#finance entrepreneurs

Text

corporate barbie 👩💼💄💗📈

gonna be starting my full-time job soon, i'm looking forward to being the newbie who's on top of things & surprise everyone with how much i know 💅

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog

517 notes

·

View notes

Text

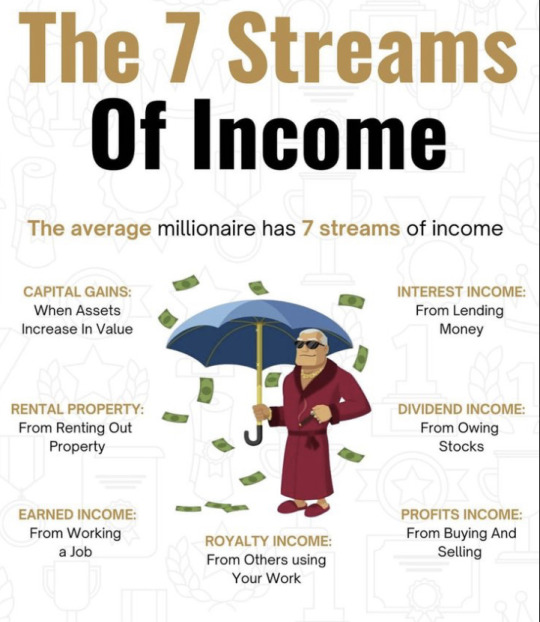

Wealth Building: Money Topics You Should Learn About If You Want To Make More Money

Budgeting: This means keeping track of how much money you have and how you spend it. It helps you save money and plan for your needs.

Investing: This is like putting your money to work so it can grow over time. It's like planting seeds to grow a money tree.

Saving: Saving is when you put some money aside for later. It's like keeping some of your treats for another day.

Debt Management: This is about handling money you owe to others, like loans or credit cards. You want to pay it back without owing too much.

Credit Scores: Think of this like a report card for your money habits. It helps others decide if they can trust you with money.

Taxation: Taxes are like a fee you pay to the government. You need to understand how they work and how to pay them correctly.

Retirement Planning: This is making sure you have enough money to live comfortably when you're older and no longer working.

Estate Planning: This is like making a plan for your stuff and money after you're no longer here.

Insurance: It's like paying for protection. You give some money to an insurance company, and they help you if something bad happens.

Investment Options: These are different ways to make your money grow, like buying parts of companies or putting money in a savings account.

Financial Markets: These are places where people buy and sell things like stocks and bonds. It can affect your investments.

Risk Management: This is about being careful with your money and making smart choices to avoid losing it.

Passive Income: This is money you get without having to work for it, like rent from a property you own.

Entrepreneurship: It's like starting your own business. You create something and try to make money from it.

Behavioral Finance: This is about understanding how your feelings and thoughts can affect how you use money. You want to make good choices even when you feel worried or excited.

Financial Goals: These are like wishes for your money. You need a plan to make them come true.

Financial Tools and Apps: These are like helpers on your phone or computer that can make it easier to manage your money.

Real Estate: This is about buying and owning property, like a house or land, to make money.

Asset Protection: It's about keeping your money safe from problems or people who want to take it.

Philanthropy: This means giving money to help others, like donating to charities or causes you care about.

Compounding Interest: This is like a money snowball. When you save or invest your money, it can grow over time. As it grows, you earn even more money on the money you already earned.

Credit Cards: When you borrow money or use a credit card to buy things, you need to show you can pay it back on time. This helps you build a good reputation with money. The better your reputation, the easier it is to borrow more money when you need it.

Alternate Currencies: These are like different kinds of money that aren't like the coins and bills you're used to like Crypto. It's digital money that's not controlled by a government. Some people use it for online shopping, and others think of it as a way to invest, like buying special tokens for a game.

924 notes

·

View notes

Text

I’m not sure what to do.

Direct Aid:

I’ve been trying to fundraise since May and I haven’t even reached half my goal. I’m not sure what kind of curse I’m suffering from where I can never do the things others are able to do. I have seen hundreds of people be able to crowdfund effortessly and I wonder what I’m doing wrong. I was sexually assaulted in the workplace, wrongfully terminated and threatened with a gun. I have overshared to the point that the only thing keeping this case together is that I haven’t shared my employers name. I’m not sure what get’s people’s attention. I’m not sure what to do. Not sure what to say or post

#entrepreneur#etsy#etymology#exercise#exo#explore#eyeliner#eyeshadow#f1#face masks#us politics#kamala harris#donald trump#family#fashion#feminism#ferrari#film#film photography#finance

33 notes

·

View notes

Text

36 notes

·

View notes

Text

Hit me up for pictures

#entrepreneur#accounting#commercial#economy#startup#finance#sales#ecommerce#success#not transformers#notes#transgender

22 notes

·

View notes

Text

30 ways to make real; money from home

Making money online from the comfort of your home has become increasingly accessible with the growth of the internet and digital technologies. In 2023, there are numerous realistic ways to earn money online. Here are 30 ideas to get you started:

1. Freelance Writing: Offer your writing skills on platforms like Upwork or Freelancer to create blog posts, articles, or website content.

2. Content Creation: Start a YouTube channel, podcast, or blog to share your expertise or passion and monetize through ads, sponsorships, and affiliate marketing.

3. Online Surveys and Market Research: Participate in online surveys and market research studies with platforms like Swagbucks or Survey Junkie.

4. Remote Customer Service: Work as a remote customer service representative for companies like Amazon or Apple.

5. Online Tutoring: Teach subjects you're knowledgeable in on platforms like VIPKid or Chegg Tutors.

6. E-commerce: Start an online store using platforms like Shopify, Etsy, or eBay to sell products.

7. Affiliate Marketing: Promote products or services on your blog or social media and earn commissions for sales made through your referral links.

8. Online Courses: Create and sell online courses on platforms like Udemy or Teachable.

9. Remote Data Entry: Find remote data entry jobs on websites like Clickworker or Remote.co.

10. Virtual Assistance: Offer administrative support services to businesses as a virtual assistant.

11. Graphic Design: Use your graphic design skills to create logos, graphics, or websites for clients on platforms like Fiverr.

12. Stock Photography: Sell your photos on stock photography websites like Shutterstock or Adobe Stock.

13. App Development: Develop and sell mobile apps or offer app development services.

14. Social Media Management: Manage social media accounts for businesses looking to enhance their online presence.

15. Dropshipping: Start an e-commerce business without holding inventory by dropshipping products.

16. Online Consultations: Offer consulting services in your area of expertise through video calls.

17. Online Surplus Sales: Sell unused items or collectibles on platforms like eBay or Facebook Marketplace.

18. Online Fitness Coaching: Become an online fitness coach and offer workout plans and guidance.

19. Virtual Events: Host webinars, workshops, or conferences on topics you're knowledgeable about.

20. Podcast Production: Offer podcast editing, production, or consulting services.

21. Remote Transcription: Transcribe audio and video files for clients.

22. Online Translation: Offer translation services if you're proficient in multiple languages.

23. Affiliate Blogging: Create a niche blog with affiliate marketing as the primary revenue source.

24. Online Art Sales: Sell your artwork, crafts, or digital art on platforms like Etsy or Redbubble.

25. Remote Bookkeeping: Offer bookkeeping services for small businesses from home.

26. Digital Marketing: Provide digital marketing services like SEO, PPC, or social media management.

27. Online Gaming: Stream your gaming sessions on platforms like Twitch and monetize through ads and donations.

28. Virtual Assistant Coaching: If you have experience as a VA, offer coaching services to aspiring virtual assistants.

29. Online Research: Conduct research for businesses or individuals in need of specific information.

30. Online Real Estate: Invest in virtual real estate, such as domain names or digital properties, and sell them for a profit.

Remember that success in making money online often requires dedication, patience, and the ability to adapt to changing trends. It's essential to research and choose the opportunities that align with your skills, interests, and long-term goals.

#founder#accounting#ecommerce#copywriting#business#commercial#economy#branding#entrepreneur#finance#make money online#earn money online#make money from home#old money#i turn to these cute#disgraced youtuber ruby franke#my mum#money#claims shock report#says terrified brit#easy money

64 notes

·

View notes

Text

Business Heads

11 powerful strategies for achieving your set goal

1. Conduct written reflections. A goal that is not on paper does not exist.

2. Define the goal specifically by answering the questions: what, where, when, and how?

3. Limit the goal in terms of time: a goal without time constraints is just a dream.

4. Consider who, besides yourself, will benefit from achieving your goal?

5. Formulate the goal in an affirmative manner, using the present tense.

6. Break down the goal into sub-goals, create a detailed plan for achieving the goal.

7. Take responsibility for your actions on the path to the goal.

8. Define intermediate results for achieving the goal.

9. Think about the goal, not the means of achieving it. Determine the final destination and move towards it.

10. Create a vision of the future where you have achieved the goal, and solidify this vision.

11. Act as if success is guaranteed to you.

#businesstips#entrepreneur#billionaire#rodrigororschach#my post#outliers#millionaire mindset#finance#money#success

14 notes

·

View notes

Text

Instant gratification, lasting regret. Choose long-term fulfillment over short-lived highs.

"Growing a tribe of hustlers. You in? Hit follow!" 👊

#motivation#quotes#quoteoftheday#life quote#book quote#beautiful quote#business#startup#money#make money online#side hustle#hustler#entrepreneur#finance#financial freedom#mindset#Net Worth

7 notes

·

View notes

Text

Blur Token Airdrop: How to Claim $Blur Airdrop

Blur Airdrop Eligibility : How to Get $Blur Token Airdrop?

Introduction Blur Airdrop:

Blur Airdrop ($BLUR) is a decentralized NFT marketplace known for its fast access to NFT reveals and improved user experience. They have completed the first season of airdrops called “Care Packages” and are now preparing for Season 3. In this guide, we will explore the steps to participate in the Blur Airdrop and maximize your rewards.

Step-by-step Guide for Blur Airdrop:

Connect your wallet to the Blur Airdrop Page.2. Navigate to the “Airdrop” tab to see the number of Care Packages you have earned.

3. Click on “Claim Airdrop” to claim your earned blur tokens.

4. To claim your $BLUR tokens, click on “Continue to BLUR,” “connect wallet and check eligibility,” and then “Next.”

5. complete all steps to approve and claim your tokens (if eligible).

6. Use MetaMask or a compatible wallet to claim $BLUR.

7. Confirm the transaction on your wallet.

Understanding $BLUR Tokenomics:

$BLUR has a maximum supply of 3 billion tokens, with 51% allocated to the community treasury, 29% to core contributors, 19% to investors, and 1% to advisors. Currently, only 360 million $BLUR tokens are unlocked and in circulation, with the remaining tokens still locked. Tokens are unlocked gradually, with the next unlock scheduled for June 15, 2023.

1. Strategies for Blur Season 3 Airdrop: Maximizing Blur Points: Bidding, listing, and lending on the Blur platform will earn you Blur Points. Actively participate in these activities to maximize your Blur Points.

2. Maximizing Bid Points: Place bids closest to the floor price across multiple active collections and keep your bids active for a longer duration to earn more Bid Points.

3. Maximizing Listing Points: List all your NFTs, especially blue chip and active collections, to earn more Listing Points. Utilize all of Blur’s listing tools and avoid gaming the system.

4. Maximizing Lending Points on Blend: Make Loan Offers using ETH in your Blur Pool with higher Max Borrow and lower APY to earn more Lending Points. Make multiple Loan Offers on different collections.

5. Maximizing Loyalty Points: List your NFTs exclusively through Blur to maintain 100% loyalty. Actively list blue chip and active collections while maintaining loyalty throughout Season 3.

6. Maximizing Holder Points: Deposit $BLUR tokens to earn Holder Points, which count for 50% of the Season 3 airdrop rewards. Maintain your deposit and avoid withdrawing to maximize your Holder Points.

24 notes

·

View notes

Text

Wealth Building: What Rich People Do Differently

Wealthy people prioritize learning about personal finance, investing, and wealth building strategies. They always strive to gain more knowledge in these areas.

They maintain a long term perspective when setting financial goals and are patient in their pursuits.

Wealthy people diversify their investments across various asset classes to manage their risk.

Many of them are entrepreneurs who create and manage businesses as a means to build wealth.

They build and nurture professional networks opens doors to opportunities for investments, partnerships, and business growth.

They set clear, specific financial goals and regularly review and adjust their strategies to stay on track.

Wealthy individuals exercise discipline in their spending habits, avoiding impulse purchases and consistently saving and investing.

They assess and manage investment risks carefully, often with the guidance of financial advisors.

Many engage in philanthropy and charitable giving, recognizing the importance of supporting their communities and causes they care about.

Wealthy people invest in their personal development, acquiring new skills and knowledge to increase their earning potential or make better investment decisions.

They use legal tax strategies to minimize tax liabilities, such as tax advantaged accounts and tax efficient investments.

Legal structures like trusts and estate planning are employed to safeguard assets and facilitate smooth wealth transfer.

Wealthy people can adapt to changing economic conditions and market trends by diversifying income sources and investments.

Building wealth often involves overcoming setbacks and failures, and the wealthy demonstrates the result of persistence in their pursuit of financial success.

They have a positive and growth oriented mindset drives their belief in their ability to succeed and willingness to take calculated risks.

They prioritize acquiring and growing assets, emphasizing that assets generate income and wealth over time.

They are cautious about spending in liabilities (Things that do not make you money) and maximize their assets (add value) and those that detract from wealth (liabilities).

Instead of working solely for money, they make money work for them.

When they indulge in luxury purchases, they do so using returns on their investments rather than the money they earn or have saved.

#finance#investment#financial planning#investing#entrepreneur#girl math#generationalwealth#rich#success mindset#wealth

1K notes

·

View notes

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

75 notes

·

View notes

Text

AliciaShonta's Insights: From a Fashion Expert, POV

How to Build Your Professional Wardrobe? Let's Talk About It?

Dress Code is Enforced. Hire a Professional Stylist. AliciaShonta Fashion House. Follow me on all social media platforms. Like, Comment, Share, Subscribe.

How to Build a Professional Wardrobe?

Editor, Writer: AliciaShonta, Founder of AliciaShonta Fashion House (ASFH)

Building a professional wardrobe can be a rewarding process that helps you feel confident and prepared for any work environment. Here are some steps to guide you:

Assess Your Current Wardrobe: Start by evaluating what you already have. Identify pieces that can be incorporated into…

#afterwork#build#business#capsule#ceo#contentcreator#dinner#entrepreneur#executive#finance#how to#investment#jobsearch#office#owner#professional#realestate#wardrobe#womenfashion#work

5 notes

·

View notes

Text

8 notes

·

View notes

Text

❣️❣️❣️welcome back home

7 notes

·

View notes

Text

SPARCKNET | TRADING | FOREX | FOREXTRADING | CRYPTO | CRYPTOTRADING | FINANCE | FINANCIALEDUCATION | STOCK | STOCKMARKET

#chiefjatinkashyap#crypto#finance#financialeducation#forex#forextrading#entrepreneur#investing#marketing#cryptotraing

4 notes

·

View notes