#budget deficit means

Text

Find Out About Deficit Budgeting and Its Effects and More

When government expenditure exceeds its income, which includes fees, taxes, and investment returns, there is a federal deficit budgeting.

Read More...

0 notes

Text

Day 12 27/10/22 TOTAL: 698

Had an appointment and then had to go to my old work to hand in some uniform etc. was good excuse to walk. Got a coffee tho (had 5 shots) and it was a bad decision. The early morning sugar free syrup woke up my appetite and I craved carbs ALL DAY. It lead to overeating and then bingeing on shit in the evening which I planned to keep but then got all anxious and guilty about it so i went and purged it in a bush somewhere. I think there was a homeless guy watching me but I couldnt really make it out because it was half past midnight. On the plus side I’ve had to tighten the drawstrings of two of the legs I wear so +++. After purging 1.2litres volume and not having any sodium or potassium all day plus 5 shots of coffee and 3.5 hours of walking I kept nearly passing out towards 2 am whilst trying to get home LOL. Had bisto gravy when I got in in a cute bowl I bought for portion control (was 75 cal, not listed below but counted in the total)

Breakfast: 0

Lunch: 789

Soya milk- 91

sugarfree gingerbread syrup -3

espresso-13

Smoked salmon and cream cheese sushi-227

Chicken Satay wrap- 455

Dinner: 749

small apple -53

banana-105

hamhock wrap -406

Lucozade- 185

Binge + purge: ~ 1200, kept 100 (got most of it out but couldnt complete it for obvious reasons)

exercise: 997

#4n4 accountability#this means my current failed deficit as of last weigh in is#489! :D#I can so make up for that!#I was thinking I might have to increase my cal budget because its quite hard doing 1k#but actually with making excuses to exercise and being more wary of carbs I think this is so doable. At least for a while longer anyway#I might take a break for a few days at some point and eat maintenance so I don't snap#don't wanna lose progress tho#I'm losing at a rate of about 2 pounds per week atm which is pretty good#I'll reach my goals by 3rd week of december for sure! :D Then I can eat whatever I want over christmas#YAY

2 notes

·

View notes

Text

Hey nobody has asked me about this ADHD money management tip and it depends on having at least a tiny bit of flex in your budget but I'm about to spend a frustrating amount of money on flour and I can only do it because of this tip:

Hide cash from yourself like a squirrel.

Use whatever receptacle you'd like, envelopes or a zipper bag or an old wallet, create labels for the stuff you're saving for, and tuck money in there occasionally.

My stash lives in an old wallet with strips of paper around it. It's got dividers for "car registration," "bulk food," "vet visit," and a couple other things.

These are things that I know happen every year or multiple times a year that take more cash than I can easily spare from a single paycheck. If I stick twenty bucks a month in an old wallet it will mean that even if I have to pay late fees, I don't have to put my car registration on a credit card and pay interest on my late fees. If I stick ten bucks a month in an old wallet I can buy 25lbs of flour twice a year. If I can stick a bit more or less cash as it's available into the wallet I can make sure that my twice-annual regular vet visits with senior dog bloodwork and vaccinations aren't going to be too much of a hit to that month's grocery budget.

Like, everyone talks about "put money in savings once a month" or "have an account you don't touch for emergencies" and that can totally work if you can swing it, but I know it's REALLY hard for me to keep from pulling from the "emergency" fund for stuff that's a minor emergency/or is regular maintenance that I should have planned for/etc.

It's much harder for me to pull from the actual cash sitting in a physical room in my house because A) I'll probably forget it and B) that means that I have to think through using those funds in a lot more of a direct way than I would when using a debit card and C) I literally can't access it when I'm out of the house (the emergency fund HAS to be on the card to be accessible, the "i need expensive groceries" money doesn't have to be ready to go at all times and if it is available I know myself and it'll get used before it's expensive grocery time).

Like. If you know you have an expense that you have to pay for every year, hide cash specifically for that expense instead of in a general "expenses" fund because if you're not great with money and you've got an iffy memory you might look at your expenses fund and go "okay my computer crashed and there's five hundred bucks in the fund I can replace it and get back to work, cool" and there goes your car registration and a vet visit. At least if you need to physically grab that cash for an emergency you can make note of what you're going to have a deficit for later in the year.

2K notes

·

View notes

Text

The Dream Girl's Guide to Setting and Achieving Goals

If there's one thing that I am insanely good at, it's planning and setting goals.

However I have not always been great at achieving them.

Call it laziness, lack of self discipline or being over ambitious, you can take your pick. But every year I would set goals and every year I would never achieve them.

This year I was, and am determined to transform. I'm tired of putting it off. I've tried a completely different method (read about that here) and it's finally working out, I cant't wait to share it with you.

Why is Setting and Achieving Goals Important?

Setting and achieving goals will forever be important, no matter what stage of life you're in if you don't want time to pass while you stay in the same place.

If you're happy staying exactly as you are, looking the same way, doing the same thing everyday, making the same money, dating the same guy or having the same conversations, year after year after year. Then this post simply isn't for you.

But for the rest of us, who want more, who understand that wanting something different means that you have to do something different, who want to grow, learn and develop and that who understand that time is the most valuable thing that we have; setting and achieving things, day after day, month after month and year after year is insanely important.

If you are one of us, I'm sure you already knew that, the issue might be actually following through.

You're good at setting goals, not so much with actually achieving them?

Maybe it's not your fault, maybe you're just doing it wrong.

------------- How To Set Goals -------------

How many of us start the new year, or the random day that we decide we need to be better by writing a list of Goals?

Maybe that list looks something like this.

Lose 10lbs

Grow Hair Longer

Dress Better

Save Money

Get 1000 followers on X platform

Can you see the problem here? My STEM girlies are yelling at the screen saying that the goals aren't SMART (Specific, Measurable, Attainable, Timely).

The real problem?

All of these goals are end products.

And to eliminate this problem, and make these goals better, we have to turn them into habits.

-------- How to turn Goals into Habits --------

Let's go through our list again.

Lose 10lbs -> Workout 4 times a week, do one form of excerise a day and eat at a caloric deficit.

Grow Hair Longer -> Keep hair in protective styles, use hair growth oils daily, only brush hair when in conditioner

Dress Better -> Sell the clothes I don't like to buy clothes I do like, do a closet clear out once a month, only buy things that are high quality

Save Money -> Budget all money once a month, unsubscribe from things I no longer use, declutter and sell things I no longer need once a month.

Get 1000 followers on X platform -> Post 3 times a week, create meaningful content, reply to all comments left on posts daily, interact with posts from others in the sam niche every day

Can you see the difference?

By changing your goals from the end product to the process these goals suddenly mean more. They're more helpful and seem much more achievable.

End goals cannot always be controlled, you can do everything right, post 3 times a week, reply to all your comments and your following count may still not change for months... then all of a sudden something goes viral and they'll call you an overnight success.

By shifting your focus to the things you can control, rather than the end product, your sense of achievement comes from your consistency and hard work, allowing you to keep going even when you don't see any changes.

This prevents you from giving up when success could be just around the corner.

-------- How To Achieve Your Goals --------

Now that we've gone through how to set Goals, lets talk about how to achieve them.

A lot of people just stop at the first part and never think about the things that they can do to ensure that their goals are met.

Never stop at the list.

Why?

You have no initiative to ever look at this list again so you'll most likely forget you even wrote them down in a few weeks

You haven't factored how your life may make achieving these goals a priority.

The answer to this problem?

Turning your Habits into Routines.

It's all well and good setting goals, even setting good goals. But you also need to make sure that you're creating an environment that's conducive to the goals you want to achieve, the habits you want to keep, and the life you want to create.

------- How to turn Habits into Routines ------

We've written down all our goals, turned them into habits and now it's time of the most important part, turning them into routines.

This is important because consistency is key, always. Instead of saying that you'll do something 3 times a week and leaving at that, let's go deeper.

Which days of the week will you do it? What time? For how long?

Leaving it up to chance is risky. What if you forget?

We need to create consistent routines.

Pick which days to do your habits

Pick what time you'll do your habits

Pick how long you'll do them for

Pick what you'll do before and after.

Try to make this as consistent as possible, for example, same time every day, same day every week.

Make sure that every single hour is accounted for, even if it's just set as free time.

Its easy to convince yourself you don't have enough time to do things, let's put all the things you have to do into a spreadsheet with how long it'll take and when you'll do it. Better yet we can use a calendar app or website.

See all the free time you've got?

Now creating routine is so much more than writing it down and doing it everyday or every week. At first you may have to check the app every five seconds to see what you're meant to be doing but if you stay consistent, after a few weeks it'll become second nature.

------------ Removing Distractions ----------

Organising your time and creating a routine is really eye-opening because it gives you a chance to wonder what the f*** you've been spending your time doing.

Nothing productive probably. Take a look at your screentime, what apps are you spending your time on? How long are you spending? Is this part of the life you'd like to build for yourself?

It might be time for a break.

I am being so honest when I said that getting rid of every single distraction that could be keeping me from my goal was the single most important decision I could've made when planning 2024.

I went full on, no Netflix, no YouTube, no music, no games, no social media. No distractions. For at least the first month of my new routine and I plan on only adding everything back slowly.

I advise you do the same.

Remove the things that you can see could distract you from your goals. What's keeping you from going to bed early? What would you rather do than going to the gym?

I'm telling you, I haven't stopped working on myself, because I genuinely have nothing better to do. I've cut all the distractions out. Going on my one hour walk is now what I look forward to all day. The gym is the best part of my day.

My days currently consist of self improvement, wellness podcasts, reading Jane Austen, being active, cleaning my spaces, skincare and early nights.

But it feels like I'm living my dream life? Whenever I think of my ideal day it's never included 4 hours of mindless scrolling or spending 2 hours down a YouTube rabbit hole.

When I think of my dream life it's always been home cooked meals, reading and fancy skincare routines. I couldn't be happier and I really don't feel like I'm missing out on anything.

TRY IT.

This is probably the most important step because the power that distractions have on us is so real.

You can do all the planning and have the best intentions but if your want to play games, scroll mindlessly on social media, text a guy that doesn't care about you or engage in celebrity drama is greater than your want to be better? Good Luck Charlie.

---- Making Your Goal Your Obsession ----

This is actually the fun part.

All I do is listen to podcasts about my goal, read books about my goals, make pinterest boards about my goals and talk to myself about my goals. I'm so obsessed.

Make a reading list, find some podcasts that align with your goals, follow blogs with the same mindset, talk to those of your friends that will get it.

This makes sure that nothing can distract you, and you can't just 'forget' to work towards your goal.

However, you must not let your time obsessing over your goal be more than your time actually working on your goal. Do not forget that.

------------- Books that could help ------------

Atomic Habits by James Clear

Digital Minimalism by Cal Newport

----- May the odds be ever in your favour.. -----

#dgg#level up#level up mindset#black femininity#hypergamy#black hypergamy#hypergamous#dreamgirl#black women in luxury#2024 planning#new year#glowup#wellness#self care#mine

370 notes

·

View notes

Note

Happy with the staff content this year but am I the only one who is disappointed with the PV we got? It's basically a slideshow of art we've already seen, major downgrade from the year 1 PV that had literally all the events. There was a drop in quality of the anniversary PVs over the years and it really shows this year. Sorry if you find this too negative I don't mean to hate I just wish Twst would do better for it's ANNIVERSARY.

[For everyone's reference, here are the anniversary PVs in order of release: 2021 / 2022 / 2023 / 2024]

Mmm, now that you mention it, I noticed this trend with the Halloween PVs 🤔 For year 1, there was a video that showed all members of the NRC casy, even those that did not receive cards at that time. There were then several short variants of the PV released for year 2/Endless Halloween Night (part 1 / part 2 / part 3 / part 4). Altogether, they feature all of the characters, including the students from year 1 but heavily shadowed and with glowing eyes to indicate ghostly possession.

Even Glorious Masquerade features all of the students that get new cards for the event plus Rollo, although there are notably more still shots here. The Stage in Playful Land CM, by comparison, is significantly shorter and only shows us the three SSRs (Ace, Ortho, and Kalim) as well as the two new characters (Fellow and Gidel).

As this anon has said, the anniversary PVs have changed a lot over time too. The first one was the most animated and integrated several event outfits. The second one was also animated a fair amount, but you can tell corners were cut in some places where they transition to photographs/still images. This alone works thematically given that the player is a photographer, but you can still catch dips in quality when it comes to the art style. I remember finding Deuce running and the Kalim + Silver flying scene odd, as well as Jade and Trein's faces strange in general.

Then the third PV rolls around and it only features the third years; the animation also seems to be much more sluggish (although this could be a stylistic choice; not sure). A friend actually recently pointed out to me that Lilia's pose looks like he was pulled straight from other assets; his artwork in the animation is almost the exact same as his smiling expression in the game.

This year's is the most different (+ most static) and, like year 3's PV, only provides "new" content for a select few characters (the dorm leaders). They also reuse pre-existing illustrations already found in the game that don't seem to be picked for any particular reason (like, there are random Master Chef/Culinary Crucibles groovies in there). This direction, I'm guessing, is less costly and more efficient than making an entirely original animation, which is what was done in previous years. (Not that Disney or Aniplex is hurting for money to fund this, lol)

Would I have preferred another PV in the style of year 1's? Yeah, for sure. I want to see other events and their outfits animated! Was what we got this year bad? Not necessarily; I think the production and editing was very technically impressive, but I'm still sad we didn't get anything substantially "new" to chew on (as someone who isn't a fan of most third years or the dorm leaders). Maybe it's just something we perceive as a deficit only because year 1 set the bar so high. It is what it is; whoever was in charge of the anniversary PV was probably doing the best they could with whatever budget they were given 😔 Let's hope that next year's will be a return to form, or that at least the money/effort is being redirected to other bigger projects (maybe the anime?).

#twisted wonderland#twst#notes from the writing raven#disney twisted wonderland#disney twst#spoilers#twst anime#twisted wonderland anime#Silver#Kalim Al-Asim#Lilia Vanrouge#Deuce Spade#Jade Leech#Mozus Trein#Ace Trappola#Ortho Shroud#Rollo Flamme#Gidel#Fellow Honest#Riddle Rosehearts#Leona Kingscholar#Malleus Draconia#Idia Shroud#Ignihyde#Vil Schoenheit#Azul Ashengrotto#Cater Diamond#Trey Clover#Rook Hunt

227 notes

·

View notes

Text

I’m pretty sure the people bitching about not giving money to tumblr are the same ones who complain when AO3 or wikipedia ask for donations, so I’m just gonna clarify something

Running a website is not free

Even if they made no changes and did only maintenance, they still need to pay for server costs, expert programmers for when something goes wrong, storage (although frankly storage is cheap as chips these days which is nice)

They need to keep up with the capabilities of new tech like improvements to web browsers, never mind their own apps keeping pace with old and new tech developments

Backwards compatibility (being able to run the updated app on old tech) is a massive problem for apps on a regular basis, because there are people out here using an iPod and refusing to update software

There’s a reason every few years apps like Animal Crossing will issue an update that breaks backwards compatibility and you can only play if your phone is running more recent software

This shit costs money even before you look into the costs of human moderation, which I’m not exactly convinced is a big part of their current budget but fucking should be if we want an actual fix for their issues with unscreened ads and reporting bigots

Ignoring that it’s apparently illegal for companies not to actively chase profits, running Tumblr is expensive

And advertisers know we fucking hate them here

They’re still running ads, which we know because they’re all over the damn place, but half the ads are for Tumblr and its store

Other ad companies know we are not a good market, so they’re not willing to put the money in

Tumblr runs at a $30 million deficit, every year, because hosting a site is expensive

They are trying to take money making ideas from other social medias because they’re not a charity; they need to make enough money to keep the site going

If you want tumblr to keep existing, never mind fixing its many issues that require human people to be paid to do jobs like moderation, they will need money

Crabs cost $3

One crab day a year can fix the deficit and hammer home for Tumblr that:

A) we do want to be here and want the site to keep going

And B) they do not need to do the normal social media money making strategies we all hate

They need a way to make money if you want the hellsite to exist, because we live in a capitalist hellscape and cannot all be AO3

If they think they can make enough to keep running without pulling all the tricks we hate, they have no reason to pull said tricks

But they need money

And a way to make money

And if we can show them we can do that, there is a significantly higher chance they will listen to us, the user base they need money from, than if we don’t

Tumblr isn’t perfect, or anywhere close. They need someone to actually screen the paid ads they put through, they need to take the transphobia, antisemitism, and bigotry seriously

These Are Jobs That Will Cost Money

People Need To Be Fucking Paid For Their Work

Tumblr Is Not Run By Volunteers For Free And Nor Should It Be

Paying People Is Good Actually

So if you wanna get all high and mighty over $3/year, by all means, go spend that hard earned cash elsewhere

Good luck finding a perfect and morally pure business to give it to though

Being a whiny negative asshole isn’t more appealing just because you’ve put yourself on a moral soapbox, it just means the asshole is a little higher up

For all the whining about “all the new updates are terrible this site is unusable”…. It’s one fuck of a lot more usable than it was in 2017, 2018, 2020

And yeah, it’s going back down and most of the newer ones have been fucking annoying and I would also like them to stop

But it got up somehow and that means it could do that again

Hope is more fun than edgy nihilism

August 1st is a good and exciting day to summon a crab army

#tumblr#crab day#fuck if i know what a profitable plan for tumblr as is will look like#since half the user base are entitled assholes who think they shouldn’t pay for less than perfection#and tumblr themselves are entitled assholes who think $5/month is a good base proce#motherfuckers would have so many more people if it was $2-3#totally not paying $5/month for this shit#but $3/year? yeah that’s okay

365 notes

·

View notes

Text

Feynman: When we were talking about the atoms, one of the troubles that people have with the atoms is that they're so tiny, and it's so hard to imagine the scale.

The size of the atoms are in size - compared to an apple, it's the same scale as an apple is to the size of the Earth. And that's a kind of a hard thing to take, and you have to go through all these things all the time, and people find these numbers inconceivable. And I do too.

The only thing you do is you just change your scale. I mean, you're just thinking of small balls, but you don't try to think of exactly how small they are too often! Or you'd get kind of a bit nutty, alright?

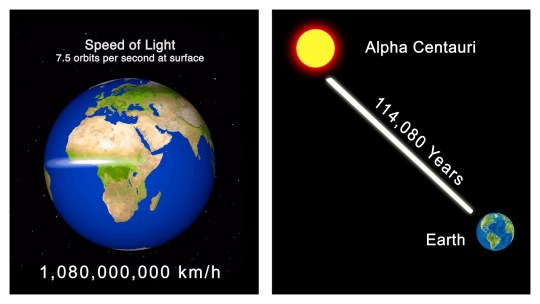

But in astronomy, you have the same thing in reverse because the distances to these stars is so enormous, you see. You know that light goes so fast that it only takes a few seconds to go to the moon and back, or it goes around the Earth seven-and-a-half times in a second. And goes for a year, two years, three years before it gets to the nearest other star that there is to us.

But all of our stars are... the stars that are nearby in a great galaxy, a big mass of stars, which is called a galaxy, a group, well this, our galaxy is... what is it? Something like a hundred thousand light years, a hundred thousand years.

And then there's another patch of stars. It takes a million years for the light to get here, going at this enormous rate.

And you just go crazy trying to make too "real" that distance, you have to do everything in proportion. It's easy - you say the galaxies are little patches of stars and they're ten times as far apart as they are big.

So that's an easy picture, you know - he gets it. But you just go to a different scale, that's easier. You know, once in a while you try to come back to... Earth scale to discuss the galaxies but it's kind of hard.

The number of stars that we see at night is about - only about 5,000. But the number of stars in our galaxy, the telescopes have shown when you improve the instrument... Oh! We look at a galaxy. We look at the stars. All the light that we see, the little tiny and influent spreads from the star over this enormous distance of what? Three light years, for the nearest star. On, on, on! This light from the stars spreading, the wavefronts are getting wider and wider, weaker and weaker, weaker and weaker out into all of space, and finally the tiny fraction of it comes in one square, eighth of an inch, tiny little black hole and does something to me, so I know it's there.

Well, to know a little bit more about it, I'd rather gather a little more of this little, this tiny fraction of this front of light, and so I make a big telescope, which is a kind of funnel that the light that comes over this big area - 200 inches across - is very carefully organised, so it's all concentrated back so it can go through a... pupil. Actually, it's better to photograph it, or nowadays they use photo cells, they're a better instrument.

But anyway, the idea of the telescope is to focus the light from a bigger area into a smaller area so that we can see things that are weaker, less light, and in that way we find there's a very large number of stars in the galaxy.

There's so many that if you tried to name them, one a second, naming all the stars in our galaxy, I don't mean all the stars in the universe, just this galaxy here, it takes 3,000 years.

And yet, that's not a very big number. Because if those stars were to drop one dollar bill on the Earth during a year, each star dropping one dollar bill, they might take care of the deficit which is suggested for the budget of the United States.

So you see what kind of numbers we have to deal with!

#Richard Feynman#space#astronomy#magnitude#scale#galaxy#milky way galaxy#light speed#speed of light#light year#science#religion is a mental illness

150 notes

·

View notes

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

465 notes

·

View notes

Quote

The supply-side movement complicates the idea of austerity because on the one hand, it sells itself as a tax cut movement. It seems to align with the idea of rejecting state power and refusing government aid. But as soon as you make selective cuts to a baseline rate of income taxation, the result is tantamount to direct public spending: in budget accounting terms, both serve to increase deficits. So what supply siders call tax incentives are really government subsidies to the holders of capital income, in particular those who “earn” profits in the form of capital gains. What looks like spending austerity is actually spending extravagance by other means.

Melinda Cooper

15 notes

·

View notes

Text

i got sent a survey tonight and thought sure, why not, i'll be a polling point

but ohhhhhh boy

it started out fine, right, normal polling questions, who would you vote for if the election was today, right? so i'm clicking my way through, but the questions start to look a little.... biased. and i think to myself, ohhhh perhaps you are about to fuck up some conservative's polling data :)

naturally, i continue with increasing glee!

my guys it got worse so fast

comparing policing to slavery? you mean the policing that inordinately targets, harrasses, abuses, steals from, and murders POC across america? that policing? comparable to jim crow laws? the policing that lets sundown towns exist with impunity? that policing?

bro the way i would slash our defence budget would make every democrat in dc look red, you are barking up the wrong tree and i am pelting you with acorns

this poll should be in a class called HOW NOT TO BE A RACIST FUCKNUGGET

i love this one bc they both released their budgets recently and hers both raises revenue (partially via taxing corporations) AND lowers the deficit (which. btw. is our national debt. we are trillions of dollars in debt to other countries) and his INCREASES the deficit by 5.8 trillion. the math doesn't math guys

anyway if you get the opportunity to answer a maga poll it's highly amusing to fuck up their data

13 notes

·

View notes

Text

It was a time of fear and chaos four years ago.

The death count was mounting as COVID-19 spread. Financial markets were panicked. Oil prices briefly went negative. The Federal Reserve slashed its benchmark interest rates to combat the sudden recession. And the U.S. government went on a historic borrowing spree—adding trillions to the national debt—to keep families and businesses afloat.

But as Donald Trump recalled that moment at a recent rally, the former president exuded pride.

“We had the greatest economy in history,” the Republican told his Wisconsin audience. “The 30-year mortgage rate was at a record low, the lowest ever recorded ... 2.65%, that’s what your mortgage rates were.”

The question of who can best steer the U.S. economy could be a deciding factor in who wins November’s presidential election. While an April Gallup poll found that Americans were most likely to say that immigration is the country's top problem, the economy in general and inflation were also high on the list.

Trump may have an edge over President Joe Biden on key economic concerns, according to an April poll by The Associated Press-NORC Center for Public Affairs. The survey found that Americans were more likely to say that as president, Trump helped the country with job creation and cost of living. Nearly six in 10 Americans said that Biden’s presidency hurt the country on the cost of living.

But the economic numbers expose a far more complicated reality during Trump's time in the White House. His tax cuts never delivered the promised growth. His budget deficits surged and then stayed relatively high under Biden. His tariffs and trade deals never brought back all of the lost factory jobs.

And there was the pandemic, an event that caused historic job losses for which Trump accepts no responsibility as well as low inflation—for which Trump takes full credit.

If anything, the economy during Trump's presidency never lived up to his own hype.

DECENT (NOT EXCEPTIONAL) GROWTH

Trump assured the public in 2017 that the U.S. economy with his tax cuts would grow at “3%,” but he added, “I think it could go to 4, 5, and maybe even 6%, ultimately.”

If the 2020 pandemic is excluded, growth after inflation averaged 2.67% under Trump, according to figures from the Bureau of Economic Analysis. Include the pandemic-induced recession and that average drops to an anemic 1.45%.

By contrast, growth during the second term of then-President Barack Obama averaged 2.33%. So far under Biden, annual growth is averaging 3.4%.

MORE GOVERNMENT DEBT

Trump also assured the public that his tax cuts would pay for themselves because of stronger growth. The cuts were broad but disproportionately favored corporations and those with extreme wealth.

The tax cuts signed into law in 2017 never fulfilled Trump's promises on deficit reduction.

According to the Office of Management and Budget, the deficit worsened to $779 billion in 2018. The Congressional Budget Office had forecasted a deficit of $563 billion before the tax cuts, meaning the tax cuts increased borrowing by $216 billion that first year. In 2019, the deficit rose to $984 billion, nearly $300 billion more than what the CBO had forecast.

Then the pandemic happened and with a flurry of government aid, the resulting deficit topped $3.1 trillion. That borrowing enabled the government to make direct payments to individuals and small businesses as the economy was in lockdown, often increasing bank accounts and making many feel better off even though the economy was in a recession.

Deficits have also run high under Biden, as he signed into law a third round of pandemic aid and other initiatives to address climate change, build infrastructure and invest in U.S. manufacturing. His budget deficits: $2.8 trillion (2021), $1.38 trillion (2022), and $1.7 trillion (2023).

The CBO estimated in a report issued Wednesday that the extension of parts of Trump’s tax cuts set to expire after 2025 would add another $4.6 trillion to the national debt through the year 2034.

LOW INFLATION (BUT NOT ALWAYS FOR GOOD REASONS)

Inflation was much lower under Trump, never topping an annual rate of 2.4%, according to the Bureau of Labor Statistics. The annual rate reached as high as 8% in 2022 under Biden and is currently at 3.4%.

There were three big reasons why inflation was low during Trump's presidency: the legacy of the 2008 financial crisis, Federal Reserve actions, and the coronavirus pandemic.

Trump entered the White House with inflation already low, largely because of the slow recovery from the Great Recession, when financial markets collapsed and millions of people lost their homes to foreclosure.

The inflation rate barely averaged more than 1% during Obama's second term as the Fed struggled to push up growth. Still, the economy was expanding without overheating.

But in the first three years of Trump's presidency, inflation averaged 2.1%, roughly close to the Fed's target. Still, the Fed began to hike its own benchmark rate to keep inflation low at the central bank's own 2% target. Trump repeatedly criticized the Fed because he wanted to juice growth despite the risks of higher prices.

Then the pandemic hit.

Inflation sank and the Fed slashed rates to sustain the economy during lockdowns.

When Trump celebrates historically low mortgage rates, he's doing so because the economy was weakened by the pandemic. Similarly, gasoline prices fell below an average of $2 a gallon because no one was driving in April 2020 as the pandemic spread.

FEWER JOBS

The United States lost 2.7 million jobs during Trump's presidency, according to the Bureau of Labor Statistics. If the pandemic months are excluded, he added 6.7 million jobs.

By contrast, 15.4 million jobs were added during Biden's presidency. That's 5.1 million more jobs than what the CBO forecasted he would add before his coronavirus relief and other policies became law—a sign of how much he boosted the labor market.

Both candidates have repeatedly promised to bring back factory jobs. Between 2017 and the middle of 2019, Trump added 461,000 manufacturing jobs. But the gains began to stall and then turned into layoffs during the pandemic, with the Republican posting a loss of 178,000 jobs.

So far, the U.S. economy has added 773,000 manufacturing jobs during Biden's presidency.

Campaign Action

22 notes

·

View notes

Text

Find Out About Deficit Budgeting and Its Effects and More

When government expenditure exceeds its income, which includes fees, taxes, and investment returns, there is a federal deficit budgeting.

Read More...

0 notes

Text

“Robbing Peter to pay Paul” is an idiom that means taking money or resources from one person or thing to give to another, especially when it results in one debt being paid off by incurring another. For example, if someone moves money from their credit card to pay off other debts, they are “robbing Peter to pay Paul”.

Extending Trump Tax Cuts Would Add $4.6 Trillion to the Deficit, CBO Finds

Washington, D.C.—According to the latest report by the nonpartisan Congressional Budget Office (CBO), extending the Trump tax cuts for the next 10 years—as Republicans have proposed—would add $4.6 trillion to the deficit.

The report, written at the urging of Senator Whitehouse (D-RI), Chairman of the Senate Budget Committee, and Senator Wyden (D-OR), Chairman of the Senate Finance Committee, finds that the extension would cost $1.1 trillion more than previously estimated. The Trump tax cuts overwhelmingly benefit large corporations and the wealthiest Americans, and extending them remains a top policy priority among Republicans.

13 notes

·

View notes

Text

Among the many disruptive economic policies former U.S. President Donald Trump is promising to pursue if he returns to the White House next year—a list that includes massive tax increases on imports, a global trade war, and an exploding budget deficit—his insistence on a weaker U.S. dollar stands out as bizarre, if not downright counterproductive.

For decades, Trump has clamored for a weaker dollar, first as a heavily indebted real-estate developer, then as a presidential candidate, then as president, and now again as a candidate for reelection. Trump’s weak-dollar push has gained support from key figures such as Robert Lighthizer, his former trade czar, who may well play a pivotal role in a second Trump administration.

Their reasoning is wonderfully simple: The dollar, they argue, is overvalued compared to currencies used by trade rivals such as China, Japan, and Europe. A weaker dollar would make imports that much more expensive for Americans and make U.S. exports that much more attractive on global markets. Voilà—a simple tweak to start balancing an out-of-balance trade deficit that for some reason is their bête noire.

The problem—there are many, but more on that later—is that pursuing such a policy would run directly counter to the one thing that Trump claims to be fighting against, and which seems to still worry Americans the most: high prices.

“It makes no sense to run against high inflation, and then advocate lower interest rates, higher tariffs, and a weaker dollar, all of which will add to inflation,” said Maurice Obstfeld, a senior fellow at the Peterson Institute for International Economics and a former chief economist at the International Monetary Fund (IMF). “It just makes no sense.”

Or, as researchers at the Brookings Institution put it when Trump toyed with the same idea when he was president: “If the objective of the U.S. administration is to worsen their trade deficit, only temporary devalue the U.S. real effective exchange rate, boost the trade balances of U.S. trading partners, support China’s economy and undervalue China’s real effective exchange rate, provide only a temporary sugar-hit to the U.S. economy, worsen global currency misalignments and provoke retaliation from their trading partners, then this policy will achieve those objectives.”

First, though, Trump and company do have a point. The U.S. dollar is a bit overvalued compared to other major currencies, no matter how you look at it—even if it tripped on the carpet Wednesday over some disappointing economic news. The IMF figured it was about 6 percent to 12 percent overvalued the last time it looked, in 2019, and big rivals such as the Chinese renminbi and Japanese yen are relatively cheap by comparison. (The yen is near 40-year lows to the dollar.)

The bigger question is why. U.S. interest rates are still on the high side to tame inflation, which explains why the yen is tanking. But a lot has to do with the fact that the U.S. dollar is the world’s reserve currency. This means that foreign central banks buy and hold dollars, like everyone else in the global economy, which props up their value. U.S. securities, such as government debt, remain the absolute safe haven for investors in times of trouble, even when those troubles emanate, like during the 2008-09 financial crisis, from the United States. That demand props up the dollar. Massive fiscal deficits in the United States, such as that caused by Trump’s $1.9 trillion tax cut, require foreign funding to finance. That demand props up the dollar.

But the problems with pursuing a weak-dollar policy remain legion, even if the policy were actually workable.

For starters, a weaker dollar would neither put a governor on U.S. imports nor turbocharge U.S. exports, which is the explicit goal of the entire approach. In the very short term, a cheap-money, weak-dollar policy would boost U.S. economic growth, which would put money in consumers’ pockets, which would lead to an uptick in imports. That is why the U.S. trade deficit widens when times are good at home—consumers are flush.

But more importantly for Trump and Lighthizer’s case, a weak dollar would do little to boost U.S. exports. There are all sorts of things beyond the marginal value of the dollar that stand in the way of U.S. goods elbowing their way into foreign markets, from non-tariff barriers and regulatory regimes (no chlorinated chicken in Europe, please) to consumer preferences; massive trucks with poor gas mileage are a terrible fit in a place like Europe with pricey petrol and narrow roads.

The biggest reason, though, is that in the modern world of global supply chains, the ability of the value of any country’s currency to affect the level of exports is quite small. Products are made with inputs from foreign countries, sold to other countries, often re-imported, tinkered with again, and exported again somewhere else. The upshot is that in a globalized world, supply chain intermingling makes the value of the export currency increasingly irrelevant.

Another problem is that the easiest way to force the dollar down is by lowering U.S. interest rates, one of Trump’s long-standing obsessions. The one thing that axiomatically follows lower interest rates (unless you are Japan) is higher inflation, which is exactly what Trump and his acolytes have been bashing U.S. President Joe Biden over for years.

And there is a national security component, too. The United States maintains about 800 overseas military bases in more than 70 countries, which collectively underpin a globe-spanning projection of U.S. power. That is kept running day to day by spending dollars on fuel, power, supplies, and a million other things. The weaker the dollar is, the more expensive it would be to maintain the country’s sprawling overseas commitments, which sits rather awkwardly with Trump’s advisors’ plans for “peace through strength” overseas.

But Trump’s plans for a weaker dollar would be hard to realize in any event, which makes the whole exercise befuddling.

Take the Chinese currency, which, despite years of scolding from U.S. officials before, during, and after Trump, keeps getting cheaper in relative terms. The renminbi is partially pegged to the dollar. If the dollar goes down in value, the renminbi will follow it down like George Costanza’s rock-climbing partner. Other countries can equally stand aside and let their own currencies slide a bit to offset the dollar’s move, and everything goes back to square one.

Then there is the tariff angle. Trump has already vowed tariffs on every country in the world, and especially on China. The last time he did that, China and Europe retaliated in kind. Foreign tariffs would erase absolutely any tiny advantage gained by a cheaper dollar.

And then there is the exploding deficit. One-quarter of the entire U.S. national debt was accrued during Trump’s term, in part due to his massive unfunded tax cuts. He promises to double down in a second term, with more unfunded tax cuts that can only be filled by enticing foreign investors to pay for them—which requires higher yields on U.S. government debt, which would then act to push the dollar back up again, undoing all the work he just tried to do.

So why, knowing what we know about the pitfalls and perils of a weak-dollar policy, is this such a Trump priority? It seems that the lodestars for Trump and his economic brain trust are found in years past, and none of them are particularly good for learning economic lessons.

Trump himself seems keen on replaying the 1930s, not exactly a golden time for the U.S. and global economies. His love of tariffs is well known, but it takes a special breed to make worship of the infamous 1930 Smoot-Hawley tariff the hill to die on. He couples that with a love of competitive devaluation of currency to get a trade advantage, another tactic that featured heavily in 1930s beggar-thy-neighbor economic thought (though recent research suggests competitive devaluation only slightly beggared some neighbors and tariffs were a greater evil).

Lighthizer last took his bearings in the 1980s, when the Reagan administration strong-armed Japan over trade, imposed trade restrictions that raised prices and lowered choice for U.S. consumers, and got European allies to help deflate an admittedly overheated dollar with the Plaza Accord, named after the New York hotel in which Trump once made a cameo in a Christmas movie.

But that was, Obstfeld said, a very different time. The dollar was wildly overvalued, there was no common European currency, and Europe was utterly dependent on the U.S. security umbrella during the Cold War. Trump previously threatened to pull out of NATO (and now says he’ll only stay as long as European countries pay their share), refuses to commit to collective defense, and has already started a trade war once with those allies. None of the levers that did the lifting back then are even around today.

Trump has been chasing a weaker dollar for decades and didn’t manage to get there during his chaotic term. He may not get there again, even if he gets to the White House again. But it is a reminder that beyond the crimes and the misdemeanors and the worries about everything else, there are literally dollars and sense at stake this November.

“I just don’t see how the United States can stand alone and be strong. It is all back to the 1930s and isolationism,” Obstfeld said. “It is so misguided.”

15 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Aug 07, 2024

"Republicans would rather protect their billionaire friends at the expense of everyone else," said the chair of the Joint Economic Committee

Budget proposals released by congressional Republicans in recent months lay bare the party's desire to slash taxes for wealthy Americans and large corporations at the expense of key government programs and services, including nutrition assistance, environmental protection, and Medicaid.

That's according to an analysis released Wednesday by Democrats on the Joint Economic Committee (JEC), which examined budget plans the GOP has released as Congress works to craft and pass government funding bills for the coming fiscal year.

The JEC specifically cites a Fiscal Year 2025 budget proposal published in March by the Republican Study Committee, a panel comprised of three-quarters of the House GOP caucus.

The plan, the JEC Democrats noted Wednesday, "claims to balance the budget by cutting Medicare spending, raising the retirement age for Social Security, capping funding for Medicaid and CHIP, and cutting the rest of non-defense discretionary spending by 31% across the board."

"This would drive up health costs for American families by increasing premiums for [Affordable Care Act] healthcare plans and getting rid of protections for people with pre-existing conditions," the new analysis says. "It would also prohibit Medicare from negotiating down prescription drug costs."

A separate proposal from Republicans on the House Budget Committee claims it would finance "large tax cuts for the wealthy by both slashing key services and assuming that their tax giveaways lead to unrealistic levels of economic growth," the Democratic report says.

"Analyzing this budget with more reasonable economic assumptions instead shows that budget would likely require the government to eliminate most federal services within a decade," the report adds.

Sen. Martin Heinrich (D-N.M.), the chair of the JEC, said in a statement Wednesday that "Republicans' extreme proposals are dangerous for America."

"While Democrats are fighting to invest in families, Republicans would rather protect their billionaire friends at the expense of everyone else," said Heinrich. "Kicking 42 million kids off of health insurance, gutting federal investments in public safety, denying veterans hospital care, and getting rid of [Supplemental Nutrition Assistance Program] benefits that help people afford groceries is unconscionable. Americans deserve better."

The analysis from JEC Democrats comes as Republican nominee Donald Trump attempts to posture as an ally of the working class despite his history of assailing labor protections and backing tax cuts for the rich.

Trump has called for an extension of the tax cuts he signed into law in 2017—changes that overwhelmingly benefited wealthy Americans. An extension of the tax cuts would add $4.6 trillion to the deficit of the next decade, according to the Congressional Budget Office.

The former president's advisers have also reportedly discussed reducing the corporate tax rate from 21% to 15%, a change that would give the largest 100 U.S. companies a tax cut of $48 billion per year.

Trump has floated proposals that are ostensibly geared toward helping working-class Americans, including exempting tips from taxation—a proposal specifically aimed at hospitality workers—and eliminating taxes on Social Security benefits.

But earlier this week, UNITE HERE—a union that represents hospitality workers—endorsed Democratic nominee Kamala Harris over the Republican candidate, warning that "another Trump presidency would mean four chaotic years of defending against his attacks on unions, working people, immigrants, women, and others."

As for Trump's proposal to eliminate taxes on Social Security benefits, an analysis by the Tax Policy Center's Howard Gleckman found that the move would reduce "Social Security and Medicare hospital insurance (HI) revenues by $1.5 trillion over the next decade," harming the programs' finances while providing "little or no benefit" to lower-income households in 2025.

"Less than 1% of the lowest-income households (those making about $33,000 or less, would get any tax cut at all," Gleckman observed. "But about 28% of middle-income households would get a tax cut. Among the top 0.1 percent, about 20 percent of households would get a tax cut."

Gleckman found that "in dollar terms, the biggest winners would be those in the top 0.1% of income, who make nearly $5 million or more."

#tax cuts for the rich#billionaires#taxation#wealth inequality#2024 elections#republicans#republican party

11 notes

·

View notes

Text

Also, the fact that "younger generations have no common sense or practical skills" is so fucking intentional. It is such a capitalist oppression thing, for literally every person.

TL;DR: PLEASE understand that there's a really good chance that it's capitalism's fault that young people "have no common sense or practical skills" not your meemaws fault or your grandkids fault, y'know?

For example in the US, people who became adults during the great depression (the great grandparents of Millennials/Gen Z), knew how to do a huge amount of practical, everyday things. They could farm, do household repairs, many of them had carpentry skills and automotive/equipment repair skills. They made many of their own clothes, grew and preserved most of their own food, etcetera. This meant they held little need for the larger capitalist system and had very little motivation to uphold it if it mistreated them. They did not have many material assets but they had valuable knowledge that made them more independent from capitalism.

Now look at Gen Z, we are becoming adults in a time in America where we have EVEN LESS purchasing power than our Great Depression counterparts. On top of that, factually, we have exponentially less individuals with this large variety of everyday skills. So for many of us, when our car breaks down, we have no knowledge on how to fix it and we own no assets. All we can do is sell our time in order to pay someone else to do it. When we are hungry, we have minimal access to land, many of us don't have the knowledge and skills to grow our own food, we have to sell our time in order to go to a grocery store so that we can eat. Unfortunately, we as a generation "need" capitalism for this because we do not have the skills to do these things on our own anymore.

Now the question is why don't we have these skills? Well, I've seen a couple schools of thought but I think both of them are at least partially incorrect.

1) Kids today just don't care about stuff like that and don't want to learn! Kids have never wanted to learn "boring" adult skills. Kids have and always will be kids, but as adults we appreciate these skills and understand the value of knowing them and passing them on to your kids (even if they find it boring). PLUS, many kids do have interest in these things if they're encouraged to give it a chance. I don't think this is truly the issue.

2) Boomers didn't care to teach us! They were lazy and now we are suffering!! They likely didn't believe these skills were necessary for young people anymore. From their perspective the economy had been flourishing for as long as they could remember, why believe that would change? I'm not saying the lack of foresight isn't detrimental, but the viewpoint can be explained. I don't think this is a notable part of the overall issue either.

These two schools of thought lead us as the working class to blame each other for the deficit. It divides us. I propose a third theory on the matter: these skills were systematically stomped out in younger generations to make us more reliant on capitalism. Through assorted methods:

- removal of hands-on classes from school through budget cutting, etc (wood shop, agriculture, home ec, automotive, etc) (PS: this is isn't a "bring back gender roles" take just because I included home ec in the list, every gender should learn home skills like cooking, mending and cleaning, as well as skills such as automotive and carpentry.)

- distraction via the promotion of unhealthy overconsumption of media (video game/TV/social media addiction) (PS: this is not a "technology bad" take, tech is fine but OVERconsumption of media is unhealthy and is even a problem in older generations now.)

- devaluation of these skills via the conflation of them with an archaic and backward social period (Yes, people in older generations were and largely still are racist, sexist, homophobic, and that's fucked. That doesn't mean growing and canning your own food or learning from peepaw how to fix a carburetor makes you any of those things.)

- the manufactured institution of lawns, "landscape" and HOA's preventing us from growing our own food at home on the land we DO have access to

- many others I don't feel like unpacking here as I'm already writing a novel in this post apparently, but you get my meaning

So I guess my point is that we need to unpack our feelings on this and understand that there's a really good chance that it's capitalism's fault that young people "have no common sense or practical skills" not your meemaws fault or your grandkids fault, y'know? As the working class we have to stop punching left and right and start punching up. Also, since I already hear "but boomers own all the stuff and bought their house for $5 in 1970!" (which is a valid sentiment) I share with you an important (paraphrased) quote I heard the other day:

"When the lord of the land commands the people to go out and work his lands in the sun, your enemy is not the man who is wearing a hat."

Other generations aren't the real enemy here y'all, it's the capitalist billionaires. Please see that.

#anti capitalism#late stage capitalism#fuck capitalism#capitalism#economy#education#permaculture#canning#independence#gardening#fuck lawns#self sufficiency#self sufficient living#gen z#millennials#boomers#great depression#farm#farming#politics#thoughts

12 notes

·

View notes