#uart protocol

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--comm-products--i2c/pca9515adp-118-nxp-5973557

I2C CAN Bus Module, I2C adapter, I2C devices, Serial Peripheral Interface

PCA9515A Series 3.6 V 5 mA 400 kHz 6 pF Surface Mount I2C-bus Repeater - SOIC-8

#Comm Products I2C#PCA9515ADP#118#NXP#I2C CAN Bus Module#I2C adapter#I2C devices#Serial Peripheral Interface#I2C Level Converter#i2c protocol#spi protocol#uart protocol#i2c communication#i2c protocol in embedded system#I2C-bus Repeater

1 note

·

View note

Text

We're vibin' with Claude 3.7 and writing uBlox drivers 😎🤖🛰️

Heeeey, we're just having a super chill vibe here at the desk of Ladyada—writing a driver for the uBlox M8Q

https://blog.adafruit.com/2024/09/10/a-mini-gps-from-ublox-with-i2c-and-uart

, which has both I2C and UART interfaces. As expected, it can do everyday NMEA output, but it can also do UBX, a "compressed" protocol for advanced data reads and writes over I2C/UART—or even SPI on some other chips.

However, the UBX protocol is a hugely complex driver to implement, with dozens of commands and hundreds of flags. But why stress when you can viiiibe? We're using this beast of a spec as an excuse to try out the new Claude 3.7, which is doing great at chomping through the UBX documentation roughage and giving us some nice code on the other side. Within an hour, we're able to connect and switch to UBX mode by sending a well-formed message and receiving an ACK.

What we like about coding with a good LLM is that it does the work we sometimes get lazy over, like handling various error conditions, timeouts, and verbose error messages.

13 notes

·

View notes

Note

WARNING: LONG ASK INCOMING

For hobby electronics there’s two major kinds of processors: Microcomputers and Microcontrollers. Microcomputers are small full computer systems like the Raspberry Pi, they typically run a general-purpose OS (typically some flavor of Linux) and are useful for the kinds of projects that require basically a full computer to function, but not necessarily individual sensors. They’re a great place to start for people who don’t know a whole ton about programming or working with individual components because they typically can output a true GUI to a screen and have the capabilities of a regular desktop computer. They have a main processor, true RAM, and either large on-board storage space or a way to read a storage device, like an SD card.

Microcontrollers are less complicated (component wise) than microcomputers, but as a result are more difficult for total beginners to begin working with. They’re typically primarily a SoC (System on a Chip) processor without discrete RAM modules and a very small EEPROM (on-ship storage space) and need to have components wired and configured to them to be able to do much more than being a fancy calculator. They’re used for when you need something to carry out electronic functions or get sensor readings, but not necessarily a full operating system, so they’re best suited for small/integrated applications. Your helmet uses a microcontroller to control the LEDs you used in the Cunt Machine post.

I build high-power model rockets as a hobby and with my university team, so I work with both kinds of processor as part of designing payload systems. I typically prefer microcontrollers in these as most of what we do doesn’t need an actual OS to run, and they’re smaller/lighter than microcomputers. One of the advantages of a microcontroller is that it runs a Real-Time OS (RTOS) which forgoes all the user-friendliness of things like windows and linux to instead be the bare minimum backend necessary to run code uploaded into the processor.

The main advantage of using a microcontroller is really that they’re typically a lot cheaper than microcomputers are and are plenty powerful for really embedded applications. They also make other parts of whatever system is being built cheaper/easier to integrate because they require less overhead to function - the raspberry pi needs a minimum of 5 volts of power to work, while a chip like an ESP32-PICO can run at 1.8V.

The main way you make sensors/buttons/peripherals work with a microcontroller is via digital communication busses. There’s a few protocols, the most common being I2C, SPI, and UART. I’ll talk about I2C since that’s generally the most common. With I2C each component is assigned a 2-byte “address” that they’re identified by. When the controller sends a request signal on the I2C data bus, every sensor along the line will return their own signal, marked with their address so that they can be identified. It allows for a large number of devices to be put on the same lines and you can daisy-chain them through each other to the microcontroller.

I’ll be honest I really can’t think of a good way to say much more on the subject as like a starting message because I’ve been working with computers so long all the tech stuff for me is second nature, but if you have any questions ask away I can probably answer them or google them.

.

#AAAAAAAAAAAAAAAAAAAA TY INFORMATION#no yeah this is either really beginner friendly or. friendly to how much i have learned so far#tysm!!!! your insight is consistently so helpful <3#ask#lobsterbitches

27 notes

·

View notes

Text

Understanding the Functionality of Samsung Refrigerator PCB Main Assembly

Samsung refrigerators have become essential appliances in modern households, offering innovative features and advanced technologies to ensure food preservation and convenience. The (Printed Circuit Board) PCB Main Assembly serves as the brain of the refrigerator, coordinating various functions and ensuring optimal performance.

Components of the Refrigerator PCB Main Assembly

The Refrigerator PCB Main Assembly consists of several essential components, each playing a crucial role in the refrigerator's operation.

Microcontroller: It is the central processing unit (CPU) and the computer performs programmed instructions to coordinate communication between the components.

Sensors: The ambient parameters (temperature, humidity, door status) supply critical information for regulation.

Relays: You control the flow of electricity to the compressor, fan motors, and defrost heater.

Capacitors: It will help you store the electrical energy and help to regulate voltage, and guarantee that the PCB is operating reliably.

Resistors: Protect sensitive components from harm by limiting the flow of electricity across certain circuits.

Diodes: Allow current to flow exclusively in one direction to avoid reverse polarity and safeguard components from damage.

Connectors: Facilitate electrical connections between the PCB and other refrigerator components to ensure seamless integration.

Working Principle PCB Main Assembly

The PCB Main Assembly operates on a set of programmed instructions that determine its behavior depending on sensor input and user command. The micro controller continuously monitors sensor input such as the reading of the temperature from the refrigerator compartment, and freezer. The microcontroller controls the transition of the compressor on, or off or the speed of the fan and also the defrost cycles based on the sensor data as to how to keep the temperature and humidity at the optimal level. In addition to the other refrigerator components, for example, display panel and user interface, the PCB Main Assembly provides feedback and enables users’’ interaction. The PCB Main Assembly incorporates safety features of overload protection and temperature sensors to protect the refrigerator from damage and to protect the user.

Communication Protocols

Data can be communicated to other components through microcontrollers by communication protocols like UART (Universal Asynchronous Receiver Transmitter), SPI (Serial Peripheral Interface), and I2C (Inter Integrated Circuit).

UART is used to transfer real-time data from a microcontroller to external devices like display panels and temperature sensors.

There is a power of communication SPI and I2C for the communication of integrated circuits associated with the PCB Main Assembly for efficient data transfer and synchronization between components.

Troubleshooting and Maintenance

Common issues with the Samsung Refrigerator PCB Main Assembly include sensor failures, relay malfunctions, and power supply issues, which can affect the refrigerator's performance.

To solve PCB Main Assembly problems, we can use diagnostic methods, like running self-tests and checking the error code.

The assembly can stay longer depending on the main, such as cleaning dust and debris from the PCB and securing appropriate ventilation.

The PCB Main Assembly is an important component of the Samsung refrigerator systems since it organizes several functions to contribute to the overall efficiency of the refrigerator and food preservation. Fore-knowledge of the PCB Main Assembly and the way it is constructed can assist users in likely managing problems in their fridges.

2 notes

·

View notes

Text

The ESP32 is a development board developed by Espressif systems. It can be programmed using Arduino IDE and ESP-IDF. It has higher processing power than ESP8266 but it is more costly and bigger in physical dimension than ESP8266. It has a built in Bluetooth module and CAN protocol and SRAM. It has 36 GPIO Pins with a CPU clock of 160MHz. It has 12-bit ADC onboard and supports CAN, UART, I2C and I2S. It can be used in prototyping IoT products, Low power Battery operated application, small range networking projects, and with the projects which require many Input Output Pins and Wi-Fi and Bluetooth connectivity.

6 notes

·

View notes

Text

Launch Your Career with Embedded Courses That Offer 100% Placement Support

In today’s technology-driven world, embedded systems are everywhere — from smartphones and home appliances to cars and industrial machines. As industries evolve, the demand for skilled embedded engineers is higher than ever. But here’s the question every student asks: “Will I get a good job after completing a course?”

At Technoscripts the best Embedded Institute in Pune, the answer is a big YES! Their embedded courses are not only designed to build strong technical skills but also to ensure students step confidently into their careers with excellent placement support.

Why Embedded Systems is a Career Game-Changer

Imagine creating the software that runs a smart TV or programming the microcontroller of an electric car. Embedded systems are the invisible force behind all smart devices. Industries like automotive, healthcare, robotics, and IoT are constantly hiring talented embedded engineers to innovate and design smarter solutions.

But to break into this exciting field, you need more than just basic knowledge. You need hands-on skills, industry exposure, and placement opportunities — exactly what Technoscripts provides.

Technoscripts Embedded Course with Placement Support

Technoscripts Embedded Institute has been a trusted name in embedded systems training for years. Their programs are designed to take students from beginner to industry-ready professionals. Here’s what makes their courses stand out:

Comprehensive Curriculum: Covers Embedded C programming, microcontrollers (like ARM, PIC, AVR), real-time operating systems (RTOS), communication protocols (UART, SPI, I2C, CAN), and IoT integration.

100% Practical Training: Students work on live projects and get real-world experience with hardware and software tools.

Soft Skills and Interview Preparation: Beyond technical training, students are guided in resume building, mock interviews, and communication skills to ace interviews.

Placement Assistance: Technoscripts has tie-ups with top companies in the embedded and automotive sector. Their dedicated placement team ensures students get connected to hiring partners and land jobs successfully.

Who Can Join These Courses?

📌 Fresh Graduates (BE/B.Tech in ECE, EEE, CSE, IT, etc.) looking to kickstart their careers. 📌 Working Professionals who want to upskill or switch to the embedded domain. 📌 Anyone passionate about technology and eager to work in a high-demand field.

Success Stories Speak for Themselves

Many Technoscripts alumni are now working with leading MNCs and startups in roles like Embedded Developer, Firmware Engineer, and IoT Specialist. With the institute’s blend of technical expertise and placement support, students have successfully transitioned from classroom learning to professional workspaces.

Why Choose Technoscripts Embedded Institute?

✨ Experienced Trainers: Learn from professionals with years of industry experience. ✨ Industry-Relevant Tools: Exposure to advanced tools and technologies used in real projects. ✨ Placement Track Record: A strong history of placing students in reputed companies.

Your Future Starts Here

An embedded course is not just about learning — it’s about building a career. And with Technoscripts Embedded Institute, you’re not only trained for the job market but are also guided to secure your dream job.

Ready to take the first step towards your embedded career?Join an Embedded Course in Pune with Placement and gear up for a future filled with opportunities.

Because the right training with the right guidance is all you need to succeed.

0 notes

Text

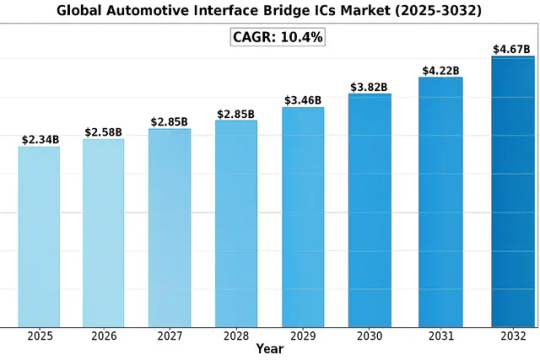

Global Automotive Interface Bridge Integrated Circuits Market is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4%

Global Automotive Interface Bridge Integrated Circuits Market size was valued at US$ 2.34 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4% during the forecast period 2025-2032.

Automotive Interface Bridge ICs are specialized semiconductor devices that facilitate communication between different protocols in vehicle electronics systems. These chips bridge interfaces such as USB to UART/I2C/SPI, PCIe to SATA, or other protocol translations critical for modern automotive architectures. Key types include USB Interface ICs, PCI/PCIe Interface ICs, and SATA Interface ICs, which enable seamless data transfer between infotainment systems, ADAS components, and vehicle control units.

The market growth is primarily driven by increasing vehicle electrification and the rising adoption of advanced driver-assistance systems (ADAS), which require robust interface solutions. While North America currently leads in technological adoption, Asia-Pacific shows the highest growth potential due to expanding automotive production in China and India. Major players like NXP, Toshiba, and Infineon Technologies are investing heavily in developing next-generation bridge ICs to support automotive Ethernet and 5G-V2X applications, further accelerating market expansion.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-automotive-interface-bridge-integrated-circuits-market/

Segment Analysis:

By Type

USB Interface IC Segment Leads Due to Proliferation of Connected Vehicle Technologies

The market is segmented based on type into:

USB Interface IC

Subtypes: USB 2.0, USB 3.0, USB-C, and others

PCI/PCIe Interface IC

Subtypes: PCIe 3.0, PCIe 4.0, and others

SATA Interface IC

Other Interfaces

Includes I2C, SPI, UART, and CAN bus bridges

By Application

Passenger Vehicle Segment Dominates with Increasing Demand for In-Vehicle Connectivity

The market is segmented based on application into:

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Autonomous Vehicles

By Vehicle System

Infotainment Systems Account for Major Market Share Due to Rising Consumer Demand

The market is segmented based on vehicle system into:

Infotainment Systems

Advanced Driver Assistance Systems (ADAS)

Telematics Systems

Powertrain Control Systems

By Technology

Wired Interface Bridges Maintain Dominance While Wireless Bridges Show Rapid Growth

The market is segmented based on technology into:

Wired Interface Bridges

Wireless Interface Bridges

Hybrid Interface Bridges

Regional Analysis: Global Automotive Interface Bridge Integrated Circuits Market

North America The North American market for automotive interface bridge ICs is characterized by strict automotive safety regulations and rapid adoption of vehicle electrification technologies. The U.S. leads regional demand, driven by high automotive OEM concentration and investments in autonomous driving systems exceeding $15 billion annually. Canada’s growing EV market (projected 20% of total sales by 2025) creates additional demand for advanced interface solutions. USB and PCIe interface ICs dominate applications, particularly in premium vehicle infotainment systems. However, supply chain disruptions and semiconductor shortages have temporarily impacted regional growth.

Europe Europe presents the most technologically mature market for automotive interface bridge ICs, with German automakers driving innovation. The region’s focus on vehicle connectivity (with 90% new cars featuring embedded connectivity by 2025) fuels demand for high-speed interface solutions. The EU’s Type Approval regulation imposes strict electromagnetic compatibility requirements on all automotive electronics, creating a competitive advantage for established players like NXP and Infineon Technologies. While Western Europe maintains technological leadership, Central and Eastern European markets show growing potential as automotive production hubs.

Asia-Pacific As the global automotive production hub, Asia-Pacific accounts for over 60% of interface bridge IC consumption, with China leading both production and innovation. Chinese domestic IC manufacturers are rapidly catching up technologically while offering competitive pricing. The Indian market shows particularly strong growth potential, with automotive electronics demand expanding at 15% CAGR. Japan maintains leadership in quality standards through automotive-grade IC certifications adopted across the region. However, price sensitivity among local OEMs and protectionist policies in some countries create market entry barriers for international suppliers.

South America The South American market remains constrained by economic volatility, though Brazil and Argentina demonstrate steady growth in automotive electronics adoption. Local content requirements in Brazil promote domestic IC production for basic interface applications, while premium vehicles continue relying on imports. The region’s aftermarket sector shows unexpected strength, with interface bridge IC demand growing for vehicle upgrade and retrofit solutions. However, infrastructure limitations and currency fluctuations continue to deter significant market expansion.

Middle East & Africa This emerging market is witnessing gradual growth through luxury vehicle sales in GCC countries and increasing Chinese automotive imports across Africa. The UAE serves as a regional technology hub with advanced vehicle connectivity adoption. South Africa’s automotive manufacturing sector drives steady demand, though mainly for basic interface solutions. Market development is hampered by limited local technical expertise and reliance on international distribution channels, creating opportunities for suppliers offering comprehensive technical support services.

MARKET OPPORTUNITIES

Vehicle-to-Everything (V2X) Communication to Create New Demand

The emerging V2X ecosystem presents significant opportunities for interface bridge IC manufacturers. As vehicles increasingly connect with infrastructure, other vehicles, and urban systems, they require sophisticated bridging solutions between communication protocols like DSRC, C-V2X, and traditional automotive networks. Regulatory mandates in several regions are accelerating V2X adoption, with China planning nationwide implementation by 2025 and the EU considering similar requirements. Interface bridge ICs that can seamlessly connect these diverse communication technologies while meeting stringent automotive requirements will be well-positioned to capitalize on this growth.

Software-Defined Vehicles to Drive Long-Term Growth

The automotive industry’s shift towards software-defined vehicles represents a paradigm shift that will require new generations of interface bridge solutions. These vehicles require flexible hardware platforms that can support evolving software features through over-the-air updates. This creates demand for programmable interface bridge ICs that can adapt to changing protocol requirements and feature sets without hardware modifications. Leading semiconductor companies are already developing solutions that combine traditional bridging functionality with FPGA-like programmability, opening new market opportunities.

Additionally, the growing importance of cybersecurity in connected vehicles presents opportunities for interface bridge ICs with built-in security features. ICs that can implement protocol-level security while maintaining real-time performance are becoming increasingly valuable in automotive designs.

AUTOMOTIVE INTERFACE BRIDGE INTEGRATED CIRCUITS MARKET TRENDS

Rising Automotive Electrification to Drive Market Growth

The global automotive industry is undergoing a transformative shift toward electrification and advanced connectivity, significantly boosting the demand for interface bridge ICs. With the automotive semiconductor market projected to reach $78 billion by 2027, bridge ICs are becoming critical components in modern vehicles. These chips enable seamless communication between legacy protocols like UART or I2C and contemporary interfaces such as USB-C or PCIe, supporting evolving in-vehicle infotainment (IVI) and advanced driver-assistance systems (ADAS). The proliferation of electric vehicles (EVs), expected to account for 30% of global vehicle sales by 2030, further amplifies this demand as automakers integrate more electronic control units (ECUs) requiring robust interface solutions.

Other Trends

Automotive Connectivity and 5G Integration

The integration of 5G networks in vehicles is accelerating the need for high-speed data bridges between telematics systems and onboard sensors. Automotive interface bridge ICs facilitate low-latency data transfer, enabling real-time V2X (vehicle-to-everything) communication. With over 50 million connected cars on the road globally, automakers are prioritizing chips that support multi-protocol interoperability, such as USB to CAN or Ethernet to SPI. This trend is particularly prominent in premium vehicles, where over 80% of new models now feature embedded connectivity modules.

Miniaturization and Power Efficiency Innovations

As automotive electronics become increasingly compact, interface bridge ICs are evolving to meet stringent space and power constraints. Leading manufacturers are leveraging 28nm and 16nm process nodes to deliver chips with 40% lower power consumption compared to previous generations. This is critical for EVs, where energy efficiency directly impacts range. Additionally, the trend toward zone-based E/E architectures in vehicles is driving demand for bridge ICs with integrated power management, reducing component counts by up to 25% in next-gen vehicle designs.

COMPETITIVE LANDSCAPE

Key Industry Players

Rapid Electrification and Connectivity Demands Drive Strategic Market Expansion

The global automotive interface bridge IC market exhibits a moderately consolidated competitive landscape, with major semiconductor companies and specialized interface solution providers vying for market share. NXP Semiconductors leads the segment, commanding approximately 22% market share in 2023, owing to its comprehensive portfolio of CAN FD and Ethernet bridge solutions for advanced driver-assistance systems (ADAS).

Infineon Technologies and Texas Instruments maintain strong positions through their vertical integration capabilities and strategic partnerships with Tier 1 automotive suppliers. The companies have collectively invested over $450 million in automotive interface R&D during 2022-2023, focusing on high-speed data transmission for electric vehicle architectures.

Japanese players like Toshiba and Fujitsu dominate the Asian market, particularly in cost-sensitive segments, with specialized bridge ICs for infotainment systems and hybrid vehicle power management. Their regional manufacturing advantages and JIS-compliant solutions give them an edge in domestic OEM supply chains.

Meanwhile, Microchip Technology and Silicon Labs are gaining traction through innovative USB-C and wireless bridge solutions, capitalizing on the growing demand for in-vehicle connectivity. Both companies have expanded production capacity by 30% since 2021 to meet the surging demand from European and North American automakers.

List of Key Automotive Interface Bridge IC Companies

NXP Semiconductors (Netherlands)

Infineon Technologies (Germany)

Texas Instruments (U.S.)

Toshiba Electronic Devices & Storage Corporation (Japan)

Fujitsu Semiconductor (Japan)

Microchip Technology Inc. (U.S.)

Silicon Laboratories (U.S.)

ROHM Semiconductor (Japan)

Cypress Semiconductor (U.S.)

Learn more about Competitive Analysis, and Forecast of Global Automotive Interface Bridge IC Market : https://semiconductorinsight.com/download-sample-report/?product_id=95784

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Automotive Interface Bridge ICs?

-> Automotive Interface Bridge Integrated Circuits Market size was valued at US$ 2.34 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4% .

Which companies lead the automotive interface IC market?

-> Market leaders include NXP Semiconductors (22% share), Toshiba (18%), Infineon Technologies (15%), followed by Microchip, Silicon Labs, and Renesas.

What drives demand for automotive interface ICs?

-> Key drivers are in-vehicle networking requirements (growing at 11% CAGR), EV adoption, and advanced driver assistance systems (ADAS) needing high-speed data bridges.

Which interface standard dominates automotive applications?

-> PCIe interface ICs account for 38% market share due to high bandwidth needs, while USB-C bridges are the fastest growing segment (14% CAGR).

How is the supply chain evolving?

-> Major players are establishing regional manufacturing hubs (e.g., NXP’s Singapore facility) and developing automotive-grade (AEC-Q100) interface solutions to meet quality requirements.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Introduction to the UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40

The UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40 is a legacy but versatile dual-channel communications controller developed by NEC Corporation (now part of Renesas). Encapsulated in a standard 40-pin dual in-line plastic (DIP-40) package, this NMOS IC supports multiple serial communication protocols and was originally designed for use in computing and telecommunications equipment of the 1980s and 1990s.

Despite being discontinued, the UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40 continues to see use among hobbyists and in legacy equipment refurbishment. Its balanced mix of performance, protocol flexibility, and ease of interfacing has preserved its relevance, even today.

2. Historical Background and Context

NEC Corporation introduced the μPD7201A series in the late 1970s/1980s to meet market demand for flexible, multi-protocol serial controllers. The UPD7201AC, a variant in that series, provided a cost-efficient, dual-channel solution, supporting asynchronous, synchronous (HDLC, SDLC), BISYNC, and external sync protocols.

These solutions were invaluable for systems needing versatile serial interfaces—such as early terminals, modems, industrial controllers, and telecommunications equipment. With integrated FIFO buffering, DMA channels, and support for 8080/8085/8086 buses, the UPD7201AC was a go-to part in its era.

3. Main Features and Specifications

Here’s a consolidated overview of what makes the UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40 noteworthy:

Dual Full‑Duplex Channels: Supports two simultaneous serial data streams.

Multi‑Protocol Support: Handles ASYNC, BIT SYNC, BYTE SYNC, HDLC, SDLC, BISYNC, and external clock modes.

Speed: Up to 0.125 MB/s (125 kb/s) throughput per channel.

Bus Compatibility: Designed for 8‑bit CPU buses like Intel 8080/8085/8086 .

DMA Channels: Contains four independent DMA channels to streamline data transfer.

Power: Standard +5 V NMOS design, current consumption around 230 mA.

Environmental Specs: Commercial grade (0–70 °C), through-hole plastic DIP-40 form factor.

Legacy Status: Discontinued, though still sourced via surplus and specialty electronics suppliers datasheets360.com.

Technical Deep Dive

1 Architecture

Internally, the UPD7201AC integrates separate logic for each channel—FIFO buffers, shift registers, CRC hardware for synchronous modes, and support for high- and low-level resets. The inclusion of four DMA channels allows for autonomous data movement between external memory and the CPU.

2 Protocol Handling

ASYNC: Adds support for traditional UART-like communication—a staple in serial messaging.

SYNC Modes: Includes byte-sync and bit-sync for systems using synchronous framing.

HDLC/SDLC: Widely used in networked and telecom environments, with built-in CRC generation and stripping.

BISYNC: IBM-style protocol—ensuring compatibility for specific enterprise systems.

External Sync: Allows user-supplied clocking for driving bespoke or timing-critical communication setups.

3 Integration

Thanks to its DIP-40 layout, the IC can easily be socketed on breadboards or through-hole PCBs. With an accompanying datasheet (available via sources such as Datasheet360 and Alldatasheet) engineers could design around port registers, interrupt vectors, and DMA system integration.

Contemporary Usage and Availability

Though NEC no longer manufactures the UPD7201AC, it remains in circulation via:

Surplus electronics vendors: Such as eBay listings for “UPD7201AC Multi Protocol Serial Controller DIP40” with prices around US $7.6 for 3-pack used units.

Specialized component suppliers: Products like “UPD7201AC NEC Multiprotocol Serial Controller IC DIP‑40” available from niche stores (e.g., Nikko Electronics UK, online at £18.99 each).

Electronic component distributors: Some still list inventory, enabling procurement for repairs or re-engineering projects .

Why It's Still Relevant

Legacy Equipment Support – IT and telecom artifacts using the UPD7201AC depend on it for ongoing functionality.

Vintage Computing – Enthusiasts building retro hardware setups use it for authentic protocol handling.

Educational Value – Demonstrating classic hardware-level communication and DMA integration to students.

Hackers & Makers – Its low cost and DIP form factor make it a fun and educational addition to electronics tinkering projects.

Practical Application Guide

If you plan to embed or work with the UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40, here's a short practical guide:

Power Setup: Provide stable +5 V (±0.5 V), keep bypass capacitors on Vcc/Vdd pins.

CPU Interface: Connect address/data lines to an 8080/8085/8086-compatible bus.

DMA Setup: Map internal DMA channels to your system’s memory arbitration; set proper vector values.

Protocol Registers: Configure mode control registers for desired protocol and clocking.

Interrupt Management: Route status interrupts into your system’s interrupt controller.

Data Buffering: Use FIFO thresholds and flags for efficient read/write operations.

Clocking: For synchronous transfers, ensure proper external or internal clock is provided.

Environment: Use within recommended temperature range and consider over-voltage protection where needed.

Alternatives and Modern Substitutes

Since the UPD7201AC is discontinued, consider modern equivalents if supporting older protocols is mandatory:

FPGA-Based UART/HDLC Controllers – Custom-implemented via HDL, offering flexibility in protocol and speed.

COTS PCI/USB Multi‑Protocol Serial Cards – Provide serial, synchronous, and networked frame support.

MCU-Based Designs – Microcontrollers (e.g., STM32F4 series) can abstract protocol handling via software libraries.

Legacy IC Equivalents – Similar devices from AMD (e.g., AM85C30) or Intel (82530 SCC) exist with broader sourcing and support nikkoe.comdatasheets360.comalldatasheet.com.

Performance Considerations

Data Throughput: Maxes out at 125 kb/s per channel—sufficient for dial-up modems, telemetry systems, and industrial controls.

CPU/DMA Offload: On-chip DMA channels reduce CPU idle cycles, beneficial where CPU cycles are precious.

Protocol Handling: Offloads framing, bit-stuffing, and CRC—saving system-level code complexity.

Legacy Constraints: NMOS tech demands steady +5 V; tech process offers limited tolerance to modern voltage variation.

Support Limitation: No modern datasheet support or application notes—design relies on archived documentation.

Troubleshooting and Maintenance

Issues with the UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40 can often be resolved with careful checks:

Power Integrity: Verify stable 5 V supply and bypass capacitors.

Clock Source: For synchronous modes, double-check external/internal clock configurations.

Signal Integrity: Use oscilloscopes to check RX/TX waveforms, CRC and flag lines.

Register Configuration: Incorrect settings can lock up FIFOs—use read-back of status registers.

DMA Channels: Address collision or incorrect vector mapping can cause transfer faults.

Thermal Conditions: Overheating may lead to communication failure; ensure airflow and heatsinking as needed.

Conclusion: A Legacy IC That Endures

The UPD7201AC NEC Multiprotocol Serial Controller IC DIP-40 stands as a testament to robust engineering from NEC’s golden era. Though discontinued, it still thrives in niche segments—legacy equipment restoration, educational platforms, and hobbyist electronics. Its dual-channel architecture, flexible protocol support, and DMA-driven efficiency make it not only historically significant but practically useful even today.

0 notes

Text

Why Microcontrollers are Essential in IoT Development?

Microcontrollers play a crucial role in the development of IoT (Internet of Things) solutions. These compact, energy-efficient computing devices are designed to perform dedicated tasks, making them ideal for controlling and interacting with sensors, actuators, and other hardware components in IoT systems. Unlike general-purpose processors, microcontrollers are built with embedded memory, timers, and input/output ports, enabling seamless integration into smart devices.

In an IoT setup, microcontrollers act as the "brains" of the device. They collect data from sensors (like temperature, humidity, motion, etc.), process that data locally or transmit it to the cloud for further analysis. Their low power consumption and cost-effectiveness make them perfect for battery-powered or resource-constrained applications, such as smart home gadgets, industrial automation, and wearable technology.

Popular microcontrollers like Arduino, ESP32, and STM32 provide built-in communication protocols (e.g., I2C, SPI, UART) and wireless capabilities (e.g., Wi-Fi, Bluetooth), allowing them to connect and share data efficiently. Their ability to operate in real-time is vital for time-sensitive applications.

Understanding how microcontrollers work is fundamental for anyone entering the IoT field. To explore more, check out this Internet of Things Course.

#IoT#Microcontrollers#EmbeddedSystems#SmartDevices#TechInnovation#Electronics#InternetOfThings#IoTDevelopment#Automation

0 notes

Text

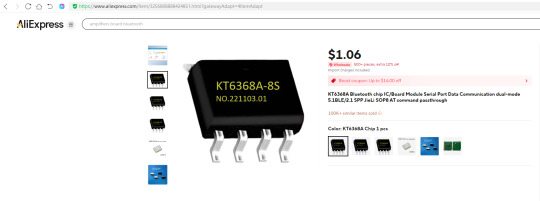

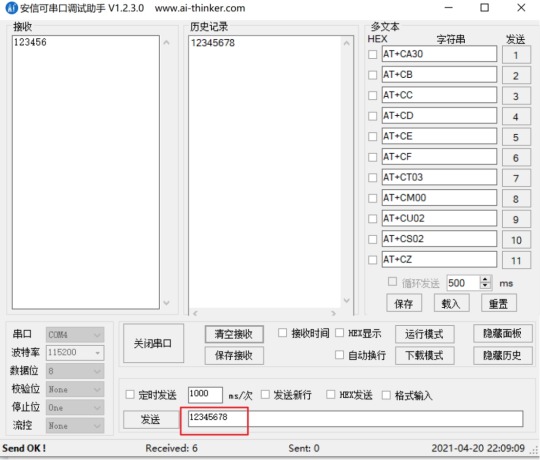

Engineer's Hands-on Review of the KT6368A Bluetooth Chip

Not long ago, someone in a tech group shared info about a SOP8 Bluetooth chip priced at just $1.06 USD, sparking a heated discussion. Of course, I couldn't contain my excitement and immediately placed an order for a few pieces. AliExpress Link:

https://www.aliexpress.com/item/3256808888424851.html

The chip model is KT6368A, Which is the product of Shenzhen Qingyue Electronics Co., Ltd., and according to the official description:

KT6368A is a dual-mode Bluetooth data chip, supporting Bluetooth 5.1. Its highlights include ultra-small size, extremely low price, and straightforward transparent transmission and UART AT command functionality—greatly reducing the difficulty and cost of embedding Bluetooth into other products. It supports both SPP and BLE, though only one protocol can be used at a time. Note: The biggest strengths of this chip are low cost, simple usage, and easy production—and nothing else. It also supports low power consumption.

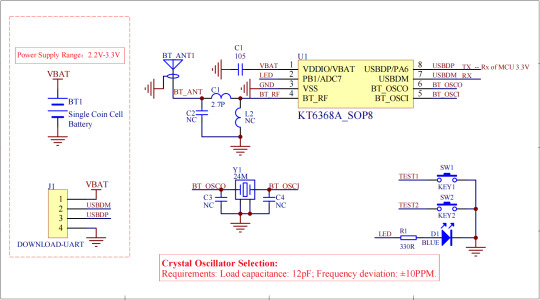

Ultra-Simple Circuit Design

This chip's circuit is shockingly simple:

Just provide power, connect a crystal oscillator, and attach an antenna—then you're ready to transmit and receive data via UART.

PCB and Soldering

I originally planned to design a PCB myself. But just as I was about to start, a friend had already finished his board design, soldered it, and completed debugging. So I asked him for two spare blank boards and did the soldering myself using a soldering iron.

The board is based on the schematic mentioned above. Here are a few reminders:

The crystal oscillator should be 24 MHz; you can buy it along with the Bluetooth chip on AliExpress — $1.06 USD for 10 pcs.

Capacitors C3 and C4 are not needed.

Likewise, C2 and L2 are not needed.

The PCB antenna can directly copy the footprint provided by the manufacturer.

Although pin 7 and pin 8 are labeled USBDP and USBDM, they are actually UART TX and RX.

Connecting the Chip

After soldering, I used a USB-to-TTL adapter to power the board and connect to the serial port.

1) Check for Boot Info Output

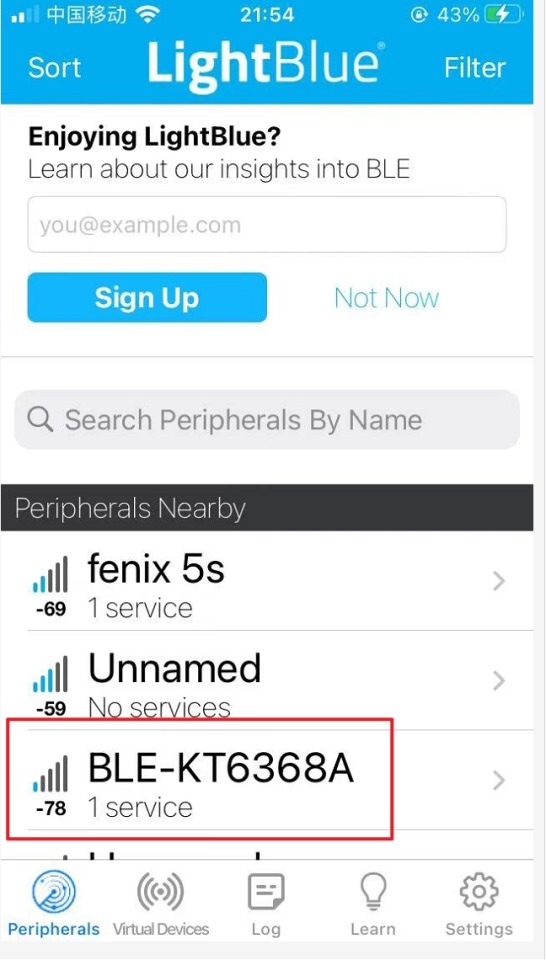

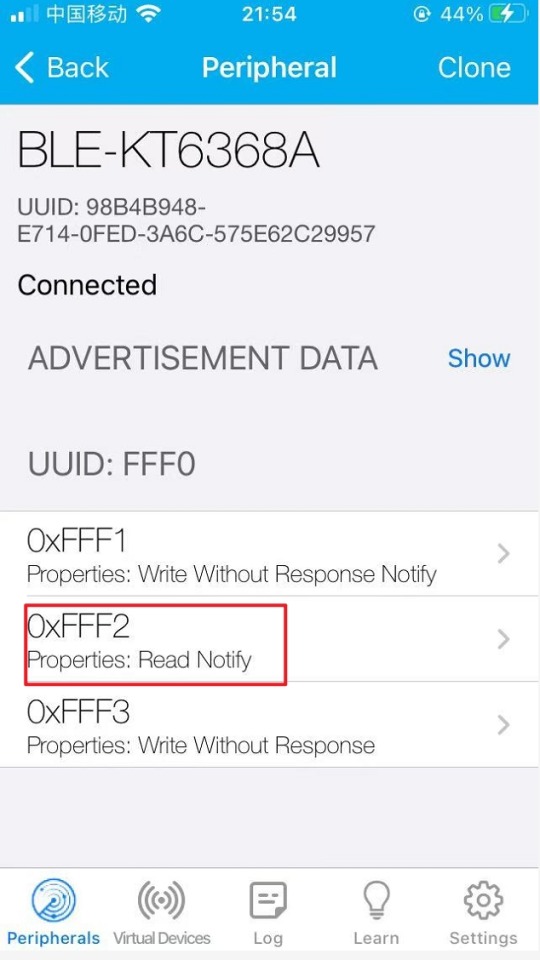

2) Modify Bluetooth Name and MAC Address

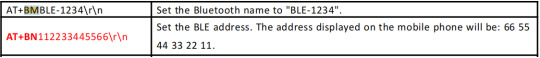

This can be done using AT commands.

3) Soft Reset

Use the command: AT+CZ\r\n

4) Mobile-to-Board Data Transmission

On iPhone, download the app LightBlue.

For Android, there's also a version: LightBlue_1.1.2.apk.

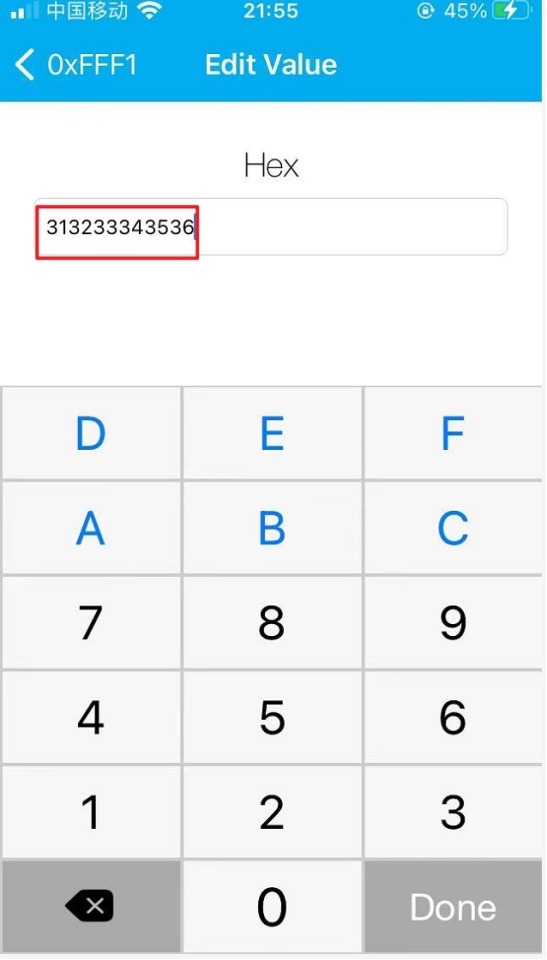

Turn on Bluetooth, open LightBlue, and search for nearby devices.

Find and connect to the KT6368A Bluetooth device.

Once connected, the status looks like this:

a) Sending Data from Phone to Board

On the computer side, you can see the data received via the serial terminal:

b) Sending Data from Board to Phone

On the phone, first tap Notify to enable data reception

On the PC, send data via a serial port debugging tool

The phone receives the corresponding data:

Final Thoughts

This chip is truly a testament to Made in China engineering—designed with engineers in mind: simple, user-friendly, and extremely affordable. Compared to common Bluetooth SoCs, it is far easier to use. It is already widely adopted in products like selfie sticks, anti-lost devices, BMS protection boards, aroma diffusers, and car tire pressure monitoring systems (TPMS).

In today's market, where Bluetooth chips tend to be expensive and complicated, the KT6368A clearly aims to deliver maximum cost-performance—making it an excellent alternative for Bluetooth applications.

0 notes

Text

Bus Pirate 5 is in stock and shipping now, going fast! 🚌 🏴☠️

Bus Pirate 5 is the latest edition of the original universal serial interface trusted by hackers since 2008. We've stocked and loved the Bus Pirate 4 for years and are excited to see the latest and greatest from the minds at WhereLabs.

The Bus Pirate is a RP2040 based, open-source hardware debugging tool that converts simple commands into common bus protocols such as 1-Wire, I2C, SPI, UART, several LEDs and more. Send commands to a chip or sensor and get the response, without writing a line of code.

#adafruit#buspirate#rp2040#opensourcehardware#debuggingtools#electronicsprojects#serialcommunication#embeddeddevelopment#hardwarehacking#diyelectronics#makersmovement#engineeringtools#prototyping

15 notes

·

View notes

Text

Universal Asynchronous Receiver Transmitters (UART) Market: Global Opportunities 2025–2032

MARKET INSIGHTS

The global Universal Asynchronous Receiver Transmitters (UART) Market size was valued at US$ 892.4 million in 2024 and is projected to reach US$ 1,560 million by 2032, at a CAGR of 8.52% during the forecast period 2025-2032.

Universal Asynchronous Receiver Transmitters are fundamental hardware components that enable serial communication between devices. These integrated circuits convert parallel data to serial format for transmission and vice versa for reception, supporting asynchronous communication protocols. UARTs are widely deployed in embedded systems, industrial automation, consumer electronics, and telecommunications equipment due to their simplicity and reliability.

The market growth is driven by increasing demand for industrial automation and IoT devices, which extensively utilize UART interfaces for device communication. While traditional applications dominate current usage, emerging sectors like automotive electronics and medical devices are creating new growth opportunities. Leading manufacturers such as NXP Semiconductors, Texas Instruments, and Microchip Technology are investing in advanced UART solutions with higher data rates and lower power consumption to address evolving market needs.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of IoT Devices to Fuel UART Market Expansion

The accelerated proliferation of Internet of Things (IoT) devices across industries serves as a primary growth catalyst for the Universal Asynchronous Receiver Transmitters market. With over 40 billion active IoT devices projected globally by 2025, embedded systems increasingly require reliable serial communication interfaces. UART chips enable efficient data transfer between microcontrollers and peripheral devices in smart home appliances, industrial sensors, and wearable technology. The technology's simplicity, low power consumption, and compatibility with legacy systems make it indispensable for IoT implementations. Recent advancements in UART functionality, such as enhanced error detection and higher baud rates, further strengthen its position in connected device ecosystems.

Automotive Electronics Revolution Creates Sustained Demand

The automotive sector's rapid digital transformation drives substantial demand for UART-enabled communication modules. Modern vehicles incorporate up to 100 electronic control units (ECUs) that require robust interfacing solutions for infotainment systems, telematics, and advanced driver-assistance systems (ADAS). As automobiles evolve into connected platforms, the industry's transition toward software-defined vehicles and electric powertrains creates new integration challenges that UART technology helps address. Leading automotive semiconductor suppliers report that serial communication interfaces account for nearly 35% of in-vehicle networking solutions, with UART remaining the preferred choice for non-time-critical data transfers.

➤ Major semiconductor manufacturers have introduced automotive-grade UART solutions capable of operating in extended temperature ranges (-40°C to +125°C) to meet rigorous vehicular requirements.

MARKET RESTRAINTS

Bandwidth Limitations Constrain High-Speed Applications

While UART remains universally adopted, its inherent technical limitations present growing challenges in data-intensive environments. The asynchronous nature of communication and lack of clock synchronization restricts maximum effective data rates to approximately 3 Mbps in practical implementations. This becomes problematic for applications requiring real-time data streaming or high-resolution sensor interfacing. Modern display technologies, high-speed industrial automation, and 5G infrastructure components increasingly demand synchronous serial protocols that can deliver bandwidth exceeding 100 Mbps.

Other Constraints

Electromagnetic Interference Sensitivity UART's voltage-based signaling makes it susceptible to noise in electrically noisy environments common in industrial and automotive applications. This necessitates additional shielding and signal conditioning components that increase system complexity and cost.

Point-to-Point Communication Limitation Unlike bus-based protocols, standard UART only supports communication between two devices, requiring multiplexing solutions for multi-node systems. This architectural constraint complicates implementation in complex embedded networks.

MARKET CHALLENGES

Design Complexity in Mixed-Signal Systems

Integrating UART interfaces into modern system-on-chip (SoC) designs presents escalating challenges as semiconductor geometries shrink below 28nm. The voltage level translation required between core logic and external RS-232/RS-485 interfaces becomes increasingly difficult to implement efficiently at advanced process nodes. Mixed-signal design teams report that UART IP integration now accounts for disproportionate development effort compared to the functional complexity, particularly when implementing robust ESD protection and noise immunity features.

Legacy Compatibility Versus Innovation Dilemma

The technology faces an inherent tension between maintaining backward compatibility and incorporating modern features. While the basic UART protocol has remained unchanged for decades, market demands push for advanced capabilities like hardware flow control, automatic baud rate detection, and enhanced error checking. Semiconductor vendors struggle to balance these evolutionary enhancements against the risk of fragmenting the established ecosystem. The challenge intensifies as emerging markets simultaneously demand cost-optimized basic UART implementations and feature-rich versions for premium applications.

MARKET OPPORTUNITIES

Industrial Automation 4.0 Presents Growth Potential

The fourth industrial revolution creates significant opportunities for ruggedized UART solutions in factory automation and process control systems. While industrial networks increasingly adopt Ethernet-based protocols, UART remains vital for device-level communication in sensors, actuators, and human-machine interfaces. The market sees growing demand for industrial-grade UART transceivers with reinforced insulation, wider voltage ranges (up to 30V), and enhanced EMC performance. These specialized components command premium pricing while addressing critical reliability requirements in harsh environments.

Medical Device Connectivity Expansion

The healthcare sector's accelerating digitization opens new avenues for UART applications in portable medical devices and diagnostic equipment. Vital signs monitors, infusion pumps, and handheld scanners increasingly incorporate wireless modules that use UART interfaces for host processor communication. Manufacturers report that medical applications now represent the fastest-growing vertical for low-power UART ICs, driven by the need for reliable data transfer in battery-operated devices. Regulatory requirements for medical device interoperability further stimulate innovation in error-resistant UART implementations.

➤ Recent product launches include medically certified UART solutions with built-in CRC error checking and automatic retransmission features specifically designed for critical healthcare applications.

UNIVERSAL ASYNCHRONOUS RECEIVER TRANSMITTERS (UART) MARKET TRENDS

Expanding Industrial IoT Applications Drive UART Market Growth

The Universal Asynchronous Receiver Transmitters (UART) market is experiencing significant growth, primarily fueled by the rapid adoption of Industrial Internet of Things (IIoT) solutions. UART interfaces remain critical for serial communication in embedded systems, particularly in industrial automation where they connect microcontrollers to sensors and peripherals. The global industrial automation market, projected to exceed $400 billion by 2030, is creating substantial demand for UART-enabled devices. While traditional UART implementations continue to dominate, recent advancements in low-power, high-speed variants are enabling more efficient data transfer in battery-operated IIoT devices. Leading manufacturers are responding to these demands by developing UART solutions with integrated error-checking capabilities and enhanced noise immunity.

Other Trends

Automotive Electronics Integration

The automotive sector is emerging as a major consumer of UART technology, with modern vehicles incorporating an average of 100-150 electronic control units (ECUs) that frequently utilize UART for inter-component communication. The transition towards electric and autonomous vehicles is further accelerating this trend, as these vehicles require robust serial communication protocols for sensor networks and infotainment systems. UART's simplicity and reliability make it particularly suitable for automotive applications where real-time data transfer is crucial but bandwidth requirements remain moderate. Industry analysts note that UART-enabled components now account for approximately 30% of all serial communication interfaces in mid-range vehicles.

Emerging Markets and Regional Growth Patterns

The Asia-Pacific region currently represents the fastest-growing market for UART technology, driven by expanding electronics manufacturing in China, South Korea, and Southeast Asia. China's semiconductor industry, which produces nearly 35% of global microcontroller units (MCUs), heavily relies on UART-compatible chips for domestic and export markets. Meanwhile, North America maintains strong demand due to its advanced industrial automation sector and ongoing investments in smart infrastructure projects. Interestingly, while traditional UART applications in consumer electronics show signs of maturity, niche segments such as medical devices and aerospace continue to present growth opportunities due to their stringent reliability requirements.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Giants Accelerate Innovation to Capture Growing UART Market Share

The global Universal Asynchronous Receiver Transmitters (UART) market exhibits a moderately concentrated competitive structure, dominated by established semiconductor manufacturers with extensive product portfolios and global distribution networks. NXP Semiconductors and Texas Instruments collectively hold over 30% of the market share, leveraging their technological expertise in embedded systems and industrial communication solutions. Their dominance stems from decades of experience in serial communication ICs and strategic partnerships with OEMs across automotive, industrial automation, and consumer electronics sectors.

Microchip Technology has emerged as another significant player, particularly in the mid-range segment, due to its focus on energy-efficient UART solutions for IoT devices. Meanwhile, Infineon Technologies is gaining traction in automotive applications, where reliable serial communication is critical for vehicle networking systems. These companies are continuously expanding their product lines through both organic R&D and strategic acquisitions, such as Microchip's recent purchase of a smaller UART specialist to bolster its portfolio.

The market also features strong competition from Asian players like Renesas Electronics and FTDI Chip, who compete aggressively on price-performance ratios. Renesas in particular has strengthened its position through vertical integration, offering UART functionality as part of its microcontroller bundles. Smaller innovators such as Lattice Semiconductor are carving out niches in high-speed UART applications, particularly in data center and 5G infrastructure markets where low-latency serial communication is paramount.

Looking ahead, the competitive dynamics are expected to intensify as companies invest in developing UART solutions with advanced features like error correction, higher baud rates, and lower power consumption. The integration of UART functionality with other communication protocols in system-on-chip designs is becoming a key differentiator, prompting companies to enhance their IP portfolios through both internal development and licensing agreements.

List of Key Universal Asynchronous Receiver Transmitter Manufacturers

NXP Semiconductors (Netherlands)

MaxLinear (U.S.)

Microchip Technology (U.S.)

Texas Instruments (U.S.)

Infineon Technologies (Germany)

Renesas Electronics (Japan)

Advanced Micro Devices (U.S.)

Diodes Incorporated (U.S.)

FTDI Chip (UK)

Lattice Semiconductor (U.S.)

Segment Analysis:

By Type

Maximum Speed Segment Leads Market Growth Due to Increasing Demand for High-Bandwidth Communication

The market is segmented based on type into:

By Maximum Speed

Subtypes: Low-speed (up to 115.2 kbps), Mid-speed (115.2 kbps to 1 Mbps), High-speed (above 1 Mbps)

By Number of Channels

Subtypes: Single-channel, Dual-channel, Multi-channel (4+ channels)

Standalone ICs

Integrated Microcontroller Solutions

Others

By Application

Serial Data Communication Dominates Due to Widespread Use in Industrial Automation

The market is segmented based on application into:

Serial Data Communication

Modem Interface

Embedded Systems

Wireless Communication Modules

Others

By End User

Industrial Automation Sector Holds Largest Share

The market is segmented based on end user into:

Industrial Automation

Consumer Electronics

Healthcare Devices

Automotive

Telecommunications

Others

Regional Analysis: Universal Asynchronous Receiver Transmitters (UART) Market

North America North America remains a mature yet innovation-driven market for UART solutions, with the U.S. accounting for majority revenue share due to strong demand from automotive, industrial automation, and IoT sectors. The region benefits from widespread adoption of high-speed UART ICs (up to 5 Mbps) in advanced manufacturing and telecommunications infrastructure. While legacy systems still utilize standard-speed UARTs (9600 bps to 115200 bps), there’s growing investment in multi-channel variants for complex embedded systems. Leading semiconductor firms like Texas Instruments and Microchip Technology dominate local supply chains through continuous product enhancements and strategic partnerships with system integrators. However, market saturation in some conventional applications has prompted vendors to explore emerging opportunities in autonomous vehicles and 5G infrastructure deployments.

Europe Europe’s UART market demonstrates stable growth, supported by stringent industrial communication standards and thriving automotive electronics manufacturing in Germany and France. The region shows particular preference for energy-efficient UART solutions compliant with EU RoHS directives, with noticeable adoption in smart metering and industrial IoT applications. Dual-channel UARTs account for over 35% of regional demand as manufacturers seek to reduce component counts in space-constrained applications. European automotive OEMs increasingly integrate UART interfaces in vehicle ECUs and telematics units, though this growth faces headwinds from the gradual shift toward CAN and Ethernet protocols in premium vehicles. Research institutions across the UK and Nordic countries are pioneering UART-based implementations in low-power wide-area networks (LPWAN), creating niche opportunities for specialized vendors.

Asia-Pacific As the fastest-growing UART market globally, Asia-Pacific benefits from explosive electronics manufacturing activity, particularly in China’s Pearl River Delta and India’s emerging semiconductor hubs. Local consumption is primarily driven by cost-sensitive applications in consumer electronics, where single-channel UARTs dominate price brackets below $0.50 per unit. China alone accounts for over 45% of regional demand, with indigenous manufacturers increasingly offering pin-compatible alternatives to Western-branded UART ICs. While Japan and South Korea focus on high-reliability UART solutions for automotive and robotics, Southeast Asian markets demonstrate strong uptake in industrial automation projects. The region’s thriving maker movement and educational robotics programs further stimulate demand for basic UART modules, though this segment faces intensifying competition from USB-based interfaces in entry-level applications.

South America The South American UART market remains comparatively underdeveloped, constrained by limited local semiconductor manufacturing capabilities and reliance on imported electronic components. Brazil represents the largest sub-regional market, where UART adoption concentrates in agricultural equipment electronics and basic industrial controls. Economic volatility continues to encourage preference for lower-cost legacy UART solutions over advanced variants, with most technical innovation limited to multinational corporations’ local subsidiaries. However, ongoing smart city initiatives in Chile and Colombia are generating incremental demand for UART interfaces in urban infrastructure monitoring systems. The lack of standardized industrial communication protocols across the region presents both challenges and opportunities for UART suppliers able to offer flexible, multi-protocol compatible solutions.

Middle East & Africa This emerging market showcases divergent adoption patterns—while Gulf Cooperation Council (GCC) countries demonstrate sophisticated UART usage in oil/gas automation and smart infrastructure projects, Sub-Saharan Africa predominantly employs basic UART configurations in entry-level consumer devices and renewable energy systems. The UAE and Saudi Arabia are investing heavily in industrial IoT deployments, driving demand for robust UART solutions capable of operating in extreme environmental conditions. In African markets, mobile payment terminals and off-grid solar systems represent key growth applications, though widespread adoption faces hurdles from counterfeit components and inconsistent power quality. Telecommunications infrastructure expansion across the region is expected to boost UART demand for modem interfaces, particularly in 4G/LTE base station installations.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Universal Asynchronous Receiver Transmitters (UART) markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global UART market is projected to grow significantly, with a notable CAGR during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Maximum Speed, Number of Channel), application (Serial Data Communication, Modem Interface), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. The U.S. and China are key markets driving growth.

Competitive Landscape: Profiles of leading market participants, including their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships. Key players include NXP Semiconductors, Texas Instruments, and Microchip Technology.

Technology Trends & Innovation: Assessment of emerging technologies, integration with modern communication protocols, semiconductor design trends, and evolving industry standards in UART applications.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers in the UART sector.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities in UART technology.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global UART Market?

-> Universal Asynchronous Receiver Transmitters (UART) Market size was valued at US$ 892.4 million in 2024 and is projected to reach US$ 1,560 million by 2032, at a CAGR of 8.52% during the forecast period 2025-2032.

Which key companies operate in Global UART Market?

-> Key players include NXP Semiconductors, Texas Instruments, Microchip Technology, Infineon Technologies, Renesas, and Advanced Micro Devices, among others.

What are the key growth drivers?

-> Key growth drivers include increasing demand for serial communication in embedded systems, growth in IoT applications, and expansion of industrial automation.

Which region dominates the market?

-> Asia-Pacific is the fastest-growing region, while North America remains a dominant market for UART technology.

What are the emerging trends?

-> Emerging trends include integration with USB interfaces, low-power UART solutions, and advanced error-checking mechanisms for improved reliability.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/hazardous-lighting-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/mobile-document-reader-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gan-drivers-market-outlook-in-key-end.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/airbag-chip-market-research-report-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-peripheral-device-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/single-ended-glass-seal-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/commercial-control-damper-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pcb-board-terminals-market-investment.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/bandpass-colored-glass-filter-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-surveillance-hardware-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pfc-ics-market-technological.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modulator-bias-controller-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tubular-cable-termination-market-demand.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/logic-buffer-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/broadband-polarizing-beamsplitters.html

0 notes

Text

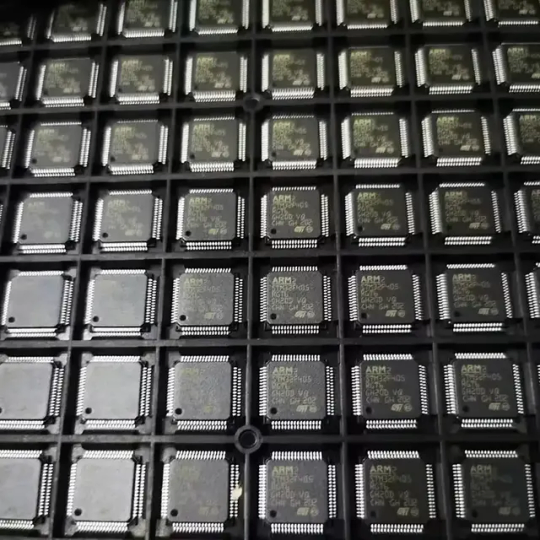

Introduction STM32F405RGT6 for ST MCU Distributor Discover the cutting-edge STM32F405RGT6 microcontroller, where advanced technology meets versatility. Designed for enthusiasts, makers, and professionals alike, this microcontroller provides the perfect blend of performance, efficiency, and reliability. Whether you're working on robotics, automation, or IoT projects, the STM32F405RGT6 is ready to bring your ideas to life. MOQ of the ST MCU The MOQ is 100units as seen online.However,they are negotiable,if you interested with much more quantity,contact us to chat details. STM32F405RGT6 boasts a powerful ARM Cortex-M4 processor that can run at frequencies up to 168 MHz. With 1024 KB of flash memory and 256 KB of SRAM, it ensures that you can handle complex computations and multitasking with ease. Its integrated digital signal processing (DSP) capabilities enable real-time data processing, making it ideal for applications requiring high-speed calculations. IOT Solution Equipped with a rich set of interfaces, the STM32F405 allows seamless integration with a variety of peripherals. It features UART, SPI, I2C, and USB connectivity options that cater to a wide range of applications. Whether you need to connect sensors, motors, or other microcontrollers, the STM32F405RGT6 offers the flexibility you need. Plus, with support for multiple communication protocols, your projects are only limited by your imagination. In addition to its impressive specifications, this stm mcu is supported by an extensive ecosystem of development tools and resources. With various libraries, example codes, and a vibrant community, you'll have everything you need to step into the world of embedded systems development confidently. Even if you are a novice, you'll find a wealth of information to guide you in harnessing the full potential of this microcontroller. In summary, the STM32F405 is not just another microcontroller; it's a gateway to limitless possibilities. By choosing this mcu for your project, you equip yourself with a reliable and fast platform that can grow alongside your ideas. Dive into the world of embedded systems today and experience the power of STM32F405! If you interested with much more electronic components price,view here to know more about our company business. Read the full article

0 notes

Text

Technoscripts: The Best Embedded Systems Training Institute in Pune

When it comes to mastering embedded systems, Technoscripts stands out as the Best embedded institute in Pune, a city renowned for its technological and educational advancements. Established in 2005, Technoscripts has earned a stellar reputation for delivering industry-focused, hands-on training in embedded systems, automotive electronics, and IoT. With a proven track record of transforming students into job-ready professionals, Technoscripts is the go-to choice for aspiring engineers. Here’s why Technoscripts is widely regarded as the best embedded systems training institute in Pune.

Comprehensive and Industry-Aligned Curriculum

Technoscripts offers a well-structured curriculum designed to meet the demands of the rapidly evolving embedded systems industry. Their flagship programs, such as the Embedded Course in Pune with Placements and the Automotive Embedded Course, cover essential topics like:

Microcontroller Programming: In-depth training on 8051, AVR, PIC, ARM, and STM32 microcontrollers.

Embedded C and C++: Core programming skills for developing efficient, real-time applications.

Real-Time Operating Systems (RTOS): Practical exposure to FreeRTOS and other RTOS frameworks.

Automotive Standards: Training on ISO 26262, MISRA, and CAN protocol for automotive applications.

IoT and Embedded Linux: Cutting-edge skills in IoT device development and Linux-based embedded systems.

The curriculum is regularly updated to align with industry trends, ensuring students are equipped with the latest tools and technologies used in companies like Bosch, NXP, and Texas Instruments.

Hands-On Learning with Live Projects

At Technoscripts, the focus is on practical, hands-on learning. Students work on live projects that simulate real-world challenges, such as designing embedded systems for automotive applications or IoT devices. The institute’s state-of-the-art labs are equipped with industry-standard tools like Keil, MPLAB, and hardware kits, allowing students to gain practical experience in:

Hardware interfacing and debugging

PCB design and prototyping

Sensor integration and communication protocols (I2C, SPI, UART)

This practical approach bridges the gap between theoretical knowledge and industry requirements, making graduates highly employable.

Expert Faculty with Industry Experience

Technoscripts boasts a team of experienced trainers with over a decade of industry expertise. These professionals bring real-world insights into the classroom, sharing practical knowledge and best practices. Their mentorship ensures that students not only understand concepts but also learn how to apply them in professional settings. Regular doubt-clearing sessions and personalized guidance further enhance the learning experience.

Unparalleled Placement Support

One of Technoscripts’ standout features is its 100% placement support. The institute has strong tie-ups with leading companies in the embedded systems and automotive sectors, including:

Tata Elxsi

KPIT Technologies

L&T Technology Services

Robert Bosch

The dedicated placement cell offers comprehensive support, including:

Resume Building: Guidance on crafting professional resumes tailored to industry standards.

Mock Interviews: Simulated interview sessions to boost confidence and communication skills.

Job Referrals: Direct connections to top recruiters through campus placements and job fairs.

Technoscripts’ placement record speaks for itself, with thousands of students securing roles as embedded systems engineers, firmware developers, and IoT specialists in top-tier companies.

Certifications and Recognition

Technoscripts is a NASSCOM-certified institute, adding credibility to its training programs. Upon course completion, students receive industry-recognized certificates that enhance their employability. The institute also offers NSDC-affiliated certifications, further validating the quality of training and aligning with national skill development standards.

Flexible Learning Options

Understanding the needs of students and working professionals, Technoscripts provides flexible learning modes, including:

Classroom Training: Interactive, in-person sessions at their Pune facility.

Online Training: Live, instructor-led virtual classes for remote learners.

Weekend Batches: Tailored for professionals balancing work and learning.

This flexibility ensures that anyone, from fresh graduates to experienced engineers, can upskill at their convenience.

Student-Centric Approach

Technoscripts prioritizes student success through a holistic approach. Beyond technical training, the institute offers:

Soft Skills Training: Sessions on communication, teamwork, and leadership to prepare students for corporate environments.

Career Counseling: Guidance on career paths and specialization choices in embedded systems.

Lifetime Support: Access to resources, alumni networks, and job assistance even after course completion.

Why Choose Technoscripts?

Technoscripts’ combination of a cutting-edge curriculum, hands-on training, expert faculty, and exceptional placement support sets it apart as the best embedded systems training institute in Pune. Whether you’re a fresh engineering graduate or a professional looking to upskill, Technoscripts equips you with the knowledge, skills, and opportunities to thrive in the competitive embedded systems industry.

Conclusion

For anyone aspiring to build a successful career in embedded systems, Technoscripts is the ultimate destination. With its industry-aligned training, practical approach, and unmatched placement support, the institute empowers students to turn their passion for technology into rewarding careers. Enroll at Technoscripts today, attend a demo class, and take the first step toward becoming an embedded systems expert!

0 notes

Text

Enterprise Guide to IoT Penetration Testing: Tools, Techniques, and Risk Reduction

The Internet of Things (IoT) has transformed our homes and workplaces but at what cost?

With billions of connected devices, hackers have more entry points than ever. IoT penetration testing is your best defense, uncovering vulnerabilities before cybercriminals do. But where do you start? Discover the top tools, techniques, and expert strategies to safeguard your IoT ecosystem. Don’t wait for a breach, stay one step ahead.

Read on to fortify your devices now!

Why IoT Penetration Testing is Critical

IoT devices often lack robust security by design. Many run on outdated firmware, use default credentials, or have unsecured communication channels. A single vulnerable device can expose an entire network.

Real-world examples of IoT vulnerabilities:

Mirai Botnet (2016): Exploited default credentials in IP cameras and DVRs, launching massive DDoS attacks.

Stuxnet (2010): Targeted industrial IoT systems, causing physical damage to nuclear centrifuges.

Smart Home Hacks: Researchers have demonstrated attacks on smart locks, thermostats, and even baby monitors.

These incidents highlight why IoT security assessment must be proactive, not reactive.

IoT Penetration Testing Methodology

A structured approach ensures thorough testing while minimizing risks to operational systems.

Reconnaissance & Information Gathering

Identify all IoT devices (smart cameras, sensors, gateways).

Use tools like Nmap, Shodan, and Wireshark to map network traffic.

Extract firmware using Binwalk or Firmware Analysis Toolkit (FAT).

Vulnerability Assessment

Scan for weak credentials, outdated protocols (e.g., Telnet, FTP), and unpatched CVEs.

Tools: OpenVAS, Nessus, OWASP ZAP.

Exploitation & Post-Exploitation

Attempt to bypass authentication, escalate privileges, or intercept data.

Use Metasploit Framework, ExploitDB, or custom scripts.

Test hardware interfaces (UART, JTAG) if physical access is possible.

Reporting & Remediation

Document findings with risk ratings (Critical/High/Medium/Low).

Recommend patches, network segmentation, or encryption upgrades.

DID YOU KNOW?

During the forecast period, the global IoT security market is expected to expand significantly, with projections indicating growth from USD 24.2 billion in 2024 to USD 56.2 billion by 2029, reflecting a CAGR of 18.4%.

[ Are You Looking: DevOps Services ]

Best Open-Source Tools for IoT Penetration Testing

Discover the top tools for assessing IoT security, from firmware analysis to network exploitation. These open-source solutions help uncover vulnerabilities before attackers do.

Firmware Analysis – Binwalk & Firmadyne

Binwalk extracts firmware binaries to analyze file systems.

Firmadyne emulates firmware to detect vulnerabilities.

Network Traffic Analysis – Wireshark & Tcpdump

Inspect unencrypted MQTT, CoAP, or HTTP traffic.

Exploitation Frameworks – Metasploit & IoTGoat

Metasploit has modules for IoT-specific exploits.

IoTGoat is a deliberately vulnerable IoT environment for practice.

Hardware Hacking – JTAGulator & Bus Pirate

Identify debug ports (UART, SPI, I2C) for firmware dumping.

Password Cracking – Hydra & Hashcat

Bruteforce weak credentials on web interfaces or SSH.

[ Good Read: AWS For Beginners ]

Real-World IoT Attack Scenarios & Mitigations

Explore how attackers exploit weak IoT security from hijacked smart cameras to unencrypted medical devices and learn actionable fixes to prevent breaches.

Case 1: Weak Authentication in Smart Cameras

Vulnerability: Default admin:password combinations.

Exploit: Attackers gain live video access.

Fix: Enforce strong passwords & multi-factor authentication (MFA).

Case 2: Unencrypted MQTT Protocols

Vulnerability: Smart sensors transmit data in plaintext.

Exploit: Man-in-the-middle (MITM) attacks steal sensitive data.

Fix: Use TLS encryption and certificate-based authentication.

Case 3: Outdated Firmware in Medical IoT

Vulnerability: Unpatched CVEs in insulin pumps.

Exploit: Remote code execution (RCE) risks patient safety.

Fix: Automated firmware updates with integrity checks.

Key Takeaways for Decision-Makers

Security leaders must enforce robust IoT policies, align penetration testing with business risk, and foster collaboration between IT and OT teams to ensure long-term resilience.

Prioritize Security by Design: Ensure vendors follow OWASP IoT Top 10 guidelines.

Segment IoT Networks: Isolate critical devices from enterprise IT systems.

Conduct Regular Pen Tests: Schedule IoT penetration testing at least annually.

Invest in Threat Monitoring: Deploy SIEM solutions like ELK Stack or Splunk for anomaly detection.

You can check more info about: Enterprise Guide to IoT Penetration Testing.

DevOps Explained.

Platform Engineering Services.

0 notes