#transtexas

Explore tagged Tumblr posts

Text

Texas denies trans people the ability to change the sex on their birth certificates

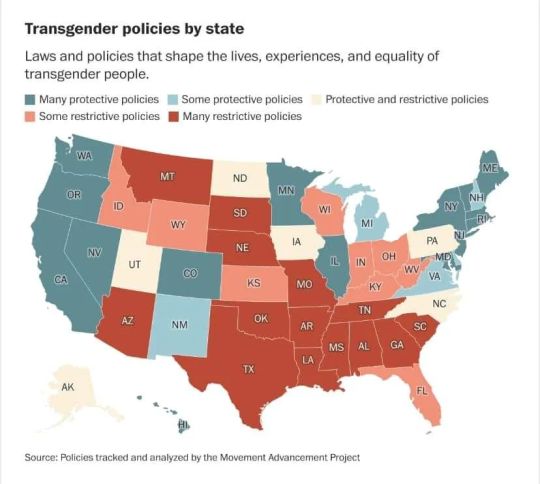

Texas has eliminated the ability for transgender people to alter the sex marker on their birth certificates. The new policy change, which was made with no forewarning or announcement, will put trans people at risk of discrimination. Previously, trans people could change the sex marker on their birth certificates by presenting proof of gender-affirming surgery, a court order signifying that they had “fully transitioned” and supporting statements from medical professionals. These are no longer sufficient, a spokesperson for the Department of State Health Services (DSHS) told The Texas Newsroom. Now, birth certificates can only be changed for children due to a hospital error or omission. Related Detransitioned man stuck in “limbo” because Texas forbids driver’s license gender changes Right-wing Attorney General Ken Paxton ordered the man’s personal info to be added to a list of transgender Texans that he’s compiling. Additionally, the DSHS website previously listed directions on how to change one’s assigned sex at birth on their birth certificate — the directions have since been removed. “Recent public reports have highlighted concerns about the validity of court orders purporting to amend sex for purposes of state-issued documents. DSHS is seeking assistance from the Office of Attorney General to determine the applicability of these concerns to amendments to vital records,” said DSHS spokesperson Chris Van Deusen. Van Deusen was likely referencing state Attorney General Ken Paxton’s continued efforts to oppose the legal recognition of trans people in Texas. Stay connected to your community Connect with the issues and events that impact your community at home and beyond by subscribing to our newsletter. Subscribe to our Newsletter today Last week, Paxton blocked trans people from being able to change the sex marker on their driver’s license. This is part of his sweeping policy to oppose gender-affirming care for trans people, particularly trans minors, who have reported mental and emotional distress over laws targeting their educational and healthcare rights. Paxton’s crusade is also part of an onslaught of policies across the country to deny any legal recognition of trans people. Five other states are enacting policies restricting birth certificates, according to the Movement Advancement Project. The Transgender Education Network of Texas (TENT) wrote of the new policy changes on Instagram, stating, “We are committed to keeping the community safe and will do all we can to assure trans Texans can get the most accurate information as possible through these rolling changes.” “Trans people have and always will exist. We will continue the legacy of our trans ancestors by fighting back, creating spaces for joy, and living our lives to the best of our abilities. Our transness is not determined by a piece of paper and cannot be taken away by hateful policies. We will overcome transphobic bigotry,” TENT’s post added. View this post on Instagram A post shared by TENT (@transtexas) “Texas Attorney General Ken Paxton has bullied state agencies into denying the specific types of updates that transgender Texans need,” wrote Johnathon Gooch, communications director for Equality Texas. “Ironically, that means the state’s top legal officer has instructed state agencies to deny court orders from state judges. So, what should be a simple administrative task has now become a nightmare.” Because birth certificates are used to help correct the gender markers on trans people’s driver’s licenses and other government-issued identity documents, if these commonly used documents don’t match their gender identity, it effectively outs a person as trans. This outing can lead to difficulty accessing various services as well as harassment and violence. http://dlvr.it/TCnF4f

0 notes

Photo

Thanks to holidays I’ve been going through old photos but man. Nine years ago doesn’t seem that long ago?? But here it is. In the first pic I still pretty actively identified as a lesbian, I’d reckon its about 6 months before I’d decide i wanted to transition? And honestly I’m sure it would’ve been a lot longer without the support of the communities around me. Places like the Transgender Foundation of America, the second home I found at Renaissance festivals, the unyielding support of my S/O, and the gradual acceptance of my family, and the love of my friends. I have a lot to be grateful for. (i recycle pictures because it’s greener) .

#ftm#transguy#transgender#bisexual#queer#transvisible#lgbt#latinx#chicanx#queerpagan#transtexas#transmasculine#transsexual#instagay#gay#instaqueer#tpoc#houstonartist#transisbeautiful#transbodies#myjourney#posttransition#afab#existanceisresistance#lgbtqia#nonbinary#demiboy#transartist

55 notes

·

View notes

Photo

Texas International was a Houston-based airline that was established in 1947 at Trans-Texas Airways (TTA). They served plenty of locations across Texas and even small towns like Brownwood, Palestine, Uvalde and Pecos had TTA service. They even flew to Marfa and Alpine! Trans-Texas got their first jet aircraft, the Douglas DC-9 Series 14, in 1966 with the delivery of the first jets. In fact, the very first DC-9 flown by Trans-Texas was N1301T “Ship One”, the former DC-9 prototype, which was the subject of a previous print I did. In 1969, they inaugurated services to Mexico City and Monterrey and in April of that year changed their name from Trans-Texas Airways to Texas International Airlines. One of the derisive names competitors called Trans-Texas (TTA) was "Tree-Top Airways" or Tinker-Toy Airways" referring to the older DC-3 fleet and the many small towns in Texas like Brownwood, Pecos, Uvalde and Palestine that TTA once served. When the name changed to Texas International in 1969, the airline ran ads in the major Texas newspapers with a Tinkertoy airplane flying above some trees and the tag line "No More Tinker Toys. No More Tree Tops. We Are Now Texas International Airlines”. This print depicts their second livery and is the last jet livery of the airline. The two profiles in the print are both of N1301T, the former “Ship One” with the top aircraft showing the purple-gray TTA livery as it debuted and the lower aircraft showing the same aircraft in the later modified livery when TTA rebranded as Texas International in 1969. Size is 16x20 inches and printed on metallic gloss finish heavy weight photographic paper. Cost is $40, shipping and handling for US domestic addresses is free. Contact me at [email protected] to get yours on its way to you. #avgeek #aviation #aircraft #planeporn #TheChickenWorks (follow this tag to see more of my artwork) #Douglas #McDonnellDouglas #DC9 #TransTexas #TexasInternational #N1301T #Avgeekery #illustrator #instaaviation #aviationlovers #aviationphotography #flight #AvgeekSchoolofKnowledge

#douglas#aviationphotography#illustrator#aircraft#dc9#avgeek#thechickenworks#mcdonnelldouglas#aviationlovers#flight#planeporn#avgeekschoolofknowledge#instaaviation#aviation#texasinternational#avgeekery#transtexas#n1301t

4 notes

·

View notes

Text

today i celebrate one year post-op top surgery. it’s been so special watching my body and mind heal this past year and it’s truly the best thing i’ve ever done for myself. not sure where or who i’d be without it.

grateful for my mom and fiancée who were angels and nurses during my recovery. grateful for my team who constantly celebrates me being a loud + proud trans artist. grateful to my doctor for saving my life. grateful to live in a state where i have access to gender affirming care.

gender affirming care is life saving care. anyone who tries to take that away is evil in my eyes. to anyone impacted by these laws - i’m here for you and i will fight for you. call your local govt and demand they stop attacking trans people, kids, and families. donate to @aclu @transtexas

we must all fight for trans liberation. and if you don’t care to.. i’m honestly not sure what you’re doing here.

74 notes

·

View notes

Photo

88th legislation session is coming in January....are we ready for the battle again ....we follow the lead of @transtexas when it come to the legislation in TX ...what orgs keep yall up to date on bills and legislation in ya area? #txlege #trans #transrightsarehumanrights🌈 https://www.instagram.com/p/Cl0VjrpugfM/?igshid=NGJjMDIxMWI=

2 notes

·

View notes

Text

La última vez que vi a Ingrid, a quien le cambiaré el nombre por, digamos, Inridg, enunció dos poemas bonitos, especialmente bonitos por involuntarios, y me sacó un retrato que, como todos los retratos, en su momento no me gustó pero ahora lo valoro pues en él aparecen mi barrio, mi mesa, mi sol opresivo, mi bebida, mi Chuco, mi hogar.

Era este:

Con estas ojeras vivo, he vivido, desde los seis años y no hay mucho que pueda hacer al respecto. Me embarro cremas antes de dormir, en secreto, desde la pandemia. No sé por qué sigo considerando la vanidad algo vergonzoso. Mentira: sí sé.

Me tomó ese retrato y me deseó suerte en mi nueva vida. Le pregunté cuál era su lugar favorito de Houston, pues en aquel entonces esa era la pregunta que yo le hacía a todo mundo, y ella respondió que la capilla Rothko. Lo apunté. Mentalmente. Y en mi diario, que no es este blog, aunque lo parezca.

Pasaron dos semanas y ocurrió la mudanza across state. Cómo me gustan esas palabras combinadas, intraducibles, inadaptables del inglés. Across state: panestatal, interestado, transTexas. En el inglés caben todos los conceptos bien compactos, igual que nuestras pertenencias en un coche arretacado.

Ahora recuerdo que Samuel, Suamel, alguna vez me explicó de dónde procede la a que le pegamos a las palabras, pero por desgracia lo he olvidado.

El coche arretacado de ropa y de preocupaciones existenciales. Lo habíamos abandonado todo. No. Yo no había abandonado todo, yo había cerrado mis asuntos en UTEP. Era Codelo quien lo había abandonado todo, él amaba su chamba, eso es algo en lo que pienso todos los días.

A mi Codelo no le cambio el nombre porque ya se lo había cambiado desde antes.

Desde nuestra llegada a Houston nos dimos a la tarea de conocerla a pie, y desde el primer día salimos a caminar por Downtown como dos verdes cualquieras, novatos, ingenuos peatones paisanos, como si no conociéramos el sol de Texas, como si los destellos de las cristaleras de El Paso no nos hubieran dejado ciegos.

En eso llegó Sylvia, mi Silvya, y me dijo que quería llevarme a su lugar favorito de Houston, que por favor le reservara un miércoles, un jueves, cualquier mañana de esa primera semana para llevarme a un lugar maravilloso.

Aquí no hay vuelta O’Henry, no hay desgracia ni redoble de percusiones. Ese lugar maravilloso era la capilla Rothko, obvvviamente.

Pasados dos párrafos, y tras haberlo pensado mejor, confieso que Codelo no amaba su chamba, no realmente. La verdad es que comenzaba a sentirse insatisfecho. Había llegado la hora de irnos.

Y sin embargo, extraño tanto El Paso. Amanecí mirando fotos y pensando en Inrigd.

No logro escapar al viejo y terrible vicio de la idealización nostálgica. Diría mi profesor que es una predisposición del mindset migrante, que vive anhelando lo que fue y ya no será. El homesick, el jamaicón, el allacito, la patria querida, el terruño, esas mamadas. Pero, no es mi caso, yo ya venía preidealizante. Siempre he sido así, desde que tengo memoria. Las ojeras me brotaron a los seis años igual que las lágrimas y las terquedades.

En fin.

Por cierto, sí había O’Henry, pero estaba encriptado.

4 notes

·

View notes

Text

Me doing research into HRT like

#wolf barking#also i learned theres a planned parenthood in arlington!! so if i decide i want t i can go there n get it w/o letter bc of informed consent#s/o to codeless for helpin me learn that#and for connectin me w transtexas#they might be able to help w namhe change process

0 notes

Text

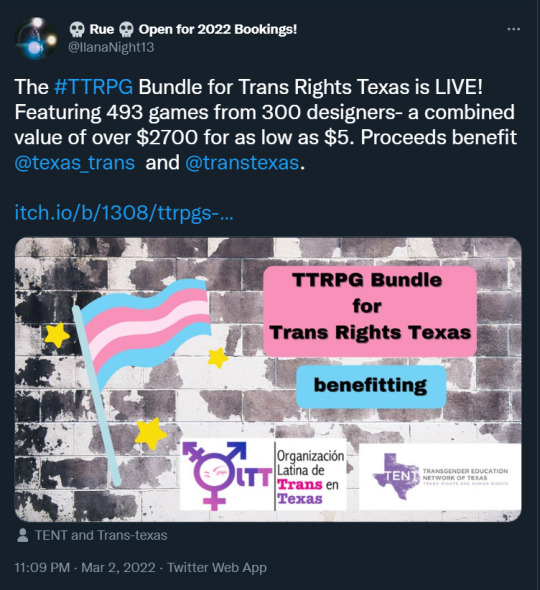

[Image: Tweet by 💀 Rue 💀 Open for 2022 Bookings! ( @/IlanaNight13 ); transcript follows.]

The #TTRPG Bundle for Trans Rights Texas is LIVE! Featuring 493 games from 300 designers- a combined value of over $2700 for as low as $5. Proceeds benefit @texas_trans and @transtexas.

https://itch.io/b/1308/ttrpgs-for-trans-rights-in-texas

[Attached image: Trans Pride flag sticker with yellow stars around it; "TTRPG Bundle for Trans Rights Texas, benefitting: Organization Latina de Trans en Texas and the Transgender Education Network of Texas".]

[End transcript/ID]

itch.io has a new ttrpg bundle up to support trans rights in Texas!! Please consider supporting it <3

5K notes

·

View notes

Text

RT @KatGraham: These trans kids in Texas are so brave. Kids shouldn’t have to skip school to fight for the right to play with their friends. Anti-trans sports bans are just plain wrong. Follow @glaad @equalitytexas @transtexas @TFN @ACLUTx @HRCATX to learn more. https://t.co/ns7u9Pv1gA https://twitter.com/hkpstreams/status/1448316511387541507

0 notes

Photo

One step takes me home Two steps back on my own Three skips to each stone Four steps back and I’m gone💨

#ftm #transguy #transgender #bisexual #queer #transvisible #lgbt #latinx #chicanx #queerpagan #transtexas #transvisible #mustachebisexual #transmasculine #instagay #instaqueer

#queerpagan#instagay#latinx#transvisible#bisexual#transgender#transguy#chicanx#transmasculine#queer#transtexas#ftm#instaqueer#mustachebisexual#lgbt#Gpoy

23 notes

·

View notes

Text

RT @watchmennews911: @electroboyusa @mjhegar @TheChrisSuprun @Castro4Congress @texasdemocrats @Spencer4Texas @texasyds @EqualityTexas @ScarletAvengers @TheUSASingers @Sky_Lee_1 @anti_orange1 @wesing4blue @WisePaxCat @jomareewade @tizzywoman @KikiAdine @KapeciaResists Thank you for alerting me. #MakeTexasSuck #CommunistsForTexas #Texas_LGBTQPOHGIFLKHLDISDOGHEHIEGDKALDGIHJODKDJEPW_PRIDE #TurnTexasIntoCalifornia #PINKOSforTEXAS #RaiseMyTaxesInTexas #TRANSTEXAS #FREECITIZENSHIP #TEXICO #NoWallFreeForAll #1stTO3rdWorld #AntiGOD #LetsKILLBabies https://t.co/SVR2j1oKX7

Thank you for alerting me. #MakeTexasSuck#CommunistsForTexas#Texas_LGBTQPOHGIFLKHLDISDOGHEHIEGDKALDGIHJODKDJEPW_PRIDE #TurnTexasIntoCalifornia#PINKOSforTEXAS#RaiseMyTaxesInTexas#TRANSTEXAS#FREECITIZENSHIP#TEXICO#NoWallFreeForAll#1stTO3rdWorld#AntiGOD#LetsKILLBabies pic.twitter.com/SVR2j1oKX7

— Watchmen News (@watchmennews911) May 3, 2019

https://platform.twitter.com/widgets.js from Twitter https…

View On WordPress

0 notes

Text

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions

In the following guest post, Jennifer Bergstrom, Esq., Senior Claim Counsel, Hiscox USA, Elan Kandel, Esq. and Jennifer Lewis, Esq. of Bailey Cavalieri take a look at the key D&O insurance coverage decisions of 2017. I would like to thank the authors for allowing me to publish their article. I welcome guest post submissions from responsible authors on topics of interest to this site’s readers. Please contact me directly if you would like to submit a guest post. Here is the authors’ guest post.

******************************************

As we begin 2018, we take a moment to look back at the key 2017 insurance coverage caselaw involving perennial coverage issues for D&O insurers and policyholders.

Disgorgement

The definition of loss in most D&O insurance policies excludes amounts that are uninsurable as a matter of law. Coverage disputes often arise, particularly in the settlement context, when insurers and policyholders disagree whether settlement amounts reflect uninsurable disgorgement such that the relief is not included within the loss definition. In 2017, two federal district courts issued insurer favorable decisions on this subject.

In Philadelphia Indemnity Insurance Company v. Sabal Insurance Group, Inc., 2017 U.S. Dist. LEXIS 159508 (S.D. Fla. Sep. 28, 2017) (“Sabal”) the policyholder sought coverage for settlement of a grand theft claim. The settlement agreement between the policyholder and the State of Florida resolving the grand theft claim did not state that the payments contemplated under the agreement constituted restitution. As such, the policyholder argued because there was no use of the word “restitution” in the settlement agreement, it followed that there could not be a finding that the payments contained within settlement agreement were restitutionary. The court, however, disagreed. The court noted that by definition, theft is wrongly acquiring the property of another. Therefore, payments made to resolve the claim “can only be said to disgorge the policyholder of property to which it was allegedly not legally entitled.” Moreover, the court found that the language of the settlement agreement did not preclude a determination that the payments within it constituted restitution or were restitutionary in nature. The court made clear that how payments are characterized in a settlement agreement is binding only on the parties themselves and not their insurers. Sabal provides a good example of how at least some courts are willing to look beyond the terms of an underlying settlement agreement when analyzing whether the relief at issue constitutes uninsurable disgorgement.

In Twin City Fire Insurance Co. v. Oceaneering International, Inc., 2017 U.S. Dist. LEXIS 47798 (S.D. Tex. Feb. 28, 2017), plaintiff in the underlying derivative claim alleged that members of the policyholder’s board had granted themselves excessive compensation. The complaint alleged breach of fiduciary duty and unjust enrichment. The underlying plaintiff sought disgorgement for the unjust enrichment claim and damages for the alleged breaches of fiduciary duties. The D&O insurer and policyholder disputed whether any portion of the underlying derivative action’s potential settlement constituted uninsurable disgorgement. Relying on the Fifth Circuit’s decision in In re TransTexas Gas Corp., 597 F.3d 298, 309 (5th Cir. 2010) (finding language stating that “loss” shall not include “matters which may be deemed uninsurable under the law pursuant to which this policy shall be construed” to be unambiguous), the court held that any settlement amounts directed at repayment of the excessive compensation is, a “disgorgement of ill-gotten gains and a restitutionary payment.” Notably, the court rejected the policyholder’s argument that the personal profit exclusion, which required a final adjudication, mandated coverage since no final adjudication had been issued.

What Constitutes a Claim?

The question of whether a letter or other document received by policyholder prior to the commencement of litigation constitutes a claim continues to spawn coverage litigation. In today’s market, most policies define a claim to include a written demand for monetary, non-monetary or injunctive relief. When the writing demands monetary relief, it is generally accepted that the writing constitutes a claim. However, when monetary relief is not expressly demanded, whether the writing constitutes a claim is a bit murkier, and is often the subject of coverage litigation. In Tree Top, Inc. v. Starr Indemnity & Liability Co., 2017 U.S. Dist. LEXIS 197375 (E.D. Wash. Nov. 21, 2017) (“Tree Top”), the United States District Court for the Eastern District of Washington held that a statutory notice of intent to sue seeking to enforce certain portions of California Proposition 65, which seeks to reduce the public’s exposure to chemicals in consumer products by requiring warning labels on products, did not constitute a claim, because it was not a “written demand for monetary, non-monetary or injunctive relief.” The notice stated the claimant “intend[ed] to bring suit in the public interest against [the insured] . . . to correct the violation occasioned by the failure to warn all customers of the exposure to lead.” The insurer argued that the notice constituted a claim. In the ensuing coverage litigation, the district court held that the notice did not constitute a claim because it lacked any “explicit” demand for relief, stating that “[t]he notice does not request a settlement or direct [the insured] to take any affirmative action. It merely provides notice of [the claimant’s] allegations and its intent to sue.” The court also rejected the insurer’s assertion that the notice contained an implied demand finding that this would require the policyholder to infer more from the notice than its plain language supports.

In contrast to the Tree Top Court’s unwillingness to infer an implied demand, the United States District Court for the District of Colorado, in Scottsdale Indemnity Co. v. Convercent, Inc., 2017 U.S. Dist. LEXIS 187939 (D. Colo. Nov. 14, 2017) (“Convercent”), found that a letter authored by an employee contained an implied settlement demand. In Convercent, the employee’s letter listed the specific legal violations that he believed had occurred in relation to his termination and suggested that the parties “get together and determine if my continued employment may be mutually addressed in a manner reflective of all issues to avoid litigation.” In so doing, the court found the employee was impliedly requesting a settlement of the issues he raised. Additionally, the employee warned that he would “pursue all appropriate remedies” if his recommended steps were not taken. The court further found that such a statement should reasonably have been read as an ultimatum and a threat to engage in litigation if his requests were not met. Accordingly, the court held that the letter constituted a claim because it was a “demand for damages or other relief.”

Another frequent “claim” touchpoint involves whether subpoenas constitute claims. This is an issue when the claim definition does not explicitly include subpoenas, as illustrated by the United States District Court for the Southern District of New York’s decision in Patriarch Partners, LLC v. AXIS Insurance Co., 2017 U.S. Dist. LEXIS 155367 (S.D.N.Y. Sep. 22, 2017) (“Patriarch”) and the Tenth Circuit Court of Appeals’ decision in MusclePharm Corp. v. Liberty Insurance Underwriters, Inc., 2017 U.S. App. LEXIS 20233 (10th Cir. Oct. 17, 2017) (“MusclePharm”).

In Patriarch, the district court held that subpoenas and a formal investigative order issued by the U.S. Securities & Exchange Commission (“SEC”) constituted claims for purposes of an excess policy’s prior and pending claims exclusion. Specifically, the prior and pending claims exclusion provided that the excess policy did not apply to “any amounts incurred by the Insureds on account of any claim or other matter based upon, arising out of or attributable to any demand, suit or other proceeding pending or order, decree, judgment or adjudication entered against any Insured…” The primary D&O policy defined a claim to include: “a written demand for monetary damages or non-monetary relief (including but not limited to injunctive relief) or a written request to toll or waive the statute of limitations” or an “Investigation of an Insured alleging a Wrongful Act.” The primary policy defined the term “Investigation” to include, among other things, “an order of investigation or other investigation by the Securities and Exchange Commission . . . .” The court held that the SEC subpoena constituted a “demand” for “non-monetary relief” under the primary policy. Although the primary policy did not define the term “demand,” the court found that a subpoena is a demand as it is an “imperative solicitation for that which is legally owed.” The court also found that the subpoena sought non-monetary relief in the form of documents that were to be produced. Additionally, the court found that the SEC formal investigative order and its underlying investigation of Patriarch were also claims under the primary policy. The court noted that the primary policy’s definition of an “Investigation” explicitly referenced “an order of investigation or other investigation by the Securities and Exchange Commission.” The court further noted that the formal investigative order also alleged a “Wrongful Act” because the order stated that the SEC has information that “tends to show” that Patriarch “may have been or may be” defrauding its clients and investors “[i]n possible violation” of the securities laws. The court found that this “[s]tatement amounts to a declaration that the SEC is investigating an allegation of wrongdoing. . . .”

In contrast to Patriarch, in MusclePharm, the United States Court of Appeals for the Tenth Circuit, held that a formal investigative order issued by the SEC and related subpoenas did not constitute “Claims” alleging “Wrongful Acts” as defined under a D&O policy. The policy at issue defined a claim to include “a written demand for monetary or non-monetary relief against an Insured Person,” “a formal administrative or regulatory proceeding against an Insured Person” or “a formal criminal, administrative or regulatory proceeding against an Insured Person when such Insured Person receives a Wells Notice or target letter in connection with such investigation.” The court rejected the policyholder’s argument that the SEC formal investigative order and related subpoenas constituted written demands for non-monetary relief. Relying on a dictionary definition of the term “relief,” the court found that through the formal investigative order and related subpoenas, the SEC sought to determine whether there would be any basis to seek monetary and/or non-monetary relief from MusclePharm. The court determined that “[By] this action, the SEC was not seeking relief, but was only gathering information.” The court also found that the formal investigative order and related subpoenas did not allege a Wrongful Act. Additionally, the court rejected the policyholder’s contention that the formal investigative order constituted a formal administrative or regulatory proceeding. The court held that although the formal investigative order was captioned as a proceeding, that alone did not result in its coverage under the policy. Moreover, the court concluded that “the events leading up to the SEC’s issuance of Wells Notices were part of a ‘regulatory investigation’ and were not a ’proceeding.’”

The Insured vs. Insured Exclusion

Application of the Insured vs. Insured exclusion remained a hot-button issue in 2017 with application of the exclusion to so-called mixed actions continuing to spawn coverage litigation. In a mixed action, the plaintiffs are comprised of both insureds and uninsured parties. Courts faced with applying the exclusion to mixed actions must decide whether the presence of some insured parties permits the exclusion to serve as a complete bar to coverage. As exemplified by the United States Court of Appeals for the Eighth Circuit’s decision in Jerry’s Enterprises. v. United States Specialty Insurance Co., 845 F.3d 883 (8th Cir. 2017) (“Jerry’s Enterprises”) and the United States District Court for the Northern District of Illinois’ decision in Vita Food Products v. Navigators Insurance Co., 2017 U.S. Dist. LEXIS 85257 (N.D. Ill. June 2, 2017) (“Vita Food Products”), how courts have addressed this issue remains a mixed bag.

In Jerry’s Enterprises, the daughter of the insured entity’s founder and her two daughters filed suit against the insured entity alleging multiple acts of misconduct by the insured entity’s directors designed to lower the value of their shares. The complaint contained claims for declaratory judgment, breach of fiduciary duty, aiding and abetting tortious conduct, equitable relief under Minnesota common and statutory law, breach of contract, civil conspiracy, and preliminary and permanent injunctive relief. All claims were brought jointly by the three plaintiffs. The daughter of the insured entity’s founder was a former member of the company’s board of directors while her daughters were not. The insurer denied coverage for the underlying litigation on the basis of the insured vs. insured exclusion, which barred coverage for any claim “brought by or on behalf of, or in the name or right of . . . any Insured Person, unless such Claim is: (1) brought and maintained independently of, and without the solicitation, assistance or active participation of . . . any Insured Person.” The Tenth Circuit determined that insured vs. exclusion applied due to the presence of a former director as an active participant. Moreover, the court noted that the former director was the driving force of the litigation. In so holding, the court rejected the policyholder’s argument that the presence of an allocation provision in the policy mandated a contrary result.

Although the Tenth Circuit refused to find that the presence of an allocation provision prevented the insured vs. insured exclusion from serving as a complete bar to coverage, the United States District Court for the Northern District of Illinois in Vita Food Products, held otherwise. In Vita Food Products, the underlying litigation was commenced by two dozen of the company’s former shareholders. Two of the plaintiffs were also Vita Food Products directors. The insured vs. insured exclusion precluded coverage for any claim made against any insured “by or on behalf of the company, or any security holder of the company, or any Directors or Officers.” The exclusion contained an exception, however, which provided that the “exclusion shall not apply to . . . any Claim brought by any security holder of the Company whether directly or derivatively, if the security holder bringing such Claim is acting totally independent of, and without the solicitation, assistance, active participation or intervention of any Director or Officer of the Company” (the “security holder exception”). The insurer argued that because at least some of the plaintiffs in the underlying lawsuit qualified as security holders or directors, the entire claim was barred under the insured vs. insured exclusion. The insurer further argued that the security holder exception did not save the claim because the director plaintiffs actively participated and assisted in the underlying litigation. The court held that the presence of the policy’s allocation provision was a dispositive factor and rejected the insurer’s argument.

Scope of the Professional Services Exclusion

The professional services exclusion precludes coverage for loss arising out of the performance of professional services. Coverage disputes most often arise involving the exclusion’s scope, particularly as it applies to service companies. The United States Court of Appeals for the Eleventh Circuit’s decision in Stettin v. National Union Fire Insurance Co., 861 F.3d 1335 (11th Cir. 2017) (“Stettin”) is illustrative of this issue.

In Stettin, the coverage litigation emanated from underlying litigation relating to a Ponzi scheme orchestrated by a Florida attorney and his law firm. The underlying litigation asserted claims against certain executives of a bank and trust company, the insured, at which the law firm maintained its accounts. The primary and excess insurers denied coverage for the underlying litigation based on the professional services exclusion, which precluded coverage for “any Claim made against any Insured alleging, arising out of, based upon, or attributable to the Organization’s or any Insured’s performance of or failure to perform professional services for others, or any act(s), error(s) or omission(s) relating thereto.” The Eleventh Circuit Court of Appeals sustained the district court’s dismissal of the coverage litigation finding that the exclusion’s use of the phrase “any Insured” unambiguously expressed a contractual intent to create joint obligations. As such, the court held that the exclusion applied to preclude coverage as to all insureds, including those bank executives who were merely responsible for internal managerial banking functions. The court further noted that the policies did not contain a severability clause and the absence of such a clause was “fatal” to the plaintiff’s argument seeking to apply the exclusion to only those executives performing professional services.

* * *

If the past is prologue, we would expect to see courts address these perennial coverage issues again in 2018. The caselaw that made this year memorable will certainly influence coverage decisions in 2018.

The post Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions appeared first on The D&O Diary.

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions syndicated from http://ift.tt/2qyreAv

0 notes

Text

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions

In the following guest post, Jennifer Bergstrom, Esq., Senior Claim Counsel, Hiscox USA, Elan Kandel, Esq. and Jennifer Lewis, Esq. of Bailey Cavalieri take a look at the key D&O insurance coverage decisions of 2017. I would like to thank the authors for allowing me to publish their article. I welcome guest post submissions from responsible authors on topics of interest to this site’s readers. Please contact me directly if you would like to submit a guest post. Here is the authors’ guest post.

******************************************

As we begin 2018, we take a moment to look back at the key 2017 insurance coverage caselaw involving perennial coverage issues for D&O insurers and policyholders.

Disgorgement

The definition of loss in most D&O insurance policies excludes amounts that are uninsurable as a matter of law. Coverage disputes often arise, particularly in the settlement context, when insurers and policyholders disagree whether settlement amounts reflect uninsurable disgorgement such that the relief is not included within the loss definition. In 2017, two federal district courts issued insurer favorable decisions on this subject.

In Philadelphia Indemnity Insurance Company v. Sabal Insurance Group, Inc., 2017 U.S. Dist. LEXIS 159508 (S.D. Fla. Sep. 28, 2017) (“Sabal”) the policyholder sought coverage for settlement of a grand theft claim. The settlement agreement between the policyholder and the State of Florida resolving the grand theft claim did not state that the payments contemplated under the agreement constituted restitution. As such, the policyholder argued because there was no use of the word “restitution” in the settlement agreement, it followed that there could not be a finding that the payments contained within settlement agreement were restitutionary. The court, however, disagreed. The court noted that by definition, theft is wrongly acquiring the property of another. Therefore, payments made to resolve the claim “can only be said to disgorge the policyholder of property to which it was allegedly not legally entitled.” Moreover, the court found that the language of the settlement agreement did not preclude a determination that the payments within it constituted restitution or were restitutionary in nature. The court made clear that how payments are characterized in a settlement agreement is binding only on the parties themselves and not their insurers. Sabal provides a good example of how at least some courts are willing to look beyond the terms of an underlying settlement agreement when analyzing whether the relief at issue constitutes uninsurable disgorgement.

In Twin City Fire Insurance Co. v. Oceaneering International, Inc., 2017 U.S. Dist. LEXIS 47798 (S.D. Tex. Feb. 28, 2017), plaintiff in the underlying derivative claim alleged that members of the policyholder’s board had granted themselves excessive compensation. The complaint alleged breach of fiduciary duty and unjust enrichment. The underlying plaintiff sought disgorgement for the unjust enrichment claim and damages for the alleged breaches of fiduciary duties. The D&O insurer and policyholder disputed whether any portion of the underlying derivative action’s potential settlement constituted uninsurable disgorgement. Relying on the Fifth Circuit’s decision in In re TransTexas Gas Corp., 597 F.3d 298, 309 (5th Cir. 2010) (finding language stating that “loss” shall not include “matters which may be deemed uninsurable under the law pursuant to which this policy shall be construed” to be unambiguous), the court held that any settlement amounts directed at repayment of the excessive compensation is, a “disgorgement of ill-gotten gains and a restitutionary payment.” Notably, the court rejected the policyholder’s argument that the personal profit exclusion, which required a final adjudication, mandated coverage since no final adjudication had been issued.

What Constitutes a Claim?

The question of whether a letter or other document received by policyholder prior to the commencement of litigation constitutes a claim continues to spawn coverage litigation. In today’s market, most policies define a claim to include a written demand for monetary, non-monetary or injunctive relief. When the writing demands monetary relief, it is generally accepted that the writing constitutes a claim. However, when monetary relief is not expressly demanded, whether the writing constitutes a claim is a bit murkier, and is often the subject of coverage litigation. In Tree Top, Inc. v. Starr Indemnity & Liability Co., 2017 U.S. Dist. LEXIS 197375 (E.D. Wash. Nov. 21, 2017) (“Tree Top”), the United States District Court for the Eastern District of Washington held that a statutory notice of intent to sue seeking to enforce certain portions of California Proposition 65, which seeks to reduce the public’s exposure to chemicals in consumer products by requiring warning labels on products, did not constitute a claim, because it was not a “written demand for monetary, non-monetary or injunctive relief.” The notice stated the claimant “intend[ed] to bring suit in the public interest against [the insured] . . . to correct the violation occasioned by the failure to warn all customers of the exposure to lead.” The insurer argued that the notice constituted a claim. In the ensuing coverage litigation, the district court held that the notice did not constitute a claim because it lacked any “explicit” demand for relief, stating that “[t]he notice does not request a settlement or direct [the insured] to take any affirmative action. It merely provides notice of [the claimant’s] allegations and its intent to sue.” The court also rejected the insurer’s assertion that the notice contained an implied demand finding that this would require the policyholder to infer more from the notice than its plain language supports.

In contrast to the Tree Top Court’s unwillingness to infer an implied demand, the United States District Court for the District of Colorado, in Scottsdale Indemnity Co. v. Convercent, Inc., 2017 U.S. Dist. LEXIS 187939 (D. Colo. Nov. 14, 2017) (“Convercent”), found that a letter authored by an employee contained an implied settlement demand. In Convercent, the employee’s letter listed the specific legal violations that he believed had occurred in relation to his termination and suggested that the parties “get together and determine if my continued employment may be mutually addressed in a manner reflective of all issues to avoid litigation.” In so doing, the court found the employee was impliedly requesting a settlement of the issues he raised. Additionally, the employee warned that he would “pursue all appropriate remedies” if his recommended steps were not taken. The court further found that such a statement should reasonably have been read as an ultimatum and a threat to engage in litigation if his requests were not met. Accordingly, the court held that the letter constituted a claim because it was a “demand for damages or other relief.”

Another frequent “claim” touchpoint involves whether subpoenas constitute claims. This is an issue when the claim definition does not explicitly include subpoenas, as illustrated by the United States District Court for the Southern District of New York’s decision in Patriarch Partners, LLC v. AXIS Insurance Co., 2017 U.S. Dist. LEXIS 155367 (S.D.N.Y. Sep. 22, 2017) (“Patriarch”) and the Tenth Circuit Court of Appeals’ decision in MusclePharm Corp. v. Liberty Insurance Underwriters, Inc., 2017 U.S. App. LEXIS 20233 (10th Cir. Oct. 17, 2017) (“MusclePharm”).

In Patriarch, the district court held that subpoenas and a formal investigative order issued by the U.S. Securities & Exchange Commission (“SEC”) constituted claims for purposes of an excess policy’s prior and pending claims exclusion. Specifically, the prior and pending claims exclusion provided that the excess policy did not apply to “any amounts incurred by the Insureds on account of any claim or other matter based upon, arising out of or attributable to any demand, suit or other proceeding pending or order, decree, judgment or adjudication entered against any Insured…” The primary D&O policy defined a claim to include: “a written demand for monetary damages or non-monetary relief (including but not limited to injunctive relief) or a written request to toll or waive the statute of limitations” or an “Investigation of an Insured alleging a Wrongful Act.” The primary policy defined the term “Investigation” to include, among other things, “an order of investigation or other investigation by the Securities and Exchange Commission . . . .” The court held that the SEC subpoena constituted a “demand” for “non-monetary relief” under the primary policy. Although the primary policy did not define the term “demand,” the court found that a subpoena is a demand as it is an “imperative solicitation for that which is legally owed.” The court also found that the subpoena sought non-monetary relief in the form of documents that were to be produced. Additionally, the court found that the SEC formal investigative order and its underlying investigation of Patriarch were also claims under the primary policy. The court noted that the primary policy’s definition of an “Investigation” explicitly referenced “an order of investigation or other investigation by the Securities and Exchange Commission.” The court further noted that the formal investigative order also alleged a “Wrongful Act” because the order stated that the SEC has information that “tends to show” that Patriarch “may have been or may be” defrauding its clients and investors “[i]n possible violation” of the securities laws. The court found that this “[s]tatement amounts to a declaration that the SEC is investigating an allegation of wrongdoing. . . .”

In contrast to Patriarch, in MusclePharm, the United States Court of Appeals for the Tenth Circuit, held that a formal investigative order issued by the SEC and related subpoenas did not constitute “Claims” alleging “Wrongful Acts” as defined under a D&O policy. The policy at issue defined a claim to include “a written demand for monetary or non-monetary relief against an Insured Person,” “a formal administrative or regulatory proceeding against an Insured Person” or “a formal criminal, administrative or regulatory proceeding against an Insured Person when such Insured Person receives a Wells Notice or target letter in connection with such investigation.” The court rejected the policyholder’s argument that the SEC formal investigative order and related subpoenas constituted written demands for non-monetary relief. Relying on a dictionary definition of the term “relief,” the court found that through the formal investigative order and related subpoenas, the SEC sought to determine whether there would be any basis to seek monetary and/or non-monetary relief from MusclePharm. The court determined that “[By] this action, the SEC was not seeking relief, but was only gathering information.” The court also found that the formal investigative order and related subpoenas did not allege a Wrongful Act. Additionally, the court rejected the policyholder’s contention that the formal investigative order constituted a formal administrative or regulatory proceeding. The court held that although the formal investigative order was captioned as a proceeding, that alone did not result in its coverage under the policy. Moreover, the court concluded that “the events leading up to the SEC’s issuance of Wells Notices were part of a ‘regulatory investigation’ and were not a ’proceeding.’”

The Insured vs. Insured Exclusion

Application of the Insured vs. Insured exclusion remained a hot-button issue in 2017 with application of the exclusion to so-called mixed actions continuing to spawn coverage litigation. In a mixed action, the plaintiffs are comprised of both insureds and uninsured parties. Courts faced with applying the exclusion to mixed actions must decide whether the presence of some insured parties permits the exclusion to serve as a complete bar to coverage. As exemplified by the United States Court of Appeals for the Eighth Circuit’s decision in Jerry’s Enterprises. v. United States Specialty Insurance Co., 845 F.3d 883 (8th Cir. 2017) (“Jerry’s Enterprises”) and the United States District Court for the Northern District of Illinois’ decision in Vita Food Products v. Navigators Insurance Co., 2017 U.S. Dist. LEXIS 85257 (N.D. Ill. June 2, 2017) (“Vita Food Products”), how courts have addressed this issue remains a mixed bag.

In Jerry’s Enterprises, the daughter of the insured entity’s founder and her two daughters filed suit against the insured entity alleging multiple acts of misconduct by the insured entity’s directors designed to lower the value of their shares. The complaint contained claims for declaratory judgment, breach of fiduciary duty, aiding and abetting tortious conduct, equitable relief under Minnesota common and statutory law, breach of contract, civil conspiracy, and preliminary and permanent injunctive relief. All claims were brought jointly by the three plaintiffs. The daughter of the insured entity’s founder was a former member of the company’s board of directors while her daughters were not. The insurer denied coverage for the underlying litigation on the basis of the insured vs. insured exclusion, which barred coverage for any claim “brought by or on behalf of, or in the name or right of . . . any Insured Person, unless such Claim is: (1) brought and maintained independently of, and without the solicitation, assistance or active participation of . . . any Insured Person.” The Tenth Circuit determined that insured vs. exclusion applied due to the presence of a former director as an active participant. Moreover, the court noted that the former director was the driving force of the litigation. In so holding, the court rejected the policyholder’s argument that the presence of an allocation provision in the policy mandated a contrary result.

Although the Tenth Circuit refused to find that the presence of an allocation provision prevented the insured vs. insured exclusion from serving as a complete bar to coverage, the United States District Court for the Northern District of Illinois in Vita Food Products, held otherwise. In Vita Food Products, the underlying litigation was commenced by two dozen of the company’s former shareholders. Two of the plaintiffs were also Vita Food Products directors. The insured vs. insured exclusion precluded coverage for any claim made against any insured “by or on behalf of the company, or any security holder of the company, or any Directors or Officers.” The exclusion contained an exception, however, which provided that the “exclusion shall not apply to . . . any Claim brought by any security holder of the Company whether directly or derivatively, if the security holder bringing such Claim is acting totally independent of, and without the solicitation, assistance, active participation or intervention of any Director or Officer of the Company” (the “security holder exception”). The insurer argued that because at least some of the plaintiffs in the underlying lawsuit qualified as security holders or directors, the entire claim was barred under the insured vs. insured exclusion. The insurer further argued that the security holder exception did not save the claim because the director plaintiffs actively participated and assisted in the underlying litigation. The court held that the presence of the policy’s allocation provision was a dispositive factor and rejected the insurer’s argument.

Scope of the Professional Services Exclusion

The professional services exclusion precludes coverage for loss arising out of the performance of professional services. Coverage disputes most often arise involving the exclusion’s scope, particularly as it applies to service companies. The United States Court of Appeals for the Eleventh Circuit’s decision in Stettin v. National Union Fire Insurance Co., 861 F.3d 1335 (11th Cir. 2017) (“Stettin”) is illustrative of this issue.

In Stettin, the coverage litigation emanated from underlying litigation relating to a Ponzi scheme orchestrated by a Florida attorney and his law firm. The underlying litigation asserted claims against certain executives of a bank and trust company, the insured, at which the law firm maintained its accounts. The primary and excess insurers denied coverage for the underlying litigation based on the professional services exclusion, which precluded coverage for “any Claim made against any Insured alleging, arising out of, based upon, or attributable to the Organization’s or any Insured’s performance of or failure to perform professional services for others, or any act(s), error(s) or omission(s) relating thereto.” The Eleventh Circuit Court of Appeals sustained the district court’s dismissal of the coverage litigation finding that the exclusion’s use of the phrase “any Insured” unambiguously expressed a contractual intent to create joint obligations. As such, the court held that the exclusion applied to preclude coverage as to all insureds, including those bank executives who were merely responsible for internal managerial banking functions. The court further noted that the policies did not contain a severability clause and the absence of such a clause was “fatal” to the plaintiff’s argument seeking to apply the exclusion to only those executives performing professional services.

* * *

If the past is prologue, we would expect to see courts address these perennial coverage issues again in 2018. The caselaw that made this year memorable will certainly influence coverage decisions in 2018.

The post Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions appeared first on The D&O Diary.

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions published first on http://ift.tt/2kTPCwo

0 notes

Text

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions

In the following guest post, Jennifer Bergstrom, Esq., Senior Claim Counsel, Hiscox USA, Elan Kandel, Esq. and Jennifer Lewis, Esq. of Bailey Cavalieri take a look at the key D&O insurance coverage decisions of 2017. I would like to thank the authors for allowing me to publish their article. I welcome guest post submissions from responsible authors on topics of interest to this site’s readers. Please contact me directly if you would like to submit a guest post. Here is the authors’ guest post.

******************************************

As we begin 2018, we take a moment to look back at the key 2017 insurance coverage caselaw involving perennial coverage issues for D&O insurers and policyholders.

Disgorgement

The definition of loss in most D&O insurance policies excludes amounts that are uninsurable as a matter of law. Coverage disputes often arise, particularly in the settlement context, when insurers and policyholders disagree whether settlement amounts reflect uninsurable disgorgement such that the relief is not included within the loss definition. In 2017, two federal district courts issued insurer favorable decisions on this subject.

In Philadelphia Indemnity Insurance Company v. Sabal Insurance Group, Inc., 2017 U.S. Dist. LEXIS 159508 (S.D. Fla. Sep. 28, 2017) (“Sabal”) the policyholder sought coverage for settlement of a grand theft claim. The settlement agreement between the policyholder and the State of Florida resolving the grand theft claim did not state that the payments contemplated under the agreement constituted restitution. As such, the policyholder argued because there was no use of the word “restitution” in the settlement agreement, it followed that there could not be a finding that the payments contained within settlement agreement were restitutionary. The court, however, disagreed. The court noted that by definition, theft is wrongly acquiring the property of another. Therefore, payments made to resolve the claim “can only be said to disgorge the policyholder of property to which it was allegedly not legally entitled.” Moreover, the court found that the language of the settlement agreement did not preclude a determination that the payments within it constituted restitution or were restitutionary in nature. The court made clear that how payments are characterized in a settlement agreement is binding only on the parties themselves and not their insurers. Sabal provides a good example of how at least some courts are willing to look beyond the terms of an underlying settlement agreement when analyzing whether the relief at issue constitutes uninsurable disgorgement.

In Twin City Fire Insurance Co. v. Oceaneering International, Inc., 2017 U.S. Dist. LEXIS 47798 (S.D. Tex. Feb. 28, 2017), plaintiff in the underlying derivative claim alleged that members of the policyholder’s board had granted themselves excessive compensation. The complaint alleged breach of fiduciary duty and unjust enrichment. The underlying plaintiff sought disgorgement for the unjust enrichment claim and damages for the alleged breaches of fiduciary duties. The D&O insurer and policyholder disputed whether any portion of the underlying derivative action’s potential settlement constituted uninsurable disgorgement. Relying on the Fifth Circuit’s decision in In re TransTexas Gas Corp., 597 F.3d 298, 309 (5th Cir. 2010) (finding language stating that “loss” shall not include “matters which may be deemed uninsurable under the law pursuant to which this policy shall be construed” to be unambiguous), the court held that any settlement amounts directed at repayment of the excessive compensation is, a “disgorgement of ill-gotten gains and a restitutionary payment.” Notably, the court rejected the policyholder’s argument that the personal profit exclusion, which required a final adjudication, mandated coverage since no final adjudication had been issued.

What Constitutes a Claim?

The question of whether a letter or other document received by policyholder prior to the commencement of litigation constitutes a claim continues to spawn coverage litigation. In today’s market, most policies define a claim to include a written demand for monetary, non-monetary or injunctive relief. When the writing demands monetary relief, it is generally accepted that the writing constitutes a claim. However, when monetary relief is not expressly demanded, whether the writing constitutes a claim is a bit murkier, and is often the subject of coverage litigation. In Tree Top, Inc. v. Starr Indemnity & Liability Co., 2017 U.S. Dist. LEXIS 197375 (E.D. Wash. Nov. 21, 2017) (“Tree Top”), the United States District Court for the Eastern District of Washington held that a statutory notice of intent to sue seeking to enforce certain portions of California Proposition 65, which seeks to reduce the public’s exposure to chemicals in consumer products by requiring warning labels on products, did not constitute a claim, because it was not a “written demand for monetary, non-monetary or injunctive relief.” The notice stated the claimant “intend[ed] to bring suit in the public interest against [the insured] . . . to correct the violation occasioned by the failure to warn all customers of the exposure to lead.” The insurer argued that the notice constituted a claim. In the ensuing coverage litigation, the district court held that the notice did not constitute a claim because it lacked any “explicit” demand for relief, stating that “[t]he notice does not request a settlement or direct [the insured] to take any affirmative action. It merely provides notice of [the claimant’s] allegations and its intent to sue.” The court also rejected the insurer’s assertion that the notice contained an implied demand finding that this would require the policyholder to infer more from the notice than its plain language supports.

In contrast to the Tree Top Court’s unwillingness to infer an implied demand, the United States District Court for the District of Colorado, in Scottsdale Indemnity Co. v. Convercent, Inc., 2017 U.S. Dist. LEXIS 187939 (D. Colo. Nov. 14, 2017) (“Convercent”), found that a letter authored by an employee contained an implied settlement demand. In Convercent, the employee’s letter listed the specific legal violations that he believed had occurred in relation to his termination and suggested that the parties “get together and determine if my continued employment may be mutually addressed in a manner reflective of all issues to avoid litigation.” In so doing, the court found the employee was impliedly requesting a settlement of the issues he raised. Additionally, the employee warned that he would “pursue all appropriate remedies” if his recommended steps were not taken. The court further found that such a statement should reasonably have been read as an ultimatum and a threat to engage in litigation if his requests were not met. Accordingly, the court held that the letter constituted a claim because it was a “demand for damages or other relief.”

Another frequent “claim” touchpoint involves whether subpoenas constitute claims. This is an issue when the claim definition does not explicitly include subpoenas, as illustrated by the United States District Court for the Southern District of New York’s decision in Patriarch Partners, LLC v. AXIS Insurance Co., 2017 U.S. Dist. LEXIS 155367 (S.D.N.Y. Sep. 22, 2017) (“Patriarch”) and the Tenth Circuit Court of Appeals’ decision in MusclePharm Corp. v. Liberty Insurance Underwriters, Inc., 2017 U.S. App. LEXIS 20233 (10th Cir. Oct. 17, 2017) (“MusclePharm”).

In Patriarch, the district court held that subpoenas and a formal investigative order issued by the U.S. Securities & Exchange Commission (“SEC”) constituted claims for purposes of an excess policy’s prior and pending claims exclusion. Specifically, the prior and pending claims exclusion provided that the excess policy did not apply to “any amounts incurred by the Insureds on account of any claim or other matter based upon, arising out of or attributable to any demand, suit or other proceeding pending or order, decree, judgment or adjudication entered against any Insured…” The primary D&O policy defined a claim to include: “a written demand for monetary damages or non-monetary relief (including but not limited to injunctive relief) or a written request to toll or waive the statute of limitations” or an “Investigation of an Insured alleging a Wrongful Act.” The primary policy defined the term “Investigation” to include, among other things, “an order of investigation or other investigation by the Securities and Exchange Commission . . . .” The court held that the SEC subpoena constituted a “demand” for “non-monetary relief” under the primary policy. Although the primary policy did not define the term “demand,” the court found that a subpoena is a demand as it is an “imperative solicitation for that which is legally owed.” The court also found that the subpoena sought non-monetary relief in the form of documents that were to be produced. Additionally, the court found that the SEC formal investigative order and its underlying investigation of Patriarch were also claims under the primary policy. The court noted that the primary policy’s definition of an “Investigation” explicitly referenced “an order of investigation or other investigation by the Securities and Exchange Commission.” The court further noted that the formal investigative order also alleged a “Wrongful Act” because the order stated that the SEC has information that “tends to show” that Patriarch “may have been or may be” defrauding its clients and investors “[i]n possible violation” of the securities laws. The court found that this “[s]tatement amounts to a declaration that the SEC is investigating an allegation of wrongdoing. . . .”

In contrast to Patriarch, in MusclePharm, the United States Court of Appeals for the Tenth Circuit, held that a formal investigative order issued by the SEC and related subpoenas did not constitute “Claims” alleging “Wrongful Acts” as defined under a D&O policy. The policy at issue defined a claim to include “a written demand for monetary or non-monetary relief against an Insured Person,” “a formal administrative or regulatory proceeding against an Insured Person” or “a formal criminal, administrative or regulatory proceeding against an Insured Person when such Insured Person receives a Wells Notice or target letter in connection with such investigation.” The court rejected the policyholder’s argument that the SEC formal investigative order and related subpoenas constituted written demands for non-monetary relief. Relying on a dictionary definition of the term “relief,” the court found that through the formal investigative order and related subpoenas, the SEC sought to determine whether there would be any basis to seek monetary and/or non-monetary relief from MusclePharm. The court determined that “[By] this action, the SEC was not seeking relief, but was only gathering information.” The court also found that the formal investigative order and related subpoenas did not allege a Wrongful Act. Additionally, the court rejected the policyholder’s contention that the formal investigative order constituted a formal administrative or regulatory proceeding. The court held that although the formal investigative order was captioned as a proceeding, that alone did not result in its coverage under the policy. Moreover, the court concluded that “the events leading up to the SEC’s issuance of Wells Notices were part of a ‘regulatory investigation’ and were not a ’proceeding.’”

The Insured vs. Insured Exclusion

Application of the Insured vs. Insured exclusion remained a hot-button issue in 2017 with application of the exclusion to so-called mixed actions continuing to spawn coverage litigation. In a mixed action, the plaintiffs are comprised of both insureds and uninsured parties. Courts faced with applying the exclusion to mixed actions must decide whether the presence of some insured parties permits the exclusion to serve as a complete bar to coverage. As exemplified by the United States Court of Appeals for the Eighth Circuit’s decision in Jerry’s Enterprises. v. United States Specialty Insurance Co., 845 F.3d 883 (8th Cir. 2017) (“Jerry’s Enterprises”) and the United States District Court for the Northern District of Illinois’ decision in Vita Food Products v. Navigators Insurance Co., 2017 U.S. Dist. LEXIS 85257 (N.D. Ill. June 2, 2017) (“Vita Food Products”), how courts have addressed this issue remains a mixed bag.

In Jerry’s Enterprises, the daughter of the insured entity’s founder and her two daughters filed suit against the insured entity alleging multiple acts of misconduct by the insured entity’s directors designed to lower the value of their shares. The complaint contained claims for declaratory judgment, breach of fiduciary duty, aiding and abetting tortious conduct, equitable relief under Minnesota common and statutory law, breach of contract, civil conspiracy, and preliminary and permanent injunctive relief. All claims were brought jointly by the three plaintiffs. The daughter of the insured entity’s founder was a former member of the company’s board of directors while her daughters were not. The insurer denied coverage for the underlying litigation on the basis of the insured vs. insured exclusion, which barred coverage for any claim “brought by or on behalf of, or in the name or right of . . . any Insured Person, unless such Claim is: (1) brought and maintained independently of, and without the solicitation, assistance or active participation of . . . any Insured Person.” The Tenth Circuit determined that insured vs. exclusion applied due to the presence of a former director as an active participant. Moreover, the court noted that the former director was the driving force of the litigation. In so holding, the court rejected the policyholder’s argument that the presence of an allocation provision in the policy mandated a contrary result.

Although the Tenth Circuit refused to find that the presence of an allocation provision prevented the insured vs. insured exclusion from serving as a complete bar to coverage, the United States District Court for the Northern District of Illinois in Vita Food Products, held otherwise. In Vita Food Products, the underlying litigation was commenced by two dozen of the company’s former shareholders. Two of the plaintiffs were also Vita Food Products directors. The insured vs. insured exclusion precluded coverage for any claim made against any insured “by or on behalf of the company, or any security holder of the company, or any Directors or Officers.” The exclusion contained an exception, however, which provided that the “exclusion shall not apply to . . . any Claim brought by any security holder of the Company whether directly or derivatively, if the security holder bringing such Claim is acting totally independent of, and without the solicitation, assistance, active participation or intervention of any Director or Officer of the Company” (the “security holder exception”). The insurer argued that because at least some of the plaintiffs in the underlying lawsuit qualified as security holders or directors, the entire claim was barred under the insured vs. insured exclusion. The insurer further argued that the security holder exception did not save the claim because the director plaintiffs actively participated and assisted in the underlying litigation. The court held that the presence of the policy’s allocation provision was a dispositive factor and rejected the insurer’s argument.

Scope of the Professional Services Exclusion

The professional services exclusion precludes coverage for loss arising out of the performance of professional services. Coverage disputes most often arise involving the exclusion’s scope, particularly as it applies to service companies. The United States Court of Appeals for the Eleventh Circuit’s decision in Stettin v. National Union Fire Insurance Co., 861 F.3d 1335 (11th Cir. 2017) (“Stettin”) is illustrative of this issue.

In Stettin, the coverage litigation emanated from underlying litigation relating to a Ponzi scheme orchestrated by a Florida attorney and his law firm. The underlying litigation asserted claims against certain executives of a bank and trust company, the insured, at which the law firm maintained its accounts. The primary and excess insurers denied coverage for the underlying litigation based on the professional services exclusion, which precluded coverage for “any Claim made against any Insured alleging, arising out of, based upon, or attributable to the Organization’s or any Insured’s performance of or failure to perform professional services for others, or any act(s), error(s) or omission(s) relating thereto.” The Eleventh Circuit Court of Appeals sustained the district court’s dismissal of the coverage litigation finding that the exclusion’s use of the phrase “any Insured” unambiguously expressed a contractual intent to create joint obligations. As such, the court held that the exclusion applied to preclude coverage as to all insureds, including those bank executives who were merely responsible for internal managerial banking functions. The court further noted that the policies did not contain a severability clause and the absence of such a clause was “fatal” to the plaintiff’s argument seeking to apply the exclusion to only those executives performing professional services.

* * *

If the past is prologue, we would expect to see courts address these perennial coverage issues again in 2018. The caselaw that made this year memorable will certainly influence coverage decisions in 2018.

The post Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions appeared first on The D&O Diary.

Guest Post: The Year in Review: 2017 Key D&O Insurance Coverage Decisions published first on

0 notes

Text

To my trans followers in Texas

I haven't checked it out yet, but my teacher told me to check out the site transtexas.org, it's a support group I hear. Just letting everyone know in case you wanna check it out, too.

2 notes

·

View notes

Photo

Shaved yesterday 🐺 #ftm #transman #transguy #queer #queerguy #bisexual #existenceisresistance #transisbeautiful #transtexas #chicanx #queerwitch #posttransition #instagay #latinx #lgbt #greeneyes

#bisexual#lgbt#queerguy#transtexas#queerwitch#posttransition#transman#existenceisresistance#latinx#greeneyes#queer#transisbeautiful#ftm#transguy#chicanx#instagay

8 notes

·

View notes