#finance technology

Text

Why Fintech Developers Are the Key to the Future of Financial Technology

In today's fast-paced world, the financial technology (fintech) sector is transforming how we manage money, invest, and conduct transactions. At the heart of this revolution are fintech developers—skilled professionals who bring innovative financial solutions to life. Whether you’re a startup founder, an established financial institution, or simply curious about the tech driving your digital wallet, understanding the role of fintech developers is crucial.

What Are Fintech Developers?

Fintech developers are specialists in creating software and applications that enhance and streamline financial services. They possess a deep understanding of both finance and technology, allowing them to design and build tools that make financial transactions more efficient, secure, and user-friendly. From mobile banking apps to complex trading platforms, these developers are pivotal in the fintech landscape.

The Role of Fintech Software Developers

Fintech software developers focus on crafting the underlying systems that power financial applications. Their work involves writing code, integrating APIs, and ensuring that software solutions are scalable and reliable. They must navigate complex regulations and security standards to create products that not only meet user needs but also comply with financial regulations.

Why Fintech Developers Are Essential?

The demand for fintech developers has surged as more people and businesses seek digital financial solutions. These developers address several key areas:

User Experience (UX): They design intuitive interfaces that simplify financial management and enhance user engagement.

Security: Ensuring the security of financial transactions and personal data is paramount. Fintech developers implement robust encryption and authentication measures.

Integration: They work on integrating various financial systems, such as payment gateways and banking services, to provide seamless experiences.

How to Find and Hire the Best Fintech App Developers?

If you’re looking to hire fintech developers, finding the right talent is crucial for your project’s success. Here are some tips to guide your search:

Define Your Needs: Identify the specific skills and experience you require. Are you looking for expertise in blockchain, machine learning, or mobile app development?

Seek Recommendations: Reach out to industry peers or use professional networks to find the best fintech app developers. Recommendations can often lead you to reliable and experienced candidates.

Evaluate Portfolios: Review candidates’ past projects to assess their ability to deliver innovative and high-quality fintech solutions.

Conduct Interviews: Engage with potential developers to gauge their understanding of financial regulations, their problem-solving skills, and their ability to work within your project’s scope.

Check References: Verify the credentials and performance of your shortlisted developers through references or previous client feedback.

The Future of Fintech Development

As financial technology continues to evolve, the role of fintech app developers will become even more integral. Emerging trends such as artificial intelligence, blockchain, and open banking will shape the next wave of fintech innovations. Staying ahead of these trends will require developers who are not only skilled in current technologies but also adaptable to future advancements.

Conclusion

The fintech sector is rapidly expanding, driven by the expertise and innovation of fintech developers. Whether you're looking to find fintech developers for a new project or simply interested in the field, understanding the role and impact of these professionals is essential. By focusing on hiring the best talent and leveraging cutting-edge technologies, you can contribute to shaping the future of financial services and creating solutions that make managing money easier and more secure.

Embrace the future of finance with the right fintech talent and watch as your financial technology solutions transform the industry!

1 note

·

View note

Text

#mitsde#mitsde placment#finanace management#pgdm in finance#pgdm course#financial#finance#finance manager#finance courses#finance jobs#finance technology#finance management distance learning#finance management pgdm#finance management#finance mba#mba in finance#mba finance#distance courses#distance mba#distancelearning#distance learning

0 notes

Text

Neturbiz Enterprises - AI Innov7ions

Our mission is to provide details about AI-powered platforms across different technologies, each of which offer unique set of features. The AI industry encompasses a broad range of technologies designed to simulate human intelligence. These include machine learning, natural language processing, robotics, computer vision, and more. Companies and research institutions are continuously advancing AI capabilities, from creating sophisticated algorithms to developing powerful hardware. The AI industry, characterized by the development and deployment of artificial intelligence technologies, has a profound impact on our daily lives, reshaping various aspects of how we live, work, and interact.

#ai technology#Technology Revolution#Machine Learning#Content Generation#Complex Algorithms#Neural Networks#Human Creativity#Original Content#Healthcare#Finance#Entertainment#Medical Image Analysis#Drug Discovery#Ethical Concerns#Data Privacy#Artificial Intelligence#GANs#AudioGeneration#Creativity#Problem Solving#ai#autonomous#deepbrain#fliki#krater#podcast#stealthgpt#riverside#restream#murf

16 notes

·

View notes

Text

The Great Tech Heist: How East Coast Money Made Silicon Valley’s Wild West Look Like a Rigged Casino

Let’s take a trip back to the ‘90s. Picture it: everyone’s wearing acid-wash jeans, video game cartridges are getting blown into like they’re ancient relics, and the internet is that weird thing we only use to email chain letters and download Metallica tracks on Napster (sorry Lars). The tech world is exploding, right? West Coast kids, wired up on Mountain Dew and Jolt Cola, are coding like mad geniuses in their garages, while on the East Coast, fat cats are throwing cash at any startup that promises to "disrupt" something, anything. Sounds like the American Dream? Think again.

The Myth of the Silicon Cowboy

Look, we’ve all heard the fairy tale: Silicon Valley was built by scrappy hackers, rebellious dreamers who pulled themselves up by their bootstraps and revolutionized the world. Yeah, no. Turns out, the tech boom wasn’t just a bunch of geeks in garage startups waiting to change the world with code—it was funded by some serious East Coast money. Yup, while the West Coast had the talent, the algorithms, and the vision, it was those Wall Street fat cats who swooped in with their big, dirty bags of cash when the rest of the world still thought the internet was just a fad for nerds.

Let’s not look at this through rose-tinted glasses. The West Coast might’ve had the hackers and engineers, but the East Coast had the old-money institutions and finance bros itching to throw dollars at anything with "tech" in its name. It wasn’t just about innovation, man. It was about control. The future wasn’t some wild frontier—it was a rigged casino. And the house? You guessed it. Ivy League-educated venture capitalists who had their claws in the game long before anyone knew what "dot-com" even meant.

East Coast Money, West Coast Hustle: The Unholy Union

Picture this: West Coast techies, hyped up on vision boards and overly optimistic projections, meeting East Coast investors in their slick suits, who smell like cigars and finance spreadsheets. It’s a match made in capitalist heaven. The techies needed funding to keep their dreams alive, and the financiers were happy to oblige—so long as they got a cut, or better yet, all the power.

This wasn’t a one-off thing. This was a system. East Coast money turned the Valley into a playground for the rich before the innovation even had a chance to breathe on its own. The money vultures from Boston and New York didn’t just see an opportunity; they saw a way to control it from the start. The ‘belief gap’ (you know, that time when people still thought tech was a passing trend) was patched over not by pure innovation or passion, but by heavy financial artillery.

The Fad That Wasn’t: Dirty Money and Nepotism

Let’s get real. Tech wasn’t some magical, equal-opportunity goldmine. It was a “get rich quick” scheme for anyone with the right connections or enough dirty cash to play the game. Nepotism was as rampant in the tech space as in any other industry—maybe even more so. Those that had old money? They were the ones who got in early, while the rest of us were busy playing GoldenEye and waiting for dial-up to connect.

Sure, there were a few exceptions—some genuine innovators who actually did come out of nowhere to change the game. But for every scrappy underdog success, there were a hundred trust-fund babies whose families were plugged into the venture capital pipeline. The rise of the tech industry wasn’t fueled by underdogs, but by a calculated infusion of East Coast dough—making sure that when the chips fell, the same people who always win were the ones holding the cards.

Media vs. Tech: A Clash of Titans or Just a Slow Dance?

And let’s not even get started on the media’s role in all this. If you thought the mainstream media (MSM) was rooting for the rise of the internet, think again. The old guard—newspapers, magazines, television—they were terrified. Internet? Pfft. Just another fad like laserdiscs and slap bracelets, right? Wrong. But of course, they had to protect their interests, so they downplayed it at first. "No, no, people will never want to read their news on a screen." Yeah, well look where we are now. They couldn’t hold back the tide, but they sure as hell tried.

And when they couldn’t? They hopped on the bandwagon, rebranded themselves as “digital pioneers,” and started their own media conglomerates online. They played both sides, hedging their bets, and ultimately getting in bed with the very tech companies they once mocked.

The House Always Wins

Look, it’s no accident that tech became what it is today. It was designed to succeed in a system that benefits the already-powerful. When East Coast money plugged into West Coast talent, it wasn’t to help build a utopian future of innovation and creativity. It was to control the next big thing. The old money powers weren’t afraid to take over the narrative—and as usual, the house won.

So yeah, every time you hear about the "wild west" of tech and how it was all about risk-takers and visionaries, take it with a grain of salt. Sure, there were some rebels in there. But the real power move was knowing which side of the table to sit on. And unless you were part of the old guard with the right connections, you were just along for the ride.

As Hunter S. Thompson would probably say, it’s all one big swindle. The game was rigged from the start, and now we’re all stuck in this digital casino, hoping we can at least break even. But let’s face it: the house always wins.

And remember, folks—when you’re sitting there staring at your screen, watching tech giants swallow the world whole, just know this: behind every slick algorithm and groundbreaking app, there’s probably a cigar-smoking finance bro laughing all the way to the bank.

And that’s the real joke.

7 notes

·

View notes

Quote

In the early 2010s... the tech business was much smaller. Back then, people used desktops more than mobile devices. Business school students preferred to work at banks. And Google’s market cap was less than $200 billion. Hoodies, not suits, ran the industry.

As the economic opportunity in tech grew though, things changed. Bankers and finance professionals, looking to reinvent themselves after the financial crisis, found the tech sector. They became CEOs and COOs as the developers stood back.

[T]he tech sector, or at least parts of it, then trended into overfinancialization. Instead of thinking about what problems they could solve for people, some companies looked only at growth and margins. They became extractive. DoorDash, for instance, counted tips toward its minimum delivery worker payments, changing the policy only after an uproar.

The Over-Financialization Of Tech And The SVB Backlash

136 notes

·

View notes

Text

Elevate your business with Magtec ERP! 📈 Experience real-time insights, smarter decisions, and streamlined operations. From CRM to manufacturing, we've got you covered. Book a demo today! 🚀

#magtec#erp#automation#business#efficiency#software#technology#innovation#digitaltransformation#enterprise#solutions#productivity#success#growth#management#finance#humanresources#supplychain#logistics#cloud#saas#onpremises#hybrid#integration#scalability#customization#support#trustedpartner#magtecerp#magtecsolutions

3 notes

·

View notes

Text

Daily Profit 4%

1st level 5%

2nd level 2%

3rd level 0.5%

Duration: 3 Days

http://tradebars.net/?ref=Freedomwithabe

#cryptocurreny trading#advertising#tumblr milestone#crypto#monney#crytotrading#blockchaintechnology#blockchain technology#claims#safety#old money#money#make money today#make money online#make money from home#earn money online#financial#finances#business#wealth#profit

22 notes

·

View notes

Text

5 Easy Passive Income Ideas for 2024

Hello, this is Taylor! Today, we’re going to dive into a fascinating topic—five ways to generate passive income. For each method, we’ll discuss how difficult it is to get started, how challenging it is to earn $100 per week, and how hard it is to maintain once it’s up and running. You’ll see that these factors vary across the different methods, so let’s jump right in!

First, what is passive…

#ad revenue#apple#digital-products#finance#gadget lovers#gear#huawei#investing#ipad#laptop#passive income#peer-to-peer-lending#smartphone#tablet#tech#technology

2 notes

·

View notes

Text

Wonderpay Your Trusted Payment Gateway With Instant Settlement And Free UPI Collection

Wonderpay offers Instant payment solutions across the country. This is very crucial for any business that aims to expand their reach for improving customer experiences. It also enhances the security of your payments with a minimum transaction cost. Our payment gateway supports a vast array of transactions, which makes it easier to manage financial transactions for all types of small e-commerce stores to large multinational corporations.

#payments#fintech#business#paymentsolutions#ecommerce#paymentprocessing#creditcardprocessing#money#merchantservices#finance#banking#bitcoin#payment#smallbusiness#pos#mobilepayments#pointofsale#paymentgateway#cryptocurrency#creditcards#crypto#blockchain#creditcard#technology#possystem#cash#onlinepayments#retail#digitalpayments#marketing

2 notes

·

View notes

Text

#mit skills india#upskilling#skills#mitskills#upskill#career upskilling#mit skills#fintech course#fintech#financial security#financial literacy#finance courses#finance#finance tech#finance technology#finance and investments#payment solutions#payment services#payments

0 notes

Text

#finance management#finance technology#finance#financial#finance management pgdm#pgdm in finance#pgdm in finance management#distance course in finance#finance jobs#income#investments#distance courses#distancelearning#distance mba#distance learning mba#distance learning#online mba#mba college#mba courses#mba

0 notes

Text

Top Futuristic AI Based Applications by 2024

2024 with Artificial Intelligence (AI) is the backdrop of what seems to be another revolutionary iteration across industries. AI has matured over the past year to provide novel use cases and innovative solutions in several industries. This article explores most exciting AI applications that are driving the future.

1. Customized Chatbots

The next year, 2024 is seeing the upward trajectory of bespoke chatbots. Google, and OpenAI are creating accessible user-friendly platforms that enable people to build their own small-scale chatbots for particular use cases. These are the most advanced Chatbots available in the market — Capable of not just processing text but also Images and Videos, giving a plethora of interactive applications. For example, estate agents can now automatically create property descriptions by adding the text and images of listings thatsurgent.

2. AI in Healthcare

AI has found numerous applications in the healthcare industry, from diagnostics to personalized treatment plans. After all, AI-driven devices can analyze medical imaging material more accurately than humans and thus among other things help to detect diseases such as cancer at an early stage. They will also describe how AI algorithms are used to create tailored treatment strategies personalized for each patient's genetics and clinical past, which helps enable more precise treatments.

3. Edge AI

A major trend in 2024 is Edge AI It enables computer processing to be done at the edge of a network, rather than in large data centers. Because of its reduced latency and added data privacy, Edge AI can be used in applications like autonomous vehicles transportations, smart cities as well as industrial automation. Example, edge AI in autonomous vehicles is able to get and process real-time data, increasing security by allowing faster decision-making.

4. AI in Finance

Today, the financial sector is using AI to make better decisions and provide an even stronger customer experience. Fraud detection, risk assessment and customised financial advice have introduced insurance into the AI algorithm. AI-powered chatbots and virtual assistants are now common enough to be in use by 2024, greatly assisting customers stay on top of their financial well-being. Those tools will review your spending behavior, write feedback to you and even help with some investment advices.

5. AI in Education

AI is revolutionizing education with individualized learning. These AI-powered adaptive learning platforms use data analytics to understand how students fare and produces a customised educational content (Hoos, 2017). This way, students get a tailored experience and realize better outcomes. Not only that, AI enabled tools are also in use for automating administrative tasks which shortens the time required by educators on teaching.

6. AI in Job Hunting

This is also reverberating in the job sector, where AI technology has been trending. With tools like Canyon AI Resume Builder, you can spin the best resumé that might catch something eye catchy recruiter among a dozen others applications he receives in-between his zoom meeting. Using AI based tools to analyze Job Descriptions and match it with the required skills, experience in different job roles help accelerating the chances of a right fit JOB.

7. Artificial Intelligence in Memory & Storage Solutions

Leading AI solutions provider Innodisk presents its own line of memory and storage with added in-house designed AI at the recent Future of Memory & Storage (FMS) 2024 event. Very typically these are solutions to make AI applications easier, faster and better by improving performance scalability as well on the quality. This has huge implications on sectors with substantial data processing and storage demands (healthcare, finance, self-driving cars).

Conclusion

2024 — Even at the edge of possible, AI is revolutionizing across many industries. AI is changing our lives from tailored chatbots and edge AI to healthcare, finance solutions or education and job search. This will not only improve your business profile as a freelancer who create SEO optimized content and write copies but also give your clients in the writing for business niche some very useful tips.

#ai#ai in healthcare#ai in finance#ai in wealth management#ai in business#AI trends#artificial intelligence#advanced technologies#innovation#technological advancements

2 notes

·

View notes

Link

Some of Europe's top fintech firms are starting to crumble as investors question their true valuation. Asset manager Schroders has cut the value of its stake in financial "superapp" Revolut by 46%, according to a filing on April 17 that threatens Revolut's title as the UK's most valuable fintech. The writedown suggests the London-headquartered firm is now valued at about $17.7bn (£14.2bn), which is substantially less than the $33bn it was valued at in a funding round last July. Revolut has been criticised for the late filing of accounts, EU regulatory breaches and corporate culture. It has also been waiting two years for regulators to approve its UK banking license. Schroders has also marked down its stake in Atom Bank by 31%. Meanwhile, Allianz is selling its stake in struggling fintech N26 at a heavily-reduced price, according to the Financial Times, while buy-now-pay-later firm Klarna has seen its valuation tumble from $45.6bn to $6.7bn.

39 notes

·

View notes

Text

August 22-23: GLA Patent and Legal Conference

The GLA Patent and Legal Conference on August 22-23 is an essential event for professionals navigating the complex landscape of intellectual property and legal regulations. Hosted by the Global Law Association (GLA), this conference brings together industry leaders, legal experts, and patent professionals for two days of intensive discussions, insightful presentations, and networking opportunities.

This year’s conference will feature a series of keynote speeches and panel discussions led by renowned experts in patent law, intellectual property rights, and legal innovations. Attendees will gain valuable insights into emerging trends, recent case studies, and best practices in patent management and legal strategy.

Whether you are a seasoned professional or new to the field, the GLA Patent and Legal Conference promises to be an invaluable experience. Don’t miss this chance to stay at the forefront of patent and legal developments and to enhance your understanding of the evolving landscape. Join us on August 22-23 to engage with experts, expand your network, and advance your knowledge in this critical field.

Address-

Global Legal Association

Suite-427,425 Broadhollow Road,

Melville, New York, USA- 11747

Website: https://www.globallegalassociation.org/

Mail id: [email protected]

US: +1 716 941 7798

#artificial intelligence#biology#business#startup#services#finance#sales#branding#innovation#technology#news#new york#global#usa#uk#bangkok#uae#africa#events#campaign#conference#management#networking#law#legal advice#legal services#lawyer#law firm#legal#meeting

2 notes

·

View notes

Text

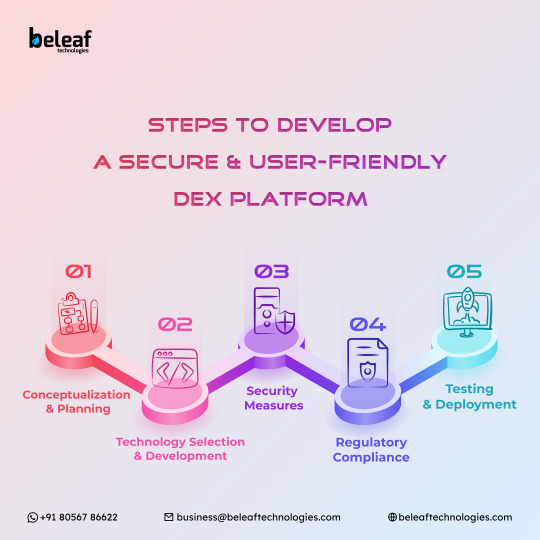

Discover the essential facts and steps required to create a secure and user-friendly DEX platform. Explore top-notch security and seamless trading experiences. Join Beleaf Technologies to uncover a wealth of previously unknown information in the realm of decentralized exchange development.

Contact details :-

Whatsapp: +91 80567 86622

Skype: live:.cid.62ff8496d3390349

Telegram: https://t.me/BeleafTech

Mail to:[email protected]

8 notes

·

View notes

Text

literally two days ago my dad was bragging about his google stock and i said "sell that shit google's getting too big for its britches" based on 0 research just vibes. wall street wishes it has what i have

#personal log#i also said meta and disney are going to get broken up#just in case apollo is with us in this chilis tonight#and also while i'm at it i predict meta is going to buy twitter and that will be the end of meta#like maybe 3-5 years from now#meta will branch off into some new fully-realized imvu/vrchat thing#and if i'm going to really go for it i'll go ahead and predict that that endeavor will be hand in hand with some kind of apple product#i'm just talking out my ass. but what if#listen. all my dad and i talk about is finance and technology 😭#my toxic trait is that i'm this 🤏 close to wanting to getting involved with stock trading at all times#but i think that would be BAAAAD for my ocd

4 notes

·

View notes