#New Economy Companies

Text

Discover the digitalization landscape in Singapore and the strategies employed by new economy companies in this insightful blog. Gain valuable insights into how Singapore is fostering a thriving digital ecosystem and driving innovation across various industries. Explore the success stories and strategies of leading companies embracing digital transformation. Stay ahead of the curve and unlock the potential of the digital economy in Singapore.

0 notes

Text

u know what i've been thinking about. how the economy expects you to be, right now, at a job you've been at and consistently getting raises in for like, ten years. it's almost like the implication is "well yeah, you'll be able to live off this job in three, five, ten years if you stick with it and grow in the company" which is all fine and dandy, but i kind of need to live right now

#the queen of trash has spoken#rewrote this post six times and it turned into an essay both times and i don't really need it to lol#also thinking about the graphic i saw this morning that said the average spending power of $100 here is $41 compared to the national averag#which i guess? min wage is just over $16 here. but uhhhhhhhh i think my city is one of the most expensive in the state as far as cost of#living goes (not hard since we're the second largest city in a state of three decent sized cities and mostly large towns)#and its just crazy bc i look at my coworkers some of whom haven't been there much longer than me#who have kids and a house and stuff#and i realize oh. their husbands are engineers or lawyers. plus they're probably making more than me because they're team leads or managers#or have been there longer. meanwhile my 25 year old ass is making $20 an hour and my boyfriend is making $18 an hour#both doing highly-specialized work#and like. the idea that in ten years if i last that long both in the company and in this mortal coil#THEN i'll be making a living wage (in today's money)#is like. so wack! considering the fact that people really aren't staying in jobs for very long for various reasons#and for some positions the only way to get a raise is to move to a whole new company#it's just crazy! the fact that a 25 year old with a bachelor's degree can't even afford a fucking APARTMENT.#like everyone should be able to have housing obvs and the obvious solution to this is a universal basic income#but the fact that my experiencce in the economy is so different from my brothers (who is seven years older than me) and COMPLETELY#unrecognizable to that of my parents when they were my age. like i know billionaires are totally disconnected from reality#but in what universe is this a successful economy? /rq i know the answer i promise

5 notes

·

View notes

Text

hyperfixations are weird as hell; every time I see a representation of a particular interest i get a surge of dopamine that makes me want to sprint a mile while writing an incomprehensible-yet-poignant essay about how much I like said interest. except I can do neither of those things because I have to leave for work in 20 minutes.

#maybe it wouldn’t be so difficult to manage if capitalism wouldn’t bleed workers dry idk man#I kind of rly miss quarantine bc I actually had time and energy to devote to my hyperfixation#I made So Much Fanart for Promare it was insane#I tried all sorts of new art techniques. wrote some fanfic. came up with a bunch of aus. it was wild [pos]#I miss having that time and energy available to me#my thoughts#adhd#hyperfixations#in some ways I’m glad CSM doesn’t have as much merch and stuff in US stores because I’d go bananas#I’m not sure I’d have the capacity to mask over my excitement if I saw like. Angel merch.#still pissed there’s no official merch for him at all. but it’s a silver lining I guess.#fuck I’m so tired#fuck capitalism#‘workers need money in order to survive and stimulate the economy’ ‘can you give us more money then?’ ‘no’#(imaginary convo between the embodiment of companies/the system of capitalism and workers)#except worker survival isn’t the important part ot capitalism. it’s whether workers can continue to be productive/exploited for profit.#:-/#feeling. hungry.#meposting

12 notes

·

View notes

Text

putting together a potential pet budget and realizing that adding a family member costs a lot of money

#idk how anyone affords to raise an entire human in this economy when adopting a pet or 2 costs so much#we're talking: adoption fees; pet rent; pet deposit; vaccines and spay/neuter costs;#med insurance (i've seen ppl getting surprised by $1k+ bills and i'm not risking that);#food; basic enrichment; a bed; a carrier; grooming supplies; and a litter box + litter#and that's just basics. i'd also want to get treats and more toys and ways to make the apt an enriching space ideally#also a harness if the kitty would want to go on walks (and i'd want to get that relatively soon so that i could harness train early)#i wonder if baby showers for pets could be a thing lmao#or pet leave from work. pls give me a few days off to bond with my new kitty and/or make sure my new pets get along#(i can only have 2 pets at the apt but i'd like at least a cat and a ferret.#but i'll wanna know they can keep each other company when i'm not home)

1 note

·

View note

Text

Oil prices rise with US interest rate cut expectations

Oil prices rose slightly in early trading on Monday on expectations of a US interest rate cut this week. However, growth was limited by weak economic data from China and lingering demand concerns.

International benchmark Brent crude rose 0.74 percent to $72.14 a barrel at 11.35 a.m. local time (0835 GMT), up from the previous session’s close of $71.61.

US benchmark West Texas Intermediate (WTI) rose 0.93% to $68.38 a barrel after closing at $67.75 in the previous session.

Markets are set for an interest rate cut by the US Federal Reserve following its meeting scheduled for Wednesday, which would be the first rate cut since 2020.

The bank is likely to start the easing cycle, but market uncertainty remains over how aggressive the rate cut will be.

While investors have raised their odds of an aggressive 50 basis point rate cut, a 25 basis point cut remains on the table. Lower interest rates typically reduce borrowing costs, which fuels expectations of increased economic activity and oil demand.

However, the rise in oil prices was tempered by rising demand in the market following the release of data from China. China’s economic data released over the weekend pointed to weakness in the economy of the world’s largest oil importer, adding to doubts about oil demand.

The country’s industrial production in August fell short of expectations, unemployment rose and house prices fell further.

Read more HERE

#world news#news#world politics#usa#usa news#usa politics#united states#usa economy#us politics#politics#oil prices#oil#oil and gas industry#oil and gas companies#energy

0 notes

Text

The merging of AI and blockchain was inevitable – but what will it mean? - AI News

New Post has been published on https://thedigitalinsider.com/the-merging-of-ai-and-blockchain-was-inevitable-but-what-will-it-mean-ai-news/

The merging of AI and blockchain was inevitable – but what will it mean? - AI News

.pp-multiple-authors-boxes-wrapper display:none;

img width:100%;

At first glance, AI and blockchain seem like completely disparate realms. For instance, blockchain emphasises decentralisation but suffers from constrained memory and throughput rates.

On the other hand, AI thrives on massive datasets and demands high-performance computing. To elaborate, Machine learning (ML) models – especially deep learning networks – require enormous amounts of data to train effectively, often relying on powerful GPUs or specialised hardware to process this information quickly.

To this point, a report from the International Energy Agency (IEA) states that the global electricity demand for AI is projected to rise to 800 TWh by 2026, a nearly 75% increase from 460 TWh in 2022. Similar projections have also been released by multinational giants such as Morgan Stanley and Wells Fargo, with the latter’s model suggesting that, by 2030, AI-centric energy consumption will account for 16% of the USA’s current electricity demand.

Morgan Stanley’s AI power consumption prediction (best-case scenario)

The best of both worlds is here.

Despite their apparent differences, the tech world is witnessing a growing convergence between AI and blockchain, with a number of innovative projects emerging. For instance, Ocean is a protocol that provides users with a decentralised data exchange centre, unlocking information sets for AI consumption while preserving their privacy and security.

Similarly, ThoughtAI embeds AI and blockchain directly into data and information, effectively eliminating traditional application layers. It aims to create more responsive and adaptive AI solutions, potentially revolutionising how people interact with the technology and manage information.

While these projects demonstrate the potential of combining AI and blockchain, they also highlight a critical challenge, i.e. scalability. For AI on blockchain to truly flourish, platforms need to overcome the inherent limitations of traditional blockchain architectures, particularly in terms of data availability and throughput.

In this regard, 0G is a platform that has made significant strides in addressing the above-mentioned bottlenecks. To elaborate, ZeroGravity (0G for short) is the world’s first data availability system with a built-in general purpose storage layer that is not only highly scalable but also decentralised. Its scalability hinges on separating the workflow of data availability into a data publishing lane and a data storage lane.

To put it technically, 0G is a scalable Data Availability (DA) service layer built directly on top of a decentralised storage system. It addresses the scalability issue by minimising the data transfer volume required for broadcast. — allowing for unprecedented levels of data availability and transaction throughput.

One of the key advantages of 0G is its performance. While competitors like Celestia are able to achieve about 1.4 to 1.5 megabytes per second, the 0G network is capable of producing about 50 gigabytes per second, making it 50,000 times faster. Additionally, 0G’s cost is approximately 100 times cheaper than its closest competitors.

This level of performance and flexibility opens the door to a wide array of AI/blockchain use cases that were previously impractical or impossible. For starters, in the realm of finance, 0G’s scalability can potentially allow for sophisticated AI-powered trading algorithms to operate directly on-chain.

Similarly, it could also be possible to implement large-scale federated learning systems on the blockchain, leading to breakthroughs in privacy-preserving AI—where multiple parties can collaboratively train AI models without sharing sensitive data directly. Such advancements could have far-reaching implications in fields like healthcare, where data privacy is paramount but collaborative research is essential.

A trillion-dollar opportunity is waiting to be tapped.

As we look to the future, it’s clear that the intersection of AI and blockchain will continue to expand and evolve.

This convergence is not just a technological curiosity but a massive economic opportunity. For example, the AI industry is projected to be worth a staggering $1.3 trillion by 2030, while the blockchain market is set to reach a valuation of $248.8 billion by 2029, reflecting their transformative potential across virtually every sector of the global economy.

Therefore, moving forward, it stands to reason that those companies and platforms (such as 0G) that are able to successfully navigate this convergence — solving the technical challenges while unlocking new value propositions — will be well-positioned to capture a significant share of this trillion-dollar opportunity.

#000#2022#ai#AI models#ai news#AI-powered#Algorithms#Articles#Artificial Intelligence#Best Of#billion#Blockchain#Capture#challenge#collaborative#Companies#computing#curiosity#data#data privacy#data storage#data transfer#datasets#Deep Learning#economic#economy#electricity#energy#energy consumption#finance

0 notes

Link

Discover how the nation's #1 brewer, Anheuser-Busch, is championing American farmers with the US Farmed Certification! Learn how this initiative supports local agriculture, ensures high-quality ingredients, and boosts sustainability. Check out the full story on how these efforts are shaping the future of US agriculture.

#BEER GROWN HERE: ANHEUSER-BUSCH ADOPTS US FARMED CERTIFICATION (Courtesy Anheuser-Busch) The nation’s 1 brewer#Anheuser-Busch#is making it easier for beer-lovers to “Buy American” with this new certification. Here’s the deal… On March#19#the American Farmland Trust#a national nonprofit that helps to keep American farmers on their land#launched a new US Farmed certification and packaging seal for products that derive at least 95 percent of their agricultural ingredients fr#the nation’s leading brewer#announced that it is the first-mover in adopting the U.S. Farmed certification and seal for several of its industry-leading beer brands. Ai#the seal will first appear on Anheuser-Busch’s Busch Light this May#and Budweiser#Bud Light and Michelob ULTRA have also obtained U.S. Farmed certification. This industry-wide effort will be supported by an Anheuser-Busch#“Choose Beer Grown Here#” to encourage consumers to seek the U.S. Farmed certification and seal when shopping for products. “American farmers are the backbone of th#and Anheuser-Busch has been deeply connected to the U.S. agricultural community and committed to sourcing high-quality ingredients from U.S#” said Anheuser-Busch CEO Brendan Whitworth. “We source nearly all the ingredients in our iconic American beers from hard-working US farmers#and we are proud to lead the industry in rallying behind American farmers to ensure the future of US agriculture#which is crucial to our country’s economy. The US Farmed certification comes at a critical moment for American agriculture. According to AF#within the next 15 years#ownership of over 30 percent of our nation’s agricultural land could be in transition as the current generation of farmers prepares to reti#farmland loss threatens the very foundation of our agricultural capacity#and new and beginning farmers are often challenged to secure the capital needed to enter agriculture. The US Farmed certification hopes to#as well as innovative strategies for transitioning their land to the next generation of farmers. We look forward to other companies joining#” added Whitworth#“so that together we can make an even greater impact and show our support for American farmers.”#certification#American farmers#sustainability

0 notes

Link

What is the New Economy and its Impact on Manufacturing Technology?

New Economy manufacturing is driven by technology and information. Learn how new economy manufacturing technology impacts productivity, quality, user-centricity and more.

Read more: https://topdigital.agency/what-is-the-new-economy-and-its-impact-on-manufacturing-technology/

#manufacturing technology#new technology manufacturing#new economy companies#new economy industries#new economy examples#benefits of new economy#new technology manufacturing industry#new economy manufacturing

0 notes

Text

You know what sucks? Having your position at work eliminated, through budget cuts so nothing you can control, with no notice or severance and then when interviewing at a new company being asked WHY your position was eliminated, and WHY you didn't do more to invest in your previous company.

Like idfk dude, do you want me to design a brand book for you or just go fuck off to the unemployment office.

#that isnt my department#gracie doesnt do finance or budgeting#tell me what im allowed to spend and ill figure it out#might start an OF later who fucking knows#i hate it here#trash economy#work#anti work#fuck my old company#and fuck the new company#fuck everyone im tired#gonna watch dragon ball z or something and pretend im a child again

0 notes

Text

it literally took us 5 hours to unload the truck delivery today and then this fuck ass store manager didn’t even help (as usual) and decides to write me up for something that happened a week ago.

#they’re lucky i even show up#finding a new job is not that easy bc these companies are trying to pay you pennies in this economy

0 notes

Text

Sustainable Furniture: Sabai

Sabai about:

[...] In 2019, [Phantila] Phataraprasit co-founded Sabai—a Thai word that roughly translates to comfortable or relaxed—with business partner and college friend Caitlin Ellen.

[...] “The core of why we wanted to start Sabai is to make sustainable furniture that was accessible to people in our demographic, knowing that we are part of an age group that cares the most about this and wants to purchase according to those values, but are limited by things like budget, lifestyle and convenience,” she says.

Sabai CEO interview:

[Phataraprasit]: [...] We started an Instagram account that served as a great tool to leverage our community to understand what they cared about. When we started the design process, we would always go back to the Instagram community and poll them on, "What do you use your couch for?" "Do you like wide arms?" "Do you like thin arms?" It seems so simple in terms of, obviously, a couch is for sitting, but the insights that we received from that were helpful in informing the design process."

[...] It was definitely difficult for two relatively young women who had never started this type of company before and in a relatively traditional space to find any factory that was willing to work with us and basically take a bet on us. [...] When we finally did find a manufacturer who wanted to work with us, that was amazing, [...], but for us, we [...] had to find the sustainable alternatives to every component of the product so that was definitely a whole process in and of itself.

Sabai Materials blog post:

[...] OEKO-TEX certified hemp fabric is used in our Evergreen slipcovers [...] We wanted to ensure we were using [natural fibers] that uses less water than the cotton and linen options we’ve seen offered.

In place of traditionally used polyester upholstery fiber, we are using a natural fiber material made from a mix of coconut fibers and natural rubber wherever possible. The wooden legs are finished in a water based finish and the frame construction uses a non-toxic, solvent free glue.

[Sabai furniture] are designed to be assembled and disassembled easily with standard hardware and tools. Second, both seating collections are made to be repaired, individual parts can be purchased to replace in case of damage and cushion covers and slipcovers can be replaced to ensure the longevity of the product.

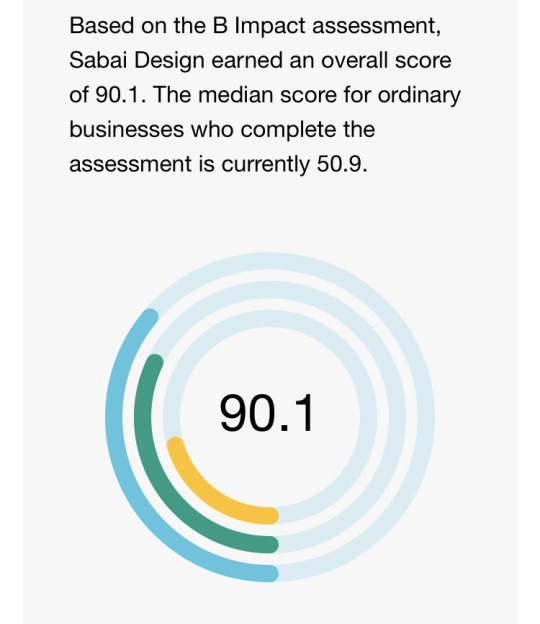

B Corp status of Sabai:

Sabai third-party product review:

#found this while considering shopping for a new couch#i think i might just invest in getting mine reupholstered/framed fixed to extend its longivity but#found this company in my search (for future reference) for sustainable furniture thats not necessarily second hand#my greens#sabai#sabai furniture#aapi#sustainable economy#sustainable furniture#furniture#interior design#non toxic#sustainable industry#women owned business#home health#green link

1 note

·

View note

Text

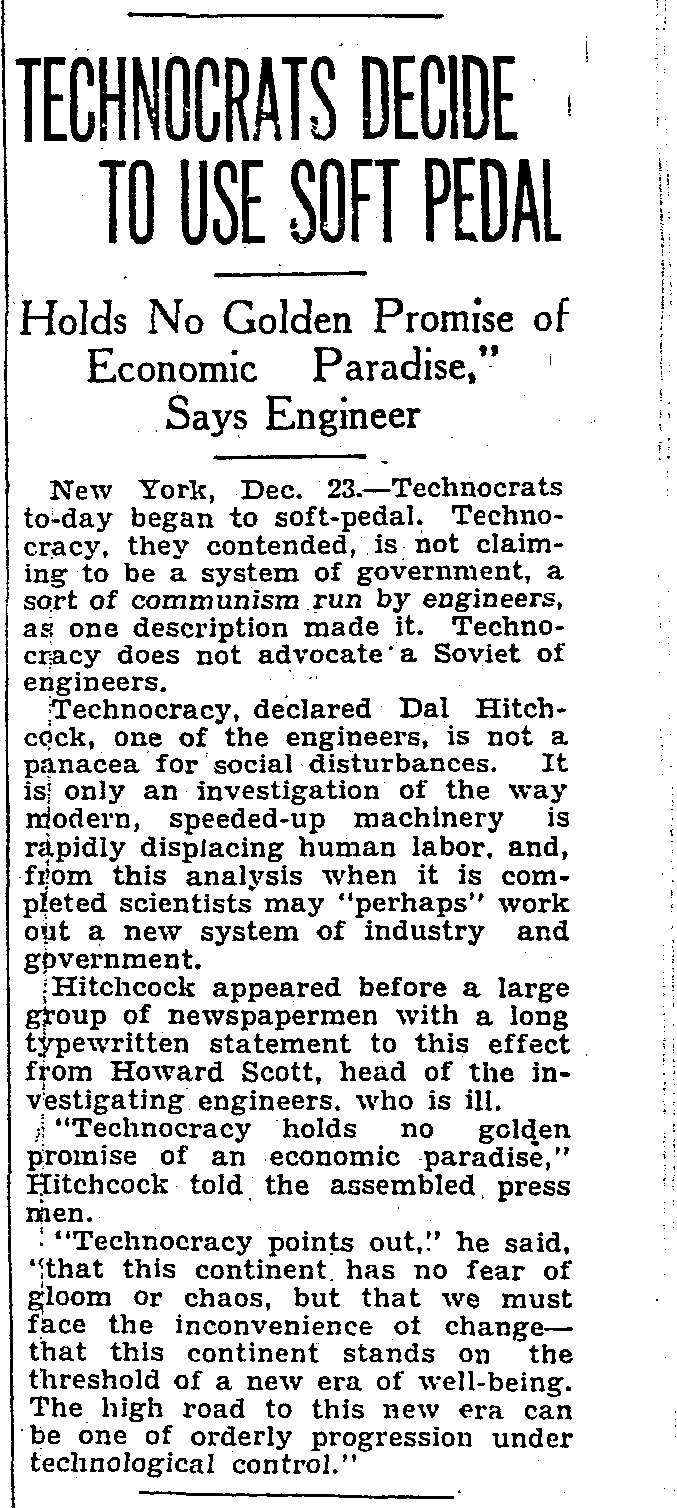

"TECHNOCRATS DECIDE TO USE SOFT PEDAL," Toronto Star. December 23, 1932. Page 1.

---

Holds No Golden Promise of Economic Paradise," Says Engineer

----

New York, Dec. 23. - Technocrats to-day began to soft-pedal. Technocracy, they contended, is not claiming to be a system of government, a sort of communism run by engineers, as one description made it. Technocracy does not advocate a Soviet of engineers.

Technocracy, declared Dal Hitchcock, one of the engineers, is not a panacea for social disturbances. It is only an investigation of the way modern, speeded-up machinery is rapidly displacing human labor, and, from this analysis when it is completed scientists may "perhaps" work out a new system of industry and government.

Hitchcock appeared before a large group of newspapermen with a long typewritten statement to this effect from Howard Scott, head of the investigating engineers, who is ill.

"Technocracy holds no golden promise of an economic paradise," Hitchcock told the assembled, press men.

"Technocracy points out," he said, that this continent has no fear of gloom or chaos, but that we must face the inconvenience of change - that this continent stands on the threshold of a new era of well-being. The high road to this new era can be one of orderly progression under technological control."

#new york#technocracy#rule of experts#engineering company#engineers#government by engineers#technocratic government#planned economy#man machine#unemployment#capitalism in crisis#the great depression

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

Empowering Business Development: The Role of Digital Payments

#Empowering Business Development: The Role of Digital Payments#digital payments#pax: empowering digital payments#digital payments empowering rural economy#small business#sustainable development#digital banking#development#digital#future of payments#payments news#digital banking solutions#development challenges#payments#united states international assistance development#sustainable development goals#international development#payments news under the lens#fintech software development companies

1 note

·

View note

Text

"Businesses like to talk about the concept of a closed loop or circular economy, but often they’re trying to close small loops. Releaf Paper takes dead leaves from city trees and turns them into paper for bags, office supplies, and more—which is to say they are striving to close one heck of a big loop.

How big? Six billion trees are cut down every year for paper products according to the WWF, producing everything from toilet paper to Amazon boxes to the latest best-selling novels. Meanwhile, the average city produces 8,000 metric tons of leaves every year which clog gutters and sewers, and have to be collected, composted, burned, or dumped in landfills.

In other words, huge supply and huge demand, but Releaf Paper is making cracking progress. They already produce 3 million paper carrier bags per year from 5,000 metric tons of leaves from their headquarters in Paris.

Joining forces with landscapers in sites across Europe, thousands of tonnes of leaves arrive at their facility where a low-water, zero-sulfur/chlorine production process sees the company create paper with much smaller water and carbon footprints...

“In a city, it’s a green waste that should be collected. Really, it’s a good solution because we are keeping the balance—we get fiber for making paper and return lignin as a semi-fertilizer for the cities to fertilize the gardens or the trees. So it’s like a win-win model,” [Valentyn] Frechka, co-founder and CTO of Releaf Paper, told Euronews.

Releaf is already selling products to LVMH, BNP Paribas, Logitech, Samsung, and various other big companies. In the coming years, Frechka and Sobolenka also plan to further increase their production capacity by opening more plants in other countries. If the process is cost-efficient, there’s no reason there shouldn’t be a paper mill of this kind in every city.

“We want to expand this idea all around the world. At the end, our vision is that the technology of making paper from fallen leaves should be accessible on all continents,” Sobolenka notes, according to ZME Science."

-via Good News Network, August 15, 2024

#trees#plants#paper#paper products#sustainability#deforestation#green waste#green waste removal#ukraine#france#paris#good news#hope

5K notes

·

View notes

Text

Hungarian companies lead in the region – Szijjártó

Hungarian Minister of Foreign Affairs and Trade Péter Szijjártó stated in Budapest on Monday that several domestic companies had become regional leaders in various key sectors due to the national interest-based economic development strategy of the past 14 years.

The minister announced that construction company Bayer Construct Zrt. would build a factory worth 15 billion Hungarian forints (38 million euros) in Sóskút, where a bathroom assembly plant would operate. The project would be supported by the state with 6.6 billion Hungarian forints (16.7 million euros), helping to create 100 new jobs.

Szijjártó claimed that the recently announced investment would contribute to further reinforcing of the construction industry, one of the main pillars of the Hungarian economy. The construction sector employed nearly 400,000 people, with output totalling €18.7 billion last year.

Read more HERE

#world news#world politics#news#europe#european news#european union#eu politics#eu news#hungary#hungary news#peter szijjarto#economy#economics#finance#companies

0 notes