#payment processing solution

Explore tagged Tumblr posts

Text

Get Paid Faster & Easier: Top Electronic Payment Solutions for Law Firms

Law firms, ditch the paper checks! Discover the best electronic payment processing solutions to streamline your workflow, boost client satisfaction, and get paid faster. Learn about features, security, and compatibility.

#Law Firm Electronic Payment#Electronic Payment Processing Solutions#best law firm payment processing platform#law firm payment processing solutions#best payment processing#payment processing solutions#payment processing solution for law firms#law office payment processing#law office credit card processing#law firm realization rate#payment processing solution#online payment options#lawyer payment methods#online lawyer payments#accept payments online#type of lawyer payment methods

2 notes

·

View notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today! Your Money, Your Way—Easily!!!

#payments#payment gateway#payment solutions#payment processing#payment fraud protection#payment plan#partnership#credit#network#paypal#wise words#wise quotes#wise zzz#payment transfer easily#spilled ink#artists on tumblr#deadpool and wolverine#hermitcraft#photography#grunge#dc comics#splatoon#splatoon 3

7 notes

·

View notes

Text

All-in-One Payment Solutions for Any Business

What Are Payment Solutions?

Imagine a world where transactions were clunky, slow, and insecure. Not only would businesses struggle, but customers would also be frustrated. That’s where payment solutions come in.

They are the backbone of the modern commerce experience, facilitating smooth, secure, and efficient money exchanges in a world that demands speed and reliability.

From in-store purchases to digital subscriptions, payment solutions enable every kind of business transaction.

At Valor, we understand that payments are not just about exchanging money – they’re about ensuring a seamless, secure, and smart transaction every time. This is why we’re constantly evolving to offer payment solutions that help businesses thrive.

#payment solutions#payment gateway#payment processor#payment processing#payments#credit card#POS#pos software#pos system#pos machine#pos solutions

3 notes

·

View notes

Text

How Does Payment Gateway Integration Simplify Online Transactions?

In the digital age, where e-commerce and online services dominate the market, payment gateway integration has emerged as a cornerstone of seamless online transactions. A payment gateway acts as a bridge between customers and merchants, enabling secure and efficient payment processing. This article delves into how payment gateway integration simplifies online transactions while highlighting the role of payment solution providers and innovations like those from Xettle Technologies in enhancing the experience.

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of embedding a payment gateway into a website, application, or e-commerce platform to facilitate the secure transfer of payment information between the customer, the merchant, and the financial institutions involved. This integration ensures that transactions are processed smoothly, enhancing the user experience and building trust among customers.

Payment gateways handle critical tasks such as encrypting sensitive data, verifying card details, and authorizing payments, making them an indispensable part of any online business.

Benefits of Payment Gateway Integration

1. Enhanced Security

One of the primary advantages of payment gateway integration is the high level of security it offers. Payment gateways use advanced encryption technologies to protect sensitive customer data, such as credit card details and personal information. By complying with industry standards like PCI DSS (Payment Card Industry Data Security Standard), they ensure that transactions remain secure from cyber threats and fraud.

Many payment solution providers also incorporate features such as tokenization, two-factor authentication, and fraud detection systems, further safeguarding the transaction process.

2. Seamless User Experience

Payment gateway integration ensures that customers can complete their transactions without any interruptions or complications. A smooth checkout process is essential for reducing cart abandonment rates and enhancing customer satisfaction. Features like multiple payment options, one-click payments, and mobile compatibility contribute to a user-friendly experience.

For example, integrated payment gateways often support a wide range of payment methods, including credit and debit cards, digital wallets, net banking, and even cryptocurrencies. This flexibility ensures that businesses can cater to diverse customer preferences.

3. Global Reach

With payment gateway integration, businesses can easily expand their reach to international markets. Most payment gateways support multiple currencies and languages, enabling businesses to offer localized payment experiences to their global customers. This capability is particularly beneficial for e-commerce platforms seeking to scale their operations.

4. Real-Time Payment Processing

Payment gateway integration ensures that transactions are processed in real-time, reducing delays and providing instant confirmation to customers and merchants. This immediacy not only enhances the customer experience but also helps businesses maintain accurate records of their transactions.

5. Simplified Reconciliation and Reporting

Integrated payment gateways often come with dashboards and reporting tools that provide businesses with detailed insights into their transactions. These tools simplify the process of tracking payments, managing refunds, and generating financial reports, enabling better decision-making and financial planning.

The Role of Payment Solution Providers

Payment solution providers play a crucial role in making payment gateway integration accessible and efficient. These providers offer a range of services, from payment gateway setup and customization to ongoing support and updates. By partnering with reliable payment solution providers, businesses can ensure a hassle-free integration process and stay ahead in the competitive digital landscape.

Xettle Technologies, for instance, is a leading payment solution provider known for its innovative approach to payment gateway integration. Their solutions are designed to cater to businesses of all sizes, offering flexibility, security, and scalability. By leveraging the expertise of providers like Xettle Technologies, businesses can focus on their core operations while leaving the technical aspects of payment processing in capable hands.

Key Considerations for Payment Gateway Integration

When integrating a payment gateway, businesses must consider several factors to ensure optimal performance and customer satisfaction:

Security: Ensure that the payment gateway complies with industry security standards and offers advanced fraud prevention features.

Compatibility: Choose a payment gateway that integrates seamlessly with your existing website or application.

User Experience: Opt for a gateway that offers a smooth and intuitive checkout process.

Cost: Evaluate the pricing structure, including setup fees, transaction fees, and monthly charges.

Support: Partner with a payment solution provider that offers reliable customer support and technical assistance.

Conclusion

Payment gateway integration is a vital component of modern online transactions, providing businesses with the tools they need to deliver secure, efficient, and user-friendly payment experiences. By partnering with trusted payment solution providers and leveraging innovative technologies, businesses can streamline their payment processes and build lasting relationships with their customers.

The expertise of companies like Xettle Technologies demonstrates how payment gateway integration can be tailored to meet the unique needs of businesses, ensuring scalability and adaptability in a fast-evolving market. As the demand for seamless online transactions continues to grow, investing in robust payment gateway integration is not just an option but a necessity for businesses aiming to thrive in the digital era.

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

Unlocking the Secrets to Effortless Payments with AuxPay

Are you a business owner tired of the hassle of managing payments? Getting paid should be simple and stress-free, right? That's where AuxPay steps in, your dedicated payment solution designer. We're here to make your financial life smoother, your payment processing more efficient, and your choices more flexible.

The Power of Payment Customization

Managing your payments shouldn't be a complicated puzzle. At AuxPay, we understand that every business is unique. That's why we offer tailored payment solutions that cater to your specific needs. Say goodbye to the one-size-fits-all approach – with AuxPay, you're in control.

Simplifying Invoice Creation

Creating and sending invoices can be a tedious chore, but it doesn't have to be. AuxPay offers an intuitive app interface that simplifies invoicing. Whether you're dealing with clients, customers, or partners, generating invoices with AuxPay is a breeze. You can kiss those invoicing headaches goodbye.

Choose How You Want to Get Paid

At AuxPay, we believe that the power to choose should be in your hands. We support multiple payment methods, allowing you to select what works best for your business. Whether it's credit cards, bank transfers, or digital wallets, AuxPay has you covered. You decide – it's your money, your rules.

Real-Time Analytics for Smarter Decisions

To succeed in today's fast-paced business environment, you need insights at your fingertips. That's where our real-time analytics come in. With AuxPay, you can keep a pulse on your financial performance, track transactions, and gain a clear understanding of your business's financial health. Make informed decisions with the data you need, precisely when you need it.

Getting Started with AuxPay

Ready to simplify your payment processing and gain more control over your financial destiny? Getting started with AuxPay is easy. Visit our website at AuxPay.net and explore the array of features and benefits we offer.

Say goodbye to payment hassles and hello to financial freedom with AuxPay! Make life easier for your business today. Get started with AuxPay now and discover a new world of payment simplicity. Your business deserves it, and so do you.

Unleash the power of easy payments with AuxPay – the key to financial freedom. It's your financial life, simplified. 🚀💰

Discover the Power of Payment Customization

Are you tired of one-size-fits-all payment solutions that don't address your unique business needs? With AuxPay, you can customize your payment solutions for a more efficient and flexible financial life.

Simplify Your Invoicing Process

Creating and sending invoices shouldn't be a hassle. Learn how AuxPay's intuitive app interface simplifies invoicing, making it easier for you to manage your financial transactions.

Multiple Payment Methods for Your Convenience

Want to choose how you get paid? AuxPay supports various payment methods, allowing you to select the one that works best for your business. Gain control over your payments – it's your money, your rules.

Real-Time Analytics for Informed Decisions

To succeed in today's fast-paced business environment, you need real-time insights. Discover how AuxPay's real-time analytics empower you to make informed decisions and track your financial performance effectively.

#business#payment solutions#fintech#business strategy#technology#payments#payment services#payment gateway#payment systems#payment processing#high risk merchant highriskpay.com#high risk merchant account#merchant services#google pay#apple pay#cashapp#point of sales#credit report#credit cards#debit card

2 notes

·

View notes

Text

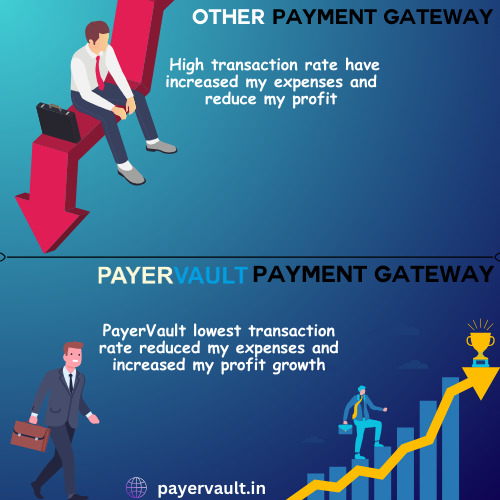

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

1 note

·

View note

Text

The Role of AP Outsourcing in Financial Transformation

Modern businesses are increasingly turning to outsourced finance solutions to gain better control over their spending and streamline operations. Among these, procurement outsourcing is one of the most impactful strategies. By outsourcing procurement, companies can reduce overheads, enhance supplier relationships, and gain access to expert market insights—all while improving efficiency.

The connection between outsourcing and procurement is especially powerful when combined with accounts payable outsourcing. This approach allows companies to automate invoice handling, ensure timely payments, and avoid late fees or duplicate payments. Many accounts payable outsourcing companies also provide real-time tracking tools, compliance support, and advanced analytics, offering full transparency and control.

By integrating procurement and payables into a unified outsourced finance model, businesses can significantly cut costs and improve operational agility. With specialized vendors handling routine finance tasks, internal teams can shift their focus to strategic growth. Whether you're a startup or an enterprise, the benefits of combining outsourcing and procurement are hard to ignore.

#outsourced financial services#AP automation#procurement management#finance process optimization#supplier payment solutions

0 notes

Text

#IoT Testing#Internet of Things#Device Testing#Functional Testing#Performance Testing#Security Testing#Interoperability Testing#Usability Testing#Regression Testing#IoT Security#Smart Devices#Connected Systems#IoT Protocols#GQATTech#IoT Solutions#Data Privacy#System Integration#User Experience#IoT Performance#Compliance Testing#POS Testing#Point of Sale#Retail Technology#Transaction Processing#System Reliability#Customer Experience#Compatibility Testing#Retail Operations#Payment Systems#PCI DSS Compliance

0 notes

Text

Join Wise and get £50. It’s simple, quick, and rewarding!

In an increasingly globalized world, managing money across borders has become a necessity for many. Whether you’re sending money to family members in another country, paying for services abroad, or simply managing multiple currencies, you need a reliable and cost-effective solution. This is where Wise.com comes into play. Known for its transparency, low fees, and user-friendly platform, Wise. com has quickly become a go-to service for those who value both their time and money.

#OnlineMoneyTransfer#paymentgateway#paymentsolutions#paymentprocessing#moneytransfer#moneymindset#moneymaker#moneymanagement#moneytransferservice#moneytransferapp#payments#payment gateway#payment solutions#payment processing#payment fraud protection#payment plan#partnership#credit#network#paypal#wise words#wise quotes#wise zzz#payment transfer easily#spilled ink#artists on tumblr#deadpool and wolverine#hermitcraft#photography#grunge

5 notes

·

View notes

Text

At Valor PayTech, we’re shaping the future of payments. Our secure & reliable solutions - powered by the Valor Payment Gateway and cloud-based CRM - help ISOs & merchants streamline transactions, boost customer experience to thrive in a digital world.

#payment solutions#payment gateway#payment processor#payment processing#payments#credit card#pos#payment device

2 notes

·

View notes

Text

Custom Kiosks & Terminals: Tailored Solutions for Smart Parking & Access Management

In an increasingly automated world, businesses and municipalities are turning to custom kiosks and terminals to streamline operations, enhance user experience, and reinforce security. From smart parking systems to access control and visitor management, these customisable solutions serve as vital touchpoints for both users and operators. At Parkomax, we offer advanced custom kiosk and terminal solutions designed to meet the unique operational demands of every environment — whether it’s a mall, office complex, school, or beachfront facility.

What Are Custom Kiosks & Terminals?

Custom kiosks and terminals are standalone or integrated digital systems built with tailored software and hardware features to perform specific tasks. Unlike off-the-shelf options, custom solutions allow organisations to design interfaces, functionalities, and physical layouts that align with their brand, infrastructure, and operational workflows.

They can be configured to handle various applications, including:

Ticketless and ticket-based parking management

Employee access control

Visitor registration and validation

Payment processing

Wayfinding and information display

Key Benefits of Custom Kiosks & Terminals

1. Tailored Functionality for Unique RequirementsEach organisation has its own set of challenges and goals. Custom kiosks allow you to select and integrate only the components you need, ensuring optimal performance and avoiding unnecessary complexity. Whether you need license plate recognition, NFC payment, or biometric authentication, custom kiosks can accommodate it all.

2. Enhanced User ExperienceUser-friendliness is at the heart of a successful kiosk. Custom terminals can be designed with intuitive touchscreens, multilingual support, and ADA-compliant accessibility to create a smooth experience for all users.

3. Seamless Integration with Existing SystemsParkomax custom kiosks integrate effortlessly with your current access control systems, ERP software, or cloud-based management platforms. This makes upgrades more efficient and ensures continuity across operations.

4. Scalable and Future-readyAs your needs evolve, custom kiosks can be easily upgraded or modified to incorporate new features — such as facial recognition or AI-powered analytics — making them a future-proof investment.

5. Brand Alignment and Aesthetic ValuePhysical design plays a crucial role in brand perception. Custom terminals can be manufactured with specific colors, logos, and materials to match your organisation's branding and architectural aesthetics.

Applications Across Industries

1. Smart Parking FacilitiesCustom kiosks are essential components in modern parking systems, enabling ticketless entry, real-time slot updates, mobile payments, and automated exit validation. They reduce congestion and manual oversight, ensuring a smoother parking experience.

2. Commercial Buildings and OfficesUse customised access terminals to control employee and visitor entry, capture attendance, and manage credentials. These systems can also help meet compliance standards for data logging and security audits.

3. Shopping Malls and Entertainment VenuesMalls benefit from kiosks that provide information, validate parking, and offer loyalty program integration. Customisation ensures the kiosks blend seamlessly into the venue's branding and customer service model.

4. Schools and Educational InstitutionsControl visitor access, student attendance, and vehicle entry with custom-built terminals that support biometric recognition, ID scanning, and real-time alerts.

5. Beachfront and Outdoor FacilitiesWeather-resistant custom kiosks can be deployed at open-air locations like beaches, parks, or events, offering features like automated entry tickets, mobile payments, and usage analytics.

Why Choose Parkomax Custom Kiosks & Terminals?

At Parkomax, we specialise in delivering purpose-built kiosk solutions that combine advanced technology, elegant design, and user-centric interfaces. Here’s what sets us apart:

End-to-End Customisation: From software functionality to physical design and user flow, we tailor every component.

Robust Hardware: Our kiosks are built to last, with high-quality enclosures, vandal-proof screens, and weatherproof options.

Smart Integrations: Compatible with ANPR cameras, RFID, barcode scanners, biometric readers, and more.

24/7 Support & Maintenance: Advanced technical support ensures your systems remain functional and secure.

Proven Deployments: Trusted by organisations across the GCC for their parking and access control needs.

Conclusion

Custom kiosks and terminals are no longer a luxury — they are a necessity for modern, efficient, and secure operations. Whether you're managing a high-traffic parking lot or streamlining access to a commercial facility, a tailor-made kiosk can significantly improve both user satisfaction and operational efficiency. With Parkomax’s expertise in smart infrastructure, you can bring your ideal system to life.

Explore our full range of custom kiosk solutions today and discover how Parkomax can help you elevate your space.

#Custom kiosks and terminals#Smart kiosk solutions#Parking management kiosk#Access control terminals#Visitor management kiosks#Tailored kiosk solutions#Self-service kiosk systems#Parkomax kiosk solutions#Ticketless parking kiosk#Ticket-based parking terminal#Payment processing kiosk#Biometric access kiosk#Employee access terminal#License plate recognition kiosk#NFC payment kiosk#Facial recognition kiosk#Real-time attendance kiosk#Wayfinding digital kiosk

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Unlocking the Secrets to Effortless Payments with AuxPay

Are you a business owner tired of the hassle of managing payments? Getting paid should be simple and stress-free, right? That's where AuxPay steps in, your dedicated payment solution designer. We're here to make your financial life smoother, your payment processing more efficient, and your choices more flexible.

The Power of Payment Customization

Managing your payments shouldn't be a complicated puzzle. At AuxPay, we understand that every business is unique. That's why we offer tailored payment solutions that cater to your specific needs. Say goodbye to the one-size-fits-all approach – with AuxPay, you're in control.

Simplifying Invoice Creation

Creating and sending invoices can be a tedious chore, but it doesn't have to be. AuxPay offers an intuitive app interface that simplifies invoicing. Whether you're dealing with clients, customers, or partners, generating invoices with AuxPay is a breeze. You can kiss those invoicing headaches goodbye.

Choose How You Want to Get Paid

At AuxPay, we believe that the power to choose should be in your hands. We support multiple payment methods, allowing you to select what works best for your business. Whether it's credit cards, bank transfers, or digital wallets, AuxPay has you covered. You decide – it's your money, your rules.

Real-Time Analytics for Smarter Decisions

To succeed in today's fast-paced business environment, you need insights at your fingertips. That's where our real-time analytics come in. With AuxPay, you can keep a pulse on your financial performance, track transactions, and gain a clear understanding of your business's financial health. Make informed decisions with the data you need, precisely when you need it.

Getting Started with AuxPay

Ready to simplify your payment processing and gain more control over your financial destiny? Getting started with AuxPay is easy. Visit our website at AuxPay.net and explore the array of features and benefits we offer.

Say goodbye to payment hassles and hello to financial freedom with AuxPay! Make life easier for your business today. Get started with AuxPay now and discover a new world of payment simplicity. Your business deserves it, and so do you.

Unleash the power of easy payments with AuxPay – the key to financial freedom. It's your financial life, simplified. 🚀💰

Discover the Power of Payment Customization

Are you tired of one-size-fits-all payment solutions that don't address your unique business needs? With AuxPay, you can customize your payment solutions for a more efficient and flexible financial life.

Simplify Your Invoicing Process

Creating and sending invoices shouldn't be a hassle. Learn how AuxPay's intuitive app interface simplifies invoicing, making it easier for you to manage your financial transactions.

Multiple Payment Methods for Your Convenience

Want to choose how you get paid? AuxPay supports various payment methods, allowing you to select the one that works best for your business. Gain control over your payments – it's your money, your rules.

Real-Time Analytics for Informed Decisions

To succeed in today's fast-paced business environment, you need real-time insights. Discover how AuxPay's real-time analytics empower you to make informed decisions and track your financial performance effectively.

#business#fintech#payment services#payments#payment gateway#payment systems#payment processing#payment solutions#apple pay#google pay#cash app#credit cards#debit card#credit report#artificial intelligence#financial freedom

3 notes

·

View notes

Text

Easy and Secure Payment Processing Solutions for Your Business

Clear Charge Solutions offers fast and secure Payment Processing Solutions for all types of businesses. Whether you're running a small shop or a growing company, they help you accept payments easily and safely. With simple tools and great customer support, Clear Charge makes it easier to manage your money and grow your business. Visit the site today to get started!

0 notes