#rough ride

Text

Microsoft put their tax-evasion in writing and now they owe $29 billion

I'm coming to Minneapolis! Oct 15: Presenting The Internet Con at Moon Palace Books. Oct 16: Keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing.

If there's one thing I took away from Propublica's explosive IRS Files, it's that "tax avoidance" (which is legal) isn't a separate phenomenon from "tax evasion" (which is not), but rather a thinly veiled euphemism for it:

https://www.propublica.org/series/the-secret-irs-files

That realization sits behind my series of noir novels about the two-fisted forensic accountant Martin Hench, which started with last April's Red Team Blues and continues with The Bezzle, this coming February:

https://us.macmillan.com/books/9781250865847/red-team-blues

A typical noir hero is an unlicensed cop, who goes places the cops can't go and asks questions the cops can't ask. The noir part comes in at the end, when the hero is forced to admit that he's being going places the cops didn't want to go and asking questions the cops didn't want to ask. Marty Hench is a noir hero, but he's not an unlicensed cop, he's an unlicensed IRS inspector, and like other noir heroes, his capers are forever resulting in his realization that the questions and places the IRS won't investigate are down to their choice not to investigate, not an inability to investigate.

The IRS Files are a testimony to this proposition: that Leona Hemsley wasn't wrong when she said, "Taxes are for the little people." Helmsley's crime wasn't believing that proposition – it was stating it aloud, repeatedly, to the press. The tax-avoidance strategies revealed in the IRS Files are obviously tax evasion, and the IRS simply let it slide, focusing their auditing firepower on working people who couldn't afford to defend themselves, looking for things like minor compliance errors committed by people receiving public benefits.

Or at least, that's how it used to be. But the Biden administration poured billions into the IRS, greenlighting 30,000 new employees whose mission would be to investigate the kinds of 0.1%ers and giant multinational corporations who'd Helmsleyed their way into tax-free fortunes. The fact that these elite monsters paid no tax was hardly a secret, and the impunity with which they functioned was a constant, corrosive force that delegitimized American society as a place where the rules only applied to everyday people and not the rich and powerful who preyed on them.

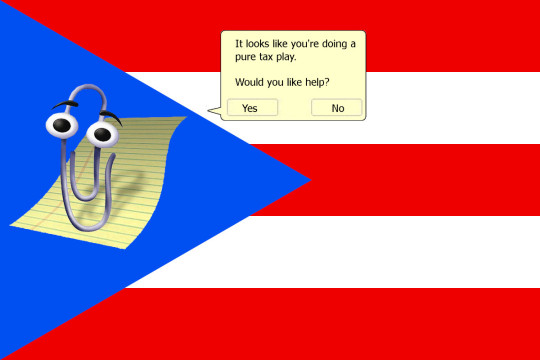

The poster-child for the IRS's new anti-impunity campaign is Microsoft, who, decades ago, "sold its IP to to an 85-person factory it owned in a small Puerto Rican city," brokered a deal with the corporate friendly Puerto Rican government to pay almost no taxes, and channeled all its profits through the tiny facility:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

That was in 2005. Now, the IRS has come after Microsoft for all the taxes it evaded through the gambit, demanding that the company pay it $29 billion. What's more, the courts are taking the IRS's side in this case, consistently ruling against Microsoft as it seeks to keep its ill-gotten billions:

https://www.propublica.org/article/irs-microsoft-audit-back-taxes-puerto-rico-billions

Now, no one expects that Microsoft is going to write a check to the IRS tomorrow. The company's made it clear that they intend to tie this up in the courts for a decade if they can, claiming, for example, that Trump's amnesty for corporate tax-cheats means the company doesn't have to give up a dime.

This gambit has worked for Microsoft before. After seven years in antitrust hell in the 1990s, the company was eventually convicted of violating the Sherman Act, America's bedrock competition law. But they kept the case in court until 2001, running out the clock until GW Bush was elected and let them go free. Bush had a very selective version of being "tough on crime."

But for all that Microsoft escaped being broken up, the seven years of depositions, investigations, subpoenas and negative publicity took a toll on the company. Bill Gates was personally humiliated when he became the star of the first viral video, as grainy VHS tapes of his disastrous and belligerent deposition spread far and wide:

https://pluralistic.net/2020/09/12/whats-a-murder/#miros-tilde-1

If you really want to know who Bill Gates is beneath that sweater-vested savior persona, check out the antitrust deposition – it's still a banger, 25 years on:

https://arstechnica.com/tech-policy/2020/09/revisiting-the-spectacular-failure-that-was-the-bill-gates-deposition/

In cases like these, the process is the punishment: Microsoft's dirty laundry was aired far and wide, its swaggering founder was brought low, and the company's conduct changed for years afterwards. Gates once told Kara Swisher that Microsoft missed its chance to buy Android because they were "distracted by the antitrust trial." But the Android acquisition came four years after the antitrust case ended. What Gates meant was that four years after he wriggled off the DoJ's hook, he was still so wounded and gunshy that he lacked the nerve to risk the regulatory scrutiny that such an anticompetitive merger would entail.

What's more, other companies got the message too. Large companies watched what happened to Microsoft and traded their reckless disregard for antitrust law for a timid respect. The effect eventually wore off, but the Microsoft antitrust case created a brief window where real competition was possible without the constant threat of being crushed by lawless monopolists. Sometimes you have to execute an admiral to encourage the others.

A decade in IRS hell will be even more painful for Microsoft than the antitrust years were. For one thing, the Puerto Rico scam was mainly a product of ex-CEO Steve Ballmer, a man possessed of so little executive function that it's a supreme irony that he was ever a corporate executive. Ballmer is a refreshingly plain-spoken corporate criminal who is so florid in his blatant admissions of guilt and shouted torrents of self-incriminating abuse that the exhibits in the Microsoft-IRS cases to come are sure to be viral sensations beyond even the Gates deposition's high-water mark.

It's not just Ballmer, either. In theory, corporate crime should be hard to prosecute because it's so hard to prove criminal intent. But tech executives can't help telling on themselves, and are very prone indeed to putting all their nefarious plans in writing (think of the FTC conspirators who hung out in a group-chat called "Wirefraud"):

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Ballmer's colleagues at Microsoft were far from circumspect on the illegitimacy of the Puerto Rico gambit. One Microsoft executive gloated – in writing – that it was a "pure tax play." That is, it was untainted by any legitimate corporate purpose other than to create a nonsensical gambit that effectively relocated Microsoft's corporate headquarters to a tiny CD-pressing plant in the Caribbean.

But if other Microsoft execs were calling this a "pure tax play," one can only imagine what Ballmer called it. Ballmer, after all, is a serial tax-cheat, the star of multiple editions of the IRS Files. For example, there's the wheeze whereby he has turned his NBA team into a bottomless sinkhole for the taxes on his vast fortune:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Or his "tax-loss harvesting" – a ploy whereby rich people do a "wash trade," buying and selling the same asset at the same time, not so much circumventing the IRS rules against this as violating those rules while expecting the IRS to turn a blind eye:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

Ballmer needs all those scams. After all, he was one of the pandemic's most successful profiteers. He was one of eight billionaires who added at least a billion more to his net worth during lockdown:

https://inequality.org/great-divide/billionaire-bonanza-2020/

Like all forms of rot, corruption spreads. Microsoft turned Washington State into a corporate tax-haven and starved the state of funds, paving the way for other tax-cheats like Amazon to establish themselves in the area. But the same anti-corruption movement that revitalized the IRS has also taken root in Washington, where reformers instituted a new capital gains tax aimed at the ultra-wealthy that has funded a renaissance in infrastructure and social spending:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

If the IRS does manage to drag Microsoft through the courts for the next decade, it's going to do more than air the company's dirty laundry. It'll expose more of Ballmer's habitual sleaze, and the ways that Microsoft dragged a whole state into a pit of austerity. And even more importantly, it'll expose the Puertopia conspiracy, a neocolonial project that transformed Puerto Rico into an onshore-offshore tax-haven that saw the island strip-mined and then placed under corporate management:

https://pluralistic.net/2022/07/27/boricua/#que-viva-albizu

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#irs#puerto rico#puertopia#microsoft#micros~1#tax avoidance#tax evasion#pure tax play#big tech can't stop telling on itself#corporate crime#rough ride#the procedure is the punishment#steve ballmer#pour encouragez les autres

890 notes

·

View notes

Text

Doraemon and his human-like teeth.

It's a turbulent ride, brace yourself.

#Doraemon#ドラえもん#El Gato Cósmico#哆啦A夢#travel#teeth#doraemonfanclub gif#brace yourself#rough ride#Nobita and the Birth of Japan#のび太の日本誕生

5 notes

·

View notes

Text

When Legolas takes a break

#fanart#lord of the rings#gimolas#legolas#gimli son of gloin#sketch#other fandoms#other fandoms: lord of the rings#yes the height difference#yes the whole riding the horse together always shebang#yes the ‘one who is always alert gets a rest’ trope#it’s a rough sketch but it’s made with lots of love and squeezing of my iPad from affection

1K notes

·

View notes

Text

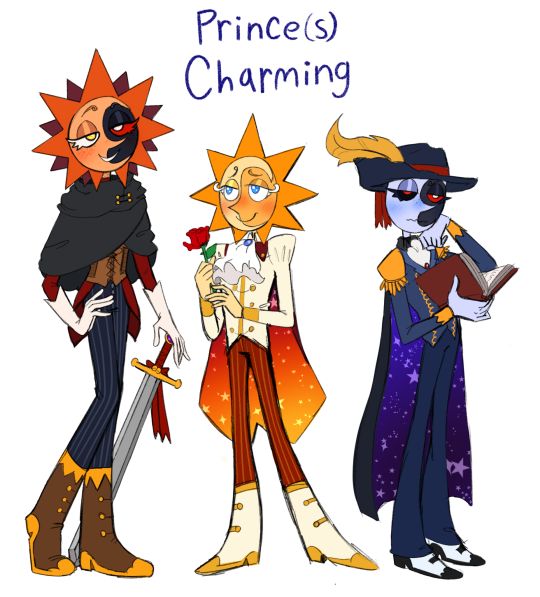

Have this Fairy Tale AU to reign in the new year!!

In this AU the prince(s) charming from all the classic stories falls in love with the woodsman rather than their Fairy tale loves after being saved from a band of marauders on their way to the castle one night

Meanwhile the woodsman (Y/N in this case) has decided to hunt down all the dark beasts in the shadows they can find to finally give the kingdom some peace, weather it be wolves or trolls or dragons, they want the people of the kingdom to feel safe. (Some more than others)

#I'm still kind of figuring out the story but I have a rough general idea#y/n got their red cloak from little red riding hood and her grandma as a thank you#for saving them from the wolf#even if things didn't work out how y/n expected#fnaf sb#fairy tale au#moondrop#sundrop#fnaf eclipse#my art#fnaf security breach#fnaf sun#fnaf moon#fanart#Prince sun#prince moon#prince eclipse#sun x reader#sun x y/n#moon x reader#moon x y/n#eclipse x reader#eclipse x y/n#woodsman y/n#monster hunter y/n#now with 3 y/n looks to choose from#and 3 different little companions#mini music man#fnaf bonbon#fnaf helpy

1K notes

·

View notes

Text

THE RESULT OF DRIVING ON CALIFORNIA ROADS

THE RESULT OF DRIVING ON CALIFORNIA ROADS

DONATENO ADVERTISING ON DAWGS BLOG- PAID FOR BY DONATIONS$10.00

View On WordPress

0 notes

Note

Of all those that Clover knows, who do they think gives the best hugs?

depends on what ur looking for :)

#monster clover au#asked and answered#undertale yellow#sorry starlo. u are so scaly and rough#more of a hair ruffle and piggyback ride guy#mcau doodle#dalv uty#martlet uty#ceroba ketsukane

311 notes

·

View notes

Note

i confess i am very curious... what is finch like as a lover

depends on who's holding the leash

#points at him. service top (usually...)#he's kinda rough but waxes dangerously saccharine if you so much as imply praise#make him earn it tho he likes it#it's a knight thing#his tryst with halsin was a wild ride (HAH) because like#halsin stripped ass naked and was talking all this sweetness and IMMEDIATELY dropped to his knees and it was very#y'know those pictures of big dogs being carried and looking confused about it#it was that#next day like: so that was kinda new for me and really nice... next time can u be a little mean tho 👉👈#oc: finch#bg3#bg3 tav#nsft#my art

376 notes

·

View notes

Text

Really awesome article was published today (April 30th, 2023) about gay rodeo!!!

Please give it a read, and if anyone wants information on how to get involved: where to go watch, or even competing- just let me know. Gay rodeo has been going on since the 60s and has chapters in several states in the US, as well as in Canada. But only has a fraction of the numbers it used to, and very few younger folks.

#gay rodeo#Texas gay rodeo association#international gay rodeo association#TGRA#IGRA#gay#rodeo#LGBTQ+#queer#trans folks#transgender#trans pride#pride#gay pride#lesbian pride#aids#aids epidemic#rough stock#country#bull riding#bronc#horse#horses#intersectional activism#multiculturalism#black cowboys#cowgirls#activism#gay rights#trans rights

668 notes

·

View notes

Text

Little dragonet Leon sketches. His fascination was quite obvious as a little noodle.

And yes, his favorite movie (aside from Jupiter Jim and Lou Jitsu) is Rio. And HTTYD. And Guardians of Ga’Hoole—

#I did this all at work fhsjfbjs#so apologies if it’s a bit ROUGH#I had the idea of Raph giving rides and just#ran with that#Mikey and Leo wagging their tails together fbsjbfjdbd#rottmnt#rottmnt fanart#rottmnt leo#rottmnt raph#rottmnt mikey#rottmnt donnie#rise dragons#dragon au#rise of the teenage mutant ninja turtles#rise of the tmnt#rise leo#rise Mikey#rise raph#rise donnie#turtle tots#but dragon edition

232 notes

·

View notes

Text

everyday i wake up in cold sweat and remember that "akutagawa rode atsushi " is an actual canon statement.

293 notes

·

View notes

Text

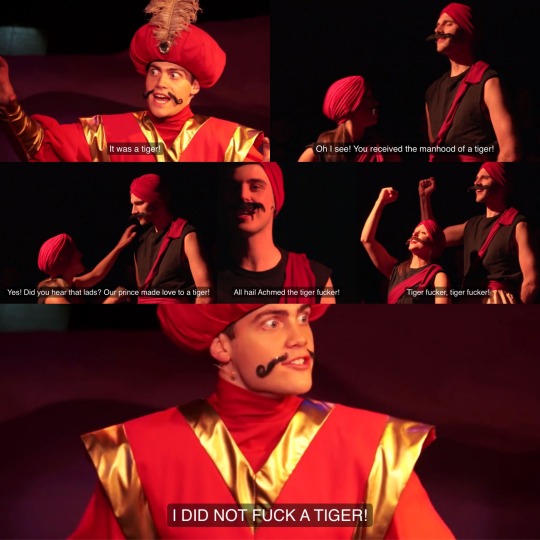

rewatching Twisted and in my head this could be a wan short with Black Lizard and Akutagawa

#Tachihara: you literally said he was a rough ride#Aku: THATS NOT-#It’s so funny to me#do I have any StarKid mutuals out there?#bsd#bungo stray dogs#sskk#shin soukoku

168 notes

·

View notes