#we buy real estate loans

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

421 notes

·

View notes

Text

Listen.

If you've read my fics, you know that I love history. I love pageantry. I love symbolism. I love beautiful clothes, and art, and jewels. I love going behind the scenes and seeing into castles and manor houses. I love parades, and the hidden meaning behind coronations, and the fairytale unreality of the lives of the gentry.

I believe, however, that all of these things should be ARTIFACTS.

I believe there is literally no point in upholding a monarchy or commonwealth any more.

Allow commonwealth countries become republics. Allow Scotland, Northern Ireland, and Wales to return to being seperate nations if they vote to become so. Allow those republics to create their own network of mutual support, should they so choose to. There's no reason to not keep up Commonwealth ties and festivals even if there's no Commonwealth.

Repatriate artifacts, art and jewels to their nations of origin. Offer monetary compensation/support for cultures violated and impoverished by colonialism. Help establish democracies where needed, and butt the hell out where they're not. (And especially don't establish puppet democracies, ew.)

Let the British royal family become symbolic tourist attractions, let them fund their own charities, and throw their parties, and knight their artists, and uphold their royal orders of garters and baths, and maintain their personal properties--and make them do it with their own wealth and real estate investments. They're multi-billionaires. They can afford it. They'll be fine.

But remove them from the machine of governance. Detach them entirely from public spending, dependance, or influence.

And if they do participate in traditions of parliament (like the Opening, which is actually really cool and fascinating panto, which I quite like and hope they WOULD continue), man, do it without the silly hat. If the King wants to wear the silly hat, make him pay for the upkeep of the silly hat out of his own pocket. It's HIS silly hat, after all. It's not like we all get a turn with it, even though we do pay for it.

(Actually, the Crown Jewels are owned by the British Public so like... if they want to take them along when they go, make the royal family buy them. And then let them charge museums a fee to loan them for exhibition, just like privately owned paintings by famous Masters are loaned to art galleries.)

Let the royals continue to do all the things the royals do, if they want to do them. Just… make them pay for it themselves. Dissolve the Sovereign Grant, and use all that money to pay for things like restitution, repatriation, and hey maybe increasing public spending on health care and social infrastructure.

Turn the public-owned properties into, yeah, tourist attractions in part (gotta fund their upkeep somehow). But also put public offices in there. Maybe some social housing. Maybe hospitals, with well-paid front-line staff. Event spaces. Seniors care homes. Something.

If Hampton Court Palace can do it, so can Buckingham.

Balmoral and Sandringham are privately owned, there's lots of land and buildings for the family to occupy. They won't be homeless.

Keep the royal family, if the royal family wants to be kept. Include the royal family if the royal family wants to be included. Just make them pay for their own stuff with their own money. And do BETTER things with the savings.

Yes, I'm aware that this may be wishful thinking.

Yes, I'm aware that unscrupilous people may take advantage of monetary support given to commonwealth nations and keep it for themselves. (And I'm not unaware that it would happen in ALL the nations, yes, even Canada where I live. There are a LOT of currently-serving politicians who are vile, scummy, self-serving arseholes.) Yes, I'm aware that mutual support between nations of the commonwealth is all that is preventing famine or religious war in some places.

Yes, I'm aware none of this is as easy as I'm making it sound.

But I think it's time to stop celebrating and upholding centuries of brutal militaristic colonialism and the destruction and subversion of so many beautiful cultures for the sake of some tourist bucks. I especially think it's time for the public to stop PAYING for it.

I love history. I love symbolism. I love the stories of royalty and treachery and gallantry and seduction. I love the architecture of great houses, and the meaning behind golden spoons from over a thousand years ago, and the fascination of birthrights and bloodlines. I love paintings, and balls, and the gorgeous work of exceptionally talented artisans that go into making all the amazing silly hats.

I write historical romances for goshsakes.

And I also think it's time to stick it all where it belongs -- in a museum.

55 notes

·

View notes

Text

Some thoughts on the hierarchy at Hillerska

A few days ago, @raincitygirl76 made a really intriguing post about how the show is about the class system (find it here!), mainly focusing on Hillerska’s impact as an employer and the types of students who go there.

That inspired me to go off on a tangent and make a separate post about the hierarchy. I’ve been using Agnes Hellström’s book about the real boarding schools (‘Att vara utan att synas: Om riksinternaten Lundsberg, Sigtuna och Grenna’, 2013) as a fanfic reference, so I’m also using that here. It was written back when the schools were still allowed to charge for tuition, and I’m sure things have improved since then. However, much of the content is pretty consistent with what Lisa has said about doing research for YR and what we see in the show.

Disclaimer: I’m not Swedish, just a Nordic neighbour, and these are just my own impressions. If I’m wrong about something, please feel free to add on to this or correct me!

Let’s start with a description of the hierarchy by a former student (he attended long ago, but the author confirmed it largely held true in 2013):

”De som var grevar, baroner och friherrar var högstatus, sedan kom de som var snuskigt rika, ’uppkomlingarna’ som inte fötts rika, företagsledares barn. Därefter kom en grå massa av oss andra, efter dem lärarbarnen och sist kom externerna.” (p. 58)

So, the top tier is reserved for the aristocracy. Kids from comital, baronial, and untitled noble families. They’ve been going to these boarding schools for a long time. Interestingly, it’s mentioned in the book that some of them may have even experienced bullying in a normal school; specifically, the ones who have grown up sheltered on their family estates (likely too far away to attend the exclusive schools favoured by the elite in the cities). They might be singled out and picked on in a more modern crowd, but at the boarding schools, they are the leaders.

The next tier is for the non-aristocratic elite: the filthy rich, the ‘upstarts’ who weren’t born rich, the children of business executives. The order that this former student lists them in feels significant, because old money looks down upon new. According to the book, the old elites felt that the schools were ‘ruined’ when even just more nouveau riche and scholarship kids started coming in (they must’ve hated it when the tuition fees were abolished!!). So, kids like Alexander are likely to be treated worse than those whose family’s wealth goes back several generations - but they are still part of this group.

The next tier is for other boarding students who aren’t as rich. At the time discussed in the book, their parents often took out loans to get them in. As we know, that isn’t the case anymore, but the schools do still have ways of keeping the ‘riffraff’ out... Some of the knowledgeable Swedes here on tumblr have written about this.

Furthermore, I think we can also include the ‘optional’ costs as a deterring factor for those who can’t afford them. Back in 2013, parents were apparently advised to put at least 10.000 SEK aside on a ‘student account’ for other expenses (some kids would take taxis to the nearest town, for example, and they could also use it to buy stuff they needed from the school). I’m guessing the student account may not be a thing anymore, but as we see Sara struggle with money in S2, there will still be stuff you don’t want to miss out on. Also, the extra tutoring seen in S1 is based on real life. The price in the show seems to be pretty close to reality, although according to the book, the teachers could sometimes offer discounts to “poorer” boarding students... (I’m sure it’s not humiliating at all to accept let alone ask for that.)

On the next tier down, we find the teachers’ kids, and the former student interviewed specifically mentions that the non-residents are at the bottom. So I guess Englund or Ådahl’s kids would be treated a little better than Simon and Sara in the show, but they would still be looked down upon. It’s mentioned in the book that the teachers often live on the premises, and I get the impression that they can bring their families too (there was a story about a teacher whose boyfriend was going to move in with her there), but I’m not 100% sure.

So why don’t we hear about these other boarders or teachers’ kids in the show?

Well, the book talks a lot about how everyone is acculturated into the same inner-circle mentality. Despite the internal hierarchy, the boarding students still feel closer to equal than one might think. They all get to be part of the elite bubble, and they want to stay there. Even though it’s a community with very strict norms and very little wiggle room.

A few illustrative quotes from the book:

Trots externerna blir tillvaron så sluten, åsikterna likriktade. En lärare flyttade sin son från Sigtuna till Märsta efter att sakta men säkert ha sett honom förvandlas till en brat. Sonen är fortfarande arg över det. (p. 76)

Lundsberg hade varit ett isolerat, klasslöst samhälle där alla tyckte likadant. Inget revolterande, ingen politisk diskussion. [...] Det var en del av hela Lundsbergs koncept, att träna ynglingarna att lyda auktoriteter och inte göra uppror. (p. 133)

Eleverna på riksinternaten påminns ständigt om att de är Sveriges framtid och Sveriges elit. Där den traditionstyngda kulturen med gamla anor är som starkast är det som svårast att våga sticka ut. Ramarna blir snäva, rörelseutrymmet begränsat. Normen är vita, heterosexuella överklassbarn (med lika vita heterosexuella överklassföräldrar). (p. 144)

To paraphrase in English, these schools are closed bubbles where everyone follows the rules and shares the same opinions, to the point where even those who aren’t technically elites (e.g. the teachers’ kids) start to turn into entitled brats. Rebellion and political discussion aren’t really a thing, and the students are taught to respect authority. As we know, this isn’t just the school’s authority; it’s also the authority of the older students (we see this in the show, and there have been plenty of real-world revelations of hazing and ‘peer upbringing’ among students). And of course, it’s also the legacy of those who came before them. They are constantly reminded of their elite status, wrapped up in old traditions and conservative thinking, and expected to fit into a white, heterosexual, upper-class box.

[As an interesting sidebar, the book supports what the creators of YR (Lisa?) have said about most queer people in such schools. Nobody is openly bullied or harassed for their sexuality, but they are gossiped about, and people usually choose to stay in the closet. Being trans is basically unheard of, and traditional binary gender norms abound. Many students feel that it’s even harder for boys to come out than it is for girls.]

In conclusion, I think it’s safe to say there probably are other students at Hillerska who aren’t necessarily part of the elite - but they want to be, so they’re not going to stand out. I’m sure there’s been a lot of progress since the book’s publishing, but considering how well it aligns with S1 of YR in particular, the changes we see Wille enact in S2 do feel rather revolutionary.

#young royals#young royals analysis#hillerska#swedish stuff#att vara utan att synas#riksinternatskolor

139 notes

·

View notes

Note

My parents are currently getting divorced, and they agreed to sell the house to me and my partner (for how ever much we can get a loan for) and split the money from it. We're working on seeing how much of a loan we'd get approved for but i have no idea how much money to expect to put down/pay for closing costs 😭 is there a way to see?

This sounds like a really tumultuous time for you, my dear. Make sure you're making space for some self-care!

And we highly--HIGHLY--recommend taking a first-time home buyer's class. If there isn't a free one in your area, meet with a realtor to pick their brains about stuff like closing costs. They'll be experts in the local real estate market, and they want your business, so they're incentivized to help you. Just don't say you've already picked out a house.

Good luck, my lamb! More tips in the episode below.

Season 2, Episode 2: “I'm Not Ready to Buy a House---But How Do I *Get Ready* to Get Ready?”

If you found this helpful, give us a tip!

25 notes

·

View notes

Text

People on Tumblr are always hyping these news articles about some rich wanker out there, buying up single family homes.

It sucks. Rich wankers are terrible yadda-yadda. Not the point of this conversation. (Burn them)

The thing is that you have some of the worst ideas on how to fix the housing crisis!

Simply because most people aren't super educated on why the housing market is this way.

Ironically, and this might tick a lot of you off. One of the causes of the housing crisis is likely you, or your co-workers, parents, siblings ect...ect.

https://www.investopedia.com/articles/credit-loans-mortgages/090116/what-do-pension-funds-typically-invest.asp

Are you saving money! (I am!)

Do you have a 401K/Pension/Superannuation? (I Do)

Are you invested in a Real Estate Investment Trust?!

Probably.

Most funds have a little bit of REIT in them. The S&P500 is 2.8% REIT,

These mega trusts own vast amounts of American housing.

https://www.reit.com/research/nareit-research/170-million-americans-own-reit-stocks

Yay. Look at this happy graphic that came from a site really stocked about the great returns on real estate investment.

Now. It should be clear REIT actually own a very small portion of American housing, around 1%. Individual owners make up a far larger portion of the housing market.

REIT live in the happy red space.

The problem with REIT is that they are often terrible.

They are bastions of widespread community gentrification. Sweeping into minority communities like Herongate in Canada and bulldozing the lot. All to make way for shinny condos they can turn a profit on.

https://acorncanada.org/news/leveller-rein-reits-tenants-demand-action-against-real-estate-investment-trusts/

REITs have been accused of slumlord like behaviour. Letting houses decay with mold and refusing repair ect. Ect.

https://www.cbc.ca/news/canada/tenants-lose-as-landlord-transglobe-racks-up-charges-1.1246084

https://doctorow.medium.com/wall-streets-landlord-business-is-turning-every-rental-into-a-slum-b15b81f18612

Essentially my point is....

You could be invested in the very Real Estate Investment Trust that acts as your landlord. You could be invested in the source of your own suffering and gentrification.

The pension investment in REITs for domestic housing is growing. It is too profitable. It is an easy source of growth.

If you are in a bad situation, you should want your pension invested in an REIT. It will help grow your savings (whatever they be). But, that very same REIT might own your home and be the very evil trying to wring cash out of you.

This isn't a call to action. This is more an observation about the neoliberal shit oroborus we are stuck in. You can choose not to invest in REITs, or try and find a good one.

But in doing so, you are worsening the housing crisis. REITs are sophisticated. They use rent increase software and have quantitative analysis of the market used to drive prices up.

If the housing market ever tanks, a good portion of your savings might tank with it.

Now. You might have no savings. You might not have elderly relying on social security. You might be fine.

But. Society is run by trashfire electoralism. If people don't see their investments going up they freak out and vote for the other party.

The pension investment into real estate, allowed in 2001 (thanks Bush), has created people whose retirements and future are dependent on housing prices always going up. Around 51% of Americans are invested in REITs. It is essentially a nightmare that will never be fixed unless people who are smarter than anyone on Tumblr actually put an effort in.

Thanks for reading my depressing rant.

(Also. Sorry if you are in Canada. It is bad in AUS but it seems like REITs can steal newborns over there. Like some articles are like wtf.)

https://www.reit.com/news/blog/market-commentary/reit-allocations-pension-funds-increase

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-pension-funds-up-real-estate-exposure-to-offset-rising-risks-71610560

https://www.benefitsandpensionsmonitor.com/investments/alternative-investments/real-estate-has-become-a-cornerstone-asset-class-for-pension-fund-investors/383790

#housing#anti capitalism#fuck neoliberals#neoliberal capitalism#neoliberalism#fuck capitalism#housing crisis

2 notes

·

View notes

Text

Kinda desperate about the place i live in.. I wanna leave but i'm really blocked by the fact i don't earn enough to even apply for anywhere else in this city

so the only way i could move would be to find another job, full time, basically work 2 jobs until i find a place lol but i'm not sure i can do that.. I'm undiagnosed and i know how it sounds, but i'm pretty sure there are some things i can't do.. but it could be cowardice too LOL

anyways.. .the person managing my building is like.. crazy... she gets emotionally invested in any request i make and even gets angry when i ask her to communicate better with me ??? she's got a problem ok, but it's not my job to be a social worker every time i talk to her LOL i'm just asking you to do your job, lady. Anyways, depending on this kind of person to fix my water damage or even deal with anything gives me so much anxiety.. anyways.. i wanna leave so bad :I

but like, i like my current part time bc i can make art at a chill pace...

big changes coming probably .. we hope....

ADDING STUFF

but like;; I HATE being poor and depending on a faceless landlord who loans me a crumbling place and a paranoid real estate agent with anger issues who thinks the landlord is their dad or something with how invested they are

need glucose guardian to buy me a tiny house so i can happily draw men that looks like women and women who fuck women all day long !

2 notes

·

View notes

Text

Leading Real Estate Consultancy in Hyderabad, Telangana

W'n'WInfra is your one-stop destination for all things real estate. Our experienced team of real estate professionals provide clients with the best advice and guidance on buying, selling, and leasing properties. We also help with interior design, home loans, and more.

Our mission is to provide clients with the highest quality services and create a positive real estate experience. Our team of experts are always available to answer questions and provide resources to help you make the best decision. Visit our website to learn more about how we can help you with your real estate needs.

#realestatelife#realtors#realestateagentlife#homeinteriore#propertyforsale#investmentopportunity#forsale#realtorlife#househunting#dreamhomes#luxuryhome#interiordesigntrends#luxuryrealestate#newhome#architecturelovers#HomeSweetHome#RealEstateInvesting#luxuryhomes#businessopportunity#designinspiration#realestateinvestor#realty#sold#entrepreneurship#MortgageAdviser#broker#homesforsale#justlisted

2 notes

·

View notes

Text

Rich People Getting Richer (Part 3 of ?)

To refresh your memory, we're addressing the question of how wealthy people have a lower effective tax rate than moderate income people.

US Government policies supporting home ownership have not only lowered the effective tax rate of those wealthy enough to own a home, they have also contributed to the accumulation of wealth.

Current tax law allows for a couple to deduct the interest on a home mortgage up to $750K (for the first or SECOND home). The current Standard Deduction for a couple is $25,900 (which is greater than many people's home mortgage interest expense and other Itemized Deductions) so most couples will chose the Standard Deduction instead of choosing Itemized Deductions which can include mortgage interest.

For most of my adult life, however, the tax limit on mortgages has been greater ($1M) and the Standard Deduction much lower, so it was advantageous for most homeowners to deduct their mortgage interest. Historically, if you owned a home with a mortgage, your effective tax rate was lower than a comparable couple who rented.

Preferable tax treatment isn't the only way the US encouraged home ownership however. With a few exceptions, loose monetary policy by the Fed has allowed relatively cheap home mortgage interest rates (the current period being one of those exceptions). The US government also established quasi-government agencies Fannie Mae and Ginny Mae, and Freddy Mac to buy mortgages and issue mortgage-backed securities. Collectively, these actions lowered borrowing costs and encouraged home ownership. When you consider the additional benefit of the rise of real estate prices over the last 30 years, the result is a huge accumulation of wealth for those able to purchase a home (mostly white people).

There are good arguments that tax and monetary policies encouraging home ownership are good ideas (stable communities, wealth accumulation for the middle class, economic growth, etc.). Like any other policy however, it favors and rewards some (those who can buy a home) over others. The opportunity costs are those different policies which would have delivered economic benefits to different groups. In other words, the US has pool of economic tools which can incentivize or de-incentivize various activities and has choosen to support home ownership.

Twenty years ago I'd have objected if you said this is a racist policy. After all, the tax policy doesn't say that the home mortgage interest deduction is only available to white people. So how can it be racist?

Here's the question... is a policy racist if the benefits are inequitably distributed to a race, especially if that race is already advantaged? In the case of financially rewarding home ownership, I think you have to say yes. According to the US Treasury:

"In the second quarter of 2022, the homeownership rate for white households was 75 percent compared to 45 percent for Black households, 48 percent for Hispanic households, and 57 percent for non-Hispanic households of any other race."

The seeds of this inequity were sown with "redlining" as described in an NPR article: The redlining maps originated in the aftermath of the Great Depression, when the federal government set out to evaluate the riskiness of mortgages in major metropolitan areas of the country. The maps, created by the federal Home Owners' Loan Corporation, color-coded neighborhoods by credit worthiness. Areas with African-Americans and immigrants were almost always considered the highest risk, and they were marked in red on maps... hence, "redlining."

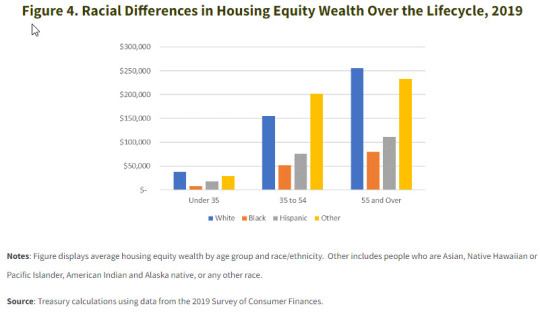

So follow the logic here... beginning with the redlining after the Great Depression and followed by tax and monetary policies rewarding home ownership, we now see a huge disparity in home ownership wealth. Again from the US Treasury:

I suspect some of you may be questioning the relevance of redlining which occurred ~60 years ago. In fact, studies have confirmed the effects of redlining are still measurable today. Again from the NPR article, the study from the National Community Reinvestment Coalition, the University of Richmond and the University of Wisconsin-Milwaukee analyzed historic redlining maps from 142 urban areas across the U.S. and found "higher rates of poverty, shorter life spans and higher rates of chronic diseases including asthma, diabetes, hypertension, obesity and kidney disease."

I know I've strayed from the original question, but the reality of statistics like these are so troubling. You either have to believe that people of color don't like owning homes and accumulating wealth or the system has disadvantaged them.

I don't think this means that the government shouldn't pursue any policy that inequitably benefits a demographic which is already advantaged, but I do think it means policies should include meaningful, well-funded actions designed to actively grow the participation of the other demographics.

27 notes

·

View notes

Text

Robert Villeneuve West Nipissing - Is Multifamily Real Estate A Good Investment?

Robert Villeneuve West Nipissing: During these economically challenging times, people look for genuine investment opportunities. They want to invest in stable and low-risk schemes that offer them high returns. These kinds of opportunities take a lot of work to come by today.

Robert Villeneuve West Nipissing, a multifamily real estate expert, points out why you should own this type of real estate.

You can outsource the management of the property to some experts. This will afford you quality time.

You can buy such properties without investing any of your money. It is easier to get loans for condos or apartments than for a family home. You can easily cover cash needs by raising some private money.

You can safeguard far better leverage of your time and energy. You can maintain a 12-unit apartment over 12 individual homes.

Valuation of income properties is done based on the profit they make. You can raise its value by increasing the rent and lowering the expenses incurred in maintaining them. You will start to appreciate the use of time and money.

There is less risk. You have a massive number of tenants and hence have many proceeds streams. Apartments are intended for business. In the case of a property, if you lose a tenant, you begin paying all the costs from your pocket.

In the case of multifamily homes, it’s pretty simple to raise the money. For instance, if you borrow 1M dollars, this now becomes non-recourse finance, meaning the asset is the only security to the bank for the loan, and you are not liable.

There’s a steep fall in subprime lenders of the loan. There are many people out there who can’t fulfil the terms and conditions for houses for which they raised loans, and as a result, there is a rise in foreclosures. There’s definitely a good demand for rentals.

As we discussed above, you have an excellent return assured for the investment if you go ahead and purchase multifamily real estate. A multifamily apartment is a perfect start if you are searching for a suitable investment venture. If you want to know more about multifamily real estate, you can ask for guidance from experts like Robert Villeneuve.

22 notes

·

View notes

Text

I testified Thursday against the City Council Fair Chance for Housing Act, my second time in Council Chambers. The first was in May 2019 when I spoke personally and passionately about protecting New York City’s specialized high schools.

The bill, also known as Int. 632, is another City Council measure designed to protect lawbreakers at the expense of the law-abiding. It would prohibit criminal background checks on prospective tenants and buyers of residential housing.

After testifying, I left City Hall. It wasn’t until hours later that I heard the racist response to my testimony from Douglas Powell, who spoke on behalf of city-funded nonprofit Vocal-NY. He and his organization want individuals such as Powell, who has a criminal record and is a level 2 registered sex offender, to be able to access housing without criminal background checks.

His testimony laid out his criminal-justice experience and his lived experience of anti-black discrimination at Asian stores — culminating in a racist attack on the Asian community where he lives. In his three-minute tirade, he called Queens’ Rego Park the most racist neighborhood because it is majority Asian. “It’s not their neighborhood — they from China, Hong Kong,” he said. “We from New York.”

Convicted sex offender spews anti-Asian slurs during NYC Council meeting — and pols do nothing to stop him

This anti-Asian, perpetual-foreigner, “You don’t belong here” rhetoric is dangerous hate speech that incites violence. Unprovoked attacks on Asian New Yorkers are on the rise.

Powell’s racist rant was delivered in the presence of three councilmembers without interruption or admonishment. Committee chair Nantasha Williams even thanked Powell for his testimony. It’s as if his anti-Asian hate speech in the chamber was unremarkable white noise. It took hours, after online pressure from constituents, for those present to issue generic disapproval statements, retweeting other electeds’ condemnation, and say “both sides” share blame for systemic racism.

Like many Asian Americans, I am a property owner and small landlord. When I graduated, my parents encouraged me to live at home, pay off my debt and save to buy a property. I lived at home for a few years and paid off my student loans as quickly as I could. Decades later, I bought my first investment property. I rented mostly to young men and women at the start of their careers. As a landlord, I treated my tenants the way I wanted to be treated: fairly and responsively. I’m fortunate real-estate brokers and condo management could conduct criminal and credit checks, not only for my benefit but for the safety of neighbors in the building.

Powell spewed hateful, anti-Asian rhetoric at the council meeting.Stephen Yang

Asian Americans have the highest rate of home ownership in the city, 42%. The stability of owning property as a means of building wealth is deeply rooted in Asian culture. New York’s pro-tenant policies, especially the Emergency Rental Assistance Program, have resulted in heartbreaking stories from small-property landlords. The laws, intended to help tenants, some of whom lost jobs during COVID, disproportionately hurt immigrant landlords. Not only have they not been paid rent for three years; some living in multi-family units are terrorized by tenants who know they can’t evict. Many Asian property owners are working class, and their modest rental income helps pay for the mortgage, property taxes and unit upkeep.

While bad tenants existed before this bill, it would make things worse. Private-property owners should not bear the burden of unknowingly renting to convicted arsonists and murderers and letting them live next door to New Yorkers who want a safe place after a long day braving our unpredictable city streets and subways. We worry about higher insurance, liability in endangering other tenants and frivolous lawsuits in tenant-friendly courts. That becomes a cost-benefit question for owners — whether it’s worth it to rent with little profit.

Like most landlords, I don’t live in the building I rent, but I do worry about the tenants I rent to. I think of the kindhearted young Asian professional who pleaded with me to let her have a Hurricane Sandy rescue dog. I worry about the wheelchair-bound young man grateful to find independence in living in an accessible building and appreciative of me letting him install an automatic door opener for his convenience. I want them to have the peace of mind that when they return to their small haven in the city, they will be safe, among neighbors who won’t pose a risk to them.

The fight to save specialized high schools that brought me to council the first time galvanized many Asian voters who had never been involved in city politics before. I am one of those newly politicized voters. This year, I co-founded Asian Wave Alliance to make sure that Asian-American New Yorkers’ needs are not ignored by the very councilmembers who sat quietly and listened to Powell’s racist attacks.

This time, I went to council to convince the Committee on Human and Civil Rights and the bill’s sponsors that the Fair Chance for Housing Act is not “fair” at all to small landlords and already-existing tenants. Getting rid of reasonable safeguards like criminal background checks is not “fair” to the city’s law-abiding citizens and will put people in danger. True fairness requires listening to all New Yorkers and prioritizing safety and transparency.

41 notes

·

View notes

Text

Support us!

Rozbrat is one of the oldest occupied social centres in Europe. This year, a small but central part of the land on which Rozbrat is located was put up for sale. We have bought it in order to secure greater control over the entire occupied area. This cost us 320,000 zloty (about 70,000 euros or £60,000). We paid for it using private loans from our friends through an association we founded especially for this purpose. We are now collecting donations to repay the private loans and to keep the property in the long term.

Rozbrat has been occupied for 29 years. Until today, we have fought and won the most important battles on the streets and in the courts: against property developers, private speculators and their allies in the city administration and the state apparatus. Some of the current owners have lost hope of evicting us and making profits from building projects for the rich. Now we have taken the opportunity to create a significant barrier for further property speculation by buying a strategic share of the site.

Help us achieve this goal permanently!

What is Rozbrat? The story of the Rozbrat at Ulica Pułaskiego 21a in Poznań began in 1994, when a group of people occupied a site of dilapidated commercial buildings neglected by the state and private owners. Since then, Rozbrat has fulfilled a central function as an infrastructure for social initiatives in Poznań and beyond. The campaigns against the eviction of Rozbrat have given rise to the local tenants' movement and the WSL (Wielkopolska Tenants' Association). Our active participation in struggles in the factories contributed to the foundation of the trade union IP (Inicjatywa Pracownicza - Workers' Initiative). Rozbrat is involved in the organisation of the Social Women's Congress, which is a counter-proposal to the bourgeois Polish "Women's Congress". Here women workers and activists coordinate activities for social justice for women. The Freedom Fighters group, which runs a sports room at Rozbrat, came out of the anti-fascist and anti-racist activities of Rozbrat. Since 2013 the Freedom Fighters organise an annual martial arts tournament at Rozbrat.

The disputes about the continued existence of Rozbrat have always been about climate justice, as Rozbrat is located in the so-called Western Green Belt of Poznań, which supplies the whole city with oxygen, but is desired by real estate speculators and the city as a potential building site close to the city centre. At Rozbrat, groups are also active at the forefront of the fight against the hunting of wild animals and the cutting down of the last primeval forests in Poland. In the last few years, right next to the Rozbrat site, a former allotment garden site was occupied, which was to be privatised and flattened. After the development company gave up, the urban gardening project WOMB (Free Urban Garden Bogdanka) was founded on the occupied site. The WOMB has already received awards at several competitions, which had been organised by the city administration, for being the best social initiative and most interesting green space in Poznań.

4 notes

·

View notes

Text

At Infinity Real estate group, we bring a new approach to real-estate. We not only help you with selling your property at record prices, but we also hold your hand to grow your wealth and be part of your prosperity Journey.

Our champion team not only helps you to sell property, but with our in-house experts Infinity Real Estate group also helps you with Tax planning, home loans, business loans, buying property through SMSF, investments, building property portfolio and personal insurance needs.

Infinity Real estate group where your journey to property and wealth begins with end to end solutions.

Find Your Dream Home with Our Real Estate Experts

Real Estate Sales | Property Management | Financing Assistance | Expert Agents

INFINITY REAL ESTATE GROUP AUSTRALIA PTY LTD

Business Address: 205/2 Infinity Drive, Truganina VIC 3029, Australia

Website: https://infinityre.com.au/

Email: [email protected]

Call: 0370 085 002

#Infinity Real Estate Group#Infinity Real Estate Group Australia#Real Estate Sales at Victoria#Property Management in Truganina#Financing Assistance in Truganina#Real Estate Experts in Truganina#Property for Sale in Victoria#Property for Sale in Truganina#Property for Sale in Tarneit#Property for Rent in Truganina#Property Buyers in Truganina#Buy Property in Truganina#Sell Property in Truganina#House Experts in Truganina#Renting Properties in Truganina#melbourne#western australia#sell property#real estate#buy property#australia#property

3 notes

·

View notes

Text

Idk if anybody else has noticed this about the real estate environment but something really weird that is happening here and in Tampa and in my husband's cousin's neighborhood outside of Orlando is that the people that have lived here for a while bought their houses for a modest price like, let's say around 175k for a 3 bed 2 bath.... like they're still living there and it's not like their income has significantly increased, but then these people that move in are buying the same kind of house in the same neighborhood for like 650-850k and then there's like these huge income gaps of people living on the same street. It's so weird. Like this can't be sustainable right? What happens next? Obviously the government is going to keep increasing property taxes so people will have to move and then what? Only the extremely wealthy get to own a house? Like what is happening?

It would be so easy for us to buy a house at a 200k price point right now like there would be no issue at all and I probably could make 350 or 400k work especially if we could get a VA home loan but all the houses in that price range I would never ever buy. Not that I would buy a house in Florida I definitely wouldn't, but even houses I look at in other places it's like.... nope thanks I'll just keep renting

2 notes

·

View notes

Note

Hi Aunties!

I've been finding myself scrolling thru real estate websites while bored recently, and found a house that in an ideal world would be perfect! it looks like a castle!!! (the bf and I are big nerds, this would be a fantasy dream come true). The only thing is, it says it's a cash-only purchase.

While I'm not yet ready to buy a house, what things should I know about cash-only home purchases, and is there some kind of special loan that would allow me to get the cash to pay right up front, then pay back the bank or loan provider on a more "typical" schedule? (and is this different from a mortgage?? I have no clue)

This is so exciting, my lamb!!! Scrolling through real estate sites is a time-honored tradition of adulthood. I still do it myself and I'm in no mood to leave the house I own!

Anyway, we answered a similar question for you right here, puggle:

Season 2, Episode 2: “I'm Not Ready to Buy a House---But How Do I *Get Ready* to Get Ready?”

If you found this helpful, tip us!

16 notes

·

View notes

Text

I've been wishing for that level of realism in the sims for years *dramatic sigh*

The Sims 4 University gave us the option of getting a student loan. Since then, I can't help but wonder: why don't we have access to loans for other stuff. Like... real estate ? I mean, I personally don't owe $20,000 to buy or rent my own place. I've got more like $20 in my pocket (mhmm Macklemore).

Anyway, days and months were passing by and I couldn't stop thinking about this. I've looked for mods like this everywhere. They do exist for sure, but I think it's way too sophisticated compared to what I'm really looking for. And it's just lately that I came up with the idea imma share with you guys.

First of all, I want to apologize if this idea has been shared by someone else somewhere else. I just didn't find it and thought of it by myself during the +7000 hours playing the game since 2014.

Let's not talk too much, let's talk well instead:

OFC YOU MUST OWN UNIVERSITY EP

• Your sim is coming out of the closet CAS:

Check out the real price of the lot you want your sim to move into

Hit ctrl+shift+c and type " freeRealEstate on "

Once inside your lot, type " money 100 " (yes i like it a bit hard)

Shift+click on your sim:

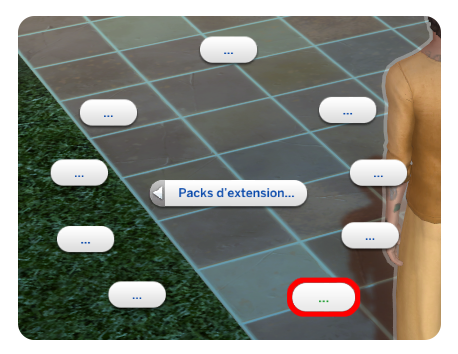

cheats for packs > expansion packs > the 4th " ... " (see screen attached) > loans > add 10,000 to the loan.

Ok i'm pretty SURE you know where I'm going now! Repeat number 4. as much as you took to the bank by cheating to buy your house until you reach the real price of the lot.

So, I know this isn't the most practical way to do so BUT it may give you realism by giving you time to earn money and refund the loan.

The game will understand that you have a (student) loan to refund and you can do so by sending the amount of money you want and whenever you want (not that much tho) through your mailbox.

• Your sim is waving bye bye to their parents for good:

Isolate your sim in a new brand new household

Just give them no money and accept the game warning

Keep going with the number 1. of the previous situation

I just don't know if someone's going to be interested by this trick. I just want to share something that I think could be interesting to play with if you don't want to download any mods.

#sims4#sims 4#ts4#the sims 4#thesims4#thesims#the sims#mcbethstudios#student loans#real estate loan#cc free#sims 4 tips#sims 4 gameplay#sims 4 cheats pc

20 notes

·

View notes

Text

Is the modern dating scene a product of our divided society?

As shocking as this title may sound, there have been multiple studies conducted by psychologists and sociologists about the deterrent effect of modern dating regarding the increase in population. Many may argue that options such as dating apps should be able to help singles find dates and get into relationships. But because of the constant availability of other, or “better” singles out there, the dating scene is met with a ruthless new phenomenon. “Situationships” better known as “delusionships” is the factor that is keeping people away from the dating pool.

Many people take into account that due to our divided culture, it is harder to set aside differences to find a partner, and with that, I agree. In this post-2016 election dating pool, many singles consider voting decisions, alongside their career, education, salary, and whether or not they own a property before making their decision official. Why is that? Have we succumbed to becoming superficial and narrow-minded?

I am no sociologist, but I know quick judgments result in lonely nights. As a college student, I understand the desire to be in a monogamous yet non-committal relationship. But that only exists in a world where STDs and constant communication exist, what I mean is this fallacy does not exist.

As a twenty-something, I have made peace with the fact that my dating pool will be inherently barren until I hit 27, solely because I refuse to be in this constant loop of being like a girlfriend without the title. We as a society all collectively agree that free labor is cruel, and as college students, we would not be caught dead with an unpaid internship, but we allow ourselves to be in “almost relationships”. Due to these harsh conditions, there has been a rise in practicing celibacy, the act of withholding sexual encounters until emotional needs are met. This rise was originally seen as a side effect of the lockdown, but after open conversations on social media, the hashtag celibacy has surpassed more than 1.2 billion views.

As an observer of these changes, the best way to explain modern dating is to view the change as if it were the real estate market. Back in the day, it was much easier to buy a house since there were fewer restrictions on home-buying, but to purchase a new property one needs a strong credit score, a loan, insurance, and also be able to buy the property in cash. The same could be said about dating, we expect too much in the worst way possible.

As a population, it is hard to admit that we have become blind to what truly defines a person and what makes a good partner. I can guarantee that an individual who is deemed “cool” most definitely lacks character, and is not dating material and we need to stop chasing people for the sake of a better status. Yes go out with someone who shares similar interests, but for the love of god DO NOT and I do mean this, but do not take someone off your roster because they have some differing views. Ask them about their opinions and be reasonable, this intolerance to any differences is not only leaving people alone, but it is creating insane division outside the dating scene. This notion of accepting differences goes a long way, accepting people for their values and their dating goals will not only make the dating pool accessible but also help heal other divided relationships.

The final issue with modern dating is that we do not want to get attached or else we will get hurt, pain is inevitable, and any venture worth going into will cause pain. If we applied this mentality in all aspects of life, more would be done.

2 notes

·

View notes