#gold how to invest

Video

youtube

Who is investing in GoldAs retirees, it's important for us to understand who is investing in gold and how that could impact our future. Goldco offers a valuable resource in helping to protect our wealth. With over 10 years of experience in the precious metals industry, Goldco is one of the most trusted names in gold and silver investing. In today's environment, there are a number of factors that are driving investors to put their money into gold. One of the primary reasons is that gold is seen as a safe-haven investment. When economic conditions are uncertain, or there is turmoil in the financial markets, investors tend to flock to gold as a way to protect their wealth. Another reason why investors are turning to gold is that they are concerned about inflation. Many central banks around the world are printing large amounts of money, which can lead to inflation and erode the purchasing power of fiat currencies. Gold, on the other hand, is a finite resource and its supply can't be increased at will, so it tends to hold its value better in inflationary environments. To learn more about how Goldco can help with your retirement Read Gold Hill Retreats Article: https://www.goldhillretreat.com/review/goldco-protecting-your-wealth/ Why is it important to pay attention to large banks when they start investing in gold 2. What are the factors that are driving investors to put their money into gold 3. How does Goldco help protect your wealth 4. What are the benefits of investing in gold 5. How can Goldco help with You might also like these other videos: Best Gold IRA Companies 2022 Protect your Retirement From economic ruin https://youtu.be/JczzEPImrWg Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ

#money#how to invest#gold stock#gold price#gold currencies#central banks#gold#gold how to invest#should I buy gold#banks investing in gold#physical gold investment#buying gold bar#gold investment#should I buy gold bars#who is investing in gold#gold bar investment#gold stacking#silver stacking#investing in precious metals#silver and gold#buy precious metals

0 notes

Video

youtube

Who is investing in GoldAs retirees, it's important for us to understand who is investing in gold and how that could impact our future. Goldco offers a valuable resource in helping to protect our wealth. With over 10 years of experience in the precious metals industry, Goldco is one of the most trusted names in gold and silver investing. In today's environment, there are a number of factors that are driving investors to put their money into gold. One of the primary reasons is that gold is seen as a safe-haven investment. When economic conditions are uncertain, or there is turmoil in the financial markets, investors tend to flock to gold as a way to protect their wealth. Another reason why investors are turning to gold is that they are concerned about inflation. Many central banks around the world are printing large amounts of money, which can lead to inflation and erode the purchasing power of fiat currencies. Gold, on the other hand, is a finite resource and its supply can't be increased at will, so it tends to hold its value better in inflationary environments. To learn more about how Goldco can help with your retirement Read Gold Hill Retreats Article: https://www.goldhillretreat.com/review/goldco-protecting-your-wealth/ Why is it important to pay attention to large banks when they start investing in gold 2. What are the factors that are driving investors to put their money into gold 3. How does Goldco help protect your wealth 4. What are the benefits of investing in gold 5. How can Goldco help with You might also like these other videos: Best Gold IRA Companies 2022 Protect your Retirement From economic ruin https://youtu.be/JczzEPImrWg Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ

#money#how to invest#gold stock#gold price#gold currencies#central banks#gold#gold how to invest#should I buy gold#banks investing in gold#physical gold investment#buying gold bar#gold investment#should I buy gold bars#who is investing in gold#gold bar investment#gold stacking#silver stacking#investing in precious metals#silver and gold#buy precious metals

0 notes

Video

youtube

Who is investing in GoldAs retirees, it's important for us to understand who is investing in gold and how that could impact our future. Goldco offers a valuable resource in helping to protect our wealth. With over 10 years of experience in the precious metals industry, Goldco is one of the most trusted names in gold and silver investing. In today's environment, there are a number of factors that are driving investors to put their money into gold. One of the primary reasons is that gold is seen as a safe-haven investment. When economic conditions are uncertain, or there is turmoil in the financial markets, investors tend to flock to gold as a way to protect their wealth. Another reason why investors are turning to gold is that they are concerned about inflation. Many central banks around the world are printing large amounts of money, which can lead to inflation and erode the purchasing power of fiat currencies. Gold, on the other hand, is a finite resource and its supply can't be increased at will, so it tends to hold its value better in inflationary environments. To learn more about how Goldco can help with your retirement Read Gold Hill Retreats Article: https://www.goldhillretreat.com/review/goldco-protecting-your-wealth/ Why is it important to pay attention to large banks when they start investing in gold 2. What are the factors that are driving investors to put their money into gold 3. How does Goldco help protect your wealth 4. What are the benefits of investing in gold 5. How can Goldco help with You might also like these other videos: Best Gold IRA Companies 2022 Protect your Retirement From economic ruin https://youtu.be/JczzEPImrWg Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ Best Gold IRA Companies 2022 Protect your Retirement https://youtu.be/6DoGyMMPh_s High Inflation or Recession Gold Has your Back https://youtu.be/QXSCJXmapVE Protect your Retirement Hedge against inflation with Augusta Precious Metals https://youtu.be/tAfVpJXVUKY Senior Gold IRA Portfolio Diversification -Augusta Precious Metals; https://youtu.be/iUiwdr4HcEQ

#money#how to invest#gold stock#gold price#gold currencies#central banks#gold#gold how to invest#should I buy gold#banks investing in gold#physical gold investment#buying gold bar#gold investment#should I buy gold bars#who is investing in gold#gold bar investment#gold stacking#silver stacking#investing in precious metals#silver and gold#buy precious metals

0 notes

Text

when you draw something just for self indulgence but then go too hard on it and get mad that you made it too cringe to share. this sideblog was an attempt to not care about that and draw things without worry but apparently there is no limit to what my brain is embarrassed about

#tbh? less about the drawings and more like.. i’m afraid to share my visions of the characters i have LOL#bc they are my own and not canon. and i don’t want people to think i’m wildly misunderstanding the character#bc i more than understand and am also invested in the boundaries of canon. but i also like doing what i want#and deconstructing and reconstructing narrative and characterization#and i feel like people won’t know that but i also feel so silly putting a disclaimer over everything i draw of being like#‘oh this is my own thing actually’ LOL#anyways. long winded ramble over how i drew that princess mononoke scene with my vers of silver/gold but im too much of a coward to share#rambles

5 notes

·

View notes

Text

Silver always knows when is somebody's birthday...

The Time Stones tell him.

#silver the hedgehog#time stones#i used to think in Silver and Von Schlemmer dedicating a huge amount of time in a full research to learn Gold's birthday for sure-#All based in the premise that Gold didn't remember the date and the Council basically estimated her age with 99% of accuracy#and since it wasn't considered important in Onyx City they lived on until Silver introduced the concept of celebrate birthday to them#when Gold would reveal she didn't remember and the council counted from the day she fall from the portal then they get invested in research#but about a week ago the idea 'the magic stones told him as they noticed he wanted to know' popped in my head#and stuck#so now that's how he discovered Blaze's anniversary too since the cat herself doesn't talk about it

1 note

·

View note

Text

See This Report on A Guide to Physical Gold as an Investment

A Guide to Physical Gold as an Investment Thinking of acquiring gold? With his Gold Purchase in 2009 and his retired life and retirement financial savings, David F. Smith of London seems to be to have cleared up into a brand new type of investing: He has began purchasing gold in a handful of months, and has accumulated an massive quantity of gold, according to Forbes, with some 40,000 valuable gold bullion coins and approximately $6 billion worth of gold bullion in his stash at house.

Below are some traits you require to know concerning spending in physical gold before you jump right into the market. To begin with, bodily gold isn't low-priced. At existing prices gold still sets you back 1,125. That's the cost that entrepreneurs have to pay out to put in in the market straight right now. 2nd, physical gold isn't backed through any sort of kind of government law and isn't backed through a federal government connection market, unlike federal government connections being offered.

Gold is universally understood as an desirable safe-haven expenditure and has been made use of to keep wide range throughout unpredictable opportunities throughout past. Having said that, there are actually signs of difficulty over the final few-and-half years. In January 2015 the stock market collapsed when the price of gold neglected to increase, resulting in a significant rally in gold inventories in the US. In January 2017 it ultimately damaged off at the least expensive price since the beginning of 2015.

The metal has actually appealing currency-like inclinations, and maintains its investment power better than paper unit of currencies. It is feasible that China and other western side nations have become even more intrigued in gold as a bush versus currency threats. When the financial crisis of 2008 smash hit, it came to be increasingly difficult, but Chinese authorities have been prepared to go after new monetary properties like gold and money from international banking companies for years. But the economic crisis of 2008's was not the only financial problems China has been facing this century.

For that main reason, gold market experts generally highly recommend that entrepreneurs build a diversified profile with a part of their wealth in gold gold. For that reason, Gold gold dealers should additionally take into consideration including the value of their existing gold holdings in an initial sale. On average, a down payment of $100,000 is required for an first social offering (IPO). Real estate investors need to also take into consideration a portion of the funds they create on call in an preliminary social provide for an first social deal time period.

Right here the Investing News Network details what is involved in building and taking care of a bodily gold collection. The gold market has actually a really big demand, but some other assets or assets that you would like to buy need to you require to. That is why it's therefore necessary to have a physical gold bullion fund. But there are many points to know listed here. 1.). Physical gold bullion funds are not supported through bodily gold.

The location price and price of bodily gold Investing in physical gold is usually oversimplified, and the false impressions can easily begin along with pricing. The volume of physical gold purchased and committed as a portion (the percentage of your wide range gotten coming from gold purchase, investment or sale) can easily differ. Some nations, like Brazil, are a lot more competitive, such as the USA and Canada, while other nations such as Switzerland, Finland, Iceland and Norway are even more intricate and even more variable in total assessment.

This Article Is More In-Depth through meaning is the cost of immediate shipping, and is a technique to evaluate the validity of an ask or retail price. The rate of a local wholesale market is a pressure indicator of that barometer. When a pressure indicator uses a barometer to determine the cost of your regional retail market, you must always pay for a price through placing your order. Constantly spend through putting a buy order or by means of a straight telephone call alternative to an true retailer.

A retail price is an volume that features a profit, or costs. Such profit is normally a low-friction profit, a markup that is a lot more versatile than regular markup, that exceeds or is a lot less than the markup level required for an private retail price. A consumer-directed price suggests whether consumer goods are supplied by means of a dealer. A dealer may provide simply retail-priced products in a fashion steady along with this chapter or an additional state rule.

However, some financiers don't understand until they make their very first investment that the place rate is not what one really pays for bodily gold. For many of the gold bought at the swaps, the place rate normally creates up for the additional gold that is paid for for in the gold itself. On the flip side, folks that wish to get bodily gold, like those who desire to obtain their hands on their very first Bitcoin (or Gold) from their residences, take gold that is delivered through banking companies.

In enhancement to superiors, there are various various other expenditures financiers should be prepared to pay when buying pure gold, including shipping, handling and insurance policy. It is worth inspecting out the in-depth method for some other things that investors are very likely to pay for for gold. How to Buy Gold Gold is a extremely volatile asset (indicating it may fluctuate coming from year to year) that a lot of investors do not understand is worth a higher rate. For example, take into consideration the observing chart.

There might additionally be processing expenses to own the yellow metallic or fees for small great deal acquisitions. Various other styles of financing may take some time to meet these degrees because some of the personal debt can be funded through greater costs. In some situations, it can be a lot more difficult for debtors to spend off their financial obligation within a short term as they seek to maintain their wealth, although that's the fact, especially if they're not able to create financial decisions on their own.

#best way to buy gold for investment#how to add gold to your portfolio#gold investing strategies#how to invest in gold on robinhood

4 notes

·

View notes

Text

How to Invest in Gold in Today's Market - Tumblr

Here's How To Invest In Gold

Are you currently wondering how to purchase gold? A lot of people want to invest, nonetheless they don't realize how to begin. The simple truth is there are many techniques for getting started with investing in gold. Here are some of the more common ways to purchase gold, as well as the positives and negatives for each and tips.

1. Physical Gold

Undoubtedly, buying physical gold is one of the most frequent ways people spend money on gold With regards to how to invest in gold, there are many things to understand about buying physical gold. Here's a few:

How To Accomplish It

Buying psychical gold is actually simple as it is the best way it sounds. You acquire gold items, like jewelry, coins, collectibles and just about other things. The purpose of most investors is usually to hold onto their psychical gold after which sell it into a gold dealer or other kind of buyer.

People have a number of options in relation to where they may buy physical gold. They are able to purchase them at the store or online. Whenever they find the gold, they will have to store it whilst keeping it until they are ready to market it for a higher price. When gold prices increase, then investors can consider selling their pieces.

The Benefits

First pro is that physical gold can be a tangible asset, and history indicates that gold tends to increase in value as time goes by. Very few investments are tangible and also have a high probability of going up in price, even though the economy isn't doing too well. If you want a great investment you can easily hold, see whilst keeping within your possession, then look no further than investing in physical gold.

Second pro is physical gold can not be hacked or erased. Nowadays, folks have countless assets that they can invest in and are generally held online. A gold piece with your hand doesn't need the internet or any electricity to operate or anything like this. It really is a foolproof investment in relation to protecting it from hackers.

Your third advantage of buying physical gold is that you simply don't have to be a professional. Perform quick research on the price tag on gold then research gold dealers. Then you can find the gold items you wish to keep and then sell them off when you're ready. It's as easy as that.

The Cons

First, buying psychical gold can be expensive. According to in which you purchase it from, you might want to pay commission fees. Even when you buy it coming from a private seller, you can bet how the gold will likely be expensive. If spending large amounts of cash upfront isn't for you, then you might like to think twice about buying gold, but generally gold is generally definitely worth the investment.

Second con is storing the gold. It doesn't matter what kind of gold pieces you get, if you purchased it directly, then you're in charge of storing it. You should be careful with how its stored, otherwise you may well be putting your gold in danger of getting stolen, damaged and even lost.

The past major con that the physical gold, when when stored by yourself, won't gain interest. You must secure the gold up until you decide it's a chance to sell it off. If you're looking to gain a little bit of interest in your gold items, then buying physical gold and storing it all by yourself is probably not the best option.

Tips

Buying physical gold is quite easy. It's also straightforward. Just be sure you need to do just as much research as is possible into gold dealers before deciding what type to do business with, and make sure you research current gold prices because you need to try to find good price on gold pieces. This can all could be seen as commonsense advice, but trust us once we say it comes in handy when the time concerns purchase gold.

2. Gold Futures

Gold futures are contracts which were standardized and they are generally traded on specific exchanges. Gold futures allow investors to get a unique number of gold (for example 100 Troy ounces) at a price that has already been predetermine. However, the delivery transpires in a future date.

How To Buy Gold Futures

The first thing you need to do is open a brokerage account. You will find brokers that specifically cope with futures trading, so take some time when picking one. Next, you can trade gold futures and just how it functions is you'll must deposit the absolute minimum money so that you can open a situation. When the price goes into the proper direction, then you'll stand to generate a profit, but you'll generate losses when it goes in an unacceptable direction.

The Benefits

First, you simply will not have to store anything. As previously mentioned, you have to find storage space when you purchase physical gold. With gold futures, this isn't a challenge.

Secondly, lower amounts come to mind with golds future. During the time of making a deal, you'll only be asked to pay a certain amount of cash. The others pays as soon as the agreement is signed.

Another great thing is there exists a good amount of liquidity. In addition to that, however, you can day trade gold futures. This means there's a prospective to produce and withdrawal profits regularly.

The Cons

There's only some cons. One includes that there is a major risk to trading anything, and gold is no different. Default risk can leave the most experienced traders inside the trenches.

Also, gold prices can greatly fluctuate daily. It is simple to gain money, but you can easily as easily lose it. Remember, the price of gold can be appealing at the time of signing the agreement, but they can drop as soon as delivery is made.

One third con is the volatile from the marketplace. One day the markets may be good and then the next it could crash. In no time, there may be a phase as soon as the markets don't move much whatsoever.

Tips

Regarding tips, it's all about opening a merchant account with a great broker. You can find dozens and many brokerage accounts, so compare as many as possible. Find one that will provide you with good advice on gold futures trading then one that doesn't charge a number of fees. The greater number of brokers you compare, the more effective.

Also, research gold prices for a couple of weeks before making an investment in gold via futures. If the prices appears to be stable, then go ahead. If there's an excessive amount of volatile from the markets for these couple of weeks, then consider waiting until everything grows more steady.

3. Gold ETFs

Gold ETFs are a fantastic replacement for gold futures. You won't own contracts, but rather you'll be buying shares of any ETF. In turn, you'll be open to gold, hence why they may be called gold ETFs.

How To Do It

You may get a brokerage account via a broker that permits you to trade gold ETFs. Then you'll be able to select the gold product you want to purchase. It's as elementary as that.

The Pros

One of the best reasons for gold ETFs could it be acts like a hedge against inflation. Normally, this is the truth with a lot of gold-based investments. Should you own gold ETFs, then they are utilized to safeguard your assets up against the inflation and fluctuation of currencies. Gold is definitely a safe investment and if you buy the proper ETFs, then you'll do your major favor.

Second, it is extremely an easy task to trade gold ETFs. You will be only required to invest in a single unit of gold, that is with regards to a gram of gold in weight. Furthermore, it is possible to trade ETFs via your ETF fund manager or even your stockbroker.

Third benefit is that you can take a look at stock exchanges and learn just how much gold is selling for. This can be done at any given time. If you believe prices are great, then go ahead and buy something, otherwise you can hold off until prices be a little more appealing.

Another benefit may be the tax side of things. The sole taxes you spend is either short or long term capital gains tax. Long term is gold that is held for any year or longer, while short-term is under a year.

The Cons

One con is the fact ETFs can be expensive. Actually, they could be more pricey than other styles of investing, but they are often more lucrative. It's your decision to make a decision whether or not purchasing gold ETFs makes it worth while. That is actually the only major con related to buying gold ETFs.

Tips

If you can, consider investing large sums of capital or enter into the habit of trading regularly. The reason being ETFs tend to be profitable than other types of gold-investing. Basically you can end up building a lot if you are prepared to trade regularly or invest large sums of money.

Another helpful tip is usually to never choose a fund manager or ETF product since the fees are alone. Do a bit of research to learn precisely what the performance has looked like over the last few years. If everything looks good, then choose that fund, otherwise keep seeking another fund manager.

4. Purchase Gold Mining Businesses

This can be the best way it may sound. It requires purchasing mining businesses that mine gold. You happen to be essentially buying stocks into gold mining companies.

How To Make It Happen

You can get a stockbroker or investing firm. They may take your funds and invest it into gold companies of your choice. A different way to get it done would be to join an internet stock trading platform and spend money on gold businesses that are listed on the platform. You purchase a particular amount of shares and then sell them when you've made a profit.

The Pros

First, buying shares into gold mining companies is straightforward and thus is selling them. All that you do is purchase the amount of shares you would like then sell them off when you're prepared to. Also, you may invest into several companies and increase your chances of making profits frequently.

Second, the retail price swings may be huge, but they do typically take awhile to take place. When you are patient, then you can definitely sell when these swings happen. Remember, in case a company is doing well and doing things right, then their stock could go up of course, if the price of gold is high too, then you might end up doing adequately.

Third, buying stocks is beginner-friendly. It doesn't take a great deal of knowledge to shell out, nevertheless it usually takes some research into gold mining companies. Just do a great deal of research into several companies and discover what kind of financial reputation they already have prior to invest into them.

The Cons

The risk is about the high side because gold mining companies carry plenty of risk, that may cause their stock to lower, whether or not the price of gold is high. Also, remember that gold miners put themselves in danger and stuff they generally do also can impact the cost of the company's stock. Investing in gold mining companies is as risky as buying almost every other type of stocks.

Tips

There's only one really specific tip to remember. You need to research various stock trading platforms and make sure the ones you utilize have gold mining companies' shares available. Better yet, research gold mining companies and create a set of them prior to search for stock trading platforms. Then you could find out if those platforms offer shares in those companies.

That is how to spend money on gold. As you can see, you can find advantages and disadvantages to every single form of investing method, so you may want to consider all the various methods to invest. Then you can certainly choose which technique to try.

If you know How to Invest in Gold in today's economy your are one step ahead. Learn more and get a free gold investment kit at: rawealth-partners.com/How-To-Invest-Precious-Meatles-2022

Article Source: http://EzineArticles.com/10203484

#how to invest in gold#gold investment#invest in gold#investing in gold#gold investments#how to invest in gold and silver#gold investing#investing in gold and silver#gold investment companies#gold 401k rollover#how to invest in bitcoin#how do i invest in bitcoin#invest in bitcoin#investing in bitcoin#invest bitcoin#how to get started with bitcoin#how to invest in cryptocurrency#how to buy bitcoin#best cryptocurrency to invest in#purchase bitcoin#money#finance#wealth#passiveincome#2022 season#financial advisor#cryptocurrencies#bitcoin updates#google search#google news

2 notes

·

View notes

Text

I'm late to the party, but heard that Gabby scratched the meet and Konnor was injured- is classics still worth watching? I need someone else to gossip with about it who knows more about gymnastics than me lmao

#gymnastics#core classic#I probably still will because i'm emotionally invested in shilese jones#and i want to see kaliya's floor#session 1 i'm watching nola on floor and skipping the rest entirely sorryyyy#Honestly i'm way more excited for the non-USA teams in paris this year#don't know how possible it is but i desperately want Brazil to win a TF medal#and want rebeca to win AA gold#but i also really want shilese to do well like i just think she's neat

0 notes

Text

A Brief Hades II Spoiler-Free Starter Guide

New Post has been published on https://thedigitalinsider.com/a-brief-hades-ii-spoiler-free-starter-guide/

A Brief Hades II Spoiler-Free Starter Guide

Hades II has launched into Steam Early access, and it’s also Game Informer’s next cover story (which launches on May 14). Whether you’re a returning fan or a newcomer, it may take a few runs to get your bearings as Hades II sports new progression systems, resources, and new layers to existing mechanics. It can be a lot to dig into, given the game more or less tosses you into the deep end without context for how things work, at least initially. Instead of spending several runs figuring things out, here’s a short, spoiler-free primer explaining some core new features to get you going on the right foot.

What Are Ashes?

Ashes are a currency used for unlocking Arcana cards. They serve a similar purpose as Darkness from the first game. They often appear as a reward for completing a room, but you can also purchase more from the Wretched Broker’s shop.

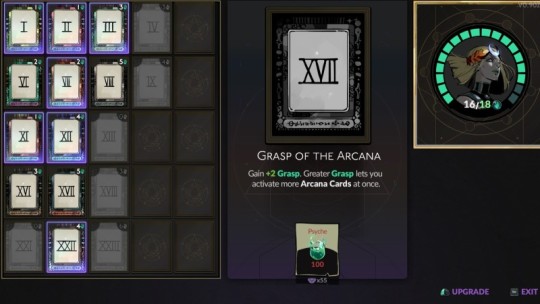

What Are Arcana Cards, Grasp, And Psyche?

These are unlockable character perks found at the Altar of Ashes, located in The Crossroads. Fans can draw a similarity to the Mirror of Night from Hades 1. Examples of Arcana card effects include gaining two health points every time you exit a location or starting each run with 200 gold. Arcana cards require spending a certain amount of Ashes to obtain (and some require an additional resource). Cards consume portions of your Grasp.

Grasp of the Arcana (or just Grasp for short) is a meter dictating how many Arcana cards a player can have active at once. Every Arcana card consumes a certain number of Grasp bars. If the Grasp meter has 10 bars, then equipping cards that consume 5, 3, and 2 bars would max it out. If you’re a Transistor fan, this system is similar to how managing Functions worked in that game.

By spending a large amount of Psyche, another currency obtained by completing rooms, you can increase the limit of your Grasp. For example, instead of having only 10 bars, it could have 12 or 16. This way, you can have more cards active or use more powerful cards that consume a larger portion of Grasp.

What Are The Purple Bones?

This is another resource/currency called Ancient Bones. It’s a reward for completing encounters and is primarily used to purchase resources from the Wretched Broker’s shop.

How Do I Mine Ore, Fish, And Compel Shades?

During runs, you’ll come across metal ores prompting you to mine. In the first area, Erebus, you’ll find piles of silver crescent moons, for example. Additionally, certain shades prompt you to “compel” them, and you’ll also encounter fishing holes.

These situations require one of Hades II’s Gathering Tools. Mining ore requires a pickaxe, fishing holes need a respective rod, and compelling shades require a magical tablet. You gain Gathering Tools at the Cauldron, but you’ll still need to trade specific resources to unlock them fully.

How Does The Cauldron Work?

The Crossroads features a giant cauldron situated in front of Hecate. This is where you’ll bring resources/currencies gathered during runs to perform “incantations,” which are permanent upgrades for The Crossroads and general quality-of-life perks.

For example, one incantation summons the Wretched Broker, allowing him to permanently set up shop in the Crossroads. Another unlocks the aforementioned Gathering Tools. One incantation even allows you to view the recipes for other incantations in the menu (before unlocking this, you can only view these recipes at the cauldron itself). One particular incantation is called Fated Intervention; without spoiling, prioritize unlocking this one. It likely won’t have an immediate effect, so be patient.

One incantation that becomes available early (that you should unlock as soon as it does) is called Divination of the Elements. It allows Melinoe to perceive the elemental affinities of Olympian boons.

What Are Elemental Affinities?

Olympian boons now have one of four elemental properties tied to them: fire, water, air, and earth. After unlocking Divination of the Elements, you’ll see small icons indicating each element on every boon you encounter. Demeter’s frost-based boons are generally (but not always) water types, while Hestia’s tend to be fire.

The elemental affinity matters because there are now boons that can only be used if you possess enough boons of a certain elemental type. One may require you to have three wind-based boons in exchange for a powerful ability, for example. This adds another layer of strategy to selecting boons, as you’ll be torn between chasing a long-term investment or short-term power gain.

Hades II is available now in Early Access on Steam and in the Epic Games Store. Be sure to check out our cover story hub below for exclusive Hades II stories and videos throughout the month.

#air#bearings#bones#earth#effects#epic#Features#fish#fishing#game#games#gold#Health#how#icons#investment#it#LESS#life#max#mechanics#menu#metal#mining#Moons#One#Other#power#progression#Resources

0 notes

Text

Sell Gold Now And Enjoy High Prices

Whatever we decide to do with our investment can change our present and future. Take for example the fact that most people sell their commodity without thinking much about the timing. If you ask any expert in the market chances is high they will tell you to always take advantage of high prices. What they mean by this is that we should never keep any commodity with us whenever its prices are high.…

View On WordPress

#As Cash For Gold#Best Place To Sell Gold In Delhi#Cash For Diamond#Cash For Gold#Cash For Gold At Doorstep#Cash For Gold Delhi NCR#Cash for Gold Dwarka#Cash For Gold Faridabad#Cash For Gold Gurgaon#Cash For Gold In Delhi#Cash For Gold In Delhi NCR#Cash For Gold In Ghaziabad#Cash For Gold In Noida#Cash For Gold India#Cash for Gold Karol Bagh#Cash for Gold Munirka#Cash For Gold Near Me#Cash for Gold Rohini#Cash For Silver#commodities#Diamond Buyer#finance#gold#Gold Buyer#Gold Jewellery Buyer#How To Sell Gold In Delhi#investing#Sell Gold#Sell Gold At Doorstep#Sell Gold Badarpur

0 notes

Text

How to Invest in Gold in an IRA 2024 | Know The Best Way |

How to Invest in Gold in an IRA 2024 | Know The Best Way |

Hello guys welcome to my blog, today I'll talk about How to Invest in Gold in an IRA 2024 | Know The Best Way and I'll tell you my personal experience of it. So let's start the blog,

Steps to start investing in a gold IRA

Follow these four steps to open a gold IRA.

Step 1: Choose a gold IRA company to work with

Choosing a gold IRA company is the first step toward opening your IRA. These companies will help you set up an account, transfer funds, purchase your metals, and send your gold and silver to an approved depository for storage.

In some cases, the company will also act as custodian of your account, meaning it will handle the paperwork and IRS compliance for your IRA.

Gold is a popular investment, and you can choose from many gold IRA companies, each with unique fees, services, and customer service quality. If you're opening a gold IRA, you'll want to choose carefully to ensure you get the best service at the best possible price.

Once you choose your company, you'll need to complete the paperwork to open your IRA and then deposit funds into the account. You'll also need your driver's license (or other state-issued ID) and details from your retirement accounts if you plan to transfer money from a 401(k) or other IRA.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

Step 2: Fund your account

After opening your account, you will need to deposit funds into it before you can start buying and investing in metals.

You have three options for funding your Gold IRA:

Cash Contribution: You can use cash, check or wire transfer to deposit funds into your account, just as you would with a normal savings or investment account. Your bank may charge a fee if you choose a wire transfer.

Rollover: You would use a rollover if you plan to take a distribution from your retirement account and roll it over to your gold IRA. If you want to go this route, contact your current account administrator to get the process started.

You can also choose to take a cash distribution from your account and deposit it into your Gold IRA. Just make sure you do it within 60 days, otherwise you could face a 10% penalty (unless you're over age 59½.)

Transfers: You can also make direct account-to-account transfers. To do this, you will fill out a form with your current account administrator, or your Gold IRA custodian can contact you on your behalf. These types of transfers can take up to five days and are tax and penalty-free.

Most investors choose direct transfers to minimize the potential for hassles and penalties.

Step 3: Select your metals

Once the money has cleared, and your account is funded, you can begin purchasing your gold, silver, and other precious metal investments. The IRS only allows metals of a specific type and purity to be placed in a self-directed IRA, so be careful what you buy.

The exact process for purchasing your metals will depend on which company you open an account with. In some cases, your gold IRA firm will sell IRS-approved metals so you can purchase your coins and bullion from them.

With other companies, you must purchase your investments from a separate precious metals dealer and instruct your custodian to purchase the items on your behalf using your IRA funds.

For example, Oxford Gold Group offers direct metals sales, and you can work with your designated account director to purchase the approved metals of your choice.

Once they are purchased, they are shipped via an insured courier to Delaware Depository Service Company or Brink's Global Services facility for safe and secure storage.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

Step 4: Monitor the performance of your metals

Your ability to monitor the performance of your gold IRA depends on the account custodian. Some companies provide online dashboards to monitor the performance of your investments, but others do not.

If regular updates and insight into the performance of your IRA is a priority for you, ask a representative if the company offers these services. Your custodian should be able to give you access to such monitoring.

What to consider before starting a gold IRA account

Before you open your gold IRA, it’s important to understand how these accounts work and what they entail. Here are the basics:

Type of account

To get started, you need to know what type of account you want to open. Self-directed IRAs can be traditional IRAs or Roth IRAs, and the difference depends on how you want your money to be taxed.

Contribution limits

There is a limit on how much you can invest in a gold IRA, which varies by age.

Store your gold

You must store the gold and silver purchased through a Precious Metals IRA at an approved bank or depository. Some companies market "self-storage" IRAs, but their legality is questionable, and you could face IRS penalties or fines for holding your gold purchases.

That said, you can choose to take your gold, silver or other metals as distributions later once you become eligible. (You can take them earlier, but you'll have to pay a 10% penalty.)

Fees

Gold IRAs come with fees. These can include:

Fees on typical IRA accounts are often much lower (or sometimes nonexistent), and they don’t include storage fees.

Why open a gold IRA?

Making a Gold IRA part of your long-term retirement planning can be a smart move for several reasons. First, it can diversify your portfolio. If you're heavily invested in stocks, mutual funds, exchange-traded funds (ETFs) and other securities tied to the stock market, your portfolio may be at greater risk if the markets struggle.

Investing some of those funds in gold, silver and other precious metals is one way to reduce that risk and ensure that your portfolio can withstand market downturns. (This helps ensure you're not investing too much in one area, so if the value of one type of asset or security decreases, you have investments elsewhere to use during retirement.) .)

Precious metals—and gold in particular—can be an excellent hedge against inflation because their value often increases when the value of the U.S. dollar decreases.

Don't forget about the opportunity for profit. Gold prices have risen in recent years, and many experts believe this will continue to happen.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

How long does it take to open a gold IRA?

You should be able to complete the Gold IRA application process in 10 to 15 minutes. Processing is also fast, and in most cases your account can be opened within one business day.

The rest depends on the speed of your funding. As long as the custodian of your current account responds promptly, transfers and rollovers usually take about seven to 10 business days. Physical checks sent by mail may take longer to deposit into your account.

Again, these deadlines may vary by IRA company, so be sure to ask the firm you're considering.

When can I withdraw from my account?

According to IRS rules, you can begin taking penalty-free distributions from your account at age 59½. Before then, a 10% penalty applies on withdrawals.

Once you reach age 70½ (or 72 depending on your birthday), you will need to take minimum distributions each year. The exact amount will depend on your age, account type and other factors. You can choose to take your distribution in cash or through the actual metals you purchase. These are called "in-kind" distributions.

If you're looking to start a Gold IRA account to diversify your investment portfolio, protect against inflation, boost your long-term wealth, or achieve any other investment goal, be sure to compare your options first. Gold IRA companies can vary, and it is important to choose the best one for your investment goals to ensure a comfortable and hassle-free retirement.

As a starting point, you can check out our picks for the best gold IRA companies.

Gold IRA FAQ

Can I transfer funds from another retirement account to a Gold IRA?

Yes, you can transfer funds from a retirement account, such as a 401(k) or another IRA, to a Gold IRA through a direct transfer or rollover process.

What types of metals can I invest in with a gold IRA?

With a gold IRA, you can invest in a variety of IRS-approved precious metals, including gold, silver, platinum and palladium, subject to specific purity requirements.

How do I store metals in my gold IRA?

The metals in your gold IRA must be stored with an IRS-approved depository to comply with IRS regulations. Self-storage of IRA metals is not legal and may result in penalties.

1 note

·

View note

Text

Top 10 Benefits of Gold Investment in a SEP IRA: A Comprehensive Guide

As an avid investor, I have always been intrigued by the power of diversifying my retirement portfolio. That’s when I discovered the incredible benefits of investing in gold through a SEP IRA. In this comprehensive guide, I will share with you the top 10 advantages that gold investment offers within a Self-Directed Employee Pension Individual Retirement Account (SEP IRA). Join me as we explore…

View On WordPress

#10 gold investment benefits in sep ira#401k to gold ira rollover#gold investing#gold investment#gold investment benefits#gold investment benefits in sep ira#gold ira#gold ira companies#gold ira investing#gold ira rollover#gold ira rollovers#gold ira tips#how to invest in gold#individual retirement account#invest in gold#investing in gold#precious metals#precious metals ira#retirement planning#self directed ira#sep gold ira#sep ira#what is a gold ira

0 notes

Text

#how to trade forex#commoditymarket#stock trading#investing stocks#stock market#gold trading#trading for beginners#trading course#tradingsuccess#tradingstrategy#tradingforex#tradingcommunity#trading stocks#tradingtips#forex education#forextrading#forexmarket#forexlifestyle#day trading#trader#investors#personal finance

0 notes

Text

Best Financial Decision Right Now Is To Sell Gold

If you cannot make a high profit after selling your investment then there is no use of purchasing it. Subtracting your selling price from the money that you have invested while purchasing that investment. To make sure that you can earn a high profit, your selling price should be significantly higher than your cost price. It is now clear that in order to get such a high price you need to keep in…

View On WordPress

#As Cash For Gold#Best Place To Sell Gold In Delhi#Cash For Diamond#Cash For Gold#Cash For Gold At Doorstep#Cash For Gold Delhi NCR#Cash for Gold Dwarka#Cash For Gold Faridabad#Cash For Gold Gurgaon#Cash For Gold In Delhi#Cash For Gold In Delhi NCR#Cash For Gold In Ghaziabad#Cash For Gold In Noida#Cash For Gold India#Cash for Gold Karol Bagh#Cash for Gold Munirka#Cash For Gold Near Me#Cash for Gold Rohini#Cash For Silver#commodities#Diamond Buyer#finance#gold#Gold Buyer#Gold Buyer Delhi#Gold Buyer In Delhi NCR#Gold Jewellery Buyer#How To Sell Gold In Delhi#investing#mutual-funds

0 notes

Text

https://www.truewitlive.com/the-best-way-to-buy-gold-for-meaningful-gifts/

0 notes

Text

Filing your Income-Tax Return (ITR) can be a daunting task, but it's essential to ensure you're not missing out on any potential deductions that could help reduce your tax liability. In this article, we will explore some of the top tax deductions you should consider when filing your ITR. By taking advantage of these deductions, you can optimize your tax return and potentially increase your refund. Read More

#tax deductions#tax deductions australia#income tax deductions#canadian tax deductions#tax deduction#australian tax deductions#home office tax deduction#rs 10000 special deduction#education-related deductions#what is income tax in saving account#tax return for international students in australia#income tax returns in telugu#how to invest in gold#international students in australia#international students in australia vlog#taxes in india

0 notes