#AND WAY MORE INTERESTING

Explore tagged Tumblr posts

Text

Despite everything, I do prefer veilguard to inquisition

#not to be a hater but i just really do not like. inquisition#it managed to beat so many AC games that i've played when it comes to “god this is the worst quest of all times”#the politics of this game drive me insane#don't get me wrong veilguard's do too but somehow inquisition's make me more mad#i don't care for the inquisitor that much and out of the 4 they're the weakest protagonist if you ask me#also the fact that as a qunari you have to ASK LELIANA TO TRANSLATE QUNLAT TO YOU#MADE ME SO MAD#trespasser is only good for the plot bc the gameplay is awful#actually so much of my hatred of this game comes form the gameplay#the final battle makes me mad#HOW WAS THE DA2 DLC FIGHT MORE DIFFICULT THAN THE INQUISITION ONE#AND WAY MORE INTERESTING#my god i have SO many problems with corypheus as a villain#and how the mage/templar war is handled#the romances are good and even tho i love blackwall and solas none of them quite had me hooked like dao and da2s#and datv despite its many problems#also.#war table#do not get me started. on the war table.#anyways#i needed to speak my truth#in that FOR ME ESPECIFICALLY#inquisition is the weakest game#FOR ME MY OPINION#i don't like inquisition#if you scroll back on my blog you'll find plenty of me rebogging dai critical posts#ANYWAYS#i'm fine now#also if you need any proof of how much i dislike inquisition#its that the first time i played dao

7 notes

·

View notes

Text

unpopular opinion but i think a ship that's not canon but both halves are canonically insane about each other is infinitely better than a ship that's canon and boring

#like on 911 buck and eddie have never kissed and maybe never will but buck watched eddie get shot and eddie bled all over him#and then eddie listed buck as chris's guardian in his will in case anything ever happened to eddie. insane! compelling!#meanwhile on 911 lone star tarlos is canon and they are not insane about each other and that's why the ship is boring as fuck#on night court dan and harry never kissed but harry planned dan's funeral when dan was presumed dead bc dan made harry his next of kin#and that's way more interesting than any harry/christine kiss we got#i'm not saying you can't want your ship to fuck i just don't see why some people are like 'xyz ship HAS to fuck or what's the POINT'#the point is they're insane about each other. are you not entertained#personal

24K notes

·

View notes

Text

(also feel free in the tags to clarify Why you made the choice you made!! :0c)

#polls#tumblr polls#For me I think the top ones would be the House. The Money. or the Friend Group. But I ultimately might would go for the house#JUST becuase it would be my Dream House which means it would already meet mostly all of my specifications#and what I might be looking for. which would save a lot of time searching or customizing/rennovating.#Also because I could use that as a way to leave the US lol.. like .. if I get to choose my dream location.. couldnt I just choose some othe#country?? But I wonder how that works. Can you legally 100% have full ownership of a property in a country yet not be a citizen of that#country?? Would you show up and be like 'erm.. i own this house.. so i shall now live in it' and theyd be like 'uh no. you cant live here#despite owning the house. leave.' ??#So I think the initial process of 1. scraping together funds to actually MOVE myself and my most valuable belongings physically#TO another country. and 2. figuring out how to STAY in that country . might end up being difficult.. BUT. if I could just work that#part of things out then.. dream house?? security for once in my life?? stability?? :0#Though the $1mil is enticing it's also like.. I feel .. with the way housing prices are now... that's not much???#it's a lot I guess if you plan on like.. investing half the money and staying in an apartment for 5 years while you grow your wealth#or something. but if you're a 'I Need Stability NOW' ready to settle down person who would be most interested in owning a property rather#than nice clothes or a car or whatever other investments you could make then.. eh..?? It seems like unless you're okay with living in#a small town or kind of far away from the city - even some SMALL houses in majorly populated areas in the US will be like#$600.000 - $900.000 or something. like that would be MOST of my money. Which I know you could just pay partially and make#payments on it but idk.. in the option of just outright owning the house it seems like it'd end up being cheaper.#Plus I would want to own it fully asap because I'd be afraid of losing it somehow otherwise. like it being taken for medical bills or#something. which I thought was supposed to be - not IMPOSSIBLE - slightly more complicated legally if you actually have#paid off the house in full. I guess the issue then would be utilities and property tax and such. But I feel like thats overcome-able??#Like I could just stipulate that my Dream House has a little furnished addition or something and then find someone#with money and be like 'Look you can live in this extremely nice area with amazing ameneties and updated everything and ALL you have#to do is give me money to cover the utilities and property tax.'' or something like that. Like the little furnished addition is nicer#than the actual house. they have their own pool and spa and movie room or something and Ill also cook all their meals for them#or whatever (how luxurious it would be depeneds on how high the property tax actually is/how much I would need to entice them into#why it's a good deal for them to pay it for me lol). idk... something like that.. ANYWAY#I asked a few people I know though and one of them answered they'd rather have a romantic partner. the other one said they'd like#to be able to choose someone to die lol.. So I'm curious what people value the most

20K notes

·

View notes

Text

don't show him modern technology; it won't end well

bonus under the cut:

#i'm not sure if ford would really be interested in using the internet much#but i could see him wanting to look something up real quick and ending up reading something so outrageously wrong#that it pisses him off to the point that he gets into an argument about it lol#gravity falls#stan pines#stanley pines#stanford pines#digital art#my stuff#anyway i really don't like how this one turned out#but i don't feel like changing it#bc i already spent way more time on this than i actually wanted to#and i don't wanna look at it any longer

51K notes

·

View notes

Text

Poppy playtime got a guy worse than William Afton

#myart#chloesimagination#comic#fnaf#five nights at freddy's#fnaf fanart#springtrap#william afton#harley sawyer#fnaf 3#poppy playtime#poppy playtime doctor#poppy playtime chapter 4#So I saw the new poppy playtime chapter#and I think the plot and characters finally worked for me#really sparked my interest#I DONT love all the directions that chapter takes#but can we all talk about how cool the doctor is#AND BY that I mean how truly twisted he is#William’s crimes somehow feel small now#in the face of the company that just experiments on just kids#the doctor is awful in every way sick and twisted#and I think that’s epic#just the idea of William hearing the shit playtime co got up to#like I think the scale of it would genuinely shock him#even if he’s interested in that science as well#I may draw a lil more poppy stuff as a treat we’ll see

11K notes

·

View notes

Text

a few chapters into sunrise on the reaping and the conclusion I’m coming to is that while katniss keeps *a lot* to herself, 16 year-old haymitch was a chronic oversharer. he dropped in ONE chapter more of the entire district’s lore than she did in 3 books

#while they’re similar in some of their actions katniss tries to conceal so much what she feels that she ends up hiding it even from herself#while haymitch is much more open and honest to himself in this sense#which is also interesting when you compare it to tbosas’s narration in third-person#because (as many people must have already stated) snow lies so much he can’t even be trusted to tell his own story#idk I just find it interesting how even the way the story is told is a sign of how she shapes the characters#haymitch abernathy#sunrise on the reaping#sotr spoilers#thg sotr#katniss everdeen#the hunger games trilogy#the hunger games#catching fire#mockingjay#suzanne collins

8K notes

·

View notes

Text

Nosferatu (2024) is unquestionably a multifaceted work, but what I personally consider to be the unifying idea behind its facets is that, for Ellen, Orlok represents validation.

Her fears are dismissed and called childish?.. He's a nightmarish manifestation of them.

She is consistently disrespected by everyone around her?.. He considers her his only equal. She never uses his title, it's permitted.

She is told to fix herself, misunderstood, and always isolated?.. He knows all the darkest parts of her and is delighted by them. He wants her just as she is, so much that he will lie, kill, and cross the ocean to find her.

The scene in their death/wedding bed is a direct parallel to the scene of her waking in that bed at the beginning of the film. She complains to Thomas that the "honeymoon is yet too short" and tries to pull him down with a kiss - however, he is worried about being late for work, and so he extricates himself and leaves. Cut forward to her sharing the same bed with Orlok, similarly early in the morning; he is startled by cock-crow and begins to rise, but she guides his head back down - and, even though he knows that he will die, he stays. He is her sexual and emotional desire, realized.

Given that there is a plethora of emotions Ellen is forced to suppress on daily basis, there is no singular correct interpretation of her relationship with Orlok. To erase any one of them is to render it shallower than it actually is; but there is no doubt as to why their attachment is mutual. To each, the other is something they’ve never had before.

#nosferatu#nosferatu meta#nosferatu 2024#ellen hutter#count orlok#orlok#lily rose depp#bill skarsgård#robert eggers#nosferatu spoilers#nosferatu movie#horror#gothic horror#horror film analysis#the script says their kiss is ecstasy for them both!!! and there is a Reason for that#to reduce ellen to just a victim is. such a disservice to her character#to treat her as a pure little sacrificial lamb feels like some madonna/whore type shit. it's just more infantilization#she has desires. she is sexual. she Wants to be selfish#her primary concern about going with orlok was that she believes he cannot love#not. say. the blood drinking and plagues and carnage#let ellen be a freak#she's so much more interesting that way

4K notes

·

View notes

Text

older korrasami

#i have thoughts about them reportedly killing her young that i wish i had the vocabulary to articulate#even if there is a redemptive angle which i think there will be#im tired of pretending like immense sacrifice at the cost of 40 more years of happiness is in any way a compelling or interesting ending#especially for korra who was essentially repeatedly brutalised on screen#its so rare to see specifically sapphic couples in media#even rarer to see them age#i am tired of pretending queer death is revolutionary#we will see korra's death animated before we see her happy#korrasami

3K notes

·

View notes

Text

Actually I have a post I want to make about Property Value.

Which is a topic that comes up a lot in discussions of rich people hoarding wealth, in NIMBY panics, and in the ever-increasing prices of homes. But I don't think we talk much about how the perniciousness of property value goes deeper and basically holds middle class people who own a home hostage.

So to set some context here: in 2025 the median US home sold for $416,000. Say you have a working class family who can't meet median, but who scraped and saved and penny-pinched their way to a $300,000 home.

Typically, when buying a first home, you pay 20% down directly, and take 80% out as a mortgage from the bank. For this family, that means $60,000 of their liquid money (and let's say it took them 10-15 years to save that amount), and a $240,000 loan from the bank.

That's $240,000 in debt the family is. Which will be repaid over 30 years, with interest, at a rate that usually means for the lifetime of the loan, they end up paying back double the original loan.

However this massive $240,000 debt is generally considered "okay" debt to have, because it's backed by the house. If things go truly sour, the bank can take the house (and what's a little homelessness between friends).

That $60,000 the family put down is considered equity, and equity is money you "have", but isn't accessible.

Scenario: Now let's say something happens. Someone in the family loses their job, and the only job they can find requires moving. Or a family member across the country can't care for themselves anymore and so this family needs to move to be closer to them. The family gets divorced. Someone in the family is allergic to material in the home. Someone in the family is being stalked or abused and needs to leave the town. Anything at all, which would require selling the home and moving.

Case 1: The family is able to sell it for exactly what they paid (same property value, no increase or decrease). You would think the math is clean. They are paid $300,000 for the house. $240,000 repays the bank loan. The remaining $60,000 of equity goes right back to them. And they can use it (which took 10+ years to save up) to move across the country and buy a different $300,000 house.

Except no, it does not work like that.

The seller of a home is on the hook to pay commission to their realtor and the buyer's realtor. This is usually ~6% of the home value. They have to pay legal costs. There are taxes. There are miscellaneous costs. It can easily be 6-9% of the selling price of the house.

The bank NEEDS its $240,000 back. So those costs come from the equity. This family is not getting their $60,000 back. They're getting $30,000-$45,000, and now no longer enough money for a downpayment in their move. They're back to renting. Back to penny pinching. They can get by, but homeownership is now out of their grasp once more. Maybe in another 5 years, they'll have enough (unless home prices have increased too much by then) then they'll maybe never be homeowners again.

Case 2: The property value has DECREASED... Family is only getting offers in the $260,000 range.

If the family accepts a $260,000 sale, well $240,000 goes to the bank. This is genuinely non-negotiable. And that leaves.... maybe not enough money to even close on the house. Not enough to pay the realtors and the fees.

That $60,000 is wiped out, and the family is incapable of moving. Never mind losing 10+ years of savings--they're below $0. They don't have the money to close. It's financially impossible to sell. They are stuck with the mortgage. They are stuck with the house. (Maybe they'll rent it, if they can. And now they're landlords by circumstance, which is often NOT profitable when you're not a trust fund baby renting out a totally-paid-for no-mortgage home.) But whatever the case, they cannot sell it. And if the reason for selling was a job loss... well, they can be homeless soon. And if the property value dropped below $240,000, they can be homeless AND owe a bank debt. A $60,000 nest egg wiped completely out, with a bank debt owed on top of that.

So how do people avoid financial destitution when moving?

The most sensible answer is building up equity by paying down the loan--but it's important to know that mortgages are super interest heavy in the early life of the loan. With a 5% interest rate (BETTER, btw, than current rates) this family would be paying $15,460 the first year, and only $3,540.88 is actually chipping at that $240,000 principle. The other $11,919.59 was pure interest to the bank.

So after 1 year, the family went from having $60,000 equity in the house to $63,540.88 equity in the house. This buys a little extra wiggle room when juggling closing costs. But not very much. Even after 3 years, the family has just a little over $70,000 of equity, and just under $230,000 still left on the loan. So if the family has to move for any reason (sickness! death! job loss!) in those 3 years, it's probably financially devastating.

But there is a second answer to avoiding financial ruin: and that is Property Value going up.

Any amount of property value increase is PURE equity. The bank only cares about the amount of money it gave you. If after 3 years, that house is now worth (and can sell for) $315,000 (which is appreciation of only 1.6% a year. Most home appreciation is closer to 3%), that's more equity increase than they got from 36 diligent months of mortgage payment.

If they can sell for $315,000, pay $230,000 of that to the bank, that leaves $85,000. $25,000 goes to paying the realtors and the closing costs and.... the family is back to their $60,000 downpayment. Not trapped. Able to sell. Able to buy a new $300,000 home in the place they moved. Able to just maintain homeownership status.

But wait, if their home appreciated to $315,000, didn't all the other homes do the same, so now $60,000 isn't enough

Smart eye, lad! You've identified why this is a TERRIBLE rat race for the people scraping money together to live, and is ONLY a profitable leisure activity for rich people who sell homes like collectables.

Now because the increase is pure equity, a similar family with decent property value increase can funnel that extra equity into affording to meet the new higher down payment (remember the downpayment is only 20%, so even if the new place is similarly higher in property value, you only need to match that increase 20% for the downpayment). Which gets their foot in the door. But now their new mortgage is higher than the old one. More expensive. More interest.

But there is a losing scenario here--if home property values increased everywhere else, but not where you live. Then this family is back to surrendering homeownership. Because even if they can sell their place, they can't buy the next home.

It forces them to care about their own Property Value increase because, if it doesn't increase while everywhere else does, it traps them.

So what do I mean by all this

If the value of all homes dropped 50% overnight, I assume most people here would celebrate. Affordable homes! Rich people upset and crying! So much to love.

But in reality, that 50% drop would likely continue to mean no home for most of us, because the people who could sell you the homes would be financially incapable.

For the family above with the $240,000 mortgage, that mortgage does not reach halfway-paid-off until year 20 of the 30 year mortgage (remember the interest frontloading). If a family still owes $230,000 in bank loans on a place that can only sell for $150,000, they can't sell it to you. That house is the bank's collateral securing the loan. Their mortgage is underwater. They're trapped. They cannot sell it. You cannot have it.

Something similar happened in the 2008 subprime mortgage crisis, and the only people who got out okay were ones who could stay the course, keep making the mortgage payments, and wait it out long enough for property value to recover.

Those who couldn't got foreclosed on. Those who couldn't were left in financial devastation.

So in conclusion?

Banks profit off of mortgages. Rich people profit off of hoarding housing stock and selling it as the property value increases. Real estate companies profit off of home sales. And the regular people, who managed to achieve home ownership, are shackled to the price-go-up system to avoid financial ruin. They're forced to care about their property value because it is the singular determinant of whether they're trapped in place, whether they'll be okay if they lose their job, whether they could move due to an important life event.

It's a profit system for the rich where the cogs are middle class people who could achieve homeownership, running a machine where every single crank locks the poorer and younger generations out of home ownership forever.

#on my next installment: how rising mortgage interest rates trap people in the exact same way!#how low mortgage rates BALLOONED home prices due to more people able to make competitive offers and how the following interest rate hikes#left prices massive AND new mortgages unaffordable and so many new people locked out of ownership forever#while trapping current owners in place because they could never afford a new mortgage at modern rates#chrissy speaks

2K notes

·

View notes

Text

emma dupain cheng on the brain😽🎀

more:

#ml#miraculous#miraculous ladybug#my art#emma dupain cheng#emma agreste#(i think that may the more popular tag for her lol. she is a dupain cheng in my heart though)#plagg#she is thirteen almost fourteen here btw. because i love circularity#emma dupain cheng to me is like. what if emilie or adrien grew up in a stable home with no trauma. that’s emma#and she is theater kid✨#and adrien and marinette are soooo so so supportive and love going to her shows and are so proud of her#/marinette has to be held back from trying to manipulate the school play casting process to secure emma the lead every year#but then emma sets her sights on bigger things(broadway west end)#and adrien pumps the breaks big time#and he’s so torn between supporting her interests and wanting so badly to keep her from like. being a child actor. having a job. b#being pulled from school#and emma gets upset bc he is standing in the way of her dreams#and they fight about it:(#and then emma discovers plagg and convinces him to help her sneak out and go to her callback that she secretly auditioned for#(and forged all the parent signatures for lol)#and. well. plagg CAN be bribed#and also she just reminds him so much of baby adrien🤧 he is a softie#and she runs away to her callback. and adrien and marinette wake up the next morning and see on the news that there is a new chat noir.#anyway. not that i’ve thought about it or anything

5K notes

·

View notes

Text

He has forever to get it right.

#crk#cr#cookie run kingdom#pure vanilla cookie#shadow milk cookie#shadowvanilla#puremilk#vanilla milkshake#jambound#this is messy and VERY rushed#I started it like an hour after the final chapter dropped and told myself I wasn't allowed to touch it after the game maintenance was done#so I'll never clean it more than this#but I REALLY wanted to draw something for the final chapter#such a beautiful story that expands on their relationship in such an interesting and logical way#and the community that got built around it has been so wonderful#I could gush about this fanfic forever#I rip off my shirt to reveal another shirt underneath that says JAMMA I LOVE YOU JAMMA

3K notes

·

View notes

Text

I feel fandom would get along a lot better if there was mutual understanding that liking a character, agreeing with a character, and thinking the character is well constructed/executed are all separate (if often overlapping) positions, each with their separate tastes and subjectivities. Also: character portrayals are intended to make the audience feel things; this is separate from (if often overlapping with) analyzing/appreciating their actions and role in the story.

#I would queue this because it's truly not character-specific#but there is always something happening with a character so that probably wouldn't help lol#anyway I'm making this nonrebloggable because I am not interested in the tomato throwing atmosphere out there#do not clown in bad faith on this post or in my inbox please I will just delete it#op#it's just over time I do see a pattern of like “I think X character was wrong in this” and some reactions being “you *hate* X character!”#or that if you like a character you *must* agree with them and/or have such a deep an endless compassion for their faults and mistakes#that it comes all the way back around to removing their agency because HOW could they do any different#and if you do not give them this grace then it is antithetical to you liking them or enjoying them or even just being neutral on them#when this is often not the case#like as an Essek and Jonas Spahr enjoyer their fuck-ups are very essential to why they have any sort of “grow as a person” arc#characters *have* to have texture and foibles or they are stagnant in the story - let your fave fuck up a bit! As a treat!#and lastly I'll just say that my point here is NOT that everyone is always positive or that haterism doesn't exist.#Some commentary just seems to happen at different frequencies from each other and it catalyzes more angst than it needs to

3K notes

·

View notes

Text

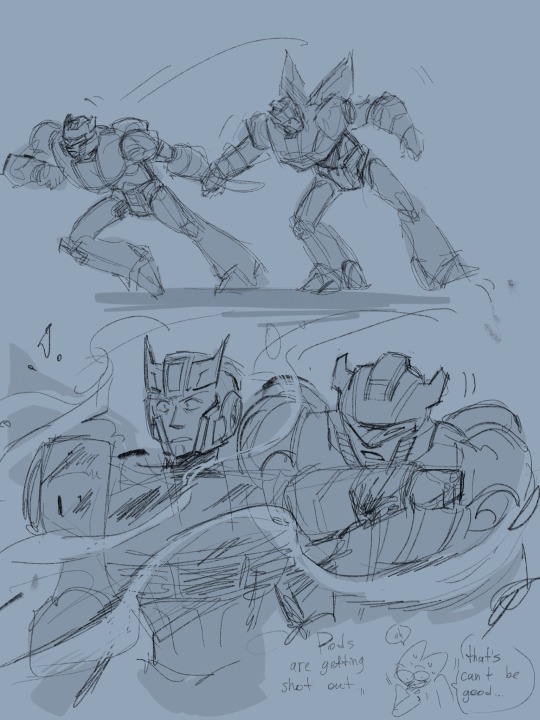

THE NEW CHAPTER OF MISTAKES ON MISTAKES UNTIL IS OUT AND YOU ALL KNOW WHAT THAT MEANS~~~~~~

Spoilers for ch 74 below >:)

Head in hands. And then they all happened to be self sacrificial idiots.

Infinitely delighted by the fact that Optimus automatically decided to catch whoever was falling and only look who that was afterwards. 100/10. Peak Optimus writing.

#fic fanart#momu fanart#maccadam#transformers#jazz#prowl#jazzprowl#optimus prime#megatron#momu is so good it made me draw megatron again✊ this is what true power looks like#teeny tiny doodle of Ratchet#I love momu Optimus beyond imaginable#usually I’m much more interested in him while he’s still Orion#because Optimus feels much more restricted in his thoughts and actions you know#in fics. I forgot to say I was talking about OP in fics#but in MOMU? I don’t even know how to describe it?? He is so comforting#he is all responsible and noble but also JUST the right amount of whimsical and chaotic 🤌#also I WAS NOT PREPARED for that level of architectural descriptions#my brain went ‘bruh we don’t fucking know all those words for space station structure components let’s give up how about that’#ahahahahahdjdjjfjf#not a critique by the way absolutely not#I’m gonna reread this fic at least one more time to catch more details and understand more of#uh#*vaguely waves hands*#this. everything.#because I’m 100% sure the whole story is FILLED with more layers I haven’t catch purely because I didn’t know what to look for

2K notes

·

View notes

Text

i kind of sympathize with Sadeas re: Dalinar in Way of Kings. if I knew a guy who was basically like a rabid dog barely contained on a leash back when we were launching a military coup together and he had a kill count of like 999999999 civilians and then he had a complete mental breakdown and then came back from it like "hey I'm Catholic now and by the way God Is Speaking To Me and told me the apocalypse is coming" well i probably wouldn't want that guy in charge of anything either. to be honest

#sadeas is a terrible person but you know. you know....#the way of kings#stormlight archive#stormlight archive spoilers#stormlight posting#dalinar kholin#oathbringer#brandon missed an opportunity he could have made dalinar and sadeas's relationship way more fucked up and interesting. i don't blame him#though because that sort of 'what if you were a ruthless military strategist and i was your barely contained weapon' homoerotic#situationship is kind of outside of his wheelhouse

2K notes

·

View notes

Text

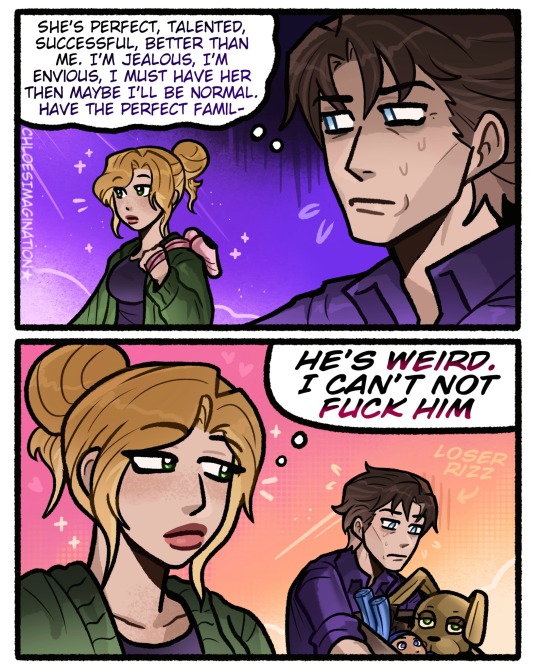

How William Afton got his wife in FNAF

#myart#chloesimagination#comic#fnaf#five nights at freddy's#fnaf fanart#william afton#mrs afton#clara afton#fnaf sister location#afton family#I don’t think William loves anyone in a normal way#he isn’t a normal guy#so meeting someone like Clara who is normal#who is well liked who’s successful in her field etc#he would want to have her so it’ll make him more normal as a result#would make the perfect American family#meanwhile on her end she just liked his vibes Pff#HE WAS just weird guy rizz#it’s funny and interesting to consider how they met#and what they actually like about each other#I definitely like explore them more in a more serious way#rn this is more of a joke bit

7K notes

·

View notes

Note

Final manifestations for Book 7?

I'm trying REALLY hard not to build up any solid expectations, because I wanna go in ~fresh~! they're already so far away from anything I thought would happen (not in a bad way, I'm just accepting that I'm on Miss Yana's Wild Ride at this point and we're seeing this thing through 'til the end, by gum). so it's nothing too major, but:

they've been handing new crying expressions out like candy lately, I want to see some delicious Malleus tears.

honestly I want everyone to cry buckets. their tears sustain me. the more Silver angst specifically I get the happier I am.

SILVER!!!! 👏 VANROUGE!!!! 👏

just let him have this. the poor boy's been through so much. let him have his big "I'm proud of you, son" moment with Lilia.

I'm 100% expecting Grim's arc (and probably whatever's going on with Crowley) to be its own episode, but a nice hook to leave us hanging on would be good!

a nice hook though, please, I don't think I can take another "Grim is attacking us! now wait eight months to find out what happens :)" cliffhanger...

some Meleanor? as a treat? just a little bit, a tiny quick flashback or something, please Twst I just, I just want to see her again. let her have a little ghost cameo like Dawnathan Knight got. Lilia and his kids are all having their big group hug or whatever and she can gently fade in to be all like

(turning asks off until I'm done playing, SEE YOU ON THE OTHER SIDE Y'ALL)

#art#twisted wonderland#twisted wonderland spoilers#twisted wonderland episode 7 spoilers#twisted wonderland book 7 spoilers#twisted wonderland episode 7 part 13 spoilers#twisted wonderland book 7 part 13 spoilers#one last chance for me to be wrong about everything!#(no it's good i am enjoying it SO much) (just stomping right down on all of my personal like buttons with its whole weight)#(it's just also VERY good at totally subverting all of my expectations)#i don't think we're actually gonna get a permanently dehorned malleus though#just because it feels like an insane thing to remove the most iconic part of one of the most iconic characters of the game#but i could see like...a temporary thing ala raisin vil#or a permanent smaller change like cracks/chips or something (kintsugi horns would be super cool actually)#but i do think it's more likely we'll find some way to keep the status quo re:horn design#if this was the END-end of all of twst then maybe but they still wanna sell merch of this guy so they can't change his design TOO much#i am sorta wondering if he might get a bit of a power nerf though? take him down from ridiculously overpowered to just normal overpowered#idk they made a point of saying the horns were specifically what caused the weather stuff#and the weather stuff has been called out in particular as one of the reasons why mal being so stupidly magical makes him pretty unhappy#everyone's scared of him all the time and he has to actively try not to accidentally kill people when he gets upset#so. idk. maybe it was just a little worldbuilding. but i thought it was interesting they brought that up was all!#me: i'm not going to form any expectations (writes a whole thing speculating on the fate of malleus' horns)#look it's now or never okay#that end of episode rhythmic better be SO cute because i'm already losing my entire head over this

2K notes

·

View notes