#canadian taxes

Text

I filed my taxes over a week ago and I am still salty that the Home Accessibility Tax Credit is only available for homeowners.

I spent ~3k this past year on furniture to make my rented, unfurnished apartment more accessible for me. Furniture is not an allowable medical expanse so I can't write it off that way.

If I owned my house, I'd be able to write the ~3k off with the Home Accessibility Tax Credit. But since I did the exact same thing in a rented apartment, no tax credit for me.

It's so fucking frustrating and exhausting how much our society is set up to only reward the wealthy. I've been trying to save up for years to buy a house but the market is growing faster than I can save, in no small part because I am disabled and need to spend more on everything (such as furniture) in order to live. 😭

#destroy ableism#ableism#taxes#canadian taxes#canada is so fucking ableist#disability#actually disabled

30 notes

·

View notes

Text

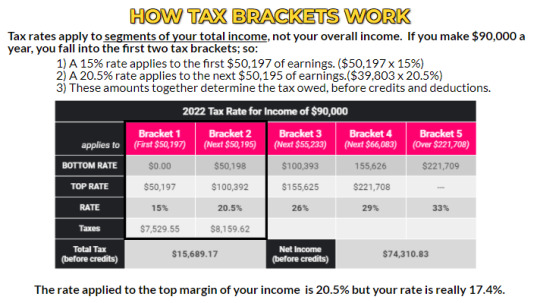

We just had tax season, yet so many Canadians don't understand how tax brackets work!

Did you know only about 2% of the population pays 30% or more in income tax?

Something to chew on the next time a Fraser Institute scholar tells you otherwise.

12 notes

·

View notes

Text

Ugh I should shower before I pick my sister up.

Literally my entire plan for today was Finish Tattoo Day Post (I really want to post it today as a one week afterthoughts thing) and hopefully do my taxes.

(Related: if anybody has knowledge on how costs of materials etc vs income from craft fairs works in Canada if I can claim the cost of what I was selling? Bc uh. I bought way more stickers than sold 😬)

#shatters’ fragments#Canadian taxes#I’m Good with the rest. but my bit of craft fair income THAT BARELY COVERS THE TABLE COST is the one that confuses me still

0 notes

Text

the irony of finding out that this link:

returns this page:

well thanks,

0 notes

Text

studiotax for my canadian icons

okay so im not sure how many ppl know about this but it's definitely tax season so im a bit late (also i do not get commission i am simply obsessed w this software)

there's a free canadian tax filing software that you can do right on your computer. if you made more than 40k in the year in taxable income, it's $17.25, and you just download the year's software, fill out some personal info (stuff like your SIN and your name and address and things) and then give it permission to log you into the CRA website.

here's the windows download link (it also supports Mac, IOS, and Android), just click the download button on the banner at the top of the page!!!

it'll give you a whole list of documents it pulled from the CRA website, just click "select all" and then "add all", this is the info that gets put on your income tax forms (both provincial and federal)

before you file, make sure all of your documents are available to the CRA!!! i made the mistake of filing slightly too early, so i had to refile a few hours later after figuring it all out... you can see if all your documents are there by:

logging into CRA

going into "tax returns" from the left-side panel

scrolling down and clicking "tax information slips (T4 and more)" on the right-side panel

choosing the tax year you're filing for (2023 in this case)

and choosing "all slips"

this will download a PDF for you that has every form that the CRA has for you for that year! make sure there isn't anything missing (tuition forms like the t2202, t4, t5, etc) and then start using StudioTax!

the reason it's only mostly free is because it's free to file for up to like 40k a year for one person, then it's a juicy $17.25 for a NetFile license (which is a number code you just input in a box in the software window)

i've been filing my taxes, my friends taxes, and my parent's taxes like this since I was 17, please use this!!! it's literally established by the canadian government so that it can stay free. DONT USE TURBOTAX PLS THEY ARE THE WORST!! they lied about being free and now there's a lawsuit

#also feel free to dm me or post an ask if you get stuck somewhere#i will post a tutorial if u need#tax szn#taxes#canada#canadian taxes#turbotax#tax returns

0 notes

Text

Welcome to our comprehensive guide on maximizing tax returns in Canada! In this blog, we delve into the intricacies of the Canadian tax system and provide valuable insights into how you can optimize your tax situation to ensure you get the maximum refund possible. From understanding the various deductions and credits available to leveraging tax-advantaged accounts like RRSPs and TFSAs, our detailed articles cover everything you need to know to navigate the complexities of Canadian taxes. Whether you're a first-time taxpayer or a seasoned veteran looking to make the most of your deductions, our blog offers practical tips, and expert advice to help you keep more money in your pocket. Stay informed, maximize your refunds, and take control of your finances with our authoritative guide to Canadian tax refunds!

Read Article:- https://medium.com/@cpamehra/what-is-the-maximum-tax-refund-you-can-get-in-canada-6c0add2e4c02

0 notes

Note

the other day, I saw a Sebastian plushie and thought 'wouw! Choccy-Milky is so popular, there's even plushies of her stuff!'..... and then I remembered Sebastian's an official character and not just Clora's boyfriend

LMFAOOOOOOOOOOO THIS IS SO FUNNY yes, good...my plan is working....

hogwarts legacy? what's that? are you feeling okay, anon? don't you mean Clora's Boyfriend™

#now i need to resume my search for sebastian plushies i want one of him so bad....im also jealous of ppl who can make plushies of their MC#i want the official merch on the hp shop of the snake and the raven mascot plushies. they come with scarves and i wanna switch them#so that the snake is wearing the ravenclaw scarf and the raven is wearing slytherins#but those plushies are like 60 canadian LMAO so......i dont want it THAT bad LMAOO#homemade frankensteined merch that will cost me like 150 bucks after taxes#honestly if they do come out with a seb plush i could just buy a luna lovegood plush and add cloras mole LMAOO pretend its her#love living in delulu land#ask

144 notes

·

View notes

Text

Alberta to introduce $200 annual electric vehicle tax

Other new tax changes in the Alberta budget include a new tax on vaping products sold in the province, and higher taxes of tobacco products

Electric car owners in Alberta will be forced to pay an annual $200 electric vehicle tax starting as early as January 2025.

In Alberta’s 2024 budget unveiled Thursday, the province says the new tax will be applied when electric car owners register their vehicle and will be in addition to the current registration fee. The province says electric vehicles tend to be heavier and cause more destruction on highways and roads, while owners don’t pay a provincial fuel tax. The tax will not apply to hybrid vehicles, the budget says.

During a Thursday news conference, Alberta Finance Minister Nate Horner said the tax rate is meant to be in line with the estimated fuel tax paid by a typical Alberta driver. Horner pointed to other jurisdictions that have moved forward with similar fees for electric vehicles.

Continue Reading

Tagging @abpoli

146 notes

·

View notes

Text

me, dolefully glaring for hours at the piles of etsy documents with fucked up numbers, ID slots that make no sense and utterly befuddled tax terminology: please, please make sense I only need to fill in ONE slot with you why are you like this with GST

(also does anyone know where the fuck to put your BN number in on etsy it keeps listing Canada as a state I think its confused as hell)

#im in tax hell don't mind me#dw i HAVE already filled the Liaison Officer Service Request Form out to get a guy about it#but by god do i hate everything about Canadian small business taxation right now#also yes i know its 4am

116 notes

·

View notes

Photo

the weirdest, longest, most boring spell

18 notes

·

View notes

Text

this ^report is from 2020. However- much news has since been reported about the staggering increase of wealth 'at the top' since COVID began.

"...Canadian capitalism is exposed in the study as an oligarchic social order.

According to the PBO, the share of wealth held by the top one percent of Canadians is 25.6 percent. This is almost double the estimate of 13.7 percent given by Statistics Canada."

@allthecanadianpolitics good resource article here.

#so called 'canada'#it's the capitalists#oligarchy#we are the 99%#capitalism is killing us#how will you resist?#the economy is meant to serve society#the economy does not have rights#regulate industry#polluter pay#tax the rich#VOTE federal NDP#luxury tax#canadian politics#canpoli

218 notes

·

View notes

Text

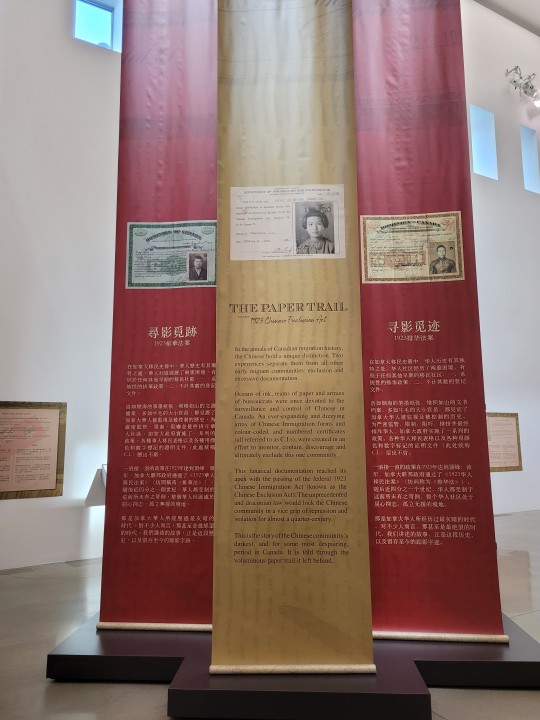

I went to the Chinese Canadian Museum in Vancouver today! It was informative, gut-wrenching, and SO WELL DONE. This might be the most well put together museum I have ever been to, and you BET I am going to be doing a video about it!

#this friday if i am feeling REALLY productive but more likely the friday after#museum#history#canadian history#chinese canadian museum#chinese exclusion act#chinese head tax

38 notes

·

View notes

Text

I'm calling it ahead of time, but the 10 year anniversary of Inquisition is going to be "Haha, remember when 10 years ago we intentionally didn't finish the story so you would buy DLC and the sequel? Anyway, Dreadwolf cancelled"

#I genuinely wasn't that excited abt it because I Do Not Enjoy Solas as much as people seem to#but also like. god#bioware please#treat your people better#I promise it pays off#you can't move to Canada to reap the tax rewards and then not pay your workers as Canadian law dictates#i need like a#studios behaving badly#tag or something#dragon age#bioware

10 notes

·

View notes

Text

#canada#canadian#poverty#homeless#economics#economy#pyramid scheme#gst#tax#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#wage slavery#slavery#anti slavery#antiwork#capitalism#anti capitalist#capitalist hell#capitalist dystopia

4 notes

·

View notes

Text

this is going to be so niche BUT if you're doing your income taxes with turbo tax, and you're under 25, and you're trying to use the free version but it's forcing you to use the deluxe version without telling you that you're trying to input a form or deduction that you can't do on free:

restart your tax return

when it prompts you to use turbotax's data from last year's return, press no.

you'll have to press all the buttons again but it really doesn't make a big difference in filling out the return because it's just asking your martial status and where you live etc.

when you get to the "deluxe is now $15!" page, just hit continue - at some point it will offer you deluxe again, but you should still be on free after hitting continue and you can just turn down deluxe.

finish the rest of your return as normal. you can connect to the CRA or whatever, it's just the turbotax info that is the problem.

this year deluxe is $15 if you're under 25, but last year it was free. so you probably used it last year if you filed with turbotax, and when it says "use your data from last return" it's also taking the version you used, which is forcing you into deluxe.

or maybe this was just a me problem. it pissed me off so bad trying to figure it out im posting this to maybe save someone the trouble lol

#im canadian fyi#and i saw on the turbotax forum that other people were having this issue but i dont really wanna post there#this is only if you have a simple return but if you have to pay to file because it's not simple then turbo tax will tell you#im just talking about if it randomly forces you into delux#turbo tax#tax season

2 notes

·

View notes

Text

Like a lot of government programs, people don't know about it, so they don't get the benefits of it.

62 notes

·

View notes