#debt securities

Text

Student Debt

#Student Debt#debt securities#debtsolutions#blood debts#debtsettlement#debts#debt recovery#debt collection#debt relief#student debt#debt#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#fascism#oppression#repression#free all oppressed peoples#oppressor#pedagogy of the oppressed#oppressive#eat the rich

4 notes

·

View notes

Text

How to shatter the class solidarity of the ruling class

I'm touring my new, nationally bestselling novel The Bezzle! Catch me WEDNESDAY (Apr 11) at UCLA, then Chicago (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Audre Lorde counsels us that "The Master's Tools Will Never Dismantle the Master's House," while MLK said "the law cannot make a man love me, but it can restrain him from lynching me." Somewhere between replacing the system and using the system lies a pragmatic – if easily derailed – course.

Lorde is telling us that a rotten system can't be redeemed by using its own chosen reform mechanisms. King's telling us that unless we live, we can't fight – so anything within the system that makes it easier for your comrades to fight on can hasten the end of the system.

Take the problems of journalism. One old model of journalism funding involved wealthy newspaper families profiting handsomely by selling local appliance store owners the right to reach the townspeople who wanted to read sports-scores. These families expressed their patrician love of their town by peeling off some of those profits to pay reporters to sit through municipal council meetings or even travel overseas and get shot at.

In retrospect, this wasn't ever going to be a stable arrangement. It relied on both the inconstant generosity of newspaper barons and the absence of a superior way to show washing-machine ads to people who might want to buy washing machines. Neither of these were good long-term bets. Not only were newspaper barons easily distracted from their sense of patrician duty (especially when their own power was called into question), but there were lots of better ways to connect buyers and sellers lurking in potentia.

All of this was grossly exacerbated by tech monopolies. Tech barons aren't smarter or more evil than newspaper barons, but they have better tools, and so now they take 51 cents out of every ad dollar and 30 cents out of ever subscriber dollar and they refuse to deliver the news to users who explicitly requested it, unless the news company pays them a bribe to "boost" their posts:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

The news is important, and people sign up to make, digest, and discuss the news for many non-economic reasons, which means that the news continues to struggle along, despite all the economic impediments and the vulture capitalists and tech monopolists who fight one another for which one will get to take the biggest bite out of the press. We've got outstanding nonprofit news outlets like Propublica, journalist-owned outlets like 404 Media, and crowdfunded reporters like Molly White (and winner-take-all outlets like the New York Times).

But as Hamilton Nolan points out, "that pot of money…is only large enough to produce a small fraction of the journalism that was being produced in past generations":

https://www.hamiltonnolan.com/p/what-will-replace-advertising-revenue

For Nolan, "public funding of journalism is the only way to fix this…If we accept that journalism is not just a business or a form of entertainment but a public good, then funding it with public money makes perfect sense":

https://www.hamiltonnolan.com/p/public-funding-of-journalism-is-the

Having grown up in Canada – under the CBC – and then lived for a quarter of my life in the UK – under the BBC – I am very enthusiastic about Nolan's solution. There are obvious problems with publicly funded journalism, like the politicization of news coverage:

https://www.theguardian.com/media/2023/jan/24/panel-approving-richard-sharp-as-bbc-chair-included-tory-party-donor

And the transformation of the funding into a cheap political football:

https://www.cbc.ca/news/politics/poilievre-defund-cbc-change-law-1.6810434

But the worst version of those problems is still better than the best version of the private-equity-funded model of news production.

But Nolan notes the emergence of a new form of hedge fund news, one that is awfully promising, and also terribly fraught: Hunterbrook Media, an investigative news outlet owned by short-sellers who pay journalists to research and publish damning reports on companies they hold a short position on:

https://hntrbrk.com/

For those of you who are blissfully distant from the machinations of the financial markets, "short selling" is a wager that a company's stock price will go down. A gambler who takes a short position on a company's stock can make a lot of money if the company stumbles or fails altogether (but if the company does well, the short can suffer literally unlimited losses).

Shorts have historically paid analysts to dig into companies and uncover the sins hidden on their balance-sheets, but as Matt Levine points out, journalists work for a fraction of the price of analysts and are at least as good at uncovering dirt as MBAs are:

https://www.bloomberg.com/opinion/articles/2024-04-02/a-hedge-fund-that-s-also-a-newspaper

What's more, shorts who discover dirt on a company still need to convince journalists to publicize their findings and trigger the sell-off that makes their short position pay off. Shorts who own a muckraking journalistic operation can skip this step: they are the journalists.

There's a way in which this is sheer genius. Well-funded shorts who don't care about the news per se can still be motivated into funding freely available, high-quality investigative journalism about corporate malfeasance (notoriously, one of the least attractive forms of journalism for advertisers). They can pay journalists top dollar – even bid against each other for the most talented journalists – and supply them with all the tools they need to ply their trade. A short won't ever try the kind of bullshit the owners of Vice pulled, paying themselves millions while their journalists lose access to Lexisnexis or the PACER database:

https://pluralistic.net/2024/02/24/anti-posse/#when-you-absolutely-positively-dont-give-a-solitary-single-fuck

The shorts whose journalists are best equipped stand to make the most money. What's not to like?

Well, the issue here is whether the ruling class's sense of solidarity is stronger than its greed. The wealthy have historically oscillated between real solidarity (think of the ultrawealthy lobbying to support bipartisan votes for tax cuts and bailouts) and "war of all against all" (as when wealthy colonizers dragged their countries into WWI after the supply of countries to steal ran out).

After all, the reason companies engage in the scams that shorts reveal is that they are profitable. "Behind every great fortune is a great crime," and that's just great. You don't win the game when you get into heaven, you win it when you get into the Forbes Rich List.

Take monopolies: investors like the upside of backing an upstart company that gobbles up some staid industry's margins – Amazon vs publishing, say, or Uber vs taxis. But while there's a lot of upside in that move, there's also a lot of risk: most companies that set out to "disrupt" an industry sink, taking their investors' capital down with them.

Contrast that with monopolies: backing a company that merges with its rivals and buys every small company that might someday grow large is a sure thing. Shriven of "wasteful competition," a company can lower quality, raise prices, capture its regulators, screw its workers and suppliers and laugh all the way to Davos. A big enough company can ignore the complaints of those workers, customers and regulators. They're not just too big to fail. They're not just too big to jail. They're too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Would-be monopolists are stuck in a high-stakes Prisoner's Dilemma. If they cooperate, they can screw over everyone else and get unimaginably rich. But if one party defects, they can raid the monopolist's margins, short its stock, and snitch to its regulators.

It's true that there's a clear incentive for hedge-fund managers to fund investigative journalism into other hedge-fund managers' portfolio companies. But it would be even more profitable for both of those hedgies to join forces and collude to screw the rest of us over. So long as they mistrust each other, we might see some benefit from that adversarial relationship. But the point of the 0.1% is that there aren't very many of them. The Aspen Institute can rent a hall that will hold an appreciable fraction of that crowd. They buy their private jets and bespoke suits and powdered rhino horn from the same exclusive sellers. Their kids go to the same elite schools. They know each other, and they have every opportunity to get drunk together at a charity ball or a society wedding and cook up a plan to join forces.

This is the problem at the core of "mechanism design" grounded in "rational self-interest." If you try to create a system where people do the right thing because they're selfish assholes, you normalize being a selfish asshole. Eventually, the selfish assholes form a cozy little League of Selfish Assholes and turn on the rest of us.

Appeals to morality don't work on unethical people, but appeals to immorality crowds out ethics. Take the ancient split between "free software" (software that is designed to maximize the freedom of the people who use it) and "open source software" (identical to free software, but promoted as a better way to make robust code through transparency and peer review).

Over the years, open source – an appeal to your own selfish need for better code – triumphed over free software, and its appeal to the ethics of a world of "software freedom." But it turns out that while the difference between "open" and "free" was once mere semantics, it's fully possible to decouple the two. Today, we have lots of "open source": you can see the code that Google, Microsoft, Apple and Facebook uses, and even contribute your labor to it for free. But you can't actually decide how the software you write works, because it all takes a loop through Google, Microsoft, Apple or Facebook's servers, and only those trillion-dollar tech monopolists have the software freedom to determine how those servers work:

https://pluralistic.net/2020/05/04/which-side-are-you-on/#tivoization-and-beyond

That's ruling class solidarity. The Big Tech firms have hidden a myriad of sins beneath their bafflegab and balance-sheets. These (as yet) undiscovered scams constitute a "bezzle," which JK Galbraith defined as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

The purpose of Hunterbrook is to discover and destroy bezzles, hastening the moment of realization that the wealth we all feel in a world of seemingly orderly technology is really an illusion. Hunterbrook certainly has its pick of bezzles to choose from, because we are living in a Golden Age of the Bezzle.

Which is why I titled my new novel The Bezzle. It's a tale of high-tech finance scams, starring my two-fisted forensic accountant Marty Hench, and in this volume, Hench is called upon to unwind a predatory prison-tech scam that victimizes the most vulnerable people in America – our army of prisoners – and their families:

https://us.macmillan.com/books/9781250865878/thebezzle

The scheme I fictionalize in The Bezzle is very real. Prison-tech monopolists like Securus and Viapath bribe prison officials to abolish calls, in-person visits, mail and parcels, then they supply prisoners with "free" tablets where they pay hugely inflated rates to receive mail, speak to their families, and access ebooks, distance education and other electronic media:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

But a group of activists have cornered these high-tech predators, run them to ground and driven them to the brink of extinction, and they've done it using "the master's tools" – with appeals to regulators and the finance sector itself.

Writing for The Appeal, Dana Floberg and Morgan Duckett describe the campaign they waged with Worth Rises to bankrupt the prison-tech sector:

https://theappeal.org/securus-bankruptcy-prison-telecom-industry/

Here's the headline figure: Securus is $1.8 billion in debt, and it has eight months to find a financier or it will go bust. What's more, all the creditors it might reasonably approach have rejected its overtures, and its bonds have been downrated to junk status. It's a dead duck.

Even better is how this happened. Securus's debt problems started with its acquisition, a leveraged buyout by Platinum Equity, who borrowed heavily against the firm and then looted it with bogus "management fees" that meant that the debt continued to grow, despite Securus's $700m in annual revenue from America's prisoners. Platinum was just the last in a long line of PE companies that loaded up Securus with debt and merged it with its competitors, who were also mortgaged to make profits for other private equity funds.

For years, Securus and Platinum were able to service their debt and roll it over when it came due. But after Worth Rises got NYC to pass a law making jail calls free, creditors started to back away from Securus. It's one thing for Securus to charge $18 for a local call from a prison when it's splitting the money with the city jail system. But when that $18 needs to be paid by the city, they're going to demand much lower prices. To make things worse for Securus, prison reformers got similar laws passed in San Francisco and in Connecticut.

Securus tried to outrun its problems by gobbling up one of its major rivals, Icsolutions, but Worth Rises and its coalition convinced regulators at the FCC to block the merger. Securus abandoned the deal:

https://worthrises.org/blogpost/securusmerger

Then, Worth Rises targeted Platinum Equity, going after the pension funds and other investors whose capital Platinum used to keep Securus going. The massive negative press campaign led to eight-figure disinvestments:

https://www.latimes.com/business/story/2019-09-05/la-fi-tom-gores-securus-prison-phone-mass-incarceration

Now, Securus's debt became "distressed," trading at $0.47 on the dollar. A brief, covid-fueled reprieve gave Securus a temporary lifeline, as prisoners' families were barred from in-person visits and had to pay Securus's rates to talk to their incarcerated loved ones. But after lockdown, Securus's troubles picked up right where they left off.

They targeted Platinum's founder, Tom Gores, who papered over his bloody fortune by styling himself as a philanthropist and sports-team owner. After a campaign by Worth Rises and Color of Change, Gores was kicked off the Los Angeles County Museum of Art board. When Gores tried to flip Securus to a SPAC – the same scam Trump pulled with Truth Social – the negative publicity about Securus's unsound morals and financials killed the deal:

https://twitter.com/WorthRises/status/1578034977828384769

Meanwhile, more states and cities are making prisoners' communications free, further worsening Securus's finances:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Congress passed the Martha Wright-Reed Just and Reasonable Communications Act, giving the FCC the power to regulate the price of federal prisoners' communications. Securus's debt prices tumbled further:

https://www.govtrack.us/congress/bills/117/s1541

Securus's debts were coming due: it owes $1.3b in 2024, and hundreds of millions more in 2025. Platinum has promised a $400m cash infusion, but that didn't sway S&P Global, a bond-rating agency that re-rated Securus's bonds as "CCC" (compare with "AAA"). Moody's concurred. Now, Securus is stuck selling junk-bonds:

https://www.govtrack.us/congress/bills/117/s1541

The company's creditors have given Securus an eight-month runway to find a new lender before they force it into bankruptcy. The company's debt is trading at $0.08 on the dollar.

Securus's major competitor is Viapath (prison tech is a duopoly). Viapath is also debt-burdened and desperate, thanks to a parallel campaign by Worth Rises, and has tried all of Securus's tricks, and failed:

https://pestakeholder.org/news/american-securities-fails-to-sell-prison-telecom-company-viapath/

Viapath's debts are due next year, and if Securus tanks, no one in their right mind will give Viapath a dime. They're the walking dead.

Worth Rise's brilliant guerrilla warfare against prison-tech and its private equity backers are a master class in using the master's tools to dismantle the master's house. The finance sector isn't a friend of justice or working people, but sometimes it can be used tactically against financialization itself. To paraphrase MLK, "finance can't make a corporation love you, but it can stop a corporation from destroying you."

Yes, the ruling class finds solidarity at the most unexpected moments, and yes, it's easy for appeals to greed to institutionalize greediness. But whether it's funding unbezzling journalism through short selling, or freeing prisons by brandishing their cooked balance-sheets in the faces of bond-rating agencies, there's a lot of good we can do on the way to dismantling the system.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

Image:

KMJ (modified)

https://commons.wikimedia.org/wiki/File:Boerse_01_KMJ.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#shorts#short sellers#news#private equity#private prisons#securus#prison profiteers#the bezzle#anything that cant go on forever eventually stop#steins law#hamilton nolan#Platinum Equity#American Securities#viapath#global tellink#debt#jpay#worth rises#insurance#spacs#fcc#bond rating#moodys#the appeal#saving the news from big tech#hunterbrook media#journalism

804 notes

·

View notes

Text

3 things to invest your money

3 things to invest your money

Experts believe that money is not properly utilized until it is invested. Many of us need to invest our money so that it can survive every up and down of the market and provide us with good returns. When it comes to money, people desire only safety at the beginning.

So Here are three ways to invest your money so that you can not only earn good returns but also survive economic and market ups…

View On WordPress

0 notes

Text

a moment of silence for our Sunman, a plushie gets more game than he does 😔

Bonus:

#jesus christ this was an ass to edit#i know some panels look shitty i tried my best :"(((#anyways haha wouldn't it be nice if we'd have official merchandise of the daycare attendant that doesn't leave you in debt?? haha#at least i got some knock off sun n moon plushies#and yes i DO sleep with them bc they're very comfortable thank you very much#so more or less self indulgent comic bc i really love plushies#fnaf security breach#fnaf daycare attendant#fnaf superstar daycare#fnaf sun#sundrop#sun x y/n#sundrop x y/n#doodles#Ghost doodles

4K notes

·

View notes

Text

its so weird seeing posts that mock uncle jim for worrying about li ming's queerness as though his dead boyfriend's parents (legally) stealing his entire life savings and leaving him to manage a restaurant business specifically because gay couples aren't legally recognized as couples wasn't what put him in a cycle of crushing debt and endless poverty in the first place

#yeah hi CONTEXT MATTERS#can western fandom pls stop ignoring this shows biting social commentary on queer people not being legally recognized#also heart is the darling of all time BUT his careless lie literally forced li ming to work off a debt that was never his#and wouldve seriously impacted jim's business and financial state had wen not offered to work free#which was a boon but having to live on someone elses generosity like that is still a stress#because people (understandably!!!!) can and do get tired of giving away a lot of time and energy for nothing#wen is uncommonly generous and luckily its not too long before other circumstances help lift jim to safer footing#but none of that was SECURE getting to that point#jim is right to worry! it comes out badly and li ming's queerness is not the actual issue but jims reasoning is EXTREMELY UNDERSTANDABLE#sighs#moonlight chicken

368 notes

·

View notes

Photo

f*ck

#never gonna pay that college debt now#would rather be put in timeout#security and staff au#fnaf sun#fnaf moon#staff-san#fnaf security breach#fnaf daycare attendant#fnaf staff#security breach daycare attendant#security breach#sundrop#moondrop#art of bunmuffin

2K notes

·

View notes

Video

undefined

tumblr

Social Security and Medicare and debt

Manufacturing consent

#tiktok#Manufacturing Consent#Social Security#Medicare#privatisation#medicare for all#public education#debt#us government#government#government and politics#defunding#defund#profits

905 notes

·

View notes

Text

so i'm leaning toward briala-celene [ugh] or public truce*. but i wanted to know ...

*I've been reading posts/articles that state that public truce isn't best long run ... but it isn't like the inquisitor would KNOW that.

#dai spoilers#for my mooties that wanna play but havent yet#dragon age#grapecase plays dai#wicked eyes and wicked hearts#aka wicked headache and wicked annoyance#grapecase polls#dai poll#grapecase complains#lmao#i feel these posts dont give briala enough credit#unless im missing something#idk that working with gaspard would long run [or even short term] be better for her and the elves than working for/with celene#[i feel it would be with but a lot of people seem to believe it will be for]#yes celene is dismissive when you show her the [REDACTED] but she KEPT it#the dismissiveness matters sure - bc the type of masks matter - but the fact that she secured it matters as much if not more#and what celene did was heinous but let's not act like gaspard wouldnt be as bad if not worse#i feel briala would be smart with both [but with celene i feel she wouldnt let sentimentaility get her as much as people think she would]#and off chance she did - doubting it - her people would be smarter. i feel they'd be on higher alert with celene#now it is a matter of what power they could milk#and okay i do think immediately she could probably twist gaspard's arms harder bc of the blackmail and celene is still worried of coming of#too soft maybe?#but i think celene is smarter - or should be at keepiing balances. like she owes briala more than a debt. and i can see briala carefully mi#king that. i can see both of them slowly building things right under the nobles noses#idk maybe im being idealistic#i do think celene would try and do better in general and for the elves alone#but idk i nee dto finish to play and see#im mostly measuring this off vibes

37 notes

·

View notes

Text

PLEASE 😂

Some comments on my post because I dared to point out MDZS is third person omniscient and anyone calling WWX an unreliable narrator is stupid... Sorry, did I hit a nerve?

Apparently, according to JC stans, by actually reading the novel as intended and coming to the logical conclusion that WWX is morally good and even meant to be the moral ideal of the story (which MXTX has stated herself...) we are just doing the same as said JC stans...

Firstly, we don't "excuse" the things WWX did because most of them are actually completely justified and only morons would argue otherwise (he was in a war, revenge was expected and if he didn't it would be considered dishonourable and JZX was a fucking accident during an ambush to kill him ffs 🤣) he did admit he went too far during the war and he resolved to never do that again. That's the fucking point. He's one of the few characters who actually understands he did make a mistake and he owns it!!! He doesn't do it again, he learns from his mistake and moves on. He literally saved the assholes who came to murder him in his first life! Lmfao. We're not saying he's never done anything wrong ,you absolute melons.

But...BUT!!!! The most HILARIOUS thing about those comments are they basically admitted JC stans excuse his shitty behaviour and toxic attitude lmfao!!! Well done 👏 that's progress 🤣

#mdzs#mo dao zu shi#wei wuxian#mdzs novel#wwxs killings were all justified#unlike jcs#who murders innocent people because they are ghost cultivators#who brought a siege to the burial mounds knowing it was just full of weak old people and a toddler#who tried to kill wn when he saved him... secured his precious family heirloom and brought hos parents ashes for him#jc has a life debt to the wen siblings and ignores it like the dishonourable ass he is#there's a difference#🙄

32 notes

·

View notes

Text

Former President Trump ran up the national debt by about twice as much as President Biden, according to a new analysis of their fiscal track records.

WHY IT MATTERS: The winner of November's election faces a gloomy fiscal outlook, with rapidly rising debt levels at a time when interest rates are already high and demographic pressure on retirement programs is rising.

• Both candidates bear a share of the responsibility, as each added trillions to that tally while in office.

• But Trump's contribution was significantly higher, according to the fiscal watchdogs at the Committee for a Responsible Federal Budget, thanks to both tax cuts and spending deals struck in his four years in the White House.

BY THE NUMBERS: Trump added $8.4 trillion in borrowing over a ten-year window, CRFB finds in a report out this morning.

• Biden's figure clocks in at $4.3 trillion with seven months remaining in his term.

• If you exclude COVID relief spending from the tally, the numbers are $4.8 trillion for Trump and $2.2 trillion for Biden.

STATE OF PLAY: For Trump, the biggest non-COVID drivers of higher public debt were his signature tax cuts enacted in 2017 (causing $1.9 trillion in additional borrowing) and bipartisan spending packages (which added $2.1 trillion).

• For Biden, major non-COVID factors include 2022 and 2023 spending bills ($1.4 trillion), student debt relief ($620 billion), and legislation to support health care for veterans ($520 billion).

• Biden deficits have also swelled, according to CRFB's analysis, due to executive actions that changed the way food stamp benefits are calculated, expanding Medicaid benefits, and other changes that total $548 billion.

BETWEEN THE LINES: Deficit politics may return to the forefront of U.S. policy debates next year.

• Much of Trump's tax law is set to expire at the end of 2025, and the CBO has estimated that fully extending it would increase deficits by $4.6 trillion over the next decade.

• High interest rates make the taxpayer burden of both existing and new debt higher than it was during the era of near-zero interest rates.

• And the Social Security trust fund is rapidly hurtling toward depletion in 2033, which would trigger huge cuts in the retirement benefits absent Congressional action.

WHAT THEY'RE SAYING: "The next president will face huge fiscal challenges," CRFB president Maya MacGuineas tells Axios.

• "Yet both candidates have track records of approving trillions in new borrowing even setting aside the justified borrowing for COVID, and neither has proposed a comprehensive and credible plan to get the debt under control," she said.

• "No president is fully responsible for the fiscal challenges that come along, but they need to use the bully pulpit to set the stage for making some hard choices," MacGuineas said.

#us politics#news#republicans#conservatives#donald trump#gop#trump administration#2024#biden administration#president joe biden#national debt#Committee for a Responsible Federal Budget#public debt#debt#interest rates#Social Security#deficits#Maya MacGuineas#Axios

30 notes

·

View notes

Text

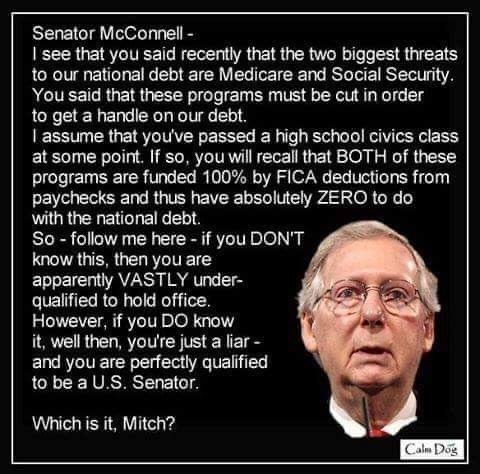

Thoughts?

#social security#politics#politicians#democrats#republicans#conservatives#liberals#economy#economics#retirement#retirement checks#retire#national debt#government#united states government#United States#USA#America#assets#reality#current events#retirement calculator#scam#scamming#pension#labor#retirement age#employers#employment#employees

22 notes

·

View notes

Text

We do not want this. This is not a decision being made on behalf of the American people. Literally, no one wants this, and we're being forced to pay for it. Our tax dollars funding genocide. I feel sick. I don't think any amount of protests on any scale will change anything because clearly, this is a nefarious and corrupt government decision, likely fueled by greed. It wasn't made with American citizens in mind, so I'm not sure how we can stop it.

#free palestine#we're still dealing with inflation#we're in a housing crisis#they won't forgive all student loan debt#they won't make university free or affordable#won't consider universal health care or#universal basic income#or reparations for Black Americans#and our social security and entitlement programs are always in danger#ALL because of what they claim we can't afford#yet we KEEP giving BILLIONS to other countries#at least it was understandable when it was actual aid#but this is literally for weapons to murder innocent people

44 notes

·

View notes

Text

Rarely do I quote Republicans for political insights, but this video of Ronald Reagan telling the truth about how Social Security doesn’t contribute to the deficit was too great to pass up. And Mitch McConnell and Republicans know Social Security doesn’t contribute to the deficit, but that won’t stop them from pushing their big lie anyway.

And lest you think that Ronald Reagan even momentarily did something good, always remember that Reagan was the first one to tax Social Security in order to pay for his tax cuts to the rich.

The only time Republicans pretend to care about the federal deficit is when there’s a Democratic President in the White House.

Peep the decades-long okie doke:

1) Republicans run up the deficit by passing giant tax cuts for millionaires and billionaires

2) and then they say that to reduce the deficit, which remember, they just caused, we need austerity cuts to the social safety net: Social Security, Medicare and Medicaid. In other words, poor people need to go without, experience some belt tightening & austerity to pay for rich people living lavishly. It’s class warfare. It’s inflicting austerity on the poor to pay for the transfer of wealth (theft) to the rich.

Conservatives venomously refer to these social programs “entitlements” as if they’re charity or handouts or something, but you earned every penny of that money—you literally have the money (taxes) taken out of your paychecks over the years. That is YOUR money.

And the deficit? That’s money that’s already been spent. It’s not money Congress is trying to decide how to appropriate in the future—IT’S MONEY THAT HAS ALREADY BEEN SPENT. So when Republicans threaten to not pay the debt, you might be surprised to know that they’re basically saying America shouldn’t pay its bills. Or maybe you wouldn’t be surprised.

The bottom line is this: Republicans run up the deficit, and Dems lower deficits.

But here’s the real kicker - deficits aren’t nearly as important as Republicans make them out to be. It’s a bit more complicated than a few sentences, but if deficits were truly as catastrophic as Republicans say, then they wouldn’t keep running up the debt every time they’re in control of Congress.

Not that I’m completely against running up a deficit. Especially if it’s used on things like Medicare For All, or universal education.

#politics#ronald reagan#social security#mitch mcconnell#republicans#debt ceiling#national debt#deficit hawks#economics#deficit#austerity

89 notes

·

View notes

Text

Haha my bad, I have $30 for the rest of the month. 8)

#for real you don't know how bad it is living on social security#and at this time I don't even have the skills to apply for part time work#which I will be immediately rejected for because algorithms hate disabled people#not that I can do the heavy lifting or man the cash register that is the bare bones requirement of entry level work#boy this BA in special education and most of an MA sure were worth the time huh?#anyway let me know how you're surviving on $950 a month if you're about to say I'm just bad at money#you have to have money to be bad at it first 8)#razz rambles#trying to pay down $2.5k credit debt when you have to keep using your credit card to live really sucks

8 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

31 notes

·

View notes

Text

Sen. Mitch McConnell says Medicare, Social Security must change to fix U.S. debt

Social Security and the Federal Deficit

8 notes

·

View notes