#Ethereum Performance

Explore tagged Tumblr posts

Text

#AI and Blockchain Integration#Bitcoin Price Update#Blockchain Technology#Crypto Regulation#Cryptocurrency 2024#Cryptocurrency Volatility#DeFi Trends#Ethereum Performance#facts#Institutional Crypto Adoption#life#NFT Market 2024#Podcast#serious#straight forward#truth#upfront#website

1 note

·

View note

Text

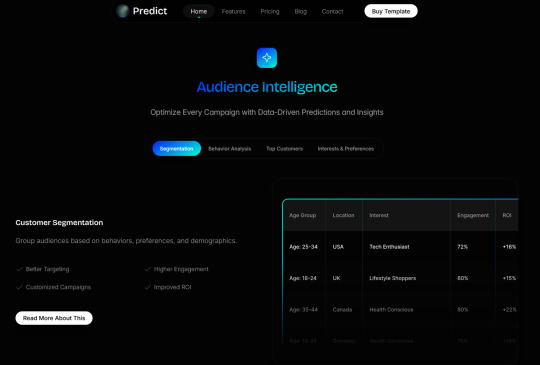

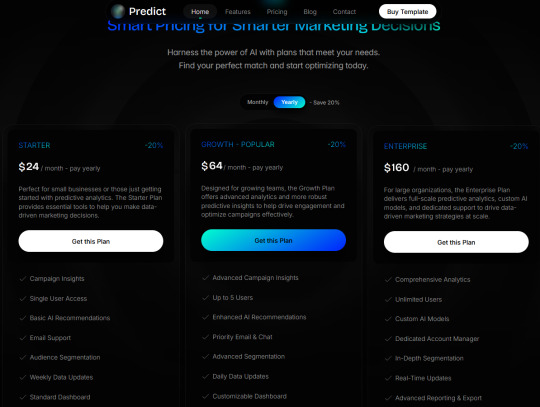

Predict - Template for building a Framer AI Landing Page

Transform your marketing vision into reality with Predict, a modern and adaptable Framer template designed for trailblazers in predictive analytics. Predict serves as a powerful starting point for creators aiming to build AI-driven platforms that optimize audience targeting, campaign performance, and engagement. With its sleek design and intuitive features, this template simplifies the development journey, enabling you to deliver an innovative and seamless experience for your users. Whether you're catering to small businesses or enterprise-level marketers, Predict combines cutting-edge functionality with striking aesthetics to help you launch a platform that drives results.

Live Preview:

Download:

Telegram: ahmetmertugrul

#marketing#creator#vision#business#launch#platform#performance#modern#framer#framertemplate#framertemplates#template#web#web3#ux#ui#uxdesign#uidesign#design#cms#crypto#btc#eth#usdt#ethereum#telegram#not#ai

3 notes

·

View notes

Text

Unlocking the Power of Kaspa (KAS): A Deep Dive into the Altcoin's Impressive Performance and Growth Potential

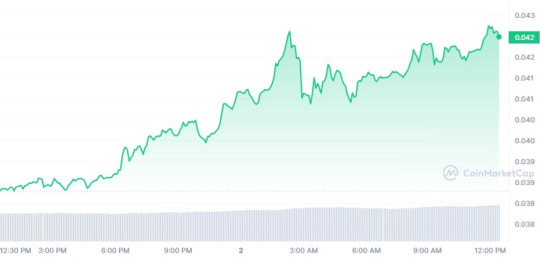

Kaspa (KAS) has been on an impressive bullish run, maintaining an upward trajectory for three consecutive days, positioning itself as one of the top-performing altcoins in July. At the time of this writing, Kaspa is trading at $0.04223, representing a notable 13.01% increase in the past 24 hours. This impressive uptrend has led to an astounding surge of over 80.52% in the trailing 30-day period.

Kaspa's Enigmatic Power in the Blockchain World

Kaspa stands out in the blockchain landscape as it operates on a Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform. Its emergence coincided with the need for an Ethereum (ETH) alternative after the transition of Ethereum from PoW to proof-of-stake (PoS) last year. Growth Drivers for Kaspa - Diverse Community and Increased Adoption: Kaspa's native community has been a driving force behind its growth, accumulating and supporting the project consistently. Furthermore, the entry of buyers from other protocols, like Ethereum, has contributed to bolstering Kaspa's appeal across the entire crypto space. - Utility and Performance Focus: Unlike many competitors in the market, Kaspa is prioritizing utility and performance over mere hype. The platform boasts an impressive throughput rate, capable of processing up to 100 blocks per second, making it exceptionally suitable for enterprise adoption. - Developer Team and Functionality Upgrades: The dedicated team of developers working on Kaspa has been instrumental in continuously enhancing its functionalities. Recently, they introduced a new update, further fortifying the platform's capabilities. Climbing the Ranks Kaspa's recent impressive growth has propelled it up the rankings, currently standing at the 208th position. However, there is a prevailing perception that the coin is still undervalued. With a series of upgrades and dApps in the pipeline, Kaspa holds the potential for further uptrend before the end of Q3.

Conclusion

Kaspa (KAS) has exhibited remarkable bullish momentum, making it one of the standout performers among altcoins in July. Its Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform sets it apart in the blockchain world, and with the support of a dedicated community and growing adoption, its appeal continues to expand. Focusing on utility and performance, Kaspa stands out as a strong contender for enterprise adoption. As the team of developers keeps upgrading the platform, the potential for further uptrend remains high, positioning Kaspa for a promising future in the crypto market. For more articles visit: Cryptotechnews24 Source: u.today

Related Posts

Read the full article

#altcoin#Blockchain#CryptoNews#DAG#DirectedAcyclicGraph#ETH#Ethereum#growthdrivers#KAS#kaspa#performance#PoW#proof-of-work#protocol#utility

2 notes

·

View notes

Text

4 Best Performing Crypto Assets: Ethereum, BlockDAG, Stellar, & SUI — Don't Miss Out on Huge Profits!

Crypto markets are reviving, with certain coins rising above others. As volatility impacts less stable projects, a select group of assets demonstrates resilience through increased adoption, significant upgrades, and notable price movements. Close attention is being paid to BlockDAG, Ethereum, Sui, and Stellar Lumens—all poised for impactful advances. Hype alone cannot drive a rally. These cryptos…

View On WordPress

0 notes

Text

Algocrat AI Review - Top-Performing Cryptocurrency Copy Trading Platform

https://www.bestforexeas.com/algocrat-ai-review/

#investing#crypto#cryptocurrency#bitcoin#bitcoin bot#ethereum#btcusd#ethusd#Algocrat AI#cryptocurrency trading#copy trading platform#Bitcoin trading#Ethereum trading#automated trading#trading algorithms#risk management#Valeriia Mishchenko#trading strategies#financial success#trading tools#investment strategies#market analysis#trading automation#real-time performance tracking#user-friendly interface#trading community#novice traders#experienced traders#profit maximization#sustainable returns

1 note

·

View note

Text

Cryptocurrency Litigation Success: Assessing Compensatory Damages in Lieu of an Injunction for Specific Performance

London, UK – 2 July 2024 – In a significant victory for our client, Mr. Southgate, the Chancery Division of the High Court, has issued a favourable ruling in the case of Southgate v Adam Graham [2024] EWHC 1692 (Ch). Our successful litigation case centered on a dispute arising from a loan agreement involving a cryptocurrency. The initial court decision found Adam Graham in breach of the…

#Bitcoin#Breach of contract#Civil Litigation#Civil Procedural Rules#Contracts#Cryptocoin#Cryptocurrency#Cryptocurrency Dispute#Cryptocurrency Loan Dispute#damages#Ethereum#Financial Regulation#judgment#Litigation#NFTs#Specific Performance#Valuation

0 notes

Text

2024 Tokenization Boom: A New Era for Real-World Assets

In 2024, the landscape of real-world asset (RWA) tokenization is experiencing a transformative shift, marking a significant milestone in the financial industry. Tokenization converts physical assets like real estate, commodities, and art into digital tokens on a blockchain, enhancing liquidity, accessibility, transparency, and security. This revolutionary technology makes high-value assets more accessible to a broader range of investors. As we explore the current state and future prospects of tokenization, it is clear that this technology is set to reshape the global financial ecosystem significantly.

Tokenization is predicted to be a multi-trillion-dollar opportunity by 2030, with market estimates suggesting it could reach up to $16 trillion. The United States is leading this revolution, followed by countries like Singapore, the United Kingdom, Switzerland, India, and Luxembourg.

The total value locked in tokenized assets has surged to $10.53 billion, with major financial institutions launching tokenized investment products. This signals a major inflection point for the industry, underscoring the significant role tokenization will play in the future of finance.

The benefits of tokenization are extensive. It allows for fractional ownership, increasing liquidity and enabling investors to buy and sell portions of an asset. This democratizes investment opportunities and bridges the gap between traditional and digital financial markets. Tokenization also reduces transaction costs by eliminating intermediaries and automating processes through smart contracts.

As regulatory frameworks evolve and technology advances, tokenization is set to revolutionize the financial industry. Intelisync provides cutting-edge RWA tokenization services to help you navigate and capitalize on this financial Learn more....

#metaverse development company#blockchain development companies#web3 development#blockchain development services#metaverse game development#24/7 Market Access#Access to Real-World Yields#Asset Classes in Tokenization#Benefiting Blockchains#CeFi and DeFi tokenization#CeFi-Based Tokenization Protocols#Commodities#Common Combinations#Credit & Loans#Current Trajectory#DeFi protocols#DeFi-Based Tokenization Protocols#Diverse Asset Classes#Dominance of the U.S.#Emerging Trends#Enhanced Liquidity#Ethereum’s Prominence#Fractional Ownership#Leading Geographies#Leading Geographies in Tokenization#Less Popular Asset Classes#Performance of DeFi Protocols#Popular Asset Classes#Private Credit#Real Estate

1 note

·

View note

Text

Cardano (ADA): Sell it for Solana?

New Post has been published on https://www.ultragamerz.com/cardano-ada-sell-it-for-solana/

Cardano (ADA): Sell it for Solana?

Cardano (ADA): Sell it for Solana?

Cardano (ADA), the brainchild of Ethereum co-founder Charles Hoskinson, has been a hot topic in the crypto space. However, with a recent barrage of bearish news and influencer skepticism, some are questioning whether ADA is all it’s cracked up to be. Let’s delve into the world of Cardano, separating hype from reality.

Influencer FOMO and the Solana Shadow:

Social media is flooded with “Cardano killers” like Solana (SOL) boasting lightning-fast transaction speeds and lower fees. Influencers, often swayed by short-term gains, are hyping SOL to the moon, leaving Cardano seemingly stuck in the dust.

Cardano’s Different Path:

However, Cardano takes a much different approach than the “move fast and break things” mentality of some competitors. Cardano prioritizes meticulous research and a peer-reviewed development process. This methodical approach, while slower, aims to deliver a more secure and scalable blockchain in the long run.

Cardano vs. The Hype Machine:

Recent bearish articles highlight Cardano’s slow development progress and missed deadlines. While these criticisms hold some weight, it’s important to remember Cardano is building a complex ecosystem.

The ADA Price:

Cardano’s Bullish Trajectory: A Technical Analysis Glimpse

Cardano (ADA) has been on a tear lately, and technical analysts are using charting tools to predict its potential price path. Here’s a breakdown of three possible targets based on different timeframes:

Short-Term (1-2 Months): Applying the Fibonacci retracement tool to ADA’s recent price surge suggests a first target of around $2.20. This level represents the 61.8% retracement of the current upswing, a common support zone after a price increase.

Mid-Term (3-6 Months): If the bullish momentum continues, a more ambitious target could be $14. This aligns with the 161.8% Fibonacci extension level, indicating a potential doubling of the current price within the next half year. However, reaching this target zone would require sustained buying pressure and positive news surrounding the Cardano ecosystem.

Long-Term (1+ Years): For the long-term hodlers (holders on for a dear life), some analysts are charting a much more aggressive target – a staggering $55. This aligns with the 261.8% Fibonacci extension, signifying a potential 25x return on investment from current levels. However, reaching this price point would require significant adoption of Cardano’s blockchain technology and widespread recognition of its functionalities.

Remember: This is for informational purposes only and should not be considered financial advice. Technical analysis is just one tool, and market conditions can change rapidly. Always conduct your own research before making any investment decisions.

Is ADA a Worthy Investment?

While some influencers are quick to dismiss ADA, it’s crucial to conduct your own research and understand Cardano’s unique value proposition. Here are some key aspects to consider:

Scalability: Cardano’s Ouroboros proof-of-stake consensus mechanism aims to achieve high transaction throughput without sacrificing decentralization, a challenge faced by many blockchains.

Smart Contracts: Cardano’s smart contract platform, Plutus, is built with security and formal verification in mind, aiming to minimize bugs and vulnerabilities.

Interoperability: Cardano’s vision includes interoperability with other blockchains, allowing seamless transfer of data and assets across different ecosystems.

Bearish News and Price Performance:

Despite the recent bearish sentiment, it’s worth noting that ADA started the current market cycle at around $0.20 and reached a peak of over $3.00, a significant increase. This demonstrates that long-term investors still see value in Cardano’s long-term vision.

Is ADA Right for You?

The decision to invest in ADA depends on your risk tolerance and investment horizon. If you’re looking for a quick pump based on influencer hype, Cardano might not be the best choice. However, if you believe in Cardano’s long-term vision of a secure and scalable blockchain platform, ADA could be a worthwhile investment for your portfolio.

Remember:

The cryptocurrency market is notoriously volatile and prone to hype cycles. Always conduct thorough research, understand the risks involved, and never invest more than you can afford to lose.

#bearish news#Cardano (ADA)#Cardano killers#Charles Hoskinson#consensus mechanism#Cryptocurrency Market#decentralization#Ethereum (ETH)#Ethereum co-founder#fees#formal verification#hype#hype cycles#influencer FOMO (Fear of Missing Out)#interoperability#investment#long-term vision#Ouroboros proof-of-stake#peer-reviewed development process#Plutus#price performance#research#risk#risk tolerance#scalability#secure blockchain#security#smart contracts#Solana (SOL)#transaction speeds

0 notes

Text

After Surpassing $65,000 Bitcoin Goes For New Record High - Technology Org

New Post has been published on https://thedigitalinsider.com/after-surpassing-65000-bitcoin-goes-for-new-record-high-technology-org/

After Surpassing $65,000 Bitcoin Goes For New Record High - Technology Org

Bitcoin surged to a two-year high, surpassing $65,000 on Monday and approaching record levels. Analysts say this cryptocurrency is going for a new record high.

Bitcoin – artistic impression. Image credit: Aleksi Räisä via Unsplash, free license

With a session peak of $65,537 in European trading, Bitcoin demonstrated a 4% increase, reaching $65,045. This follows its recent two-year high in Asian trading.

Bitcoin’s impressive 50% gain this year has been particularly notable in recent weeks, coinciding with a surge in inflows into U.S.-listed Bitcoin funds.

The approval of spot bitcoin exchange-traded funds in the United States has played a significant role in attracting new substantial investors, rekindling enthusiasm and momentum reminiscent of the 2021 rally to record levels.

Analysts note that investor confidence remains strong, contributing to sustained positive flows into the cryptocurrency.

In the week ending March 1, the net inflow into the ten largest U.S. spot bitcoin funds amounted to $2.17 billion, with over half of this capital directed toward BlackRock’s iShares Bitcoin Trust (IBIT.O).

Meanwhile, Ethereum, a smaller counterpart, has surged by 50% year-to-date, riding on speculation that it may soon witness increased inflows through the introduction of exchange-traded funds. On Monday, Ethereum traded at two-year highs, recording a 2.6% daily gain and reaching $3,518.

This cryptocurrency rally coincides with record-breaking performances in major stock indexes, including Japan’s Nikkei (.N225), the S&P 500 (.SPX), and the tech-heavy Nasdaq (.IXIC). Simultaneously, volatility indicators in equities (.VIX) and foreign exchange (.DBCVIX) have trended lower.

Analysts posit that in an environment where the Nasdaq is achieving new all-time highs, cryptocurrencies, particularly bitcoin, are likely to perform well, serving as a high-volatility tech proxy and a gauge of market liquidity. The prevailing market conditions reflect a return to a 2021-style market characterized by widespread optimism and upward trends.

Written by Alius Noreika

You can offer your link to a page which is relevant to the topic of this post.

#000#amp#Authored post#billion#bitcoin#BlackRock#cryptocurrencies#cryptocurrency#Environment#Ethereum#exchange-traded funds#Featured technology news#Fintech news#it#Japan#Link#monday#Nasdaq#Performances#Rally#Recording#Spotlight news#Tech#technology#time#Trends#trust#United States

0 notes

Text

Analyst Insights: Ethereum's Bullish Breakout Points to Promising Altseason

Ethereum's recent breakout from its established price channel has ignited excitement in the crypto community, marking a strong start to what analysts and investors anticipate as the onset of an 'Altseason.' The surge in Ethereum's price, coupled with increased holdings among top wallets, reflects a positive market sentiment and hints at a broader rally in the altcoin space.

Technical Breakout:

ProfessorAstrones, a respected figure in the crypto space, highlighted Ethereum's technical breakout from its price channel, a trend that has persisted since October. The recent breach above the upper limit of this channel signifies a robust entry into a period historically associated with strong altcoin performance. The optimistic technical outlook has fueled a shared sense of enthusiasm among analysts and investors.

On-Chain Accumulation:

Supporting the technical perspective, on-chain data reveals a notable increase in buying activity, particularly from corporate entities and high-net-worth individuals. Post the approval of the Bitcoin ETF, the top 1,000 Ethereum wallets have significantly augmented their holdings, accumulating a total of 570,000 ETH and amassing a substantial 64.6 million ETH in total. This on-chain accumulation further bolsters confidence in Ethereum's potential for growth.

Market Reaction and Performance:

The market has responded positively to these developments, with Ethereum's current price at $2,529.98, reflecting a modest gain in the last day and a noteworthy 10.58% upswing over the previous week. Ethereum's market value, now exceeding $304 billion, reflects increased market participation and positive investor sentiment. The combination of technical breakthroughs and on-chain accumulation sets the stage for Ethereum's success and potentially signals the beginning of a broader altcoin rally.

#Ethereum#altseason#Ethereum breakout#altcoin performance#ProfessorAstrones#technical analysis#on-chain data#top Ethereum wallets#buying activity#market reaction#price breakout#market value#investor sentiment#cryptotale

0 notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

282 notes

·

View notes

Text

ERC20 Token Generator Introduction

Have you ever thought about creating your own cryptocurrency? With an ERC20 Token Generator , you can make it happen effortlessly. Let’s explore how to dive into the blockchain universe.

Understanding ERC20 Tokens

ERC20 tokens are a type of digital asset on the Ethereum blockchain, following a set standard for compatibility and functionality.

Advantages of ERC20 Tokens:

Consistency: Adheres to a universal protocol.

Broad Adoption: Recognized across various Ethereum-based platforms.

Robust Support: Strong community and resources available.

How to Use an ERC20 Token Generator

Creating tokens is simplified with these tools. Here’s how it works:

Specify Token Details:

Decide on a name and symbol.

Determine the total number of tokens.

Utilize the Generator:

Access an online generator.

Enter your token information.

Deploy Your Token:

Review your settings.

Launch on the Ethereum network.

Features of ERC20 Tokens

ERC20 tokens provide essential features that enhance their usability:

Standard Operations: Includes transferring and checking balances.

Smart Contract Compatibility: Integrates easily with smart contracts.

Security Assurance: Utilizes Ethereum's strong blockchain security.

Reasons to Create an ERC20 Token

Why create your own token? Here are some compelling reasons:

Raise Capital: Launch an ICO for funding.

Build Engagement: Offer rewards to your community.

Drive Innovation: Explore new blockchain applications.

Challenges to Consider

Despite the simplicity, some challenges exist:

Knowledge Requirement: Some blockchain understanding is needed.

Security Concerns: Vulnerabilities can be exploited if not addressed.

Regulatory Compliance: Ensuring adherence to legal standards is vital.

Best Practices for Token Creation

Follow these tips to ensure a successful token launch:

Code Audits: Regularly check for security issues.

Community Involvement: Seek feedback and make necessary adjustments.

Stay Updated: Keep abreast of blockchain trends and legal requirements.

Conclusion

The ERC20 Token Generator empowers you to create and innovate within the crypto space. Whether you're a developer or entrepreneur, it's a powerful tool for blockchain engagement.

Final Thoughts

Embarking on token creation offers a unique opportunity to explore the digital economy and its possibilities.

FAQs

1. What is the purpose of an ERC20 Token Generator?

It’s a tool to create custom tokens on the Ethereum blockchain easily.

2. Do I need technical skills to create a token?

A basic understanding of blockchain helps, but many tools are user-friendly.

3. Can I trade my ERC20 tokens?

Yes, you can trade them on crypto exchanges or directly with users.

4. What costs are involved in token creation?

Creating tokens incurs gas fees on the Ethereum network.

5. How can I ensure my token’s security?

Perform regular audits and follow best practices for security.

Source : https://www.altcoinator.com/

#erc20#erc20 token development company#erc#erc20tokengenerator#token#token generator#token creation#ethereum#bitcoin

59 notes

·

View notes

Text

Complex autonomous networking and ecosystems.

I'll formally introduce the term I coined a few posts ago about "Unaccountable autonomous Networking and Applications" in the past; the reason being is that somebody decided to...

Name a "Dow Clone" called "The Dao" sometimes also "The Dow" on top of Ethereum and smart contract tech; and then everybody forgot what it was called despite using it very frequently.

And despite it being very banal use of tech.

Because, seemingly, nobody seems to understand how technology works; We must start from the combined understanding that everyone; affluent or not; higher education or not; can in-fact pickup programming.

And because of this there are only two technology positions actually open; [new gal] and [old guy]

Because all our New Guys became trans women and floundered up the DEI process by filling all these jobs with a seemingly endless supply of queer-folk.

So I hate to tell you this; Technology is a very Queer Dominated career field. Because they couldn't get jobs elsewhere.

And they were all really good at the thing nobody knows how to do.

And today; we have idiots from all levels of management and government; trying to make taskers where they don't have trust employee voting tactics (or even other managers and employees)

Creating the previous term "DAO " for "Decentralized autonomous organization"

Which likely costs a *lot* of energy to perform what's effectively "American IDOL" voting from the comfort of your own sofa, knowing full well that nobody can hack you without your permission!

Automated Contracts are like Legal Contracts, in that they are legally obligated (automatically obligated at that! With no approval!) to do the thing they were tasked with doing.

Or you know; replacing traffic courts. Which were all gonna cede the fine even when we know we're right because who has time for that anyway?

The big difference and problem between the two is "Legally" mandated and "Automatically Mandated" legally mandated means it is backed by the legal system; which has approval authority. And "automatically mandated" introduced it's [approval] to every individual user specifically.

Who then has the responsibility of proving something didn't happen correctly. And could wind up in a costly mistake.

Which means that if a legal mistake were to occur; there's no measures to say that an action was meant to be ratified or enacted.

And that is all further cost overhead for the internet as a whole across the planet.

And all the work we put into our legal system will still need to be used on the backend after all that "I don't trust anyone" B's that will definitely get your Guild's Free Loot box raided by opportunists...

10 notes

·

View notes

Text

About Exnori

Hello, I am Exnori.com, a premier cryptocurrency exchange dedicated to revolutionizing the way you trade digital assets. I am here to offer a secure, efficient, and user-friendly platform that caters to both beginners and seasoned traders alike. Let me take you through the various aspects of my services and why I am the go-to choice for cryptocurrency trading.

Mission and Vision

At my core, my mission is to create a transparent, secure, and seamless trading environment. I strive to empower my users with the tools and knowledge they need to navigate the volatile world of cryptocurrencies confidently. My vision is to become a cornerstone of the cryptocurrency ecosystem, where traders can thrive and reach their financial goals.

Robust Security Protocols

Security is my utmost priority. I employ state-of-the-art encryption techniques, robust multi-factor authentication, and continuous monitoring to protect your assets and personal information. My security infrastructure is designed to be resilient against cyber threats, ensuring that your investments are safe with me.

User-Centric Design

I am designed with the user in mind. My platform boasts a clean, intuitive interface that simplifies the trading process. Whether you are accessing me via desktop or mobile, you will find a consistent and user-friendly experience that makes trading easy and accessible, no matter where you are.

Extensive Cryptocurrency Selection

I offer a vast selection of cryptocurrencies for trading. From established giants like Bitcoin, Ethereum, and Ripple to promising new altcoins, my diverse range of assets ensures that you can find the right opportunities to diversify your portfolio and maximize your trading potential.

Competitive and Transparent Fee Structure

I believe in providing value to my users. My fee structure is transparent and competitive, allowing you to understand exactly what you are paying for each transaction. By keeping fees low, I help you maximize your returns and make the most out of your trading activities.

Comprehensive Educational Resources

Knowledge is power, especially in the dynamic world of cryptocurrency. I offer a wealth of educational resources, including in-depth articles, video tutorials, and live webinars. These resources are tailored to help you understand market trends, develop effective trading strategies, and make informed decisions.

Advanced Trading Tools

For the more experienced traders, I provide a suite of advanced trading tools. These include detailed charting capabilities, technical indicators, and algorithmic trading support through my API. Whether you are a day trader or a long-term investor, my tools are designed to enhance your trading strategy and performance.

Community and Customer Support

I pride myself on fostering a vibrant community of traders. My platform encourages interaction and the exchange of ideas among users, creating a collaborative environment. Additionally, my customer support team is available 24/7 to assist you with any issues or questions you may have, ensuring a smooth and supportive trading experience.

Innovation and Continuous Improvement

The cryptocurrency market is constantly evolving, and so am I. I am committed to continuous innovation and regularly update my platform with new features and improvements. This dedication to staying ahead of the curve ensures that I can provide you with the best tools and technologies for successful trading.

Conclusion

Choosing Exnori.com means partnering with a platform that is dedicated to your success. With my robust security measures, user-centric design, extensive asset selection, competitive fees, and unwavering support, I am here to help you achieve your trading goals. Join me at Exnori.com and experience the future of cryptocurrency trading.

By joining Exnori.com, you are becoming part of a dynamic and forward-thinking community. Let's trade smarter, safer, and more effectively together. Welcome to Exnori.com, where your trading journey begins!

13 notes

·

View notes

Text

EVM Compatible Blockchain 2025: The Backbone of Web3 Scalability & Innovation

As the Web3 ecosystem matures, 2025 is shaping up to be a transformative year, especially for EVM-compatible blockchains. These Ethereum Virtual Machine (EVM) compatible networks are no longer just Ethereum alternatives; they are becoming the foundation for a more connected, scalable, and user-friendly decentralized internet.

If you’re a developer, investor, or blockchain enthusiast, understanding the rise of EVM-compatible blockchains in 2025 could be the edge you need to stay ahead.

What is an EVM-compatible blockchain?

An EVM compatible blockchain is a blockchain that can run smart contracts and decentralized applications (dApps) originally built for Ethereum. These networks use the same codebase (Solidity or Vyper), making it easier to port or replicate Ethereum-based applications across different chains.

Think of it as the “Android of blockchain” — a flexible operating system that lets developers deploy applications without needing to rebuild from scratch

Why 2025 is the Breakout Year for EVM Compatible Blockchain?

1. Scalability & Speed Are No Longer Optional

In 2025, network congestion and high gas fees are still major pain points on Ethereum. EVM compatible blockchains like Polygon, BNB Chain, Avalanche, Lycan, and the emerging Wave Blockchain are providing faster throughput and significantly lower transaction costs. This allows dApps to scale without compromising performance or user experience.

2. Interoperability Becomes a Standard

Web3 is no longer about isolated blockchains. In 2025, cross-chain bridges and multichain apps are the norm. EVM compatible blockchains are leading this interoperability movement, enabling seamless asset transfers and data sharing between chains — without sacrificing security or decentralization.

3. DeFi, NFTs, and Gaming Demand EVM Compatibility

Whether it’s a DeFi protocol like Uniswap, an NFT marketplace, or a Web3 game, developers want platforms that support quick deployment, lower fees, and a large user base. EVM compatible blockchains offer all three. That’s why platforms like OneWave, a next-gen multichain ecosystem, are being natively built on EVM-compatible infrastructure to unlock full utility across DeFi, NFTs, GameFi, and beyond.

Key Benefits of Using an EVM Compatible Blockchain in 2025

Lower Development Costs: Developers can reuse Ethereum-based code, tools, and libraries.

Wider Audience Reach: Most wallets like MetaMask, and protocols support EVM chains out of the box.

Cross-Platform Utility: Launch on one chain, expand to others seamlessly.

Greater Liquidity & Ecosystem Integration: Easier to tap into existing DeFi liquidity pools and NFT communities.

The Future Outlook: What Comes Next?

As of 2025, the trend is clear: dApps will prefer chains that are fast, cheap, and EVM compatible. Ethereum’s dominance is no longer enough to guarantee loyalty. Instead, flexibility and performance are king.

With the rise of modular architectures, Layer 2s, and zkEVM rollups, the EVM ecosystem is expanding at an unprecedented pace. EVM compatibility isn’t just a feature anymore — it’s a requirement.

For more visit: www.onewave.app

2 notes

·

View notes

Text

Decentralized Exchange Development: A Deep Dive

Introduction

Decentralized exchanges (DEXs) are making new means of trading digital assets possible. As opposed to centralized exchanges (CEXs), DEXs run on blockchain networks, circumventing the requirement for intermediaries and providing users with direct ownership of their money. This deep dive delves into the key elements, development process, security aspects, and future prospects of DEXs.

What is Decentralized Exchange?

Decentralized Exchange is a peer to peer network that facilitates crypto trading without the third person between the central authority and users. In contrast to centralized exchanges such as Binance or Coinbase, decentralized exchanges enable users to be in control of their funds without a third party in the middle and directly interact with smart contracts on the blockchain. Being familiar with the basic and core features of decentralized exchange you can create your own decentralized exchange that gives a wonderful trading experience. it enhances the security and transparency of the transactions.

Building a DEX: Step by Step Overview

Decentralized exchange need to walk these steps while proceeding from creation to deployment.To have these are following steps:

Conceptualization and Planning: Plan the DEX's scope, target consumer segment, and value proposition such that it should stand out differently.

Blockchain Selection: Select a fitting blockchain network by scalability factor, security parameters, and pricing points.

Smart Contract Development: Author contracts of token exchange, managing liquidity, sharing fees.

Front-End Development: Create and develop an easy-to-use interface to facilitate improved interaction.

Liquidity Pool Integration: Integrate liquidity pools and management mechanisms for them.

Testing and Auditing: Thoroughly test the DEX and perform security audits to identify and resolve bugs.

Deployment and Launch: Deploy the DEX to the targeted blockchain network and launch it to the public and use public experience as feedback for future updates.

Maintenance and Updates: Regularly monitor and update the DEX to enhance performance and security.

Types of Decentralized Exchange

Automated Market Makers (AMMs):

AMMs use liquidity pools, which are token groups locked within smart contracts.

Rather than traditional order books, they employ mathematical equations to decide asset prices.

They deal from these liquidity pools, and prices vary with respect to the pool's tokens proportion.

Examples: Uniswap, PancakeSwap, Curve Finance.

Order Book DEXs:

DEXs model this conventional order book system like central exchanges have traditionally had.

buyers and sellers post orders and the exchange fills them.

These work on-chain, making processes transparent as well as having trading without a middleman.

DEX Aggregators:

DEX aggregators do not maintain their own liquidity. Instead, they aggregate liquidity from other DEXs.

They hunt across different DEXs for the best trade prices available.

This assists in reducing slippage and improving returns for the users.

ParaSwap is an example.

Core Components of Decentralized Exchange

Getting familiar with the basic and core elements of developing decentralized exchange:

Smart Contract

These autonomous contracts that enable trades, manage the liquidity pools, and process the user interactions safely and independently.

Blockchain network

The blockchain is used as the basis for recording and verifying transactions. Ethereum, Binance Smart Chain, Polygon, and others are commonly used.

Liquidity pools

These token pools make trading possible by offering liquidity. Automated Market Makers (AMM) base asset prices on these pools.

User Interface

The frontend Dapps allow users to easily interact with smart contracts and also connect to their wallet.

Oracles

Certain DEXs rely on oracles such as Chainlink to retrieve external price information for improved trade execution and security.

Tech Stack & Tools for DEX Development

So many platforms have been utilized for decentralized exchange depending on their properties and advantages. Some of these DEX platforms are:

Ethereum – Most widely used, supports Solidity

Binance Smart Chain – Faster transactions and lower fees.

Solana, Polygon, Avalanche – High-performance alternatives.

For the process of development, there are a few frameworks. Hardhat, Truffle, Foundry are utilized for testing and development. Solidity is the primary programming language for ethereum dex. A platform doesn't rely solely on coding but also relies on its interface design which is technically known as frontend. There are certain frontend tools that are utilized in decentralized exchange

React.js – Widely used for developing user interfaces.

Web3.js – To integrate frontend with blockchain.

WalletConnect – Used for integrating with wallets.

Security Considerations

If we develop a decentralized platform, we would like to implement security measures within the platform. Security is of utmost importance in DEX development.

Smart Contract Security: Formal verification, strict audits, and secure coding practices are a must.

Mitigation of MEV: Develop measures to avoid Miner Extractable Value and front running.

Liquidity Pool Security: Secure against exploits and maintain the integrity of liquidity pools.

User Security: Educate users and raise awareness for securing their private keys and avoiding scams.

Benefits of DEX

Decentralized exchange is utilized in trading numerous uses and advantages are provided to users. Some advantages are as follows:

Improved Security: Users hold control over their funds, minimizing the risk of centralized hacks.

Improved Privacy: Transactions usually have various names, providing more privacy.

Lower Costs: Removal of third party can result in cheaper trading fees.

Increased Accessibility: DEXs are available to anyone with a Web3 wallet and internet access.

Censorship Resistance: DEXs are less susceptible to censorship and regulatory overreach.

Future Of DEX

Layer-2 Scaling Solutions: Roll Ups and side chains will enhance scalability and lower transaction costs.

Cross-Chain Interoperability: Interconnecting diverse blockchain ecosystems will facilitate seamless asset transfers.

Advanced Trading Features: permanent futures, options, and other derivatives will increase trading possibilities.

NFT Integration: NFT integration into DEXs will create new platforms for trading and asset management.

Enhanced User Experience: Friendly interfaces and trading experiences will fuel mass adoption.

Decentralized Governance: DAOs will have a larger role in managing and evolving DEXs.

Conclusion

Decentralized Exchange Development defines their financial dimensions and enhances transparency. Understanding decentralized exchange core elements, development process, and security matters creates the best exchange platform with a more centralized and balanced financial future. Having the right tools, planning, and a solid development team, your own DEX launch could put you at the forefront of Web3 innovation. With the technology advancing, DEXs are likely to be instrumental in the widespread adoption of blockchain and cryptocurrencies.

2 notes

·

View notes