#gold mutual funds

Text

Things You Should Know About Gold Mutual Funds vs Gold ETF

Gold Mutual Funds vs Gold ETF

Both gold mutual funds and gold ETFs are investment options that allow investors to gain exposure to the price movements of gold, but they have some key differences.

Gold mutual funds are investment funds that pool money from multiple investors to purchase gold or gold-related assets, such as stocks of companies involved in the gold mining industry. They are typically managed by a professional investment manager who makes decisions on which assets to buy and sell in order to achieve the fund's investment objectives. The value of the fund's shares is based on the net asset value (NAV) of the underlying assets, which is calculated daily.

On the other hand, gold ETFs are exchange-traded funds that track the price of gold. They are traded on stock exchanges like stocks and their value is based on the current market price of gold. Investors can purchase shares in the ETF, which represents ownership in a certain amount of gold. ETFs are not actively managed and the fund simply seeks to track the underlying index or benchmark.

One of the main differences between the two is that gold mutual funds are actively managed, while gold ETFs are not. This means that the investment manager of a gold mutual fund has the discretion to buy and sell assets in the fund based on their view of the market, while the manager of a gold ETF simply seeks to track the underlying index or benchmark. This could potentially lead to a better return for the mutual fund, but also a higher management fee.

Another difference is that mutual funds are priced once a day after the market close, while ETFs are priced throughout the trading day like stocks. This means that the price you pay for mutual funds may not be the same as the net asset value (NAV), while ETFs are traded at market price.

In conclusion, both gold mutual funds and gold ETFs provide investors with an opportunity to gain exposure to the price movements of gold, but they have some key differences. Investors should consider their investment objectives, risk tolerance and research the management team before choosing between the two options.

What is an ETF for gold?

An ETF for gold is a type of exchange-traded fund that tracks the price of gold and allows investors to purchase shares in the fund, which represents ownership in a certain amount of gold. These ETFs are traded on stock exchanges like stocks and their value is based on the current market price of gold. This allows investors to gain exposure to the price movements of gold without the need to physically purchase and store the metal. Some popular examples of gold ETFs include the SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU).

What is a mutual fund for gold?

A mutual fund for gold is a type of investment fund that pools money from multiple investors to purchase gold or gold-related assets, such as stocks of companies involved in the gold mining industry. Mutual funds are typically managed by a professional investment manager who makes decisions on which assets to buy and sell in order to achieve the fund's investment objectives.

Gold mutual funds typically invest in a combination of physical gold, gold futures contracts, and stocks of companies involved in the gold mining industry. The value of the fund's shares is based on the net asset value (NAV) of the underlying assets, which is calculated by dividing the total value of the fund's assets by the number of shares outstanding.

One of the advantages of investing in a gold mutual fund is that it provides diversification. By investing in a variety of different assets, the fund is able to spread out the risk and potential for loss across a larger number of investments. Additionally, mutual funds are generally more accessible to individual investors than buying and storing physical gold, which can be costly and logistically difficult.

However, it is important to keep in mind that mutual funds, like all investments, come with risks. The value of the fund's shares can go up or down depending on the performance of the underlying assets. Additionally, mutual funds typically come with management fees and other expenses, which can eat into the fund's returns. It is always recommended to research the fund and its management team, and read the prospectus before investing in any mutual fund.

Overall, a gold mutual fund is an investment option that provides exposure to gold, and the potential for returns, through a professionally managed and diversified portfolio. It can be a good option for those who want to invest in gold but do not want to physically purchase and store the metal or for those who want to diversify their investment portfolio.

Gold Mutual Funds vs Gold ETF | Major Difference

The major difference between gold mutual funds and gold ETFs is that gold mutual funds are actively managed, while gold ETFs are not.

Gold mutual funds are investment funds that pool money from multiple investors to purchase gold or gold-related assets, such as stocks of companies involved in the gold mining industry. They are typically managed by a professional investment manager who makes decisions on which assets to buy and sell in order to achieve the fund's investment objectives. The value of the fund's shares is based on the net asset value (NAV) of the underlying assets, which is calculated daily.

On the other hand, gold ETFs are exchange-traded funds that track the price of gold. They are traded on stock exchanges like stocks and their value is based on the current market price of gold. Investors can purchase shares in the ETF, which represents ownership in a certain amount of gold. ETFs are not actively managed and the fund simply seeks to track the underlying index or benchmark.

This means that the investment manager of a gold mutual fund has the discretion to buy and sell assets in the fund based on their view of the market, while the manager of a gold ETF simply seeks to track the underlying index or benchmark. This could potentially lead to a better return for the mutual fund, but also a higher management fee.

For more info: Things You Should Know About Gold Mutual Funds vs Gold ETF

0 notes

Text

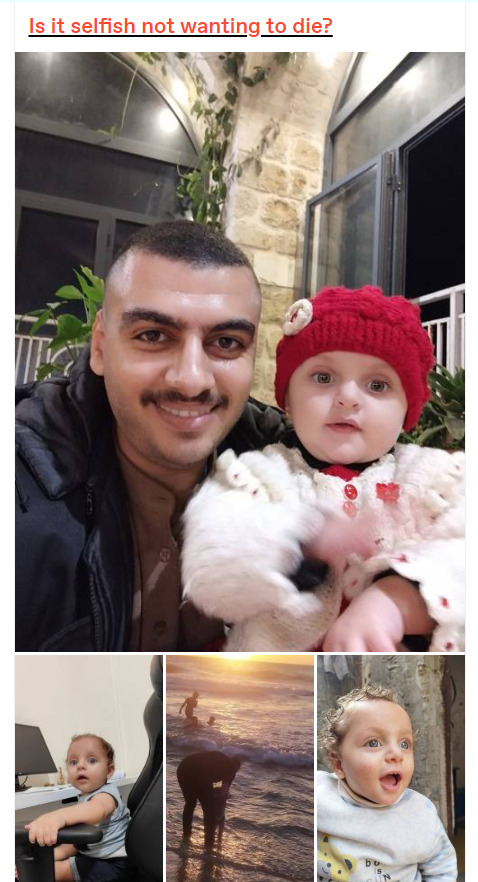

Can we support Firas through this Exceptionally Hard Time ?

Firas's One year old son is sick while he can't be with his children right now, as his parents are sick and in desperate need of him!

Verified by @el-shab-hussein Here

To Donate Click Here

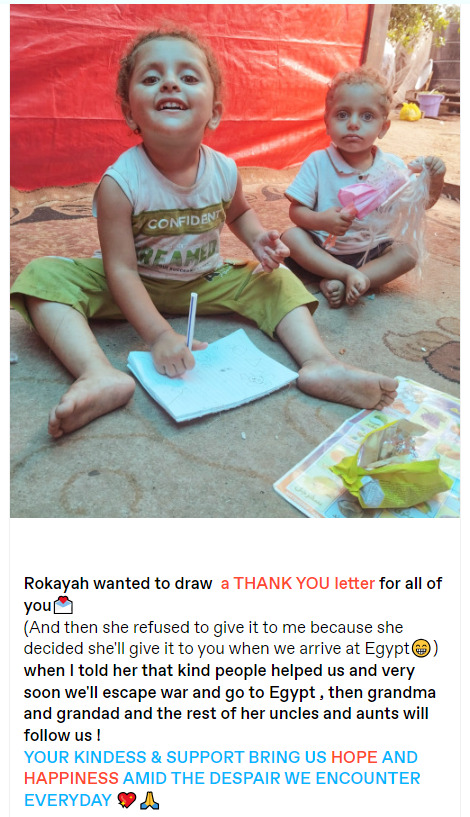

My Angels .. God Bless Them 💖🙏

Firas Salem and his family are my friends from Gaza , he is a software Engineer .

He is a father of two Wonderful kids (2 Year Old and 1 Year old )

Currently he is the Provider for his Parents and younger siblings

His Family All together in Gaza = 11 Members).

They need to get out as soon as possible (hopefully together) .

Your Donations will help them get out of Gaza to Egypt ( 5000$ per person).

A part of it will help them afford life and medical expenses in Gaza and in Egypt for one month until they can work and get on their feet again.

Their current living condition is hellish but they're considered lucky to live in cramped tent !

His 1 year old is very sick and got Hospitalized with severe Gastroenteritis, vomiting and diarrhea ..

Magid Updates : here & here

Rokayah Update : here & here

His mother and teenage brother had Hepatitis C and the mother's health keep getting worse and worse with little medical care and clean water and food . Here & Here

Vetted or added to lists Here:

#111 @el-shab-hussein list Here - #4 @fallahifag list Here @blackpearlblast list Here - @communistchilchuck list Here #1 @riding-with-the-wild-hunt list Here @palestinecharitycommissionsassoc list Here @kordeliiius list Here

___________________________________________

@ibtisams Here ,@fairuzfan Here , @palipu Here ,

@brutaliakhoa Here and many others if you searched his name

Can We Help Him and Share his Words and Story on his behalf

so People Can DONATE AND SHARE ?

PLEASE FOLLOW HIS ACCOUNTS: @firas-salem & @firassalemgaza

THANK YOU SO MUCH! Your Support Means The World to them .. PLEASE DONATE TO WHOEVER YOU FIND WORTHY

AND PLEASE DONATE TO MY FRIEND &HIS FAMILY

Pray for Magid and Firas's MOTHER AND BROTHER

€29,310 raised of €65,000 goal

#free gaza#all eyes on rafah#help gaza#gaza#rafah#firassalem#free rafah#gaza genocide#free palestine#gaza strip#firas salem#save palestine#signal boost#boost#boosting#mutual aid#fundrasier#fundraiser#please boost#booster gold#palestine aid#ai digital art#humanitarian aid#mobility aid#donate#fundraisers#gfm#gaza fundraiser#go fund them#go fund me

1K notes

·

View notes

Note

Hello there 👋

@islamgazaaccount2

Islam, a 27-year-old from Gaza, is currently sleeping on the streets without any form of shelter or safety for himself and his family. Their home was demolished by a bombing from the Israeli occupation. While shelter is crucial, they also urgently need food and water. All of their necessities were taken away.

Islam tried sharing a donation link, but with limited followers, it wasn't reaching enough people. Thankfully, he created a GoFundMe account, making it easier for those who want to help.

Please consider sharing Islam's story and donating to his GoFundMe. Even a small contribution can make a big difference in their time of need. 🙏❤️

https://gofund.me/08ed0b8c

This fundraiser is on the following list of vetted ones and has been verified by @90-ghost and @riding-with-the-wild-hunt

hi, I am currently not in a well financial state but I will be sure to boost this ask so you can get the help you need.

#gazaunderattack#free gaza#gaza strip#gaza#gaza genocide#free palestine#fuck israel#the gaza strip#palestine gfm#palestine#gfm#gaza gfm#go fund them#donate if you can#palestine gofundme#verified fundraiser#boost#signal boost#please boost#booster gold#boosting#donations#fundraising#palestine aid#mutual aid#fundraisers#humanitarian aid#reblog this#important#reblog to save a life

21 notes

·

View notes

Note

Hello, I am Ahmed. The war destroyed my life. Can you help me? I need 3 things from you: Share, repost, and donate if you are able to donate. Thank you for listening to me

My post link 👇💕

https://www.tumblr.com/ahmed4palestine/756439898525974528/urgent

My GFM link 👇🔗

https://gofund.me/1d8bb3df

Go ahead and donate to this one as well!

#palestine will be free#free palestine#free gaza#save palestine#save gaza#save rafah#send help#please help#mutual aid#gofundme#go fund them#go fund me#tumblr gold

6 notes

·

View notes

Note

Hello

I'm Amira from Gaza 🍉, responsible for my family since my father passed away. Despite becoming a university lecturer and app developer, the recent war destroyed everything 😥.

I urgently need to leave Gaza to care for my sick mother and continue my aspirations.

Any help or sharing of a support link would be deeply appreciated.

https://www.gofundme.com/f/amiras-story-between-hope-and-resilience-a-call-for-soli

Thank you sincerely 🙏🙏

Amira

Please check out Amira's account, donate for her family. Thank you

#donation#donate if you can#please donate#donations#keep donating#please consider donating#palestine donation#donate#fundraising#go fund them#go fund me#fundrasier#fundriser#emergency funds#funds needed#gaza funds#mutual funds#funds#funding#funds for gaza#donations for palestine#donations for gaza#please help#reblog#signal boost#signal b00st#signal boooooost#boost#please boost#booster gold

2 notes

·

View notes

Text

5 Myths: Essential Facts About Gold Bars and Coins for Investors

Top Gold investment plan has kept investors in a primordial trance for ages, however, different gold legends and myths come out to go along with this. Let’s go through the main five stereotypes about gold coins and bars to help investors invest with a higher level of consciousness.

#gold bars. coin investors#Gold Investment#gold plans#buying gold in Diwali#Best Gold Investment plan#Top Gold investment plan#Financenu Gold mutual fund

1 note

·

View note

Text

Which Loan is Best, FD, Gold Loan, Mutual Fund, Personal Loan

What is Loan

Some Types of Loans

FD (Fixed Deposit) Loan

You can take a loan against bank FD without breaking it. In this way, along with the benefit of maintaining the savings deposited in the bank, one also gets the necessary cash.

The interest rates (12–15%) applicable on FD loans are also lower than personal loans. This loan is also easily available immediately. Also, there is no need to submit many documents to the bank for this. Savings also remain intact along with debt.

Gold Loan

Gold loans have become attractive these days as gold prices have reached Rs 75,000 per 10 grams. Now you will get more loan than before on mortgaging jewellery.

READ MORE>>>>

#which loan is best#Which loan is best in india#Which Bank is best for personal loan with low interest#Which loan is best for bad credit#FD LOAN#Personal Loan#Gold Loan#Mutual Fund#HDFC Personal Loan#Personal loan rate of interest#Personal loan calculator#interest rate#Fd loan sbi#Gold Loan interest rates#Gold loan Calculator#Gold Loan SBI#Mutual fund calculator#Mutual funds India#SBI Mutual Fund#Mutual fund investment#4 types of mutual funds#Mutual Fund Sahi Hai#HDFC Mutual Fund#Mutual Fund investment Plan#SBI Gold Loan interest rate#Gold loan per gram#Gold loan EMI calculator#Gold loan near me#IIFL gold loan#Fd loan calculator

0 notes

Text

youtube

In this latest video, Mr. Ajay Patwari, a renowned Financial Freedom Coach, explains "Why Invest in Gold & Silver?

Gold & Silver Analysis for Investment Purpose. So, Ready to Explore Gold & Silver Analysis? Watch this latest video uploaded by Wealth Insight Capital Services Pvt. Ltd.

0 notes

Text

Who Provides the Best Commodity Market Services in Alwar?

When it comes to investing in commodities, the residents of Alwar have a gem in their midst. Our financial services firm, which has been a guiding light for many investors, stands out as the go-to place for commodity market services in Alwar.

Understanding Commodity Markets

Before we dive into the services, let’s understand what commodity markets are. Simply put, they are places where you can buy or sell things like wheat, cotton, and even gold. It’s like a big shop where instead of clothes or toys, people trade in goods that come from the earth or are made in large quantities.

Why choose us?

We have been around for a while, and they know the ins and outs of the commodity market like the back of their hand. They offer advice that’s easy to understand and act on, making sure you’re not left scratching your head wondering what to do next.

Gold Trading Expertise

Gold is a big deal in Alwar, and we have got some of the best gold trading experts in Alwar. We can help you understand when to buy gold, when to sell, and how to keep your investments diversified and safe from market volatility. It’s like having a friend who knows all about gold and is always there to give you the best advice.

Personal Touch

What makes us special is the personal touch they bring to their services. They will sit down with you, listen to your aspirations, requirements, and plans, and then help you make the right decisions. Because it’s not just about making money; it’s about making your money work for you.

Community Trust

The people of Alwar trust us because they’ve seen the results. Neighbors, friends, and family members have all worked with us and come away happier and more confident about their investments.

Conclusion

In a city like Alwar, finding someone who understands your financial needs and can offer solid advice on commodity markets is priceless. We have proven time and again that we are the leaders in this field. Whether you’re looking to invest in gold or other commodities, we can be your partner you need.

This article is a brief overview of why we are considered the best provider of commodity market services, especially for those interested in gold trading. For more detailed information and personalized advice, visiting their website or contacting them directly would be the best course of action.

#mutual fund company in alwar#mutual fund sip experts in alwar#mutual fund expert in alwar#mutual fund investment advisor in alwar#mutual funds advisor in alwar#mutual funds sip advisor in alwar#best insurance company in alwar#mutual fund sip services in alwar#online investment in mutual funds in alwar#equity savings funds advisor in Alwar#top equity mutual fund experts in Alwar#equity fund investment advisor in alwar#equity fund experts in alwar#investing in equity mutual funds#equity based mutual funds services in Alwar#commodity market services in Alwar#commodity market news in Alwar#gold trading experts in Alwar#oil trading advisors in Alwar#commodity trading advisor in Alwar#share trading in bhiwadi#f and o trading advisor in bhiwadi#bonds investment platforms in bhiwadi

0 notes

Text

Best Financial Decision Right Now Is To Sell Gold

If you cannot make a high profit after selling your investment then there is no use of purchasing it. Subtracting your selling price from the money that you have invested while purchasing that investment. To make sure that you can earn a high profit, your selling price should be significantly higher than your cost price. It is now clear that in order to get such a high price you need to keep in…

View On WordPress

#As Cash For Gold#Best Place To Sell Gold In Delhi#Cash For Diamond#Cash For Gold#Cash For Gold At Doorstep#Cash For Gold Delhi NCR#Cash for Gold Dwarka#Cash For Gold Faridabad#Cash For Gold Gurgaon#Cash For Gold In Delhi#Cash For Gold In Delhi NCR#Cash For Gold In Ghaziabad#Cash For Gold In Noida#Cash For Gold India#Cash for Gold Karol Bagh#Cash for Gold Munirka#Cash For Gold Near Me#Cash for Gold Rohini#Cash For Silver#commodities#Diamond Buyer#finance#gold#Gold Buyer#Gold Buyer Delhi#Gold Buyer In Delhi NCR#Gold Jewellery Buyer#How To Sell Gold In Delhi#investing#mutual-funds

0 notes

Text

VV Stock Zone provides full coverage of the stock market, cryptocurrencies, commodities, mutual funds, economic opinions, IPO announcements, and more to help you stay on top in the world of finance.

1 note

·

View note

Text

Unlocking Digital Gold: Best Prices for Your Precious Investment

Unlock the future of wealth with our digital gold at the best prices. Experience the pinnacle of value and convenience in every transaction. Invest smartly, invest in digital gold.

Contact Us:1104,11th Floor, GD-ITL Tower, B-08, NSP, Pitampura, Delhi-110034

+91 8010033320

[email protected]

Click Now

#sip calculator#digital gold#digital gold investment app in india#digital gold investment is good or bad#mutual fund calculator#buying digital gold online

0 notes

Text

Unlocking Financial Success: Finding the Best Mutual Fund Distributor in Beawar

In the dynamic landscape of financial markets, making informed investment decisions is crucial for achieving long-term financial goals. For residents of Beawar, a key concern is often finding the right financial partner to guide them through the complex world of mutual funds. In this pursuit, identifying the best mutual fund distributor becomes paramount.

Navigating the Financial Maze: The Need for Expert Guidance

Beawar, like any other city, is home to a diverse population with varying financial aspirations. Many individuals face a common challenge: the lack of financial expertise to make sound investment decisions. This gap often leads to missed opportunities and suboptimal investment choices. Enter mutual funds – a popular and accessible investment avenue for those seeking to grow their wealth.

Why Do You Need a Mutual Fund Distributor in Beawar?

Choosing the right mutual fund distributor is akin to having a financial guide by your side. Here's why you need one:

Expertise Matters: Mutual funds can be complex, with various schemes catering to different risk appetites. An experienced mutual fund distributor in Beawar possesses the knowledge to align your investment goals with the most suitable funds.

Customized Solutions: A skilled distributor understands that one size does not fit all. Every individual has a unique financial situation, so he/she customizes the investment strategy and the portfolio according to the needs. It can be a short-term or long-term objective.

Risk Mitigation: Investing always involves an element of risk. A proficient mutual fund sip advisor in Beawar helps you navigate these risks by providing insights into market trends and adjusting your portfolio accordingly.

Benefits of Choosing the Best Mutual Fund Distributor

Optimized Returns: With a deep understanding of market dynamics, the best mutual distributor can identify opportunities that maximize returns while minimizing risks.

Portfolio Diversification: It is a key investment strategy to help individuals minimize the risk and improve returns. A skilled distributor helps you diversify across different asset classes, ensuring a well-balanced and resilient portfolio.

Regular Monitoring: Financial markets are dynamic, and staying updated is essential. Your chosen distributor keeps a vigilant eye on your investments, making timely adjustments to capitalize on emerging opportunities or mitigate potential losses.

Conclusion: Partnering for Financial Success

Choosing the best mutual fund distributor is not just a prudent decision; it's a step toward financial empowerment. At Ambition Finserve, we understand the unique financial landscape of Beawar and are committed to guiding you toward your financial aspirations. Explore the world of mutual funds with confidence, knowing that you have a trusted partner by your side.

Embark on your financial journey with Ambition Finserve – Your Gateway to Financial Excellence.

#best mutual fund distributor in Beawar#financial planning companies in Beawar#mutual funds services in Beawar#mutual fund sip advisor in Beawar#equity investment planner in Beawar#portfolio management services in Beawar#pms services in Beawar#retirement planning company in Beawar#goal based planning in Beawar#child education advisor in Beawar#marriage fund management planner in Beawar#corporate fixed deposit services in Beawar#bonds investment services in Beawar#sovereign gold bond planner in Beawar#govt of India bonds services in Beawar#tax planning agency in Beawar#alternative investment funds service in Beawar#aif service in Beawar#life insurance planning in Beawar#financial services in Beawar#Wealth management service in Beawar#tax consulting services in Beawar#financial goals planner in Beawar#portfolios management service in Beawar#portfolio advisory services in Beawar

1 note

·

View note

Note

Dear/Lovely supporter🌷

I hope you're well😃. I'm doctor Mohammed Aldeeb,a medical doctor from gaza🇵🇸🕊🍉 , my family and I have faced a devastating loss😓; our home and my workplace at the hospital have been destroyed😢💔. We are in dire need of assistance to rebuild our lives🥺🙏❤.

I've started a fundraising campaign and urgently need your help to spread it to the world💚🤍.

Reblogging our story on your platforms would greatly increase our reach🥺🙏🇵🇸🖤.

Please know that our campaign is verified😁by @el-shab-hussein @90-ghost @nabulsi @mangocheesecakes,

and all funds will go directly to our recovery efforts💞.

Thank you for your support during this challenging time🙏🇵🇸.

Best regards,

Dr.mohammed aldeeb from gaza.

Image of my cat in a strawberry hat upon you because I’m broke as a joke but I can post your ask.

#tumblr gold#palestine#free palestine#gaza genocide#free gaza#gofundme#go fund them#emergency#mutual aid

0 notes

Text

Investment plans with high returns

People invest for a variety of reasons. They may do so to build wealth, protect their resources, or achieve a specific life objective. You can invest in short-term investments that offer security and pose little risk if capital preservation is your goal. However, experts advise choosing long-term investments if you want to generate wealth.

Investing money, in the long run, can help you accumulate resources for your later years. They are vital for helping you save for retirement and other important life goals because of the capital appreciation they offer. But are long-term capable of producing investment plans with higher returns?

A long-term investment is one made with the intention of generating significant profits over a minimum of five years.

Although they carry some risk, long-term investments have the potential to offer you much larger returns over a longer period of time than other types of investments. These are appropriate for those who have the financial resources to lay away a certain amount of money for a lengthy period of time.

You do not need to be concerned about market volatility because short-term losses are eventually made up for.

They are economical since they lower commission and other management costs over the long term.

The power of compounding and long-term investments can help you expand your money dramatically.

The rupee cost averaging tool might assist you in increasing your investment's return.

Long-term investments help you prepare for your life goals while also generating wealth appreciation and balancing the dangers. They may also aid in forming the habit of saving.

You can choose from a range of long-term investment strategies. To find the investment option that will best help you achieve your objectives, you must first evaluate your needs.

ULIPs are among the greatest long-term investment plans since they offer the benefits of both insurance and investing. They can support a range of life objectives, such as retirement planning, children's marriages, and property purchases, among others. Additionally, you are eligible for an annual tax deduction of up to 1.5 lakhs.

Mutual funds called equity funds invest in the stock market. Even though the risks are higher, they allow you the possibility to earn substantial profits. If you choose an ELSS, you can also get tax breaks (Equity Linked Savings Scheme). Equity funds are a great tool for preparing for long-term objectives like retirement, home ownership, or paying for your child's higher education.

PPF is one of the best long-term investing solutions. For those investing in the future, this is a relatively secure option. In addition, they offer tax advantages.

The real estate market is rising. It has great prospects, and real estate investments typically increase in value over time. But there is also a large upfront cost.

Gold is a popular long-term investment option among Indians and is one of their favored investment products. Among other options, you can invest in gold mutual funds, ETFs, gold bars, or deposit schemes. The investment does, however, have a lock-in term of 3–7 years.

Long-term investments do in fact ensure higher returns. To have a chance at making the biggest earnings, you must start investing early and be patient. Additionally, before investing your money, you should think it through and look at the investment's prior results. Your money is safe and your chances of getting better returns are increased as a result. You can also speak with a financial expert to see whether the investment is sound and will help you reach your objectives in life.

0 notes

Text

https://rollbol.com/blogs/1361165/How-do-Gold-Funds-Work

How do Gold Funds Work

Gold mutual funds are gaining popularity among people who want to invest in something that can help them in the future.

0 notes