#what is income tax in saving account

Text

A big cost and concern for many seniors in the U.S. is the price of prescription drugs and other healthcare expenses—and this year, thanks to The Inflation Reduction Act, their costs may go down dramatically, especially for patients fighting cancer or heart disease.

I learned about the new benefits because my ‘Medicare birthday’ is coming up in a couple months when I turn 65. I was shocked that there were so many positive changes being made, which I never heard about on the news.

Thousands of Americans on Medicare have been paying more than $14,000 a year for blood cancer drugs, more than $10,000 a year for ovarian cancer drugs, and more than $9,000 a year for breast cancer drugs, for instance.

That all changed beginning in 2023, after the Biden administration capped out-of-pocket prescriptions at $3,500—no matter what drugs were needed. And this year, in 2024, the cap for all Medicare out-of-pocket prescriptions went down to a maximum of $2,000.

“The American people won, and Big Pharma lost,” said President Biden in September 2022, after the legislation passed. “It’s going to be a godsend to many families.”

Another crucial medical necessity, the shingles vaccine, which many seniors skip because of the cost, is now free. Shingles is a painful rash with blisters, that can be followed by chronic pain, and other complications, for which there is no cure

In 2022, more than 2 million seniors paid between $100 and $200 for that vaccine, but starting last year, Medicare prescription drug plans dropped the cost for shots down to zero.

Another victory for consumers over Big Pharma affects anyone of any age who struggles with diabetes. The cost of life-saving insulin was capped at $35 a month [for people on Medicare].

Medicare is also lowering the costs of the premium for Part B—which covers outpatient visits to your doctors. 15 million Americans will save an average of $800 per year on health insurance costs, according to the US Department of Health and Human Services.

Last year, for the first time in history, Medicare began using the leverage power of its large patient pool to negotiate fair prices for drugs. Medicare is no longer accepting whatever drug prices that pharmaceutical companies demand.

Negotiations began on ten of the most widely used and expensive drugs.

Among the ten drugs selected for Medicare drug price negotiation were Eliquis, used by 3.7 million Americans and Jardiance and Xarelto, each used by over a million people. The ten drugs account for the highest total spending in Medicare Part D prescription plans...

How are all these cost-savings being paid for?

The government is able to pay for these benefits by making sure the biggest corporations in America are paying their fair share of federal taxes.

In 2020, for instance, dozens of American companies on the Fortune 500 list who made $40 billion in profit paid zero in federal taxes.

Starting in 2023, U.S. corporations are required to pay a minimum corporate tax of 15 percent. The Inflation Reduction Act created the CAMT, which imposed the 15% minimum tax on the adjusted financial statement income of any corporation with average income that exceeds $1 billion.

For years, Americans have decried the rising costs of health care—but in the last three years, there are plenty of positive developments.

-via Good News Network, February 25, 2024

#united states#medicare#healthcare#healthcare access#big pharma#prescription drugs#health insurance#us politics#good news#hope#seniors#aging#healthy aging

2K notes

·

View notes

Text

Wealth Building: What Rich People Do Differently

Wealthy people prioritize learning about personal finance, investing, and wealth building strategies. They always strive to gain more knowledge in these areas.

They maintain a long term perspective when setting financial goals and are patient in their pursuits.

Wealthy people diversify their investments across various asset classes to manage their risk.

Many of them are entrepreneurs who create and manage businesses as a means to build wealth.

They build and nurture professional networks opens doors to opportunities for investments, partnerships, and business growth.

They set clear, specific financial goals and regularly review and adjust their strategies to stay on track.

Wealthy individuals exercise discipline in their spending habits, avoiding impulse purchases and consistently saving and investing.

They assess and manage investment risks carefully, often with the guidance of financial advisors.

Many engage in philanthropy and charitable giving, recognizing the importance of supporting their communities and causes they care about.

Wealthy people invest in their personal development, acquiring new skills and knowledge to increase their earning potential or make better investment decisions.

They use legal tax strategies to minimize tax liabilities, such as tax advantaged accounts and tax efficient investments.

Legal structures like trusts and estate planning are employed to safeguard assets and facilitate smooth wealth transfer.

Wealthy people can adapt to changing economic conditions and market trends by diversifying income sources and investments.

Building wealth often involves overcoming setbacks and failures, and the wealthy demonstrates the result of persistence in their pursuit of financial success.

They have a positive and growth oriented mindset drives their belief in their ability to succeed and willingness to take calculated risks.

They prioritize acquiring and growing assets, emphasizing that assets generate income and wealth over time.

They are cautious about spending in liabilities (Things that do not make you money) and maximize their assets (add value) and those that detract from wealth (liabilities).

Instead of working solely for money, they make money work for them.

When they indulge in luxury purchases, they do so using returns on their investments rather than the money they earn or have saved.

#finance#investment#financial planning#investing#entrepreneur#girl math#generationalwealth#rich#success mindset#wealth

1K notes

·

View notes

Text

Cosmere Characters Do Their Taxes

It was just Tax Day in the US! Let's say that Cosmere characters had to pay taxes. How would that go for them?

Sigzil: Knows the tax code inside and out. Saves his receipts. Is basically the IRS's dream guy.

Hoid: Does not pay taxes. This is canon.

Kelsier: Does not pay taxes. This feels canon.

Marasi: Always pays her taxes.

Vivenna: Always pays her taxes.

Denth: Sure talks a lot about how complicated mercenary taxes are but if you listen carefully, he never actually says he did them...

Nale: Rigorously follows the tax code of whatever country he is in.

Wyndle: Claims Lift as a dependent. Reports all illegally acquired income at fair market value, as the tax code requires.

Lightsong: Does not pay taxes because he's, like, a god. But it's always bothered him, somewhere in the back of his mind, for some reason...

Adolin: Cheerfully hires someone else to do his taxes, at least so long as he's single.

Shallan: Does her own taxes, Sebarial's taxes, and Adolin's taxes post-marriage.

Steris & Wax: Do their taxes together. Romantically.

Wayne: Gives so much money to charity that he never owes any taxes. Orders his accountants to find a way for him to pay taxes anyway.

Straff: Does not pay taxes in the way rich people don't pay taxes--through, like, legal loopholes and off-shore accounts and shit

Elend: Rewrites the tax code to pay more taxes.

Lirin: Committed tax fraud. But only once.

Taravangian: Is not allowed to file his taxes when he is too stupid--because he cries about how confusing it is--or when he's too smart--because he's too good at finding all of the super obvious tax loopholes and anyway he's obviously way better than the government at knowing how to spend his own money!

Painter: Got in trouble once for not filing taxes because he knew he didn't make enough to owe any taxes. Seemed kinda stupid to him.

Moash: Makes an ethical argument against taxes, since the tax laws are written to benefit the rich and screw over the poor and he has no control over what the government uses his taxes for.

Kaladin: Is torn between paying his taxes like Dalinar ordered or not paying his taxes since he promised Moash he wouldn't until he finally files his taxes at, like, midnight on tax day

It's a whole thing.

#cosmere#cosmerelists#Sigzil#Hoid#Kelsier#Marasi#Vivenna#Denth#nale#Wyndle#Lightsong#Adolin#Shallan#Steris#Wax#Wayne#Straff#Elend#Lirin#Taravangian#Painter#Moash#Kaladin

249 notes

·

View notes

Text

btw there is a difference between SSI (supplemental security income) and SSDI (social security disability income).

SSDI is whats typically meant by disability. This is for people who become disabled and have previously worked and accrued “work credits.” How much you receive is based on how much you have worked and paid into the system via social security tax. There is no specific asset limit on SSDI, however too much income via something like a savings account could impact your eligibility.

SSI is for disabled and elderly people who have either not worked enough to be eligible for SSDI, or for whom SSDI alone isn’t enough to cover their living expenses. Just being disabled isn’t enough, it is a needs based program. How much you receive is based on your current financial status, and is regularly adjusted and means tested. It is very easy to lose SSI by design, and has the infamous $2,000 asset limit.

sorry if I got anything wrong here, you may notice when you try to research this its extremely confusing and shockingly difficult to find good information. but this is the basic difference between the two.

133 notes

·

View notes

Text

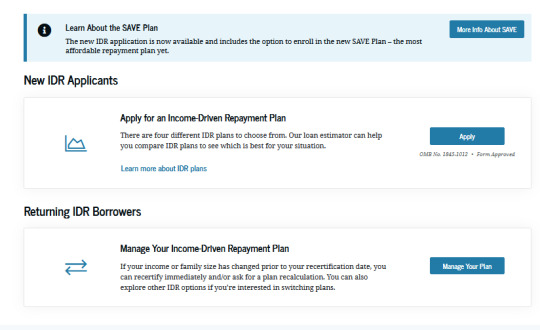

Hey, student loans payments are coming back in October, you should know about the SAVE plan.

this is america-centric but pls spread this around if you think any of ur mutuals could use the info.

If you're currently shitting yourself thinking how you're gonna start making student loan payments again, I suggest taking a deep breath, first off. Get comfy, put on some music and strap in.

If you got your student loans through the Federal Student Aid program FAFSA, then you can apply for an IDR (Income Driven Repayment plan) called SAVE.

what is SAVE?

This got my $115 monthly payment down to $40 a month, if you don't work or you can't afford much, this has the potential to reduce your payment even further.

Alls you need to do is go to https://studentaid.gov/idr/ and log into your federal student aid account, there's a section for both first time applicants and returning borrowers who previously may have had an IDR.

Even if you've done an IDR before! Look into the SAVE plan!! It forgave about 10k of debt for me!

Anyway, first time applicants can click the first option, "Apply for an Income-Driven Repayment Plan" and just go through and answer all their prompts, make sure you have all your financial information on hand (tax returns, most recent pay stub, etc) and go through the prompts until it gives you the option to apply for the SAVE plan. CLICK IT!

It should let you know at the end exactly how much you'll be paying per month and you should get an email confirmation as well. Any account specific questions should be directed to their call center

+1 (800) 433-3243

GOOD LUCK AND BE PATIENT, THE SITE IS SLOW AS SHIT.

DON'T GIVE UP! I BELIEVE IN YOU!!

if you have any questions feel free to DM me btw

#student loans#SAVE plan#FAFSA#student loan forgiveness#IDR#income driven repayment plan#THIS DOES NOT PAUSE INTEREST BTW#adulting#life tips#helpful#resources#websites#og post

436 notes

·

View notes

Text

Weiss: Ruby, can you tell me what da- i mean jaune is doing?

Ruby: Taxes.

Weiss: ... What?

Ruby: Yeah, it seems he was the only one who knew how to make them.

Weiss: W-well, i'm certain it cannot be as complicated as you seem to believe! I was tutored by the greatest in Atlas after all.

Jaune: *using only paper and pen* ... So with an annual revenue of 43260… remove 15%… yo Weiss, you forgot to add your passive income. And since the SDC is no more, i would strongly advise you put them in your taxes if you don't want to get arrested. Though if you put the dust you buy as work expenses, you could be saving almost 7000$.

Weiss: ... What?

Ruby: Yeah, i saw the kind of school he came from. He learned what we were learning in history and math in beacon when he was 10.

Weiss: What?!

Ruby: Seems also he paid his false paper to enter Beacon by doing Roman and Neo taxes and doing accountability for Junior.

Jaune: *still calculating* my mom told me i should have continued my scholarship in university. But it was really boring you know?

Weiss: *sweating* J-just to know, which university were you supposed to go?

Jaune: Atlas university of robotic why?

Weiss: ... Jaune, that university is one of the most prestigious one in remnant. You are a genius!

Jaune: Nah, i think you are the real genius. Being good both in combat and school? I wish i was half as good as you are.

Weiss: ... My pride was just shattered by your honest opinion.

Ruby: yeah... I know that feeling.

388 notes

·

View notes

Text

It's tax season and I don't wanna do mine so instead here's my hcs about AA characters and taxes that literally nobody asked for.

Phoenix: does his own taxes until Apollo shows up then foists the WAA taxes onto Apollo. Does he always do his own taxes correctly or give Apollo the right numbers? Perhaps not. But hey, if they're wrong the IRS will let him know, right? He hasn't been audited yet. 🤷🏻

Edgeworth: has never filled out a tax form in his life. Only knows how taxes work on a theoretical level. Because he's stupid rich and has foreign income, his taxes are wildly complicated. That is what Stephanie, his accountant is for.

Franziska: same as Edgeworth. She also thinks it's stupid that she has to pay American taxes when she's not here.

Apollo: actually capable of doing taxes. Does not use turbotax, thank you very much, because he does not trust them and they are evil. He will check and double check his taxes himself. He has also somehow been conscripted into doing the WAA taxes. Unfortunately, he's not sure if his calculations are correct there because he frankly doesn't trust the numbers that Phoenix has given him. It makes him Wildly Anxious. Terrified of the IRS.

Athena: TurboTax dot com babeyyyyy.

Klavier: also rich and has complicated taxes so he has an accountant to do his. He offered his accountant's services to Apollo but Apollo just ended up double checking the accountant's numbers so he's not sure if the accountant actually saved Apollo any time or grief.

Simon: with Athena on TurboTax dot com. He didn't do taxes for years on account of the being in jail thing so he's not sure what's going on. He also doesn't care that much and his taxes aren't that complicated so he just sorta throws his w2 at Athena and assumes she knows what's going on.

Godot: jail :) No income :)

Gumshoe: free file. He cannot afford turbotax. 😔

Pearl: doing fraud (accidentally)

Maya: doing fraud (negligently)

Trucy: doing fraud (for fun and profit)

#ace attorney#phoenix wright#miles edgeworth#franziska von karma#apollo justice#athena cykes#klavier gavin#simon blackquill#Godot#pearl fey#maya fey#trucy wright#dick gumshoe#i just think about mundane things these characters do a lot okay#and taxes is as mundane as you can get#tom talks

468 notes

·

View notes

Note

I work in accounting in Canada and over the years I have realized just how many people aren’t aware of all the various government programs they can take advantage of so I was hoping you could post this on the chance someone who it could help sees it. The main one I see people missing out on is the disability tax credit. If you live in Canada and are disabled you may qualify for the disability tax credit. It’s a non refundable tax credit that’s relatively easy to apply for. All you need to do is get form t2201 from Canada.ca and fill out the first portion with your information then you take it to your doctors office and get them to fill out the remainder. Depending on your provinces medical coverage they might charge you a form fee. Once it’s filled out you can either mail it to the address Canada.ca tells you to or you can submit it online through MyCRA if you’ve set up access to it. If you have an accountant do your taxes for you they might be authorized to submit the form for you once it has been filled out by a medical professional. Processing time for the application is 8 weeks. They’ll mail you a letter letting you know if you qualify or not. It’s also available to people with temporary disabilities or illnesses depending on the disability. And if you do qualify that means you can open a registered disability savings plan. I think it’s similar to an IRA but I don’t actually know what an IRA is cause I’m Canadian lol. The registered disability savings plan is an account where you can put money to save for retirement. It’s different from a registered retirement savings plan because with an RDSP the government will give you grants and match your contributions up to a certain amount each year based on income. There are rules about how much you can take out of the account and when you can take it out but if you take the letter from the CRA saying you qualify for the disability tax credit to your bank they’ll help you set up the account and explain all the rules and everything else. Here ends my speech about federal disability benefits. Go forth and take the federal government for everything it’s worth my fellow disabled bitches.

You are doing the lord's work, my dove. Thank you so much for sharing with the whole class. Canadian bitchlings, take note of the above! Especially if you're a person with disabilities!

This might also help for our United Statesian readers:

How to Pay Hospital Bills When You’re Flat Broke

Did we just help you out? Tip us!

59 notes

·

View notes

Text

"...[W]e must continue to challenge the societal arrangements that leads to preventable pain and suffering. Marriage can be quite beautiful and sacred, for example. Marriage can also privatize dependence: it encourages people to enter relationships for resources and benefits, like health care, savings, and tax deductions. I was nineteen years old when I got married, mostly informed by my faith tradition. I was also in love, but very poor, and marriage offered me a stability that I never had as a child. I was so lucky that the person I married was kind, thoughtful, and also very much trying to figure out his relationship to Christianity and his evolving manhood.

When we divorced nine years later and became friends and co-parents, I realized how the marital benefits I once aspire dot have did not make sense. I could remove him from my health insurance to account for the divorce, but I couldn't add any of my uninsured siblings, whom I would be related to forever. And our children had two options for insurance because they had parents who went to college and worked jobs that offered it, but independent contractors in my family did not have an option that wasn't a financial sacrifice.

If we focused on meeting the healthcare, employment, educational, and housing needs of people in society, then those who want to marry could more freely enter those relationships in their terms, and people who needed to escape because of violence could more easily leave without worrying what will happen if they get sick and need to see a doctor.

We should heed to calls for investment in the programs, opportunities, and laws that make everyone free and safe. Here too, universal basic income can help, allowing people to meet their basic needs and not rely on potentially sexually exploitative intimate relationships for income. Removing benefits from marriage accomplishes this, too. With universal health care, and other programs like free and quality childhood education, people vulnerable to violence have more free range to move, live, and practice healthy lifestyles."

-- Becoming Abolitionists: Police, Protests, and the Pursuit of Freedom by Derecka Purnell

#angel posts#angel reads#becoming abolitionists#derecka purnell#the more i read this book the better it gets tbh#every page she's talking about a new activist or abolitionist she's met#she's BUSY#and im googling the orgs here bc i wanna get more active too#but this passage made me think of the tradwife thing#people fail to realize that tying economic stability to marriage is so dangerous

96 notes

·

View notes

Text

Project 2025 outlines a radical policy agenda that would dramatically reshape the federal government. The report was spearheaded by the right-wing Heritage Foundation and represents the policy aims of a large coalition of conservative activists. While former President Trump has attempted to distance himself from Project 2025, many of the report’s authors worked in the previous Trump administration and could return for a second round. Trump, himself, said in 2022, “This is a great group, and they’re going to lay the groundwork and detail plans for exactly what our movement will do.”

In other words, Project 2025 warrants a close look, even if the Trump campaign would like Americans to avert their gaze.

Project 2025’s education agenda proposes a drastic overhaul of federal education policy, from early childhood through higher education. Here’s just a sample of the Project 2025 education-related recommendations:

Dismantle the U.S. Department of Education (ED)

Eliminate the Head Start program for young children in poverty

Discontinue the Title I program that provides federal funding to schools serving low-income children

Rescind federal civil rights protections for LGBTQ+ students

Undercut federal capacity to enforce civil rights law

Reduce federal funding for students with disabilities and remove guardrails designed to ensure these children are adequately served by schools

Promote universal private school choice

Privatize the federal student loan portfolio

It’s an outrageous list, and that’s just the start of it.

We’ve reviewed the Project 2025 chapter on education (Chapter 11), along with other chapters with implications for students. We’ve come away with four main observations:

1. Most of the major policy proposals in Project 2025 would require an unlikely amount of congressional cooperation

Project 2025 is presented as a to-do list for an incoming Trump administration. However, most of its big-ticket education items would require a great deal of cooperation from Congress.

Proposals to create controversial, new laws or programs would require majority support in the House and, very likely, a filibuster-proof, 60-vote majority in the Senate. Ideas like a Parents’ Bill of Rights, the Department of Education Reorganization Act, and a federal tax-credit scholarship program fall into this category. Even if Republicans outperform expectations in this fall’s Senate races, they’d have to attract several Democratic votes to get to 60. That’s not happening for these types of proposals.

The same goes for major changes to existing legislation. This includes, for example, a proposal to convert funding associated with the Individuals with Disabilities Education Act (IDEA) to no-strings-attached block grants and education savings accounts (with, presumably, much less accountability for spending those funds appropriately). It also includes a proposal to end the “negotiated rulemaking” (“neg-reg”) process that ED follows when developing regulations related to programs authorized under Title IV of the Higher Education Act (HEA). The neg-reg requirement is written into HEA itself, which means that unwinding neg-reg would require Congress to amend the HEA. That’s unlikely given that HEA reauthorization is already more than a decade overdue—and that’s without the political baggage of Project 2025 weighing down the process.

The prospect of changing funding levels for existing programs is a little more complicated. Programs like Title I are permanently authorized. Eliminating Title I or changing the formulas it uses to allocate funds to local educational agencies would require new and unlikely legislation. Year-to-year funding levels can and do change, but the vast majority of ED’s budget consists of discretionary funding that’s provided through the regular, annual appropriations process and subject to a filibuster. This limits the ability of one party to make major, unilateral changes. (ED’s mandatory funding is more vulnerable.)

In sum, one limiting factor on what an incoming Trump administration could realistically enact from Project 2025 is that many of these proposals are too unpopular with Democrats to overcome their legislative hurdles.

2. Some Project 2025 proposals would disproportionately harm conservative, rural areas and likely encounter Republican opposition

Another limiting factor is that some of Project 2025’s most substantive proposals probably wouldn’t be all that popular with Republicans either.

Let’s take, for example, the proposed sunsetting of the Title I program. Project 2025 proposes to phase out federal spending on Title I over a 10-year period, with states left to decide whether and how to continue that funding. It justifies this with misleading suggestions that persistent test score gaps between wealthy and poor students indicate that investments like Title I funding aren’t paying off. (In fact, evidence from school finance reforms suggests real benefits from education spending, especially for students from low-income families.)

The phrase “Title I schools” might conjure up images of under-resourced schools in urban areas that predominantly serve students of color, and it’s true that these schools are major beneficiaries of Title I. However, many types of schools, across many types of communities, receive critical support through Title I. In fact, schools in Republican-leaning areas could be hit the hardest by major cuts or changes to Title I. In the map below, we show the share of total per-pupil funding coming from Title I by state. Note that many of the states that rely the most on Title I funds (darkest blue) are politically conservative.

Of course, the impact of shifting from federal to state control of Title I would depend on how states choose to handle their newfound decision-making power. Given that several red states are among the lowest spenders on education—and have skimped on programs like Summer EBT and Medicaid expansion—it’s hard to believe that low-income students in red states would benefit from a shift to state control.

What does that mean for the type of support that Project 2025 proposals might get from red-state Republicans in Congress? It’s hard to know. It’s worth keeping in mind, though, that the GOP’s push for universal private school voucher programs has encountered some of its fiercest resistance from rural Republicans across several states.

3. Project 2025 also has significant proposals that a second Trump administration could enact unilaterally

While a second Trump administration couldn’t enact everything outlined in Project 2025 even if it wanted to, several consequential proposals wouldn’t require cooperation from Congress. This includes some actions that ED took during the first Trump administration and certainly could take again.

Here are a few of the Project 2025 proposals that the Trump administration could enact with the authority of the executive branch alone:

Roll back civil rights protections for LGBTQ+ students

Roll back Title IX protections against sex-based discrimination

Dismantle the federal civil rights enforcement apparatus

Eliminate current income-driven repayment plans and require higher monthly payments for low-income borrowers

Remove protections from predatory colleges that leave students with excessive debt

Federal education policy has suffered from regulatory whiplash over the last decade, with presidential administrations launching counter-regulations to undo the executive actions of the prior administration. Take, for example, “gainful employment” regulations that Democratic administrations have used to limit eligibility for federal financial aid for colleges that leave students with excessive loan debt. A second Trump administration would likely seek to reverse the Biden administration’s “gainful employment” regulations like the first Trump administration did to the Obama administration’s rules. (Then again, with the Supreme Court striking down Chevron, which provided deference to agency expertise in setting regulations, the Trump administration might not even need to formally undo regulations.)

Other Project 2025 proposals, not explicitly about education, also could wreak havoc. This includes a major overhaul of the federal civil service. Specifically, Project 2025 seeks to reinstate Schedule F, an executive order that Trump signed during his final weeks in office. Schedule F would reclassify thousands of civil service positions in the federal government to policy roles—a shift that would empower the president to fire civil servants and fill their positions with political appointees. Much has been written about the consequences of decimating the civil service, and the U.S. Department of Education, along with other federal agencies that serve students, would feel its effects.

4. Project 2025 reflects a white Christian nationalist agenda as much as it reflects a traditional conservative education policy agenda

If one were to read Project 2025’s appeals to principles such as local control and parental choice, they might think this is a standard conservative agenda for education policy. Republicans, after all, have been calling for the dismantling of ED since the Reagan administration, and every administration since has supported some types of school choice reforms.

But in many ways, Project 2025’s proposals really don’t look conservative at all. For example, a large-scale, tax-credit scholarship program would substantially increase the federal government’s role in K-12 education. A Parents’ Bill of Rights would require the construction of a massive federal oversight and enforcement function that does not currently exist. And a proposal that “states should require schools to post classroom materials online to provide maximum transparency to parents” would impose an enormous compliance burden on schools, districts, and teachers.

Much of Project 2025 is more easily interpretable through the lens of white Christian nationalism than traditional political conservatism. Scholars Philip Gorski and Samuel Perry describe white Christian nationalism as being “about ethno-traditionalism and protecting the freedoms of a very narrowly defined ‘us’.” The Project 2025 chapter on education is loaded with proposals fitting this description. That includes a stunning number of proposals focused on gender identity, with transgender students as a frequent target. Project 2025 seeks to secure rights for certain people (e.g., parents who support a particular vision of parental rights) while removing protections for many others (e.g., LGBTQ+ and racially minoritized children). Case in point, its proposal for “Safeguarding civil rights” says only, “Enforcement of civil rights should be based on a proper understanding of those laws, rejecting gender ideology and critical race theory.”

These types of proposals don’t come from the traditional conservative playbook for education policy reform. They come from a white Christian nationalist playbook that has gained prominence in far-right politics in recent years.

At this point, it’s clear that the Trump campaign sees Project 2025 as a political liability that requires distance through the election season. Let’s not confuse that with what might happen during a second Trump administration.

20 notes

·

View notes

Text

They Lies Government and Banks Tell They Citizens

If the banks lived by their own advice which is to save money, the banks would be losing money.

When you go and deposit $1,000 in the bank, that cash that you deposited is a liability for the bank.

An Asset to something that puts money in your pocket, a Liability is something that takes money away from your pocket so when the bank have your cash, it's a liability for them. They want to get rid of it as fast as possible and the way they do that is by lending it out because it's an Investment for the bank.

They don't want to hold onto cash, but they want you to save your money with them and leave it there and your money is losing value to Inflation each and every day.

Everyday that you keep your money in the bank, you're becoming poorer each and everyday.

When you keep your cash in the bank, they bank is paying you 0.1% or maybe 0.5% if you're lucky and the turn around lending it out for like 5% to 6%, so they don't keep your cash because its liability for them, they want to keep you spending money on their credit card because now they'll get to earn 18 to 25% in interest every time you spend $1.

The Government wants you to be Financially Uneducated and do you know why; because you're an employee and a consumer, so who pays the highest taxes? Employees and consumers!!!

Everybody knows that rich people don't pay taxes, it makes people angry but a lot of times, we don't understand why and we get angry at the wrong things and wrong reasons and you know that you can do a lot of things legally to pay less money in taxes and there are different ways that you can invest your money to pay less money in taxes.

Well, let me actually start with this; Tax Avoidance and Tax Evading are two similar words with two different outcomes.

Tax evading is illegal and then you go to jail.

Tax avoiding is legal and then you get hated for doing it.

And if you learn the IRS Code, it's a rulebook, the people who understand the Rulebook are the people who have the money to hire the good accountants and the good attorneys and so what happens is wealthy people will understand how this works, play within that system and pay little to no money in taxes.

Lets assume that you have either some sort of your own income, you're a side hustler or you're a business owner, and you make $500,000 profit.

You're taxed on Income.

So if you take out a Salary, that's going to be Taxed.

Now the question is what is a Tax Deduction or the better question is how can you make something a tax deduction??

Because anything can be a tax deduction if you know how to make it a deduction and that's the question you have to ask yourself.

So if you don't have an income, you don't have any tax on you.

The government and its system are so corrupt that they don't want you to know this and that's the more reason Money In The Bank Is At Risk, move your funds into the Quantum Financial Ledger Account (QFS).

#donald trump#bank of america#wells fargo#breaking news#bank crash#bad government#world news#qfs#bank clash#new york#trump 2024#republicans#decentralised finance#decentralisation#educate yourself#education#reeducation#reeducate yourself#marine life#veterans#patriotic#politics#washington dc#xrp news#xrpcommunity#xrp#xlm#quantum financial system#be aware#stay woke

29 notes

·

View notes

Text

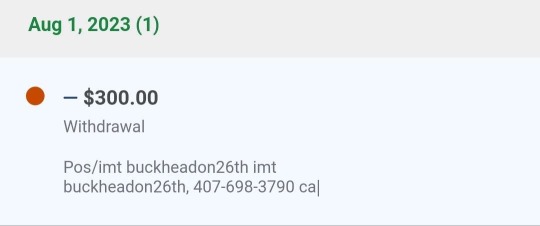

Sorry for the early morning rant but ugh we had a rough night last night. Our dishwasher has been broken for quite some time with no communication from the property on when it���ll be fixed or replaced. We’ve had to make time to hand wash dishes on top of us both working 9 hour shifts everyday and our usual daily chores of (vacuuming, taking out the trash, wiping down surfaces with bleach, steam mopping the floors, and up until last night doing laundry). Last night our laundry washer not only crapped out and stopped going through it’s cleaning cycles it also backed up with what looks and smells like sewage water. The smell is so strong it’s making Dean’s existing nasal infection (brought on by the unaddressed mold and ventilation issues in the apartment) even worse. They’re so hoarse they can barely be heard after being up all night coughing. We are at our wits end right now.

We went through the application process for a new apartment that lasted for about 3 months of back and forth. We managed to raise enough money to pay the insane fees to apply to the apartment which were $300 for the applications, administrative fee, and holding fee and and the $1,810 deposit for the guarantor company we had to apply with because we couldn’t raise enough to pay down our credit debt accounts in time. The apartment approved us based on the proof of income given and then radio silence until we happened to check the apartments website and notice the apartment we had paid to apply to and reserve was back on the market. We called them to get an explanation since nothing was communicated to us after the approval. After basically dragging it out of them over the course of another week of back and forth the property manager explained that corporate decided to revoke our approval because Dean works through a staffing agency so they couldn’t take Deans income as valid. An insane concept all things considered. Money is money.

So there we were fully packed and no longer with anywhere to go.

Our lease end was fast approaching and we had no other option but to extend the lease here from the end date of November 2023 to the end date of February 2024 and try to pay off the $11,210 in collections that was dragging our scores down to the point that no apartment would approve our application despite a near perfect rental history (no evictions, lease violations, or even complaints) and at the times of applying perfectly qualifiable and verifiable income based on the 3X rent rule.

Our plan is to try to pay $1,868/month towards this total of debt collections in order to have them cleared and letters of payment available to apply for an apartment that checks every single box we were looking for in a new place. The minimum score requirement for this apartment is 599. We are both about 50 points from that as of today.

Currently our non negotiable expenses per month are as listed

Rent $1,680 (this will increase to $3,025.99 starting November 18th)

Renters insurance $30.50 (required according to the lease. A lapse in coverage results in fees charged by property)

Phone bill $350 (mine, Dean’s work and personal, and my disabled MIL lines)

Light bill $110 (this is with budget billing in place)

Pet insurance $40 (we have a cat for our anxiety)

Food shopping $400 (this includes both human and cat food as well as travel expenses to get to and from an affordable grocery store to do the big shop once a month because we do not have a car or if that option is not feasible then to pay for grocery delivery through Shipt)

Medical expenses $600 (at minimum, sometimes more) (Sertraline x2, Ritalin, Quetiapine, Duloxetine, Labs and blood work, Testosterone, and immunotherapy.)

Toiletries $75 ish (pads, tissue, soap, toothpaste, laundry detergent, dish soap/pods, cleaning suppplies)

Totaling $3,285.50/month (until November when this will increase to $4,631.49)

Currently we are both working full time jobs, no health insurance, no car, no savings.

After taxes we bring in a combined income of $5,050/month and as shown above $3,285 of that is unavoidably spoken for until November to February when $4,631.49 of that will be spoken for.

All this to say that we do not have room to pay off the necessary debt that would allow us to apply to, get approved for, and move into a new apartment within our budget and needs. We would really appreciate any kind of help that could be given. We just really want to be in a place that doesn’t make our already pretty bad health issues even worse. In addition, we want to be able to know that what we are bringing in will be enough to support ourselves without the overwhelming worry of “will we need to crowdfund and borrow this month?” and “will it be enough?”

If you’ve read this far thank you so much and please consider reblogging and sharing this and/or donating!

121 notes

·

View notes

Text

Basic Financial Skills Everyone Should Learn

Budgeting: Creating a budget is a crucial skill for managing personal finances. A budget helps you keep track of your income and expenses and enables you to plan and prioritize your spending.

Saving: Saving is another important financial skill. It's essential to set aside a portion of your income for emergencies, retirement, or other long-term goals.

Investing: Understanding the basics of investing can help you grow your money over time. Learning about different investment options such as stocks, bonds, mutual funds, and ETFs can help you make informed investment decisions.

Debt Management: Understanding debt and how to manage it is essential for financial stability. This includes understanding interest rates, payment schedules, and strategies for paying off debt.

Credit Scores: Your credit score is a critical component of your financial health. Understanding how credit scores work, what factors affect them, and how to improve them is vital.

Taxes: Understanding the basics of taxes, such as tax deductions, credits, and filing requirements, is essential for managing your finances.

Financial Planning: Developing a financial plan helps you achieve your financial goals by identifying your priorities, creating a budget, and determining the best investment strategies for your needs.

Understanding Interest Rates: Interest rates are an important component of many financial products, such as loans, credit cards, and savings accounts. Understanding how interest rates work, how they are calculated, and how they can impact your finances is important.

Insurance: Understanding the different types of insurance, such as health, life, and property insurance, is crucial for protecting yourself and your assets. Knowing what types of coverage you need, how to choose a policy, and how to file a claim is important.

Retirement Planning: Planning for retirement is essential for everyone, regardless of age. Knowing how much you need to save, how to invest your money, and when to start taking Social Security benefits can help you achieve a comfortable retirement.

Estate Planning: Estate planning involves creating a plan for the distribution of your assets after you die. Understanding the basics of estate planning, such as creating a will and selecting beneficiaries, can help ensure that your assets are distributed according to your wishes.

Basic Math Skills: Having a basic understanding of math, such as calculating percentages, can help you make informed financial decisions. This includes understanding how interest rates are calculated, how much you can save by making extra payments on your loans, and how much you will earn from your investments.

2K notes

·

View notes

Text

""Moreover, it turns out that the United States is not all that tightfisted when it comes to social spending. “If you count all public benefits offered by the federal government, America’s welfare state (as a share of its gross domestic product) is the second biggest in the world, after France’s,” Desmond tells us. Why doesn’t this largesse accomplish more?

For one thing, it unduly assists the affluent. That statistic about the U.S. spending almost as much as France on social welfare, he explains, is accurate only “if you include things like government-subsidized retirement benefits provided by employers, student loans and 529 college savings plans, child tax credits, and homeowner subsidies: benefits disproportionately flowing to Americans well above the poverty line.” To enjoy most of these, you need to have a well-paying job, a home that you own, and probably an accountant (and, if you’re really in clover, a money manager).

“The American government gives the most help to those who need it least,” Desmond argues. “This is the true nature of our welfare state, and it has far-reaching implications, not only for our bank accounts and poverty levels, but also for our psychology and civic spirit.” Americans who benefit from social spending in the form of, say, a mortgage-interest tax deduction don’t see themselves as recipients of governmental generosity. The boon it offers them may be as hard for them to recognize and acknowledge as the persistence of poverty once was to Harrington’s suburban housewives and professional men. These Americans may be anti-government and vote that way. They may picture other people, poor people, as weak and dependent and themselves as hardworking and upstanding. Desmond allows that one reason for this is that tax breaks don’t feel the same as direct payments. Although they may amount to the same thing for household incomes and for the federal budget—“You can benefit a family by lowering its tax burden or by increasing its benefits, same difference”—they are associated with an obligation and a procedure that Americans, in particular, find onerous. Tax-cutting Republican lawmakers want the process to be both difficult and Swiss-cheesed with loopholes. (“Taxes should hurt,” Ronald Reagan once said.) But that’s not the only reason. What Desmond calls the “rudest explanation” is that if, for whatever reason, we get a tax break, most of us like it. That’s the case for people affluent and lucky enough to take advantage of the legitimate breaks designed for their benefit, and for the wily super-rich who game the system with expensive lawyering and ingenious use of tax shelters.

And there are other ways, Desmond points out, that government help gets thwarted or misdirected. When President Clinton instituted welfare reform, in 1996, pledging to “transform a broken system that traps too many people in a cycle of dependence,” an older model, Aid to Families with Dependent Children, or A.F.D.C., was replaced by Temporary Assistance for Needy Families, or TANF. Where most funds administered by A.F.D.C. went straight to families in the form of cash aid, TANF gave grants to states with the added directive to promote two-parent families and discourage out-of-wedlock childbirth, and let the states fund programs to achieve those goals as they saw fit. As a result, “states have come up with rather creative ways to spend TANF dollars,” Desmond writes. “Nationwide, for every dollar budgeted for TANF in 2020, poor families directly received just 22 cents. Only Kentucky and the District of Columbia spent over half of their TANF funds on basic cash assistance.” Between 1999 and 2016, Oklahoma directed more than seventy million dollars toward initiatives to promote marriage, offering couples counselling and workshops that were mostly open to people of all income levels. Arizona used some of the funds to pay for abstinence education; Pennsylvania gave some of its TANF money to anti-abortion programs. Mississippi treated its TANF funds as an unexpected Christmas present, hiring a Christian-rock singer to perform at concerts, for instance, and a former professional wrestler—the author of an autobiography titled “Every Man Has His Price”—to deliver inspirational speeches. (Much of this was revealed by assiduous investigative reporters, and by a 2020 audit of Mississippi’s Department of Human Services.) Moreover, because states don’t have to spend all their TANF funds each year, many carry over big sums. In 2020, Tennessee, which has one of the highest child-poverty rates in the nation, left seven hundred and ninety million dollars in TANF funds unspent."

- The New Yorker: "How America Manufactures Poverty" by Margaret Talbot (review of Matthew Desmond's Poverty by America).

196 notes

·

View notes

Text

I’ve seen a lot of news outlets discuss how removing content from streaming services that isn’t available anywhere else is done as a tax write-off. But I haven’t seen nearly as many talk about what else is going on here: residuals.

The entertainment industry is famous for, “creative,” (aka shady) accounting tactics that take money that would’ve gone to creatives and use it to pad the pockets of executives. There’s even a Wikipedia page for it called Hollywood Accounting. So it’s unsurprising that we’ve seen a lot of crappy, “cost cutting,” measures over the last year that have made projects like the Batgirl movie unavailable to the public despite being finished or near-finished.

The prevailing narrative here is that these are done as tax write-offs, where the less a title makes the less the studio has to pay taxes on its production costs (I think. To be honest the tax details are a little over my head, I just know they say burying these titles saves them money). But how does that work with titles that have already been out for months or, in some cases, YEARS. For example: Disney+ removed Stargirl & Artemis Fowl from their platform three years after those films were released. So how big can a tax write off really be?

That’s where residuals come in. For those who don’t know, residuals are a form of income artists like actors and writers get when their project is broadcast. You get a check with an amount based on how many times it’s on TV or viewed on streaming. Now, the way streaming residuals are structured are already inherently broken. Ideally, the more successful a show is the more residuals the artists make. But streamers don’t SHARE how much people are watching their shows so they can just say whatever & pay their artists a tiny amount while padding their pockets. This has been happening with Suits on Netflix lately, which it turns out is HUGE on the streamer but the creatives involved aren’t being fairly compensated.

So what does this have to do with burying projects? Well, if no one can watch a tv show or movie in any (legal) way that means the studios aren’t obligated to pay the folks who worked on that project their residuals. And if they were paying enough residuals on a title that removing it saves them millions or billions of dollars, that essentially means they’re stealing millions of dollars from those artists.

What’s more - as a WGA picketer I know pointed out - studios may be worried the removed content could end up being a HUGE HIT. What’s wrong with that? Because if it becomes that big and people notice, actors and writers will wonder where their residuals are. So they’re not removing these projects because no one is watching them. If no one was watching them, they’d be able to take a tax write off and not worry about expensive residual payments while keeping it available. The fact that removing the shows saves them money means people ARE watching it.

TL;DR - Studios removing exclusive streaming content isn’t just about tax write-offs, it’s about keeping residuals from the artists too.

67 notes

·

View notes

Note

Do you have any advice or tips for saving and budgeting?

Live below your means. Basically don't try to spend more than what you should in things that are pointless and vain, especially not if it's with the intent of impressing others on social media and the likes.

I live in Canada, the cost of living in this country is through the roof, and I oftentimes can't help but feel flabbergasted that many people my age don't have any investments (or at least plans to), or a savings account, mostly due to imbalanced priorities. Many people choose to rent places that take up over half of their monthly income and go every weekend to party and spend money on alcohol and Ubers. They pay $80 bucks each month on a phone plan and $40 on their iPhone bill, when they could get a cheaper plan and refurbished phone and save much more money.

There should be no reason why any grown adult should prioritize leisure over basic necessities, especially when their finances are strained. Investments and/or savings are a necessity. You will not be able to leave the money rat race unless you cement the foundations for your life in the future, and financial literacy is key to this. Sure, you only live once and our 20s shouldn't be used solely to work without taking times to relax and enjoy life, but one has to be mindful that every action has a consequence and nobody will come to rescue us from our bad habits and choices.

Some practical tips on budgeting and savings:

* Don't spend more than 40% of you post-taxed income on rent. Get roommates or stay with relatives if you must. Save as much as you can on rent.

* Some people may be triggered by this but I honestly don't care. Don't waste your money on alcohol or drugs.

* Look into opening a tax free savings accounts in your country of residency and put at least 10-20% of your monthly income there if you can. If you can't, any small percentage can help.

* Place your tax free savings on long-term, low-risk investments that can compound in the future. The S&P500 is a famous and safe bet, but I would consult and partner with a financial advisor for this as each person's particular financial situation will vary. As an adult independent woman, having a financial advisor should be a priority.

* Download a good Excel spread sheet with charts and fields to populate and track your monthly spending. These are easily found in many places online and are not hard to use. Give yourself a baseline of how much you wish to spend on a particular item monthly and try to stick to it as much as you can. This will also give you a rough idea of how much money you will have left to save and invest into your portfolio.

* Stop trying to compete with people's highlight reals and quit the superficial rate race of social media. The dumbest way to go broke is to do it trying to impress people who don't like you and who are not worth it.

* Finally, consume as much content as you can on financial literacy. There are tons of books and podcasts out there to help you with this. Having the right mindset when it comes to managing your money will be one of the best things you can do for yourself and your future self with thank you in the future.

188 notes

·

View notes