#dotcom bubble

Explore tagged Tumblr posts

Text

Crypto-bubble

A 2000-es Dotcom-lufi és a 2008-as gazdasági válság után úgy kell ez, mint a szar a zsebbe. Szabályozatlan kriptoderivatívák és állami felelősségvállalás, ha az amerikai demokrácia nem lenne rohadóban, akkor ez tényleg bebaszhat, hogy pár tucat szociopata elmondhassa, megbaszták a rendszert. Végülis, mi baj lehet belőle.

3 notes

·

View notes

Text

We're in the dotcom-bubble era of machine learning.

Its clearly the next big thing, but right now its being sold mostly on marketing and impossible promises. The con artists will have the floor fall out in not that long, but the researchers will continue developing the underlying technology until in 5-15 years it actually becomes useful and widely accepted and integrated into society.

Also, hard agree on the moral-panic side. Most of the hardcore anti machine learning stances stem from emotional responses to wildly misunderstood ideas about how machine learning actually works, how copyright law actually works, and a vague debate about what "real art" is or isn't. Instead of the actual debate about the economics of using computers to replace skilled labor on a mass scale, and how the only people who get to benefit are the already-ungodly-rich.

My hot take is that AI bears all of the hallmarks of an economic bubble but that anti-AI bears all of the hallmarks of a moral panic. I contain multitudes.

9K notes

·

View notes

Text

Un día como hoy (7 de noviembre) en la tecnología

El 7 de noviembre de 2000 el sitio web Pets.com cierra operaciones debido al colapso de la burbuja .com. la compañía había acrecentado su reconocimiento de marca a través de campañas de marketing pero debido a la mala planeación financiera y de negocios se fue a la quiebra. Asi como ésta empresa miles se fueron a la bancarrota alcanzando el pico más alto en el año 2000. Solo las más organizadas sobreviviron. #retrocomputingmx #dotcombubble

0 notes

Text

youtube

#Internet Underground#Josh Harris#Jupiter#pseudo#pseudo.com#Tanya Corrin#Quiet#dotcom#dotcom bubble#Y2K#internet#old web#Andy Warhol#Warhol#webcore#internetcore#We Live In Public#Luvvy#Luvvy the Clown#Gilligan's Island#Jess Zaino#Luke Simms#Youtube#video essay#podcast

0 notes

Text

Nasdaq giù! Attesa FED per JP Morgan rischio 'dotcom bubble'

Wall Street: Dow in rialzo, Nasdaq in calo. Aspettative per la Fed e AMD, mentre JP Morgan avverte di possibili rischi simili alla “dotcom bubble”. Il panorama dei mercati statunitensi è contrastante martedì, con il Dow Jones registrando un modesto aumento mentre il Nasdaq mostra una leggera flessione in seguito ai dati sulle offerte di lavoro. Gli investitori, nel frattempo, sono in attesa…

View On WordPress

0 notes

Text

Internet Detritus.

Back in 1996 I was driving to work in the Clearwater, Florida area and saw a billboard to Brainbuzz.com, now viewable only through the Wayback Machine. I joined, and I ended up writing for them. Not around anymore. They became CramSession.com, where I continued writing for them. I had roughly 100 articles I wrote for them about software engineering and C++ which are just… gone. Granted, that was…

View On WordPress

#AI#artificial intelligence#deep learning#dotcom bubble#Faster Reference#information age#internet#machine learning#social media#Technology#time

0 notes

Text

A summary of the Chinese AI situation, for the uninitiated.

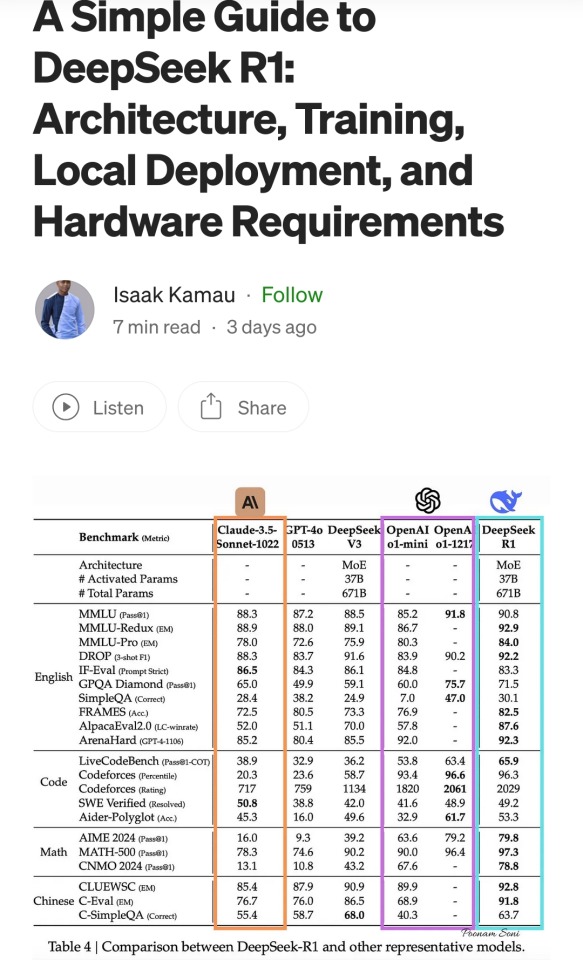

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy

433 notes

·

View notes

Text

my plan for college since i graduated high school has always been to get a bachelor's in web and software design (or a comparable program wherever i end up going) basically as a default choice but now that i actually might be attending someplace later this year uh. the job market sure has never looked any more politically dangerous or any closer to disintegration has it

#well probably closer to disintegration right before the dotcom bubble burst. but what's that‚ an ai bubble cresting over the horizon...?#glances meaningfully

0 notes

Text

The AI Bubble Burst - Big Bang Or A Thousand Cuts?

How will the AI Bubble Burst of 2025 differ from the dot.com 2001 explosion?

AI probably won’t crash and burn as sensationally as the dot.com bubble. I already had similar thoughts around blockchain and in the end the solutions vanished quitely and selected good ones remained. AI will be a similar story. – Ulf Venne, Everstream Analytics (August 23, 2024) Ulf Venne, I agree, but this time around, the impact will be concentrated on procurement and supply chains, which…

0 notes

Text

Zinssenkungen: Ein zweischneidiges Schwert für die Märkte

Die Reaktion der Finanzmärkte auf Zinssenkungen ist ein komplexes Thema, das oft missverstanden wird. Auf den ersten Blick scheinen Zinssenkungen immer positiv für Aktienmärkte zu sein. Aber ein tieferer Blick zeigt, dass wiederholte Zinssenkungen oft ein Zeichen wirtschaftlicher Schwäche sind und langfristig zu Marktverwerfungen führen können. Dieser Blogartikel beleuchtet die verschiedenen Aspekte von Zinssenkungen und ihre Auswirkungen auf die Märkte, basierend auf historischen Daten und ökonomischen Theorien.

Die unmittelbare Reaktion auf Zinssenkungen

Kurzfristige positive Effekte: Wenn die Zentralbank die Zinsen senkt, reagiert der Markt oft zunächst positiv. Niedrigere Zinsen bedeuten geringere Finanzierungskosten für Unternehmen und Verbraucher, was den Konsum und Investitionen ankurbeln kann. Diese kurzfristige Reaktion führt oft zu steigenden Aktienkursen, da Anleger optimistisch sind, dass billigere Kredite das Wirtschaftswachstum fördern werden.

Langfristige Implikationen wiederholter Zinssenkungen

Zeichen wirtschaftlicher Schwäche: Wiederholte Zinssenkungen signalisieren, dass die Zentralbank versucht, einer schwächelnden Wirtschaft entgegenzuwirken. Dies kann als Warnzeichen interpretiert werden, dass die wirtschaftlichen Fundamentaldaten nicht stark sind. Anleger beginnen zu realisieren, dass anhaltende Zinssenkungen ein Versuch sind, ernsthafte wirtschaftliche Probleme zu bekämpfen.

Rezessionsrisiko: Wenn die Wirtschaft trotz niedriger Zinsen nicht anspringt, steigt das Risiko einer Rezession. In solchen Phasen reagieren die Märkte oft negativ, da die Aussichten auf Unternehmensgewinne und Wirtschaftswachstum trüben. Die anfängliche Euphorie über niedrigere Zinsen kann schnell in Pessimismus umschlagen, wenn klar wird, dass die wirtschaftlichen Probleme tiefer liegen.

Historische Daten und Muster

Dotcom-Bubble und Finanzkrise 2008: Historische Beispiele wie die Dotcom-Blase und die Finanzkrise 2008 zeigen, dass anhaltende Zinssenkungen letztlich zu Marktabschwüngen führen können. Während die ersten Zinssenkungen oft eine Erholungsphase einleiteten, folgten häufig Korrekturen, als sich herausstellte, dass die wirtschaftlichen Probleme tief verwurzelt waren.

Aktuelle Entwicklungen: In den letzten Jahren haben wir ähnliche Muster beobachtet. Zinssenkungen führten zunächst zu einer Rally an den Märkten, gefolgt von Unsicherheiten und Korrekturen, als die wirtschaftlichen Fundamentaldaten nicht verbesserten.

Fehlinterpretationen durch Retailinvestoren

Überschätzung der positiven Effekte: Viele Retailinvestoren interpretieren Zinssenkungen als ausschließlich positiv, da sie kurzfristig für steigende Kurse sorgen können. Langfristig unterschätzen sie jedoch oft die zugrunde liegenden wirtschaftlichen Probleme, die zu den Zinssenkungen geführt haben.

Gefahr einer Blasenbildung: Die Erwartung, dass sinkende Zinsen automatisch zu hohen Gewinnen führen, kann zu einer Überbewertung von Aktien und Blasenbildung führen. Wenn die Realität der wirtschaftlichen Schwäche schließlich einsetzt, können die Märkte stark korrigieren.

Staatsverschuldung und fiskalische Risiken

Hohe Staatsverschuldung: Hohe Staatsverschuldung, insbesondere in den USA, führt zu zusätzlichen Risiken. Zinssenkungen können zwar die Finanzierungskosten des Staates senken, aber auch signalisieren, dass die Wirtschaft Probleme hat. Langfristig kann dies zu Unsicherheiten über die fiskalische Stabilität führen.

Langfristige wirtschaftliche Stabilität: Zinssenkungen sind oft ein Versuch, kurzfristige wirtschaftliche Probleme zu lösen. Langfristig können sie jedoch strukturelle Probleme verschleiern und das Risiko von fiskalischen Krisen erhöhen.

Fazit

Die Argumentation, dass Zinssenkungen kurzfristig positive Effekte haben, aber langfristig wirtschaftliche Schwäche signalisieren, ist gut durchdacht und basiert auf einer umfassenden Analyse historischer Daten. Anleger sollten die zugrunde liegenden wirtschaftlichen Bedingungen und die langfristigen Implikationen von Zinssenkungen verstehen, um fundierte Entscheidungen zu treffen. Zinssenkungen sind ein zweischneidiges Schwert: Sie können kurzfristig den Markt stützen, aber langfristig signalisieren sie oft tiefere wirtschaftliche Probleme.

Über den Autor

Jens Wahnfried ist Analyst bei der ChartWise Trading und hat umfassende Erfahrungen in der Analyse von Finanzmärkten und makroökonomischen Trends. Seine Expertise liegt in der Bewertung der Auswirkungen von Geldpolitik und wirtschaftlichen Indikatoren auf die Märkte.

Quellen und weiterführende Literatur

Dotcom Bubble Analysis

Financial Crisis 2008 Overview

Effects of Interest Rate Changes

Verstehen Sie die Dynamik der Zinssenkungen und deren Auswirkungen auf die Märkte, um klügere Investitionsentscheidungen zu treffen und langfristig erfolgreich zu sein.

#Zinssenkungen#Finanzmärkte#Zentralbank#Aktienkurse#wirtschaftliche Schwäche#Rezessionsrisiko#Marktverwerfungen#Dotcom-Bubble#Finanzkrise 2008#Retailinvestoren#Blasenbildung#Staatsverschuldung#fiskalische Risiken#langfristige Stabilität#Geldpolitik#makroökonomische Trends#kurzfristige Effekte#historische Daten#Marktpsychologie#Finanzintelligenz.

0 notes

Text

Sorry to be talking about financial stuff on the eat-capitalists website but pointing out that 1.58% is… not tiny tiny when it’s out of ~US$28 billion. That’s about US$420 million (note: not actual figures because Microsoft (MSFT) doesn’t split out Azure from it’s overarching reporting segment but you can imagine it’s a pretty large segment).

I haven’t followed MSFT for a hot second but Azure is it’s cloud computing segment and iirc one of the main products that MSFT is using to sell its AI ambitions in some manner.

Stepping back a bit: We all know that AI has been a hot topic for several… years… now. There’s a lot that can be said about it but to simplify, this could be seen as the Tech sector’s ‘we aren’t Kodak’ moment. New technology has emerged (digital film, AI) and they won’t be ‘left behind’.

Another simplification; stock prices can be understood as what the company is currently worth now + what it could be worth in the future. Earning reports indicate what the company is currently worth, and market expectations are about the future worth.

High growth companies usually have a higher weightage towards future worth, whereas low growth companies are supposed to match their current worth closer (in theory, in a very simplistic way).

While MSFT could totally coast on their current software stuff (Microsoft 365, Windows PC, OneDrive), you can guess where on the growth spectrum MSFT is trying to fall on by chasing AI. And Azure is sort of MSFT’s representation of their AI plans. Which means if their AI plans are not doing so hot, then their future worth may not be so much after all. So now the people who bought into the AI hype are possibly going, “hey AI’s not going to contribute that much after all” (possibly irrationally) and peacing out to put their money to other stuff. Possibly yachts.

But some other points:

Last quarter Meta’s earnings report beat expectations but still fell 12% immediately after. This is because of the ‘future worth’ component. Beating expectations is never a guarantee that stock goes up in the aftermath (Meta has recovered though as of 30 Jul 2024. I'm sure MSFT will too)

Tech as a sector is notoriously volatile, honestly wouldn’t put too much emphasis on day-to-day movements if the underlying company is good (MSFT has a good base imo, not saying this because OP is an employee)

There has been a bit of a cooling towards tech companies – some of it due to matters outside the hands of companies like geopolitics, macroeconomics or simply investors deciding to realise profits/rotate out of Tech.

Sorry for caring about stocks it’s just that my paycheck is tied to them.

Anyway who wants to know the latest in Infinite Growth Fuckery

$250 billion vanished from the Microsoft market cap because Azure only grew 29% when it was supposed to grow 30.58%

I love economy built on the logic of a cancer cell

#not going into too much detail and trying to be as impartial as possible this still ended up kind of long#but since tags don't carry over gonna say Tech stock pricing has never been very rational even in 2016 imo#maybe since the dotcom bubble but i don't go that far back#there's been some correction for the smaller/more out there stock that benefitted from low interest rates#but privately i've always found it hard to justify big tech's valuations sorry#opinions that would get people fired lmao#margan muses

2K notes

·

View notes

Text

#borsa#borsa istanbul#finans#yatırım#bist100#ekonomi#bist30#hisse#finance#temettü#nasdaq#dotcom#dot-com#nokkta com#balon#baloon#bubble

1 note

·

View note

Text

What kind of bubble is AI?

My latest column for Locus Magazine is "What Kind of Bubble is AI?" All economic bubbles are hugely destructive, but some of them leave behind wreckage that can be salvaged for useful purposes, while others leave nothing behind but ashes:

https://locusmag.com/2023/12/commentary-cory-doctorow-what-kind-of-bubble-is-ai/

Think about some 21st century bubbles. The dotcom bubble was a terrible tragedy, one that drained the coffers of pension funds and other institutional investors and wiped out retail investors who were gulled by Superbowl Ads. But there was a lot left behind after the dotcoms were wiped out: cheap servers, office furniture and space, but far more importantly, a generation of young people who'd been trained as web makers, leaving nontechnical degree programs to learn HTML, perl and python. This created a whole cohort of technologists from non-technical backgrounds, a first in technological history. Many of these people became the vanguard of a more inclusive and humane tech development movement, and they were able to make interesting and useful services and products in an environment where raw materials – compute, bandwidth, space and talent – were available at firesale prices.

Contrast this with the crypto bubble. It, too, destroyed the fortunes of institutional and individual investors through fraud and Superbowl Ads. It, too, lured in nontechnical people to learn esoteric disciplines at investor expense. But apart from a smattering of Rust programmers, the main residue of crypto is bad digital art and worse Austrian economics.

Or think of Worldcom vs Enron. Both bubbles were built on pure fraud, but Enron's fraud left nothing behind but a string of suspicious deaths. By contrast, Worldcom's fraud was a Big Store con that required laying a ton of fiber that is still in the ground to this day, and is being bought and used at pennies on the dollar.

AI is definitely a bubble. As I write in the column, if you fly into SFO and rent a car and drive north to San Francisco or south to Silicon Valley, every single billboard is advertising an "AI" startup, many of which are not even using anything that can be remotely characterized as AI. That's amazing, considering what a meaningless buzzword AI already is.

So which kind of bubble is AI? When it pops, will something useful be left behind, or will it go away altogether? To be sure, there's a legion of technologists who are learning Tensorflow and Pytorch. These nominally open source tools are bound, respectively, to Google and Facebook's AI environments:

https://pluralistic.net/2023/08/18/openwashing/#you-keep-using-that-word-i-do-not-think-it-means-what-you-think-it-means

But if those environments go away, those programming skills become a lot less useful. Live, large-scale Big Tech AI projects are shockingly expensive to run. Some of their costs are fixed – collecting, labeling and processing training data – but the running costs for each query are prodigious. There's a massive primary energy bill for the servers, a nearly as large energy bill for the chillers, and a titanic wage bill for the specialized technical staff involved.

Once investor subsidies dry up, will the real-world, non-hyperbolic applications for AI be enough to cover these running costs? AI applications can be plotted on a 2X2 grid whose axes are "value" (how much customers will pay for them) and "risk tolerance" (how perfect the product needs to be).

Charging teenaged D&D players $10 month for an image generator that creates epic illustrations of their characters fighting monsters is low value and very risk tolerant (teenagers aren't overly worried about six-fingered swordspeople with three pupils in each eye). Charging scammy spamfarms $500/month for a text generator that spits out dull, search-algorithm-pleasing narratives to appear over recipes is likewise low-value and highly risk tolerant (your customer doesn't care if the text is nonsense). Charging visually impaired people $100 month for an app that plays a text-to-speech description of anything they point their cameras at is low-value and moderately risk tolerant ("that's your blue shirt" when it's green is not a big deal, while "the street is safe to cross" when it's not is a much bigger one).

Morganstanley doesn't talk about the trillions the AI industry will be worth some day because of these applications. These are just spinoffs from the main event, a collection of extremely high-value applications. Think of self-driving cars or radiology bots that analyze chest x-rays and characterize masses as cancerous or noncancerous.

These are high value – but only if they are also risk-tolerant. The pitch for self-driving cars is "fire most drivers and replace them with 'humans in the loop' who intervene at critical junctures." That's the risk-tolerant version of self-driving cars, and it's a failure. More than $100b has been incinerated chasing self-driving cars, and cars are nowhere near driving themselves:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Quite the reverse, in fact. Cruise was just forced to quit the field after one of their cars maimed a woman – a pedestrian who had not opted into being part of a high-risk AI experiment – and dragged her body 20 feet through the streets of San Francisco. Afterwards, it emerged that Cruise had replaced the single low-waged driver who would normally be paid to operate a taxi with 1.5 high-waged skilled technicians who remotely oversaw each of its vehicles:

https://www.nytimes.com/2023/11/03/technology/cruise-general-motors-self-driving-cars.html

The self-driving pitch isn't that your car will correct your own human errors (like an alarm that sounds when you activate your turn signal while someone is in your blind-spot). Self-driving isn't about using automation to augment human skill – it's about replacing humans. There's no business case for spending hundreds of billions on better safety systems for cars (there's a human case for it, though!). The only way the price-tag justifies itself is if paid drivers can be fired and replaced with software that costs less than their wages.

What about radiologists? Radiologists certainly make mistakes from time to time, and if there's a computer vision system that makes different mistakes than the sort that humans make, they could be a cheap way of generating second opinions that trigger re-examination by a human radiologist. But no AI investor thinks their return will come from selling hospitals that reduce the number of X-rays each radiologist processes every day, as a second-opinion-generating system would. Rather, the value of AI radiologists comes from firing most of your human radiologists and replacing them with software whose judgments are cursorily double-checked by a human whose "automation blindness" will turn them into an OK-button-mashing automaton:

https://pluralistic.net/2023/08/23/automation-blindness/#humans-in-the-loop

The profit-generating pitch for high-value AI applications lies in creating "reverse centaurs": humans who serve as appendages for automation that operates at a speed and scale that is unrelated to the capacity or needs of the worker:

https://pluralistic.net/2022/04/17/revenge-of-the-chickenized-reverse-centaurs/

But unless these high-value applications are intrinsically risk-tolerant, they are poor candidates for automation. Cruise was able to nonconsensually enlist the population of San Francisco in an experimental murderbot development program thanks to the vast sums of money sloshing around the industry. Some of this money funds the inevitabilist narrative that self-driving cars are coming, it's only a matter of when, not if, and so SF had better get in the autonomous vehicle or get run over by the forces of history.

Once the bubble pops (all bubbles pop), AI applications will have to rise or fall on their actual merits, not their promise. The odds are stacked against the long-term survival of high-value, risk-intolerant AI applications.

The problem for AI is that while there are a lot of risk-tolerant applications, they're almost all low-value; while nearly all the high-value applications are risk-intolerant. Once AI has to be profitable – once investors withdraw their subsidies from money-losing ventures – the risk-tolerant applications need to be sufficient to run those tremendously expensive servers in those brutally expensive data-centers tended by exceptionally expensive technical workers.

If they aren't, then the business case for running those servers goes away, and so do the servers – and so do all those risk-tolerant, low-value applications. It doesn't matter if helping blind people make sense of their surroundings is socially beneficial. It doesn't matter if teenaged gamers love their epic character art. It doesn't even matter how horny scammers are for generating AI nonsense SEO websites:

https://twitter.com/jakezward/status/1728032634037567509

These applications are all riding on the coattails of the big AI models that are being built and operated at a loss in order to be profitable. If they remain unprofitable long enough, the private sector will no longer pay to operate them.

Now, there are smaller models, models that stand alone and run on commodity hardware. These would persist even after the AI bubble bursts, because most of their costs are setup costs that have already been borne by the well-funded companies who created them. These models are limited, of course, though the communities that have formed around them have pushed those limits in surprising ways, far beyond their original manufacturers' beliefs about their capacity. These communities will continue to push those limits for as long as they find the models useful.

These standalone, "toy" models are derived from the big models, though. When the AI bubble bursts and the private sector no longer subsidizes mass-scale model creation, it will cease to spin out more sophisticated models that run on commodity hardware (it's possible that Federated learning and other techniques for spreading out the work of making large-scale models will fill the gap).

So what kind of bubble is the AI bubble? What will we salvage from its wreckage? Perhaps the communities who've invested in becoming experts in Pytorch and Tensorflow will wrestle them away from their corporate masters and make them generally useful. Certainly, a lot of people will have gained skills in applying statistical techniques.

But there will also be a lot of unsalvageable wreckage. As big AI models get integrated into the processes of the productive economy, AI becomes a source of systemic risk. The only thing worse than having an automated process that is rendered dangerous or erratic based on AI integration is to have that process fail entirely because the AI suddenly disappeared, a collapse that is too precipitous for former AI customers to engineer a soft landing for their systems.

This is a blind spot in our policymakers debates about AI. The smart policymakers are asking questions about fairness, algorithmic bias, and fraud. The foolish policymakers are ensnared in fantasies about "AI safety," AKA "Will the chatbot become a superintelligence that turns the whole human race into paperclips?"

https://pluralistic.net/2023/11/27/10-types-of-people/#taking-up-a-lot-of-space

But no one is asking, "What will we do if" – when – "the AI bubble pops and most of this stuff disappears overnight?"

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/19/bubblenomics/#pop

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

tom_bullock (modified) https://www.flickr.com/photos/tombullock/25173469495/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

4K notes

·

View notes

Text

mustve felt soooooo good to be in the dotcom bubble

134 notes

·

View notes

Text

I don't even know yet what cohost is, but I already love them for their attitude about targeted ads.

adorable. doomed. sounds accurate tho

@ the people telling me cohost proves porn friendly social media is possible uhhh I don't know how to tell you guys this

they've been riding a temporary wave of people leaving twitter, and even with that behind them they only made around 10% of their operating costs in May

you can read their financial assessments yourself if you like, they are very upfront that profitability is all but impossible for social media without major investors who are willing to lose money on it (which means they are getting something else out of the deal, usually your data)

adorable. doomed.

they're a four person team with one superuser bankrolling them. I know their hearts are in the right place but I'd be amazed if cohost lasts another financial year. this is not proof of anything, the second payment processors notice they're hosting porn they are dead(er) in the water. sorry!

487 notes

·

View notes

Text

pleased to announce i'm buying tumblr (i mortgaged my magic cards)

first order of business, name's gotta change. dropping the vowel is dotcom bubble bullshit. will be changing the address to tumblur.website as soon as i can figure out how

second order of business, you can post hog. bowing to apple's content guidelines in hopes that a couple of cents would come our way from their end was a mistake

apple users can get real phones or use the mobile page in "adventure" or whatever their browser is called

finally, and mostly, i'm banning basically everyone. its going to be just me and the porn bots and the hogs on our samsungs

549 notes

·

View notes