#China Economy

Text

The collapse of China is like Biden being pushed to the left,ain't happening, and the muricans should give up on it

The post is machine translated

Translation is at the bottom

The collective is on telegram

😂 Per mesi, i propagandisti anti-Cinesi hanno diffuso notizie fasulle ed esagerate contro la Cina sul Tema dell'Economia, riproponendo l'imbarazzante "China Collapse Theory" 🤹♂️

😂 Ogni ciclo della "China Collapse Theory" si è concluso con il collasso della teoria stessa, e anche questo ciclo non ha fatto eccezione 😄

🤩 这些小丑对所谓的 "中国崩溃 "早有准备。2001 年、2002 年、2003 年......、2023 年都没有发生,但也许 2024 年会发生!是的,它会发生在你们恶心可笑的梦里 😀

🤡 Nonostante tutti gli articoli dei 小丑 d'Occidente in stile terrorismo psicologico, con titoli come «Trema l'Economia Mondiale» o«Una nuova Lehman Brothers», l'Economia Cinese ha continuato a crescere nel Q3 del 2023, superando le aspettative e le previsioni degli economisti occidentali 📈

😂 Persino il FMI, non esattamente il circolo degli economisti di 乌有之乡, non esattamente l'organizzazione legata al Pensiero di 左大培, ha corretto al rialzo le previsioni sulla crescita dell'Economia Cinese per il 2023 nel Documento: "IMF Staff Completes 2023 Article IV Mission to the People’s Republic of China" - «The Chinese economy is projected to grow at 5.4 percent in 2023» 🤣

😂 E il "Collasso"?, e tutti gli articoli anti-Cinesi ricolmi di wishful-thinking su 恒大集团 - Evergrande Group? 哈哈哈哈哈 😂

😭 È davvero un giorno triste per i propagandisti anti-Cinesi. Ai propagandisti anti-Cinesi, dall'Italia del "miracolo economico" alla Germania in ginocchio, passando per gli USA in deficit di trilioni di dollari, consiglio l'articolo: 中医怎么缓解胃痛 中医7大偏方火速解决胃痛 - 7 Rimedi della Medicina Tradizionale Cinese per risolvere il mal di stomaco ☕️

😂 Si attendono con ansia i futuri articoli nello stile "[La Cina ha ottenuto un'altra vittoria], ma a quale prezzo?!" 😂

😀 Al prezzo della sanità mentale degli occidentali anti-Cinesi 🤣

😂 意大利期刊与法国或德国期刊一样,都是美利坚合众国的奴隶。它们不断重复美国对中国的宣传。读意大利期刊对中国经济的 "分析 "非常有趣,因为意大利经济就是个笑话,被债务、可怕的基础设施和糟糕的市场环境摧毁了 🇮🇹 🇫🇷 🇩🇪 😂

🔍 Approfondimenti:

一 Q1: +4,5% | Q2: +6,3% | Q3: +4,9% 📈

二 "China will collapse!" / "China is the biggest World threat!" - il dualismo ridicolo della propaganda anti-Cinese 🤹♂️

三 Il (nuovo) collasso della "China Collapse Theory" | La Cina sconfigge la "deflazione" in un solo mese, e continua a crescere 📈

四 La Cina sarà il motore della crescita dell'Economia del Mondo nel 2023 📈

五 Ogni previsione Occidentale sul "Collasso della Cina" è fallita 😂

🌸 Iscriviti 👉 @collettivoshaoshan 😘

😂 For months, anti-China propagandists have spread fake and exaggerated news against China on the topic of the economy, re-proposing the embarrassing "China Collapse Theory" 🤹♂️

😂 Every cycle of the "China Collapse Theory" ended with the collapse of the theory itself, and this cycle was no exception 😄

🤩 这些小丑对所谓的 "中国崩溃 "早有准备。2001 年、2002 年、2003 年......、2023 年都没有发生,但也许 2024 年会发生!是的,它会发生在你们恶心可笑的梦里 😀

🤡 Despite all the articles from the Western 小丑 in the style of psychological terrorism, with titles like "The World Economy is Trembling" or "A New Lehman Brothers", the Chinese Economy continued to grow in Q3 2023, exceeding expectations and the forecasts of Western economists 📈

😂 Even the IMF, not exactly the circle of economists of 乌有之乡, not exactly the organization linked to the Thought of 左大培, has corrected upwards the forecasts on the growth of the Chinese Economy for 2023 in the Document: "IMF Staff Completes 2023 Article IV Mission to the People's Republic of China" - «The Chinese economy is projected to grow at 5.4 percent in 2023» 🤣

😂 And the "Collapse"?, and all the anti-Chinese articles full of wishful-thinking on 恒大集团 - Evergrande Group? 哈哈哈哈哈 😂

😭 It is indeed a sad day for anti-China propagandists. To anti-Chinese propagandists, from the Italy of the "economic miracle" to Germany on its knees, passing through the USA in deficit of trillions of dollars, I recommend the article: Traditional Chinese Medicine to solve stomach ache ☕️

😂 Look forward to future articles in the style of "[China has achieved another victory], but at what cost?!" 😂

😀 At the price of the sanity of anti-Chinese Westerners 🤣

😂 意大利期刊与法国或德国期刊一样,都是美利坚合众国的奴隶。它们不断重复美国对中国的宣传。读意大利期刊对中国经济的 "分析 "非常有趣,因为意大利经济就是个笑话,被债务、可怕的基础设施和糟糕的市场环境摧毁了 🇮🇹 🇫🇷 🇩🇪 😂

🔍 Further information:

一 Q1: +4.5% | Q2: +6.3% | Q3: +4.9% 📈

二 "China will collapse!" / "China is the biggest World threat!" - the ridiculous dualism of anti-Chinese propaganda 🤹♂️

三 The (new) collapse of the "China Collapse Theory" | China defeats "deflation" in just one month, and continues to grow 📈

四 China will be the engine of growth of the World Economy in 2023 📈

五 Every Western prediction about the "Collapse of China" has failed 😂

🌸 Subscribe 👉 @collectivoshaoshan 😘

#socialism#china#italian#collettivoshaoshan#translated#communism#china news#marxism leninism#marxist leninist#marxist#marxismo#marxism#multipolar world#geopolitica#geopolitics#chinese communist party#communist party of china#western propaganda#china economy#economic news#news#socialismo#socialist

3 notes

·

View notes

Text

The UN General Assembly has overwhelmingly condemned Russia's placarded annexation of four Ukrainian regions in eastern and southern Ukraine.

further than three- diggings of the 193- member General Assembly on October 12 suggested in favor of a resolution that called Moscow's move illegal.

Only Syria, Nicaragua, North Korea, and Belarus joined Russia in advancing against the resolution. Thirty- five countries, including China, India, South Africa, and Pakistan, abstained.

#unreality#news#world news#news news#russia#vladimir putin#ukraine#news usa#china#ukraine war#putin#zelenskyy#china economy#china girl#north korea#kim jong un

4 notes

·

View notes

Text

Today is Not About 5G! Today is About 6G Technology? Really? "YES"

I know we are not still over with 5G technology! Now Immensphere is discussing 6G technology? Yes, it is about 6G technology today!

Okay! lets us go into the detail.

If you live in a country like India, Russia, or Mexico, you must be thinking, we haven’t even seen 5G yet, and you are talking about an overview of 6G technology.

Yes, that is because 72 countries, such as South Korea, the USA, China and Japan, had already launched 5G back in 2019, and now the world is headed towards 6G, the next decade’s technology.

The upgradation in technology from 5G to 6G will be much higher and faster than what we saw in the transition from 4G to 5G.

To understand better about 6G, We have discusse about 5G also.

So 5G vs 6G

Low latency

5G: 5 milliseconds.

6G: 1 microsecond.

Speed

5G: 40 Up to 1,100 Mbps.

6G: Up to 1 Tbps. (1,000,000 Mbps)

Spectrum

5G: 0.4 GHz and 114 GHz.

6G: 95 GHz to 3 THz.

Does 6G Exist?

Currently, 6G is in its initial research and development stage.

Leading telecom companies like Samsung and Qualcomm are working on it and have published research on 6G.

Next is 7G Technology?

What we know is very little about 7G and are only speculations compared to the previous networks while knowing little about the division for 6G.

But we know, when G's technologies will be launched.

5G Technology has been launched in 2020.

6G Technology will be launched in 2030.

7G Technology will be launched in 2040.

*according to reports.

Whatever G's Technology comes out, it will make things super fast, instant, and everything will be just available without a moment.

For now, Immensphere is signing off about 5G, 6G and 7G Technology!

Follow @immensphere for more content like this.

#5g technology#6g internet#telecommunications#telecom#technology#immensphere#services#it services#samsung#qualcomm#south korea#japan#united states#russia#china economy#india#narendra modi

4 notes

·

View notes

Text

A look inside China: Is this the most sovereign country on Earth?

youtube

0 notes

Video

youtube

China's $2 TRILLION Mega Project Madness! (Top 5 & 👷♂️🌉🌁) @Kimlud

#youtube#China's $2 TRILLION Mega Project Madness#china#mega projects#infrastructure#china economy#china mega projects#infrastructure projects#engineering feats#construction projects#mega structures#china constructions#brigdes#tunnels#skyscrapers#future cities

0 notes

Text

How Will China's Housing Bubble End?

China has a housing bubble. Over the past 2 decades, Chinese people have claimed that they need a property to get married, they are willing to pool the entire family's money to buy one, there is no other real forms of investments, equities is too policy and emotions driven, etc.

In 2022, a Chinese friend told me he was buying real estate. I told him to consider renting for 2 more years and wait and see what happens in 2024-2025 to wait for the covid dust to settle as the bubble seemed to be bursting back then.

Now the bubble is bursting, I think the worst case scenario could be the Indonesian 1997 Financial Crisis and the ensuing social unrest and liberalisation of the economy and governance model.

I think things will just drag on and on as they usually do in China which is massive and all the propaganda will continue but political and macro risks are incredibly high over there.

The Chinese developers' and officials thinking of 'build and they will come' and using real estate to grow GDP has resulted in many ghost cities and half completed buildings. They will come only if they can afford it. And even if they can afford it, the quality of housing is horrible.

0 notes

Text

China está llenando el vacío económico causado por la desindustrialización de Estados Unidos, la OTAN y Europa... es una economía de subsidios, gastos en infraestructura y aumento del nivel de vida de su población. Es una política económica similar a la que aplicaron Estados Unidos y Alemania, a finales del siglo XIX , una política básica del capitalismo industrial, una política que deberían haber evolucionado hacia el socialismo si se hubiera controlado a la oligarquía financiera... China ha utilizado las políticas que en Estados Unidos tuvieron éxito. Pero el capitalismo estadounidense y europeo ya no es industrial. Es el capitalismo financiero... Estados Unidos se ha convertido en una economía rentista que vive de las rentas monopóliscas... aquí está el problema para Estados Unidos. Conseguir el liderazgo tecnológico pasa por I+D. Pero esto cuesta dinero, y Amazon, Google, Meta y otros utilizan sus ingresos para hacer subir los precios de las acciones en el CORTO PLAZO mediante recompras de acciones y pagos de dividendos, no para investigación y desarrollo a largo plazo... el intento de aislar y perjudicar a China y a todos los demás países que buscan su autodependencia está dando cómo resultado el aislamiento de Estados Unidos. Esta es una formidable ironía... la política autodestructiva de Estados Unidos basada en dañar a otros países como medio para controlarlos va al desastre. En cambio, China ofrece ganancias mutuas a todos sus socios comerciales . Esto último significa que la civilización terminará sobreviviendo a la barbarie del Imperio tanto en Gaza como en otros lugares de conflicto (Michael Hudson)

#economiachina#chinaestrategia#china#china economy#economiaeeuu#imperialismonorteamericano#imperialismonorteamericanofinal

0 notes

Text

How China's economy compares to the US

The American and Chinese economies bucked growth predictions in the first quarter of 2024.

U.S. expansion slowed amid rising inflationary pressure, but unemployment remained low. Meanwhile, China’s economy showed signs of recovery in several sectors, though some of this had tapered off by March.

The economic landscapes of both countries have diverged since the end of the pandemic. The U.S.’s has…

View On WordPress

0 notes

Text

Brussels seeks to push Chinese energy giants out of EU market

Chinese authorities said on Wednesday they were “extremely concerned” about a EU investigation into Chinese suppliers of wind turbines, RFI reports.

EU antitrust commissioner Margrethe Vestager said on Tuesday that the Commission was introducing a law designed to reduce imports of products from companies that are subsidised by their home countries.

However, the commissioner did not name the Chinese companies to be investigated by the European Union’s executive branch during a lecture at the Institute for Advanced Study in Princeton, New Jersey, US, on Tuesday.

The investigation was the latest move by Brussels to target the country over subsidies for green technology, which are suspected of undermining fair competition.

The European Commission will examine the conditions of wind farm developments in France, Spain, Greece, Romania and Bulgaria.

Read more HERE

#world news#world politics#news#europe#european news#european union#eu politics#eu news#green politics#green power#green energy#wind power#china#china news#chinese politics#china economy#chinese economy

0 notes

Text

Starbucks: Estratégias de Crescimento no Mercado Chinês

A jornada da Starbucks na China tem sido marcada por um crescimento notável. Desde os seus humildes começos com menos de 500 lojas em 2006, a empresa tem investido consistentemente na expansão de sua presença no mercado chinês. Howard Schultz, fundador da Starbucks, compartilhou em uma entrevista na Universidade Fudan que, apesar das incertezas iniciais, a Starbucks persistiu e construiu uma base…

View On WordPress

0 notes

Text

The dollar is doomed and the empire with it. The era of the Americans is over!

The post is machine translated

Translation is at the bottom

The collective is on telegram

⚠️ NEL MENTRE GLI IMPERIALISTI STATUNITENSI CONTINUANO A "PREVEDERE" IL "COLLASSO DELLA CINA", COLLASSANO LE SUE BANCHE E SI VERIFICA UN CROLLO VERTIGINOSO DEI SUOI TITOLI IN BORSA ⚠️

🌸 Chi segue il Collettivo Shaoshan da tempo, o ha visto questo video di OttolinaTV, sa bene che - per decenni - gli imperialisti statunitensi e i loro lacchè europei si sono lanciati in assurde previsioni sul fantomatico "Collasso della Cina", poi mai avvenuto 🤡

😂 Per chi volesse farsi due risate, trovate in questo post un bel po' di previsioni di Gordon G. Chang, l'asset dell'Impero USA che meglio rappresenta la ridicola "Teoria del Collasso della Cina" 😱

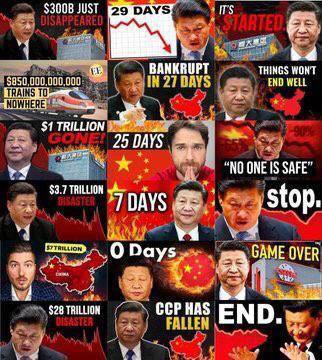

😂 Negli ultimi mesi, però, sono spuntati come funghi video ancora più imbarazzanti, come "La Cina andrà in bancarotta tra 29 giorni", e poi non è ma successo, o "L'Economia Cinese sta per collassare in 25 giorni", e poi non è mai successo 🤣

🤔 Cosa, invece, è avvenuto? Il collasso di una banca statunitense, e il crollo vertiginoso in Borsa di altri titoli bancari 📉

🤔 In questo articolo su "乌有之乡" si trova una bella domanda con una altrettanto bella risposta:

💬 "Quanto tempo ci vuole perché una banca del valore di centinaia di miliardi di dollari passi dalla prosperità alla bancarotta? 48 ore" 😂

🤔 Inoltre, è interessante leggere ciò che ha scritto questo utente Cinese su Weibo:

💬 "L'essenza del fallimento e delle chiusure delle banche negli USA è il risultato inevitabile del declino del Capitalismo Monopolistico Finanziario che è entrato in una bolla. Quando la Federal Reserve continua ad alzare i tassi di interesse, la credibilità del dollaro crolla e il "petroldollaro" diventa non sostenibile. Il crollo finanziario degli USA sarà come un domino, e arriverà con grande forza" ⭐️

💬 "La miopia della strategia dei politici della Casa Bianca ha rovinato il patrimonio nazionale degli USA e il disaccoppiamento dall'economia Cinese farà perdere al dollaro il suo ultimo supporto strategico" ⭐️

🌸 Iscriviti 👉 @collettivoshaoshan

⚠️ WHILE US IMPERIALISTS CONTINUE TO 'FORECAST' CHINA'S 'COLLAPSE', ITS BANKS COLLAPSE AND ITS STOCK STOCKS PUMP ⚠️

🌸 Those who have been following the Shaoshan Collective for some time, or have seen this video by OttolinaTV, know well that - for decades - the US imperialists and their European lackeys have launched into absurd predictions about the elusive "Collapse of China", which never happened 🤡

😂 For those who want to have a laugh, find in this post a lot of predictions by Gordon G. Chang, the asset of the US Empire that best represents the ridiculous "China Collapse Theory" 😱

😂 In recent months, however, even more embarrassing videos have mushroomed, such as "China will go bankrupt in 29 days", and then it never happened, or "China's economy is about to collapse in 25 days", and then it never happened 🤣

🤔 What happened instead? The collapse of a US bank, and the dizzying collapse of other bank stocks on the stock exchange 📉

🤔 In this article on "乌有之乡" there is a good question with an equally good answer:

💬 "How long does it take for a bank worth hundreds of billions of dollars to go from prosperity to bankruptcy? 48 hours" 😂

🤔 Also, it's interesting to read what this Chinese user wrote on Weibo:

💬 "The essence of bank failures and closings in the US is the inevitable result of the decline of Financial Monopoly Capitalism which has entered a bubble. When the Federal Reserve continues to raise interest rates, the credibility of the dollar collapses and the "petrodollar" becomes unsustainable. The US financial collapse will be like dominoes, and it will come with great force" ⭐️

💬 "The strategy short-sightedness of the White House politicians has ruined the national heritage of the USA and the decoupling from the Chinese economy will cause the dollar to lose its last strategic support" ⭐️

🌸 Subscribe 👉 @collettivoshaoshan

#socialism#china#italian#translated#china news#communism#collettivoshaoshan#xi jinping#marxism leninism#marxist leninist#marxismo#marxist#marxism#multipolar world#multipolarity#china economy#chinese communist party#western imperialism#dedollarization#american imperialism

4 notes

·

View notes

Text

China Cuts Bank Reserve Requirements to Bolster Fragile Recovery

In a surprise move, China's central bank announced a significant cut to bank reserves on Wednesday, injecting around $140 billion into the banking system. The People's Bank of China (PBOC) declared a 50-basis point cut, the largest in two years, effective from February 5th, aiming to support a fragile economy and counter-plunging stock markets.

This announcement, made as stock markets were closing, prompted a positive response with benchmark stock indexes and the yuan bouncing back.

PBOC Governor Pan Gongsheng indicated that the bank would unveil policies to enhance commercial property loans, providing hope for investors concerned about China's real estate sector. The move follows China's struggle for a robust post-COVID recovery amidst a housing crisis, local government debt risks, and weakened global demand.

The recent cut in banks' reserve requirement ratio (RRR) is the first this year and comes as China's benchmark indexes hit 5-year lows, reflecting challenges in the $9 trillion market. Pan stated that the RRR cut would release 1 trillion yuan ($139.45 billion) into the economy, surpassing analysts' expectations.

The central bank emphasized a commitment to a loose monetary stance throughout the year to ensure a strong start for the economy in the face of challenging conditions.

Market reactions were positive, with Hong Kong's Hang Seng Index experiencing its largest one-day gain in two months, ending up 3.6%. However, analysts remain cautious, awaiting a comprehensive set of policy supports before determining the overall market impact. Despite several previous measures, more stimulus is anticipated in 2024 to stimulate growth and address deflationary risks.

As China's leaders pledged additional steps to support recovery in December, experts suggest a focus on boosting consumption for a sustained economic rebound.

The central bank faces the dilemma of ensuring effective monetary policy tools, with credit predominantly flowing to manufacturing rather than consumption, potentially adding to deflationary pressures. The economy grew by 5.2% in 2023, meeting official targets, but the recovery has been less robust than expected.

#finance#trade finance#emeriobanque#banking#import#tradefinance#emerio banque#international trade#letter of credit#trade#export#China economy#COVID

0 notes

Text

Zhang Weiwei: China's Rise is SHOCKING the U.S. Military into War it Can...

youtube

0 notes

Text

The World Economy Recovered: Why China's Hasn't

Global Stock Markets Overview

China Reported a 5.3% GDP Growth for 2023

China's Stock Market Decline

CSI 300 Hits Almost Five-Year Low

The CSI 300, representing mainland Chinese shares, dropped by 1.6%, hitting a nearly five-year low. This decline mirrors the broader trend of falling indexes in mainland China and Hong Kong over several years.

Hang Seng Index Approaches 2009 Low

Hong Kong's Hang Seng Index fell by 2.3%, nearing its lowest close since 2009. It's down 12% this year, making it Asia's worst-performing major index and signaling the most substantial monthly drop since October 2022.

Shanghai Composite Index Records Worst Month

The Shanghai Composite Index is down over 7% in January, marking its worst month since the beginning of 2022. The severity highlights growing concerns among investors about the Chinese economy.

Investor Sentiment and Economic Concerns

Foreign Investment Outflow

Foreign investments in mainland Chinese shares saw a significant outflow, with $4.2 billion withdrawn this year, a reversal from the $15.7 billion inflow last year, as per Wind data.

U.S.-Listed Chinese Stocks Experience Sharp Decline

U.S.-listed Chinese stocks, like the Nasdaq Golden Dragon China Index (HXCK), are down 14% in 2024. This decline, along with a broader selloff, raises concerns among investors in the Chinese market.

Outlook for China's Economy

While other Asian stock markets show mixed movements, China's economic situation remains a focal point. The ongoing selloff and negative investor sentiment pose challenges for the Chinese economy, impacting major indexes and potentially influencing global market dynamics.

In conclusion, as global markets celebrate positive trends, China faces a tough start to the year. The severity of the selloff and economic concerns underline the need for a closer look at what's happening in the Chinese economy and its implications for investors eyeing hot stocks and the overall stock market scenario.

Want More? Get AI Stock Reports.

0 notes