#How to Change Your Cash App Pin

Explore tagged Tumblr posts

Text

i'm currently locked out of my debit card (put in pin wrong three times) so i'm cash-only right now. and in london, in the touristy bits, loads of stuff is card only? it's insane. like these businesses prefer to pay a transaction fee. in [mid-size regional uk city] half the restaurants prefer you to pay in cash, to avoid the transaction fees and presumably for tax evasion purposes.

I guess the benefits of card only are like:

keep homeless beggars out of your shop

it's faster - important if you have lots of footfall

you aren't holding cash in the shop which can get robbed

you don't have to worry about staff stealing out of the till

since few people pay by cash now, making change is becoming an obsolete skill (so it slows things down even longer as the person behind the till needs to whip out a smartphone and open a calculator app)

relatedly, i've been staying with my nan & have had to help her out setting up an account on her local government website so she can buy visitor parking vouchers. You used to be able to go into the council office and pay in cash for this. like there was a bureaucratic process obviously, but it was you go and talk to someone at the council. She's in her eighties, she's not going to learn how to use the internet lol.

40 notes

·

View notes

Text

December- January Forecast

Many changes, upheavals along with blessings will be the highlight for the next few months. For some, may be longer and others shorter depending where you are on your journey. Move in silence is definitely being highlighted so make sure you’re paying attention to when you intuitively feel to keep things quite between you and your dreams/ goals/ passions because not everyone is going to be rooting for you. I see room for improvement with self and again being silent is also part of that. The less you say the better and more at more you’ll be because not everyone is going to try to put their little 2 cents into what it is that you’re doing or rain on your parade or wish ill intent towards you.

I feel like there’s going to be an air sign (doesn’t have to be that sign) that’s going to pry into your life or this person is nosy. They act like they’re keeping tabs on you but honestly they have other intentions. I feel like this might be more prominent when you begin to silence yourself… in other words, move in silence. I see a hard lesson you may be going through or passing but I also get the feeling that you’re going learn why you had to go through this lesson or why certain things had to happen. The sun is radiating for you in the horizon. It gives me the feeling of leaving what once was and stepping into a new chapter . The color red is significant which gives me the feeling of fire, warmth, passion, drive and like I mentioned before, something positive on the horizon, you’re going to enter a new chapter. New chapter, new year, new you and new motives.

I feel that there’s going to be a dream deal of pain before everything can get better. But first some things and people must be taken care of first. What may take place or impact you especially negatively it was done for your own good. That may sound off but it’s like how weird or negative chains of events happen and suddenly something good comes out of every negative events that happened in your life? Like something negative had to be the catalyst of something positive to happen for you. I hope that made sense. It can be something as losing a friend but losing that friend was a catalyst for you to prosper and glow up and become one with self and your goals. Maybe that friend was an unhealthy distraction or maybe they were praying on your downfall. Like I mentioned before, it’s for your own good.

If you haven’t done so already or you are, cut off season is either now or coming up for a lot of you. Detaching yourself from karmic situations, family, friends, environments, etc. I see that there may be someone or people may be manifesting or manipulating you or a situation to how they see fit… not sure what that means but it’s what I heard. Someone could be lying or could be creating or shaping a storyline that isn’t true.. it may make you seem like the ungrateful or bad person but it’s not true. False narrative is what I’m getting. However I’m also getting like a flip, like how someone is falsely making something seem is going to be flipped. For example, let’s say your best friend is telling people that you’re jealous that they’re in a relationship and/or that they moves in with their partner but what they falsely accused you of will flip. They’ll be the ones to live through that. While your life glows up and gets better, they’ll feel the effects of their words. In general people who wished on your downfall or treated you unfairly will be getting that same treatment back to them… like the roles flipping and reversing. Return to sender may be significant too!

*Please keep in mind that these messages are for the collective so the messages may or may not resonate with you. If you would like a personal reading, my prices, cash app and PayPal are pinned on my profile. Before sending in any payment please be sure to DM me first. Thank you!*

P.S. $5 readings are still available but keep in mind that these are mini reads!

#fypシ#tarotcommunity#tarot cards#tarot reading#tarot#tumblr fyp#fypage#daily tarot#tarot reader#pick a deck#tarot witch#free tarot readings#tarot spread#tarot deck#tarot spreads#free tarot#tarotblr#witches of tumblr#tarot asks#message for the collective#divine messages#channeled message#message me#tarot divination#tarot of the day#dailymessage#divination#free readings#fyp#general readings

13 notes

·

View notes

Text

Hey guyz so I’m a tad bit nervous making this post but it’s gotta get done Lol

So I’ve decided to open emote commissions Yeyy

Basic info:

1 = 1$

4= 3.50$

6= 5$

8= 7.50$

10= 8.50$

Price can change depending on how many you want !

rules:

I’m allowed to decline a request if I want to /don’t think I can make the emote. if that is the case I’ll always be sure to refund you :3!

I will try to get your commission don’t in a timely manner but I also have a life outside emojis and the more emotes you request the more time it can take to finish them but I will give updates!

Will do won’t do:

Will: anything from my “will do” on my pinned, oc’s, shows / characters, if they are simple enough,

Won’t do: nsfw

I can do system headmates IF I am absolutely able to draw them.

payment:

I only take cash app (usd only)

Your able can pay half and half ( so half before and half after)

After everything is done and the emotes are finished there is no refund :3

What to expect:

You can pay half before the emotes are made, and once they are finished I will show them to you with the watermark, if everything is to your liking you will pay the rest and get the emotes without watermark ^^

you can contact me through my discord! (ang3lz_cup1d)

this is again my first time doing this so please be patient with me T^T

Thank you to @/mkys emotes you were a big big help with this :3

12 notes

·

View notes

Text

ghostly habits. | wolfstar | non-canon!au | wc: 0.497k ( inspired by this pin but originally from @courfeycute on this shithole of an app :) )

content includes course language :)

a.n: the beginning of a new au :) not necessarily a series, but this may have a pt2? i'm not sure. i'm not a huge fan of this but i need to start this blog one way or another :)

"you bloody wanker."

"i have no idea what you're talking about."

to the naked eye, it would appear that remus was talking to himself; maybe that's why his reputation lately has been so rambunctious lately. or maybe it was the ghostly figure looming over his shoulder like it had been for two weeks now.

"you see that group of teenage girls over there? the ones who have never looked my way before? yes well, thanks to somebody," remus glanced at the ghost over his shoulder, "they've been staring at me for the past ten minutes!" he whispered, attempting to pour every ounce of venom possible into his words.

the ghost, sirius, smiled. "remus, dear, i made you the talk of the town, really you should be thanking me. now, where were we on the list?" sirius craned his neck to get a look at the shopping list remus was holding in his left hand. his right was occupied by a half-full shopping basket. remus moved the list from sirius's line of vision.

"you made people think i'm a witch, sirius. let me go back through the chain of events for you, shall i? somebody throws a baseball at me-- which is a very normal thing to do in a game of baseball-- and remind me, sirius, what did you do?" remus stares expectantly at his ghostly companion.

"i caught it," sirius supplies. remus frowns. "i caught it while invisible." sirius rolls his eyes.

"exactly," remus says while placing a carton of eggs into his basket. "and now the whole town thinks i'm some sort of sorcerer. if one more person asks me to make them float i'm going to perform an exorcism on you."

"oi! i'm the one who has to bloody pick up everything people ask you to levitate. how tired do you think my arms get?" sirius follows remus up to the cash register. the boy scanning the items has a bored look on his face.

"that'll be thirty eight dollars. cash or card?"

"cash, please." remus hands the boy a fifty dollar note.

"i wonder what would happen if i socked this kid right in his face," sirius says, smugly. "it'd get you in a spot of trouble with the coppers, that's for sure."

the boy behind the register hands remus his change. "see you later, man. uh, keep me in your good books, okay? my mam says if i come home reeking of 'bad vibes' from seeing you, she's gonna kick me out."

remus stares blankly at the boy while sirius howls with laughter. "yeah, sure, dude." remus walks out of the store.

"oh my god that was gold!" sirius cackles, wiping iridescent tears from his eyes.

"for you, maybe. you see what you've done to me?"

"you did this to yourself, darling. you are the one who summoned me, whether it was on purpose or not. now you deal with the consequences. aka, me."

sirius winks, and remus knows he's thoroughly screwed.

divider cred to @cafekitsune :)

#olivander writes#wolfstar#sirius black#remus lupin#remus lupin x sirius black#sirius black x remus lupin#wolfstar microfic#the marauders#wolfstar fanfiction#marauders era#marauders#sirius black fanfic#remus lupin fanfic#harry potter#hp fanfic#wolfstar fanfic#fluff#au

9 notes

·

View notes

Text

Key Highlights of WWDC 2025 and iOS 26 Rumors

What Made WWDC 2025 Different from Years Past?

WWDC 2025 was a major milestone event, ushering in a new chapter of Apple’s software ecosystem. Aside from a major visual redesign, Apple unified versioning across all operating systems and represented a substantial investment in on-device AI. This year's WWDC succeeded in achieving Apple’s trademark mantra of being ambitious yet practical, and continued to set an example of the valuable balance between usability and privacy.

Unlike past years, WWDC 2025 emphasized action and on-device enhancements instead of an over-the-top flash of AI branded software. Notable areas announced were the new “Liquid Glass” design language, the use of naming devices by year of the operating system, and new Apple Intelligence features, which put things in place for the next decade of Apple experiences.

How Has Apple Changed Its Operations Systems?

Apple introduced a new design across all software products called "Liquid Glass." This new user interface allows for an immersive experience with liquid-like translucency, depth and motion. Every product and operating system across iOS, iPadOS, macOS, watchOS, and tvOS now incorporate a sophisticated glass feel - from controls to navigation bars, widgets, and even the lock screen. All the interface has become more immersive and expressive while keeping the standard user's understanding of the basic controls.

The design elements are not just bringing a different look; they are also inspiring a different way to interact with content. The Liquid Glass design can change in shape and sizes with content and context to keep the user focused on the important things and not extraneous distractions. Developers are also supported through the introduction of new APIs in SwiftUI, UIKit, and AppKit which will aid the transition to this redesigned interface and help improve overall consistency across Apple's entire ecosystem.

What Prompted the Change to Year-Based OS Naming?

In a bid to simplify software versioning, Apple changed the naming of all the major version operating systems to now just be the release year: iOS 26, iPadOS 26, macOS 26 (Tahoe), watchOS 26, tvOS 26, and visionOS 26. This not only makes it easier for users and developers to track their updates but matches Apple's product cycles more closely with the calendar year. The new OS year naming convention also emphasizes a unified approach to software development, as most features and design language will be available concurrently across platforms.

What Are the Greatest Aspects of iOS 26?

iOS 26 has a lot to offer. It has some great advancements that even add value in usability and connectivity:

Liquid Glass Design: The entire system is using a translucent, dynamic material for everything found from the lock screen to app icons that provides a new and familiar feel to your iPhone.

Messages Upgrades: Group chats gain new polls in their group chats. Also, they can do Apple Cash-based bill-splitting for messages, typing indicators for groups, and custom backgrounds for group chats and one-on-one conversations.

Apple Games App: A all-new games hub, with groups of players, and streamlined links to titles across devices.

CarPlay Enhancements: Tapbacks are now available in CarPlay Messages. And, the new designs are even present in the car.

Apple Music and Maps: Pinned music, smarter suggestions and navigation features, and more make these two apps even better.

Wallet and Call Screening: Yet more of privacy and security enhancements, but even new ways to take control of those pesky unwanted calls.

What's Apple Making with Apple Intelligence and AI Features Expanded?

In 2025, Apple is not rushing when it comes to dealing with AI. They added several Apple Intelligence features focused on privacy and on-device processing:

Visual Intelligence: This new AI-powered capability scans images and identifies objects, and places them in context to help users understand certain images better. It can identify a plant, a restaurant, a jacket, and/or the person wearing that jacket. Visual Intelligence also interacts with what's on your iPhone's screen and performs image search through experiences like Google Search and ChatGPT. You can access Visual Intelligence from your Control Center as well as using the customizable Action button.

Live Translation: The AI can now produce real-time translation built-in to Messages, FaceTime, and Phone that will provide instant text translation or voice translation while talking.

An Image Playground with ChatGPT: Apple finally hooked up ChatGPT to use in its image generation tool and allow users to produce images with styles like anime, or oil painting, or watercolor just by sending prompts.

Foundation Models for Developers: Apple's new framework now allows developers to use on-device AI to develop and use on-device AI models, and let developers build on-device third party apps that are respectively smarter and intelligent.

Which Devices Will Support iOS 26?

iOS 26 will be available for iPhone 11 and newer models, including the second-generation iPhone SE and all subsequent releases. This means older devices like the iPhone XR and XS will not receive iOS 26 but will continue to get security updates on iOS 18 for a limited period.

When Can Users Expect to Get iOS 26?

Developer Beta: Available now, immediately following the WWDC keynote.

Public Beta: Expected in July 2025.

Official Release: Scheduled for September 2025, coinciding with the launch of the next iPhone lineup.

What Are the Most Talked-About iOS 26 Rumors?

While Apple confirmed many features, several rumors are generating buzz in the tech community:

HomePod with Display: Speculation continues about a new HomePod featuring a built-in display and deeper integration with Apple Intelligence.

Major Siri Overhaul: Although not arriving this year, a significant update to Siri—featuring advanced AI and contextual awareness—is rumored for 2026.

Expanded Health and Fitness AI: Future updates may leverage Apple Intelligence for more personalized health tracking and coaching, building on the new workout coach announced at WWDC 2025.

Third-Party AI Integrations: Developers may soon have even more options to integrate Apple’s on-device AI into their own apps, thanks to the Foundation Models framework.

Frequently Asked Questions About WWDC 2025 and iOS 26 Rumors

What is the Liquid Glass design and why is it important?

Liquid Glass is Apple’s new dynamic, translucent UI material that brings depth and focus to the interface, making navigation more intuitive and visually appealing.

How does Visual Intelligence work in iOS 26?

Visual Intelligence uses on-device AI to analyze images, recognize objects, and interact with content on your screen. It can identify items, provide contextual info, and even search the web for related content, all while prioritizing privacy.

Will my device get iOS 26?

If you own an iPhone 11 or newer, you’ll receive iOS 26. Older models will remain on iOS 18 with continued security updates.

When will iOS 26 be available to the public?

The public beta is expected in July 2025, with the full release scheduled for September 20255.

What are the main AI features in iOS 26?

Key AI features include Visual Intelligence, live translation in communication apps, and image generation via ChatGPT in Image Playground.

Are there any new apps in iOS 26?

Yes, the new Apple Games app serves as a unified hub for all your games, with group features and easier access across devices.

Is Siri getting an upgrade in iOS 26?

A major Siri overhaul is rumored but not arriving until 2026. For now, incremental improvements and expanded AI capabilities are the focus.

How Will These Updates Affect Everyday Apple Users?

The updates from WWDC 2025 and iOS 26 rumors point to a more unified, visually engaging, and intelligent Apple ecosystem. The Liquid Glass design refreshes the user experience without sacrificing familiarity, while new AI features make everyday tasks—like translation, image search, and messaging—more powerful and private. The shift to year-based OS naming also makes it easier for users to understand when their devices are up to date.

For developers, the new frameworks and APIs offer opportunities to build richer, smarter apps. For users, the changes mean more convenience, security, and delight—whether you’re gaming, messaging, or exploring the world through your camera.

What’s Next for Apple After WWDC 2025?

Apple’s strategy is clear: unify its platforms, double down on privacy-focused AI, and set the stage for even more ambitious updates in the years ahead. As the company refines its software and prepares for the next wave of hardware, users and developers alike can look forward to an ecosystem that’s more connected, intelligent, and visually stunning than ever before.

0 notes

Note

Hey there 🌍💙

I hope you're doing well. Today, I’m reaching out with a heartfelt request. My family is going through an incredibly difficult time, and I need your help to make our story heard.

🔄 A simple reblog of my pinned post can spread awareness.

💖 A small $5 donation could bring hope where it’s desperately needed.

@nasr-daher

Even the smallest act of kindness can create ripples of change. Your support means the world—thank you for standing with us! 🙏✨

Alright, I get these kinds of things in my inbox a lot, and it is currently flooded with them. So, I'm going to make this perfectly clear.

I cannot donate. Even if I could, I wouldn't, not when these are the lengths that people are going. Not because I harbor ill-will, but because this feels like a scam, and I won't fall for it.

I know there ARE real people who need help. I know that those people would benefit from even the smallest donation. But this feels a little too much like I'm being played.

My kindness has been a fault in even the best scenarios. I know no one here probably cares. But I have been scammed for my kindness once. I will not fall for it again. I will not donate to personal accounts on stuff like GoFundMe, and I will not donate to anyone on PayPal, or cash app, or anything like that. The ONLY thing I feel comfortable donating to is charities with a reputable history and actual work to show for how they have helped people.

I'm not on Tumblr much. Mostly because I don't have the time. But I'm kind of getting sick of seeing this stuff in my inbox when I AM here.

I know people need help. But I cannot provide it without putting my financial stability in jeopardy, and as a trans person in America, I'd wager to say that I need whatever money I can scrape together just in case shit hits the fan. And I cannot healthily prioritize strangers online in that regard.

So, no, I will not be donating anything to these people. I don't think anyone else should, either. This feels way too much like a scam.

Be safe out there, guys. And to all the people who really do need help out there, I hope you can get it. I'm sorry it can't come from me.

0 notes

Text

Tap on Phone – The Smarter Way to Accept Payments in the UAE

According to recent reports, over 80% of consumers in the UAE now prefer contactless payments including NFC (Near Field Communication) payments — over cash or even chip-and-PIN methods. That’s a big number, and it shows how much trust and comfort people have developed in just a few years. In a world where convenience is king, contactless payments have become a game changer. With more than 440 million contactless cards in use across 9 million locations worldwide, paying with a simple tap is faster and more efficient than ever before. This technology, powered by embedded chips and RFID antennas, enables secure transactions with just a tap of your card or phone—no need to swipe, dip, or enter a PIN.

Despite its rapid adoption, many people still have concerns about the security of contactless payments. The idea of transmitting personal information wirelessly raises questions: Is it safe? Could my data be compromised? While these concerns are understandable, contactless payments are equipped with robust security measures designed to protect your financial information.

In this blog, we’ll break down the most common myths about contactless payments and reveal the facts behind the technology, so you can confidently embrace the future of secure, tap-to-pay transactions

10 common Myths and Facts about contactless payments: Myth: It’s easy to get charged twice with contactless.

Fact: Payment terminals are smart. They process only one payment per tap, and you need to remove the card or phone before the next tap works.

Myth: There’s no way to track contactless transactions.

Fact: Every tap leaves a digital record. You can see all your transactions on your bank app or wallet, just like any other payment.

Myth: Merchants need expensive machines to accept contactless.

Fact: Not anymore. Smart POS systems and even Tap-on-Phone apps let businesses accept payments with just a smartphone. Affordable and flexible!

Myth: You can accidentally pay while standing near the terminal.

Fact: Nope. Terminals need intentional, close, and direct taps — plus, most merchants prompt the amount before activating payment.

Myth: All contactless payments are done through mobile apps only.

Fact: Not true! Contactless works through debit/credit cards, smartwatches, wristbands, keychains, and even rings — not just mobile wallets.

Myth: You can't use contactless for refunds or returns.

Fact: Absolutely you can! Merchants can process refunds back to the same contactless method — just like a regular card payment.

Myth: Contactless payments charge hidden fees

Fact: For customers, contactless payments cost the same as regular card payments — no extra or hidden fees involved.

Myth: You can’t split a bill with contactless.

Fact: You totally can! Many POS systems let you split bills and accept multiple contactless payments in one go — tap by tap.

Myth: Using contactless payments too much can negatively affect your credit score.

Fact: Using contactless payments does not impact your credit score. The way you manage your payments (timely payment of balances, responsible spending) affects your credit score, not the payment method.

Myth: You can only use contactless payments with your own bank’s card or account.

Fact: You can use contactless payments with cards and accounts from various banks and financial institutions. Whether it’s a Visa, Mastercard, or other networks, many banks support this feature, and it’s compatible with multiple devices like smartphones and smartwatches.

The Impact of Contactless Payments on the UAE Market: In the UAE, the way people pay is changing fast — and it’s making a big difference for businesses. Contactless payments, once seen as just a modern feature, are now a key part of daily life.

According to recent reports, over 80% of consumers in the UAE now prefer contactless payments including NFC (Near Field Communication) payments — over cash or even chip-and-PIN methods. That’s a big number, and it shows how much trust and comfort people have developed in just a few years.

From restaurants and cafés to retail stores and delivery services, contactless payment options are helping businesses speed up service, reduce queues, and give customers a smoother, safer experience. In fact, businesses that adopted contactless early have seen up to 30% faster checkouts compared to traditional methods.

Not only is it fast and secure, but it also meets the growing demand for touch-free transactions, something that’s especially important in today’s health-conscious world.

More importantly, the UAE government continues to support digital transformation, pushing businesses towards smarter, faster ways to accept payments.

Conclusion The myths surrounding contactless payments might have caused some confusion, but the facts are clear: these payments are not only convenient but also secure and efficient. As technology continues to evolve, contactless payments are quickly becoming the preferred method for many consumers around the world, including here in the UAE.

The shift towards contactless payment methods is reshaping how we interact with money. For businesses, adopting these payment solutions means faster transactions, less hassle at checkout, and an overall better customer experience. For consumers, it’s all about convenience and peace of mind, knowing that their transactions are safe and quick.

As more people embrace contactless payments, the myths will continue to fade, and the facts will shine through. So, whether you're a business owner or a shopper, there’s no denying that contactless payments are a step forward in the way we handle money — simple, secure, and ready for the future.

Let’s tap into the future of payments and enjoy the simplicity it brings! Want to learn more about how your business can benefit from tap-to-phone technology? Discover more here!

#uae business#digital payments#fintech solution#Best tap on phone in UAE#Top tap to pay in UAE#abudhabipayments#digital payments in dubai#Tap to pay in dubai#tap on phone in sharjah

0 notes

Text

How UPI Mobile Banking is Revolutionizing Digital Payments in India

Introduction to UPI Mobile Banking

India has witnessed a dramatic transformation in digital payments over the last decade, with UPI mobile banking emerging as the key driver. Introduced by the National Payments Corporation of India (NPCI), the Unified Payments Interface (UPI) allows instant money transfers through mobile devices using a simple and secure platform. With over 10 billion transactions monthly as of 2025, UPI mobile banking is now the backbone of digital finance in India.

Key Features of UPI Mobile Banking

UPI mobile banking apps come with a host of features that make them appealing to both individuals and businesses:

Instant Bank-to-Bank Transfers: Using a Virtual Payment Address (VPA) or mobile number.

24/7 Accessibility: Payments can be made anytime, including holidays.

Secure Authentication: Every transaction is verified through a mobile PIN (MPIN).

Interoperability: A single banking UPI mobile app can manage accounts across multiple banks.

These features have made the UPI net banking app ecosystem the go-to choice for millions of users across India.

Benefits of UPI for Consumers and Businesses

For Consumers

Ease of Use: A few taps are all it takes for payments and fund transfers.

Quick Setup: Users can start transacting minutes after UPI application download.

Reduced Cash Dependency: Encourages a cashless economy and minimizes risks.

Transaction Tracking: Users get instant SMS/email alerts.

For Businesses

Faster Payments: No need to wait for settlements.

Lower Costs: Compared to card-based payment systems.

Easy Integration: Can link their systems directly with UPI app bank APIs.

Wider Reach: Accept payments from any UPI transaction app.

Comparison with Traditional Banking Methods

Traditional digital banking options like NEFT, RTGS, and IMPS are gradually being overshadowed by the convenience of banking mobile UPI apps. Where older systems require bank details and long processing times, UPI mobile banking enables real-time transfers with minimal information.

Unlike card payments, banking UPI mobile services don’t need additional hardware like POS machines. This accessibility has revolutionized financial inclusion, especially in semi-urban and rural areas.

Security and Future of UPI Mobile Banking

Security is a top priority in UPI mobile banking. Multi-factor authentication, encrypted transactions, and AI-based fraud detection systems ensure that your data and money remain safe. Users receive real-time alerts, and suspicious activities are flagged instantly.

The future holds exciting potential—UPI transaction apps may soon integrate with smartwatches, voice assistants, and even IoT-enabled devices for seamless, contactless payments.

How to Get Started with a UPI Mobile Banking App

Here's how users can begin using UPI mobile banking in just a few steps:

Download a UPI Application: Search for a trusted UPI application download in your app store.

Register Your Mobile Number: Ensure the number is linked to your bank account.

Select Your Bank: The app will fetch your account details automatically.

Create a UPI ID: Usually in the format name@bank.

Set Your MPIN: This PIN will be used for authorizing every UPI transaction.

Start Using the App: You’re ready to send or receive money instantly.

Conclusion

UPI mobile banking has fundamentally changed how India transacts. With its unmatched convenience, security, and inclusivity, it continues to drive the country towards a truly digital economy. Whether you're an individual making daily payments or a business processing thousands of transactions, UPI mobile banking apps provide the perfect solution. As technology evolves, expect even more innovations from this robust and growing UPI net banking app ecosystem.

#upi mobile banking#upi mobile banking app#banking mobile upi#banking upi mobile#upi net banking app#upi app bank#upi transaction app#upi application download#secure upi#upi download app

0 notes

Text

How to Operate POS: A Beginner’s Guide to Mastering Point of Sale Systems

How to Operate POS? Operating a Point of Sale (POS) system is an essential skill for business owners and employees, especially in retail, hospitality, and other industries that handle frequent transactions. A POS system helps streamline sales, manage inventory, process payments, and generate reports. If you're wondering how to operate POS, this guide will walk you through the basic steps to ensure efficient business operations.

Why Is Learning How to Operate POS Important?

A well-managed POS system can enhance the efficiency of sales processes, reduce errors, and offer valuable insights into your business's performance. Understanding how to operate POS will allow you to:

Process sales faster

Manage inventory with real-time updates

Handle various payment methods securely

Keep track of sales data and generate reports

Improve customer service with smoother checkout experiences

Whether you’re setting up your first POS system or need a refresher, here’s how to get started.

Step 1: Access the POS System

The first step in learning how to operate POS is accessing the system itself. Most POS systems require users to log in with a username and password. Some businesses may use employee-specific codes or PINs for tracking purposes.

Once logged in, you’ll be greeted with the main dashboard. Familiarize yourself with its layout, which typically includes sections for sales, inventory, reports, and settings. This will make navigation easier as you begin to use the system.

Step 2: Adding Products to the Transaction

When a customer is ready to make a purchase, the next step is to add items to the transaction. Depending on your POS system, you can either:

Scan the barcode using a barcode scanner, which will automatically pull up the product details, including price and inventory.

Manually input product codes if there is no barcode available.

Select products from a digital catalog displayed on the POS screen.

Make sure the quantity and pricing of the items are correct before proceeding to the next step.

Step 3: Processing the Payment

Once all items have been added to the cart, the next critical step in operating a POS system is processing the payment. Most modern POS systems support a variety of payment methods, such as:

Credit or Debit Cards: Customers can swipe, insert, or tap their cards on the card reader.

Cash: If paying with cash, enter the amount received, and the POS system will calculate the change due.

Mobile Payments: Many systems now accept contactless payments through apps like Apple Pay, Google Pay, and other mobile wallets.

It’s important to verify that the payment has been successfully processed before completing the transaction.

Step 4: Providing a Receipt

After processing the payment, your POS system will prompt you to offer the customer a receipt. You can either:

Print a physical receipt, which is the traditional method.

Email the receipt to customers who prefer a digital copy, which also contributes to eco-friendly business practices.

Receipts serve as proof of purchase and often include details such as the transaction ID, product details, and store information.

Step 5: Managing Inventory

A major advantage of using a POS system is the ability to track inventory in real-time. Every time a sale is made, the system updates the stock levels automatically. You can check the remaining quantity of products at any time, ensuring you never run out of popular items.

Learning how to use the inventory management feature of a POS system helps you stay organized and allows you to reorder items before stock runs out.

Step 6: Handling Returns and Refunds

Understanding how to handle returns and refunds is an important part of how to operate POS. If a customer needs to return an item, the POS system will guide you through the process. You’ll need to:

Locate the original transaction within the system.

Process the return by removing the item from the sale.

Issue a refund via the same payment method used during the original transaction.

Being familiar with return policies and how to manage refunds quickly ensures a smoother process for both the business and the customer.

Step 7: Generating Sales Reports

Another key feature of most POS systems is the ability to generate sales reports. Reports can provide detailed information about daily sales, peak transaction times, popular products, and overall business performance.

These insights help business owners make data-driven decisions, adjust inventory levels, and plan marketing strategies. Learning how to generate and read reports is crucial for operating a POS efficiently.

Conclusion

Mastering how to operate POS is essential for running a modern business. By following these steps, you’ll be able to navigate your POS system confidently, process sales, manage inventory, and handle returns with ease. Whether you’re a new employee or a seasoned manager, knowing how to operate a POS system ensures smoother transactions and enhances the overall customer experience. With practice, you’ll find that using a POS system can significantly boost your business’s efficiency and profitability.

0 notes

Text

Payment Trends for Credit Cards

Credit cards are a popular payment method with several perks. Online payment options have impacted credit card usage. Today, we have more efficient and cost-effective payment methods centered around credit cards. Services like personalized reward programs and pay by credit card are provided by the best credit card payment apps in the marketplace. Check out how credit card payments are evolving.

Pay by Credit Card: The pay by credit card function, which enables customers to make payments even in cases where the payees do not take credit cards, has been one of the main breakthroughs. Owing to the transaction cost, certain companies and sellers may decline to take credit card payments. But today, credit card payment apps allow users to overcome this problem as payees will receive payments as wires, checks or ACH and they don’t have to pay the transaction fee. This is a highly convenient solution that allows businesses to reap cash back rewards and other perks.

Integration with Mobile Apps: Mobile payment applications allow you to link credit cards with their platform and make transactions on your smartphones. This makes payments faster and easier. Several e-commerce platforms have also integrated credit cards with payment options to promote credit card use. This allows users to make better use of their mobile wallets while paying bills or buying things online. This also makes it easier to track spending and control expenses. This is a great feature that allows users to make wise payment decisions to get maximum credit card rewards.

Embedded Payment: Just like mobile apps, personal gadgets also allow the integration with credit cards. The ease of making transactions will result in better user experience. Smart watches and other wearable gadgets may now be utilized for online shopping and payment. When consumers are unable to carry a credit card or smartphone, this will be a fantastic substitute. These gadgets also have very good security measures like PIN verification and biometric authentication in place. So users do not have to worry about security threats.

Personalized Rewards: Credit card firms are providing unique rewards according to the way that their clients spend. These might be vouchers or cashbacks for particular goods or services. Businesses can take advantage of this to get a lot of reward points that can be then exchanged. This way, they can offset the transaction fee and reduce operating costs.

Crypto Transactions: Some credit cards are also promoting cryptocurrency transactions to attract more customers. The major benefit of using crypto is that users can protect their privacy. So, these credit card companies allow users to earn rewards while making crypto purchases. This trend is based on the growing popularity of digital currencies.

Online payment platforms have completely changed the way credit cards can be used by introducing unique features. Today, users can take advantage of features like pay by credit card, mobile app integration, embedded payments, personalized rewards and crypto transactions to get the most out of credit cards. This gives more flexibility to businesses that use credit cards for financial transactions.

0 notes

Text

TECHNOPRENEURSHIP 003:

TECHNOPRENEURSHIP?

Ever Thought of Turning Your Tech Idea into a Business?

Have you ever heard of someone who invented a life-saving medical device or a super cool app that changed the way we do things? That's the magic of technopreneurship! It's like being your own boss, but with a tech twist. Technopreneurs use all sorts of technology to solve problems, create awesome new products and services, and build businesses that make a real difference.

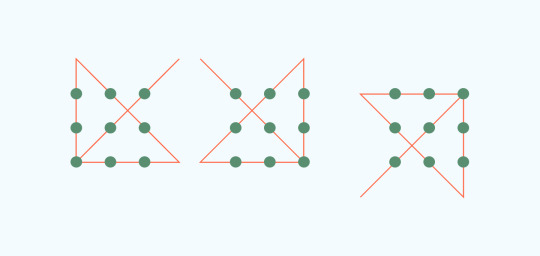

Thinking Different: Like a Puzzle Master!

Our class started with a brain teaser – a logic puzzle with nine pins that you connect with only four lines. Tough, right? That's the point! It teaches us to think outside the box, just like those who come up with amazing business ideas. We gotta ditch the usual way of doing things and see problems from new angles.

From Worker Bee to Tech Boss: A Mindset Shift

Next, we explored two different mindsets: the "worker mindset" and the "technopreneur mindset." Most of us grow up thinking about getting a good-paying job after school. That's the worker mindset. But the technopreneur mindset is all about being a leader and an innovator. Technopreneurs use technology to create businesses that make a positive impact. They're the bosses, building something cool and meaningful. Pretty inspiring, right?

Ideas Are Great, But They Need a Plan!

We all get those flashes of inspiration, but true technopreneurship is about more than just a cool idea. Think about it – would people actually use your idea? Can you turn it into a real business that makes money? Don't jump in head first – having a solid plan is key!

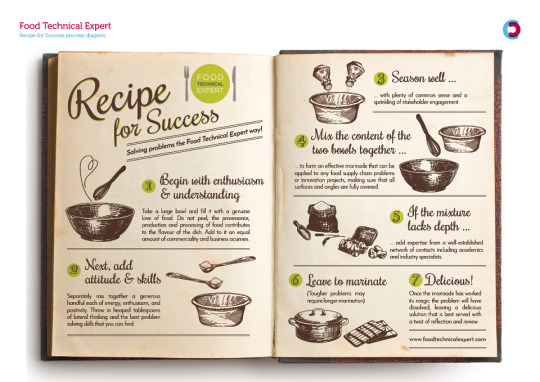

Becoming a Technopreneur: The Recipe for Success

Just like becoming a chef, building a successful tech business requires specific ingredients:

Tech Savvy: You gotta understand technology and how it can be used to solve problems.

Planning Pro: Don't wing it! Make a business plan that outlines your idea, who your customers are, how much money you need, and how you'll reach your target market.

The Right Tools: Depending on your idea, you might need special software, hardware, or even lab equipment to make it a reality.

Funding Power: Most businesses need some cash to get started. Look for investors, grants, or other ways to finance your dream.

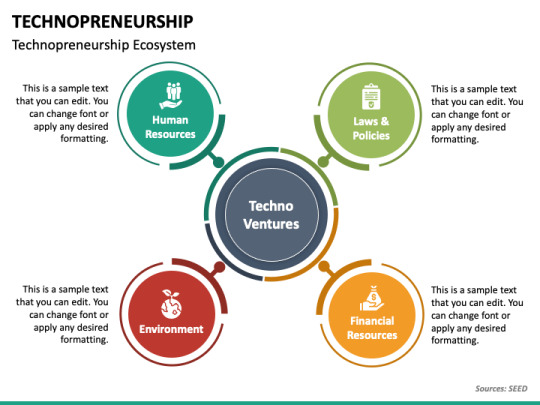

HELF: Your Technopreneurial Toolkit

Imagine a strong foundation for your business – that's what HELF stands for!

Human Resources: You'll need a team of talented people with different skills. Think idea generators (researchers), builders (developers), promoters (marketing), and money managers (financial experts).

Supportive Environment: Surround yourself with the right people and places! Look for incubators (business support centers), science parks, or universities that can provide resources and guidance.

Legal Stuff: Gotta play by the rules! Understand laws around intellectual property (protecting your ideas), technology licensing (making money from your creation), and business registration (making it official).

Financial Resources: Money makes the world go round! Explore options like venture capitalists (investors), government grants, or angel investors (wealthy individuals who support startups).

Collaboration is Key: We're All in This Together!

Technopreneurship isn't a solo act. Universities, government agencies, funding bodies, and business incubators all work together to create a healthy environment for tech startups to thrive.

More Than Just Tech: Building a Great Business

Technology is awesome, but it's not the only ingredient for a successful business. Here are some other things you need to consider:

Solving a Real Problem: Is there a genuine need for your idea in the market? Who are your customers, and will they actually pay for your product or service?

Planning Makes Perfect: Don't just jump in! Develop a comprehensive business plan that outlines your strategy for success.

Standing Out From the Crowd: What makes your idea unique? Don't just copy someone else – find a way to offer something different and valuable.

Ready to Be a Technopreneur?

The journey of a technopreneur is exciting, challenging, and incredibly rewarding. If you're passionate about technology and have a great idea, this path could be for you. Just remember, it takes more than just a cool idea to succeed. Prepare yourself with the knowledge, resources, and a solid plan to turn your vision into reality. Stay tuned for more adventures in the exciting world of tech startups!

𝓜𝔂 𝓣𝓮𝓬𝓱𝓷𝓸𝓹𝓻𝓮𝓷𝓮𝓾𝓻𝓼𝓱𝓲𝓹 𝓳𝓸𝓾𝓻𝓷𝓮𝔂 𝓬𝓸𝓷𝓽𝓲𝓷𝓾𝓮𝓼 𝓸𝓷 𝓫𝓵𝓸𝓰 #004. 𝓢𝓽𝓪𝔂 𝓽𝓾𝓷𝓮𝓭 𝓯𝓸𝓻 𝓶𝓸𝓻𝓮 𝓮𝔁𝓬𝓲𝓽𝓲𝓷𝓰 𝓪𝓭𝓿𝓮𝓷𝓽𝓾𝓻𝓮𝓼! :3

0 notes

Text

How much money can you send on Cash App in one day?

Cash App has become an indispensable tool for millions seeking a quick, user-friendly method to manage money transactions digitally. Whether you're splitting a bill with friends or paying for services, understanding the Cash App daily and weekly limits is crucial for efficient financial management. Here, we delve into the specifics of these limits and provide insights on how to increase Cash App limit.

Understanding the Cash App Max Limit for Daily Spending

Cash App imposes certain limits on the amount of money you can send and receive daily and weekly to ensure user security and comply with regulatory measures. Initially, unverified users are limited to sending up to $250 within any 7-day period and receiving up to $1,000 within any 30-day period. These limits can be restrictive for users who require more substantial transactions.

How Much Money Can You Send on Cash App in One Day?

For verified users, Cash App spending limit to $2,500 per week, which provides significantly more flexibility? Verification requires providing your full name, date of birth, and the last four digits of your Social Security number. The process not only helps in increasing your transaction limits but also in safeguarding your account against fraud.

How Does the Cash App Weekly Limit Reset?

Understanding the reset timing of your Cash App weekly limit is essential for planning large payments or transfers. The weekly sending limit resets exactly one week after you reach your sending threshold. For example, if you hit your Cash App limit on a Wednesday, the limit will reset the next Wednesday. Keeping track of this cycle can help you manage your transactions without interruption.

How to Increase Your Cash App Daily or Weekly Limits?

Increasing your Cash App limits involves a straightforward verification process. You need to provide additional information beyond the initial requirements. This may include answering further identity verification questions or submitting additional documentation such as a government-issued ID.

Start the Verification Process: In the Cash App, navigate to your profile settings and find the section for personal information. Fill out the necessary fields for verification.

Await Confirmation: After submitting your details, Cash App will typically increase your Cash App limits within a few days. You will receive a notification once your limits have been updated.

Maintain Account Security: Keeping your account secure is crucial. Ensure that your information is up to date and be cautious of phishing attempts and other forms of fraud.

Key Tips for Maximizing Your Cash App Experience

Regularly Update Your App: Ensure that you have the latest version of Cash App installed to benefit from updated features and enhanced security measures.

Monitor Your Transactions: Regularly check your history to track your spending and stay within your limits.

Secure Your Account: Enable two-factor authentication and never share your Cash App PIN or sign-in code with anyone.

Be Informed: Keep abreast of changes in terms and conditions that may affect your sending and receiving limits.

Conclusion

Navigating the limits of Cash App requires a clear understanding of the rules and the knowledge to manage them effectively. Whether you're a new user or looking to expand your transaction capacity, following the steps to verify and secure your account is essential. With these measures in place, you can maximize your Cash App usage to fit your financial needs seamlessly.

1 note

·

View note

Text

Understanding UPI: A Comprehensive Guide

The digital landscape of financial transactions has been transformed by the advent of UPI, or Unified Payments Interface. This article delves into the essentials of UPI, its evolution, functionality, impact on the digital economy, and more.

What is UPI?

Unified Payments Interface (UPI) is a state-of-the-art payment system facilitating instant and secure transactions between banks. It eliminates the need for traditional fund transfer methods, offering users a unified platform to link multiple bank accounts to a single mobile application.

Importance of UPI

UPI has garnered significance for several compelling reasons:

Convenience and Accessibility: Users enjoy a seamless platform for peer-to-peer (P2P) transactions, bill payments, and online purchases, all from the convenience of their smartphones.

Interoperability: UPI is designed to be interoperable across different banks, simplifying transactions with individuals or businesses regardless of their banking affiliation.

Real-Time Transactions: A standout feature of UPI is its ability to facilitate instantaneous fund transfers, providing users immediate access to their funds when needed urgently.

Financial Inclusion: UPI promotes financial inclusivity by offering a digital payment platform accessible to individuals without traditional banking services, provided they have a smartphone and a linked bank account.

Security Features: Robust security measures, including two-factor authentication, bolster the safety of UPI transactions, fostering user trust in digital payment methods.

Cost-Effectiveness: Compared to traditional banking methods, UPI transactions typically incur lower costs, appealing to users and businesses alike.

Promoting Cashless Economy: UPI aligns with government efforts to reduce cash transactions, facilitating a smoother transition to a cashless economy.

Innovation and Integration: UPI serves as a platform for innovation, with numerous third-party applications integrating UPI for a range of services within its ecosystem.

Security Tips for UPI Transactions

Using UPI for transactions abroad can be convenient, but it's crucial to prioritize security:

Secure Your Smartphone with strong authentication methods.

Use Trusted Apps downloaded from official sources.

Enable Two-Factor Authentication (2FA) for added security.

Safeguard Your UPI PIN by not sharing it and changing it regularly.

Monitor Transaction Alerts for any unauthorized activities.

Consider using a Virtual Private Network (VPN) for transactions on public Wi-Fi.

Stay Vigilant against phishing attempts and verify communication with your bank.

Regularly Review and Manage App Permissions.

Ensure Email Account Security and update contact information with your bank.

How UPI Works?

CheqUPI, a cutting-edge digital payment platform, simplifies financial transactions with its user-friendly interface and robust security features. Here's how it works:

Download the CheqUPI App:

Begin by downloading the CheqUPI mobile application from the official app store on your smartphone.

Sign Up or Log In:

Upon launching the app, you'll have the option to either sign up for a new account or log in if you're an existing user.

Link Your Bank Account:

To start using CheqUPI, link your bank account(s) to the app. This step involves selecting your bank and providing the necessary details for verification.

Create a CheqUPI ID:

Next, create your unique CheqUPI ID, also known as a Virtual Payment Address (VPA). This VPA acts as your identifier for sending and receiving money through CheqUPI.

Set Your Transaction PIN:

For added security, set up a secure Transaction PIN. This PIN is required to authorize any transactions made through the CheqUPI app.

Send and Receive Money:

With your bank account linked and CheqUPI ID set, you can now easily send money to others by entering their CheqUPI ID or scanning their QR code.

To receive money, simply share your CheqUPI ID with the sender, who can then transfer funds to your account.

Explore Additional Features:

CheqUPI offers a range of features beyond basic transactions. You can pay bills, recharge mobile phones, make online purchases, and more, all within the app.

Explore the various options available to streamline your financial transactions and payments.

Enhanced Security Measures:

Rest assured, CheqUPI prioritizes the security of your transactions. The app employs robust encryption protocols and two-factor authentication to safeguard your financial information.

Instant Notifications and Transaction History:

Stay informed about your transactions with instant notifications for payments sent and received.

Access your transaction history within the app to keep track of your financial activities.

Enjoy Seamless and Convenient Transactions:

With CheqUPI, you can experience the convenience of digital payments, making transactions anytime, anywhere, with just a few taps on your smartphone.

Conclusion

Understanding UPI is pivotal in today's digital financial realm, offering a streamlined platform for seamless transactions. Its real-time nature, interoperability, and security features have made it a preferred choice for millions. By linking bank accounts and creating unique UPI IDs, individuals experience secure and efficient financial transactions, shaping the future of digital payments.

FAQs (Frequently Asked Questions)

What is UPI?

UPI, or Unified Payments Interface, is a real-time payment system facilitating transactions between bank accounts through a single mobile application.

How does UPI work?

UPI enables users to send and receive money using smartphones by linking their bank accounts to a UPI-enabled app.

What is a UPI ID?

A UPI ID, or Unified Payments Interface ID, is a unique identifier linked to a user's bank account, allowing others to send money using this ID.

Is UPI secure?

Yes, UPI transactions are secured with two-factor authentication and end-to-end encryption for data protection.

Can UPI be used for international transactions?

UPI is primarily designed for domestic transactions within the country of implementation.

Are there transaction limits with UPI?

Transaction limits may vary, and users should check with their banks or UPI apps for specific information.

Can multiple bank accounts be linked to UPI?

Yes, UPI allows users to link multiple bank accounts to a single UPI-enabled app, providing flexibility in transactions.

0 notes

Text

Not an Ordinary Day

I can't even say today was one of those days, because it wasn't. I was plagued by the Evil Forces to really hand me my behind on a platter with a side of my heart and my soul with my crown on top. I could feel the Evil Forces laughing at me in the shadows, watching my nightmare unfold.

I am trying to find stability out of chaos. I left chaos and it seems to find me. I have 2 weeks worth of living saved up in my cash app account. It has been sitting there as I use it since December.

You know how you just go to something just on the whim and you are met with UTTER SHOCK. I am still trying to figure out how this even happened. I go into my cash app account and I have $1 to my name and this complete stranger has sent themselves ALL of my money to them the day before my rent is due! I was HYSTERICAL. I couldn't believe it. I have a security pin and everything! How could this have happened to me! I am in sheer panic. I am crying on the phone with cash app losing my marbles. The man puts me in time out to punish me for my melt down. I am in the middle of nowhere. I have no one, no other resources, NOTHING. I am in a hotel! If I don't have the money to pay they can be like , NOT OUR PROBLEM. I don't want to be homeless. I don't want to be destitute. But the devil just knew he was gonna do this major sabotage moment to have my life in shambles without any way out. So he thought.

I was filled with anxiety and panic. I kept staring at the app hoping it would magically change and my money would come running back to me after being abducted! And suddenly, I just sat on my bed and laid forward and began to pray. I gave it to God. A shield of calmness ran down my body and I felt at ease. I began a GoFundMe page, knowing that it really ain't gone work, it never has in the past so I need another alternative solution. Then a light bulb moment came.

This is why it is imperative to listen to your gut and follow your intuition. Before I left I had a Nintendo Switch and I was going to sale it for $70 but something told me to hold on to it and take it Texas for just in case an emergency pops up and I need emergency money. Far fetched but I decided not to sale it just YET! Why didn't that come in handy! I was able to sale the Switch for $90 and now I am held over until the dispute claim is cleared up!

Call me Houdini. I will get out of any trap placed in front of me and you can too.

#female hysteria#alchemy#journey to a new life#blog#femcel#magick#metaphysics#problem solving#the great escape#overcome challenges#overcome obstacles#strength#wisdom#intuition#inspiring words#inspiration#empowerment

1 note

·

View note

Text

How to Check Your ATM Withdrawal Limit on Cash App?

In this digital age, mobile payment apps like Cash App have become an integral part of our financial lives. They make it incredibly convenient to send money, pay bills, and even withdraw cash from ATMs. However, understanding your ATM withdrawal limit on Cash App is crucial to avoid any surprises when you need cash urgently.

In this article, we'll guide you through the process of checking your ATM withdrawal limit on Cash App. We'll use simple language, avoid complex terms, and provide you with all the information you need. Let's dive in!

1. What is Cash App?

Before we delve into the details, let's briefly explain what Cash App is. Cash App is a mobile payment app that allows you to send and receive money, make purchases, and even invest. It's a user-friendly platform that simplifies financial transactions.

2. Why should you know you’re ATM Withdrawal Limit?

Understanding your Cash App ATM withdrawal limit is crucial for several reasons. First, it helps you plan your cash withdrawals effectively. Second, it prevents you from exceeding your limit and incurring additional fees. Lastly, knowing your limit ensures that you're never left without cash when you need it the most.

3. How to Find Your Cash App ATM Withdrawal Limit

To check your ATM withdrawal limit on Cash App, follow these simple steps:

Open the Cash App on your smartphone.

Tap on your profile icon at the top-right corner of the screen.

Scroll down and select "Cash."

Under the "Cash" section, you'll find your "ATM Withdrawal" limit.

Your ATM withdrawal limit may vary depending on your account type and usage history. Make sure to check it regularly to stay informed.

4. Understanding ATM Withdrawal Limits

Cash App imposes ATM withdrawal limits to ensure the security of your account. These limits are in place to prevent unauthorized access to your funds. The limits may be daily, weekly, or monthly, and they vary from user to user.

It's essential to be aware of your specific limit and plan your withdrawals accordingly. If you need to withdraw more than your limit allows, you'll have to explore other options or request a limit increase.

5. How to Increase Your ATM Withdrawal Limit

If you find that your current ATM withdrawal limit on Cash App doesn't meet your needs, you can request an increase. Here's how to do it:

Open the Cash App.

Tap on your profile icon.

Scroll down and select "Personal."

Find the "ATM Withdrawal Limit" option.

Follow the prompts to request a limit increase.

Cash App will review your request, and if approved, your new limit will be updated accordingly. Keep in mind that Cash App will consider your account history and activity when evaluating your request.

6. ATM Withdrawal Fees on Cash App

While Cash App offers the convenience of ATM withdrawals, it's essential to be aware of any associated fees. Cash App may charge a fee for ATM transactions, and the ATM provider may also impose additional charges.

Before making an ATM withdrawal, check the Cash App fee structure and the ATM's fee disclosure to avoid any surprises.

7. What to Do If You Forget Your PIN

Your Personal Identification Number (PIN) is crucial for ATM withdrawals. If you forget your PIN, don't worry; you can reset it. Follow these steps:

Open the Cash App.

Tap on your profile icon.

Scroll down and select "Privacy & Security."

Choose "Change Cash PIN" and follow the prompts.

Cash App will guide you through the process of resetting your PIN, ensuring the security of your account.

8. Staying Secure with Cash App

When dealing with financial transactions, security is paramount. Here are some tips to help you stay secure while using Cash App:

Enable two-factor authentication (2FA) for added security.

Regularly review your transaction history for any suspicious activity.

Never share your PIN or login credentials with anyone.

Keep your Cash App and smartphone software up to date.

9. Conclusion

In conclusion, knowing your ATM withdrawal limit on Cash App is essential for effective financial planning and security. By following the steps mentioned above, you can easily check your limit, request an increase if needed, and stay informed about associated fees.

10. FAQs

Q1: What if my ATM withdrawal limit is too low for my needs?

A1: You can request an increase in your cash app ATM withdrawal limit by following the steps mentioned in this article. Cash App will review your request and update your limit accordingly.

Q2: Are there any fees for ATM withdrawals on Cash App?

A2: Yes, Cash App may charge a fee for ATM transactions, and the ATM provider may also impose additional charges. Check the fee structure before making withdrawals.

Q3: How often should I check my ATM withdrawal limit?

A5: It's a good practice to check your Cash App ATM withdrawal limit periodically, especially if you anticipate needing to withdraw larger sums of cash. This helps you plan your finances effectively.

Q4: Can I change my Cash App PIN if I forget it?

A3: Yes, you can change your Cash App PIN by going to the "Privacy & Security" section in the app and following the prompts for PIN reset.

Q5: Is it safe to use Cash App for financial transactions?

A4: Yes, Cash App is generally safe to use for financial transactions. However, it's essential to follow security best practices, such as enabling 2FA and keeping your PIN confidential.

0 notes

Text

Cash App Limits: How Much You Can Send, Receive and Withdrawal

There are the general limits for Cash App:-

Sending and Receiving Money:

Unverified Account (Standard): You can send up to $250 within 7 days and receive up to $1,000 within 30 days.

Verified Account: Once you verify your account by providing personal information (full name, date of birth, last four digits of your Social Security number), you can send up to $7,500 per week and receive an unlimited amount.

Cash Card Transactions:

Unverified Account (Standard): You can spend up to $250 per day and withdraw up to $250 per day.

Verified Account: With a verified account, you can spend up to $7,500 per week and withdraw up to $2,500 per transaction, with a maximum of $7,500 per week.

To get the most accurate and up-to-date information on Cash App's limits, I recommend checking the Cash App website or app or contacting their customer support. They will provide you with the latest details regarding sending, receiving, and cash app withdrawal limits.

How to Check Cash App Limits?

To check your Cash App limits, follow these steps:-

Open the Cash App: Launch the Cash App on your mobile device.

Log In: Log in to your Cash App account using your email or mobile phone number and your unique Cash App PIN or Touch ID/Face ID (if enabled).

Access Your Profile: On the home screen, tap on your profile icon, which is typically represented as your profile picture or initials in a circle. This will take you to your profile page.

View Limits: On your profile page, you'll see a section that shows your Cash App limits. These limits include your sending, receiving, and spending limits, as well as any additional limits related to your Cash Card (if you have one).

Review Limits: Review the specific limits provided on your profile page. These limits are based on your account's verification status and usage history.

Keep in mind that your Cash App limit can vary based on factors such as whether your account is verified, how long you've been using Cash App, and your transaction history. If you want to increase your cash app limits, you may need to verify your account and maintain a positive transaction history, as I mentioned in a previous response.

Please note that Cash App's policies and limits can change over time, so it's a good idea to periodically check your limits on the Cash App and review the most up-to-date information on their website or contact Cash App customer support for any specific inquiries regarding your account's limits.

0 notes