#demographic dividend

Text

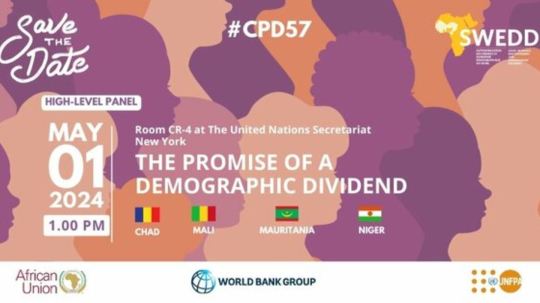

The Promise of a Demographic Dividend (CPD57 Side Event).

Africa's youth population offers immense potential, with three-quarters under 35, creating a demographic dividend. Despite challenges like gender inequality and high fertility rates, family planning policies have begun to shape a positive demographic transition. National Demographic Dividend Observatories (NODDs) in seven countries are driving progress, producing vital data and tools for policymaking.

At this high-level session, the focus will be on recognizing NODDs' contributions, addressing challenges, and advocating for renewed commitment to harnessing the demographic dividend.

Related Sites and Documents

Concept Note

Watch The Promise of a Demographic Dividend (CPD57 Side Event)!

#Demographic transition#African youth#demographic dividend#population#cpd57#unfpa#commission on population and development#young people#side-events#african union#world bank group#demographics#icpd30#fertility rates#family planning policies#gender inequality

0 notes

Text

Day 541 of telling people to Have More Babies, The Pending Doomsday of Retirement!

Day 541 of telling people to Have More Babies, The Pending Doomsday of Retirement!

Photo by shutter_speed on Pexels.com

The Problem

The Developed world and even some parts of the Developing world are facing the largest ever demographic change in history. The combination of increasing life expectancies due to improvements of hygiene and in our diets, coupled with the issue of low fertility rates (approximately the total number of children born to each woman) being way below…

View On WordPress

#Ageing Population#America#APAC#ASEAN#Australia#Canada#Childcare#China#Civilization#Civilization is going to crumble#Climate Change#DCs#Demographic Collapse#Demographic Dividend#Developed Countries#Developing Countries#Doomsday#East Asia#Economics#Elderly#Elon Musk#Europe#European Union#Far East#Fertility#Fertility Rate#France#Germany#Global#Have more babies

0 notes

Text

UIIC (USA, Indonesia, India, China): Four Countries Make Up Half the World's Population

In a world where countries are diverse and cultures vary greatly, there are four nations that stand out due to their sheer population size. The United States, Indonesia, India, and China, collectively known as the UIIC countries, are home to approximately half of the world's population. This article delves into the significance of these nations, their impact on global demographics, and the unique challenges and opportunities they face.

The United States: A Melting Pot of Cultures and Ideas

The United States, with a population exceeding 330 million people, remains one of the most influential and economically powerful countries in the world. Renowned for its "melting pot" of cultures and diverse demographics, the U.S. has been a beacon of opportunity for individuals from all walks of life. People flock to its shores in pursuit of the American Dream, seeking better opportunities, freedom, and a chance to contribute to its vibrant society.

Beyond its vast population, the United States has left an indelible mark on global culture, politics, and technology. It has been at the forefront of scientific and technological innovations, fostering advancements in fields such as space exploration, medicine, and information technology. Furthermore, its entertainment industry, centered in Hollywood, has captivated audiences worldwide, shaping popular culture and influencing trends in music, film, and fashion.

Indonesia: A Rising Economic Power in Southeast Asia

With a population of over 270 million people, Indonesia stands as the fourth-most populous nation on the planet. Spanning thousands of islands, Indonesia boasts a rich tapestry of cultures, languages, and traditions. Its diversity is a testament to the country's vibrant heritage and harmonious coexistence.

In recent years, Indonesia has experienced significant economic growth, propelling it to become a rising star in Southeast Asia. The nation's abundant natural resources, strategic location, and young and dynamic workforce have attracted substantial foreign investment. Indonesia's economic trajectory, coupled with its commitment to sustainable development, positions it as an important player in regional and global markets.

India: A Land of Diversity and Rapid Development

India, the world's second-most populous country, surpasses the 1.3 billion mark in population. This vast and diverse nation is a tapestry of languages, religions, and cultural practices. Its ancient civilization and rich history have contributed to a deep sense of cultural pride and identity.

In recent decades, India has undergone remarkable economic growth, transforming itself into one of the fastest-growing major economies. The country's demographic dividend, characterized by a large and young workforce, has been a driving force behind its economic rise. India has emerged as a global leader in the information technology and services sectors, with its bustling cities serving as hubs for innovation and entrepreneurship.

Despite its rapid development, India faces unique challenges related to poverty, inequality, and infrastructure development. However, the government and various stakeholders are actively working towards inclusive growth, social welfare programs, and sustainable development to address these issues.

China: A Giant on the Global Stage

China, with a population approaching 1.4 billion, stands as the most populous country in the world. Its ancient civilization, remarkable cultural heritage, and rapid economic rise have captivated the attention of the international community. China's influence extends far beyond its borders, impacting global trade, geopolitical affairs, and technological advancements.

China's manufacturing capabilities have been unparalleled, making it the world's factory. Its infrastructure development projects, such as the Belt and Road Initiative, have linked nations across continents, fostering connectivity and enhancing global trade. Moreover, China has made significant investments in emerging technologies, including artificial intelligence, renewable energy, and space exploration, positioning itself as a formidable player in the Fourth Industrial Revolution.

Challenges and Opportunities for the UIIC Countries

While the UIIC countries collectively represent a significant portion of the world's population, they also face unique challenges and opportunities:

Managing Urbanization and Infrastructure: As these countries continue to experience population growth and rapid urbanization, managing sustainable infrastructure development becomes paramount. Balancing economic progress with environmental considerations and social stability poses a complex challenge that requires innovative solutions.

Healthcare and Social Welfare: With large populations comes the responsibility of providing adequate healthcare and social welfare services. Ensuring access to quality education, healthcare facilities, and social safety nets is essential to promote overall well-being and reduce disparities within these nations.

Technological Advancements: The UIIC countries are at the forefront of technological innovation and advancement. Embracing emerging technologies such as artificial intelligence, blockchain, renewable energy, and digital connectivity can drive economic growth, increase productivity, and improve the quality of life for their citizens.

Global Cooperation and Diplomacy: As influential nations, the UIIC countries play a vital role in global cooperation and diplomacy. Collaborative efforts in addressing global challenges such as climate change, cybersecurity, and economic inequality are essential for a sustainable and prosperous future.

Conclusion

The UIIC countries, comprising the United States, Indonesia, India, and China, collectively represent an astounding portion of the world's population and exert immense influence on the global stage. Each of these nations brings unique characteristics, challenges, and opportunities to the table, and understanding their significance and fostering cooperation among them can pave the way for a more prosperous and inclusive world. As these countries continue to evolve, their impact on global demographics, economy, and culture is set to be profound.

United States: As the third most populous country globally, the United States holds a prominent position in shaping the global landscape. Its democratic values, entrepreneurial spirit, and cultural diversity have made it a beacon of opportunity and innovation. The United States has long been at the forefront of scientific research, technological advancements, and economic prowess. It boasts some of the world's leading universities, research institutions, and corporations, driving breakthroughs in various fields, including healthcare, information technology, and renewable energy. Additionally, its robust entertainment industry has garnered a global following, exporting music, movies, and popular culture that resonate across borders.

Indonesia: With the fourth-largest population in the world, Indonesia is an archipelago nation that spans thousands of islands, each contributing to its rich cultural heritage. As a rising economic power in Southeast Asia, Indonesia's vibrant markets and burgeoning middle class present significant opportunities for both domestic and international businesses. The country's young and dynamic workforce, coupled with its vast natural resources, make it an attractive destination for foreign investments. However, Indonesia faces challenges in infrastructure development, poverty alleviation, and maintaining environmental sustainability. By addressing these issues and promoting inclusive growth, Indonesia can harness its potential and become an even stronger player in the global economy.

India: As the world's second-most populous country, India's cultural diversity, ancient history, and rapid development make it a force to be reckoned with. India's large and youthful population has propelled it to become one of the fastest-growing major economies. The country has embraced information technology and services, with cities like Bangalore emerging as global technology hubs. India's robust startup ecosystem has given rise to innovative solutions in various sectors, including fintech, e-commerce, and healthcare. However, India grapples with challenges such as poverty, infrastructure gaps, and social inequalities. By addressing these issues, investing in education, and leveraging its demographic dividend, India can chart a course towards sustainable and inclusive development.

China: With the world's largest population, China's rise as a global economic powerhouse has been nothing short of remarkable. Over the past few decades, China has experienced unprecedented economic growth, lifting hundreds of millions of people out of poverty. Its manufacturing capabilities, infrastructure development projects, and investments in technology have made it a major player in the global market. China's Belt and Road Initiative, an ambitious infrastructure program, aims to enhance connectivity and promote economic cooperation across continents. The nation's commitment to research and development has propelled it to the forefront of emerging technologies, such as artificial intelligence and renewable energy. However, China faces challenges related to environmental degradation, social inequality, and human rights concerns. Addressing these challenges while continuing to foster innovation and sustainable development will shape China's role in the global community.

The significance of the UIIC countries extends beyond their sheer population size. Their collective influence spans across various domains, including trade, politics, culture, and technological advancements. Cooperation among these nations can drive progress in addressing global challenges such as climate change, cybersecurity, and economic inequality. By sharing best practices, collaborating on research and development, and promoting cultural exchange, the UIIC countries can foster a more interconnected and harmonious world.

Furthermore, the UIIC countries' impact on global demographics cannot be overstated. Their population dynamics, urbanization patterns, and social trends shape global migration, labor markets, and cultural exchanges. As these countries continue to evolve, their demographic shifts will have ripple effects on regional and global economies, healthcare systems, and social welfare policies.

In terms of the global economy, the UIIC countries serve as major engines of growth and consumption. Their domestic markets and investments influence industries ranging from technology and finance to manufacturing and entertainment. Moreover, their economic policies, trade agreements, and geopolitical relations have far-reaching implications for global trade and financial stability.

Culturally, the UIIC countries contribute to the world's cultural tapestry through their arts, languages, cuisines, and traditions. Their vibrant cultures and diverse populations enrich global cultural exchanges, promoting understanding, tolerance, and appreciation of different perspectives.

In conclusion, the UIIC countries - the United States, Indonesia, India, and China - collectively represent half of the world's population and play a pivotal role in shaping the global landscape. Their unique characteristics, challenges, and opportunities present a rich tapestry of potential for collaboration and progress. By understanding their significance, fostering cooperation, and addressing shared challenges, we can work towards a more prosperous, inclusive, and interconnected world. The impact of the UIIC countries on global demographics, economy, and culture will undoubtedly be profound as they continue to evolve and shape the future of our interconnected world.

#UIIC countries population size#Significance of UIIC nations#UIIC countries' impact on global demographics#United States population and influence#Indonesia's rising economic power in Southeast Asia#India's rapid development and diverse population#China's role as a global giant#Challenges and opportunities for UIIC nations#Cooperation among UIIC countries#UIIC countries shaping the global landscape#United States and its cultural diversity#Indonesia's potential for economic growth#India's demographic dividend#China's manufacturing capabilities and infrastructure development#UIIC countries' impact on global trade#United States' technological advancements#Indonesia's middle class and market opportunities#India's IT and services sector growth#China's investments in emerging technologies#Sustainable development in UIIC countries#UIIC countries' role in global cooperation and diplomacy#Urbanization and infrastructure challenges in UIIC nations#Healthcare and social welfare in UIIC countries#Technological advancements in UIIC nations#Global cooperation for a prosperous future#UIIC countries' influence on global culture#Inclusive growth in UIIC nations#UIIC countries' impact on global economy#Cultural exchanges among UIIC nations#Demographic shifts and global implications of UIIC countries

0 notes

Text

India pips China in World Population – What’s Next?

The hungry world cannot be fed until and unless the growth of its resources and the growth of its population come into balance. Each man and woman-and each nation-must make decisions of conscience and policy in the face of this great problem. – Lyndon B. Johnson

Last year 2022, world population has crossed the eight billion mark. The rate of population growth is slowing down and the next billion…

View On WordPress

#Ageing Population#China Population#Demographic Dividends#Economic Dividends#Family System#Globalisation#Human Resources#India Population#World Population

1 note

·

View note

Text

Indian media's collapse has meant that serious issues such as unemployment do not get the attention they deserve. Joblessness is not framed as a question of political accountability but is couched in technocratic language and buried in a maze of data and conflicting claims. Those who intruded into parliament reportedly told the police they were upset about high rates of unemployment. Youth unemployment in India is at around a staggering 23 percent, the highest for any major global economy and nearly double that of neighbouring Pakistan and Bangladesh. For graduates under 25, a report by the Azim Premji University estimates, this number rises to 42 percent. IT firms such as Infosys, Tata Consultancy Services and Wipro have announced they will reduce the hiring of engineering graduates by 30 percent-reducing it by 40 percent from the prestigious Indian Institutes of Technology-leaving thousands of freshly graduated students without jobs. Since the onset of the 2022 funding winter, 34,785 employees have been laid off by just 121 Indian startups, with 15,247 of them fired by 69 Indian startups so far this year. An improvement is unlikely. Pranjul Bhandari, the chief India economist at Hongkong and Shanghai Banking Corporation, estimates that while India will need to create 70 million jobs over the next decade, it will only end up with 24 million. Put simply, India's demographic dividend has turned into a demographic disaster.

Sushant Singh, ‘Fire and Smoke’, Caravan

#Caravan#Sushant Singh#Pranjul Bhandari#HSBC#India#Indian startups#Wipro#TCS#Infosys#IIT#Azim Premji University#Joblessness

163 notes

·

View notes

Text

i love how the self-titled Effective Altruists and cuntbags like musk believe that the “demographic crisis” of the 21st century is like a massive insane problem that we need to solve by farting out babies 24/7, as they said in that recent Kurzgesagt propaganda video they produced

it is capitalism that’s the problem, again. growth for the sake of growth is the ideology of a cancer cell. we ‘grow’ when we produce more, and our investments are based around potential growths rather than what is needed - so when alleged ‘potential’ can’t materialise, the economy collapses

we will be able to produce less when there will be less workers. future spacex neuralink hyperloop tech might soften the blow but won’t be able to change that fact

this is coming towards capitalism like a high-speed train. most executives are essentially wagies visàvis their positions as gods of the world, so systemically cannot respond to a problem more than twenty years ahead of time. but oligarchs like musk and formerly bankman-fried, with their oligarchic status seemingly made permanent (lol), become weird nutters who’ve given themselves messiah complexes about “solving” it. we must increase production always at all costs, so we must increase babies at all costs

growth for the sake of growth is the ideology of a cancer cell. the economy is going to shrink and we must not let this cause a world-eating depression under capitalism. we have to accept that we’re peaking, stop investing resources into growth and start investing resources into efficiency, systemic resilience, and services, and drop dead-weight unsustainable overproduction that’s killing the planet. stop even trying to grow the economy during a period of global decline - the global Very Long Boom and global Baby Boom gave a economic dividend that must be repaid

socialistic economics, redistribution, and economic democracy can let this pressure. we have to do managed decline, work towards working better with less workers and less labour, and support untold masses of pensioners. capitalism simply cannot do this. if under capitalism the economy was recessing massively, but don’t worry, in many years the ageing recession will cease and growth should resume with stability - investment simply will not go towards what is needed to improve life under the status quo and will be hedged until growth resumes, and so nothing good will ever come

that’s why the so-called “effective altruists” and muskists are so bothered about preventing what they see as demographic collapse - should it occur it’ll wreak a huge economic recession, be it slow or as a crash, and lead to a world of impoverished pensioners starving on the street. so their solution is babies at all costs, when instead we could have a world where a period of managed decline spurs reinvestment in what we have, a silver age of planet earth, a global new deal beyond measure. and when the massive wave of pensioners dies, we will have good services and sustainable economics, and enriched communities with fruitful childhoods and good educations, and yeah, we can use our growth potential to not just prevent environmental destruction (capitalism’ll’ve already triggered a lot) but do our level headed best to fix it, become the stewards of Earth that we’re abdicating ourselves as, and fuck it, have enough money to reshape the world into a happy and good place to live a life

but capitalism cannot do that. because capitalism cannot accept decline. because capitalism must have growth at any costs, and will continue to beat the dead horse until the skies darken with soot and until the baby boomers who built the longest boom are left to rot without care or food and their children are enslaved to keep the fires burning. and to bring back the boom times, it must be babies at any cost

footnote: this was mostly about economics but there’s one more angle that would’ve made a bit of a tangent. musk’s side of the coin has a massive, massive misogynistic basis. musk, the individual, is famously a total creep. people with breeding kinks can breathe a sigh of relief because he is not one of you - his is a breeding perversion. he has an obsession with creating as many of his own children as possible and subscribes to the belief that a Man’s worth can be measured with his spawn. and so many of his ilk believe the same. this is how he can have child after child despite obviously not caring for them and doing his duty as a parent - parenting ten children should basically be a full time job. it takes a village: this is a village. and i don’t mean to point fingers, but with his first wife he had a set of twins via ivf and then a set of triplets via ivf, and many more children later, including after the birth of the human person he calls “X Æ A-Xii”, he had a second child with Grimes via surrogacy. this worldview undoubtedly affects his everyday misogyny and transphobia - women’s utility is as utility, trans men do iRrEvErSiBlE dAmAgE to their mere utility, and trans women go against womanhood due to having no utility. he abandoned his own fucking daughter for being trans. creepy, disgusting, indefensible - and this man is one of the gods of our world, enacting his poisonous worldview without oversight

and ragging on cunts like musk isn’t letting the ““effective altruists”” off the hook. their circles, as organisations or just general society, has an oft-reported massive sexism problem. multiple EA members have been accused of creating a toxic atmosphere hostile to women, of sexual misconduct, and of grooming with intention to form poly relationships. an ideology of reducing humans to utility, of stressing population growth, and of getting ants in your pants about demographic crisis does not combine well with latent misogyny and the patriarchal, male near-exclusive echelons of capitalism

34 notes

·

View notes

Photo

India overtakes China to become world’s most populous country (Hannah Ellis-Petersen, The Guardian, April 24 2023)

“It is also the first time since 1950, when the UN first began keeping global population records, that China has been knocked off the top spot.

China’s population decline follows decades of strict laws to bring the country’s booming birthrate under control, including the introduction of a one-child policy in the 1980s.

This included fines for having extra children, forced abortions and sterilisations.

While initially highly effective in controlling the population, these policies became a victim of their own success, and the country is now grappling with an ageing population in steep decline, which could have severe economic implications.

Part of the problem is that because of a traditional preference for boys, the one-child policy led to a massive gender imbalance.

Men now outnumber women by about 32 million. “How can the country now shore up birth rates, with millions of missing women?” asks Mei Fong, the author of One Child, a book about the impact of the policy.

Recent policies introduced in China trying to incentivise women to have more children have done little to stimulate population growth.

Women still have only 1.2 children and the population is expected to fall by almost 10% in the next two decades.

According to projections, the size of the Chinese population could drop below 1 billion before the end of the century.

In India, the population has grown by more than a billion since 1950. Though growth has now slowed, the number of people in the country is still expected to continue to rise for the next few decades, hitting its peak of 1.7 billion by 2064. (…)

India’s demography is far from uniform across the country.

One third of predicted population growth over the next decade will come from just two states, Bihar and Uttar Pradesh, in the north of the country, which are some of India’s poorest and most agricultural states.

Uttar Pradesh alone already has a population of about 235 million, bigger than Nigeria or Brazil.

Meanwhile states in India’s south, which is more prosperous and has far higher rates of literacy, population rates have already stabilised and have begun to fall.

In the next decade, states in the southern states such as Kerala and Tamil Nadu are likely to start grappling with an ageing population, and by 2025, one in five people in Kerala will be over 60.

The divide in population growth between India’s north and south could also have political implications.

After 2026, India’s electoral lines are due to be revised and redrawn based on census data, in particular relating to the number of people in constituencies.

Many politicians in southern states have expressed concern that their successes in bringing down population numbers, through education programmes, family planning and high literacy, could result in a reduction in their political representation in parliament, and a further political domination of the northern states that continue to have a population boom.

Currently the average age in India is just 29, and the country will continue to have a largely youthful population for the next two decades.

A similar “demographic dividend” proved highly useful in China, leading to an economic boom, particularly in manufacturing.

While India has one of the world’s fastest-growing economies in the world, and recently overtook the UK as the fifth-largest, experts have stressed that the country needs more investment in education and employment to seize the opportunity presented by a young population over the next few decades.

India continues to struggle with high youth unemployment and less than 50% of working-age Indians are in the workforce.

The figure for women is even lower, with just 20% of women participating in the formal labour market, a figure that is decreasing as India develops.”

71 notes

·

View notes

Note

The poin is, can Lewis climb again? we have seen the greats like Schumacher and Vettel having their high, and after that, there isn't much left.

Another thing that had me thinking today, the rumors about how much Merc offer Max, if it's true, shows that their relationship with Hamilton was in bad water for quite some time, because they didn't accept his demand, not for lack of money, it was simply because they did not want

The package they are said to be offering Max is insane. €150m per year…and then ambassadorship when he’s done? Mad. Honestly that is unbelievable considering how long Lewis was with the team and how it was largely him that made the brand recognisable in F1.

I’m semi confused how Max fits their demographic in terms of brand identity, just like I’m unsure how Lewis fits Ferrari’s, but I suppose you sign ambassadors to reach new customers.

If Max signs a deal like that, that is a bit of a middle finger to Lewis from them because Max would essentially be stepping into the contract that Lewis wrote the blueprint for and was told no. I would love to know what happened at Merc that made them think Lewis was not worth that money. Apparently the three Merc shareholders will be present at that meeting with Max, and if that’s true I guess part of that €150m will be dividends from an equity share in the company. Wild.

Can Lewis climb again? Depends if there’s a climb to make. Some people think he’s just as good as he always was and he just needs the car, if that’s true then it’s just rolling the dice to see if the car materialises. But also, he’s been doing this a long time and I’m sure there’s a mental and physical fatigue that comes with that. If he gets the car, is he going be able to keep Charles at bay over a season? That’s the €200m question

6 notes

·

View notes

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.

6. Risk Management: Assess and manage risks effectively by diversifying your investment portfolio, conducting thorough due diligence, and implementing risk mitigation strategies. Consider geopolitical risks, currency fluctuations, regulatory changes, and market volatility when making investment decisions.

7. Sustainability and ESG Factors: Consider environmental, social, and governance (ESG) factors when evaluating investment opportunities in India. Increasingly, investors are prioritizing sustainability and responsible investing practices to mitigate risks, enhance long-term value, and align investments with their values and principles.

8. Stay Flexible and Agile: Remain flexible and agile in adapting to changing market conditions, regulatory requirements, and investor preferences. India's business environment is dynamic and evolving, requiring investors to stay nimble and responsive to emerging opportunities and challenges.

India offers a wealth of investment opportunities for international investors seeking high growth potential and diversification benefits. With its robust economy, favorable demographic trends, and supportive regulatory environment, India continues to attract capital inflows across various sectors. By understanding the Indian investment landscape, adopting sound investment strategies, and leveraging local expertise, international investors can capitalize on India's growth story and unlock significant value for their investment portfolios. As India continues on its path of economic development and reform, it remains a compelling destination for investors looking to participate in one of the world's most dynamic and promising markets.

In conclusion, navigating the “Invest in India” landscape requires careful planning, strategic decision-making, and a long-term perspective. By understanding the key sectors, regulatory considerations, investment strategies, and tips outlined in this guide, international investors can position themselves to capitalize on the vast opportunities offered by India's vibrant economy and emerging market dynamics. With the right approach and guidance, investing in India can yield attractive returns and contribute to portfolio diversification and long-term wealth creation for investors around the globe.

This post was originally published on: Foxnangel

#regulatory environment#international investors#investment opportunities#investment ideas#india's economy#startup india#investing in India#investment opportunities in india#investments in india#foxnangel

3 notes

·

View notes

Text

“I suggest trusting your discomfort, because you clearly feel it. But discomfort is a wonderful motivator,” he advised. “Action is the antidote to anxiety. And if you feel anxiety, it will lessen as you take action. Small actions, like a little bit every day. Honestly, that discomfort will spur you on. I am sure of it and your generation.”

[IMAGE ID: Screen shots of an essay that read as follows:

In this particular clip, an audience member told Stewart she thinks a lot of people her age (she’s 22), are “not happy with the choice of candidates we have in November.” She went on to explain, “We feel like our vote, our voice doesn’t matter.”

We here at Steady have discussed the importance of the youth vote and young people’s dissatisfaction with their choices in November. What we haven’t delved into is her second point: that members of Gen Z do not believe their voices are being heard.

Stewart emphatically told her that her voice counts. “Oh, it so matters,” he assured her. “Advertisers look at demographics, but the largest demographic that they look at is 18-24. That’s the one that means everything to them — use that power. I’m 61, I’m not even listed anymore. Don’t discount the power that you guys have. This is the fight. No generation ever feels empowered, or seen, or any of those things.”

I think Stewart hit the proverbial nail, hard.

It’s understandable that a group of people new to the voting rolls might not recognize their political clout. Gen Z is not a monolith — no voting bloc is — but one thing its members do have in common is a naivete about the power they can wield. They will decide one of the most important elections in our history, if they vote. And on the issues most important to them — the economy, climate change, gun control, and abortion — they are more closely aligned with President Biden than Donald Trump. But they have to be assured, convinced that their vote will make a difference. That is a tall order when they get most of their news from doom scrolling on social media.

So Stewart met them where they are, leaning into rather than discounting the malaise that many are feeling.

“I suggest trusting your discomfort, because you clearly feel it. But discomfort is a wonderful motivator,” he advised. “Action is the antidote to anxiety. And if you feel anxiety, it will lessen as you take action. Small actions, like a little bit every day. Honestly, that discomfort will spur you on. I am sure of it and your generation.”

Great advice, and I couldn’t agree more. Small actions can yield big dividends. Encourage the young people you know to register to vote, learn where candidates stand on issues, volunteer at a local food bank … anything that will engage this new generation of voters and show them that their votes and their voices can and will make a difference. Democracy depends on it. [end ID]

4 notes

·

View notes

Text

Be Part Of Our Nation’s Growth - Enable an NGO Working For Skill Development

A nation’s evolution depends significantly on developing its youth and women. A country requires proper training and skill development mechanisms so that its people can leverage their potential and positively impact the nation’s economy. India has a pool of bright youth and women compared to other countries where the working population is diminishing day by day. The median age of India’s population is twenty-eight years, which denotes that we have much to gain as a younger workforce implies accelerated economic growth and development in various spheres.

However, India faces many challenges when it comes to skill development and needs to catch up. Women’s participation in our country’s workforce has been below adequate levels for many decades. We can not reap the benefits of our demographic dividend in its entirety if we do not strive to bridge this gap at the earliest.

Let us delve into why skill development is so crucial, what challenges the Indian population faces in their skill development, and how an NGO working for skill development can make a massive difference in this endeavor.

The Significance of Skill Development for a Nation

Skill development refers to the process of enhancing existing skills or acquiring new ones. Skill development enables people to become more employable and gain a competitive edge in the job market.

Through various training and certification programs, youth can develop their skills as required by the job arena. One can opt for apprenticeships, on-the-job training, formal schooling, or vocational training to gain skills.

Makes you more competitive and improves income - Employers need employees who are up-to-date with the latest skills, and one needs to change with changes in market trends. So, people need to upgrade their skills to stay ahead of the competition. If you have modernized skills, you have better chances of landing a job with high pay.

Bridges the gap between education qualification and job requirements - In most cases, there is a considerable gap between the knowledge that educational institutes impart and what an industry needs. Skill development aims to bridge this gap and make youth better equipped to handle jobs.

Makes a person independent - As one goes on gaining skills and upgrading themselves, they get opportunities to become entrepreneurs and launch their own firms, which in turn boosts the economy. Entrepreneurship and self-employment are rising trends, and skill development is crucial in letting people have the ability to achieve these dreams.

Facilitates occupation changes - People can change their professions numerous times during their lives in today’s competitive job market by improving their skills. Once you learn new abilities and information through skill development programs, you can change your job paths as and when needed.

Facilitates social mobility - Youth from any background can move up the social ladder with the help of skill development as it gives them equal opportunities to compete in the job arena.

Helps a developing nation compete with developed countries - The current era is for the skilled, and a country can only hope to compete with other developed nations with a skilled workforce. Sadly, our education system has not yet evolved and keeps churning out unemployable graduates.

The Current Scenario in India’s Skill Development

As per a report, a developing economy like India needs approximately 103 million skilled workers.

Contrary to this requirement, more than thirty percent of youth and women (around a hundred million) between fifteen and twenty-nine years of age are not employed or in any education or training programs (NEET).

Amongst the unemployed hundred million, more than eighty percent are young women. Though there has been a rise in the number of women receiving vocational training over the years, it is still much less than men (less than half.)

A report in 2015 on the National Policy on Skill Development and Entrepreneurship revealed that only 4.7 percent of the entire workforce of India received formal skill training, while that in the USA was fifty-two percent and in South Korea was ninety-six percent.

NSDC (National Skill Development Corporation) did a study on the skill gap, which showed that India needs an additional 10.97 crore skilled manpower in twenty-four key industry sectors by 2022. Also, around 29.82 crore workforce in farm and nonfarm areas must be reskilled or up-skilled.

Challenges Around Skill Development

The challenges that India faces in making women participate in the labor force are multifaceted. Though the government takes measures to ensure higher rates of enrolment in primary, secondary, and higher education for women and curb dropout rates, there is a vast number of women who hold degrees but are not employed.

Social and cultural hindrances - The number of women holding degrees but being unemployed points to the fact that literacy alone can not ensure employment. Women face many social, cultural, and historical barriers that must be addressed. To worsen the situation, the women who enter the workforce experience gender bias that puts them in a disadvantageous position against men. Women are also expected to perform unpaid domestic work and care, which hinders them from working in the formal workforce.

Responsibility overburden - The government’s skill development initiative “Pradhan Mantri Kaushal Vikas Yojna” launched its Phase III in 2020-21 with an aim to provide skill development programs to more than eight lakh Indians. However, this initiative depends heavily on District Skills Development Committees (DSC). The DSCs are chaired by the district collectors who have many other responsibilities, and skill development does not get the priority that it needs.

Massive increase in number of new entrants - As per NSDC, more than seven crore new people between fifteen and fifty-nine years of age are going to enter the labor force by 2023. This sheer number of people who need skill development needs adequate policy efforts in place.

Discontinuity of policy processes - In 2013, NSDA (National Skill Development Agency) was established to handle issues of inter-departmental and inter-ministerial problems. However, NCVT is now part of NSCT (National Council for Vocational Training), which reflects a break in the policy process and also a lack of clarity on the part of policymakers.

Employers’ reluctance - The joblessness issue in India is not just because of a lack of skills but also due to SMEs' and industrialists' reluctance to recruit. Due to banks’ NPAs (Performing Assets), there is less credit availability, resulting in a decline in investment rates. This eventually impacts the creation of new jobs.

NGOs Enhance the Skill Development Progress

NGOs' strength lies in their community-focused approach, where they reach out to the majority of people living in dispersal rural or cut-off zones to provide aid to victims and facilitate social restorations.

NGOs work at lower costs - NGOs are capable of mobilizing and reaching poor and remote communities and empowering poor people to gain control of their lives by working with local institutions and strengthening them. They are also more efficient than government agencies and carry out projects at lower costs for sustainable development. NGO mantra is a social awakening that includes legal literacy.

Mobilization of youth - NGOs use various mobilization tools such as meeting with communities at night, door-to-door contacts, meeting with parents, social media advertising, etc., to reach out to the youth and propagate the activities of SEDI (Skill and Entrepreneurship Development Institutes).

Scan skills - NGOs scan local industries to find out skills they require in different areas and upgrade syllabi to make youth employable after schooling. This method ensures youths find jobs locally in regional businesses.

On-the-job training - By facilitating workplace experiences and on-the-job training, NGOs acquaint the students with the realities of the world, which prepares them for employment.

Build Strength of an NGO Working For Skill Development

Skill development needs significant contributions from both the public and private sectors, along with help from educational institutions. The government alone can not meet the needs of the humongous population of unemployed youth and women in India.

Hence, NGOs like Search NGO have taken it upon themselves to reduce inequality in poor households by equipping them with skills needed for generating employment. Donating to NGOs that support skill development will build employable skills in the youth and women of India and bridge the wide gap that exists currently.

2 notes

·

View notes

Text

India as an Emerging Power: Challenges and Prospects- Part 2

Table of contents

• India's Role in the Global Economy

• Political Landscape and Foreign Relations

• Conclusion

India's Role in the Global Economy

Move over, world! India is stepping onto the global stage and ready to strut its stuff. With a rising middle class and a consumer market that is hotter than a summer day in Delhi, India is a force to be reckoned with.

But it's not just about shopping and spending. India is also making waves in the tech and start-up scene. Move aside Silicon Valley, Bengaluru is where the real innovation is happening. With a boom in technology and entrepreneurship, India is churning out bright minds and game-changing ideas faster than you can say "unicorn startup".

And let's not forget about outsourcing and the service sector. It may not sound glamorous, but it's a key player in India's economic growth. From call centers to IT services, India is the go-to destination for businesses looking for affordable talent and quality work. We've got all your customer service needs covered, with a side of chai.

So next time you're sipping on your morning coffee and using a fancy new app. remember that it might just be powered by India. We're not just the land of yoga and curry, we're shaping the global economy one billion-strong population at a time. So, buckle up world, because India is ready to take center stage. And trust me, you don't want to miss the show.

Political Landscape and Foreign Relations

India's political landscape is as diverse as it comes. With a proud tradition of democracy and a population that could easily create a football team, India's political scene is truly a sight to behold. It's a lot like going to a potluck dinner, where you get a little taste of everything.

One of the key pillars of India's political system is its democracy. Unlike some countries where leaders are chosen based on their ability to wave a flag, India prides itself on giving everyone a say in who gets to run the show. It's like a reality TV show, but with less drama and more debating.

But it's not all sunshine and rainbows. India also has its fair share of security concerns, especially when it comes to nuclear power. With great power comes great responsibility, and India knows that all too well. It's like having a pet tiger in your backyard - you have to make sure it doesn't get out and create mischief.

In addition to domestic issues, India also has to navigate the complexities of regional and international alliances. It's like trying to juggle multiple relationships at once. Sometimes you have to choose between attending your friend's wedding and going to your cousin's birthday party. It's a delicate balancing act, and India is the ultimate multitasker.

So, when it comes to India's political landscape and foreign relations, it's a colorful tapestry of democracy, security concerns, and international alliances. It's like a Bollywood movie - full of drama, action, and a few dance numbers thrown in for good measure. India is a protagonist in its own right, navigating its way through a complex web of challenges and opportunities. Buckle up, folks, because this is one rollercoaster ride you won't want to miss.

Conclusion

India, with its immense potential on the global stage, faces a multitude of challenges, Overpopulation and the management of resources pose significant hurdles. Social Inequality and poverty hinder progress and innovation. Corruption and bureaucracy add an extra layer of complexity. However, India also has promising prospects. The demographic dividend, coupled with investment in infrastructure, can fuel growth. Moreover, India's expanding global influence is a positive sign. In terms of the global economy, India's rising middle class and booming tech and start-up scene, along with its service sector, play a pivotal role. Politically, India's democracy and diversity, nuclear power, and regional and international alliances shape its position. In conclusion, India's journey as an emerging power presents both challenges and opportunities that need to be navigated strategically.

2 notes

·

View notes

Text

Day 540 of telling people to Have More Babies, The Pending Doomsday of Retirement!

Day 540 of telling people to Have More Babies, The Pending Doomsday of Retirement!

Photo by shutter_speed on Pexels.com

The Problem

The Developed world and even some parts of the Developing world are facing the largest ever demographic change in history. The combination of increasing life expectancies due to improvements of hygiene and in our diets, coupled with the issue of low fertility rates (approximately the total number of children born to each woman) being way below…

View On WordPress

#Ageing Population#America#APAC#ASEAN#Australia#Canada#Childcare#China#Civilization#Civilization is going to crumble#Climate Change#DCs#Demographic Collapse#Demographic Dividend#Developed Countries#Developing Countries#Doomsday#East Asia#Economics#Elderly#Elon Musk#Europe#European Union#Far East#Fertility#Fertility Rate#France#Germany#Global#Have more babies

0 notes

Text

This revolutionary transition came as a considerable shock to conservatives within the regime and Khatami’s administration was blamed. Supreme Leader Ayatollah Khamenei denounced “the negative aspects of the Western life style” and with the election of Mahmoud Ahmadinejad as president, the biopolitical stance of the regime abruptly pivoted. Ahmadinejad pilloried family planning as a Western conspiracy and in 2010 he rolled out a program of lavish subsidies for large Iranian families. Ayatollah Ali Khamenei now denounced his governments’ previous population control measures as a “mistake.” In a dramatic declaration of responsibility in 2012 he declared: “Government officials were wrong on this matter, and I, too, had a part. . . . May God and history forgive us.” In 2014 Iran ended free contraception and passed legislation to prohibit vasectomies, enable younger marriages for women, subsidize additional births and curtailed Iran’s unusually progressive pre-marriage education program. It was as part of this same package that women students were also excluded from some professional university majors.

Having unleashed a genuine social revolution, the regime has tried for the last decade to vainly stem the tide. The idea of reversing the demographic transition is most likely hopelessly unrealistic. The most that the regime can presumably hope for is to hold the birth rate above 2 children per woman as opposed to East Asia’s plunge to 1.6. In any event, most credible predictions see Iran’s population stabilizing around 90 million. For the foreseeable future, Teheran would presumably be best-advised to make all it can of the demographic dividend, which the governments of the 1990s and the early 2000s have bestowed on it.

8 notes

·

View notes

Note

tumblr(.)com/rametarin/680819598272151552/speaking-as-a-man-and-not-as-a-collectivist "We are not contributing to the social welfare system equally, and we’re not equally serviced by it, despite men contributing more to it." Women and people of color are disproportionately poor and social welfare disproportionately goes to poor people. It's not MEN paying more in taxes and not getting anything out of it, but WHITE MEN who earn more and have to give it up for welfare for women and minorities.

Objectively it is men paying more in taxes and when white men that are not upper-middle class or rich need those services, being told they're the wrong demographic to benefit from it by the people that claim they have interest in helping the por. Because the people distributing the help don't care about your poverty, they care about your demographics poverty. They don't care about the poor unless they're the right kind of poor. And that's just deciding what demographics you favor versus the ones you don't.

That isn't helping the poor, that's helping your chosen tribe based on the needs of your chosen tribe. Delineating the help by demographics is also denying help by demographics. If you are an upper middle class person or wealthy, you don't feel this pinch or lack of access to the social safety net. If you are poor and of that "rich and privileged" demographic, you're expected to contribute to the pot based on your demographic without the presumed benefits inherent to said demographic.

Choosing to discriminate because "more of those people have more to give" is still demographic discrimination, and it underlines just how arbitrary and tribalistic this way of deciding whom contributes and whom doesn't is political in nature and just geared to try and make class into a bunch of tribes that will band together and argue for their own interests at the expense of others. You aren't equalizing anything, you're just choosing what discrimination is fair and acceptable while claiming to be fighting against it with your shitty policies.

At the same time encouraging people on the basis of their race or sex to come together collectively to petition on behalf of themselves as a group on the basis of civil rights- for their class, they delegitimize the entire idea of a white group or a male group, much less a white male group, on the basis that such a thing would be, "racist." One set of not just standards and expectations socially for one group, but LAWS, and one set for another. No matter how you mental gymnast this, you're choosing to say it's okay to treat someone as a paypig based on their race, sex, orientation and gender identity. "Because they have things and there's a lot of them."

So cry me a river if I say social services should disentangle itself from demographics if it wishes to say it cares about poverty at all. Despite men and a woman needing an education equally, the female would have a whole treasure trove of free shit like scholarships and endowments just to get them into college enrollment. Whereas lacking those things, I might mercenarily CHOOSE to get an apprenticeship or trade that would offer high dividends, but receive no help from society in doing so.

2 notes

·

View notes

Text

During the 1980s, as China plotted its way toward national recovery and strength following years of political and economic chaos under former leader Mao Zedong, it benefitted from a historically rare and golden combination of smart reform moves and profoundly lucky timing.

Even before Deng Xiaoping’s anointment in 1980 and 1981, Mao’s hand-chosen (and now largely forgotten) immediate successor, Hua Guofeng, began experimenting with ways to loosen the state’s stranglehold on the economy, which had long banned private enterprise and markets and relied instead on central planning for virtually everything that China produced.

Deng subsequently received almost all the credit for China’s extraordinary takeoff in the second half of the decade, even though much younger officials—such as Hu Yaobang, who was chairman and later general secretary of the Communist Party, and especially Zhao Ziyang, the country’s premier in the pre-Tiananmen Square massacre years—oversaw the generation and implementation of this new economic thinking.

To a far greater extent than many experts recognize even today, the ideas that these men carried out came from abroad, as economist Julian Gewirtz documented in his recent account of the country’s reform era: Never Turn Back: China and the Forbidden History of the 1980s. Chinese officials consulted with Eastern European economists who were involved in plotting their own countries’ way out of state-dominated markets, and they scrupulously studied the successes of nearby Asian countries, such as Japan and Singapore.

To their credit, instead of trying to reinvent the wheel, they overcame a powerful bias that has long existed in Chinese society of insisting on putatively native solutions to China’s problems by drawing on foreign ideas. This allowed them to quickly throw open the doors of their recently autarkic country to the international economy and radically reorient its strategy to one based on manufacturing for export.

Here, the first in a long string of lucky strokes came with changing tides in international relations. Japan, eager to find ways of sustaining its own then-fast economic growth, provided substantial help to China by extending loans, investment, technology, and advice to its neighbor. And the United States, seeking an edge in its Cold War competition with the Soviet Union, helped usher in a period of warmer relations with China, allowing the World Bank to play a major role in the reforms and welcoming large numbers of Chinese students who were heavily concentrated in economically relevant areas like science and technology.

Another great source of good fortune for China at this very moment was its shifting demographics. The country was entering into what population experts call a “demographic dividend,” a situation when the number of working age people, and especially those skewed toward the younger end of this range, is high compared to the dependent population, meaning children and older adults.

These young workers eagerly poured into China’s factories, first in the so-called special economic zones, such as Shenzhen and Zhuhai, that were rolled out during the Deng-era reforms and then onto shop floors throughout China as the country rapidly industrialized and became known as the world’s factory.

As this happened, China began to reap bigger and bigger trade surpluses and invested enormously in infrastructure. This term is usually understood as physically tangible things, such as rail and road projects, subways, ports, and fancy air travel facilities—all of which the country began to roll out in astonishing quantities. Yet that provides a too narrow sense of what infrastructure meant to China’s rise in the reform era.

Infrastructure was also understood to include a human dimension, and China began investing in upgrading its population as much as it did in physical things. The numbers of university graduates began to soar, with a particular focus on engineering and science. Crucially, education for women opened dramatically too, and in time, the workplace and career worlds largely followed.

With this mixture of good moves and good fortune, many scholars around the world—and in China—gradually came to see the country as a virtually unstoppable force economically, rising decade after decade almost as if without resistance. Over a three-decade period starting in 1990, China’s real GDP per capita increased nearly tenfold while urban wages quadrupled.

In a remarkably short period of time, however, that widely held sentiment has dramatically shifted, just as the country’s growth rates have downshifted more sharply after several years of steady, more moderate decline. In fact, things have now reached the point where some observers, myself included, are predicting that the world’s most populous country will not manage to claim, or at least hold for long, the title of world’s largest economy.

As the Chinese Communist Party opens its high-level Party Congress this week to consecrate Chinese President Xi Jinping as leader for a precedent-breaking third term, beneath the carefully polished surface of ritualized praise and approval, many of the offstage conversations will be about how to restore the country’s economic momentum.

As I have taught my students for years, many of the seeds of China’s present and future difficulties were planted in the early, most striking phase of the country’s takeoff. Beijing did not muster the wherewithal for the investments that drove its years of rapid growth through export surpluses alone. An equally vital but little-known tool of the state was something called “financial repression.”

To understand this requires stripping away from the word “repression” its usual political connotations and reimagining the phrase in purely economic terms. Used here, what it means is that China made it difficult for its citizens to consume. This was accomplished by keeping the interest rates that banks pay depositors artificially low, limiting access to foreign exchanges or personal investments outside of the country and slow-walking reforms to the domestic stock market that could make it more transparent and globalized and less like a casino run by powerful insiders.

Even as they grew richer and richer, these limitations left most Chinese citizens with only two choices for what to do with their money. They could place it in bank accounts that paid little, allowing the state to use the capital cheaply for its own purposes. Or they could invest in the only vehicle that seemed to offer them a big upside: real estate. That they did both of these things in huge numbers explains a lot about the country’s present predicament.

The Chinese state used its access to enormous national savings to pursue an investment-driven approach to economic growth, with the state making strategic decisions about which companies and sectors to back in a process it hoped would produce so-called national champions—that is, domestically dominant companies. This was seen as a necessary first step toward creating world-beating corporations that could roll out globally powerful brands, of which China so far has surprisingly few.

Citizens, meanwhile, poured whatever funds they could into real estate, taking the rosy but unrealistic view that in a rapidly urbanizing country with so many people, property values could only go in one direction: up. Today, as a result, the property sector accounts for an astonishing 20 percent to 30 percent of all economic activity in the country.

As careful observers began to note long ago, however, the investment-driven approach to sustaining growth, which worked so well (and so quickly) in the early years, soon revealed its innate limitations. Over the years, China has had to spend more and more money to produce each new increment of investment-driven growth, and it has now reached the point where, by some accounts, it is investing more in this pursuit than any large country has in history. In the last decade, according to Michael Pettis, a nonresident senior fellow at the Carnegie Endowment for International Peace, Chinese investment has hovered between 40 percent and 50 percent of GDP each year, compared to a more typical global average of about 25 percent.

As an economic model, this costly strategy has crowded out consumption and engendered tremendous waste. This is best seen in officials’ continued addiction to big-ticket infrastructure projects—new highways, new high-speed trains, new subways even in already well-served areas—to sustain high levels of economic activity. Considerations of the long-term costs and benefits of many investments of this kind have been tossed out to keep propping up sagging topline GDP numbers and bolster the legitimacy of the country’s leadership.

For all of its past successes, this approach, in other words, has reached the end of its useful life span. Making matters worse, the state’s record of picking would-be corporate winners to back in what it deems to be the most strategically important sectors of the future has been mixed at best. With little success, China has poured untold billions of dollars into the passenger aircraft and microchip industries, for example, determined that Beijing must become a leader in these (and other) fields.

In the meantime, Chinese real estate, long seen by citizens as the best alternative for personal investment in a casino-like stock market, has come to look more and more like a Ponzi scheme. For decades, local governments in China have funded their operations by selling access to land and issuing permits to builders. But this has led to a bubble, with enormous quantities of housing stock and other real estate going unoccupied, creating unsustainable debts and a reversal of personal fortunes for the tens of millions of people who invested their savings so heavily in the sector.

This points to an additional crisis. The fact that people in China save more than in almost any other nation was once widely regarded as something of a cultural quirk. In reality, it is the result of insecurity about their financial futures based on the existence of a still nearly embryonic welfare state.

Chinese are both saving and investing in real estate for the day when they will have to finance their retirements and pay for the care of costly and incurable chronic conditions, such as diabetes and dementia, that proliferate with aging. They do so because the state, so eager to produce world-beating growth in recent decades, has put off the kinds of giant safety net investments that can provide more security.

Finally, this is all happening at a time when the population dynamics only recently so favorable to the country have grown starkly adverse. China’s population has begun aging with a speed and scale unmatched in history. Between 2012 and 2021, the country’s birth rate declined by a head-spinning 45 percent, meaning far fewer workers in the future to help pay for the retired and ill older adults of tomorrow.

This dramatic shift is only partly due to the so-called one-child policy, introduced nationwide in 1980 and only relaxed in 2016. It also reflects an unintended and seemingly unanticipated consequence that flowed from one of the country’s signal successes. By providing women access to education, the workplace, and careers in ever larger numbers during the reform era, the country enabled women to pursue fulfillment in both work and leisure, freeing millions of people from the traditionally confining role of motherhood.

Women in China have seized these opportunities with gusto, just as they have in other highly developed societies—with one crucial distinction. Shifts like these occurred in the West and in Japan and South Korea only after these societies had begun to reach a level of high per capita income. China, by this measure, is still relatively poor—and as I have previously written, this also will make the funding of so-called entitlements, meaning elder care and social security systems, much more difficult.

This leaves Xi and the rest of the Chinese Communist Party’s leadership in a considerable pickle. In all likelihood, China’s high growth era is over—or at least already ending. Human nature makes it difficult to change a formula that has worked well in the past. But China’s best way of sustaining economic competitiveness and modest growth in the future is by doing things that depart from old recipes and go strongly against its leaders’ usual instincts.

This means loosening up and relinquishing some control over people’s savings by abandoning financial repression as well as scaling back investment-driven growth and the costly efforts of picking winners that accompany it. A growing, classic guns-versus-butter dilemma means it may also require taking the foot off the pedal some in terms of the build-out of an ever larger and more costly national security state, which not only includes the ongoing rapid modernization of the world’s largest military but also its biggest and almost certainly most costly domestic security apparatus.

This would be difficult enough to imagine under any circumstances, but it is especially hard to do in a situation of increasingly direct rivalry with the United States. Unfortunately for China, like it or not, a stark reckoning with difficult choices like these is coming. The choice before the new Xi leadership team is whether to try to kick the can down the road—when the pain from overdue choices will be ever greater thanks to the population’s rapid aging—or whether a leader who seems to brook no criticism bites the bullet now.

2 notes

·

View notes