#Saving and Investing Advice

Text

A healthy relationship with money

Healthy relationship with money

Maintaining a healthy and positive relationship with money involves a combination of mindset, behaviors, and practical strategies. Here are key aspects to consider:1. Mindset Shift: – Abundance vs. Scarcity: Adopt an abundance mindset, focusing on opportunities and possibilities rather than a scarcity mindset centered on limitations. – Gratitude: Acknowledge and…

View On WordPress

#Budgeting for Success#Building Sustainable Wealth#Financial Freedom Blueprint#Financial Independence Roadmap#Financial Literacy Resources#Financial Planning Strategies#Frugal Living Tips#Growing Your Net Worth#Investment Planning Guide#Investment Portfolio Diversification#Money Management Techniques#Personal Finance Wisdom#Practical Money Saving Tips#Saving and Investing Advice#Smart Investing Insights#Strategic Financial Decision-Making#Wealth Accumulation Strategies#Wealth Building Tips#Wealth Creation Habits#Wise Money Choices

1 note

·

View note

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

31 notes

·

View notes

Text

#brownsugar4hersoul#👻#turn into a ghost#save#hustle#invest#disappear#you don't need anyone#achievegreatness#you need to focus#to achieve greatness#stay focused#focus on your goals#focus on yourself#hustle hard#word of advice#stack money#get money#getting money#hustlehard#making money#making moves#investing#keep a small circle#move in silence#keep to yourself#mind your own#life advice#best advice#life reminders

14 notes

·

View notes

Link

55 notes

·

View notes

Text

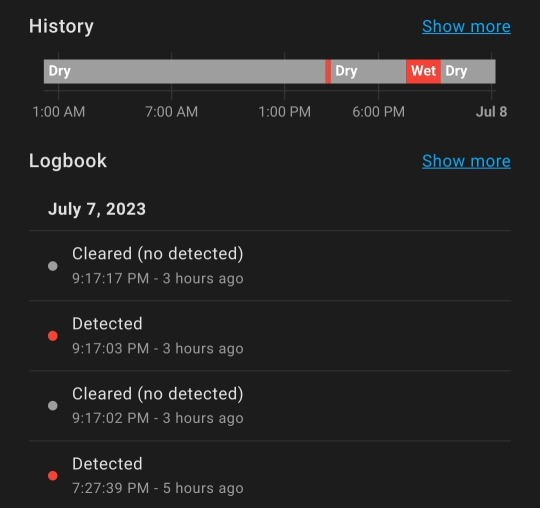

Installed a sensor on my girl so i know when

#Funy jokey#I've become addicted to cheap zigbee switches and sensors#I set this up so the air conditioner in our bedroom will stop running when the bucket is almost full theres something wrong with me#It works too and i love it :')#Next up is a small switched pump that will pump the water out for a set amount of time#Directly to the balcony plants#Our windowsill is too high up to run the condensed water out with gravity sadly so some kind of reservoir with sensor and pump has to do#Also planning a dedicated channel for outside air directly to the compressor with some kind of blowback valve#I hate mobile acs for how they are designed but there are no good high capacity mobile acs on the market yet#This should mitigate most of the issues though#The main issue is the lack of separation of compression and expansion stages which is why you should use outside air for the former#AND i have an hourly energy price contract which means i should switch the ac on/of on a set of preset conditions#I love tinkering and this is both pretty cheap and actually rewarding us with much better sleep during heat waves & less fuss#Also electricity savings#I put a bunch of stuff on this kind of sensing/logic already and its so nice to see your expenses go down with little to no impact#I feel like such a dad even though i dont have any kids#All of this is completely local and relatively cheap to set up but you have to like tinkering a little#Hmu if you want some advice i can point you away from large cloud based nonsense & help with initial startup#The two investments are a raspberry pi and a zigbee dongle#Possibly also a p1 reader or similar if you want data directly from your utilities#And after that most investments should be 10 dollars max per sensor or switch and most of the ali ones will work#And even have fancy features like somewhat accurately displaying power usage and current#Sorry for extremely rambly long tags i just get excited sometimes

2 notes

·

View notes

Text

17 Money Secrets to Help You Become a Millionaire

Hey there, future millionaire! Do you dream of having lots of money one day? Well, guess what? It’s not impossible! In fact, I’m here to share 17 secrets about money that can help you become a millionaire. Sounds exciting, doesn’t it? Let’s dive in!

The earlier you start saving and investing your money, the more it can grow. It’s like planting a seed that grows into a big tree over time.

#personal finance#money management#wealth building#financial goals#saving#investing#budgeting#debt repayment#multiple income streams#emergency fund#financial education#wise investments#tax planning#mindful spending#technology tools#networking#market volatility#financial advice#patience#financial success.

2 notes

·

View notes

Text

Why Savers Should Capitalise on Rising Interest Rates | Wills & Trusts Wealth

Learn how to make the most of rising interest rates with the right savings and investment strategies. Explore options like ISAs, fixed-rate accounts, and notice accounts to maximise your returns. Get expert advice from Wills & Trusts Wealth Management to secure your financial future. Contact us today.

#rising interest rates#UK savings strategies#Individual Savings Accounts#fixed-rate savings#investment advice UK#Wills & Trusts Wealth Management#maximise savings UK#financial planning UK#secure financial future

0 notes

Text

Explore comprehensive budgeting tips for managing your personal finances with confidence. This guide offers strategies for creating a budget, tracking expenses, and maximizing savings. Learn how to effectively reduce debt, plan for retirement, and invest wisely to secure your financial future. Take control of your finances today and achieve your financial goals with expert advice and practical tools.

#Financial Planning Tips#Budget Planner Tools#Expense Tracking Methods#Saving Money Techniques#Debt Reduction Strategies#Money Management Advice#Investment Basics#Retirement Planning Guide#Household Budgeting Ideas#Financial Goal Setting#Frugal Living Tips#Emergency Fund Importance#Smart Spending Habits#Credit Score Improvement#Income Diversification Strategies

0 notes

Text

Hey young adults! Starting your financial journey? This video is packed with 6 practical money lessons to help you manage your finances, spend wisely, and save for your future. Jasbir Singh, Retd. GM of Oriental Bank of Commerce shares his insights to set you on the path to financial success. Don't miss out!

Click on the link to watch the full video https://youtu.be/S5lMChPofWw

#Money#Finance#Budgeting#Saving#Spending#Investing#Tips#Advice#Education#Wealth#Success#Goals#Planning#Management#Financial#Freedom#YoungAdults#Millennials#Income#Expenses#Strategy#Banking#Retirement#Future#Insights#Guidance#Learning#Debt#WealthBuilding#FinancialSuccess

0 notes

Text

The most effective method to Stretch out Beyond the vast majority Of Individuals Monetarily

We will let you know how you could advance beyond the vast majority of others, the tips we will let you know in this video will take you in front of the group, and this has proactively worked for every one of the companions I told to watch this video till the end and miss no tips from between, or you might lament later for, not getting rich. Presently, how about we start one take the short test on your ongoing monetary status. One significant stage in being monetarily cognizant is to know precisely where your cash is going down to the fragrance. Could you have the option to breeze through a fast assessment on your monetary circumstance?

#financial freedom#wealth building#money management#passive income#financial independence#investing tips#budgeting advice#side hustle ideas#money mindset#financial goals#personal finance#saving money#financial success#building wealth#financial planning#financial literacy#money saving tips#financial tips#money habits#achieving financial freedom

0 notes

Text

youtube

#student motivational speech#life lessons short videos#how to succeed in life motivation#success in life motivational video#success in life#advice for students#life lessons#advice for young people#success in life motivation#student motivational video#life advice#how to become a millionaire#how to invest as a teenager#motivational video#how to save money#how to build wealth#money#invest#wealth#fine living#luxury#17 Life Lessons (I Wish Someone Had Told Me)#budget#business#goals#money affirmations#affirmations#health#yearly resolution#wealthy

0 notes

Text

Pension Financial Advice

Seeking Pension Financial Advice for a secure retirement? At 2020 Financial Advice, our expert team in Shrewsbury offers tailored solutions to optimize your pension plans. Whether you're planning for the future or nearing retirement, our comprehensive retirement planning services ensure financial stability. Visit us online to explore individualized retirement strategies and secure your financial future with confidence.

#trusted financial advice#business tax planning#financial advisor#business financial#finance#retirement savings investment#tax advisor uk

0 notes

Text

How to Work Less to Achieve More

Key Point:

keep your attention on an important task by adopting hyperfocus. When you hyperfocus, you rid your environment of distractions, and become aware of what’s occupying your mind. What’s more, every time your attention strays, redirect it. Remember is that scatterfocus can help you with tricky problems that require creative solutions. With scatterfocus, you allow the mind to wander and make unusual connections. You can help create scatterfocus by nourishing your mind and allowing time to reflect.

In our fast-paced world, working long hours has become the norm. However, the key to achieving more is not simply working harder or longer—it's about working smarter. In this article, we will explore strategies to help you work less while accomplishing more. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success.

Train yourself to enjoy hyperfocus more.

Hyperfocus is a state of intense concentration where you become fully immersed in a task or activity. To work less and achieve more, it's important to train yourself to enjoy and leverage hyperfocus. Set clear goals, break tasks into manageable chunks, and eliminate distractions. Engage in activities that naturally captivate your attention and give you a sense of fulfillment. By training yourself to enjoy hyperfocus, you can maximize productivity and accomplish more in less time.

Meta-awareness and intentional focus are key to managing your attention.

Meta-awareness refers to being aware of your own thoughts and mental processes. Intentional focus involves directing your attention consciously and purposefully. Cultivating these skills is essential for effective attention management. Develop the ability to notice when your mind starts to wander and gently bring your focus back to the task at hand. By practicing meta-awareness and intentional focus, you can reduce time wasted on distractions and stay on track to achieve your goals.

Achieve hyperfocus by ridding your environment of distractions.

Distractions can significantly impact productivity and hinder your ability to work efficiently. Create a conducive work environment by minimizing distractions. Turn off notifications on your phone, close unnecessary browser tabs, and create a physical workspace that promotes focus. Consider using productivity tools or apps that block or limit access to distracting websites or applications. By eliminating external distractions, you can enter a state of hyperfocus and accomplish more in less time.

Scatterfocus helps you plan and think creatively.

Scatterfocus is the practice of intentionally allowing your mind to wander and explore different ideas, without a specific goal or objective. This mental state can be beneficial for planning and creative thinking. Set aside dedicated time for scatterfocus, allowing your mind to freely explore different thoughts and possibilities. Embrace daydreaming, engage in activities that stimulate your imagination, and give yourself permission to think outside the box. By incorporating scatterfocus into your work routine, you can generate fresh ideas and enhance your problem-solving skills.

Use scatterfocus to connect the dots between seemingly unrelated bits of information.

One of the unique benefits of scatterfocus is its ability to facilitate connections between seemingly unrelated information. During moments of scatterfocus, your mind can make unexpected connections and insights. Capture these ideas by carrying a notebook or using a note-taking app to jot down your thoughts. When you revisit these notes later, you may discover valuable connections and insights that can fuel your productivity and lead to innovative solutions.

Nourish your mind to make the most of scatterfocus.

To optimize scatterfocus and enhance your overall productivity, it's important to nourish your mind. Engage in activities that promote mental well-being, such as regular exercise, quality sleep, and mindfulness practices. Take breaks throughout the day to recharge and refresh your mind. Additionally, fuel your brain with nutritious foods that support cognitive function, such as fruits, vegetables, whole grains, and omega-3 fatty acids. By prioritizing self-care and nourishing your mind, you can maximize the benefits of scatterfocus and achieve more with less effort.

Working less while achieving more is within your reach. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success. Remember, it's not about working longer hours, but about working smarter. Embrace these strategies, experiment with different techniques, and find the balance that works best for you. As you implement these practices, you'll discover the power of effective attention management and witness your productivity soar.

Action Plan: Have a cup of coffee to help you hyperfocus.

Caffeine and hyperfocus are a match made in heaven. Caffeine keeps you alert and focused. It helps you persevere when work gets boring. And perhaps most importantly, it can improve your performance on a number of cognitive tasks. So the next time you need a burst of intense concentration, make sure you’ve got a cup of coffee to hand – if nothing else, it tastes wonderful.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

13 notes

·

View notes

Text

Avoid This Hidden But Very Costly Investment Mistake (Financial Advice For 20s)

youtube

0:00 Introduction 0:07 Financial instability. 0:23 Limited flexibility. 0:42 High debt burden: 0:56 Maintenance costs. 1:14 Missing investment opportunities. 1:38 Market volatility. 1:55 Summary and Conclusion

Buying a dream home in your 20s might not always be the best financial decision to make. Avoid This Costly Investment Trap (Financial Advice For 20s) due to these reasons: Financial instability. In your 20s, you might not have stable income or job security. Committing to a large mortgage for your dream home can be financially burdensome if your income isn't steady or expected to increase significantly in the near future.

Limited flexibility. Your 20s are often a time of change. You might be exploring career opportunities, considering further education, or even contemplating moving to a different city or country. Owning a home can tie you down and limit your flexibility to embrace these changes.

High debt burden: Taking on a substantial mortgage at a young age can result in significant debt. This might restrict your ability to invest in other opportunities, such as starting a business or furthering your education.

Maintenance costs. Homeownership comes with various expenses beyond the mortgage. These may include property taxes, maintenance, repairs, and insurance. These costs can be unexpected and can strain your finances, especially if you're unprepared for them.

Missing investment opportunities. Instead of sinking money into a property at an early age, you could consider investing in more liquid and diversified assets like stocks, bonds, or starting a business. These investments might yield higher returns in the long term compared to real estate, especially considering the opportunity cost of tying up a significant portion of your savings in a property.

Market volatility. Real estate markets can fluctuate. Buying a dream home in your 20s might expose you to the risk of property value depreciation if the market changes unfavorably. This situation could leave you financially underwater.

Ultimately, the decision to buy a home in your 20s should be based on careful consideration of your financial situation, long-term goals, and personal circumstances. It's essential to weigh the pros and cons before making such a significant financial commitment. #wealth #property #moneymistakes #investment

WEBSITE

YOUTUBE

YOUTUBE PLAYLIST

FACEBOOK

X (TWITTER)

TUMBLR

QUORA

LinkedIn

Mix

FLIPBOARD

#investment#realestate#savings#investments#investing#mortgage#moneymistakes#investingtips#Homeownership#investingmistakes#SustainableInvesting#PersonalFinance#FinancialPlanning#FinancialLiteracy#DebtFree#FinancialAdvisor#mortgagebroker#luxuryhomes#makememove#homesforsale#homesweethome#realestateinvesting#RealEstateExpert#financial planning for 25 year old#financial advice for 20s#real estate market 2024#personal finance tips for beginners#personal finance tips for college students

0 notes

Text

Navigating the Financial Challenges of the Gig Economy: A Comprehensive Guide for Young Adults

🌟 Dive into the gig economy with our latest guide! 🚀 Tips on budgeting, saving, & taxes for freelancers. Make your gig work financially rewarding! 💼💰

#GigEconomy #FinancialTips #FreelanceLife 📈💸

Embracing the Flexibility with a Financial Plan

The gig economy, a bustling marketplace of freelance and short-term work, has become an increasingly popular career path for young adults. It offers unparalleled flexibility and autonomy, but with this freedom comes unique financial challenges. This article aims to guide you through managing your finances effectively while thriving in the gig…

View On WordPress

#adapting to gig work#budgeting tips#emergency fund#Financial planning#Financial stability#freelance finance management#gig economy#income diversification#investing for gig workers#irregular income#retirement savings#saving strategies#self-employment tax guide#tax advice for freelancers#young adults finance

0 notes