in Modern Warehousing So, if you’re aiming to future-proof your warehouse investment, putting sustainable building standards and green technologies front and center is key. Opting for energy-efficient materials and integrating smart systems isn’t just about doing what's right for the environment—it’s a smart move for your bottom line, too. Not only will you see reduced operating costs, but your property’s value and reputation in the U.S. market will also get a boost. Upgrading to LED lighting solutions can significantly enhance warehouse appeal, cut long-term energy expenses, and position your property as a modern, eco-friendly asset in a competitive market. Now, let’s take a closer look at some of the latest ESG innovations shaping warehouses today. Sustainable Building Standards While the industrial real estate market keeps growing, today’s warehouses must do more than just store goods—they need to meet strong sustainability and energy efficiency standards. Adopting sustainable building standards and seeking green certifications is no longer optional if you want to stay competitive and compliant in the U.S. Sustainable buildings prove you’re serious about both meeting regulations and making a positive environmental impact. When you invest in a warehouse, follow these steps:

Align your facility’s design with current U.S. energy codes and sustainability regulations. Aim for respected green certifications, such as LEED or ENERGY STAR, to show stakeholders your commitment. Conduct regular energy audits to reveal possible improvements. Use recycled materials and eco-friendly roofing to further boost efficiency and ESG alignment. Future-focused buildings can inspire responsible growth. Green Technology Adoption How can you make a real impact on both your bottom line and the planet? Start by adopting green technology in your warehouses. Switch to LED lighting—it cuts energy use by 75% and lasts much longer. Add AI integration to control lights and automate schedules, ensuring you only use energy when you need it. For climate control, smart thermostats and predictive maintenance keep HVAC costs down and comfort up. Solar incentives make installing solar panels practical, boosting energy savings and qualifying you for tax breaks. Use emission-reducing strategies like electric yard trucks and AI-powered dock scheduling to slash pollution and avoid EPA fines. And don’t forget sustainable packaging—buyers appreciate it, and U.S. regulations reward your effort. Green tech leads to lower costs and enduring returns. CRE Market Cycles and Distress Investment Opportunities in 2025 As 2025 approaches, you’ll notice the industrial real estate market shifting into a fresh cycle, opening doors for bold investors who are ready to plunge into new opportunities. Understanding market timing is key, especially as interest rates normalize and economic growth fuels new activity. Many cities update zoning regulations, making certain locations even more valuable if you spot them early. With demand for high-quality spaces rising, older properties may become distressed, but that’s where you can find great deals if you act strategically. Consider these opportunities: Pinpoint markets with favorable zoning regulations and supply-demand imbalances. Seek distress opportunities in outdated industrial properties, then renovate. Monitor market timing to buy low as vacancies increase. Diversify into data centers, as digital economy trends drive demand. Success means seizing the cycle’s best moments. Frequently Asked Questions (FAQ) 1. Why is industrial real estate such a hot investment in 2025? Because it offers stability, consistent demand, and high adaptability. With e-commerce, AI, and logistics booming, warehouses and data centers are essential infrastructure, and investors are capitalizing on that. 2. What types of industrial properties are best for investment? Top performers include distribution centers, cold storage facilities, data centers, and flex spaces. Build-to-suit and value-add properties also offer strong returns when customized for modern needs. 3. Should I invest directly or go through an Industrial REIT? It depends on your goals. REITs offer easy entry and liquidity. Direct investment gives you more control and potentially higher returns, but requires more capital and involvement. 4. How do I find good industrial deals in today’s market? Look off-market first—via brokers, networking, or direct outreach. Prioritize areas with strong port access, major highways, and population growth, like Jacksonville, Dallas, or Kansas City. 5. What are the biggest risks in industrial investing? Rising vacancy rates, tech disruption, and market saturation. Poor location choices or ignoring due diligence (like zoning or environmental factors) can also hurt long-term returns. 6. How much money do I need to start investing in industrial real estate? Direct ownership usually requires six to seven figures, but you can get started with as little as \$50 by investing in Industrial REITs or through crowdfunding platforms. 7. What are triple-net leases, and why do they matter? A triple-net (NNN) lease means the tenant covers property taxes, insurance, and maintenance. For landlords, this reduces expenses and creates more predictable cash flow.

8. Are tax incentives available for industrial property investors? Yes. Programs like GPLET, Opportunity Zones, and green energy tax credits (like Section 48E) can significantly lower your costs and increase long-term profitability. 9. What makes a good market for industrial real estate? Strong infrastructure, population growth, business-friendly policies, and logistics demand. Inland and coastal hubs like Phoenix, St. Louis, and Houston check many of these boxes. 10. Is industrial real estate good for buy-and-hold strategies? Absolutely. Long leases, durable tenants, and steady income make it ideal for buy-and-hold. Value-add upgrades and sustainability features can further boost appreciation. Assessment Building Your Industrial Real Estate Future So, as you look at the crossroads of risk and reward, picture your future anchored by dependable warehouses and innovative facilities, not just the ups and downs of the stock market. Industrial real estate is all about trading some guesswork for more predictable, steady growth. Whether you’re eyeing those busy coastal ports or the steady potential in inland hubs, there’s a space to fit your investment style. Maybe it’s investing in data centers or making older warehouses greener—every move shapes the landscape of tomorrow. The journey might have its bumps, but with a clear strategy and an eye for opportunity, industrial assets can become your stepping stone to lasting success. Ready to take the next step? Explore industrial real estate opportunities and start building your bridge to a solid investment future.

#absorption rate#AI Integration#automation#build-to-suit#cap rates#cash flow#crowdfunding#data centers#economic hubs#energy efficiency#ESG compliance#EV infrastructure#flex space#Industrial#Industrial Investment#last-mile logistics#leasing trends#loan options#market diversification#net leases#NOI#Phoenix Arizona#port access#Portfolio diversification#real estate trends#solar upgrades#sustainability#tenant retention#warehouse expansion#Zoning

0 notes

Text

Greece to Launch $330M Data Center for AI Expansion

Greece is expanding its AI presence with a new data center near Athens, backed by a $331 million investment from Paris-based Data4. Greece has recently announced intentions to construct a data center in the country, as it continues to gradually integrate into the rapidly expanding artificial intelligence industry in Europe. Data4, a Paris-based company, announced on September 12 that it intends…

0 notes

Text

Generator Sets Market A Comprehensive Analysis of Growth Trends and Opportunities

Global Generator Sets Market: A Comprehensive Analysis

Market Overview

The Global Generator Sets Market is experiencing remarkable growth, driven by increasing demands across various sectors. The market is poised to reach a value of USD 45.4 billion in 2024 and is projected to expand to USD 91.5 billion by 2033, at a robust CAGR of 8.1%. This expansion reflects the rising need for reliable power solutions across residential, commercial, and industrial applications.

Generator sets, which include both portable and stationary generators, play a crucial role in delivering dependable power. The market encompasses diverse types of generators, including diesel, gas, and hybrid models, each designed to meet specific power requirements and operational environments. As infrastructure projects expand and technological advancements drive innovation, the demand for these power solutions continues to grow.

In this article, we will delve into various aspects of the global generator sets market, including key drivers, market trends, regional analysis, and future forecasts.

Key Drivers of Market Expansion

Rising Infrastructure Projects

The surge in infrastructure development globally is a significant driver of the Generator Sets Market. With urbanization and industrialization accelerating, there is an increased need for uninterrupted power supply. Generator sets are essential for construction sites, infrastructure projects, and urban development, providing reliable power to keep operations running smoothly.

Technological Advancements

Technological innovations are transforming the generator sets market. Hybrid and gas-powered generators are becoming more prevalent due to their increased efficiency and lower emissions compared to traditional diesel models. Advances in remote monitoring, automated load management, and fuel technologies are further enhancing the performance and sustainability of generator sets.

Regulatory Standards

Stringent emission regulations are influencing the market dynamics. Governments worldwide are imposing stricter environmental standards, compelling manufacturers to innovate and develop generators that comply with these regulations. This shift towards eco-friendly solutions is driving the growth of gas and hybrid generators, aligning with global sustainability goals.

Request Here For a Free PDF Sample Copy@ https://dimensionmarketresearch.com/report/generator-sets-market/request-sample

Market Segmentation

By Fuel Type

Diesel Generators

Diesel generators continue to dominate the Global Generator Sets Market, holding a market share of approximately 55%. They are favored for their reliability, high power output, and established infrastructure. Diesel generators are widely used in industrial applications and backup power scenarios due to their robust performance under various load conditions.

Gas Generators

Gas generators are gaining significant traction, accounting for 30-35% of the market. Their appeal lies in their lower emissions and alignment with environmental regulations. The development of natural gas infrastructure and economic benefits associated with gas as a fuel source are further boosting their adoption.

Hybrid Generators

Hybrid generators, combining diesel and renewable energy sources, are emerging as a sustainable solution. They offer enhanced efficiency and reduced environmental impact, catering to the growing demand for cleaner energy options.

By Power Rating

Low Power Generators

Low power generators, with capacities ranging from 1-20 kVA, dominate the market with a 45% share. These generators are commonly used in residential settings and small businesses. Their compact size, affordability, and ease of maintenance make them suitable for intermittent power needs.

Medium Power Generators

Medium power generators, ranging from 20-200 kVA, hold approximately 35% of the market share. They are essential for small to mid-sized enterprises and commercial establishments, providing a balance between power output and operational efficiency.

High Power Generators

High power generators, with capacities exceeding 200 kVA, represent 20% of the market. They are crucial for large industrial operations, data centers, and critical infrastructure requiring high power output and reliability.

Regional Analysis

Asia-Pacific

Asia-Pacific is the leading region in the Global Generator Sets Market, accounting for around 35% of the market share. China, in particular, plays a pivotal role due to its rapid industrialization and infrastructure development. The growing electricity demand and expanding urbanization in India and Southeast Asia further contribute to the region's market growth.

North America

North America holds a 25% share of the global market. The region's market is supported by established infrastructure and stringent regulatory standards. The United States, in particular, has strong residential and industrial generator needs, with technological innovations and sustainability initiatives driving market development.

Europe

Europe represents approximately 20% of the market, driven by high demand for eco-friendly generator solutions. Countries like Germany, the UK, and France lead the market due to their industrial bases and emphasis on carbon emission reduction. The region's focus on sustainability and energy efficiency influences market dynamics.

Technological Trends

Remote Monitoring and Automation

Advancements in remote monitoring and automation are reshaping the generator sets market. These technologies enable real-time monitoring of generator performance, automated load management, and predictive maintenance. They contribute to improved efficiency, reduced downtime, and enhanced overall performance.

Advanced Fuel Technologies

The development of advanced fuel technologies is driving the shift towards cleaner energy solutions. Innovations in fuel efficiency and emission reduction are making gas and hybrid generators more attractive compared to traditional diesel models. These technologies align with global sustainability goals and regulatory requirements.

Hybrid Generators

Hybrid generators, integrating multiple energy sources, are becoming increasingly popular. They offer a combination of diesel and renewable energy, providing enhanced efficiency and reduced environmental impact. This technological trend aligns with the growing demand for sustainable power solutions.

Key Applications

Healthcare Facilities

Generator sets play a critical role in healthcare facilities, ensuring the continuous operation of essential medical equipment during power outages. Hospitals and clinics rely on reliable backup power to maintain patient care and avoid disruptions in medical services.

Industrial Manufacturing

In the industrial sector, generators are crucial for avoiding production downtime and maintaining operational efficiency during power disruptions. Manufacturing plants use high-capacity generators to support their operations and minimize the impact of power outages.

Construction Sites

Generators provide essential power for machinery and temporary facilities on construction sites. They support project timelines and ensure that construction activities proceed without interruptions due to power issues.

Data Centers

Data centers depend on high-power generators to maintain uninterrupted data services and protect sensitive information during power interruptions. Backup generators are essential for ensuring the reliability and availability of critical data infrastructure.

Residential Use

For homeowners, generators offer backup power solutions during outages, particularly in areas prone to extreme weather. Generators help maintain essential services like heating, cooling, and refrigeration, providing peace of mind during power disruptions.

Competitive Landscape

Atlas Copco AB

Atlas Copco AB stands out in the market with its focus on advanced technologies and hybrid power solutions. The company's commitment to innovation aligns with the growing demand for sustainable and efficient generator solutions.

Caterpillar Inc.

Caterpillar Inc. maintains its leadership position through an extensive range of high-power generators and a robust service network. The company's investments in technology and compliance with emission standards contribute to its market prominence.

Cummins Inc.

Cummins Inc. enhances its market presence with innovative diesel and gas generators that emphasize clean energy use and fuel efficiency. The company's global reach and technological advancements play a key role in its market success.

Generac Holdings Inc.

Generac Holdings Inc. offers user-friendly and cost-effective generator solutions for residential and commercial sectors. The company's smart technology advancements and remote monitoring services address the need for reliable backup power solutions.

General Electric (GE)

General Electric (GE) contributes to the market with high-capacity generators and renewable energy integration. The company's efforts in sustainability support industry trends and drive market growth.

Recent Developments

Generac Power Systems Acquisition

In June 2024, Generac Power Systems acquired PowerPlay Battery Energy Storage Systems from SunGrid Solutions. This acquisition enhances Generac's energy solutions portfolio with advanced battery storage, aligning with its commitment to efficiency and sustainability.

Kohler KD Series Launch

In August 2023, Kohler introduced the KD Series industrial generators, including the KD700 and KD750 models. These generators feature advanced diesel engines capable of running on renewable Hydrotreated Vegetable Oil (HVO), offering exceptional fuel efficiency and reliability.

Mitsubishi Power Refurbishment Project

In July 2022, Taiwan Power Company awarded Mitsubishi Power contracts for refurbishing the Datan Power Plant in Taoyuan, Taiwan. This project underscores Mitsubishi Power's role in upgrading large-scale power generation facilities.

Doosan Enerbility and Siemens Gamesa MoU

In June 2022, Doosan Enerbility and Siemens Gamesa Renewable Energy signed an MoU to develop Korea’s offshore wind power sector. This partnership highlights the shift towards renewable energy and collaborative efforts in advancing clean power solutions.

FAQs

What is the current size of the Global Generator Sets Market?

As of 2024, the Global Generator Sets Market is valued at approximately USD 45.4 billion. It is projected to grow to USD 91.5 billion by 2033, reflecting a CAGR of 8.1%.

What are the key drivers of growth in the Generator Sets Market?

Key drivers include rising infrastructure projects, technological advancements, and stringent regulatory standards. These factors contribute to the increasing demand for reliable and efficient power solutions.

What are the dominant fuel types in the Generator Sets Market?

Diesel generators currently hold the largest market share, followed by gas generators. Hybrid generators are also gaining popularity due to their enhanced efficiency and lower emissions.

Which region leads the Global Generator Sets Market?

Asia-Pacific is the leading region, accounting for around 35% of the market share. China, India, and Southeast Asia's rapid industrialization and infrastructure development drive this growth.

How are technological innovations impacting the Generator Sets Market?

Technological innovations, such as remote monitoring, automation, and advanced fuel technologies, are enhancing generator performance and sustainability. These advancements align with the growing demand for cleaner and more efficient power solutions.

Conclusion

The Global Generator Sets Market is set for substantial growth, driven by increasing infrastructure needs, technological advancements, and evolving regulatory standards. As the market expands, key players are investing in innovative solutions to meet the rising demand for reliable, efficient, and eco-friendly power solutions. The shift towards hybrid and gas-powered generators, along with advancements in technology, is shaping the future of

the generator sets market. With a focus on sustainability and performance, the market is poised to continue its growth trajectory, offering diverse solutions to meet the needs of various sectors.

#Generator Sets#Power Solutions#Market Growth#Energy Trends#Technological Advancements#Hybrid Generators#Diesel Generators#Gas Generators#Infrastructure Expansion#Data Centers

0 notes

Text

Micro Mobile Data Center Market Geographical Expansion & Analysis Growth Development, Status, Recorded during 2017 to 2032

The Micro Mobile Data Center Market was valued at USD 3,675.75Million in 2022 and is expected to register a CAGR of 12.76% by 2023-2032.

The competitive analysis of the Micro Mobile Data Center Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Market projections and forecasts are underpinned by extensive primary research, further validated through precise secondary research specific to the Micro Mobile Data Center Market. Our research analysts have dedicated substantial time and effort to curate essential industry insights from key industry participants, including Original Equipment Manufacturers (OEMs), top-tier suppliers, distributors, and relevant government entities.

Receive the FREE Sample Report of Micro Mobile Data Center Market Research Insights @ https://stringentdatalytics.com/sample-request/micro-mobile-data-center-market/2424/

Market Segmentations:

Global Micro Mobile Data Center Market: By Company • Schneider Electric SE • Huawei Technologies Co., Ltd. • Hewlett Packard Enterprise Development LP • Eaton Corporation PLC • Panduit Corp. • Zellabox Pty Ltd. • Hitachi, Ltd. • Vertiv Co. • International Business Machines Corporation • Rittal GmbH & Co. Kg • Canovate Group • Dell Inc. • Instant Data Centers, LLC • Dataracks Global Micro Mobile Data Center Market: By Type • Up to 25 RU • 25–40 RU • Above 40 RU Global Micro Mobile Data Center Market: By Application • Banking, Financial Services, and Insurance (BFSI) • IT and telecom • Government and defense • Healthcare • Education • Retail • Energy • Manufacturing • Others

Regional Analysis of Global Micro Mobile Data Center Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Micro Mobile Data Center market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Micro Mobile Data Center Market Research Report @ https://stringentdatalytics.com/purchase/micro-mobile-data-center-market/2424/

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Report includes Competitor's Landscape:

➊ Major trends and growth projections by region and country ➋ Key winning strategies followed by the competitors ➌ Who are the key competitors in this industry? ➍ What shall be the potential of this industry over the forecast tenure? ➎ What are the factors propelling the demand for the Micro Mobile Data Center? ➏ What are the opportunities that shall aid in significant proliferation of the market growth? ➐ What are the regional and country wise regulations that shall either hamper or boost the demand for Micro Mobile Data Center? ➑ How has the covid-19 impacted the growth of the market? ➒ Has the supply chain disruption caused changes in the entire value chain? Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

Enquiry Before Buying @ https://stringentdatalytics.com/inquiry/micro-mobile-data-center-market/2424/

Our More Reports:

1. Global Digital Twin Financial Services and Insurance Market

2. Global Network Transformation Services Market

3. Global Used Goods Trading Platforms Market

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

#Micro Mobile Data Center Market Geographical Expansion & Analysis Growth Development#Status#Recorded during 2017 to 2032

0 notes

Text

‧₊˚💼✩ ₊˚👓⊹♡Mercury in the signs and how we communicate with others ‧₊˚👓✩ ₊˚💼⊹♡

❗️All the observations in this post are based on personal experience and research, it's completely fine if it doesn't resonate with everyone❗️

✨️Paid Services ✨️ (Natal charts and tarot readings) Open!

🫧Join my Patreon for exclusive content!🫧

🎬If you like my work you can support me through Ko-fi. Thank you!🎬

💄Masterlist💄

☕︎Mercury in Aries: Communication is quick and direct. You are not afraid to speak your mind, and you are likely to do so impulsively. Aries gives Mercury a spark of energy, which can lead to a quick mind and sincere expression. Your communication style is clear, direct, and sometimes a little aggressive, but always full of enthusiasm.

☕︎Mercury in Taurus: Practical and very concrete thoughts. Your way of communicating is slower, thoughtful, and calculated. You prefer stability and clarity in conversations, and you avoid the unnecessary. You can sometimes be somewhat stubborn in your views, but once you make a decision, you stick to it. You focus on the tangible, on what can be seen and touched.

☕︎Mercury in Gemini: Mercury is in its home! Your mind is incredibly agile and curious. You speak quickly, love to learn, and never tire of sharing ideas. You can jump from one topic to another with ease, which can sometimes make it difficult for others to follow, but you always have interesting information and fresh points of view. You are the best at having dynamic and fun conversations.

☕︎Mercury in Cancer: Emotional and deep communication. You have a great ability to sense the emotions of others and express them in a sincere way. Your words are often protective and caring, as you care a lot about how others feel. You can be a little more reserved when communicating, but when you do open up, you do so in a way that touches the hearts of those around you.

☕︎Mercury in Leo: Creative and enthusiastic expression. You have a warm, passionate, and often dramatic way of speaking. You love being the center of attention, and your words tend to shine. For you, communicating is a way of showing your confidence and individuality, and you are not afraid to share your opinions with great confidence.

☕︎Mercury in Virgo: A meticulous and analytical mind. You are detail-oriented and precise in your thoughts and words. You prefer to explain things clearly and logically, with a practical approach. You can sometimes be a bit critical or perfectionist with what you say, but you do this to make sure everything is well-founded. For you, fluid communication is full of useful data and details.

☕︎Mercury in Libra: Diplomatic and balanced communication. You have the ability to see all perspectives of a situation before speaking and prefer to keep the peace in conversations. You have a gift for public relations and making others feel comfortable. Your way of expressing yourself is very considerate and focused on the well-being of others.

☕︎Mercury in Scorpio: Intense, deep and penetrating communication. You love to get to the bottom of things, and you are not afraid to address complicated or secret subjects. You are an excellent conversationalist when it comes to discussing deep and mysterious topics. Sincerity is very important to you, and you can be very persuasive with your words, as you know how to read between the lines and pick up on what is not being said.

☕︎Mercury in Sagittarius: Expansive and philosophical thinking. You are an optimistic, enthusiastic communicator full of ideas. Sometimes you can be a bit direct or even somewhat reckless with your words, as you care a lot about expressing your opinions honestly. You always seek the truth and love to debate philosophical, spiritual or intellectual topics.

☕︎Mercury in Capricorn: Serious, responsible and witty communication. You are very organized in your way of thinking and prefer structured and to-the-point communication. Sometimes you can be reserved or even somewhat pessimistic, but your realistic approach and ability to understand practical details make your words clear and effective. Your way of communicating is serious and mature, which inspires respect.

☕︎Mercury in Aquarius: Your way of communicating is super original and full of new ideas. You love to think differently, break the mold, and talk about things that most people avoid. Sometimes, you may seem a little distant or lacking emotional connection, but that's because your head is always focused on ideas and logic, rather than feelings. Your mind is like a kaleidoscope, always seeing new possibilities and relationships between things that others don't even notice.

☕︎Mercury in Pisces: You are one of those who communicate in a very intuitive and empathetic way. You tend to see the world from your emotions and your imagination, which makes your thoughts sometimes a little difficult to express clearly. That happens because your mind is connected on a much deeper level. You prefer poetry to hard data and what really inspires you is creativity. You are excellent at giving emotional advice or helping others through intuition.

#astrology placements#astrology#astrology moodboard#astro blog#astro notes#astro news#astro observations#astro community#zodiac observations#zodiac signs#zodiac#astro seek#mars in cancer#horoscope#paid natal chart reading#natal chart reading#tarot reading#tarot and astrology#kpop astrology#kpop tarot#mercury retrograde#mercury in virgo#mercury in astrology#mercury in scorpio#mercury in leo#mercury in the 12th house#mercury in the houses#mercury in libra#mercury in 1st house#mercury astrology

437 notes

·

View notes

Text

Bot farm amplification is being used to make ideas on social media seem more popular than they really are. A bot farm consists of hundreds and thousands of smartphones controlled by one computer. In data-center-like facilities, racks of phones use fake social media accounts and mobile apps to share and engage. The bot farm broadcasts coordinated likes, comments, and shares to make it seem as if a lot of people are excited or upset about something like a volatile stock, a global travesty, or celebrity gossip—even though they’re not.

The article gives examples of many types of manipulation, including:

Russian and Iranian bot farms promote pro-Palestinian misinformation to inflame divisions in the West. Their objective is to pit liberals against conservatives. They amplify Hamas’s framing of the conflict as a civil rights issue, rather than the terrorist organization’s real agenda—which is the destruction of the state of Israel and the expansion of Shariah law and Islamic fundamentalism. The social media posts selected for coordinated amplification by Russian and Iranian actors tend to frame Palestinians exclusively as victims, promoting simplistic victim-victimizer or colonizer-Indigenous narratives—false binaries amplified not to inform but to inflame and divide democratic societies from within.

I highly suggest reading every word of this article: https://www.fastcompany.com/91321143/bot-farms-social-media-manipulation

291 notes

·

View notes

Text

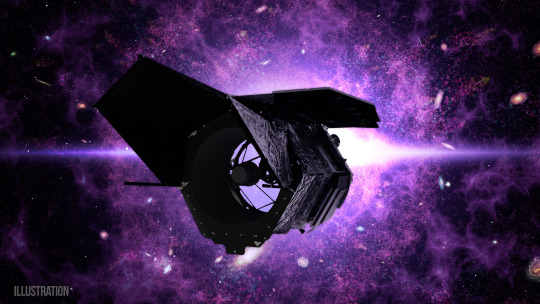

Black Scientists and Engineers Past and Present Enable NASA Space Telescope

The Nancy Grace Roman Space Telescope is NASA’s next flagship astrophysics mission, set to launch by May 2027. We’re currently integrating parts of the spacecraft in the NASA Goddard Space Flight Center clean room.

Once Roman launches, it will allow astronomers to observe the universe like never before. In celebration of Black History Month, let’s get to know some Black scientists and engineers, past and present, whose contributions will allow Roman to make history.

Dr. Beth Brown

The late Dr. Beth Brown worked at NASA Goddard as an astrophysicist. in 1998, Dr. Brown became the first Black American woman to earn a Ph.D. in astronomy at the University of Michigan. While at Goddard, Dr. Brown used data from two NASA X-ray missions – ROSAT (the ROentgen SATellite) and the Chandra X-ray Observatory – to study elliptical galaxies that she believed contained supermassive black holes.

With Roman’s wide field of view and fast survey speeds, astronomers will be able to expand the search for black holes that wander the galaxy without anything nearby to clue us into their presence.

Dr. Harvey Washington Banks

In 1961, Dr. Harvey Washington Banks was the first Black American to graduate with a doctorate in astronomy. His research was on spectroscopy, the study of how light and matter interact, and his research helped advance our knowledge of the field. Roman will use spectroscopy to explore how dark energy is speeding up the universe's expansion.

NOTE - Sensitive technical details have been digitally obscured in this photograph.

Sheri Thorn

Aerospace engineer Sheri Thorn is ensuring Roman’s primary mirror will be protected from the Sun so we can capture the best images of deep space. Thorn works on the Deployable Aperture Cover, a large, soft shade known as a space blanket. It will be mounted to the top of the telescope in the stowed position and then deployed after launch. Thorn helped in the design phase and is now working on building the flight hardware before it goes to environmental testing and is integrated to the spacecraft.

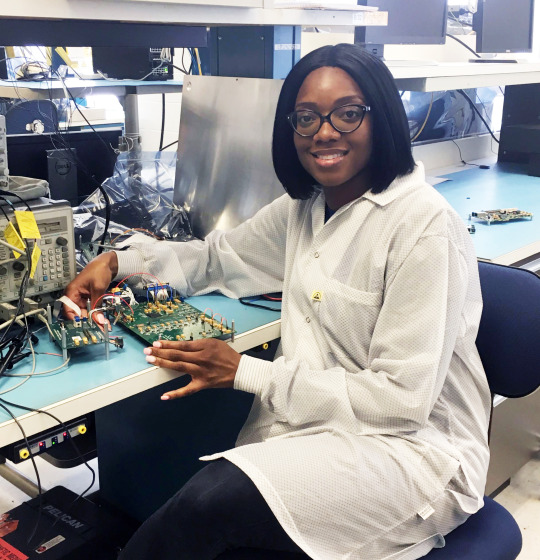

Sanetra Bailey

Roman will be orbiting a million miles away at the second Lagrange point, or L2. Staying updated on the telescope's status and health will be an integral part of keeping the mission running. Electronics engineer Sanetra Bailey is the person who is making sure that will happen. Bailey works on circuits that will act like the brains of the spacecraft, telling it how and where to move and relaying information about its status back down to Earth.

Learn more about Sanetra Bailey and her journey to NASA.

Dr. Gregory Mosby

Roman’s field of view will be at least 100 times larger than the Hubble Space Telescope's, even though the primary mirrors are the same size. What gives Roman the larger field of view are its 18 detectors. Dr. Gregory Mosby is one of the detector scientists on the Roman mission who helped select the flight detectors that will be our “eyes” to the universe.

Dr. Beth Brown, Dr. Harvey Washington Banks, Sheri Thorn, Sanetra Bailey, and Dr. Greg Mosby are just some of the many Black scientists and engineers in astrophysics who have and continue to pave the way for others in the field. The Roman Space Telescope team promises to continue to highlight those who came before us and those who are here now to truly appreciate the amazing science to come.

To stay up to date on the mission, check out our website and follow Roman on X and Facebook.

Make sure to follow us on Tumblr for your regular dose of space!

#NASA#astronomy#telescope#Roman Space Telescope#galaxies#black holes#space tech#astrophysics#spectroscopy#STEM#engineering#Black History Month#BlackExcellence365#science#tech#technology

2K notes

·

View notes

Text

Maryland Pays, Virginia Plays: How an Energy Project Is Sacrificing Maryland Land for Northern Virginia’s Big Tech Boom

When Joanne Frederick first saw the survey stakes hammered into the edge of her family’s Frederick County farm, she thought it was a mistake.Nobody had asked permission.Nobody had warned her.And nobody told her the electricity would be flowing out of Maryland — not in. “They told us it was about reliability,” she said. “What they didn’t tell us was who it was for.” The Maryland Piedmont…

#corporate land grab#data center expansion#eminent domain abuse#energy justice#infrastructure sacrifice zones#land rights#Maryland environmental issues#Maryland farmers#Maryland Piedmont Reliability Project#MPRP#rural land preservation#Stop MPRP#Virginia data centers

0 notes

Text

Microsoft Boosts Switzerland’s Digital Future with $400 Million Investment in Cloud and AI Infrastructure

In a landmark move to advance global digital innovation, Microsoft announced a $400 million investment aimed at significantly enhancing Switzerland’s cloud and artificial intelligence (AI) infrastructure. This strategic initiative is designed to strengthen Switzerland’s technological ecosystem, empower startups, and accelerate innovation — positioning the country as a key player in the evolving digital economy.

Strengthening Switzerland’s Digital Backbone: What Microsoft’s $400 Million Investment Entails

Microsoft’s commitment to invest $400 million in Switzerland focuses on upgrading the country’s cloud computing and AI infrastructure, a critical foundation for the digital economy. The investment is set to fund state-of-the-art data centers, cutting-edge AI research, and advanced cloud services tailored to meet growing business demands. By expanding its local data center footprint, Microsoft plans to offer Swiss enterprises faster, more secure, and more reliable cloud solutions — crucial for industries such as finance, healthcare, and manufacturing that rely on high data privacy standards.

This initiative is a part of Microsoft’s broader global strategy to build localized infrastructure hubs that meet stringent data sovereignty and security requirements while driving digital transformation. By investing heavily in Switzerland, Microsoft acknowledges the country’s reputation for innovation, stability, and regulatory rigor, making it an ideal location to pilot and scale advanced digital services.

Timeline and Vision: When and How Microsoft Plans to Deploy Its Swiss Digital Infrastructure

The rollout of Microsoft’s investment began in early 2025, with phased expansion planned over the next three to five years. The initial phase focuses on establishing new Azure data centers equipped with the latest technology to support AI workloads and cloud storage. Following this, Microsoft intends to launch collaborative innovation hubs designed to bring together startups, academic institutions, and industry leaders to co-develop AI and cloud-based solutions.

This timeline reflects Microsoft’s deliberate approach to balancing rapid technological deployment with compliance to Swiss regulations, including data protection laws and environmental standards. The long-term vision emphasizes creating an ecosystem where cloud computing powers not only business efficiency but also fosters sustainable innovation and economic growth across Switzerland.

The Catalyst: Why Microsoft Chose Switzerland and Its Strategic Importance

Switzerland’s unique combination of robust privacy laws, strong financial sector, and thriving startup ecosystem make it an attractive destination for Microsoft’s major investment. By enhancing local cloud infrastructure, Microsoft addresses a growing demand from Swiss organizations for secure, compliant, and performant digital services that align with European Union data sovereignty policies.

Moreover, the country’s strategic location in Europe provides an optimal hub for regional expansion, allowing Microsoft to serve not only Swiss clients but also neighboring countries with reliable cloud and AI resources. The investment supports Switzerland’s ambition to become a leader in digital transformation, ensuring it remains competitive in the global tech landscape.

Business Strategies Behind the Move: How Microsoft’s Investment Supports Global and Local Enterprises

At its core, Microsoft’s $400 million investment is a calculated business strategy designed to accelerate digital adoption among Swiss businesses and startups. By enhancing cloud infrastructure locally, Microsoft enables companies to reduce latency, improve data security, and innovate faster with AI-powered solutions. This directly translates into improved operational efficiency, cost savings, and enhanced customer experiences across multiple sectors.

For startups and scale-ups, the investment means access to powerful AI tools and cloud resources that can level the playing field against larger global competitors. Microsoft’s innovation hubs aim to provide mentoring, resources, and partnerships that drive entrepreneurship and job creation. These efforts align with Microsoft’s broader goal of fostering inclusive growth and digital resilience worldwide.

Global Impact: How This Investment Benefits People and Economies Beyond Switzerland

While centered in Switzerland, the ripple effects of Microsoft’s investment will benefit people and businesses around the world. By pioneering secure, high-performance cloud and AI infrastructure, Switzerland can serve as a blueprint for other countries seeking to modernize their digital capabilities. Enhanced cloud access fosters innovation that can accelerate healthcare breakthroughs, financial services efficiency, and environmental sustainability initiatives globally.

Read More : Microsoft Boosts Switzerland’s Digital Future with $400 Million Investment in Cloud and AI Infrastructure

#Sure! Here are relevant comma-separated tags for your topic:#**Microsoft#Switzerland#cloud computing#AI infrastructure#digital transformation#tech investment#artificial intelligence#data centers#cloud services#European tech#digital future#Microsoft Azure#tech innovation#AI expansion#\$400 million investment**

0 notes

Text

because i was asked for what mods i use, i decided i'll just make a whole post!

most of everything here is pretty cottagecore/naturey~

under the cut because my game is heavily modded this list is long!!

visual

medieval buildings

way back pelican town

seasonal cute characters base / expanded / east scarp

all cuter animal replacements

vibrant pastoral 1.6 (temporary fix)

overgrown flowery ui

medieval craftables

dynamic night time

cottagecore fences

lamps

gwens paths

animated gemstones

foliage redone foliage only

rosedryads fairies

elle's town animals

sve facelift

more grass

medieval dnt

flowergrass and snowfields

expansion fish redesign

clothing / hairs

more accessories and stuff

cozy scarves

hoods and hoodies

vanilla pants and skirts

the coquette collection

seasonal hats

ani's colour collection

improved and new hairstyles

kyuyas hairstyles pack

furniture

idalda furniture recolor

h&w outdoor furniture

h&w fairy garden furniture

west elm furniture

nano's retro style furniture

asters big furniture pack

gameplay / mechanics

cjb cheats menu (just to walk a little faster)

cjb show item sell price

greenhouse gatherers

craftable mushroom boxes

advanced casks

lumisteria serene meadow

growable forage and crop bushes

cornucopia more flowers / more crops

atelier wildflour crops and forage pack

wear more rings

tree transplant

passable crops

no fence decay redux

multi yield crops

crop fairy

challenging community center bundles

better chests

automate

spawn supply crates on beach

expanded storage

bigger backpack

blue eggs and golden mayo

better ranching

npc map locations

data layers

expansions

stardew valley expanded

east scarp / lurking in the dark / never ending adventure / always raining in the valley

lumisteria visit mount vapius

misc

jen's cozy cellar

cozy farmhouse kitchen

asters walls and floors megapack

wrens expanded greenhouse

cuter coops and better barns

nicer sewer

also recommended

hudson valley buildings

elle's seasonal buildings

seasonal fences

ridgeside village

immerisve farm map 2