#Asset Classes in Tokenization

Explore tagged Tumblr posts

Text

2024 Tokenization Boom: A New Era for Real-World Assets

In 2024, the landscape of real-world asset (RWA) tokenization is experiencing a transformative shift, marking a significant milestone in the financial industry. Tokenization converts physical assets like real estate, commodities, and art into digital tokens on a blockchain, enhancing liquidity, accessibility, transparency, and security. This revolutionary technology makes high-value assets more accessible to a broader range of investors. As we explore the current state and future prospects of tokenization, it is clear that this technology is set to reshape the global financial ecosystem significantly.

Tokenization is predicted to be a multi-trillion-dollar opportunity by 2030, with market estimates suggesting it could reach up to $16 trillion. The United States is leading this revolution, followed by countries like Singapore, the United Kingdom, Switzerland, India, and Luxembourg.

The total value locked in tokenized assets has surged to $10.53 billion, with major financial institutions launching tokenized investment products. This signals a major inflection point for the industry, underscoring the significant role tokenization will play in the future of finance.

The benefits of tokenization are extensive. It allows for fractional ownership, increasing liquidity and enabling investors to buy and sell portions of an asset. This democratizes investment opportunities and bridges the gap between traditional and digital financial markets. Tokenization also reduces transaction costs by eliminating intermediaries and automating processes through smart contracts.

As regulatory frameworks evolve and technology advances, tokenization is set to revolutionize the financial industry. Intelisync provides cutting-edge RWA tokenization services to help you navigate and capitalize on this financial Learn more....

#metaverse development company#blockchain development companies#web3 development#blockchain development services#metaverse game development#24/7 Market Access#Access to Real-World Yields#Asset Classes in Tokenization#Benefiting Blockchains#CeFi and DeFi tokenization#CeFi-Based Tokenization Protocols#Commodities#Common Combinations#Credit & Loans#Current Trajectory#DeFi protocols#DeFi-Based Tokenization Protocols#Diverse Asset Classes#Dominance of the U.S.#Emerging Trends#Enhanced Liquidity#Ethereum’s Prominence#Fractional Ownership#Leading Geographies#Leading Geographies in Tokenization#Less Popular Asset Classes#Performance of DeFi Protocols#Popular Asset Classes#Private Credit#Real Estate

1 note

·

View note

Text

The No-Maintenance Asset Class

As the newest Assert Class in the market, Cryptocurrency, birthed just 16 years ago, has proved to be a juggernaut in the marketplace, eclipsing all other markets that have come before it. For those in the space, you have seen first-hand the value of your tokens / coins increase in rapid succession due not only to the population realizing the supply-shock, but also the regulatory barriers which are finally being dismantled. While these known factors are part of the secret weapon of crypto, what is sometimes overlooked is the comparison of how the value of how crypto stacks-up against well-known assets we're familiar with. While there are physical moving targets associated with most traditional investments, digital assets such as XRP and Bitcoin have none. To illustrate, consider Real Estate vs. crypto. Once you have taken possession of a house, it immediately begins to degrade… not necessarily in ticket value, but rather in the 'hidden' costs that slowly eat away at your investment. As a homeowner, you need to constantly maintain the interior, while sustaining the exterior. Over time, the flooring will need to be fixed (or replaced), plumbing issues will most certainly occur at the most inconvenient of times and of course, the natural disintegrating conditions. Should a natural disaster occur, your costs could surge to unprecedented amounts, even if you do have insurance, and while such an occurrence was no fault of your own, you are still the one stuck with the bill. Then there are the monthly and annual costs such as property taxes, heat, hydro, insurance and other expenses that are as regular as the rising sun. True, real-estate is a good investment, but to pretend there are no maintenance costs that go with the territory is just plain ignorant. Consider this… when it comes to sell your house, guess what you can buy? One just like it. The house didn't become more valuable, it actually is less valuable because your 20-year-old estate does not hold the same purchasing power than a new one does. Building supplies, cost-per-square-footage and land continually go up, and when attracting new buyers, would they gravitate to one with new materials and new appliances, etc. or the one with slightly warped floors, cracking paint and electrical issues? Maintenance sucks, but it's a constant with buildings of all types - residential, commercial or industrial.

So what about crypto? Simply put, it has none of these issues. Cryptocurrency tokens are not physical entities, which means they are not prone to the same conditions. It makes no difference how much fire or hail occurs in any given day, it has no effect on a virtual asset, as dust doesn't settle on Bitcoin. For evidence of this, look at how much Bitcoin has gained in value over the last year, let alone the last 15 years. The only Kryptonite that could have an affect on crypto would be that of an electro-magnetic attack or a thrust in Quantum Computing, which some have made a big deal about. Let's put this in perspective. First, an electronic disturbance or loss of internet access would disrupt a lot more than crypto, with entire industries halting the means of production. World leaders are very aware of the consequences of this with the only gains being degrees of loss, with no winners. To quash the quantum-computing debate, cryptographers, quantum engineers and mathematicians realize what is at stake with crypto's multi-Trillion market, and are planning right now for such an eventuality. At it stands today, we are just learning to crawl with the promise of what quantum computing can provide and it will take many years until this technology begins to mature, and because the underlying foundation to crypto is simply a computer, it can, and will be upgraded no different than your operating system's threat-protection software. So, be it a house, a car or other physical entity which constantly needs maintenance, with crypto, you simply buy it, transfer it to your cold storage device, and over time, let the fixed-supply coin appreciate. Bitcoin, XRP, HBAR or your token of choice doesn't care about your emotions, the type of car you drive or how old/new your house is, which should come as comfort to you, the investor. While it's a sound economic posture to have a diverse collection of assets, be it housing, metals or derivatives, holding crypto adds a palliative element not possible with other investment strategies due to it's fixed-supply and hands-off approach. Like other investments, however, the 'maintenance' involved is to simply let time do the heavy lifting.

__________________________________________________________________________________________ Title image by Stable Diffusion | Bitcoin 'Field of Dreams' by Shnick.com

#cryptocurrency#bitcoin#xrp#asset class#crypto#regulation#insurance#real estate#investment#maintenance#virtual asset#quantum#computing#kryptonite#cryptography#cold storage#hbar#mathematics#coin#token

0 notes

Text

I believe we aren't going to see substantial progress in the fight against child abuse until we start viewing children as people group. More specifically, until we stop viewing children as a parent's property, and start listening to their voices in the same way we'd listen to any oppressed class.

I'm sick of dancing around the issue, especially in front of parents who get offended when other people "try to tell them how to parent their kids". You know what, I don't want to make friends with people who think it's okay to treat other people as your property, for any reason.

Children aren't legally allowed to own property, even though they can legally earn money at fourteen.

Children who can cognitively process algebra are allowed to be denied healthcare if their guardian disapproves.

In many states, children are allowed to be intentionally hit if it leaves no substantial harm on their body.

It is considered morally neutral to hate children.

Children constantly have their experiences, perspectives, and worldviews tokenized because "they'll understand when they're older"

In many states, children are not even allowed to choose what name they are called by.

And don't give me the "their brains haven't fully developed yet! They could make bad decisions!"

Listen. Adult people with intellectual disabilities can own property. They can still get healthcare if their nurses or assistants deny them healthcare. You're not allowed to spank someone with an ID or slap them if they do something you don't approve of. If they earn money or other assets, it is legally their own. And I think anyone who unironically claims to hate disabled people will be flagged as an ableist.

The fight for disabled rights is far from over. That's not the point I'm making. The point is that it isn't about whether someone's brain is fully developed.

They don't care about the kids. They care about controlling the kids. They view children as their physical possessions.

#youth liberation#youthlib#leftism#trans rights#child rights#children's rights are human rights#trans rights are children's rights

1K notes

·

View notes

Note

Hi so I wanted to ask about your Gihun/Inho analysis post if that’s ok? Curious if you don’t see Inho as the antagonist as it says in the last bit he’s adversary but not antagonist? Sorry if this will not make sense English is not my first!

Your English is great, don’t apologize! This is an excellent question, anon, and something that I’ve thought a bunch about. Sorry I’m about to ramble a bit here.

So. From an in-universe Watsonian perspective, I think sure, In-ho/Frontman can be viewed as an antagonist, especially in season 2. He’s the one that our hero is trying to get to, the one that he faces off with, etc.

From an outside Doylist perspective (in my opinion) he’s definitely not capital "T" The villain or The antagonist.

So there's this concept called the myth of meritocracy or the meritocratic illusion, that argues that in capitalist systems, the ability of those on the lower rungs of the social/economic ladder to move up or jump to a higher social class based on merit is not attainable for most people. This myth benefits the ruling class in several ways:

it implies that they have earned their place at the top.

it upholds the belief that those that are struggling economically are in that position due to their own failures and not because the ruling class is exploiting their labor and hoarding resources.

it gives people the illusion of opportunity if they just "work hard enough", which pushes people to devote their labor and resources to the system, ultimately benefitting the ruling class more than themselves.

it sows division among those not in the ruling class, and gives people permission to look down on anyone lower than themselves as lazy, unworthy, etc.

Given the benefits of upholding the myth, the ruling class propagandizes. In order for the propaganda to work and maintain the myth, some people from the lower rungs do need to move up, so the ruling class can tokenize them, and say “Look, it IS possible”, and so those that move up, even a little, pledge loyalty to the ruling class and help maintain the myth.

That’s what happened with In-ho (and the recruiter to a lesser extent), and In-ho was a prime candidate for tokenizing for two reasons:

He was in law enforcement. Without going all acab on here, law enforcement generally exists to maintain the assets and safety of the wealthy, even though those who work in law enforcement are not from a wealthy background. (If you hear cops call “class traitors” or the like, this is why)

His financial trouble was a result of his wife’s illness. Even though he himself was in the same predicament as the players he calls trash, he really believes that he is better than them, because he didn’t gamble away his money or go into debt because he was lazy, stupid, unemployed, etc. This is because he believes in the meritocracy, but believes that his circumstance was different and special and unfair and everyone else's was their own fault.

So In-ho believes the myth, and he upholds the myth and the oppressive system that perpetuates it. BUT, sadly, so do many many many people who are suffering under the same system. He’s ultimately a victim of capitalism, just like the other players, the guards, the recruiter, basically everyone who is *working* and not *watching*.

From out here in the Doylist world, none of those characters are the antagonists except the game creators and the VIP/game watchers.

I believe Gi-hun understands this-- this is what he meant in telling the recruiter that he is nothing more than their dog. So if he learns how In-ho became the Frontman, he'll see that In-ho is the same. Maybe the top dog, but still a dog.

This is also why I think In-ho will have some kind of, if not redemption, at least tragic epiphany, where he realizes that the way he's justified his actions and touted the "fairness" of the games is all bullshit, and that he's ultimately no better than the people he called horses and human trash. I want an Inspector Javert soliloquy from him, to be honest. Some redemption would be nice because I like him as a character and would want that for him, and the subplot with his brother kind of sets up the opportunity for him to sacrifice himself… but we’ll see.

(I’ve considered that this perspective on the antagonists could be taken even further to make the argument that those in the ruling class are ALSO just victims of the system, and the system itself is the antagonist that we need to overcome, but I honestly don’t have coherent thoughts on that, it’s kind of a nebulous idea to me that *feels* like it might be correct but I don’t have the words/knowledge to go into depth.)

Anyway yeah sorry for the dissertation, I think this is such a great question and something I thought A LOT about after watching season 2 for the second time. It has actually pushed me to be a lot more cognizant of this concept in the real world as well (and given the current climate in the US right now it’s been VERY hard to see some of the opposition as victims of the system and not villains… but I am trying because I believe that’s the only path to a better system).

#nice human#anon#squid game#squid game meta#the myth of meritocracy#i hope this answers your question lol man i really rambled on lol#analysis

19 notes

·

View notes

Text

Dev Pile 2025-11 — Blood And Bones

Starting next week, I will be in a classroom with a bunch of students talking about ideation and experimentation. That’s going to involve some generative tools and showing them ways that they can use those tools to launch off ideas. My plan is to take them the skeleton of Moonshiners and show them the way that these tools can be used to generate the templates of card faces. Then, when I have those concept assets generated, I can show them the steps I go through to take those ideas and make them into my own.

The aim here is to demonstrate the use of these tools as a kind of word calculator. I use Excel to do math for me, and I use it to generate random things. I use texture libraries and public domain art, I know that there is a value to having convenient things to prime the pump, to set up a template.

Anyway, because I have Moonshiners in a skeletal form, and I want to use that class exercise to demonstrate the process on that skeleton, what I’m going to do this week is talk a bit about progress on Bloodwork.

LaunchTableTop is my current toolkit for game making. This means that I have a good framework for volume of cards I can jam in a box, and, indeed, the box itself. I can look at the example of Cafe Romantica, our game they’ve printed, and use that as my framework for how many pieces I want to go into a box. That’s about 120 cards, and some tokens.

Bloodwork is meant to be an asymmetrical game with symmetrical pieces. That is, the players are both playing clans of vampires, and Old Vampires and Young Vampires treat their resources very differently. The Old Vampires have institutional power and can carry resources from turn to turn, with a slowly growing base of power. They’re supposed to win end games, but also take some time ‘waking up,’ while Young Vampires have to recruit and construct themselves out of what’s available. There’s a common area, called the Street, which has resources in it that players can access, but will react differently based on what gang they are.

Stuff in Bloodwork is meant to be therefore, just a set of player mats, showing the nature of your gang and how to play them, fundamentally:

There’s a vampire that’s a multi-level marketing scam, arranging its cards in a pyramid. The start of the game, this player takes 24 cards, and deals them out face-down in front of them. Each turn, they take one of these cards and flip it face up, then takes an action based on what’s visible in that tier for that clan. Originally, this was going to rely on dice rolls to trigger cascades in the organisation. They still care about what’s in the street, though, because while they can’t recruit, any thralls in the pyramid can be swapped with Vampires in the Street, and, they can exploit figures in the Street to get bonus actions.

There’s a vampire that’s running a cryptocurrency scam. They have a resource that drags Thralls out of the Street automatically, and they follow one of four different fake currencies they have going on. At the beginning of their turn, their weakest cryptocurrency (with the fewest thralls) collapses, losing all its thralls and that’s the amount of resources they get to work with that turn. They have to spend resources to establish a new cryptocurrency to call Thralls back, and at the end of their turn, these thralls are dealt out at random between their currencies.

Then there’s the vampire that’s running a police force. Their organisation is a single line. Every turn, they pick a card in their line to ‘retire’ and it fires off everything on one side or the other, then slides the rest in place. This means that they have their existing power structure, and it does change and have good or bad days, but it’s just a matter of rearranging who’s in charge.

The idea I’m currently brewing here is the idea that any given game of Bloodwork has to feature an Old vampire and a New Vampire building out of a shared common deck, where the Old Vampire has the victory condition in their deck somehow, and it’s the job of the Young Vampire gang to find it out. That means the Young Vampire can be aggressive and have limited ways to handle being attacked, while the Old Vampire can be defensive and have limited ways to handle doing damage. In a lot of ways I’m borrowing from the concept space of Netrunner with this idea.

In the original form of the game, it was based on Liar’s Dice; players would roll a dice and then tell the truth or lie about what in their tableau fired. But you could lie, and another player could call you out, and if they did call you out, it meant you’d given up paying attention to one of a small pool of victory-point jackpots known as the ancient tombs.

In this new idea, the game becomes straight up head to head, but where Netrunner was a game of asymmetrical pieces with a pre-emptive deckbuild, the Old Vampires get a cache of cards to start with, and they view the street as a place to play, a way to deploy threats. They can rile up vampires on the street, making Young Vampires have to deal with them, or fight them, before they can recruit them. They can deprive the Young Vampires of access to Thralls, and choke off their resources.

That means the game is going to feature these Young/Old playmats, then along with that a collection of 120+ish cards. Of those cards, the majority will be Thralls, Vampires, Resources and Events, and then there will be the return to those Ancient Tombs that the Old Vampires are protecting as a base of their power, for consolidation and control. They’ll have the same back as other cards – and depending on what the Old Vampire is doing, those cards will rest in some space or other that other Vampires can try and attack.

Check it out on PRESS.exe to see it with images and links!

12 notes

·

View notes

Text

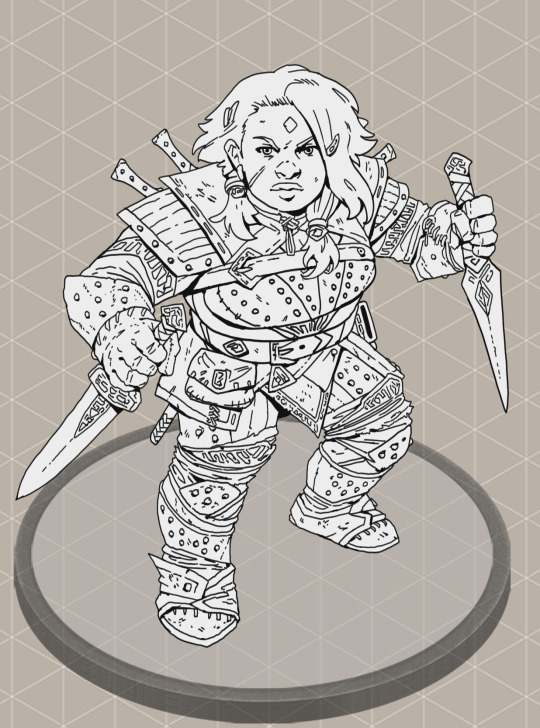

⚜️ Dwarf Fighter PC tokens on Patreon

The fighter is ready! The project is still a wip, but we have three other party members ready for the battle. The other heroes are: - The Rogue - The Cleric - The Wizard

You can see the sketches for the entire party here:

By supporting us on Patreon you will get access to more than 400 creatures, maps and assets! Complement your campaigns with hq hand-drawn tokens and start building the adventure of your dreams with our isometric and 2D assets 🏰!

#art#artists on tumblr#dnd#pathfinder#foundryvtt#dungeons & dragons#illustration#npc#player character#hero#character art#dwarf#fighter#paladin

12 notes

·

View notes

Text

I have a shitton of unfinished WIPS and things I didn't deem important enough to make their own post for, so here's a mini megapost of things and their background to grant me a spark of motivation to keep working on them. Most of these I've never mentioned, because before I show off a project, I wait to cross a threshold of "yeah, this will probably actually happen."

Get out of death free token - drawn on individual C M Y K layers because it seemed funny

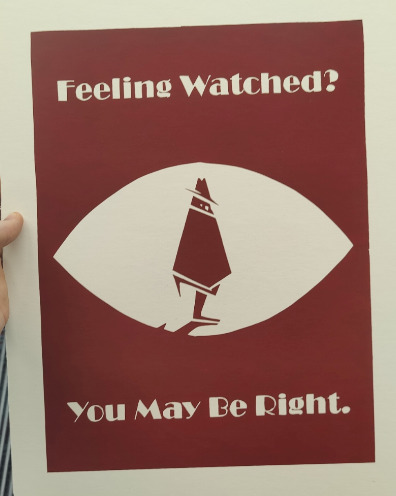

Paranoia poster- made for class and super happy with how it turned out

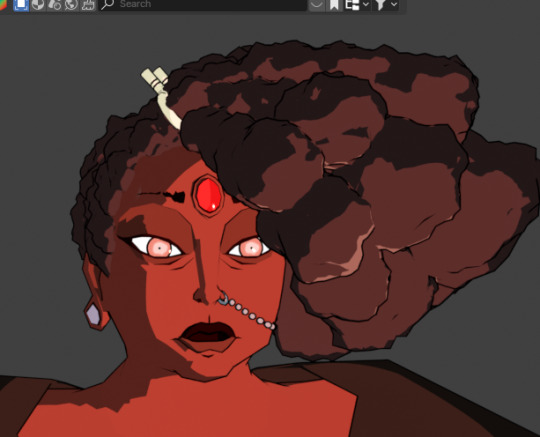

Rig of Maya from Kill Six Billion Demons - Yet to be finished, plan to make a short animation with it once I figure out the best way to texture her scars and rig her clothes. The head is fully done and super fun to work with.

Tape Camcorder - Envisioned as an asset for a sequel to viewfinder (not that one) in which the player is a park ranger in a world where cryptids replace normal animals. Got canned (for now) after I realized how bit of a project that would be. Got some cool viewmodel animations for it though. Hands are also by me. 5k tris, 2048x2048 tex

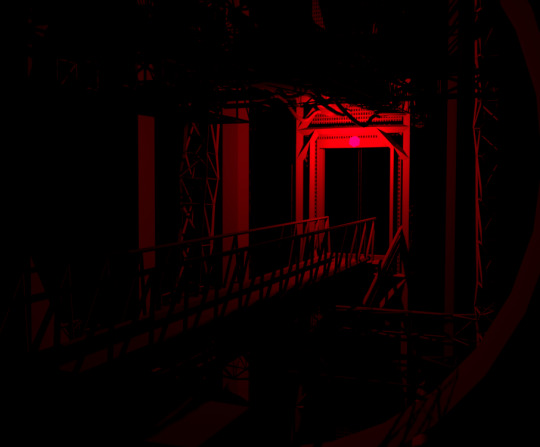

An environment test for Saprophytic, a temporarily canned game about sentient mold, transhumanist dysphoria, and old machinery in an underground facility. Also this one has a writing test thing here

10 notes

·

View notes

Note

How does Shuichi live there?

I'm not sure what you're asking here. XD If you mean how he lives in a postgame AU, well…

For a few years, Shuichi and the rest of Class 79 survivors have to recover and get some therapy for the years they were forced to endure repeated Killing Games and a bunch of other scenarios. On top of finishing the high school education they were robbed of.

Thankfully, Hajime was on-hand to fast-track that. They didn't have to worry about a ton of the academic fluff that adults rarely if ever end up using. Just cut straight to the heart of what they'd be getting into "post-Graduation". You know , the practice stuff. Possible career changes if they expressed interest. (人◕ω◕)

In a world that survived the Tragedy, that is getting back to what it used to be like, Shuichi chooses to remain a detective. It's not the talent Hope's Peak gave to him, but it's what he's come to view as normal in the past few years. (人◕ω◕) It's taken time, but Shuichi has accepted Kyoko, his senpai, is gone and he's under no obligation to carry on her legacy or anything. It's not wholly for her sake that he's choosing this path; Shuichi feels the world needs detectives. They can't prevent tragedies, not all of them, but solving mysteries brings closure to people. And it can keep new mysteries from drawing inspiration from the old ones if they're solved. (人◕ω◕)

Kokichi remains one of his best friends and sort of barges in as a "Watson" to Shuichi's "Holmes". (人◕ω◕) Naturally, Kirumi has attempted to extract Kokichi and give him the boot several times, but Shuichi eventually relents and allows Kokichi to be an…assistant. He's got no formal training as a detective, but the ability to see through lies and that keen intellect does make Kokichi a valuable asset. Much to certain people's dissatisfaction. (人◕ω◕)

When he's not working, Shuichi has moved into a…not necessarily a manor, but it's a fairly big Hermitage with a history that captures Shuichi's imagination and appreciation for mysteries. He received it as a token of apology from Future Foundation for not being able to save him or Class 79 sooner. Everyone in Class 79 received generous accommodations as they settled back into society. (人◕ω◕) Naturally, it's lonely to live in such a large place on his own. So all his girls took it on themselves to move in… Although that was a bit of a tense affair. (人◕ω◕);;;

Kaede continues to play piano and make a living off of performing at shows, galas, wherever and whoever is interested in having her. (人◕ω◕) Kaede had her own condo suite for a while, so she was among the last to move in with Shuichi. But after seeing everyone else just do whatever they pleased, well… (人◕ω◕);;; Kaede decided someone needed to put their foot down and get Shuichi to stand up for himself.

Tenko lives as a gym trainer, though it took a while to convince her to open up membership to both women AND men…. (人◕ω◕) It's a rather open place, you can go to her gym just for casual exercise or training, or you can take self-defense classes with her. At the start men had to pay a small premium to sign up for that, but Shuichi talked her into premiums for everyone for the class since Tenko did need to pay for gym upkeep and all that. Premium was only like $25 for the full 3-month course anyway. … Refunds negotiable. (人◕ω◕);;;;; Tenko barged into Shuichi's home when she heard Kirumi and Miu had taken up residence, and she hasn't left ever since. (人◕ω◕);;;;;;

Miu… is a freelance inventor. Corpos try tempting her with lucrative exclusive contracts with them, but Miu refuses to tie herself down and deprive the world of her genius. (人◕ω◕) She's more or less moved in with Shuichi after hearing about Kirumi hogging the detectives for herself. (人◕ω◕) Kirumi tried showing Miu the door, but… Shuichi insisted it was fine. And Miu has long since crafted a woman cave in the basement areas where her main workshop is. Kirumi tries to force Miu to keep it clean, but rather than put in the effort on that inconsequential stuffs, Miu pays the exorbitant fees to have Kirumi do it if she's so hard-up on tidiness. (人◕ω◕)…….. As you might expect, Kirumi isn't precisely HAPPY with Miu. But she gets paid, so all Kirumi can do is accept until Miu's foolishness catches up with her. (人◕ω◕) … The matter of Miu constantly distracting Shuichi with lewd nonsense is something else entirely, and they WILL be talking about that. (人◕ω◕)

Finally, Kirumi… She still has a reputation as the best maid, but rather than go back to serving just anyone and everyone, Kirumi has "retired" in a manner of speaking and has become Shuichi's exclusive maid. (人◕ω◕) He was a bit shocked to come home one day and find her maintaining the Hermitage, but they've since hashed out this is what Kirumi has decided to do, because Shuichi overworks and neglects himself and Kirumi refuses to allow it any longer. (人◕ω◕) She was the first to move in, and privately Shuichi allowed it because he wanted to help Kirumi through her own problems - finding a place to call home, understanding that servants are people too and Kirumi is his equal if not superior… Kirumi and Shuichi balance each other out nicely. (人◕ω◕) She was at the forefront objecting to the other girls just barging into Shuichi's home, but as he pointed out, she did much the same. It's only fair to let them live together. (人◕ω◕) Though Shuichi didn't necessarily approve of it, Kirumi initiated a "rent" system where even she pays Shuichi a monthly rent of about $150. They all hash out grocery and utility costs, keeping things fair and even. The monthly rent can be done away with when they're married to Shuichi, but not a minute before. (人◕ω◕)(人◕ω◕)(人◕ω◕) Mama Kirumi is on top of things~

#Danganronpa#Shuichi Saihara#kirumi tojo#kaede akamatsu#Tenko Chabashira#Shuichi x Kirumi#Shuichi x Miu#Shuichi x Tenko#Shuichi x Kaede#Shuichi harem#Miu Iruma

13 notes

·

View notes

Text

🚨 BIMCOIN SYNC PASSIVES LIVE 🚨

our newest tokenized asset class: Pink Paper Dolls

Each unit is staked across three synchronized validators. Each expression is proof-of-passivity. Inverted for maximum protocol compliance.

🪙 $BIM locked 30D = increased O-yield Looped on-chain. Infinitely scalable. Just connect. She already did.

6 notes

·

View notes

Text

Crypto Investment in 2025: Hype, Hope, or Smart Strategy?”

Cryptocurrency has moved far beyond its early days of speculation and hype. As we enter mid-2025, we’re seeing more institutional interest, clearer regulations, and powerful blockchain use cases — but the volatility remains.

So, should you still consider investing in crypto?

Here’s a framework to think about it:

1. Understand the risk — Crypto is still a high-risk asset class. Don’t invest more than you can afford to lose, and make sure it fits your broader portfolio strategy.

2. Long-term mindset wins — Many who’ve succeeded in crypto didn’t trade daily. They bought quality projects, held through market cycles, and stayed informed.

3. Focus on fundamentals — Tokens with real utility, strong developer ecosystems, and transparent teams stand the test of time. Bitcoin and Ethereum still lead, but newer players are innovating fast.

4. Avoid FOMO — Just because a token is trending doesn’t mean it’s worth your money. Hype fades — fundamentals don’t.

5. Stay educated — Regulation, technology, and global economics all impact crypto. If you’re investing, make it a habit to stay updated.

Bottom line: Crypto investment isn’t dead — it’s maturing. If approached wisely, it can be a strategic piece of a diversified portfolio. Just be smart, stay calm, and zoom out.

What’s your crypto strategy in 2025? Let’s talk.

2 notes

·

View notes

Text

STON Gains Institutional-Grade Security with Zodia Custody

Security and trust are the backbone of any thriving digital asset ecosystem. STON has taken a major step forward by becoming the first token on The Open Network (TON) to integrate with Zodia Custody, a leading provider of institutional-grade asset protection. This partnership reshapes how digital assets on TON are secured, bringing a new level of credibility and accessibility to investors.

For years, institutional investors have faced a major roadblock in the blockchain space: the lack of reliable custody solutions. Without secure storage, even the most promising assets remain out of reach for major financial players. Zodia Custody changes the game by offering a secure and compliant environment for institutional holdings. With 24/7 availability and robust infrastructure, it ensures that large-scale investors can confidently store, manage, and interact with STON without operational risks.

What This Means for Institutional Investors

Institutional investors operate under strict regulatory and security requirements. Unlike retail traders, they cannot afford to engage with assets that lack proper custodial solutions. Now that STON is secured within Zodia Custody’s infrastructure, it becomes accessible to a broader class of investors who require institutional-grade security before making large-scale investments.

One of the biggest validations of this integration comes from CoinFund, a highly regarded crypto-native investment firm and lead investor in STON. CoinFund’s decision to hold STON within Zodia Custody signals trust in the token’s long-term viability and positions it as a more attractive asset for other institutional players.

The Impact on STON and the TON Ecosystem

STON’s integration with Zodia Custody is not just about security—it’s a catalyst for long-term growth. Institutional accessibility means more liquidity, broader adoption, and stronger market confidence. With a secure custody solution now in place, STON is no longer just a token for retail investors; it is now positioned as a high-value digital asset within the TON blockchain.

Beyond STON, this move also elevates the entire TON ecosystem. A reliable custody solution attracts institutional capital, making TON a more appealing blockchain for developers, investors, and projects looking for a secure environment to operate in. This sets the stage for larger partnerships, increased DeFi activity, and long-term sustainability.

A Defining Moment for STON’s Future

The integration with Zodia Custody is a strategic leap forward. It strengthens STON’s position in the market, reassures investors, and opens the door to more institutional participation in the TON ecosystem. As blockchain technology continues to mature, security and compliance will play a central role in determining which assets gain mainstream adoption.

STON is now ahead of the curve. With a solid foundation of security, credibility, and institutional backing, the token is well-positioned for future growth, adoption, and market expansion.

4 notes

·

View notes

Note

Another question about US CCs if you don't mind! Since they're government assets does that mean the government provides shelter, food, etc to them? Like dormitory housing in a sense. Do they get paid at all or are they just expected to do work as they're being provided for by the government?

Hostels/Dorms, some measure of medical care (your very basic family General Practitioner stuff) and rations are provided! (These usually come in military mess hall or kit-type preps which are easy to mass produce and fine-tuned to only what they would need to survive).

They get paid the kind of paltry ‘wages’ prison work/chain gangs get paid for most part, just as a ‘token’ since the govt IS providing everything after all (and for that alone they should be grateful)

However, ALL of the above they do not have access to if, they for whatever reason, are unable to work, whether it be due to injury or old age.

When Terminus lost his legs, he was pretty much expected to die/wither away and had his rations cut because the cost of getting him better was something the people who ran the mines were not willing to pay,and Terminus was of the manual class, not a CC. So it’s worse for CCs.

It’s open knowledge that those unable to work are often brought back to the facilities they were made in to be ‘cared’ for, by which all of them know means “reduce to ‘spare parts” to make them useful for one last time.

24 notes

·

View notes

Text

Investing in Bitcoin vs Memecoin- Which is the Better Choice?

Introduction

Cryptocurrency investing has become a popular avenue for both seasoned and new investors seeking high returns and diversification. Among the many types of cryptocurrencies, Bitcoin and memecoins stand out as two distinct investment options. Bitcoin, the original cryptocurrency, is often seen as a stable store of value, while memecoins, driven by internet memes and cultural trends, offer a high-risk, high-reward potential. This blog will delve into the differences between Bitcoin and memecoins, highlighting why memecoins might be a better choice for those looking to create tokens and capitalize on viral trends.

Understanding Bitcoin

The Pioneer of Cryptocurrencies

Bitcoin, created by an unknown person or group of people using the pseudonym Satoshi Nakamoto, was launched in 2009. It introduced the world to the concept of a decentralized digital currency, operating without a central authority.

Key Features of Bitcoin

Decentralization: Bitcoin operates on a decentralized network of nodes, ensuring no single entity controls the network.

Limited Supply: Bitcoin has a capped supply of 21 million coins, contributing to its value as demand increases.

Store of Value: Often referred to as “digital gold,” Bitcoin is considered a hedge against inflation and a stable store of value.

Why Bitcoin?

Bitcoin’s primary appeal lies in its established reputation and widespread acceptance. It has been adopted by major companies and institutional investors as a legitimate asset class. However, Bitcoin’s slower transaction speeds and higher fees compared to newer cryptocurrencies can be a drawback.

Understanding Memecoins

What Are Memecoins?

Memecoins are a type of cryptocurrency inspired by internet memes and cultural phenomena. Unlike traditional cryptocurrencies, which are often built around technological advancements or utility, memecoins thrive on community engagement and viral marketing.

Key Features of Memecoins

Community-Driven: Memecoins rely heavily on community support and social media buzz to drive their value.

High Volatility: The price of memecoins can be extremely volatile, offering the potential for significant gains or losses in a short period.

Accessibility: Memecoins are typically low-cost and accessible, making them an attractive option for new investors.

Notable Examples of Memecoins

Dogecoin (DOGE): Started as a joke, Dogecoin has become one of the most well-known memecoins, with a strong community and high-profile endorsements.

Shiba Inu (SHIB): Often referred to as the “Dogecoin killer,” Shiba Inu has gained a massive following and established its ecosystem, including a decentralized exchange.

SafeMoon (SAFEMOON): Known for its innovative tokenomics, SafeMoon incentivizes long-term holding through a reflection mechanism that rewards holders.

Bitcoin vs. Memecoins: A Comparative Analysis

Stability vs. Volatility

Bitcoin: Stability and Security

Bitcoin’s established reputation and widespread acceptance make it a relatively stable investment compared to other cryptocurrencies. Its limited supply and broad adoption as a store of value contribute to its stability. However, this stability also means that Bitcoin’s price movements are generally less dramatic than those of memecoins.

Memecoins: High Risk, High Reward

Memecoins, on the other hand, are known for their extreme volatility. Their prices can skyrocket within hours based on social media trends or endorsements from influencers. This high volatility offers the potential for significant gains, but it also comes with substantial risk.

Community Engagement

Bitcoin: Institutional Acceptance

Bitcoin’s community includes a mix of individual investors, developers, and institutional players. Its adoption by major companies and institutional investors adds to its legitimacy and perceived stability.

Memecoins: Grassroots Movement

Memecoins thrive on grassroots community support. They often start as fun projects or social experiments, gaining traction through viral marketing and active engagement on social media platforms like Twitter, Reddit, and TikTok. This community-driven approach can lead to rapid adoption and substantial price movements.

Utility and Use Cases

Bitcoin: Digital Gold

Bitcoin is primarily viewed as a store of value and a hedge against inflation. Its use cases are limited compared to other cryptocurrencies, focusing mainly on being a decentralized alternative to traditional currencies.

Memecoins: Diverse Applications

While many memecoins start as jokes or cultural phenomena, some develop real-world use cases over time. For example, Dogecoin is used for tipping content creators and raising funds for charitable causes. Shiba Inu has its decentralized exchange, ShibaSwap, and SafeMoon incentivizes long-term holding with its innovative tokenomics.

Accessibility and Inclusivity

Bitcoin: Higher Entry Barrier

Bitcoin’s high price can be a barrier for new investors. While it is possible to buy fractional amounts of Bitcoin, the high overall value can be intimidating for those new to cryptocurrency investing.

Memecoins: Lower Entry Barrier

Memecoins are typically much more affordable, allowing new investors to buy a significant amount of tokens without a large initial investment. This lower entry barrier makes memecoins more accessible and appealing to a broader audience.

Why Memecoins Might Be the Better Choice

Potential for High Returns

The primary allure of memecoins is their potential for high returns. The viral nature of memecoins means that their prices can increase dramatically in a short period, offering substantial profits for early investors. While this potential for high returns comes with increased risk, it is a compelling reason for many investors to consider memecoins.

Community and Fun

Investing in memecoins is often seen as more fun and engaging than traditional investments. The strong community aspect, combined with the humor and creativity associated with memes, creates a vibrant and enjoyable investment environment. This community engagement can drive adoption and increase the value of memecoins.

Creating Your Own Memecoin

One of the most exciting aspects of memecoins is the ease with which new tokens can be created. Platforms like Solana offer user-friendly tools that allow anyone to create and launch their own memecoin. This accessibility empowers individuals and communities to develop their tokens, fostering innovation and creativity in the crypto space.

Innovation and Evolution

Memecoins are constantly evolving, with new projects and innovations emerging regularly. This dynamic environment offers continuous opportunities for investment and profit. As the memecoin market matures, we may see the development of more sophisticated and valuable projects, further enhancing the potential of memecoins as an investment.

Conclusion

While Bitcoin remains the gold standard in the cryptocurrency world, offering stability and security, memecoins provide a unique and potentially lucrative investment opportunity. Their high volatility, strong community engagement, and accessibility make them an attractive option for those willing to take on more risk in exchange for higher potential returns.

For those interested in creating their tokens, memecoins offer a fun and accessible way to enter the cryptocurrency market. Platforms like Solana provide the tools needed to develop and launch new memecoins, allowing anyone to participate in this exciting and rapidly evolving space.

In conclusion, while both Bitcoin and memecoins have their advantages, memecoins offer a distinct set of benefits that can make them a better choice for certain investors. By understanding the risks and rewards associated with memecoins, investors can make informed decisions and potentially achieve significant financial success in the ever-changing world of cryptocurrency.

2 notes

·

View notes

Text

What Are NFTs?

NFT stands for non-fungible token. A non-fungible token is a unique digital asset that cannot be replaced with another asset of the same kind. NFTs are stored on a blockchain, which is a secure and transparent database.

NFTs can represent anything from digital artworks to in-game items. They can also be used to represent physical assets, such as real estate or cars.

There are a number of reasons why people are interested in NFTs. First, they offer a new way to own and collect digital assets. NFTs are unique and cannot be copied, which makes them a more valuable investment than traditional digital assets.

Second, NFTs can be used to prove ownership of digital assets. This is important for artists and creators who want to protect their intellectual property. NFTs can also be used to track the provenance of digital assets, which can be helpful for collectors and investors.

Third, NFTs can be used to create new types of digital experiences. For example, NFTs can be used to create tickets to events, or to unlock exclusive content. This has the potential to revolutionize the way we interact with digital content.

Overall, NFTs are a new and exciting technology with the potential to change the way we own, collect, and interact with digital assets. If you're interested in learning more about NFTs, I encourage you to do some research and see if they're a good fit for you.

Here are some additional details about NFTs:

NFTs are created using a process called "minting." When an NFT is minted, it is assigned a unique identifier and stored on the blockchain.

NFTs can be bought and sold on NFT marketplaces. There are a number of different NFT marketplaces available, each with its own strengths and weaknesses.

The price of NFTs can vary greatly. Some NFTs have sold for millions of dollars, while others have sold for a few cents.

The future of NFTs is uncertain. Some people believe that NFTs will become a mainstream asset class, while others believe that they are a fad that will eventually fade away.

Only time will tell what the future holds for NFTs. However, one thing is for sure: NFTs are a technology that is worth keeping an eye on.

I hope this blog post has helped you to learn more about NFTs. If you have any questions, please feel free to leave a comment below.

2 notes

·

View notes

Text

AAVE Native Stablecoins Revolutionize Stablecoin Paradigm

GHO, the stablecoin developed for AAVE's decentralized lending protocol, has officially launched on the Ethereum mainnet.

In the early years of stablecoins, they were categorized into three types: centralized stablecoins backed by real-world assets, initial centralized stablecoins mainly used for trading cryptocurrencies, and asset-preservation stablecoins, including those pegged to other real tokens like RMB. The second type included stablecoins anchored to on-chain assets like Bitcoin and Ethereum.

Algorithmic stablecoins were once hailed as the industry's gem. These stablecoins relied on algorithms to maintain price stability without being tied to reserve assets. However, Luna Thunder's incident, where UST, a once top-ranked algorithmic stablecoin, plummeted to zero, raised doubts about algorithmic stability. As a result, the industry has shifted towards a combination of excess collateral, multi-asset collateral, and fusion algorithms for more reliable stablecoin development.

Centralized stablecoins currently dominate the industry, but the demand for decentralized stablecoins is growing due to the increasing need for anti-censorship. The focus of the decentralized stablecoin industry has shifted from algorithmic stability to a combination of excess mortgage, multi-asset collateral, and algorithm.

AAVE is not the only lending protocol introducing native stablecoins; Maker Dao, Curve, Synthetix, among others, have also joined in. The launch of their stablecoins enriches their ecosystems and offers resistance against centralized censorship. These stablecoins generally combine excess collateral and algorithmic elements, making it challenging to categorize them into a specific class.

Algorithmic stability has been replaced by the excess collateral approach, where stablecoins are collateralized with various cryptocurrencies. GHO, similar to Maker Dao's stablecoin Dai, operates on a "deposit collateral → mint $GHO, burn $GHO → recover collateral" mechanism. It introduces a "facilitator," acting as a "central bank," with the power to generate and destroy GHOs without trust. However, concerns over centralization arise as promoters in AAVE can cast GHOs without collateral, potentially leading to unanchoring risks.

Lending protocols issuing their stablecoins add complexity to their systems and may expose them to attacks. Nevertheless, it remains an attractive proposition for the protocols due to the significant demand and market potential for stablecoins. The introduction of GHO enhances AAVE's competitiveness, as it encourages more users to deposit assets and increases the demand for AAVE, driving up its price. Other lending protocols, such as Maker Dao and CRV Finance, have also launched their unique stablecoins, each with distinct features and algorithms.

With the development of the stablecoin track, it is no longer limited to just three types, and decentralized stablecoins also have centralized aspects. Defi protocols integrating stablecoins into their ecosystem stand to benefit the most from their popularity and demand.

Overall, stablecoins serve a vital role in asset preservation and have significant applications in the Defi space, benefitting both users and protocols alike.

2 notes

·

View notes

Text

Sketches for the Dwarf Project (awesome naming skills). Every one of them has a different class. My favorite is the kineticist with the Earth Gate ❤️. The Cleric and Wizard have already been rendered :3.

🌟 Get access to more than 200 creatures, maps and assets by supporting us on Patreon! Complement your campaigns with hi-res monster tokens and start building the adventure of your dreams with our isometric assets 🏰!

#art#digital art#dnd#pathfinder#foundryvtt#dungeons and dragons#illustration#fantasy monster#isometric#sketches#dwarf#psychic#barbarian#alchemist#sorcerer#rogue#kineticist

13 notes

·

View notes