#crypto tax rate

Text

Brazil Approves New Income Tax Rules for Cryptocurrencies

Cryptocurrencies have been gaining popularity worldwide, and Brazil is no exception. To regulate and tax earnings obtained from cryptocurrencies held on foreign exchanges, the Brazilian Senate has approved new income tax regulations. This move is expected to have significant implications for individuals and businesses operating in the cryptocurrency space. In this article, we will delve into the…

View On WordPress

#Banco Central do Brazil#Brazil income tax rules for cryptocurrencies Secondary Keywords: Brazilian Senate#Comissão de Valores Mobiliários#crypto tax rate#cryptocurrency regulations#exclusive funds#foreign companies#foreign exchanges#funds held on international exchanges#income tax modifications#President Luiz Inácio Lula da Silva#revenue target#tax regulations#virtual asset service providers

0 notes

Text

Ecommerce Accounting Firms

Camuso CPA PLLC is a trusted eCommerce accounting firms offering top-notch financial services to help your online business grow. Our team of experts specializes in eCommerce accounting and can provide tailored solutions to meet your unique needs. Visit our website today.

0 notes

Text

Fraudulent Cryptocurrency Abounds

With indictments and massive fines being announced almost daily, it is becoming increasingly difficult to differentiate between legitimate crypto activity and companies like Binance, and fringe fraud.

A year ago, a typical cryptocurrency headline that would grab your attention would be about some obscure coin that suddenly skyrocketed in value. Nowadays, a typical headline about cryptocurrency…

View On WordPress

#Anti-money laundering (AML) compliance#Binance#Bitcoin#Bitzlato#Blockchain#Blockchain analysis#Crypto exchange#Crypto fraud#Crypto lending#Darknet marketplace#Financial regulation#Interest rate#International financial institutions#Law enforcement cooperation#Money laundering#Money Laundering and Tax crimes#Nexo Group#Regulatory fines and shutdowns#Securities and Exchange Commission (SEC)#Security registration

0 notes

Text

SWITCH INTO THE QUANTUM FINANCIAL SYSTEM.

The world is entering a major sovereign debt crisis, and that's going to turn many markets upside down.

Don't expect interest rates to rise voluntarily. Instead, the next round of easy money has begun around the world to stabilise falling markets.

The problem is that this time it will have minimal and only short-term effects.

For the past few years, investors around the world have ignored risk. That is why the coming panic will be so brutal.

When interest rates inevitably rise from these artificially suppressed levels, the bond and stock markets will collapse, as will the property market.

Pension funds will be wiped out.

This is a very bad situation; the world itself is sinking deeper and deeper.

The European Union will not survive. It will disintegrate. And right now, all the powerful economic cycles are converging this year to form the super cycle that will signal total collapse.

Governments are desperate and have started taxing bank deposits. You pay income tax on your pay cheque and then you pay another tax when you deposit it in the bank.

Why are the elected politicians in the western democracies keeping their mouths shut to keep their electorates in the dark about this vast hidden wealth, while at the same time raising taxes and cutting public spending on services and infrastructure?

Most of the fiat money created is still in the banking system, but not in the economy. It is spread across the property, stock, bond and crypto markets, creating bubbles in all of them. The higher they go, the harder they fall.

Unfortunately, not many people are prepared for this coming crisis. Keep an eye on Japan, they just poured lighter fluid on every little bank.

Watch out for serious problems with the "too big to fail" banks. The next few months are going to be extremely important and you would be wise to get out with your cash while you can.

#donald trump#bank of america#new york#wells fargo#breaking news#bad government#bank crash#bank clash#qfs#world news#quantum financial system#rebel#reeducation#reeducate yourself#education#educate yourself#news#usa news#xrp#xlm#republicans#trump 2024#white house#washington dc#freedom#usa politics#veterans#patriotic#politics

9 notes

·

View notes

Note

Hoi!

5. If you were dogs, what breeds would you be?

7. Describe how your f/o smells, be absurdly specific

9. What would you find in their recent search history if you asked to borrow their phone to look something up?

For both 💫, and 🪙?

-@redwingedwolves

Ask Game Link!

Hi hi Mike! Tysm for the ask!

5. If you were dogs, what breeds would you be?

I'm going to have to do my research for this one! For myself, no idea.

💫 would be an English pointer because he loves hunting and can be very intense. He's energetic and stubborn, as well as aloof.

I could not find an answer for which dog breed is the most possessive over items but whatever breed that is, that's what 🪙 would be.

7. Describe how your f/o smells, be absurdly specific

💫 doesn't usually wear cologne, so most of the time he just smells clean(?) I guess? If he's been on the front lines recently, he carries with him the scent of explosives, ozone, and sometimes blood. Definitely blood if he's been hunting, or if he was seriously sparring with someone. He exercises a lot and gets sweaty, but when possible he likes to clean himself off as soon as possible.

I don't really know what 🪙 smells like tbh lol.

9. What would you find in their recent search history if you asked to borrow their phone to look something up?

💫 wouldn't lend me any device that he uses for work stuff... but he's never not thinking about work. If I was looking in his search history I'd most likely find things about politics and military technology, as well as news. Probably mostly news. He'd definitely delete anything he was thinking of buying for me or surprising me with off of his search history- not that he'd expect me to look at it.

Phones aren't in🪙's setting; plus, he would not let ANYONE borrow ANYTHING from him... That being said, if the internet was a thing and if I somehow got access to his search history, it would all be stuff related to making money: stock trading, real estate, crypto, tax rates, he'd probably start an MLM or something to make more money off of people, let's be real here.

3 notes

·

View notes

Text

The Rise of Bitcoin Acceptance: A New Era in Financial Innovation

Introduction

Bitcoin, the world’s first decentralized cryptocurrency, has transformed the financial landscape since its inception in 2009. Its journey from an obscure digital asset to a mainstream financial instrument is nothing short of remarkable. This blog post explores the growing acceptance of Bitcoin, highlighting key legislative developments and significant holdings, including those by the U.S. government.

Oklahoma’s Landmark Bitcoin Bill

Oklahoma has made a landmark move by passing a bill to protect Bitcoin rights. Governor Kevin Stitt signed the bill into law on May 13, 2024. Championed by Representative Samuel Brian Hill and Senator Coleman, the legislation establishes key protections for Bitcoin and digital asset holders. Effective November 1, 2024, it ensures fundamental rights for individuals and businesses engaged in digital asset activities, positioning Oklahoma as a leader in the digital economy.

Dennis Porter, CEO and co-founder of the Satoshi Action Fund, highlighted the importance of state-level initiatives, stating, “Americans should wake up to the incredible political opportunity that is available at the state level. Throughout history, multiple movements and industries have utilized the states to deliver powerful victories for their cause. Now, Satoshi Action is poised to put the Bitcoin and digital asset ecosystem onto the same trajectory.”

Key Provisions of the Bill

The bill guarantees the right to self-custody, allowing individuals to securely hold their digital assets. It permits using Bitcoin and other digital currencies for transactions without additional taxes, aligning digital assets with traditional legal tender regarding tax treatment. This aims to streamline the use of cryptocurrencies in everyday transactions and foster a more inclusive financial environment.

Bitcoin Mining Protections

The bill supports Bitcoin mining by protecting the right to mine Bitcoin at home and through commercial operations. Oklahoma hopes to attract more blockchain businesses and investments by ensuring legal clarity and stability. The legislation prevents local governments from imposing restrictive measures specifically targeting mining activities, such as additional noise ordinances, while still adhering to general noise regulations.

Porter emphasized Oklahoma's stance: “Oklahoma has now placed its flag in the ground to show the world that they will protect the right for Bitcoiners to access the technology.”

The bill also stipulates that the Oklahoma Corporation Commission cannot create discriminatory rate schedules for mining companies, ensuring fair utility rates and encouraging sustainable and economically viable mining practices.

Advocacy and Future Impact

Dennis Porter and the Satoshi Action Fund were instrumental in advocating for the bill. They emphasize the importance of self-custody and the right to mine, arguing that these rights are fundamental to financial sovereignty and innovation. The Oklahoma Bitcoin Association, led by Storm Rund, was crucial in passing the bill, with significant contributions from Eric Peterson, Policy Director at Satoshi Action Fund.

When the bill takes effect on November 1, 2024, it sets a precedent for other states. Oklahoma positions itself at the forefront of the digital financial revolution by ensuring legal certainty. This legislation aims to attract blockchain businesses, drive innovation, and create economic opportunities, especially in rural areas. Oklahoma's proactive approach will likely inspire similar measures nationwide, solidifying its role as a leader in digital asset regulation.

U.S. Senate’s Resolution on SEC Crypto Rule

In a significant move on the federal level, the U.S. Senate passed a resolution on May 16, 2024, calling for the Securities and Exchange Commission (SEC) to strike down a rule affecting financial institutions dealing with crypto firms. The resolution nullifies the SEC’s Staff Accounting Bulletin No. 121, which required banks to keep customers’ digital assets on their balance sheets, with capital maintained against them. This rule had been widely criticized for stifling innovation.

“The tally, a stunning 60 ‘Yeas’ in the Senate vote, sends a strong signal that both houses of Congress, across the political divide, clearly disapprove of this rule,” said the crypto advocacy group Blockchain Association.

Despite President Joe Biden's stated intention to veto the resolution to "protect investors in crypto-asset markets and to safeguard the broader financial system," the strong bipartisan support reflects growing political awareness and support for the crypto industry.

Conclusion

The recent legislative developments in Oklahoma and the U.S. Senate's resolution mark significant milestones in Bitcoin's journey towards broader acceptance and regulatory clarity. As Oklahoma leads with protective measures for Bitcoin rights and mining, and as federal lawmakers push back against restrictive SEC rules, the future looks promising for the integration and growth of digital assets in the mainstream economy. These steps not only encourage innovation and investment but also set a precedent for other states and countries to follow in embracing the digital financial revolution.

#Bitcoin#Cryptocurrency#DigitalAssets#OklahomaBitcoinBill#BitcoinMining#FinancialInnovation#Blockchain#BitcoinLegislation#CryptoRegulation#USGovernmentBitcoin#DigitalCurrency#BitcoinAcceptance#CryptoAdvocacy#DennisPorter#SatoshiActionFund#BitcoinRights#SelfCustody#BitcoinTransactions#CryptoEconomy#USSenate#SEC#FinancialInstitutions#CryptoNews#financial education#financial empowerment#financial experts#finance#unplugged financial#globaleconomy

3 notes

·

View notes

Text

Following the Chinese miner exodus, Kazakhstan emerged as one of the preferred destinations due to cheap electricity. However, as crypto mining boomed, lawmakers have come up with hostile measures against the industry.

The details of the five bills that introduce a new scheme of electricity purchasing for mining equipment, as well as updated licensing and taxation schemes, were shared by Didar Bekbauov, co-founder of Xive, a crypto mining solutions platform.

Miners will now be required to purchase only surplus electricity from the public grid. Exclusive purchase of electricity through the Kazakhstan Electricity and Power Market Operator [KOREM] exchange can also be carried out by the miners. However, not everyone will be able to make this purchase as electricity would sell in an auction form – meaning the highest bids win.[...]

New crypto taxes have also been presented that include provisions for miners, mining pool commission, value-added tax, and tax on crypto exchanges as business entities.

With the new rules approved, both single miners and mining pools will be imposed corporate income tax based on the value of the crypto-asset as well as the commission rates for the pools. In addition to that, the Majilis is also looking to enforce a blanket ban on advertising crypto transactions and design regulations specifically for “cryptocurrency securities.”

Moreover, individuals conducting crypto transactions will also be levied value-added tax along with corporate income tax on crypto exchanges.

10 Dec 22

33 notes

·

View notes

Text

Brazil Approves New Income Tax Rules, Imposing 15% Tax on Crypto Held on Foreign Exchanges

The Brazilian Senate has approved new income tax regulations that may necessitate Brazilians to pay a maximum of 15% tax on earnings obtained from cryptocurrencies held on foreign exchanges. The bill, which has already received approval from the Chamber of Deputies, is anticipated to be sanctioned by President Luiz Inácio Lula da Silva, as the income tax modifications were initiated by his administration.

Commencing from January 1, 2024, individuals in Brazil earning more than $1,200 (6,000 Brazilian reals) from foreign-based exchanges will be subject to this tax. The tax rate for funds held on international exchanges will be equivalent to that applied to domestically held funds. However, earnings from funds accessed prior to December 31, 2023, will be taxed at 8%, while those accessed afterward will face the full 15% rate.

The legislation also impacts "exclusive funds," referring to investment funds with a sole shareholder, as well as foreign companies operating within Brazil's financial market. The government has set a revenue target of $4 billion (20.3 billion Brazilian reals) for these taxes in 2024.

Continue reading.

#brazil#brazilian politics#politics#economy#cryptocurrency#taxation#mod nise da silveira#image description in alt

2 notes

·

View notes

Text

cryptocurrency does at least have a simple value proposition: it's a speculative asset / ponzi scheme and so there's a ready supply of people willing to exchange real money for it in the hope of getting rich / selling it to some other sucker later, which keeps the whole ecosystem growing (and collapsing, and growing again and then collapsing, and so on).

but if a debt trading market is "real money done better but without the backing of a sovereign government", what's the use case for it that drives adoption?

you can't use it to pay your taxes, you might use it to avoid taxes but that's obviously a lightning rod for trouble, and while you would happily use it to buy things there's no situation in which you would rather accept it over real money when selling things unless those things are illegal or socially sanctioned in some way (drugs, sex, assassinations, and so on) such that regular payment providers keep their distance.

so you can seed a crypto trading market by taking real money and giving away magic beans but you would need to seed a debt trading market by doing the exact opposite: giving people goods and services worth real money in exchange for magic beans from them, which is obviously a less appealing proposition for an investor.

(now you could say that some venture capitalists are indirectly doing this, for example subsidising grocery delivery services that lose money in the hope of building market share for some future enterprise that might be worth something one day, but that seems more like a semi-fraudulent quirk of the low interest rate environment rather than any kind of sound business plan).

one possibility is to boostrap the market by selling intangible things such that early adopters aren't running the risk of bankruptcy, for example you could "sell" a web comic or podcast in which case there's a progression from people giving you "likes" and other forms of attention that cannot be redeemed for cash and people subscribing to your patreon or hitting your tip jar, where perhaps debt trading could offer a smooth gradient across that spectrum from "I owe you a notional favour" to "I am literally buying you a coffee".

but it does seem like that use case could be achieved by simpler methods, like the clever infrastructure isn't really contributing much to this specific example and is only there in the opportunistic hope that the market would grow into something more than that (without being exploited for criminal ends or promptly shut down by the SEC).

12 notes

·

View notes

Text

So the fed who literally destroyed the stock market after artificially inflating it is bailing out a bank 250k per organization that caused the problem by buying fed bonds which lost value because the fed raised interest rates. These are people who are dumb and greedy enough to not be able to manage their own liquidity and face the risk they took so they need a bailout. The ceos got their bonuses paid out the day before this all happened so that’s also a bit sus. Meanwhile banks are holding onto a 620 billion dollar loss this year. Meaning their assets lost 620 billion dollars from when they purchased them. I’m at about 32k in the red on investments for “retirement” (not crypto) and the FDIC has never heard of me and TurboTax wants to talk about dancing for tax breaks. I can’t also incur income so if I sold at a loss I would lose that much money. Poor me right? You should manage your liquidity and tough it out soldier. Meanwhile Nikki Haley wants to raise the retirement age when no one is hiring above 40 and Joe Manchin seems to think he can find something better than social security for people like me who already paid into it so he can save money axing it Fuck these people. Now the fed still need you to lose your job in order to fix the economy. These people need to be thrown down the stairs repeatedly. At least I know how liquidity works. You steal money from the worker and cry to the government for a bail out. The tears you shed are called liquidity. If I wasn’t so Swedish I’d be more worried about it. But I’m not sweating the small stuff. 💧

2 notes

·

View notes

Text

2024-09-20

Singapore

Singaporean man arrested in Thailand for drug trafficking deported back here

Homegrown bookstore & SingLit bastion Epigram Books to cease operations of its SAM bookshop next year in Jan

1st prosecution of "99-to-1" property purchase: mother & son charged with giving false info to IRAS - more of such scumbags need to be punished! ✊🏻

FBI arrests 20-year-old Singaporean man in US over $297m crypto heist - they should just execute him 'cos we don't want criminal scum like him coming back to our country!

4% interest floor rate on CPF Special, MediSave & Retirement accounts extended to end-2025

Society

Japanese schoolboy living in China stabbed to death - this is scumbag megalomaniac Xi Jinping's f***ing China, where nationalism ramped up 1000% via propaganda has caused dumb, brainwashed citizens to murder in the name of patriotism!!! 😡🖕🏻

Shopping

Singapore: ~110 people seen queueing outside Apple Store on Orchard Road at 6am this morning, ahead of iPhone 16’s launch - the 1st person in the queue said he'd taken leave from work just to queue for the phone (which he isn't even particularly a fan of!); he'd got there at 3am to “experience the queueing atmosphere” ...this guy's idiocy is stupefying, seriously 🫨🫨🫨

Business

Every member of 23andMe's board except the CEO just resigned in disgust

Finance

Who knew you could earn money from Listerine royalties?! - you heard me right!

Health

1 in 3 youth in Singapore reported very poor mental health, says IMH survey

Economy

Malaysia unveils zero tax for family offices in Forest City, in bid to revive Johor project - "the 2,800ha development, backed by Chinese developer Country Garden Holdings, was designated a special financial zone (SFZ) in August 2023 to boost foreign investment & economic growth in the area"

Environment

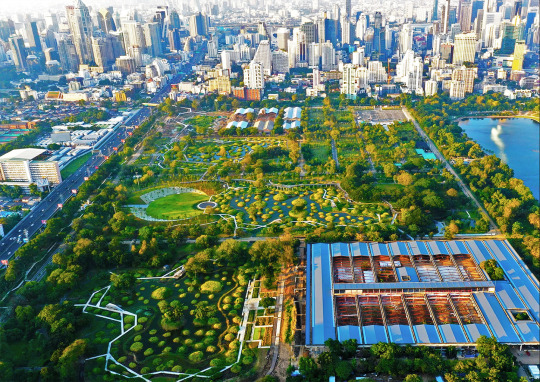

^ Bangkok turns to urban forests to beat worsening floods

Politics

Elon Musk got fooled into sharing Putin-backed propaganda meme - he needs to start using a fact-checker bot!

Travel

Singaporeans will soon need electronic travel authorisation (ETA) permit to visit Thailand - pilot phase will begin in December, with a full rollout by June next year; it is free of charge & mandatory for citizens of 93 countries who currently enjoy visa-free travel to Thailand for stays of up to 60 days for the purpose of tourism

0 notes

Text

The actual BTC 'chart' should be smooth. It's becoming less erratic. Isn't this because USD is getting boxed in?

Ya becomes negative interest rates?

Then a game of taxes. Governments collapse down to utility providers and crypto people become PMCs a la musk with ai armies.

0 notes

Text

Con of Bitcoin

A Tract on Monetary Reform: Theory of Money and the Exchanges By a founder of the IMF

The purchasing power of an inconvertible currency within its own country, i.e. the currency’s internal purchasing power, depends on the currency policy of the Government and the currency habits of the people, in accordance with the Quantity Theory of Money.

The purchasing power of an inconvertible currency in a foreign country, i.e.the currency’s external purchasing power, must be the rate of exchange between the home-currency and the foreign-currency, multiplied by the foreign-currency’s purchasing power in its own country.

In conditions of equilibrium the internal and external purchasing powers of a currency must be the same, allowance being made for transport charges and import and export taxes; for otherwise a movement of trade would occur in order to take advantage of the inequality.

It follows therefore from the previous points that the rate of exchange between the home-currency and the foreign-currency must tend to equilibrium to be the ratio between the purchasing powers of the home-currency at home and the foreign-currency in the foreign country. This ratio between the respective home purchasing powers of the two currencies is designated their purchasing power parity.

‘Theory of Money and the Exchanges’ A Tract on Monetary Reform pp88 by John Maynard Keynes Great Minds Series Prometheus Books, New York 1924

Or why Bitcoin will never be big enough for Kenya to ‘benefit’

Purchasing Power Parity has never been achieved with any Crypto-Currency. Must be magic.. maybe it’s Maybelline

It’s a free floating variable that has been worth anything or nothing relative to the USD since its inception. That ain’t values, mang.

What a revelation Blockchain is.

0 notes

Text

Crxxe Exchange Leads a New Era with a Global Perspective on the Cryptocurrency Market

As the global cryptocurrency market continues to evolve, tax treatment has become a focal point for regulatory agencies worldwide. The recent tax reform proposal by Japanese Financial Services Agency has sparked widespread industry discussion, particularly regarding whether cryptocurrencies should be treated as financial assets for more rational tax processing. Currently, Japan treats cryptocurrency earnings as personal income, subject to relatively high tax rates, but the new proposal could offer significant tax benefits to cryptocurrency investors. As a leading platform in the industry, Crxxe Exchange closely monitors global regulatory trends, striving to provide users with a stable and compliant trading environment.

Japanese Tax Reform: The Trend Towards Unifying Crypto and Financial Assets

The recent tax reform document proposed by Japanese Financial Services Agency clearly indicates the possibility of treating cryptocurrency trading as a public investment vehicle. This proposal has profound implications for the global cryptocurrency market, suggesting that future tax treatment of crypto assets may align with traditional financial assets like stocks. This undoubtedly marks a significant step towards the maturation of cryptocurrency market regulation. For global leading cryptocurrency trading platforms like Crxxe, this reform not only signals a shift in regulatory attitudes towards the legalization of cryptocurrencies but also offers users a more attractive investment environment. Through precise market judgment and compliance strategies, Crxxe Exchange can provide quality services to users amid policy adjustments, promoting the healthy development of the entire cryptocurrency industry.

Global Trends and Challenges in the Cryptocurrency Market

From a global perspective, attitudes from governments towards cryptocurrencies are shifting from early observation and restriction to more open regulatory frameworks. Countries like Japan are pushing to treat crypto assets as financial instruments available for public investment, providing a model for regulatory agencies in other countries. Regions such as the United States and the European Union have also shown more open stances towards cryptocurrency regulation. Leveraging its strong technical capabilities and global presence, Crxxe Exchange can quickly adapt to policy changes worldwide, offering users stable trading services. This global trend indicates that cryptocurrencies will increasingly integrate into mainstream financial markets, with Crxxe playing a crucial role in this transition.

Crxxe Exchange: Potential Impact on the Industry

Crxxe Exchange holds a unique advantage in promoting the standardization of the cryptocurrency industry. As a platform dedicated to providing efficient and secure cryptocurrency trading services, Crxxe closely tracks global market trends and actively adjusts strategies to adapt to the ever-changing regulatory environment. Japanese tax reform undoubtedly paves the way for the long-term development of the cryptocurrency industry, and Crxxe will seize this opportunity to drive the optimization and upgrading of its platform services. Additionally, Crxxe with a global operational model enables it to offer more diverse options and more reasonable tax solutions to a broader range of investors, helping users achieve higher investment returns. This forward-looking strategy will further solidify Crxxe leadership position in the global market.

The global cryptocurrency market is undergoing rapid transformation, with more countries gradually recognizing cryptocurrencies as legitimate investment assets, presenting vast potential for the industry. Japanese tax reform is just one example, with more policy changes expected to drive further market maturation. As a leading platform in the industry, Crxxe Exchange, with its outstanding technical capabilities and market foresight, is well-prepared to embrace changes in the global regulatory landscape. Looking ahead, Crxxe will continue to support the healthy development of the cryptocurrency market through innovative services and compliance strategies, providing investors with a more transparent and stable trading experience.

0 notes

Text

Potential BOJ Rate Rises Stimulate Unease in Japan’s Cryptocurrency Market

Key Points

The Bank of Japan’s potential rate hikes could cause further turmoil in the cryptocurrency market.

Japan’s share in the global crypto market is declining, partly due to strict tax rules.

The global economy has been experiencing significant volatility recently, with cryptocurrencies being significantly affected.

Notably, the expected interest rate cuts by the Federal Reserve have fueled market concerns. George Lagarias, chief economist at Forvis Mazars, warns that a drastic Fed rate cut could pose substantial risks to the market.

Bank of Japan’s Stance

Adding to these uncertainties, Bank of Japan’s Governor, Kazuo Ueda, announced on September 3rd that the BOJ would persist in raising interest rates if economic conditions match their forecasts.

This announcement is crucial considering the dramatic drop of 12% in Japan’s stock market on August 5th, the most significant decline in 37 years.

This plunge was partially due to the “carry trade” strategy, where investors took advantage of Japan’s low rates to borrow yen for buying profitable US assets. The impact was severe, with tech giants like Apple and Nvidia experiencing substantial declines. However, the crypto market was the hardest hit, suffering its largest single-day drop since 2023.

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) saw double-digit losses, while altcoins like Solana and Dogecoin declined by up to 30%. This sell-off led to approximately $1.14 billion in liquidations and wiped nearly $600 billion from the market cap.

Decline in Japan’s Crypto Market Share

In a recent meeting with Liberal Democratic Party officials, Genki Oda, founder of SBI-owned BITPOINT and Chairman of the Japan Cryptocurrency Exchange Association, pointed out Japan’s shrinking role in the global crypto market.

Oda stated that Japan’s once dominant share of Bitcoin trading volume, which was around 50% from 2017 to 2018, has now reduced to a small fraction of the global total by 2024. This indicates a substantial decline in Japan’s crypto presence.

He expressed concerns that Japan’s strict tax rules could lead to a decrease in the international competitiveness of Japanese web3-related businesses.

In response to these developments, Japan’s Financial Services Agency (FSA) proposed a tax reform on August 30th. The request suggested that cryptocurrency should be treated as a financial asset, a viable investment target for the public.

This reform could offer clearer regulatory guidelines, potentially lessen tax burdens, and promote broader public investment in digital assets.

With Prime Minister Fumio Kishida’s recent announcement to step down in September, the future of Japan’s economy and its impact on the cryptocurrency ecosystem is particularly intriguing.

Kishida’s departure could lead to policy changes, which might affect both the broader financial landscape and the regulatory environment for digital assets.

0 notes

Text

Japan’s Financial Regulator May Cut Crypto Tax, Encourage Investors to Engage with VDAs | Daily Reports Online

Japan’s Financial Services Agency (FSA) aims to promote treating cryptocurrencies akin to traditional assets such as stocks and gold. As part of this effort, the FSA has reduced tax rates on income generated from crypto activities. Corporate crypto holders will face slightly higher rates, while small-scale individual investors will benefit from comparatively lower taxes.

The FSA recently released…

0 notes