#Fintech data analytics

Explore tagged Tumblr posts

Text

Unveiling the Power of Fintech Data Analytics

Unlock the potential of Fintech data analytics with IGT Solutions. We offer enterprise-wide services, including customer identification, secure transactions, and end-user support. Our data-driven solutions empower financial institutions with precision and security for informed decision-making, operational efficiency, and customer trust.

0 notes

Text

Ultimate Guide to DeepSeek AI for Business Growth

Table of Contents of DeepSeek AI for Business Growth1. Introduction: Why AI is Essential for Modern Business Growth2. What Is DeepSeek AI?3. Top 5 DeepSeek AI Tools for Scaling Businesses3.1 Demand Forecasting Engine3.2 Customer Lifetime Value (CLV) Predictor3.3 Automated Supply Chain Optimizer3.4 Dynamic Pricing Module3.5 Sentiment Analysis Hub4. How DeepSeek AI Reduces Costs and Boosts…

#AI automation 2024#AI budgeting#AI business growth#AI for non-tech teams#AI for startups#AI implementation guide#AI in retail#AI supply chain#Business Intelligence#cost reduction strategies#data-driven decisions#DeepSeek AI#enterprise AI adoption#fintech AI solutions#generative AI for business#Predictive Analytics#ROI optimization#scaling with AI#SME AI tools#startup scaling

2 notes

·

View notes

Text

Data Fragmentation

This is the list of challenges that the businesses face due to data distribution across multiple systems in the digital lending industry

3 notes

·

View notes

Text

Business Data Analytics Software

Discover how business data analytics software empowers organizations to turn raw data into actionable insights. This blog explores key features, benefits, and use cases, highlighting how the right analytics tools can drive smarter decisions, improve efficiency, and support strategic growth.

#lumify#software#data analytics#fintech#credit unions#banks#finance#financial services#analytics tools

0 notes

Text

Say Goodbye to Manual Integrations with AI Manual processes slow you down. Explore how Aurotek uses AI to eliminate errors and speed up system integration for growing enterprises.

#manufacturer#bigdata#healthcare#youtube#fintech#retrail#ecommerce#datascience#data analytics#startups

0 notes

Text

How Portfolio Management Firms Use Advanced Data Analytics to Transform Investment Strategies

Portfolio management firms are experiencing an innovative shift in how they make funding selections. Gone are the days of gut-feeling investments and conventional stock-picking methods. Today's wealth management firms are harnessing the notable electricity of statistics analytics to create extra sturdy, sensible, and strategically sound investment portfolio management procedures.

The Financial Landscape: Why Data Matters More Than Ever

Imagine navigating a complicated maze blindfolded. That's how investment decisions used to feel earlier than the data revolution. Portfolio control corporations now have access to unheard-of stages of facts, remodelling blind guesswork into precision-centered strategies.

The international economic actions are lightning-fast. Market conditions can change in milliseconds, and traders need partners who can adapt quickly. Sophisticated information analysis has grown to be the cornerstone of a successful funding portfolio control, permitting wealth control corporations to:

Predict market trends with first-rate accuracy.

Minimize chance via comprehensive data modelling.

Create personalized funding strategies tailor-made to your wishes.

Respond to worldwide economic shifts in close to actual time.

The Data-Driven Approach: How Modern Firms Gain an Edge

Top-tier portfolio control corporations aren't simply amassing records—they are interpreting them intelligently. Advanced algorithms and machine-learning techniques permit these corporations to gather large amounts of facts from more than one asset, inclusive of:

Global marketplace indexes

Economic reviews

Corporate economic statements

Geopolitical news and developments

Social media sentiment analysis

By integrating these diverse record streams, wealth management corporations can develop nuanced investment strategies that move a ways past conventional economic analysis.

Real-World Impact: A Case Study in Smart Data Usage

Consider a mid-sized portfolio management firm that transformed its approach via strategic statistics utilization. Imposing superior predictive analytics, they reduced customer portfolio volatility by 22%, even as they preserved competitive returns. This is not simply variety-crunching—it's approximately offering true monetary protection and peace of mind.

Key Factors in Selecting a Data-Driven Portfolio Management Partner

When evaluating investment portfolio management offerings, sophisticated traders should search for companies that demonstrate

Transparent Data Methodologies: Clear reasons for ways information influences funding decisions

Cutting-Edge Technology: Investment in superior predictive analytics and system mastering

Proven Track Record: Demonstrable achievement in the use of facts-pushed strategies

Customisation Capabilities: Ability to tailor techniques to individual risk profiles and monetary goals

The Human Touch in a Data-Driven World

While data analytics presents powerful insights, the most successful portfolio control firms firmsrecognizee that generation complements—however in no way replaces—human knowledge. Expert monetary analysts interpret complicated fact patterns, including critical contextual knowledge that raw algorithms cannot.

Emotional Intelligence Meets Mathematical Precision

Data does not simply represent numbers; it tells testimonies about financial landscapes, enterprise tendencies, and ability opportunities. The best wealth control firms translate these records and memories into actionable, personalized investment techniques.

Making Your Move: Choosing the Right Portfolio Management Partner

Selecting a portfolio control firm is a deeply personal selection. Look beyond flashy advertising and marketing and observe the firm's proper commitment to records-pushed, wise investment techniques. The right companion will offer:

Comprehensive statistics evaluation

Transparent communication

Personalised investment approaches

Continuous strategy optimisation

Final Thoughts: The Future of Intelligent Investing

Portfolio control firms standing at the forefront of the data revolution are rewriting the guidelines of the funding method. By combining advanced technological abilities with profound financial understanding, those companies provide buyers something that is, in reality, transformative: self-assurance in an unsure monetary world.

The message is obvious: in current investment portfolio management, facts aren't always simply information—they are the important thing to unlocking unparalleled financial potential.

#portfolio firms#data analytics#investment tech#risk analysis#AI in finance#smart investing#asset trends#market insights#predictive tools#fintech growth#hedge funds#ROI tracking#fund analysis#trading signals#wealth growth#algo trading#big data#risk metrics#investment AI#financial tech

0 notes

Text

Drive FinTech innovation with Gen AI-powered customer analytics, maximizing efficiency and delivering tailored financial solutions.

#AI in Finance#AI-driven Data Insights#Customer Analytics#Customer Analytics in FinTech#Fraud Detection in FinTech#Generative AI#Generative AI in inTech#Infographic#Predictive Analytics

0 notes

Text

Discover how Gen AI amplifies customer analytics in FinTech, driving innovation, precision, and smarter business outcomes.

#AI in Finance#AI-driven Data Insights#Customer Analytics#Customer Analytics in FinTech#Fraud Detection in FinTech#Generative AI#Generative AI in inTech#Infographic#Predictive Analytics

0 notes

Text

Discover how Gen AI amplifies customer analytics in FinTech, driving innovation, precision, and smarter business outcomes.

#AI in Finance#AI-driven Data Insights#Customer Analytics#Customer Analytics in FinTech#Fraud Detection in FinTech#Generative AI#Generative AI in inTech#Infographic#Predictive Analytics

0 notes

Text

Maximizing Customer Analytics with Gen AI in FinTech - Infographic

Drive FinTech innovation with Gen AI-powered customer analytics, maximizing efficiency and delivering tailored financial solutions. Leveraging the potential of Generative AI to transform customer analytics for the FinTech industry. With many financial companies crossing over into the world of data analytics in an attempt to leverage their applications of AI, Generative AI is proving to hold…

#AI for Personalization#AI in Finance#AI-driven Data Insights#Customer Analytics#Customer Analytics in FinTech#FinTech Customer Experience#Fraud Detection in FinTech#Generative AI#Generative AI in FinTech#infographic#Predictive Analytics

0 notes

Text

How FinTech is being empowered with AI and analytics

New Post has been published on https://thedigitalinsider.com/how-fintech-is-being-empowered-with-ai-and-analytics/

How FinTech is being empowered with AI and analytics

This article was adapted from one of our previous virtual FP&A Summits, featuring Amit Kurhekar, Head of Data at MoneyLion.

Unless you’ve been consistently offline over the last few years, you’ll know that the financial industry is undergoing a significant transformation driven by AI and machine learning technologies.

This revolution isn’t just about adopting new technologies but about changing how financial services and processes are delivered and experienced by consumers.

In this article, we’ll explore some of the most compelling AI and ML strategies in finance with use cases to show how they work in real-life scenarios.

Whether you’re a financial professional or simply interested in the evolving landscape of FinTech, this article offers valuable insights into the intersection of finance, AI, and digital transformation.

Case study: Day in the life of ‘financially savvy’ John

Let me introduce you to John. He considers himself to be very financially savvy, he’s in his 30s, intelligent and he uses a smartphone like so many of us.

One day, he receives a notification on his phone that reads:

“John, your utility bill of $50 is due tomorrow. Do you want to pay now?”

A few seconds later, another notification comes through,

“John, your net-worth increased by 1% last week with Apple stock making the maximum gains.”

John gets on with his day. He goes to work, enjoys chatting to his co-workers, and then in the afternoon, he notices yet another notification on his phone. This one says,

“John, you have excess balance in your savings account. Invest 20% of the amount to earn an extra 8% vs keeping in your savings account. Invest now?”

These are smart notifications and nudges and in today’s financial world, it’s a reality. If you’re not using technology to help improve your finances, you’re missing out.

By embracing AI and ML, you can make a huge impact not just in your role but also in your daily life.

Pillars of digital transformation

Within digital transformation, there are emerging technologies. Most companies are utilizing these emerging technologies to drive and improve consumer experiences. These include things like internet of things (IoT), robotics, AR/VR and Cloud.

Before 2020, not many people were working online or working from home, and then almost the majority of the IT workforce moved into remote working. The transformation from almost everyone working in-office to everyone working remotely because of Covid meant that many people had to embrace technology in new ways. There was a huge mobilization of IT and IT infrastructure.

I think that both AI and ML are critical pieces that are enabling today’s world. So, a part of that could be coming as simple as receiving smart nudges throughout the day on your smartphone or you could even have nudges to help you forecast numbers for your financial forecast.

This post is for paying subscribers only

Subscribe now

Already have an account? Sign in

Become a member to see the rest

Certain pieces of content are only to AIAI members and you’ve landed on one of them. To access tonnes of articles like this and more, get yourself signed up.

Subscribe now

Already a member? Awesome Sign in

#ai#amp#Analytics#apple#ar#Article#Articles#Artificial Intelligence#Case Study#Cloud#Companies#consumers#content#covid#data#Digital Transformation#emerging technologies#Experienced#expert insights#finance#finances#financial#Financial industry#financial services#fintech#forecast#how#impact#Industry#Infrastructure

0 notes

Text

Key Features of Unified Data Analytics Platform

With the rapid progression of digital lending technologies, staying ahead requires leveraging the best tools and insights. Our Unified Data Analytics Platform integrates data from LMS, LOS, CRM, and other sources into a cohesive system, enabling accurate credit assessments and actionable insights. With real-time analytics, automated reporting, customizable dashboards, robust security features, and effortless scalability, our platform is designed to optimize your operations and support your long-term growth objectives.

For more information, contact us at https://www.aptuz.com/contact-us/

0 notes

Text

What are the best accounting softwares in India?

When evaluating the best accounting software in India, several prominent options come to mind, such as Tally ERP 9, Zoho Books, QuickBooks India, Marg ERP 9+, and Vyapar. Each of these platforms offers robust features tailored to meet various business accounting needs, from inventory management to GST compliance and financial reporting.

However, if you're looking for a comprehensive and cost-effective solution, our Billing Management Software stands out as an exceptional choice. Priced at just ₹10,500 or $125, it not only covers all your accounting requirements but also comes with a host of additional benefits, including:

Free SSL Certificate: Ensure the security of your data with an SSL certificate at no extra cost.

Free Domain: Get a professional online presence with a free domain.

Free Hosting: Enjoy reliable and fast hosting services included in the package.

Free Payment Gateway: Seamlessly integrate payment processing capabilities without any additional fees.

Our Billing Management Software is designed to simplify and streamline your accounting processes, offering features such as invoicing, expense tracking, inventory management, and comprehensive financial reporting. It is user-friendly and can be customized to fit the specific needs of your business, making it a versatile choice for businesses of all sizes.

For a detailed demonstration and to experience the full capabilities of our software, call us at +91 6261084537 today. Get started with a solution that not only meets but exceeds your accounting needs, all at an unbeatable price.

#software#tech#technology#softwaredevelopment#webdevelopment#coding#programming#developer#innovation#IT#startup#digital#business#entrepreneur#smallbusiness#marketing#onlinemarketing#digitalmarketing#SEO#webdesign#ecommerce#cloudcomputing#data#bigdata#analytics#AI#machinelearning#blockchain#cybersecurity#fintech

0 notes

Text

AI is Revolutionizing System Integration

Discover how Artificial Intelligence transforms businesses, connects and optimizes their digital systems. From real-time data flow to self-healing workflows, AI-powered system integration means smarter, faster, and more secure operations. Tap to explore the future of intelligent integration with Aurotek!

✅ Real-Time Processing

✅ Predictive Analytics

✅ Smarter Workflows

✅ Better Data Security

0 notes

Text

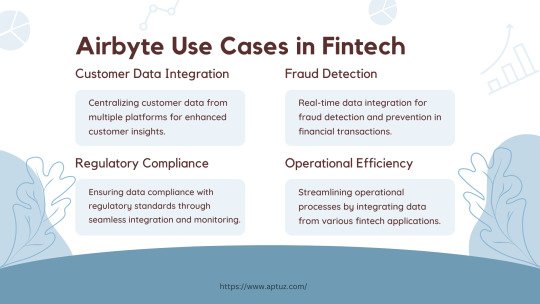

Explore the impactful use cases of Airbyte in the fintech industry, from centralizing customer data for enhanced insights to real-time fraud detection and ensuring regulatory compliance. Learn how Airbyte drives operational efficiency by streamlining data integration across various fintech applications, providing businesses with actionable insights and improved processes.

Know more at: https://bit.ly/3UbqGyT

#Fintech#data analytics#data engineering#technology#Airbyte#ETL#ELT#Cloud data#Data Integration#Data Transformation#Data management#Data extraction#Data Loading#Tech videos

0 notes

Text

Transform how FinTech companies analyze customers with Gen AI, offering deeper insights and precision for strategic growth.

#AI in Finance#AI-driven Data Insights#Customer Analytics#Customer Analytics in FinTech#Fraud Detection in FinTech#Generative AI#Generative AI in inTech#Infographic#Predictive Analytics

0 notes